UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 16, 2025

| PureCycle Technologies, Inc. | ||

| (Exact name of registrant as specified in its charter) |

| Delaware | 001-40234 | 86-2293091 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| 20 North Orange Avenue, Suite 106 Orlando, Florida | 32801 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each which registered |

||

| Common Stock, par value $0.001 per share | PCT | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share | PCTTW | The Nasdaq Stock Market LLC | ||

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant | PCTTU | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

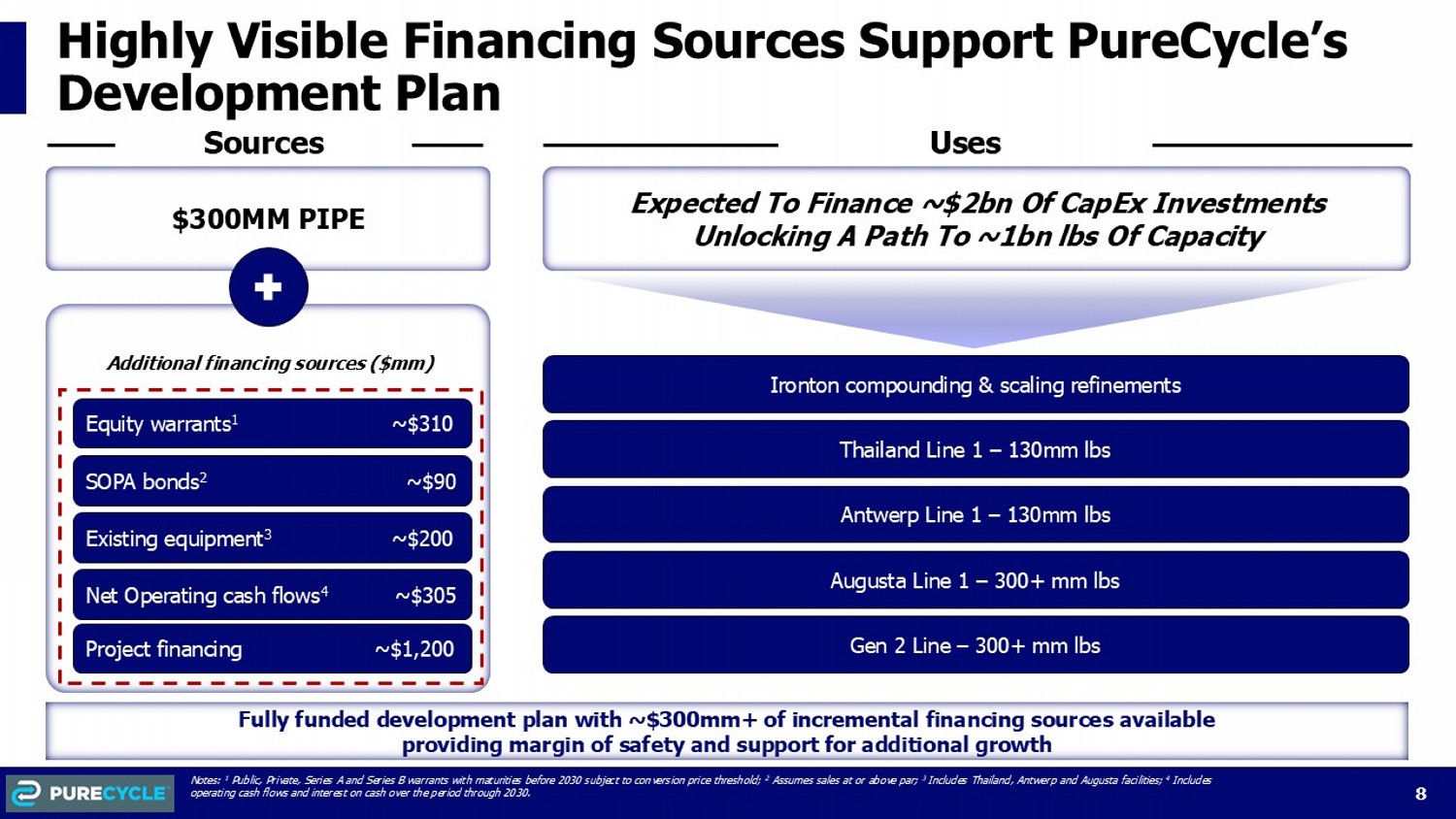

Subscription Agreements

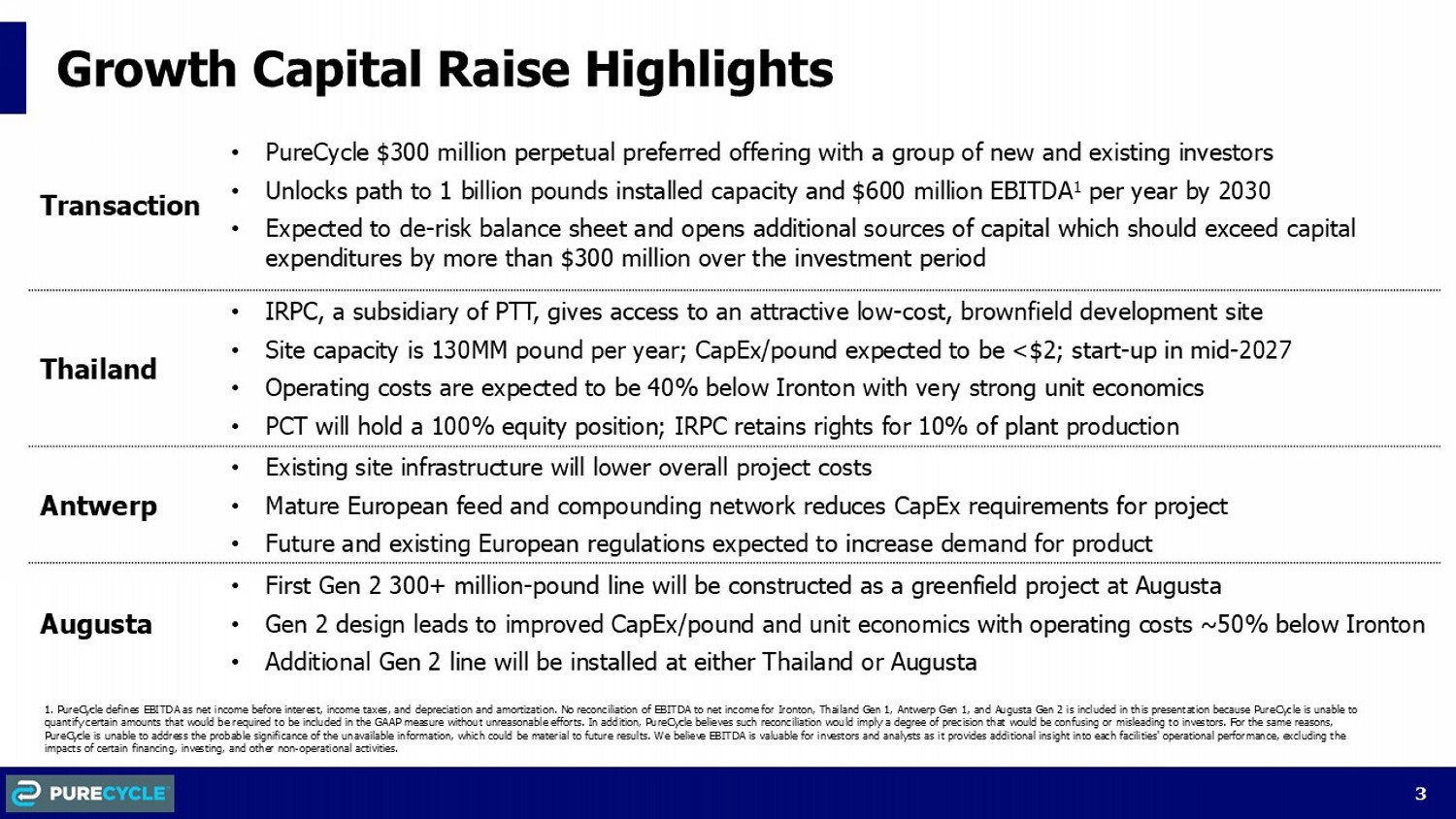

On June 16, 2025, PureCycle Technologies, Inc. (the “Company”) entered into binding subscription agreements (the “Subscription Agreements”) with certain investors (collectively, the “Investors”), including investment entities affiliated with The Henry Crown Company, Daniel Gibson, Sylebra Capital Management and Samlyn Capital, LLC, pursuant to which the Company agreed to sell to the Investors, in a private placement transaction (the “Offering”), an aggregate of 300,000 shares of the Company’s Series B Convertible Perpetual Preferred Stock, par value $0.001 per share (“Convertible Preferred Shares”), at an initial issue price of $1,000 per share (the “Initial Issue Price”). The Offering is expected to close on June 20, 2025 (the “Closing Date”). The gross proceeds to the Company from the Offering are expected to be approximately $300.0 million before deducting placement agent fees and other estimated offering expenses.

