UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 16, 2025

Commerce Bancshares, Inc.

(Exact name of registrant as specified in its charter)

| Missouri | 001-36502 | 43-0889454 | ||

| (State or other jurisdiction) | (Commission File Number) | (IRS Employer Identification No.) | ||

| of incorporation |

|

1000 Walnut, Kansas City, MO |

64106 | |

| (Address of principal executive offices) | (Zip Code) |

(816) 234-2000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| $5 Par Value Common Stock | CBSH | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

Commerce Bancshares, Inc., a Missouri corporation (“Commerce”), issued a press release on June 16, 2025 announcing the execution of the Merger Agreement (as defined below). A copy of the press release is furnished as Exhibit 99.1 and incorporated herein by reference. Commerce also intends to provide supplemental information regarding the transactions disclosed under Item 8.01 of this Current Report on Form 8-K in connection with presentations to analysts and investors. The slides that will be made available in connection with the presentations are furnished as Exhibit 99.2 and are incorporated herein by reference.

The information contained in this Item 7.01, as well as Exhibits 99.1 and 99.2 referenced herein, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall they be deemed incorporated by reference in any filing of Commerce under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings.

| Item 8.01 | Other Events. |

On June 16, 2025, Commerce entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among Commerce, CBI-Kansas, Inc., a Kansas corporation and direct wholly owned subsidiary of Commerce (“CBI-Kansas”), and FineMark Holdings, Inc., a Florida corporation (“FineMark”), pursuant to which, upon the terms and subject to the conditions set forth therein, (i) FineMark will merge with and into CBI-Kansas (the “Merger”), with CBI-Kansas surviving the Merger and (ii) promptly following the Merger, FineMark National Bank & Trust, a nationally-chartered commercial bank and trust company and wholly owned subsidiary of FineMark, will merge with and into Commerce Bank, a Missouri state-chartered trust company and wholly owned subsidiary of CBI-Kansas, with Commerce Bank continuing as the surviving bank.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| 99.1 | Press Release, dated June 16, 2025 |

| 99.2 | Investor Presentation, dated June 16, 2025 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication may contain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed business combination transaction between Commerce and FineMark (the “Proposed Transaction”), the plans, objectives, expectations and intentions of Commerce and FineMark, the expected timing of completion of the Proposed Transaction, and other statements that are not historical facts. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions. Forward-looking statements, by their nature, are subject to risks and uncertainties. There are many factors that could cause actual results to differ materially from expected results described in the forward-looking statements. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995.

Factors relating to the Proposed Transaction that could cause or contribute to actual results differing materially from those contained or implied in forward-looking statements or historical performance include, in addition to those factors identified elsewhere in this communication the occurrence of any event, change or other circumstances that could give rise to the right of Commerce or FineMark to terminate the definitive merger agreement governing the terms and conditions of the Proposed Transaction; the outcome of any legal proceedings that may be instituted against Commerce or FineMark; the possibility that revenue or expense synergies or the other expected benefits of the Proposed Transaction may not fully materialize or may take longer to realize than expected, or may be more costly to achieve than anticipated, including as a result of the impact of, or problems arising from, the integration of the two companies, the strength of the economy and competitive factors in the areas where Commerce and FineMark do business, or other unexpected factors or events; the possibility that the Proposed Transaction may not be completed when expected or at all because required regulatory, shareholder or other approvals or other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect Commerce or FineMark or the expected benefits of the Proposed Transaction); the risk that Commerce is unable to successfully and promptly implement its integration strategies; reputational risks and potential adverse reactions from or changes to the relationships with the companies’ customers, employees or other business partners, including resulting from the announcement or the completion of the Proposed Transaction; the dilution caused by Commerce’s issuance of common stock in connection with the Proposed Transaction; diversion of management’s attention and time from ongoing business operations and other opportunities on matters relating to the Proposed Transaction; and other factors that may affect the future results of Commerce and FineMark, including continued pressures and uncertainties within the banking industry and Commerce’s and FineMark’s markets, including changes in interest rates and deposit amounts and composition, adverse developments in the level and direction of loan delinquencies, charge-offs, and estimates of the adequacy of the allowance for loan losses, increased competitive pressures, asset and credit quality deterioration, the impact of proposed or imposed tariffs by the U.S. government or retaliatory tariffs proposed or imposed by U.S. trading partners that could have an adverse impact on customers or any recession or slowdown in economic growth particularly in the markets in which Commerce or FineMark operate, and legislative, regulatory, and fiscal policy changes and related compliance costs.

These factors are not necessarily all of the factors that could cause Commerce’s or FineMark’s actual results, performance, or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other unknown or unpredictable factors also could harm Commerce’s or FineMark’s results.

Further information regarding Commerce and factors that could affect the forward-looking statements contained herein can be found in Commerce’s Annual Report on Form 10-K for the year ended December 31, 2024, which is accessible on the Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov and at Investor.Commercebank.com, and in other documents Commerce files with the SEC. Information on these websites is not part of this document.

All forward-looking statements attributable to Commerce or FineMark, or persons acting on Commerce’s or FineMark’s behalf, are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and Commerce and FineMark do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If Commerce or FineMark update one or more forward-looking statements, no inference should be drawn that Commerce or FineMark will make additional updates with respect to those or other forward-looking statements.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Proposed Transaction, Commerce will file with the SEC a Registration Statement on Form S-4 to register the shares of Commerce common stock to be issued in connection with the Proposed Transaction that will include a proxy statement of FineMark and a prospectus of Commerce (the “proxy statement/prospectus”), as well as other relevant documents concerning the Proposed Transaction. The definitive proxy statement/prospectus will be sent to the shareholders of FineMark seeking their approval of the Proposed Transaction and other related matters. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF FINEMARK ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE AND EACH OTHER RELEVANT DOCUMENT FILED WITH THE SEC BY COMMERCE IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain a free copy of the definitive proxy statement/prospectus, as well as other filings containing information about the Proposed Transaction, Commerce and FineMark, without charge, at the SEC’s website, http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Commerce’s Investor Relations via email at matthew.burkemper@commercebank.com or by telephone at (314) 746-7485, or to FineMark's Investor Relations via email at investorrelations@finemarkbank.com or by telephone at (239) 461-3850.

PARTICIPANTS IN THE SOLICITATION

Commerce, FineMark and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of FineMark in connection with the Proposed Transaction under the rules of the SEC. Information regarding Commerce’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Commerce’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 25, 2025; in the sections entitled “Security Ownership of Certain Beneficial Owners and Management,” “Composition of the Board, Board Diversity and Director Qualifications,” “Corporate Governance” “Compensation Discussion and Analysis” and “Executive Compensation,” in Commerce’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on March 14, 2025; and other documents filed by Commerce with the SEC. To the extent holdings of Commerce common stock by the directors and executive officers of Commerce have changed from the amounts held by such persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus relating to the Proposed Transaction. Free copies of this document may be obtained as described in the preceding paragraph.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COMMERCE BANCSHARES, INC. | ||

| By: | /s/ Paul A. Steiner | |

| Paul A. Steiner | ||

|

Controller (Chief Accounting Officer) |

||

Date: June 16, 2025

Exhibit 99.1

|

|

FOR IMMEDIATE RELEASE

For more information, please contact:

Public Relations

Tiffany Charles (314) 746-8567

Tiffany.Charles@commercebank.com

Investor Relations

Matt Burkemper (314) 746-7485

Matthew.Burkemper@CommerceBank.com

COMMERCE BANCSHARES, INC. AND FINEMARK HOLDINGS, INC. ANNOUNCE DEFINITIVE MERGER AGREEMENT

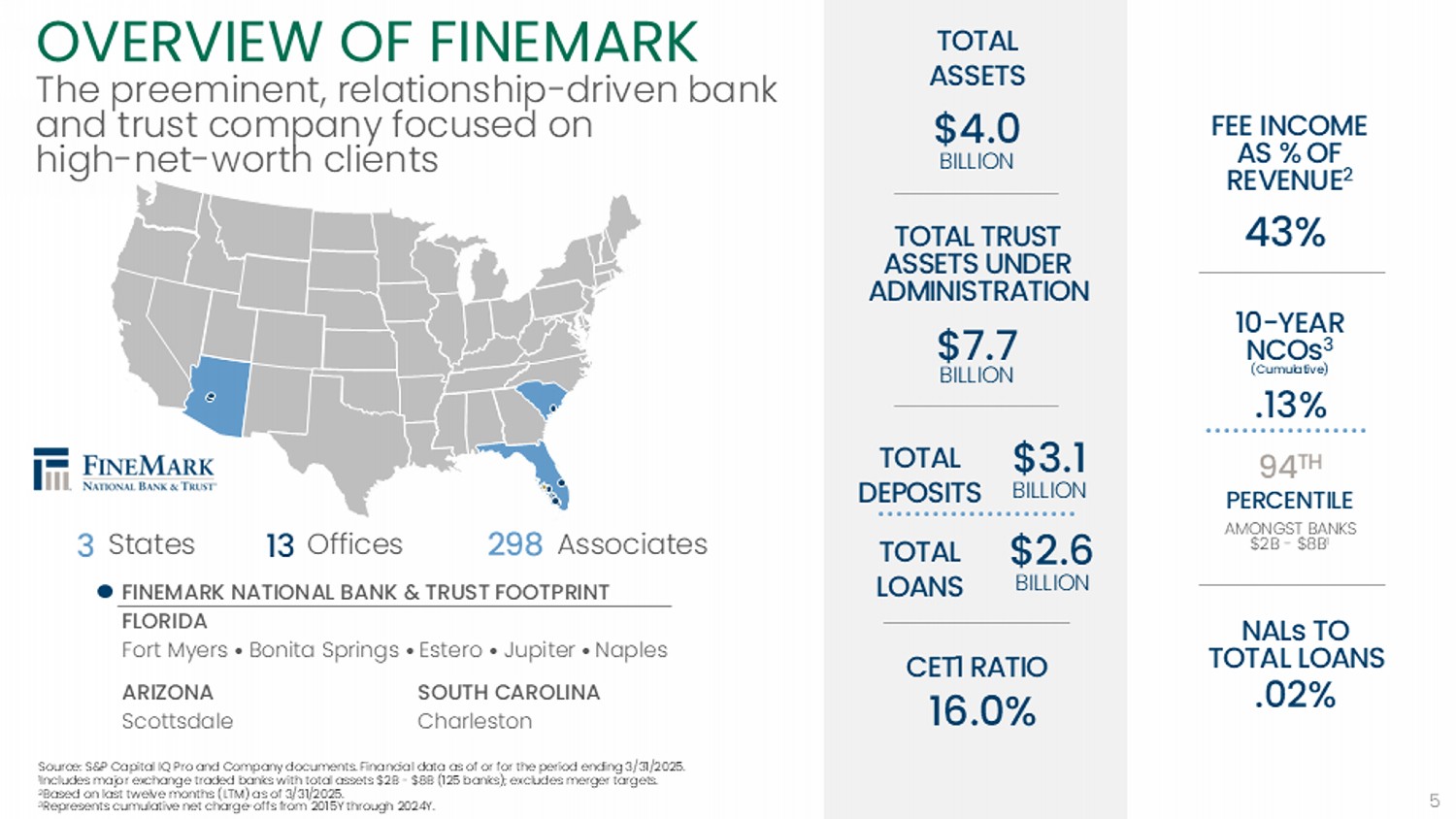

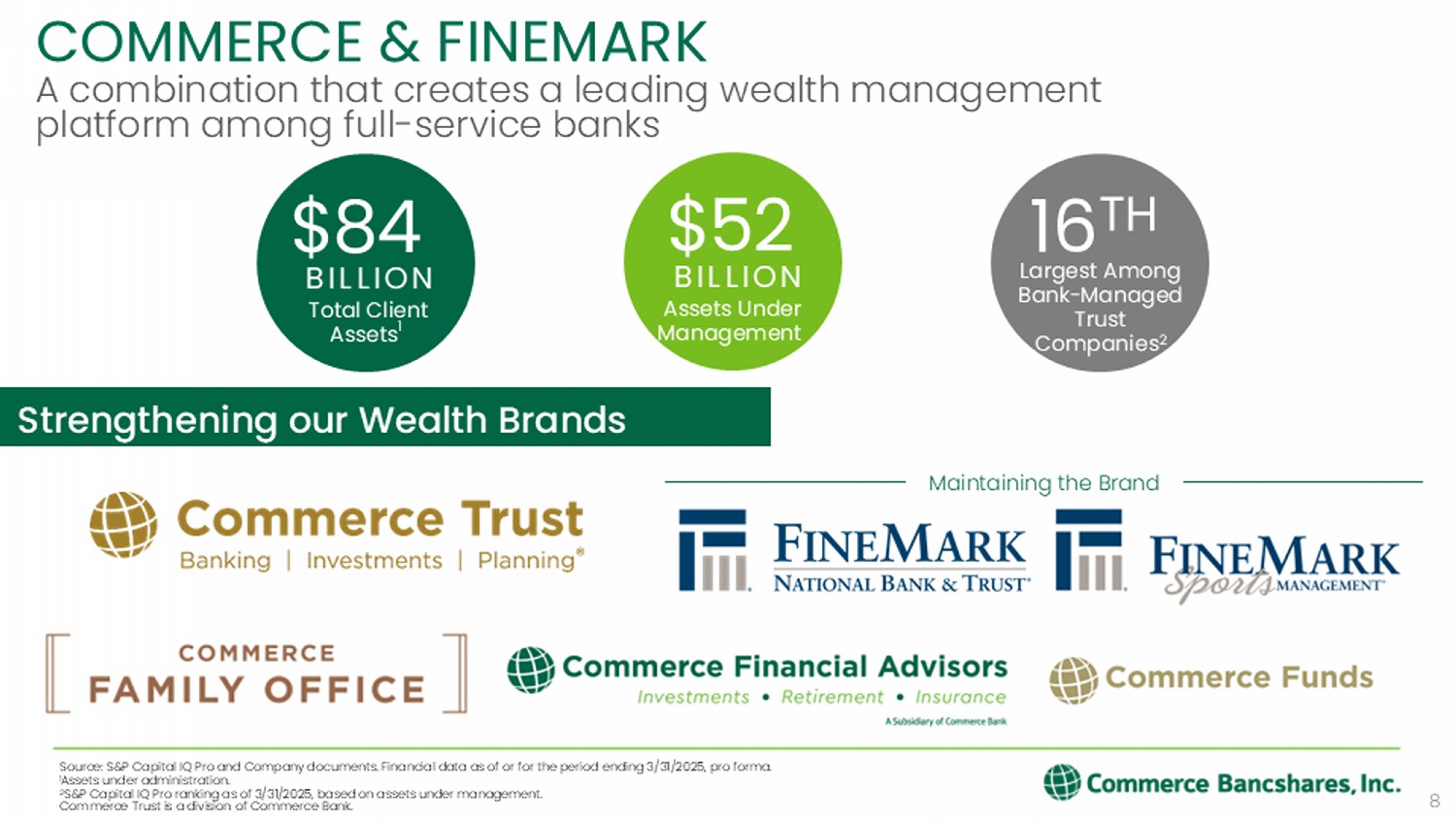

Bolsters wealth management business in high-growth markets with addition of FineMark’s assets under administration of $7.7 billion and bank assets of $4.0 billion

KANSAS CITY, MO & FORT MYERS, FL, June 16, 2025 – Commerce Bancshares, Inc. (NASDAQ:CBSH) (“Commerce”) and FineMark Holdings, Inc. (OTCQX:FNBT) (“FineMark”) today jointly announced they have entered into a definitive merger agreement pursuant to which Commerce will acquire FineMark in an all-stock transaction valued at approximately $585MM. FineMark is the parent company of FineMark National Bank & Trust, a nationally chartered commercial bank and trust company serving clients through 13 banking offices in Florida, Arizona and South Carolina.

Founded in 2007, FineMark has a long history of building extraordinary client relationships through a holistic, integrated approach to asset management, banking, investments and planning - an approach that aligns closely with Commerce’s own client-first philosophy.

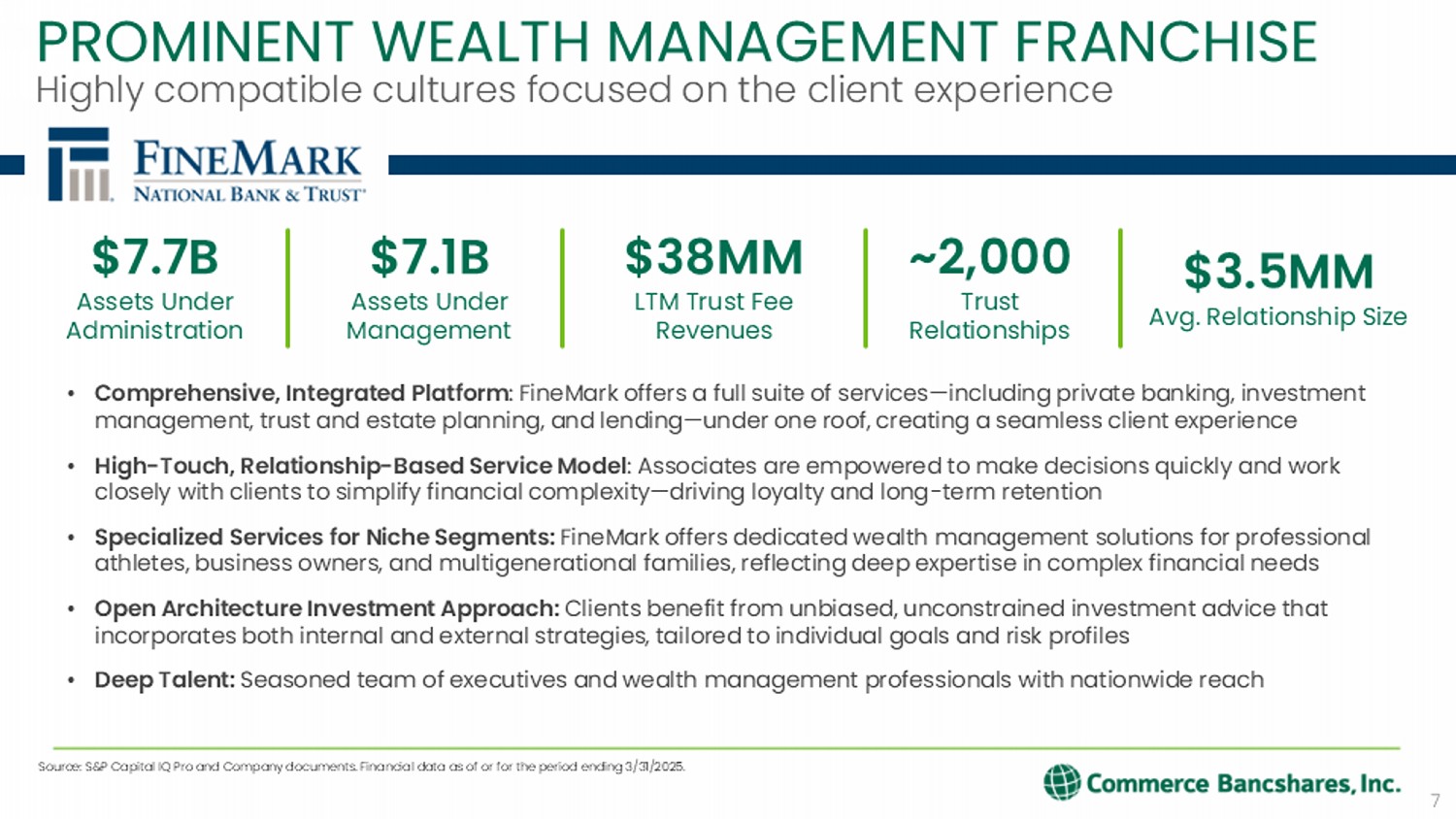

As of March 31, 2025, FineMark had assets of $4.0 billion, deposits of $3.1 billion and loans of $2.6 billion. FineMark’s Trust and Investment business delivers a comprehensive suite of highly personalized services to approximately 2,000 clients with approximately $7.7 billion in assets under administration (“AUA”).

John Kemper, President and Chief Executive Officer of Commerce, said, "We are excited to welcome FineMark, marking a strategic milestone that is the culmination of years of relationship building, mutual trust, and shared values. FineMark is a natural culture fit, with a history of strong asset quality, a shared client-centric approach to wealth management and banking, and a commitment to building strong communities. Together, with over $36 billion in assets and over $82 billion in wealth assets under administration, we are poised to accelerate growth, expand our reach, and deliver even greater value to clients, shareholders, and the communities we serve for many years to come. This acquisition is about more than scale—it's about shared purpose and the opportunity to achieve more together." John Handy, President and Chief Executive Officer of Commerce Trust, adds, "FineMark's higher-growth markets and exceptional team of professionals provide a platform for continued growth, building on our existing presence in Florida and expanding our footprint in attractive new geographies.

We are thrilled to welcome FineMark's team, clients, and shareholders to Commerce."

Joseph R. Catti, Chairman and Chief Executive Officer of FineMark, said, "When we started FineMark in February 2007, the mission was to build extraordinary relationships by going above and beyond. Central to this mission is our culture. We work every day to build and protect the primary attributes which include integrity, hard work, caring and service to others — both in the bank and in the communities we serve.

After several years of getting to know the team at Commerce, we are delighted to have identified a partner that shares these same values and will enable us to continue to grow and further our mission. We believe it reflects well on FineMark that a bank of Commerce’s caliber would see the value in what we have created. We are excited to announce a partnership that will benefit both institutions, our clients, and shareholders, while also positioning us to work together towards the next chapter of our combined organization’s legacy."

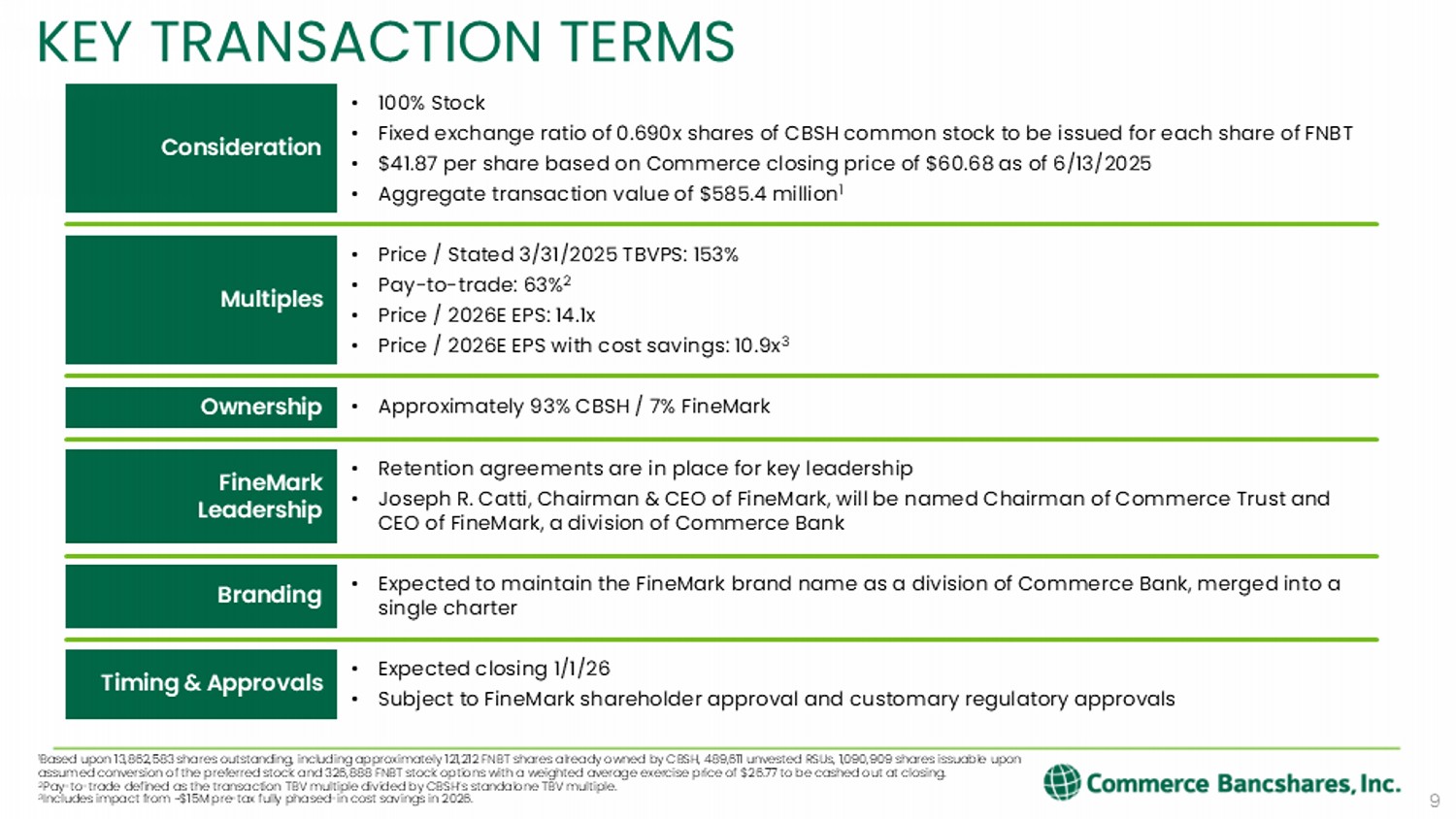

TRANSACTION TERMS

Under the terms of the agreement, shareholders of FineMark will receive a fixed exchange ratio of 0.690 shares of Commerce common stock for each share of FineMark common stock. The per share value equates to $41.87 for FineMark shareholders based on the closing price of Commerce common stock on June 13, 2025, or approximately $585 million in the aggregate including the conversion of outstanding preferred stock. The definitive merger agreement has been approved by the board of directors of each company. The transaction remains subject to regulatory approval, approval of FineMark shareholders and other customary closing conditions. Pending these approvals, the transaction is anticipated to close on January 1, 2026.

CONFERENCE CALL

Commerce will host an investor call on Monday, June 16, at 10:00 a.m. (CT) / 11:00 a.m. (ET), to discuss the acquisition of FineMark. The live audio webcast link and corresponding presentation slides will be available on Commerce’s Investor Relations web page at investor.commercebank.com.

A replay of the conference call will be available at investor.commercebank.com.

TRANSACTION ADVISORS

Keefe, Bruyette & Woods, A Stifel Company, served as financial advisor and Holland & Knight LLP acted as legal advisor to Commerce. Piper Sandler & Co. served as financial advisor and Alston & Bird LLP acted as legal advisor to FineMark.

ABOUT COMMERCE

With $32.4 billion in assets1, Commerce Bancshares, Inc. (NASDAQ: CBSH) is a regional bank holding company offering a full line of banking services through its subsidiaries, including payment solutions, investment management and securities brokerage. One of its subsidiaries, Commerce Bank, leverages 160 years of proven strength and experience to help individuals and businesses solve financial challenges. In addition to offering payment solutions across the U.S., Commerce Bank currently operates full-service banking facilities across the Midwest including the St. Louis and Kansas City metropolitan areas, Springfield, Central Missouri, Central Illinois, Wichita, Tulsa, Oklahoma City, and Denver. Beyond the Midwest, Commerce also maintains commercial offices in Dallas, Houston, Cincinnati, Nashville, Des Moines, Indianapolis, and Grand Rapids and wealth offices in Dallas, Houston and Naples. Commerce delivers high-touch service and sophisticated financial solutions at regional branches, commercial and wealth offices, ATMs, online, mobile and through a 24/7 customer service line. Learn more at www.commercebank.com.

1As of March 31, 2025

ABOUT FINEMARK

FineMark Holdings, Inc. is the parent company of FineMark National Bank & Trust. Founded in 2007, FineMark is a nationally chartered bank and trust company, headquartered in Florida. Through its offices located in Florida, Arizona and South Carolina, FineMark offers a full range of financial services, including personal and business banking, lending, trust and investment services. FineMark’s common stock trades on the OTCQX under the symbol FNBT. Investor information is available on FineMark’s website at www.finemarkbank.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed business combination transaction between Commerce and FineMark (the “Proposed Transaction”), the plans, objectives, expectations and intentions of Commerce and FineMark, the expected timing of completion of the Proposed Transaction, and other statements that are not historical facts. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions. Forward-looking statements, by their nature, are subject to risks and uncertainties. There are many factors that could cause actual results to differ materially from expected results described in the forward-looking statements. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995.

Factors relating to the Proposed Transaction that could cause or contribute to actual results differing materially from those contained or implied in forward-looking statements or historical performance include, in addition to those factors identified elsewhere in this press release the occurrence of any event, change or other circumstances that could give rise to the right of Commerce or FineMark to terminate the definitive merger agreement governing the terms and conditions of the Proposed Transaction; the outcome of any legal proceedings that may be instituted against Commerce or FineMark; the possibility that revenue or expense synergies or the other expected benefits of the Proposed Transaction may not fully materialize or may take longer to realize than expected, or may be more costly to achieve than anticipated, including as a result of the impact of, or problems arising from, the integration of the two companies, the strength of the economy and competitive factors in the areas where Commerce and FineMark do business, or other unexpected factors or events; the possibility that the Proposed Transaction may not be completed when expected or at all because required regulatory, shareholder or other approvals or other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect Commerce or FineMark or the expected benefits of the Proposed Transaction); the risk that Commerce is unable to successfully and promptly implement its integration strategies; reputational risks and potential adverse reactions from or changes to the relationships with the companies’ customers, employees or other business partners, including resulting from the announcement or the completion of the Proposed Transaction; the dilution caused by Commerce’s issuance of common stock in connection with the Proposed Transaction; diversion of management’s attention and time from ongoing business operations and other opportunities on matters relating to the Proposed Transaction; and other factors that may affect the future results of Commerce and FineMark, including continued pressures and uncertainties within the banking industry and Commerce’s and FineMark’s markets, including changes in interest rates and deposit amounts and composition, adverse developments in the level and direction of loan delinquencies, charge-offs, and estimates of the adequacy of the allowance for loan losses, increased competitive pressures, asset and credit quality deterioration, the impact of proposed or imposed tariffs by the U.S. government or retaliatory tariffs proposed or imposed by U.S. trading partners that could have an adverse impact on customers or any recession or slowdown in economic growth particularly in the markets in which Commerce or FineMark operate, and legislative, regulatory, and fiscal policy changes and related compliance costs.

These factors are not necessarily all of the factors that could cause Commerce’s or FineMark’s actual results, performance, or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other unknown or unpredictable factors also could harm Commerce’s or FineMark’s results.

Further information regarding Commerce and factors that could affect the forward-looking statements contained herein can be found in Commerce’s Annual Report on Form 10-K for the year ended December 31, 2024, which is accessible on the Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov and at Investor.Commercebank.com, and in other documents Commerce files with the SEC. Information on these websites is not part of this document.

