UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 31, 2025

| Commission | Registrant; State of Incorporation; | IRS Employer | ||

| File Number | Address; and Telephone Number | Identification No. | ||

| 1-9513 |

CMS ENERGY CORPORATION (A Michigan Corporation) |

38-2726431 | ||

| 1-5611 |

CONSUMERS ENERGY COMPANY (A

Michigan Corporation) |

38-0442310 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

||

| CMS Energy Corporation Common Stock, $0.01 par value | CMS | New York Stock Exchange | ||

| CMS Energy Corporation 5.625% Junior Subordinated Notes due 2078 | CMSA | New York Stock Exchange | ||

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2078 | CMSC | New York Stock Exchange | ||

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2079 | CMSD | New York Stock Exchange | ||

| CMS Energy Corporation, Depositary Shares, each representing a 1/1,000th interest in a share of 4.200% Cumulative Redeemable Perpetual Preferred Stock, Series C | CMS PRC | New York Stock Exchange | ||

| Consumers Energy Company Cumulative Preferred Stock, $100 par value: $4.50 Series | CMS-PB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company: CMS Energy Corporation ¨ Consumers Energy Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. CMS Energy Corporation ¨ Consumers Energy Company ¨

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2025, CMS Energy Corporation (“CMS Energy”) issued a News Release, in which it announced its 2025 second quarter results. Attached as Exhibit 99.1 to this report and incorporated herein by reference is a copy of the CMS Energy News Release, furnished as a part of this report.

Exhibit 99.1 contains certain financial measures that are considered “non-GAAP financial measures” as defined in Securities and Exchange Commission rules. Other than forward-looking earnings guidance, Exhibit 99.1 contains a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, major enterprise resource planning software implementations, changes in accounting principles, voluntary separation program, changes in federal and state tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, recognized in net income related to NorthStar Clean Energy's interest expense, or other items. Management views adjusted earnings as a key measure of CMS Energy’s present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, CMS Energy uses adjusted earnings to measure and assess performance. Because CMS Energy is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, reported earnings in future periods, Exhibit 99.1 does not contain reported earnings guidance nor a reconciliation for the comparable future period earnings. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the reported earnings. All references to net income refer to net income available to common stockholders and references to earnings per share are on a diluted basis.

Item 7.01. Regulation FD Disclosure.

The information set forth in the CMS Energy News Release dated July 31, 2025, attached as Exhibit 99.1, is incorporated by reference in response to this Item 7.01.

CMS Energy will hold a webcast to discuss its 2025 second quarter results and provide a business and financial outlook on July 31 at 9:30 a.m. (ET). A copy of the CMS Energy presentation is furnished as Exhibit 99.2 to this report. A webcast of the presentation will be available on the CMS Energy website, www.cmsenergy.com.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Index | ||

| 99.1 | CMS Energy News Release dated July 31, 2025 | |

| 99.2 | CMS Energy presentation dated July 31, 2025 | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| CMS ENERGY CORPORATION | ||

| Dated: July 31, 2025 | By: | /s/ Rejji P. Hayes |

| Rejji P. Hayes | ||

| Executive Vice President and Chief Financial Officer | ||

| CONSUMERS ENERGY COMPANY | ||

| Dated: July 31, 2025 | By: | /s/ Rejji P. Hayes |

| Rejji P. Hayes | ||

| Executive Vice President and Chief Financial Officer | ||

Exhibit 99.1

CMS Energy Announces Strong Second Quarter Results, Reaffirms 2025 Adjusted EPS Guidance

