UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

| For the month of | July | 2025 | |

| Commission File Number | 001-40569 |

| Standard Lithium Ltd. |

| (Translation of registrant’s name into English) |

|

Suite 1625, 1075 W Georgia Street Vancouver, British Columbia, Canada V6E 3C9 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | ¨ | Form 40-F | x |

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Standard Lithium Ltd. | |||||

| (Registrant) | |||||

| Date: | July 31, 2025 | By: | /s/ Salah Gamoudi | ||

| Name: | Salah Gamoudi | ||||

| Title: | Chief Financial Officer | ||||

Exhibit 99.1

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Cautionary Note Regarding Forward-Looking Information

Information contained in this report and the documents referred to herein which are not statements of historical facts, may be “forward-looking information” for the purposes of Canadian Securities laws. Such forward looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward looking information. The words “expect”, “target”, “estimate”, “may”, “anticipate”, “should”, “will”, and similar expressions identify forward-looking information.

These forward-looking statements relate to, among other things, resource estimates, grades and recoveries, development plans, mining methods and metrics including recovery process and, mining and production expectations including expected cash flows, capital cost estimates and expected life of mine, operating costs, the expected payback period, receipt of government approvals and licenses, time frame for construction, financial forecasts including net present value and internal rate of return estimates, tax and royalty rates, and other expected costs.

Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable, are inherently subject to significant political, business, economic and competitive uncertainties and contingencies. There may be factors that cause results, assumptions, performance, achievements, prospects or opportunities in future periods not to be as anticipated, estimated or intended.

There can be no assurances that forward-looking information and statements will prove to be accurate, as many factors and future events, both known and unknown could cause actual results, performance or achievements to vary or differ materially from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained herein or incorporated by reference. Accordingly, all such factors should be considered carefully when making decisions with respect to the Project, and prospective investors should not place undue reliance on forward-looking information. Forward-looking information in this technical report is as of the issue date, July 23, 2025. Standard Lithium Ltd. assumes no obligation to update or revise forward-looking information to reflect changes in assumptions, changes in circumstances or any other events affecting such forward-looking information, except as required by applicable law.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Table of Contents

| 1 | Summary | 1 |

| 1.1 | Issuer and Purpose | 1 |

| 1.2 | Property Location and Ownership | 1 |

| 1.3 | Geology and Mineralization | 2 |

| 1.4 | Status of Exploration | 2 |

| 1.5 | Updated Mineral Resource Estimation | 3 |

| 1.6 | Mining Methods | 5 |

| 1.7 | Recovery Method and Mineral Processing | 6 |

| 1.8 | Capital and Operating Cost Estimates | 7 |

| 1.8.1 | Capital Expenditure Costs | 7 |

| 1.8.2 | Operating Expenditure Costs (OPEX) | 8 |

| 1.9 | Economic Analysis | 10 |

| 1.10 | QP Conclusions | 12 |

| 1.10.1 | Exploration work | 12 |

| 1.10.2 | Mineral Processing work | 12 |

| 1.11 | Key Study Recommendations | 13 |

| 2 | Introduction | 15 |

| 2.1 | Issuer and Purpose | 15 |

| 2.2 | Technical Report Authors and Personal Inspection of Property | 17 |

| 2.3 | Sources of Information | 18 |

| 2.4 | Units of Measure, Currency, and Acronyms | 20 |

| 3 | Reliance on Other Experts | 24 |

| 4 | Property Description and Location | 25 |

| 4.1 | Property Description and Location | 25 |

| 4.2 | Lithium-Brine Mineral Production Rights | 25 |

| 4.2.1 | Summary of the Standard Lithium – TETRA Agreement | 27 |

| 4.2.2 | Summary of Salt Water (Brine) Deeds | 27 |

| 4.2.3 | Summary of Leases | 27 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 4.2.4 | Mineral Brine Right Distribution on Individual Leases | 28 |

| 4.3 | Surface (and Mineral) Rights in Arkansas | 32 |

| 4.4 | Unitization | 33 |

| 4.5 | Potential Future Royalty Payments to Lessors | 34 |

| 4.6 | Property Environmental Liabilities and Permitting | 35 |

| 4.7 | Risks and Uncertainties | 36 |

| 5 | Accessibility, Climate, Local Resources, Infrastructure, and Physiography | 37 |

| 5.1 | Accessibility | 37 |

| 5.1.1 | Airport Access | 37 |

| 5.1.2 | Rail Access | 37 |

| 5.1.3 | Road Access | 37 |

| 5.2 | Climate | 39 |

| 5.3 | Local Resources and Infrastructure | 39 |

| 5.4 | Physiography | 39 |

| 6 | History | 41 |

| 6.1 | Introduction To Brine Production | 41 |

| 6.2 | Regional Assessment of the Lithium Potential of the Smackover Formation Brine | 43 |

| 6.3 | SWA Property Historical Infrastructure Summary | 48 |

| 7 | Geological Setting and Mineralization | 50 |

| 8 | Deposit Type | 58 |

| 9 | Exploration | 59 |

| 9.1 | Subsurface data review | 59 |

| 9.2 | 2018 and 2023 Lithium Concentration Data Sampling program | 59 |

| 9.3 | Exploration Results and Interpretation | 63 |

| 10 | Drilling | 65 |

| 10.1 | Standard Lithium exploration program | 68 |

| 10.1.1 | Taylor, Beulah et al 1 Well Re-entry | 71 |

| 10.1.2 | International Paper Company 1 Well Re-entry | 72 |

| 10.1.3 | Carter-Moore 1 Well Re-entry | 72 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 10.1.4 | Speer 1 New Well | 72 |

| 10.1.5 | Montague 1 New Well | 72 |

| 11 | Sample Preparation, Analyses, and Security | 73 |

| 11.1 | Sampling Methods | 73 |

| 11.2 | Sample Preparation, Analyses And Security | 73 |

| 11.2.1 | Brine Sample Collection | 73 |

| 11.2.2 | Security | 75 |

| 11.2.3 | Analytical Methodology | 75 |

| 11.3 | Quality Control/Quality Assurance | 76 |

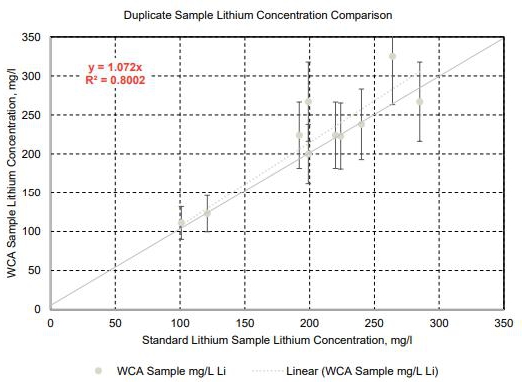

| 11.3.1 | Field Duplicate Samples | 76 |

| 11.4 | Other Data: Core Reports | 77 |

| 11.5 | Summary | 78 |

| 12 | Data Verification | 79 |

| 12.1 | Verification of Lithium Concentration Data, Well Logs, and Core Data | 79 |

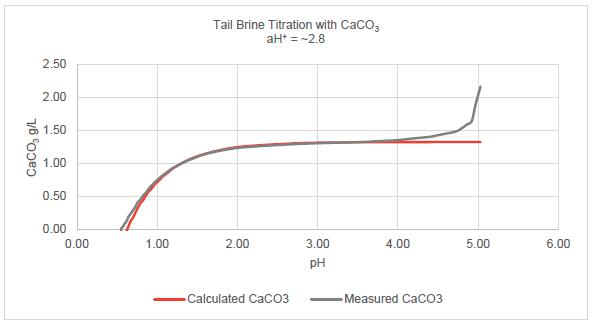

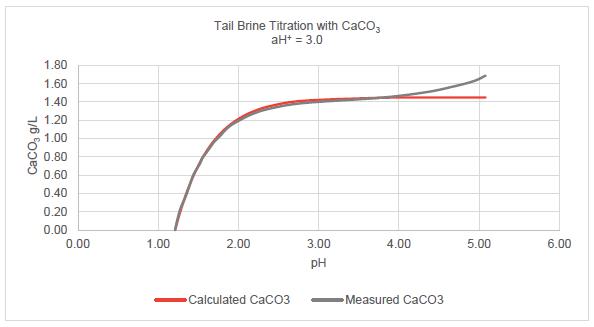

| 12.2 | Verification of Metallurgical Process Data | 81 |

| 13 | Mineral Processing and Metallurgical Testing | 83 |

| 13.1 | Introduction | 83 |

| 13.1.1 | Process Selection Rationale | 84 |

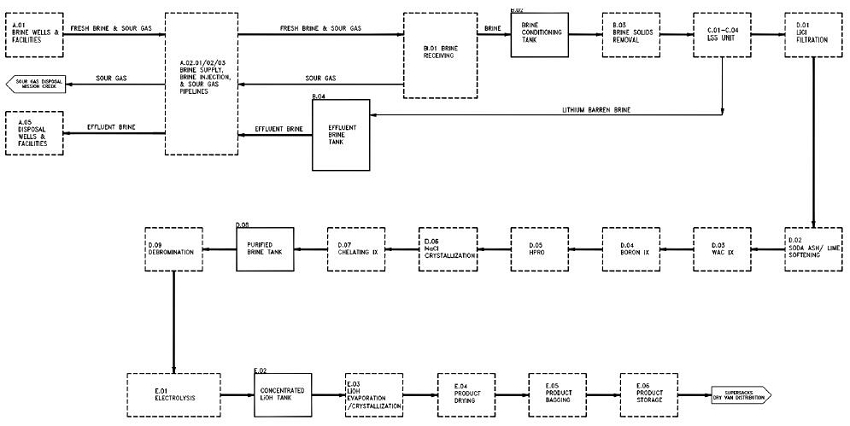

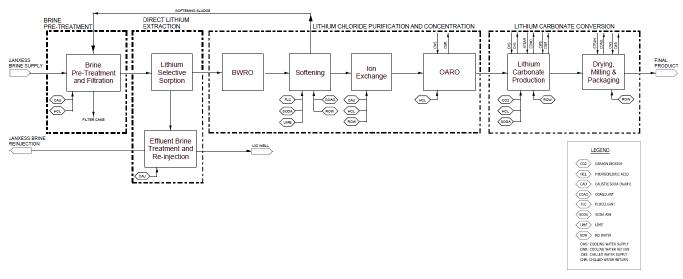

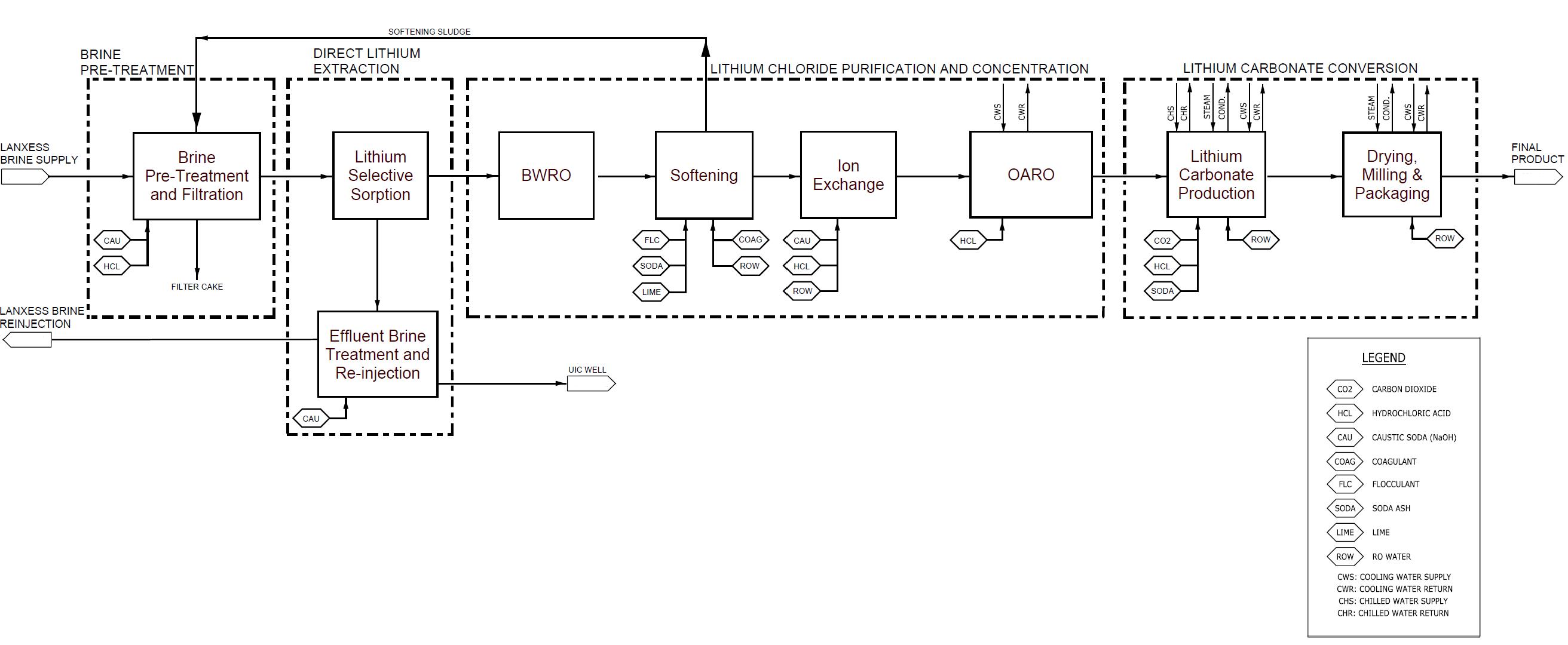

| 13.1.2 | Process Overview | 85 |

| 13.2 | Historical Testing | 86 |

| 13.3 | Demonstration Plant Testing | 86 |

| 13.3.1 | Overview | 86 |

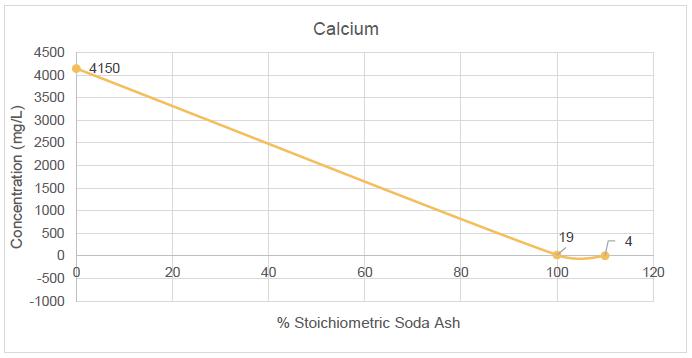

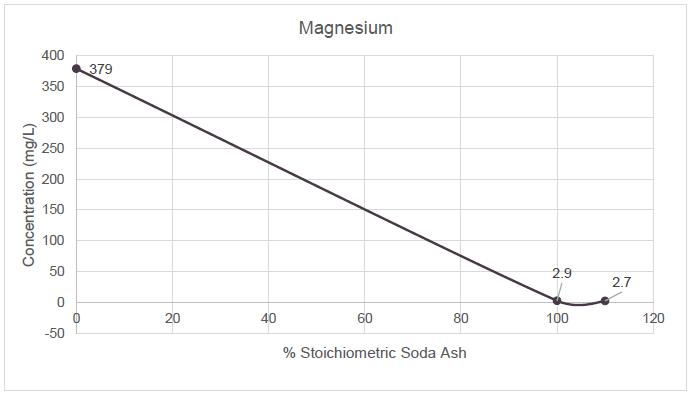

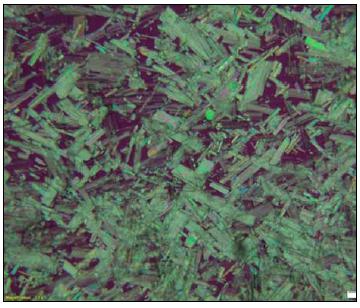

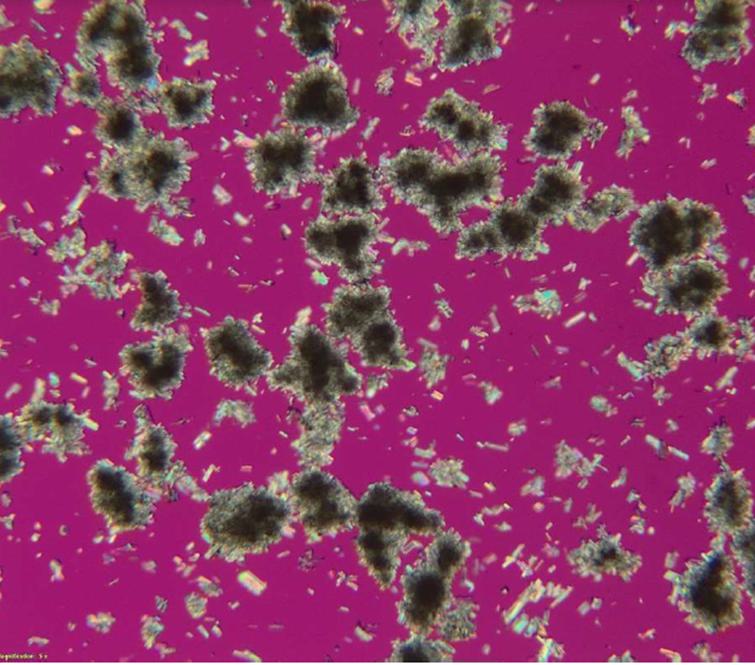

| 13.3.2 | Brine Pre-Treatment Testing | 91 |

| 13.3.3 | DLE Testing at the Demonstration Plant | 91 |

| 13.3.4 | LSS Laboratory Testing | 94 |

| 13.4 | Demonstration Plant LiCl Purification and Concentration | 95 |

| 13.5 | Additional LiCl Purification and Concentration Testing | 96 |

| 13.6 | LiCl Conversion Testing | 96 |

| 13.6.1 | Electrolysis | 97 |

| 13.6.2 | Bi-polar Membrane Electrodialysis (BPMED) | 98 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 13.6.3 | Direct Lithium Conversion | 99 |

| 13.6.4 | Further Development | 99 |

| 13.7 | Crystallization and Packaging | 100 |

| 13.8 | Process Testing QA/QC | 100 |

| 13.9 | Process Scalability | 101 |

| 13.10 | Process Technical Risks and Mitigation Measures | 101 |

| 13.11 | Conclusions and Recommendations | 102 |

| 14 | Mineral Resource Estimates | 103 |

| 14.1 | Geologic Model Description | 104 |

| 14.2 | Lithium Resource Estimates | 113 |

| 14.3 | QP Discussion | 115 |

| 15 | Mineral Reserve Estimates | 117 |

| 16 | Mining Methods | 118 |

| 16.1 | Lithium Recovery Process | 118 |

| 16.2 | Methodology | 119 |

| 16.3 | Well Field Overview | 121 |

| 16.4 | Well Field Configuration | 122 |

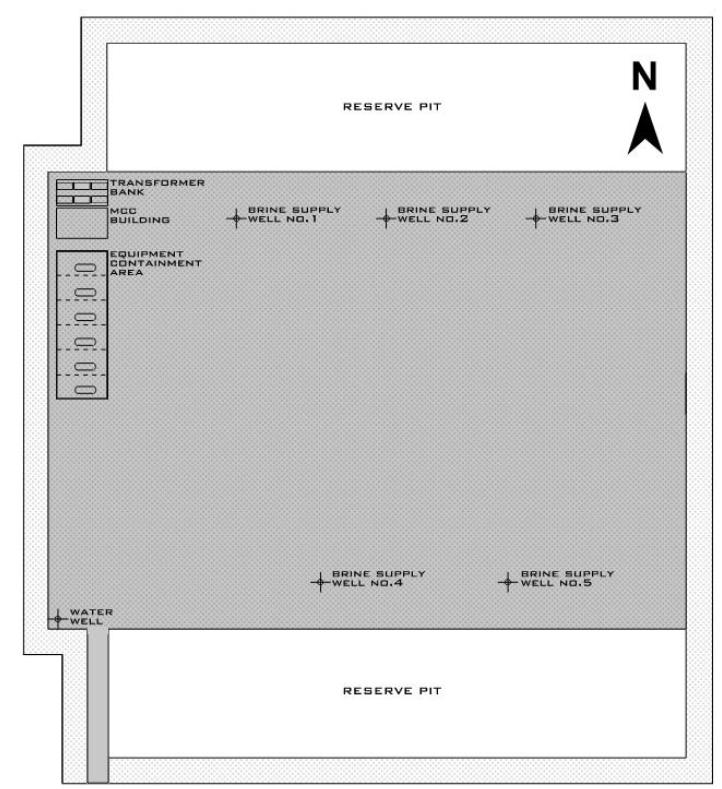

| 16.4.1 | Production Wells | 122 |

| 16.4.2 | Injection Wells | 123 |

| 17 | Recovery Methods | 124 |

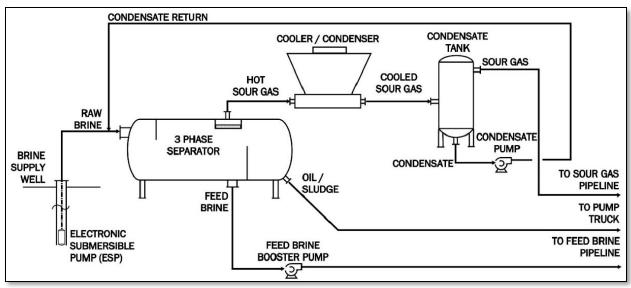

| 17.1 | Brine Production and Delivery | 126 |

| 17.2 | Production of Purified Lithium Chloride Solution | 126 |

| 17.2.1 | Pretreatment of the Feed Brine | 126 |

| 17.2.2 | Lithium Extraction Process | 127 |

| 17.2.3 | Lithium Barren Brine Disposal | 127 |

| 17.2.4 | Raw Lithium Chloride Purification and Concentration | 128 |

| 17.3 | Production of Lithium Hydroxide | 128 |

| 17.4 | Packaging of Lithium Hydroxide | 129 |

| 17.5 | Projected Energy, Water, and Raw Material Requirements | 129 |

| 18 | Project Infrastructure | 132 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 18.1 | Brine Supply Wells Infrastructure | 132 |