Certificate of Designations

The Convertible Preferred Shares will be issued pursuant to a Certificate of Designations (the “Certificate of Designations”), expected to be filed on the Closing Date with the Secretary of State of the State of Delaware, establishing the preferences, limitations and relative rights of the Convertible Preferred Shares. The Certificate of Designations will amend the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), and will be effective immediately on filing. The Certificate of Designations is expected to include the following terms:

Ranking

The Convertible Preferred Shares rank, with respect to dividend rights and rights upon any liquidation, dissolution or winding up of the Company (a “Liquidation Event”): (a) senior to the Company’s common stock, par value $0.001 per share (“Common Stock”), and other capital stock of the Company the terms of which do not expressly provide that such class or series ranks senior to or on a parity with the Convertible Preferred Shares (other than the Company’s Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”)) as to divided rights and rights upon Liquidation Events; (b) on a parity with any other class or series of capital stock of the Company the terms of which expressly provide that such class or series ranks on a parity with the Convertible Preferred Shares as to dividend rights and rights upon Liquidation Events; (c) junior to the Series A Preferred Stock and any other class or series of capital stock of the Company, the terms of which expressly provide that such class or series ranks senior to the Series B Preferred Stock as to dividend rights and rights upon Liquidation Events; and (d) junior to all existing and future indebtedness of the Company.

Conversion

A holder of the Convertible Preferred Shares may elect to convert such holder’s Convertible Preferred Shares into shares of Common Stock, at any time. In addition, on or after the dividend payment date following the fourth anniversary of the Closing Date, if at any time the closing price of the Common Stock has been at least 175% of the applicable conversion price for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading days ending on the trading day immediately preceding the trading day on which a conversion notice is given (a “Conversion Notice”), the Company may elect to convert all of the Convertible Preferred Shares into a number of shares of Common Stock equal to the Accrued Value (as defined below) divided by the conversion price on the date of the Conversion Notice, unless modified pursuant to a Make-Whole Change (as defined below). The Convertible Preferred Shares are convertible into Common Stock at an initial conversion price equal to $14.02, which represents a 30% premium to the 10-day volume weighted average price of the Common Stock on the trading day immediately prior to the execution of the Subscription Agreements.

Voting Rights

Except as may be expressly required by the Delaware General Corporation Law, holders of the Convertible Preferred Shares are not entitled to any voting rights.

Dividends

Holders of the Convertible Preferred Shares are entitled to receive cumulative dividends at a rate equal to seven (7)% per annum, payable in kind or in cash at the Company’s option, which dividends, if paid in kind, will be capitalized to the Accrued Value.

Liquidation Preference

In the event of any Liquidation Event, each holder of the Convertible Preferred Shares will be entitled to receive a per share amount equal to the greater of (i) the per share purchase price of the Convertible Preferred Shares (as adjusted for any in kind dividends paid thereon) plus all accrued and unpaid dividends thereon (the “Accrued Value”) and (ii) the amount that such Convertible Preferred Shares would have been entitled to receive if they had converted into Common Stock immediately prior to such Liquidation Event.

Protective Provisions

The Company may not take any of the following actions unless otherwise approved by the holders of a majority of the then-outstanding Convertible Preferred Shares: (a) amend or waive any provision in the Certificate of Incorporation in any way that materially, adversely and disproportionately affects the rights, preferences, and privileges or power of the Convertible Preferred Shares; (b) increase the authorized number of shares of Series A Preferred Stock unless such increase is required pursuant to the existing terms of the Certificate of Designations of Series A Preferred Stock, as modified by the waivers entered into by all of the holders of the Series A Preferred Stock on September 17, 2024; (c) other than in connection with the Series A Preferred Stock, issue any equity securities of the Company containing rights, preferences or privileges with respect to distributions or liquidation superior to or on parity with the Convertible Preferred Shares; or (d) repurchase or redeem any issued and outstanding Common Stock other than any such repurchases or redemptions (i) undertaken in connection with any equity incentive agreements approved by the Company’s board of directors, (ii) undertaken to satisfy obligations of the Company existing on the date of the Certificate of Designations or (iii) that do not result in payments by the Company in an aggregate amount, together with all prior payments made pursuant to this clause (iii), in excess of $50.0 million.

Holder Redemption Rights

Except in the case of a change in control, the Convertible Preferred Shares may not be redeemed or repurchased upon the election of the holders of the Convertible Preferred Shares.

Change in Control

Upon certain change in control events involving the Company, (i) the holders of the Convertible Preferred Shares will have the right to require the Company to redeem any or all of their Convertible Preferred Shares and (ii) the Company will have the option to redeem all (but not less than all) of the then-outstanding Convertible Preferred Shares, in each case, for a cash amount equal to the Accrued Value, on a per share basis. In connection with the Company delivering a Conversion Notice or in connection with a change in control, the Company will, in certain circumstances, be required to increase the conversion rate for shares of Convertible Preferred Shares converting in connection therewith (a “Make-Whole Change”). Such Make-Whole Change will be calculated using a make-whole table calculated over a 10-year period.

Registration Rights

As part of the Subscription Agreements, the Company is required to, among other things, prepare and file a registration statement (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), covering the resale of the shares of Common Stock issuable upon conversion of the Convertible Preferred Shares. The Company is required to use commercially reasonable efforts to have such Registration Statement filed within 30 days of the Closing Date and have such Registration Statement declared effective by the Commission no later than 60 calendar days after the Closing Date (or 90 calendar days in the event of a “full review” by the Commission).

Amendment to the Credit Agreement

The Company is also party to a Revolving Credit Facility pursuant to a credit agreement (as amended from time to time, the “Revolving Credit Agreement”) dated as of March 15, 2023, with PureCycle Technologies Holdings Corp. and PureCycle Technologies, LLC and PureCycle Augusta, LLC (collectively, the “Guarantors”), Sylebra Capital Partners Master Fund, LTD, Sylebra Capital Parc Master Fund, and Sylebra Capital Menlo Master Fund (collectively, the “Lenders”), and Madison Pacific Trust Limited (the “Administrative Agent” and the “Security Agent”). In conjunction with the Offering, on June 16, 2025, the Company, the Guarantors, the Administrative Agent, the Security Agent and the Lenders executed a Ninth Amendment to the Credit Agreement (“Ninth Amendment to Credit Agreement”) to, among other things, (i) permit the Offering and (ii) amend the indebtedness covenant to add a basket for unsecured indebtedness of the Company in an aggregate principal amount not to exceed $50.0 million.

The foregoing summaries of the Subscription Agreements and the Ninth Amendment to Credit Agreement are subject to, and qualified in their entirety by, the text of the form of Subscription Agreement and the Ninth Amendment to Credit Agreement, as applicable, which are filed as Exhibits 10.1 and 10.2, respectively, hereto and incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth under Item 1.01 is incorporated by reference into this Item 3.02. The Company offered and sold the Convertible Preferred Shares in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act as a transaction between an issuer and sophisticated investors not involving a public offering, and for resale by certain initial purchasers to persons reasonably believed by them to be qualified institutional buyers pursuant to the exemption from registration provided by Rule 144A under the Securities Act.

The shares of the Common Stock issuable upon conversion of the Convertible Preferred Shares, if any, have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. To the extent that any shares of Common Stock are issued upon conversion of the Convertible Preferred Shares, they will be issued in transactions anticipated to be exempt from registration under the Securities Act by virtue of Section 3(a)(9) thereof because no commission or other remuneration is expected to be paid in connection with conversion of the Convertible Preferred Shares and any resulting issuance of shares of Common Stock.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors’ Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 16, 2025, the Company entered into an employment agreement with Dustin Olson, the Company’s Chief Executive Officer (the “Olson Employment Agreement”). The Olson Employment Agreement is effective as of June 16, 2025 and has an initial term through June 15, 2028 and contains a provision for automatic extensions for one-year periods thereafter, unless either party provides at least 90 days’ written notice of non-renewal in accordance with the terms thereof.

Consistent with his current compensation, the Olson Employment Agreement provides that Mr. Olson is entitled to receive an annual base salary of $773,000, subject to increase as may be approved by the Board of Directors of the Company (the “Board”). The Olson Employment Agreement also provides that Mr. Olson will be eligible for an annual cash incentive award determined based upon achievement with respect to performance criteria established by the Compensation Committee of the Board (the “Compensation Committee”) and approved by the Board. Mr. Olson’s target annual cash incentive opportunity is 100% of his base salary, subject to potential increase by the Board. Mr. Olson is also eligible to participate in the Company’s 2021 Equity and Incentive Compensation Plan or any successor plan (the “Equity Plan”), subject to the terms of the Equity Plan, as determined by the Board and as recommended by the Compensation Committee.

The Olson Employment Agreement also provides that on or as soon as reasonably practicable following the effective date of the Olson Employment Agreement, the Company will grant him an award of 200,000 fully vested shares of common stock of the Company under the Equity Plan.

If the Company terminates Mr. Olson’s employment without “cause” or Mr. Olson terminates his employment for “good reason” other than within 12 months following a “change in control” (as these terms are defined in the Olson Employment Agreement), or if Mr. Olson’s employment is terminated due to his death or “disability,” Mr. Olson will be entitled to the following (in addition to certain earned and accrued obligations):

| · | payment of an amount equal to 150% of his base salary over a 12-month period; |

| · | a lump sum cash payment equal to 100% of his target bonus for the year of termination; |

| · | vesting of a portion of the then-outstanding and unvested restricted stock units (“RSUs”) and stock options granted to Mr. Olson, with such pro-rata portion determined based on the number of days that would have elapsed in the applicable vesting period or performance period on the date that is 12 months after the date of termination (with respect to performance-based RSUs (“PRSUs”), based on actual achievement of the applicable performance goals over the full performance period as determined by the Compensation Committee); and |

| · | Subsidized COBRA coverage based on the cost-sharing applicable to Mr. Olson during his employment (or an economic equivalent) for up to 18 months following termination, subject to the restrictions as set forth in the Olson Employment Agreement (the “COBRA Benefit”). |

If the Company terminates Mr. Olson’s employment without “cause” or Mr. Olson terminates his employment for “good reason” within 12 months following a “change in control,” Mr. Olson will be entitled to the following (in addition to certain earned and accrued obligations):

| · | a lump sum payment equal to 300% of his base salary; |

| · | a lump sum cash payment equal to 200% of his target bonus for the year of termination; |

| · | full vesting of his outstanding RSUs and stock options (with any applicable performance goals for PRSUs that have not yet been scored deemed to be attained at the target level); and |

| · | the COBRA Benefit. |

The severance benefits payable in connection with a termination without “cause” or a termination for “good reason” are generally subject to Mr. Olson’s execution of a customary release of claims against the Company. The Olson Employment Agreement provides that Mr. Olson will enter into a customary restrictive covenants agreement with the Company.

