UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2025

Commission File Number 001-42611

ISOENERGY LTD.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

217 Queen Street West, Suite 401

Toronto, Ontario

M5V 0R2

Tel: 1-833-572-2333

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

INCORPORATION BY REFERENCE

The exhibit to this report on Form 6-K is incorporated by reference into, and as an exhibit to, the Registration Statements on Form F-10 (Commission File No. 333-287236) and Form S-8 (Commission File No. 333-287876) of the registrant, IsoEnergy Ltd.

EXHIBIT INDEX

| Exhibit Number | Description |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ISOENERGY LTD. | ||

| Date: July 31, 2025 | By: | /s/ Graham du Preez |

| Name: Graham du Preez | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the Three and Six Months Ended June 30, 2025 and 2024

Dated: July 31, 2025

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

GENERAL INFORMATION

This Management’s Discussion and Analysis (“MD&A”) is management’s interpretation of the results and financial condition of IsoEnergy Ltd. and its subsidiaries (“IsoEnergy” or the “Company”) for the three and six months ended June 30, 2025 and includes events up to the date of this MD&A. This discussion should be read in conjunction with the unaudited condensed consolidated interim financial statements for the three and six months ended June 30, 2025 and 2024 and the notes thereto (the “Interim Financial Statements”) and other corporate filings, including the Company’s audited consolidated financial statements for the years ended December 31, 2024 and 2023 and the notes thereto (the “Annual Financial Statements”) and Annual Information Form for the year ended December 31, 2024 (the “AIF”), which are available under the Company’s profile on SEDAR+ at www.sedarplus.ca and in the Company’s initial registration Form 40-F available on EDGAR at www.sec.gov. All dollar figures stated herein are expressed in Canadian dollars and referenced as “$”, unless otherwise specified. Monetary amounts expressed in US dollars and Australian dollars are referenced as “US$” and “AUD$”, respectively. This MD&A contains forward-looking information. Please see “Note Regarding Forward-Looking Information” for a discussion of certain of the risks, uncertainties and assumptions used to develop the Company’s forward-looking information.

Technical Disclosure

All scientific and technical information in this MD&A has been reviewed and approved by Dr. Dan Brisbin, P.Geo., Ph.D., IsoEnergy’s Vice-President, Exploration. Dr. Brisbin is a “Qualified Person” for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”). Dr. Brisbin has verified the data disclosed, including sampling, analytical and test data.

All chemical analyses disclosed in this MD&A were completed for the Company by SRC Geoanalytical Laboratories in Saskatoon, Saskatchewan, which is independent of the Company.

All references in this MD&A to “Mineral Resource”, “Inferred Mineral Resource”, “Indicated Mineral Resource”, and “Mineral Reserve” have the meanings ascribed to those terms by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended.

For additional information regarding the Company’s 100% owned Larocque East, Tony M, and Radio Projects and its 50% owned Thorburn Lake Project, including its Quality Assurance and Quality Control (“QA/QC”) and data verification procedures, please see the AIF and corresponding technical reports entitled “Technical Report on the Larocque East Project, Northern Saskatchewan, Canada” prepared by SLR Consulting (Canada) Ltd. and dated effective July 8, 2022 (the “Larocque East Technical Report”), “Technical Report on the Tony M Mine, Utah, USA, Report for NI 43-101” prepared by SLR International Corporation and dated effective September 9, 2022 (the “Tony M Technical Report”), “Technical Report for the Radio Project, Northern Saskatchewan” prepared by Tim Maunula, P. Geo. and dated effective August 19, 2016 and “Technical Report for the Thorburn Lake Project, Northern Saskatchewan” prepared by Tim Maunula, P. Geo. and dated effective September 26, 2016, all of which are available under the Company’s profile on SEDAR+ at www.sedarplus.ca.

Each of the Mineral Resource estimates with respect to the properties of IsoEnergy contained in this MD&A, except for the Larocque East Project and the Tony M Mine, are considered to be “historical estimates” as defined under NI 43-101 and are not considered to be current by IsoEnergy. See “Historical Estimates” for additional details.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Differences in United States and Canadian Reporting Practices

This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements promulgated by the Securities and Exchange Commission (the “SEC”). For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this MD&A may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements. The Company prepares its financial statements, which are referred to in this MD&A, in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), and the audit of its annual financial statements is subject to Canadian auditing and auditor independence standards.

Industry and Economic Factors that May Affect the Business

The business of mining for minerals involves a high degree of risk. IsoEnergy is an exploration and development company and is subject to risks and challenges similar to companies in a comparable stage and industry. These risks include, but are not limited to, the challenges of securing adequate capital; exploration, development and operational risks inherent in the mining industry; changes in government policies and regulations; the ability to obtain the necessary permitting; as well as global economic and uranium price volatility; all of which are uncertain.

As with other companies involved with mineral exploration and development, the Company is subject to cost inflation on exploration drilling and development activities and the Company may experience difficulty and / or delays in securing goods (including spare parts) and services from time-to-time.

The underlying value of the Company’s exploration and development assets is dependent upon the existence and economic recovery of Mineral Reserves and is subject to, among others, the risks and challenges identified above. Changes in future conditions could require material write-downs of the carrying value of the Company’s exploration and development assets. The Company does not have any current Mineral Reserves.

In particular, the Company does not generate revenue. As a result, IsoEnergy continues to be dependent on third party financing to continue exploration and development activities on the Company’s properties. Accordingly, the Company’s future performance will be most affected by its access to financing, whether debt, equity or other means. Access to such financing, in turn, is affected by general economic conditions, the price of uranium, exploration risks and the other factors some of which are described in the section entitled “Risk Factors” included below.

ABOUT ISOENERGY

IsoEnergy was incorporated on February 2, 2016 under the Business Corporations Act (British Columbia) to acquire certain exploration assets of NexGen Energy Ltd. (“NexGen”). On October 19, 2016, IsoEnergy was listed on the TSX Venture Exchange (“TSXV”). On June 20, 2024, the Company completed its continuance from the province of British Columbia to the province of Ontario under the same name. The Company’s common shares were delisted from the TSXV and began trading on the Toronto Stock Exchange (the “TSX”) on July 8, 2024 under the trading symbol “ISO”. On March 20, 2025, the Company completed the consolidation of its issued and outstanding common shares on the basis of one post-consolidation common share for every four pre-consolidation common shares (the “Share Consolidation”). Throughout this MD&A, references to common shares, stock options, restricted share units and per share amounts are restated to post-consolidation amounts where applicable. The Share Consolidation was implemented in connection with the Company’s application to list its common shares on the NYSE American LLC (the “NYSE American”). On May 5, 2025, the Company’s common shares began trading on the NYSE American under the trading symbol “ISOU”. As of the date hereof, NexGen holds approximately 30.9% of IsoEnergy’s outstanding common shares.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

The principal business activity of IsoEnergy is the acquisition, exploration and development of uranium mineral properties in Canada, the United Sates, and Australia.

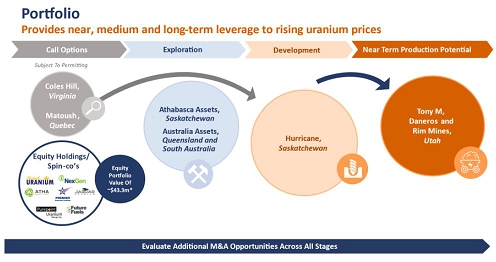

* Equity holdings include investments in NexGen, Premier American Uranium Inc., Atha Energy Corp., Purepoint Uranium Inc., and Future Fuels Inc., based on market close of July 30, 2025, and Jaguar Uranium Inc. and Royal Uranium Inc. at cost translated to Canadian dollars using the Bank of Canada USD:CAD exchange rate on the same date.

The Company is currently advancing it’s Larocque East Project in the Athabasca Basin, Saskatchewan, Canada, which is home to the Hurricane deposit (“Hurricane” or “Hurricane Deposit”), which has the world's highest grade published Indicated uranium Mineral Resource – 48.6 million pounds of U3O8 at an average grade of 34.5% contained in 63,800 tonnes. The Company also holds a portfolio of permitted, past-producing conventional uranium mines in Utah with toll milling agreements in place with Energy Fuels Inc. (“Energy Fuels”). These mines are currently on stand-by, ready for a potential restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer. The Company also has a 50% interest in a joint venture formed on December 18, 2024 with Purepoint Uranium Group Inc. (“Purepoint Uranium”), with respect to a portfolio of exploration projects in the Athabasca Basin (the “Purepoint Joint Venture”). The Company’s projects are at varying stages of exploration and development, providing near, medium, and long-term leverage to rising uranium prices. None of the Company’s projects are currently in production and no decisions have been made to bring any of the Company’s projects to the production stage.

