UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): August 12, 2025

THERAVANCE BIOPHARMA, INC.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands | 001-36033 | 98-1226628 | ||

| (State or Other Jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification | ||

| Incorporation) | Number) |

C/O Theravance Biopharma US, LLC

901 Gateway Boulevard

South San Francisco, CA 94080

(650) 808-6000

(Addresses, including zip code, and telephone numbers, including area code, of principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||

| Ordinary Share $0.00001 Par Value | TBPH | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On August 12, 2025, Theravance Biopharma, Inc. (the “Company”) issued a press release and is holding a conference call regarding its financial results for the quarter ended June 30, 2025, and a business update. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and a copy of materials that will accompany the call is furnished as Exhibit 99.2 to this Current Report.

The information in Item 2.02 and in Item 9.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act of 1934”), or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 | Press Release dated August 12, 2025 |

| 99.2 | Slide deck entitled Second Quarter 2025 Financial Results and Business Update |

| 104 | Cover Page Interactive Data File (cover page XBRL tags embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THERAVANCE BIOPHARMA, INC. | |||

| Date: | August 12, 2025 | By: | /s/ Aziz Sawaf |

| Aziz Sawaf | |||

| Senior Vice President and Chief Financial Officer | |||

Exhibit 99.1

Theravance Biopharma, Inc. Reports Second

Quarter 2025

Financial Results and Provides Corporate Update

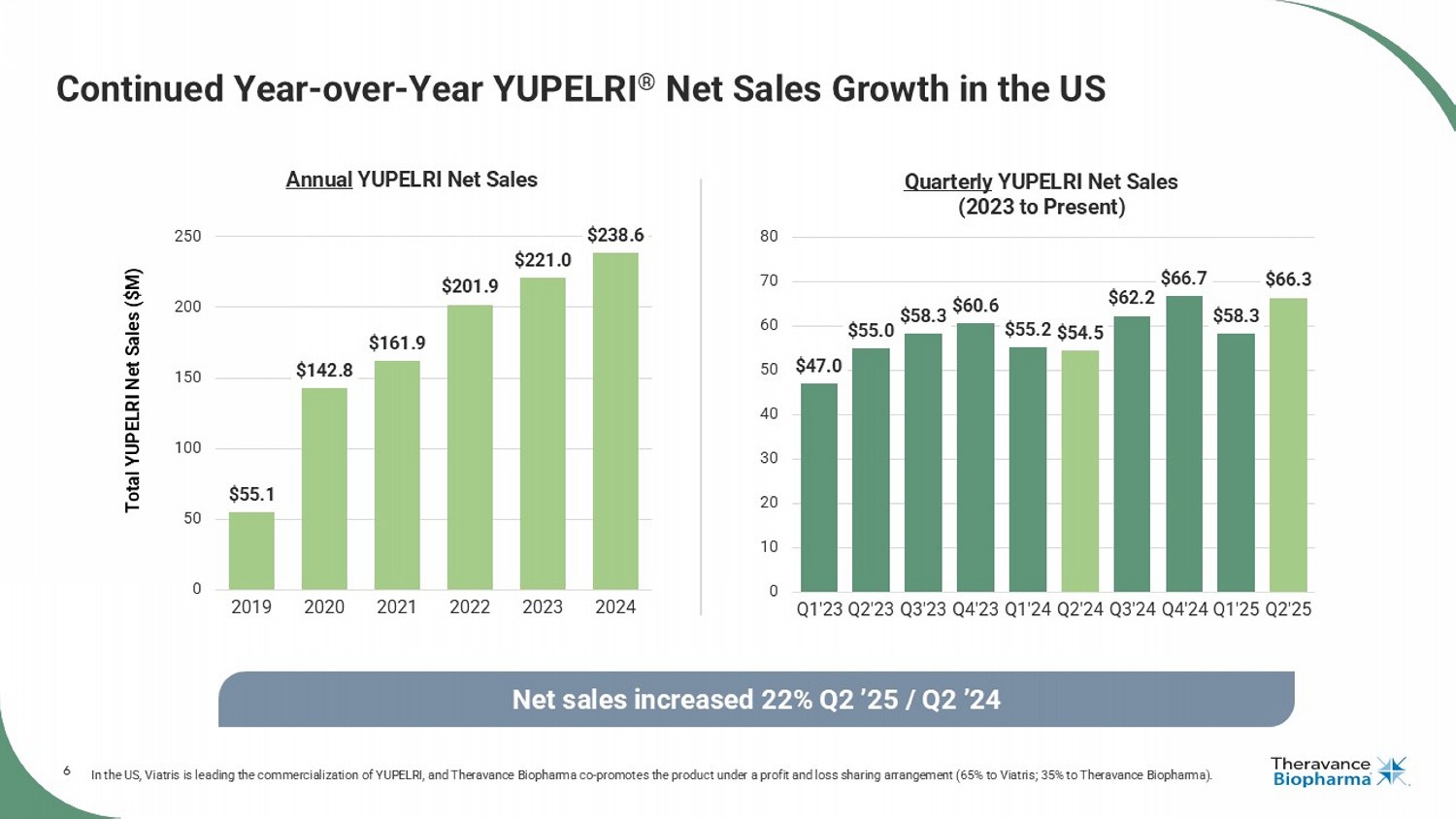

| · | YUPELRI® (revefenacin) net sales of $66.3 million, recognized by Viatris, increased 22% year-over-year1 |

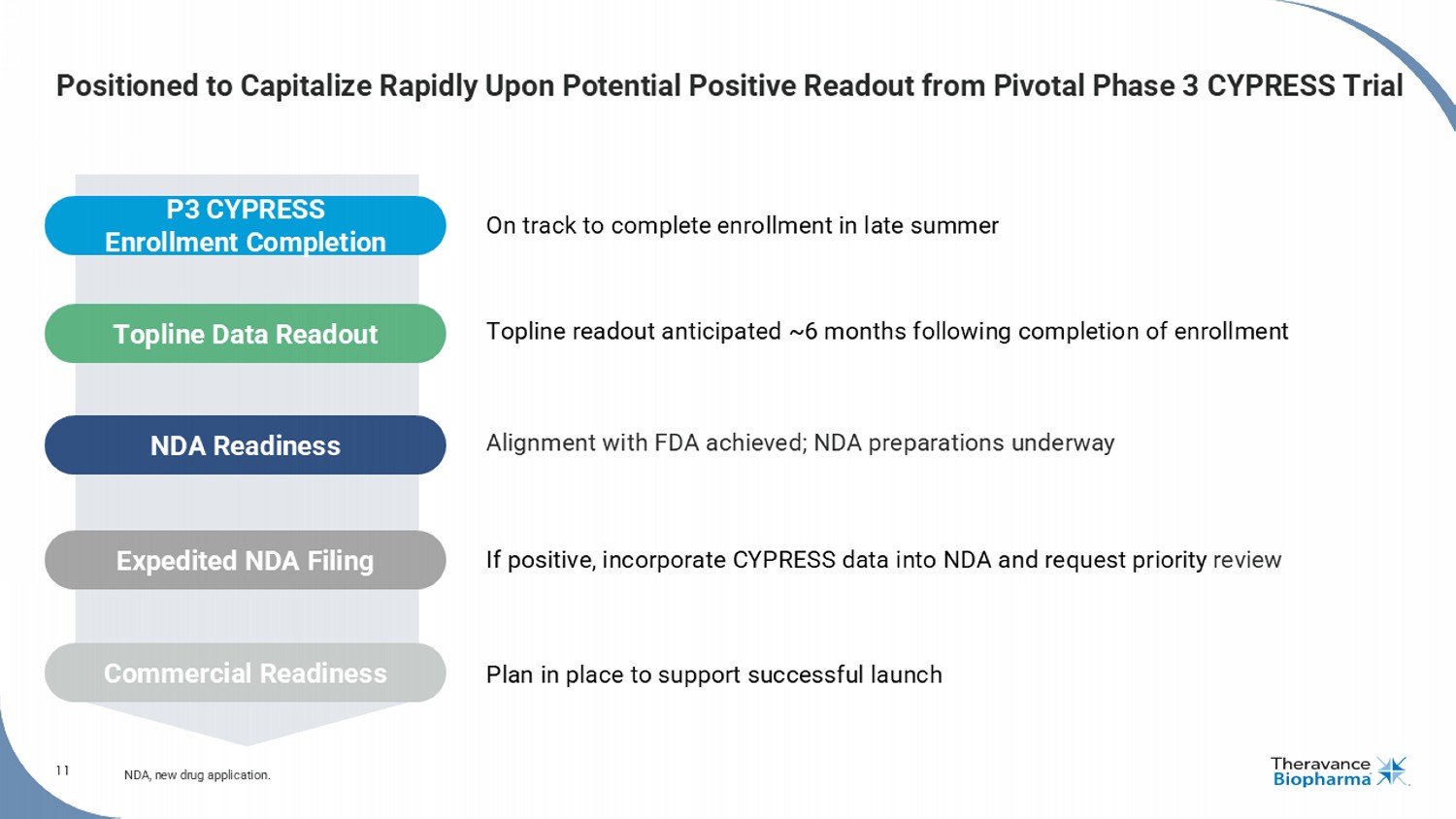

| · | Pivotal Phase 3 CYPRESS study enrollment on track to complete by late summer |

| · | Completed sale of TRELEGY ELLIPTA royalty interest to GSK for $225 million |

| · | TRELEGY year-to-date sales on track to trigger $50 million milestone in 2025 |

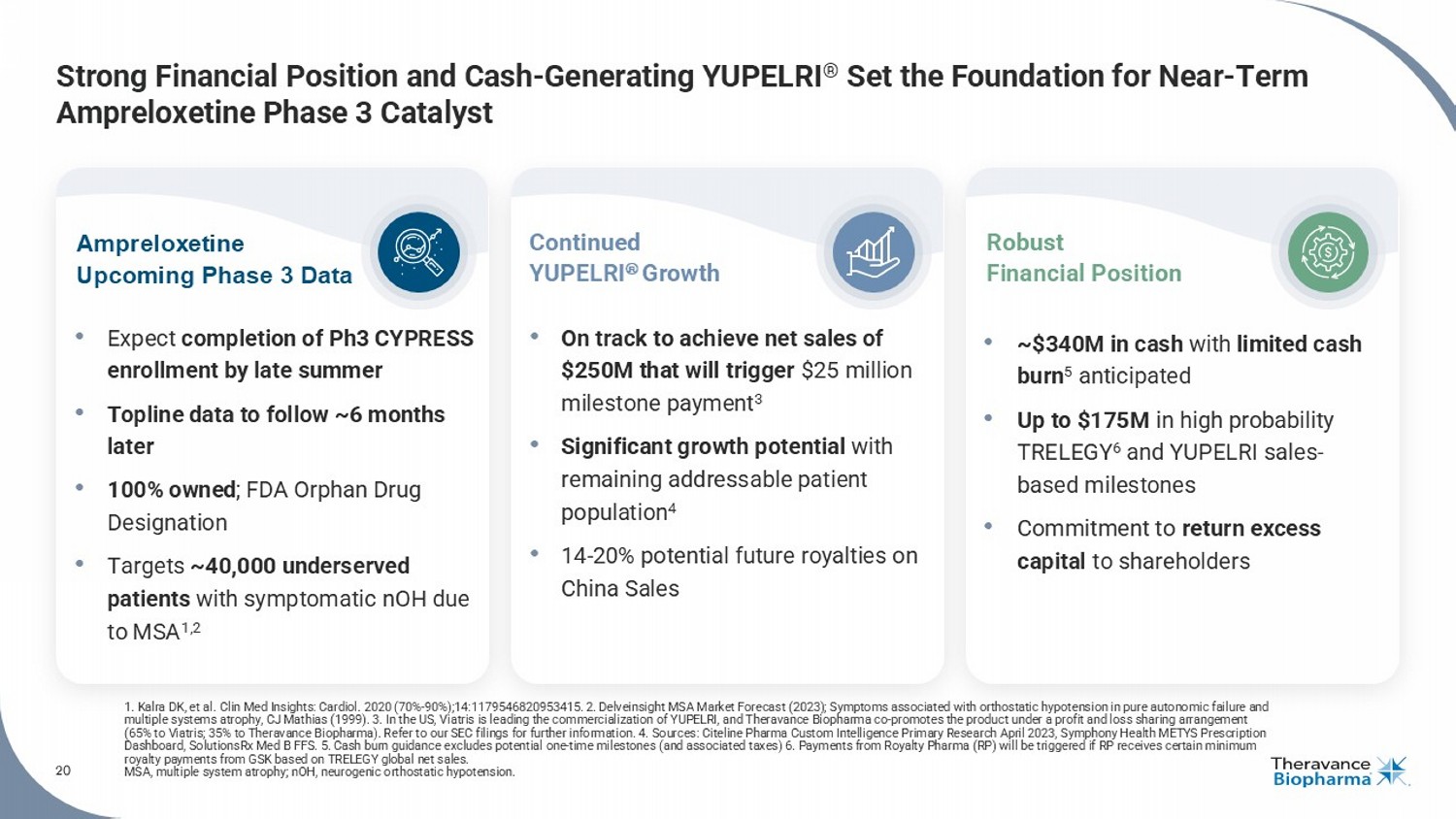

| · | Strong balance sheet with $339 million in cash and no debt |

DUBLIN, IRELAND – AUGUST 12, 2025– Theravance Biopharma, Inc. (“Theravance Biopharma” or the “Company”) (NASDAQ: TBPH) today reported financial and operational results for the second quarter of 2025.