The foregoing description of the Olson Employment is qualified in its entirety by reference to the full text thereof, which is attached hereto as Exhibit 10.3 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

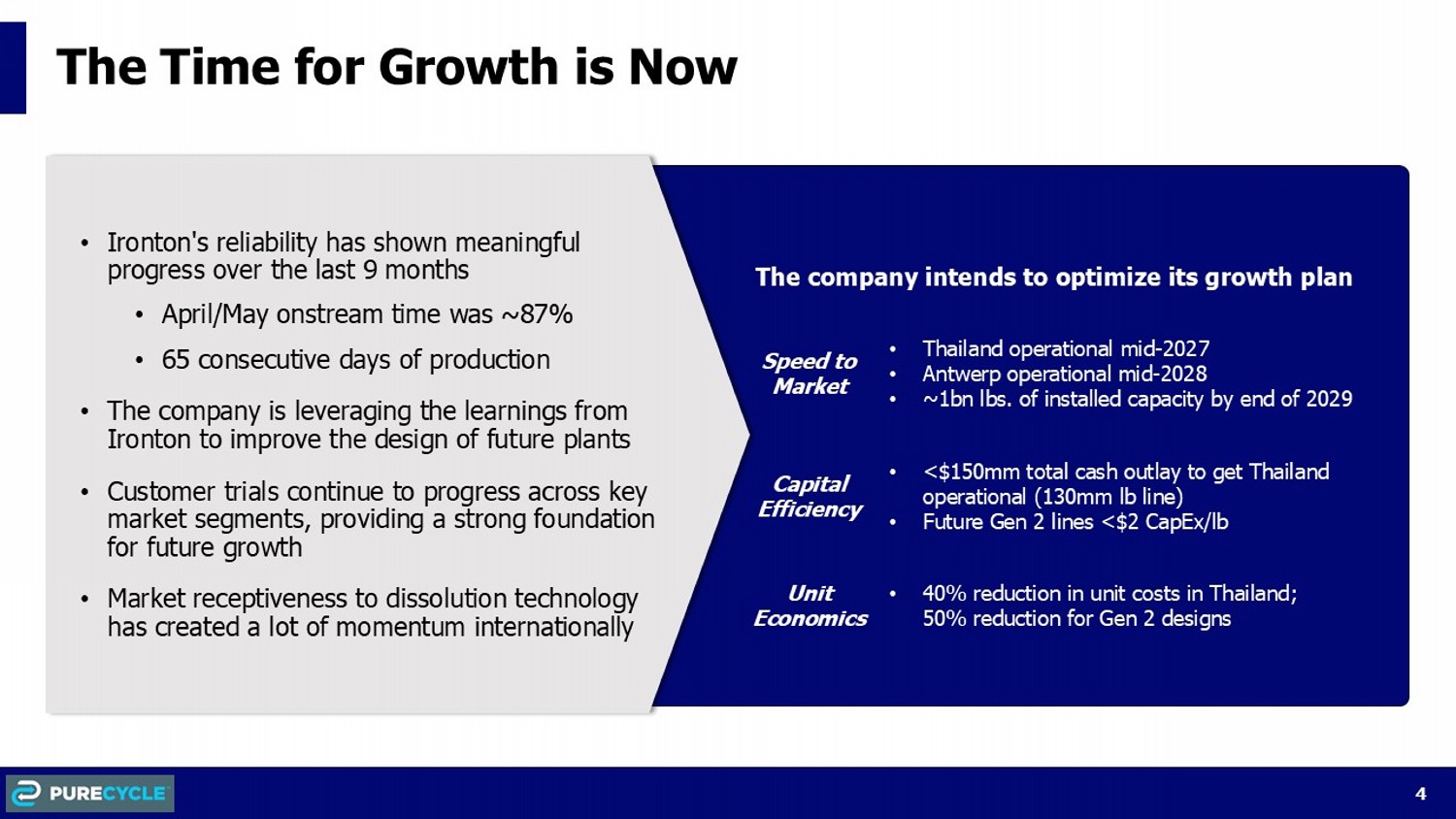

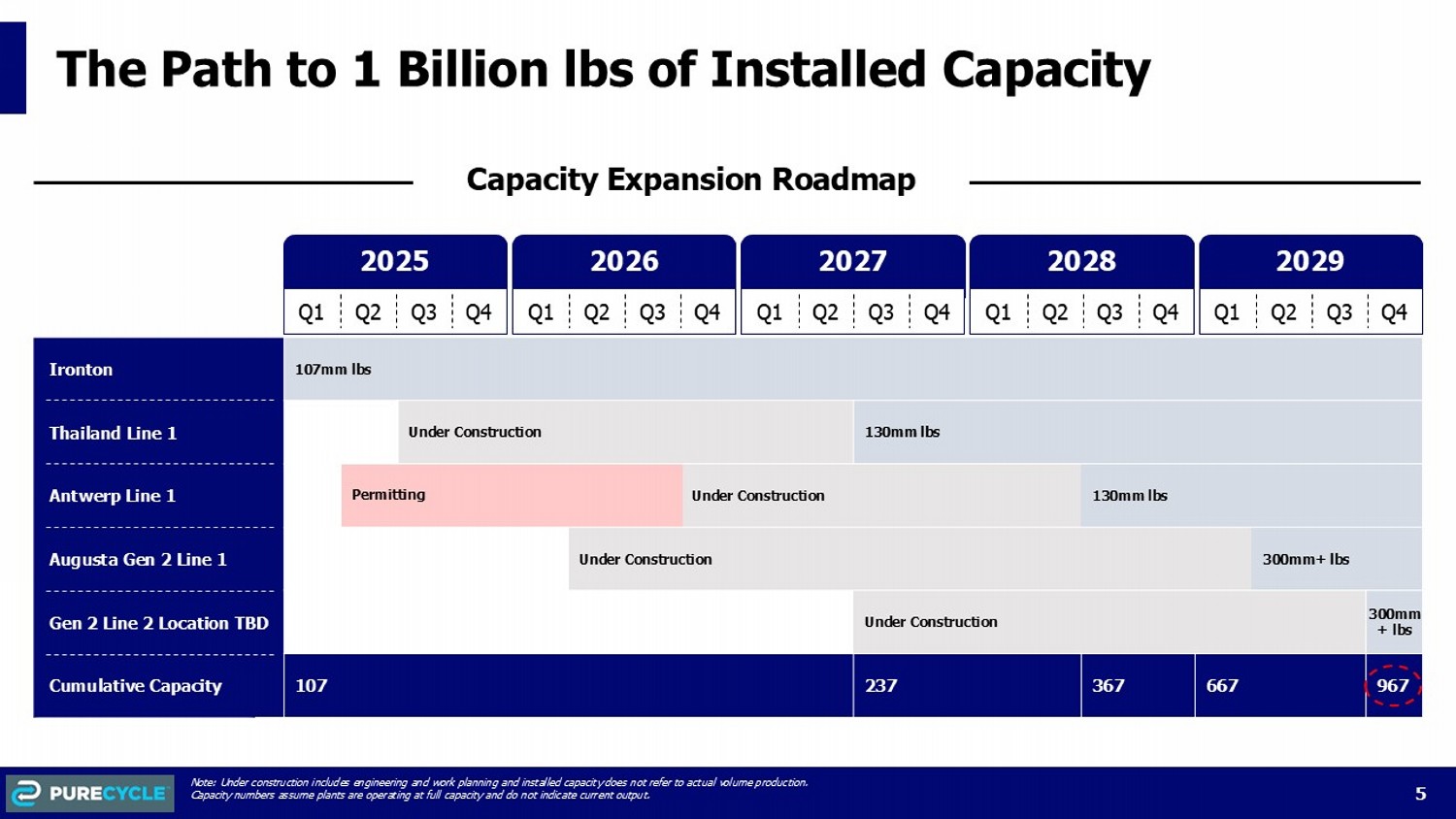

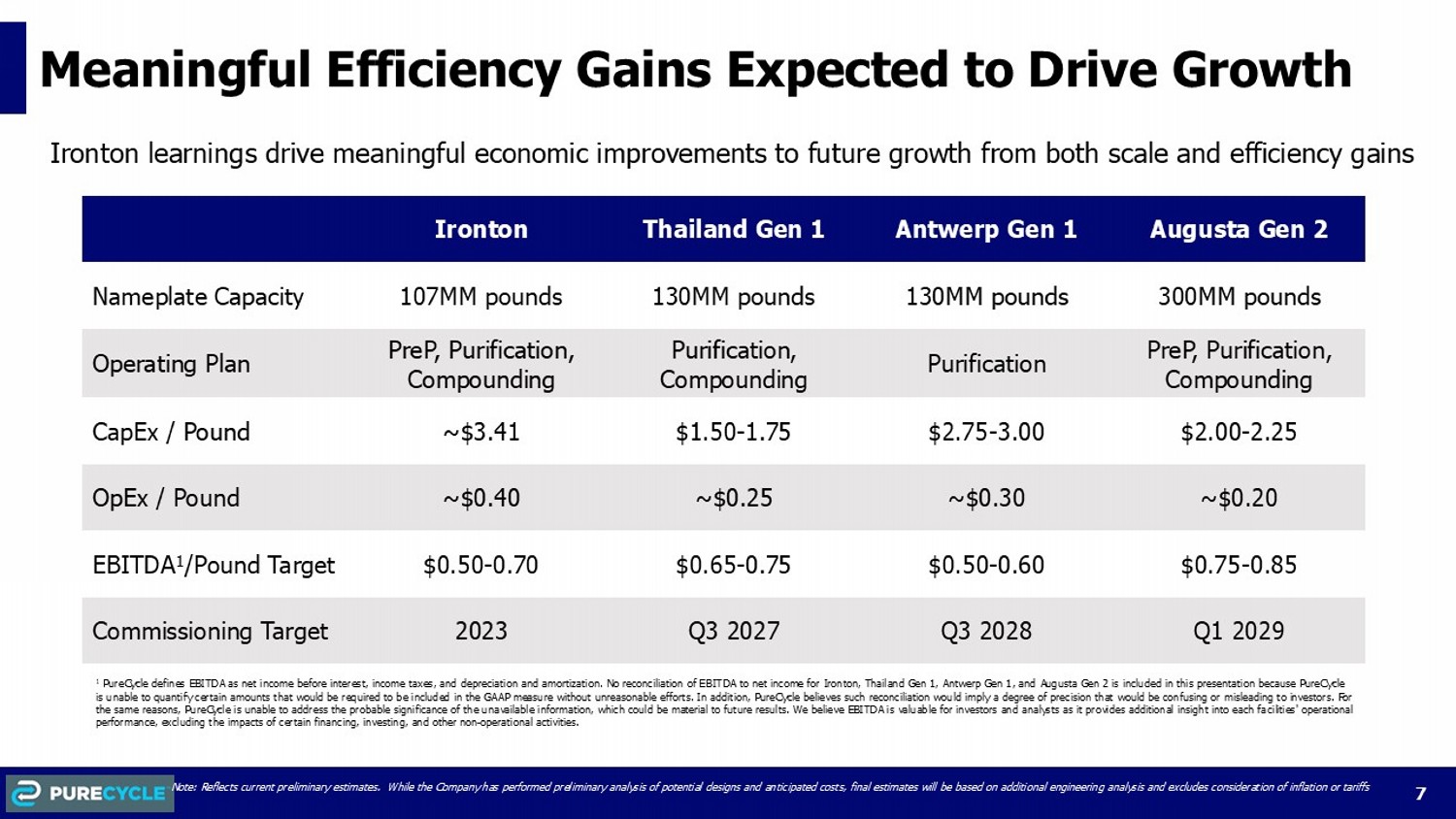

On June 17, 2025, the Company issued a press release announcing the Offering, a copy of which is furnished herewith as Exhibit 99.1 and is incorporated herein by reference. An investor presentation relating to the Offering is also furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be incorporated by reference into any filing of the Company, whether made before, on, or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Set forth below is a list of exhibits included as part of this Current Report.

| Exhibit Number |

Description of Exhibit | |

| 10.1 | Form of Subscription Agreement | |

| 10.2 | Ninth Amendment to Credit Agreement, dated as of June 16, 2025, among PureCycle Technologies, Inc., as the Borrower, PureCycle Technologies, LLC and PureCycle Technologies Holdings Corp., as Guarantors, the Lenders party thereto, and Madison Pacific Trust Limited, as Administrative Agent and Security Agent | |

| 10.3 | Employment Agreement, dated as of June 16, 2025 | |

| 99.1 | Press release, dated June 17, 2025 | |

| 99.2 | Investor Presentation | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PURECYCLE TECHNOLOGIES, INC. | ||

| June 17, 2025 | By: | /s/ Jaime Vasquez |

| Name: Jaime Vasquez | ||

| Title: Chief Financial Officer | ||

Exhibit 10.1

Execution Version

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT (this “Subscription Agreement”) is entered into this 16th day of June, 2025, by and between PureCycle Technologies, Inc., a corporation incorporated and existing under the laws of the State of Delaware (the “Company”), and the undersigned (“Subscriber”).

WHEREAS, the Amended and Restated Certificate of Incorporation of the Company (as amended from time to time, the “Certificate of Incorporation”), authorizes the issuance of 475,000,000 shares of capital stock, consisting of 450,000,000 shares of common stock, par value $0.001 per share (“Common Stock”), and 25,000,000 shares of preferred stock, par value $0.001 per share (“Preferred Stock”) ;

WHEREAS, the Common Stock is listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the ticker symbol “PCT”;

WHEREAS, the Company authorized the issuance of 100,000 shares of Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), on September 13, 2024 and 50,000 shares of the Series A Preferred Stock is issued and outstanding as of the date hereof;

WHEREAS, the Company intends to issue a new series of Preferred Stock, which shall be designated “Series B Convertible Perpetual Preferred Stock” (“Convertible Preferred Stock”) and shall have the designations, powers, preferences, rights, qualifications, limitations and restrictions as set forth in substantially the form of Certificate of Designations attached hereto as Exhibit A (the “Certificate of Designations”);

WHEREAS, Subscriber desires to subscribe for and to purchase from the Company that number shares of Convertible Preferred Stock set forth on the signature page hereto (the “Preferred Shares”), for the aggregate purchase price set forth on the signature page hereto (the “Purchase Price”), which payment (other than the aggregate par value of the Convertible Preferred Stock) will be directed to the Company, and the Company desires to issue and sell to Subscriber the Preferred Shares in consideration of the payment of the Purchase Price by or on behalf of Subscriber to the Company;

WHEREAS, the Preferred Shares are being issued and sold to Subscriber in reliance on Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”); and

WHEREAS, certain other “qualified institutional buyers” (within the meaning of Rule 144A under the Securities Act) and “accredited investors” (within the meaning of Rule 501(a) under the Securities Act) have entered into separate subscription agreements with the Company (“Other Subscription Agreements”), pursuant to which all such investors (the “Other Subscribers”) have, together with Subscriber pursuant to this Subscription Agreement, agreed to purchase an aggregate of up to 300,000 shares of Convertible Preferred Stock, at an aggregate purchase price of $300 million.

NOW, THEREFORE, in consideration of the foregoing and the mutual representations, warranties and covenants, and subject to the conditions herein contained, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