IsoEnergy’s uranium mineral properties are reflected below.

| 1. | For additional information please refer to the Tony M Technical Report. | |

| 2. | This estimate is a “historical estimate” as defined under NI 43-101. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources and the Company is not treating the historical estimate as current mineral resources. See “Historical Estimates” below for additional details. | |

| 3. | For additional information please refer to the Larocque East Technical Report. | |

| 4. | Jurisdiction rankings are based on the Investment Attractiveness Index from the Fraser Institute Annual Survey of Mining Companies 2024. |

As an exploration stage company, IsoEnergy does not have revenues and is expected to generate operating losses. As of June 30, 2025, the Company had cash and cash equivalents of $84,666,913, an accumulated deficit of $99,326,901 and adjusted working capital of $124,922,827 (as defined in “Non-IFRS Financial Measures” below).

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

YEAR-TO-DATE 2025 HIGHLIGHTS

| · | Exploration update in the Athabasca Basin |

A total of 6,396 metres of drilling in 17 diamond drill holes were successfully completed early in 2025 along the Larocque East Project focused on the Larocque regional geological-geophysical corridor (“Larocque Trend”), which hosts the Hurricane Deposit (Figure 4). Drilling intersected strongly elevated radioactivity along the eastern extensions of the Hurricane Deposit’s Main and South trends (Figure 2), as well as at Area D, 2.8 kilometres east (Figure 4), highlighting the potential for additional uranium zones near the deposit and along the Larocque Trend. The summer 2025 drill program at Larocque East has commenced and is expected to encompass a total of 20 diamond drill holes for 7,600 metres of drilling following up on encouraging results from the winter 2025 program. This will be followed by 3,400 metres of drilling in four holes on the Hawk project. The inaugural drill program at the Dorado project, operated through the Purepoint Joint Venture, focused on the Q48 target and intersected uranium mineralization in four holes and led to the recent discovery of the Nova zone.

Additional work has been completed or is planned to be completed in summer 2025 to advance a pipeline of exploration targets across the Athabasca Basin, including helicopter-borne MobileMT surveys at the East Rim project, ground electromagnetic (“EM”) and Ambient Noise Tomography (“ANT”) surveys on the Hawk project, and prospecting work at the Bulyea River, East Rim, and Evergreen projects.

| · | Commencement of key work programs at Tony M |

The Company has initiated several work programs at the Tony M Mine that are intended to optimize operational readiness and reduce future production costs. Technical studies are underway, including ore sorting and High-Pressure Slurry Ablation (“HPSA”) testing programs, as well as an enhanced evaporation study. Multiple mining methods are being evaluated to optimize future production scenarios. The Tony M Mine remains fully permitted and these efforts will inform a potential production decision targeted for later in 2025.

| · | Exercise of put option on Joint Venture Agreement with Purepoint Uranium |

On January 14, 2025, the Company exercised a put option to sell to Purepoint Uranium 10% of the Company’s initial participation interest in the Purepoint Joint Venture in exchange for 4,000,000 common shares of Purepoint Uranium. After the exercise of the put option, each of the Company and Purepoint Uranium holds a 50% interest in the Purepoint Joint Venture.

| · | Terminated transaction with Anfield Energy |

On January 14, 2025, Anfield Energy Inc. (“Anfield Energy”) provided IsoEnergy with notice of termination of the previously announced arrangement agreement pursuant to which, among other things, IsoEnergy agreed to acquire all the issued and outstanding common shares of Anfield Energy by way of a court-approved plan of arrangement (the “AEC Arrangement”). IsoEnergy had provided a bridge loan (“Bridge Loan”) to Anfield Energy in the form of a promissory note of approximately $6.0 million and an indemnity for up to US$3.0 million in principal (the “Indemnity”) with respect to certain of Anfield Energy’s property obligations. On January 21, 2025, the Bridge Loan was fully repaid, including accrued interest at 15% per annum. On March 3, 2025, the Indemnity was released in full.

| · | Sale of Mountain Lake property |

On February 14, 2025, the Company completed the sale of its Mountain Lake property located in Nunavut pursuant to an asset purchase agreement with Future Fuels Inc. (“Future Fuels”). As consideration for this sale, the Company received 12,500,000 common shares of Future Fuels on closing, a 2% NSR payable on all future uranium production from Mountain Lake, of which half can be repurchased by Future Fuels for $1.0 million, and a 1% NSR payable on all future uranium production on all other Future Fuels properties. The Company is entitled to receive an additional 2,500,000 common shares of Future Fuels on the earliest date practicable such that it will not result in the Company owning or controlling more than 19.99% of all outstanding common shares of Future Fuels.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

| · | Flow Through Financing and Concurrent Private Placement |

On February 28, 2025, the Company closed a financing with a syndicate of underwriters (the “Underwriters”) under a bought deal financing arrangement (the “February 2025 Flow-Through Financing”) whereby the Company issued 1,333,825 “flow-through” common shares at a price of $15.00 per share, for gross proceeds of approximately $20.0 million. The Underwriters were paid a cash commission of 6.0% of the gross proceeds of the February 2025 Flow-Through Financing.

The proceeds from the February 2025 Flow-Through Financing are required to be spent on eligible “Canadian exploration expenses” that will qualify as “flow-through critical mineral mining expenditures” (in each case as defined in the Income Tax Act (Canada) (the “Tax Act”)) by December 31, 2026 and the Company is required to renounce the full amount of the gross proceeds of the financing to the subscribers of the flow-through shares no later than December 31, 2025.

Concurrent with the February 2025 Flow-Through Financing, the Company completed a non-brokered private placement with NexGen to issue 625,000 common shares at a price of $10.00 per share for total gross proceeds of approximately $6.3 million (the “Concurrent Private Placement”). The Concurrent Private Placement enabled NexGen to maintain its pro-rata ownership interest in the Company at approximately 31.8%.

| · | Share Consolidation |

On March 20, 2025, the Company completed the consolidation of the Company’s issued and outstanding common shares on the basis of one post-consolidation common share for every four pre-consolidation common shares and any fractional shares were rounded down to the nearest whole common share. The Share Consolidation was effected following approval from the Company’s Board of Directors and regulatory approval from the TSX. The Share Consolidation was implemented in connection with the Company’s application to list its common shares on the NYSE American.

| · | Listing on the NYSE American |

On May 5, 2025, the Company’s common shares commenced trading on the NYSE American under the trading symbol “ISOU”.

| · | Sale of royalty assets |

On May 15, 2025, the Company completed the sale of all the current royalty interests held by IsoEnergy and its subsidiary with respect to properties in Nunavut and Argentina, to Royal Uranium Inc. (“Royal Uranium”) for 8,000,000 Royal Uranium shares at a price of $0.35 per share, for total proceeds of $2,800,000.

| · | Launch of At-The-Market equity program |

On June 2, 2025, the Company entered into an equity distribution agreement (the “Distribution Agreement”) with a group of agents (the “Agents”). The Distribution Agreements allows to Company to distribute up to $75.0 million of its common shares, through the Agents, through the NYSE American or TSX (the “ATM Program”).

| · | Bought Deal Financing |

On June 24, 2025, the Company issued 5,121,500 common shares at a price of $10.00 per share for gross proceeds of $51.2 million (the “Bought Deal Financing”). A cash commission of up to 5% of the gross proceeds of the financing was paid to the brokers involved in the Bought Deal Financing. NexGen participated in the Bought Deal Financing and purchased 1,200,000 common shares.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

| · | Sustainability Report |

On July 15, 2025, the Company released its inaugural sustainability report for the year ended December 31, 2024 (the “Sustainability Report”). The Sustainability Report highlights the Company’s progress in advancing its global uranium portfolio with a focus on environmental stewardship, Indigenous partnerships, and responsible governance, and marks a milestone in the Company’s evolution. The full Sustainability Report is available on the Company’s website at www.isoenergy.ca.

| · | Common share issuances and stock options (1) |

In the six months ended June 30, 2025, the Company issued 180,000 common shares on the exercise of stock options for proceeds of $277,200 and granted 516,375 stock options at an exercise price of $11.72. The Company issued 1,221,818 common shares to Queens Road Capital Investment Ltd. (“QRC”) as a result of QRC’s election to convert US$3,000,000 of the US$6,000,000 principal of the unsecured convertible debentures issued on August 18, 2020 (the “2020 Debentures”). The Company also elected to issue 16,666 common shares to Critical Path Minerals Corp. to satisfy the 1st anniversary payment due related to the Company’s purchase of the Bulyea River project (Figure 1).

