UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 26, 2025

| QXO, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 001-38063 | 16-1633636 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| Five American Lane Greenwich, Connecticut |

06831 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 888-998-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

||

| Common stock, par value $0.00001 per share | QXO | New York Stock Exchange | ||

| Depositary Shares, each representing a 1/20th interest in a share of 5.50% Series B Mandatory Convertible Preferred Stock, par value $0.001 per share | QXO.PRB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On June 26, 2025, QXO, Inc. (the “Company”) released certain investor presentation materials that will be used by the Company in connection with investor meetings. Copies of the materials are attached as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K.

The investor presentation materials should be read together and with the Company’s filings with the Securities and Exchange Commission, including the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2025.

The information furnished in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, except to the extent that the registrant specifically incorporates any such information by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Investor Slides, dated June 26, 2025. | |

| 99.2 | Investor Presentation Script, dated June 26, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 26, 2025

| QXO, INC. | |||

| By: | /s/ Christopher Signorello | ||

| Name: | Christopher Signorello | ||

| Title: | Chief Legal Officer | ||

|

|

Exhibit 99.1

Investor presentation June 2025

2 This presentation has been prepared by QXO, Inc . (the "Company" or "QXO") solely for informational purposes and does not constitute or form part of, and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of the Company, nor shall there be any sale of securities in any state or other jurisdiction to any person or entity to which it is unlawful to make such offer, solicitation or sale in such state or jurisdiction . Sales and offers to sell securities of the Company will only be made in accordance with the Securities Act of 1933 , as amended, and applicable SEC regulations or an exemption therefrom, and by means of separate formal documents, the terms of which would govern any such offering in all respects . You should not rely on this presentation as the basis upon which to make any investment decision . This presentation is not for publication, release or distribution in any jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction nor should this presentation be taken or transmitted into such jurisdiction . This presentation includes market and industry data and forecasts that the Company has derived from independent consultant reports, publicly available information, various industry publications, other published industry sources, and its internal data and estimates . Independent consultant reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable . Although the Company believes that these third - party sources are reliable, it does not guarantee the accuracy or completeness of this information, and the Company has not independently verified this information . The Company’s internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which the Company operates and management’s understanding of industry conditions . Although the Company believes that such information is reliable, it has not had this information verified by any independent sources . In addition, the information contained in this presentation is as of the date hereof (except where otherwise indicated), and the Company has no obligation to update such information, including in the event that such information becomes inaccurate or if estimates change . Subsequent materials may be provided by or on behalf of the Company in its discretion and such information may supplement, modify or supersede the information in these materials . Legal disclaimers 3 This presentation contains forward - looking statements.

Statements that are not historical facts, including statements about beli efs, expectations, targets or goals, such as statements regarding net sales and EBITDA goals and expected benefits of the proposed acquisition of GMS, Inc. (“GMS”), are forward - looking statements. These statements are based on plans, estimates, expectations and/or goals at the time the statements are made, and readers should not place undue reliance on them. In some cases, readers can identify forward - looking statements by the use of forward - looking terms such as “may,” “will,” “should,” “expect,” “opportunity,” “intend,” “plan ,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “target,” “goal,” or “continue,” or the negative of these terms or other comparable terms. Forward - looking statements involve in herent risks and uncertainties and readers are cautioned that a number of important factors could cause actual results to differ materially from those contained in any such fo rward - looking statements. Factors that could cause actual results to differ materially from those described herein include, among others: ▪ An inability to obtain the products we distribute resulting in lost revenues and reduced margins and damaging relationships w ith customers; ▪ A change in supplier pricing and demand adversely affecting our income and gross margins; ▪ A change in vendor rebates adversely affecting our income and gross margins; ▪ Our inability to identify potential acquisition targets or successfully complete acquisitions on acceptable terms; ▪ Risks related to maintaining our safety record; ▪ The possibility that building products distribution industry demand may soften or shift substantially due to cyclicality or d epe ndence on general economic and political conditions, including inflation or deflation, interest rates, governmental subsidies or incentives, consumer confidence, labor and supply sh ortages, weather and commodity prices; ▪ The possibility that regional or global barriers to trade or a global trade war could increase the cost of products in the bu ild ing products distribution industry, which could adversely impact the competitiveness of such products and the financial results of businesses in the industry; ▪ Seasonality, weather - related conditions and natural disasters; ▪ Risks related to the proper functioning of our information technology systems, including from cybersecurity threats; ▪ Loss of key talent or our inability to attract and retain new qualified talent; ▪ Risks related to work stoppages, union negotiations, labor disputes and other matters associated with our labor force or the lab or force of our suppliers or customers; ▪ The risk that the anticipated benefits of our acquisition of Beacon Roofing Supply, Inc.