1. Subscription. Subject to the terms and conditions hereof (including without limitation the satisfaction or waiver of the conditions to closing set forth in Section 3.2), Subscriber hereby irrevocably subscribes for, and the Company hereby agrees to issue to Subscriber, upon the payment of the Purchase Price, the Preferred Shares on the terms and subject to the conditions set forth herein (such subscription and issuance, the “Subscription”). The proceeds from the Subscription shall be used by the Company for working capital and other general corporate purposes.

2. Representations, Warranties and Agreements.

2.1 Subscriber’s Representations, Warranties and Agreements. To induce the Company to issue the Preferred Shares to Subscriber, Subscriber hereby represents and warrants to the Company and agrees with the Company as follows:

2.1.1 To the extent Subscriber is an entity, Subscriber has been duly formed or incorporated and is validly existing and in good standing under the laws of its jurisdiction of incorporation or formation, with power and authority to enter into, deliver and perform its obligations under this Subscription Agreement.

2.1.2 This Subscription Agreement has been duly authorized, executed and delivered by Subscriber. This Subscription Agreement is enforceable against Subscriber in accordance with its terms, except as may be limited or otherwise affected by (a) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to or affecting the rights of creditors generally, and (b) principles of equity, whether considered at law or equity.

2.1.3 The execution, delivery and performance by Subscriber of this Subscription Agreement and the consummation of the transactions contemplated in this Subscription Agreement will not (a) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any of the property or assets of Subscriber pursuant to the terms of any indenture, mortgage, deed of trust, loan agreement, lease, license or other agreement or instrument to which Subscriber is a party or by which Subscriber is bound or to which any of the property or assets of Subscriber is subject, which would reasonably be expected to have a material adverse effect on the business, properties, financial condition, stockholders’ equity or results of operations of Subscriber, taken as a whole (a “Subscriber Material Adverse Effect”), or materially affect the legal authority of Subscriber to comply in all material respects with the terms of this Subscription Agreement; (b) result in any violation of the provisions of the organizational documents of Subscriber; (c) result in any violation of any statute or any judgment, order, rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over Subscriber or any of its properties that would reasonably be expected to have a Subscriber Material Adverse Effect or materially affect the legal authority of Subscriber to comply in all material respects with this Subscription Agreement; or (d) result in the violation of the provisions of the Subscriber’s investment policies or guidelines applicable thereto.

2.1.4 Subscriber (a) is a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act) or an “accredited investor” (within the meaning of Rule 501(a) under the Securities Act) satisfying the applicable requirements set forth in Schedule A, (b) is acquiring the Preferred Shares only for its own account and not for the account of others, or if Subscriber is subscribing for the Preferred Shares as a fiduciary or agent for one or more investor accounts, each owner of such account is an accredited investor and Subscriber has full investment discretion with respect to each such account, and the full power and authority to make the acknowledgements, representations and agreements herein on behalf of each owner of each such account, and (c) is not acquiring the Preferred Shares with a view to, or for offer or sale in connection with, any distribution thereof in violation of the Securities Act (and shall provide the requested information on Schedule A following the signature page hereto). Subscriber is not an entity formed for the specific purpose of acquiring the Preferred Shares. Subscriber further acknowledges that it is an Institutional Account as defined in FINRA Rule 4512(c) and accordingly, the offering to the Subscriber meets (i) the exemptions from filing under FINRA Rule 5123(b)(1)(A) and (ii) the institutional customer exemption under FINRA Rule 2111(b).

