UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

August 1st, 2025

Commission File Number 001-10888

TotalEnergies SE

(Translation of registrant’s name into English)

2, place Jean Millier

La Défense 6

92400 Courbevoie

France

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

TotalEnergies SE is providing on this Form 6-K a description of certain recent developments relating to its business.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TotalEnergies SE | |||

| Date: August 1st, 2025 | By: | /s/ DENIS TOULOUSE | |

| Name: | Denis Toulouse | ||

| Title: | Company Treasurer | ||

Exhibit 99.1

|

PRESS RELEASE |

In Line With its Business Model,

TotalEnergies is Selling 50% of a

Portfolio of Renewable Assets in Portugal

| · | TotalEnergies remains operator of the assets | |

| · | The portfolio consists of wind, solar and hydroelectric assets in operation |

Paris, July 2, 2025 – In line with its renewables business model, TotalEnergies announces the completion of the sale of 50% of its 604 MW wind, solar and hydro portfolio in Portugal to the Consortium composed of MM Capital Partners 2 Co., Ltd., Daiwa Energy & Infrastructure Co. Ltd., and Mizuho Leasing Co., Ltd. for a consideration of 178,5 million euros, equivalent to an enterprise value of €550 m.

Following this transaction, TotalEnergies will retain a 50% stake and continue to operate the assets. Additionally, once the regulated tariffs they benefit from expire, TotalEnergies will purchase the production of these assets, which have an average age of 16 years, and will handle their commercialization.

“We are pleased with this partnership in Portugal, a country where TotalEnergies intends to continue its development in renewables. In line with our strategy, this transaction allows us to optimize our capital allocation in our integrated electricity activities and contribute to improving the sector's profitability”, said Olivier Jouny, SVP Renewables at TotalEnergies.

***

TotalEnergies and electricity

TotalEnergies is building a competitive portfolio that combines renewables (solar, onshore wind, offshore wind) and flexible assets (CCGT, storage) to deliver clean firm power to its customers.

As of the end of March 2025, TotalEnergies has 28 GW of installed gross renewable electricity generation capacity and aims to reach 35 GW by the end of 2025, and more than 100 TWh of net electricity production by 2030.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.2

|

PRESS RELEASE |

Caribbean: TotalEnergies Expands its Partnership

with AES

from LNG to Renewable Energy

| · | TotalEnergies expands its long-standing LNG partnership with AES on renewable and battery storage in the Caribbean |

| · | TotalEnergies has purchased 50% of AES renewable portfolio in the Dominican Republic, following a previous acquisition of 30% in AES’ Puerto Rican assets |

| · | The combined 1.5 GW portfolio will produce 2.5 TWh/y of renewable electricity |

Paris, July 2nd, 2025 – TotalEnergies announces the closing of its acquisition of a 50% stake in the solar, wind and Battery Energy Storage Systems (BESS) portfolio of AES Dominicana Renewables Energy. This deal follows TotalEnergies’ 2024 acquisition of a 30% share in AES solar and battery assets currently under construction in Puerto Rico. The combined portfolio now exceeds 1.5 GW of renewable energy and BESS capacity across the Caribbean.

These transactions advance TotalEnergies' multi-energy strategy in a region where it is a key player in the liquefied natural gas (LNG) value chain.

Dominican Republic: TotalEnergies acquires 50% of AES renewables portfolio

AES’ renewables portfolio includes over 1 GW of contracted wind, solar, and BESS projects, of which 410 MW is already operational or under construction, supplying electricity under long-term Power Purchase Agreements (PPAs). The portfolio also includes over 500 MW of solar and wind capacity in development, alongside BESS projects, which will be integrated into solar plants to mitigate intermittency and enhance grid stability.

This acquisition will allow TotalEnergies to expand its renewables business in the Dominican Republic, where the Company already has a partially solarized network of 184 service stations, natural gas distribution and a 103 MW solar plant under construction.

Puerto Rico: TotalEnergies already holds 30% of a portfolio of AES renewables

The AES’ renewables portfolio includes 485 MW of contracted solar and BESS projects, comprising 200 MW of solar and 285 MW/1,140 MWh of BESS projects currently under construction.

After acquiring 30% of these assets in 2024, TotalEnergies is pursuing deployment of its multi-energy strategy on the island, where it is already active in the fuel, lubricants, and aviation sectors, and operates a network of 200 service stations between Puerto Rico and the island of St Thomas.

“We are pleased to expand our multi-energy strategy through this partnership with AES, focusing on renewables and battery storage in a region where TotalEnergies is already a leading supplier of LNG, notably for power generation. Since 2018, we have been supplying LNG to AES’s subsidiaries in Panama and the Dominican Republic”, said Stéphane Michel, President of Gas, Renewables & Power at TotalEnergies. “These new transactions will contribute to our targets of 35 GW of gross renewable capacity by 2025 and over 100 TWh of electricity production by 2030.”

“We are excited to join forces with TotalEnergies as we diversify the island’s energy mix. The proceeds from this transaction will be reinvested in AES Dominicana, to grow our renewables footprint”, said Juan Ignacio Rubiolo, AES Executive Vice President & President, Energy Infrastructure and Leader of International Markets.

***

TotalEnergies and electricity

TotalEnergies is building a competitive portfolio that combines renewables (solar, onshore wind, offshore wind) and flexible assets (CCGT, storage) to deliver clean firm power to its customers. As of the end of March 2025, TotalEnergies has 28 GW of installed gross renewable electricity generation capacity and aims to reach 35 GW by the end of 2025, and more than 100 TWh of net electricity production by 2030.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.3

Disclosure of Transactions in Own Shares

Paris, July 7, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from July 1 to July 4, 2025:

| Transaction Date | Total

daily volume (number of shares) |

Daily

weighted average purchase price of shares (EUR/share) |

Amount

of (EUR) |

Market (MIC Code) |

| 01/07/2025 | 297,444 | 52.164630 | 15,516,056.21 | XPAR |

| 01/07/2025 | 150,000 | 52.154348 | 7,823,152.20 | CEUX |

| 01/07/2025 | 19,999 | 52.162602 | 1,043,199.88 | TQEX |

| 01/07/2025 | 10,000 | 52.166981 | 521,669.81 | AQEU |

| 02/07/2025 | 302,167 | 53.337697 | 16,116,891.89 | XPAR |

| 02/07/2025 | 125,000 | 53.312603 | 6,664,075.38 | CEUX |

| 02/07/2025 | 22,000 | 53.316152 | 1,172,955.34 | TQEX |

| 02/07/2025 | 20,000 | 53.334052 | 1,066,681.04 | AQEU |

| 03/07/2025 | 302,100 | 53.446408 | 16,146,159.86 | XPAR |

| 03/07/2025 | 115,000 | 53.437045 | 6,145,260.18 | CEUX |

| 03/07/2025 | 30,000 | 53.432220 | 1,602,966.60 | TQEX |

| 03/07/2025 | 20,000 | 53.443730 | 1,068,874.60 | AQEU |

| 04/07/2025 | 322,142 | 53.051946 | 17,090,259.99 | XPAR |

| 04/07/2025 | 120,000 | 53.055232 | 6,366,627.84 | CEUX |

| 04/07/2025 | 15,000 | 53.048488 | 795,727.32 | TQEX |

| 04/07/2025 | 14,000 | 53.037966 | 742,531.52 | AQEU |

| Total | 1,884,852 | 52.992537 | 99,883,089.65 |

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC”).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.4

Disclosure of Transactions in Own Shares

Paris, July 15, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from July 7 to July 11, 2025:

| Transaction Date | Total daily volume (number of shares) |

Daily

weighted average purchase price of shares (EUR/share) |

Amount

of (EUR) |

Market (MIC Code) | |

| 07/07/2025 | 310,781 | 52.162075 | 16,210,981.83 | XPAR | |

| 07/07/2025 | 120,000 | 52.158215 | 6,258,985.80 | CEUX | |

| 07/07/2025 | 30,000 | 52.160629 | 1,564,818.87 | TQEX | |

| 07/07/2025 | 20,000 | 52.171796 | 1,043,435.92 | AQEU | |

| 08/07/2025 | 331,302 | 52.156376 | 17,279,511.68 | XPAR | |

| 08/07/2025 | 125,000 | 52.135009 | 6,516,876.13 | CEUX | |

| 08/07/2025 | 15,000 | 52.132197 | 781,982.96 | TQEX | |

| 08/07/2025 | 10,000 | 52.123395 | 521,233.95 | AQEU | |

| 09/07/2025 | 320,403 | 53.450099 | 17,125,572.07 | XPAR | |

| 09/07/2025 | 110,000 | 53.445231 | 5,878,975.41 | CEUX | |

| 09/07/2025 | 30,000 | 53.451365 | 1,603,540.95 | TQEX | |

| 09/07/2025 | 10,000 | 53.446356 | 534,463.56 | AQEU | |

| 10/07/2025 | 339,925 | 53.439886 | 18,165,553.25 | XPAR | |

| 10/07/2025 | 100,000 | 53.479268 | 5,347,926.80 | CEUX | |

| 10/07/2025 | 20,000 | 53.502965 | 1,070,059.30 | TQEX | |

| 10/07/2025 | 10,000 | 53.535197 | 535,351.97 | AQEU | |

| 11/07/2025 | 303,674 | 53.721021 | 16,313,677.33 | XPAR | |

| 11/07/2025 | 120,000 | 53.709100 | 6,445,092.00 | CEUX | |

| 11/07/2025 | 25,000 | 53.676548 | 1,341,913.70 | TQEX | |

| 11/07/2025 | 20,000 | 53.707477 | 1,074,149.54 | AQEU | |

| Total | 2,371,085 | 52.977478 | 125,614,103.01 | ||

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC”).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.5

|

PRESS RELEASE |

Data & Digital: TotalEnergies and

Emerson Sign a Strategic

Collaboration to Boost the Value of Industrial Data

· TotalEnergies and Emerson are joining forces to implement large-scale industrial data collection solutions across TotalEnergies’ operational sites.

· The aim is to leverage the power of continuous, real-time data collection to optimize the operational, energy, and environmental performance of the Company's sites.

Paris, July 22, 2025 – TotalEnergies and Emerson’s Aspen Technology business have announced a strategic collaboration to deploy advanced digital technologies for the continuous, real-time collection of data from TotalEnergies’ industrial sites. The objective is to harness the value of that data to enhance decision-making, specifically through the use of artificial intelligence (AI), and optimize operational efficiency, energy use and environmental performance at TotalEnergies sites worldwide, thereby continuing to supply more reliable and sustainable energy.

Leveraging data in real time...

Under the terms of the deal, TotalEnergies will roll out Emerson’s AspenTech InmationTM across its industrial sites worldwide. This industrial data fabric will continuously collect and centralize millions of real-time data points from TotalEnergies’ facilities, providing secure and unified access to data across the organization.

The digital infrastructure, which also includes Emerson’s advanced process control solutions, will subsequently allow TotalEnergies to deploy AI use cases.

...to improve industrial performance

This rollout is planned over a two-year period and will ultimately enable TotalEnergies to extract more value from its data by:

| · | Accelerating the detection of anomalies and performance degradation; |

| · | Optimizing energy consumption; |

| · | Enhancing operational safety; |

| · | Speeding up the integration of AI into industrial processes. |

“At TotalEnergies, digital technology is a key enabler of our transformation toward a more sustainable and efficient energy future. Our collaboration with Emerson demonstrates how advanced technologies such as Inmation help us optimize operations, reduce emissions, and generate long-term value. This collaboration is a sign of our intention to turn data and digital tech into the hallmarks of our facilities’ industrial excellence,” said Namita Shah, President of OneTech at TotalEnergies.

“Emerson’s Aspen Technology business has worked with TotalEnergies for almost 30 years, and we’re excited to continue our collaboration by supporting their operational and sustainability objectives with our digital technologies. The powerful combination of AI and our industrial data fabric solution will serve to accelerate TotalEnergies’ mission,” said Vincent Servello, President of Emerson’s Aspen Technology business.

***

About Emerson

Emerson (NYSE: EMR) is a global industrial technology leader that provides advanced automation. With an unmatched portfolio of intelligent devices, control systems and industrial software, Emerson delivers solutions that automate and optimize business performance. Headquartered in St. Louis, Missouri, Emerson combines innovative technology with proven operational excellence to power the future of automation. For more information, visit Emerson.com.

Emerson Global Media Contacts

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas and green gases, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.6

Disclosure of Transactions in Own Shares

Paris, July 22, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from July 14 to July 18, 2025:

| Transaction Date | Total daily volume (number of shares) |

Daily

weighted average purchase price of shares (EUR/share) |

Amount

of |

Market (MIC Code) | |

| 14/07/2025 | 326,702 | 53.898550 | 17,608,764.08 | XPAR | |

| 14/07/2025 | 100,000 | 53.935489 | 5,393,548.90 | CEUX | |

| 14/07/2025 | 25,000 | 53.931280 | 1,348,282.00 | TQEX | |

| 14/07/2025 | 15,000 | 53.942954 | 809,144.31 | AQEU | |

| 15/07/2025 | 316,408 | 53.485791 | 16,923,332.16 | XPAR | |

| 15/07/2025 | 120,000 | 53.486452 | 6,418,374.24 | CEUX | |

| 15/07/2025 | 25,000 | 53.484466 | 1,337,111.65 | TQEX | |

| 15/07/2025 | 10,000 | 53.484047 | 534,840.47 | AQEU | |

| 16/07/2025 | 279,057 | 53.688997 | 14,982,290.44 | XPAR | |

| 16/07/2025 | 154,259 | 53.700282 | 8,283,751.80 | CEUX | |

| 16/07/2025 | 20,000 | 53.703341 | 1,074,066.82 | TQEX | |

| 16/07/2025 | 18,804 | 53.736626 | 1,010,463.52 | AQEU | |

| 17/07/2025 | 330,466 | 52.867269 | 17,470,834.92 | XPAR | |

| 17/07/2025 | 120,000 | 52.868224 | 6,344,186.88 | CEUX | |

| 17/07/2025 | 20,000 | 52.863669 | 1,057,273.38 | TQEX | |

| 17/07/2025 | 10,000 | 52.864013 | 528,640.13 | AQEU | |

| 18/07/2025 | 332,610 | 53.417635 | 17,767,239.58 | XPAR | |

| 18/07/2025 | 110,000 | 53.420416 | 5,876,245.76 | CEUX | |

| 18/07/2025 | 20,000 | 53.418569 | 1,068,371.38 | TQEX | |

| 18/07/2025 | 10,000 | 53.428568 | 534,285.68 | AQEU | |

| Total | 2,363,306 | 53.472148 | 126,371,048.09 | ||

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l mailto:presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC)”.