| 18.1.1 | Well Field | 132 |

| 18.2 | Central Processing Facility Infrastructure | 136 |

| 18.2.1 | Fresh Water Supply and Distribution | 137 |

| 18.2.2 | Steam Supply | 138 |

| 18.2.3 | Power Supply | 138 |

| 18.2.4 | Compressed Air | 138 |

| 18.2.5 | Compressed Nitrogen | 138 |

| 18.2.6 | Sour Gas Transfer | 138 |

| 18.2.7 | Chemicals and Reagents | 139 |

| 18.2.8 | Auxiliary Facilities | 139 |

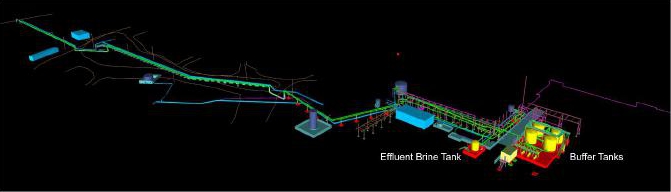

| 18.3 | Effluent Brine/Process Water Injection Wells Network Infrastructure | 140 |

| 18.3.1 | Well Field | 140 |

| 18.3.2 | Pipelines | 143 |

| 19 | Market Studies And Contracts | 144 |

| 19.1 | Background | 144 |

| 19.2 | Lithium Hydroxide Price | 147 |

| 20 | Environmental Studies, Permitting, and Social or Community Impact | 150 |

| 20.1 | Introduction | 150 |

| 20.2 | Environmental Considerations | 150 |

| 20.3 | Permitting | 151 |

| 20.3.1 | Overview | 151 |

| 20.3.2 | Clean Water Act Section 404 Permitting | 152 |

| 20.3.3 | Air Emissions Permitting | 153 |

| 20.3.4 | Water Discharge Permitting | 154 |

| 20.4 | Brine Supply/Disposal Well Permits | 155 |

| 20.4.1 | Underground Injection Control (UIC) Permitting | 156 |

| 20.4.2 | Public Water Supply | 157 |

| 20.4.3 | Resource Conservation Recovery Act | 157 |

| 20.4.4 | Construction Permits, Approvals, and Plans | 157 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 20.5 | Social Impact | 158 |

| 20.6 | Environmental Management and Closure Plan | 159 |

| 21 | Capital and Operating Expenditure Costs | 160 |

| 21.1 | Capital Expenditure Estimate | 160 |

| 21.1.1 | Basis of Estimate | 160 |

| 21.1.2 | General | 160 |

| 21.1.3 | Brine Supply and Injection Well Fields | 160 |

| 21.1.4 | Brine Supply/Return and Sour Gas Pipeline Network | 161 |

| 21.1.5 | Central Processing Facility | 162 |

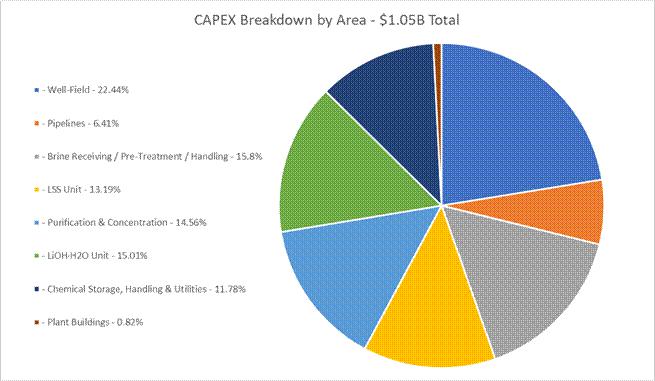

| 21.1.6 | CAPEX Summary | 163 |

| 21.1.7 | Sustaining Capital | 165 |

| 21.1.8 | Land Costs | 166 |

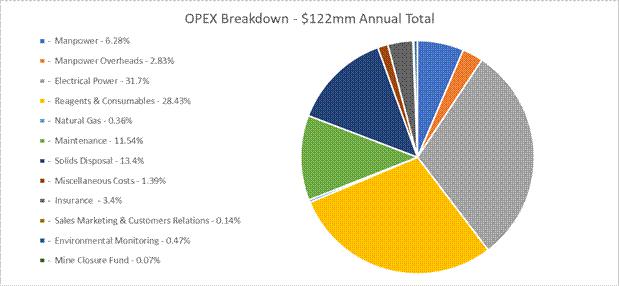

| 21.2 | Operating Expenditure Estimate | 167 |

| 21.2.1 | Basis of Estimate (BOE) | 167 |

| 21.2.2 | Direct Operational Expenditures | 167 |

| 21.2.3 | Indirect Operational Expenditures | 173 |

| 21.2.4 | Mineral Rights, Royalties and Land Fees | 174 |

| 21.2.5 | OPEX Summary | 175 |

| 21.2.6 | All-In Operating Costs | 177 |

| 21.3 | Exclusions | 177 |

| 21.4 | Upside Production Analysis | 178 |

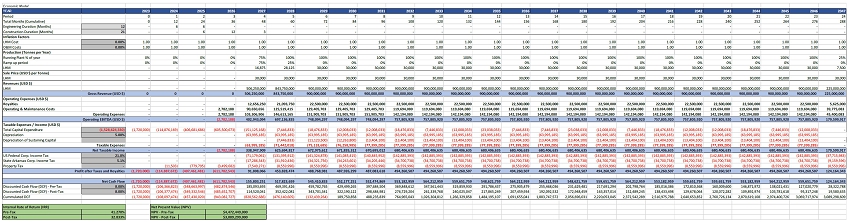

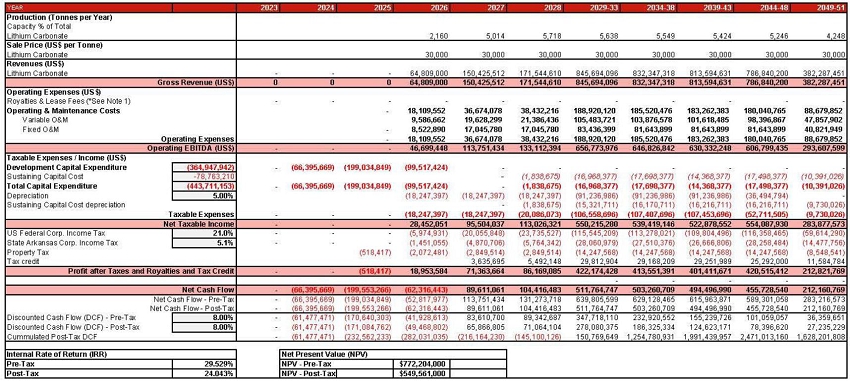

| 22 | Economic Analysis | 179 |

| 22.1 | Evaluation Criteria | 179 |

| 22.2 | Taxes & Royalties | 180 |

| 22.2.1 | Royalties and Lease Fees | 180 |

| 22.2.2 | Depreciation | 180 |

| 22.2.3 | Corporate Taxes | 180 |

| 22.2.4 | Property Tax | 180 |

| 22.2.5 | Federal Funding and Tax Benefits | 181 |

| 22.3 | CAPEX Spend Schedule | 181 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

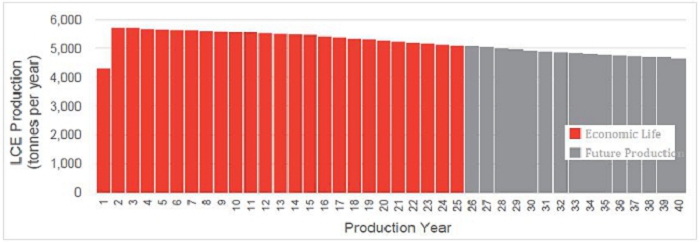

| 22.4 | Production Revenues | 181 |

| 22.5 | Cash-Flow Projection | 181 |

| 22.6 | Economic Evaluation Results | 183 |

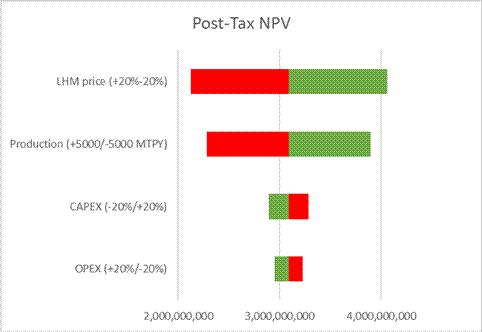

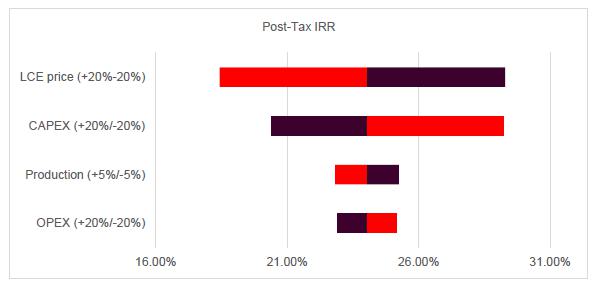

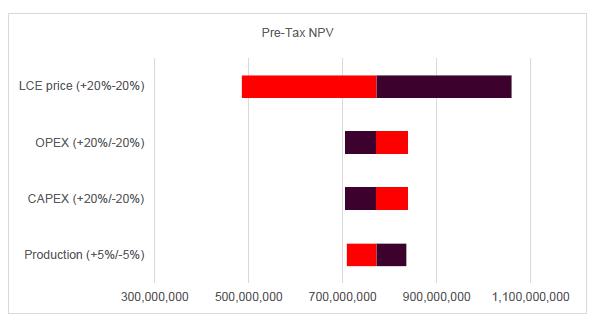

| 22.7 | Sensitivity Analysis | 184 |

| 22.8 | Sensitivity Analysis Conclusions | 187 |

| 22.9 | Upside Production Scenario | 187 |

| 22.9.1 | Deviation of Alternative Upside Scenario from Base Case | 187 |

| 23 | Adjacent Properties | 189 |

| 24 | Other Relevant Data and Information | 191 |

| 25 | Interpretations and Conclusions | 192 |

| 25.1 | Exploration Work | 192 |

| 25.2 | Process Development Work | 192 |

| 25.3 | SWA Pre-Feasibility Study Summary | 193 |

| 25.4 | Project Risks | 193 |

| 26 | Recommendations | 196 |

| 27 | References | 197 |

| 28 | Certificate of Authors | 204 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

List of Figures

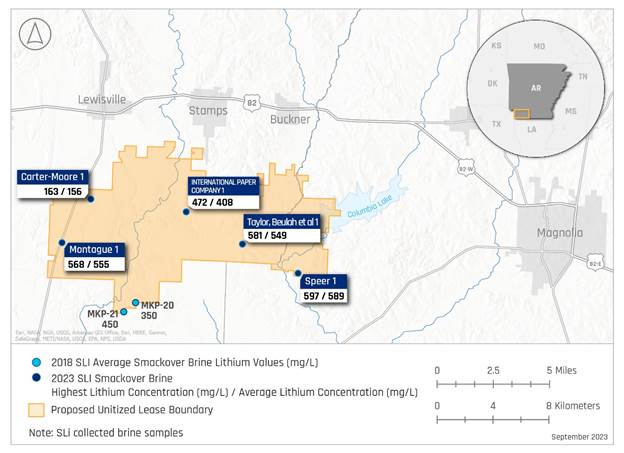

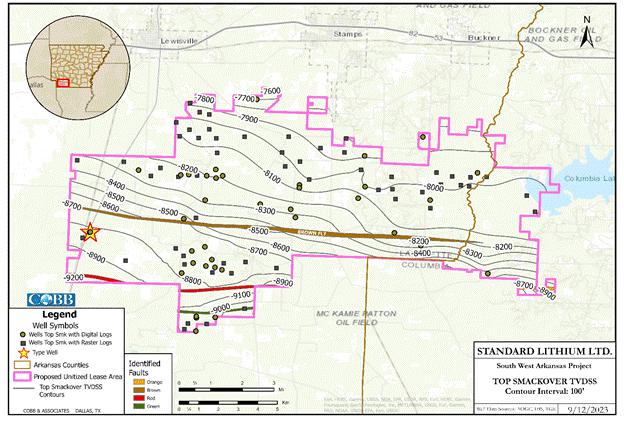

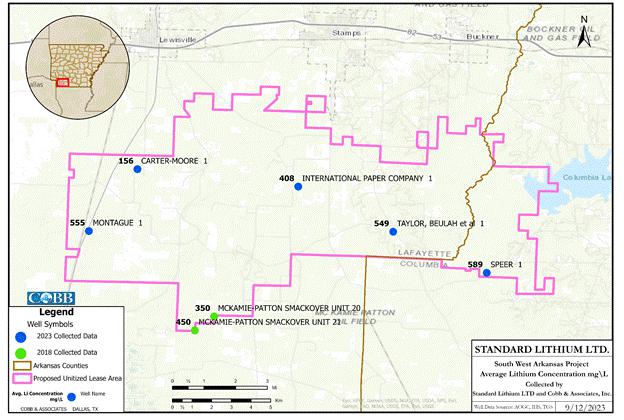

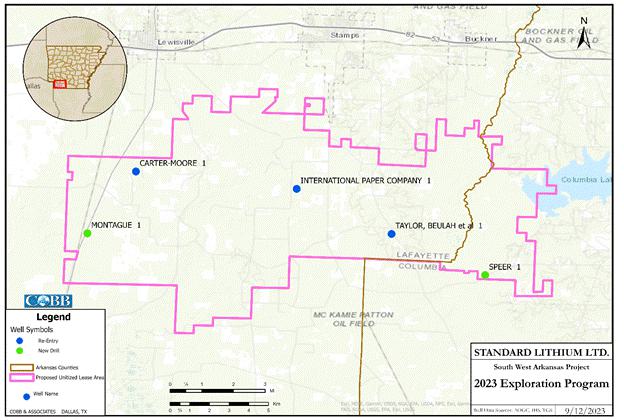

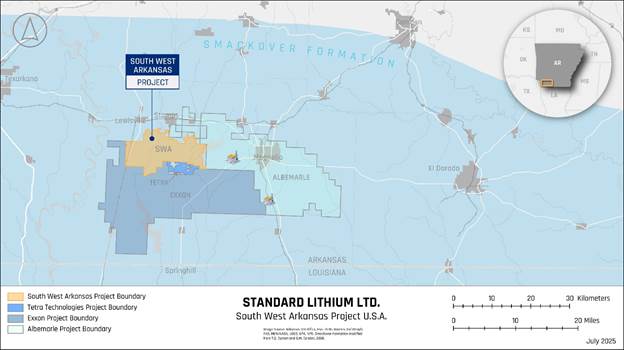

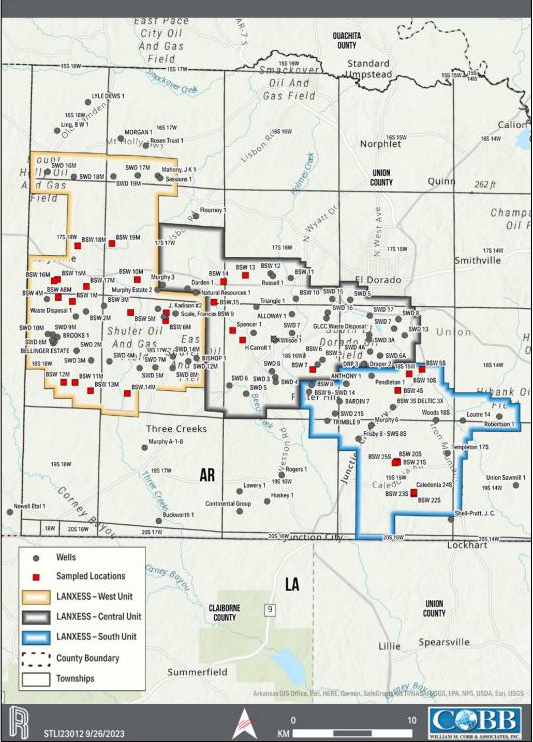

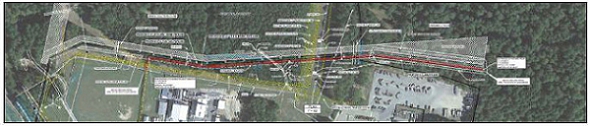

| Figure 1-1. SWA Project 2023 Exploration Program | 3 |

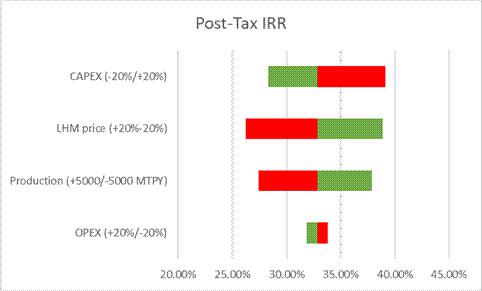

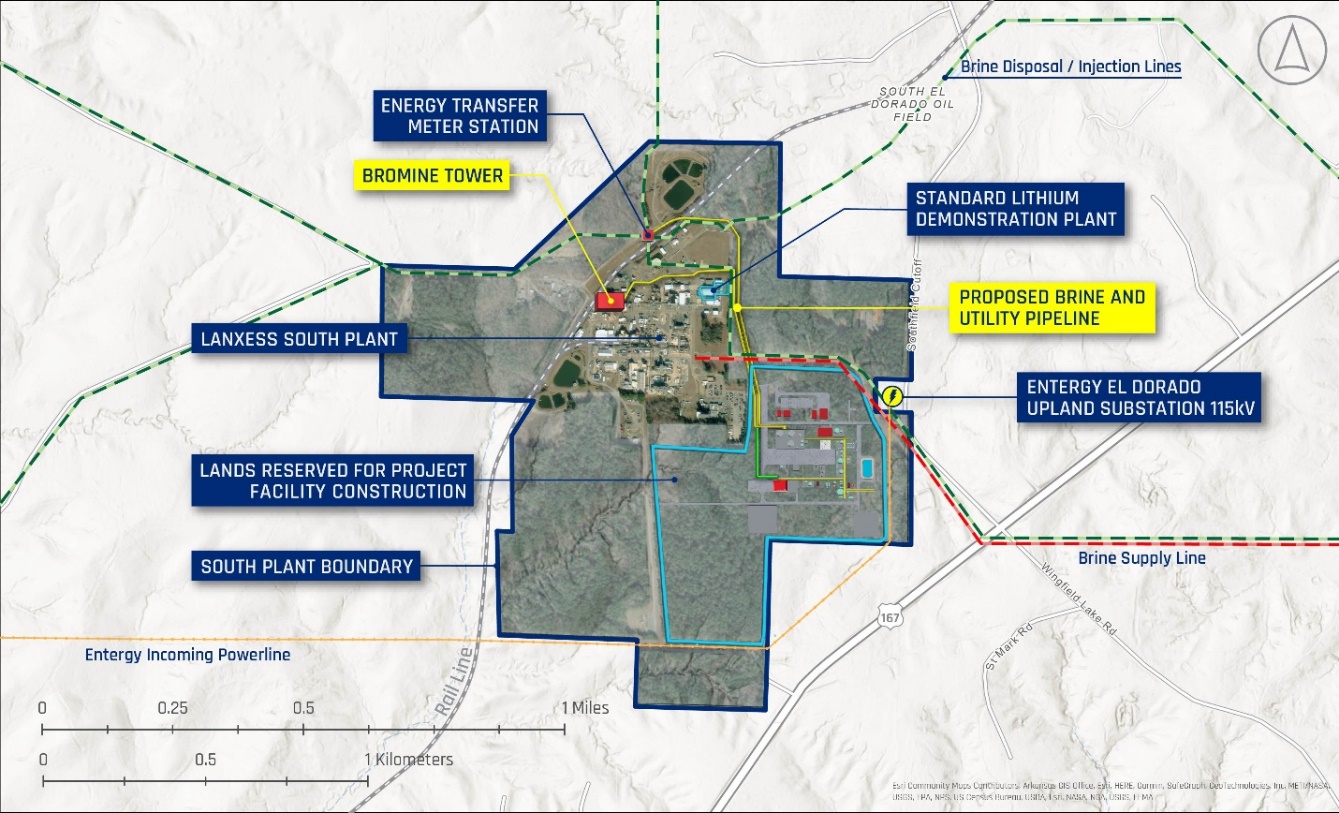

| Figure 2-1. SWA Project discussed in this Technical Report | 16 |

| Figure 4-1. SWA Project discussed in this Technical Report | 26 |

| Figure 4-2. SWA Property Ownership Summary | 31 |

| Figure 5-1. SWA Property with cities/towns and access routes, including major and secondary U.S. highways and railway lines | 38 |