(the “Beacon Acquisition”) or any fu tur e acquisition may not be fully realized or may take longer to realize than expected; ▪ The effect of the Beacon Acquisition or any future acquisition on our business relationships with employees, customers or sup pli ers, operating results and business generally; ▪ The possibility that we may not engage in discussions with respect to, proceed with or consummate the proposed acquisition of GM S or, if we do consummate a transaction with GMS, such transaction may not be on the terms proposed or within the anticipated time frame; Cautionary statement regarding forward - looking statements 4 ▪ Unexpected costs, charges or expenses resulting from the Beacon Acquisition or any future acquisition or difficulties in inte gra ting and operating acquired companies; ▪ The risk that the Company is or becomes highly dependent on the continued leadership of Brad Jacobs as chairman and chief exe cut ive officer and the possibility that the loss of Jacobs in these roles could have a material adverse effect on the Company’s business, financial condition and results of oper ati ons; ▪ The possibility that the Company’s outstanding warrants and preferred stock may or may not be converted or exercised, and the ec onomic impact on the Company and the holders of common stock of the Company that may result from either such exercise or conversion, including dilution, or the continuanc e o f the preferred stock remaining outstanding, and the impact its terms, including its dividend, may have on the Company and the common stock of the Company; ▪ Challenges raising additional equity or debt capital from public or private markets to pursue the Company’s business plan and th e effects that raising such capital may have on the Company and its business; ▪ The possibility that new investors in any future financing transactions could gain rights, preferences and privileges senior to those of the Company’s existing stockholders; ▪ Risks associated with periodic litigation, regulatory proceedings and enforcement actions, which may adversely affect the Com pan y’s business and financial performance; ▪ The impact of legislative, regulatory, economic, competitive and technological changes; ▪ Unknown liabilities and uncertainties regarding general economic, business, competitive, legal, regulatory, tax and geopoliti cal conditions; and ▪ Other factors, including those set forth in the Company’s filings with the SEC, including its Annual Report on Form 10 - K for the fiscal year ended December 31, 2024 and subsequent Quarterly Reports on Form 10 - Q incorporated by reference into the prospectus supplement for this offering, and in suc h prospectus supplement. Forward - looking statements should not be relied on as predictions of future events, and these statements are not guarantees of p erformance or results. Forward - looking statements herein speak only as of the date each statement is made. QXO does not undertake any obligation to update any of these stateme nts in light of new information or future events, except to the extent required by applicable law. Cautionary statement regarding forward - looking statements (cont’d)

5 QXO is the largest publicly traded distributor of roofing, waterproofing, and complementary building products in the United States. The company plans to become the tech - enabled leader in the $800 billion building products distribution industry and generate outsized value for shareholders. QXO is targeting $50 billion in annual revenue within the next decade through accretive acquisitions and organic growth.