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.7

|

|

PRESS RELEASE

United States: TotalEnergies Expands Its Investments

in

Sustainable Forestry Operations to Preserve Carbon Sinks

Paris, July 22, 2025 – TotalEnergies signed an agreement with NativState, an Arkansas-based forest carbon project developer, to conserve forests from land conversion and heavy timber harvesting.

The transaction includes 13 Improved Forest Management (IFM) projects located in Arkansas, Louisiana, Mississippi and Tennessee, U.S.A, covering 100,000 hectares (247,000 acres) owned by more than 280 private family forest landowners. The carbon program managed by NativState offers landowners a sustainable income alternative to this region’s common practice of heavy timber harvesting while restoring forest health and improving carbon stocks.

This investment will support sustainable forest practices, such as identifying and preserving high conservation value forests, implementing best management practices for streamside management zones, improving forest species diversity, and conserving wildlife corridors. It will also generate social benefits to small landowners such as forestry management education and technical support, as well as financial benefits by giving them access to voluntary carbon markets.

All carbon credits generated by the project will be certified by the ACR, an internationally recognized carbon crediting program, and will be acquired by TotalEnergies. After prioritizing emission avoidance and reduction, the Company will use these credits from 2030 onwards to voluntarily offset part of its remaining direct Scope 1 & 2 emissions.

“TotalEnergies confirms its commitment to support the conservation and enhancement of carbon sinks, with local value creation”, said Adrien Henry, Vice President Nature Based Solutions at TotalEnergies. “We are thrilled to support NativState to scale up their operations, directly benefiting the environment and their local communities.”

“We, at NativState, are honored and deeply grateful for our partnership with TotalEnergies and our forest landowner families, which creates extraordinary opportunities to build a lasting legacy for small forest landowners in our communities across the southern United States while supporting TotalEnergies in addressing the challenges of global energy markets,” said Stuart Allen, NativState Founder and CEO. “It is a privilege to empower these landowners to embrace sustainable forestry practices, cultivating healthier lands and stronger communities for generations to come.”

***

About TotalEnergies Nature Based Solutions

As part of its climate ambition, and in addition to its existing actions to avoid and reduce emissions, TotalEnergies works with many local partners around the world to develop and conserve natural carbon sinks, while helping to preserve or improve their biodiversity. These operations follow a long-term approach of sustainable and integrated economic development of areas with local communities. TotalEnergies plans to invest $100 million per year to build a portfolio of projects capable of generating at least 5 million metric tons of CO2e of carbon credits per year by 2030. These carbon credits will be used after 2030 to offset the Company's scope 1 & 2 emissions.

Learn more with our TotalEnergies’ Sustainability and Climate 2025 – Progress Report

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

About NativState

NativState LLC (www.nativstate.com) is a forest carbon development company partnering with small forest landowners across the southern United States to deliver access to global carbon markets. We work with landowners to improve and conserve their forests while realizing a financial return based on the creation of high-quality carbon credits sold to companies seeking to meet and exceed their carbon emission reduction goals. Using ACR’s Improved Forest Management (IFM) methodology and our forty-year carbon agreement, we work with landowners to provide a new source of income from their forests versus historical, intensive timber harvesting. Through this process NativState empowers forest owners with the ability to manage their properties sustainably and provide the co-benefits of improved water quality, improved biodiversity, and improved overall health of the forest.

NativState Media Contact

Mark Z. Fortune, Vice President, Marketing | 501-580-0550 | mfortune@nativstate.com

|

NativState |

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.8

|

|

PRESS RELEASE

TotalEnergies and CMA CGM to Launch LNG Bunkering

Logistics Joint Venture to Accelerate Maritime Decarbonization

| · | For the first time, a shipping line will collaborate with an energy provider to co-develop and jointly operate LNG bunkering facilities. | |

| · | The TotalEnergies-CMA CGM JV will offer a complete logistics service in the Amsterdam-Rotterdam-Antwerp (ARA) region. | |

| · | A 20,000 m3 LNG bunker vessel will be jointly deployed and operated by 2028. | |

| · | Under a new long-term agreement, TotalEnergies will supply CMA CGM up to 360,000 tons of LNG per year until 2040. |

Paris/Marseille, 23 July 2025 – TotalEnergies, a global integrated energy company, and CMA CGM Group, a global player in sea, land, air and logistics solutions, have entered into an agreement to develop a 50/50 logistics joint venture dedicated to the implementation and operation of a liquefied natural gas (LNG) bunker supply solution at the port of Rotterdam, in the Netherlands. This strategic partnership reflects the shared ambition of both French companies to work jointly towards the acceleration of the energy transition in the maritime sector.

Expanding LNG Infrastructure in Europe

As part of this new logistics joint venture, a new 20,000 cubic-meter LNG bunker vessel will be positioned in Rotterdam by the end of 2028 and jointly operated. The CMA CGM-TotalEnergies JV will offer a complete logistics service, from reload access at Gate terminal facilities to LNG bunker delivery to a wide range of vessels operating in the Amsterdam-Rotterdam-Antwerp (ARA) region, including those of CMA CGM as well as other shipping operators.

The joint venture will capitalize on TotalEnergies’ established logistics infrastructure in the ARA region, where the 18,600 m3 LNG bunker vessel Gas Agility has been in operation since 2020. By integrating the JV’s future LNG bunker vessel with Gas Agility, the partnership aims to create synergies that enhance delivery flexibility and boost operational efficiency across the region.

A Long-Term LNG Supply Agreement

To support CMA CGM’s goal of reaching Net Zero Carbon by 2050 and ensure the supply of its dual-fuel LNG-powered fleet, which will grow to 123 vessels by 2029, TotalEnergies will supply CMA CGM with up to 360,000 tons of LNG annually, from 2028 onwards and until 2040.

“We are proud to further contribute, alongside a partner like CMA CGM, to the development of an LNG bunkering supply chain in one of Europe’s leading port hubs. LNG is today the most mature and immediately available solution to reduce the environmental footprint of maritime transport. This strategic partnership not only strengthens our position as a major player in LNG bunkering but also illustrates the shared commitment of two leading French companies to actively support the energy transition,” said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

“With this joint venture, CMA CGM and TotalEnergies are taking a new step to support the energy transition in shipping. For the first time, a shipping company and an energy provider will jointly operate an LNG bunkering vessel, based in the port of Rotterdam. It is a concrete way to scale up alternative fuels and accelerate the decarbonization of global trade,” said Rodolphe Saadé, Chairman and CEO of CMA CGM Group.

The creation of the joint venture is subject to applicable regulatory approvals.

A Committed Partnership Between Two French Industry Leaders

TotalEnergies and CMA CGM have been long-standing partners committed to advancing low-carbon marine solutions:

| · | In 2017: Signing of a 10-year agreement under which TotalEnergies supplies 300,000 tons of LNG annually to CMA CGM in Rotterdam. | |

| · | In 2019: Signing of a 10-year agreement under which TotalEnergies supplies 250,000 tons of LNG annually to CMA CGM in Marseille Fos. | |

| · | In 2020: First LNG bunkering of a large CMA CGM container vessel in Rotterdam, with 17,300 m3 of LNG delivered by TotalEnergies. | |

| · | In 2021: First LNG bunkering of a CMA CGM container ship in France, in Dunkirk, with nearly 16,400 m3 of LNG supplied. | |

| · | In 2022: First ship-to-containership LNG bunkering operation at the Port of Marseille Fos, with around 6,000 m3 of LNG delivered in Marseille Fos. |

***

LNG’s role in shipping’s energy transition

Used as a marine fuel, LNG helps cut greenhouse gas emissions by up to 20% compared to conventional marine fuel and has the potential to reduce emissions significantly more if bio or synthetic (respectively -67% and -85% of GHG emissions). It also significantly improves air quality by reducing nitrogen oxides (NOx) emissions by up to 85%, and it almost completely eliminates (by 99%) sulfur oxides (SOx) and fine particles. As such, marine LNG is a sustainable, affordable and immediately available way of reducing emissions in the shipping sector. TotalEnergies has actively invested in LNG bunkering infrastructure, critical to supporting its shipping customers' adoption of LNG as a marine fuel.

TotalEnergies, the world’s third largest LNG player

TotalEnergies is the world’s third largest LNG player with a global portfolio of 40 Mt/y in 2024 thanks to its interests in liquefaction plants in all geographies. The Company benefits from an integrated position across the LNG value chain, including production, transportation, access to more than 20 Mt/y of regasification capacity in Europe, trading, and LNG bunkering. TotalEnergies’ ambition is to increase the share of natural gas in its sales mix to close to 50% by 2030, to reduce carbon emissions and eliminate methane emissions associated with the gas value chain, and to work with local partners to promote the transition from coal to natural gas.

CMA CGM, a pioneer in decarbonizing the maritime industry

As a global player in shipping and logistics, committed to achieving Net Zero Carbon by 2050, CMA CGM has made bold decisions that set new standards in the maritime industry. The Group’s strategy is based on optimizing its fleet and operations, accelerating the use of low-carbon fuels, developing energy-efficient technologies, and promoting modal shift. CMA CGM has made significant investments in next-generation vessels powered by alternative energies such as LNG, biomethane and, in the future, e-methane and green methanol.

***

About the CMA CGM Group

The CMA CGM Group is a global player in sea, land, air and logistics solutions, true to its corporate Purpose, We imagine better ways to serve a world in motion.

Present in 177 countries, it employs 160,000 people, of which nearly 6,000 in Marseilles where its head office is located.

The world's 3rd largest shipping company, CMA CGM serves more than 420 ports across 5 continents with a fleet of over 650 vessels. In 2024, CMA CGM carried over 23 million TEU (twenty-foot equivalent unit) containers. Its subsidiary CEVA Logistics, one of the world's top five players, operates 1,000 warehouses and handled 15 million shipments in 2024. The Group's air freight division operates a fleet of cargo aircraft under the CMA CGM AIR CARGO and Air Belgium brands.

CMA Media, France's 3rd largest private media group, includes RMC-BFM and several national and regional press titles (La Tribune Dimanche, La Tribune, La Provence and Corse Matin).

Committed to energy transition, the CMA CGM Group is aiming for Net Zero Carbon by 2050.

The CMA CGM Foundation provides humanitarian aid in crisis situations, and is committed to education for all and equal opportunities throughout the world. To date, the CMA CGM Foundation has transported 63,000 tons of humanitarian aid to 97 countries and supported over 550 educational projects.

CMA CGM Contacts

· Media Relations: Press-relations@cma-cgm.com

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

· Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

· Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.9

PRESS RELEASE

Angola: Start-up of BEGONIA and CLOV Phase 3

Offshore

Projects

| · | TotalEnergies announces the start of production from the BEGONIA and CLOV Phase 3 projects, adding a total of 60,000 barrels per day of production offshore Angola. | |

| · | Low cost, low emissions projects leveraging existing facilities |

Paris, July 23, 2025 – TotalEnergies announces the start of production from the BEGONIA and CLOV Phase 3 offshore projects, leveraging ullage in the PAZFLOR and CLOV floating production, storage and offloading units (FPSO) to add a total of 60,000 barrels a day of new production.

These two subsea tie-back projects deliver additional production leveraging available capacity on existing FPSO’s and as such have low marginal costs and low carbon intensities.

BEGONIA, the first development on Block 17/06

TotalEnergies (30%, operator) announces the start of production from BEGONIA, the first inter-block development in Angola. A project made possible thanks to good cooperation between the Angolan concession holder Agencia Nacional de Petróleo, Gás e Biocombustíveis (ANPG), the partners of the block 17/06, Sonangol E&P (30%), SSI (27,5%), ETU Energias (7.5%), Falcon Oil (5%), and the partners of block 17 also operated by TotalEnergies.

Located 150 kilometers off the Angolan coast, BEGONIA is a 30,000 barrels per day project consisting of five wells subsea tied back to the PAZFLOR FPSO.

CLOV Phase 3, continued upsides on Block 17

TotalEnergies (38%, operator) also announces the first oil from CLOV Phase 3 in Block 17, in agreement with ANPG and its partners Equinor (22,16%), ExxonMobil (19%), Azule Energy (15.84%) and Sonangol E&P (5%).

Located 140 kilometers from the Angolan coast, CLOV Phase 3 is a 30,000 barrels per day project consisting of four wells subsea tie-back to the CLOV FPSO.

“TotalEnergies, operator of Block 17 and 17/06, continues to actively deliver its low-cost and low-emissions developments to grow its upstream production by more than 3% in 2025,” stated Nicolas Terraz, President Exploration & Production at TotalEnergies. “With BEGONIA and CLOV Phase 3, we are leveraging available production capacity in existing FPSOs of Block 17 (PAZFLOR and CLOV) while reducing costs and emissions.”

“Good news for the country, as those two First Oils will help Angola maintain its production levels above 1 million baril per day. BEGONIA is the first project between Blocks in Angola with a significant component of Local Content and CLOV 3 is a great achievement resulting from intense work between the concessionaire and the B17 contractor group, operated by TotalEnergies. Projects like these are extremely important as they prove the innovative spirit and dynamism of the oil sector in Angola,” declared Paulino Jerónimo, Chairman of the Board of Directors of the National Agency for Petroleum, Gas and Biofuels.

