UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): (May 12, 2025)

| ALCHEMY INVESTMENTS ACQUISITION CORP 1 |

| (Exact name of registrant as specified in its charter) |

| Cayman Islands | 001-41699 | N/A | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

850 Library Avenue, Suite 204-F

Newark, DE 19711

(Address of principal executive offices, including zip code)

(212) 877-1588

Registrant’s telephone number, including area code:

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||

| Units, each consisting of one Class A Ordinary Share and one-half of one Redeemable Warrant | ALCYU | The Nasdaq Stock Market, LLC | ||

| Class A Ordinary Share, par value $0.0001 per share | ALCY | The Nasdaq Stock Market, LLC | ||

| Warrant, each whole warrant exercisable for one Class A Ordinary Share for $11.50 per share | ALCYW | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On May 12, 2025, Alchemy Investments Acquisition Corp 1 (“Alchemy”) and Cartiga, LLC, a Delaware limited liability company (“Cartiga”), issued a joint press release announcing a non-binding letter of intent in connection with a potential business combination.

Furnished as Exhibit 99.1 hereto and incorporated by reference herein is a press release issued in connection with the proposed business combination and related matters.

Furnished as Exhibit 99.2 hereto and incorporated by reference herein is the investor presentation that will be used by Alchemy and Cartiga in connection with the proposed business combination and related matters.

Important Information and Where To Find It

This Current Report on Form 8-K is provided for information purposes only and contains information with respect to a potential Business Combination described herein. If the Parties enter into definitive documentation regarding a Business Combination, a newly formed holding company intends to file relevant materials with the SEC, including a Registration Statement on Form S-4, that includes a preliminary proxy statement/prospectus, and when available, a definitive proxy statement and final prospectus. Promptly after filing any definitive proxy statement with the SEC, Alchemy will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the Extraordinary Meeting relating to the transaction. INVESTORS AND SHAREHOLDERS OF ALCHEMY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT ALCHEMY FILES WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ALCHEMY, CARTIGA AND THE BUSINESS COMBINATION. Any definitive proxy statement, preliminary proxy statement and other relevant materials in connection with the transaction (if and when they become available), and any other documents filed by Alchemy with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov).

Participants in the Solicitation

Alchemy and its directors and executive officers may be deemed participants in the solicitation of proxies from Alchemy’s shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in Alchemy will be included in any proxy statement for the Business Combination and be available at www.sec.gov. Information about Alchemy’s directors and executive officers and their ownership of ordinary shares is set forth in Alchemy’s final prospectus, dated as of May 4, 2023, and filed with the SEC (File No. 333-268659) on May 5, 2023, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing (the “Prospectus”). Additional information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed Business Combination when it becomes available. These documents can be obtained free of charge at the SEC’s website (www.sec.gov).

Cartiga and its managers and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Alchemy in connection with the proposed Business Combination. A list of the names of such managers and executive officers and information regarding their interests in the proposed Business Combination will be included in any proxy statement for the proposed Business Combination when it becomes available.

Forward-Looking Statements

This Current Report on Form 8-K contains certain “forward-looking statements”. Forward-looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “shall,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” “forecast,” “intend,” “plan,” “project,” “outlook” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Examples of forward-looking statements include, among others, statements regarding the proposed transactions contemplated by the non-binding letter of intent, including the benefits of the Business Combination, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the Business Combination. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Parties’ managements’ current beliefs, expectations and assumptions. Because forward- looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward- looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, the non-binding nature of the letter of intent and the ability of the Parties’ to cease discussions regarding a Business Combination for any reason or no reason, as well as the following, even if the Parties do in their discretion enter into definitive documentation regarding a proposed Business Combination: (a) the occurrence of any event, change, or other circumstances that could give rise to the termination of the Business Combination Agreement; (b) the outcome of any legal proceedings that may be instituted against the Parties following the announcement of the Business Combination Agreement and the transactions contemplated therein; (c) the inability to complete the proposed Business Combination, including due to failure to obtain approval of the shareholders of Alchemy or members of Cartiga, certain regulatory approvals, or satisfy other conditions to closing in the Business Combination Agreement; (d) the occurrence of any event, change, or other circumstance that could give rise to the termination of the Business Combination Agreement or could otherwise cause the transaction to fail to close; (e) the inability to obtain or maintain the listing of securities on Nasdaq following the proposed Business Combination; (f) the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation of the proposed Business Combination; (g) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of Cartiga to grow and manage growth profitably, and retain its key employees; (h) costs related to the proposed Business Combination; (i) changes in applicable laws or regulations; (j) the possibility that Alchemy or Cartiga may be adversely affected by other economic, business, and/or competitive factors; (k) risks relating to the uncertainty of the projected financial information with respect to Cartiga; (l) risks related to the organic and inorganic growth of Cartiga’s business and the timing of expected business milestones; (m) the amount of redemption requests made by Alchemy’s shareholders; and (n) other risks and uncertainties indicated from time to time in any Prospectus that includes a preliminary proxy statement/prospectus, and if and when available, a definitive proxy statement and final prospectus relating to the proposed Business Combination, including those under “Risk Factors” therein, and in Alchemy’s other filings with the SEC. Alchemy cautions that the foregoing list of factors is not exclusive. The Parties caution readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Parties do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their expectations or any change in events, conditions, or circumstances on which any such statement is based, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Neither Alchemy nor Cartiga gives any assurance that either Cartiga or Alchemy, or the combined company, will achieve its expectations.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in respect of the proposed Business Combination, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Current Report on Form 8-K does not constitute either advice or a recommendation regarding any securities. No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