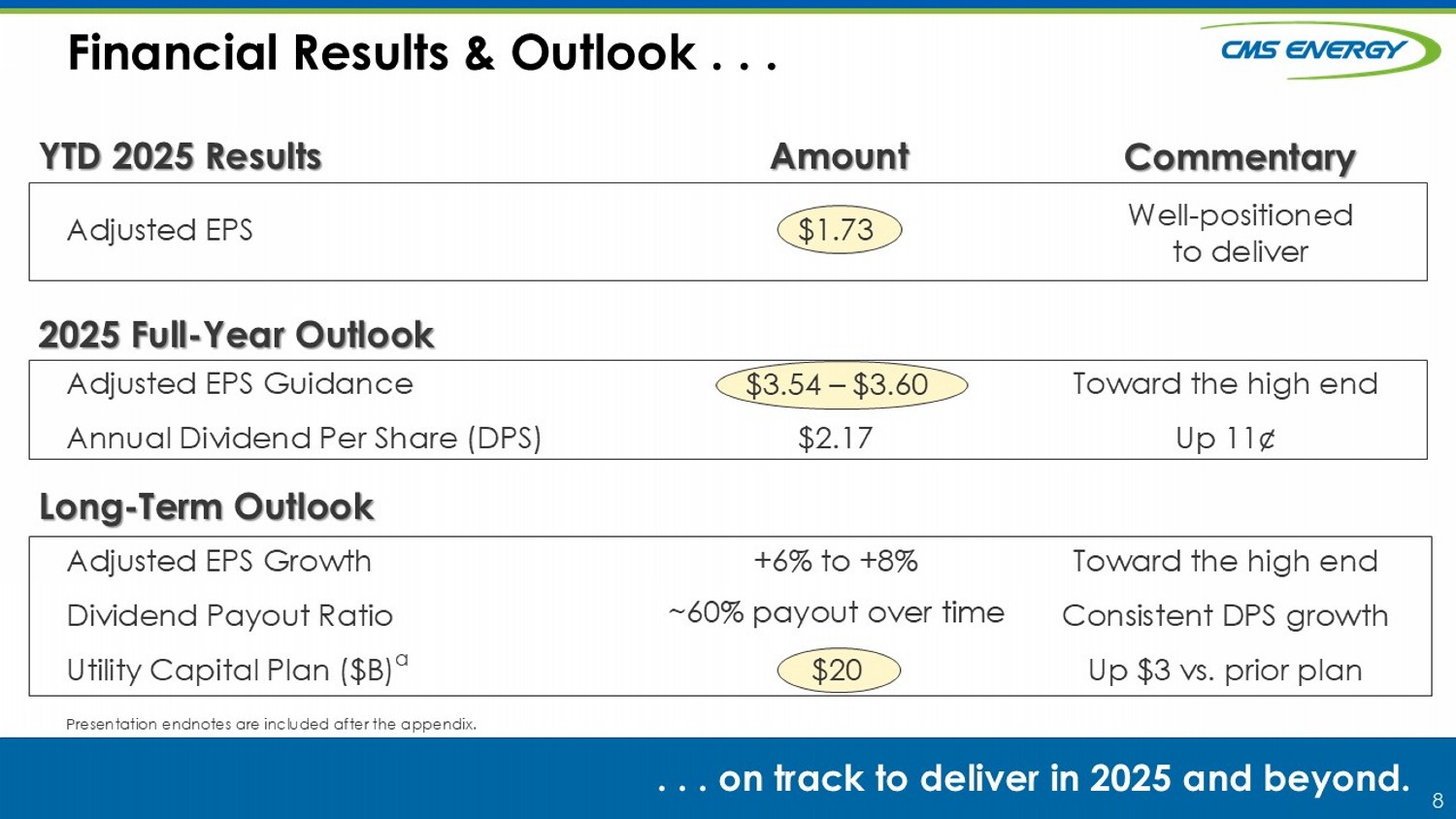

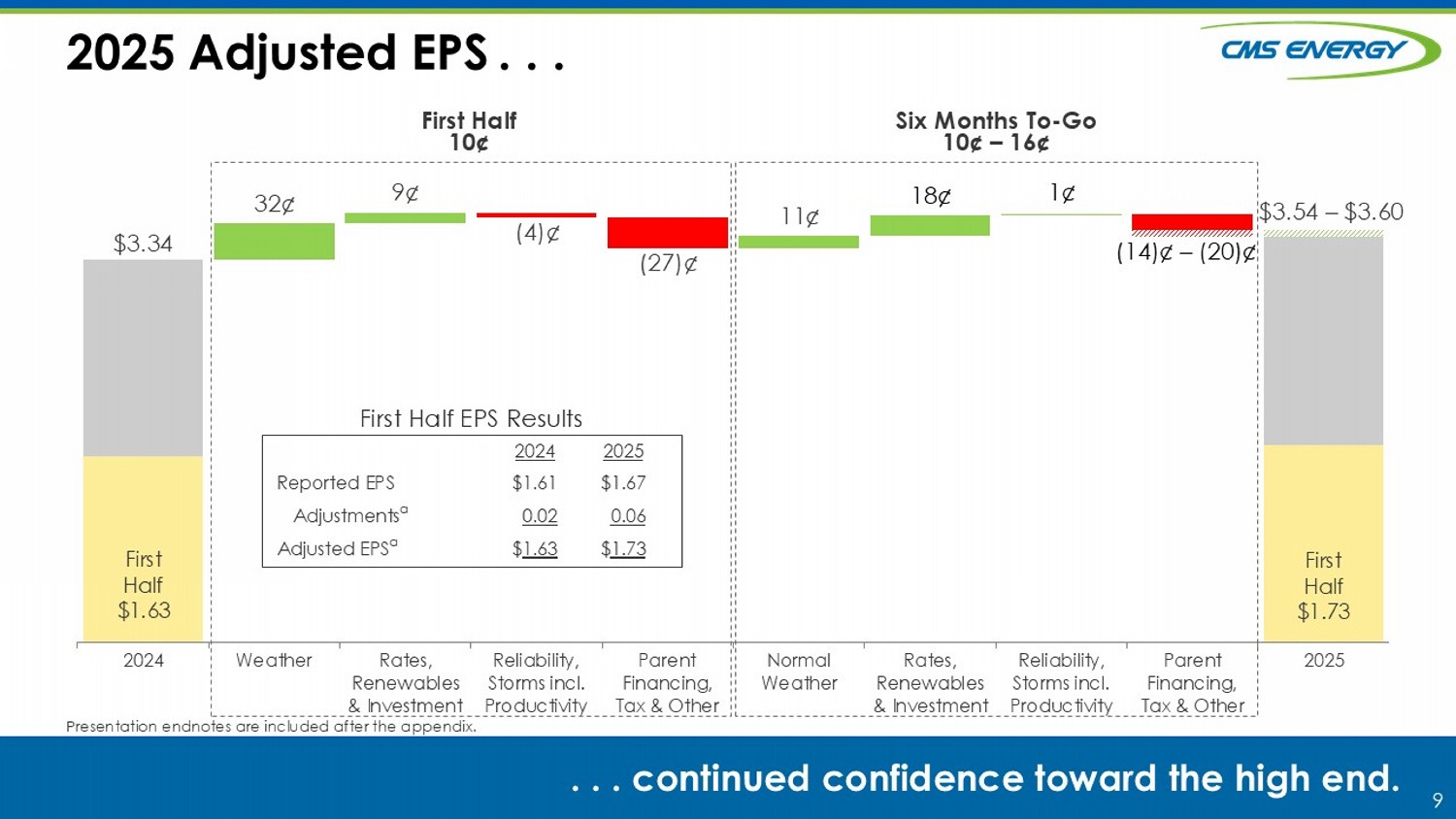

JACKSON, Mich., July 31, 2025 – CMS Energy announced today reported earnings per share of $0.66 for the second quarter of 2025, compared to $0.65 per share for 2024. The company’s adjusted earnings per share for the second quarter were $0.71, compared to $0.66 per share for the same quarter in 2024. For the first six months of the year, the company reported $1.67 per share compared to $1.61 per share for the same timeframe in 2024. On an adjusted earnings per share basis year to date, the company reported $1.73 per share in 2025, compared to $1.63 per share in 2024, driven by constructive regulatory outcomes, cost-reduction initiatives and favorable weather.

CMS Energy reaffirmed its 2025 adjusted earnings guidance of $3.54 to $3.60 per share (*See below for important information about non-GAAP measures) and long-term adjusted EPS growth of 6 to 8 percent, with continued confidence toward the high end.

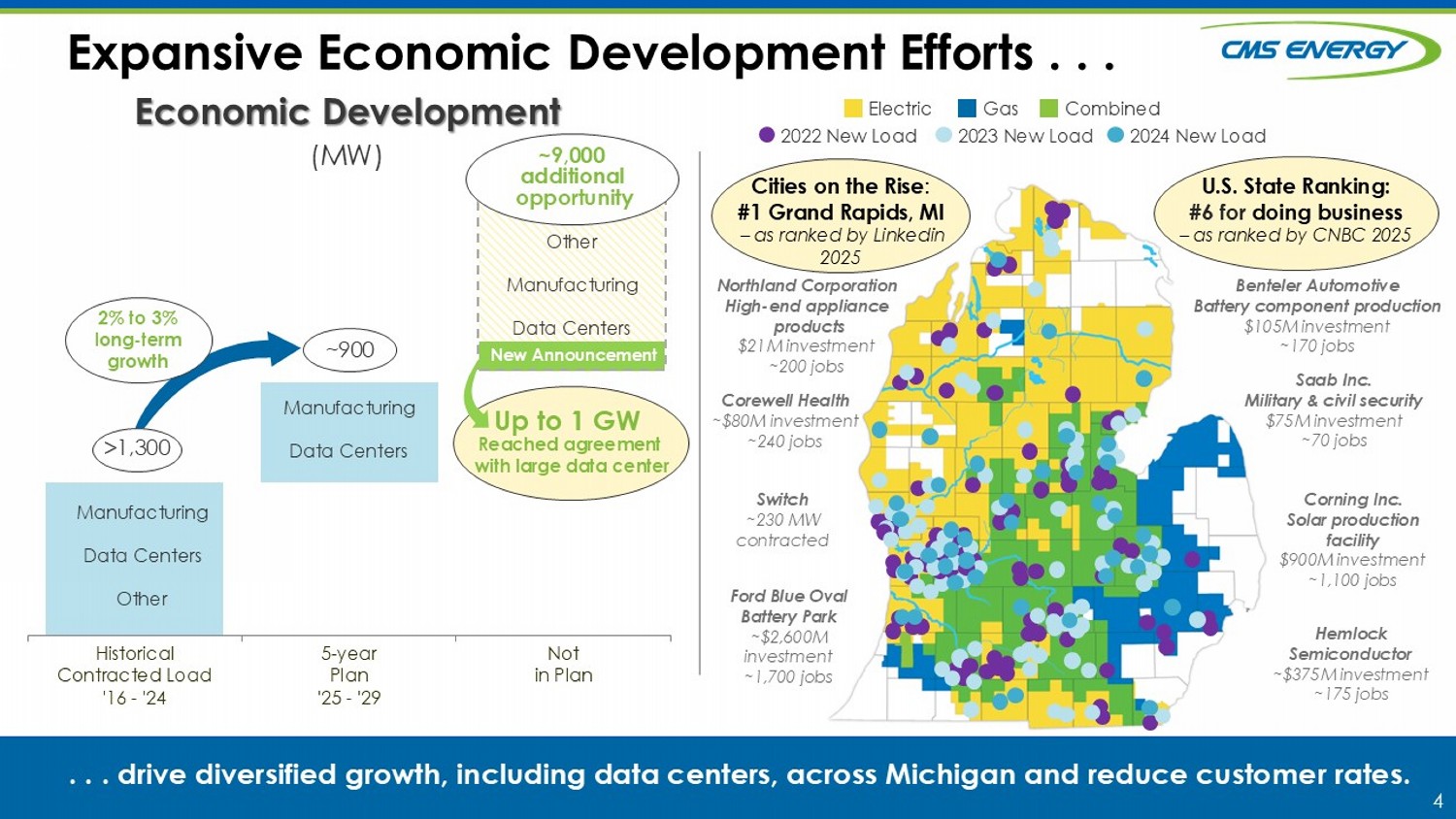

“Given the team’s strong performance in the second quarter, we are on track to deliver on our earnings guidance and key operational objectives for the year, prioritizing investments in our electric and gas businesses to the benefit of our customers, investors and the communities we serve,” said Garrick Rochow, President and CEO of CMS Energy and Consumers Energy. “I am also pleased to announce we have reached an agreement with a new data center, which is expected to add up to 1 gigawatt of load growth in our service territory, along with additional economic benefits for Michigan.”