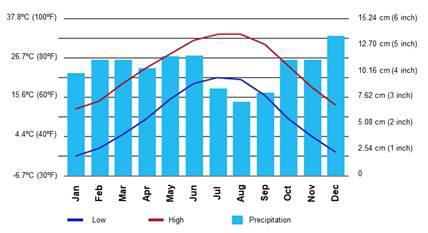

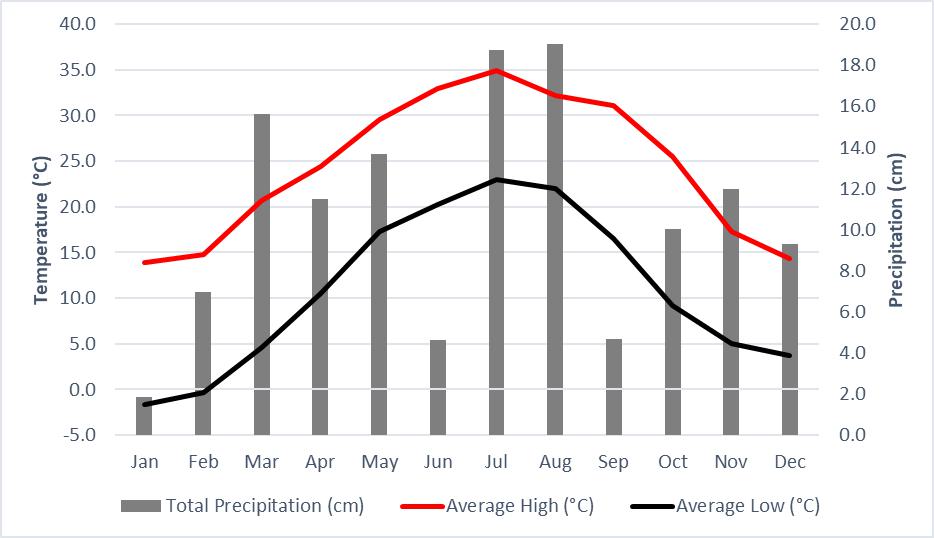

| Figure 5-2. Average Temperature and Precipitation in Magnolia, AR | 39 |

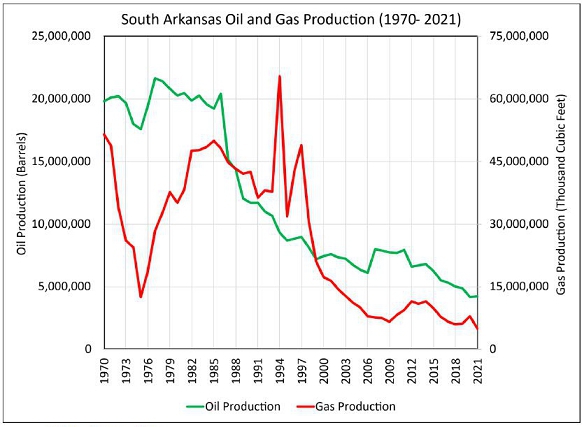

| Figure 6-1. Summary of South Arkansas Oil and Gas Production | 42 |

| Figure 6-2. Summary of South Arkansas Brine Production | 43 |

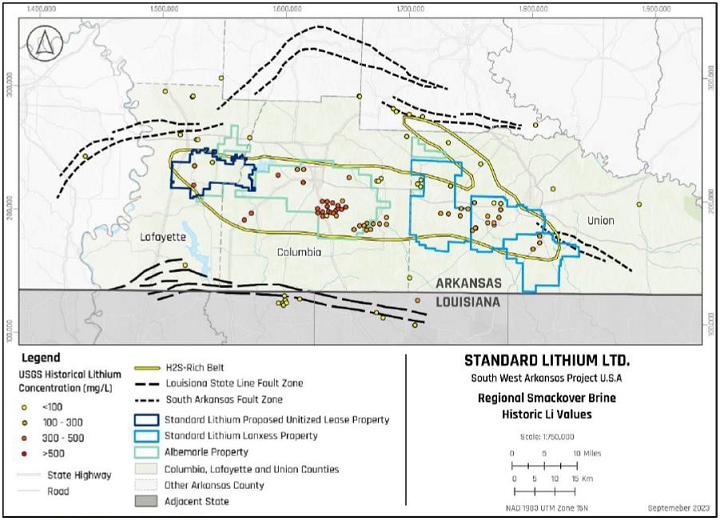

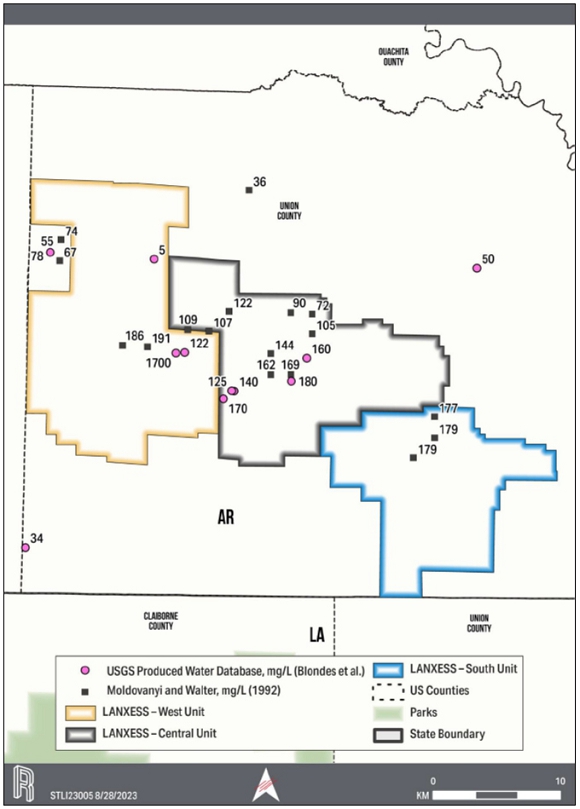

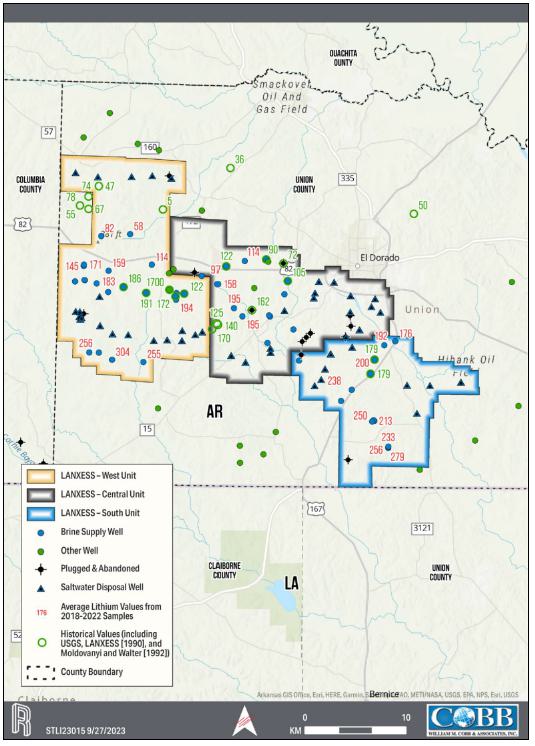

| Figure 6-3. Regional Smackover Formation Lithium Brine Values from the USGS National Produced Waters Database | 45 |

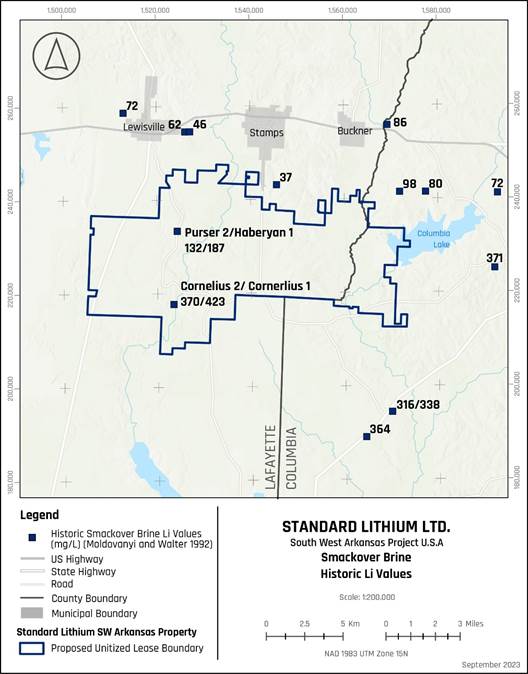

| Figure 6-4. Historic Smackover Formation Lithium Brine Values Derived within, and Adjacent to, the South West Arkansas Property | 47 |

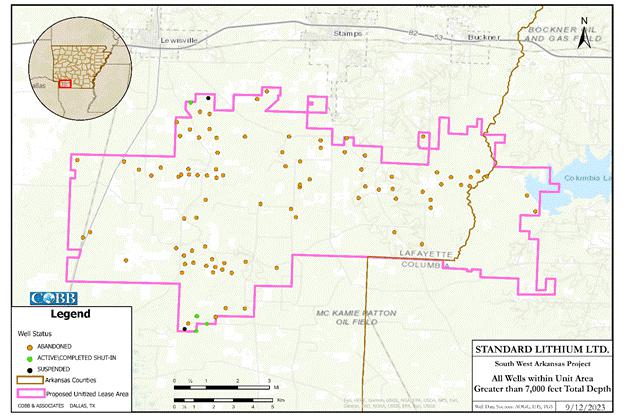

| Figure 6-5. Well Status on the SWA Property | 49 |

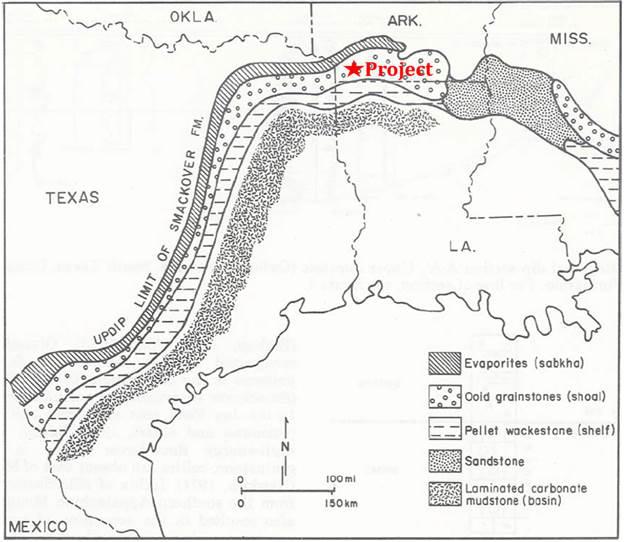

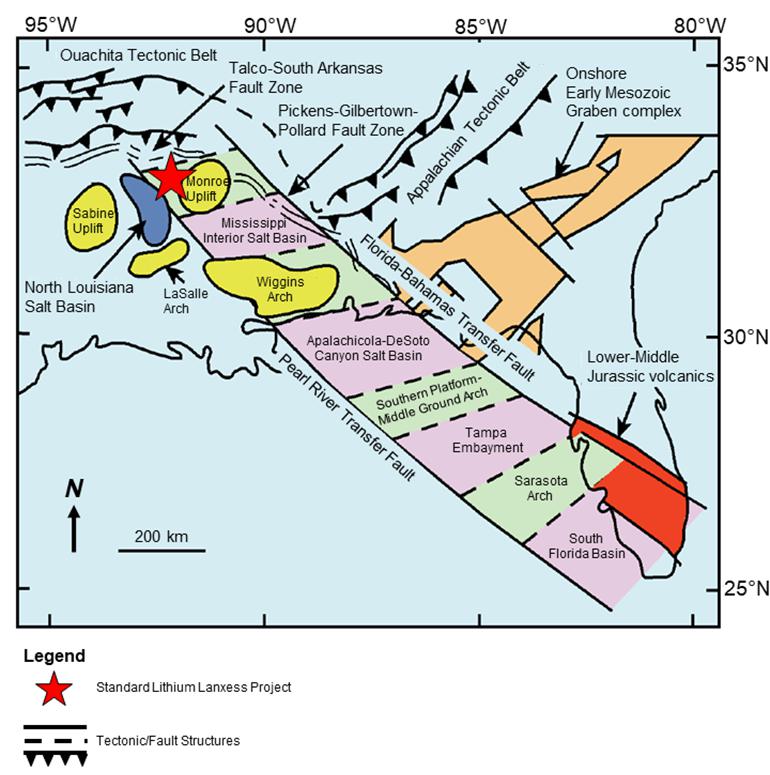

| Figure 7-1. Facies Map of the Smackover Formation, Northern Gulf Coast Basin | 52 |

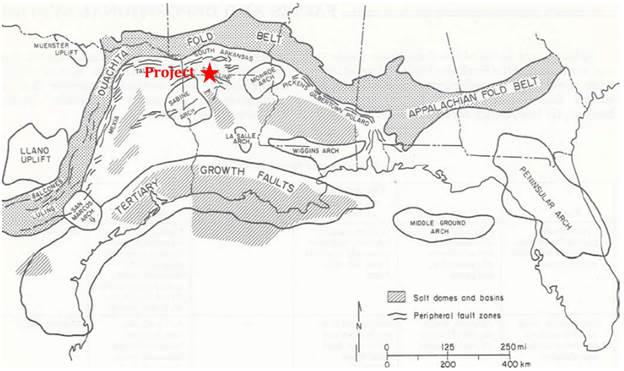

| Figure 7-2. Structural Framework, Northern Gulf Coast | 53 |

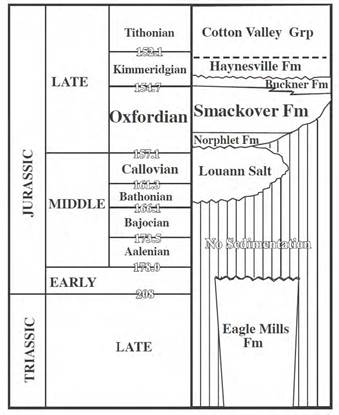

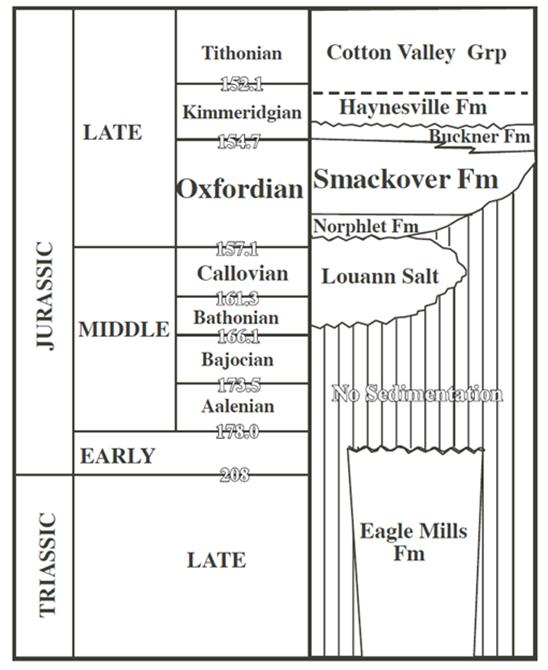

| Figure 7-3. Stratigraphic Column of the Late Triassic to Late Jurassic Formations | 54 |

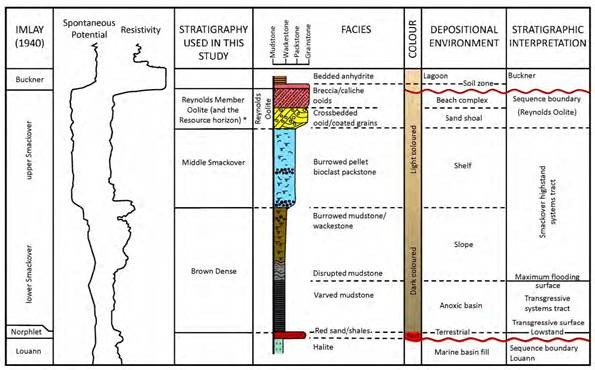

| Figure 7-4. Smackover Stratigraphic Column | 55 |

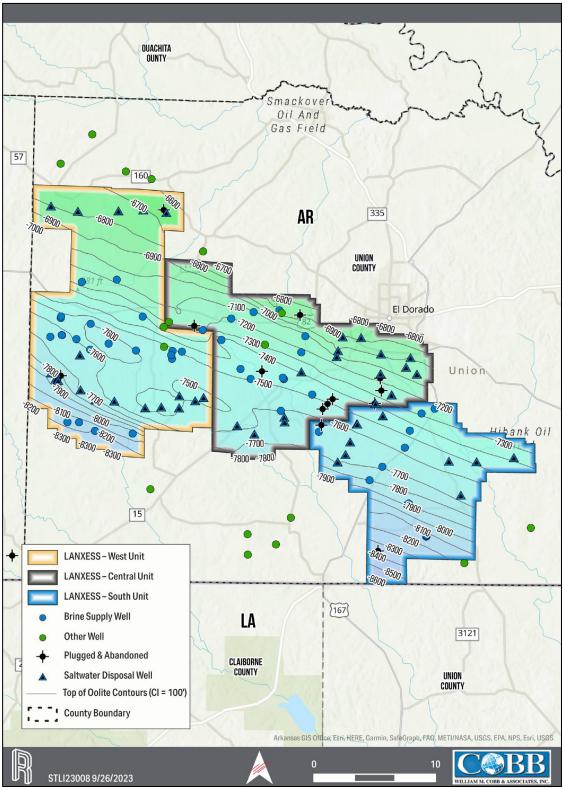

| Figure 7-5. Smackover Structure Map | 56 |

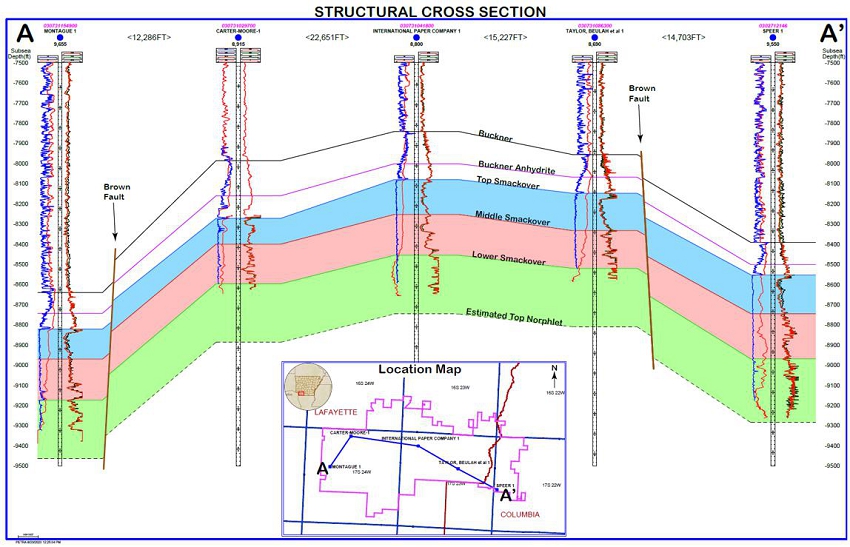

| Figure 7-6. Exploration Program Wells Cross Section | 57 |

| Figure 9-1. SWA Property Concentration Data | 63 |

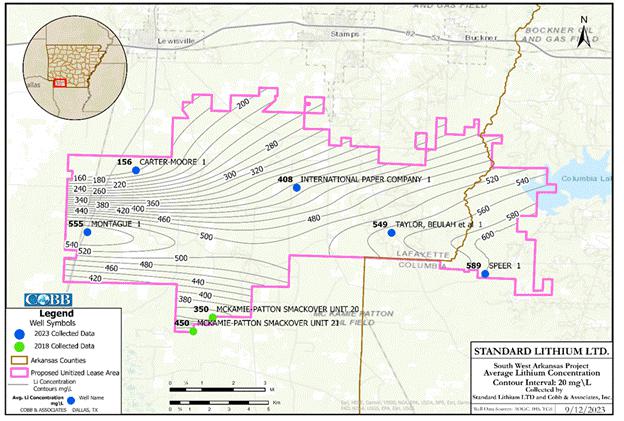

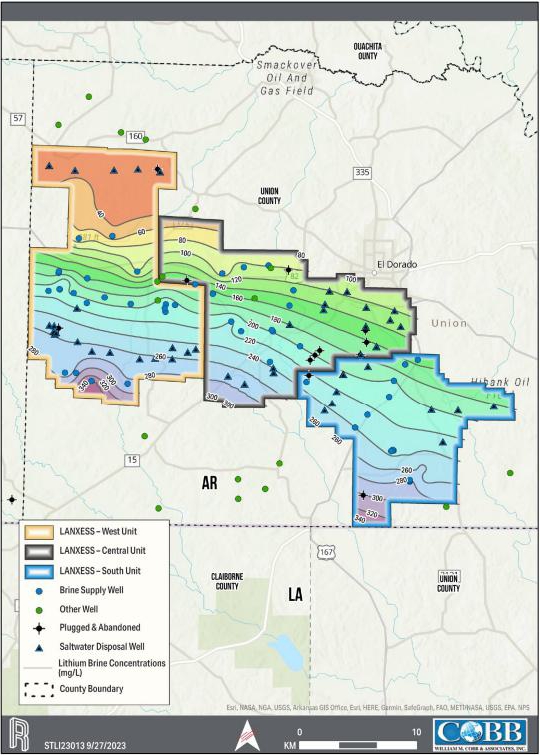

| Figure 9-2. Lithium Concentration Map Based on Data Gathered by Standard Lithium | 64 |