| Exhibit No. | Description | |

| 99.1 | Press Release dated May 12, 2025 | |

| 99.2 | Investor Presentation dated May 12, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ALCHEMY INVESTMENTS ACQUISITION CORP 1 | ||

| Dated: May 12, 2025 | By: | /s/ Mattia Tomba |

| Name: Mattia Tomba | ||

| Title: Co-Chief Executive Officer | ||

Exhibit 99.1

Alchemy Investments Acquisition Corp 1 Signs Non-Binding LOI with Cartiga, LLC, a Leading Litigation Finance Asset Management Platform

Business Combination Would Unlock Significant Value for Cartiga as a Nasdaq-Listed Tech-Forward Vertically-Integrated Alternative Asset Management Company

New York, NY, May 12, 2025 – Alchemy Investments Acquisition Corp 1 (“Alchemy”; Nasdaq: ALCY), a publicly traded special purpose acquisition company (“SPAC”), has entered into a non-binding letter of intent with Cartiga, LLC, a Delaware limited liability company (“Cartiga” and together with Alchemy, the “Parties”), in connection with a potential business combination (“Business Combination”).

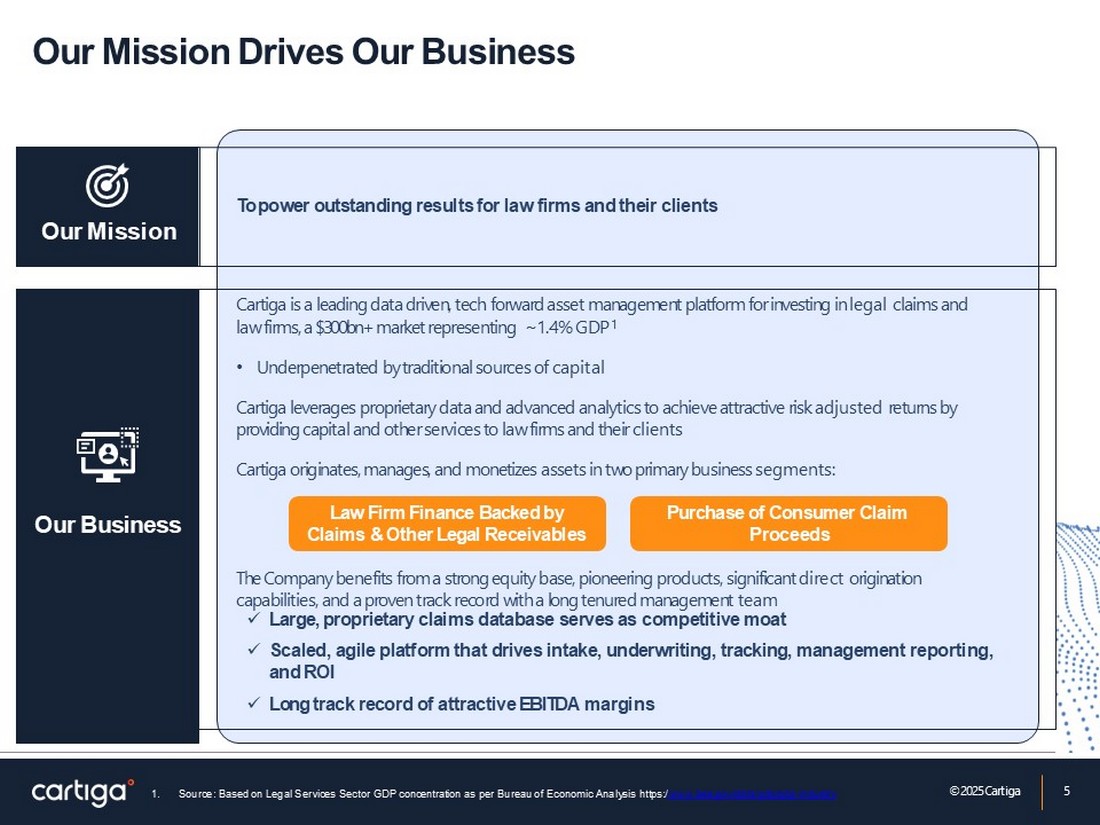

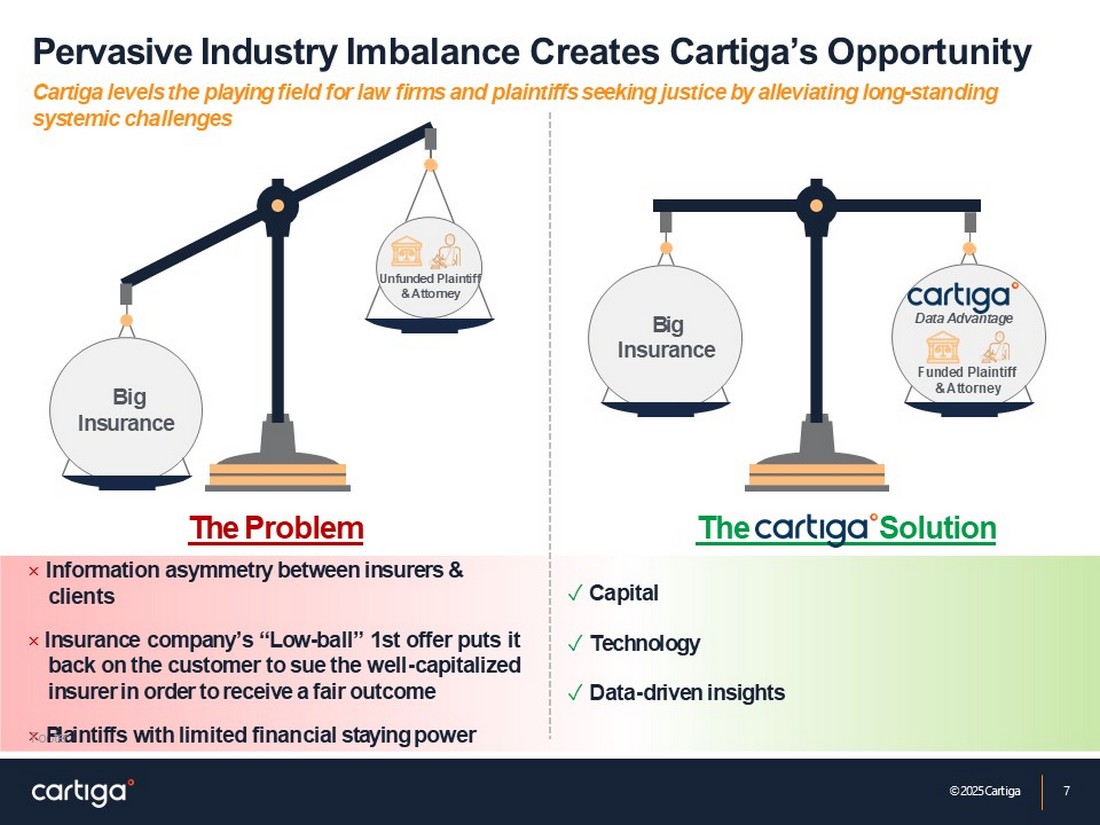

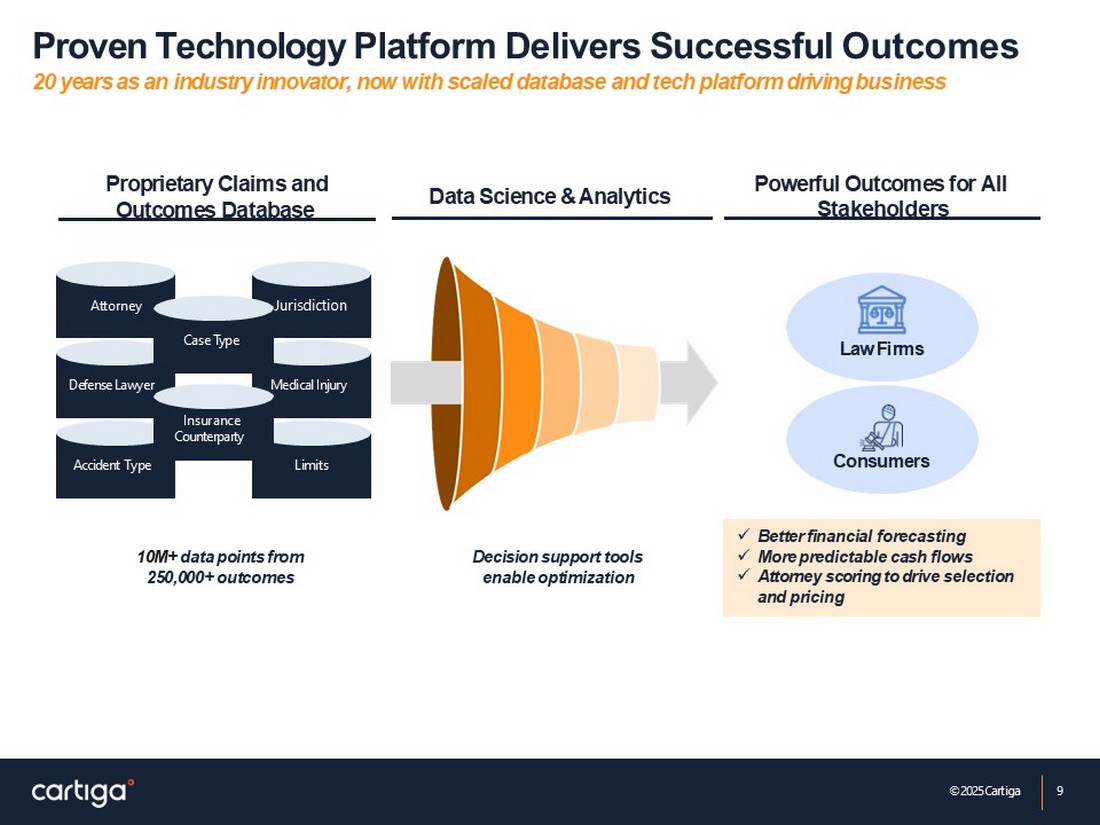

Cartiga is a specialized alternative investment firm using advanced data analytics to drive investments in litigation finance. By integrating legal and financial data, Cartiga leverages proprietary information and deep domain expertise to predict litigation outcomes, optimize asset allocation and investment performance, and deliver case and business management insights to law firms.

Its analytics-driven strategy enables claim valuation, tech-enabled case monitoring, and dynamic risk adjustment. Cartiga streamlines the origination and investment process in a manner designed to mitigate risk and maximize returns. By investing in legal claims and legal services businesses, Cartiga continually improves its data advantage and value proposition to customers while delivering attractive non-correlated risk-adjusted returnsi. Cartiga believes that it is optimally positioned to drive growth by leveraging direct distribution and machine learning tools to both accelerate originations and deploy business optimization tools for law firms.

As a public company, the pro forma business plans to opportunistically consolidate the fragmented litigation finance market through the intended acquisition and integration of complementary companies and assets. This strategy is designed to enhance scale, operational efficiency and market presence, driving long-term growth for shareholders.