CMS Energy (NYSE: CMS) is a Michigan-based energy provider featuring Consumers Energy as its primary business. It also owns and operates independent power generation businesses.

# # #

CMS Energy will hold a webcast to discuss its 2025 second quarter results and provide a business and financial outlook on Thursday, July 31 at 9:30 a.m. (EDT). To participate in the webcast, go to CMS Energy’s homepage (cmsenergy.com) and select “Events and Presentations.”

Important information for investors about non-GAAP measures and other disclosures.

This news release contains non-Generally Accepted Accounting Principles (non-GAAP) measures, such as adjusted earnings. All references to net income refer to net income available to common stockholders and references to earnings per share are on a diluted basis. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, major enterprise resource planning software implementations, changes in accounting principles, voluntary separation program, changes in federal and state tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, recognized in net income related to NorthStar Clean Energy's interest expense, or other items. Management views adjusted earnings as a key measure of the company's present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the company uses adjusted earnings to measure and assess performance. Because the company is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, the company's reported earnings in future periods, the company is not providing reported earnings guidance nor is it providing a reconciliation for the comparable future period earnings. The company's adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the reported earnings.

This news release contains "forward-looking statements." The forward-looking statements are subject to risks and uncertainties that could cause CMS Energy's and Consumers Energy's results to differ materially. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy's and Consumers Energy's Securities and Exchange Commission filings.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

Media Contacts: Katie Carey, 517/740-1739

Investment Analyst Contact: Travis Uphaus, 517/817-9241

Page 1 of 3

CMS ENERGY CORPORATION

Consolidated Statements of Income

(Unaudited)

| In Millions, Except Per Share Amounts | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| 6/30/25 | 6/30/24 | 6/30/25 | 6/30/24 | |||||||||||||

| Operating revenue | $ | 1,838 | $ | 1,607 | $ | 4,285 | $ | 3,783 | ||||||||

| Operating expenses | 1,521 | 1,324 | 3,474 | 3,088 | ||||||||||||

| Operating Income | 317 | 283 | 811 | 695 | ||||||||||||

| Other income | 137 | 113 | 187 | 199 | ||||||||||||

| Interest charges | 199 | 173 | 385 | 350 | ||||||||||||

| Income Before Income Taxes | 255 | 223 | 613 | 544 | ||||||||||||

| Income tax expense | 62 | 41 | 125 | 99 | ||||||||||||

| Net Income | 193 | 182 | 488 | 445 | ||||||||||||

| Loss attributable to noncontrolling interests | (8 | ) | (16 | ) | (17 | ) | (40 | ) | ||||||||

| Net Income Attributable to CMS Energy | 201 | 198 | 505 | 485 | ||||||||||||

| Preferred stock dividends | 3 | 3 | 5 | 5 | ||||||||||||

| Net Income Available to Common Stockholders | $ | 198 | $ | 195 | $ | 500 | $ | 480 | ||||||||

| Diluted Earnings Per Average Common Share | $ | 0.66 | $ | 0.65 | $ | 1.67 | $ | 1.61 | ||||||||

Page 2 of 3

CMS ENERGY CORPORATION

Summarized Consolidated Balance Sheets

(Unaudited)

| In Millions | ||||||||

| As of | ||||||||

| 6/30/25 | 12/31/24 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 844 | $ | 103 | ||||

| Restricted cash and cash equivalents | 81 | 75 | ||||||

| Other current assets | 2,268 | 2,612 | ||||||

| Total current assets | 3,193 | 2,790 | ||||||

| Non-current assets | ||||||||

| Plant, property, and equipment | 28,847 | 27,461 | ||||||

| Other non-current assets | 5,659 | 5,669 | ||||||

| Total Assets | $ | 37,699 | $ | 35,920 | ||||

| Liabilities and Equity | ||||||||

| Current liabilities (1) | $ | 2,071 | $ | 2,261 | ||||

| Non-current liabilities (1) | 8,612 | 8,345 | ||||||

| Capitalization | ||||||||

| Debt and finance leases (excluding securitization debt) (2) | 17,402 | 15,866 | ||||||

| Preferred stock and securities | 224 | 224 | ||||||

| Noncontrolling interests | 577 | 518 | ||||||

| Common stockholders' equity | 8,170 | 8,006 | ||||||

| Total capitalization (excluding securitization debt) | 26,373 | 24,614 | ||||||

| Securitization debt (2) | 643 | 700 | ||||||

| Total Liabilities and Equity | $ | 37,699 | $ | 35,920 | ||||

| (1) | Excludes debt and finance leases. |

| (2) | Includes current and non-current portions. |

CMS ENERGY CORPORATION

Summarized Consolidated Statements of Cash Flows

(Unaudited)

| In Millions | ||||||||

| Six Months Ended | ||||||||

| 6/30/25 | 6/30/24 | |||||||

| Beginning of Period Cash and Cash Equivalents, Including Restricted Amounts | $ | 178 | $ | 248 | ||||

| Net cash provided by operating activities | 1,414 | 1,663 | ||||||

| Net cash used in investing activities | (1,880 | ) | (1,246) | |||||

| Cash flows from operating and investing activities | (466 | ) | 417 | |||||

| Net cash provided by financing activities | 1,213 | 124 | ||||||

| Total Cash Flows | $ | 747 | $ | 541 | ||||

| End of Period Cash and Cash Equivalents, Including Restricted Amounts | $ | 925 | $ | 789 | ||||

