UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2025

American Public Education, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33810 | 01-0724376 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

111 W. Congress Street Charles Town, West Virginia |

25414 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 304-724-3700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | APEI | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On May 12, 2025, American Public Education, Inc. (the “Company”) issued a press release reporting financial results for the three months ended March 31, 2025. A copy of the Company’s press release is attached to this report as Exhibit 99.1 and is incorporated in this report by reference. The Company has scheduled a webcast for 5:00 p.m. ET on May 12, 2025, to discuss its financial results, and slides for that webcast are attached to this report as Exhibit 99.2 and are incorporated in this report by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits |

| 99.1 | American Public Education, Inc. press release dated May 12, 2025, reporting financial results for the three months ended March 31, 2025. | |

| 99.2 | American Public Education, Inc. slides for May 12, 2025 conference call and Webcast for the three months ended March 31, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| American Public Education, Inc. | ||

Date: May 12, 2025 |

By: | /s/ Richard W. Sunderland, Jr. |

| Richard W. Sunderland, Jr., | ||

| Executive Vice President and Chief Financial Officer | ||

Exhibit 99.1

American Public Education Reports First Quarter 2025 Financial Results

Net Income & Adjusted EBITDA Exceeded Guidance, Driven by Increased Enrollment and Operating Leverage in Rasmussen Segment

CHARLES TOWN, W.V. – May 12, 2025 -- American Public Education, Inc. (Nasdaq: APEI), a portfolio of education companies providing online and campus-based postsecondary education and career learning to over 125,000 students through four subsidiary institutions, has reported unaudited financial and operational results for the first quarter ended March 31, 2025.

Key First Quarter 2025 Highlights

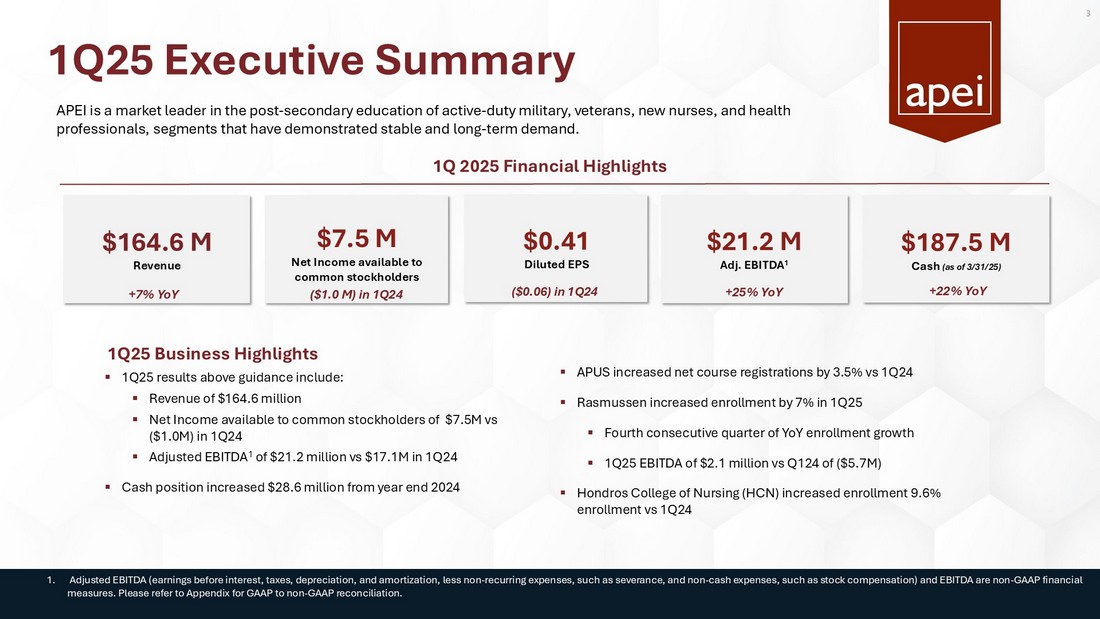

| · | Consolidated revenue for Q1 2025 increased 6.6% year-over-year to $164.6 million. |

| · | Net income available to common stockholders in Q1 2025 was $7.5 million, compared to a net loss available to common stockholders of ($1.0) million in Q1 2024. |

| · | Net income per diluted common share in Q1 2025 was $0.41, compared to net loss per diluted common share of ($0.06) in Q1 2024. |

| · | Q1 2025 Adjusted EBITDA was $21.2 million compared to $17.1 million in Q1 2024. |

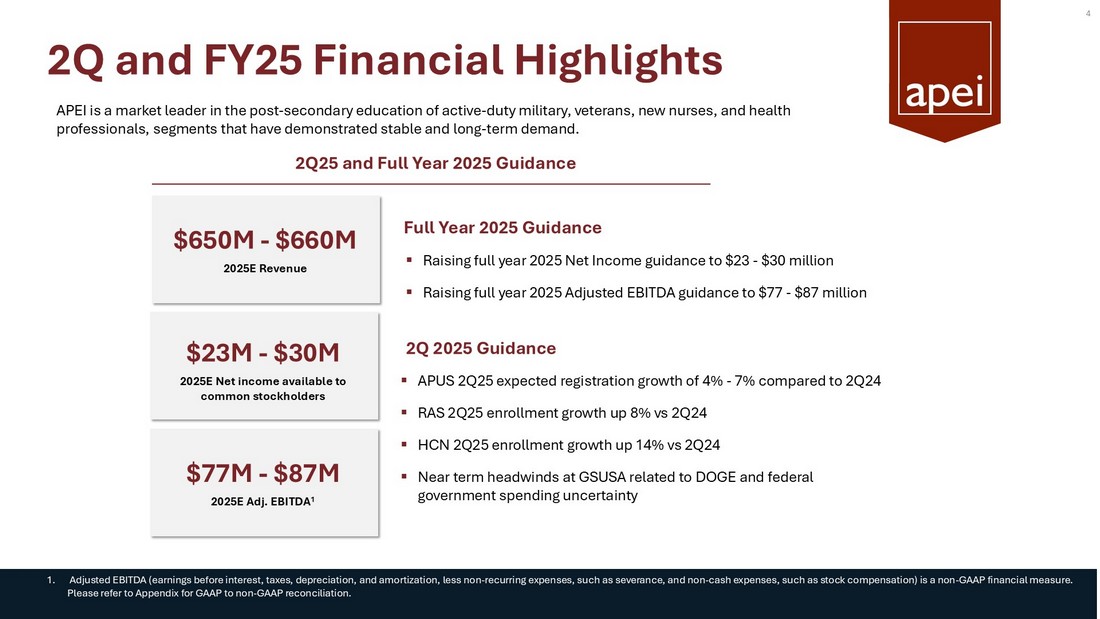

| · | Increasing guidance for full year 2025 net income available to common stockholders to a range between $23 - $30 million and Adjusted EBITDA to a range between $77 million and $87 million. Full year 2025 revenue estimates of between $650 million and $660 million remain unchanged. |

Management Commentary

"This first quarter of 2025 proved to be an excellent start to the year,” said Angela Selden, President and Chief Executive Officer of APEI. “We exceeded the expectations we set forth for the first quarter largely due to strong enrollment trends at Rasmussen which are beginning to show the operating leverage benefits of greater enrollment and disciplined operations.”

“The areas for improvements that we have focused on over the past two years are driving better and more consistent financial results. We have been able to deliver better results due to improved operations and student outcomes at our educational units, and we continue to educate service-minded professionals in high demand industries," concluded Selden.