“Strong execution across our business defined the second quarter, driven by commercial growth, disciplined operations, and continued progress on ampreloxetine. YUPELRI posted another strong quarter in the U.S., and its recent approval in China triggered a $7.5 million milestone payment. With the completion of the strategic monetization of our TRELEGY royalty interest, which brought in $225 million, these accomplishments have meaningfully strengthened our business,” said Rick E Winningham, Chief Executive Officer of Theravance Biopharma. “We enter the second half of 2025 with momentum and a clear focus on ampreloxetine. We remain on track for completing the enrollment in our pivotal Phase 3 CYPRESS study in late summer, and continue to prepare for reporting top-line data approximately six months later.”

Second Quarter Operational Highlights:

YUPELRI® (revefenacin) inhalation solution, the first and only once-daily, nebulized LAMA (long-acting muscarinic antagonist) bronchodilator approved in the US for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD):

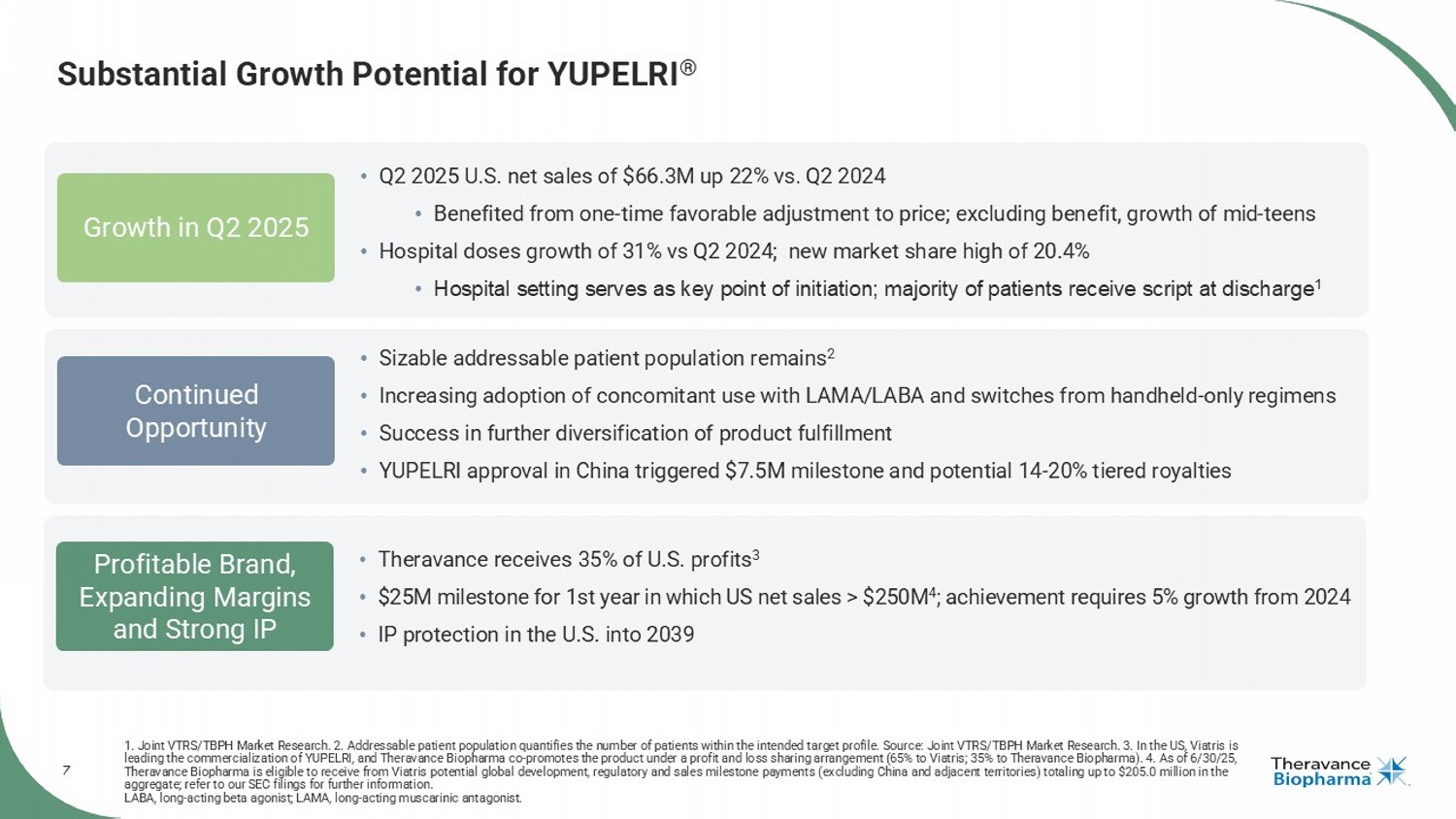

| · | Achieved total U.S. net sales of $66.3 million in Q2 2025, increasing 22% year-over-year (Q2 2025 vs Q2 2024).1 |

| · | Grew customer demand 4% for the quarter (Q2 2025 vs Q2 2024).2 |

| · | Net sales benefited from continued improvement to net pricing and a one-time favorable adjustment to net price. Excluding the one-time adjustment, year-over-year net sales growth would have been in the mid-teens. |

| · | Increased doses pulled through the hospital channel by 31% year-over-year (Q2 2025 vs Q2 2024), reflecting another quarter of strong momentum.3 |

| · | Earned $7.5 million milestone payment from Viatris in Q2 2025 for YUPELRI approval in China. |

1 In the US, Viatris is leading the commercialization of YUPELRI, and the Company co-promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to the Company).