6 Investment highlights Building products distribution — immense TAM supported by attractive long - term demand drivers 2 Beacon: a smart first move 4 Well - defined plan to at least double legacy Beacon EBITDA organically 5 Extensive opportunity for additional M&A 6 Exemplary track record of creating outsized shareholder value 3 Building a $50 billion revenue company — a compelling path to value creation 1 Management incentives aligned with shareholders 7 7 ▪ Address large, highly fragmented industry ▪ Acquire businesses at attractive valuations ‒ Regional targets in roofing, waterproofing, and complementary categories ‒ Transformational opportunities in adjacent verticals ▪ Deploy proven approach to substantially grow earnings of acquired businesses ‒ Drive above - market organic revenue growth ‒ Significantly expand EBITDA margin ‒ Leverage game - changing technology opportunities ‒ Time - tested playbook: CEO Brad Jacobs and his team have driven outsized value at United Waste, United Rentals, and XPO ▪ Generate free cash to replenish acquisition capacity ▪ Rinse, wash, repeat: Execute additional acquisitions and replicate transformation plan Building a $50 billion company — a compelling path to value creation Forward - looking revenue, EBITDA, leverage and organic growth goals are not guarantees or management projections of future perfor mance. These goals are based on various assumptions that may prove to be incorrect and are subject to significant risks and uncertainties, including those described on the slides titled "Cautionary Statement Regarding Forward - Looking Statements," including risks relating to QXO's ability to identify, consummate and integrate acquisitions. There can be no assurance that QXO will be successful in executing the activities underlying these goals or that the other assumptions underlying these goals will prove to be correct. As a result, th ere can be no assurance that QXO will be able to achieve these goals.

8 ▪ ~$800 billion building products distribution industry 1 ▪ Highly fragmented; ~7,000 distributors across North America ▪ Strong demand drivers ‒ Shortage of ~4 million homes in the U.S. ‒ Significantly aged housing stock (>40 years) requiring R&R (repair & remodeling) ‒ >$2 trillion infrastructure spend needed in North America over the next two decades ▪ Large distributors have significant scale benefits ▪ Strong free cash flow conversion Building products distribution — large TAM supported by attractive long - term demand drivers Perfectly suited for QXO’s transformation playbook 1 Includes North America and Europe. Sources: U.S. Federal Reserve Economic Data, U.S.

Census Bureau as of April 30, 2024, National Association of Homebuilders as of Febru ary 12, 2024 9 Highly - experienced management team with strong track record in driving transformations Brad Jacobs Chairman and Chief Executive Officer ▪ Founder of five multibillion - dollar public companies, including United Waste, United Rentals, XPO, and XPO spin - offs GXO and RXO ▪ Serves as Executive Chairman of XPO Matt Fassler Chief Strategy Officer ▪ Former Chief Strategy Officer of XPO ▪ Previously Goldman Sachs Managing Director, Consumer Business Unit Leader in Global Investment Research Ihsan Essaid Chief Financial Officer ▪ Former Global Head of M&A at Barclays ▪ Previously held senior M&A roles at Credit Suisse and Perella Weinberg Partners Jeff England Chief Supply Chain Officer ▪ Former Chief Supply Chain Officer at Genuine Parts Company ▪ Previously Senior Vice President, Supply Chain, at Walmart Val Liborski Chief Technology Officer ▪ Former Chief Technology Officer for Yahoo! and HelloFresh ▪ Previously at Amazon Web Services and Microsoft Josephine Berisha Chief Human Resources Officer ▪ Former CHRO of XPO ▪ Previously Managing Director, Head of Corporate Compensation and Firmwide Human Capital Analysis at Morgan Stanley 10 Highly - experienced management team with strong track record in driving transformations (cont’d) Sean Smith Chief Accounting and Deputy Chief Financial Officer ▪ Most recently served as corporate controller for Chewy ▪ Previously held key finance positions with XPO Chris Signorello Chief Legal Officer ▪ Former Deputy General Counsel and Chief Compliance Officer at XPO ▪ Previously at Henkel Corporation and Goodwin Procter Luke Scott Executive Vice President, Sales and Operations Enablement ▪ Led merchandising strategy at 7 - Eleven convenience stores ▪ Previously Partner at Boston Consulting Group Eduardo Pelleissone Chief Transformation Officer ▪ Led operations across Americas and Asia Pacific for GXO Logistics ▪ Extensive senior leadership experience across 3G companies; CEO of America Latina Logistica SA, COO of Kraft Heinz Mark Manduca Chief Investment Officer ▪ Previously Chief Investment Officer at GXO Logistics ▪ Prior to GXO Logistics, held senior positions at Citigroup and Bank of America Ashwin Rao, PhD Chief Artificial Intelligence Officer ▪ Former head of AI at Target Corporation ▪ Previously led science and engineering teams at Goldman Sachs and Morgan Stanley, creating products for pricing and risk management