(1) Common share issuances and stock options granted in the six months ended June 30, 2025 above are presented on a post-consolidation basis. Refer to the discussion on the Share Consolidation, as described above in “About IsoEnergy”.

DISCUSSION OF OPERATIONS

Six months ended June 30, 2025

During the six months ended June 30, 2025, the Company incurred $9,406,468 of exploration and evaluation spending on its exploration properties globally, as set out below. Most of the spending was at the Company’s Larocque East Project in the Athabasca Basin as further discussed below. See “Outlook” below for future exploration plans.

Exploration and evaluation spending

| Canada | United States | Australia | Total | |||||||||||||

| Drilling | $ | 3,258,690 | $ | - | $ | - | $ | 3,258,690 | ||||||||

| Geological and geophysical | 1,532,983 | 88,566 | - | 1,621,549 | ||||||||||||

| Labour and wages | 716,879 | 541,867 | 104,684 | 1,363,430 | ||||||||||||

| Camp costs | 859,805 | 54,964 | 23,990 | 938,759 | ||||||||||||

| Engineering and underground access | 41,085 | 370,364 | - | 411,449 | ||||||||||||

| Community relations | 255,996 | - | - | 255,996 | ||||||||||||

| Travel | 136,026 | 40,421 | 27,152 | 203,599 | ||||||||||||

| Health and safety and environmental | 141,300 | 2,482 | 38,377 | 182,159 | ||||||||||||

| Geochemistry and assays | 142,541 | - | - | 142,541 | ||||||||||||

| Claim holding costs and advance royalties | 17,518 | 71,092 | 31,725 | 120,335 | ||||||||||||

| Extension of claim refunds | (10,713 | ) | - | - | (10,713 | ) | ||||||||||

| Other | 168,918 | 111,916 | 26,096 | 306,930 | ||||||||||||

| Cash expenditures | $ | 7,261,028 | $ | 1,281,672 | $ | 252,024 | $ | 8,794,724 | ||||||||

| Share-based compensation | 618,242 | 253,778 | 14,427 | 886,447 | ||||||||||||

| Foreign exchange movements | - | (278,522 | ) | 3,819 | (274,703 | ) | ||||||||||

| Total expenditures | $ | 7,879,270 | $ | 1,256,928 | $ | 270,270 | $ | 9,406,468 | ||||||||

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Canada

Expenditures on the Company’s properties in the Athabasca Basin (Figure 1) and Quebec were primarily focused on the following projects during the six months ended June 30, 2025:

| Larocque East |

Hawk | Purepoint JV | East Rim | Other | Total | |||||||||||||||||||

| Drilling | $ | 2,657,684 | $ | 69,574 | $ | 531,432 | $ | - | $ | - | $ | 3,258,690 | ||||||||||||

| Geological and geophysical | 26,493 | 623,139 | 3,500 | 672,576 | 207,275 | 1,532,983 | ||||||||||||||||||

| Camp costs | 711,466 | 39,841 | 92,732 | - | 15,766 | 859,805 | ||||||||||||||||||

| Labour and wages | 441,381 | 68,311 | 85,931 | 43,451 | 77,805 | 716,879 | ||||||||||||||||||

| Community Relations | 152,811 | 49,903 | 26,117 | 19,841 | 7,324 | 255,996 | ||||||||||||||||||

| Geochemistry and assays | 142,263 | - | - | - | 278 | 142,541 | ||||||||||||||||||

| Travel | 96,197 | 1,403 | 17,044 | - | 21,382 | 136,026 | ||||||||||||||||||

| Health and safety and environmental | 129,188 | 1,750 | 1,657 | 1,540 | 7,165 | 141,300 | ||||||||||||||||||

| Engineering | - | - | - | - | 41,085 | 41,085 | ||||||||||||||||||

| Claim holding costs | 1,519 | - | 350 | 525 | 15,124 | 17,518 | ||||||||||||||||||

| Net extension of claim refunds | - | - | - | - | (10,713 | ) | (10,713 | ) | ||||||||||||||||

| Other | 13,397 | 4,933 | 75,693 | 1,143 | 73,752 | 168,918 | ||||||||||||||||||

| Cash expenditures | $ | 4,372,399 | $ | 858,854 | $ | 834,456 | $ | 739,076 | $ | 456,243 | 7,261,028 | |||||||||||||

| Share-based compensation | 382,868 | 77,732 | 73,601 | 68,399 | 15,642 | 618,242 | ||||||||||||||||||

| Total expenditures | $ | 4,755,267 | $ | 936,586 | $ | 908,057 | $ | 807,475 | $ | 471,885 | $ | 7,879,270 | ||||||||||||

Figure 1 – Athabasca Basin Property Location Map

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Larocque East Project

Winter 2025 – Diamond Drilling and Geophysical Work

The winter 2025 drilling program focused on testing resource expansion targets near the Hurricane Deposit and at the Target Area D 2.8 kilometres east-northeast of Hurricane along the prospective Larocque Trend where ANT surveys in 2023 and 2024 outlined prospective velocity anomalies. The winter 2025 drilling program was designed to drill at these identified targets and 17 diamond drill holes totalling 6,396 metres were completed. The drilling intersected strongly elevated radioactivity in five holes along the eastern extensions of the Hurricane Deposit main and south trends, as well as at Area D, 2.8 kilometres east of Hurricane, highlighting the potential for additional zones of uranium mineralization both immediately on strike of Hurricane and regionally along the 9 kilometres of the Larocque Trend on the Project (Figures 2 and 4).

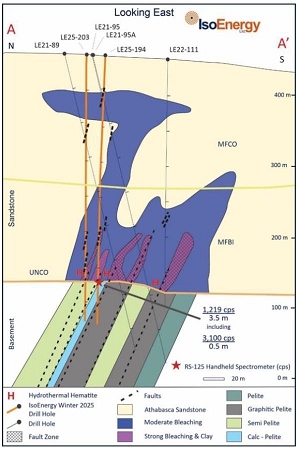

A total of 13 holes were completed to test three interpreted structural trends at Hurricane (Figure 2). Four holes (LE25-194, 195, 198, 203) were drilled to test the projected eastern extension of the faults that control the main high-grade portion of Hurricane (the “Main Trend”). Seven holes (LE25-197, 199, 200, 201, 207, 208, 210) were drilled to test the projected extension of faults that control the Hurricane southern high-grade lens (the “South Trend”). Two holes (LE25-196, 205A) were drilled to test a structure intersected in historic drill holes in the middle sandstone north of Hurricane at the unconformity.

In the Main Trend, hole LE25-194 tested down-dip of structure and anomalous geochemistry intersected in LE21-89 and LE21-95A (Figure 3). Hole LE25-194 intersected widespread moderate to strongly bleached core through most of the sandstone. Strong pervasive bleaching, clay alteration and desilicification were intersected below 295 metres. Moderate hematite and grey alteration, typical of Hurricane were intersected immediately above the unconformity associated with strongly elevated radioactivity over 3.5 metres from 316.0 to 319.5 metres which included a 0.5 metre-long interval with an average RS-125 spectrometer value of 3,100 counts per second (“cps”) and a corresponding gamma ray (“2PGA”) probe value of 30,829 cps. Mineralization styles include worm-rock replacement, fault-controlled and disseminated. Hole LE25-198 drilled 100 metres east of hole LE25-194, intersected widespread bleaching throughout the sandstone. Clay and limonite alteration, centered on a fault, were intersected from 259 to 263 metres. A broad structural zone with continuous strong bleaching, desilicification, and clay alteration is present below 287 metres. Fault-controlled hydrothermal hematite and weak grey alteration were intersected approximately 10 metres above the unconformity, indicating the hole overshot the ideal target. Strong pervasive limonite and clay alteration continued to the unconformity at 316.5 metres. The basement rock immediately below the unconformity is moderately argillitized and chloritized, with above-background radioactivity as measured on core and by downhole gamma probing extending from 314.0 metres in sandstone down to 321.1 metres in basement. Peak values recorded on drill core with the RS-125 spectrometer and with the 2PGA downhole probe are 625 cps average over a 0.5 metre interval and 26,503 cps respectively. Hole LE25-198 is interpreted to have overshot the target, and potential for mineralization remains high to the north. Hole LE25-203 tested north of hole LE25-194 and intersected strong bleaching, moderate clay and desilicification centred on structural zones below 283 metres. Fault-controlled hematite alteration was intersected at 320.3 metres. A peak of 4,809 cps was recorded on the 2PGA probe at 325.0 metres, one metre below the unconformity.