2.1.5 Subscriber understands that the Preferred Shares are being offered in a transaction not involving any public offering within the meaning of the Securities Act and that the Preferred Shares have not been registered under the Securities Act. Subscriber understands that the Preferred Shares may not be resold, transferred, pledged or otherwise disposed of by Subscriber, any investment fund or managed account managed by the same investment adviser as Subscriber or having the same general partner or an affiliated general partner (each “Subscriber Affiliate”) absent an effective registration statement under the Securities Act with respect to the Preferred Shares or an opinion of counsel reasonably satisfactory to the Company that such registration statement is not required and an applicable exemption from the registration requirements of the Securities Act is available, and that any certificates or book entries representing the Preferred Shares may contain a legend to such effect. Subscriber understands and agrees that the Preferred Shares will be subject to transfer restrictions and, as a result of these transfer restrictions, Subscriber may not be able to readily resell the Preferred Shares and may be required to bear the financial risk of an investment in the Preferred Shares for an indefinite period of time. Subscriber understands that it has been advised to consult legal counsel prior to making any offer, resale, pledge or transfer of any of the Preferred Shares.

2.1.6 Subscriber acknowledges that no representations, warranties, covenants and agreements are being made to Subscriber by the Company or any of its officers, affiliates, directors, agents or advisors expressly or by implication, other than those representations, warranties, covenants and agreements included in this Subscription Agreement.

2.1.7 Subscriber represents and warrants that (a) it is not a Benefit Plan Investor as contemplated by the Employee Retirement Income Security Act of 1974, as amended, or (b) its acquisition and holding of the Preferred Shares will not constitute or result in a non-exempt prohibited transaction under Section 406 of the Employee Retirement Income Security Act of 1974, as amended, Section 4975 of the Internal Revenue Code of 1986, as amended, or any applicable similar law.

2.1.8 In making its decision to purchase the Preferred Shares, Subscriber represents that it has relied solely upon independent investigation made by Subscriber. Subscriber acknowledges and agrees that Subscriber has received and has had an adequate opportunity to review, and ask questions with respect to, such financial and other information as Subscriber deems necessary in order to make an investment decision with respect to the Preferred Shares and made its own assessment and is satisfied concerning the relevant tax, legal and other economic considerations, and received such professional advice it deems appropriate, relevant to Subscriber’s investment in the Preferred Shares. Without limiting the generality of the foregoing, Subscriber acknowledges that it has reviewed the documents, including the offering materials, provided to Subscriber by the Company. Subscriber represents and agrees that Subscriber has had the full opportunity to ask such questions, and has received such answers and obtained such information regarding the Company as Subscriber has deemed necessary and adequate to make an investment decision with respect to the Preferred Shares.

2.1.9 Subscriber acknowledges that the Company represents and warrants that the Preferred Shares (a) were not offered by any form of general solicitation or general advertising and (b) are not being offered in a manner involving a public offering under, or in a distribution in violation of, the Securities Act, or any other federal, state or foreign securities laws. Subscriber represents and acknowledges that it has not been solicited by or through anyone other than the Company or, on the Company’s behalf, J.P. Morgan Securities LLC and Cantor Fitzgerald & Co. (together, the “Placement Agents”), who have been engaged as placement agents for the offering of the Preferred Shares with respect to Subscribers who are not natural persons.

2.1.10 Subscriber acknowledges that it is aware that there are substantial risks incident to the purchase and ownership of the Preferred Shares. Subscriber has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the Preferred Shares, and Subscriber has sought such accounting, legal and tax advice as Subscriber has considered necessary to make an informed investment decision.

2.1.11 Subscriber represents and acknowledges that Subscriber has such knowledge and experience in financial, investment and business matters as to be capable of evaluating the merits and risks of the investment in the Preferred Shares independently and, without reliance on the Placement Agents, has adequately analyzed and fully considered the risks of an investment in the Preferred Shares and determined that the Preferred Shares are a suitable investment for Subscriber and that Subscriber is able at this time and in the foreseeable future to bear the economic risk of a total loss of Subscriber’s investment in the Company. Subscriber further acknowledges specifically that a possibility of total loss of investment exists and that it is able to fend for itself in the transactions contemplated in this Subscription Agreement.

2.1.12 Subscriber understands and agrees that no federal, state or other agency has passed upon or endorsed the merits of the offering of the Preferred Shares or made any findings or determination as to the fairness of this investment.

2.1.13 Subscriber represents and warrants that neither Subscriber, nor any director or officer of Subscriber, nor to the knowledge of Subscriber, any employee, agent, affiliate or representative of Subscriber or any director or officer of any of its controlled subsidiaries is (a) a person or entity named on the List of Specially Designated Nationals and Blocked Persons administered by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”) or in any Executive Order issued by the President of the United States and administered by OFAC (“OFAC List”), or a person or entity that is the subject of any sanctions administered or enforced by OFAC, the United Nations Security Council, the European Union, His Majesty’s Treasury, or other relevant sanctions authorities (“Sanctions”), (b) a Designated National as defined in the Cuban Assets Control Regulations, 31 C.F.R. Part 515, (c) a non-U.S. shell bank or providing banking services indirectly to a non-U.S. shell bank, or (d) located, organized or resident in a country or territory that is the subject of Sanctions that broadly prohibit dealings with that country or territory (including, without limitation, the so-called Donetsk People’s Republic, or the so-called Luhansk People’s Republic or any other Covered Region of Ukraine identified pursuant to Executive Order 14065, and the Crimea region, Cuba, Iran, North Korea and Syria). Subscriber agrees to provide law enforcement agencies, if requested thereby, such records as required by applicable law, provided that Subscriber is permitted to do so under applicable law. Subscriber represents that if it is a financial institution subject to the Bank Secrecy Act (31 U.S.C. Section 5311 et seq.) (the “BSA”), as amended by the USA PATRIOT Act of 2001 (the “PATRIOT Act”), and its implementing regulations (collectively, the “BSA/PATRIOT Act”), Subscriber maintains policies and procedures reasonably designed to comply with applicable obligations under the BSA/PATRIOT Act. Subscriber also represents that, it maintains policies and procedures reasonably designed for the screening of its investors against Sanctions and the OFAC sanctions programs, including the OFAC List. Subscriber further represents and warrants that, to the extent required, it maintains policies and procedures reasonably designed to ensure that the funds held by Subscriber and used to purchase the Preferred Shares were legally derived.

2.1.14 Subscriber has, and at the Closing will have, sufficient available funds to pay the Purchase Price pursuant to Section 3.1.

2.1.15 [Reserved].

2.1.16 Subscriber agrees that Subscriber shall provide to the Company at the time of executing this Subscription Agreement a properly completed and duly executed U.S. Internal Revenue Service Form W-9, W-8BEN, W-8BEN-E, W-8EXP, W-8ECI, or W-8IMY and any related withholding certificates and/or withholding statements (as each may be amended from time to time), as applicable, or successor or additional forms thereto, together with any required supporting documentation. Subscriber shall update the Company and provide the Company with a new properly completed U.S. Internal Revenue Service Form, within 30 days of a change in circumstances that makes any information provided on such U.S. Internal Revenue Service Form incorrect or incomplete. Subscriber also agrees that Subscriber shall provide to the Company at the time of executing this Subscription Agreement and from time to time thereafter upon the reasonable request of the Company and at the time or times prescribed by applicable law, executed copies of any other form or documentation prescribed by applicable law as a basis for claiming exemption from or a reduction in U.S. federal withholding tax, to permit the Company to determine the withholding or deduction required to be made with respect to distributions and deemed distributions with respect to Subscriber, including, but not limited to, any documentation relating to the application of Section 899 of the Internal Revenue Code of 1986, as amended (as proposed in the One Big Beautiful Bill Act, H.R. 1, Report No. 119-106 (May 20, 2025)) or any substantially similar provision, in each case, as finally enacted, or any substantially similar amended or successor provision.

2.1.17 With respect to Subscribers who are not natural persons and who are selling in reliance on Rule 144A, Subscriber agrees that Subscriber will solicit offers for the Preferred Shares only from, and will offer the Preferred Shares only to persons whom the Subscriber reasonably believes to be “qualified institutional buyers” (within the meaning of Rule 144A under the Securities Act) or, if any such person is buying for one or more institutional accounts for which such person is acting as fiduciary or agent, only when such person has represented to the Subscriber that each such account is a qualified institutional buyers, to whom notice has been given that such sale or delivery is being made in reliance on Rule 144A, and, in each case, in transactions under Rule 144A.

2.1.18 Subscriber agrees that Subscriber will take reasonable steps to inform persons acquiring Preferred Shares from the Subscriber that the Preferred Shares (A) have not been and will not be registered under the Securities Act, (B) are being sold to them without registration under the Securities Act in reliance on Rule 144A or in accordance with another exemption from registration under the Securities Act, as the case may be, and (C) may not be offered, sold or otherwise transferred except (1) to the Company, or (2) in accordance with (x) Rule 144A to a person whom the seller (with respect to sellers who are not natural persons) reasonably believes to be a qualified institutional buyer that is purchasing such Preferred Shares for its own account or for the account of a qualified institutional buyer to whom notice is given that the offer, sale or transfer is being made in reliance on Rule 144A or (y) pursuant to another available exemption from registration under the Securities Act.

