UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 17, 2025

EYENOVIA, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-38365 | 47-1178401 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

23461 South Pointe Drive, Suite 390

Laguna Hills, CA 92653

(Address of Principal Executive Offices, and Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) | (Trading Symbol) |

(Name of each exchange on which registered) |

||

| Common stock, par value $0.0001 per share | EYEN | The Nasdaq Stock Market (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry Into a Material Definitive Agreement. |

Securities Purchase Agreement and Registration Rights Agreement

On June 17, 2025, Eyenovia, Inc., a Delaware corporation (the “Company”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) for a private placement (the “Private Placement”) with institutional accredited investors (the “Purchasers”). The closing of the Private Placement occurred on June 20, 2025 (the “Closing Date”). The Company intends to use the net proceeds from the Private Placement to build a reserve of a token called HYPE, which is native to the decentralized digital asset exchange and Layer-1 blockchain, Hyperliquid. As part of its new cryptocurrency treasury strategy, the Company intends to implement a HYPE staking program. In parallel, the Company intends to continue to focus on its existing business, including development of the Gen-2 Optejet User Filled Device.

Pursuant to the Purchase Agreement, the Purchasers purchased an aggregate of 5,128,205 shares (the “Preferred Shares”) of the Company’s Series A Non-Voting Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”) and warrants (the “Purchaser Warrants”) to purchase 200% of the number of shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) issuable upon full conversion of the Preferred Shares, for an aggregate purchase price of approximately $50,000,000. Each Preferred Share is convertible into three shares of Common Stock. The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Preferred Shares are set forth in the Certificate of Designation (as defined below). See Item 5.03 of this Current Report on Form 8-K (this “Form 8-K”) for further information regarding the Preferred Shares and the Certificate of Designation.

The Purchaser Warrants will be exercisable following the day that is six months and one day after the date of issuance and may be exercised for five years from the initial exercise date at an exercise price of $3.25 per share. The exercise price and number of shares of Common Stock issuable upon exercise of the Purchaser Warrants will be subject to adjustment in the event of stock dividends, stock splits, recapitalization or similar events affecting the Common Stock. A holder may not exercise any portion of such holder’s Purchaser Warrants to the extent that the holder would own more than 4.99% of the Company’s outstanding Common Stock immediately after exercise, which percentage may be increased by the holder to a maximum of 19.99%.

The Purchase Agreement contained customary representations and warranties of the Company, on the one hand, and the Purchasers, on the other hand.

Also on June 17, 2025, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Purchasers, which provides that the Company will register the resale of the shares of Common Stock issuable upon conversion of the Preferred Shares and exercise of the Purchaser Warrants. The Company is required to prepare and file a registration statement with the Securities and Exchange Commission (the “SEC”) no later than 20 business days following the date of the Registration Rights Agreement and to use its commercially reasonable efforts to have the registration statement declared effective as soon as practicable after it is filed, subject to certain exceptions. The Company has also agreed to, among other things, indemnify each Purchaser, its officers, directors, agents and each person who controls such Purchaser under the registration statement from certain liabilities and pay all reasonable expenses (excluding any underwriting discounts and commissions) incident to the Company’s obligations under the Registration Rights Agreement.

Chardan Capital Markets LLC (“Chardan”) acted as placement agent to the Company in connection with the Private Placement. As compensation for its services, the Company issued to Chardan 307,692 shares of Series A Preferred Stock and warrants to purchase 1,846,153 shares of Common Stock at an exercise price of $3.25 per share (the “Placement Agent Warrants”).

The securities issued and sold to the Purchasers under the Purchase Agreement, and the securities issued to Chardan in connection with its services as placement agent, were not registered under the Securities Act of 1933, as amended (the “Securities Act”) in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated thereunder, or under any state securities laws. The Company relied on this exemption from registration based in part on representations made by the Purchasers or Chardan, as applicable. The securities (including the Common Stock underlying such securities) may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Neither this Form 8-K, nor the exhibits attached hereto, is an offer to sell or the solicitation of an offer to buy the securities described herein.

The foregoing summary of the Purchase Agreement, the Registration Rights Agreement, the Purchaser Warrants and the Placement Agent Warrants do not purport to be complete and are qualified in their entirety by reference to the forms of Purchase Agreement, Registration Rights Agreement, Purchaser Warrant and Placement Agent Warrant, copies of which are filed as Exhibits 10.1, 10.2, 4.1 and 4.2, respectively, to this Current Report on Form 8-K and are incorporated by reference herein.

Following the closing of the Private Placement, the Company has 5,104,355 shares of Common Stock issued and outstanding and 54,027,429 shares of Common Stock issued and outstanding on a pro forma basis, which gives effect to the full conversion of the 5,435,898 outstanding shares of Series A Preferred Stock and the exercise of the Purchaser Warrants and the Placement Agent Warrants as of the Closing Date, without regard to beneficial ownership limitations that may limit the ability of certain holders of Series A Preferred Stock to convert such shares to Common Stock or the ability of certain holders of Purchaser Warrants or Placement Agent Warrants to exercise such warrants at such time.

Fourth Amendment to Loan and Security Agreement

On June 17, 2025, Company entered into the Fourth Amendment (the “Fourth Amendment”) to the Supplement (as previously amended, the “Supplement”) to that certain Loan and Security Agreement, dated November 22, 2022 (the “Loan and Security Agreement”) with Avenue Capital Management II, L.P., as administrative agent and collateral agent, Avenue Venture Opportunities Fund, L.P., as a lender (“Avenue 1”) and Avenue Venture Opportunities Fund II, L.P., as a lender (together with Avenue 1, the “Lenders”).

As previously disclosed, the Loan and Security Agreement, as supplemented by the Supplement, provides for term loans in an aggregate principal amount of up to $15.0 million to be delivered in multiple tranches. The Fourth Amendment, among other things, extends the maturity date of the loans to July 1, 2028; provides for an interest-only period from July 1, 2025 until January 31, 2027; reduces the interest rate from 12.0% to 8.0%, payable half in cash and half in kind; eliminates the option of the Lenders to convert an aggregate amount of up to $10.0 million of the loans outstanding into shares of Common Stock; and provides the Company with the option to prepay debt owed under the Loan and Security Agreement in part, subject to certain limitations.

In connection with the Fourth Amendment, the Company issued to the Lenders warrants (the “Lender Warrants”) to purchase an aggregate of 350,000 shares of Common Stock at an exercise price of $4.00 per share. The issuance of the Lender Warrants was not registered under the Securities Act in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act or under any state securities laws. The Company relied on this exemption from registration based in part on representations made by the Lenders. The securities (including the Common Stock underlying such securities) may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Neither this Form 8-K, nor the exhibits attached hereto, is an offer to sell or the solicitation of an offer to buy the securities described herein.