11 ▪ Brad Jacobs founded and led three highly successful consolidators ‒ United Waste: Created fifth largest solid waste business in North America ‒ United Rentals: Built world’s largest equipment rental company ‒ XPO: Grew XPO into one of the world’s largest logistics companies ▪ Jacobs has raised ~$50 billion in institutional capital ‒ Investing alongside Jacobs in all his companies would have earned >300x 1 returns ▪ In 2015, XPO acquired both Norbert Dentressangle, a European transportation icon, and Con - way, one of the largest less - than - truc kload freight carriers in North America ‒ Doubled Norbert Dentressangle’s profit from 2015 to 2018 ‒ Doubled Con - way’s profit from 2015 to 2018 and generated more than $4 billion of net cash in less - than - truckload from 2016 to 2022 We’ve done this before: track record of successful transformations 1 Assumes sequential investment aligned with Brad Jacobs’ tenure in his prior public ventures — United Waste, United Rentals, and XP O — with proceeds monetized and rolled into each successive venture. Measured through December 31, 2024.

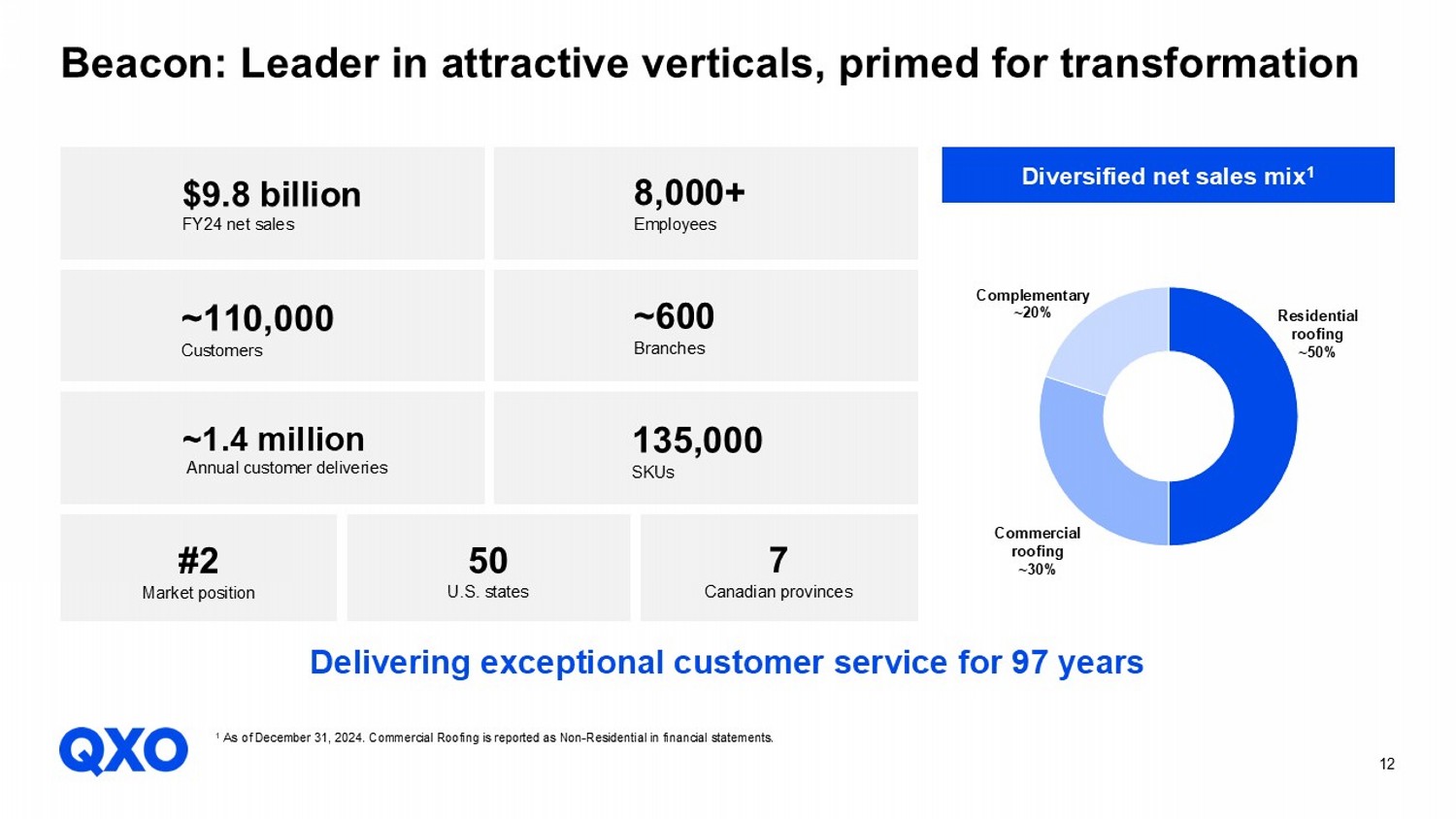

Sources: XPO, Inc., Company information 12 Complementary ~20% Commercial roofing ~30% Residential roofing ~50% Beacon: Leader in attractive verticals, primed for transformation Diversified net sales mix 1 8,000+ Employees ~600 Branches $9.8 billion FY24 net sales 135,000 SKUs ~1.4 million Annual customer deliveries ~110,000 Customers 7 Canadian provinces 50 U.S. states #2 Market position Delivering exceptional customer service for 97 years 1 As of December 31, 2024. Commercial Roofing is reported as Non - Residential in financial statements.

13 Beacon: a smart first move ▪ Attractive demand drivers for the roofing sector: ~80% driven by non - discretionary repair & remodel activity ▪ Resilient performance through cycles: Beacon generated organic revenue growth in 17 of the 21 years since its 2004 IPO ▪ Limited tariff exposure: Vast majority of products made and sold in the U.S. ▪ Weather disruption: Severe