In the South Trend, hole LE25-207 was drilled between holes LE21-101 and LE22-115A to test for continuity of mineralization. Hole LE25-207 intersected moderate bleaching beginning at 245 metres. Elevated radioactivity was intersected within hematitic breccia at 293 metres. Strong structurally controlled bleaching and moderate clay alteration were observed from 301 metres to the unconformity at 323.8 metres, with significant core loss recorded from 308 to 323 metres. Strongly elevated radioactivity was recorded over 6.0 metres from 323.0 metres in the sandstone to 329.0 metres in the basement (Figure 5). The interval included RS-125 spectrometer and 2PGA probe values of 8,800 cps averaged over a 0.5 metre interval and 30,096 cps, respectively. Hole LE25-210 tested down-dip of the sandstone structure intersected in hole LE22-118A. Strong bleaching, clay alteration, and desilicification were observed below 251 metres. Weak to moderate fault-controlled hematite alteration was intersected at 319.5 metres and 323.6 metres. Continuous radioactivity exceeding 350 cps was intersected in sandstone at 319 metres and extended into the basement to 324 metres. The highest radioactivity measured on core of 3,700 cps averaged over a 0.5 metre interval and a corresponding 2PGA downhole probe peak of 20,280 cps were recorded within a basement-hosted fault, highlighting the potential for a basement extension of Hurricane.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Drilling in Area D along the Larocque Trend had the best radioactivity intercept to date outside of the Hurricane deposit area and confirms regional potential. Four holes (LE25-202, 204, 206 and 209) were completed this winter (Figure 4). Three holes on one section in the northwest end of Target Area D in which strongly anomalous radioactivity was intersected are summarized below.

Hole LE25-202, the first drill hole on section (Figure 5), intersected weak to moderate bleaching in the upper sandstone. In the lower sandstone, below 206 metres, alteration is moderate to strong with a broad bleached, clay and desilicified zone centred on faults. Moderate to strong limonite in present over a 10 metre interval below 254 metres. The hole intersected unconformity at 270.3 metres and hematitic breccia immediately below unconformity. A second hematitic fault was intersected at 282 metres before the drill hole intersected a moderately hematitic radioactive zone from 286.5 to 291.0 metres. Blebs and fracture-hosted uranium mineralization are associated with the highest RS-125 spectrometer value reading of 6,200 cps over 0.5 metres. Hole LE25-204, drilled to the south and designed to test down dip of the LE25-202 intersection, intersected broad bleaching throughout the sandstone. Moderate clay alteration and desilicification with significant core loss were intersected below 245 metres to unconformity at 262.9 metres.

A new geophysical model generated from joint inversion of ground loop domain EM and direct current resistivity data collected during historic EM and resistivity surveys, has highlighted a previously underexplored conductive structure 800 metres north of the main Hurricane conductor (Figure 6). This 2,500-metre trend has been inadequately tested by two historic drill holes, which is referred to as Area K and exhibits two geophysical features like those at Hurricane (Figure 4).

Summer 2025 – Diamond Drilling and Resource Expansion

The summer 2025 drilling program has commenced, with a total of 20 diamond drill holes totalling 7,600 metres planned testing Areas D, E, F, and K along a six-kilometre prospective segment of the Larocque Trend (Figure 4).

See the Company’s press releases dated April 23, 2025 entitled “IsoEnergy Intersects Strongly Elevated Radioactivity in Multiple Holes Immediately Along Strike of Hurricane and In Step-Out Target Area D, 2.8km East” and dated June 12, 2025 entitled “IsoEnergy Commences Athabasca Basin Summer 2025 Exploration Program” for additional information regarding the results of the 2025 winter exploration program and plans for the summer 2025 exploration program, respectively.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Figure 2 – Location of winter 2025 drill holes with respect to the Hurricane Deposit resource footprint (blue) and the ANT seismic low velocity zone in which the deposit occurs, and projected Hurricane mineralization-controlling fault zones. RS-125 spectrometer values are highest averages over 0.5 metre intervals.

Figure 3 – Main Trend: Cross section through LE25-194 and LE25-203 on the Main Trend looking east.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Figure 4 – Compilation map of Larocque East project showing the Hurricane deposit, winter 2025 and summer 2024 drill hole locations and ANT seismic velocity anomalies (A though J) on a plan view of the 2025 conductivity model 50 metres below the unconformity. 20 drill holes planned for the summer will test targets at Hurricane, in target areas D, E and F, and at the untested northern conductive trend (Target K)

Figure 5 – Cross section through LE25-202, 204 and 206 on the west end of Target Area ‘D’ looking east.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Figure 6 – Joint resistivity – electromagnetic inversion model of the Larocque East project that highlights an untested 2,500m northern conductivity trend

Purepoint Joint Venture – Dorado Project

2025 – Drilling and Geophysical Work

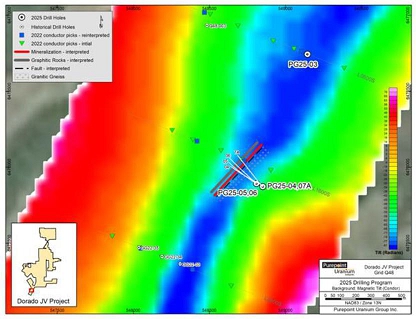

Initial drilling at the Q48 target at the Dorado project, which was completed by Purepoint Uranium as the operator of the exploration program, intersected uranium mineralization in four holes and led to the “Nova Discovery” intercepts at the Q48 target area. The recent Nova Discovery further defines the mineralized trend at the Q48 target as a steeply dipping, uranium-bearing structure hosted within the basement rocks, underscoring the potential scale and strength of the system emerging at the Dorado project.

Drill hole PG25-04 targeted the Q48 conductor, approximately 800 metres northwest of the Company’s previous drilling in 2022 (Figure 7). This drill hole was collared with a dip of -60 degrees and encountered Athabasca sandstone to a depth of 321 metres. Clay altered granitic gneiss and pegmatites were drilled to 393 meteres then garnet-rich pelitic gneiss, with local pyrite and graphite, was drilled to the completion depth of 489 metres. The altered radioactive gouge seams were hosted by a chloritized pegmatite and returned an average of 64,220 cps over 0.4 metres.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Drill hole PG25-05 was collared using the same azimuth as PG25-04 and intercepted radioactive structure approximately 40 metres up-dip of the latter hole (Figure 7). This drill hole encountered unconformity at 309 metres, clay altered granitic gneiss and pegmatites to 371 metres, then garnet-rich pelitic gneiss, with local pyrite and graphite, was drilled to the completion depth of 498 metres.

Drill hole PG25-06 targeted the brittle fault associated with mineralization at the unconformity (Figure 7). The drill hole was collared with a dip of -64 degrees and encountered Athabasca sandstone to a depth of 316 metres. Granitic gneiss displaying paleo-weathering alteration was drilled to 341 metres then generally unaltered granite, pegmatites and pelitic gneiss was drilled to the completion depth of 482 metres. Projection of the Nova Discovery zone mineralization suggests the radioactive sandstone interval of 1,040 cps over 2.3 metres in the Mount Sopris 2PGA-1000 downhole gamma probe is related to the primary mineral structure.

Drill hole PG25-07A resulted in a large 70 metre step out to the northeast of the PG25-05 mineralized intercept. The unconformity was intersected at a depth of 322 metres and the drill hole intercepted the radioactive structure approximately 40 metres up-dip of PG25-05.

The Q48 target zone lies within the southern portion of the Dorado project and is characterized by a steeply dipping, north-south trending conductive package identified through geophysical surveys. Drilling by the Company in 2022 confirmed that the conductive trend at the Q48 target hosts structure, shearing, and alteration, characteristics of uranium-bearing hydrothermal systems in the Athabasca Basin. The recently discovered Nova zone shows mineralization within granitic gneiss at 382.3 metres and extends into pelitic gneiss to a depth of 396.3 metres returning an average of 11,100 cps over 14.0 metres. A primary mineralized structure of the Nova zone is hosted in sheared, reddish-brown altered granitic gneiss with pitchblende that returned an average of 82,300 cps over 0.6 metres with a peak of 110,800 cps. A second strongly mineralized interval occurs within lost pelitic gneiss core and returned an average of 46,000 cps over 0.4 metres. All assays from the current 2025 drill program at the Dorado project are pending.

See the Company’s press releases dated July 8, 2025 entitled “IsoEnergy and Purepoint Confirm Uranium Discovery In Initial Drilling at the Dorado Joint Venture Project” and dated July 23, 2025 entitled “IsoEnergy and Purepoint Extend High-Grade Mineralization at the Dorado JV with a 70 Metre Step-Out Peaking at 110,800 CPS” for additional information regarding the results of the 2025 exploration program at the Dorado project.

Figure 7 – Location map of 2025 drill program at Q48 target area and the new Nova Discovery

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Hawk

Exploration work for summer 2025 at the Hawk project include a stepwise moving loop EM survey to more accurately locate conductors for drill hole targeting. ANT surveys over the northern portion of the project are in progress with the aim to test for the extension of the existing ANT velocity anomaly along the conductivity corridor in an area where there is 35 metres of unconformity elevation change between 2023 drill holes HK23-01 and HK23-02. Four diamond drill holes totalling 3,400 metres will be planned to be drilled to target coincident EM conductors and ANT velocity anomalies along a sparsely drill-tested 12-kilometre-long prospective corridor once interpretations of 2025 geophysical survey results are received and integrated with existing geoscience information. Previous drilling at the Hawk project intersected structural disruption, alteration, and elevated uranium geochemistry and radiometric responses, which are consistent with a setting conductive to unconformity-style uranium mineralization (Figure 8).

Figure 8 – Hawk project map showing the locations of the planned summer 2025 geophysical surveys. The locations of four drill holes planned for late in the summer will be finalized after interpretation of the geophysical survey results. Locations of past drill holes, interpreted ground EM conductors, and drill intersected faults are shown on a colour ZTEM conductivity map.

East Rim

A helicopter-borne MobileMT conductivity and magnetic survey was completed over the East Rim project. Data processing and interpretation are in progress and information obtained for the survey will inform targets for future exploration programs on the East Rim project.

Other Canadian projects

The majority of exploration and evaluation costs incurred for other projects in Canada during the six months ended June 30, 2025, relate to assessment report writing and community engagement payments accrued for properties in the Athabasca Basin, as well as beginning an updated technical report for the Dieter Lake property in Quebec, and community engagement work and site visits to the Matoush and Dieter Lake properties in Quebec. See “Outlook” below for further details on the 2025 exploration program plans for the Company’s properties in Canada.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

United States

Expenditure on the Company’s properties in the United States was as follows during the six months ended June 30, 2025:

| Tony M | Other | Total | ||||||||||

| Labour and wages | $ | 182,958 | $ | 358,909 | $ | 541,867 | ||||||

| Engineering and underground access | 164,437 | 205,927 | 370,364 | |||||||||

| Geological and geophysical | - | 88,566 | 88,566 | |||||||||

| Claim holding costs and advance royalties | 30,444 | 40,648 | 71,092 | |||||||||

| Camp costs | 27,369 | 27,595 | 54,964 | |||||||||

| Travel | 27,868 | 12,553 | 40,421 | |||||||||

| Health, safety and environmental | 1,732 | 750 | 2,482 | |||||||||

| Other | 35,939 | 75,977 | 111,916 | |||||||||

| Cash expenditures | $ | 470,747 | $ | 810,925 | $ | 1,281,672 | ||||||

| Share-based compensation | 169,273 | 84,505 | 253,778 | |||||||||

| Foreign exchange movements | (278,522 | ) | - | (278,522 | ) | |||||||

| Total expenditures | $ | 361,498 | $ | 895,430 | $ | 1,256,928 | ||||||

Tony M Mine

The Company has commenced ore sorting and high-pressure slurry ablation testing programs to evaluate material processing and reduce haulage and operating costs, as well as an evaporation study with the aim to reduce capital costs and increase evaporation rates at the existing evaporation pond infrastructure at the Tony M Mine. For the ore sorting study, the Company has engaged Steinert Group to test sensor-based ore sorting on mineralized material from the Tony M Mine. This study utilizes technology that uses a combination of 3D, color, induction, and x-ray sensors to identify and separate target material, with the potential to: reduce haulage costs by concentrating mineralization and lowering transport volumes to the White Mesa Mill, where toll-milling will take place; improve mining productivity by reducing waste and enhancing ore advance rates; and minimize dilution through more precise material handling. The Company is also testing mineralized material from Tony M at Disa Technologies using their patented HPSA process. This process uses high-pressure slurry streams to separate uranium coatings from sand grains, with the intended benefit of improving process efficiency and reducing costs. Lastly, the Company is working with RWI Enhanced Evaporation to evaluate the use of landshark evaporators on the Tony M Mine evaporation pond. Preliminary results suggest that enhanced evaporation could eliminate the need for constructing additional pond capacity, reducing future dewatering timelines and associated costs for the later stages of mining.

The Company continues to secure and install new equipment on site, and intends to use the results of the above studies as inputs for an updated technical and economic study to be commenced later in 2025. See “Outlook” below for further details on the Company’s planned 2025 work program at the Tony M Mine.

Utah Exploration

In 2025 to date, the Company has continued to carry out geological fieldwork to advance understanding of the local sedimentary architecture and uranium mineralization controls at the Tony M Mine and surrounding claims, Daneros Mine, Rim Mine, and Sage Plain project. This new geological information is being integrated with the interpretation of the results of seismic, EM, and induced polarization surveys conducted in 2024 and compiled historic data to identify the most prospective areas for future work.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Claim Staking and Claim Maintenance

The Company staked additional ground adjacent to the Tony M Mine during the six months ended June 30, 2025 at a cost of $2,630 and incurred $71,092 in expenditure on annual state lease fees, advance royalties, other short-term lease payments, and land management fees related to the Company’s properties in Utah.

The Company has renegotiated the royalty on the Utah Trust Lands (SITLA) lease at the Tony M Mine. The royalty on uranium production was previously 8% gross and has been reduced to 3%. In addition, the advanced minimum royalty has been meaningfully reduced.

Year ended December 31, 2024

During the year ended December 31, 2024, the Company incurred $23,495,786 of exploration and evaluation spending primarily on its exploration properties in Canada and in Utah, as set out below. Total exploration and evaluation spending in the year ended December 31, 2024 excludes $378,879 spent on properties in Argentina, which the Company disposed of during the year ended December 31, 2024.

Exploration and evaluation spending from continuing operations

| Canada | United States | Australia | Total | |||||||||||||

| Drilling | $ | 6,000,455 | $ | 154,306 | $ | - | $ | 6,154,761 | ||||||||

| Geological & geophysical | 4,968,309 | 522,167 | 5,895 | 5,496,371 | ||||||||||||

| Labour & wages | 1,537,927 | 1,290,233 | 247,070 | 3,075,230 | ||||||||||||

| Camp costs | 1,936,029 | 83,738 | - | 2,019,767 | ||||||||||||

| Claim holding costs and advance royalties | 50,449 | 1,236,488 | 226,100 | 1,513,037 | ||||||||||||

| Engineering and underground access | 70,687 | 1,150,702 | - | 1,221,389 | ||||||||||||

| Travel | 364,385 | 247,757 | 33,430 | 645,572 | ||||||||||||

| Community relations | 575,462 | - | - | 575,462 | ||||||||||||

| Health and safety and environmental | 444,369 | 43,566 | 73,635 | 561,570 | ||||||||||||

| Geochemistry & Assays | 312,268 | 48,391 | 2,119 | 362,778 | ||||||||||||

| Extension of claim refunds | (67,713 | ) | - | - | (67,713 | ) | ||||||||||

| Other | 254,853 | 153,439 | 75,601 | 483,893 | ||||||||||||

| Cash expenditures | $ | 16,447,480 | $ | 4,930,787 | $ | 663,850 | $ | 22,042,117 | ||||||||

| Share-based compensation | 1,095,546 | 343,121 | 11,041 | 1,449,708 | ||||||||||||

| Foreign exchange movements | - | 4,528 | (567 | ) | 3,961 | |||||||||||

| Total expenditures | $ | 17,543,026 | $ | 5,278,436 | $ | 674,324 | $ | 23,495,786 | ||||||||

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Expenditure on the Company’s properties in Canada during the year ended December 31, 2024 was primarily on Larocque East, Hawk, Matoush, and East Rim, as set out below. Spending at Matoush also included travel and labour and wages related to community engagement work.