2 Source: Viatris Customer Demand (Q2’25).

3 Source: IQVIA DDD, HDS, VA and Non-Reporting Hospital through Jun ’25.

Page

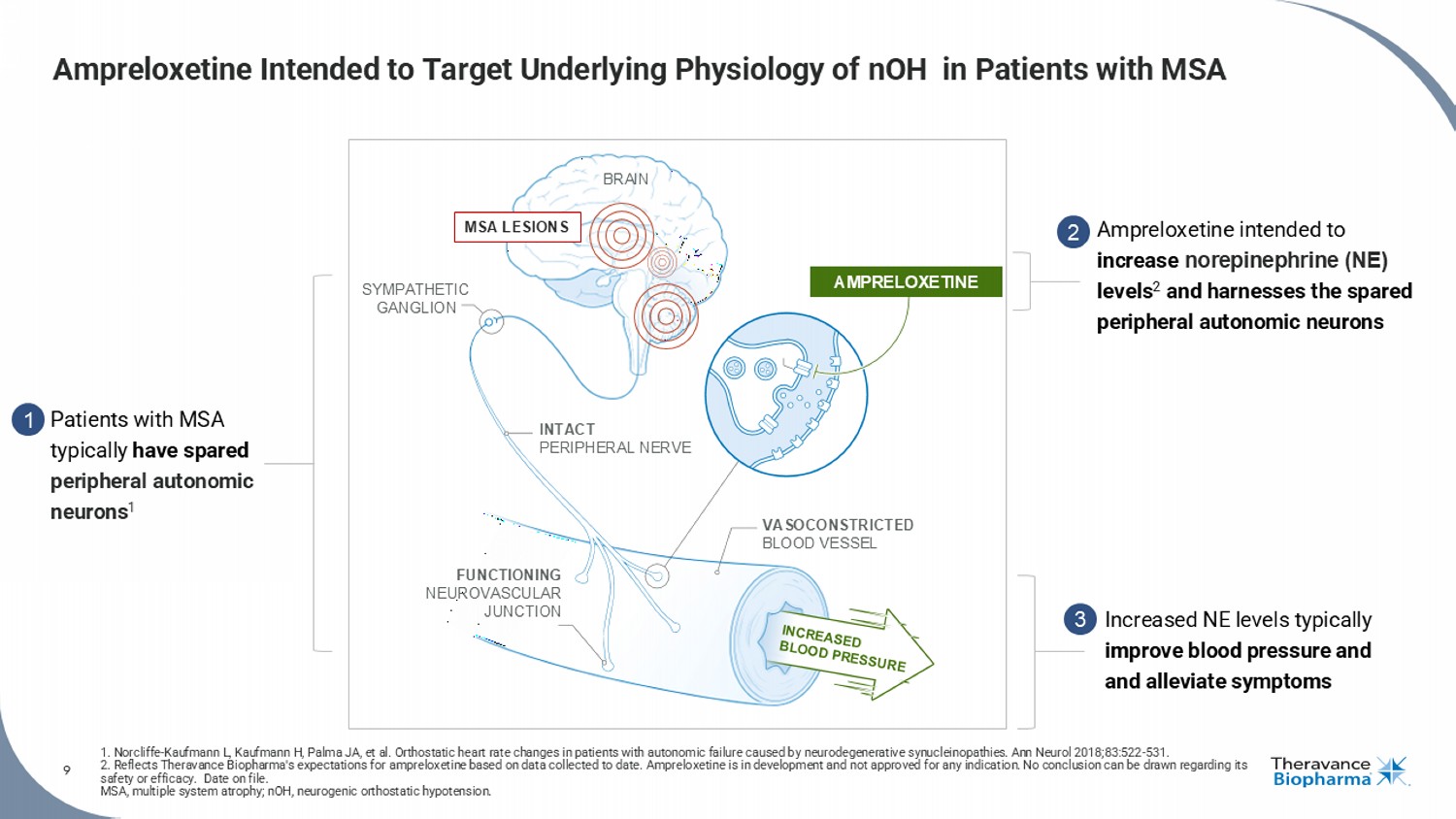

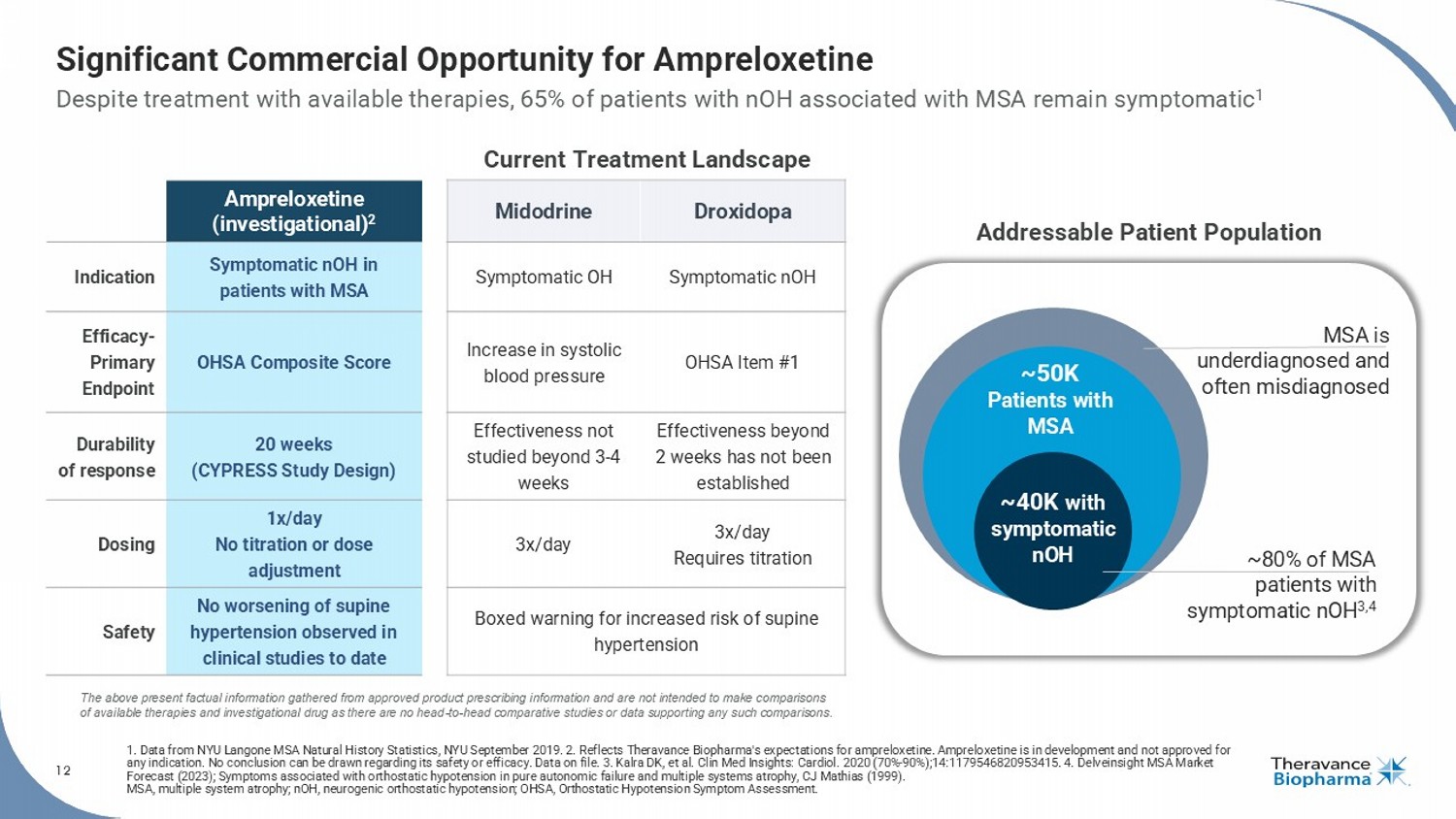

Ampreloxetine, an investigational, once-daily, selective norepinephrine reuptake inhibitor in development for the treatment of symptomatic neurogenic orthostatic hypotension (nOH) in patients with multiple system atrophy (MSA):

| · | Pivotal Phase 3 CYPRESS study enrollment nearing completion with final patient expected to be enrolled by late summer; top-line data anticipated approximately six months later. |

| · | Advancing pre-launch activities across medical affairs and commercial functions in preparation for the potential approval of ampreloxetine, a once-daily therapy aiming to transform treatment for symptomatic nOH in patients with MSA. |

TRELEGY

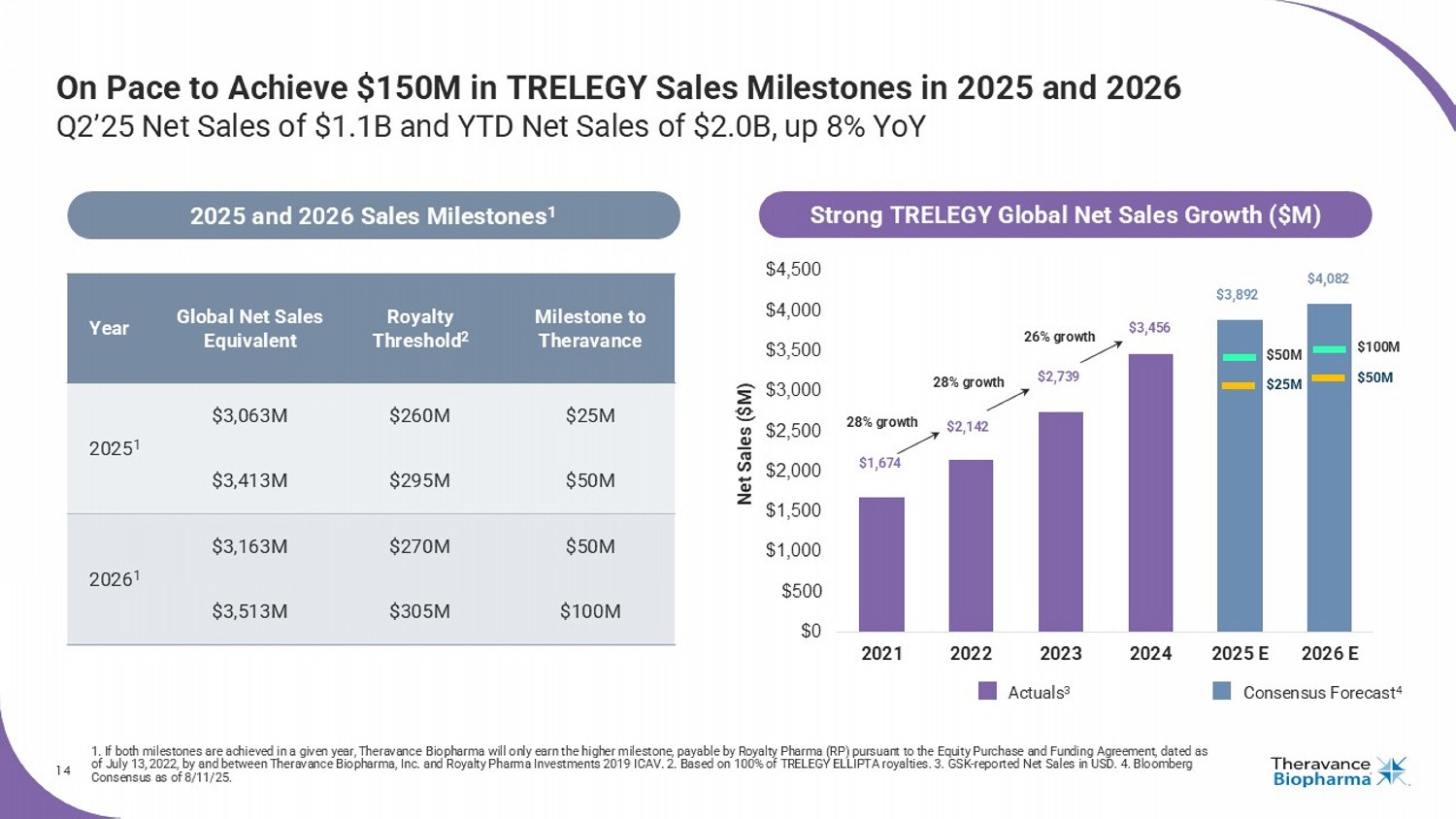

GSK posted second quarter 2025 global net sales of approximately $1.1 billion (up 4% vs. the second quarter of 2024) and year-to-date net sales of approximately $2.0 billion (up 8% vs. 2024 year-to-date):

| · | Currently on track to exceed full year (FY) 2025 global net sales of ~$3.4 billion (representing minus 1% growth vs. 2024) required to trigger $50M milestone from Royalty Pharma. |

| · | FY 2026 global net sales of ~$3.5 billion (representing 2% growth vs. 2024) required to trigger $100M milestone from Royalty Pharma. |

Sale of Remaining Royalty Interest in Trelegy Ellipta to GSK:

| · | One-time cash payment of $225 million received in late Q2 2025. |

| · | This transaction represents the first outcome of the ongoing efforts of the Strategic Review Committee of the Board of Directors. Theravance Biopharma announced on November 12, 2024, that the Board of Directors had formed the Committee, composed entirely of independent directors, to assess all strategic alternatives available to the Company. |

| · | The Company remains focused on disciplined capital allocation and returning excess cash to shareholders. The Committee will continue to evaluate a range of alternatives to further enhance shareholder value, though there can be no assurance that additional transactions will occur. |