Page 3 of 3

CMS ENERGY CORPORATION

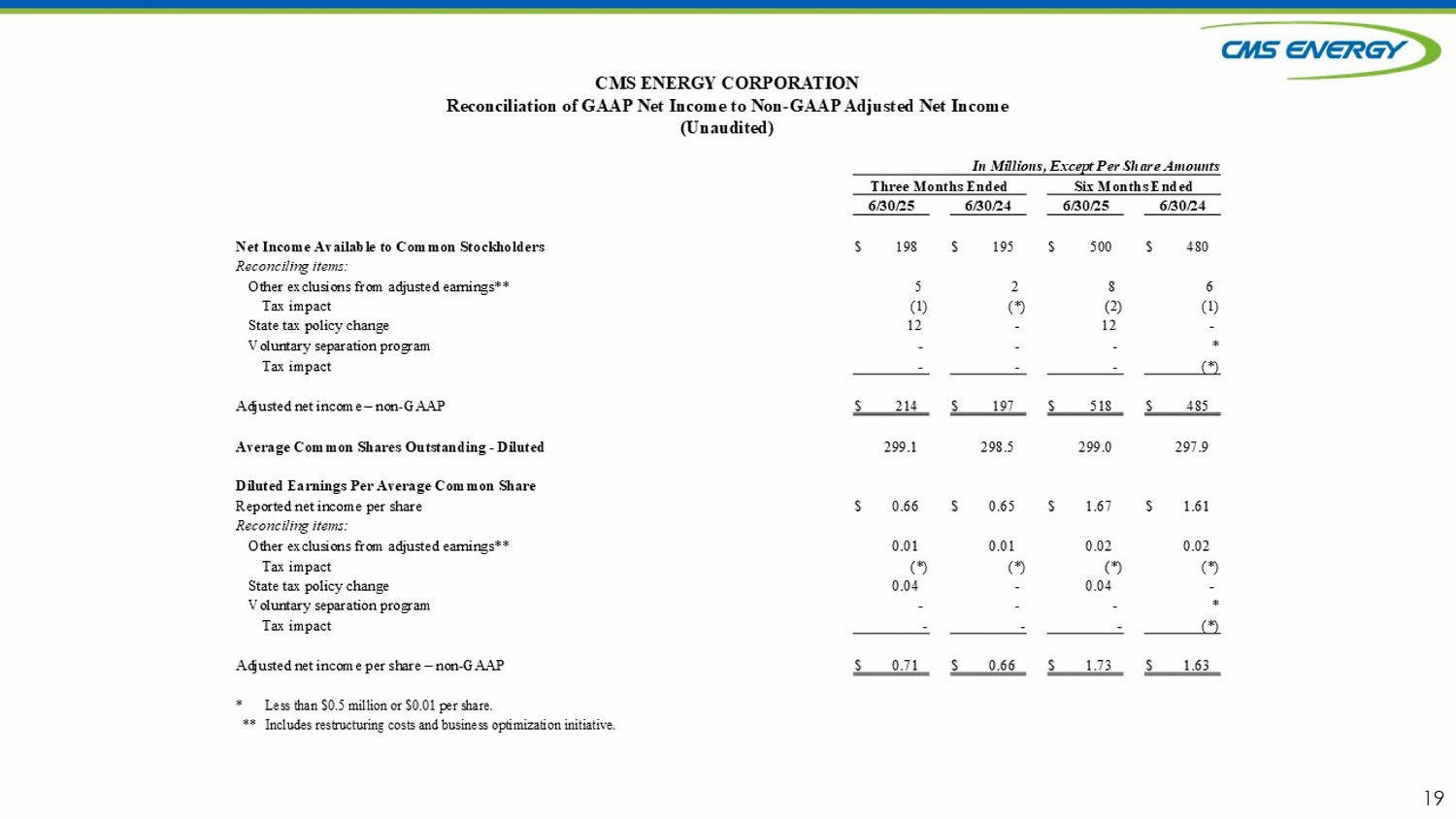

Reconciliation of GAAP Net Income to Non-GAAP Adjusted Net Income

(Unaudited)

| In Millions, Except Per Share Amounts | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| 6/30/25 | 6/30/24 | 6/30/25 | 6/30/24 | |||||||||||||

| Net Income Available to Common Stockholders | $ | 198 | $ | 195 | $ | 500 | $ | 480 | ||||||||

| Reconciling items: | ||||||||||||||||

| Other exclusions from adjusted earnings** | 5 | 2 | 8 | 6 | ||||||||||||

| Tax impact | (1 | ) | (* | ) | (2 | ) | (1 | ) | ||||||||

| State tax policy change | 12 | - | 12 | - | ||||||||||||

| Voluntary separation program | - | - | - | * | ||||||||||||

| Tax impact | - | - | - | (* | ) | |||||||||||

| Adjusted net income – non-GAAP | $ | 214 | $ | 197 | $ | 518 | $ | 485 | ||||||||

| Average Common Shares Outstanding - Diluted | 299.1 | 298.5 | 299.0 | 297.9 | ||||||||||||

| Diluted Earnings Per Average Common Share | ||||||||||||||||

| Reported net income per share | $ | 0.66 | $ | 0.65 | $ | 1.67 | $ | 1.61 | ||||||||

| Reconciling items: | ||||||||||||||||

| Other exclusions from adjusted earnings** | 0.01 | 0.01 | 0.02 | 0.02 | ||||||||||||

| Tax impact | (* | ) | (* | ) | (* | ) | (* | ) | ||||||||

| State tax policy change | 0.04 | - | 0.04 | - | ||||||||||||

| Voluntary separation program | - | - | - | * | ||||||||||||

| Tax impact | - | - | - | (* | ) | |||||||||||

| Adjusted net income per share – non-GAAP | $ | 0.71 | $ | 0.66 | $ | 1.73 | $ | 1.63 | ||||||||

| * | Less than $0.5 million or $0.01 per share. |

| ** | Includes restructuring costs and business optimization initiative. |

Management views adjusted (non-Generally Accepted Accounting Principles) earnings as a key measure of the Company's present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the Company uses adjusted earnings to measure and assess performance. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, major enterprise resource planning software implementations, changes in accounting principles, voluntary separation program, changes in federal and state tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, recognized in net income related to NorthStar Clean Energy's interest expense, or other items. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for reported earnings.

Exhibit 99.2

LEADING THE CLEAN ENERGY TRANSFORMATION 2025 Second Quarter Results & Outlook July 31, 2025

2 Enter “so what” if necessary – Century Gothic, Bold, Size 18 or smaller This presentation is made as of the date hereof and contains “forward - looking statements” as defined in Rule 3b - 6 of the Securit ies Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward - looking statements are subject to risks and uncertainties. All forward - lo oking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commissi on filings. Forward - looking statements should be read in conjunction with “FORWARD - LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s most recent Form 10 - K and as updated in reports CMS Energy and Consumers Energy file with the Securities and Exchange Commission. CMS Energy’s and Cons ume rs Energy’s “FORWARD - LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors th at could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no ob ligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof. The presentation also includes non - GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com . Investors and others should note that CMS Energy routinely posts important information on its website and considers the Inves tor Relations section, www.cmsenergy.com/investor - relations , a channel of distribution. Presentation endnotes are included after the appendix. 2 3 Investment Thesis . . . . . . is simple, clean and lean. Over two decades of industry - leading financial performance Industry - leading c lean e nergy commitments Excellence through the Top - tier regulatory jurisdiction a with attractive growth Premium total shareholder r eturn 6% to 8% adjusted EPS growth + ~3% dividend yield Presentation endnotes are included after the appendix. Strong Cash Flow & Balance Sheet Attractive & Diversified Territory Clean Energy Leader Infrastructure Renewal Constructive Legislation & Regulation Affordable Prices

4 Expansive Economic Development Efforts . . . . . . drive diversified growth, including data centers, across Michigan and reduce customer rates. Electric Gas Combined 2022 New Load 2023 New Load 2024 New Load Corning Inc. Solar production facility $900M investment ~1,100 jobs Saab Inc. Military & civil security $75M investment ~70 jobs Northland Corporation High - end appliance products $21M investment ~200 jobs Hemlock Semiconductor ~$375M investment ~175 jobs Ford Blue Oval Battery Park ~$2,600M investment ~1,700 jobs Benteler Automotive Battery component production $105M investment ~170 jobs Corewell Health ~$80M investment ~240 jobs Switch ~230 MW contracted Economic Development (MW) Historical Contracted Load '16 - '24 5-year Plan '25 - '29 Not in Plan >1,300 ~900 2% to 3% l ong - term g rowth Other Manufacturing Data Centers ~9,000 additional opportunity Manufacturing Data Centers Manufacturing Data Centers Other New Announcement Reached agreement with large data center Up to 1 GW Cities on the Rise : #1 Grand Rapids, MI – as ranked by Linkedin 2025 U.S. State Ranking: #6 for doing business – as ranked by CNBC 2025 5 Key Affordability Drivers.