***

About TotalEnergies in Angola

TotalEnergies has been present in Angola since 1953 and today employs around 1,500 people across different business segments. With a diversified portfolio, deep offshore operated assets representing more than 45% of the country’s oil production, service stations in partnership with Sonangol and renewable energy projects, TotalEnergies in Angola is a key player in supporting the country’s sustainable energy transition.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

· Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

· Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.10

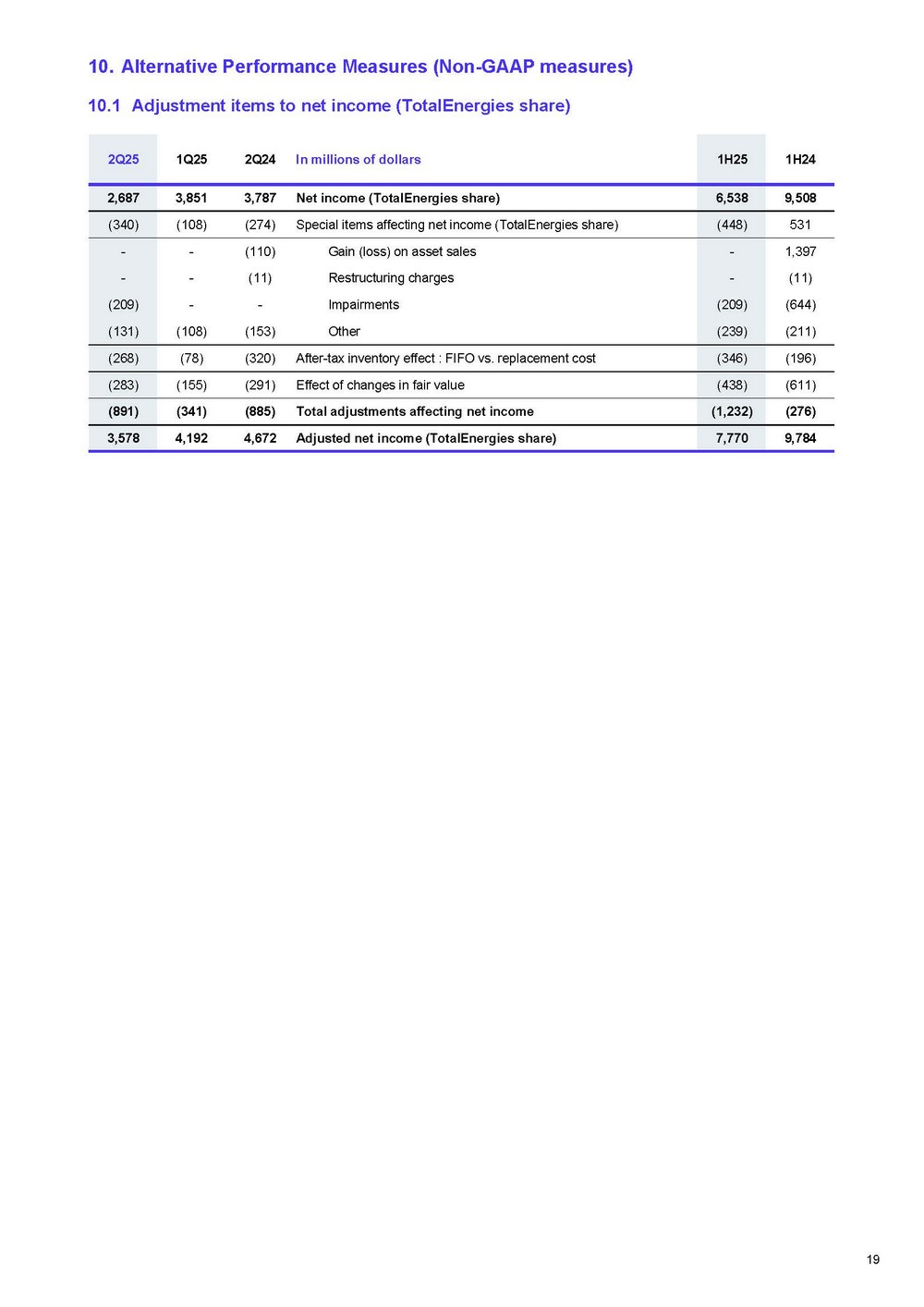

PRESS RELEASE Second quarter and first half 2025 results TotalEnergies generates $6.6 billion of cash flow during the quarter, driven by production growth of its energies, demonstrating the Company’s robustness in a lower price environment and maintains shareholder returns Paris, July 24 , 2025 – The Board of Directors of TotalEnergies SE, chaired by CEO Patrick Pouyanné, met on July 23 , 2025 , to approve the 2 nd quarter 2025 financial statements . On the occasion, Patrick Pouyanné said : “TotalEnergies delivered robust financial results in the second quarter : cash flow only decreased by 5 % to $ 6 . 6 billion despite a 10 % decrease in oil price, notably thanks to accretive hydrocarbon production growth . The Company posted adjusted net income of $ 3 . 6 billion for the quarter, resulting in first half adjusted net income of $ 7 . 8 billion . In the first half of the year TotalEnergies continued to successfully execute its balanced multi - energy strategy, supported by sustained growth in hydrocarbon and electricity production : - 2 . 53 Mboe/d of hydrocarbon production, which is an increase of more than 3 % year - on - year and benefiting notably from the start - up of the Ballymore field in the United States and Mero - 4 in Brazil, a quarter ahead of schedule - nearly 23 TWh of electricity production in the first half of 2025 , an increase of over 20 % year - on - year Exploration & Production reported adjusted net operating income of $ 2 . 0 billion and cash flow of $ 3 . 8 billion in the second quarter, benefiting from accretive project start - ups in 2024 and 2025 . Consistent with our strategy, the Company continued to actively manage its low - cost, low - emission portfolio by divesting non - operated interests in non - core projects in Nigeria and Brazil, and entering into new exploration permits in the United States, Malaysia, Indonesia, and Algeria . Integrated LNG achieved adjusted ne t operating income o f $ 1 . 0 billion a n d cash flow o f $ 1 . 2 billion this quarter, reflecting a 10 % decrease in t h e LNG selling price, in line with oil price evolution, a n d low market volatility for gas trading activities . The Company strengthened its LNG portfolio by signing a 1 . 5 Mtpa LNG offtake agreement from Rio Grande LNG Train 4 a n d taking a positioning in t h e future Ksi Lisims LNG plant located o n t h e Pacific Coast o f Canada . Integrated Power posted adjusted net operating income and cash flow of close to $ 0 . 6 billion this quarter, resulting in cash flow of $ 1 . 2 billion in the first half of 2025 , in line with the annual guidance . As part of its business model, the Company divested 50 % of a renewable asset portfolio in Portugal . Downstream delivered adjusted net operating income of $ 0 . 8 billion and cash flow of $ 1 . 5 billion, reflecting improved refining margins (but still in the context of a globally weak environment) and utilization rate . Downstream results benefitted from the positive seasonal effect of Marketing & Services activities, with stronger results year - on - year . (1) Re fer to Glossary pages 23 & 24 for the definitions and further information on alternative performance measures (Non - GAAP measures) and to page 19 and following for reconciliation tables.

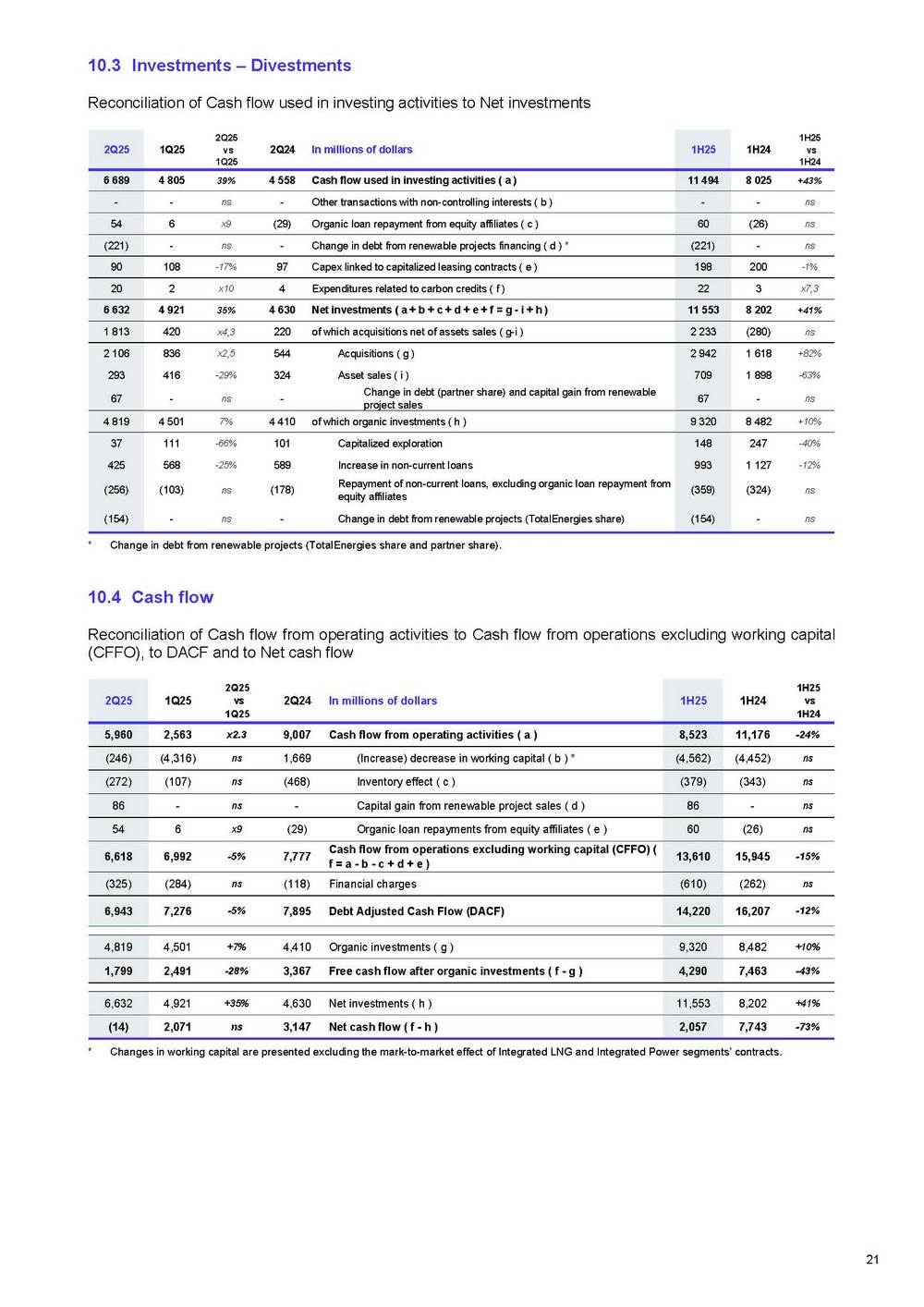

Change vs 1H24 1H25 Change vs 1Q25 2Q25 - 15% 13.6 - 5% 6.6 Cash flow from operations excluding working capital (CFFO) (1) (B$) - 21% 7.8 - 15% 3.6 - in billions of dollars (B$) - 18% 3.41 - 14% 1.57 - in dollars per share (fully - diluted) - 31% 6.5 - 30% 2.7 Net income (TotalEnergies share) (B$) - 11% 20.2 - 8% 9.7 Adjusted EBITDA (1) (B$) Adjusted net income (TotalEnergies share) (1) 1 2 During the first half of 2025 , net investments reached $ 11 . 6 billion, including $ 2 . 2 billion of net acquisitions, notably related to the acquisition of VSB . The Company anticipates that net investments for the full year will be within the $ 17 - 17 . 5 billion guidance range given the disposal program planned for the second half of the year . Normalized gearing ( 1 ) , which excludes seasonal effects of working capital and investment pace, is 15 % . Comforted by the Company’s ability to reach its 2025 underlying growth objective while maintaining a strong balance sheet, the Board of Directors has confirmed the distribution of the second interim dividend of 0.85 €/share for fiscal year 2025, an increase close to 7.6% compared to 2024. It also decided to continue share buybacks for up to $2 billion in the third quarter. The Board also highlighted the recent success of the Capital increase reserved for employees, which brings TotalEnergies’ employee ownership to nearly 9 % of the Company’s share capital and demonstrates their support of the Company’s strategy . ”

3 1. Highlights (2 ) Upstream Production start - up of the Mero - 4 offshore oil development, for 180,000 b/d, in Brazil Production start - up of the Ballymore offshore oil field, for 75,000 b/d, in the United States Divestment of TotalEnergies’ 12.5% non - operated interest in the Bonga field, in Nigeria Divestment of TotalEnergies’ 20% non - operated interest in Gato do Mato project to Shell in exchange for an increased 48% stake in the operated Lapa offshore field, in Brazil Acquisition of a 25% working interest in a portfolio of 40 Chevron - operated offshore exploration leases, in the United States Acquisition from Petronas of interests in multiple blocks, offshore Malaysia and Indonesia Acquisition of a 25% interest in Block 53, in Suriname Award of the Ahara Exploration license, in Algeria Downstream Announcement of the shut - down of the cracker NC2 in the Antwerp platform by 2027, in the context of over - capacity of petrochemicals in Europe Integrated LNG Signature of an agreement with NextDecade for LNG offtake of 1.5 Mt/year over 20 years from the future Train 4 of Rio Grande LNG, in Texas Signature of agreements with Western LNG for a future equity stake and LNG offtake in Ksi Lisims LNG project, in Canada Agreement between with CMA CGM to create a JV for LNG bunkering in Rotterdam, with TotalEnergies providing up to 360,000 tons of LNG per year Integrated Power Closing of the acquisition of the German renewable energy developer VSB Closing of the sale of 50% of TotalEnergies’ 604 MW renewables portfolio, in Portugal Closing of the acquisition of 50% of AES’ renewables portfolio, in the Dominican Republic Acquisition of 350 MW of solar projects and 85 MW of BESS projects, in the UK Award of a concession to develop a 1GW offshore wind farm, in Germany Signature of an agreement with RGE for the development of a solar and battery project, in Indonesia, to supply the local market and Singapore Carbon footprint reduction and low - carbon molecules Signature of an agreement for the sale of 50% of biogas leader PGB in Poland Signature of a 15 - year agreement with Quatra for the supply of 60,000 tons/yr of European used cooking oil to TotalEnergies’ biorefineries Innovation and Performance Collaboration with Mistral AI through a joint innovation lab to increase the application of AI in TotalEnergies’ multi - energy strategy (2 ) Some of the transactions mentioned in the highlights remain subject to the agreement of the authorities or to the fulfilment of conditions precedent under the terms of the agreements.