The foregoing descriptions of the Loan and Security Agreement and the Supplement do not purport to be complete and are qualified in their entirety by reference to the full text of the Loan and Security Agreement and the Supplement, copies of which were filed as Exhibits 10.9 and 10.10, respectively, to the Annual Report on Form 10-K filed by the Company on April 15, 2025. The foregoing descriptions of the Fourth Amendment and the Lender Warrants do not purport to be complete and are qualified in their entirety by reference to the full text of the Fourth Amendment and form of Lender Warrant, copies of which are filed as Exhibits 10.3 and 4.3, respectively, to this Form 8-K and incorporated herein by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information contained in Item 1.01 of this Form 8-K under the heading “Fourth Amendment to Loan and Security Agreement” is incorporated into this Item 2.03 by reference.

| Item 3.02. | Unregistered Sales of Equity Securities. |

To the extent required by Form 8-K, the information contained in Item 1.01 of this Form 8-K is incorporated into this Item 3.02 by reference.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Chief Investment Officer and Director

On June 17, 2025, the Board of Directors (the “Board”) of the Company appointed Hyunsu Jung to the position of Chief Investment Officer and to serve on the Board, effective immediately. Mr. Jung will serve as a director until the Company’s 2025 annual meeting of stockholders and thereafter until his successor has been elected and qualified or until his earlier death, resignation or removal.

Hyunsu Jung, age 29, has served as the Company’s Chief Investment Officer and as a director since June 2025. Prior to that, from June 2021 to June 2025, he was a Portfolio Manager at DARMA Capital, an $1B+ asset manager registered with the CFTC and NFA. Previously, he was a Consultant at EY-Parthenon from October 2018 to June 2021, where he drove Finance and Digital Transformation for major enterprise M&A deals. Mr. Jung earned his B.A. from Vassar College in 2018.

Mr. Jung was appointed to his positions pursuant to the terms of the Purchase Agreement. The Purchase Agreement provides that to the extent that at any time during the 36 months following the Closing Date (assuming Hyperion DeFi Holdings, LLC (“Hyperion”) continues to hold at least 50% of the shares of Common Stock underlying the Preferred Shares and the Purchaser Warrants originally issued pursuant to the Purchase Agreement), Mr. Jung no longer serves as a director or the Company’s Chief Investment Officer, Hyperion shall have the right to nominate a replacement to fill either or both of those roles and the Company shall use its commercially reasonable efforts to have the replacement(s) appointed as soon as reasonably practicable. In addition, the Purchase Agreement provides that Hyperion shall have the ability to nominate a director to serve as the Chair of the Board.

There is no family relationship between Mr. Jung and any other director or executive officer of the Company.

In connection with his appointment as Chief Investment Officer, Mr. Jung entered into an Executive Employment Agreement with the Company (the “Jung Employment Agreement”), pursuant to which the Company will pay Mr. Jung an initial salary of $250,000. Mr. Jung received an inducement equity award consisting of 500,000 shares of Common Stock, which were granted in accordance with Nasdaq Listing Rule 5635(c)(4). Mr. Jung also received an aggregate of 1,000,000 restricted stock units, to vest in two equal installments subject to certain milestones being achieved and any necessary approvals by the Board or the Company’s stockholders.

Mr. Jung’s term of employment will extend four years or until earlier termination under the Jung Employment Agreement. If Mr. Jung’s employment is terminated by the Company for cause (as defined in the Jung Employment Agreement), by the Company without cause within the first six months of his employment, by Mr. Jung without good reason (as defined in the Jung Employment Agreement) or as a result of Mr. Jung’s disability or death, Mr. Jung is entitled to receive Accrued Obligations (as defined in the Jung Employment Agreement). If Mr. Jung’s employment is terminated by the Company without cause or by Mr. Jung for good reason after the first six months of his employment, he is entitled to receive (i) Accrued Obligations, (ii) 12 months of his then-current annual base salary, less applicable withholdings and (iii) continuation of up to 12 months of group health insurance benefits. In the event of a qualifying termination within 12 months following any change in control of the Company, Mr. Jung would be eligible for similar benefits.

The foregoing description of the Jung Employment Agreement does not purport to be complete and is qualified in its entirety by the full text of the Jung Employment Agreement, a copy of which is attached as Exhibit 10.4 to this Form 8-K and incorporated herein by reference.

Director Resignations

On June 17, 2025, Sean Ianchulev, M.D., Charles Mather IV (Chair) and Ram Palanki, Pharm. D., resigned from the Board and their respective positions on the committees of the Board. These resignations occurred by agreement with the Purchasers in connection with the Private Placement, pursuant to which the Company agreed to reconstitute its Board with five members, including Mr. Jung and Mr. Rowe. Ellen Strahlman, M.D., Michael Geltzeiler, and Rachel Jacobson have remained on the Board and will comprise the members of the Company’s audit committee, compensation committee and nominating and governance committee going forward.

Amendment to Employment Agreement

Effective June 17, 2025, the Company and Michael Rowe entered into an Amended and Restated Employment Agreement (the “Rowe Employment Agreement”). The Rowe Employment Agreement provides Mr. Rowe with the option to retire from his positions as Director, President and Chief Executive Officer of the Company after November 1, 2025 and still retain severance benefits under Section 4(c) of the Rowe Employment Agreement. The other material terms of the Rowe Employment Agreement remain unchanged.

The foregoing summary of the Rowe Employment Agreement does not purport to be complete and is qualified in its entirety by the full text of the Rowe Employment Agreement, a copy of which is attached as Exhibit 10.5 to this Form 8-K and incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 20, 2025, the Company filed a Certificate of Designation of Preferences, Rights and Limitations with the Secretary of State of the State of Delaware to provide for the designation of shares of the Series A Preferred Stock (the "Certificate of Designation"), which became effective upon filing.

Holders of shares of Series A Preferred Stock are entitled to receive dividends on shares of Series A Preferred Stock equal to an annual rate of 6%, payable quarterly in arrears in cash or, at the Company’s option, shares of Common Stock. Except as otherwise required by law, the Series A Preferred Stock does not have voting rights. However, as long as any shares of Series A Preferred Stock are outstanding, the Company will not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series A Preferred Stock, (a) agree to a any consolidation or merger, consolidation, amalgamation or arrangement to which the Company is a party, or to any sale or transfer of all or substantially all of the assets of the Company, (b) alter or change adversely the powers, preferences or rights given to the Series A Preferred Stock, (c) alter or amend the Certificate of Designation, (c) amend its certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Preferred Stock, (d) increase or decrease the size of the Board, or (e) incur additional indebtedness other than presently outstanding indebtedness. Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary that is not a Fundamental Transaction (as defined in the Certificate of Designation), the holders of shares of Series A Preferred Stock will be entitled to receive out of the assets, whether capital or surplus, of the Company, before any payment shall be made to the holders of Common Stock by reason of their ownership thereof, an amount per share equal to the greater of (i) the applicable purchase price per share of Series A Preferred Stock originally paid by the Holder, plus any dividends declared but unpaid thereon, and (ii) the same amount that a holder of Common Stock would receive if the Series A Preferred Stock were fully converted to Common Stock (disregarding for such purpose any beneficial ownership limitations). Each share of Series A Preferred Stock will be convertible at any time and from time to time, at the option of the holder, into a number of shares of Common Stock equal to the Conversion Ratio (as defined in the Certificate of Designation), subject to certain limitations, including that a holder of Series A Preferred Stock is prohibited from converting shares of Series A Preferred Stock into shares of Common Stock if, as a result of such conversion, such holder, together with its affiliates, would beneficially own more than 4.99% of the total number of shares of Common Stock issued and outstanding immediately after giving effect to such conversion.