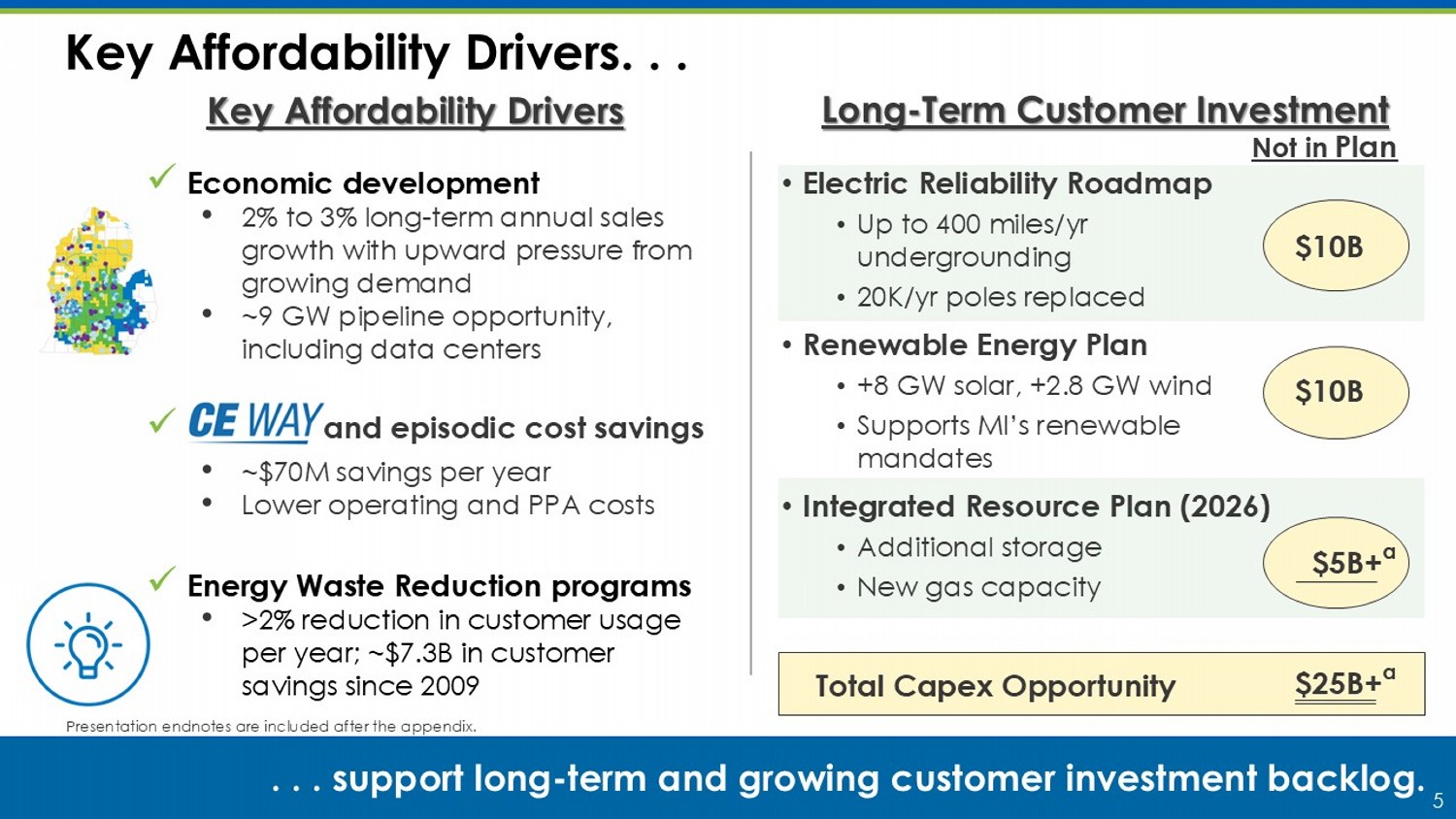

. . . . . s upport long - term and growing customer investment backlog . Key Affordability Drivers x Economic development • 2% to 3% long - term annual sales growth with upward pressure from growing demand • ~9 GW pipeline opportunity, including data centers x and episodic cost savings • ~$70M savings per year • Lower operating and PPA costs x Energy Waste Reduction programs • >2% reduction in customer usage per year; ~$7.3B in customer savings since 2009 Long - Term Customer Investment • Electric Reliability Roadmap • Up to 400 miles/yr undergrounding • 20K/yr poles replaced • Renewable Energy Plan • +8 GW solar, +2.8 GW wind • Supports MI’s renewable mandates • Integrated Resource Plan (2026) • Additional storage • New gas capacity Total Capex Opportunity Not in Plan $10B $10B $5B+ a $25B+ a Presentation endnotes are included after the appendix.

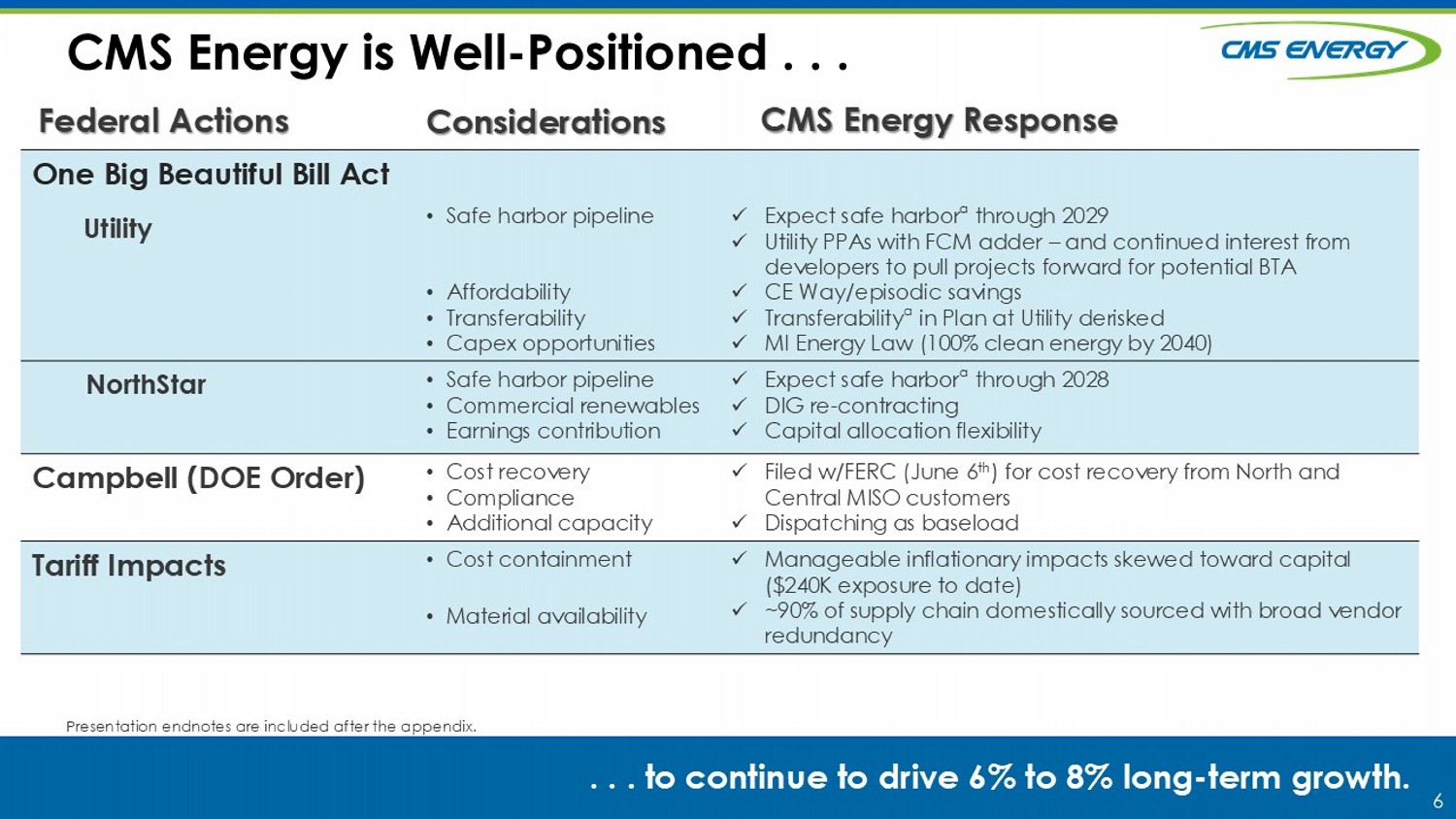

6 CMS Energy is Well - Positioned . . . . . . t o continue to drive 6% to 8% long - term growth . Federal Actions CMS Energy Response One Big Beautiful Bill Act x Expect safe harbor a through 2029 x Utility PPAs with FCM adder – and continued interest from developers to pull projects forward for potential BTA x CE Way/episodic savings x Transferability a in Plan at Utility derisked x MI Energy Law (100% clean energy by 2040) • Safe harbor pipeline • Affordability • Transferability • Capex opportunities Utility x Expect safe harbor a through 2028 x DIG re - contracting x Capital allocation flexibility • Safe harbor pipeline • Commercial renewables • Earnings contribution NorthStar x Filed w/FERC (June 6 th ) for cost recovery from North and Central MISO customers x Dispatching as baseload • Cost recovery • Compliance • Additional capacity Campbell (DOE Order) x Manageable inflationary impacts skewed toward capital ($240K exposure to date) x ~90% of supply chain domestically sourced with broad vendor redundancy • Cost containment • Material availability Tariff Impacts Considerations Presentation endnotes are included after the appendix.

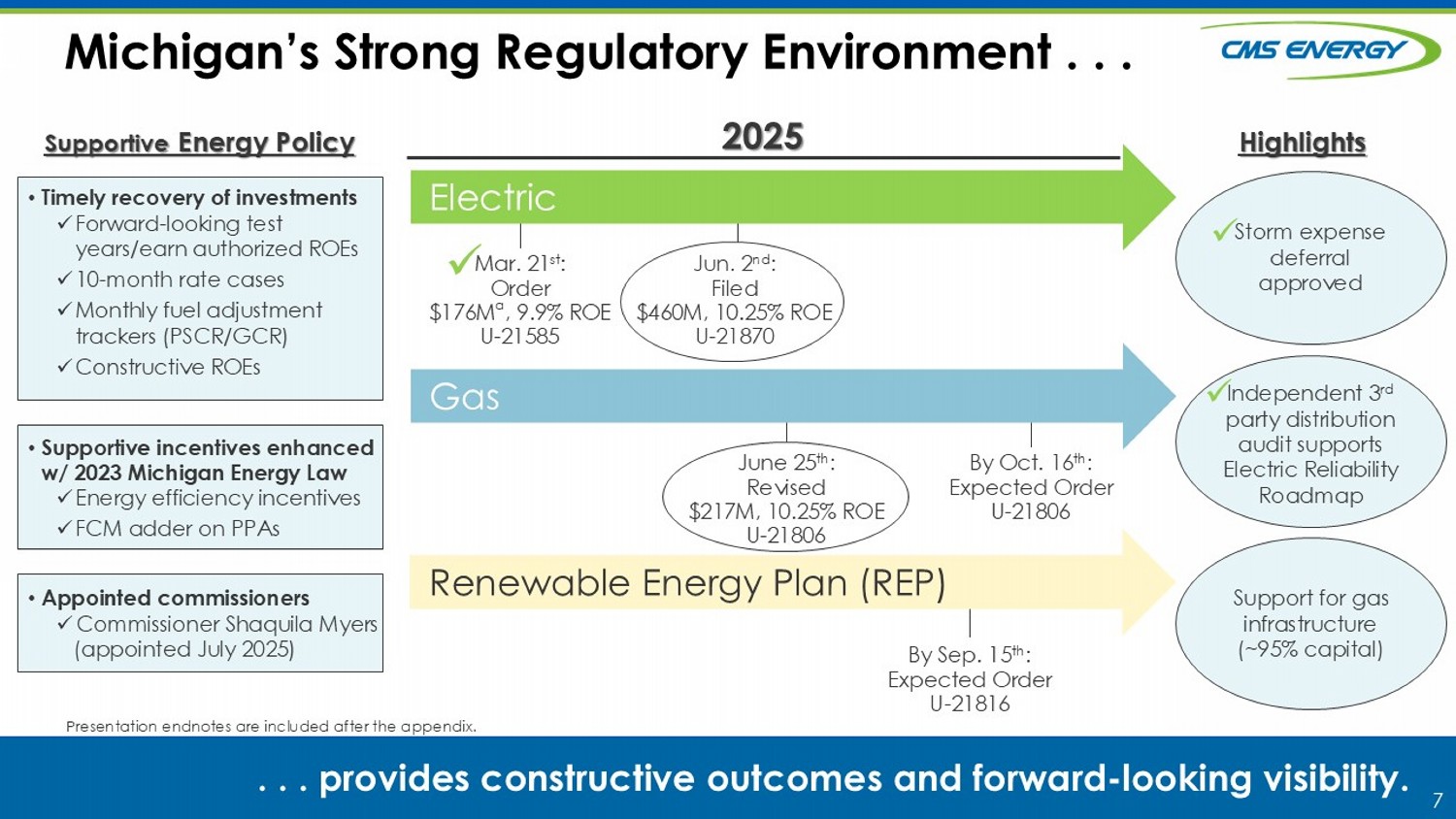

7 By Oct. 16 th : Expected Order U - 21806 Michigan’s Strong Regulatory Environment . . . . . . provides constructive outcomes and forward - looking visibility. Electric Gas Supportive Energy Policy • Timely recovery of investments x Forward - looking test years/earn authorized ROEs x 10 - month rate cases x Monthly fuel adjustment trackers (PSCR/GCR) x Constructive ROEs • Supportive incentives enhanced w/ 2023 Michigan Energy Law x Energy efficiency incentives x FCM adder on PPAs • Appointed commissioners x Commissioner Shaquila Myers (appointed July 2025) Renewable Energy Plan (REP) Presentation endnotes are included after the appendix. By Sep. 15 th : Expected Order U - 21816 2025 Mar. 21 st : Order $176M a , 9.9% ROE U - 21585 x June 25 th : Revised $217M, 10.25% ROE U - 21806 Jun.

2 nd : Filed $460M, 10.25% ROE U - 21870 Highlights x Storm e xpense deferral approved Support for gas infrastructure ( ~95 % capital) x Independent 3 rd party distribution audit supports Electric Reliability Roadmap 8 Commentary Amount Financial Results & Outlook . . . . . . on track to deliver in 2025 and beyond. Long - Term Outlook 2025 Full - Year Outlook YTD 2025 Results $1.73 Adjusted EPS Toward the high end Up 11¢ $3.06 – $3.12 $2.17 Adjusted EPS Guidance Annual Dividend Per Share (DPS) Toward the high end Consistent DPS growth Up $3 vs. prior plan +6% to +8% Adjusted EPS Growth Dividend Payout Ratio Utility Capital Plan ($B) a $20 $3.54 – $3.60 Well - positioned to deliver ~60% payout over time Presentation endnotes are included after the appendix.

9 2024 Weather Rates, Renewables & Investment Reliability, Storms incl. Productivity Parent Financing, Tax & Other Normal Weather Rates, Renewables & Investment Reliability, Storms incl. Productivity Parent Financing, Tax & Other 2025 2025 Adjusted EPS . . . . . . continued confidence toward the high end. First Half 10¢ Six Months To - Go 10 ¢ – 16 ¢ Presentation endnotes are included after the appendix.

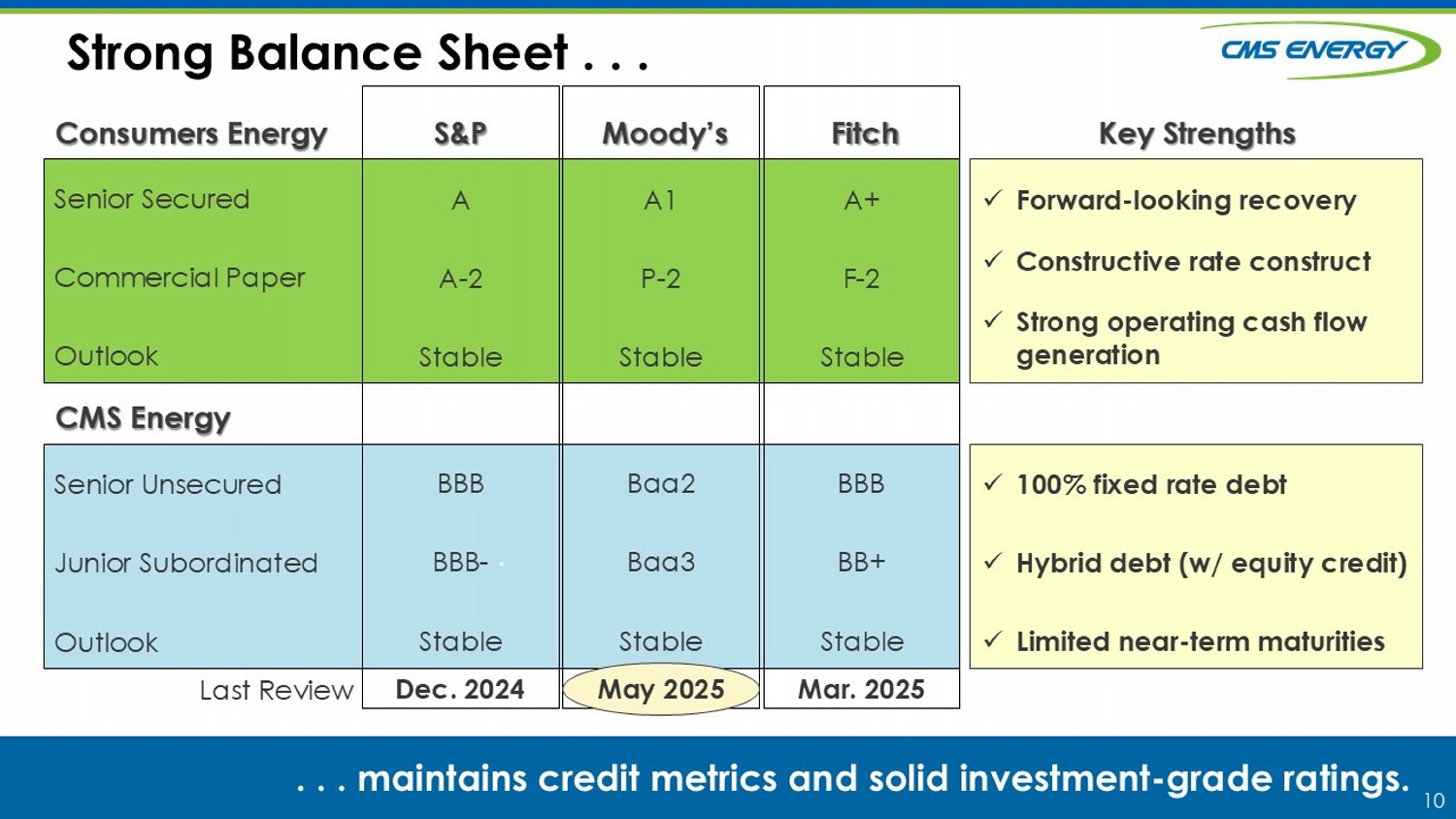

$3.54 – $3.60 32 ¢ $3.34 9 ¢ ( 27 )¢ 11 ¢ 18¢ (14) ¢ – (20)¢ (4)¢ 1¢ First Half $1.73 First Half $ 1.63 2025 2024 $1.67 $1.61 Reported EPS 0.06 0.02 Adjustments a $ 1.73 $ 1.63 Adjusted EPS a First Half EPS Results 10 . Strong Balance Sheet . . . . . . m aintains credit metrics and solid investment - grade ratings. Consumers Energy CMS Energy Senior Secured Commercial Paper Outlook Senior Unsecured Junior Subordinated Outlook Last Review A1 P - 2 Stable Baa2 Baa3 Stable May 2025 A+ F - 2 Stable BBB BB+ Stable Mar. 2025 S&P Moody’s Fitch x Forward - looking recovery x Constructive rate construct x Strong operating cash flow generation x 100% fixed rate debt x Hybrid debt (w/ equity credit) x Limited near - term maturities Key Strengths A A - 2 Stable BBB BBB - Stable Dec. 2024 Ma y 2025 11 YTD Plan ($M) ($M) Consumers Energy: $1,125 $1,125 First Mortgage Bonds CMS Energy: $1,000 $1,270 New Debt Issuances -- Up to $500 Planned Equity Retirements (incl.

term loans): -- None Consumers Energy $600 $850 CMS Energy Existing Facilities $1,100M (Dec - 2027) $550M (Dec - 2027) $250M (Nov - 2025) Consumers Energy CMS Energy Financings 2025 Planned Financings . . . . . . fund customer investments and provide ample liquidity. Presentation endnotes are included after the appendix.

~$2.7B a of net liquidity ~$350M priced favorably to Plan x 12 Recession Industry - Leading Financial Performance . . . . . . for over two decades, regardless of conditions. 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025+ Recession Adjusted EPS Dividend +6% to +8% Weather Help Hurt Cold winter Mild summer Warm winter Hot summer Mild summer Cold winter Polar vortex Mild summer Warm winter Hot summer Hot summer Summer - less Storms Hot summer Storms Hot summer Warm winter Warm winter Mild winter Governor (D) Governor (R) Governor (D) Commission (D) Commission (D) Commission (R) Commission (I) Commission (D) Dave Joos John Russell Patti Poppe K. Whipple Recession / Pandemic Garrick Rochow Mild w/ storms Hot summer Mild w/ storms 13 13 Q&A Thank You!