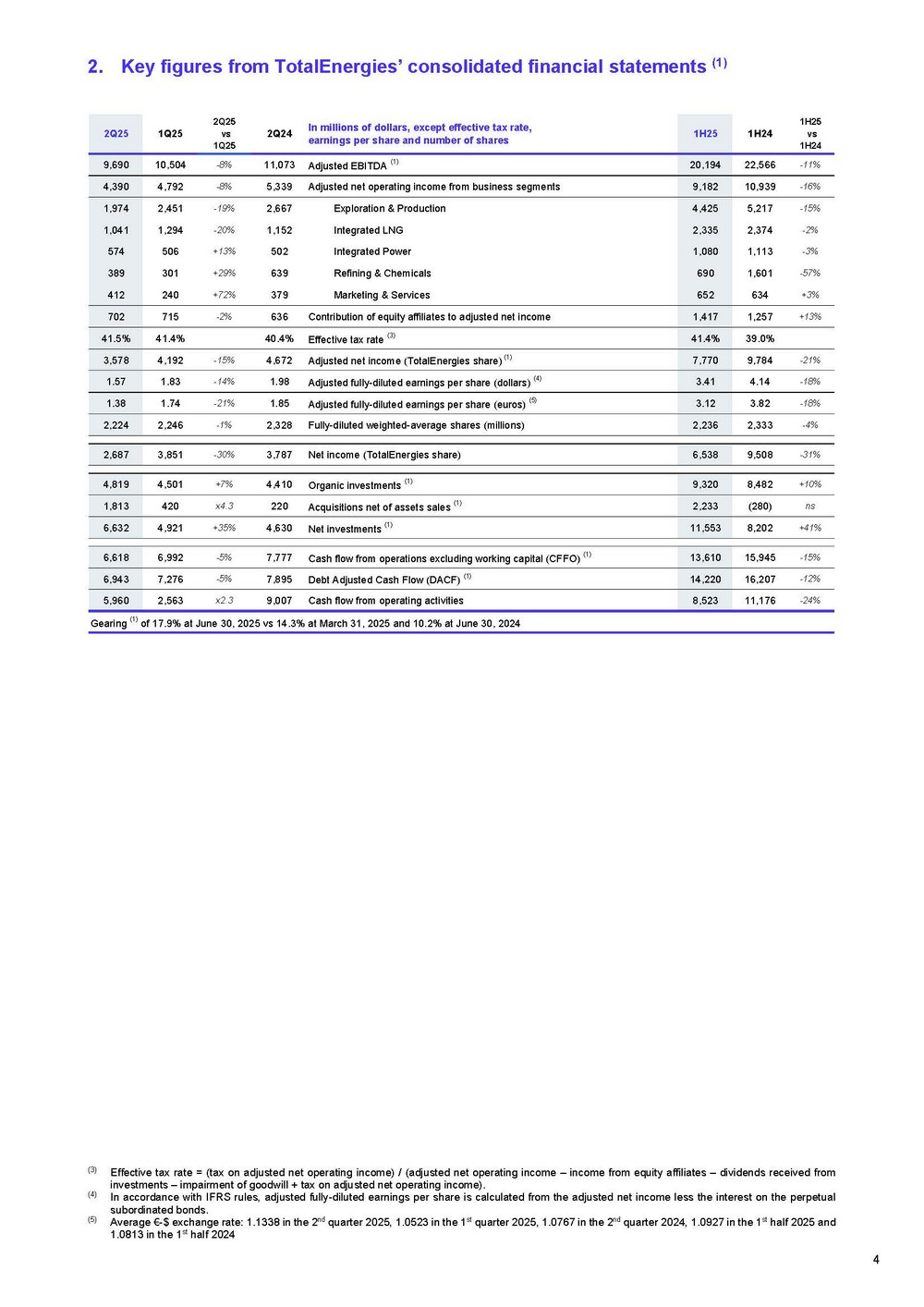

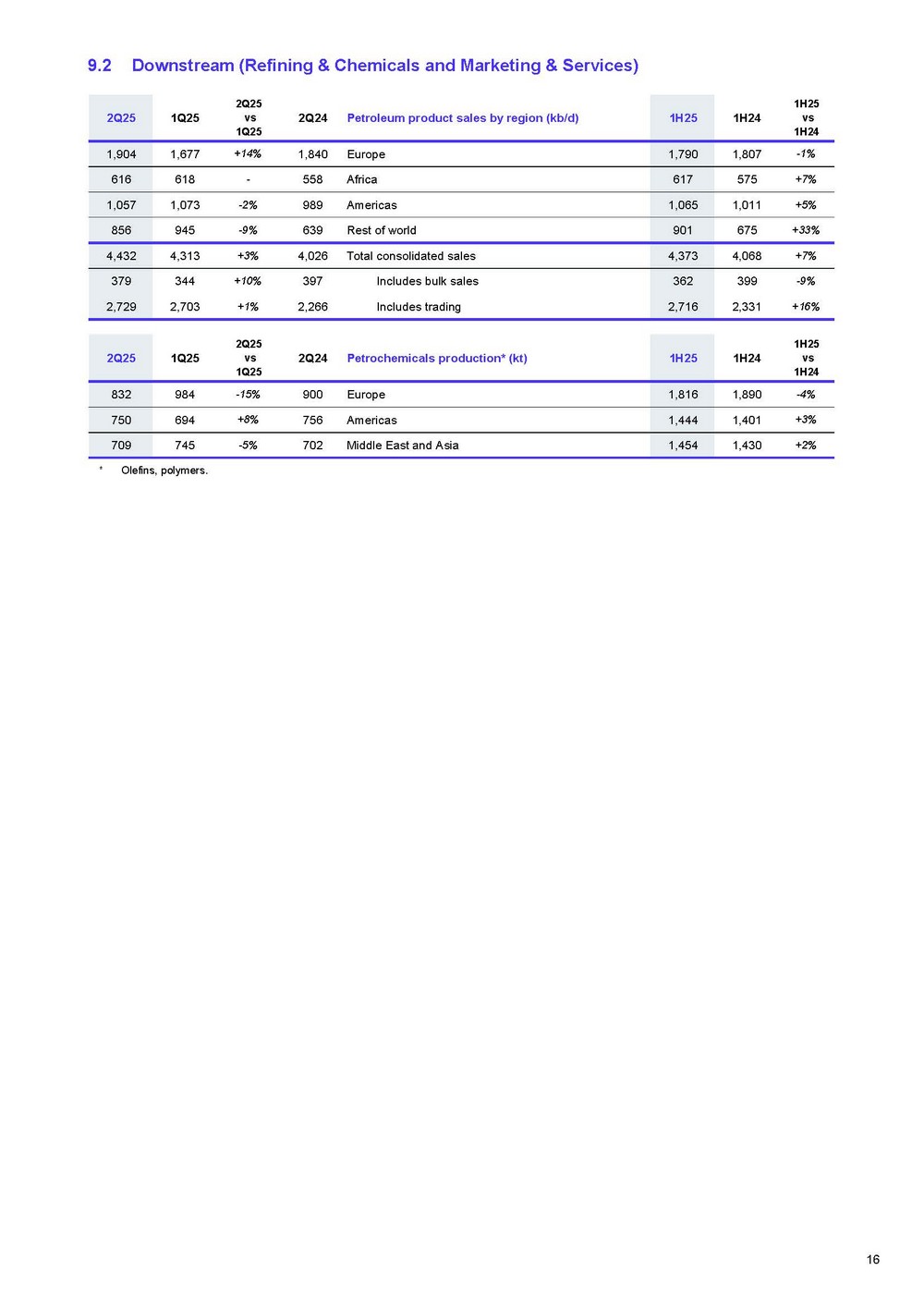

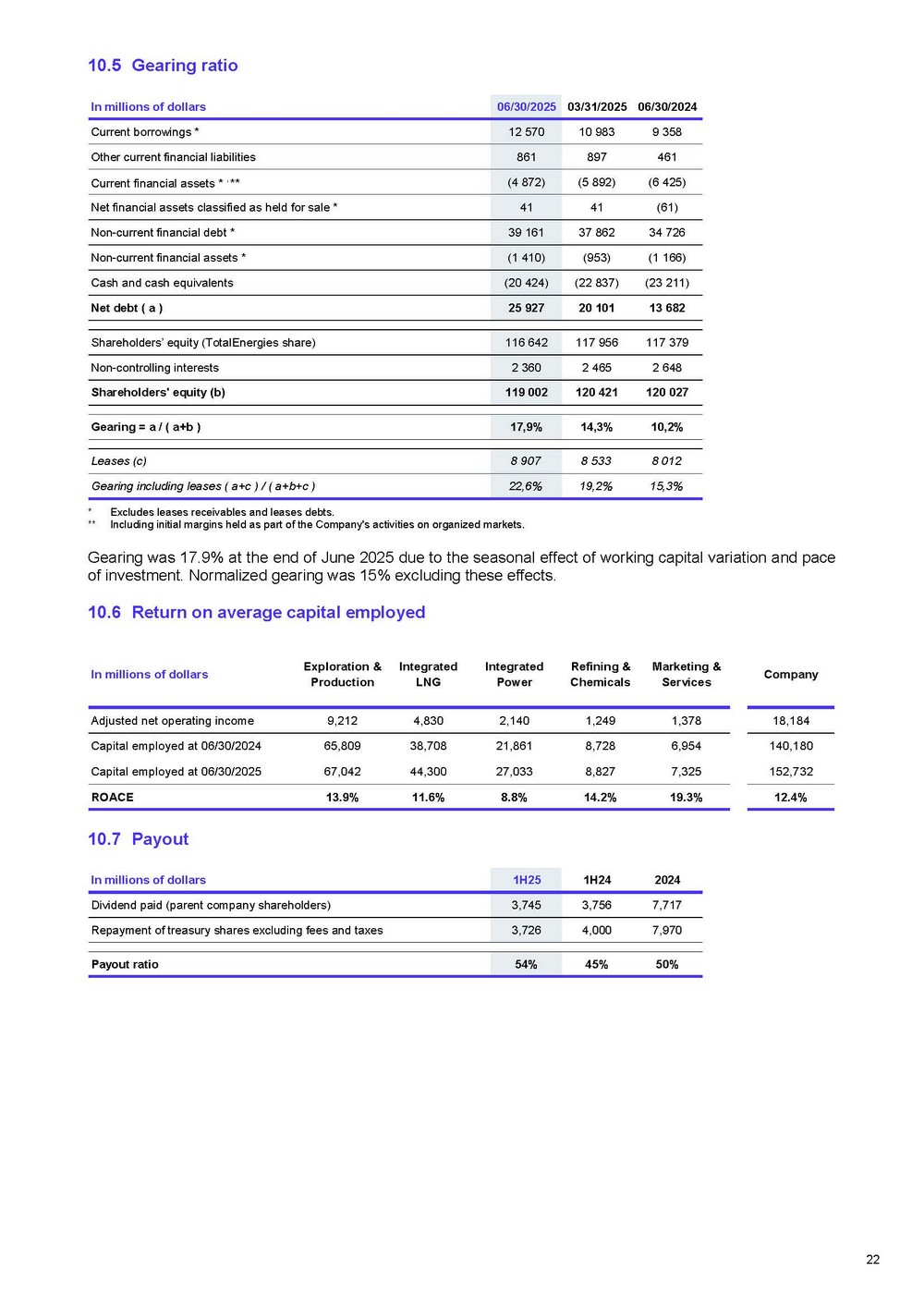

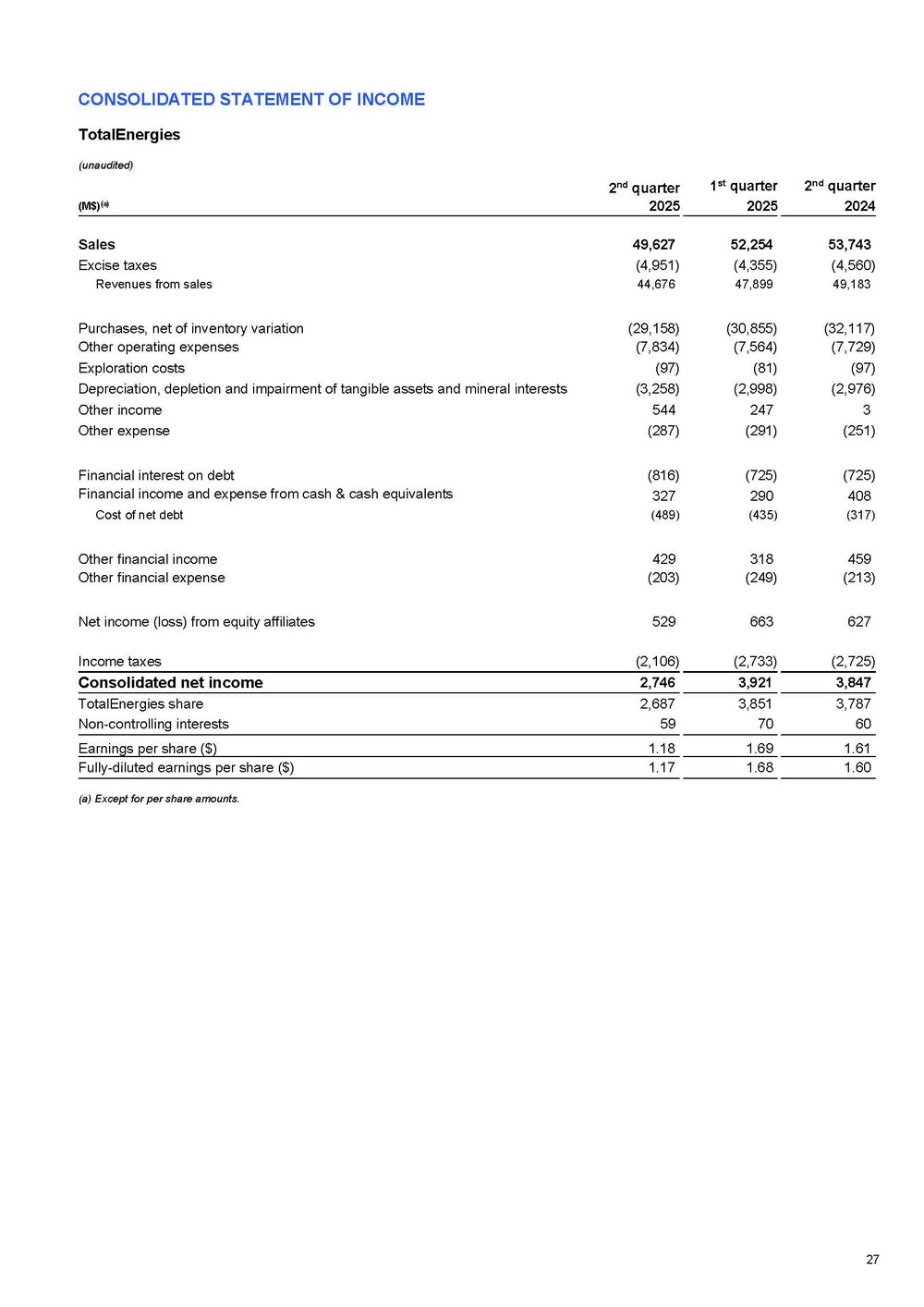

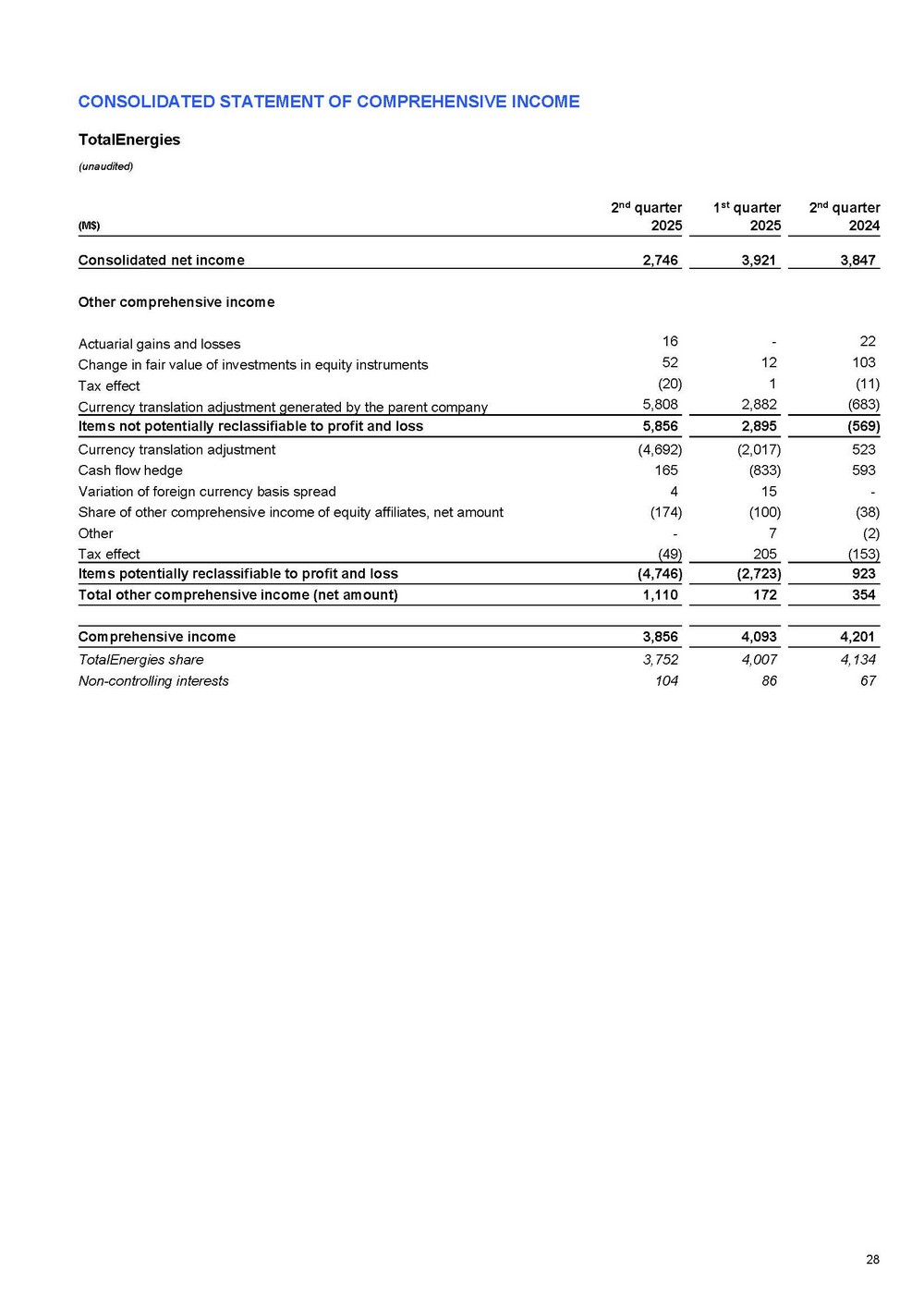

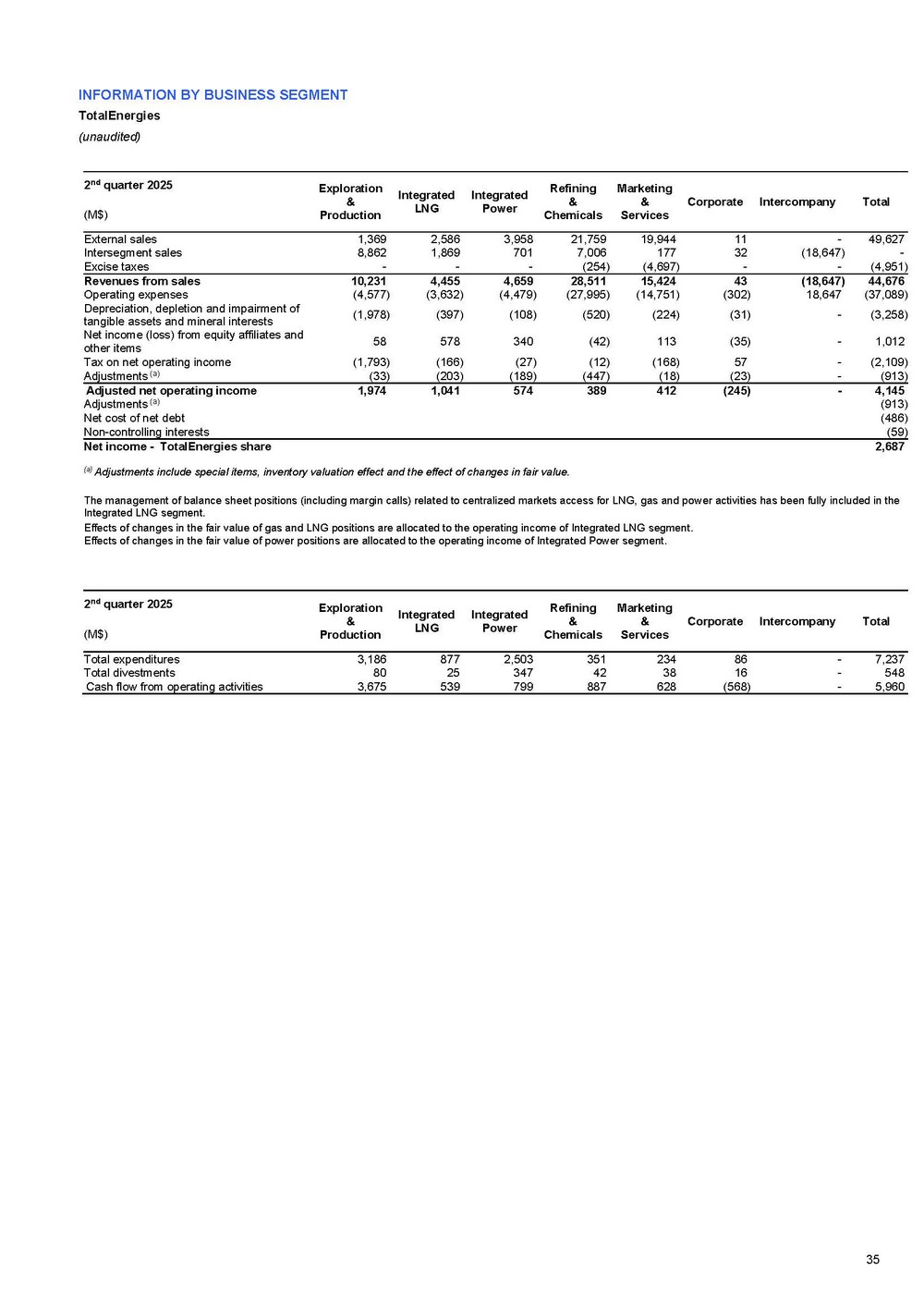

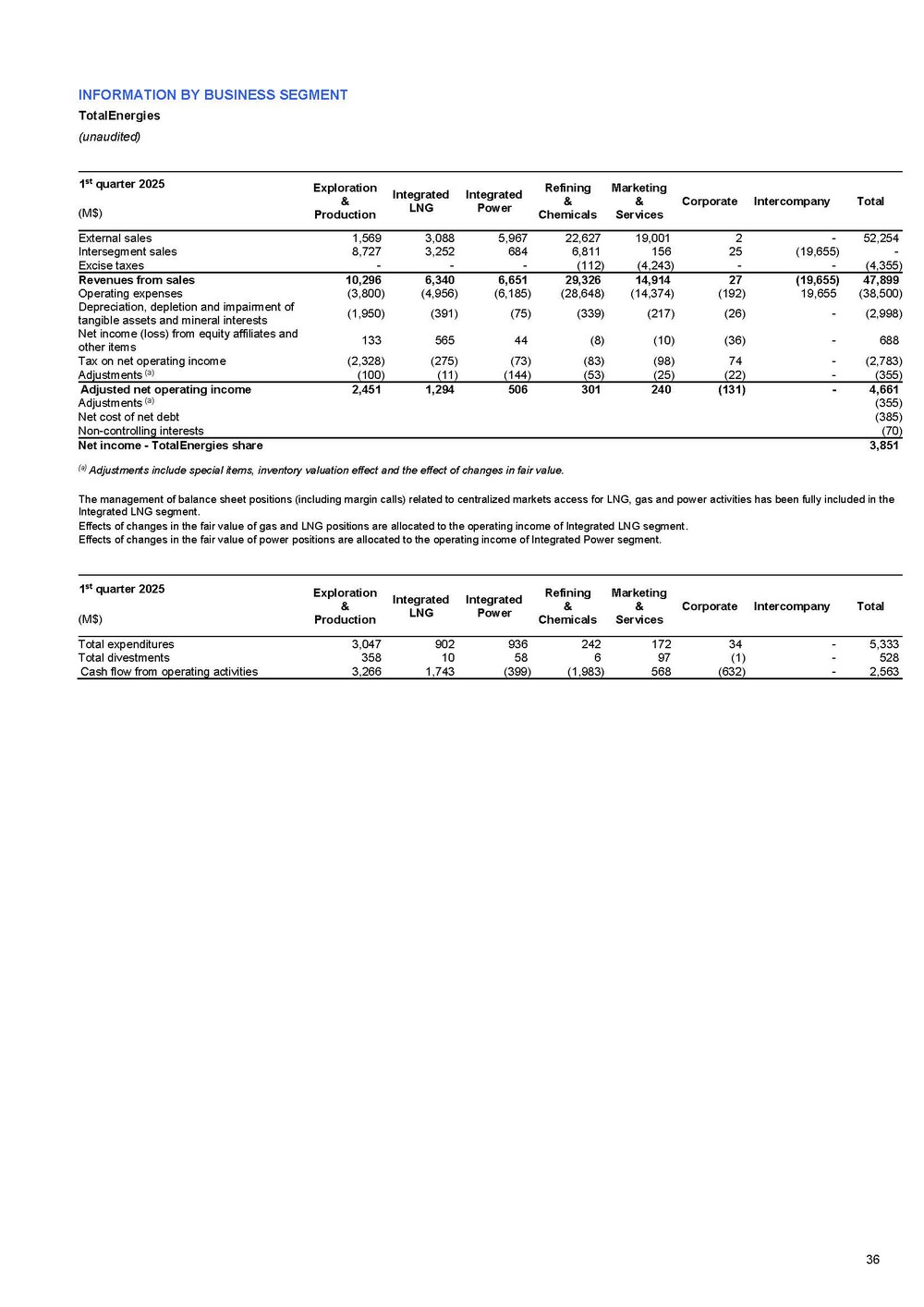

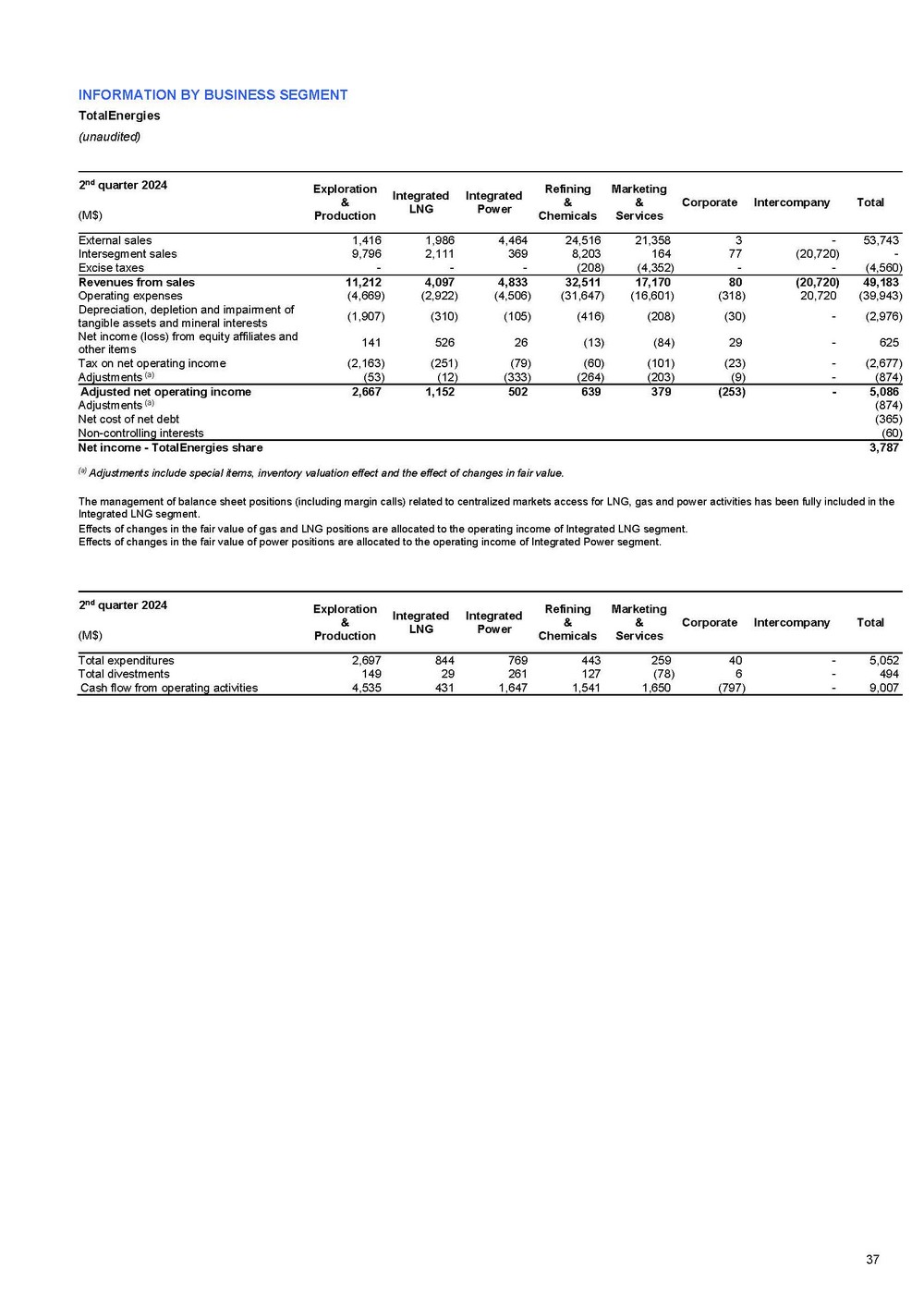

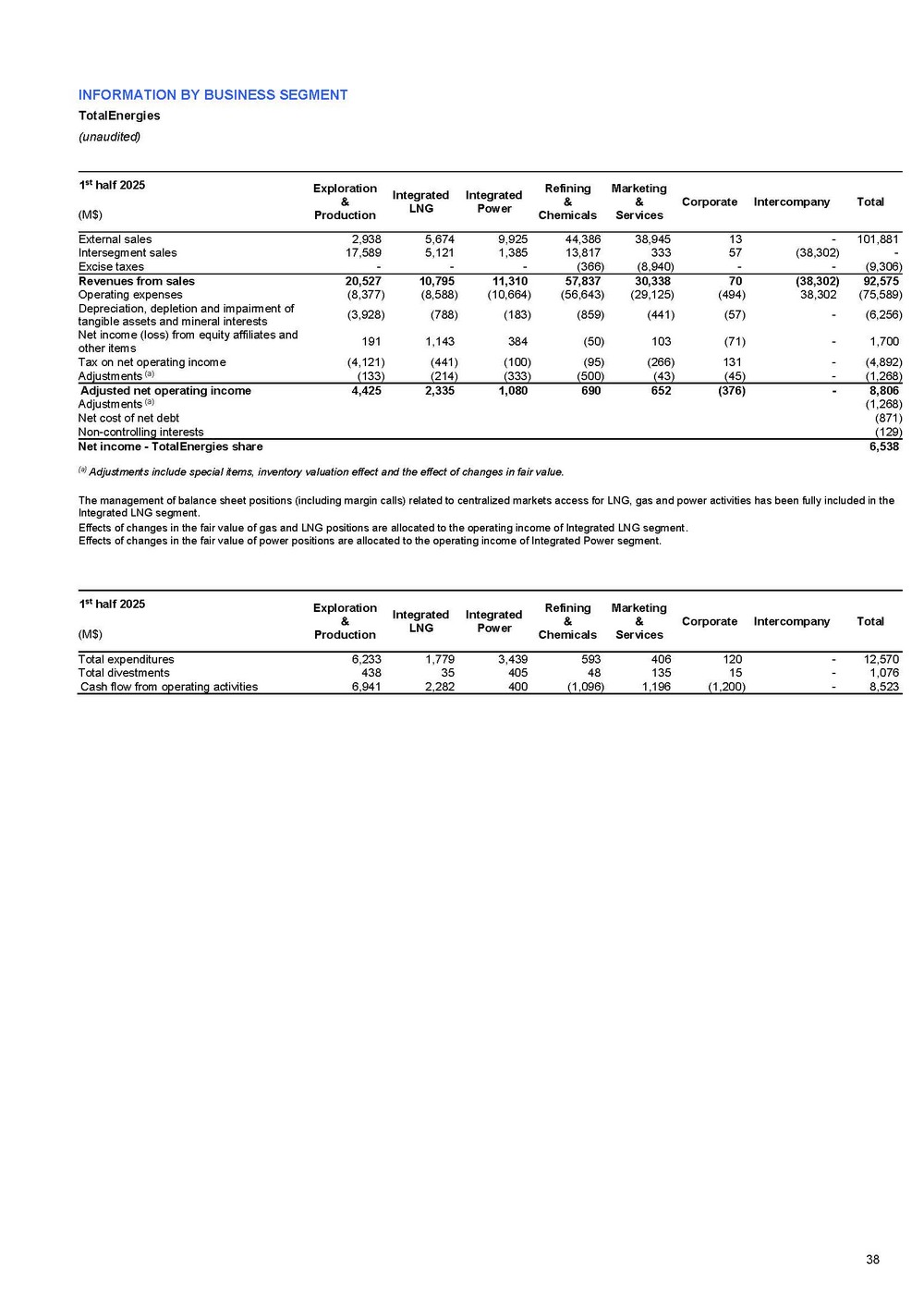

2. Key figures from TotalEnergies’ consolidated financial statements (1) (3 ) Effective tax rate = (tax on adjusted net operating income) / (adjusted net operating income – income from equity affiliates – dividends received from investments – impairment of goodwill + tax on adjusted net operating income). In accordance with IFRS rules, adjusted fully - diluted earnings per share is calculated from the adjusted net income less the interest on the perpetual subordinated bonds. Average € - $ exchange rate: 1.1338 in the 2 nd quarter 2025, 1.0523 in the 1 