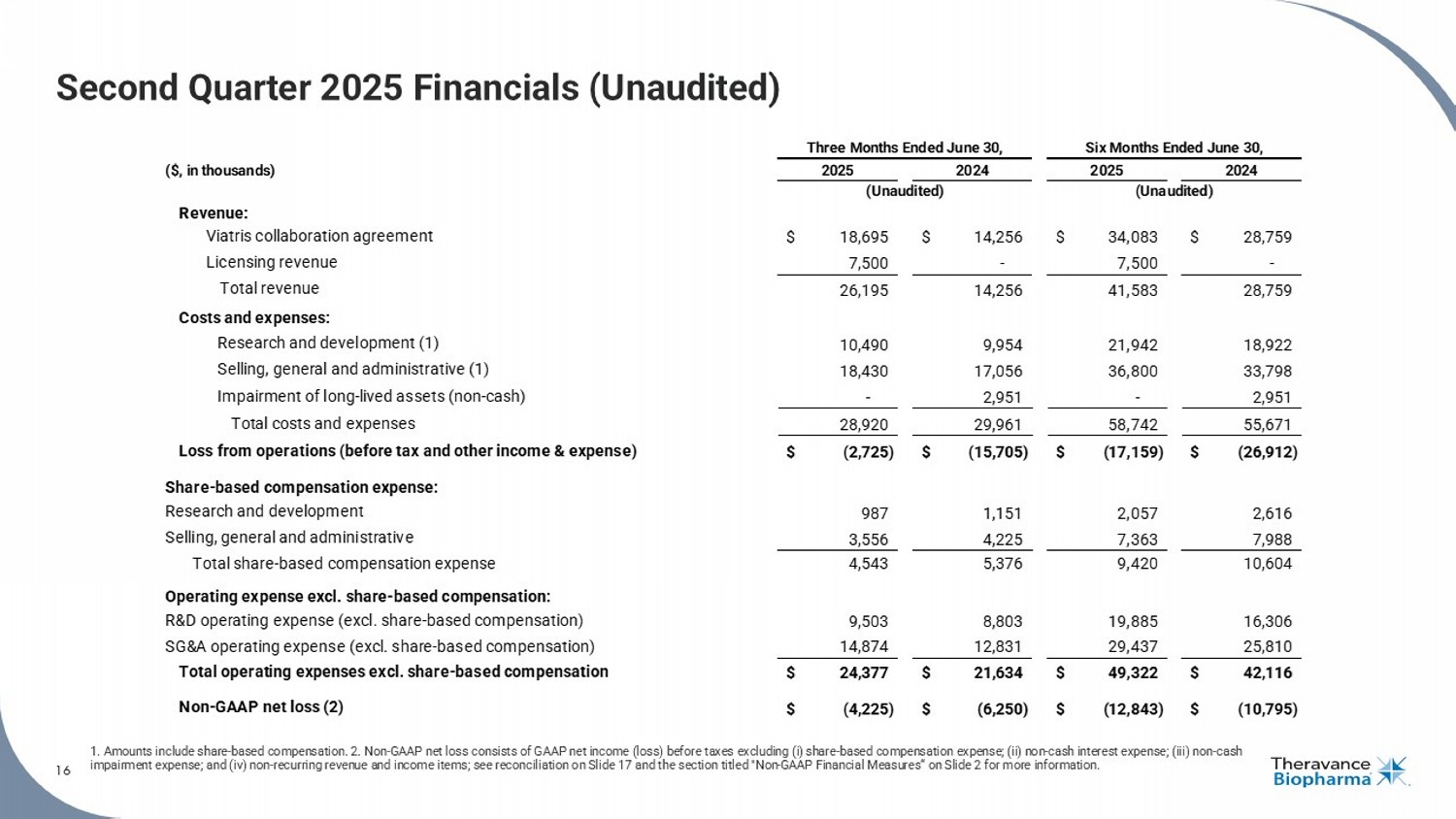

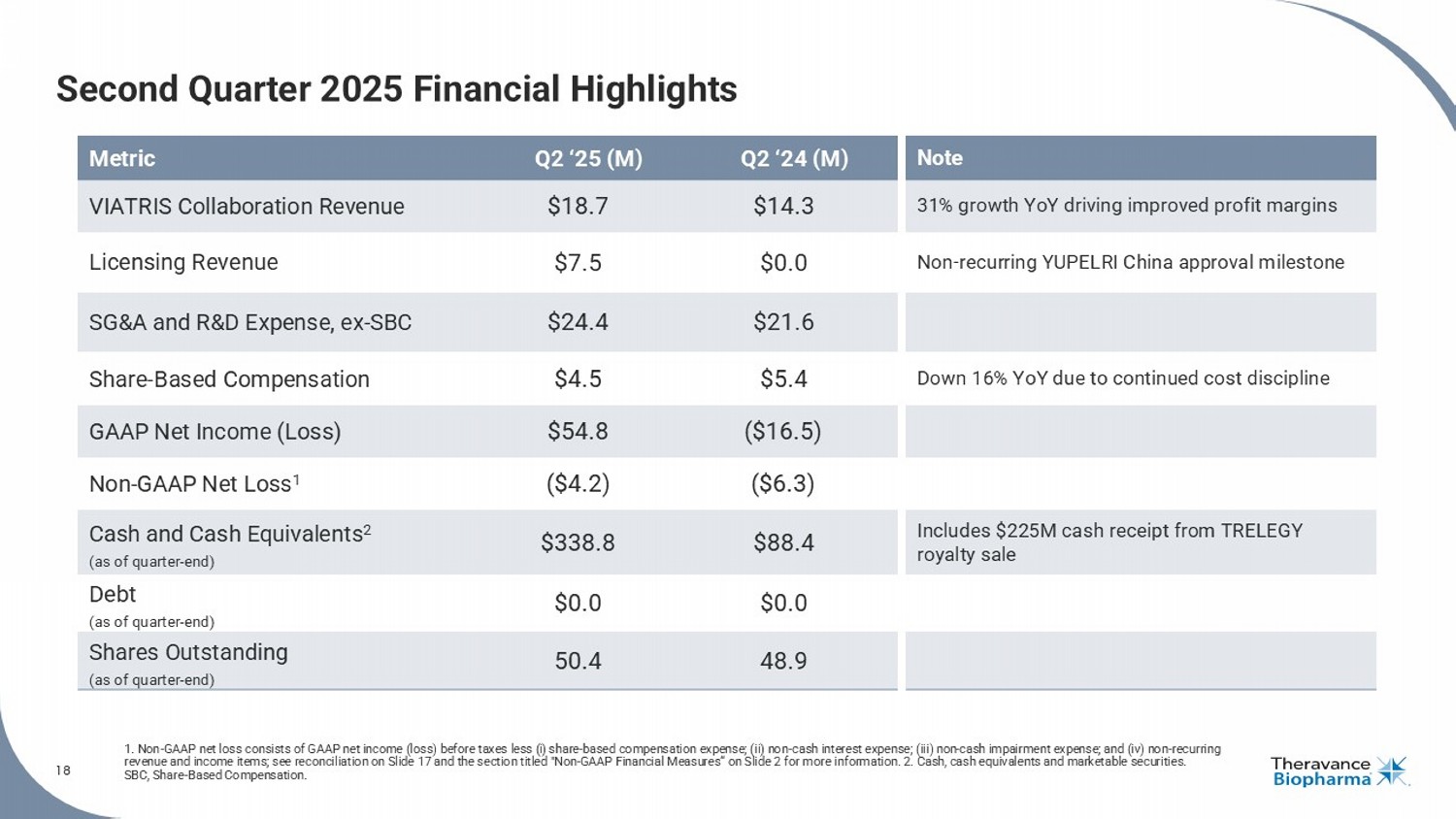

Second quarter Financial Results:

| · | Revenue: Total revenue for the second quarter of 2025 was $26.2 million, consisting of $18.7 million of Viatris collaboration revenue and $7.5 million of licensing revenue from YUPELRI’s regulatory approval in China. Viatris collaboration revenue increased by $4.4 million, or 31%, in the second quarter compared to the same period in 2024. The Viatris collaboration revenue represents amounts receivable from Viatris and comprises the Company’s 35% share of net sales of YUPELRI, as well as its proportionate amount of the total shared commercial costs incurred by the two companies. The non-shared YUPELRI costs incurred by Theravance Biopharma are recorded within operating expenses. While Viatris records the total net sales of YUPELRI within its financial statements, Theravance Biopharma’s implied 35% share of net sales of YUPELRI for the second quarter of 2025 was $23.2 million which represented a 22% increase compared to the same period in 2024. |

Page

| · | Research and Development (R&D) Expenses: R&D expenses for the second quarter of 2025 were $10.5 million, compared to $10.0 million in the same period in 2024. Second quarter R&D expenses included total non-cash share-based compensation of $1.0 million. |

| · | Selling, General and Administrative (SG&A) Expenses: SG&A expenses for the second quarter of 2025 were $18.4 million, compared to $17.1 million in the same period in 2024. Second quarter SG&A expenses included total non-cash share-based compensation of $3.5 million. |

| · | Share-Based Compensation: Share-based compensation expenses for the second quarter of 2025 were $4.5 million, compared to $5.4 million in the same period in 2024. Share-based compensation expenses consisted of $1.0 million for R&D and $3.5 million for SG&A in the second quarter of 2025, compared to $1.2 million and $4.2 million, respectively, in the same period in 2024. |

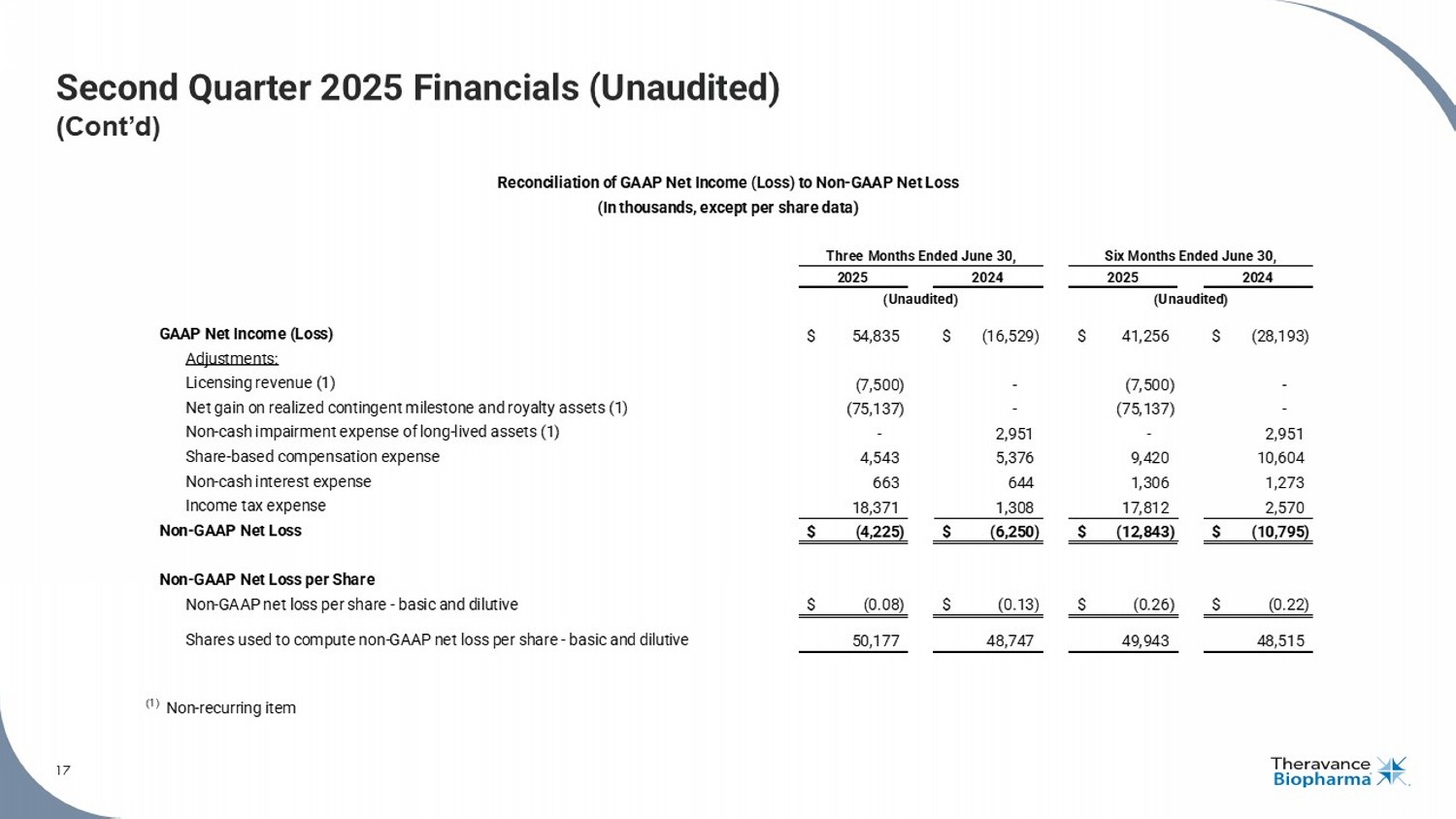

| · | Net Gain on Realized Contingent Milestone and Royalty Assets: Net gain on contingent milestone and royalty assets (representing the sale of our remaining interest in TRELEGY royalties) was $75.1 million. The net gain was based on sales proceeds of $225.0 million less our carrying value of TRELEGY’s contingent milestone and royalty assets of $144.2 million and less transaction costs of $5.7 million. |

| · | Income Taxes: Income tax expense for the second quarter of 2025 was $18.4 million, compared to $1.3 million in the same period in 2024. The increase was driven by the net gain on contingent milestone and royalty assets arising from the sale of our remaining interest in TRELEGY royalties. |

| · | Net Income (Loss) and Non-GAAP Net Loss from Operations4: Net income was $54.8 million in the second quarter of 2025 compared to a net loss of $16.5 million in the same period in 2024. Non-GAAP net loss from operations was $4.2 million in the second quarter 2025 compared to a non-GAAP net loss from operations of $6.3 million in the same period in 2024. See the section titled "Non-GAAP Financial Measures" for more information. |

| · | Cash Position: Cash, cash equivalents and marketable securities totaled $338.8 million as of June 30, 2025. |

4 Non-GAAP profit (loss) consists of GAAP net income (loss) before taxes less (i) share-based compensation expense, (ii) non-cash interest expense, (iii) non-cash impairment expense; and (iv) non-recurring revenue and income items. See the section titled "Non-GAAP Financial Measures" for more information.

Page

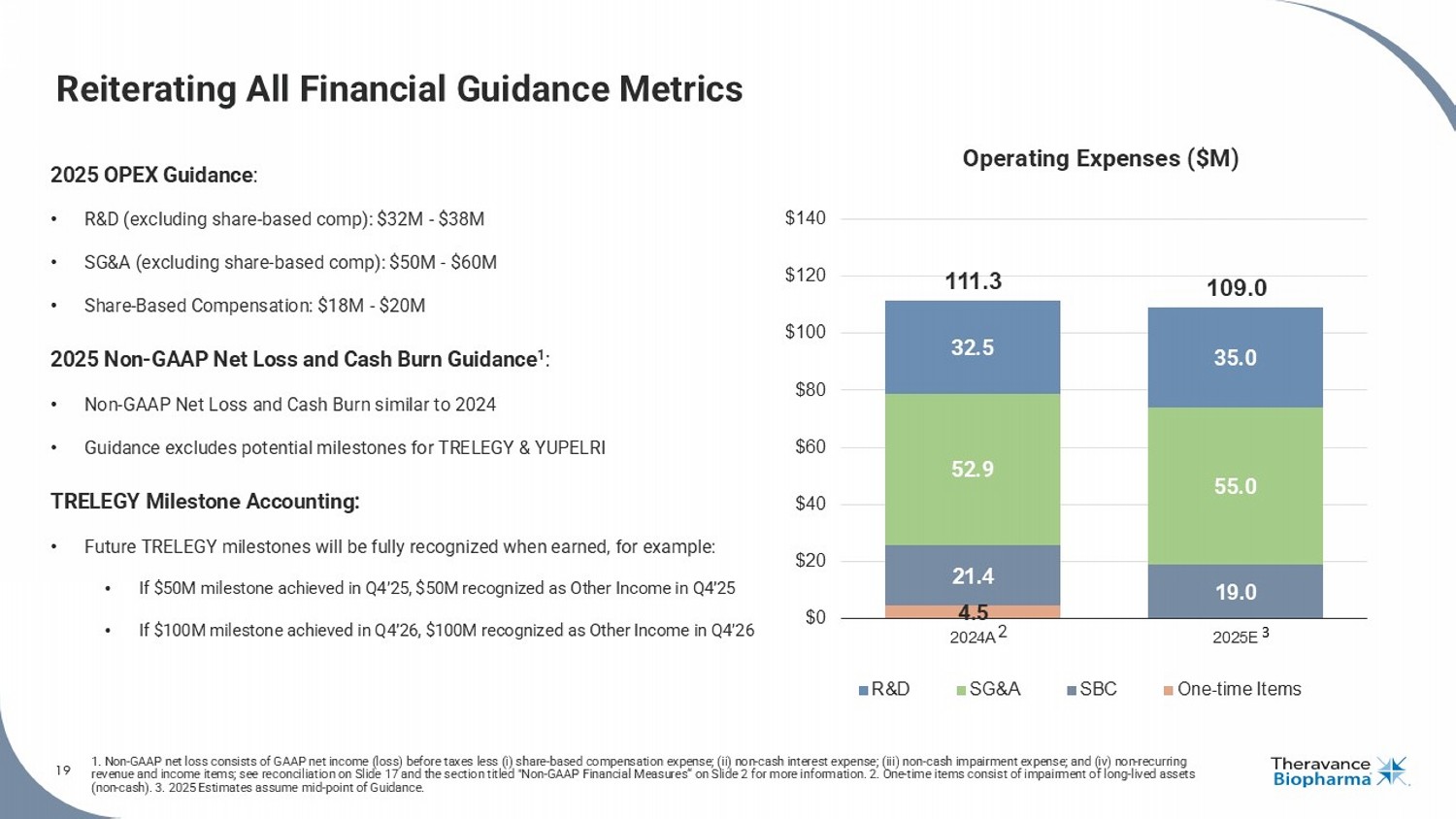

2025 Financial Guidance:

| · | Operating Expenses (excluding share-based compensation): The Company continues to expect full year 2025 R&D expenses of $32 million to $38 million and SG&A expenses of $50 million to $60 million, in each case excluding share-based compensation. |

| · | Share-Based Compensation: The Company continues to expect full year share-based compensation expenses of $18 million to $20 million. |

| · | Non-GAAP Net Income (Loss) from Operations and Cash Burn4: The Company continues to expect 2025 levels of Non-GAAP Net Income (Loss) from Operations and Cash Burn in 2025 to be similar to levels incurred in 2024. Both Non-GAAP Net Income (Loss) from Operations and Cash Burn guidance metrics exclude one-time, non-recurring Revenue and Income items incurred throughout 2025. |

Conference Call and Live Webcast Today at 5:00 pm ET

Theravance Biopharma will hold a conference call and live webcast accompanied by slides today at 5:00 pm ET / 2:00 pm PT / 9:00 pm GMT. To participate in the live call by telephone, please pre-register here. Those interested in listening to the conference call live via the internet may do so by clicking here or visiting the Events and Presentation page under the Investors Section on Theravance Biopharma’s website.

A replay of the webcast will be available on Theravance Biopharma’s website for 30 days through September 11, 2025.

About Ampreloxetine

Ampreloxetine, an investigational, once-daily, selective norepinephrine reuptake inhibitor in development for the treatment of symptomatic neurogenic orthostatic hypotension (nOH) in patients with multiple system atrophy (MSA). The unique benefits of ampreloxetine treatment reported in MSA patients from Study 0170 included an increase in norepinephrine levels, a favorable impact on blood pressure, clinically meaningful and durable symptom improvement, and no signal for worsening of supine hypertension. In the US, the Company has been granted an Orphan Drug Designation for ampreloxetine for the treatment of symptomatic nOH in patients with MSA and, if results from the ongoing Phase 3 CYPRESS study are supportive, plans to file an NDA for full approval in this indication.

Page

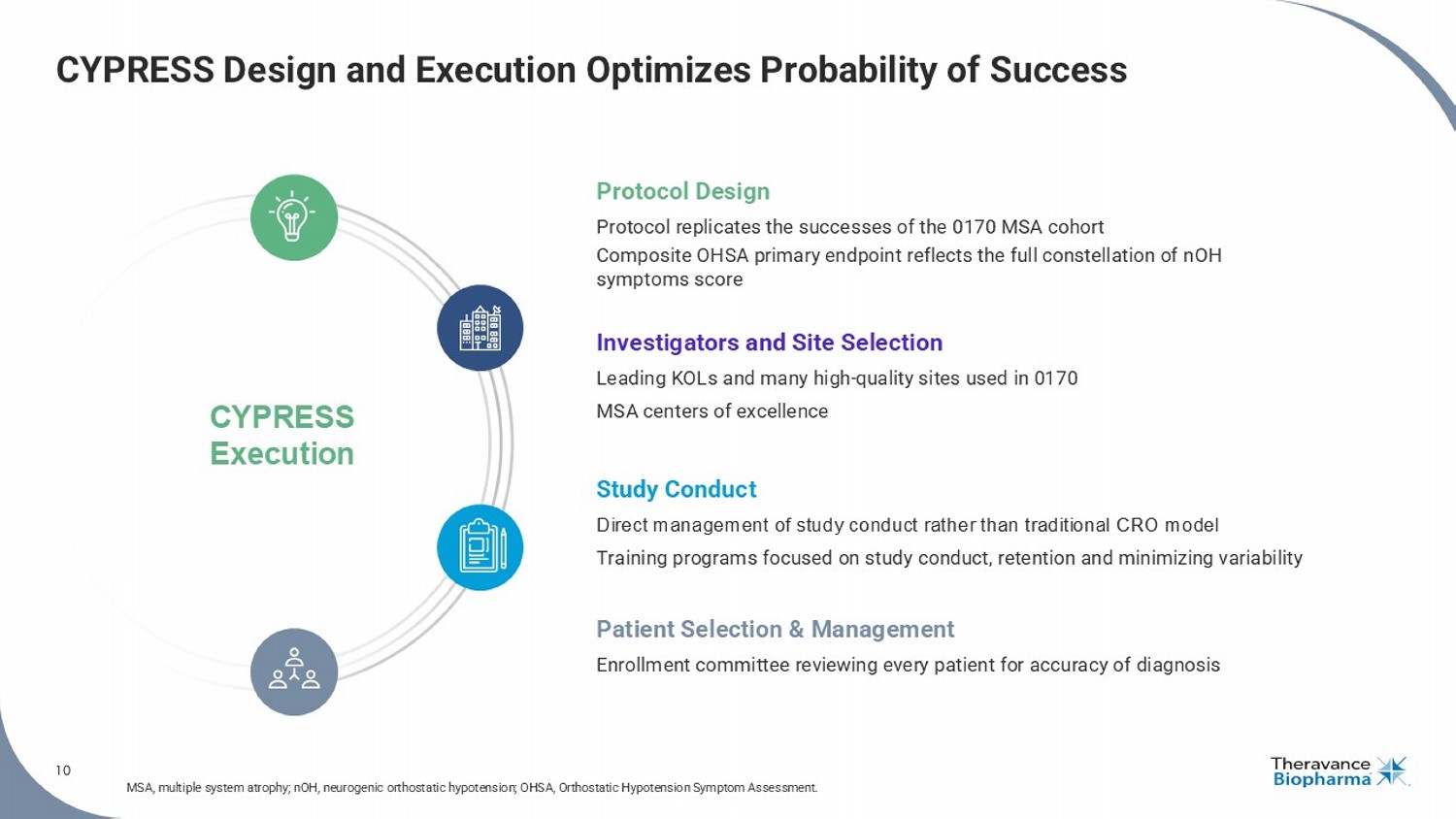

About CYPRESS (Study 0197), a Phase 3 Study

Study 0197 (NCT05696717) is currently enrolling. This is a registrational Phase 3, multi-center, randomized withdrawal study to evaluate the efficacy and durability of ampreloxetine in participants with MSA and symptomatic nOH after 20 weeks of treatment; the primary endpoint of the study is change in the Orthostatic Hypotension Symptom Assessment (OHSA) composite score. The Study includes four periods: screening, open label (12-week period, participants will receive a single daily 10 mg dose of ampreloxetine), randomized withdrawal (eight-week period, double-blind, placebo-controlled, participants will receive a single daily 10 mg dose of placebo or ampreloxetine), and a long-term treatment extension. Secondary outcome measures include change from baseline in Orthostatic Hypotension Daily Activity Scale (OHDAS) item 1 (activities that require standing for a short time) and item 3 (activities that require walking for a short time).

About Multiple System Atrophy (MSA) and Symptomatic Neurogenic Orthostatic Hypotension (nOH)

MSA is a progressive brain disorder that affects movement and balance and disrupts the function of the autonomic nervous system. The autonomic nervous system controls body functions that are mostly involuntary. One of the most frequent autonomic symptoms associated with MSA is a sudden drop in blood pressure upon standing (nOH).5 There are approximately 50,000 MSA patients in the US6 and 70-90% of MSA patients experience nOH symptoms.7 Despite available therapies, many MSA patients remain symptomatic with nOH.

Neurogenic orthostatic hypotension (nOH) is a rare disorder defined as a fall in systolic blood pressure of ≥ 20 mm Hg or diastolic blood pressure of ≥ 10 mm Hg, within 3 minutes of standing. Severely affected patients are unable to stand for more than a few seconds because of their decrease in blood pressure, leading to cerebral hypoperfusion and syncope. A debilitating condition, nOH results in a range of symptoms including dizziness, lightheadedness, fainting, fatigue, blurry vision, weakness, trouble concentrating, and head and neck pain.

About Theravance Biopharma

Theravance Biopharma, Inc.’s focus is to deliver Medicines that Make a Difference® in people’s lives. In pursuit of its purpose, Theravance Biopharma leverages decades of expertise, which has led to the development of FDA-approved YUPELRI® (revefenacin) inhalation solution indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD). Ampreloxetine, its late-stage investigational once-daily norepinephrine reuptake inhibitor in development for symptomatic neurogenic orthostatic hypotension (nOH) in patients with Multiple System Atrophy (MSA), has the potential to be a first in class therapy effective in treating a constellation of cardinal symptoms in MSA patients. The Company is committed to creating/driving shareholder value.

5 https://medlineplus.gov/genetics/condition/multiple-system-atrophy/

6 UCSD Neurological Institute (25K-75K, with ~10K new cases per year); NIH National Institute of Neurological Disorders and Stroke (15K-50K).

7 Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias (1999).

Page

For more information, please visit www.theravance.com.

THERAVANCE BIOPHARMA®, THERAVANCE® and the Cross/Star logo are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries).

YUPELRI® is a registered trademark of Viatris Specialty LLC. Trademarks, trade names or service marks of other companies appearing on this press release are the property of their respective owners.

Forward-Looking Statements

This press release will contain certain "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, statements relating to goals, plans, objectives, expectations and future events. Theravance Biopharma, Inc. (the “Company”) intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Examples of such statements include statements relating to: the Company’s expectations regarding its future profitability, expenses and uses of cash, the Company’s goals, designs, strategies, plans and objectives, future growth of YUPELRI sales, future milestone or royalty payments, the ability to provide value to shareholders, the Company’s regulatory strategies and timing of clinical studies, the safety, efficacy or differentiation of our investigational therapy, the status of patent infringement litigation initiated by the Company and its partner against certain generic companies in federal district courts; , and expectations around the use of OHSA scores as endpoints for clinical trials. These statements are based on the current estimates and assumptions of the management of Theravance Biopharma as of the date of this press release and the conference call and are subject to risks, uncertainties, changes in circumstances, assumptions and other factors that may cause the actual results of Theravance Biopharma to be materially different from those reflected in the forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, among others, risks related to: factors that could increase the Company’s cash requirements or expenses beyond its expectations and any factors that could adversely affect its profitability, whether the milestone thresholds can be achieved, delays or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non-clinical studies indicate the Company’s product candidates or product are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporting infrastructure, the ability of the Company to protect and to enforce its intellectual property rights, volatility and fluctuations in the trading price and volume of the Company’s shares, and general economic and market conditions. Other risks affecting the Company are in the Company’s Form 10-Q filed with the SEC on May 12, 2025, and other periodic reports filed with the SEC. In addition to the risks described above and in Theravance Biopharma's filings with the SEC, other unknown or unpredictable factors also could affect Theravance Biopharma’s results. No forward-looking statements can be guaranteed, and actual results may differ materially from such statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Theravance Biopharma assumes no obligation to update its forward-looking statements on account of new information, future events or otherwise, except as required by law.

Page

Non-GAAP Financial Measures

Theravance Biopharma provides a non-GAAP profitability target and a non-GAAP metric in this press release. Theravance Biopharma believes that the non-GAAP profitability target and non-GAAP net income (loss) provide meaningful information to assist investors in assessing prospects for future performance and actual performance as they provide better metrics for analyzing the performance of its business by excluding items that may not be indicative of core operating results and the Company's cash position. Because non-GAAP financial targets and metrics, such as non-GAAP profitability and non-GAAP net loss, are not standardized, it may not be possible to compare these measures with other companies' non-GAAP targets or measures having the same or a similar name. Thus, Theravance Biopharma's non-GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the Company's actual GAAP results and other targets.

Please see the appendix attached to this press release for a reconciliation of non-GAAP net loss to its corresponding measure, net income (loss). A reconciliation of non-GAAP net loss to its corresponding GAAP measure is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future.

Contact:

investor.relations@theravance.com

650-808-4045

Page

THERAVANCE BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| June 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (1) | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents and short-term marketable securities | $ | 338,804 | $ | 88,350 | ||||

| Receivables from collaborative arrangements | 21,919 | 18,440 | ||||||

| Receivables from milestone and royalty assets | - | 50,000 | ||||||

| Other prepaid and current assets | 5,571 | 4,277 | ||||||

| Total current assets | 366,294 | 161,067 | ||||||

| Property and equipment, net | 6,641 | 7,418 | ||||||

| Operating lease assets | 26,493 | 28,354 | ||||||

| Future contingent milestone and royalty assets | - | 144,200 | ||||||

| Restricted cash | 836 | 836 | ||||||

| Other assets | 25,771 | 12,286 | ||||||

| Total assets | $ | 426,035 | $ | 354,161 | ||||

| Liabilities and Shareholders' Equity | ||||||||

| Income tax payable | $ | 26,696 | $ | 5,853 | ||||

| Other current liabilities | 27,937 | 26,232 | ||||||

| Total current liabilities | 54,633 | 32,085 | ||||||

| Long-term operating lease liabilities | 35,561 | 39,108 | ||||||

| Future royalty payment contingency | 31,640 | 30,334 | ||||||

| Unrecognized tax benefits | 77,805 | 75,199 | ||||||

| Other long-term liabilities | 1,548 | 1,890 | ||||||

| Shareholders' equity | 224,848 | 175,545 | ||||||

| Total liabilities and shareholders’ equity | $ | 426,035 | $ | 354,161 | ||||

(1) The condensed consolidated balance sheet as of December 31, 2024 has been derived from the audited consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2024.

Page

THERAVANCE BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Revenue: | ||||||||||||||||

| Viatris collaboration agreement (1) | $ | 18,695 | $ | 14,256 | $ | 34,083 | $ | 28,759 | ||||||||

| Licensing revenue | 7,500 | - | 7,500 | - | ||||||||||||

| Total revenue | 26,195 | 14,256 | 41,583 | 28,759 | ||||||||||||

| Costs and expenses: | ||||||||||||||||

| Research and development (2) | 10,490 | 9,954 | 21,942 | 18,922 | ||||||||||||

| Selling, general and administrative (2) | 18,430 | 17,056 | 36,800 | 33,798 | ||||||||||||

| Impairment of long-lived assets (non-cash) | - | 2,951 | - | 2,951 | ||||||||||||

| Total costs and expenses | 28,920 | 29,961 | 58,742 | 55,671 | ||||||||||||

| Loss from operations | (2,725 | ) | (15,705 | ) | (17,159 | ) | (26,912 | ) | ||||||||

| Net gain on realized contingent milestone and royalty assets | 75,137 | - | 75,137 | - | ||||||||||||

| Interest expense (non-cash) | (663 | ) | (644 | ) | (1,306 | ) | (1,273 | ) | ||||||||

| Interest income and other income, net | 1,457 | 1,128 | 2,396 | 2,562 | ||||||||||||

| Loss before income taxes | 73,206 | (15,221 | ) | 59,068 | (25,623 | ) | ||||||||||

| Provision for income tax expense | (18,371 | ) | (1,308 | ) | (17,812 | ) | (2,570 | ) | ||||||||

| Net income (loss) | $ | 54,835 | $ | (16,529 | ) | $ | 41,256 | $ | (28,193 | ) | ||||||

| Net income (loss) per share: | ||||||||||||||||

| Net income (loss) per share - basic | $ | 1.09 | $ | (0.34 | ) | $ | 0.83 | $ | (0.58 | ) | ||||||

| Net income (loss) per share - diluted | $ | 1.08 | $ | (0.34 | ) | $ | 0.81 | $ | (0.58 | ) | ||||||

| Shares used to compute net income (loss) per share - basis | 50,177 | 48,747 | 49,943 | 48,515 | ||||||||||||

| Shares used to compute net income (loss) per share - diluted | 50,726 | 48,747 | 50,685 | 48,515 | ||||||||||||

| Non-GAAP net loss | $ | (4,225 | ) | $ | (6,250 | ) | $ | (12,843 | ) | $ | (10,795 | ) | ||||

(1) While Viatris, Inc. records the total YUPELRI net sales, the Company is entitled to a 35% share of the net profit (loss) pursuant to a co-promotion agreement with Viatris as presented below:

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (In thousands) | 2025 | 2024 | 2025 | 2024 | ||||||||||||

| YUPELRI net sales (100% recorded by Viatris) | $ | 66,330 | $ | 54,530 | $ | 124,674 | $ | 109,756 | ||||||||

| YUPELRI net sales (Theravance Biopharma implied 35%) | 23,216 | 19,085 | 43,636 | 38,415 | ||||||||||||

(2) Amounts include share-based compensation expense as follows:

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (In thousands) | 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Research and development | $ | 987 | $ | 1,151 | $ | 2,057 | $ | 2,616 | ||||||||

| Selling, general and administrative | 3,556 | 4,225 | 7,363 | 7,988 | ||||||||||||

| Total share-based compensation expense | $ | 4,543 | $ | 5,376 | $ | 9,420 | $ | 10,604 | ||||||||

Page

THERAVANCE BIOPHARMA, INC.

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Net Loss

(In thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| GAAP net income (loss) | $ | 54,835 | $ | (16,529 | ) | $ | 41,256 | $ | (28,193 | ) | ||||||

| Adjustments: | ||||||||||||||||

| Licensing revenue (1) | (7,500 | ) | - | (7,500 | ) | - | ||||||||||

| Net gain on realized contingent milestone and royalty assets (1) | (75,137 | ) | - | (75,137 | ) | - | ||||||||||

| Non-cash impairment expense of long-lived assets (1) | - | 2,951 | - | 2,951 | ||||||||||||

| Share-based compensation expense | 4,543 | 5,376 | 9,420 | 10,604 | ||||||||||||

| Non-cash interest expense | 663 | 644 | 1,306 | 1,273 | ||||||||||||

| Income tax expense | 18,371 | 1,308 | 17,812 | 2,570 | ||||||||||||

| Non-GAAP net loss | $ | (4,225 | ) | $ | (6,250 | ) | $ | (12,843 | ) | $ | (10,795 | ) | ||||

(1) Non-recurring item

Page

Exhibit 99.2

THERAVANCE BIOPHARMA ® , THERAVANCE ® , the Cross/Star logo and MEDICINES THAT MAKE A DIFFERENCE ® are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries). All third - party trademarks used herein are the property of their respective owners. © 2025 Theravance Biopharma. All rights reserved.

Theravance Biopharma Second Quarter 2025 Financial Results and Business Update August 12 , 2025 2 Forward Looking Statements This presentation contains certain "forward - looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, statements relating to goals, plans, objectives, expectations and future events . Theravance Biopharma, Inc . (the “Company”) intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . Examples of such statements include statements relating to : the Company’s expectations regarding its future profitability, expenses and uses of cash, the Company’s goals, designs, strategies, plans and objectives, future growth of YUPELRI sales, the ability to provide value to shareholders, the Company’s regulatory strategies and timing of clinical studies, possible safety, efficacy or differentiation of our investigational therapy, the status of patent infringement litigation initiated by the Company and its partner against certain generic companies in federal district courts ; contingent Trelegy sales - based milestones payable by Royalty Pharma, and expectations around the use of OHSA scores as endpoints for clinical trials . These statements are based on the current estimates and assumptions of the management of Theravance Biopharma as of the date of this presentation and the conference call and are subject to risks, uncertainties, changes in circumstances, assumptions and other factors that may cause the actual results of Theravance Biopharma to be materially different from those reflected in the forward - looking statements . Important factors that could cause actual results to differ materially from those indicated by such forward - looking statements include, among others, risks related to : factors that could increase the Company’s cash requirements or expenses beyond its expectations and any factors that could adversely affect its profitability, whether the milestone thresholds can be achieved, delays or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non - clinical studies indicate the Company’s product candidates or product are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporting infrastructure, the ability of the Company to protect and to enforce its intellectual property rights, volatility and fluctuations in the trading price and volume of the Company’s shares, and general economic and market conditions . Other risks affecting the Company are in the Company’s Form 10 - Q filed with the SEC on May 12 , 2025 , and other periodic reports filed with the SEC . In addition to the risks described above and in Theravance Biopharma's filings with the SEC, other unknown or unpredictable factors also could affect Theravance Biopharma’s results . No forward - looking statements can be guaranteed, and actual results may differ materially from such statements . Given these uncertainties, you should not place undue reliance on these forward - looking statements . Theravance Biopharma assumes no obligation to update its forward - looking statements on account of new information, future events or otherwise, except as required by law . Non - GAAP Financial Measures Theravance Biopharma provides a non - GAAP profitability target and a non - GAAP metric in this presentation . Theravance Biopharma believes that the non - GAAP profitability target and non - GAAP net income (loss) provide meaningful information to assist investors in assessing prospects for future performance and actual performance as they provide better metrics for analyzing the performance of its business by excluding items that may not be indicative of core operating results and the Company's cash position . Because non - GAAP financial targets and metrics, such as non - GAAP profitability and non - GAAP net income (loss) are not standardized, it may not be possible to compare these measures with other companies' non - GAAP targets or measures having the same or a similar name . Thus, Theravance Biopharma's non - GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the Company's actual GAAP results and other targets . This presentation contains a reconciliation of non - GAAP net income (loss) to its corresponding measure, net income (loss) . A reconciliation of non - GAAP net income (loss) to its corresponding GAAP measure is not available on a forward - looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future .

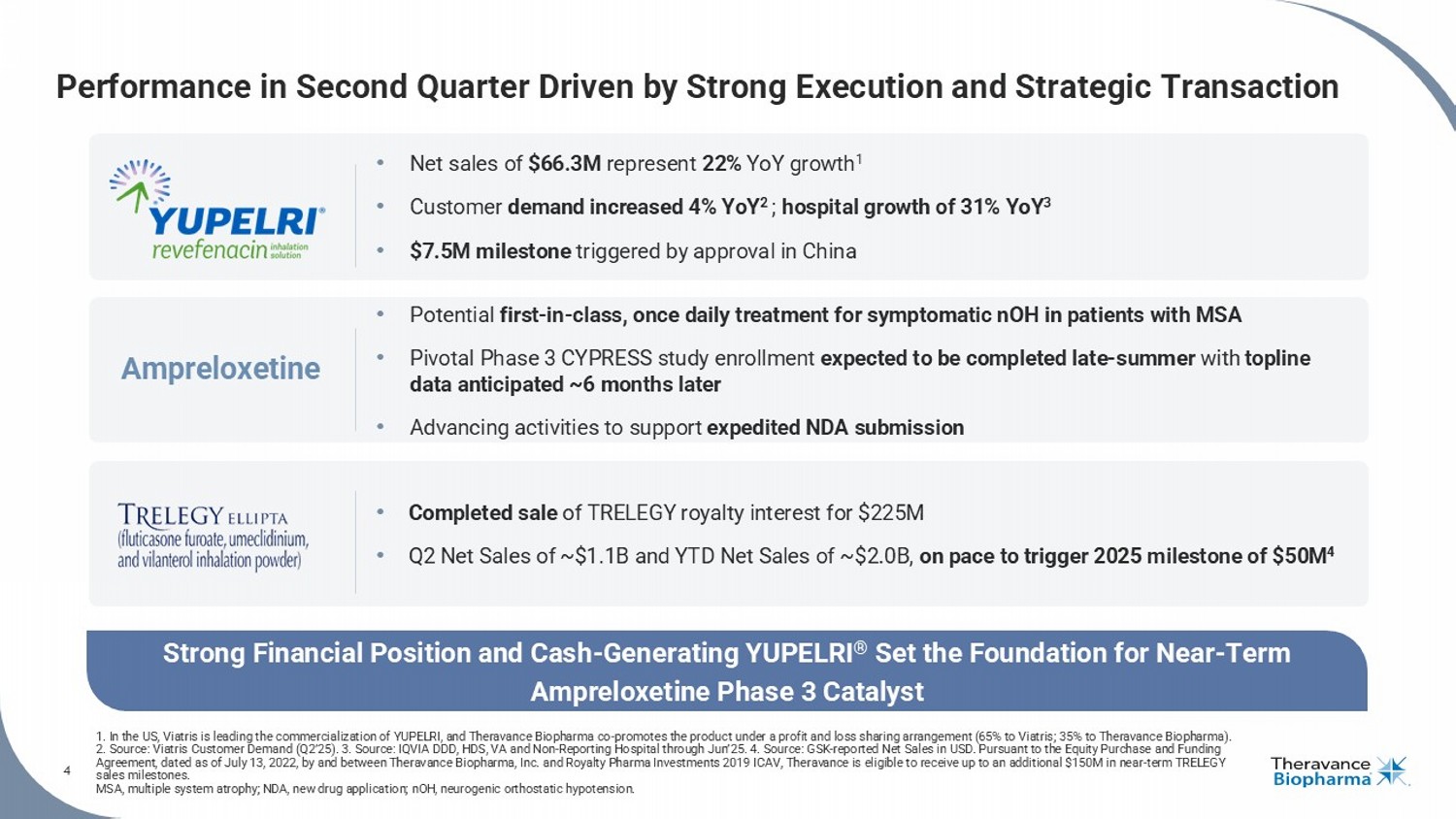

3 Agenda Opening & Closing Remarks Rick Winningham : Chief Executive Officer Commercial Updates Rhonda Farnum: Senior Vice President, Chief Business Officer TRELEGY & Financial Updates Aziz Sawaf: Senior Vice President, Chief Financial Officer Q&A Team Development & Regulatory Updates Dr. Áine Miller: Senior Vice President, Development 4 Strong Financial Position and Cash - Generating YUPELRI ® Set the Foundation for Near - Term Ampreloxetine Phase 3 Catalyst Performance in Second Quarter Driven by Strong Execution and Strategic Transaction 1.

In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing a rrangement (65% to Viatris ; 35% to Theravance Biopharma). 2. Source: Viatris Customer Demand (Q2’25). 3. Source: IQVIA DDD, HDS, VA and Non - Reporting Hospital through Jun’25. 4. Source: GSK - reported Net S ales in USD. Pursuant to the Equity Purchase and Funding Agreement, dated as of July 13, 2022, by and between Theravance Biopharma, Inc. and Royalty Pharma Investments 2019 ICAV, The rav ance is eligible to receive up to an additional $150M in near - term TRELEGY sales milestones. MSA, multiple system atrophy; NDA, new drug application; nOH , neurogenic orthostatic hypotension. 4 • Net sales of $66.3M represent 22% YoY growth 1 • Customer demand increased 4% YoY 2 ; hospital growth of 31 % YoY 3 • $7.5M milestone triggered by approval in China Ampreloxetine • Potential first - in - class, once daily treatment for symptomatic nOH in patients with MSA • Pivotal Phase 3 CYPRESS study enrollment expected to be completed late - summer with topline data anticipated ~6 months later • Advancing activities to support expedited NDA submission • Completed sale of TRELEGY royalty interest for $225M • Q2 Net Sales of ~$1.1B and YTD Net Sales of ~$2.0B, on pace to trigger 2025 milestone of $ 50 M 4 The Only Once - Daily, Nebulized LAMA Maintenance Medicine for COPD Co - promotion agreement with VIATRIS TM (35% / 65% Profit Share) Rhonda Farnum Senior Vice President, Chief Business Officer COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist.

6 Continued Year - over - Year YUPELRI ® Net Sales Growth in the US In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). Net sales increased 22% Q2 ’25 / Q2 ’24 Total YUPELRI Net Sales ($M) $55.1 $142.8 $161.9 $201.9 $221.0 $238.6 0 50 100 150 200 250 2019 2020 2021 2022 2023 2024 Quarterly YUPELRI Net Sales (2023 to Present) $47.0 $55.0 $58.3 $60.6 $55.2 $54.5 $62.2 $66.7 $58.3 $66.3 0 10 20 30 40 50 60 70 80 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Annual YUPELRI Net Sales 7 Substantial Growth Potential for YUPELRI ® 1.

Joint VTRS/TBPH Market Research. 2. Addressable patient population quantifies the number of patients within the intended t arg et profile. Source: Joint VTRS/TBPH Market Research. 3. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arran gement (65% to Viatris ; 35% to Theravance Biopharma). 4. As of 6/30/25, Theravance Biopharma is eligible to receive from Viatris potential global development, regulatory and sales milestone payments (excluding China and adjacent territories) totaling up to $205.0 million in the aggregate; refer to our SEC filings for further information. LABA, long - acting beta agonist; LAMA, long - acting muscarinic antagonist. Profitable Brand, Expanding Margins and Strong IP Growth in Q2 2025 Continued Opportunity • Theravance receives 35% of U.S. profits 3 • $25M milestone for 1st year in which US net sales > $250M 4 ; achievement requires 5% growth from 2024 • IP protection in the U.S. into 2039 • Q2 2025 U.S. net sales of $66.3M up 22% vs. Q2 2024 • Benefited from one - time favorable adjustment to price; excluding benefit, growth of mid - teens • Hospital doses growth of 31% vs Q2 2024; new market share high of 20.4% • Hospital setting serves as key point of initiation; majority of patients receive script at discharge 1 • Sizable addressable patient population remains 2 • Increasing adoption of concomitant use with LAMA/LABA and switches from handheld - only regimens • Success in further diversification of product fulfillment • YUPELRI approval in China triggered $7.5M milestone and potential 14 - 20% tiered royalties The first once - daily, selective norepinephrine reuptake inhibitor in development to treat symptomatic neurogenic orthostatic hypotension ( nOH ) in patients with multiple system atrophy (MSA) Dr. Áine Miller Senior Vice President, Development AMPRELOXETINE

9 Ampreloxetine Intended to Target Underlying Physiology of nOH in Patients with MSA 1. Norcliffe - Kaufmann L, Kaufmann H, Palma JA, et al. Orthostatic heart rate changes in patients with autonomic failure caused b y neurodegenerative synucleinopathies . Ann Neurol 2018;83:522 - 531. 2. Reflects Theravance Biopharma's expectations for ampreloxetine based on data collected to date. Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. Date on file.

MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension MSA LESIONS SYMPATHETIC GANGLION BRAIN INTACT PERIPHERAL NERVE VASOCONSTRICTED BLOOD VESSEL FUNCTIONING NEUROVASCULAR JUNCTION AMPRELOXETINE Patients with MSA typically have spared peripheral autonomic neurons 1 Ampreloxetine intended to increase norepinephrine (NE) levels 2 and harnesses the spared peripheral autonomic neurons Increased NE levels typically improve blood pressure and and alleviate symptoms 1 2 3 10 CYPRESS Design and Execution Optimizes Probability of Success Protocol Design Protocol replicates the successes of the 0170 MSA cohort Composite OHSA primary endpoint reflects the full constellation of nOH symptoms score Investigators and Site Selection Leading KOLs and many high - quality sites used in 0170 MSA centers of excellence Study Conduct Direct management of study conduct rather than traditional CRO model Training programs focused on study conduct, retention and minimizing variability Patient Selection & Management Enrollment committee reviewing every patient for accuracy of diagnosis CYPRESS Execution MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHSA, Orthostatic Hypotension Symptom Assessment. 1 2 11 Positioned to Capitalize Rapidly Upon Potential Positive Readout from Pivotal Phase 3 CYPRESS Trial NDA, new drug application.

If positive, incorporate CYPRESS data into NDA and request priority review Plan in place to support successful launch Alignment with FDA achieved; NDA preparations underway NDA Readiness On track to complete enrollment in late summer P3 CYPRESS Enrollment Completion Topline readout anticipated ~6 months following completion of enrollment Topline Data Readout Expedited NDA Filling Commercial readiness 12 Significant Commercial Opportunity for Ampreloxetine 1.

Data from NYU Langone MSA Natural History Statistics, NYU September 2019. 2. Reflects Theravance Biopharma's expectations for ampreloxetine . Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. Data on file. 3. Kalra DK, et al. Clin Med Insights: Cardiol . 2020 (70% - 90%);14:1179546820953415. 4. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mat hias (1999). MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHSA, Orthostatic Hypotension Symptom Assessment. MSA is underdiagnosed and often misdiagnosed ~80% of MSA patients with symptomatic nOH 3,4 ~40K with symptomatic nOH ~50K Patients with MSA Addressable Patient Population Despite treatment with available therapies, 65% of patients with nOH associated with MSA remain symptomatic 1 Droxidopa Midodrine Ampreloxetine (investigational) 2 Symptomatic nOH Symptomatic OH Symptomatic nOH in patients with MSA Indication OHSA Item #1 Increase in systolic blood pressure OHSA Composite Score Efficacy - Primary Endpoint Effectiveness beyond 2 weeks has not been established Effectiveness not studied beyond 3 - 4 weeks 20 weeks (CYPRESS Study Design) Durability of response 3x/day Requires titration 3x/day 1x/day No titration or dose adjustment Dosing Boxed warning for increased risk of supine hypertension No worsening of supine hypertension observed in clinical studies to date Safety Current Treatment Landscape The above present factual information gathered from approved product prescribing information and are not intended to make com par isons of available therapies and investigational drug as there are no head - to - head comparative studies or data supporting any such com parisons.