2.2 Company’s Representations, Warranties and Agreements. To induce Subscriber to purchase the Preferred Shares, the Company hereby represents and warrants to Subscriber and agrees with Subscriber as follows:

2.2.1 The Company has been duly incorporated and is validly existing as a corporation in good standing under the Delaware General Corporation Law (the “DGCL”), with corporate power and authority to own, lease and operate its properties and conduct its business as presently conducted and to enter into, deliver and perform its obligations under this Subscription Agreement.

2.2.2 The Preferred Shares have been duly authorized and, when issued and delivered to Subscriber against full payment for the Preferred Shares in accordance with the terms of this Subscription Agreement and registered with the Company’s transfer agent, the Preferred Shares will be validly issued, fully paid and non-assessable and the Preferred Shares will not have been authorized in violation of or subject to any preemptive or similar rights created under the Certificate of Incorporation, under the Certificate of Designations, or under the DGCL. The Company has reserved from its duly authorized capital stock the maximum number of shares of Convertible Preferred Stock issuable pursuant to the Certificate of Designations.

2.2.3 The shares of Common Stock issuable upon conversion of the Preferred Shares (the “Preferred Stock Common Shares”), if any, when and if issued in accordance with the terms of the Certificate of Designations and the Subscription Agreement and registered with the Company’s transfer agent, will be validly issued, fully paid and non-assessable and the Preferred Stock Common Shares will not have been authorized in violation of or subject to any preemptive or similar rights created under the Certificate of Incorporation, under the Certificate of Designations, or under the DGCL. The Company has reserved from its duly authorized capital stock the maximum number of shares of Common Stock issuable pursuant to the Certificate of Designations.

2.2.4 This Subscription Agreement has been duly authorized, executed and delivered by the Company and is enforceable against it in accordance with its terms, except as may be limited or otherwise affected by (a) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to or affecting the rights of creditors generally, and (b) principles of equity, whether considered at law or equity.

2.2.5 The execution, delivery and performance of this Subscription Agreement (including compliance by the Company with all of the provisions hereof), the issuance and sale of the Preferred Shares and the consummation of the other transactions contemplated herein will not (a) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any of the property or assets of the Company pursuant to the terms of any indenture, mortgage, deed of trust, loan agreement, lease, license or other agreement or instrument to which the Company is a party or by which the Company is bound or to which any of the property or assets of the Company is subject, which would reasonably be expected to have a material adverse effect on the business, properties, condition (financial or otherwise), stockholders’ equity or results of operations of the Company (a “Material Adverse Effect”) or materially affect the validity of the Preferred Shares or the legal authority of the Company to comply in all material respects with the terms of this Subscription Agreement; (b) result in any violation of the provisions of the organizational documents of the Company; or (c) result in any violation of any statute or any judgment, order, rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over the Company or any of its properties that would reasonably be expected to have a Material Adverse Effect or materially affect the validity of the Preferred Shares or the legal authority of the Company to comply in all material respects with this Subscription Agreement.

2.2.6 None of the Company nor any person acting on its behalf has, directly or indirectly, made any offers or sales of any Company securities or solicited any offers to buy any Company securities, under circumstances that would adversely affect reliance by the Company, as applicable, on Section 4(a)(2) of the Securities Act for the exemption from registration for the transactions contemplated hereby or would require registration of the Preferred Shares under the Securities Act.

2.2.7 None of the Company nor any person acting on its behalf has, directly or indirectly, conducted any general solicitation or general advertising (as those terms are used in Regulation D under the Securities Act) in connection with the offer or sale of any of the Preferred Shares.

2.2.8 The Company has provided Subscriber an opportunity to ask questions regarding the Company and made available to Subscriber all the information reasonably available to the Company that Subscriber has requested for deciding whether to acquire the Preferred Shares.

2.2.9 No disqualifying event described in Rule 506(d)(1)(i)-(viii) under the Securities Act (a “Disqualification Event”) is applicable to the Company or, to the Company’s knowledge, any Company Covered Person (as defined below), except for a Disqualification Event as to which Rule 506(d)(2)(ii)-(iv) or (d)(3) under the Securities Act is applicable. The Company has complied, to the extent applicable, with any disclosure obligations under Rule 506(e) under the Securities Act. “Company Covered Person” means, with respect to the Company as an “issuer” for purposes of Rule 506 under the Securities Act, any person listed in the first paragraph of Rule 506(d)(1) under the Securities Act other than the Placement Agents.

2.2.10 As of the date of this Subscription Agreement, the authorized capital stock of the Company consists of 450,000,000 shares of Common Stock and 25,000,000 shares of Preferred Stock. As of May 5, 2025, (i) 179,559,510 shares of Common Stock were issued and outstanding; (ii) 50,000 shares of Series A Preferred Stock were issued and outstanding; and (iii) no shares of Convertible Preferred Stock were issued and outstanding. All issued and outstanding shares of Common Stock and Series A Preferred Stock have been duly authorized and validly issued, are fully paid and are non-assessable and are not subject to preemptive rights, other than as set forth in the Company’s filings with the Securities and Exchange Commission (the “Commission”), together with any amendments, restatements or supplements thereto and including any draft filings distributed to Subscriber and the Other Subscribers (the “SEC Documents”). As of the date of this Subscription Agreement, except as disclosed in the SEC Documents, there are no outstanding options, warrants or other rights to subscribe for, purchase or acquire from the Company any shares of Common Stock, Convertible Preferred Stock or other equity interests in the Company, or securities convertible into or exchangeable or exercisable for such equity interests. As of the date hereof, the Company has no subsidiaries, other than as set forth in the SEC Documents, and other than through such subsidiaries, does not own, directly or indirectly, interests or investments (whether equity or debt) in any person, whether incorporated or unincorporated. There are no stockholder agreements, voting trusts or other agreements or understandings to which the Company is a party or by which it is bound relating to the voting of any securities of the Company, other than as set forth in the SEC Documents. Except as disclosed in the SEC Documents, the Company had no outstanding indebtedness and will not have any outstanding long-term indebtedness as of immediately prior to the Closing.

2.2.11 The Company is not: (a) in default under or in violation of (and no event has occurred that has not been waived that, with notice or lapse of time or both, would result in a default by the Company under), nor has the Company received notice of a claim that it is in default under or that it is in violation of, any indenture, loan or credit agreement or any other agreement or instrument to which it is a party or by which it or any of its properties is bound (whether or not such default or violation has been waived), (b) in violation of any judgment, decree, or order of any court, arbitrator or other governmental authority or (c) in violation of any statute, rule, ordinance or regulation of any governmental authority, including without limitation all foreign, federal, state and local laws relating to taxes, environmental protection, occupational health and safety, product quality and safety and employment and labor matters, except in each case as could not have or reasonably be expected to result in a Material Adverse Effect.

2.2.12 Except as set forth herein, the Company is not required to obtain any consent, approval, authorization, permit, declaration or order of, or make any other filings as may be required by state securities agencies and the filing with the Delaware Secretary of State of the Certificate of Designations), any court, governmental agency or any regulatory or self-regulatory agency or any other person in order for it to execute, deliver or perform any of its obligations under or contemplated by this Subscription Agreement, in each case in accordance with the terms hereof or thereof. All consents, authorizations, orders, filings and registrations which the Company is required to obtain pursuant to the preceding sentence have been obtained or effected on or prior to the Closing Date (or in the case of the filings detailed above, will be made after the Closing Date within the time period required by applicable law), and the Company is unaware of any facts or circumstances that might prevent the Company from obtaining or effecting any of the consent, registration, application or filings pursuant to the preceding sentence. Subject to the accuracy of the representations and warranties of Subscriber set forth in Section 2.1 hereof, the Company has taken all action necessary to exempt the issuance and sale of the Preferred Shares. The Company does not have a stockholder rights plan or other “poison pill” arrangement in place.

2.2.13 Except as otherwise disclosed in the SEC Documents, the Company has received no written notice of any, and there are no, actions, suits or proceedings before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the Company, threatened against or affecting the Company, except as arising in the ordinary course of the Company’s business and which would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect or prevent, materially delay or materially impair the Company’s ability to consummate any of the transactions contemplated under this Subscription Agreement.

2.2.14 The Company possesses all certificates, authorizations and permits issued by the appropriate domestic or foreign regulatory authority necessary to conduct its business, except where the failure to possess such permits could not reasonably be expected to result in a Material Adverse Effect (“Material Permits”), and the Company has not received any notice of proceedings relating to the revocation or modification of any Material Permit.

2.2.15 Subject to the accuracy of Subscriber’s representations set forth in this Subscription Agreement, the offer, sale and issuance of the Preferred Shares to be issued in conformity with the terms of this Subscription Agreement constitute transactions which are exempt from the registration requirements of the Securities Act and from all applicable state registration or qualification requirements. Neither the Company nor any Person acting on its behalf will take any action that would cause the loss of such exemption.

2.2.16 As of the date of this Subscription Agreement, the Common Stock is listed on Nasdaq, the Company is in compliance with applicable Nasdaq continued listing requirements and the Company has taken no action designed to, or which to its knowledge is likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act (as defined below) or delisting the Common Stock from Nasdaq. As of the date of this Subscription Agreement, the Company has not received any notification that, and has no knowledge that, the Commission or Nasdaq is contemplating terminating such listing or registration. There are no proceedings pending or, to the Company’s knowledge, threatened against the Company relating to the continued listing of the Common Stock on Nasdaq.