14 14 Appendix

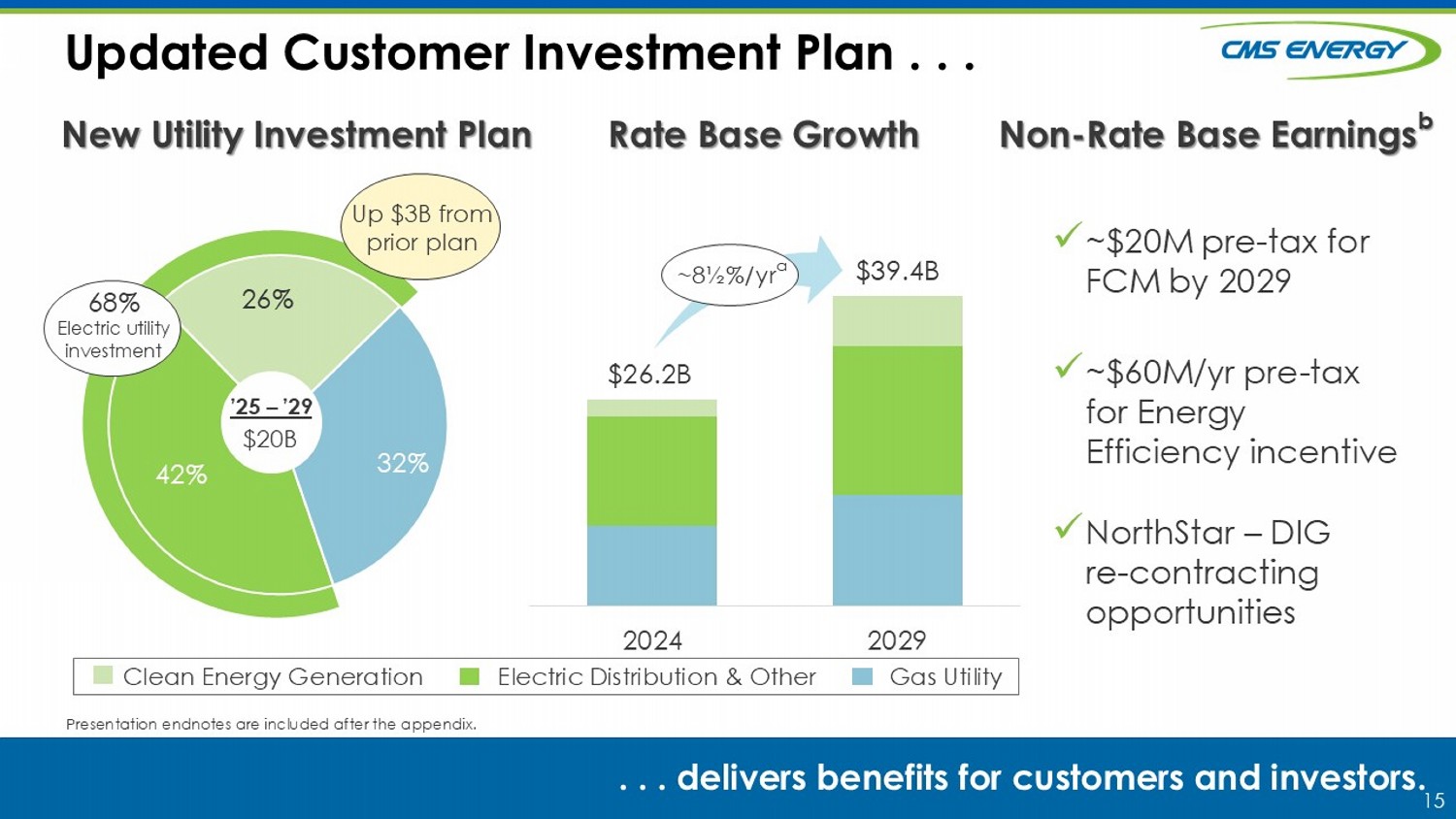

15 42% 26% 32% Updated Customer Investment Plan . . . . . . delivers benefits for customers and investors. New Utility Investment Plan Rate Base Growth Presentation endnotes are included after the appendix.

16 16 Endnotes

Clean Energy Generation Electric Distribution & Other Gas Utility $20B ’25 – ’29 68% Electric utility investment x ~$20M pre - tax for FCM by 2029 x ~$60M/yr pre - tax for Energy Efficiency incentive x NorthStar – DIG re - contracting opportunities Non - Rate Base Earnings b 2024 2029 $26.2B $39.4B ~8½%/ yr a Up $3B from prior plan 17 Presentation Endnotes Slide 3: a UBS Research, 2025 state rankings and D.C. Slide 5: a $5B estimate reflects preliminary estimate Slide 6: a Assumptions are based on pre - existing safe harbor provisions Slide 7 : a $176M order includes a $22M surcharge related to distribution investments made in 2023 above prior approved levels Slide 8: a $20B utility capital investment plan (2025 - 2029), up $3B from prior plan (2024 - 2028) Slide 9: a Adjusted EPS; see GAAP reconciliation Slide 11 : a $1,870M in unreserved revolvers + $815M of unrestricted cash; excludes cash unavailable for debt retirement, such as cash hel d a t NorthStar Slide 15: a Assumes $2 6 .2B rate base in 2024, $39.4B in 2029, CAGR b Over plan period years 2025 - 2029 17 18 GAAP Reconciliation CMS Energy provides historical financial results on both a reported (GAAP) and adjusted (non - GAAP) basis and provides forward - lo oking guidance on an adjusted basis.

During an oral presentation, references to “earnings” are on an adjusted basis. All references to net income ref er to net income available to common stockholders and references to earnings per share are on a diluted basis. Adjustments could include items such as disc ont inued operations, asset sales, impairments, restructuring costs, business optimization initiative, major enterprise resource planning software implementatio ns, changes in accounting principles, voluntary separation program, changes in federal and state tax policy, regulatory items from prior years, unrealized gains or lo sses from mark - to - market adjustments, recognized in net income related to NorthStar Clean Energy's interest expense, or other items. Management views adj usted earnings as a key measure of the company’s present operating financial performance and uses adjusted earnings for external communications with ana lysts and investors. Internally, the company uses adjusted earnings to measure and assess performance. Because the company is not able to estimate th e impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, the company's reported earnings in future per iods, the company is not providing reported earnings guidance nor is it providing a reconciliation for the comparable future period earnings. The adju ste d earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the reported earnin gs. 18 CMS ENERGY CORPORATION Reconciliation of GAAP Net Income to Non - GAAP Adjusted Net Income (Unaudited) 19 In Millions, Except Per Share Amounts Six Months Ended Three Months Ended 6/30/24 6/30/25 6/30/24 6/30/25 480 $ 500 $ 195 $ 198 $ Net Income Available to Common Stockholders Reconciling items: 6 8 2 5 Other exclusions from adjusted earnings** (1) (2) (*) (1) Tax impact - 12 - 12 State tax policy change * - - - Voluntary separation program (*) - - - Tax impact 485 $ 518 $ 197 $ 214 $ Adjusted net income – non - GAAP 297.9 299.0 298.5 299.1 Average Common Shares Outstanding - Diluted Diluted Earnings Per Average Common Share 1.61 $ 1.67 $ 0.65 $ 0.66 $ Reported net income per share Reconciling items: 0.02 0.02 0.01 0.01 Other exclusions from adjusted earnings** (*) (*) (*) (*) Tax impact - 0.04 - 0.04 State tax policy change * - - - Voluntary separation program (*) - - - Tax impact 1.63 $ 1.73 $ 0.66 $ 0.71 $ Adjusted net income per share – non - GAAP Less than $0.5 million or $0.01 per share.

* Includes restructuring costs and business optimization initiative. ** 20 CMS ENERGY CORPORATION Reconciliation of GAAP Net Income to Non - GAAP Adjusted Net Income by Quarter (Unaudited) In Millions, Except Per Share Amounts 2024 2025 4Q 3Q 2Q 1Q 2Q 1Q 262 $ 251 $ 195 $ 285 $ 198 $ 302 $ Net Income Available to Common Stockholders Reconciling items: * * 2 4 4 * Electric utility and gas utility (*) (*) (*) (1) 11 (*) Tax impact - - - - 1 3 NorthStar Clean Energy - - - - (*) (1) Tax impact - - - - - - Corporate interest and other - - - - (*) - Tax impact (*) - - - - - Disposal of discontinued operations (gain) loss * - - - - - Tax impact 262 $ 251 $ 197 $ 288 $ 214 $ 304 $ Adjusted Net Income – Non - GAAP 298.7 298.8 298.5 297.2 299.1 299.1 Average Common Shares Outstanding – Diluted 0.87 $ 0.84 $ 0.65 $ 0.96 $ 0.66 $ 1.01 $ Diluted Earnings Per Average Common Share Reconciling items: * * 0.01 0.01 0.01 * Electric utility and gas utility (*) (*) (*) (*) 0.04 (*) Tax impact - - - - * 0.01 NorthStar Clean Energy - - - - (*) (*) Tax impact - - - - - - Corporate interest and other - - - - (*) - Tax impact (*) - - - - - Disposal of discontinued operations (gain) loss * - - - - - Tax impact 0.87 $ 0.84 $ 0.66 $ 0.97 $ 0.71 $ 1.02 $ Adjusted Diluted Earnings Per Average Common Share – Non - GAAP Less than $0.5 million or $0.01 per share. *