First Quarter 2025 Financial Results

| · | Total consolidated revenue for the three months ended March 31, 2025, was $164.6 million, an increase of $10.1 million, or 6.6%, compared to $154.4 million for the three months ended March 31, 2024. The increase in revenue was primarily due to a $6.1 million increase in revenue in our Rasmussen University (“RU”) Segment, a $3.3 million increase in our American Public University System (“APUS”) Segment, and a $1.2 million increase in our Hondros College of Nursing (“HCN”) Segment. |

| · | Total costs and expenses for the three months ended March 31, 2025, were $152.3 million, an increase of $3.1 million, or 2.0%, compared to $149.3 million for the three months ended March 31, 2024. The increase in costs and expenses for the three months ended March 31, 2025 was primarily driven by increases in employee compensation costs and advertising costs, partially offset by a decrease in information technology costs, and depreciation and amortization expenses. |

| · | Instructional costs and services expenses for the three months ended March 31, 2025, were $74.9 million, an increase of $2.5 million, or 3.5%, compared to $72.4 million for the three months ended March 31, 2024. |

| · | Selling and promotional expenses for the three months ended March 31, 2025, were $35.2 million, an increase of $2.7 million, or 8.5%, compared to $32.5 million for the three months ended March 31, 2024. |

| · | General and administrative expenses for the three months ended March 31, 2025, were $36.4 million, an increase of $0.1 million, or 0.4%, compared to $36.3 million for the three months ended March 31, 2024. General and administrative expenses as a percentage of revenue decreased to 22.1% for the three months ended March 31, 2025, from 23.5% for the three months ended March 31, 2024. |

| · | Net income available to common stockholders was $7.5 million, or $0.41 per diluted common share for the three months ended March 31, 2025, compared to a net loss of ($1.0) million, or ($0.06) per diluted common share, for the three months ended March 31, 2024. |

| · | Adjusted EBITDA was $21.2 million for the three months ended March 31, 2025, compared to $17.1 million for the three months ended March 31, 2024. Adjusted EBITDA excludes adjustment for stock compensation, loss on disposals of long-lived assets, loss on assets held for sale, other professional fees and loss on leases. |

Balance Sheet and Liquidity

| · | Total cash, cash equivalents, and restricted cash were $187.5 million at March 31, 2025, compared to $158.9 million and December 31, 2024, representing an increase of $28.6 million, or 18.0%. |

Registrations and Enrollment

| Q1 2025 | Q1 2024 | % Change | |

| American Public University System1 | |||

| For the three months ended March 31, Net Course Registrations |

102,500 | 99,000 | 3.5% |

| Rasmussen University2 | |||

| For the three months ended March 31, Total Student Enrollment |

14,500 | 13,500 | 7.4% |

| Hondros College of Nursing3 | |||

| For the three months ended March 31, Total Student Enrollment |

3,600 | 3,300 | 9.6% |

| 1. | APUS Net Course Registrations represents the approximate aggregate number of courses for which students remain enrolled after the date by which they may drop a course without financial penalty. Excludes students in doctoral programs. |

| 2. | RU Total Student Enrollment represents students in an active status as of the full-term census or billing date. |

| 3. | HCN Total Student Enrollment represents the approximate number of students enrolled in a course after the date by which students may drop a course without financial penalty. |

Second Quarter and Full Year 2025 Outlook

The following statements are based on APEI's current expectations. These statements are forward-looking and actual results may differ materially. APEI undertakes no obligation to update publicly any forward-looking statements for any reason unless required by law. Refer to APEI's earnings conference call and presentation for further details.

| Second Quarter 2025 Guidance | ||||

| (Approximate) | (% Yr/Yr Change) | |||

| APUS Net course registrations | 93,500 to 96,100 | 4% to 7% | ||

| HCN Student enrollment | 3,700 | 14% | ||

| RU Student enrollment | 14,600 | 8% | ||

| - On-ground Healthcare | 6,400 | 3% | ||

| - Online | 8,300 | 12% | ||

| ($ in millions except EPS) | ||||

| APEI Consolidated revenue | $160.0 – $162.0 | 4% to 5% | ||

| APEI Net loss/income available to common stockholders | ($2.5) – ($0.7) | n.a. | ||

| APEI Adjusted EBITDA | $11.5 – $14.0 | 6% to 28% | ||

| APEI Diluted EPS | ($0.13) – ($0.04) | n.a. | ||

| Full Year 2025 Guidance | ||||

| (Approximate) | (% Yr/Yr Change) | |||

| ($ in millions) | ||||

| APEI Consolidated Revenue | $650 – $660 | 4% to 6% | ||

| APEI Net income available to common stockholders | $23 – $30 | 129% to 198% | ||

| APEI Adjusted EBITDA | $77 – $87 | 7% to 20% | ||

| APEI Capital Expenditure (CapEx) | $18 – $22 | (14%) to 4% | ||

Non-GAAP Financial Measures

This press release contains the non-GAAP financial measures of EBITDA (earnings before interest, taxes, depreciation, and amortization) and adjusted EBITDA (EBITDA less non-cash expenses such as stock compensation and non-recurring expenses). APEI believes that the use of these measures is useful because they allow investors to better evaluate APEI's operating profit and cash generation capabilities.

For the three months ended March 31, 2025 and 2024, adjusted EBITDA excludes stock compensation, loss on disposals of long-lived assets, loss on assets held for sale, other professional fees and loss on leases.

These non-GAAP measures should not be considered in isolation or as an alternative to measures determined in accordance with generally accepted accounting principles in the United States (GAAP). The principal limitation of our non-GAAP measures is that they exclude expenses that are required by GAAP to be recorded. In addition, non-GAAP measures are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses are excluded.

APEI is presenting EBITDA and adjusted EBITDA in connection with its GAAP results and urges investors to review the reconciliation of EBITDA and adjusted EBITDA to the comparable GAAP financial measures that is included in the tables following this press release (under the captions "GAAP Net Income to Adjusted EBITDA," and "GAAP Outlook Net Income to Outlook Adjusted EBITDA") and not to rely on any single financial measure to evaluate its business.

About American Public Education

American Public Education, Inc. (Nasdaq: APEI), through its institutions American Public University System, Rasmussen University, Hondros College of Nursing, and Graduate School USA, provides education that transforms lives, advances careers, and improves communities.

APUS, which operates through American Military University and American Public University, is the leading educator to active-duty military and veteran students* and serves approximately 88,000 adult learners worldwide via accessible and affordable higher education.

Rasmussen University is a 125-year-old nursing and health sciences-focused institution that serves approximately 14,600 students across its 20 campuses in six states and online. It also has schools of Business, Technology, Design, Early Childhood Education and Justice Studies.

Hondros College of Nursing focuses on educating pre-licensure nursing students at eight campuses (six in Ohio, one in Indiana, and one in Michigan). It is the largest educator of PN (LPN) nurses in the state of Ohio** and serves approximately 3,700 total students.

Graduate School USA is a leading training provider to the federal workforce with an extensive portfolio of government agency customers. It serves the federal workforce through customized contract training (B2G) to federal agencies and through open enrollment (B2C) to government professionals.

Both APUS and Rasmussen University are institutionally accredited by the Higher Learning Commission (HLC), an institutional accreditation agency recognized by the U.S. Department of Education. Hondros is accredited by the Accrediting Bureau of Health Education Schools (ABHES). Graduate School USA is accredited by the Accrediting Council for Continuing Education & Training (ACCET). For additional information, visit www.apei.com.

*Based on FY 2019 Department of Defense tuition assistance data, as reported by Military Times, and Veterans Administration student enrollment data as of 2024.

**Based on information compiled by the National Council of State Boards of Nursing and Ohio Board of Nursing.

Forward Looking Statements

Statements made in this press release regarding APEI or its subsidiaries that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates and projections about APEI and the industry. In some cases, forward-looking statements can be identified by words such as "anticipate," "believe," "seek," "could," "estimate," "expect," "intend," "may," "plan," "should," "will," "would," and similar words or their opposites. Forward-looking statements include, without limitation, statements regarding the Company's future path, expected growth, registration, enrollments, revenues, net income, Adjusted EBITDA and EBITDA, capital expenditures, the growth and profitability of Rasmussen University and plans with respect to recent, current and future initiatives.

Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, among others, risks related to: APEI's failure to comply with regulatory and accrediting agency requirements, including the "90/10 Rule", and to maintain institutional accreditation and the impacts of any actions APEI may take to prevent or correct such failure; changes in the postsecondary education regulatory environment as a result of U.S. federal elections, including any changes by or as a result of actions of the current administration to the operations of the Department of Education or changes to or the elimination or implementation of laws, regulations, standards, policies, and practices; potential or actual government shutdowns; the impact, timing, and projected benefits of the planned combination of APUS, RU, and HCN into one consolidated institution; APEI's dependence on the effectiveness of its ability to attract students who persist in its institutions' programs; changing market demands; declines in enrollments at APEI's subsidiaries;; APEI's inability to effectively market its institutions' programs; APEI's inability to maintain strong relationships with the military and maintain course registrations and enrollments from military students; the loss or disruption of APEI's ability to receive funds under Title IV or tuition assistance programs or the reduction, elimination, or suspension of federal funds; adverse effects of changes APEI makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed; APEI's need to successfully adjust to future market demands by updating existing programs and developing new programs; APEI's loss of eligibility to participate in Title IV programs or ability to process Title IV financial aid; economic and market conditions and changes in interest rates; difficulties involving acquisitions; APEI's indebtedness and preferred stock, including the refinancing or redemption thereof; APEI's dependence on and the need to continue to invest in its technology infrastructure, including with respect to third-party vendors; the inability to recognize the anticipated benefits of APEI's cost savings and revenue generating efforts; APEI's ability to manage and limit its exposure to bad debt; and the various risks described in the "Risk Factors" section and elsewhere in APEI's Annual Report on Form 10-K for the year ended March 31, 2025, and in other filings with the SEC. You should not place undue reliance on any forward-looking statements. APEI undertakes no obligation to update publicly any forward-looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future.

Company Contact

Frank Tutalo

Director, Public Relations

American Public Education, Inc.

ftutalo@apei.com

571-358-3042

Investor Relations

Brian M. Prenoveau, CFA

MZ North America

Direct: 561-489-5315

APEI@mzgroup.us

| American Public Education, Inc. | ||||||

| Consolidated Balance Sheet | ||||||

| (In thousands) | ||||||

| As of March 31, 2025 | As of December 31, 2024 | |||||||

| ASSETS | (Unaudited) | |||||||

| Current assets: | ||||||||

| Cash, cash equivalents, and restricted cash | $ | 187,502 | $ | 158,941 | ||||

| Accounts receivable, net of allowance of $19,547 in 2025 and $19,280 in 2024 | 41,872 | 62,465 | ||||||

| Prepaid expenses | 20,667 | 13,748 | ||||||

| Income tax receivable | - | 949 | ||||||

| Assets held for sale | 22,467 | 24,469 | ||||||

| Total current assets | 272,508 | 260,572 | ||||||

| Property and equipment, net | 73,038 | 73,383 | ||||||

| Operating lease assets, net | 92,649 | 94,776 | ||||||

| Deferred income taxes | 46,066 | 47,311 | ||||||

| Intangible assets, net | 28,221 | 28,221 | ||||||

| Goodwill | 59,593 | 59,593 | ||||||

| Other assets, net | 6,586 | 6,247 | ||||||

| Total assets | $ | 578,661 | $ | 570,103 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 7,849 | $ | 7,847 | ||||

| Accrued compensation and benefits | 18,039 | 20,546 | ||||||

| Accrued liabilities | 18,790 | 13,735 | ||||||

| Deferred revenue and student deposits | 25,087 | 23,474 | ||||||

| Income tax payable | 177 | - | ||||||

| Lease liabilities, current | 13,489 | 13,553 | ||||||

| Total current liabilities | 83,431 | 79,155 | ||||||

| Lease liabilities, long-term | 91,471 | 93,645 | ||||||

| Long-term debt, net | 93,747 | 93,424 | ||||||

| Total liabilities | $ | 268,649 | $ | 266,224 | ||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $.01 par value; 10,000,000 shares authorized; 400 shares issued and outstanding in 2025 and 2024, respectively ($112,471 and $117,439 liquidation preference per share, $44,988 and $46,976 in aggregate, for 2025 and 2024, respectively) | 39,691 | 39,691 | ||||||

| Common stock, $.01 par value; 100,000,000 shares authorized; 18,036,421 issued and outstanding in 2025; 17,712,575 issued and outstanding in 2024 | 180 | 177 | ||||||

| Additional paid-in capital | 304,533 | 305,823 | ||||||

| Accumulated other comprehensive loss | (48 | ) | (7 | ) | ||||

| Accumulated deficit | (34,344 | ) | (41,805 | ) | ||||

| Total stockholders’ equity | 310,012 | 303,879 | ||||||

| Total liabilities and stockholders’ equity | $ | 578,661 | $ | 570,103 | ||||

| American Public Education, Inc. |

| Consolidated Statement of Income |

| (In thousands, except per share data) |

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2025 | 2024 | |||||||

| (unaudited) | ||||||||

| Revenue | $ | 164,551 | $ | 154,432 | ||||

| Costs and expenses: | ||||||||

| Instructional costs and services | 74,944 | 72,425 | ||||||

| Selling and promotional | 35,205 | 32,456 | ||||||

| General and administrative | 36,407 | 36,277 | ||||||

| Depreciation and amortization | 3,992 | 5,128 | ||||||

| Loss on assets held for sale | 1,527 | - | ||||||

| Loss on leases | - | 2,936 | ||||||

| Loss on disposals of long-lived assets | 230 | 28 | ||||||

| Total costs and expenses | 152,305 | 149,250 | ||||||

| Income from operations before | ||||||||

| interest and income taxes | 12,246 | 5,182 | ||||||

| Interest expense, net | (887 | ) | (126 | ) | ||||

| Income before income taxes | 11,359 | 5,056 | ||||||

| Income tax expense | 2,466 | 1,213 | ||||||

| Equity investment loss | - | (3,327 | ) | |||||

| Net income | $ | 8,893 | $ | 516 | ||||

| Preferred stock dividends | 1,432 | 1,535 | ||||||

| Net income (loss) available to common stockholders | $ | 7,461 | $ | (1,019 | ) | |||

| Income (loss) per common share: | ||||||||

| Basic | $ | 0.42 | $ | (0.06 | ) | |||

| Diluted | $ | 0.41 | $ | (0.06 | ) | |||

| Weighted average number of | ||||||||

| common shares: | ||||||||

| Basic | 17,840 | 17,510 | ||||||

| Diluted | 18,417 | 17,811 | ||||||

| Three Months Ended | ||||||||

| Segment Information: | March 31, | |||||||

| 2025 | 2024 | |||||||

| Revenue: | ||||||||

| APUS Segment | $ | 83,946 | $ | 80,656 | ||||

| RU Segment | $ | 59,251 | $ | 53,135 | ||||

| HCN Segment | $ | 17,676 | $ | 16,447 | ||||

| Corporate and other1 | $ | 3,678 | $ | 4,194 | ||||

| Income (loss) from operations before | ||||||||

| interest and income taxes: | ||||||||

| APUS Segment | $ | 24,126 | $ | 23,087 | ||||

| RU Segment | $ | (72 | ) | $ | (8,966 | ) | ||

| HCN Segment | $ | (746 | ) | $ | (304 | ) | ||

| Corporate and other | $ | (11,062 | ) | $ | (8,635 | ) | ||

1. Corporate and Other includes tuition and contract training revenue earned by GSUSA and the elimination of intersegment revenue for courses taken by employees of one segment at other segments.

| GAAP Net Income to Adjusted EBITDA: |

| The following table sets forth the reconciliation of the Company’s reported GAAP net income to the calculation of adjusted EBITDA for the three months ended March 31, 2025 and 2024: |

| Three Months Ended | ||||||||

| March 31, | ||||||||

| (in thousands, except per share data) | 2025 | 2024 | ||||||

| Net income (loss) available to common stockholders | $ | 7,461 | $ | (1,019 | ) | |||

| Preferred dividends | 1,432 | 1,535 | ||||||

| Net income | $ | 8,893 | $ | 516 | ||||

| Income tax expense | 2,466 | 1,213 | ||||||

| Interest expense, net | 887 | 126 | ||||||

| Equity investment loss | - | 3,327 | ||||||

| Depreciation and amortization | 3,992 | 5,128 | ||||||

| EBITDA | 16,238 | 10,310 | ||||||

| Loss on assets held for sale | 1,527 | - | ||||||

| Loss on leases | - | 2,936 | ||||||

| Other professional fees | 989 | - | ||||||

| Stock compensation | 2,263 | 1,918 | ||||||

| Loss on disposals of long-lived assets | 230 | 28 | ||||||

| Transition services costs | - | 1,865 | ||||||

| Adjusted EBITDA | $ | 21,247 | $ | 17,057 | ||||

| GAAP Outlook Net Income to Outlook Adjusted EBITDA: |

| The following table sets forth the reconciliation of the Company’s outlook GAAP net income to the calculation of outlook adjusted EBITDA for the three months ending June 30, 2025 and twelve months ending December 31, 2025: |

| Three Months Ending | Twelve Months Ending | |||||||||||||||

| June 30, 2025 | December 31, 2025 | |||||||||||||||

| (in thousands, except per share data) | Low | High | Low | High | ||||||||||||

| Net income/(loss) available to common stockholders | $ | (2,461 | ) | $ | (711 | ) | $ | 22,937 | $ | 29,937 | ||||||

| Preferred dividends | 1,488 | 1,488 | 2,920 | 2,920 | ||||||||||||

| Net Income/(Loss) | (973 | ) | 777 | 25,857 | 32,857 | |||||||||||

| Income tax expense/(benefit) | (417 | ) | 333 | 11,082 | 14,082 | |||||||||||

| Interest expense | 4,127 | 4,127 | 7,852 | 7,852 | ||||||||||||

| Depreciation and amortization | 4,459 | 4,459 | 17,986 | 17,986 | ||||||||||||

| EBITDA | 7,196 | 9,696 | 62,777 | 72,777 | ||||||||||||

| Stock compensation | 2,254 | 2,254 | 7,349 | 7,349 | ||||||||||||

| Professional Services | 1,688 | 1,688 | 3,953 | 3,953 | ||||||||||||

| Transition services cost | 363 | 363 | 1,164 | 1,164 | ||||||||||||

| Other | - | 1,757 | 1,757 | |||||||||||||

| Adjusted EBITDA | $ | 11,500 | $ | 14,000 | $ | 77,000 | $ | 87,000 | ||||||||

| EPS | $ | (0.13 | ) | $ | (0.04 | ) | $ | 1.23 | $ | 1.61 | ||||||

Exhibit 99.2

1Q 2025 Earnings Presentation May 2025

FORWARD - LOOKING STATEMENTS Statements made in this presentation regarding American Public Education, Inc . or its subsidiary institutions (“APEI” or the “Company”) that are not historical facts are forward - looking statements based on current expectations, assumptions, estimates and projections about APEI and the industry . In some cases, forward looking statements can be identified by words such as “anticipate,” “believe,” “seek,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “project,” “should,” “will,” “would,” and similar words or their opposites . Forward - looking statements include, without limitation, statements regarding expectations for growth, registration, enrollments, demand, revenues, net income, earnings per share, EBITDA and Adjusted EBITDA, capital expenditures, free cash flow, and plans with respect to and future impacts of recent, current and future initiatives, including the planned combination of APUS, RU and HCN into one consolidated institution, campus and corporate center consolidation, and redemption of preferred stock . Forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements . Such risks and uncertainties include, among others, risks related to : the Company’s failure to comply with regulatory and accrediting agency requirements, including the “ 90 / 10 Rule”, and to maintain institutional accreditation and the impacts of any actions the Company may take to prevent or correct such failure ; changes in the postsecondary education regulatory environment as a result of U . S . federal elections, including any changes by or as a result of actions of the current administration to the operations of the Department of Education or changes to or the elimination or implementation of laws, regulations, standards, policies, and practices ; potential or actual government shutdowns, as well as government budget and federal workforce uncertainty ; the impact, timing, and projected benefits of the planned combination the Company’s dependence on the effectiveness of its ability to attract students who persist in its subsidiary institutions’ programs ; declines in enrollments at the Company’s subsidiary institutions ; the Company’s inability to effectively brand or market its subsidiary institutions and its subsidiary institutions’ programs ; the Company’s inability to maintain strong relationships with the military and maintain course registrations and enrollments from military students ; the loss or disruption of the Company’s ability to receive funds under Title IV or tuition assistance programs or the reduction, elimination, or suspension of federal funds ; adverse effects of changes the Company makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed ; the Company’s need to successfully adjust to future market demands including updating existing programs and developing new programs ; the Company’s loss of eligibility to participate in Title IV programs or ability to process Title IV financial aid ; economic and market conditions and changes in interest rates ; difficulties involving acquisitions ; the Company’s indebtedness and preferred stock, including the refinancing or redemption thereof ; the Company’s dependence on and the need to continue to invest in its technology infrastructure, including with respect to third - party vendors ; the inability to recognize the anticipated benefits of the Company’s cost savings and revenue generating efforts ; the Company’s ability to manage and limit its exposure to bad debt ; and the risk factors described in the risk factor section and elsewhere in the Company’s most recent annual report on Form 10 - K and quarterly report on Form 10 - Q and in the Company’s other SEC filings . You should not place undue reliance on any forward - looking statements . The Company undertakes no obligation to update publicly any forward - looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future . 2 1Q25 Executive Summary $164.6 M Revenue $21.2 M Adj.

EBITDA 1 $7.5 M Net Income available to common stockholders $187.5 M Cash (as of 3/31/25) 1. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization, less non - recurring expenses, such as severanc e, and non - cash expenses, such as stock compensation) and EBITDA are non - GAAP financial measures. Please refer to Appendix for GAAP to non - GAAP reconciliation. $0.41 Diluted EPS ▪ 1Q25 results above guidance include: ▪ Revenue of $164.6 million ▪ Net Income available to common stockholders of $7.5M vs ($1.0M) in 1Q24 ▪ Adjusted EBITDA 1 of $21.2 million vs $17.1M in 1Q24 ▪ Cash position increased $28.6 million from year end 2024 1Q25 Business Highlights APEI is a market leader in the post - secondary education of active - duty military, veterans, new nurses, and health professionals, segments that have demonstrated stable and long - term demand. 1Q 2025 Financial Highlights +7% YoY +25% YoY +22% YoY 3 ▪ APUS increased net course registrations by 3.5% vs 1Q24 ▪ Rasmussen increased enrollment by 7% in 1Q25 ▪ Fourth consecutive quarter of YoY enrollment growth ▪ 1Q25 EBITDA of $2.1 million vs Q124 of ($5.7M) ▪ Hondros College of Nursing (HCN) increased enrollment 9.6% enrollment vs 1Q24 ($1.0 M) in 1Q24 ($0.06) in 1Q24 2Q and FY25 Financial Highlights APEI is a market leader in the post - secondary education of active - duty military, veterans, new nurses, and health professionals, segments that have demonstrated stable and long - term demand.

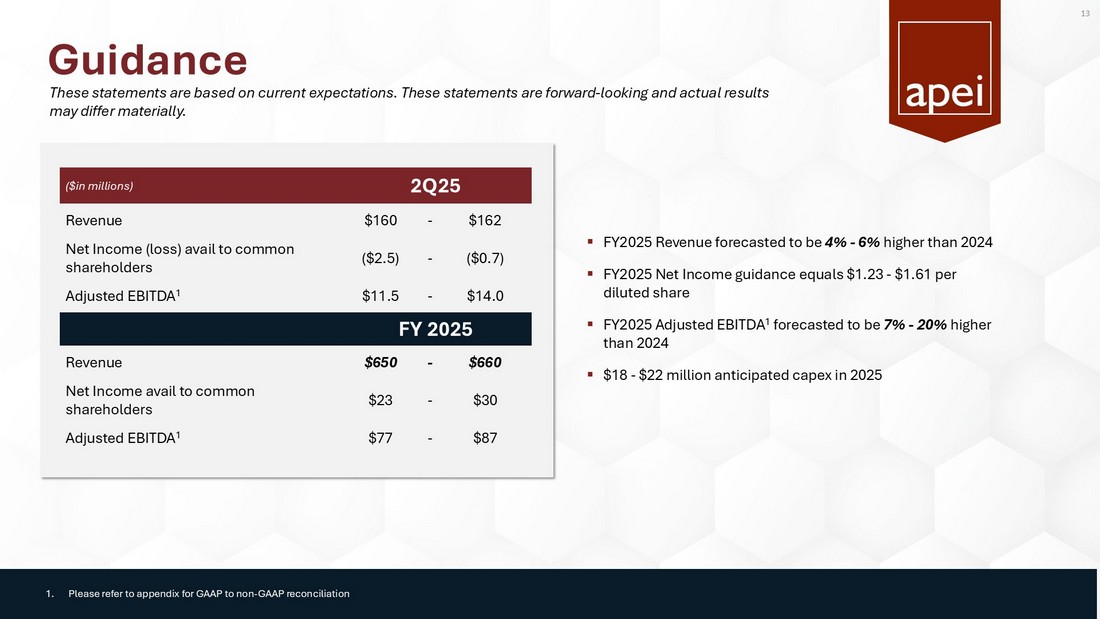

2Q25 and Full Year 2025 Guidance 4 $650M - $660M 2025E Revenue $23M - $30M 2025E Net income available to common stockholders $77M - $87M 2025E Adj. EBITDA 1 ▪ APUS 2Q25 expected registration growth of 4% - 7% compared to 2Q24 ▪ RAS 2Q25 enrollment growth up 8% vs 2Q24 ▪ HCN 2Q25 enrollment growth up 14% vs 2Q24 ▪ Near term headwinds at GSUSA related to DOGE and federal government spending uncertainty 1. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization, less non - recurring expenses, such as severanc e, and non - cash expenses, such as stock compensation) is a non - GAAP financial measure. Please refer to Appendix for GAAP to non - GAAP reconciliation.

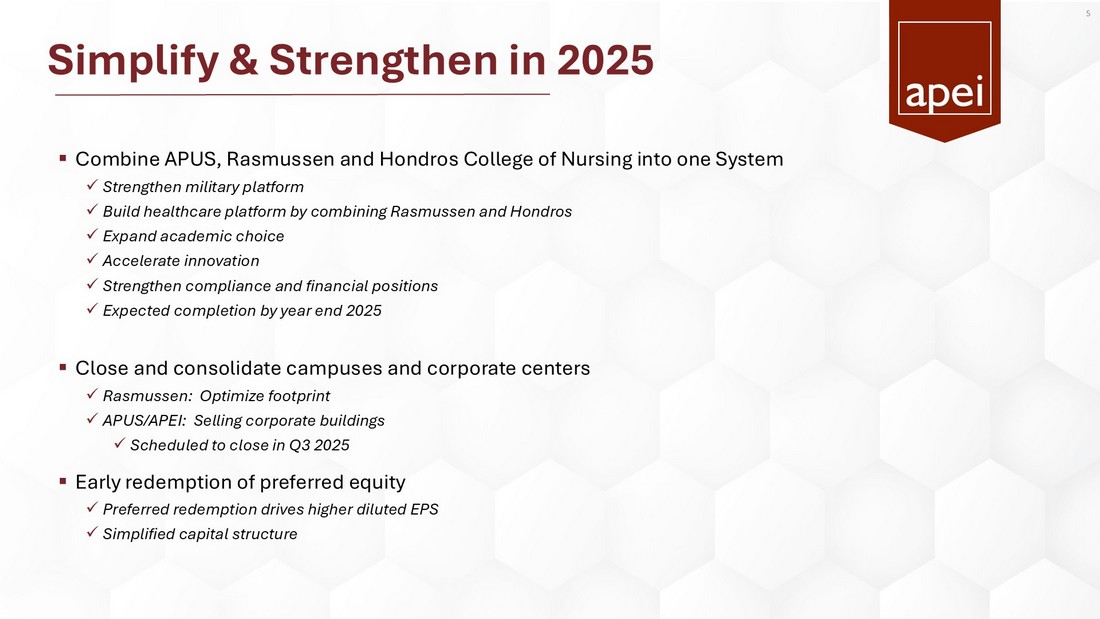

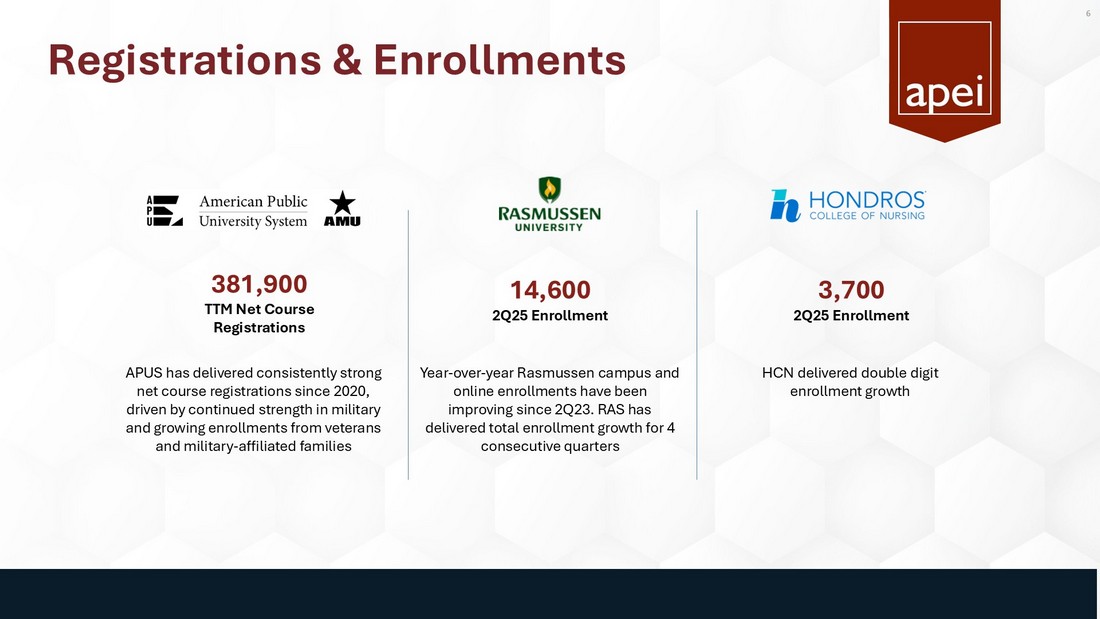

▪ Raising full year 2025 Net Income guidance to $23 - $30 million ▪ Raising full year 2025 Adjusted EBITDA guidance to $77 - $87 million Full Year 2025 Guidance 2Q 2025 Guidance Simplify & Strengthen in 2025 5 ▪ Combine APUS, Rasmussen and Hondros College of Nursing into one System x Strengthen military platform x Build healthcare platform by combining Rasmussen and Hondros x Expand academic choice x Accelerate innovation x Strengthen compliance and financial positions x Expected completion by year end 2025 ▪ Close and consolidate campuses and corporate centers x Rasmussen: Optimize footprint x APUS/APEI: Selling corporate buildings x Scheduled to close in Q3 2025 ▪ Early redemption of preferred equity x Preferred redemption drives higher diluted EPS x Simplified capital structure Registrations & Enrollments 381,900 TTM Net Course Registrations 14,600 2Q25 Enrollment APUS has delivered consistently strong net course registrations since 2020, driven by continued strength in military and growing enrollments from veterans and military - affiliated families Year - over - year Rasmussen campus and online enrollments have been improving since 2Q23.

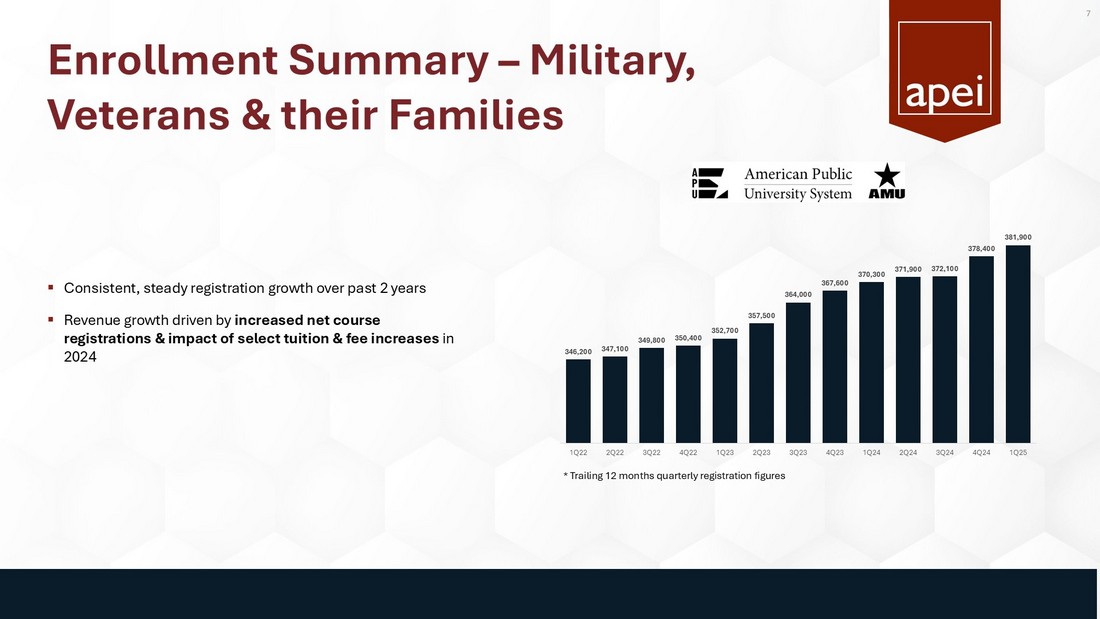

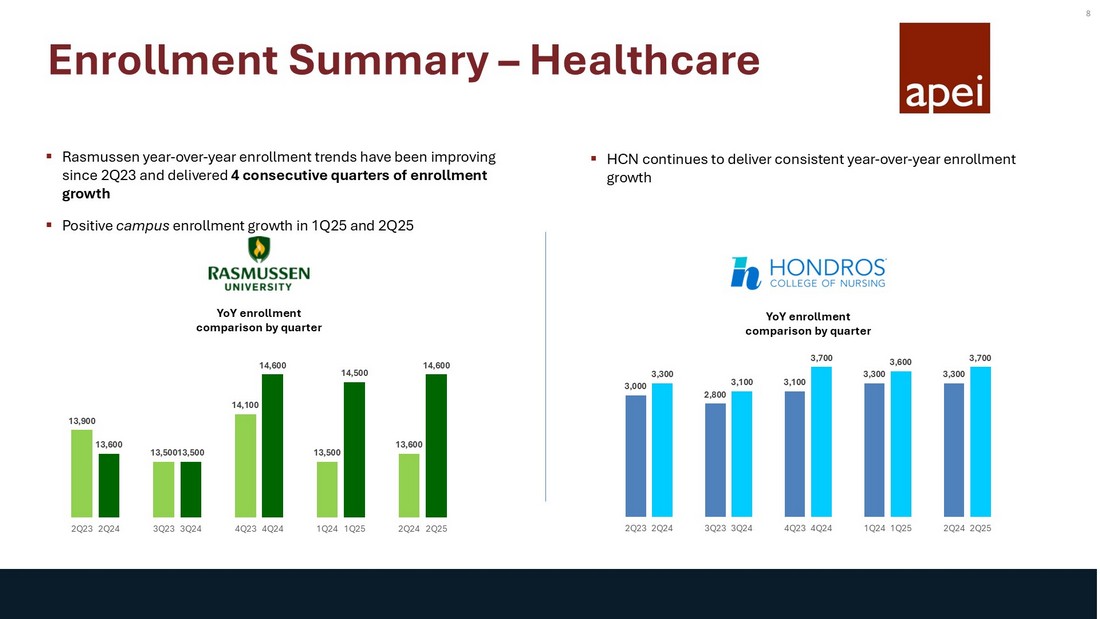

RAS has delivered total enrollment growth for 4 consecutive quarters HCN delivered double digit enrollment growth 6 3,700 2Q25 Enrollment Enrollment Summary – Military, Veterans & their Families * Trailing 12 months quarterly registration figures ▪ Consistent, steady registration growth over past 2 years ▪ Revenue growth driven by increased net course registrations & impact of select tuition & fee increases in 2024 7 346,200 347,100 349,800 350,400 352,700 357,500 364,000 367,600 370,300 371,900 372,100 378,400 381,900 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 Enrollment Summary – Healthcare ▪ Rasmussen year - over - year enrollment trends have been improving since 2Q23 and delivered 4 consecutive quarters of enrollment growth ▪ Positive campus enrollment growth in 1Q25 and 2Q25 YoY enrollment comparison by quarter 8 13,900 13,600 13,500 13,500 14,100 14,600 13,500 14,500 13,600 14,600 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 2Q24 2Q25 YoY enrollment comparison by quarter 3,000 3,300 2,800 3,100 3,100 3,700 3,300 3,600 3,300 3,700 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 2Q24 2Q25 ▪ HCN continues to deliver consistent year - over - year enrollment growth

Financial Update

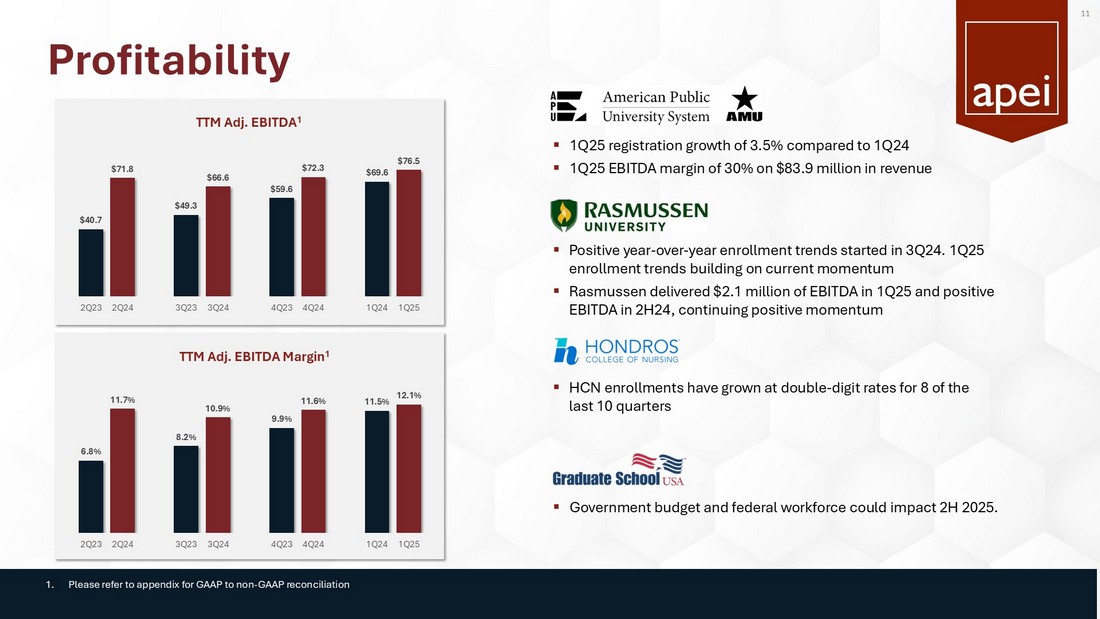

Segment Revenue • APUS has delivered consistent year - over - year growth driven by modest increases in registrations and targeted tuition and fee increases • Rasmussen continues to build on a solid foundation with higher revenue and enrollment trends • 1Q25 enrollment growth is 7% over 1Q24 • Fourth consecutive quarter of year - over - year revenue growth • 1Q25 revenue growth of 7.5% APUS increased revenue year over year and is expected to grow net course registrations in 2025. Rasmussen and Hondros College of Nursing experienced year - over - year revenue growth and positive enrollment trends. 10 $73.6 $77.0 $76.4 $77.0 $79.4 $82.4 $80.7 $83.9 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 $52.0 $53.0 $52.1 $52.6 $52.6 $57.5 $53.1 $59.3 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 $14.3 $16.4 $13.7 $15.5 $15.8 $18.9 $16.4 $17.7 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 Profitability ▪ 1Q25 registration growth of 3.5% compared to 1Q24 ▪ 1Q25 EBITDA margin of 30% on $83.9 million in revenue TTM Adj.

EBITDA 1 TTM Adj. EBITDA Margin 1 ▪ Positive year - over - year enrollment trends started in 3Q24. 1Q25 enrollment trends building on current momentum ▪ Rasmussen delivered $2.1 million of EBITDA in 1Q25 and positive EBITDA in 2H24, continuing positive momentum ▪ HCN enrollments have grown at double - digit rates for 8 of the last 10 quarters ▪ Government budget and federal workforce could impact 2H 2025. 1.

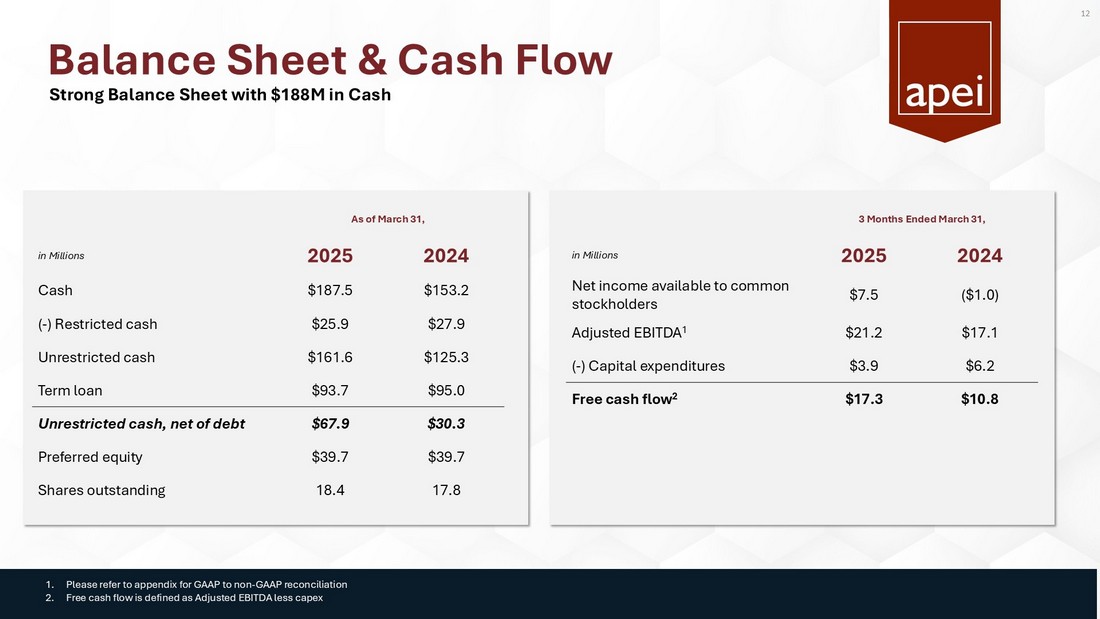

Please refer to appendix for GAAP to non - GAAP reconciliation 11 $40.7 $71.8 $49.3 $66.6 $59.6 $72.3 $69.6 $76.5 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 6.8% 11.7% 8.2% 10.9% 9.9% 11.6% 11.5% 12.1% 2Q23 2Q24 3Q23 3Q24 4Q23 4Q24 1Q24 1Q25 Balance Sheet & Cash Flow 3 Months Ended March 31, 2024 2025 in Millions ($1.0) $7.5 Net income available to common stockholders $17.1 $21.2 Adjusted EBITDA 1 $6.2 $3.9 ( - ) Capital expenditures $10.8 $17.3 Free cash flow 2 As of March 31, 2024 2025 in Millions $153.2 $187.5 Cash $27.9 $25.9 ( - ) Restricted cash $125.3 $161.6 Unrestricted cash $95.0 $93.7 Term loan $30.3 $67.9 Unrestricted cash, net of debt $39.7 $39.7 Preferred equity 17.8 18.4 Shares outstanding Strong Balance Sheet with $188M in Cash 1. Please refer to appendix for GAAP to non - GAAP reconciliation 2.

Free cash flow is defined as Adjusted EBITDA less capex 12 Guidance 13 2Q25 ($in millions) $162 - $160 Revenue ($0.7) - ($2.5) Net Income (loss) avail to common shareholders $14.0 - $11.5 Adjusted EBITDA 1 FY 2025 $660 - $650 Revenue $30 - $23 Net Income avail to common shareholders $87 - $77 Adjusted EBITDA 1 ▪ FY2025 Revenue forecasted to be 4% - 6% higher than 2024 ▪ FY2025 Net Income guidance equals $1.23 - $1.61 per diluted share ▪ FY2025 Adjusted EBITDA 1 forecasted to be 7% - 20% higher than 2024 ▪ $18 - $22 million anticipated capex in 2025 1. Please refer to appendix for GAAP to non - GAAP reconciliation These statements are based on current expectations. These statements are forward - looking and actual results may differ materially.

INVESTMENT HIGHLIGHTS Large Addressable Market Online education expected to increase to >$100 billion in 5 years Solid ROI for Education & Stable Long - Term Demand APUS in top 11% for student return on educational investment 1 Demand for nurses estimated to be 200,000+ per year Improving Performance and Operating Leverage Solid growth, margins and cash flow performance at APUS Rasmussen delivering positive enrollment and leveraging its higher fixed cost base Simplifying Business Operations Consolidating three separate institutions into one university system Plan to redeem preferred equity Reduction or elimination of assets, campus leases and corporate buildings 1. According to the Georgetown University Center on Education and the Workforce (2022) 2.

Appendix

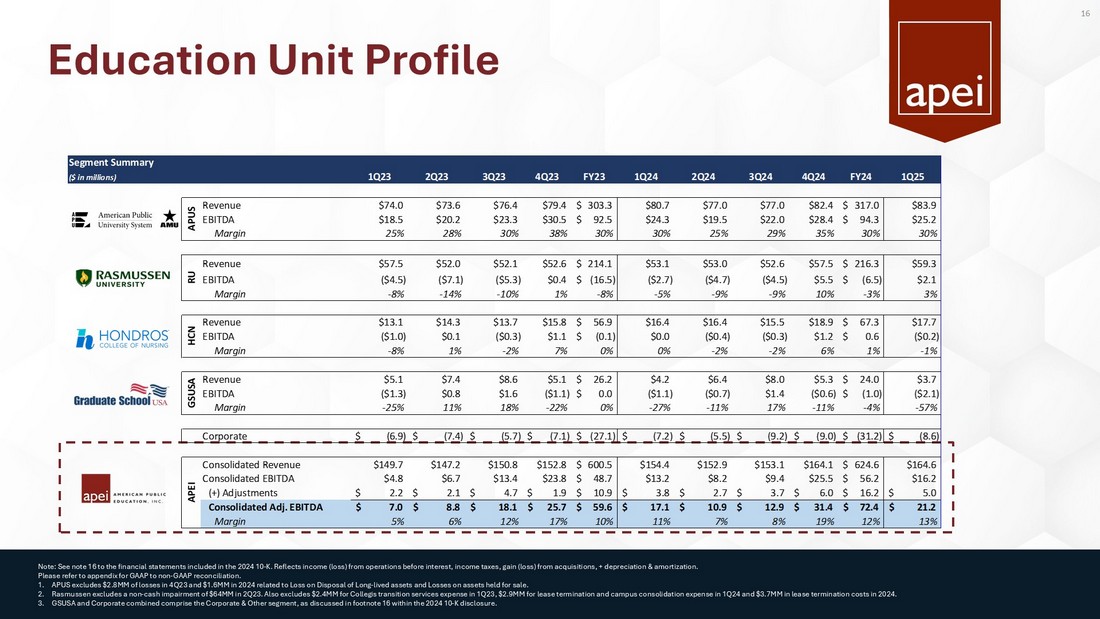

Free cash flow defined as Adjusted EBITDA less Capital Expenditures Strong Cash Flow Free cash flow 2 expected to be $55 million to $69 million in 2025 14 Education Unit Profile Note: See note 16 to the financial statements included in the 2024 10 - K. Reflects income (loss) from operations before interest, income taxes, gain (loss) from acquisitions, + depreciation & amortization. Please refer to appendix for GAAP to non - GAAP reconciliation. 1. APUS excludes $2.8MM of losses in 4Q23 and $1.6MM in 2024 related to Loss on Disposal of Long - lived assets and Losses on assets held for sale. 2. Rasmussen excludes a non - cash impairment of $64MM in 2Q23. Also excludes $2.4MM for Collegis transition services expense in 1Q23, $2.9MM for lease termination and campus consolidation expense in 1Q24 and $3.7MM in leas e termination costs in 2024. 3. GSUSA and Corporate combined comprise the Corporate & Other segment, as discussed in footnote 16 within the 2024 10 - K disclosure . 16 Segment Summary ($ in millions) 1Q23 2Q23 3Q23 4Q23 FY23 1Q24 2Q24 3Q24 4Q24 FY24 1Q25 Revenue $74.0 $73.6 $76.4 $79.4 303.3$ $80.7 $77.0 $77.0 $82.4 317.0$ $83.9 EBITDA $18.5 $20.2 $23.3 $30.5 92.5$ $24.3 $19.5 $22.0 $28.4 94.3$ $25.2 Margin 25% 28% 30% 38% 30% 30% 25% 29% 35% 30% 30% Revenue $57.5 $52.0 $52.1 $52.6 214.1$ $53.1 $53.0 $52.6 $57.5 216.3$ $59.3 EBITDA ($4.5) ($7.1) ($5.3) $0.4 (16.5)$ ($2.7) ($4.7) ($4.5) $5.5 (6.5)$ $2.1 Margin -8% -14% -10% 1% -8% -5% -9% -9% 10% -3% 3% Revenue $13.1 $14.3 $13.7 $15.8 56.9$ $16.4 $16.4 $15.5 $18.9 67.3$ $17.7 EBITDA ($1.0) $0.1 ($0.3) $1.1 (0.1)$ $0.0 ($0.4) ($0.3) $1.2 0.6$ ($0.2) Margin -8% 1% -2% 7% 0% 0% -2% -2% 6% 1% -1% Revenue $5.1 $7.4 $8.6 $5.1 26.2$ $4.2 $6.4 $8.0 $5.3 24.0$ $3.7 EBITDA ($1.3) $0.8 $1.6 ($1.1) 0.0$ ($1.1) ($0.7) $1.4 ($0.6) (1.0)$ ($2.1) Margin -25% 11% 18% -22% 0% -27% -11% 17% -11% -4% -57% Corporate (6.9)$ (7.4)$ (5.7)$ (7.1)$ (27.1)$ (7.2)$ (5.5)$ (9.2)$ (9.0)$ (31.2)$ (8.6)$ Consolidated Revenue $149.7 $147.2 $150.8 $152.8 600.5$ $154.4 $152.9 $153.1 $164.1 624.6$ $164.6 Consolidated EBITDA $4.8 $6.7 $13.4 $23.8 48.7$ $13.2 $8.2 $9.4 $25.5 56.2$ $16.2 (+) Adjustments 2.2$ 2.1$ 4.7$ 1.9$ 10.9$ 3.8$ 2.7$ 3.7$ 6.0$ 16.2$ 5.0$ Consolidated Adj.

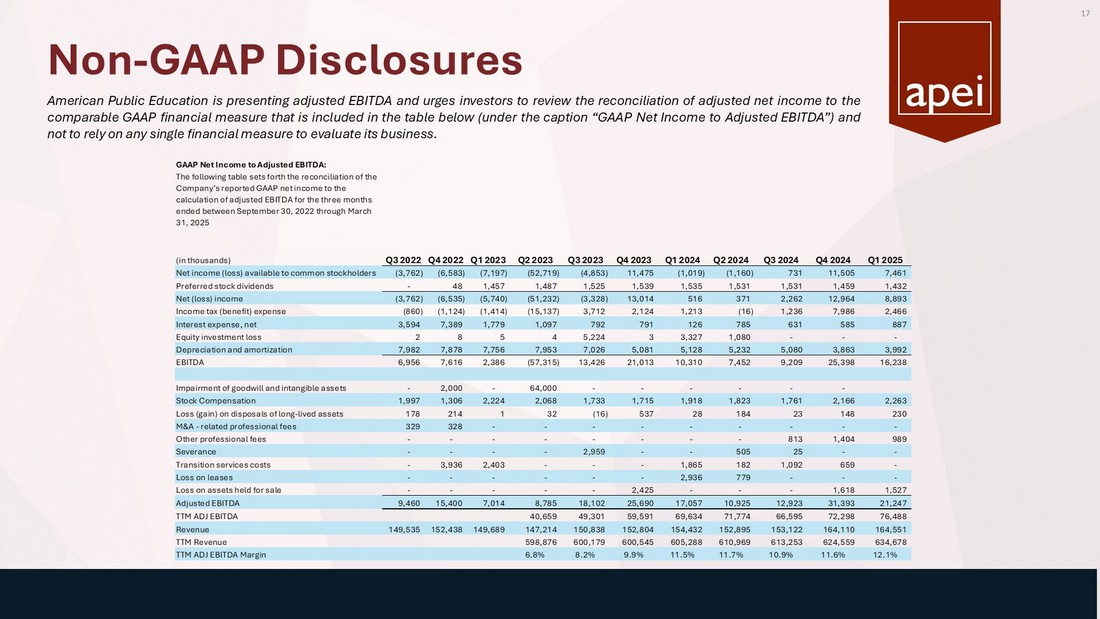

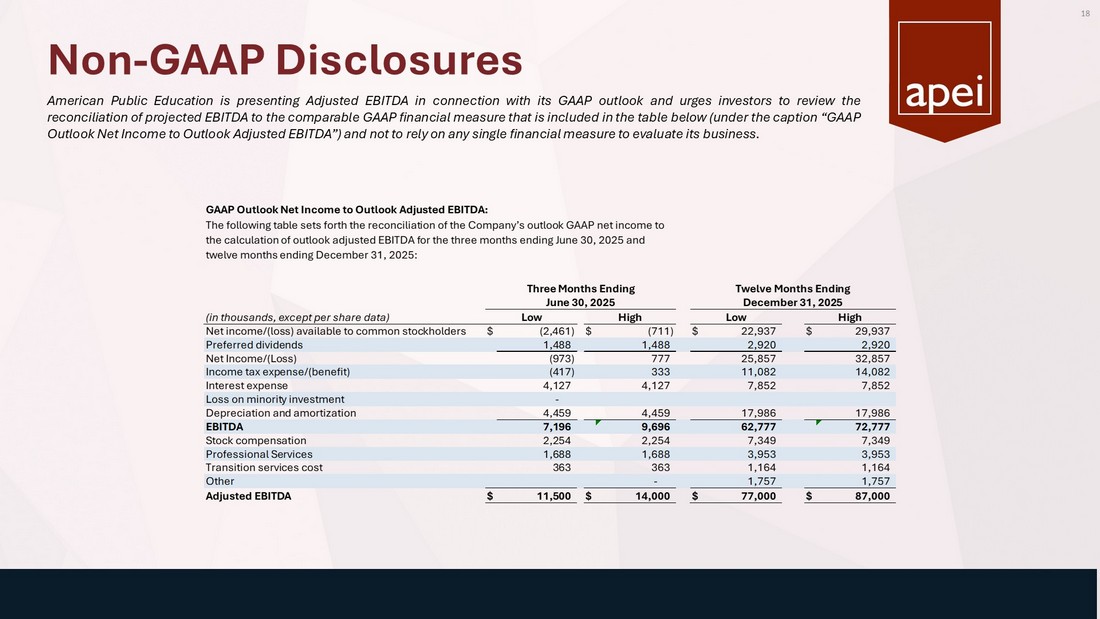

EBITDA 7.0$ 8.8$ 18.1$ 25.7$ 59.6$ 17.1$ 10.9$ 12.9$ 31.4$ 72.4$ 21.2$ Margin 5% 6% 12% 17% 10% 11% 7% 8% 19% 12% 13% APEI APUS RU HCN GSUSA Non - GAAP Disclosures American Public Education is presenting adjusted EBITDA and urges investors to review the reconciliation of adjusted net income to the comparable GAAP financial measure that is included in the table below (under the caption “GAAP Net Income to Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . 17 GAAP Net Income to Adjusted EBITDA: The following table sets forth the reconciliation of the Company’s reported GAAP net income to the calculation of adjusted EBITDA for the three months ended between September 30, 2022 through March 31, 2025 (in thousands) Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Net income (loss) available to common stockholders (3,762) (6,583) (7,197) (52,719) (4,853) 11,475 (1,019) (1,160) 731 11,505 7,461 Preferred stock dividends - 48 1,457 1,487 1,525 1,539 1,535 1,531 1,531 1,459 1,432 Net (loss) income (3,762) (6,535) (5,740) (51,232) (3,328) 13,014 516 371 2,262 12,964 8,893 Income tax (benefit) expense (860) (1,124) (1,414) (15,137) 3,712 2,124 1,213 (16) 1,236 7,986 2,466 Interest expense, net 3,594 7,389 1,779 1,097 792 791 126 785 631 585 887 Equity investment loss 2 8 5 4 5,224 3 3,327 1,080 - - - Depreciation and amortization 7,982 7,878 7,756 7,953 7,026 5,081 5,128 5,232 5,080 3,863 3,992 EBITDA 6,956 7,616 2,386 (57,315) 13,426 21,013 10,310 7,452 9,209 25,398 16,238 Impairment of goodwill and intangible assets - 2,000 - 64,000 - - - - - - Stock Compensation 1,997 1,306 2,224 2,068 1,733 1,715 1,918 1,823 1,761 2,166 2,263 Loss (gain) on disposals of long-lived assets 178 214 1 32 (16) 537 28 184 23 148 230 M&A - related professional fees 329 328 - - - - - - - - - Other professional fees - - - - - - - - 813 1,404 989 Severance - - - - 2,959 - - 505 25 - - Transition services costs - 3,936 2,403 - - - 1,865 182 1,092 659 - Loss on leases - - - - - - 2,936 779 - - - Loss on assets held for sale - - - - - 2,425 - - - 1,618 1,527 Adjusted EBITDA 9,460 15,400 7,014 8,785 18,102 25,690 17,057 10,925 12,923 31,393 21,247 TTM ADJ EBITDA 40,659 49,301 59,591 69,634 71,774 66,595 72,298 76,488 Revenue 149,535 152,438 149,689 147,214 150,838 152,804 154,432 152,895 153,122 164,110 164,551 TTM Revenue 598,876 600,179 600,545 605,288 610,969 613,253 624,559 634,678 TTM ADJ EBITDA Margin 6.8% 8.2% 9.9% 11.5% 11.7% 10.9% 11.6% 12.1% Non - GAAP Disclosures American Public Education is presenting Adjusted EBITDA in connection with its GAAP outlook and urges investors to review the reconciliation of projected EBITDA to the comparable GAAP financial measure that is included in the table below (under the caption “GAAP Outlook Net Income to Outlook Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . 18 GAAP Outlook Net Income to Outlook Adjusted EBITDA: (in thousands, except per share data) Net income/(loss) available to common stockholders $ (2,461) $ (711) $ 22,937 $ 29,937 Preferred dividends 1,488 1,488 2,920 2,920 Net Income/(Loss) (973) 777 25,857 32,857 Income tax expense/(benefit) (417) 333 11,082 14,082 Interest expense 4,127 4,127 7,852 7,852 Loss on minority investment - Depreciation and amortization 4,459 4,459 17,986 17,986 EBITDA 7,196 9,696 62,777 72,777 Stock compensation 2,254 2,254 7,349 7,349 Professional Services 1,688 1,688 3,953 3,953 Transition services cost 363 363 1,164 1,164 Other - 1,757 1,757 Adjusted EBITDA $ 11,500 $ 14,000 $ 77,000 $ 87,000 The following table sets forth the reconciliation of the Company’s outlook GAAP net income to the calculation of outlook adjusted EBITDA for the three months ending June 30, 2025 and twelve months ending December 31, 2025: Three Months Ending Twelve Months Ending June 30, 2025 December 31, 2025 Low High Low High

Thank You Company Steve Somers, CFA Chief Strategy & Corporate Development Officer investorrelations@apei.com Investor Relations Brian M. Prenoveau , CFA MZ Group 561 - 489 - 5315 APEI@mzgroup.us