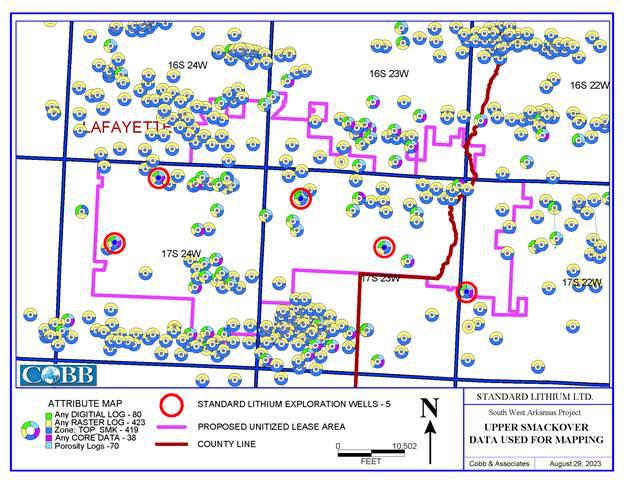

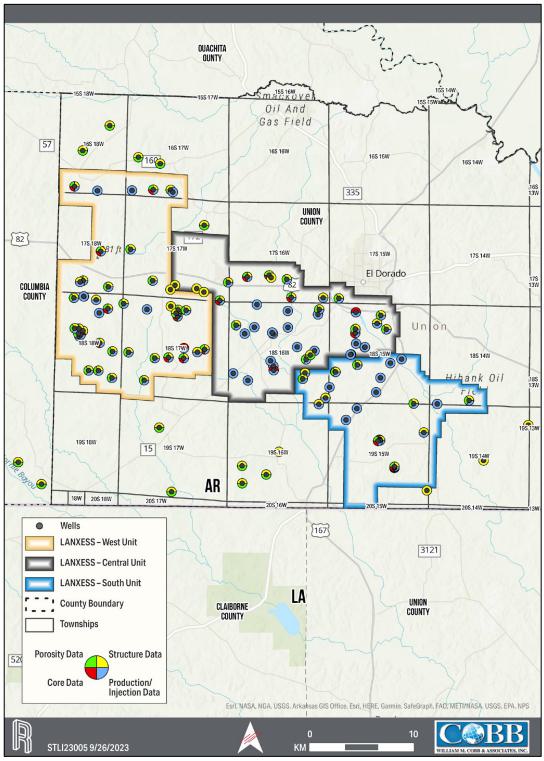

| Figure 10-1. Upper Smackover Well Data Source | 66 |

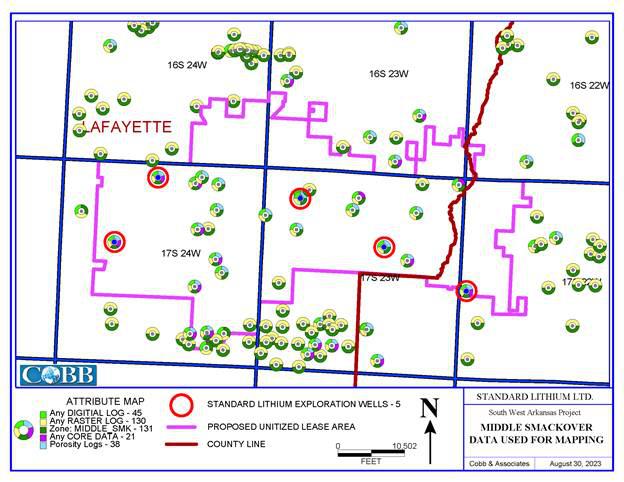

| Figure 10-2. Middle Smackover Well Data Source | 67 |

| Figure 10-3. SWA Property Exploration Program | 69 |

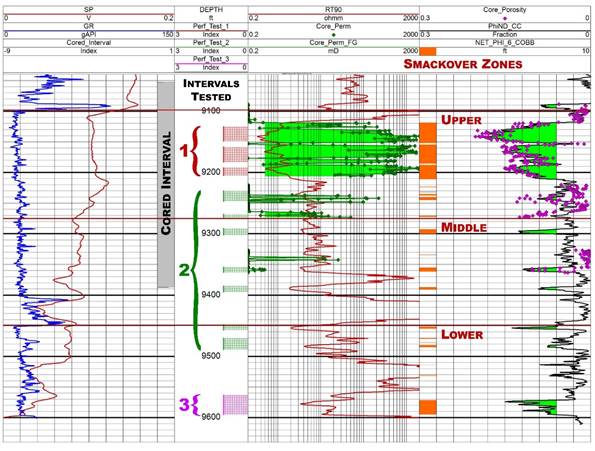

| Figure 10-4. Montague 1 Type Well | 71 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

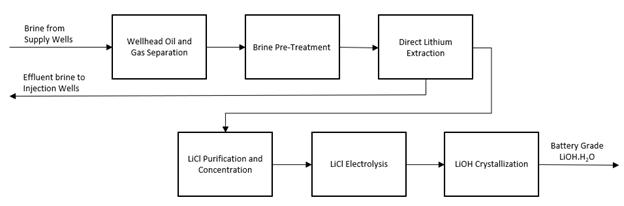

| Figure 13-1. SWA Lithium Brine Project Flowsheet Schematic | 86 |

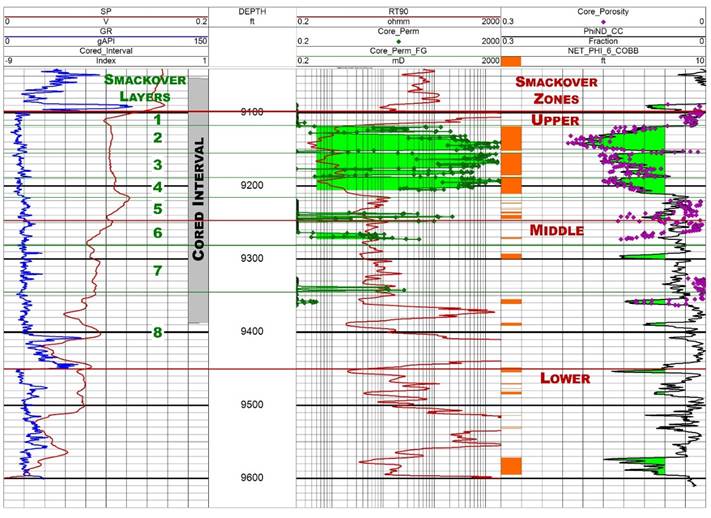

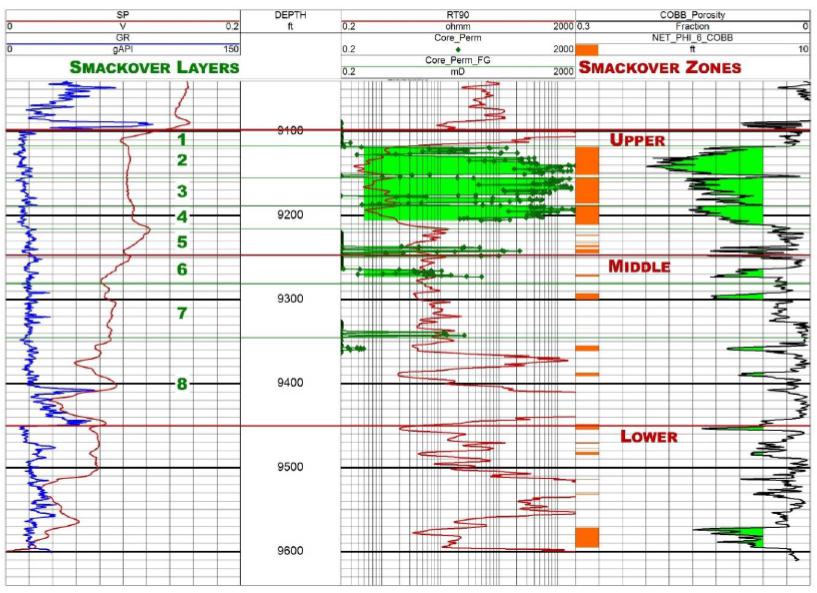

| Figure 14-1. South West Arkansas Field Smackover Type Well, Montague 1 | 108 |

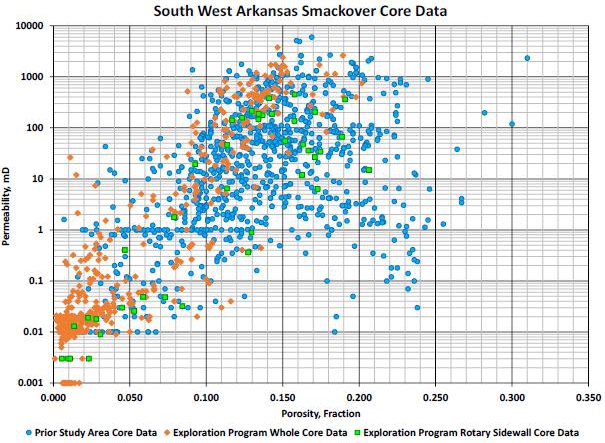

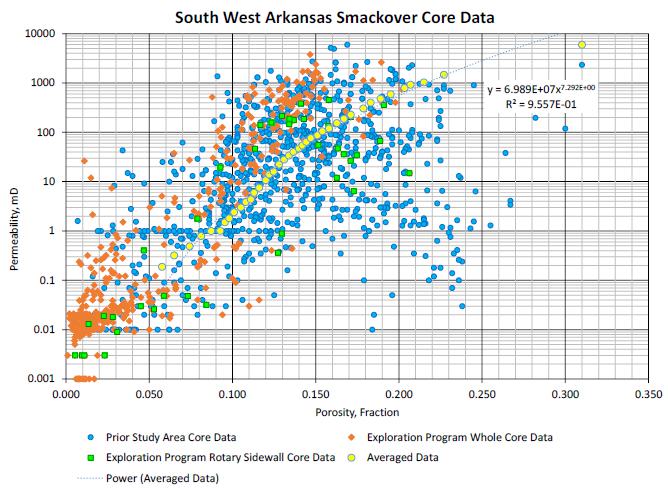

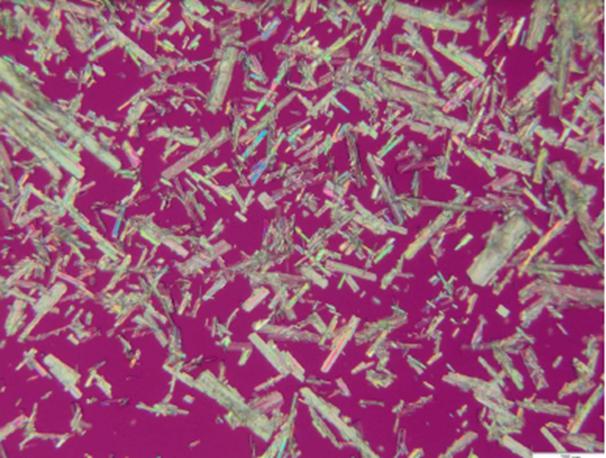

| Figure 14-2. Core Data Plot | 109 |

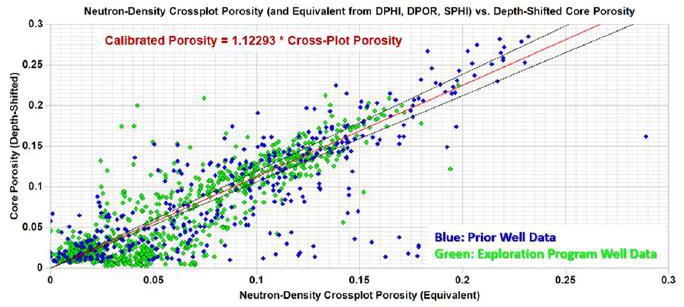

| Figure 14-3. Porosity Log Calibration to Core Data Plot | 109 |

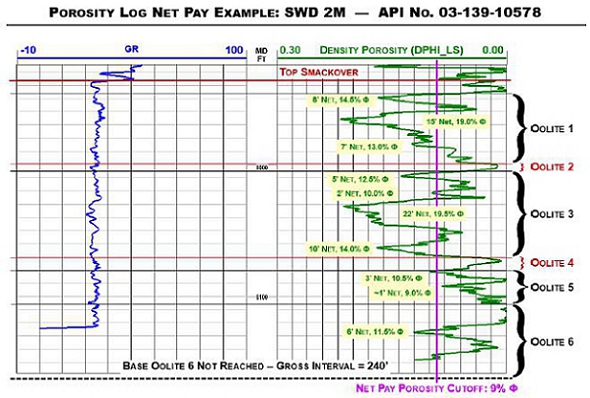

| Figure 14-4. Porosity Log Net Pay Example | 110 |

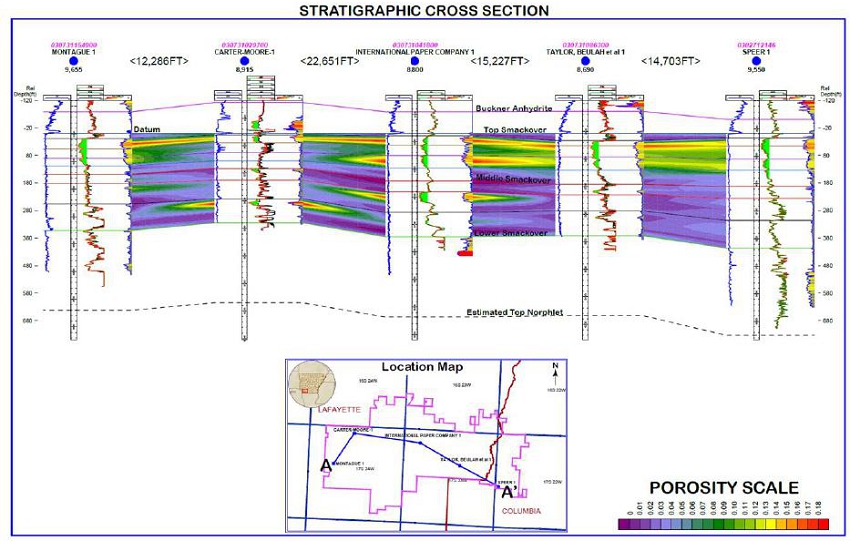

| Figure 14-5. Stratigraphic Cross Section, Exploration Program Wells | 111 |

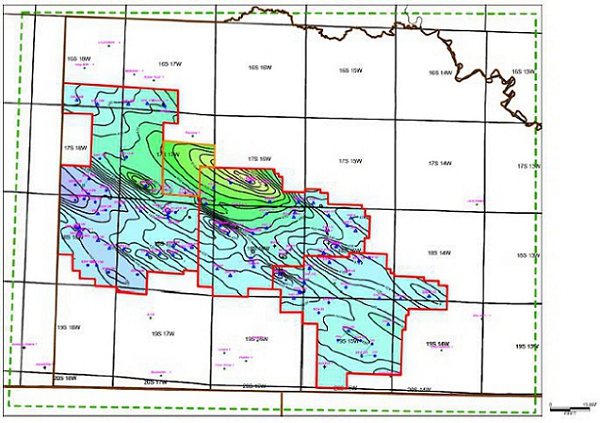

| Figure 14-6. Total Upper Smackover Net Porosity-Thickness | 112 |

| Figure 14-7. Total Middle Smackover Net Porosity-Thickness | 113 |

| Figure 16-1. Core Data Plot with Permeability Data Fit and Equation | 121 |

| Figure 16-2. Supply Well Process | 122 |

| Figure 17-1. Overall Block Flow Diagram of Lithium Hydroxide Production from Smackover Formation Brine | 125 |

| Figure 18-1. Brine Supply Multi-Well Pad Conceptual Layout | 133 |

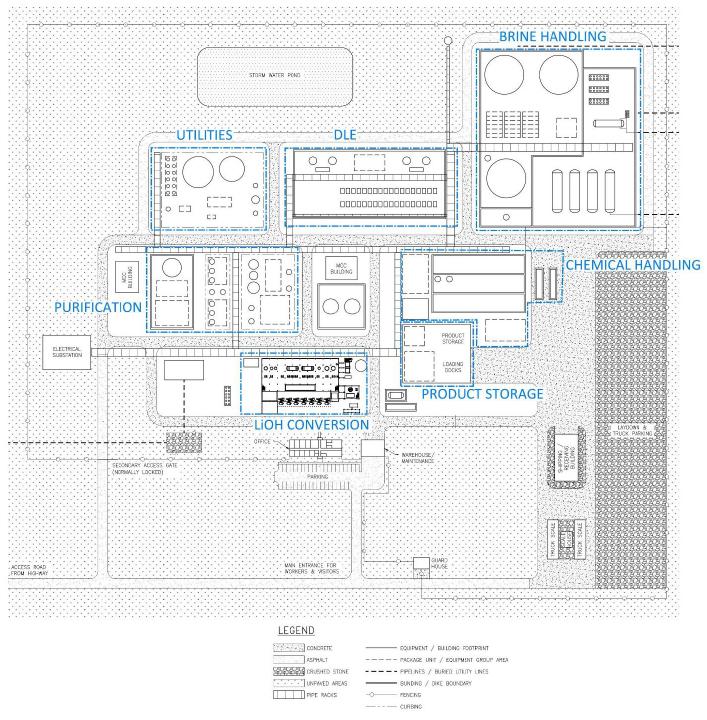

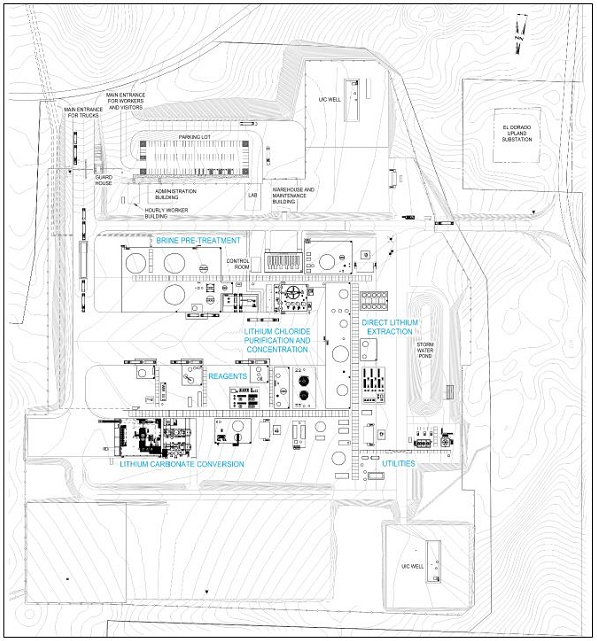

| Figure 18-2. Central Production Facility Conceptual Layout | 137 |

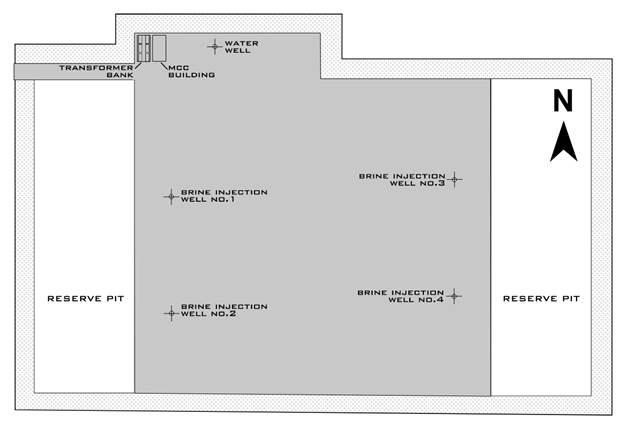

| Figure 18-3. Brine Injection Multi-Well Pad Conceptual Layout | 141 |

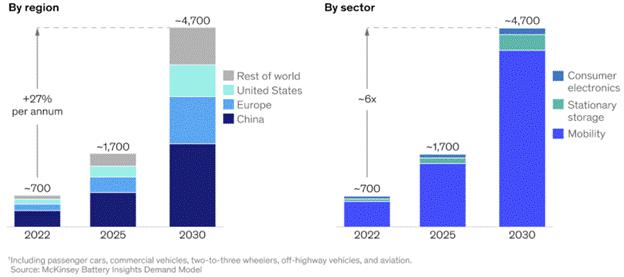

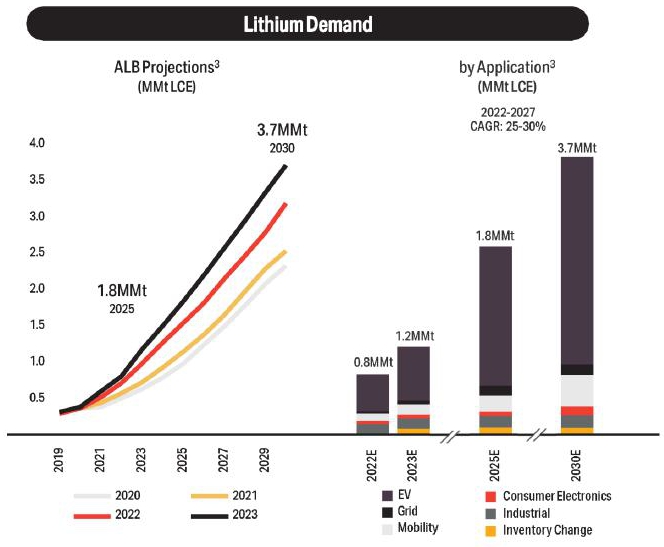

| Figure 19-1. Global Li-ion Battery Cell Demand, GWh, Base Case | 145 |

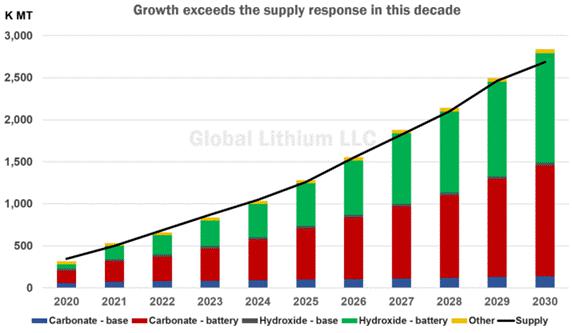

| Figure 19-2. Lithium Supply and Demand - Historical and forecast from 2020-2030 | 146 |

| Figure 19-3. Global Weighted Average Lithium Hydroxide | 148 |

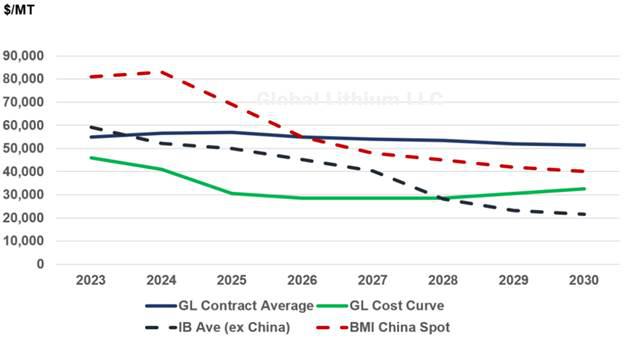

| Figure 19-4. Global Lithium Price Forecast | 149 |

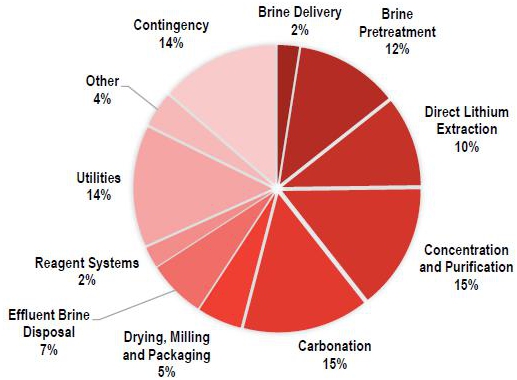

| Figure 21-1. CAPEX Breakdown | 165 |

| Figure 21-2. OPEX Breakdown | 177 |

| Figure 22-1. NPV Post Tax Sensitivity | 186 |

| Figure 22-2. IRR Post-Tax Sensitivity | 186 |

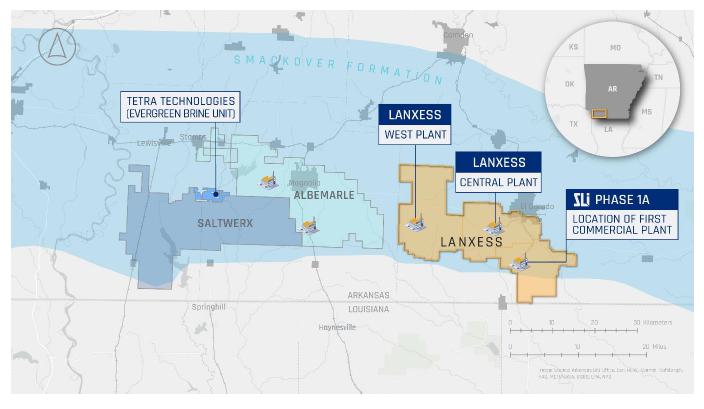

| Figure 23-1. Arkansas Regional Activity | 1989 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

List of Tables

| Table 1-1. SWA Property Geologic Factors and Indicated Lithium Resource Estimates | 4 |

| Table 1-2. SWA Property Geologic Factors and Inferred Lithium Resource Estimates | 4 |

| Table 1-3. Capital Cost Summary | 8 |

| Table 1-4. Operating Cost Summary | 9 |

| Table 1-5. Economic Evaluation Summary | 11 |

| Table 2-1. Qualified Persons and Their Responsibilities | 17 |

| Table 2-2. Abbreviations | 20 |

| Table 4-1. SWA Property Ownership Summary | 29 |

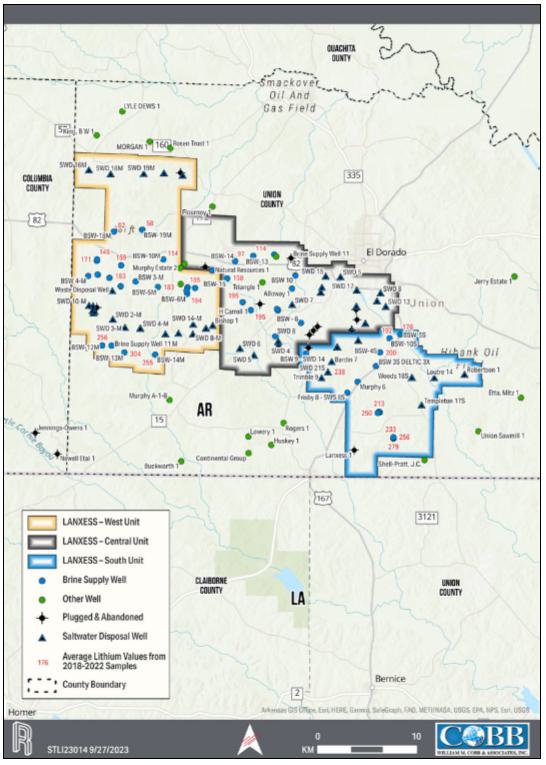

| Table 9-1. SWA Property Lithium Concentration Data | 61 |

| Table 10-1. Types of Well Data | 65 |

| Table 10-2. Well Actions Taken During Exploration Program | 70 |

| Table 11-1. Comparison of Field Duplicate Samples from the 2023 Sampling Program | 77 |

| Table 12-1. Comparison of Verification Samples from the 2023 Sampling Program | 80 |

| Table 13-1. Representative Brine Analyses and LiCl Product | 89 |

| Table 14-1. SWA Property Geologic Factors and Indicated Lithium Resource Estimates | 114 |

| Table 14-2. SWA Property Geologic Factors and Inferred Lithium Resource Estimates | 115 |

| Table 17-1. Raw Material Requirements | 131 |

| Table 18-1. Power Consumption for the Brine Supply Well Facilities | 134 |

| Table 18-2. Estimated Brine Supply and Sour Gas Pipeline Details | 136 |

| Table 18-3. Estimated Sour Gas Disposal Pipeline Details | 139 |

| Table 18-4. Power Consumption for the Brine Injection Well Facilities | 142 |

| Table 18-5. Estimated Effluent Brine Pipeline Details | 143 |

| Table 20-1. Applicable Permits and Schedule for SWA Project | 158 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| Table 21-1. Pipeline Material Summary | 162 |

| Table 21-2. SWA Project Capital Expenditure Cost Estimate | 164 |

| Table 21-3. Sustaining Capital | 166 |

| Table 21-4. Well Facilities and Central Processing Plant Land Costs | 167 |

| Table 21-5. Manpower Cost Summary | 168 |

| Table 21-6. Annual Electrical Use and Cost | 169 |

| Table 21-7. Average Annual Reagents Cost For 30,000 Tonnes Lithium Hydroxide Per Year Production | 170 |

| Table 21-8. Natural Gas Use | 171 |

| Table 21-9. Maintenance & Servicing Costs | 172 |

| Table 21-10. Solids Disposal | 173 |

| Table 21-11. TETRA Brine Lease Agreement Summary | 175 |

| Table 21-12. Annual OPEX Summary | 176 |

| Table 22-1. Annual Operating Cost Summary | 182 |

| Table 22-2. Economic Evaluation – Case 1 (Base Case) Summary | 183 |

| Table 22-3. Sensitivity Analysis | 185 |

| Table 22-4. Economic Evaluation – Case 2 (Alternative Upside Scenario) Summary | 188 |

| Table 26-1. Recommendations Cost Summary | 197 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 1 | Summary |

| 1.1 | Issuer and Purpose |

This Technical Report has been commissioned by, and completed for, Standard Lithium Ltd. (Standard Lithium, or the Company); a public company with its corporate headquarters in Vancouver, B.C. This report focuses on Standard Lithium’s greenfield development in southwest Arkansas referred to as the South West Arkansas Project (SWA Project), which considers extraction of lithium produced from brine associated with mineral leases acquired by TETRA Technologies Inc. (TETRA) under which Standard Lithium has an option agreement for the lithium.

This report outlines Standard Lithium’s plans for the SWA Project, including how the lease acreage could be unitized in compliance with the Arkansas Brine Statute (AR Code § 15-76-301) to facilitate production from the underlying Smackover Formation brine aquifer in conjunction with the preparation of a Pre-Feasibility Study (PFS). This Technical Report updates and refines the findings and recommendations presented in the 2021 Preliminary Economic Assessment (PEA). This PFS also outlines and updates the proposed method of extraction of the brine from the resource while also presenting a more refined flowsheet to extract and purify the lithium to produce a marketable product.

| 1.2 | Property Location and Ownership |

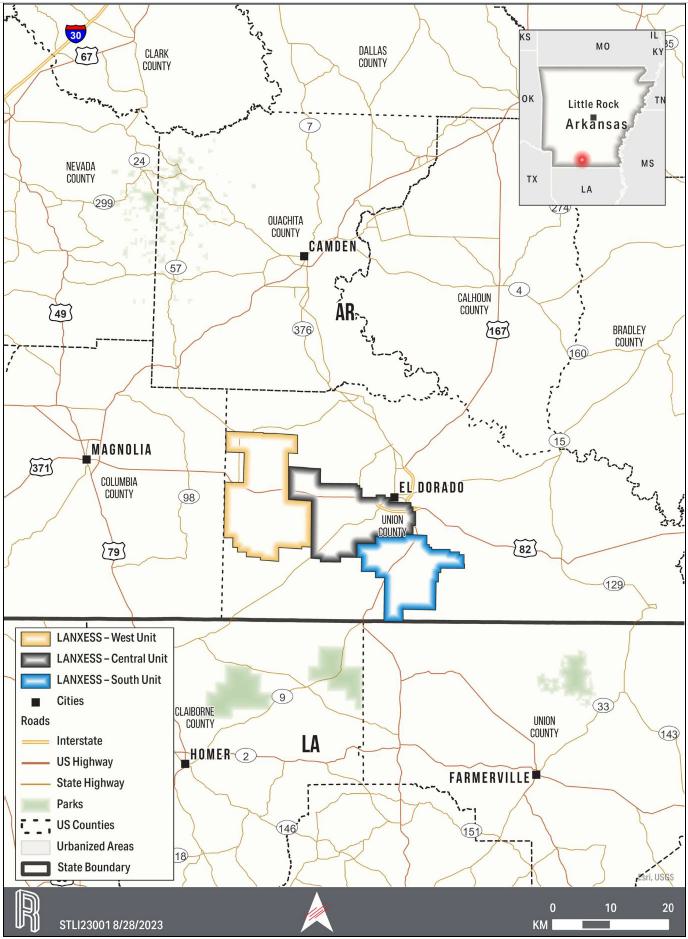

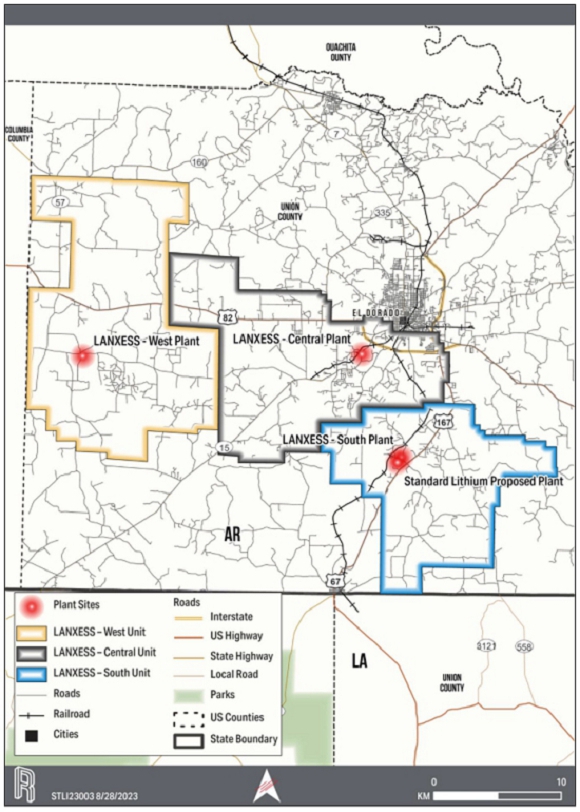

The center of the SWA Project is located approximately 24 km (15 miles) west of the City of Magnolia in Lafayette County, southwestern Arkansas, United States. The SWA Property encompasses Townships 16-17 South and Ranges 22-24 West of the 5th Meridian and lies wholly within Lafayette and Columbia counties.

The SWA Property is comprised of 489 land tracts containing 851 individual leases and eight salt water (brine) deeds that covers 27,066 net mineral acres (10,953 net mineral hectares). The proposed unitized SWA Property encompasses 36,839 gross mineral acres (14,908 gross mineral hectares) and forms the updated 2023 resource and project area.

The leases and deeds are held by TETRA. TETRA began acquiring brine deeds and/or brine leases in 1992 and added additional brine leases in 1994, 2006 and 2017. Standard Lithium acquired the SWA Project brine production rights to lithium directly from TETRA through an option agreement providing that Standard Lithium makes annual payments. At the time of writing, Standard Lithium is up to date with all required payments. As of the date of this report, the process of unitization has not commenced and neither Standard Lithium nor TETRA have developed the SWA Project brine leases and deeds for production of brine minerals.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 1.3 | Geology and Mineralization |

The SWA Property lithium deposit is a confined brine deposit in the form of a lithium-bearing brine contained within the porosity of the Smackover Formation within the SWA Property boundaries. The Smackover Formation in southern Arkansas is commonly subdivided into three intervals, the Reynolds Member Oolite (predominantly oolitic limestone), referred to in this report as the Upper Smackover, the Middle Smackover (a burrowed pellet packstone), and the Brown Dense (dark, dense limestone), referred to in this report as the Lower Smackover. The lithium brine resource, as reported, is contained within the Upper and Middle Members of the Smackover Formation (which underlie the entire Project area). The Lower Smackover does not contribute to the resource estimates in this report, but is a future target for exploration.

The depth of the top of the Smackover in the Property area generally dips from north-northeast to south-southwest and varies in depth from approximately 7,600 feet (2,316 meters) subsea to approximately 9,100 feet (2,773 meters) subsea. Brine has been extracted commercially from the Smackover in southern Arkansas for approximately 60 years and is well understood.

The volume of in-place lithium is proportional to the product of the brine-saturated pore volume and the lithium concentration, both of which are known with reasonable accuracy, based on the drilling, logging, coring, and sampling data obtained throughout the property area. The data used to estimate and model the resource were gathered from the five project specific wells described in Section 1.4 along with 424 existing and suspended oil and gas production wells on or adjacent to the SWA Project and surface seismic information.

| 1.4 | Status of Exploration |

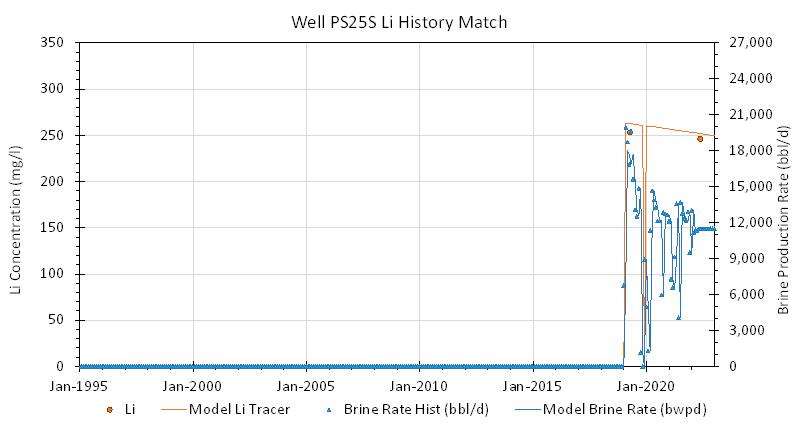

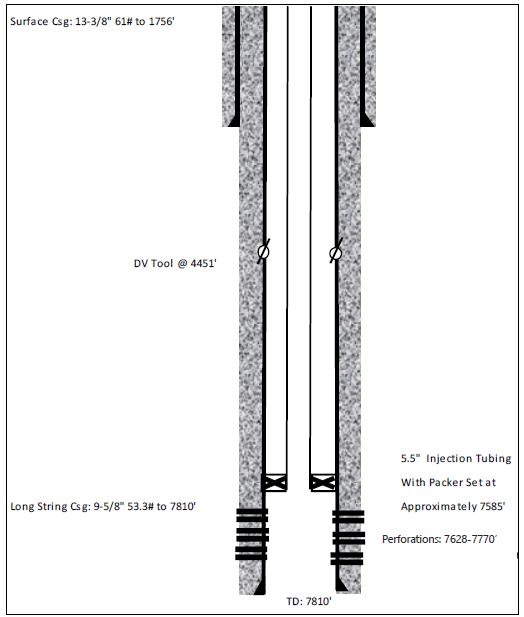

From February to July in 2023 Standard Lithium conducted a five-well exploration program at the SWA Property. The exploration program design and execution was supported by the QP Williams, including choice of well locations, data gathering plans, monitoring well progress, advising on coring targets and procedures, and interpretation of results. This program included re-entry into three existing abandoned wells (Taylor, Beulah et al 1, International Paper Co. 1, and Carter Moore 1) and drilling two all-new wells (Speer 1 and Montague 1). These five well locations were chosen to maximize the description of the geologic properties and lithium concentrations within the Property. Figure 1-1 depicts the locations of those five wells and the observed maximum and average lithium concentrations. In support of further project definition, up to three additional wells will be considered for the next phase to provide in-fill data in support of a reserve classification.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Figure 1-1. SWA Project 2023 Exploration Program

| 1.5 | Updated Mineral Resource Estimation |

The resource present in the Smackover Formation below the SWA Project was updated based on the proposed unitized area encompassing 36,839 gross mineral acres (14,908 gross mineral hectares). Using a conversion factor of 5.323 kg of lithium carbonate equivalent (LCE) per kg of lithium, the Indicated Resource value corresponds to an estimate of 1,430 thousand metric tonnes LCE. For the Inferred Resource, the estimate is 392 thousand metric tonnes LCE; see Table 1-1 and Table 1-2 below for more detail.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Table 1-1. SWA Property Geologic Factors and Indicated Lithium Resource Estimates

| Indicated Resource | |||

| Smackover Formation | North

Upper |

South

Upper |

Total

Upper |

| Gross Volume, km3 | 4.69 | 2.80 | 7.49 |

| Net Volume, km3 | 3.17 | 1.93 | 5.11 |

| Average Porosity | 11.7% | 11.9% | 11.8% |

| Average Lithium Concentration, mg/L | 408 | 507 | 446 |

| Indicated Lithium Resource, Thousand Tonnes | 152 | 116 | 269 |

| LCE, Thousand Tonnes | 810 | 620 | 1,430 |

Table 1-2. SWA Property Geologic Factors and Inferred Lithium Resource Estimates

| Inferred Resource | |||

| Smackover Formation | North Middle |

South Middle |

Total Middle |

| Gross Volume, km3 | 6.04 | 2.98 | 9.02 |

| Net Volume, km3 | 1.60 | 0.46 | 2.06 |

| Average Porosity | 9.0% | 8.1% | 8.8% |

| Average Lithium Concentration, mg/L | 379 | 508 | 405 |

| Inferred Lithium Resource, Thousand Tonnes | 55 | 19 | 74 |

| LCE, Thousand Tonnes | 291 | 100 | 392 |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Notes for Table 1-1 and Table 1-2:

1. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will be converted into a mineral reserve. The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

2. Numbers may not add up due to rounding to the nearest 1,000 unit.

3. A minimum lithium concentration cutoff was not applied in this analysis because the entirety of the SWA Property exceeds the previously used 100 mg/L cutoff value.

4. The resource estimate was developed and classified in accordance with guidelines established by the Canadian Institute of Mining and Metallurgy. The associated Technical Report was completed in accordance with the Canadian Securities Administration’s National Instrument 43-101 and all associated documents and amendments. As per these guidelines, the resource was estimated in terms of metallic (or elemental) lithium.

5. In order to describe the resource in terms of ‘industry standard’ lithium carbonate equivalent, a conversion factor of 5.323 was used to convert elemental lithium to LCE.

The average lithium concentrations used in the indicated resource calculation are 507 mg/L and 408 mg/L, for the South and North resource areas, respectively.

The updated 2023 SWA Project resource is 52% larger than the 2021 PEA resource estimate. The resource increase is primarily related to the higher concentration of lithium, which increased in concentration from an overall average of 255 mg/L to 437 mg/L. Higher lithium concentrations offset a reduction in brine volume associated with tightened and enhanced reservoir definition.

| 1.6 | Mining Methods |

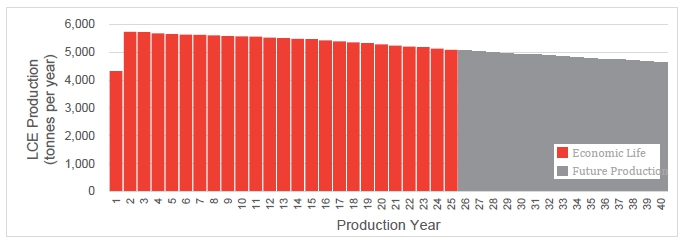

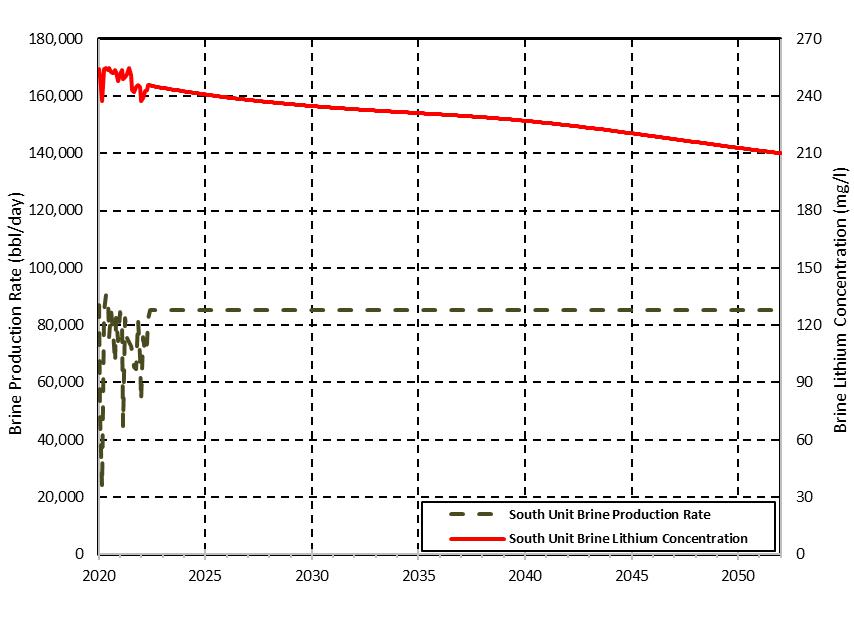

The resource will be extracted using a network of brine supply wells and injection wells (which are required for pressure maintenance and are standard throughout the Arkansas brine industry). The configuration of this well field has been determined using a finite difference computer model based on the eight-layer geologic model developed for the resource categorization. The preliminary results of this model indicate the SWA Property appears to be capable of producing greater than 30,000 metric tonnes per annum (tpa) of lithium hydroxide monohydrate (the commercially sold form, also referred to as lithium hydroxide or hydroxide) for 20 years or more, and that production rates greater than 35,000 metric tpa are probable with modifications to the assumed production and injection well count and configuration, given the current understanding of the SWA Property’s geology and distribution of lithium.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 1.7 | Recovery Method and Mineral Processing |

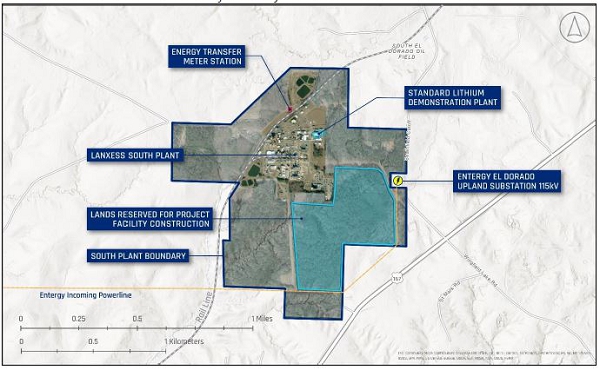

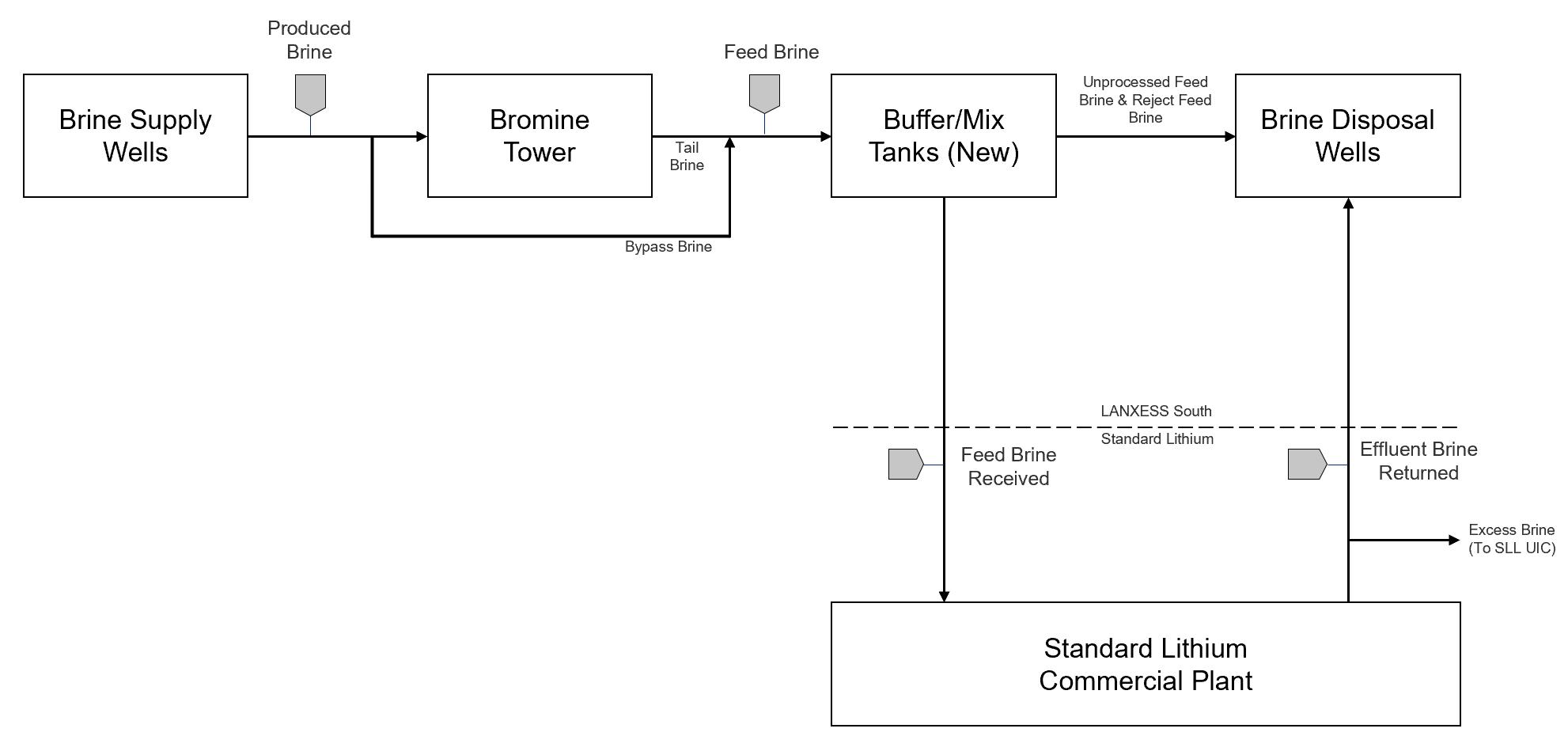

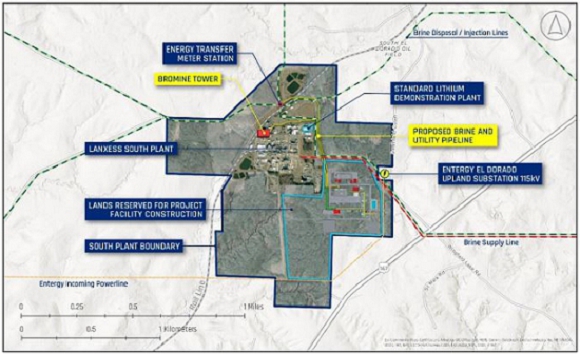

Standard Lithium have operated a Demonstration Plant, exclusively processing Smackover brine, since May 2020. This has provided a valuable source of knowledge in regards to the behavior of the brine, testing of various flowsheet elements directly, and providing a test bed for operator training. In addition, the Demonstration Plant has facilitated an ability to produce lithium chloride samples along with brine samples from various stages of the flowsheet to support bench scale metallurgical testing, mini-pilot plant testing and vendor testing in support of equipment design and process guarantees. The Demonstration Plant is located about 40 km (25 miles) east of the SWA Project and it is the Company’s intent to continue to use the information obtained from the Demonstration Plant to aid in flowsheet development, optimize lithium extraction and lithium chloride purification and to develop operations capability.

The development plan considered for the SWA Project PFS demonstrates production of battery-quality lithium hydroxide averaging 30,000 tpa over a 20-year operating life. The Project will pump brine from the Smackover Formation aquifer via production wells, extract lithium from the brine, convert it to a saleable product, and then reinject the effluent brine via injection wells to maintain pressure in the reservoir.

The PFS assumes a network of 21 brine supply wells will be completed in the Smackover Formation, producing approximately 1,800 m3/hr or 7,925 US gallons per minute(gpm). Twenty-two injection wells will support pressure maintenance in the Smackover aquifer to maintain long-term production.

Brine from the supply wells will be routed to a lithium extraction and lithium hydroxide production facility by a network of underground fiberglass pipelines. The brine entering the production facility will be pre-treated and then processed via Koch Technology Solutions’ Lithium Selective Sorption (“LSS”) Direct Lithium Extraction (DLE) process. The lithium chloride extracted by the DLE has a significantly higher relative concentration of lithium chloride relative to the other naturally occurring salts in the brine and is subsequently purified and concentrated using industry proven and commercially established processes prior to conversion to lithium hydroxide via a modified chlor-alkali process.

After lithium extraction, the lithium-depleted, effluent brine will be returned to the resource area by a pipeline system to the network of brine injection wells.

The further concentrated and purified lithium chloride solution will be processed by electrolyzers to form a high-purity lithium hydroxide solution. The Company evaluated several technologies at laboratory and pilot scale testing to support the selection of electrolysis as the core technology for conversion of lithium chloride to lithium hydroxide.

The testing undertaken during the PFS phase produced battery-quality lithium hydroxide from Smackover brines processed through the Demonstration Plant, confirming the viability of the process. The output solution from electrolysis will be crystalized into a solid, battery-quality lithium hydroxide using standard, proven processes.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

The base case development for the project as proposed will produce, on average, 30,000 tonnes of battery-quality lithium hydroxide per year, over a 20-year timeframe with an upside production scenario of 35,000 tpa of lithium hydroxide production that was identified in July 2023 as a result of the exploration assessment and resource evaluation outlined in Sections 9, 10, 14 and 16.

Although the potential for further upside will be assessed further in the Feasibility Study phase, this PFS addresses the identified 35,000 tpa assessed as a probable upside economic case.

| 1.8 | Capital and Operating Cost Estimates |

| 1.8.1 | Capital Expenditure Costs |

At full build-out, with estimated average production over 20 years of 30,000 tpa of lithium hydroxide, the direct capital costs are estimated to be US$845 million, with indirect costs of US$218 million. A contingency of 20% was applied to direct costs (US$211 million) to yield an estimated all-in capital cost of US$1.3 billion. A summary of the capital costs is provided in Table 1-3.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Table 1-3. Capital Cost Summary

| Description | Direct Costs Million US$[1] | Indirect Costs Million US$[2] |

| Extraction and Injection Well Field[3] | 234.6 | 2.2 |

| Pipelines[3] | 60.5 | 7.1 |

| Receiving/Pre-Treatment | 118.4 | 48.2 |

| Direct Lithium Extraction (LSS) | 110.3 | 28.8 |

| Purification & Concentration | 110.8 | 42.8 |

| Lithium Hydroxide Unit | 121.5 | 36.8 |

| Chemical Storage, Handling & Utilities | 74.0 | 50.1 |

| Plant Buildings | 6.8 | 1.8 |

| Sub-Total | 837.0 | 217.9 |

| Freight | 8.0 | - |

| Contingency | 211.0[4] |

- |

| CAPEX TOTAL | US$1.27 billion | |

Notes:

1. Direct costs were estimated using either vendor-supplied quotes, and/or engineer estimated pricing (based on recent experience) for all major equipment. Major equipment prices were scaled using appropriate AACE Class 4 Direct Cost Factors to derive all direct equipment costs.

2. Indirect costs were estimated using AACE Class 4 Indirect Cost Factors. Indirect costs include all contractor costs (including engineering), indirect labor costs, and Owner’s Engineer costs.

3. Exceptions to above costing estimate methodology were the well field and pipelines, which were based on HGA’s recent project experience in the local area.

4. AACE Class 4 estimate includes 20% contingency on direct capital costs.

| 1.8.2 | Operating Expenditure Costs (OPEX) |

The operating cost estimate includes both direct costs and indirect costs, as well as allowances for mine closure (see Table 1-4). The majority of the operating cost comprises electricity usage including conversion to lithium hydroxide, as well as reagent usage required to extract the lithium from the brine. The all-in operating cost is $5,229 per tonne of lithium hydroxide.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Table 1-4. Operating Cost Summary

| Description | Operating

Cost US$/tonne Lithium Hydroxide[1] |

| Workforce[2] | 371 |

| Electrical Power[3] | 1,291 |

| Reagents and Consumables[4] | 1,158 |

| Natural Gas[5] | 15 |

| Maintenance/Waste Disposal/Misc[6] | 1,073 |

| Indirect Operational Costs[7] | 168 |

| Royalties[8] |

741 |

| Sustaining Capital[9] | 415 |

| All-in OPEX Total | 5,229 |

Notes:

1. Operating costs are calculated based on average annual production of 30,000 tonnes of lithium hydroxide.

2. Approximately 91 full time equivalent (FTE) positions.

3. Approximately 30% of electrical energy consumed by well field and pipelines; 70% by the processing facilities.

4. Majority of reagent costs are comprised of sodium hydroxide and soda ash. Other reagents and consumables are air, hydrochloric acid, sodium metabisulfite, lime, membrane replacement, nitrogen, and scale inhibitors for pumps/wellheads.

5. Assumes that all of the natural gas is purchased from open market and none is co-produced at the wellheads.

6. Includes all maintenance and workover costs and is based on experience in similar-sized electrochemical facilities, brine processing facilities, and Smackover Formation brine production well fields.

7. Indirect costs (insurance, environmental monitoring, etc.) are factored from other capital and operational costs, except for mine closure, which is based on known well-abandonment costs.

8. Based on agreed royalties and expected future lease costs. Does not include future lease-fees-in-lieu-of-royalties which are still to be determined and subject to regulatory approval (lease-fees-in-lieu-of-royalties have been determined for bromine and certain other minerals in the State of Arkansas, but have not yet been determined for lithium extraction).

9. Major equipment refurbishment and replacement is categorized as sustaining capital. Sustaining Capital is shown included in the OPEX here to present an all-in annual operating cost.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 1.9 | Economic Analysis |

The results for internal rate of return (IRR) and net present value (NPV) from the assumed Capital Expenditure (CAPEX), Operating Expenditure (OPEX) and price scenario at full Base Case production, are presented in Table 1-5.

In addition, the upside case of 35,000 tpa production was assessed. To support this assessment, CAPEX costs are scaled based on a capacity factored estimate considering the increased production, resulting in an estimated upside case CAPEX estimate of US$1.36 billion.