Investment Highlights of Cartiga

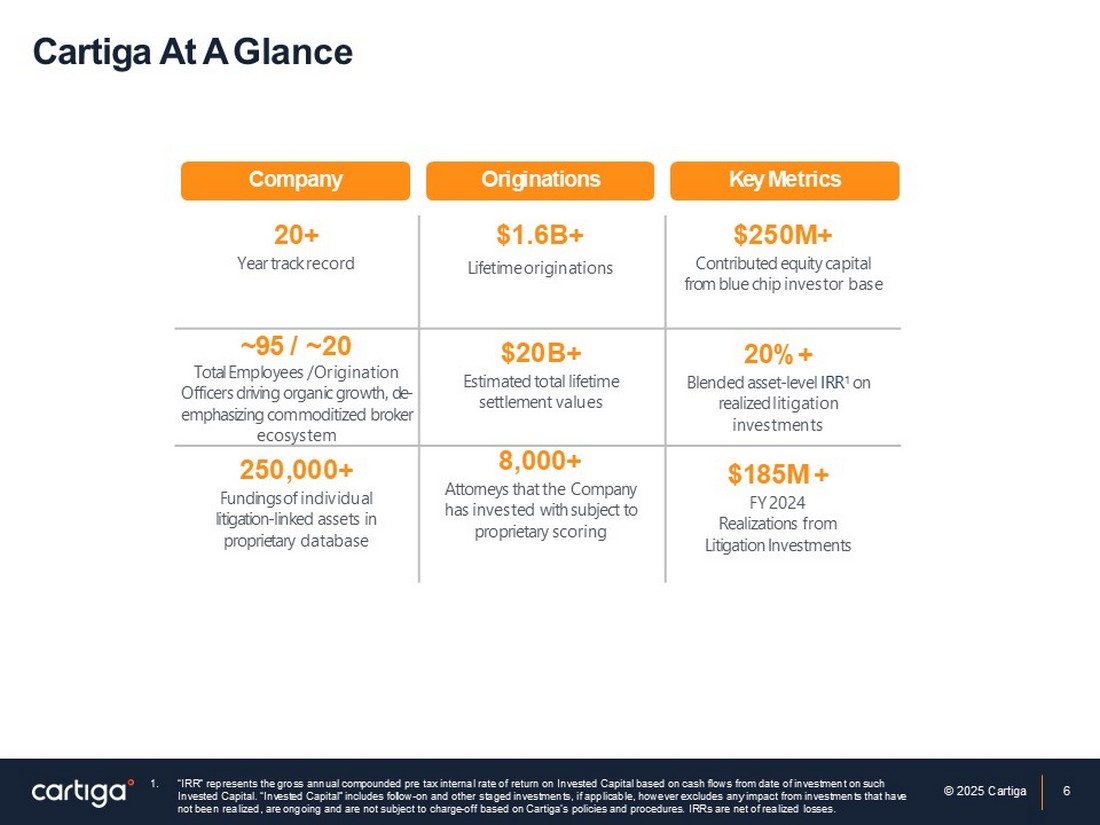

| · | Proven Track Record: More than $1.6 billion in lifetime originations and $1.6 billion in cash realizations since inception in 2000, demonstrating strong performance and profitability across market cycles. | |

| · | Comprehensive Platform: A multi-product alternative asset management and direct origination platform investing in the U.S. litigation and legal services market. | |

| · | Data-Driven Success: Advanced data analytics and bespoke technology enhance underwriting, risk assessment and portfolio management. |

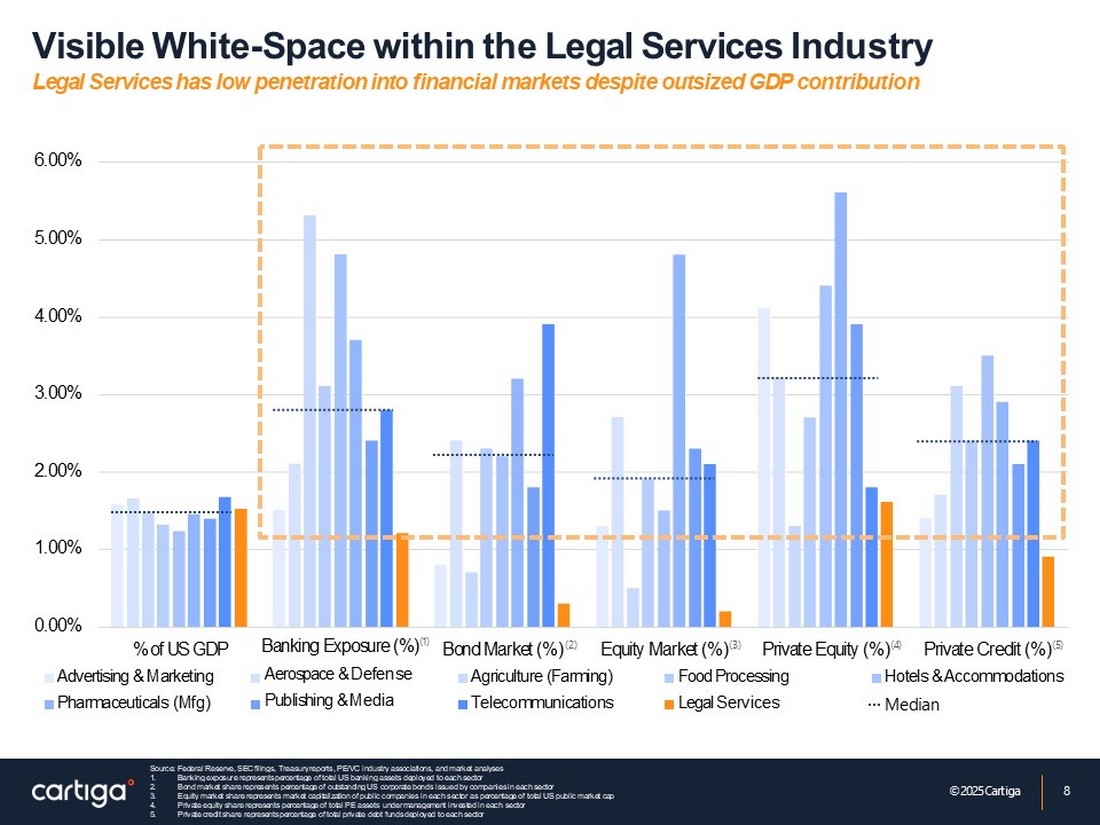

| · | Large Addressable Market: Large $300 billion+ addressable market representing approximately 1.4% of US GDP with a limited number of scaled competitors and meaningfully underpenetrated by traditional capital providers.ii | |

| · | Strategic Relationships: Longstanding partnerships with lawyers supported by 20-person in-house sales and business development team. | |

| · | Robust Data Moat: Proprietary claims and outcomes database provides durable competitive differentiator. | |

| · | Experienced Leadership: Led by seasoned, long-tenured professionals with domain expertise in the legal, finance and asset management industries. | |

| · | Financial Strength: Profitable, well-capitalized, scalable business with diversified portfolio of non-correlated assets generating predictable shorter duration cash flows. | |

| · | Institutional Backing: Supported by over $250 million in committed equity capital from blue chip investor base. |

Other Key Metrics

| · | Proprietary Database: Contains over 250,000 individual litigation-linked asset fundings diversified across 8,000+ unique lawyers and law firms | |

| · | Investment Track Record: 20+ year track-record originating assets exhibiting non-correlated riskiii and outsized risk-adjusted returns versus traditional private creditiv | |

| · | IT and Product Development Investment: Over $20 million invested since 2020 | |

| · | Team Size: Approximately 95 employees | |

| · | Structured Finance Expertise: Four rated securitization transactions completed – three have been fully realized. |

Leadership Commentary

“We view Cartiga’s platform as an attractive alternative investment, offering a return profile that is uncorrelated with other asset classes. This sector is massive and rapidly expanding,” said Mr. Vittorio Savoia, Co-CEO of Alchemy.

Mr. Mattia Tomba, Co-CEO of Alchemy, added, “We believe Cartiga and Alchemy make a compelling partnership. As funding, disclosure, and regulatory standards evolve, we expect the interest for publicly traded litigation finance asset management companies to grow. We believe a Nasdaq listing will put Cartiga in a leadership position in the industry by enhancing transparency, reducing the cost of capital, and expanding access to flexible funding. ”

Cartiga’s CEO, Mr. Sam Wathen, remarked, “Combining with Alchemy aligns perfectly with our goals. Leveraging a Nasdaq listing would enable Cartiga to establish new industry guidelines with full transparency and utilize its public currency to drive growth and acquire complementary businesses. Enhanced transparency would ultimately lower funding costs, benefiting companies like ours.”

About Cartiga, LLC

Cartiga is a specialized alternative investment firm that leverages advanced data analytics to drive decision-making in the litigation finance sector. Cartiga combines capital with proprietary technology to help law firms and their clients achieve better litigation outcomes. The company applies a data-driven approach to underwriting, risk assessment and portfolio management, utilizing proprietary data, structured and unstructured legal and financial information, and continuously updated datasets from ongoing capital deployment. This iterative process enhances Cartiga’s predictive capabilities and strengthens its competitive edge.