2.2.17 As of the date of this Subscription Agreement, the filed SEC Documents are the only filings required of the Company pursuant to the Exchange Act. The Company is engaged in all material respects only in the business described in the SEC Documents and the SEC Documents contain a complete and accurate description in all material respects of the business of the Company. As of the time it was filed with the Commission (or, if amended or superseded by a filing prior to the date hereof, then on the date of such filing), each of the filed SEC Documents complied in all material respects with the applicable requirements of the Exchange Act, and, as of the time they were filed, none of the filed SEC Reports contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. Since the filing of each of the filed SEC Documents, no event has occurred that would require an amendment or supplement to any such SEC Document and as to which such an amendment or supplement has not been filed prior to the date hereof.

2.2.18 The financial statements included in each SEC Document comply in all material respects with applicable accounting requirements and the rules and regulations of the Commission with respect thereto as in effect at the time of filing (or to the extent corrected by a subsequent restatement) and present fairly, in all material respects, the financial position of the Company as of the dates shown and its results of operations and cash flows for the periods shown, and such financial statements have been prepared in conformity with United States generally accepted accounting principles (“GAAP”) applied on a consistent basis (except as may be disclosed therein or in the notes thereto, and, in the case of quarterly financial statements, as permitted by Form 10-Q under the Exchange Act). Except as set forth in the financial statements of the Company included in the SEC Documents, the Company has not incurred any liabilities, contingent or otherwise, except those incurred in the ordinary course of business, consistent (as to amount and nature) with past practices since the date of such financial statements, none of which, individually or in the aggregate, have had or could reasonably be expected to have a Material Adverse Effect.

2.2.19 Except as otherwise set forth in the SEC Documents, the Company maintains a system of internal accounting controls sufficient to provide reasonable assurance that (a) transactions are executed in accordance with management’s general or specific authorizations, (b) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability, (c) access to assets is permitted only in accordance with management’s general or specific authorization, and (d) the recorded accountability for assets and liabilities is compared with the existing assets and liabilities at reasonable intervals and appropriate action is taken with respect to any differences.

The Company has established disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the Company and designed such disclosure controls and procedures to ensure that material information relating to the Company is made known to the certifying officers by others within those entities, particularly during the period in which the Company’s most recently filed periodic report under the Exchange Act, as the case may be, is being prepared. The Company has established internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP. The Company’s certifying officers have evaluated the effectiveness of the Company’s disclosure controls and procedures (the “internal controls”) as of the end of the period covered by the most recently filed periodic report under the Exchange Act (such date, the “Evaluation Date”). The Company presented in its most recently filed periodic report under the Exchange Act the conclusions of the certifying officers about the effectiveness of such internal controls based on their evaluations as of the Evaluation Date. Except as otherwise set forth in the SEC Documents, since the Evaluation Date, there have been no significant changes in the Company’s internal controls or in other factors that could significantly affect the Company’s internal controls. The Company maintains and will continue to maintain a standard system of accounting established and administered in accordance with GAAP and the applicable requirements of the Exchange Act.

2.2.20 The Company has timely prepared and filed (or has obtained an extension of time within which to file) all tax returns required to have been filed by the Company with all appropriate governmental agencies and timely paid all taxes shown thereon or otherwise owed by it, other than taxes being contested in good faith and for which adequate reserves have been made on the Company’s financial statements included in the SEC Documents, except in all such cases where the failure to so file or the failure to so pay has not had and could not reasonably be expected to have a Material Adverse Effect. The charges, accruals and reserves on the books of the Company in respect of taxes for all fiscal periods are adequate in all material respects, and there are no material unpaid assessments against the Company nor any basis for the assessment of any additional taxes, penalties or interest for any fiscal period or audits by any federal, state or local taxing authority except for any assessment which is not material to the Company. All taxes and other assessments and levies that the Company is required to withhold or to collect for payment have been duly withheld and collected and paid to the proper governmental entity or third party when due, other than taxes being contested in good faith and for which adequate reserves have been made on the Company’s financial statements included in the SEC Documents, except where the failure to so withhold, collect or pay has not had and could not reasonably be expected to have a Material Adverse Effect. There are no tax liens or claims pending or, to the Company’s knowledge, threatened against the Company or any of its assets or property. Except as described in the SEC Documents, there are no outstanding tax sharing agreements or other such arrangements between the Company or other corporation or entity.

2.2.21 Except as disclosed in the SEC Documents, the Company has good and marketable title to all real properties and all other properties and assets owned by it, in each case free from liens, encumbrances and defects that would materially affect the value thereof or materially interfere with the use made or currently planned to be made thereof by them; and except as disclosed in the SEC Documents, the Company holds any leased real or personal property under valid and enforceable leases with no exceptions that would materially interfere with the use made or currently planned to be made thereof by them, except where such exceptions have not had and could not reasonably be expected to have a Material Adverse Effect.

2.2.22 All Intellectual Property of the Company is currently in compliance in all material respects with all legal requirements (including timely filings, proofs and payments of fees) and is valid and enforceable, except where such failure has not had and could not reasonably be expected to have a Material Adverse Effect. To the Company’s knowledge, no Intellectual Property of the Company which is necessary for the conduct of the Company’s business as currently conducted or as currently proposed to be conducted is now involved in any cancellation, dispute or litigation, and no such action is threatened. To the Company’s knowledge, no patent of the Company has been or is now involved in any interference, reissue, re-examination or opposition proceeding. For purposes of this Section 2.2.22, “Intellectual Property” means, unless the context provides otherwise, all of the Company’s (a) patents, patent applications, patent disclosures and inventions (whether or not patentable and whether or not reduced to practice); (b) trademarks, service marks, trade dress, trade names, corporate names, logos, slogans and Internet domain names, together with all goodwill associated with each of the foregoing; (c) copyrights and copyrightable works; (d) registrations, applications and renewals for any of the foregoing; and (e) proprietary computer software (including but not limited to data, data bases and documentation).

All of the licenses and sublicenses and consent, royalty or other agreements concerning Intellectual Property which are necessary for the conduct of the Company’s business as currently conducted or as currently proposed to be conducted to which the Company is a party or by which any of its assets are bound (other than generally commercially available, non-custom, off-the-shelf software application programs having a retail acquisition price of less than $10,000 per license) (collectively, “License Agreements”) are valid and binding obligations of the Company and, to the Company’s knowledge, the other parties thereto, enforceable in accordance with their terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting the enforcement of creditors’ rights generally, and, to the Company’s knowledge, there exists no event or condition which will result in a violation or breach of or constitute (with or without due notice or lapse of time or both) a default by the Company under any such License Agreement, except for such violations, breaches and defaults as have not had and could not reasonably be expected to have a Material Adverse Effect, individually or in the aggregate.

To the Company’s knowledge, the Company owns or has the valid right to use all of the Intellectual Property that is necessary for the conduct of the Company’s business as currently conducted or as currently proposed to be conducted and for the ownership, maintenance and operation of the Company’s properties and assets, free and clear of all liens, encumbrances, adverse claims or obligations to license all such owned Intellectual Property, other than licenses entered into in the ordinary course of the Company’s business, except for such liens, encumbrances, adverse claims or obligations as have not had and could not reasonably be expected to have a Material Adverse Effect. The Company has a valid and enforceable right to use all third party Intellectual Property used or held for use in the business of the Company.

To the Company’s knowledge, the conduct of the Company’s business as currently conducted does not infringe or otherwise impair or conflict with in any material respect (collectively, “Infringe”) any Intellectual Property rights of any third party or any confidentiality obligation owed to a third party, and, to the Company’s knowledge, the Intellectual Property of the Company which is necessary for the conduct of Company’s business as currently conducted or as currently proposed to be conducted is not being Infringed by any third party. There is no litigation or order pending or outstanding or, to the Company’s knowledge, threatened or imminent, that seeks to limit or challenge or that concerns the ownership, use, validity or enforceability of any Intellectual Property of the Company and the Company’s use of any Intellectual Property owned by a third party, and, to the Company’s knowledge, there is no valid basis for the same.

The consummation of the transactions contemplated by this Subscription Agreement will not result in the alteration, loss, impairment of or restriction on the Company’s ownership or right to use any of the Intellectual Property which is necessary for the conduct of Company’s business as currently conducted or as currently proposed to be conducted.

2.2.23 The Company is not in violation of any statute, rule, regulation, decision or order of any governmental agency or body or any court, domestic or foreign, relating to the use, disposal or release of hazardous or toxic substances or relating to the protection or restoration of the environment or human exposure to hazardous or toxic substances (collectively, “Environmental Laws”), does not own or operate any real property contaminated by the Company with any substance that is subject to any Environmental Laws, is not liable for any off-site disposal or contamination caused by the Company pursuant to any Environmental Laws, and is not subject to any claim relating to any Environmental Laws, which violation, contamination, liability or claim has had or could reasonably be expected to have a Material Adverse Effect, individually or in the aggregate; and there is no pending or, to the Company’s knowledge, threatened investigation that might lead to such a claim.

2.2.24 The Company maintains in full force and effect insurance coverage that, to the Company’s knowledge, is customary for comparably situated companies for the business being conducted and properties owned or leased by the Company, and the Company reasonably believes such insurance coverage to be adequate against all liabilities, claims and risks against which it is customary for comparably situated companies.