Operating costs were evaluated in two categories, fixed and variable. Manpower was assumed to be a fixed cost based on the incremental sizing of the facility. Variable costs including reagents, consumables and electrical usage were scaled linearly for the increased consumption. Other costs including maintenance and miscellaneous costs were automatically adjusted as a percentage of the increased CAPEX resulting in an average annual OPEX cost of US$3,964/tonne. The economic analysis for this upside scenario is presented in Table 1-5.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Table 1-5. Economic Evaluation Summary

| Description | Units | Base Case | Upside Case |

| Average Annual Production of Lithium Hydroxide | tpa[1] | 30,000[2] | 35,000[2] |

| Plant Operating Life | years | 20 | 20 |

| Total Capital Expenditures | Million US$ | 1,274[3,4] | 1,360[3,4] |

| Average Annual Operating Cost | US$/t | 4,073 | 3,964 |

| Average Annual All-in Operating Cost | US$/t | 5,229[5,6] | 5,060[5,6] |

| Selling Price | US$/t | 30,000[7] | 30,000[7] |

| Discount Rate | % |

8.0 |

8.0 |

| Net Present Value (NPV) Pre-Tax | Million US$ | 4,473 | 5,367 |

| Net Present Value (NPV) After-Tax | Million US$ | 3,090[8] | 3,736[8] |

| Internal Rate of Return (IRR) Pre-Tax | % | 41.3 | 44.4 |

| Internal Rate of Return (IRR) After-Tax | % | 32.8 | 35.4 |

Notes: All model outputs are expressed on a 100% project ownership basis with no adjustments for project financing assumptions.

1. Metric tonnes (1,000 kg) per annum.

2. Resource modelling work indicates the SWA Property appears to be capable of producing more than 30,000 tpa of lithium hydroxide for 20 years or more, and that production rates greater than 35,000 tpa are probable.

3. Capital Expenditures include 20% contingency on total installed costs.

4. No inflation or escalation has been carried for the economic modelling.

5. Includes all operating expenditures, ongoing land costs, royalties, and sustaining capital.

6. Brine lease fees in-lieu-of-royalties (to be approved by the Arkansas Oil and Gas Commission) have not been defined and are not currently included in the economic modelling.

7. Selling price of battery-quality lithium hydroxide based on a flatline price of $30,000/t over total project lifetime.

8. Assumes a U.S. Federal tax rate of 21% and State of Arkansas Tax rate of 5.1%, as well as variable property taxes.

A sensitivity analysis for the project indicates that the economics remain robust even under the downside scenarios of a 20% increased CAPEX, a 20% reduced product selling price, a 5,000 tpa reduced production output, or a 20% increased OPEX.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 1.10 | QP Conclusions |

| 1.10.1 | Exploration work |

Standard Lithium successfully executed a five-well exploration program that significantly improved the geologic description of the target Smackover Formation. The program addressed the three key factors that determine the quality of the resource: the total volume of brine based on core and log porosity data, the brine’s lithium concentration based on the analysis of multiple brine samples from the wells, and the productivity of the formation based on the core permeability data collected. QP Williams was closely involved with all aspects of the exploration program, including selecting the well locations; designing the coring, logging, and sampling programs; attending the coring and sampling of the wells; and analyzing the resulting data. In the opinion of QP Williams, the resulting data and analyses fully support the conclusion that the inferred and indicated resources present at the SWA Property are of sufficient quality to justify pursuit of a lithium extraction project at the site.

| 1.10.2 | Mineral Processing work |

Because continuous start-to-finish DLE (without the use of evaporation ponds) is not yet commercially proven, test work becomes especially critical to reduce process and scale-up risks. The test work needs to be conducted over a reasonable period of time and at a suitable scale-up factor. The Demonstration Plant operation has achieved both these objectives. In addition, the equipment operated in the Demonstration Plant has shown reliability in terms of having the required availabilities for stable process operation. The process control and chemical analysis applied in the Demonstration Plant have provided a solid foundation for reliable results.

The LSS DLE process has been run over many months, demonstrating consistency of results and its applicability for the SWA project. For further effective optimization and applicability for the Definitive Feasibility Study (DFS), the LSS DLE process needs to be run on actual SWA brine for a long-term, continuous test.

The conversion of a lithium chloride solution to a lithium hydroxide solution using electrolysis has been shown to be the process route with the least process risk, mainly because it is based, to a large extent, on the commercially proven chlor-alkali process. The approach taken by Standard Lithium to develop this process route has been appropriate for the PFS stage of the project. During the DFS, Standard Lithium should focus on further reducing the process risk. This can be accomplished by longer testing and by larger scale testing.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 1.11 | Key Study Recommendations |

The recommended next steps for Standard Lithium to elevate the SWA Project to a higher level of resource classification and project definition are to:

| · | Further develop the reservoir model in support of development of an optimized well plan and brine production profile. |

| · | Develop and optimize the flowsheet using the Demonstration Plant with a target of additional optimization. For example, review and optimize the process such that the reagent usage can be minimized and solid-waste generation from the process can be substantially reduced or eliminated. |

| · | Continue optimization of the LSS DLE to improve the quality of the raw LiCl solution by elimination of impurities, including testing of new sorbents and adjustments to operating parameters. |

| · | Conduct all additional necessary engineering and feasibility studies (i.e. FEED level engineering definition) to integrate the project development findings into an updated resource classification and DFS. |

| · | Continue testing of electrolytic conversion of lithium chloride to lithium hydroxide in support of development of engineering inputs for design. |

| · | Undertake a logistics study to assess road versus rail for supply of reagents and for export of products during the next project phase. |

| · | Complete any necessary process equipment vendor testing for lithium hydroxide concentration and evaporation/crystallization to a battery-quality product. |

| · | Identify long lead items that impact project schedule and develop procurement packages and strategy to facilitate potential opportunity for early purchasing in support of optimizing the project execution schedule. |

| · | Engage with AOGC to support definition of royalty for lithium production from brine in Arkansas in support of detailed understanding of project economics. |

| · | Continue to engage with the local electrical supplier Southwest Arkansas Electric Cooperative to continue to work through the interconnection requirements and ensure timeliness of power availability for the project. |

| · | The project as it is currently envisaged does not trigger a National Environmental Policy Act (NEPA) process, however the NEPA process would be triggered if federal funds are obtained for the project. It is recommended to pro-actively assess NEPA requirements and initiate key activities to facilitate flexibility in project financing. |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| · | Drill additional test wells targeting the Upper, Middle, and Lower Smackover to provide: |

| o | Geologic data; |

| o | Lithium concentrations; |

| o | Long term production test information to estimate well rates, the number of wells needed, facility rates, and the completion plans for those wells; |

| o | Information regarding the potential extent of a Lower Smackover development target; and, |

| o | Information regarding the benefit of well stimulation to well productivity. |

| o | Monitor the test wells for salt precipitation, evaluate the potential effect of salt precipitation on production operations, identify remediation options. |

| o | Conduct long term production tests on one or more of the 2023 exploration program wells; decide on scope of these tests based on the results of the new test wells. |

| · | Update the geologic description. |

| · | Revise and adjust the categories of the resource estimates. |

| · | Revise the simulation model input geologic description and optimize the SWA Property development plan, brine flow rate, well count, and well configuration. |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 2 | Introduction |

| 2.1 | Issuer and Purpose |

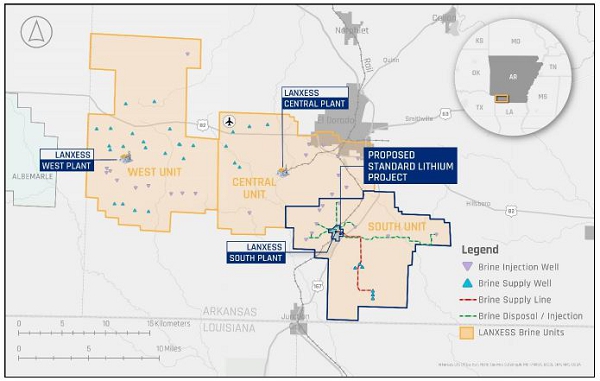

This Technical Report has been commissioned by, and completed for, Standard Lithium Ltd. (Standard Lithium, or the Company); a public company with its corporate headquarters in Vancouver, B.C. Standard Lithium is focused on unlocking the lithium potential from brine. As such, Standard Lithium has established ‘brine access agreements’ with historically/presently permitted and active brine operators that include:

| · | TETRA Technologies Inc. (TETRA) and National Chloride Company of America (National Chloride) in the Mojave Desert of California (Standard Lithium’s Bristol and Cadiz Dry Lakes play lithium-brine projects). |

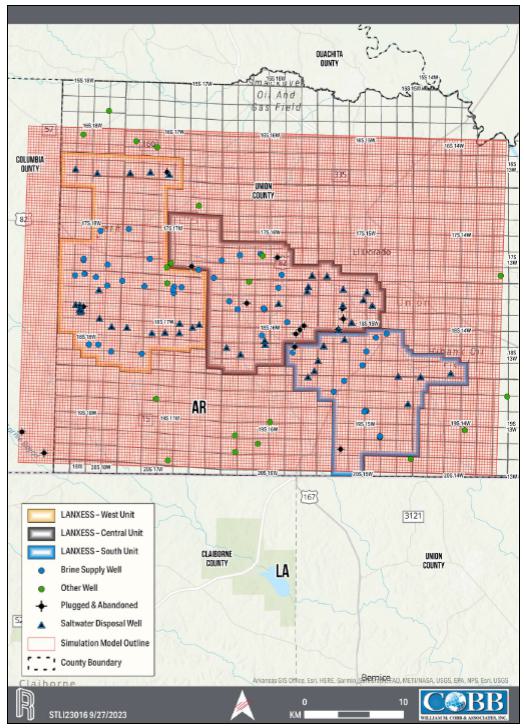

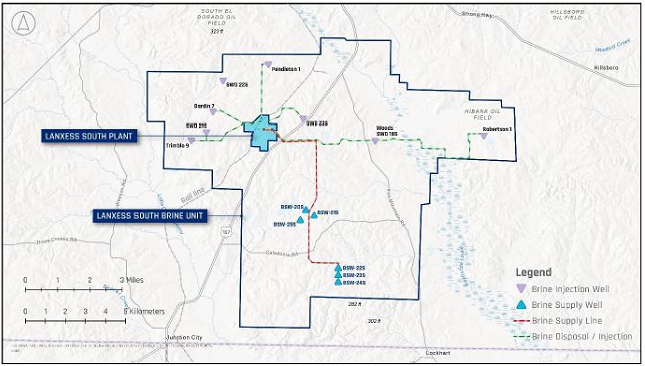

| · | Lanxess Corporation (Lanxess) in the Smackover Formation of south-central Arkansas (Standard Lithium’s LANXESS Project Phase 1A). |

| · | TETRA in the Smackover Formation of southwestern Arkansas (Standard Lithium’s South West Arkansas (SWA) Project and the focus of this Technical Report). |

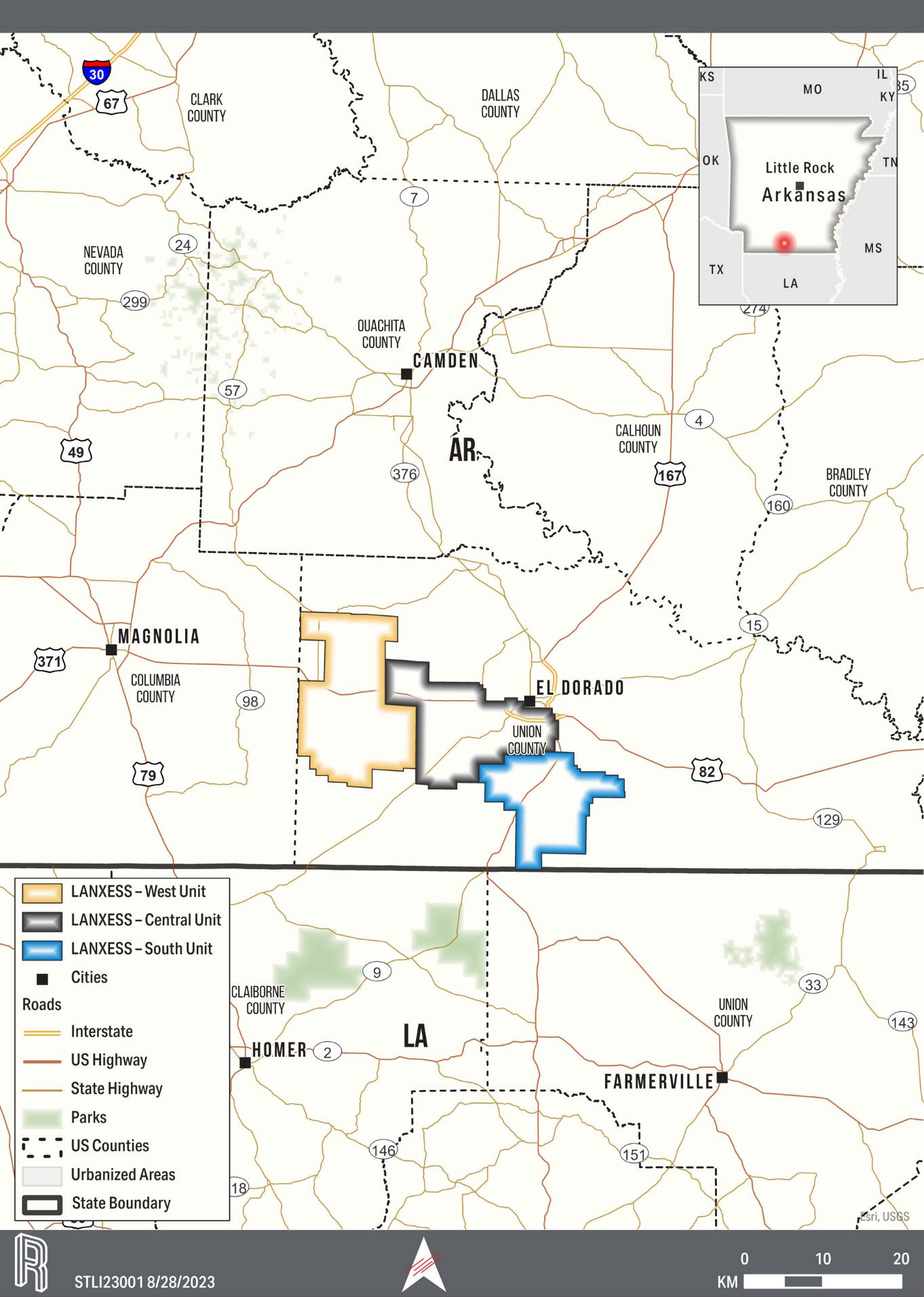

The center of the SWA Property is located approximately 24 km (15 miles) west of the City of Magnolia in Lafayette County, Arkansas, United States (Figure 2-1). The SWA Property encompasses Townships 16-17 South and Ranges 22-24 West of the 5th Meridian.

The SWA Property comprises 851 brine leases and 8 salt water (brine) deeds from private mineral owners covering 27,066 net mineral acres (10,953 net mineral hectares).

At the SWA Project, which is the focus of this report, Standard Lithium has outlined how it could unitize the underlying Smackover Formation brine aquifer in conjunction with the preparation of a PFS. This Technical Report updates the 2021 Preliminary Economic Assessment report and applies a gross acreage with 100% brine ownership that is consistent with unitization within the Arkansas Brine Statute. This PFS also outlines a proposed method of extraction of the brine from the resource, a proposed flowsheet to extract and purify the lithium to potentially produce a marketable product, as well as other necessary SWA Project information.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Figure 2-1. SWA Project discussed in this Technical Report

Consequently, this Technical Report provides an updated 2023 mineral resource estimate at the SWA Project in accordance with the Canadian Securities Administration’s (CSA’s) National Instrument 43-101 (NI 43-101) with the mineral resource being estimated using the CIM “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” dated November 29th, 2019, the CIM “Definition Standards for Mineral Resources and Mineral Reserves” amended and adopted May 10th, 2014 and the CIM "Leading Practice Guidelines for Mineral Processing" adopted November 25th, 2022. The effective date of this Technical Report is August 8, 2023.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 2.2 | Technical Report Authors and Personal Inspection of Property |

Table 2-1 presents the list of Qualified Persons (QPs) for the Technical Report and their responsibilities.

Table 2-1. Qualified Persons and Their Responsibilities

| Qualified Person | Company | Sections |

| Frank Gay, P.E. | HGA | 1-6, 18-19, 22-27 |

| Marek Dworzanowski, EUR ING, CEng | N/A | 1, 12.2, 13, 17, 18, 21-22, 25, 26 |

| Randal M. Brush, P.E. | Cobb & Associates | 10, 14.2, 14.3, 15 and 16 |

| Robert E. Williams, P.G., CPG | Cobb & Associates | 7, 8, 9, 11, 12.1, and 14.1 |

| Caleb Mutschler, P.E. | HGA | 17.1-17.3, 17.5 |

| Dutch Johnson, P.E. | HGA | 17.4 |

| Charles Campbell, P.E. | Alliance Technical Group | 20 |

Notes:

1. N/A denotes not applicable.

2. Marek Dworzanowski operates as an independent contractor.

In accordance with the CIM Best Practice Guidelines for Resource and Reserve Estimation for Lithium Brines (1 November 2012), this lithium-brine PFS has been prepared by a multi-disciplinary team that includes geologists, hydrogeologists, chemical, process and civil engineers with relevant experience in the lithium-brine confined aquifer type deposits, Smackover Formation geology and brine processing.

Mr. Caleb Mutschler (HGA) and Mr. Marek Dworzanowski visited the existing Standard Lithium Demonstration Plant in El Dorado, AR on October 27, 2022 and November 14-15, 2022 respectively to inspect the LSS equipment in service and verify the process conditions and technology. Mr. Dworzanowski also inspected the electrolysis process on January 18-19, 2023 at Electrosynthesis Company, Inc. in Lancaster, NY.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Mr. Robert Williams (Cobb & Associates) visited the Standard Lithium Project site April 19, May 23, and June 1, 2023, and participated in sampling three different wells (Taylor, Beulah et al 1, Carter Moore 1, and International Paper Company 1, respectively).

Randal Brush (Cobb & Associates) visited the Standard Lithium Project site on July 24, 2023, and inspected the Montague 1 well and the International Paper Co. 1 well.

All authors are independent of Standard Lithium (and TETRA) and are QPs as defined by the CSA’s NI 43-101.

| 2.3 | Sources of Information |

This Technical Report is based, in part, on internal company technical reports, maps, company letters, memoranda, public disclosure, and public information, as listed in the NI 43-101 Technical Report Preliminary Economic Assessment of Southwest Arkansas Smackover Project (Eccles, et al., 2019).

This Technical Report is a compilation of publicly available information, as well as information obtained from the 2018 and 2023 exploration programs. The 2018 exploration program included core analysis and brine analytical test programs conducted by Standard Lithium at the SWA Property. The 2023 exploration program included gathering and analyzing log data, core samples, pressure data, and brine samples from five wells: three were existing wells that were re-entered; two were new wells drilled by Standard Lithium.

References in this Technical Report are made to publicly available reports that were written prior to implementation of NI 43-101, including government geological publications. All reports are cited in Section 27, References.

Government reports include those that provide:

| · | Smackover Formation stratigraphic information; |

| · | Arkansas policy and regulation; |

| · | Well information; |

| · | Produced water geochemistry; and, |

| · | Oil, gas, and brine production statistics (e.g., Dickinson, 1968; Arkansas Code, 2016 a to f; Blondes et al., 2018; Arkansas Geological Survey, 2018; AOG Commission, 2021 & 2022 a to b). |

Miscellaneous journal articles were used to set the geological setting of southern Arkansas (e.g., Bishop, 1967; Alkin and Graves, 1969; Bishop, 1971a and b; Buffler et al., 1981; Moore and Druckman, 1981; Moore, 1984; Harris and Dodman, 1987; Salvador, 1991a and b; Troell and Robinson, 1987; Kopaska-Merkel et al., 1992; Moldovanyi and Walter, 1992; Zimmerman, 1992; Heydari and Baria, 2005; Mancini et al., 2008). Company information and news releases were used to reference any historical mineral exploration work at the SWA Property (e.g., Standard Lithium Ltd., 2018a and b).

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Geochemical data collected in 2018 presented in the previous revision of this Technical Report were analyzed at independent and accredited laboratories: ALS-Houston Environmental Services (ALS-Houston) in Houston, Texas, and Western Environmental Testing Laboratory (WetLab) in Sparks, Nevada. Geochemical data collected in 2023 presented in this Technical Report were analyzed at WetLab. Historical Smackover Formation brine geochemical data from a peer reviewed journal were also used (Moldovanyi and Walter, 1992).