| Larocque East | Hawk | Matoush | East Rim | Other | Total | |||||||||||||||||||

| Drilling | $ | 4,757,266 | $ | 1,243,189 | $ | - | $ | - | $ | - | $ | 6,000,455 | ||||||||||||

| Geological & geophysical | 1,816,725 | 151,953 | 811,982 | 538,928 | 1,648,721 | 4,968,309 | ||||||||||||||||||

| Camp costs | 1,282,932 | 483,469 | 134,789 | - | 34,839 | 1,936,029 | ||||||||||||||||||

| Labour & wages | 867,305 | 205,730 | 178,760 | 72,371 | 213,761 | 1,537,927 | ||||||||||||||||||

| Community relations | 321,550 | 73,500 | 1,299 | 14,600 | 164,513 | 575,462 | ||||||||||||||||||

| Health and safety and environmental | 402,329 | 18,048 | 533 | 4,099 | 19,360 | 444,369 | ||||||||||||||||||

| Travel | 252,175 | 24,894 | 87,294 | - | 22 | 364,385 | ||||||||||||||||||

| Geochemistry & Assays | 219,942 | 51,924 | 40,000 | 402 | - | 312,268 | ||||||||||||||||||

| Engineering | 70,687 | - | - | - | - | 70,687 | ||||||||||||||||||

| Claim holding costs | - | - | 50,449 | - | - | 50,449 | ||||||||||||||||||

| Extension of claim refunds | - | - | - | (21,529 | ) | (46,184 | ) | (67,713 | ) | |||||||||||||||

| Other | 76,896 | 56,168 | 48,355 | 20,983 | 52,451 | 254,853 | ||||||||||||||||||

| Cash expenditures | 10,067,807 | 2,308,875 | 1,353,461 | 629,854 | 2,087,483 | 16,447,480 | ||||||||||||||||||

| Share-based compensation | 725,609 | 166,516 | 6,162 | 44,899 | 152,360 | 1,095,546 | ||||||||||||||||||

| Total expenditures | $ | 10,793,416 | $ | 2,475,391 | $ | 1,359,623 | $ | 674,753 | $ | 2,239,843 | $ | 17,543,026 | ||||||||||||

Expenditure on the Company’s properties in the United States during the year ended December 31, 2024, was primarily focused on reopening access to the Tony M Mine and exploration activities on Henry Mountains, Daneros, and Sage Plain in Utah, as set out below:

| Tony M | Other | Total | ||||||||||

| Labour and wages | $ | 1,254,659 | $ | 35,574 | $ | 1,290,233 | ||||||

| Claim holding costs and advance royalties | 1,191,257 | 45,231 | 1,236,488 | |||||||||

| Engineering and underground access | 1,150,702 | - | 1,150,702 | |||||||||

| Geological & geophysical | 496,671 | 25,496 | 522,167 | |||||||||

| Camp costs | 81,921 | 1,817 | 83,738 | |||||||||

| Travel | 245,060 | 2,697 | 247,757 | |||||||||

| Drilling | 154,306 | - | 154,306 | |||||||||

| Geochemistry and assays | 48,391 | - | 48,391 | |||||||||

| Health and safety and environmental | 43,566 | - | 43,566 | |||||||||

| Other | 153,172 | 267 | 153,439 | |||||||||

| Cash expenditures | 4,819,705 | 111,082 | 4,930,787 | |||||||||

| Share-based compensation | 343,121 | - | 343,121 | |||||||||

| Foreign exchange movements | 4,528 | - | 4,528 | |||||||||

| Total expenditures | $ | 5,167,354 | $ | 111,082 | $ | 5,278,436 | ||||||

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

OUTLOOK

The Company intends to actively explore all of its exploration projects as and when resources permit. The nature and extent of further exploration on any of the Company’s properties, however, will depend on the results of completed and ongoing exploration activities, an assessment of the Company’s recently acquired properties and the Company’s financial resources.

Activities in Canada for 2025 include completing the summer exploration programs at Larocque East, Hawk, and East Rim, with the continued focus of testing resource expansion potential near the Hurricane Deposit and evaluating greenfield targets along the Larocque Trend, as further outlined in “Discussion of Operations” above. Activities in Canada for 2025 also include completing the 2025 drilling program at the Dorado Project, where Purepoint Uranium is the operator. Planned activities on other IsoEnergy projects include prospecting, sampling, and mapping at the Bulyea River, East Rim, and Evergreen projects in the Athabasca Basin, completing an updated technical report for the Dieter Lake project, continuing geochemical sampling and geophysical work at Matoush based on 2024 exploration results, and proposing future exploration work.

The Company’s planned work program at the Tony M Mine in 2025 includes completing the ore sorting study, evaporation trade-off study, and evaluation of multiple mining methods. The ore sorting study is being undertaken in an effort to reduce haulage costs to the Energy Fuels White Mesa Mill. The evaporation trade-off study has shown some early potential for minimising the cost, work and timeline for full dewatering of the underground when the mine is put back into production. Results of these studies, when completed, could provide important inputs for a technical and economic study, which could begin later this year and would include a mine plan, production rates, expected operational costs and capital requirements. In any such plan, the price of uranium will be a key factor.

The Company intends to undertake internal technical studies on several non-material properties in 2025.

SELECTED FINANCIAL INFORMATION

Management is responsible for the Interim Financial Statements referred to in this MD&A. The Audit Committee of the Board of Directors (the “Board”) has been delegated the responsibility to review the Interim Financial Statements and MD&A and make recommendations to the Board. The Board is responsible for final approval of the Interim Financial Statements and MD&A.

The Interim Financial Statements have been prepared in accordance with IAS 34, Interim Financial Reporting as issued by the IFRS and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”). The Company’s presentation currency and the functional currency of its Canadian operations is Canadian dollars; the functional currency of its Australian operations is the Australian dollar; and the functional currency of its United States operations and the Argentinian discontinued operations is the US dollar.

The Company’s Interim Financial Statements have been prepared using IFRS applicable to a going concern, which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The ability of the Company to continue as a going concern is dependent on its ability to obtain financing and achieve future profitable operations.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Financial Position

The following financial data is derived from and should be read in conjunction with the Interim Financial Statements and the Annual Financial Statements. As an exploration stage company, IsoEnergy does not have revenues.

| June 30, 2025 | December 31, 2024 |

December 31, 2023 Restated |

||||||||||

| Exploration and evaluation assets | $ | 263,830,842 | $ | 262,291,098 | $ | 274,756,338 | ||||||

| Total assets | 410,630,810 | 340,835,023 | 347,198,222 | |||||||||

| Total current liabilities | 27,578,269 | 35,103,977 | 41,065,120 | |||||||||

| Total non-current liabilities | 2,815,142 | 2,567,887 | 3,112,545 | |||||||||

| Adjusted working capital (1) | 124,922,827 | 56,116,942 | 51,644,330 | |||||||||

| Cash dividends declared per share | Nil | Nil | Nil | |||||||||

| (1) | Adjusted working capital is a non-IFRS financial measure, as discussed below, and is defined as current assets less current liabilities, excluding flow-though share premium liabilities and convertible debenture liabilities. |

In the six months ended June 30, 2025, the Company capitalized $9,406,468 of exploration and evaluation costs, as further described in “Discussion of Operations” above. Exploration and evaluation assets of $1,060,000 relating to 10% of the Company’s interest in the Purepoint Joint Venture and $151,010 relating to the Mountain Lake property were disposed of, as further described in “Year-to-date 2025 Highlights” above. Total assets increased primarily due to $51,215,000 raised in the Bought Deal Financing and $26,257,375 raised in the February 2025 Flow-Through Financing and Concurrent Private Placement, with associated share issuance costs of $4,463,707. Total assets also increased due to the fair value of marketable securities increasing by $9,482,825, primarily from $8,625,000 of Future Fuels common shares received on the disposal of the Mountain Lake property, $2,800,000 of Royal Uranium common shares on the disposal of certain of the Company’s royalty assets, and $1,060,000 of Purepoint Uranium common shares received from the exercise of the put option in the Purepoint Joint Venture, offset by a fair value loss related to marketable securities of $3,252,175 during the six months ended June 30, 2025.