2.2.25 Neither the Company nor, to the Company’s knowledge, any of its current or former stockholders, directors, officers, employees, agents or other Persons acting on behalf of the Company, has on behalf of the Company or in connection with its business: (a) used any corporate funds for unlawful contributions, gifts, entertainment or other unlawful expenses relating to political activity; (b) made any direct or indirect unlawful payments to any governmental officials or employees from corporate funds; (c) established or maintained any unlawful or unrecorded fund of corporate monies or other assets; (d) made any false or fictitious entries on the books and records of the Company; or (e) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment of any nature.

2.2.26 The Company represents and warrants that neither the Company, nor any director or officer of the Company, nor to the knowledge of the Company, any employee, agent, affiliate or representative of the Company or any director or officer of any of its controlled subsidiaries is (a) a person or entity named on the List of Specially Designated Nationals and Blocked Persons administered by OFAC or in any OFAC List, or a person or entity that is the subject of any Sanctions, (b) a Designated National as defined in the Cuban Assets Control Regulations, 31 C.F.R. Part 515, (c) a non-U.S. shell bank or providing banking services indirectly to a non-U.S. shell bank, or (d) located, organized or resident in a country or territory that is the subject of Sanctions that broadly prohibit dealings with that country or territory (including, without limitation, the so-called Donetsk People’s Republic, or the so-called Luhansk People’s Republic or any other Covered Region of Ukraine identified pursuant to Executive Order 14065, and the Crimea region, Cuba, Iran, North Korea and Syria). The Company agrees to provide law enforcement agencies, if requested thereby, such records as required by applicable law, provided that the Company is permitted to do so under applicable law. The Company represents that if it is a financial institution subject to the PATRIOT Act the BSA/PATRIOT Act, the Company maintains policies and procedures reasonably designed to comply with applicable obligations under the BSA/PATRIOT Act. The Company also represents that, it maintains policies and procedures reasonably designed for the screening of its investors against Sanctions and the OFAC sanctions programs, including the OFAC List.

2.2.27 Except as disclosed in the SEC Documents or in any future document filed with the Commission, to the Company’s knowledge, none of the officers or directors of the Company and, to the Company’s knowledge, none of the employees of the Company is presently a party to any transaction with the Company (other than as holders of stock options and/or warrants, and for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from, to the Company’s knowledge, any officer, director or such employee or, to the Company’s knowledge, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner, except for such transaction the omission of which has not had and could not reasonably be expected to have a Material Adverse Effect.

2.2.28 The Company acknowledges that Subscriber is not acting as a financial advisor or fiduciary of the Company (or in any similar capacity) with respect to this Subscription Agreement and the transactions contemplated hereby, and any advice or other guidance provided by Subscriber or any of its representatives and agents with respect to this Subscription Agreement and the transactions contemplated hereby is merely incidental to Subscriber’s entry into such transactions. The Company’s decision to enter into this Subscription Agreement has been based solely on the independent evaluation by the Company and its representatives and agents.

2.2.29 The Company is not and, after giving effect to the offer and sale of the Preferred Shares and the application of the proceeds therefrom, will not be, required to register as an “investment company” within the meaning of the Investment Company Act of 1940, as amended (the “Investment Company Act”), and the rules and regulations promulgated thereunder.

2.2.30 With respect to Subscribers who are not natural persons, other than the Placement Agents, there is no broker, investment banker, financial advisor, finder or other Person that has been retained by or is authorized to act on behalf of the Company that is entitled to any fee or commission in connection with the execution of this Subscription Agreement and the consummation of the transactions contemplated hereby.

2.2.31 The Preferred Shares are eligible for resale pursuant to Rule 144A and will not be, at the Closing Date, of the same class as securities listed on a national securities exchange registered under Section 6 of the Exchange Act or quoted in a U.S. automated interdealer quotation system. The Preferred Shares satisfy the requirements set forth in Rule 144A(d)(3) under the Securities Act.

2.2.32 The Company qualifies in all respects as a "well-known seasoned issuer" within the meaning of Rule 405 under the Securities Act.

3. Settlement Date and Delivery.

3.1 Closing. The closing of the purchase and sale of the Preferred Shares hereunder (the “Closing”) shall occur on Friday, June 20, 2025 (the “Closing Date”) at 4:00 p.m., Eastern Time, or at such other time as the parties shall mutually agree, upon satisfaction of the covenants and conditions set forth in Section 3. The parties agree that the Closing may occur via delivery of photocopies or electronic PDF versions of this Subscription Agreement and the closing deliverables contemplated hereby and thereby. Unless otherwise provided herein, all proceedings to be taken and all documents to be executed and delivered by all parties at the Closing will be deemed to have been taken and executed simultaneously, and no proceedings will be deemed to have been taken nor documents executed or delivered until all have been taken. At the Closing, on the Closing Date, upon the terms and subject to the conditions set forth herein:

(i) The Company agrees to sell, and Subscriber agrees to purchase, the Preferred Shares in exchange for the Purchase Price; provided, however, that, unless otherwise approved by the holders of a majority of the outstanding shares of Common Stock (excluding, for the avoidance of doubt, the Preferred Stock Common Shares), the Company shall not issue to Subscriber or any parties aggregated with Subscriber for purposes of Nasdaq Rule 5635 (the “Subscriber Parties”) any Preferred Stock Common Shares issuable upon conversion of the Convertible Preferred Stock to the extent such shares after giving effect to such issuance (x) would cause the Subscriber Parties’ or any Prior Subscriber Parties’ (as defined below) ownership to exceed 19.99% of the outstanding shares of the Common Stock or 19.99% of the outstanding voting power of the Company as of immediately prior to the closing of the Prior Subscription Agreements and prior to giving effect to the issuance of Common Stock pursuant to the Prior Subscription Agreements or the issuance of the Preferred Stock Common Shares pursuant to this Subscription Agreement or (y) would result in the aggregate number of shares of Common Stock issued (i) pursuant to this Subscription Agreement (the Preferred Stock Common Shares), (ii) to any Other Subscribers pursuant to the Other Subscription Agreements and (iii) to the Prior Subscriber Parties pursuant to the Prior Subscription Agreements (as defined below) at a price that is below the “Minimum Price” as determined consistently with Nasdaq Rule 5635(d) to exceed 19.99% of the outstanding shares of the Common Stock or 19.99% of the outstanding voting power of the Company as of immediately prior to the closing of the Prior Subscription Agreements and prior to giving effect to the issuance of Common Stock pursuant to the Prior Subscription Agreements or the issuance of the Preferred Stock Common Shares pursuant to this Subscription Agreement. Any reduction as a result of the foregoing shall be borne pro rata amongst Subscriber and the Other Subscribers pursuant in the Other Subscription Agreements based on the number of shares of Common Stock purchased and issuable upon conversion of Convertible Preferred Stock pursuant to the applicable agreement. As used herein, “Prior Subscriber Parties” means the investors (and any parties aggregated with such investors for purposes of Nasdaq Rule 5635) party to those certain subscription agreements (the “Prior Subscription Agreements”) dated September 11, 2024 and February 5, 2025, with the Company.

(ii) To effect the purchases and sales described in this Section 3.1, (x) Subscriber shall deliver to the Company, via wire transfer, to an account designated by the Company on the Closing Date, immediately available funds equal to the Purchase Amount and (y) the Company shall deliver to Subscriber the Preferred Shares, which shall be issued (A) if the Subscriber is not a Natural Person, in book entry form, registered in the name of Subscriber, with such legends or notations as applicable, referring to the terms, conditions, and restrictions set forth in this Subscription Agreement and (B) if the Subscriber is a Natural Person, in either physical certificated form or book entry form (at the reasonable discretion of the Company in consultation with Subscriber), registered in the name of Subscriber, with such legends or notations as applicable, referring to the terms, conditions, and restrictions set forth in this Subscription Agreement.

3.2 Conditions to Closing.

3.2.1 The obligations of each of the Company and Subscriber to consummate the Closing shall be subject to the satisfaction or valid waiver by the Company, on the one hand, or Subscriber, on the other, of the conditions that, on the Closing Date:

(i) No suspension of the qualification of the Common Stock for offering or sale or trading in any jurisdiction, or initiation or threatening of any proceedings for any of such purposes, shall have occurred.

(ii) No governmental authority shall have enacted, issued, promulgated, enforced or entered any judgment, order, rule or regulation (whether temporary, preliminary or permanent) which is then in effect and has the effect of making consummation of the transactions contemplated hereby illegal or otherwise preventing or prohibiting consummation of the transactions contemplated hereby.

(iii) Each of the Company and Subscriber acknowledge the Common Stock ownership and issuance limitations set forth in Section 3.1(i) above and the Company agrees that in no event shall such limitations be exceeded by either this Subscription Agreement or as a result of the Other Subscription Agreements.

3.2.2 The obligation of the Company to consummate the Closing shall be subject to the satisfaction or valid waiver by the Company of the additional conditions that, on the Closing Date:

(i) All representations and warranties of Subscriber contained in this Subscription Agreement shall be true and correct in all material respects as of the Closing Date (other than those representations and warranties expressly made as of an earlier date, which shall be true and correct in all material respects as of such date), and consummation of the Closing shall constitute a reaffirmation by Subscriber of each of the representations, warranties and agreements contained in this Subscription Agreement as of the Closing Date (other than those representations and warranties expressly made as of an earlier date, which shall be true and correct in all respects as of such date).

(ii) Subscriber shall have performed or complied in all material respects with all agreements and covenants required by this Subscription Agreement.

(iii) Since the date of this Subscription Agreement, no event, the result of which is a Subscriber Material Adverse Effect, shall have occurred that is continuing.

3.2.3 The obligation of Subscriber to consummate the Closing shall be subject to the satisfaction or valid waiver by Subscriber of the additional conditions that, on the Closing Date: