UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 2, 2025

Verastem, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-35403 | 27-3269467 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 117 Kendrick Street, Suite 500, Needham, MA | 02494 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (781) 292-4200

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common stock, $0.0001 par value per share | VSTM | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure

On June 2, 2025, the Company posted its investor webcast presentation on its website, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

| Exhibit No. | Description | |

| 99.1 | Investor Webcast Presentation, dated June 2, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VERASTEM, INC. | ||

| Dated: June 2, 2025 | By: | /s/ Daniel W. Paterson |

| Daniel W. Paterson | ||

| Chief Executive Officer | ||

Exhibit 99.1

Verastem Oncology R&D Investor Event ASCO 2025 June 2, 2025

2 Forward - Looking Statements This presentation includes forward - looking statements about, among other things, Verastem Oncology’s (the “Company”) programs and product candidates, strategy, future plans and prospects, including statements relate d to the anticipated timing of a potential launch of avutometinib and defactinib in Low - Grade Serous Ovarian Cancer, the expected outcome and benefits of collaborations, including with GenFleet Therapeutics (Shanghai), Inc. ( GenFleet ), including the timing of the IND for VS - 7375 and the initiation of a Phase 1/2a study with respect to the same, the status of enrollments for and potential of the results of the RAM P 301 Phase 3 trial to expand the indication regardless of KRAS mutation status, the structure of our planned and pending cli nic al trials, the potential clinical value of various of the Company's clinical trials, including the RAMP 201, RAMP 205 and RAMP 301 trial s, the timing of commencing and completing trials, including topline data reports, interactions with regulators, the timeline an d indications for clinical development, regulatory submissions, the potential for and timing of commercialization of product ca ndi dates and potential for additional development programs involving the Company’s lead compound and the potential market opportunities of, and estimated addressable markets for, our drug candidates. The words "anticipate," "believe," "estimate," "ex pect," "may," "plan," "target," "potential," "will," "would," "could," "should," "continue," “can” and similar expressions ar e i ntended to identify forward - looking statements, although not all forward - looking statements contain these identifying words. Each forward - l ooking statement is subject to risks and uncertainties that could cause actual results to differ materially from those expres sed or implied in such statement. Applicable risks and uncertainties include the risks and uncertainties, among other things, regarding: the success in the dev elo pment and potential commercialization of our product candidates, including avutometinib in combination with other compounds, including defactinib , LUMAKRAS and others; the uncertainties inherent in research and development, such as negative or unexpected results of clin ica l trials, the occurrence or timing of applications for our product candidates that may be filed with regulatory authorities in any jurisdictions; whether and when regulatory authorities in any jurisdictions may approve any such applicati ons that may be filed for our product candidates, and, if approved, whether our product candidates will be commercially successfu l in such jurisdictions; our ability to obtain, maintain and enforce patent and other intellectual property protection for our pro duc t candidates; the scope, timing, and outcome of any legal proceedings; decisions by regulatory authorities regarding trial de sig n, labeling and other matters that could affect the timing, availability or commercial potential of our product candidates; whet her preclinical testing of our product candidates and preliminary or interim data from clinical trials will be predictive of the re sults or success of ongoing or later clinical trials; that the timing, scope and rate of reimbursement for our product candidates is u nce rtain; that the market opportunities of our drug candidates are based on internal and third - party estimates which may prove to b e incorrect; that third - party payors (including government agencies) may not reimburse; that there may be competitive developments affecting our product candidates; that data may not be available when expected; that enrollment of clinical trials may take l on ger than expected, which may delay our development programs ; risks associated with preliminary and interim data, which may not be representative of more mature data, including with respe ct to interim duration of therapy data; uncertainties related to the recent change in the U.S. presidential administration, including regulatory and policy changes that may adversely affect our busines s; that our product candidates will cause adverse safety events and/or unexpected concerns may arise from additional data or ana lys is, or result in unmanageable safety profiles as compared to their levels of efficacy; that we may be unable to successfully val ida te, develop and obtain regulatory approval for companion diagnostic tests for our product candidates that require or would commercially benefit from such tests, or experience significant delays in doing so; that our product candidates may experienc e m anufacturing or supply interruptions or failures; that any of our third - party contract research organizations, contract manufact uring organizations, clinical sites, or contractors, among others, who we rely on fail to fully perform; that we face substantial c omp etition, which may result in others developing or commercializing products before or more successfully than we do which could re sult in reduced market share or market potential for our product candidates; that we will be unable to successfully initiate or compl ete the clinical development and eventual commercialization of our product candidates; that the development and commercializatio n of our product candidates will take longer or cost more than planned, including as a result of conducting additional studies or our decisions regarding execution of such commercialization; that we may not have sufficient cash to fund our contemplated operat io ns, including certain of our product development programs; that we may not attract and retain high quality personnel; that we or Chu gai Pharmaceutical Co., Ltd. will fail to fully perform under the avutometinib license agreement; that our total addressable and target markets for our product candidates might be smaller than we are presently estimating; that we or Secura Bio, Inc. will fa il to fully perform under the asset purchase agreement with Secura Bio, Inc., including in relation to milestone payments; th at we will not see a return on investment on the payments we have and may continue to make pursuant to the collaboration and option agre eme nt with GenFleet , or that GenFleet will fail to fully perform under the agreement; that we may not be able to establish new or expand on existing collaborations or partnerships, including with respect to in - licensing of our product candidates, on favorabl e terms, or at all; that we may be unable to obtain adequate financing in the future through product licensing, co - promotional arrangements, public or private equity, debt financing or otherwise; that we will not pursue or submit regulatory filings for ou r product candidates; and that our product candidates may not receive regulatory approval, become commercially successful products, or result in new treatment options being offered to patients. Other risks and uncertainties include those identified under the heading “Risk Factors” in the Company’s Annual Report on For m 1 0 - K for the year ended December 31, 2024 , as filed with the Securities and Exchange Commission (SEC) on March 20 , 2025 , and in any subsequent filings with the SEC, which are available at www.sec.gov and www.verastem.com. The forward - looking statements in this presentation speak only as of the original date of this presentation, and we undertake n o obligation to update or revise any of these statements whether as a result of new information, future events or otherwise, except as required by law. Use of Non - GAAP Financial Measures This presentation contains references to our non - GAAP operating expense, a financial measure that is not calculated in accordanc e with generally accepted accounting principles in the US (GAAP). This non - GAAP financial measure excludes certain amounts or expenses from the corresponding financial measures determined in accordance with GAAP. Management believes this non - GAAP informa tion is useful for investors, taken in conjunction with the Company’s GAAP financial statements, because it provides greater transparency and period - over - period comparability with respect to the Company’s operating performance and can enhance in vestors’ ability to identify operating trends in the Company’s business. Management uses this measure, among other factors, to assess and analyze operational results and trends and to make financial and operational decisions. Non - GAAP information is no t prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of the Company’s operating results as reported under GAAP, not in isolation or as a substitute for, or superior to, financial inform ati on prepared and presented in accordance with GAAP. In addition, this non - GAAP financial measure is unlikely to be comparable wit h non - GAAP information provided by other companies. The determination of the amounts that are excluded from non - GAAP financial mea sures is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts. Reconciliations between this non - GAAP financial measure and the most comparable GAAP financial measure are in cluded in the footnotes to the slides in this presentation on which such non - GAAP number appears. Third - Party Sources Certain information contained in this presentation, including industry and market data and other statistical information, rel ate s to or is based on studies, publications, surveys and other data obtained from third - party sources and the Company’s own intern al estimates and research. While the Company believes these third - party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources.

In addition, all of the market data included in this presentation involves a numb er of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions Disclaimers 3 3 Agenda Dan Paterson, President & CEO Welcome & Overview Vincent Picozzi, M.D. Pancreatic Cancer Treatment Landscape & RAMP 205 Data Update Jon Pachter, Ph.D., CSO VS - 7375: KRAS G12D (ON/OFF) Inhibitor with a Differentiated Preclinical Profile David Hong, M.D. Review of VS - 7375 US Phase 1/2a Trial and Supportive Data John Hayslip, M.D., CMO Clinical Development Plans and Timelines for RAMP 205 and VS - 7375 Dan Paterson Closing Remarks Q&A 4 Daniel Paterson President & CEO Welcome & Overview

5 Verastem Oncology: Multi - faceted Approach to Improve Outcomes in RAS/MAPK Pathway Driven Cancers Pursuing unexplored avenues in the RAS/MAPK pathway with novel small molecule drugs that inhibit critical signaling pathways in cancer that promote cancer cell survival and tumor growth. • Address cancers with high unmet treatment needs • Pursue targets with strong biologic rationale • Drive to clear preclinical evidence and clinical proof - of - concept • Advance best - in - class molecules • Enter viable market opportunities Guiding Principles Synergistic Combinations with Current Pipeline and External Assets • RAF/MEK Inhibition • Avutometinib • FAK Inhibition • Defactinib • KRAS G12D Inhibition • VS - 7375 • 2 Undisclosed RAS Pathway - related Targets RAF: Rapidly Accelerated Fibrosarcoma; MEK: Mitogen - activated extracellular signal - regulated kinase; RAS: Rat Sarcoma; FAK: Foc al Adhesion Kinase; MAPK: Mitogen - activated Protein Kinases; 6 AVMAPKI FAKZYNJA CO - PACK is the First and Only FDA - Approved Treatment for KRAS - Mutated Recurrent LGSOC FDA Approved on May 8, 2025 RAS/MAPK Pathway Directed MOA • AVMAPKI offers dual inhibition of RAF and MEK • FAKZYNJA mediates drug resistance of activated RAF/MEK • Together, they offer a more complete blockade of the signaling that drives growth and drug resistance in the RAS/MAPK pathway Clinically Meaningful Response Rates and Long Duration of Treatment • 44% ORR, 3.3 to 31.1 months mDOR Manageable Safety Allows for Treatment Until Progression for Most Patients Convenient, Two Orally Dosed Treatments • Novel intermittent dosing schedules Please see the full Prescribing Information for more information FDA: Food and Drug Administration; ORR: overall response rate; mDOR : median Duration of Response

Pancreatic Cancer Treatment Landscape & RAMP 205 Data Update Pancreatic Cancer Treatment Landscape & RAMP 205 Data Update Vincent J. Picozzi, M.D.

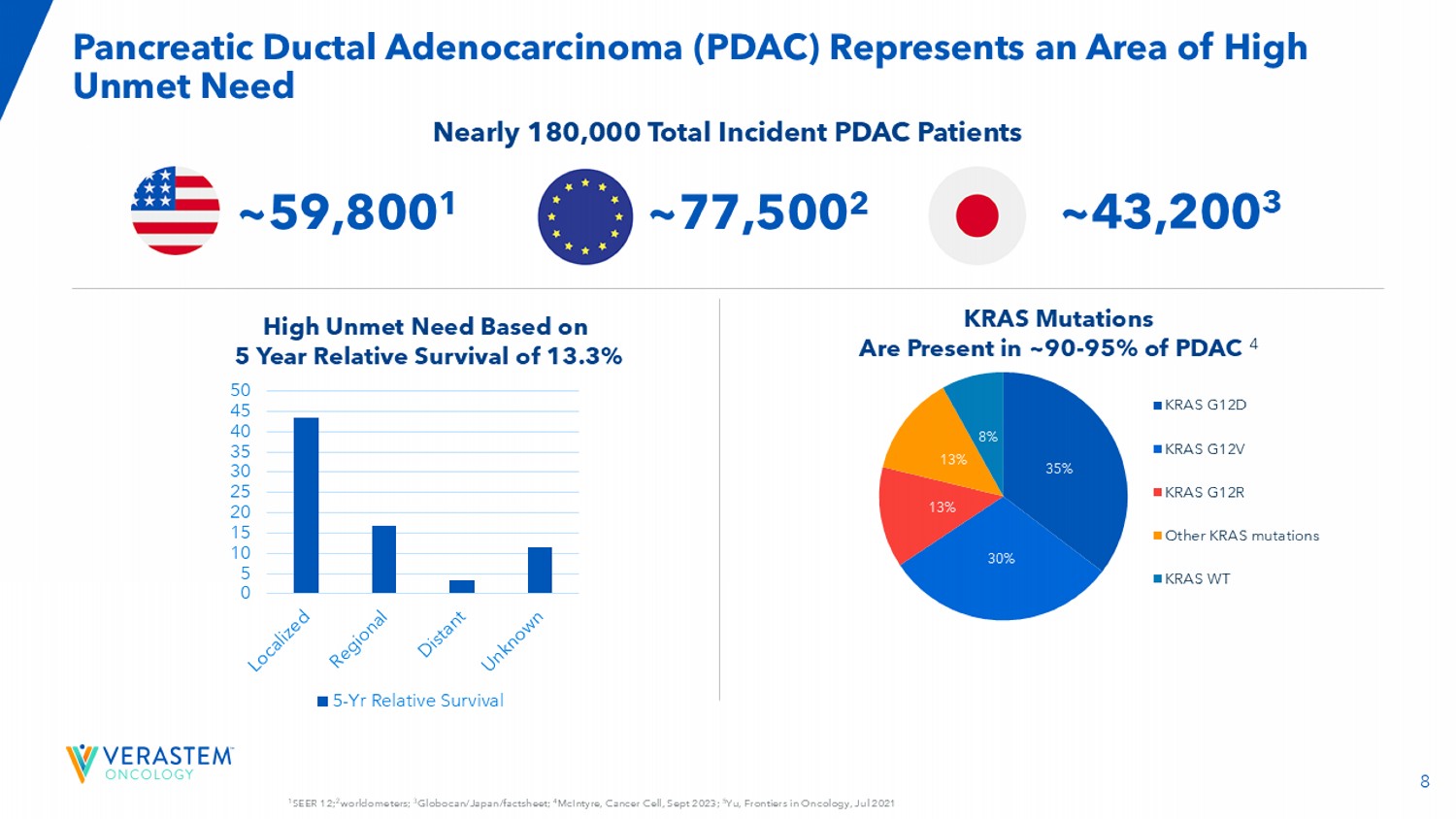

Director for the Pancreaticobiliary Program at the Virginia Mason Medical Center Investigator for RAMP 205 and VS - 7375 - 101 clinical trials 8 1 SEER 12; 2 worldometers; 3 Globocan/Japan/factsheet; 4 McIntyre, Cancer Cell, Sept 2023; 5 Yu, Frontiers in Oncology, Jul 2021 Pancreatic Ductal Adenocarcinoma (PDAC) Represents an Area of High Unmet Need 0 5 10 15 20 25 30 35 40 45 50 5-Yr Relative Survival KRAS Mutations Are Present in ~90 - 95% of PDAC 4 High Unmet Need Based on 5 Year Relative Survival of 13.3% Nearly 180,000 Total Incident PDAC Patients 35% 30% 13% 13% 8% KRAS G12D KRAS G12V KRAS G12R Other KRAS mutations KRAS WT ~59,800 1 ~43,200 3 ~77,500 2 9 Locally Advanced and Metastatic PDAC: 1L and 2L+ Treatment Paradigm Locally Advanced (LA)/Metastatic PDAC (50 - 60% 2 will recur with LA/Metastatic disease) ~40 - 50% 1 local/regional disease at diagnosis ~50 - 60% 1 metastatic disease at diagnosis 1 SEER 21 (2015 - 20210), 2 Jones, JAMA Surg.

Sep 2019, 3 Conroy, 2011 . , 4 VonHoff , 2013, 5 O'Reilly, 2023, 6 Sezgin, 2025.

Gem/nab - paclitaxel NALIRIFOX FOLFIRINOX 1L SOC Limitations • FOLFIRINOX: median overall survival ( mOS ) = 11.1 months and ORR = 31.6% 3 • Gem/nab - paclitaxel: median overall survival ( mOS ) = 8.5 - 9.2 months and ORR = 23 - 36.2% 4,5 FOLFIRINOX Gem/nab - paclitaxel FOLFOX 2L • Gem/nab - paclitaxel: median overall survival ( mOS ) = 8.6 months and ORR = 15.6% 6 10 More Complete Blockade of the Signaling that Drives Growth and Resistance of RAS/MAPK Pathway - Dependent Tumors RAF - MEK Complex Inhibited FAK The Combination of Avutometinib and Defactinib Induces Deeper Inhibition of Tumor Growth • Avutometinib inhibits MEK kinase activity while blocking the compensatory reactivation of MEK by upstream RAF 5,6,7 • Blocking RAF and/or MEK activates FAK, a key mediator of drug resistance 8,9 • Defactinib, a FAK inhibitor, inhibits parallel pathway signaling 10,11,12 • Together, avutometinib plus defactinib offer more complete blockade of the signaling that drives the growth of RAS/MAPK pathway - dependent tumors 1 Coma et al., AACR 2022 ; 2 Ishii et al., Cancer Res, 2013 ; 3 Lito et al., Cancer Cell, 2014 ; 4 Lubrano et al., AACR 2024 ; 5 Banerji et al., AACR 2020 ; 6 Jones et al., Invest New Drugs 2015; 7 McNamara et al., Gynecol Oncol 2024 ; 8 Banerjee et al., ASCO 2023 ERK: Extracellular Signal - regulated Kinase; FAK: Focal Adhesion Kinase; MEK, Mitogen - Activated Extracellular Signal - regulated Kinase; mTOR: Mammalian Target of Rapamycin; P: Phosphate; PI3K: Phosphatidylinositol 3 - Kinase; RAF: Rapidly Accelerated Fibrosarcoma; RA: Rat Sarcoma Virus; RhoA: Ras Homolog Family Member A; RTK: Receptor Tyrosine Kinase; YAP: Yes - Associated Protein.

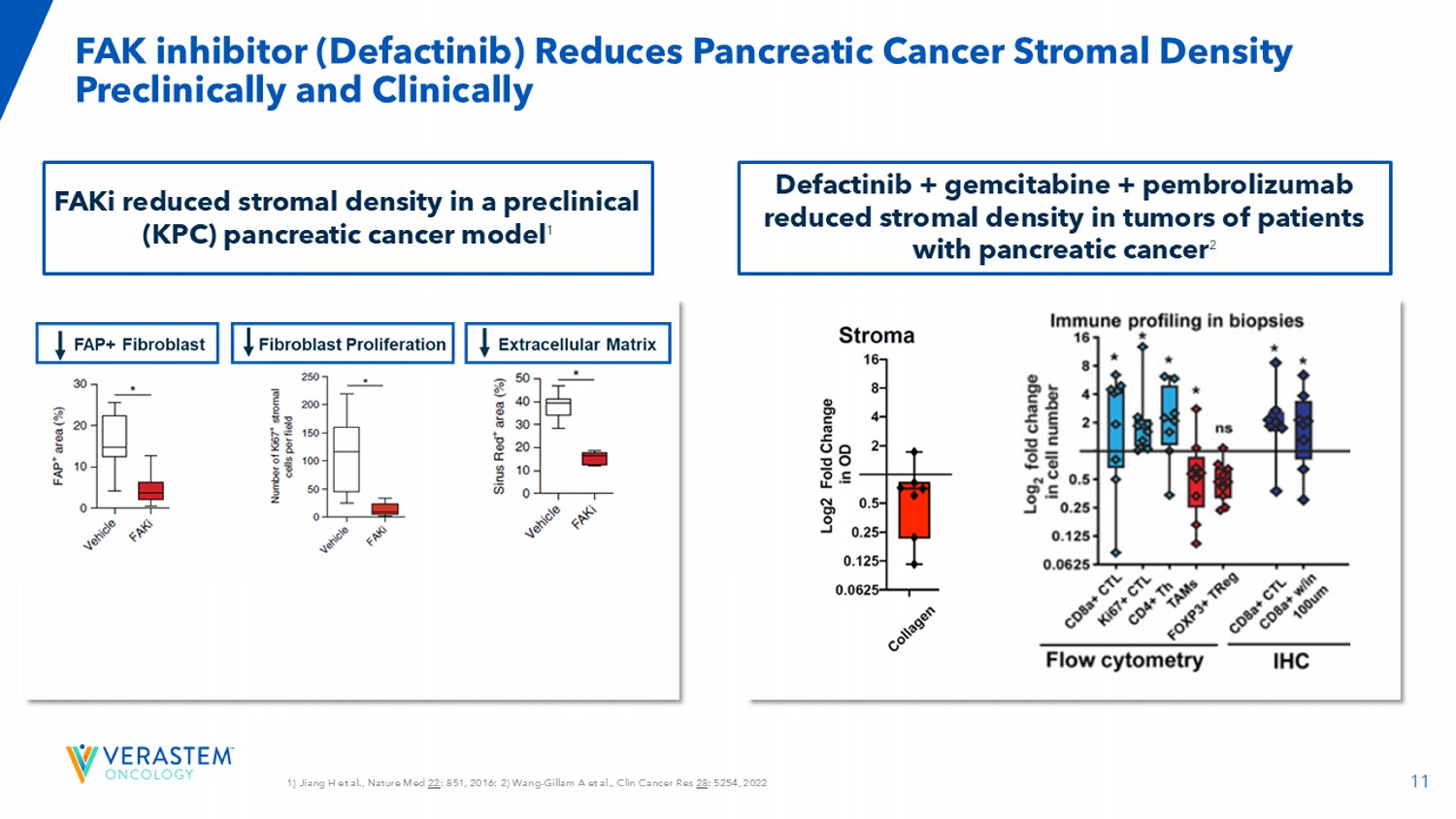

11 1) Jiang H et al., Nature Med 22 : 851, 2016; 2) Wang - Gillam A et al., Clin Cancer Res 28 : 5254, 2022 FAK inhibitor ( Defactinib ) Reduces Pancreatic Cancer Stromal Density Preclinically and Clinically FAKi reduced stromal density in a preclinical (KPC) pancreatic cancer model 1 Defactinib + gemcitabine + pembrolizumab reduced stromal density in tumors of patients with pancreatic cancer 2 12 Liu X et al., Sci Transl Med 2024; GEM: gemcitabine, PTX: paclitaxel Addition of Avutometinib + FAKi with Chemotherapy Induces Tumor Regression, and Decreases Liver Metastases in a KRAS/p53 Pancreatic Cancer Mouse Model vehicle avutometinib/ FAKi gemcitabine/paclitaxel avutometinib / FAKi + gemcitabine/paclitaxel V e h i c l e G E M / P T X G E M / P T X + F A K i G E M / P T X + a v u t o m e t i n i b G E M / P T X + F A K i + a v u t o m e t i n i b 0 10 20 30 40 L i v e r m e t a s t a s i s ( % o f t o t a l a r e a ) **** ** ** n.s

13 DLT: dose - limiting toxicity; RP2D: recommended phase 2 dose; CT: computed tomography; ECOG: European Cooperative Oncology Group; MRI: magnetic resonance imaging RAMP 205: Designed to Identify and Evaluate RP2D in Combination with Chemotherapy for Treatment of Newly Diagnosed mPDAC Ongoing Phase 1/2 Evaluating Avutometinib + Defactinib with Gemcitabine and Nab - paclitaxel Inclusion Criteria • Histologic or cytologic confirmed mPDAC • Eligible for treatment in the first - line setting (no prior systemic therapy for advanced or metastatic disease) • Measurable by RECIST v1.1 by CT or MRI • ECOG Performance status of ≤1 • Part B only, adequate tissue sample to evaluate KRA mutational status Collaboration with PanCAN , NCT05669482 Part A: Dose Evaluation (3+3 DLT Assessment) RP2D Selection Part B: Dose Expansion (Primary Endpoint: ORR) Avutometinib + Defactinib + Gemcitabine + Nab - paclitaxel Dose Finding Cohorts n=3 - 6 Avutometinib + Defactinib + Gemcitabine + Nab - paclitaxel DLT - Cleared Dose Level Expansion • Patients with PDAC treated at RP2D • Stage 1: 17 patients if ≥4 responders, then • Simon’s 2 - stage design: expand to 29 patients 14 Updated 05/01/25 Enrolled N=60 Days Chemo Dosing Nab - Paclitaxel Gemcitabine Defactinib Avutometinib Dose Level 12 1 - 8 - 15 125 800 200 2.4 1 12 1 - 8 - 15 100 800 200 3.2 0 12 1 - 8 - 15 100 800 200 2.4 - 1 12 1 - 15 125 800 200 3.2 1a 12 1 - 15 125 1000 200 3.2 2a PART A Enrollment Summary Dose Levels & Administration Schedule (28 - day) Cycle RAMP 205: 12 Patients Enrolled in Each Dose Cohort • Enrolled: (n=60) • Treatment Ongoing: (n=19) • Ended Study: (n=30) • Survival Follow Up: (n=11) Dose level 1 selected as the RP2D

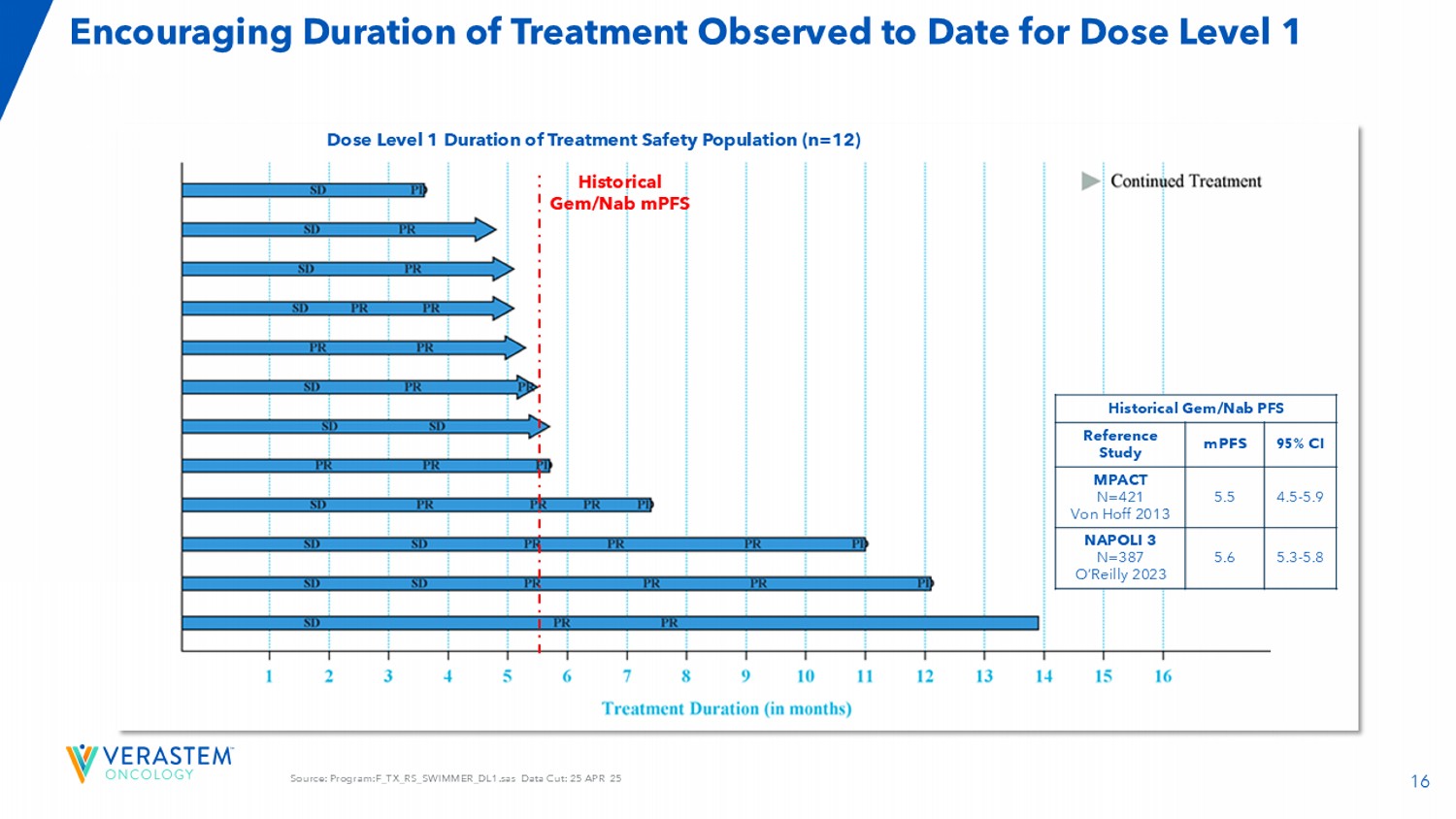

15 Source: F_TR_WATERFALL.sas Data Cut: 25 APR 25 Dose Level 1 Demonstrated an 83% ORR with Tumor Shrinkage Observed in All Patients Dose Level 1: Efficacy Evaluable Population (n=12) Dose Level 1: Response & Disease Control Rate as of April 25, 2025 83.3% ( 10/12) Unconfirmed ORR, n (%) 66.7% (8/12) Confirmed ORR, n (%) 8 (66.7) PR, n (%) 2 (16.7) uPR, n (%) 2 (16.7) SD, n (%) 0 PD, n (%) 92% (11/12 ) DCR, n (%) ≥ 4 cycles As of April 30, 9 th patient confirmed responses, 1 unconfirmed response 16 Source: Program:F_TX_RS_SWIMMER_DL1.sas Data Cut: 25 APR 25 Encouraging Duration of Treatment Observed to Date for Dose Level 1 Dose Level 1 Duration of Treatment Safety Population (n=12) Historical Gem/Nab PFS 95% CI mPFS Reference Study 4.5 - 5.9 5.5 MPACT N=421 Von Hoff 2013 5.3 - 5.8 5.6 NAPOLI 3 N=387 O’Reilly 2023 Historical Gem/Nab mPFS

17 AEs were Generally Manageable, Allowing Patients to Remain on Treatment DL1 Treatment Emergent AE All Grades ≥ 25% / Non - laboratory AEs NAPOLI 3* (N=379) Dose Level 1 (n=12) TEAEs Grade ≥3 n (%) All Grades n (%) Grade ≥3 n (%) All Grades n (%) Preferred term 10 (3) 162 (43) 0 10 (83) Nausea 17 (4) 139 (37) 0 9 (75) Diarrhoea 20 (5) 143 (38) 0 9 (75) Fatigue Not Listed** 119 (31) 0 8 (67) Alopecia 8 (2) 113 (30) 0 8 (67) Constipation Not Listed** 108 (29) 2 (17) 7 (58) Oedema peripheral Not Listed** Not Listed** 0 7 (58) Rash maculo - papular Not Listed** 45 (12) 1 (8) 7 (58) Stomatitis 8 (2) 100 (26) 1 (8) 7 (58) Vomiting Not Listed** 58 (15) 0 6 (50) Dysgeusia Not Listed** Not Listed** 0 6 (50) Hypotension Not Listed** 87 (23) 1 (8) 6 (50) Pyrexia 10 (3) 106 (28) 0 5 (42) Decreased appetite 8 (2) Not Listed** 1 (8) 5 (42) Hypertension 22 (6) 66 (17) 1 (8) 5 (42) Neuropathy peripheral Not Listed** Not Listed** 0 4 (33) Cough Not Listed** Not Listed** 0 4 (33) Dyspepsia 8 (2) 47 (12) 0 4 (33) Dyspnoea Not Listed** Not Listed** 1 (8) 4 (33) Retinopathy Not Listed** Not Listed** 1 (8) 4 (33) Vision blurred Not Listed** Not Listed** 0 3 (25) Abdominal Distension 14 (4) 77 (20) 0 3 (25) Abdominal Pain Not Listed** Not Listed** 0 3 (25) Depression Not Listed** 43 (11) 0 3 (25) Epistaxis 9 (2) Not Listed** 3 (25) 3 (25) Febrile Neutropenia Not Listed** Not Listed** 0 3 (25) Rash • No new or unexpected AEs observed • Most non - laboratory AEs were grade 1 or 2 • AEs were generally manageable, allowing patients to remain on treatment • The rates and severities of most AEs are consistent with the individual rates reported for Gem/Nab and Avutometinib/Defactinib • Nausea, diarrhea, constipation, febrile neutropenia, and anemia may be increased in comparison to those expected with Gem/Nab DL1 Treatment Emergent AE All Grades ≥ 25% / Laboratory - related AEs NAPOLI 3* (N=379) Dose Level (n=12) TEAEs Grade ≥3 n (%) All Grades n (%) Grade ≥3 n (%) All Grades n (%) Preferred term 66 (17) 153 (40) 5 (42) 8 (67) Anaemia 144 (38) 192 (51) 6 (50) 8 (67) Neutropenia*** 11 (3) Not Listed** 2 (17) 7 (58) Hyperbilirubinaemia*** 23 (6) 154 (41) 1 (8) 5 (42) Thrombocytopenia*** 8 (2) 40 (11) 1 (8) 3 (25) Aspartate aminotransferase increased 15 (4) 49 (13) 0 3 (25) Hypokalemia RAMP 205 data source:T_AE_GRADE_PT.sas : Data Cut: 11 APR 25 *Supplement Appendix: (NAPOLI 3). Wainberg et al. The Lancet, Volume 402, Issue 10409, 1272 – 1281 **If “Not Listed” then adverse event is either not reported or did not meet threshold of <10% all grade TEAE or <2% G3 or hig her TEAE. * **'Neutropenia' and 'Neutrophil count decreased' are grouped as 'Neutropenia'. 'Thrombocytopenia' and 'Platelet count decreas ed' are grouped as 'Thrombocytopenia'. ' Hyperbilirubinaemia ' and 'Blood bilirubin increased' are grouped as ' Hyperbilirubinaemia ’’. AE, adverse event; 18 Source: F_TR_WATERFALL.sas Data Cut: 25 APR 25 2 patients excluded from efficacy evaluable population due to no post baseline scan.

Change from baseline at each visit is ca lcu lated for the lesions that were measured at both baseline and post - baseline visit. One patient in DL1 came off study treatment in Cycle 3, but continued to receive Nab - paclitaxel and gemcitabine and is counted in the efficacy population. 2a 1a - 1 0 1 Dose Level 25% 3/12 22.2% 2/9 27.3% 3/11 25% 2/8 83.3% 10/12 Unconfirmed ORR, n (%) 25% 3/12 22.2% 2/9 18.2% 2/11 25% 2/8 66.7% 8/12 Confirmed ORR, n (%) 58.3% 7 55.6% 5 81.8% 9 50% 4 83.3% 10 DCR, n (%) ≥ 4 cycles 25% 2/8 27.3% 3/11 22.2% 2/9 25% 3/12 92% (48/52) of Patients Showed Tumor Reduction Across All Dose Cohorts 83.3% 10/12 2a 1a - 1 0 1 Dose Level 25% 3/12 22.2% 2/9 27.3% 3/11 25% 2/8 83.3% 10/12 Unconfirmed ORR, n (%) 25% 3/12 22.2% 2/9 18.2% 2/11 25% 2/8 66.7% 8/12 Confirmed ORR, n (%) 58.3% 7 55.6% 5 81.8% 9 50% 4 83.3% 10 DCR, n (%) ≥ 4 cycles 83.3% 10/12 25% 2/8 27.3% 3/11 22.2% 2/9 25% 3/12 Unconfirmed ORR% Efficacy Evaluable Population (n=52)

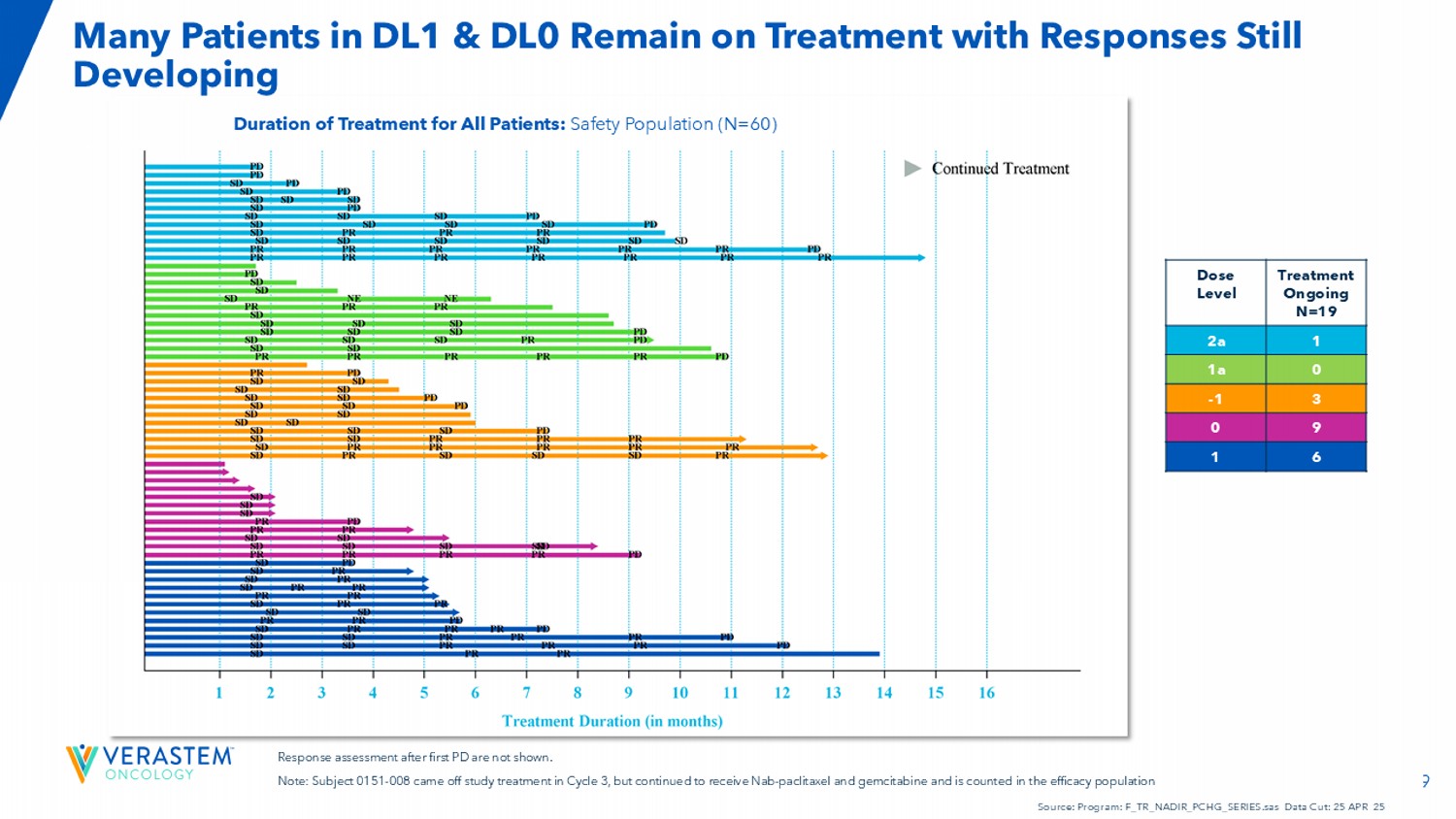

19 Duration of Treatment for All Patients: Safety Population (N=60) Response assessment after first PD are not shown. Note: Subject 0151 - 008 came off study treatment in Cycle 3, but continued to receive Nab - paclitaxel and gemcitabine and is count ed in the efficacy population Source: Program: F_TR_NADIR_PCHG_SERIES.sas Data Cut: 25 APR 25 Treatment Ongoing N=19 Dose Level 1 2a 0 1a 3 - 1 9 0 6 1 Many Patients in DL1 & DL0 Remain on Treatment with Responses Still Developing 20 • Impressive efficacy signals and a manageable safety profile • Dose level 1 selected as the RP2D • 10/12 patients in dose level 1 achieved an objective response • Preliminary observations suggest increased Nab - paclitaxel dose intensity, along with optimizing avutometinib, defactinib, and gemcitabine correlates with efficacy • Most patients poi sed to exceed historical estimates of mPFS • Expansion enrollment underway to 29 patients Conclusions

21 Jonathan Pachter, PhD Chief Scientific Officer VS - 7375: KRAS G12D (ON/OFF) Inhibitor with a Differentiated Preclinical Profile 22 *Piro Lito, RAS Initiative Conference 2024; GEF: Guanine nucleotide exchange factor; GAP: GTPase - activating protein; *Zhou et al ., AACR 2024 VS - 7375 is an Oral KRAS G12D (ON/OFF) Inhibitor GEF GTP GDP GTP GDP RAS/MAPK pathway signaling GAP P KRAS OFF (inactive) KRAS ON (active) VS - 7375 KRAS G12D (ON/OFF) inhibitor VS - 7375 IC50 ( nM ) (KRAS G12D binding) KRAS G12D State 2 1 GppNp - bound (ON/active) 6 1 GDP - bound (OFF/inactive) VS - 7375 is a dual inhibitor of ON (GTP) and OFF (GDP) states of KRAS G12D* Non - covalent inhibitor of KRAS G12D (ON/OFF) with potent anti - tumor efficacy across preclinical models • KRAS - GTP is the active (ON) state, which drives cancer growth • KRAS - GDP is the inactive (OFF) state and represents a KRAS pool that will cycle back to the active ON state • OFF - state selective agents (e.g., approved G12C inhibitors) may give sub - optimal efficacy because they do not target the active ON state • ON - state selective agents (e.g., RMC - 6236) can also drive GTP hydrolysis to the OFF state, which they can no longer bind* • May be ideal to have an inhibitor capable of targeting both the ON and OFF states of KRAS to maintain inhibition around the clock, aiming for maximum efficacy 23 MRTX1133 IC50 (nM) RMC - 9805 IC50 (nM) VS - 7375 IC50 (nM) KRAS status Cell Line 414 7 8 G12D SKLU1 187 4 2 G12D KP4 >5000 8 2 G12D GP2D 156 9 7 G12D HPAC 124 18 5 G12D HPAF - II 248 19 7 G12D AsPC1 739 26 8 G12D Panc08.13 265 28 7 G12D LS513 >5000 96 33 G12D LS180 1332 111 63 G12D Panc04.03 1052 3 133 G12C MiaPaca2 2277 6 1471 G12C H358 >5000 43 3069 G12C H1373 >5000 334 >5000 G12C H2122 2487 51 828 G12V H441 >5000 3337 >5000 G12S A549 >5000 358 756 G13D HCT116 >5000 1003 >5000 wild - type H1299 >5000 1109 3287 wild - type GAK >5000 1600 >5000 wild - type SKMEL2 >5000 1986 >5000 wild - type PC9 >5000 2514 >5000 wild - type H1975 >5000 >5000 >5000 wild - type A375 >5000 >5000 >5000 wild - type HT29 > 125 nM 65 - 125 nM < 65 nM VS - 7375 Shows Improved KRAS G12D Selectivity and Potency vs Other KRAS G12D inhibitors Presented at AACR 2025 0.001 0.01 0.1 1 10 0 20 40 60 80 100 VS-7375 (µM) C e l l P r o l i f e r a t i o n ( % c o n t r o l ) LS180 (KRAS G12D) Panc04.03 (KRAS G12D) SKLU1 (KRAS G12D) AsPC1 (KRAS G12D) HPAF-II (KRAS G12D) KP4 (KRAS G12D) A549 (KRAS G12S) MiaPaca2 (KRAS G12C) H1975 (KRAS wt) A375 (KRAS wt) GAK (KRAS wt) H441 (KRAS G12V) VS-7375 HT29 (KRAS wt) H1373 (KRAS G12C) PC9 (KRAS wt) H358 (KRAS G12C) GP2D (KRAS G12D) Panc08.13 (KRAS G12D) H2122 (KRAS G12C) SKMEL2 (KRAS wt) KRAS G12D-mutant KRAS non-G12D-mutant KRAS wild-type HPAC (KRAS G12D) HCT116 (KRAS G13D) HT1299 (KRAS wt) LS513 (KRAS G12D) 0.001 0.01 0.1 1 10 0 20 40 60 80 100 VS-7375 (µM) C e l l P r o l i f e r a t i o n ( % c o n t r o l ) LS180 (KRAS G12D) Panc04.03 (KRAS G12D) SKLU1 (KRAS G12D) AsPC1 (KRAS G12D) HPAF-II (KRAS G12D) KP4 (KRAS G12D) A549 (KRAS G12S) MiaPaca2 (KRAS G12C) H1975 (KRAS wt) A375 (KRAS wt) GAK (KRAS wt) H441 (KRAS G12V) VS-7375 HT29 (KRAS wt) H1373 (KRAS G12C) PC9 (KRAS wt) H358 (KRAS G12C) GP2D (KRAS G12D) Panc08.13 (KRAS G12D) H2122 (KRAS G12C) SKMEL2 (KRAS wt) KRAS G12D-mutant KRAS non-G12D-mutant KRAS wild-type HPAC (KRAS G12D) HCT116 (KRAS G13D) HT1299 (KRAS wt) LS513 (KRAS G12D) 0.001 0.01 0.1 1 10 0 20 40 60 80 100 RMC-9805 (µM) C e l l P r o l i f e r a t i o n ( % c o n t r o l ) LS180 (KRAS G12D) Panc04.03 (KRAS G12D) SKLU1 (KRAS G12D) AsPC1 (KRAS G12D) HPAF-II (KRAS G12D) KP4 (KRAS G12D) A549 (KRAS G12S) MiaPaca2 (KRAS G12C) H1975 (KRAS wt) A375 (KRAS wt) GAK (KRAS wt) H441 (KRAS G12V) RMC-9805 HT29 (KRAS wt) H1373 (KRAS G12C) PC9 (KRAS wt) H358 (KRAS G12C) GP2D (KRAS G12D) Panc08.13 (KRAS G12D) H2122 (KRAS G12C) SKMEL2 (KRAS wt) HPAC (KRAS G12D) HCT116 (KRAS G13D) HT1299 (KRAS wt) LS513 (KRAS G12D) 0.001 0.01 0.1 1 10 0 20 40 60 80 100 MRTX1133 (µM) C e l l P r o l i f e r a t i o n ( % c o n t r o l ) LS180 (KRAS G12D) Panc04.03 (KRAS G12D) SKLU1 (KRAS G12D) AsPC1 (KRAS G12D) HPAF-II (KRAS G12D) KP4 (KRAS G12D) A549 (KRAS G12S) MiaPaca2 (KRAS G12C) H1975 (KRAS wt) A375 (KRAS wt) GAK (KRAS wt) H441 (KRAS G12V) HT29 (KRAS wt) H1373 (KRAS G12C) PC9 (KRAS wt) H358 (KRAS G12C) GP2D (KRAS G12D) Panc08.13 (KRAS G12D) H2122 (KRAS G12C) SKMEL2 (KRAS wt) MRTX1133 HPAC (KRAS G12D) HCT116 (KRAS G13D) H1299 (KRAS wt) LS513 (KRAS G12D)

24 VS - 7375 (G12D ON/OFF inhibitor) is More Efficacious than KRAS ON Inhibitors in Reducing Tumor Growth in KRAS G12D Models KP4 KRAS G12D PDAC model LS513 KRAS G12D CRC model 0 10 20 30 40 0 500 1000 1500 Days after first dose T u m o r v o l u m e ( m m 3 + / - S E M ) Vehicle RMC-6236 25 mg/kg QD po Last dose RMC-9805 60 mg/kg QD po VS-7375 30 mg/kg BID po 0 10 20 30 0 500 1000 1500 2000 2500 Days after first dose T u m o r v o l u m e ( m m 3 + / - S E M ) Vehicle VS-7375 50 mg/kg BID RMC-9805 100 mg/kg QD RMC-6236 25 mg/kg QD VSTM Data on File.

25 Oral Administration of VS - 7375 Inhibits Tumor Growth in a Dose - Dependent Manner in KRAS G12D models AsPC - 1 PDAC Panc 04.03 PDAC GP2D CRC LS513 CRC -100 -50 0 50 100 150 200 250 300 350 R e s p o n s e @ D a y 1 4 ( % c h a n g e f r o m b a s e l i n e ) v e h i c l e V S - 7 3 7 5 1 0 m g / k g V S - 7 3 7 5 3 0 m g / k g V S - 7 3 7 5 1 0 0 m g / k g 6 SDs 1 PR 5 SDs 8 PRs 8 PRs V S - 7 3 7 5 5 m g / k g -100 -50 0 50 100 150 200 250 300 350 R e s p o n s e @ D a y 1 4 ( % c h a n g e f r o m b a s e l i n e ) v e h i c l e V S - 7 3 7 5 1 0 m g / k g V S - 7 3 7 5 3 0 m g / k g V S - 7 3 7 5 1 0 0 m g / k g V S - 7 3 7 5 5 m g / k g 1 SD 4 SDs 5 PRs 3SDs 8 PRs -100 0 100 200 300 500 1000 1500 R e s p o n s e @ D a y 2 1 ( % c h a n g e f r o m b a s e l i n e ) v e h i c l e V S - 7 3 7 5 1 0 m g / k g V S - 7 3 7 5 3 0 m g / k g V S - 7 3 7 5 1 0 0 m g / k g 4 PRs 3 SDs 7 PRs 1 SD Presented at AACR 2024 • 10 mg/kg conferred strong tumor regressions in the most sensitive model (GP2D) • 30 mg/kg conferred strong tumor regressions across all models • 100 mg/kg conferred partial responses (>30% reduction) in >95% of all mice 26 Addition of Cetuximab with VS - 7375 Induces Complete Responses in All Mice in a KRAS G12D Colorectal Cancer Model LS513 Colorectal Cancer Model 0 10 20 30 40 0 500 1000 1500 Tumor growth Days after first dose T u m o r v o l u m e ( m m 3 + / - S E M ) Vehicle GFH375 Cetuximab GFH375 + cetuximab Last dose 0 500 1000 R e s p o n s e @ D a y 3 7 ( % c h a n g e f r o m b a s e l i n e ) v e h i c l e V S - 7 3 7 5 C e t u x i m a b V S - 7 3 7 5 + c e t u x i m a b 1 PR 1 SD 8 CRs -100 Presented at AACR 2025

David S. Hong, MD Douglas E. Johnson Endowed Professor Deputy Chair of the Department of Investigational Cancer Therapeutics [A Phase I Program] Division of Cancer Medicine Clinical Medical Director of the Clinical and Translational Research Center (CTRC) University of Texas M.D.

Anderson Cancer Center Investigator: VS - 7375 - 101 trial Review of VS - 7375 US Phase 1/2a Trial and Supportive Data 28 Adapted from Hofmann et al., Cancer Discovery 2022 • The only approved KRAS inhibitors target KRAS G12C, which is largely restricted to NSCLC • KRAS G12D accounts for 26% of all KRAS mutations • KRAS G12D mutations are especially prevalent in pancreatic and colorectal cancers • Targeting KRAS G12D has historically been challenging due to the shallow pocket for drug interaction and lack of a cysteine for covalent binding KRAS G12D is the Most Frequent KRAS Mutation in Human Cancers 29 Source: GenFleet Therapeutics ASCO 2025 Rapid Oral Presentation June 2, 2025; A First - in - human Phase I/II Study of GFH375, a Hig hly Selective and Potent Oral KRAS G12D Inhibitor in Patients in KRAS G12D Mutant Advanced Solid Tumors GFH375 Demonstrated Encouraging Initial Efficacy in Lung and Pancreatic Cancers 52% ORR in PDAC, 100% DCR 42% ORR in NSCLC, 83% DCR • 62 patients were enrolled in the Phase 1 monotherapy portion of the study in China • Oral doses ranging from 100 to 900 mg daily • Patients with advanced KRAS G12D mutant solid tumors • Previously treated with standard therapies

30 Initial AE Profile Demonstrates that GFH375 is Tolerable with a Manageable Safety Profile Source: GenFleet Therapeutics ASCO 2025 Rapid Oral Presentation June 2, 2025; A First - in - human Phase I/II Study of GFH375, a Hig hly Selective and Potent Oral KRAS G12D Inhibitor in Patients in KRAS G12D Mutant Advanced Solid Tumors 31 Convenient Once Daily Dosing Achieves Trough Concentrations 3x the IC 90 for pERK inhibition in KRAS G12D cell lines Source: GenFleet Therapeutics ASCO 2025 Rapid Oral Presentation June 2, 2025; A First - in - human Phase I/II Study of GFH375, a Hig hly Selective and Potent Oral KRAS G12D Inhibitor in Patients in KRAS G12D Mutant Advanced Solid Tumors

32 Verastem Phase 1/2a Study Includes Monotherapy Expansion Cohorts in PDAC and NSCLC and Cetuximab Combination in CRC Part A: Single Agent Dose Escalation – Any KRAS G12D Solid Tumor VS - 7375 Single Agent: Advanced solid tumors Cohort B1 (N=20) 2L+ PDAC Cohort D1 (N=20) 2L+ CRC w/ Cetuximab VS - 7375 + Cetuximab Combination Part B: Dose Expansion RP2D Selection Part C: Combination Dose Escalation – Any KRAS G12D Solid Tumor Part D: Combination Dose Expansion Cohort B2: (N=20) 2L+ NSCLC Combo RP2D Selection Dose Level - 1 VS - 7375 200 mg QD + Cetuximab Dose Level 2 VS - 7375 400mg QD* + Cetuximab Dose Level 3 VS - 7375 600 mg QD + Cetuximab Dose Level 1 VS - 7375 300mg QD + Cetuximab Dose Level 2: VS - 7375 600 mg QD Dose Level 3: VS - 7375 900 mg QD Dose Level 1: VS - 7375 400 mg QD Dose Level - 1: VS - 7375 300 mg QD The study will evaluate dosing with meals and utilize prophylactic anti - emetics *Anticipated starting dose level for cetuximab combination once the monotherapy clears 600 mg dose level 33 Conclusions • With promising early results, VS - 7375 has the potential to meet a significant unmet need in solid tumor cancers o The unmet need is high: 61,000 metastatic KRAS G12D patients are diagnosed every year across pancreatic, lung, colorectal and other solid tumor cancers • In the initial Phase 1 study in China, GFH375/VS - 7375 demonstrated: o Pharmacokinetics showed good oral bioavailability and a half - life that supports once daily dosing o Proof of concept in humans with encouraging initial data in pancreatic & lung cancers • Potential for unique combinations with VS - 7375, including: o Avutometinib (RAF/MEKi) o Defactinib (FAKi) Key questions remain for the G12D inhibitor space o What will be the impact of ON - selective, ON/OFF dual or OFF - selective KRAS inhibitors on efficacy/safety profile? o Which asset has brain penetration for potential treatment of lung mets ?

John Hayslip, MD Chief Medical Officer Clinical Development Plans and Timelines 35 Opportunity for Avutometinib Plus Defactinib with SOC Chemo to Reshape Expectations in Advanced Pancreatic Cancer • Our Opportunity: • A novel regimen for metastatic PDAC, with most patients achieving objective responses • Target Product Profile: Clinical Focus: • Phase 2 RAMP 205 IL mPDAC • Expand to Simon’s 2 - stage design: expand to 29 patients • Phase 3 study in IL PDAC • Plan to launch Phase 3 pivotal study in 1L PDAC in 2026 • Additional Expansion Opportunities: • Evaluate two potential treatment indications: • Newly diagnosed metastatic PDAC • Newly diagnosed borderline resectable PDAC • Plan for further regulatory interactions to align on plans • Continue to evaluate combination strategies with current pipeline and external assets to improve outcomes in mPDAC • Efficacy: Preliminary efficacy suggests this combination may be amongst the most efficacious treatments in development for newly diagnosed metastatic PDAC • Safety/Tolerability: GI and heme effects may be increased compared to traditional Gem/Nab, though manageable for most patients to date • Convenient regimen without increased chemo chair time 36 • Our Opportunity: • Target Product Profile: • Once - daily oral administration • Highly potent and selective for KRAS G12D with binding to ON/OFF states • Efficacy: potential for best - in - class response rates and durability • Safety: MTD not yet declared and potential to further improve the GI profile with prophylaxis Emerging VS - 7375 KRAS G12D (ON/OFF) Inhibitor Clinical Findings and Planned Next Steps Clinical Focus: • US Trial: VS - 7375 - 101 Phase 1/2a • First three sites initiated in May 2025 • Initiating enrollment with an efficacious dose level – 400 mg QD • Planned expansion cohorts in PDAC and NSCLC • Planned expansion cohort with cetuximab in CRC • Additional Combinations and Tumor Types • Planning to evaluate VS - 7375 in additional combinations and tumor types • Newly diagnosed PDAC • Newly diagnosed NSCLC • Additional KRAS G12D mutated tumor types including recurrent endometrial cancer High Responses Rates Deeper Regressions

37 Closing Remarks Daniel Paterson President & CEO 38 Delivering on Our Multi - Faceted Approach to Advance Novel Therapies for RAS/MAPK Pathway Driven Cancers RAMP 205 • ~180,000 PDAC patients globally with 5 - year relative survival of 13.3% • Avutometinib plus defactinib offer more complete blockade of signaling that drives growth of RAS/MAPK pathway - dependent tumors • Dose level 1 demonstrated ORR of 83% (10/12) in frontline mPDAC with a manageable side effect profile • Plans to launch Phase 3 study in 1L mPDAC in 2026 Address Unmet Need Differentiated Treatment Benefits over Standard of Care Next Steps VS - 7375 • 61,000 metastatic KRAS G12D diagnoses annually across pancreatic, lung, colorectal and other solid tumor cancers • Highly potent and selective oral KRAS G12D inhibitor capable of targeting both ON and OFF states to maintain inhibition, aiming for maximum efficacy and more durable benefit • Demonstrated oral bioavailability and ORR of 52% in pancreatic and 43% in lung cancers; manageable side effect profile • Activating sites for Phase 1/2a trial in advanced solid tumors in the U.S.

Q&A