All forward-looking statements attributable to Commerce or FineMark, or persons acting on Commerce’s or FineMark’s behalf, are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and Commerce and FineMark do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If Commerce or FineMark update one or more forward-looking statements, no inference should be drawn that Commerce or FineMark will make additional updates with respect to those or other forward-looking statements.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Proposed Transaction, Commerce will file with the SEC a Registration Statement on Form S-4 to register the shares of Commerce common stock to be issued in connection with the Proposed Transaction that will include a proxy statement of FineMark and a prospectus of Commerce (the “proxy statement/prospectus”), as well as other relevant documents concerning the Proposed Transaction. The definitive proxy statement/prospectus will be sent to the shareholders of FineMark seeking their approval of the Proposed Transaction and other related matters. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF FINEMARK ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE AND EACH OTHER RELEVANT DOCUMENT FILED WITH THE SEC BY COMMERCE IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain a free copy of the definitive proxy statement/prospectus, as well as other filings containing information about the Proposed Transaction, Commerce and FineMark, without charge, at the SEC’s website, http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Commerce’s Investor Relations via email at matthew.burkemper@commercebank.com or by telephone at (314) 746-7485, or to FineMark's Investor Relations via email at investorrelations@finemarkbank.com or by telephone at (239) 461-3850.

PARTICIPANTS IN THE SOLICITATION

Commerce, FineMark and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of FineMark in connection with the Proposed Transaction under the rules of the SEC. Information regarding Commerce’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Commerce’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 25, 2025 (available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000022356/000002235625000016/cbsh-20241231.htm); in the sections entitled “Security Ownership of Certain Beneficial Owners and Management,” “Composition of the Board, Board Diversity and Director Qualifications,” “Corporate Governance” “Compensation Discussion and Analysis” and “Executive Compensation,” in Commerce’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on March 14, 2025 (available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000022356/000002235625000021/cbsh-20250307.htm); and other documents filed by Commerce with the SEC. To the extent holdings of Commerce common stock by the directors and executive officers of Commerce have changed from the amounts held by such persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus relating to the Proposed Transaction. Free copies of this document may be obtained as described in the preceding paragraph.

Exhibit 99.2

COMMERCE BANCSHARES, INC. STRATEGIC ACQUISITION OF FINEMARK HOLDINGS, INC.

Expanding our presence in high - growth markets and leveraging our substantial wealth platform June 16, 2025 DISCLOSURES 2 CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS This presentation may contain forward - looking statements, including, but not limited to, certain plans, expectations, goals, pro jections, and statements about the benefits of the proposed business combination transaction between Commerce Bancshares, Inc. (“Commerce”) and FineMark Holdings, Inc. (“FineMark”) (the “P roposed Transaction”), the plans, objectives, expectations and intentions of Commerce and FineMark, the expected timing of completion of the Proposed Transaction, and othe r s tatements that are not historical facts. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward - looking statements. F orward - looking statements may be identified by words such as “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipa te, ” “expect,” “target” and similar expressions. Forward - looking statements, by their nature, are subject to risks and uncertainties. There are many factors that could cause actual results t o d iffer materially from expected results described in the forward - looking statements. The forward - looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Factors relating to the Proposed Transaction that could cause or contribute to actual results differing materially from those co ntained or implied in forward - looking statements or historical performance include, in addition to those factors identified elsewhere in this presentation the occurrence of any eve nt, change or other circumstances that could give rise to the right of Commerce or FineMark to terminate the definitive merger agreement governing the terms and conditions of the Proposed Tr ansaction; the outcome of any legal proceedings that may be instituted against Commerce or FineMark; the possibility that revenue or expense synergies or the other expected benef its of the Proposed Transaction may not fully materialize or may take longer to realize than expected, or may be more costly to achieve than anticipated, including as a result of the imp act of, or problems arising from, the integration of the two companies, the strength of the economy and competitive factors in the areas where Commerce and FineMark do business, or other un expected factors or events; the possibility that the Proposed Transaction may not be completed when expected or at all because required regulatory, shareholder or other approvals or other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could ad versely affect Commerce or FineMark or the expected benefits of the Proposed Transaction); the risk that Commerce is unable to successfully and promptly implement its integration strateg ies ; reputational risks and potential adverse reactions from or changes to the relationships with the companies’ customers, employees or other business partners, including resulting from th e announcement or the completion of the Proposed Transaction; the dilution caused by Commerce’s issuance of common stock in connection with the Proposed Transaction; diversio n o f management’s attention and time from ongoing business operations and other opportunities on matters relating to the Proposed Transaction; and other factors that may affec t t he future results of Commerce and FineMark, including continued pressures and uncertainties within the banking industry and Commerce’s and FineMark’s markets, including changes in in terest rates and deposit amounts and composition, adverse developments in the level and direction of loan delinquencies, charge - offs, and estimates of the adequacy of the allowan ce for loan losses, increased competitive pressures, asset and credit quality deterioration, the impact of proposed or imposed tariffs by the U.S. government or retaliatory tarif fs proposed or imposed by U.S. trading partners that could have an adverse impact on customers or any recession or slowdown in economic growth particularly in the markets in which Commerce or FineMark operate, and legislative, regulatory, and fiscal policy changes and related compliance costs. These factors are not necessarily all of the factors that could cause Commerce’s or FineMark’s actual results, performance, o r a chievements to differ materially from those expressed in or implied by any of the forward - looking statements. Other unknown or unpredictable factors also could harm Commerce’s or FineMark’ s results. Further information regarding Commerce and factors that could affect the forward - looking statements contained herein can be foun d in Commerce’s Annual Report on Form 10 - K for the year ended December 31, 2024, which is accessible on the Securities and Exchange Commission’s (the “SEC”) website at www.sec. gov and at Investor.Commercebank.com, and in other documents Commerce files with the SEC. Information on these websites is not part of this document. All forward - looking statements attributable to Commerce or FineMark, or persons acting on Commerce’s or FineMark’s behalf, are e xpressly qualified in their entirety by the cautionary statements set forth above. Forward - looking statements speak only as of the date they are made and Commerce and FineMark do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions, or chan ges in other factors affecting forward - looking statements, except to the extent required by applicable law. If Commerce or FineMark update one or more forward - looking statements, no infer ence should be drawn that Commerce or FineMark will make additional updates with respect to those or other forward - looking statements.

3 ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the Proposed Transaction, Commerce will file with the SEC a Registration Statement on Form S - 4 to register th e shares of Commerce common stock to be issued in connection with the Proposed Transaction that will include a proxy statement of FineMark and a prospectus of Commerce (the “p rox y statement/prospectus”), as well as other relevant documents concerning the Proposed Transaction. The definitive proxy statement/prospectus will be sent to the shareholders of Fin eMark seeking their approval of the Proposed Transaction and other related matters. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior t o r egistration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF FINEMARK ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PRO SPE CTUS REGARDING THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE AND EACH OTHER RELEVANT DOCUMENT FILED WITH THE SEC BY COMMERCE IN CONNECTION WITH THE PROPOSED TR ANS ACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain a free c opy of the definitive proxy statement/prospectus, as well as other filings containing information about the Proposed Transaction, Commerce and FineMark, without charge, at the SE C’s website, http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus ca n a lso be obtained, without charge, by directing a request to Commerce’s Investor Relations via email at matthew.burkemper@commercebank.com or by telephone at (314) 746 - 7485, or to FineMark’ s Investor Relations via email at investorrelations@finemarkbank.com or by telephone at (239) 461 - 3850. PARTICIPANTS IN THE SOLICITATION Commerce, FineMark and certain of their respective directors and executive officers may be deemed to be participants in the s oli citation of proxies from the shareholders of FineMark in connection with the Proposed Transaction under the rules of the SEC. Information regarding Commerce’s directors and executive of ficers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Sto ckholder Matters” in Commerce’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 25, 2025 (available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000022356/000002235625000016/cbsh - 20241231.htm); in the sections entitled “Secu rity Ownership of Certain Beneficial Owners and Management,” “Composition of the Board, Board Diversity and Director Qualifications,” “Corporate Governance,” “Compensation D isc ussion and Analysis” and “Executive Compensation,” in Commerce’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on Ma rch 14, 2025 (available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000022356/000002235625000021/cbsh - 20250307.htm); and other documents filed by C ommerce with the SEC. To the extent holdings of Commerce common stock by the directors and executive officers of Commerce have changed from the amounts held by s uch persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SE C. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be conta ine d in the proxy statement/prospectus relating to the Proposed Transaction. Free copies of this document may be obtained as described in the preceding paragraph.

DISCLOSURES TRANSACTION HIGHLIGHTS Expands presence in high - growth markets & leverages our wealth platform Strategically Compelling Financially Attractive Low Integration Risk • Unique opportunity to partner with a highly compatible private bank and trust company focused on delivering personalized wealth management to high - net - worth clients bringing nearly $8 billion in AUA 1 and $4 billion in banking assets • Meaningful expansion in growth markets of Florida, where CBSH has a wealth presence, Arizona & South Carolina • FineMark offers differentiated wealth expertise, representing ~300 professional athletes with ~$600 million of AUA 1 within their Sports Management division • CBSH’s deposit strength can support future growth opportunities in FineMark’s markets • Ability to leverage larger balance sheet & product suite across FineMark’s business • ~6% accretive to 2026 consensus GAAP earnings, with fully phased cost savings – attractive accretion considering the relative size 2 • Tangible book value per share (TBVPS) earnback of 1.6 years, inclusive of all one - time charges and purchase accounting marks 3 • Limited capital impact at closing, with CET1 ~17%, well - positioned for continued growth • Limited reliance on cost savings (cost savings at 15%) in assumptions • Deep cultural alignment and relationship - based business philosophies • CBSH has over $76 billion of total wealth assets 1 and is recognized as a leader in the industry • Retention of the FineMark brand as a division of Commerce Bank, combined with agreements in place with key leaders, ensures minimal disruption to client relationships • Similar underwriting discipline confirmed during comprehensive diligence Source: S&P Capital IQ Pro and Company documents. Financial data as of 3/31/2025. 1 Assets under administration. 2 Pro forma impact is presented for illustrative purposes only and is subject to change based on final purchase accounting entr ies . EPS accretion illustrated assuming no share buybacks, fully phased cost savings and excluding any restructuring charges or provision expense related to th e CECL “double count”. 3 The tangible book value per share (“TBVPS”) earnback is calculated using the crossover method. See page 17 for purchasing acc oun ting summary. Pro Forma Impact 2 ~6% 2026 EPS Accretion 2 ~2.2% TBVPS Dilution 1.6 Yrs TBVPS Earnback 3 ~17% CET1 Ratio 4 Adds $7.7B Assets under Administration OVERVIEW OF FINEMARK The preeminent, relationship - driven bank and trust company focused on high - net - worth clients 5 Source: S&P Capital IQ Pro and Company documents.

Financial data as of or for the period ending 3/31/2025. 1 Includes major exchange traded banks with total assets $2B - $8B (125 banks); excludes merger targets. 2 Based on last twelve months (LTM) as of 3/31/2025. 3 Represents cumulative net charge - offs from 2015Y through 2024Y. $4.0 BILLION TOTAL ASSETS 16.0% CET1 RATIO $3.1 BILLION TOTAL DEPOSITS $2.6 BILLION TOTAL LOANS 3 States 13 Offices 298 Associates $7.7 BILLION TOTAL TRUST ASSETS UNDER ADMINISTRATION 43% FEE INCOME AS % OF REVENUE 2 .13% 10 - YEAR NCOs 3 (Cumulative) 94 TH AMONGST BANKS $2B - $8B 1 PERCENTILE NALs TO TOTAL LOANS .02% FINEMARK NATIONAL BANK & TRUST FOOTPRINT FLORIDA Fort Myers Ȉ Bonita Springs Ȉ Estero Ȉ Jupiter Ȉ Naples ARIZONA Scottsdale SOUTH CAROLINA Charleston 6 CONCIERGE WEALTH MANAGEMENT AND BANKING AT 13 LOCATIONS IN THREE STATES Bonita Springs Estero Fort Myers (HQ) Fort Myers Jupiter Naples Naples Naples Naples Fort Myers Charleston Scottsdale Scottsdale

7 Source: S&P Capital IQ Pro and Company documents. Financial data as of or for the period ending 3/31/2025. $7.7B Assets Under Administration $38MM LTM Trust Fee Revenues ~2,000 Trust Relationships $3.5MM Avg. Relationship Size • Comprehensive, Integrated Platform : FineMark offers a full suite of services — including private banking, investment management, trust and estate planning, and lending — under one roof, creating a seamless client experience • High - Touch, Relationship - Based Service Model : Associates are empowered to make decisions quickly and work closely with clients to simplify financial complexity — driving loyalty and long - term retention • Specialized Services for Niche Segments: FineMark offers dedicated wealth management solutions for professional athletes, business owners, and multigenerational families, reflecting deep expertise in complex financial needs • Open Architecture Investment Approach: Clients benefit from unbiased, unconstrained investment advice that incorporates both internal and external strategies, tailored to individual goals and risk profiles • Deep Talent: Seasoned team of executives and wealth management professionals with nationwide reach PROMINENT WEALTH MANAGEMENT FRANCHISE Highly compatible cultures focused on the client experience $7.1B Assets Under Management BILLION $52 Assets Under Management $84 BILLION Total Client Assets 1 8 Source: S&P Capital IQ Pro and Company documents.

Financial data as of or for the period ending 3/31/2025, pro forma. 1 Assets under administration. 2 S&P Capital IQ Pro ranking as of 3/31/2025, based on assets under management. Commerce Trust is a division of Commerce Bank.

Maintaining the Brand COMMERCE & FINEMARK A combination that creates a leading wealth management platform among full - service banks Largest Among Bank - Managed Trust Companies 2 16 TH Strengthening our Wealth Brands KEY TRANSACTION TERMS 9 • 100% Stock • Fixed exchange ratio of 0.690x shares of CBSH common stock to be issued for each share of FNBT • $41.87 per share based on Commerce closing price of $60.68 as of 6/13/2025 • Aggregate transaction value of $585.4 million 1 Consideration • Price / Stated 3/31/2025 TBVPS: 153% • Pay - to - trade: 63% 2 • Price / 2026E EPS: 14.1x • Price / 2026E EPS with cost savings: 10.9x 3 Multiples • Approximately 93% CBSH / 7% FineMark Ownership • Retention agreements are in place for key leadership • Joseph R. Catti, Chairman & CEO of FineMark, will be named Chairman of Commerce Trust and CEO of FineMark, a division of Commerce Bank FineMark Leadership • Expected to maintain the FineMark brand name as a division of Commerce Bank, merged into a single charter Branding • Expected closing 1/1/26 • Subject to FineMark shareholder approval and customary regulatory approvals Timing & Approvals 1 Based upon 13,862,583 shares outstanding, including approximately 121,212 FNBT shares already owned by CBSH, 489,611 unvested RSUs, 1,090,909 shares issuable upon assumed conversion of the preferred stock and 326,888 FNBT stock options with a weighted average exercise price of $26.77 to be cashed out at closing. 2 Pay - to - trade defined as the transaction TBV multiple divided by CBSH’s standalone TBV multiple. 3 Includes impact from ~$15M pre - tax fully phased - in cost savings in 2026.

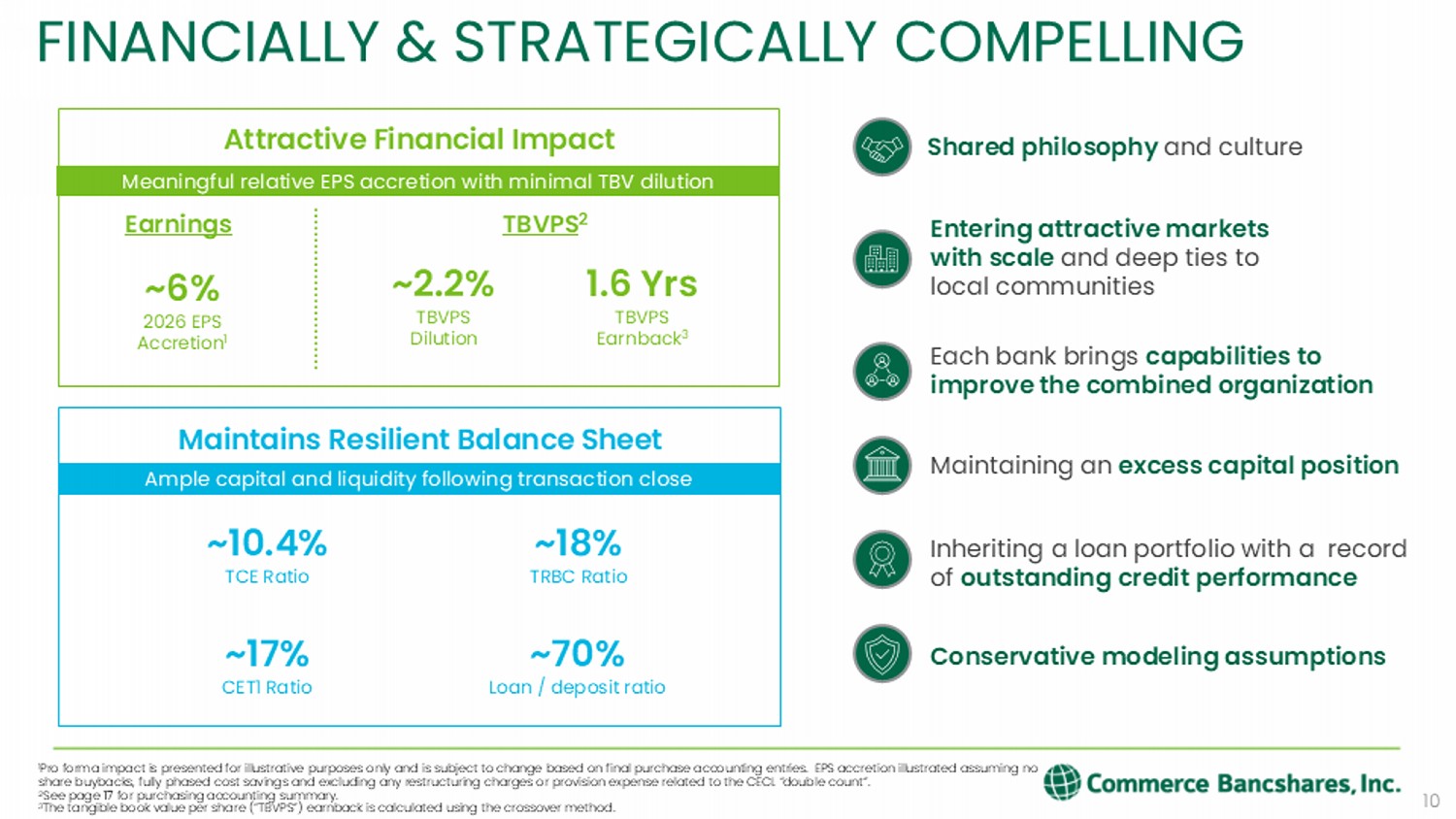

Shared philosophy and culture Entering attractive markets with scale and deep ties to local communities Each bank brings capabilities to improve the combined organization Maintaining an excess capital position Inheriting a loan portfolio with a record of outstanding credit performance Conservative modeling assumptions Earnings 10 1 Pro forma impact is presented for illustrative purposes only and is subject to change based on final purchase accounting entr ies . EPS accretion illustrated assuming no share buybacks, fully phased cost savings and excluding any restructuring charges or provision expense related to the CECL “d oub le count”. 2 See page 17 for purchasing accounting summary. 3 The tangible book value per share (“TBVPS”) earnback is calculated using the crossover method.

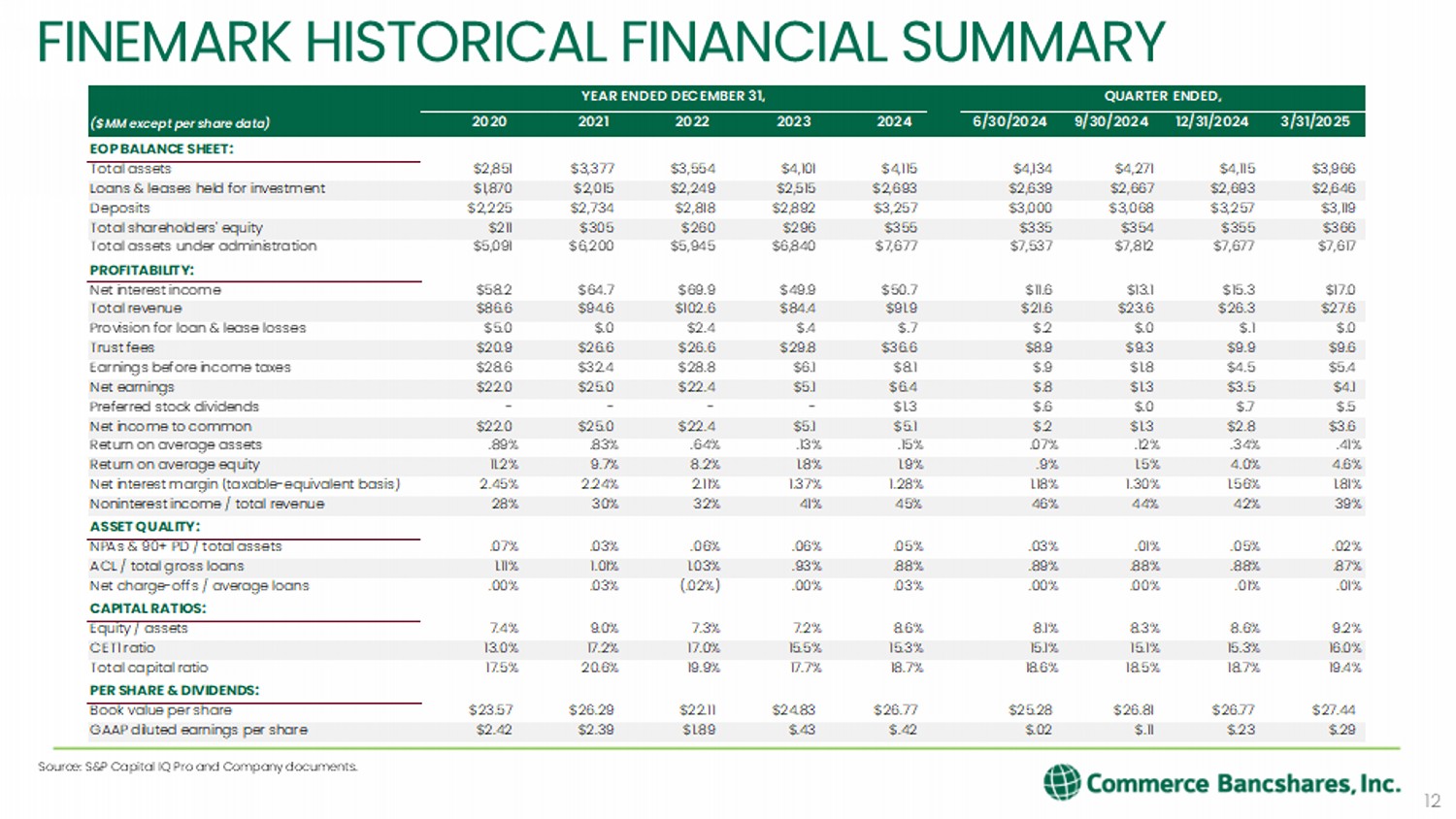

11 APPENDIX

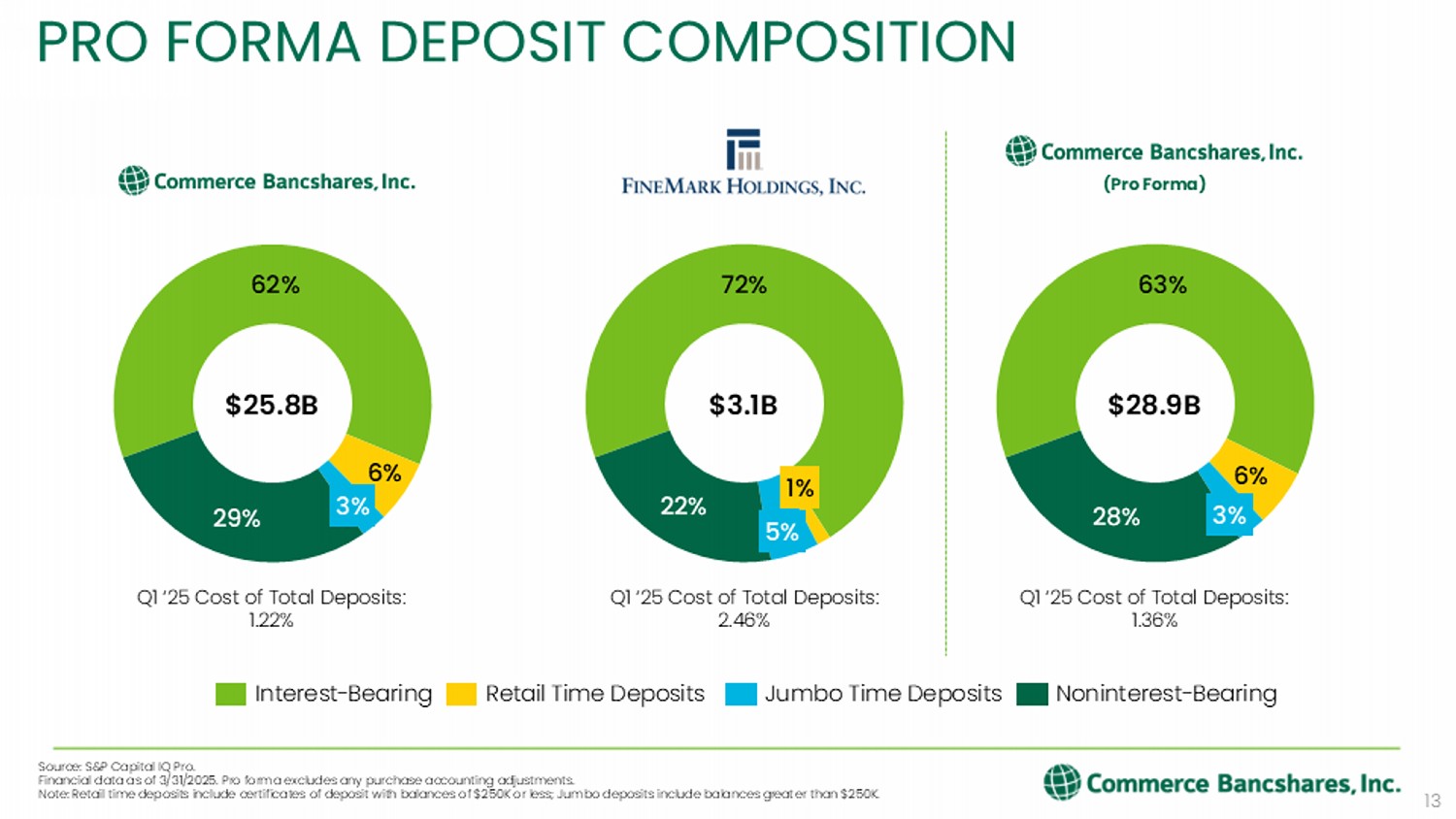

Attractive Financial Impact ~6% 2026 EPS Accretion 1 ~2.2% TBVPS Dilution 1.6 Yrs TBVPS Earnback 3 TBVPS 2 Maintains Resilient Balance Sheet ~10.4% TCE Ratio ~17% CET1 Ratio ~70% Loan / deposit ratio ~18% TRBC Ratio FINANCIALLY & STRATEGICALLY COMPELLING Meaningful relative EPS accretion with minimal TBV dilution Ample capital and liquidity following transaction close 12 YEAR ENDED DECEMBER 31, QUARTER ENDED, ($MM except per share data) 2020 2021 2022 2023 2024 6/30/2024 9/30/2024 12/31/2024 3/31/2025 EOP BALANCE SHEET: Total assets $2,851 $3,377 $3,554 $4,101 $4,115 $4,134 $4,271 $4,115 $3,966 Loans & leases held for investment $1,870 $2,015 $2,249 $2,515 $2,693 $2,639 $2,667 $2,693 $2,646 Deposits $2,225 $2,734 $2,818 $2,892 $3,257 $3,000 $3,068 $3,257 $3,119 Total shareholders' equity $211 $305 $260 $296 $355 $335 $354 $355 $366 Total assets under administration $5,091 $6,200 $5,945 $6,840 $7,677 $7,537 $7,812 $7,677 $7,617 PROFITABILITY: Net interest income $58.2 $64.7 $69.9 $49.9 $50.7 $11.6 $13.1 $15.3 $17.0 Total revenue $86.6 $94.6 $102.6 $84.4 $91.9 $21.6 $23.6 $26.3 $27.6 Provision for loan & lease losses $5.0 $.0 $2.4 $.4 $.7 $.2 $.0 $.1 $.0 Trust fees $20.9 $26.6 $26.6 $29.8 $36.6 $8.9 $9.3 $9.9 $9.6 Earnings before income taxes $28.6 $32.4 $28.8 $6.1 $8.1 $.9 $1.8 $4.5 $5.4 Net earnings $22.0 $25.0 $22.4 $5.1 $6.4 $.8 $1.3 $3.5 $4.1 Preferred stock dividends - - - - $1.3 $.6 $.0 $.7 $.5 Net income to common $22.0 $25.0 $22.4 $5.1 $5.1 $.2 $1.3 $2.8 $3.6 Return on average assets .89% .83% .64% .13% .15% .07% .12% .34% .41% Return on average equity 11.2% 9.7% 8.2% 1.8% 1.9% .9% 1.5% 4.0% 4.6% Net interest margin (taxable-equivalent basis) 2.45% 2.24% 2.11% 1.37% 1.28% 1.18% 1.30% 1.56% 1.81% Noninterest income / total revenue 28% 30% 32% 41% 45% 46% 44% 42% 39% ASSET QUALITY: NPAs & 90+ PD / total assets .07% .03% .06% .06% .05% .03% .01% .05% .02% ACL / total gross loans 1.11% 1.01% 1.03% .93% .88% .89% .88% .88% .87% Net charge-offs / average loans .00% .03% (.02%) .00% .03% .00% .00% .01% .01% CAPITAL RATIOS: Equity / assets 7.4% 9.0% 7.3% 7.2% 8.6% 8.1% 8.3% 8.6% 9.2% CET1 ratio 13.0% 17.2% 17.0% 15.5% 15.3% 15.1% 15.1% 15.3% 16.0% Total capital ratio 17.5% 20.6% 19.9% 17.7% 18.7% 18.6% 18.5% 18.7% 19.4% PER SHARE & DIVIDENDS: Book value per share $23.57 $26.29 $22.11 $24.83 $26.77 $25.28 $26.81 $26.77 $27.44 GAAP diluted earnings per share $2.42 $2.39 $1.89 $.43 $.42 $.02 $.11 $.23 $.29 Source: S&P Capital IQ Pro and Company documents. FINEMARK HISTORICAL FINANCIAL SUMMARY 62% 6% 3% 29% 63% 6% 3% 28% 72% 1% 5% 22% 13 Q1 ‘25 Cost of Total Deposits: 1.22% Q1 ‘25 Cost of Total Deposits: 2.46% Q1 ‘25 Cost of Total Deposits: 1.36% $25.8B $3.1B (Pro Forma) $28.9B Source: S&P Capital IQ Pro.

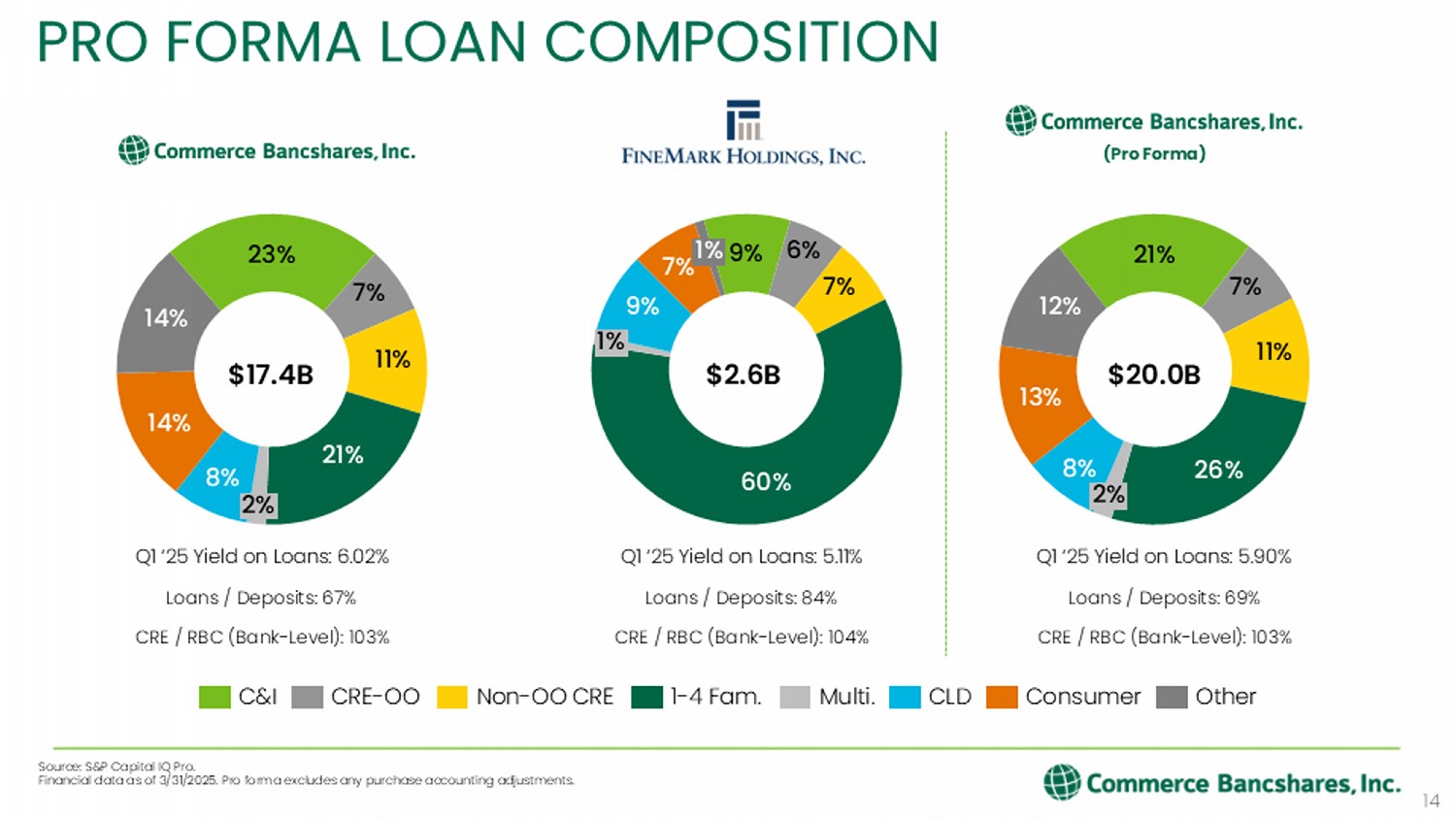

Financial data as of 3/31/2025. Pro forma excludes any purchase accounting adjustments. Note: Retail time deposits include certificates of deposit with balances of $250K or less; Jumbo deposits include balances gr eat er than $250K. PRO FORMA DEPOSIT COMPOSITION Interest - Bearing Retail Time Deposits Jumbo Time Deposits Noninterest - Bearing 2% 26% 11% 7% 21% 12% 13% 8% 9% 7% 60% 1% 9% 7% 1% 6% 23% 7% 11% 21% 2% 8% 14% 14% 14 $17.4B $2.6B (Pro Forma) $20.0B PRO FORMA LOAN COMPOSITION C&I CRE - OO Non - OO CRE 1 - 4 Fam.

Multi. CLD Consumer Other Q1 ‘25 Yield on Loans: 6.02% Q1 ‘25 Yield on Loans: 5.11% Q1 ‘25 Yield on Loans: 5.90% Loans / Deposits: 67% Loans / Deposits: 84% Loans / Deposits: 69% CRE / RBC (Bank - Level): 103% CRE / RBC (Bank - Level): 104% CRE / RBC (Bank - Level): 103% Source: S&P Capital IQ Pro. Financial data as of 3/31/2025. Pro forma excludes any purchase accounting adjustments.

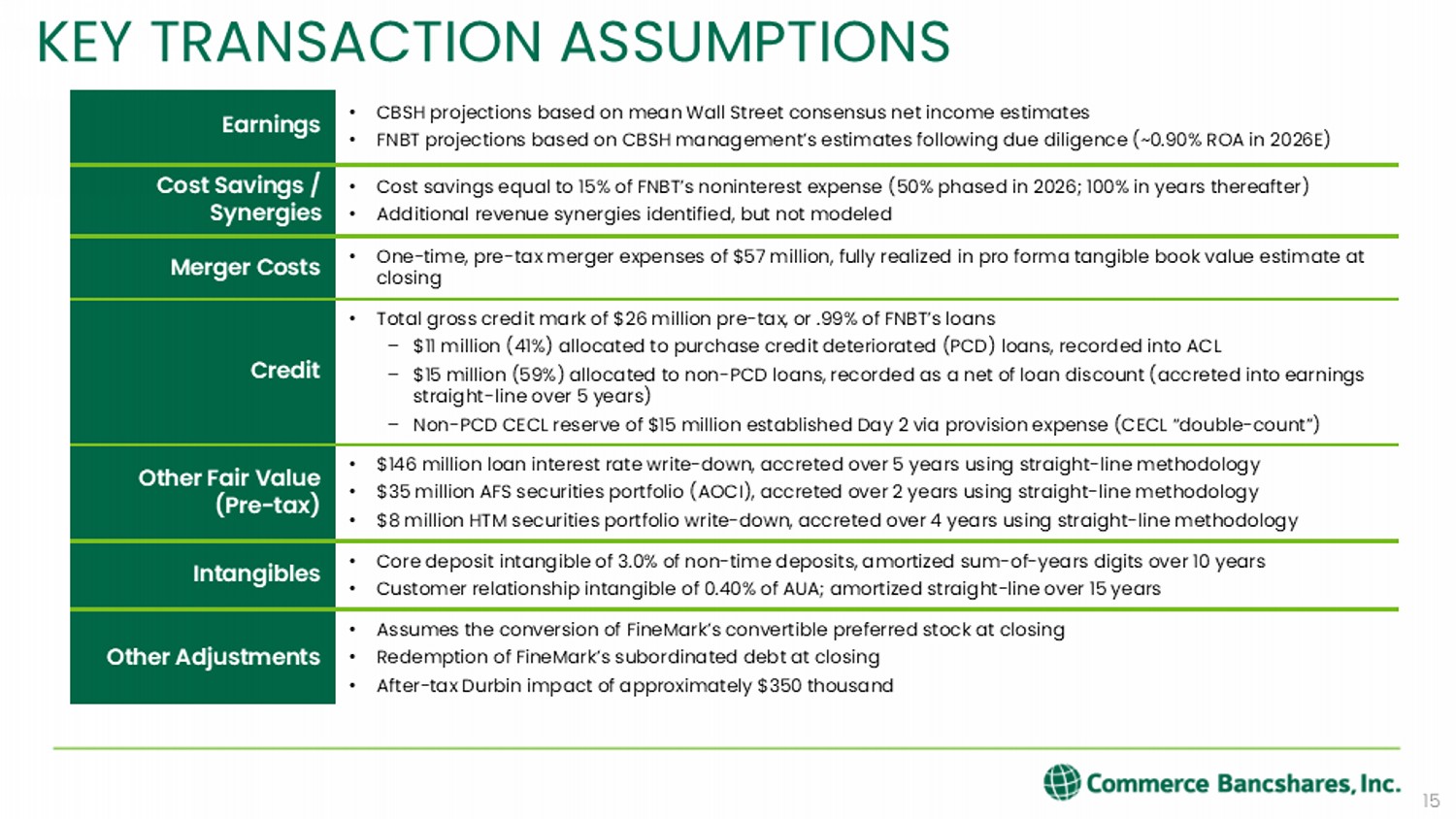

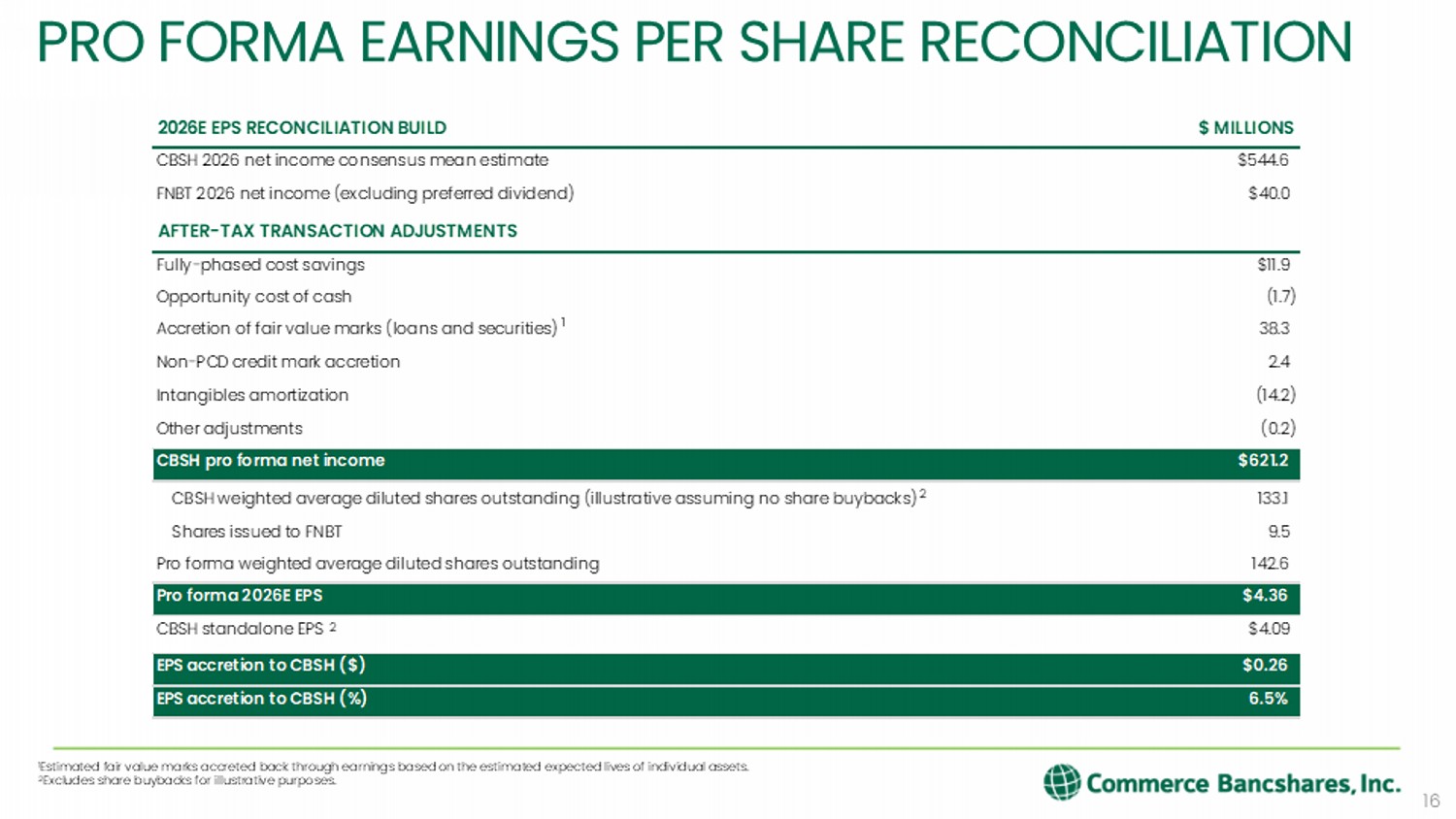

15 • CBSH projections based on mean Wall Street consensus net income estimates • FNBT projections based on CBSH management’s estimates following due diligence (~0.90% ROA in 2026E) Earnings • Cost savings equal to 15% of FNBT’s noninterest expense (50% phased in 2026; 100% in years thereafter) • Additional revenue synergies identified, but not modeled Cost Savings / Synergies • One - time, pre - tax merger expenses of $57 million, fully realized in pro forma tangible book value estimate at closing Merger Costs • Total gross credit mark of $26 million pre - tax, or .99% of FNBT’s loans – $11 million (41%) allocated to purchase credit deteriorated (PCD) loans, recorded into ACL – $15 million (59%) allocated to non - PCD loans, recorded as a net of loan discount (accreted into earnings straight - line over 5 years) – Non - PCD CECL reserve of $15 million established Day 2 via provision expense (CECL “double - count”) Credit • $146 million loan interest rate write - down, accreted over 5 years using straight - line methodology • $35 million AFS securities portfolio (AOCI), accreted over 2 years using straight - line methodology • $8 million HTM securities portfolio write - down, accreted over 4 years using straight - line methodology Other Fair Value (Pre - tax) • Core deposit intangible of 3.0% of non - time deposits, amortized sum - of - years digits over 10 years • Customer relationship intangible of 0.40% of AUA; amortized straight - line over 15 years Intangibles • Assumes the conversion of FineMark’s convertible preferred stock at closing • Redemption of FineMark’s subordinated debt at closing • After - tax Durbin impact of approximately $350 thousand Other Adjustments KEY TRANSACTION ASSUMPTIONS PRO FORMA EARNINGS PER SHARE RECONCILIATION 16 2026E EPS RECONCILIATION BUILD $ MILLIONS CBSH 2026 net income consensus mean estimate $544.6 FNBT 2026 net income (excluding preferred dividend) $40.0 AFTER-TAX TRANSACTION ADJUSTMENTS Fully-phased cost savings $11.9 Opportunity cost of cash (1.7) Accretion of fair value marks (loans and securities) 38.3 Non-PCD credit mark accretion 2.4 Intangibles amortization (14.2) Other adjustments (0.2) CBSH pro forma net income $621.2 CBSH weighted average diluted shares outstanding (illustrative assuming no share buybacks) 133.1 Shares issued to FNBT 9.5 Pro forma weighted average diluted shares outstanding 142.6 Pro forma 2026E EPS $4.36 CBSH standalone EPS $4.09 EPS accretion to CBSH ($) $0.26 EPS accretion to CBSH (%) 6.5% 1 3 2 2 1 Estimated fair value marks accreted back through earnings based on the estimated expected lives of individual assets.

2 Excludes share buybacks for illustrative purposes.

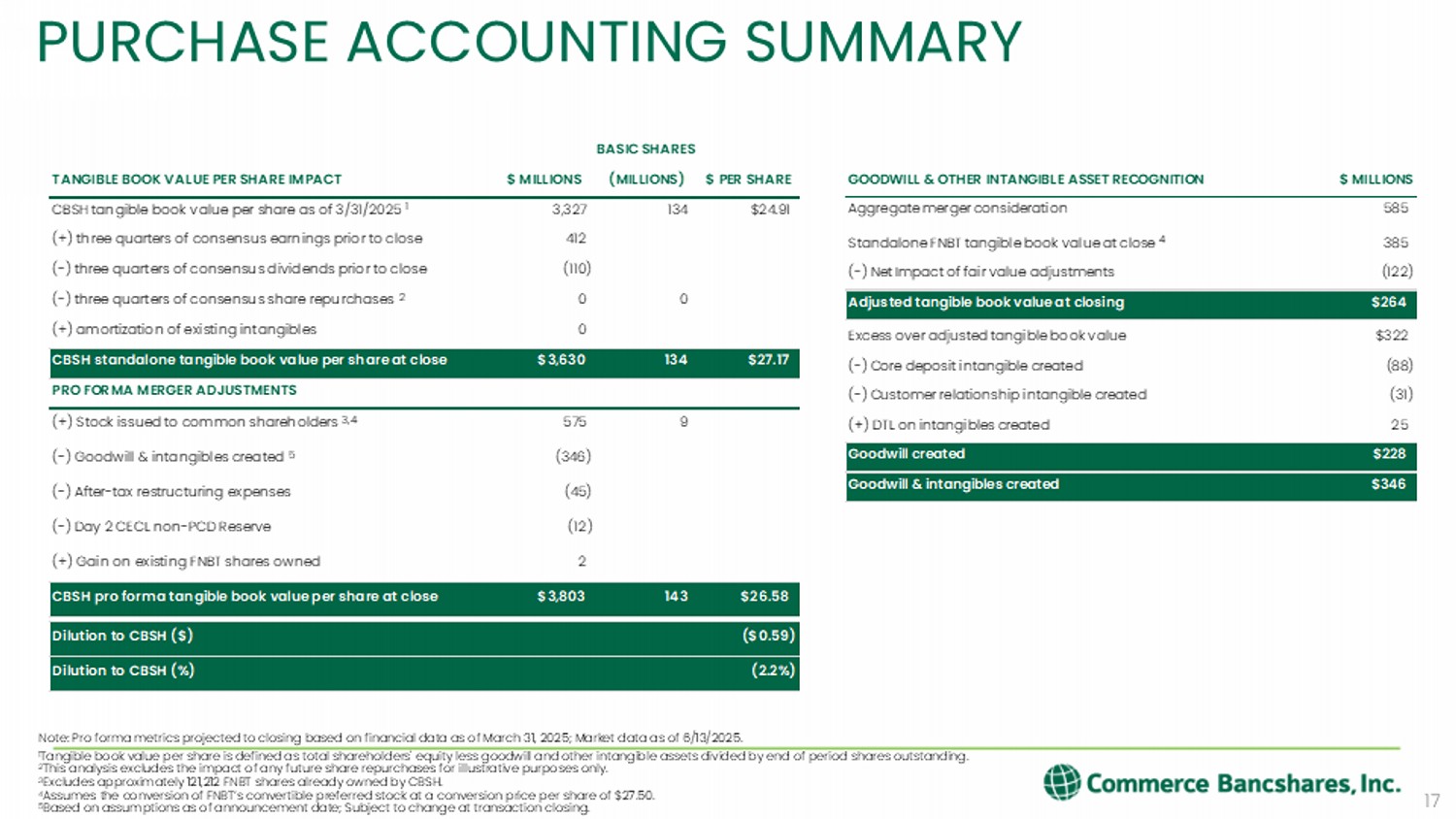

17 BASIC SHARES TANGIBLE BOOK VALUE PER SHARE IMPACT $ MILLIONS (MILLIONS) $ PER SHARE CBSH tangible book value per share as of 3/31/2025 3,327 134 $24.91 (+) three quarters of consensus earnings prior to close 412 (-) three quarters of consensus dividends prior to close (110) (-) three quarters of consensus share repurchases 0 0 (+) amortization of existing intangibles 0 CBSH standalone tangible book value per share at close $3,630 134 $27.17 PRO FORMA MERGER ADJUSTMENTS (+) Stock issued to common shareholders 575 9 (-) Goodwill & intangibles created (346) (-) After-tax restructuring expenses (45) (-) Day 2 CECL non-PCD Reserve (12) (+) Gain on existing FNBT shares owned 2 CBSH pro forma tangible book value per share at close $3,803 143 $26.58 Dilution to CBSH ($) ($0.59) Dilution to CBSH (%) (2.2%) 2 1 3,4 5 2 2 GOODWILL & OTHER INTANGIBLE ASSET RECOGNITION $ MILLIONS Aggregate merger consideration 585 Standalone FNBT tangible book value at close 385 (-) Net Impact of fair value adjustments (122) Adjusted tangible book value at closing $264 Excess over adjusted tangible book value $322 (-) Core deposit intangible created (88) (-) Customer relationship intangible created (31) (+) DTL on intangibles created 25 Goodwill created $228 Goodwill & intangibles created $346 4 Note: Pro forma metrics projected to closing based on financial data as of March 31, 2025; Market data as of 6/13/2025. 1 Tangible book value per share is defined as total shareholders' equity less goodwill and other intangible assets divided by e nd of period shares outstanding. 2 This analysis excludes the impact of any future share repurchases for illustrative purposes only. 3 Excludes approximately 121,212 FNBT shares already owned by CBSH. 4 Assumes the conversion of FNBT’s convertible preferred stock at a conversion price per share of $27.50. 5 Based on assumptions as of announcement date; Subject to change at transaction closing. PURCHASE ACCOUNTING SUMMARY