Advisor to Cartiga, LLC

B. Riley Securities is acting as exclusive financial advisor to Cartiga, LLC.

About Alchemy Investments Acquisition Corp 1

Alchemy is a “special purpose acquisition company” or “SPAC,” commonly known as a blank-check company, incorporated under the laws of the Cayman Islands as an exempted company for the purpose of completing a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses, with a focus on companies acquiring, processing, analyzing, and utilizing data acquired from a variety of systems and sources.

Advisor to Alchemy Investments Acquisition Corp 1

Keefe, Bruyette and Woods, A Stifel Company, is acting as exclusive financial advisor to Alchemy Investments Acquisition Corp 1.

Important Information and Where To Find It

This press release is provided for information purposes only and contains information with respect to a potential Business Combination described herein. If the Parties enter into definitive documentation regarding a Business Combination, a newly formed holding company intends to file relevant materials with the SEC, including a Registration Statement on Form S-4, that includes a preliminary proxy statement/prospectus, and when available, a definitive proxy statement and final prospectus. Promptly after filing any definitive proxy statement with the SEC, Alchemy will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the Extraordinary Meeting relating to the transaction. INVESTORS AND SHAREHOLDERS OF ALCHEMY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT ALCHEMY FILES WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ALCHEMY, CARTIGA AND THE BUSINESS COMBINATION. Any definitive proxy statement, preliminary proxy statement and other relevant materials in connection with the transaction (if and when they become available), and any other documents filed by Alchemy with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov).

Participants in the Solicitation

Alchemy and its directors and executive officers may be deemed participants in the solicitation of proxies from Alchemy’s shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in Alchemy will be included in any proxy statement for the Business Combination and be available at www.sec.gov. Information about Alchemy’s directors and executive officers and their ownership of ordinary shares is set forth in Alchemy’s final prospectus, dated as of May 4, 2023, and filed with the SEC (File No. 333-268659) on May 5, 2023, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing (the “Prospectus”). Additional information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed Business Combination when it becomes available. These documents can be obtained free of charge at the SEC’s website (www.sec.gov).

Cartiga and its managers and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Alchemy in connection with the proposed Business Combination. A list of the names of such managers and executive officers and information regarding their interests in the proposed Business Combination will be included in any proxy statement for the proposed Business Combination when it becomes available.

Forward-Looking Statements

This press release contains certain “forward-looking statements”. Forward-looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “shall,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” “forecast,” “intend,” “plan,” “project,” “outlook” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Examples of forward-looking statements include, among others, statements regarding the proposed transactions contemplated by the non-binding letter of intent, including the benefits of the Business Combination, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the Business Combination. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Parties’ managements’ current beliefs, expectations and assumptions. Because forward- looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward- looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, the non-binding nature of the letter of intent and the ability of the Parties’ to cease discussions regarding a Business Combination for any reason or no reason, as well as the following, even if the Parties do in their discretion enter into definitive documentation regarding a proposed Business Combination: (a) the occurrence of any event, change, or other circumstances that could give rise to the termination of the Business Combination Agreement; (b) the outcome of any legal proceedings that may be instituted against the Parties following the announcement of the Business Combination Agreement and the transactions contemplated therein; (c) the inability to complete the proposed Business Combination, including due to failure to obtain approval of the shareholders of Alchemy or members of Cartiga, certain regulatory approvals, or satisfy other conditions to closing in the Business Combination Agreement; (d) the occurrence of any event, change, or other circumstance that could give rise to the termination of the Business Combination Agreement or could otherwise cause the transaction to fail to close; (e) the inability to obtain or maintain the listing of securities on Nasdaq following the proposed Business Combination; (f) the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation of the proposed Business Combination; (g) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of Cartiga to grow and manage growth profitably, and retain its key employees; (h) costs related to the proposed Business Combination; (i) changes in applicable laws or regulations; (j) the possibility that Alchemy or Cartiga may be adversely affected by other economic, business, and/or competitive factors; (k) risks relating to the uncertainty of the projected financial information with respect to Cartiga; (l) risks related to the organic and inorganic growth of Cartiga’s business and the timing of expected business milestones; (m) the amount of redemption requests made by Alchemy’s shareholders; and (n) other risks and uncertainties indicated from time to time in any Prospectus that includes a preliminary proxy statement/prospectus, and if and when available, a definitive proxy statement and final prospectus relating to the proposed Business Combination, including those under “Risk Factors” therein, and in Alchemy’s other filings with the SEC. Alchemy cautions that the foregoing list of factors is not exclusive. The Parties caution readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Parties do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their expectations or any change in events, conditions, or circumstances on which any such statement is based, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Neither Alchemy nor Cartiga gives any assurance that either Cartiga or Alchemy, or the combined company, will achieve its expectations.