weather events, which create demand for roofing products, have quadrupled in frequency over the last 20 years ▪ Appealing adjacencies for M&A Target to more than double Beacon’s EBITDA organically within five years Note: The forward - looking goals are not guarantees of future performance. These goals are based on various assumptions that may prove to be incorrect and are subject to significant risks and uncertainties, including those described on the slides titled "Cautionary Statement Regarding Forward - Looking Statemen ts," including risks relating to QXO's ability to identify, consummate and integrate acquisitions. There can be no assurance that QXO will be successful in executing the activities unde rly ing these goals or that the other assumptions underlying these goals will prove to be correct. As a result, there can be no assurance that QXO will be able to achieve these goals.

14 We’ve hit the ground running on the Beacon transformation Immediate integration and operational uplift ▪ Rebranded to QXO on Day 1, including e - commerce site and mobile app; customer communications executed seamlessly ▪ Redesigned org chart, reducing layers and increasing spans of control, optimizing cost and improving the flow of information ▪ Implemented initial transformation efforts in key areas of opportunity, including systematic pricing adjustments, new sales e nab lement tools, and key procurement practices ▪ Ongoing benefits from sales “win room” for lead generation, and sharply improved in - stock through rapid inventory rebalancing ef fort ▪ Immediate monthly operating review outline ▪ Optimizing compensation models to align with commercial initiatives Direct leadership engagement ▪ CEO Brad Jacobs conducted live - streamed town halls with ~3,500 Beacon employees upon announcement and at closing. Both featured live Q&A with unvetted questions ▪ Jacobs has conducted daily mini - town halls with frontline teams, with deep engagement and consistent follow - up ▪ Prior to close, surveyed Beacon employees on job satisfaction and best ideas.

Received ~3,500 responses, shared insights comp any wide, and actioned takeaways into transformation plan We’re driving employee enthusiasm and gaining early traction 15 GMS offers an accretive opportunity in a near adjacency ▪ On June 18, 2025, we made an offer to acquire 100% of GMS in an all - cash $95.20 per share transaction that values GMS at approximately $5 billion ▪ GMS transaction would enhance scale and accelerate QXO’s position as a market - leading distributor ▪ GMS core product offerings adjacent to current QXO portfolio ▪ We could deploy our transformation playbook at GMS, accelerating revenue growth and driving meaningful margin expansion ‒ Opportunities to share improvements in logistics, pricing, procurement, sales excellence ‒ Significant opportunity to deploy industry - leading technology, leveraging innovation underway at QXO 1 If GMS elects not to engage or we otherwise do not reach agreement on a transaction with the board of directors of GMS, we may take our offer directly to its shareholders. There can be no assurance that we will engage in discussions with respect to, proceed with or consummate any transaction with GMS. We c oul d choose at any time not to pursue a transaction with GMS or GMS could consummate a transaction with another party. We could also choose to pursue one or more alternative acquisit ion transactions. If we do consummate a transaction with GMS, such transaction may not be on the terms proposed or within the anticipated time frame.

16 Strong alignment between management and shareholders ▪ The senior management team, including CEO Brad Jacobs, and the board own approximately 36% 1 of QXO’s equity ▪ Meaningful portion of each senior leader’s net worth is tied to QXO ▪ QXO’s executive officer compensation is built on a strict pay - for - performance philosophy that emphasizes equity - based incentives tied to sustainable value creation ▪ Two - thirds of CEO and CFO equity compensation is tied to total stockholder return (“TSR”) ▪ No payout is made unless TSR exceeds the 55th percentile of the S&P 500 index ▪ All restricted shares (RSUs and PSUs), once vested, are subject to a sale and transfer restriction until January 1, 2030 1 Senior management and board equity ownership based on beneficial ownership as disclosed in QXO’s 2024 proxy statement filed o n April 2, 2025, adjusting Warrants to net shares using the treasury stock method, excluding unvested RSUs and PSUs and including an additional ~16 million shares issued in co nne ction with the April 29, 2025 PIPE transaction. Percentage ownership calculated based on QXO's fully diluted shares outstanding as of June 15, 2025, including pre - funded warran ts and mandatory convertible preferred stock, using the treasury stock method for Warrants and Stock Options and excluding unvested RSUs and PSUs.

17 Appendix

18 Pricing ▪ Align salesforce incentive compensation with optimized price parameters ▪ Increase capture rate of indicated price ▪ Leverage data analysis to determine price elasticity by SKU Sales excellence ▪ Recruit additional growth - oriented salespeople, including for national accounts ▪ Strengthen inside sales team to increase growth with small residential contractors ▪ Increase cross - selling across key customer verticals ▪ Increase AI - driven lead generation Assortment/portfolio optimization ▪ Optimize mix and inventory levels by customer segment and location ▪ Accelerate growth in complementary products (insulation, waterproofing, siding, and gutters) Service enhancements ▪ Increase product availability through AI - driven forecasting ▪ Deliver industry - leading “on - time and in - full” performance for customers Plan to double EBITDA at legacy Beacon organically: Driving above - market revenue growth 19 Procurement ▪ Improve buying power through centralized procurement and inventory management; drive collaborative programs with key vendors to leverage QXO’s scale and market reach Org chart ▪ Optimize organizational chart to increase spans of control and drive agility; fine - tune branch operating model Supply chain optimization ▪ Streamline network to optimize delivery distance and improve service; reduce transportation cost Warehouse operational excellence ▪ Optimize inbound, outbound, and SKU - handling processes; implement automation where ROI supports Non - personnel spend ▪ Apply ZBB (zero based budgeting) to non - people costs Plan to double EBITDA at legacy Beacon organically: Targeting >500 bps of margin expansion

20 As Reported Adjustments 1 As Adjusted 31-Mar-25 (+) (-) 31-Mar-25 Cash and Cash Equivalents 5,082 2,189 (4,682) 2,589 ABL Facility -- 400 (84) 316 Term Loan Facility -- 2,250 (1,400) 850 Notes -- 2,250 -- 2,250 Total Debt -- 3,416 Net Debt (5,082) 827 Fully Diluted Market Capitalization 2,3,4 24,811 QXO’s adjusted capitalization table Adjusted capitalization ($ in Millions; Unless Otherwise Noted) Sources: Company Information 1 Reflects pro forma adjustments described in QXO’s Form 8 - K filed on May 20, 2025 with the SEC, but giving effect to the actual proceeds and use thereof in the May 2025 equity offerings and consummation of the June 2025 equity offering. 2 Reflects the value of QXO Equity of ~580 million shares of common stock outstanding as of June 15, 2025, ~219 million of as - converted convertible preferred equity shares, 42 million shares of pre - funded warrants. 3 ~145 million of Warrant dilution based on three tranches of Warrants totaling ~219 million with strike prices of $4.57 per share, $6.85 per share and $13.70 per share respectively, ~29 million of unvested RSUs, ~2 mi lli on outstanding equity options with average strike price of $5.14 and ~28 million issuable upon conversion of the mandatory preferred issued in May 2025. 4 QXO share price of $21.81 as of June 25, 2025 .

Exhibit 99.2

Investor presentation script

June 26, 2025

Hello, everyone. QXO is the largest publicly traded distributor of roofing, waterproofing, and complementary building products in the United States.

We plan to become the tech-enabled leader in the $800 billion building products distribution industry. Our goal is to achieve $50 billion in annual revenue within the next decade through a combination of accretive acquisitions and organic growth.

In this presentation, we’ll cover seven core themes:

First, we plan to create substantial shareholder value while building a highly profitable $50 billion revenue distribution business.

Second, the building products distribution industry offers an immense total addressable market with strong, durable demand drivers.

Third, our leadership team has an outstanding track record of creating shareholder value at scale.

Fourth, acquiring Beacon provided a strong platform to expand upon.

Fifth, we’re confident in our ability to at least double Beacon’s legacy EBITDA organically.

Sixth, there’s a significant M&A opportunity in the building products distribution space.

Seventh, our management compensation is closely aligned with our goal of creating long-term shareholder value.

Our business strategy centers on consolidating a highly fragmented, $800 billion industry. We will be disciplined in how much we pay for acquisitions.

With each acquisition, we’ll apply our proven approach to drive above-market organic growth and significantly expand margins—generating free cash flow to fund continued M&A.

|

|

This is the same playbook we used to drive outsized value at United Waste, United Rentals and XPO.

So, our business plan is to do disciplined M&A, significantly improve the profitability of the acquired operations, then rinse, wash, repeat.

We selected the building products distribution industry after a comprehensive blue-sky exercise because the fundamentals that drive success in this sector perfectly match our playbook.

The industry has secular tailwinds. The U.S. housing market is currently undersupplied by approximately 4 million units. At today’s pace, it would take roughly 15 years of homebuilding to close that gap. Meanwhile, the average single-family home is over 40 years old and in need of repair and remodeling.

Infrastructure investment also offers clear visibility, with more than $2 trillion in projected spending across North America over the next two decades.

The building products distribution industry is large and highly fragmented—and scale is a clear competitive advantage. In addition, our tech prowess is a differentiator.

The industry also generates substantial free cash flow, which supports our strategy to de-lever and reinvest for growth.

Our management team brings deep expertise across the skill sets required to execute our plan—disciplined M&A, seamless integration, profit improvement, capital markets experience, culture building, logistics optimization, and deploying cutting-edge technology to enhance both customer satisfaction and financial performance.

We have a track record of successful transformations over the years. We’ve raised approximately $50 billion of debt and equity. We’ve acquired, integrated, and optimized around 500 acquisitions. And, most importantly, if you had invested alongside us in all of our companies, you would have made over 300 times1 your money.

1 Assumes sequential investment aligned with Brad Jacobs’ tenure in his prior public ventures—United Waste, United Rentals, and XPO—with proceeds monetized and rolled into each successive venture. Measured through December 31, 2024.

|

|

Recall that at XPO, between 2015 and 2018, we doubled the profits of our two largest acquisitions—Norbert Dentressangle and Con-way.