The foregoing description of the Series A Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designation, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On June 17, 2025, the Company issued a press release announcing the Private Placement and the appointment of Mr. Jung as the Chief Investment Officer and a director the Company. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

On June 18, 2025, the Company issued a press release announcing the Fourth Amendment. A copy of the press release is furnished as Exhibit 99.2 to this Form 8-K.

The information in Item 7.01 of this Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| # | Certain information in this Exhibit was omitted by means of marking such information with brackets (“[***]”) because the identified information (i) is not material and (ii) is the type of information that the Company treats as private or confidential. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| EYENOVIA, INC. | ||

| Dated: June 24, 2025 | By: | /s/ Michael Rowe |

| Michael Rowe | ||

| Chief Executive Officer | ||

Exhibit 3.1

EYENOVIA, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES, RIGHTS AND LIMITATIONS OF SERIES A NON-VOTING CONVERTIBLE PREFERRED STOCK

Pursuant to Section 151 of the

General Corporation Law of the State of Delaware

THE UNDERSIGNED DOES HEREBY CERTIFY, on behalf of Eyenovia, Inc., a Delaware corporation (the “Corporation”), that the following resolution was duly adopted by the Board of Directors of the Corporation (the “Board of Directors”), in accordance with the provisions of Section 151 of the General Corporation Law of the State of Delaware (the “DGCL”), via unanimous written consent on June 17, 2025, which resolution provides for the creation of a series of the Corporation’s Preferred Stock, par value $0.0001 per share, which is designated as “Series A Non-Voting Convertible Preferred Stock,” with the preferences, rights and limitations set forth therein relating to dividends, conversion, redemption, dissolution and distribution of assets of the Corporation.

WHEREAS: the Amended and Restated Certificate of Incorporation of the Corporation, as amended (the “Certificate of Incorporation”), provides for a class of its authorized stock known as Preferred Stock, consisting of 6,000,000 shares, $0.0001 par value per share (the “Preferred Stock”), issuable from time to time in one or more series.

RESOLVED: that, pursuant to authority conferred upon the Board of Directors by the Certificate of Incorporation, (i) a series of Preferred Stock of the Corporation be, and hereby is authorized by the Board of Directors, (ii) the Board of Directors hereby authorizes the issuance of 5,435,898 shares of “Series A Non-Voting Convertible Preferred Stock” pursuant to the terms of the Securities Purchase Agreement, dated as of the date hereof, by and among the Corporation and the Holders (as defined below) (the “Purchase Agreement”), and (iii) the Board of Directors hereby fixes the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, of such shares of Preferred Stock, in addition to any provisions set forth in the Certificate of Incorporation that are applicable to the Preferred Stock of all classes and series, as follows:

TERMS OF SERIES A NON-VOTING CONVERTIBLE PREFERRED STOCK

1. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in the City of New York are authorized or required by law to remain closed.

“Closing Sale Price” means, for any security as of any date, the last closing trade price for such security on the Principal Market, as reported by Bloomberg, or, if the Principal Market begins to operate on an extended hours basis and does not designate the closing trade price, then the last trade price of such security prior to 4:00:00 p.m., New York time, as reported by Bloomberg, or, if the Principal Market is not the principal securities exchange or trading market for such security, the last trade price of such security on the principal securities exchange or trading market where such security is listed or traded as reported by Bloomberg, or if the foregoing does not apply, the last trade price of such security in the over-the-counter market on the electronic bulletin board for such security as reported by Bloomberg, or, if no last trade price is reported for such security by Bloomberg, the average of the ask prices of any market makers for such security as reported in The Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices). If the Closing Sale Price cannot be calculated for a security on a particular date on any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair market value as mutually determined by the Company and the Holder. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination or other similar transaction during such period.

“Commission” means the United States Securities and Exchange Commission.

“Common Stock” means the Corporation’s common stock, par value $0.0001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed.

“Conversion Price” means $3.25.

“Conversion Shares” means, collectively, the shares of Common Stock issuable upon conversion of the shares of Series A Non-Voting Convertible Preferred Stock in accordance with the terms hereof.

“Conversion Shares Registration Statement” means the registration statement or statements to be filed pursuant to that certain Registration Rights Agreement, dated as of June 17, 2025, by and between the Company and Holder.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Holder” means a holder of shares of Series A Non-Voting Convertible Preferred Stock.

“Person” means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization, any other entity or a government or any department or agency thereof.

“Principal Market” means the Nasdaq Capital Market.

“Trading Day” means, as applicable, (x) with respect to all price or trading volume determinations relating to the Common Stock, any day on which the Common Stock is traded on the Principal Market, or, if the Principal Market is not the principal trading market for the Common Stock, then on the principal securities exchange or securities market on which the Common Stock is then traded, provided that “Trading Day” shall not include any day on which the Common Stock is scheduled to trade on such exchange or market for less than 4.5 hours or any day that the Common Stock is suspended from trading during the final hour of trading on such exchange or market (or if such exchange or market does not designate in advance the closing time of trading on such exchange or market, then during the hour ending at 4:00:00 p.m., New York time) unless such day is otherwise designated as a Trading Day in writing by the Holder or (y) with respect to all determinations other than price or trading volume determinations relating to the Common Stock, any day on which The New York Stock Exchange (or any successor thereto) is open for trading of securities.

2. Designation, Amount and Par Value. The series of Preferred Stock shall be designated as the Corporation’s Series A Non-Voting Convertible Preferred Stock (the “Series A Non-Voting Convertible Preferred Stock”) and the number of shares so designated shall be 5,435,898. Each share of Series A Non-Voting Convertible Preferred Stock shall have a par value of $0.0001 per share.

3. Dividends.

3.1 Holders of shares of the Series A Non-Voting Convertible Preferred Stock are entitled to receive dividends at an annual rate of 6%, payable quarterly in arrears (the “Dividend Rate”). Such dividend shall be payable in cash or, at the Corporation’s option, in freely tradeable shares of Common Stock (the “PIK Dividend”), at the Conversion Price, measured as of the date on which such shares are issued, subject to the Beneficial Ownership Limitation (as defined below). Such dividends will accrue on all issued and outstanding shares of Series A Non-Voting Convertible Preferred Stock, prior to and in preference to all other shares of capital stock of the Corporation. PIK Dividends shall be paid by delivering to each record holder of Series A Non-Voting Convertible Preferred Stock a number of shares of Common Stock (“PIK Dividend Shares”) determined by dividing (x) the total aggregate dollar amount of dividends accrued and unpaid with respect to the number of Series A Non-Voting Convertible Preferred Stock owned by such record holder on the record date for the applicable Dividend Payment Date (rounded to the nearest whole cent) by (y) the then applicable Conversion Price. In order to deliver PIK Dividend Shares in lieu of cash on a Dividend Payment Date (as defined below), the Corporation must deliver, on or before the fifteenth (15th) calendar day immediately prior to such date, written notice to each Holder of Series A Non-Voting Convertible Preferred Stock stating that the Corporation wishes to do so (a “PIK Stock Dividend Notice”); in the event that the Corporation does not deliver a PIK Stock Dividend Notice on or before such fifteenth (15th) day, the Corporation will be deemed to have elected to pay the related dividend in cash. Dividends on the Series A Non-Voting Convertible Preferred Stock shall accrue daily and be cumulative until paid from, and including, the Issuance Date and shall be payable monthly on the fifth (5th) day following the last day of each fiscal quarter (each such payment date, a “Dividend Payment Date,” and each such quarterly period, a “Dividend Period”); provided that if any Dividend Payment Date is not a Business Day, then the dividend that would otherwise have been payable on that Dividend Payment Date may be paid on the next succeeding Business Day, and no interest, additional dividends or other sums will accrue on the amount so payable for the period from and after that Dividend Payment Date to that next succeeding Business Day. Any dividend payable on the Series A Non-Voting Convertible Preferred Stock, including dividends payable for any partial Dividend Period, will be computed on the basis of a 360-day year consisting of four 90-day quarters. Dividends will be payable to holders of record as they appear in the Corporation’s stock records for the Series A Non-Voting Convertible Preferred Stock at the close of business on the applicable record date, which shall be the last day of the calendar quarter, whether or not a Business Day, in which the applicable Dividend Payment Date falls (each, a “Dividend Record Date”). All Dividend Amounts payable with respect to the Holders of Series A Non-Voting Convertible Preferred Stock shall be paid, whether in cash or in PIK Dividend Shares pursuant to this Section 3.1, pro rata to each Holder of shares of Series A Non-Voting Convertible Preferred Stock based upon the aggregate accrued but unpaid dividends on the shares held by each such Holder. PIK Dividend Shares issued on the applicable Dividend Payment Date shall have an aggregate Dividend Amount on such Dividend Payment Date equal to the total Dividend Amount accrued on such shares as of such Dividend Payment Date minus any portion thereof paid in cash pursuant hereto. Notwithstanding anything contained herein to the contrary, the Corporation shall take all actions necessary for all PIK Dividend Shares to be duly authorized and validly issued, fully paid and nonassessable, and issued free and clear of all liens, mortgages, security interests, pledges, deposits, restrictions or other encumbrances, on each Dividend Payment Date. The Corporation shall update its books and records to reflect the issuance of any PIK Dividend Shares promptly following each Dividend Payment Date, and at the request of any Holder of shares of Series A Non-Voting Convertible Preferred Stock, shall deliver to such Holder a copy of such books and records reflecting the issuance of such PIK Dividend Shares; provided, however, that the failure of the Corporation to comply with the terms of this sentence shall not in any way affect the issuance of such PIK Dividend Shares in accordance with the terms hereof. To the extent that the Corporation determines a shelf registration statement to cover resales of PIK Dividend Shares is required in connection with the issuance of, or for resales of, such PIK Dividend Shares, the Corporation will use its commercially reasonable efforts to file and maintain the effectiveness of such a shelf registration statement until such time as all shares of such stock have been resold thereunder or such shares are eligible for resale pursuant to Rule 144(b)(1) under the Securities Act of 1933, as amended.

3.2 If the Corporation fails to pay in full any dividend on the Series A Non-Voting Convertible Preferred Stock on the applicable Dividend Payment Date, then, commencing on the day immediately following such missed Dividend Payment Date and continuing until all accrued and unpaid dividends have been paid in full, all unpaid dividends shall be cumulative and shall automatically accrue and compound as the PIK Dividend, which shall be added to the liquidation preference of the Series A Non-Voting Convertible Preferred Stock.

3.3 In addition to their rights under Section 3.1 above, Holders shall be entitled to receive, and the Corporation shall pay, dividends on shares of the Series A Non-Voting Convertible Preferred Stock (on an as-if-converted-to-Common-Stock basis, without regard to the Beneficial Ownership Limitation) equal to and in the same form, and in the same manner, as dividends (other than dividends on shares of the Common Stock payable in the form of Common Stock) actually paid on shares of the Common Stock when, as and if such dividends are paid on shares of the Common Stock. Other than as set forth in the previous sentence, no other dividends shall be paid on shares of Series A Non-Voting Convertible Preferred Stock, and the Corporation shall pay no dividends (other than dividends payable in the form of Common Stock) on shares of the Common Stock unless it simultaneously complies with the previous sentence.

4. Voting Rights.

4.1 Except as otherwise provided herein or as otherwise required by the DGCL, the Series A Non-Voting Convertible Preferred Stock shall have no voting rights. However, as long as any shares of Series A Non-Voting Convertible Preferred Stock are outstanding, the Corporation shall not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series A Non-Voting Convertible Preferred Stock: (i) agree to a any consolidation or merger, consolidation, amalgamation or arrangement to which the Company is a party, any sale or transfer of all or substantially all of the assets of its, or any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property, any recapitalization, reclassification, conversion or otherwise; (ii) alter or change adversely the powers, preferences or rights given to the Series A Non-Voting Convertible Preferred Stock or alter or amend this Certificate of Designation, amend or repeal any provision of, or add any provision to, the Certificate of Incorporation or Amended and Restated Bylaws of the Corporation, or file any articles of amendment, certificate of designations, preferences, limitations and relative rights of any series of Preferred Stock, if such action would adversely alter or change the preferences, rights, privileges or powers of, or restrictions provided for the benefit of the Series A Non-Voting Convertible Preferred Stock, regardless of whether any of the foregoing actions shall be by means of amendment to the Certificate of Incorporation or by merger, consolidation, recapitalization, reclassification, conversion or otherwise, (iii) issue further shares of Series A Non-Voting Convertible Preferred Stock or increase or decrease (other than by conversion) the number of authorized shares of Series A Non-Voting Convertible Preferred Stock; (iv) enter into any agreement with respect to any of the foregoing; (v) increase or decrease the size of the Company’s Board of Directors from five (5); or (vi) incur additional indebtedness other than presently outstanding indebtedness. Holders of shares of Common Stock acquired upon the conversion of shares of Series A Non-Voting Convertible Preferred Stock shall be entitled to the same voting rights as each other holder of Common Stock.

4.2 Any vote required or permitted under Section 4.1 may be taken at a meeting of the Holders or through the execution of an action by written consent in lieu of such meeting, provided that the consent is executed by Holders representing a majority of the outstanding shares of Series A Non-Voting Convertible Preferred Stock.

5. Rank; Liquidation.

5.1 The Series A Non-Voting Convertible Preferred Stock shall rank on parity with the Common Stock as to distributions of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntarily or involuntarily.

5.2 Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a “Liquidation”), each Holder shall be entitled to receive out of the assets, whether capital or surplus, of the Corporation before any payment shall be made to the holders of Common Stock by reason of their ownership thereof, an amount per share equal to the greater of (i) the applicable purchase price per share of Preferred Stock originally paid by the Holder, plus any dividends declared but unpaid thereon, or (ii) the same amount that a holder of Common Stock would receive if the Series A Non-Voting Convertible Preferred Stock were fully converted (disregarding for such purpose any Beneficial Ownership Limitation) to Common Stock,. If, upon any such Liquidation, the assets of the Corporation shall be insufficient to pay the Holders of shares of the Series A Non-Voting Convertible Preferred Stock the amount required under the preceding sentence, then all remaining assets of the Corporation shall be distributed ratably to the Holders and the holders of Common Stock in accordance with the respective amounts that would be payable on all such securities if all amounts payable thereon were paid in full. For the avoidance of any doubt, a Fundamental Transaction (as defined below) shall not be deemed a Liquidation unless the Corporation expressly declares that such Fundamental Transaction shall be treated as if it were a Liquidation.

6. Conversion.

6.1 Conversion at Option of Holder. Subject to Section 6.3, each share of Series A Non-Voting Convertible Preferred Stock then outstanding shall be convertible, at any time and from time to time, at the option of the Holder thereof, into a number of shares of Common Stock equal to the Conversion Ratio, subject to the Beneficial Ownership Limitation (each, an “Optional Conversion”). Holders shall effect conversions by providing the Corporation with the form of conversion notice attached hereto as Annex A (a “Notice of Conversion”), duly completed and executed. Provided the Corporation’s transfer agent is participating in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer program, the Notice of Conversion may specify, at the Holder’s election, whether the applicable Conversion Shares shall be credited to the account of the Holder’s prime broker with DTC through its DWAC Delivery. The date on which an Optional Conversion shall be deemed effective (the “Conversion Date”) shall be the Trading Day that the Notice of Conversion, completed and executed, is sent via email to, and received during regular business hours by, the Corporation; provided, that the original certificate(s) (if any) representing such shares of Series A Non-Voting Convertible Preferred Stock being converted, duly endorsed, and the accompanying Notice of Conversion, are received by the Corporation within two (2) Trading Days thereafter. In all other cases, the Conversion Date shall be defined as the Trading Day on which the original certificate(s) (if any) representing such shares of Series A Non-Voting Convertible Preferred Stock being converted, duly endorsed, and the accompanying Notice of Conversion, are received by the Corporation. The calculations set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error.

6.2 Conversion Ratio. The “Conversion Ratio” for each share of Series A Non-Voting Convertible Preferred Stock shall be three (3) shares of Common Stock issuable upon the conversion (the “Conversion”) of each share of Series A Non-Voting Convertible Preferred Stock, subject to adjustment as provided herein.

6.3 Beneficial Ownership Limitation. The Company shall not effect conversion of any share of Series A Non-Voting Convertible Preferred Stock, and a Holder shall not have the right to convert any portion of the Series A Non-Voting Convertible Preferred Stock, pursuant to the terms and conditions of this Certificate of Designations, and any such conversion shall be null and void and treated as if never made, to the extent that after giving effect to such conversion, such Holder (or any of such Holder’s affiliates or any other Person who would be a beneficial owner of Common Stock beneficially owned by the Holder for purposes of Section 13(d) or Section 16 of the Exchange Act and the applicable rules and regulations of the Commission, including any “group” of which the Holder is a member (the foregoing, “Attribution Parties”)) collectively would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the shares of Common Stock outstanding immediately after giving effect to such conversion; provided, however, that in no event shall the Maximum Percentage when combined with the number of shares of Common Stock held by Holder and the other Attribution Parties exceed 19.99%. For purposes of the foregoing sentence, the aggregate number of shares of Common Stock beneficially owned by the Holder and the other Attribution Parties shall include the number of shares of Common Stock held by the Holder and all other Attribution Parties plus the number of shares of Common Stock issuable upon conversion of the Series A Non-Voting Convertible Preferred Stock with respect to which the determination of such sentence is being made, but shall exclude shares of Common Stock which would be issuable upon (A) conversion of the remaining, unconverted Series A Non-Voting Convertible Preferred Stock beneficially owned by the Holder or any of the other Attribution Parties and (B) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company beneficially owned by the Holder or any other Attribution Party subject to a limitation on conversion or exercise analogous to the limitation contained in this Section 6.3. For purposes of this Section 6.3, beneficial ownership shall be calculated in accordance with Section 13(d) of the 1934 Act. If the Company receives a Notice of Conversion from the Holder which would cause beneficial ownership in excess of the Maximum Percentage, the Company shall (i) notify the Holder in writing of the number of shares of Common Stock then outstanding and, to the extent that such Conversion would otherwise cause the Holder’s beneficial ownership, as determined pursuant to this Section 6.3, to exceed the Maximum Percentage, the Holder must notify the Company of a reduced number of Conversion Shares to be acquired pursuant to such Notice of Conversion (the number of shares by which such conversion is reduced, the “Reduction Shares”) and (ii) as soon as reasonably practicable, the Company shall return to the Holder any conversion price paid by the Holder for the Reduction Shares. In the event that the issuance of shares of Common Stock to the Holder upon conversion of the Series A Non-Voting Convertible Preferred Stock results in the Holder and the other Attribution Parties being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of the number of outstanding shares of Common Stock (as determined under Section 13(d) of the 1934 Act), the number of shares so issued by which the Holder’s and the other Attribution Parties’ aggregate beneficial ownership exceeds the Maximum Percentage (the “Excess Shares”) shall be deemed null and void and shall be cancelled ab initio, and the Holder shall not have the power to vote or to transfer the Excess Shares. As soon as reasonably practicable after the issuance of the Excess Shares has been deemed null and void, the Company shall return to the Holder the conversion price paid by the Holder for the Excess Shares. Upon delivery of a written notice to the Company, the Holder may from time to time increase (with such increase not effective until the sixty-first (61st) day after delivery of such notice) or decrease the Maximum Percentage to any other percentage not in excess of 19.99% as specified in such notice; provided that (i) any such increase in the Maximum Percentage will not be effective until the sixty-first (61st) day after such notice is delivered to the Company. For purposes of clarity, the shares of Common Stock issuable pursuant to the terms of this Certificate of Designations in excess of the Maximum Percentage shall not be deemed to be beneficially owned by the Holder for any purpose including for purposes of Section 13(d) or Rule 16a-1(a)(1) of the 1934 Act. To the extent that the limitations contained in this Section 6.3 apply, the determination of whether the Series A Non-Voting Convertible Preferred Stock is convertible (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties) and of which portion of the Series A Non-Voting Convertible Preferred Stock is convertible shall be in the sole discretion of the Holder, and the submission of a Notice of Conversion shall be deemed to be the Holder’s determination of whether the Series A Non-Voting Convertible Preferred Stock is convertible (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties) and of which portion of the Series A Non-Voting Convertible Preferred Stock is convertible, in each case subject to the Beneficial Ownership Limitation, and the Company shall have no obligation to verify or confirm the accuracy of such determination. No prior inability to convert the Series A Non-Voting Convertible Preferred Stock pursuant to this paragraph shall have any effect on the applicability of the provisions of this paragraph with respect to any subsequent determination of convertibility. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 6.3 to the extent necessary to correct this paragraph or any portion of this paragraph which may be defective or inconsistent with the intended beneficial ownership limitation contained in this Section 6.3 or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation contained in this paragraph may not be waived and shall apply to a successor holder of Series A Non-Voting Convertible Preferred Stock.

6.4 Mechanics of Conversion.

6.4.1 Delivery of Certificate or Electronic Issuance. Upon Conversion not later than (i) two (2) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined below) after the applicable Conversion Date, or if the Holder requests the issuance of physical certificate(s), two (2) Trading Days after receipt by the Corporation of the original certificate(s) representing such shares of Series A Non-Voting Convertible Preferred Stock being converted, duly endorsed, and the accompanying Notice of Conversion (the “Share Delivery Date”), the Corporation shall either: (a) deliver, or cause to be delivered, to the converting Holder a physical certificate or certificates representing the number of Conversion Shares being acquired upon the conversion of shares of Series A Non-Voting Convertible Preferred Stock, or (b) in the case of a DWAC Delivery (if so requested by the Holder), electronically transfer such Conversion Shares by crediting the account of the Holder’s prime broker with DTC through its DWAC system. If in the case of any Notice of Conversion such certificate or certificates for the Conversion Shares are not delivered to or as directed by or, in the case of a DWAC Delivery, such shares are not electronically delivered to or as directed by, the applicable Holder by the Share Delivery Date, the applicable Holder shall be entitled to elect to rescind such Notice of Conversion by written notice to the Corporation at any time on or before its receipt of such certificate or certificates for Conversion Shares or electronic receipt of such shares, as applicable, in which event the Corporation shall promptly return to such Holder any original Series A Non-Voting Convertible Preferred Stock certificate delivered to the Corporation and such Holder shall promptly return to the Corporation any Common Stock certificates or otherwise direct the return of any shares of Common Stock delivered to the Holder through the DWAC system, representing the shares of Series A Non-Voting Convertible Preferred Stock unsuccessfully tendered for conversion to the Corporation. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Corporation’s Principal Market with respect to the Common Stock as in effect on the Conversion Date.

6.4.2 Obligation Absolute. Subject to Section 6.3 and subject to Holder’s right to rescind a Notice of Conversion pursuant to Section 6.4.1, the Corporation’s obligation to issue and deliver the Conversion Shares upon conversion of Series A Non-Voting Convertible Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by a Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by such Holder or any other Person of any obligation to the Corporation or any violation or alleged violation of law by such Holder or any other Person, and irrespective of any other circumstance which might otherwise limit such obligation of the Corporation to such Holder in connection with the issuance of such Conversion Shares..

6.4.3 Reservation of Shares Issuable Upon Conversion. The Corporation covenants that at all times it will reserve and keep available out of its authorized and unissued shares of Common Stock for the sole purpose of issuance upon conversion of the Series A Non-Voting Convertible Preferred Stock, free from preemptive rights or any other actual contingent purchase rights of Persons other than the Holders of the Series A Non-Voting Convertible Preferred Stock, not less than such aggregate number of shares of the Common Stock as shall be issuable (taking into account the adjustments of Section 7) upon the conversion of all outstanding shares of Series A Non-Voting Convertible Preferred Stock. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly issued, fully paid and non-assessable and, if the Conversion Shares Registration Statement is then effective under the Securities Act, shall be registered for public resale in accordance with such Conversion Shares Registration Statement (subject to such Holder’s compliance with its obligations under the Purchase Agreement and applicable securities laws).

6.4.4 Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series A Non-Voting Convertible Preferred Stock, no certificates or scrip for any such fractional shares shall be issued and no cash shall be paid for any such fractional shares. Any fractional shares of Common Stock that a Holder of Series A Non-Voting Convertible Preferred Stock would otherwise be entitled to receive shall be aggregated with all fractional shares of Common Stock issuable to such Holder and any remaining fractional shares shall be rounded up to the nearest whole share. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series A Non-Voting Convertible Preferred Stock the Holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable upon such conversion.

6.4.5 Transfer Taxes. The issuance of certificates for shares of the Common Stock upon conversion of the Series A Non-Voting Convertible Preferred Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificates, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the registered Holder(s) of such shares of Series A Non-Voting Convertible Preferred Stock and the Corporation shall not be required to issue or deliver such certificates unless or until the Person or Persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid.

6.5 Status as Stockholder. Upon each Conversion Date, (i) the shares of Series A Non-Voting Convertible Preferred Stock being converted shall be deemed converted into shares of Common Stock and (ii) the Holder’s rights as a holder of such converted shares of Series A Non-Voting Convertible Preferred Stock shall cease and terminate, excepting only the right to receive certificates for such shares of Common Stock and to any remedies provided herein or otherwise available at law or in equity to such Holder because of a failure by the Corporation to comply with the terms of this Certificate of Designation. In all cases, the Holder shall retain all of its rights and remedies for the Corporation’s failure to convert Series A Non-Voting Convertible Preferred Stock.

7. Certain Adjustments.

7.1 Stock Dividends and Stock Splits. If the Corporation, at any time while this Series A Non-Voting Convertible Preferred Stock is outstanding: (A) pays a stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock or in other securities of the Corporation (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Corporation upon conversion of this Series A Non-Voting Convertible Preferred Stock) with respect to the then outstanding shares of Common Stock; (B) subdivides outstanding shares of Common Stock into a larger number of shares; or (C) combines (including by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then the Conversion Ratio shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding any treasury shares of the Corporation) outstanding immediately after such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately before such event (excluding any treasury shares of the Corporation). Any adjustment made pursuant to this Section 7.1 shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision or combination.

7.2 Fundamental Transaction. If, at any time while this Series A Non-Voting Convertible Preferred Stock is outstanding, (A) the Corporation effects any merger or consolidation of the Corporation with or into another Person or any stock sale to, or other business combination (including, without limitation, a reorganization, recapitalization, spin-off, share exchange or scheme of arrangement) with or into another Person (other than such a transaction in which the Corporation is the surviving or continuing entity and its Common Stock is not exchanged for or converted into other securities, cash or property), (B) the Corporation effects any sale, lease, transfer or exclusive license of all or substantially all of its assets in one transaction or a series of related transactions, (C) any tender offer or exchange offer (whether by the Corporation or another Person) is completed pursuant to which more than 50% of the voting power of the common equity not held by the Corporation or such Person is exchanged for or converted into other securities, cash or property, or (D) the Corporation effects any reclassification of the Common Stock or any compulsory share exchange pursuant (other than as a result of a dividend, subdivision or combination covered by Section 7.1) to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (in any such case, a “Fundamental Transaction”), then, upon any subsequent conversion of this Series A Non-Voting Convertible Preferred Stock the Holders shall have the right to receive, in lieu of the right to receive Conversion Shares, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such Fundamental Transaction, the same kind and amount of securities, cash or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of one share of Common Stock (the “Alternate Consideration”). For purposes of any such subsequent conversion, the determination of the Conversion Ratio shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Corporation shall adjust the Conversion Ratio in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holders shall be given the same choice as to the Alternate Consideration it receives upon any conversion of this Series A Non-Voting Convertible Preferred Stock following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Corporation or surviving entity in such Fundamental Transaction shall file a new certificate of designations with the same terms and conditions and issue to the Holders new preferred stock consistent with the foregoing provisions and evidencing the Holders’ right to convert such preferred stock into Alternate Consideration. The terms of any agreement to which the Corporation is a party and pursuant to which a Fundamental Transaction is effected shall include terms requiring any such successor or surviving entity to comply with the provisions of this Section 7.2 and insuring that this Series A Non-Voting Convertible Preferred Stock (or any such replacement security) will be similarly adjusted upon any subsequent transaction analogous to a Fundamental Transaction. The Corporation shall cause to be delivered to each Holder, at its last address as it shall appear upon the stock books of the Corporation, written notice of any Fundamental Transaction at least 10 calendar days prior to the date on which such Fundamental Transaction is expected to become effective or close.

7.3 Calculations. All calculations under this Section 7 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 7, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding any treasury shares of the Corporation) issued and outstanding.

8. Redemption. The shares of Series A Non-Voting Convertible Preferred Stock shall not be redeemable; provided, however, that the foregoing shall not limit the ability of the Corporation to purchase or otherwise deal in such shares to the extent otherwise permitted hereby and by law.

9. Transfer. A Holder may transfer any shares of Series A Non-Voting Convertible Preferred Stock together with the accompanying rights set forth herein, held by such holder without the consent of the Corporation; provided that such transfer is in compliance with applicable securities laws. The Corporation shall in good faith (a) do and perform, or cause to be done and performed, all such further acts and things, and (b) execute and deliver all such other agreements, certificates, instruments and documents, in each case, as any holder of Series A Non-Voting Convertible Preferred Stock may reasonably request in order to carry out the intent and accomplish the purposes of this Section 9. The transferee of any shares of Series A Non-Voting Convertible Preferred Stock shall be subject to the Beneficial Ownership Limitation applicable to the transferor as of the time of such transfer.

10. Series A Non-Voting Convertible Preferred Stock Register. The Corporation shall maintain at its principal executive offices (or such other office or agency of the Corporation as it may designate by notice to the Holders in accordance with Section 11), a register for the Series A Non-Voting Convertible Preferred Stock, in which the Corporation shall record (a) the name, address, and electronic mail address of each holder in whose name the shares of Series A Non-Voting Convertible Preferred Stock have been issued and (b) the name, address, and electronic mail address of each transferee of any shares of Series A Non-Voting Convertible Preferred Stock. The Corporation may deem and treat the registered Holder of shares of Series A Non-Voting Convertible Preferred Stock as the absolute owner thereof for the purpose of any conversion thereof and for all other purposes.

11. Notices. Any notice required or permitted by the provisions of this Certificate of Designation to be given to a Holder of shares of Series A Non-Voting Convertible Preferred Stock shall be mailed, postage prepaid, to the post office address last shown on the records of the Corporation, or given by electronic communication in compliance with the provisions of the DGCL, and shall be deemed sent upon such mailing or electronic transmission.

12. Book-Entry; Certificates. The Series A Non-Voting Convertible Preferred Stock will be issued in book-entry form; provided that, if a Holder requests that such Holder’s shares of Series A Non-Voting Convertible Preferred Stock be issued in certificated form, the Corporation will instead issue a stock certificate to such Holder representing such Holder’s shares of Series A Non-Voting Convertible Preferred Stock. To the extent that any shares of Series A Non-Voting Convertible Preferred Stock are issued in book-entry form, references herein to “certificates” shall instead refer to the book-entry notation relating to such shares.

13. Waiver. Any waiver by the Corporation or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation or a waiver by any other Holders, other than as expressly set forth herein. The failure of the Corporation or a Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designation. Any waiver by the Corporation or a Holder must be in writing. Notwithstanding any provision in this Certificate of Designation to the contrary, any provision contained herein and any right of the Holders of Series A Non-Voting Convertible Preferred Stock granted hereunder may be waived as to all shares of Series A Non-Voting Convertible Preferred Stock (and the Holders thereof) upon the written consent of the Holders of not less than a majority of the shares of Series A Non-Voting Convertible Preferred Stock then outstanding, provided, however, that the Beneficial Ownership Limitation applicable to a Holder, and any provisions contained herein that are related to such Beneficial Ownership Limitation, cannot be modified, waived or terminated without the consent of such Holder, provided further, that any proposed waiver that would, by its terms, have a disproportionate and materially adverse effect on any Holder shall require the consent of such Holder(s).

14. Severability. Whenever possible, each provision hereof shall be interpreted in a manner as to be effective and valid under applicable law, but if any provision hereof is held to be prohibited by or invalid under applicable law, then such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions hereof.

15. Status of Converted Series A Non-Voting Convertible Preferred Stock. If any shares of Series A Non-Voting Convertible Preferred Stock shall be converted by the Corporation, such shares shall, to the fullest extent permitted by applicable law, be retired and cancelled upon such acquisition, and shall not be reissued as a share of Series A Non-Voting Convertible Preferred Stock. Any share of Series A Non-Voting Convertible Preferred Stock so acquired shall, upon its retirement and cancellation, and upon the taking of any action required by applicable law, resume the status of authorized but unissued shares of preferred stock and shall no longer be designated as Series A Non-Voting Convertible Preferred Stock.