st quarter 2025, 1.0767 in the 2 nd quarter 2024, 1.0927 in the 1 st half 2025 and (4) (5) 1H25 vs 1H24 1H24 1H25 In millions of dollars, except effective tax rate, earnings per share and number of shares 2Q24 2Q25 vs 1Q25 1Q25 2Q25 - 11% 22,566 20,194 Adjusted EBITDA (1) 11,073 - 8% 10,504 9,690 - 16% 10,939 9,182 Adjusted net operating income from business segments 5,339 - 8% 4,792 4,390 - 15% 5,217 4,425 Exploration & Production 2,667 - 19% 2,451 1,974 - 2% 2,374 2,335 Integrated LNG 1,152 - 20% 1,294 1,041 - 3% 1,113 1,080 Integrated Power 502 +13% 506 574 - 57% 1,601 690 Refining & Chemicals 639 +29% 301 389 +3% 634 652 Marketing & Services 379 +72% 240 412 +13% 1,257 1,417 Contribution of equity affiliates to adjusted net income 636 - 2% 715 702 39.0% 41.4% Effective tax rate (3) 40.4% 41.4% 41.5% - 21% 9,784 7,770 Adjusted net income (TotalEnergies share) (1) 4,672 - 15% 4,192 3,578 - 18% 4.14 3.41 Adjusted fully - diluted earnings per share (dollars) (4) 1.98 - 14% 1.83 1.57 - 18% 3.82 3.12 Adjusted fully - diluted earnings per share (euros) (5) 1.85 - 21% 1.74 1.38 - 4% 2,333 2,236 Fully - diluted weighted - average shares (millions) 2,328 - 1% 2,246 2,224 - 31% 9,508 6,538 Net income (TotalEnergies share) 3,787 - 30% 3,851 2,687 +10% 8,482 9,320 Organic investments (1) 4,410 +7% 4,501 4,819 (280) ns 2,233 Acquisitions net of assets sales (1) 220 x4.3 420 1,813 +41% 8,202 11,553 Net investments (1) 4,630 +35% 4,921 6,632 - 15% 15,945 13,610 Cash flow from operations excluding working capital (CFFO) (1) 7,777 - 5% 6,992 6,618 - 12% 16,207 14,220 Debt Adjusted Cash Flow (DACF) (1) 7,895 - 5% 7,276 6,943 - 24% 11,176 8,523 Cash flow from operating activities 9,007 x2.3 2,563 5,960 Gearing (1) of 17.9% at June 30, 2025 vs 14.3% at March 31, 2025 and 10.2% at June 30, 2024 1.0813 in the 1 st half 2024 4 resale to non - end users (e.g.

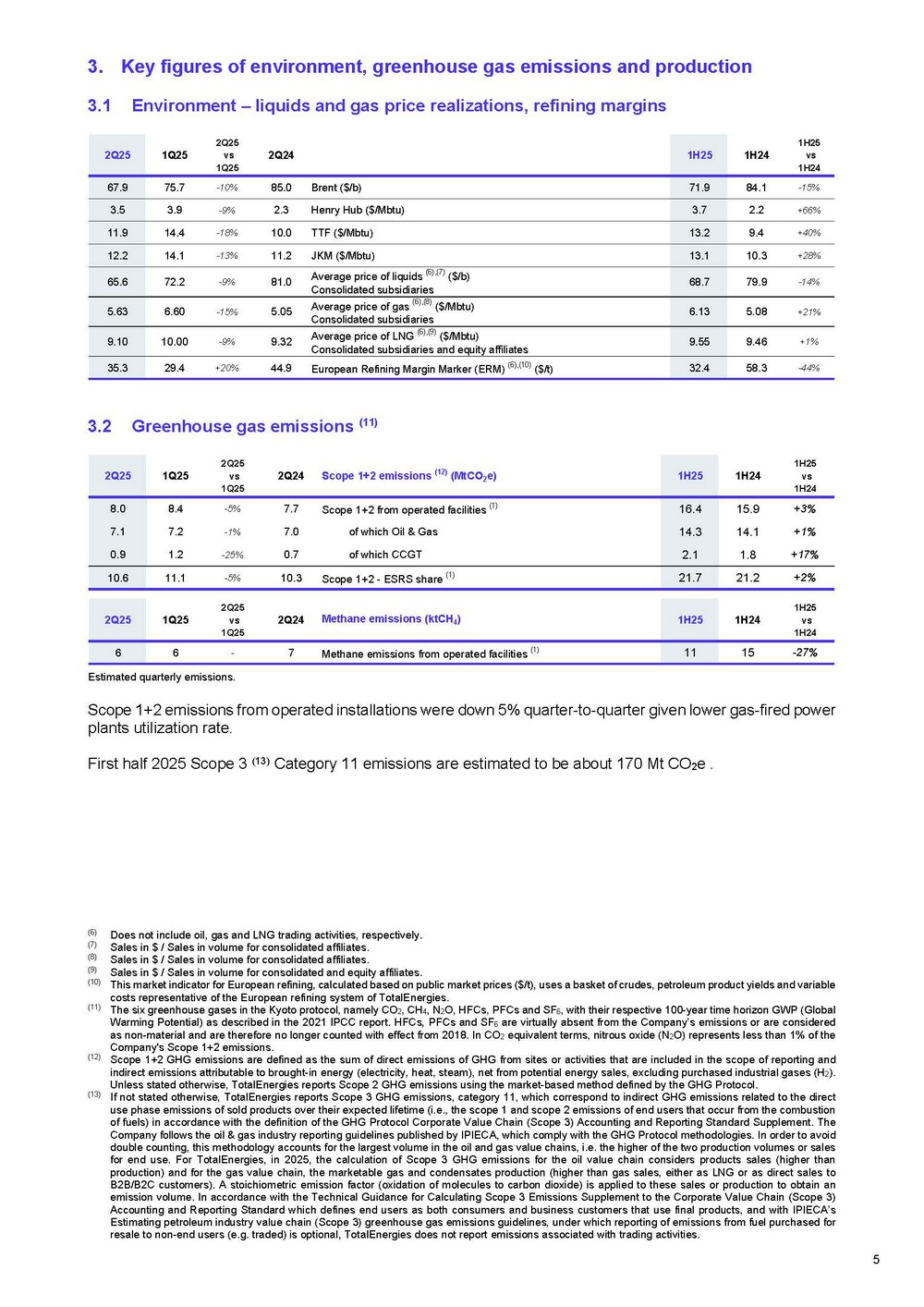

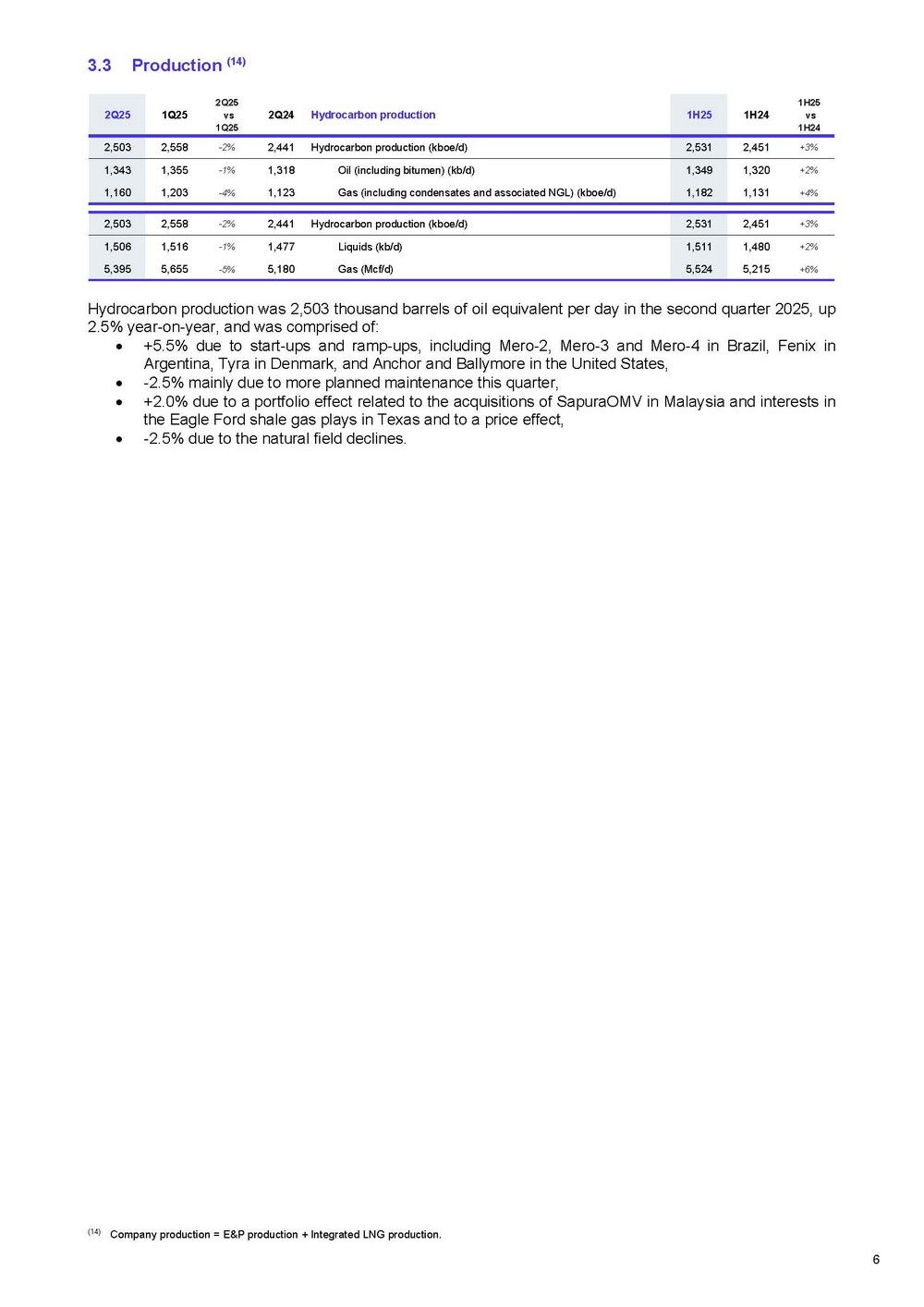

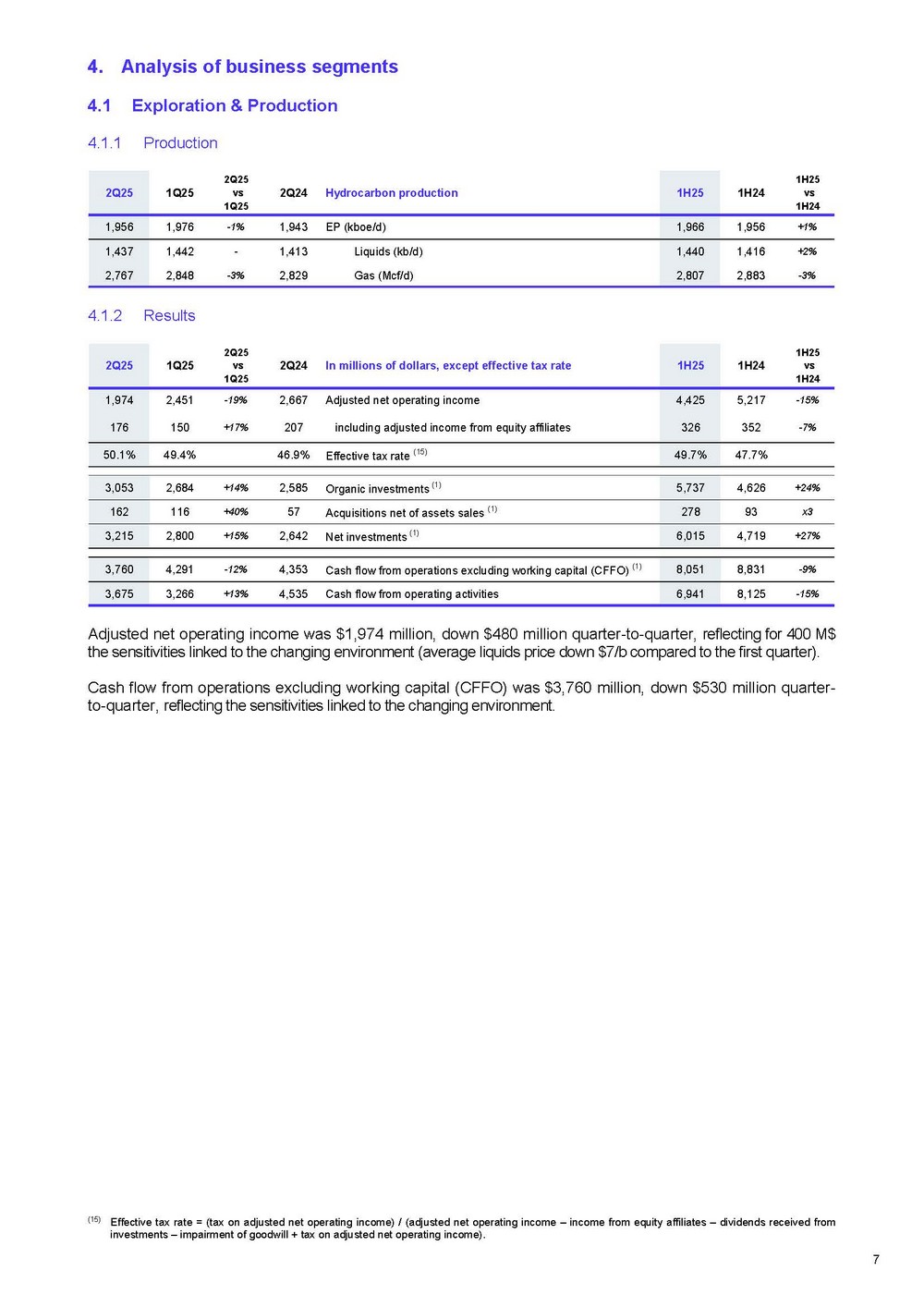

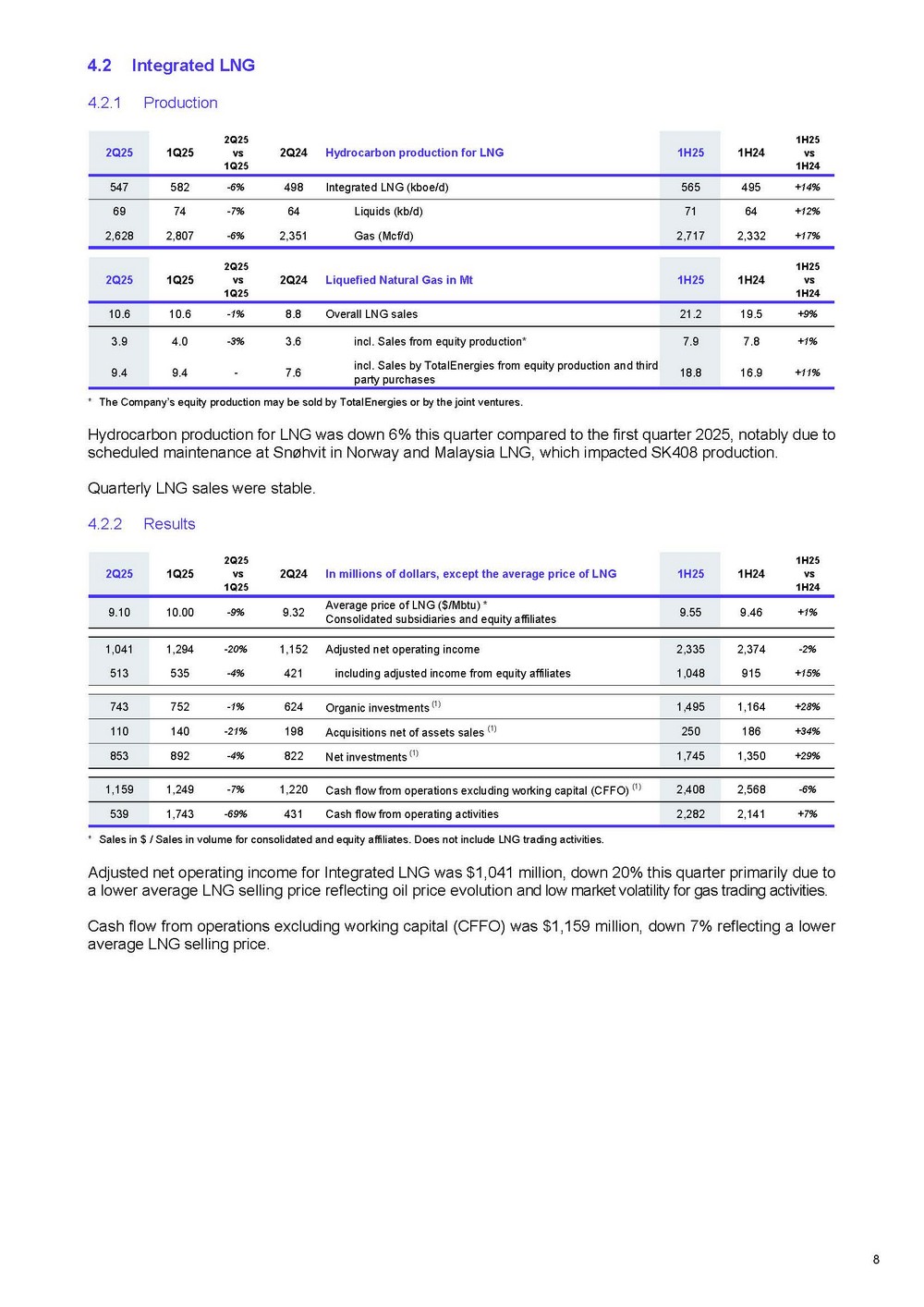

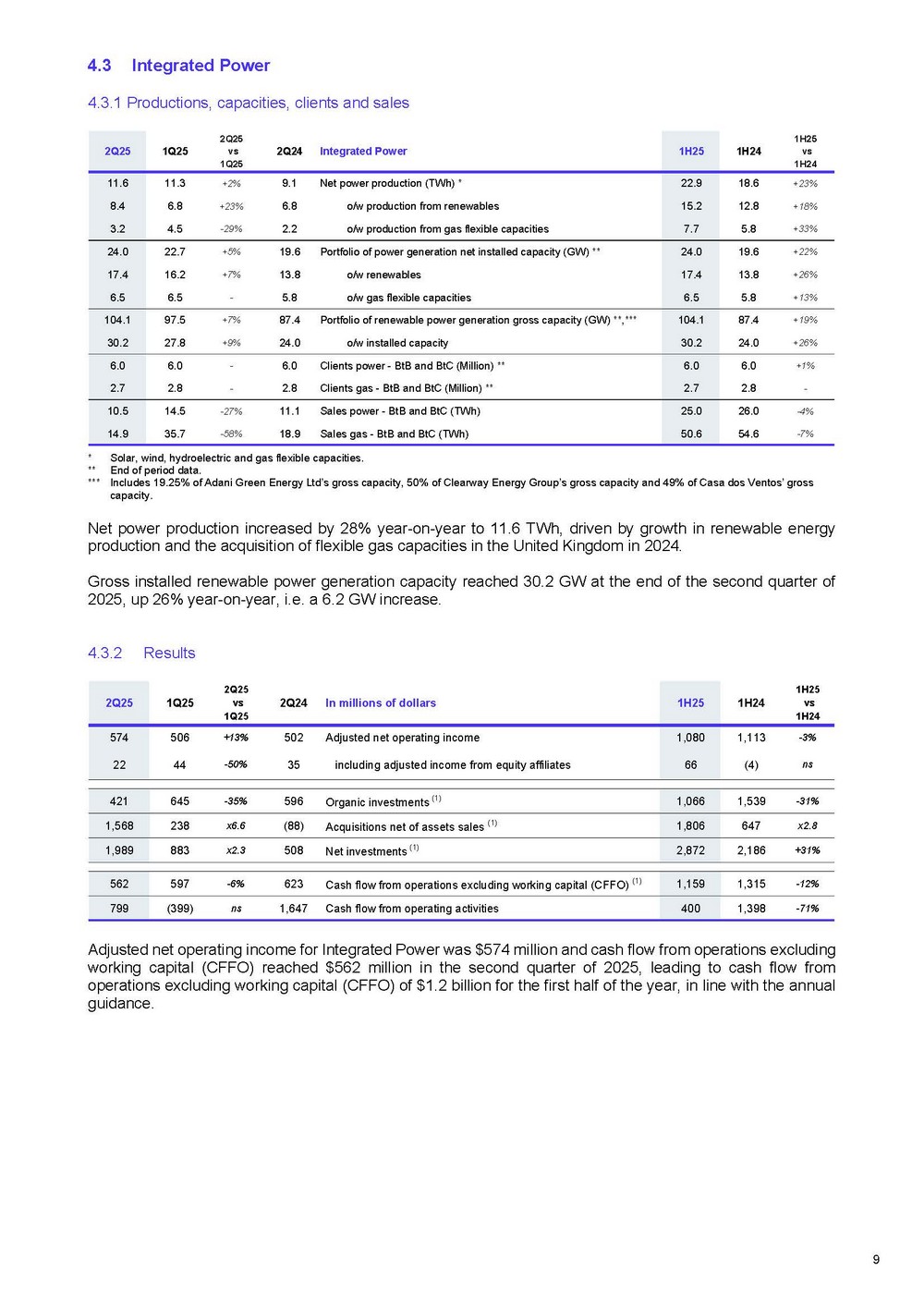

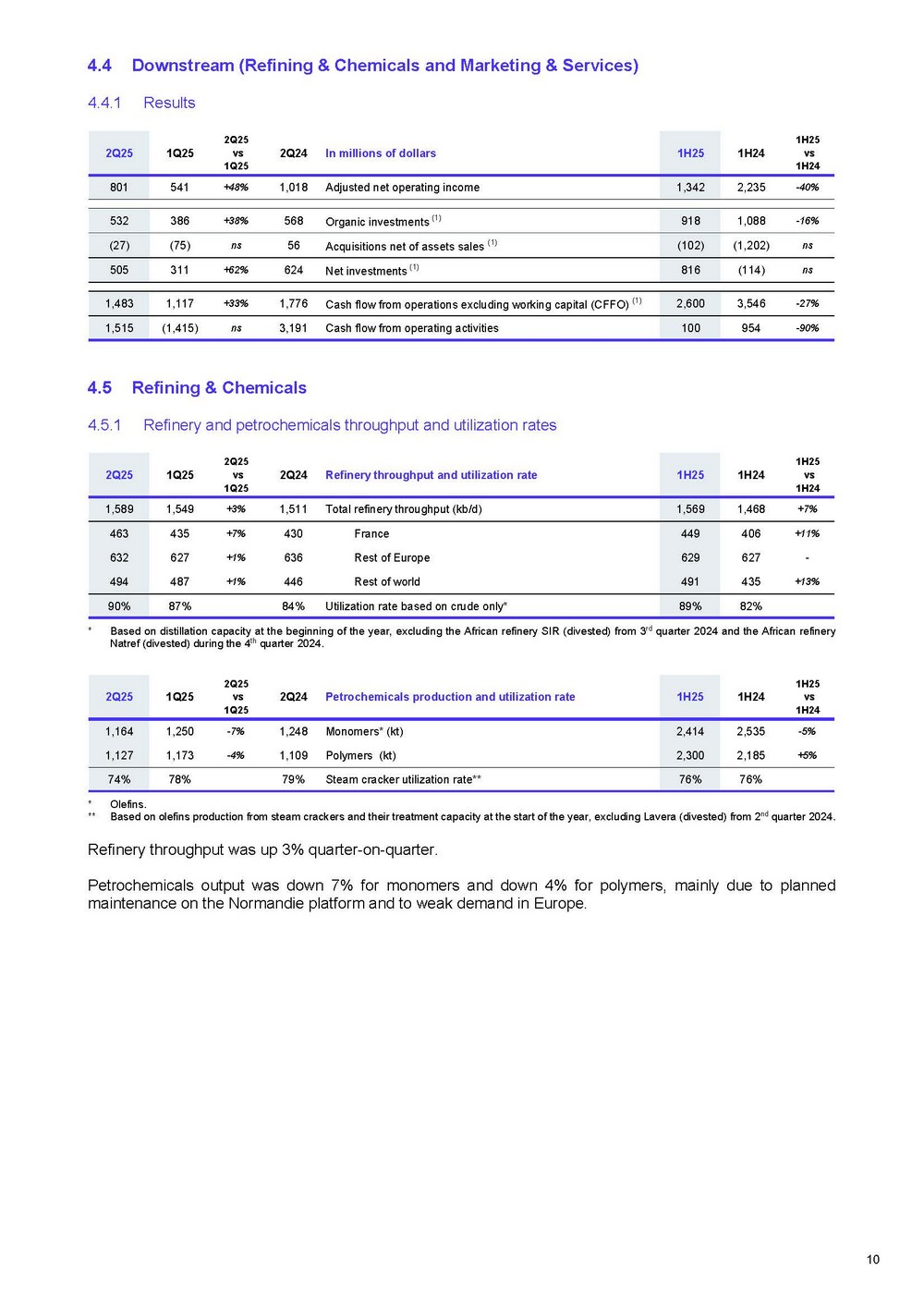

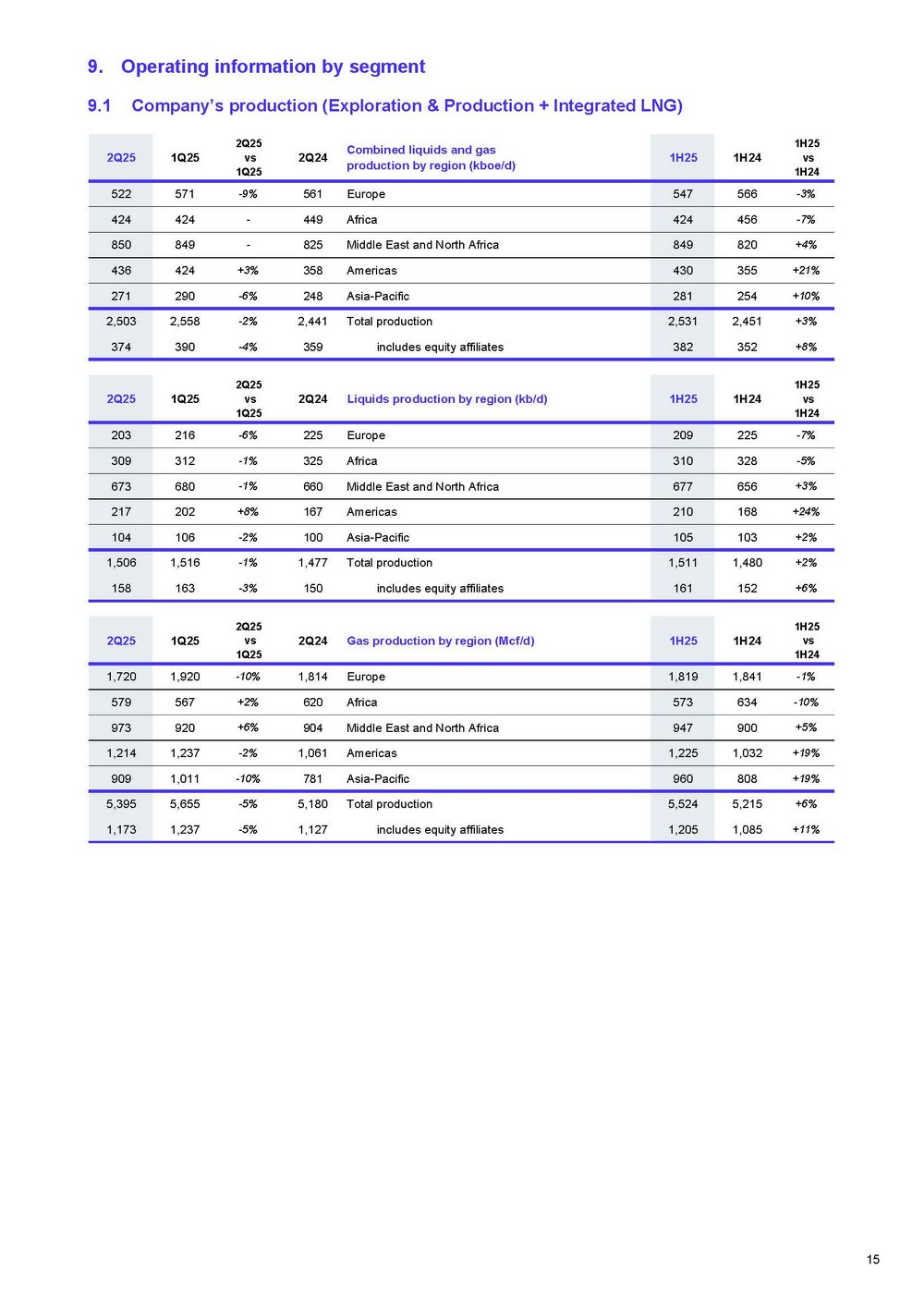

traded) is optional, TotalEnergies does not report emissions associated with trading activities. 5 3. Key figures of environment, greenhouse gas emissions and production 1. Environment – liquids and gas price realizations, refining margins 3.2 Greenhouse gas emissions (11) Estimated quarterly emissions. Scope 1+2 emissions from operated installations were down 5% quarter - to - quarter given lower gas - fired power plants utilization rate. First half 2025 Scope 3 (13) Category 11 emissions are estimated to be about 170 Mt CO 2 e . (6 ) (7) (8) (9) Does not include oil, gas and LNG trading activities, respectively. Sales in $ / Sales in volume for consolidated affiliates. Sales in $ / Sales in volume for consolidated affiliates. Sales in $ / Sales in volume for consolidated and equity affiliates. ( 10 ) This market indicator for European refining, calculated based on public market prices ( $ /t), uses a basket of crudes, petroleum product yields and variable costs representative of the European refining system of TotalEnergies . ( 11 ) The six greenhouse gases in the Kyoto protocol, namely CO 2 , CH 4 , N 2 O, HFCs, PFCs and SF 6 , with their respective 100 - year time horizon GWP (Global Warming Potential) as described in the 2021 IPCC report . HFCs, PFCs and SF 6 are virtually absent from the Company’s emissions or are considered as non - material and are therefore no longer counted with effect from 2018 . In CO 2 equivalent terms, nitrous oxide (N 2 O) represents less than 1 % of the Company's Scope 1 + 2 emissions . ( 12 ) Scope 1 + 2 GHG emissions are defined as the sum of direct emissions of GHG from sites or activities that are included in the scope of reporting and indirect emissions attributable to brought - in energy (electricity, heat, steam), net from potential energy sales, excluding purchased industrial gases (H 2 ) . Unless stated otherwise, TotalEnergies reports Scope 2 GHG emissions using the market - based method defined by the GHG Protocol . ( 13 ) If not stated otherwise, TotalEnergies reports Scope 3 GHG emissions, category 11 , which correspond to indirect GHG emissions related to the direct use phase emissions of sold products over their expected lifetime (i . e . , the scope 1 and scope 2 emissions of end users that occur from the combustion of fuels) in accordance with the definition of the GHG Protocol Corporate Value Chain (Scope 3 ) Accounting and Reporting Standard Supplement . The Company follows the oil & gas industry reporting guidelines published by IPIECA, which comply with the GHG Protocol methodologies . In order to avoid double counting, this methodology accounts for the largest volume in the oil and gas value chains, i . e . the higher of the two production volumes or sales for end use . For TotalEnergies, in 2025 , the calculation of