Let’s now talk about why Beacon was a strategic first acquisition—and why we’re confident in our ability to improve its EBITDA with a goal to double its EBITDA organically over the next five years.

Beacon was a leading national platform in exterior building products, connecting suppliers and customers for essential roofing and related materials for nearly 100 years.

The company generated nearly $10 billion in net sales across about 600 branches from coast to coast, supported by 8,000 employees.

It served about 110,000 customers and completed approximately 1.4 million deliveries annually across 135,000 SKUs.

Beacon was an ideal launchpad for our $50 billion revenue ambition.

Roofing is a steady, highly predictable vertical, bolstered by strong long-term trends.

Everyone has a roof—and roofs require upkeep.

Over 80% of roofing demand is repair and remodeling, mostly driven by non-discretionary needs like storm damage and leaks. When your roof goes bad, you fix it.

Beacon was resilient through economic cycles including the 2008 Financial Crisis and the Covid pandemic. It generated organic revenue growth in 17 of the last 21 years, and has generated consistent profitability throughout that timeframe.

Severe weather events, which increase demand for roofing products, have quadrupled in frequency over the last 20 years. In fact, 2023 and 2024 marked the two year period with the most ever billion-dollar natural disasters in America.

Roofing products also face limited tariff risk, as most roofing goods are produced and sold in the U.S.

Our plan is to at least double Beacon’s EBITDA organically—boosting above-market revenue growth and expanding margins by over 500 basis points.

|

|

Our early integration efforts are delivering impact.

We immediately began the rebranding process on Day One, and customer communications went smoothly.

We redesigned the organizational chart, reducing layers and increasing spans of control, optimizing cost and improving the flow of information.

We implemented transformations in some of the areas of biggest opportunity, including demand forecasting, pricing, sales enablement, and procurement.

We kicked off a significant enhancement of the tech stack, focusing on enterprise systems, ecommerce, and the data analytics that power better decisions.

We’re generating sales from our “win room” for lead generation.

And, we’ve sharply improved our in-stock position through a rapid inventory rebalancing effort that focuses on the 4% of SKUs that generate 80% of revenue.

Our senior team is fully engaged through in-person visits, virtual town halls, and employee and customer surveys. We’ve been asking two questions: What’s working? What can we improve? The insights we’ve received have been invaluable and are already shaping our transformation roadmap.

On June 18, we made an offer to acquire 100% of GMS in an all-cash transaction for $95.20 per share, which values GMS at approximately $5 billion, the high end of our valuation range.

The acquisition of GMS would enhance our scale, accelerating our position as a market-leading distributor.

Its core product offerings are adjacent to our own portfolio.

We could deploy our transformation playbook at GMS, accelerating revenue growth and driving meaningful margin expansion.

|

|

We see opportunities to drive improvements in logistics, pricing, procurement, and sales excellence across these two businesses, and significant opportunity to deploy industry-leading technology, leveraging the innovation already underway at QXO.

However, we can give you no assurances that our offer to GMS will be accepted, or and that we will be able to close a transaction with them. The good news is we have many more acquisition targets in our sights.

At QXO, we’ve built a compensation structure that tightly aligns management’s interests with those of our shareholders.

The senior management team and board own approximately 36% of QXO’s equity.

A meaningful portion of each senior executive’s net worth is tied to QXO’s success. Two-thirds of the CEO’s and CFO's equity compensation is tied directly to total shareholder return.

There’s no payout unless QXO’s performance exceeds the 55th percentile of the S&P 500—underscoring our pay-for-performance philosophy.

And to ensure long-term alignment, all restricted shares—whether RSUs or PSUs—are subject to a sale and transfer restriction through January 1, 2030.

Conclusion

In closing, we hope you share our excitement about QXO’s strategy to build the leading tech-enabled building products distributor globally.

Acquiring Beacon was a strong first move—it’s a solid, growing business that aligns perfectly with our team’s strengths.

We believe we can significantly improve its EBITDA with a goal to at least double its EBITDA within five years.

And we’re confident we can replicate this success across both adjacent and new verticals—delivering significant value to shareholders.

Thank you for your time and support. We appreciate your interest in QXO.

|

|