Historic well log data and well status information used to create the layered geologic model was obtained from TGS and IHS, two companies that supply well log and well status information to the petroleum and bromine industry. Historical geotechnical data presented in this Technical Report include core reports that were prepared by independent petroleum laboratories and engineering firms that include:

| · | Core Laboratories Inc. in Dallas, TX and Shreveport, LA; |

| · | Delta Core Analysts in Shreveport, LA; |

| · | All Points Inc. in Houston, TX; |

| · | Thigpen Core Laboratories, Inc. in Shreveport, LA; |

| · | O’Malley Laboratories, Inc. in Natchez, Miss; and |

| · | Bell Core Laboratories in Shreveport, LA. |

The geotechnical data collected in the 2023 exploration program include core reports prepared by these independent petroleum laboratories and engineering firms:

| · | Intertek Westport Technology Center in Houston, TX; and, |

| · | Delta Core Analysts in Shreveport, LA. |

The laboratories and engineering firms are independent and certified third-party consultants and/or include certified Professional Geologists or Engineers. The geochemical laboratories for the brine samples collected in 2018 and 2023 cite National and State accreditations (e.g., ISO/IEC 17025:2005; 2009 TNI Environmental Testing Laboratory Standard; DoD Environmental Laboratory Accreditation Program (DoD ELAP); ISO/IEC Guide 25-1990; NAC 445A). Historical brine analytical data originated from a peer reviewed journal (American Association of Petroleum Geologist Bulletin) and is considered a reputable source of information (Moldovanyi and Walter, 1992).

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 2.4 | Units of Measure, Currency, and Acronyms |

With respect to units of measure and currency, unless otherwise stated, this Report uses:

| · | Abbreviated shorthand consistent with the International System of Units (International Bureau of Weights and Measures, 2006); |

| · | ‘Bulk’ weight is presented in both metric and imperial units. Metric is presented as tonnes and is equivalent to 1,000 kg or 2,204.6 lbs. Imperial is United States short tons which is presented as tons and is equivalent to 2,000 lbs or 907.2 kg; |

| · | Geographic coordinates projected in the Universal Transverse Mercator (UTM) system relative to Zone 15 of the North American Datum (NAD) 1983; |

| · | Currency in U.S. dollars (USD$), unless otherwise specified (e.g., Canadian dollars, CDN$; Euros, €); |

| · | Key well field dimensions such as well depth, reservoir depth and casing sizes will be presented using standard oil field units as the primary unit of measure with SI units in brackets; and, |

| · | Brine leases and surface leases are presented in acres to maintain consistency with Arkansas brine leases and property legal descriptions. |

| · | Lithium hydroxide or hydroxide refer to lithium hydroxide monohydrate which is the commercially sold form of lithium. |

Table 2-2 describes the various abbreviations used in the Technical Report.

Table 2-2. Abbreviations

| Abbreviation | Description |

| mm | Micrometers |

| AACE | American Association of Cost Engineers |

| ADEE | Arkansas Department of Energy and Environment |

| ADEE-AOGC | Arkansas Department of Energy and Environment Arkansas Oil & Gas Commission |

| ADEE-DEQ | Arkansas Department of Energy and Environment Division of Environmental Quality |

| ADH | Arkansas Department of Health |

| AOGC | Arkansas Oil and Gas Commission |

| ASTM | American Society for Testing and Materials |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| Abbreviation | Description |

| BFD | Block Flow Diagram |

| BOE | Basis of Estimate |

| CAPEX | Capital Expenditure |

| CIM | Canadian Institute of Mining |

| CIT | Corporate Income Tax |

| CPF | Central Processing Facility |

| CSA | Canadian Securities Administration |

| DCF | Discounted Cash Flow |

| DLE | Direct Lithium Extraction |

| EA | Environmental Assessment |

| EPA | Environmental Protection Agency |

| ESP | Electric Submersible Pump |

| ESS | Energy Storage Systems |

| EVs | Electric Vehicles |

| GPM | US Gallons per Minute |

| GWh | Gigawatt-hour |

| H2S | Hydrogen Sulfide |

| HDPE | High Density Polyethylene |

| HPRO | High Pressure Reverse Osmosis |

| ICE | Internal Combustion Engine |

| ICP-OES | Inductively Coupled Plasma Optical Emission Spectroscopy |

| IRR | Internal Rate of Return |

| ISBL | Inside Boundary Limit |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| Abbreviation | Description |

| IX | Ion Exchange |

| LCE | Lithium Carbonate Equivalent |

| Li2CO3 | Lithium Carbonate |

| Li2O | Lithium Oxide |

| LiOH | Lithium Hydroxide |

| LiOH.H2O | Lithium Hydroxide Monohydrate |

| LiSTR | Lithium Stirred Tank Reactor |

| LSS | Lithium Selective Sorption |

| m3 | Cubic Meter |

| MCC | Motor Control Center |

| mD | Millidarcies |

| mg/L | Milligrams per litre |

| MKP | McKamie-Patton |

| MMBTU | Million British Thermal Units |

| MW | Megawatts |

| MWh | Megawatt-hour |

| NAD | North American Datum |

| NI 43-101 | National Instrument 43-101 |

| NPDES | National Pollutant Discharge Elimination System |

| NPV | Net Present Value |

| OARO | Osmotically Assisted Reserve Osmosis |

| OPEX | Operating Expenditure |

| PEA | Preliminary Economic Assessment |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| Abbreviation | Description |

| PFD | Process Flow Diagram |

| PFS | Pre-Feasibility Study |

| ppm | Parts Per Million |

| psi | Pounds per square inch |

| QA/QC | Quality Assurance/Quality Control |

| QP(s) | Qualified Person(s) |

| RCRA | Resource Conservation and Recovery Act |

| RO | Reverse Osmosis |

| ROW | Right-of-Way |

| RPD | Relative Percentage Difference |

| SM | Standard Methods |

| SX | Solvent Extraction |

| TDS | Total Dissolved Solids |

| TEC | Total Equipment Cost |

| TIC | Total Installed Cost |

| TPC | Total Plant Cost |

| UIC | Underground Injection Control |

| USACE | U. S. Army Corps of Engineers |

| USGS | United States Geological Survey |

| UTM | Universal Transverse Mercator |

| WetLab | Western Environmental Testing Laboratory |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 3 | Reliance on Other Experts |

The authors are not qualified to provide an opinion or comment on issues related to legal agreements and royalties. They have relied entirely on background information and details regarding the nature and extent of TETRA’s Land Titles. The author has not reviewed the approximately 851 leases and 8 salt water (brine) deeds owned by TETRA or the transactional agreement between Standard Lithium and TETRA (and/or the agreement between TETRA and the underlying landowners) to obtain mineral brine production rights. The legal and survey validation of the leases and brine rights is not in our expertise, and we are relying on Standard Lithium and TETRA’s land-persons and lawyers.

The QP of Section 4 has no reason to question the validity or good standing of the TETRA leases and brine deeds through which Standard Lithium is gaining access to brine for process test work.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 4 | Property Description and Location |

| 4.1 | Property Description and Location |

The SWA Property encompasses Townships 16-17 South and Ranges 22-24 West of the 5th Meridian. The center of SWA Project is located approximately 24 km (15 miles) west of the City of Magnolia in Lafayette and Columbia Counties, Arkansas, United States. Coordinates for the Property center are:

| · | Latitude 33.2843 and Longitude -93.5135; or |

| · | Universal Transverse Mercator 452185.15 Easting, 3682922.78 Northing, Zone 15N, North American Datum 83 (Figure 4-1). |

The SWA Property consists of 27,066 net mineral acres (10,953 net mineral hectares) and covers a surface area of approximately 110 km2 (42 square miles) and is comprised of 489 land tracts containing 851 individual leases and 8 salt water (brine) deeds from private mineral owners, as illustrated in Figure 4-2. The proposed unitized area encompasses the individual leases and consists of 36,839 gross mineral acres (14,908 gross mineral hectares) (see Table 4-1).

| 4.2 | Lithium-Brine Mineral Production Rights |

Standard Lithium acquired the SWA Project brine rights to produce lithium from TETRA through an option agreement. As part of the agreement between Standard Lithium and TETRA, Standard Lithium owns the ‘lithium-brine’ production rights within the SWA Property brine lease holding. The Standard Lithium-TETRA agreement and a summary of the leases and deeds are discussed in more detail in the following sub-sections.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Figure 4-1. SWA Project discussed in this Technical Report

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 4.2.1 | Summary of the Standard Lithium – TETRA Agreement |

Standard Lithium owns the rights to produce lithium from TETRA’s brine leasehold for a period of 10-years (the exploratory period) through an option agreement providing that Standard Lithium makes annual payments on the annual anniversary of the effective date (December 29, 2017) of the agreement with TETRA, as follows:

| · | US$500,000 before January 28, 2018 (paid) |

| · | An additional US$600,000 on or before December 29, 2018 (paid) |

| · | An additional US$700,000 on or before December 29, 2019 (paid) |

| · | An additional US$750,000 on or before December 29, 2020 (paid) |

| · | Years 4-5: $1,000,000 per year (paid) |

| · | Years 6-10: $1,000,000 per year |

As of the writing of this report, the option agreement is still in place and all required payments have been fulfilled. When Standard Lithium commences production of lithium or exercises the option, Standard Lithium will pay TETRA a 2.5% royalty on gross revenue, and not less than $1,000,000 in any year, starting on the date that Standard Lithium exercises the option.

| 4.2.2 | Summary of Salt Water (Brine) Deeds |

In 1992, TETRA acquired the rights to 2,045 acres in the form of eight salt water (Brine) Deeds. The brine deeds are a 35-year term conveyance of brine within the Smackover Formation limestone. The initial brine deeds were executed from March 23 to April 29, 1992 and will expire in 2027 unless the term is extended by agreement.

The Brine Deeds permit TETRA or its assignee to produce brine attributable to its Grantor’s interest in the covered lands without royalty becoming due. Thus, with respect to those Grantors’ brine interests, no delay rental or brine royalty payment is required, and no additional royalty will become due upon commercial extraction of lithium. Instead, TETRA is obligated to make annual promissory note installment payments of $79,125, in the aggregate, on promissory notes executed by TETRA in favor of the Grantor and its related parties. These notes provide for 35 annual installments, coinciding with the term of the Brine Deed.

| 4.2.3 | Summary of Leases |

In 1994, TETRA implemented a brine leasing strategy and added additional brine leases in 2006 and 2017-2018 bringing their total lease holdings to 802 leases at the Effective Date of the PEA. Except for 3 leases with five-year terms dated 26 September 2018, representing 240 acres, each lease has a 25-year term, and there is an attempt to renew or extend the leases prior to the expiration of the original 25-year term. Since the publishing of the PEA, a campaign to maintain and increase the lease acreage in line with TETRA’s obligation under the option agreement was implemented and the number of leases was increased to 934.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Subsequently, 83 leases totaling 196 net mineral acres have lapsed leaving a total of 851 leases at the effective date of this report. A summary of the leases in place at the effective date of this report can be found in Table 4-1 and shown in Figure 4-2.

The SWA Property brine leases have yet to be developed for production of brine minerals.

| 4.2.4 | Mineral Brine Right Distribution on Individual Leases |

In some instances, the property encompassed by an individual brine lease may be very small, less than one acre, or much larger, up to several hundred acres. The percentage of brine rights ownership varies from section to section. In some instances, the percentage of the area leased within an individual brine lease may be small, less than 10%, or up to 100% ownership within any arbitrary section.

Overall, the lease ownership is complex, however, Standard Lithium has conducted a due diligence compilation of the percentage ownership of the individual brine leases on a section-by-section basis. That is, Standard Lithium engaged third-party firm R&J Land Services, LLC (R&J Land) of Bossier City, Louisiana to conduct due diligence of TETRA title of the brine leases and salt water (brine) deeds.

Standard Lithium also retained Arkansas attorney, Mr. Robert Honea, of Hardin, Jesson & Terry PLC of Fort Smith, AR regarded as having expertise in Arkansas State brine as well as oil and gas law. Mr. Honea issued an opinion letter to Standard Lithium, prior to Standard Lithium signing the Option Agreement with TETRA, after reviewing R&J Land’s review into the documentation of title to TETRA leasehold, confirming his professional opinion that the title due diligence performed by R&J Land was reasonable. In July 2023, Tetra provided an updated status report for the validity of leases. Standard Lithium engaged third-party firm R&J Land Services, LLC (R&J Land) of Bossier City, Louisiana to review the original brine leases and the revised listing was subsequently confirmed as part of project specific due diligence. The updated list from Tetra was confirmed to be valid and the leases identified as being in good-standing.

The resulting section-based mineral brine lease percentage compilation is presented in Table 4-1 and Figure 4-2. To simplify the brine ownership for the purpose of reporting, TETRA has amassed a mineral brine rights ownership that encompasses approximately 73% of the total mineral brine rights at the SWA Property, of which, Standard Lithium has acquired the corresponding lithium-brine production rights as described in Section 4.2, Lithium Brine Mineral Production Rights.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Table 4-1. SWA Property Ownership Summary

| Township | Range | Section | Net

Acres Leased |

Total

Gross acres within Section |

Percentage

leased |

| 16 | 22 | 31 | 37.815 | 200 | 19% |

| 16 | 23 | 19 | 80 | 80 | 100% |

| 16 | 23 | 24 | 40 | 50 | 80% |

| 16 | 23 | 25 | 80 | 80 | 100% |

| 16 | 23 | 26 | 20 | 80 | 25% |

| 16 | 23 | 29 | 192.5 | 195 | 99% |

| 16 | 23 | 30 | 213.84 | 516.34 | 41% |

| 16 | 23 | 31 | 610 | 640 | 95% |

| 16 | 23 | 32 | 511.34 | 545 | 94% |

| 16 | 23 | 33 | 267.013 | 335.36 | 80% |

| 16 | 23 | 34 | 255.33 | 296.6 | 86% |

| 16 | 23 | 35 | 192.58 | 499.33 | 39% |

| 16 | 23 | 36 | 160 | 640 | 25% |

| 16 | 24 | 25 | 586.66 | 640 | 92% |

| 16 | 24 | 26 | 566.71 | 640 | 89% |

| 16 | 24 | 27 | 36.67 | 40 | 92% |

| 16 | 24 | 34 | 136.67 | 160 | 85% |

| 16 | 24 | 35 | 593.68 | 640 | 93% |

| 16 | 24 | 36 | 613.33 | 640 | 96% |

| 17 | 22 | 5 | 407.5 | 640 | 64% |

| 17 | 22 | 6 | 473.09 | 640 | 74% |

| 17 | 22 | 7 | 640 | 640 | 100% |

| 17 | 22 | 8 | 160 | 160 | 100% |

| 17 | 22 | 17 | 276 | 280 | 99% |

| 17 | 22 | 18 | 560 | 640 | 88% |

| 17 | 22 | 19 | 320.5 | 320.5 | 100% |

| 17 | 22 | 20 | 357.5 | 400 | 89% |

| 17 | 23 | 1 | 31.27 | 640 | 5% |

| 17 | 23 | 2 | 405 | 640 | 63% |

| 17 | 23 | 3 | 556.92 | 640 | 87% |

| 17 | 23 | 4 | 270.64 | 640 | 42% |

| 17 | 23 | 5 | 351.5 | 640 | 55% |

| 17 | 23 | 6 | 554.17 | 640 | 87% |

| 17 | 23 | 7 | 498.83 | 640 | 78% |

| 17 | 23 | 8 | 541.04 | 640 | 85% |

| 17 | 23 | 9 | 429.51 | 640 | 67% |

| 17 | 23 | 10 | 308.19 | 640 | 48% |

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| Township | Range | Section | Net

Acres Leased |

Total

Gross acres within Section |

Percentage

leased |

| 17 | 23 | 11 | 140 | 640 | 22% |

| 17 | 23 | 12 | 315 | 640 | 49% |

| 17 | 23 | 13 | 450 | 640 | 70% |

| 17 | 23 | 14 | 573.8 | 600 | 96% |

| 17 | 23 | 15 | 368.32 | 478.32 | 77% |

| 17 | 23 | 16 | 409.38 | 640 | 64% |

| 17 | 23 | 17 | 585.46 | 640 | 91% |

| 17 | 23 | 18 | 570.83 | 640 | 89% |

| 17 | 23 | 19 | 207.497 | 640 | 32% |

| 17 | 23 | 24 | 125 | 165 | 76% |

| 17 | 23 | 31 | 14.92 | 40 | 37% |

| 17 | 24 | 1 | 561.489 | 640 | 88% |

| 17 | 24 | 2 | 548.634 | 640 | 86% |

| 17 | 24 | 3 | 457.951 | 640 | 72% |

| 17 | 24 | 4 | 453.345 | 640 | 71% |

| 17 | 24 | 5 | 562.46 | 640 | 88% |

| 17 | 24 | 8 | 397.95 | 640 | 62% |

| 17 | 24 | 9 | 416.025 | 640 | 65% |

| 17 | 24 | 10 | 594.76 | 640 | 93% |

| 17 | 24 | 11 | 627.58 | 640 | 98% |

| 17 | 24 | 12 | 623.87 | 640 | 97% |

| 17 | 24 | 13 | 638 | 638 | 100% |

| 17 | 24 | 14 | 525.48 | 640 | 82% |

| 17 | 24 | 15 | 535.78 | 640 | 84% |

| 17 | 24 | 16 | 582.5 | 640 | 91% |

| 17 | 24 | 17 | 640 | 640 | 100% |

| 17 | 24 | 20 | 290.846 | 640 | 45% |

| 17 | 24 | 21 | 441.53 | 640 | 69% |

| 17 | 24 | 22 | 498 | 640 | 78% |

| 17 | 24 | 23 | 614.3 | 640 | 96% |

| 17 | 24 | 24 | 452.71 | 640 | 71% |

| 17 | 24 | 25 | 20 | 40 | 50% |

| 17 | 24 | 26 | 206.39 | 320 | 64% |

| 17 | 24 | 35 | 240 | 240 | 100% |

| 17 | 24 | 36 | 40 | 640 | 6% |

| Total | 27,065.61 | 36,839.45 | 73.469% | ||

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

Figure 4-2. SWA Property Ownership Summary

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |

| 4.3 | Surface (and Mineral) Rights in Arkansas |

The definition of minerals is established by Arkansas Code Title 15, Natural Resources and Economic Development § 15-56-301 (the Brine Statue), which has been amended to include salt water, or brine, “whose naturally dissolved components or solutes are used as a source of raw material for Bromine and other products derived therefrom." The mineral interest owner has the inherent right to develop the minerals and the right to lease the minerals to others for development. When a company desires to develop the mineral resources in an area, the company will need to secure mineral lease agreements from the mineral owners. The mineral lease is a legal binding contract between the mineral owner (Lessor) and an individual or company (Lessee), which allows for the exploration and extraction of the minerals covered under the lease.

Payments made to the Lessor for production of brine are known as “in lieu” royalty payments because the payments are made annually based on a statutory rate, as opposed to a true royalty based on the amount of the produced brine. The statutory in lieu royalty payment is increased or decreased annually based on changes in the Producer Price Index.

The Brine Deeds permit TETRA or its assignee to produce brine attributable to its Grantor’s interest in the covered lands without royalty becoming due. Thus, with respect to those Grantors’ brine interests, no delay rental or brine royalty payment is required, and no additional royalty will become due upon commercial extraction of Lithium. Instead, TETRA is obligated to make annual promissory note installment payments of $79,125, in the aggregate, on promissory notes executed by TETRA in favor of the Grantor and its related parties. These notes provide for 35 annual installments, coinciding with the term of the Brine Deed. TETRA is also required to pay annual rental of $100 each to the two surface owners who leased the surface right of ingress and egress to TETRA in documents called “Landowner Agreements.”

With respect to surface rights, Arkansas law allows the severance of the surface estate from the mineral estate by proper grant or reservation, thereby creating separate estates. Under the laws of conservation in the State of Arkansas, however, the mineral rights are dominant over the surface rights. In some cases, when the mineral owner leases the right to produce oil, gas and/or brine, the Lessee succeeds to the mineral owner’s right of surface use, subject to lease restrictions. Authority of the mineral estate over the surface is a crucial legal concept for the mineral owner and Lessee because ownership of subsurface minerals without the right to use the surface to explore for and produce them would be practically worthless. If a Lessor does not want the land surface disturbed a “No Surface Operations Clause” may be negotiated with the Lessee and included in the mineral Lease agreement. This clause may be used to limit or restrict the use of the property for drilling activity or long-term production operations. Conflicts arising between the Lessee and surface owner can be avoided by creating Lease agreements that clearly identify the scope of surface use rights.

| South West Arkansas Project Pre-Feasibility Study | 23 July 25 |