16. Headings. The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not be deemed to limit or affect any of the provisions hereof.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, Eyenovia, Inc. has caused this Certificate of Designation of Preferences, Rights and Limitations of Series A Non-Voting Convertible Preferred Stock to be duly executed by its Chief Executive Officer on June 17, 2025.

| EYENOVIA, INC. | ||

| By: | /s/ Michael M. Rowe | |

| Name: | Michael M. Rowe | |

| Title: | Chief Executive Officer | |

ANNEX A

NOTICE OF CONVERSION

(TO BE EXECUTED BY THE REGISTERED HOLDER IN ORDER TO CONVERT SHARES OF SERIES A NON-VOTING CONVERTIBLE PREFERRED STOCK)

The undersigned Holder hereby irrevocably elects to convert the number of shares of Series A Non-Voting Convertible Preferred Stock indicated below, represented in book-entry form, into shares of common stock, par value $0.0001 per share (the “Common Stock”), of Eyenovia, Inc., a Delaware corporation (the “Corporation”), as of the date written below. If securities are to be issued in the name of a Person other than the undersigned, the undersigned will pay all transfer taxes payable with respect thereto. Capitalized terms utilized but not defined herein shall have the meaning ascribed to such terms in that certain Certificate of Designation of Preferences, Rights and Limitations of Series A Non-Voting Convertible Preferred Stock (the “Certificate of Designation”) filed by the Corporation with the Secretary of State of the State of Delaware on June 17, 2025.

As of the date hereof, the number of shares of Common Stock beneficially owned by the undersigned Holder (together with such Holder’s Attribution Parties), including the number of shares of Common Stock issuable upon conversion of the Series A Non-Voting Convertible Preferred Stock subject to this Notice of Conversion, but excluding the number of shares of Common Stock which are issuable upon (A) conversion of the remaining, unconverted Series A Non-Voting Convertible Preferred Stock beneficially owned by such Holder or any of its Attribution Parties, and (B) exercise or conversion of the unexercised or unconverted portion of any other securities of the Corporation (including any warrants) beneficially owned by such Holder or any of its Attribution Parties that are subject to a limitation on conversion or exercise similar to the limitation contained in Section 6.4 of the Certificate of Designation, is _____. For purposes hereof, beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the applicable regulations of the Commission. In addition, for purposes hereof, “group” has the meaning set forth in Section 13(d) of the Exchange Act and the applicable regulations of the Commission.

CONVERSION CALCULATIONS:

| Date to Effect Conversion: |

| Number of shares of Series A Non-Voting Convertible Preferred Stock owned prior to Conversion: |

| Number of shares of Series A Non-Voting Convertible Preferred Stock to be Converted: |

| Number of shares of Common Stock to be Issued: |

| Address for delivery of physical certificates: |

For DWAC Delivery, please provide the following:

Broker No.: ________________

Account No.: _______________

[HOLDER]

| By: | ||

| Name: | ||

| Title: |

Exhibit 4.1

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL TO THE HOLDER (IF REQUESTED BY THE COMPANY), IN A FORM REASONABLY ACCEPTABLE TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD OR ELIGIBLE TO BE SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT.

Eyenovia, Inc.

Warrant To Purchase Common Stock

Warrant No.:

Date of Issuance: [________], 2025 (“Issuance Date”)

Eyenovia, Inc., a Delaware corporation (the “Company”), hereby certifies that, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, [_________________], the registered holder hereof or its permitted assigns (the “Holder”), is entitled, subject to the terms set forth below, to purchase from the Company, at the Exercise Price (as defined below) up to [_________________] (subject to adjustment as provided herein) fully paid and non-assessable shares of Common Stock (as defined below) (the “Warrant Shares”), at any time or times following the day that is six months and one day after the Issuance Date, but not after 11:59 p.m., New York time, on the Expiration Date (as defined below). The period during which this Warrant is exercisable is referred to herein as the “Exercise Period.”

Except as otherwise defined herein, capitalized terms in this Warrant shall have the meanings set forth in Section 12. This Warrant is issued pursuant to that certain Securities Purchase Agreement, dated as of June 17, 2025, by and between the Company and the Holder (the “Securities Purchase Agreement”).

1. EXERCISE OF WARRANT.

(a) Mechanics of Exercise. Subject to the terms and conditions hereof (including, without limitation, the limitations set forth in Section 1(e)), this Warrant may be exercised by the Holder on any day during the Exercise Period (an “Exercise Date”), in whole or in part, by delivery (whether via facsimile or otherwise) of a written notice, in the form attached hereto as Exhibit A (the “Exercise Notice”), of the Holder’s election to exercise this Warrant. Within one (1) Trading Day following an exercise of this Warrant as aforesaid, the Holder shall deliver payment to the Company of an amount equal to the Exercise Price in effect on the date of such exercise multiplied by the number of Warrant Shares as to which this Warrant was so exercised (the “Aggregate Exercise Price”) in cash or via wire transfer of immediately available funds if the Holder did not notify the Company in such Exercise Notice that such exercise was made pursuant to a Cashless Exercise (as defined in Section 1(c)). The Holder shall not be required to deliver the original of this Warrant in order to effect an exercise hereunder. Execution and delivery of an Exercise Notice with respect to less than all of the Warrant Shares shall have the same effect as cancellation of the original of this Warrant and issuance of a new Warrant evidencing the right to purchase the remaining number of Warrant Shares. Execution and delivery of an Exercise Notice for all of the then-remaining Warrant Shares shall have the same effect as cancellation of the original of this Warrant after delivery of the Warrant Shares in accordance with the terms hereof. On the date on which the Company has received an Exercise Notice, the Company shall transmit by facsimile or electronic mail an acknowledgment of confirmation of receipt of such Exercise Notice, in the form attached hereto as Exhibit B, to the Holder and the Company’s transfer agent (the “Transfer Agent”), which confirmation shall constitute an instruction to the Transfer Agent to process such Exercise Notice in accordance with the terms herein.

(b) Exercise Price. For purposes of this Warrant, “Exercise Price” means $3.25, subject to adjustment as provided herein.

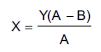

(c) Cashless Exercise. This Warrant may also be exercised, in whole or in part, at such time by means of a “cashless exercise” in which the Holder shall be entitled to receive a number of Warrant Shares for the deemed surrender of the Warrant in whole or in part equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

(A) = as applicable: (i) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise if such Notice of Exercise is (1) both executed and delivered pursuant to Section 1(a) hereof on a day that is not a Trading Day or (2) both executed and delivered pursuant to Section 1(a) hereof on a Trading Day prior to the opening of “regular trading hours” (as defined in Rule 600(b) of Regulation NMS promulgated under the federal securities laws) on such Trading Day, or (ii) the VWAP on the date of the applicable Notice of Exercise if the date of such Notice of Exercise is a Trading Day and such Notice of Exercise is both executed and delivered pursuant to Section 1(a) hereof after the close of “regular trading hours” on such Trading Day;

(B) = the Exercise Price of this Warrant, as adjusted hereunder; and

(X) = the number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise.

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Holders of a majority in interest of the Securities then outstanding and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

(d) Disputes. In the case of a dispute as to the determination of the Exercise Price or the arithmetic calculation of the number of Warrant Shares to be issued pursuant to the terms hereof, the Company shall promptly cause the Transfer Agent to issue to the Holder the number of Warrant Shares that are not disputed and resolve such dispute in accordance with the procedures documented in the Securities Purchase Agreement.

(e) Limitations on Exercises.