Current liabilities on June 30, 2025, include a flow through share premium liability of $7,648,249 and $380,331 related to the February 2025 Flow-Through Financing and the February 2024 Private Placement (as defined below), respectively. Accounts payable and accrued liabilities increased by $67,637 during the six months ended June 30, 2025 mostly as a result of additional professional fees and public company costs related to the Company’s listing on the NYSE American and Bought Deal Financing, as well as timing variances related to the start of the 2025 winter exploration program at Larocque East and the 2025 summer exploration programs in the Athabasca Basin. The fair value of the Company’s 2020 Debentures and the US$4 million in principle of unsecured convertible debentures issued on December 6, 2022 (the “2022 Debentures” and collectively with the 2020 Debentures, the “Debentures”) decreased by $14,298,515 during the six months ended June 30, 2025 mostly due to the partial conversion of US$3 million principal of the 2020 Debentures, further described in “Year-to-date 2025 Highlights” above and discussed in “Results of Operations” below.

Adjusted working capital increased during the six months ended June 30, 2025 mainly due to the Bought Deal Financing, February 2025 Flow-Through Financing, and Concurrent Private Placement, as well as an increase in the fair value of marketable securities during the period, partly offset by exploration and evaluation spending discussed above.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Results of Operations

The following financial data is derived from and should be read in conjunction with the Interim Financial Statements.

| For the three months ended June 30 | For the six months ended June 30 | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| General and administrative costs | ||||||||||||||||

| Share-based compensation | $ | 1,101,397 | $ | 1,054,796 | $ | 3,047,236 | $ | 2,231,325 | ||||||||

| Administrative salaries, contractor and directors’ fees | 788,798 | 802,078 | 1,584,112 | 1,873,115 | ||||||||||||

| Investor relations | 302,131 | 244,021 | 523,087 | 450,660 | ||||||||||||

| Office and administrative | 293,457 | 184,524 | 537,457 | 405,985 | ||||||||||||

| Professional and consultant fees | 889,659 | 701,840 | 1,950,470 | 1,360,712 | ||||||||||||

| Travel | 90,292 | 117,686 | 266,317 | 263,750 | ||||||||||||

| Public company costs | 480,127 | 94,788 | 625,853 | 260,954 | ||||||||||||

| Total general and administrative costs | $ | (3,945,861 | ) | (3,199,733 | ) | $ | (8,534,532 | ) | (6,846,501 | ) | ||||||

| Interest income | 364,387 | 563,560 | 674,684 | 1,050,077 | ||||||||||||

| Interest expense | (34,179 | ) | (20,413 | ) | (76,058 | ) | (40,303 | ) | ||||||||

| Interest on convertible debentures | (226,594 | ) | (311,288 | ) | (489,144 | ) | (618,095 | ) | ||||||||

| Fair value gain (loss) on convertible debentures | 627,079 | (2,856,776 | ) | 338,497 | (4,755,860 | ) | ||||||||||

| Gain on disposal of assets | 820,394 | - | 11,189,425 | - | ||||||||||||

| Foreign exchange (loss) gain | (75,864 | ) | (38,579 | ) | (68,945 | ) | 12,534 | |||||||||

| Other income | 92,020 | 27,322 | 523,941 | 46,702 | ||||||||||||

| (Loss) income from operations | $ | (2,378,618 | ) | (5,835,907 | ) | $ | 3,557,868 | (11,151,446 | ) | |||||||

| Deferred income tax recovery (expense) | 491,348 | (168,253 | ) | (339,523 | ) | 488,674 | ||||||||||

| (Loss) income from continuing operations | $ | (1,887,270 | ) | (6,004,160 | ) | $ | 3,218,345 | (10,662,772 | ) | |||||||

| Loss from discontinued operations (1) | - | (55,133 | ) | - | (126,499 | ) | ||||||||||

| (Loss) income for period | $ | (1,887,270 | ) | $ | (6,059,293 | ) | $ | 3,218,345 | $ | (10,789,271 | ) | |||||

| (Loss) income per share – basic (2) | $ | (0.04 | ) | $ | (0.13 | ) | $ | 0.07 | $ | (0.24 | ) | |||||

| (Loss) income per share – diluted (2) | $ | (0.03 | ) | $ | (0.13 | ) | $ | 0.07 | $ | (0.24 | ) | |||||

| Loss per share relating to discontinued operations – basic and diluted (1)(2) | Nil | $ | (0.00 | ) | Nil | $ | (0.00 | ) | ||||||||

| (1) | Loss from discontinued operations, net of tax, relates to the Argentina reporting segment, which was disposed of during the year ended December 31, 2024. | |

| (2) | (Loss) income per share amounts in the comparative period were retroactively restated on a post-consolidation basis. Refer to the discussion on the Share Consolidation, as described above in “About IsoEnergy”. |

Three months ended June 30, 2025

During the three months ended June 30, 2025, the Company recorded a net loss of $1,887,270, compared to a net loss of $6,059,293 in the three months ended June 30, 2024. Included in the net loss for the three months ended June 30, 2024, is a $55,133 loss from discontinued operations relating to the Argentina reporting segment that was sold in 2024. The main driver of the difference between the two periods was a gain on the sale of certain royalty assets of $820,394, a fair value gain on the Debentures of $627,079, and a deferred income tax recovery of $491,348, partially offset by an increase in general and administrative costs of $746,128. Other factors causing the difference between the two periods is further described below.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

General and administrative costs

Share-based compensation was $1,101,397 in the three months ended June 30, 2025, compared to $1,054,796 in the three months ended June 30, 2024. The share-based compensation expense is a non-cash charge based on the Black-Scholes value of stock options, calculated using the graded vesting method. Stock options granted to directors, consultants and employees typically vest in three tranches – 1/3 immediately, 1/3 on the first anniversary of the grant date, and the remaining 1/3 on the second anniversary of the grant date, with the corresponding share-based compensation expense being recognized over this period. The similar expense in both periods is consistent with the fact that there were no material grants of stock options in either period.

Administrative salaries, contractor and directors’ fees of $788,798 for the three months ended June 30, 2025, decreased slightly from $802,078 during the prior period primarily due to a smaller management team as compared to the prior period.

Investor relations expenses relate primarily to costs incurred in communicating with existing and potential shareholders, conferences and marketing. The increase in the current period is primarily from additional marketing services in Europe engaged.

Office and administrative expenses primarily consist of office operating costs and other general administrative costs. The increase in office and administrative expenses from the prior period is primarily from the Company being responsible for all costs for its new office in Saskatoon, Saskatchewan, whereas previously it shared its office and office-related services in that city with NexGen.

Professional and consultant fees were $889,659 for the three months ended June 30, 2025, compared to $701,840 for the three months ended June 30, 2024. Professional fees were higher mainly due to legal fees incurred for the Company’s listing on the NYSE American, increased business development activities, and legal fees related to the now terminated AEC Arrangement, including costs incurred for completing customary termination procedures such as repayment of the Bridge Loan and release of the Indemnity.

Travel expenses primarily relate to travel and accommodation costs for conferences, business development activities, public relations activities, and general corporate purposes. Travel costs decreased slightly from the prior period mainly due to the timing of site visits undertaken compared to the prior period.

Public company costs consist primarily of costs associated with the Company’s continuous disclosure obligations, listing fees, directors and officers insurance, transfer agent costs, press releases and other shareholder communications. The increase in public company costs from $94,788 to $480,127 is primarily due to the additional costs of uplisting to the NYSE American, including the initial listing and sustaining fees, additional insurance requirements, and filing costs.

Other items

The Company recorded interest income of $364,387 in the three months ended June 30, 2025, compared to $563,560 in the three months ended June 30, 2024, which represents interest earned on cash balances. The amounts were lower in the three months ended June 30, 2025 mainly due to a lower average cash balance and a decrease in interest rates earned on cash.

Interest expense on the Debentures was $226,594 in the three months ended June 30, 2025, which was lower than the $311,288 in the three months ended June 30, 2024. The 2020 Debentures and 2022 Debentures bear interest of 8.5% and 10%, respectively, per annum and are payable, with a combination of cash and common shares of the Company, on June 30 and December 31. The principal amount of the 2020 Debentures decreased in the period following the conversion of US$3 million of the US$6 million principal of the 2020 Debentures.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

The fair value of the Debentures on June 30, 2025 was $15,980,791 compared to $16,607,205 on March 31, 2025. The decrease in the fair value of the Debentures is primarily due to the strengthening of the Canadian dollar against the US dollar during the three months. The decrease in fair value include a decrease in the fair value of the Debentures of $627,079 included in the statement of income, partially offset by a fair value gain attributable to the change in credit risk of $665 included in other comprehensive income (loss). The Company’s Debentures are classified as measured at fair value through profit and loss. In accordance with IFRS 9 – Financial Instruments, the part of a fair value change due to an entity’s own credit risk is presented in other comprehensive income (loss). As of June 30, 2025, the discount on the 2020 Debentures is assumed to be 0%, as it is assumed that the 2020 Debentures can be converted immediately and the shares received can be sold at the fair market value of the conversion shares, with no additional discount. As of June 30, 2025, the time to maturity of the 2020 Debentures and 2022 Debentures was 0.1 and 2.4 years, respectively.