Scope 3 GHG emissions for the oil value chain considers products sales (higher than production) and for the gas value chain, the marketable gas and condensates production (higher than gas sales, either as LNG or as direct sales to B 2 B/B 2 C customers) . A stoichiometric emission factor (oxidation of molecules to carbon dioxide) is applied to these sales or production to obtain an emission volume . In accordance with the Technical Guidance for Calculating Scope 3 Emissions Supplement to the Corporate Value Chain (Scope 3 ) Accounting and Reporting Standard which defines end users as both consumers and business customers that use final products, and with IPIECA’s Estimating petroleum industry value chain (Scope 3 ) greenhouse gas emissions guidelines, under which reporting of emissions from fuel purchased for 1H25 vs 1H24 1H24 1H25 2Q25 1Q25 vs 2Q24 1Q25 2Q25 - 15% 84.1 71.9 Brent ($/b) 75.7 - 10% 85.0 67.9 +66% 2.2 3.7 Henry Hub ($/Mbtu) 3.9 - 9% 2.3 3.5 +40% 9.4 13.2 TTF ($/Mbtu) 14.4 - 18% 10.0 11.9 +28% 10.3 13.1 JKM ($/Mbtu) 14.1 - 13% 11.2 12.2 - 14% 79.9 68.7 Average price of liquids (6),(7) ($/b) Consolidated subsidiaries 72.2 - 9% 81.0 65.6 +21% 5.08 6.13 Average price of gas (6),(8) ($/Mbtu) Consolidated subsidiaries 6.60 - 15% 5.05 5.63 +1% 9.46 9.55 Average price of LNG (6),(9) ($/Mbtu) Consolidated subsidiaries and equity affiliates 10.00 - 9% 9.32 9.10 - 44% 58.3 32.4 European Refining Margin Marker (ERM) (6),(10) ($/t) 29.4 +20% 44.9 35.3 1H25 2Q25 vs 1H24 1H25 Scope 1+2 emissions (12) (MtCO 2 e) 2Q24 1Q25 vs 2Q25 1H24 1Q25 +3% 15.9 16.4 Scope 1+2 from operated facilities (1) 7.7 8.4 - 5% 8.0 +1% 14.1 14.3 of which Oil & Gas 7.0 7.2 - 1% 7.1 +17% 1.8 2.1 of which CCGT 0.7 1.2 - 25% 0.9 +2% 21.2 21.7 Scope 1+2 - ESRS share (1) 10.3 11.1 - 5% 10.6 1H25 vs 1H24 1H24 1H25 Methane emissions (ktCH 4 ) 2Q24 2Q25 vs 1Q25 1Q25 2Q25 - 27% 15 11 Methane emissions from operated facilities (1) 7 - 6 6 6 3.3 Production (14 ) Hydrocarbon production was 2,503 thousand barrels of oil equivalent per day in the second quarter 2025, up 2.5% year - on - year, and was comprised of: +5.5% due to start - ups and ramp - ups, including Mero - 2, Mero - 3 and Mero - 4 in Brazil, Fenix in Argentina, Tyra in Denmark, and Anchor and Ballymore in the United States, - 2.5% mainly due to more planned maintenance this quarter, +2.0% due to a portfolio effect related to the acquisitions of SapuraOMV in Malaysia and interests in the Eagle Ford shale gas plays in Texas and to a price effect, - 2.5% due to the natural field declines.

(1 4) Company production = E&P production + Integrated LNG production. 1H25 vs 1H24 1H24 1H25 Hydrocarbon production 2Q24 2Q25 vs 1Q25 1Q25 2Q25 +3% 2,451 2,531 Hydrocarbon production (kboe/d) 2,441 - 2% 2,558 2,503 +2% 1,320 1,349 Oil (including bitumen) (kb/d) 1,318 - 1% 1,355 1,343 +4% 1,131 1,182 Gas (including condensates and associated NGL) (kboe/d) 1,123 - 4% 1,203 1,160 +3% 2,451 2,531 Hydrocarbon production (kboe/d) 2,441 - 2% 2,558 2,503 +2% 1,480 1,511 Liquids (kb/d) 1,477 - 1% 1,516 1,506 +6% 5,215 5,524 Gas (Mcf/d) 5,180 - 5% 5,655 5,395 7 4.