The First And Only Once - Daily Triple Therapy In a Single Inhaler For Adult Patients With COPD Or Asthma Milestones from Royalty Pharma Aziz Sawaf Senior Vice President, Chief Financial Officer GSK’s TRELEGY COPD, chronic obstructive pulmonary disease 14 On Pace to Achieve $150M in TRELEGY Sales Milestones in 2025 and 2026 Q2’25 Net Sales of $1.1B and YTD Net Sales of $2.0B, up 8% YoY 1.

If both milestones are achieved in a given year, Theravance Biopharma will only earn the higher milestone, payable by Royalty Pharma (RP) pursuant to the Equity Purchase and Funding Agr ee ment, dated as of July 13, 2022, by and between Theravance Biopharma, Inc. and Royalty Pharma Investments 2019 ICAV. 2. Based on 100% of TRELEGY ELLIPTA royalties. 3. GSK - reported Net Sa les in USD. 4. Bloomberg Consensus as of 8/11/25. Milestone to Theravance Royalty Threshold 2 Global Net Sales Equivalent Year $25M $260M $3,063M 2025 1 $50M $295M $3,413M $50M $270M $3,163M 2026 1 $100M $305M $3,513M 2025 and 202 6 Sales Milestones 1 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2021 2022 2023 2024 2025 E 2026 E Consensus Forecast 4 Actuals 3 Net Sales ($M) $50M $25M $100M $50M $1,674 $2,142 $2,739 $3,456 $3,892 $4,082 28% growth 28% growth Strong TRELEGY Global Net Sales Growth ($M) 26% growth Financial Update Aziz Sawaf Senior Vice President, Chief Financial Officer

16 Second Quarter 2025 Financials (Unaudited) 1. Amounts include share - based compensation. 2. Non - GAAP net loss consists of GAAP net income (loss) before taxes excluding (i) share - based compensation expense; (ii) non - cash interest expense; (iii) non - cash impairment expense; and (iv) non - recurring revenue and income items; see reconciliation on Slide 17 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for more information. 16 ($, in thousands) Revenue: Viatris collaboration agreement $ 18,695 $ 14,256 $ 34,083 $ 28,759 Licensing revenue 7,500 - 7,500 - Total revenue 26,195 14,256 41,583 28,759 Costs and expenses: Research and development (1) 10,490 9,954 21,942 18,922 Selling, general and administrative (1) 18,430 17,056 36,800 33,798 Impairment of long-lived assets (non-cash) - 2,951 - 2,951 Total costs and expenses 28,920 29,961 58,742 55,671 Loss from operations (before tax and other income & expense) $ (2,725) $ (15,705) $ (17,159) $ (26,912) Share-based compensation expense: Research and development 987 1,151 2,057 2,616 Selling, general and administrative 3,556 4,225 7,363 7,988 Total share-based compensation expense 4,543 5,376 9,420 10,604 Operating expense excl. share-based compensation: R&D operating expense (excl. share-based compensation) 9,503 8,803 19,885 16,306 SG&A operating expense (excl. share-based compensation) 14,874 12,831 29,437 25,810 Total operating expenses excl. share-based compensation $ 24,377 $ 21,634 $ 49,322 $ 42,116 Non-GAAP net loss (2) $ (4,225) $ (6,250) $ (12,843) $ (10,795) Three Months Ended June 30, 2025 2024 (Unaudited) Six Months Ended June 30, 2025 2024 (Unaudited)

17 Second Quarter 2025 Financials (Unaudited) (Cont’d) 17 See the section titled "Non - GAAP Financial Measures" on Slide 2 for more information. GAAP Net Income (Loss) $ 54,835 $ (16,529) $ 41,256 $ (28,193) Adjustments: Licensing revenue (1) (7,500) - (7,500) - Net gain on realized contingent milestone and royalty assets (1) (75,137) - (75,137) - Non-cash impairment expense of long-lived assets (1) - 2,951 - 2,951 Share-based compensation expense 4,543 5,376 9,420 10,604 Non-cash interest expense 663 644 1,306 1,273 Income tax expense 18,371 1,308 17,812 2,570 Non-GAAP Net Loss $ (4,225) $ (6,250) $ (12,843) $ (10,795) Non-GAAP Net Loss per Share Non-GAAP net loss per share - basic and dilutive $ (0.08) $ (0.13) $ (0.26) $ (0.22) Shares used to compute non-GAAP net loss per share - basic and dilutive 50,177 48,747 49,943 48,515 (1) Non-recurring item (Unaudited) Reconciliation of GAAP Net Income (Loss) to Non-GAAP Net Loss (In thousands, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 (Unaudited)

18 Second Quarter 2025 Financial Highlights 1. Non - GAAP net loss consists of GAAP net income (loss) before taxes less ( i ) share - based compensation expense; (ii) non - cash interest expense; (iii) non - cash impairment expense; and (iv) non - recurring revenue and income items; see reconciliation on Slide 17 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for mor e information. 2. Cash, cash equivalents and marketable securities. SBC, Share - Based Compensation. Note Q2 ‘24 (M) Q2 ‘25 (M) Metric 31% growth YoY driving improved profit margins $14.3 $18.7 VIATRIS Collaboration Revenue Non - recurring YUPELRI China approval milestone $0.0 $7.5 Licensing Revenue $21.6 $24.4 SG&A and R&D Expense, ex - SBC Down 16% YoY due to continued cost discipline $5.4 $4.5 Share - Based Compensation ($16.5) $54.8 GAAP Net Income (Loss) ($6.3) ($4.2) Non - GAAP Net Loss 1 Includes $225M cash receipt from TRELEGY royalty sale $88.4 $338.8 Cash and Cash Equivalents 2 (as of quarter - end) $0.0 $0.0 Debt (as of quarter - end) 48.9 50.4 Shares Outstanding (as of quarter - end)

19 1. Non - GAAP net loss consists of GAAP net income (loss) before taxes less ( i ) share - based compensation expense; (ii) non - cash interest expense; (iii) non - cash impairment expense; and (iv) non - recurring revenue and income items; see reconciliation on Slide 17 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for mor e information. 2. One - time items consist of impairment of long - lived assets (non - cash). 3. 2025 Estimates assume mid - point of Guidance. Reiterating All Financial Guidance Metrics 2025 OPEX Guidance : • R&D (excluding share - based comp): $32M - $38M • SG&A (excluding share - based comp): $50M - $60M • Share - Based Compensation: $18M - $20M 2025 Non - GAAP Net Loss and Cash Burn Guidance 1 : • Non - GAAP Net Loss and Cash Burn similar to 2024 • Guidance excludes potential milestones for TRELEGY & YUPELRI TRELEGY Milestone Accounting: • Future TRELEGY milestones will be fully recognized when earned, for example: • If $50M milestone achieved in Q4’25, $50M recognized as Other Income in Q4’25 • If $100M milestone achieved in Q4’26, $100M recognized as Other Income in Q4’26 4.5 21.4 19.0 52.9 55.0 32.5 35.0 111.3 109.0 $0 $20 $40 $60 $80 $100 $120 $140 2024A 2025E R&D SG&A SBC One-time Items 3 Operating Expenses ($M) 2 20 Strong Financial Position and Cash - Generating YUPELRI ® Set the Foundation for Near - Term Ampreloxetine Phase 3 Catalyst 1.

Kalra DK, et al. Clin Med Insights: Cardiol . 2020 (70% - 90%);14:1179546820953415. 2. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias (1999). 3. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). Refer to our SEC filings for further information. 4. Sources: Citeline Pharma Custom Intelligence Primary Research April 2023, Symphony Health METYS Prescription Dashboard, SolutionsRx Med B FFS. 5. Cash burn guidance excludes potential one - time milestones (and associated taxes) 6. Payments from Royalty Pharma (RP) will be triggered if RP receives certain minimum royalty payments from GSK based on TRELEGY global net sales. MSA, multiple system atrophy ; nOH, neurogenic orthostatic hypotension. • ~$340M in cash with limited cash burn 5 anticipated • Up to $175M in high probability TRELEGY 6 and YUPELRI sales - based milestones • Commitment to return excess capital to shareholders • On track to achieve net sales of $250M that will trigger $25 million milestone payment 3 • Significant growth potential with remaining addressable patient population 4 • 14 - 20% potential future royalties on China Sales • Expect completion of Ph3 CYPRESS enrollment by late summer • T opline data to follow ~6 months later • 100% owned ; FDA Orphan Drug Designation • Targets ~40,000 underserved patients with symptomatic nOH due to MSA 1,2 Ampreloxetine Upcoming Phase 3 Data Continued YUPELRI Growth Robust Financial Position Rick Winningham Chief Executive Officer Aziz Sawaf, CFA Senior Vice President, Chief Financial Officer Rhonda Farnum Senior Vice President, Chief Business Officer Áine Miller Senior Vice President, Development Q&A Session

22 YUPELRI ® (revefenacin) Inhalation Solution YUPELRI ® inhalation solution is indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD) . Important Safety Information (US) YUPELRI is contraindicated in patients with hypersensitivity to revefenacin or any component of this product . YUPELRI should not be initiated in patients during acutely deteriorating or potentially life - threatening episodes of COPD, or for the relief of acute symptoms, i . e . , as rescue therapy for the treatment of acute episodes of bronchospasm . Acute symptoms should be treated with an inhaled short - acting beta 2 - agonist . As with other inhaled medicines, YUPELRI can produce paradoxical bronchospasm that may be life - threatening . If paradoxical bronchospasm occurs following dosing with YUPELRI, it should be treated immediately with an inhaled, short - acting bronchodilator . YUPELRI should be discontinued immediately and alternative therapy should be instituted . YUPELRI should be used with caution in patients with narrow - angle glaucoma . Patients should be instructed to immediately consult their healthcare provider if they develop any signs and symptoms of acute narrow - angle glaucoma, including eye pain or discomfort, blurred vision, visual halos or colored images in association with red eyes from conjunctival congestion and corneal edema . Worsening of urinary retention may occur . Use with caution in patients with prostatic hyperplasia or bladder - neck obstruction and instruct patients to contact a healthcare provider immediately if symptoms occur . Immediate hypersensitivity reactions may occur after administration of YUPELRI . If a reaction occurs, YUPELRI should be stopped at once and alternative treatments considered . The most common adverse reactions occurring in clinical trials at an incidence greater than or equal to 2 % in the YUPELRI group, and higher than placebo, included cough, nasopharyngitis, upper respiratory infection, headache and back pain . Coadministration of anticholinergic medicines or OATP 1 B 1 and OATP 1 B 3 inhibitors with YUPELRI is not recommended . YUPELRI is not recommended in patients with any degree of hepatic impairment . OATP, organic anion transporting polypeptide. 22 23 About YUPELRI ® (revefenacin) Inhalation Solution YUPELRI ® (revefenacin) inhalation solution is a once - daily nebulized LAMA approved for the maintenance treatment of COPD in the US . Market research by Theravance Biopharma indicates approximately 9 % of the treated COPD patients in the US use nebulizers for ongoing maintenance therapy . 1 LAMAs are a cornerstone of maintenance therapy for COPD and YUPELRI ® is positioned as the first once - daily single - agent bronchodilator product for COPD patients who require, or prefer, nebulized therapy . YUPELRI ® ’s stability in both metered dose inhaler and dry powder device formulations suggest that this LAMA could also serve as a foundation for novel handheld combination products . 1. TBPH market research (N=160 physicians); refers to US COPD patients. COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist. 23