Foreign exchange loss was $75,864 in the three months ended June 30, 2025, compared to a loss of $38,579 in the three months ended June 30, 2024, and mainly relates to exchange movements on working capital in United States dollars held by the Company. The Company has larger US dollar denominated cash balances compared to the prior period, which combined with the weakening of the US dollar compared to the Canadian dollar, led to an increased foreign exchange loss.

Other income was $92,021 in the three months ended June 30, 2025, compared to $27,322 in the three months ended June 30, 2024. This primarily relates to higher timber sales and an increase in rental income earned from the Company’s operations in the US.

The Company records a deferred tax recovery or expense which is comprised of a recovery on losses or expense on gains recognized in the period and, when applicable, the release of flow-through share premium liability which is offset by the renunciation of flow-through share expenditures to shareholders. In the three months ended June 30, 2025, this resulted in a recovery of $491,348, compared to an expense of $168,253 in the three months ended June 30, 2024. The increase in expense is due to a larger proportion of flow-through share spending renounced during the three months ended June 30, 2025.

Six months ended June 30, 2025

During the six months ended June 30, 2025, the Company recorded net income of $3,218,345, compared to net loss of $10,789,271 in the six months ended June 30, 2024. Included in the net loss for the six months ended June 30, 2024, is a $126,499 loss from discontinued operations relating to the Argentina reporting segment that was sold in 2024. The main driver of the difference between the two periods was a gain on the sale of the Mountain Lake property and certain royalty assets of $11,189,425 and a fair value gain on the Debentures of $338,497 in the 6 months ended June 30, 2025, partially offset by an increase in general and administrative costs of $1,688,031. Other factors causing the difference between the two periods is further described below.

General and administrative costs

Share-based compensation was $3,047,236 in the six months ended June 30, 2025, compared to $2,231,325 in the six months ended June 30, 2024. The share-based compensation expense is a non-cash charge based on the Black-Scholes value of stock options, calculated using the graded vesting method. Stock options granted to directors, consultants and employees typically vest in three tranches – 1/3 immediately, 1/3 on the first anniversary of the grant date, and the remaining 1/3 on the second anniversary of the grant date, with the corresponding share-based compensation expense being recognized over this period. The increase in the current period was primarily due to stock options granted during the six months ended June 30, 2025 while no material amounts were granted in the prior period.

Administrative salaries, contractor and directors’ fees of $1,584,112 for the six months ended June 30, 2025, decreased from $1,873,115 during the prior period primarily due to a smaller management team as compared to the prior period.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

Investor relations expenses relate primarily to costs incurred in communicating with existing and potential shareholders, conferences and marketing. The variance between the two periods is for similar reasons discussed above for the three months ended June 30, 2025.

Office and administrative expenses primarily consist of office operating costs and other general administrative costs. The variance between the two periods is for similar reasons discussed above for the three months ended June 30, 2025.

Professional and consultant fees were $1,950,470 for the six months ended June 30, 2025, compared to $1,360,712 for the six months ended June 30, 2024. Professional fees were higher mainly due to similar reasons discussed above for the three months ended June 30, 2025.

Travel expenses primarily relate to travel and accommodation costs for conferences, business development activities, public relations activities, and general corporate purposes. Travel costs between the two periods remained mostly similar as the timing of business development and corporate activities mostly offset the timing of site visits between the two periods.

Public company costs consist primarily of costs associated with the Company’s continuous disclosure obligations, listing fees, directors and officers insurance, transfer agent costs, press releases and other shareholder communications. The increase in public company costs from the prior period is for similar reasons discussed above for the three months ended June 30, 2025.

Other items

The Company recorded interest income of $674,684 in the six months ended June 30, 2025, compared to $1,050,077 in the three months ended June 30, 2024, which represents interest earned on cash balances and the Bridge Loan advanced to Anfield Energy. The amounts were lower in the six months ended June 30, 2025 mainly due to a lower average cash balance and a decrease in interest rates earned on cash, partially offset by interest earned on the Bridge Loan to Anfield Energy, which was fully repaid in January 2025.

Interest expense on the Debentures was $489,144 in the six months ended June 30, 2025, which was lower than the $618,095 in the six months ended June 30, 2024. The reasons for the decrease in the interest expense on the Debentures between the two periods are for similar reasons discussed above for the three months ended June 30, 2025.

The fair value of the Debentures on June 30, 2025 was $15,980,791 compared to $30,279,306 on December 31, 2024. The decrease in the fair value of the Debentures is primarily due to the partial conversion of the 2020 Debentures which resulted in debentures with a fair value of $13,928,728 being derecognized. The fair value was further decreased by a fair value gain on the Debentures of $338,497 included in the statement of income and a fair value gain attributable to the change in credit risk of $31,290 included in other comprehensive income (loss).

Foreign exchange loss was $68,945 in the six months ended June 30, 2025, compared to a gain of $12,534 in the six months ended June 30, 2024, and mainly relates to the same fluctuations discussed above for the three months ended June 30, 2025.

Other income was $523,942 in the six months ended June 30, 2025, compared to $46,702 in the six months ended June 30, 2024. This primarily relates to higher timber sales and an increase in rental income earned from the Company’s operations in the US.

The Company records a deferred tax recovery or expense which is comprised of a recovery on losses or expense on gains recognized in the period and, when applicable, the release of flow-through share premium liability which is offset by the renunciation of flow-through share expenditures to shareholders. In the six months ended June 30, 2025, this resulted in an expense of $339,523, compared to a recovery of $488,674 in the six months ended June 30, 2024. The increase in expense is mainly due to a gain in the period as compared to a loss in the prior period and a smaller proportion of flow-through share spending renounced during the six months ended June 30, 2025.

|

|

ISOENERGY LTD.

For the three and six months ended June 30, 2025 and 2024

SUMMARY OF QUARTERLY RESULTS

The following information is derived from the Company’s Interim and Annual Financial Statements prepared in accordance with IFRS. The information below should be read in conjunction with the Company’s interim and annual financial statements for each of the past seven quarters.

| Jun. 30, 2025 | Mar. 31, 2025 | Dec. 31, 2024 | Sep. 30, 2024 | |||||||||||||

| Revenue | Nil | Nil | Nil | Nil | ||||||||||||

| Net (loss) income | $ | (1,887,270 | ) | $ | 5,105,615 | $ | (35,505,105 | ) | $ | 4,159,285 | ||||||

| Net (loss) income per share: (1) | ||||||||||||||||

| Basic | $ | (0.04 | ) | $ | 0.11 | $ | (0.80 | ) | $ | 0.08 | ||||||

| Diluted | $ | (0.03 | ) | $ | 0.10 | $ | (0.88 | ) | $ | (0.00 | ) | |||||

| Loss from discontinued operations (2) | Nil | Nil | Nil | $ | (1,859 | ) | ||||||||||

| Loss from discontinued operations per share – basic and diluted (1)(2) | Nil | Nil | Nil | $ | (0.00 | ) | ||||||||||

| Jun. 30, 2024 | Mar. 31, 2024 | Dec. 31, 2023 | Sep. 30, 2023 | |||||||||||||

| Revenue | Nil | Nil | Nil | Nil | ||||||||||||

| Net (loss) income | $ | (6,059,293 | ) | $ | (4,729,978 | ) | $ | 4,630,838 | $ | (21,988,054 | ) | |||||

| Net (loss) income per share: (1) | ||||||||||||||||

| Basic | $ | (0.13 | ) | $ | 0.16 | $ | 0.16 | $ | (0.80 | ) | ||||||

| Diluted | $ | (0.13 | ) | $ | (0.08 | ) | $ | (0.08 | ) | $ | (0.80 | ) | ||||

| Loss from discontinued operations (2) | $ | (55,133 | ) | $ | (71,366 | ) | $ | (17,856 | ) | Nil | ||||||

| Loss from discontinued operations per share – basic and diluted (1)(2) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | Nil | ||||||

| (1) | (Loss) income per share amounts in the past seven quarters presented are retroactively restated on a post-consolidation basis. Refer to the discussion on the Share Consolidation, as described above in “About IsoEnergy”. | |

| (2) | Loss from discontinued operations relates to the Argentina reporting segment, as described above. |