No Offer or Solicitation

This press release shall not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in respect of the proposed Business Combination, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This press release does not constitute either advice or a recommendation regarding any securities. No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Investor Relations Contacts: Steven Wasserman

Mattia Tomba

Vittorio Savoia

info@alchemyinvest.co

+1 516 428 2816

i Source: As measured vs. US GDP published by the US Bureau of Economic Analysis, S&P 500 and the Merrill Lynch High Yield Bond Index performance

ii Source: GDP Figure based on the legal services market size as per the Beaureau of Economic Analysis. Underprenetration as measured based on the ratio of GDP contribution to US banking sector assets; US banking sector data as per the US Federal Reserve.

iii Source: As measured vs. US GDP published by the US Bureau of Economic Analysis, S&P 500 and the Merrill Lynch High Yield Bond Index performance

iv Based on asset performance measured versus the Cliffwater Direct Lending Index (CDLI) for 12/31/2019 through 12/31/2024

Exhibit 99.2

Investor Presentation May 2025 Alchemy Investments Acquisition Corp 1

Important Information and Where To Find It • This presentation is provided for information purposes only and contains information with respect to a potential business combination (“Business Combination”) described herein. If Alchemy Investments Acquisition Corp 1 (“Alchemy”) and Cartiga, LLC (“Cartiga,” and together with Alchemy, the “Parties”) enter into definitive documentation regarding a Business Combination, a newly formed holding company intends to file relevant materials with the Securities and Exchange Commission (“SEC”), including a Registration Statement on Form S - 4, that includes a preliminary proxy statement/prospectus, and when available, a definitive proxy statement and final prospectus. Promptly after filing any definitive proxy statement with the SEC, Alchemy will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the Extraordinary Meeting relating to the transaction . INVESTORS AND SHAREHOLDERS OF ALCHEMY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT ALCHEMY FILES WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ALCHEMY, CARTIGA AND THE BUSINESS COMBINATION . Any definitive proxy statement, preliminary proxy statement and other relevant materials in connection with the transaction (if and when they become available), and any other documents filed by Alchemy with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov). Participants in the Solicitation • Alchemy and its directors and executive officers may be deemed participants in the solicitation of proxies from Alchemy’s shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in Alchemy will be included in any proxy statement for the Business Combination and be available at www.sec.gov. Information about Alchemy’s directors and executive officers and their ownership of ordinary shares is set forth in Alchemy’s final prospectus, dated as of May 4, 2023, and filed with the SEC (File No. 333 - 268659) on May 5, 2023, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing (the “Prospectus”). Additional information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed Business Combination when it becomes available. These documents can be obtained free of charge at the SEC’s website (www.sec.gov). • Cartiga and its managers and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Alchemy in connection with the proposed Business Combination. A list of the names of such managers and executive officers and information regarding their interests in the proposed Business Combination will be included in any proxy statement for the proposed Business Combination when it becomes available.

© 2025 Cartiga 2 Disclaimer Disclaimer © 2025 Cartiga 3 Forward - Looking Statements • This presentation contains certain “forward - looking statements.” Forward - looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “shall,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” “forecast,” “intend,” “plan,” “project,” “outlook” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Examples of forward - looking statements include, among others, statements regarding the proposed transactions contemplated by the non - binding letter of intent, including the benefits of the Business Combination, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the Business Combination. Forward - looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Parties’ managements’ current beliefs, expectations and assumptions. Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Actual results and outcomes may differ materially from those indicated in the forward - looking statements. Therefore, you should not rely on any of these forward - looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward - looking statements include, among others, the non - binding nature of the letter of intent and the ability of the Parties’ to cease discussions regarding a Business Combination for any reason or no reason, as well as the following, even if the Parties do in their discretion enter into definitive documentation regarding a proposed Business Combination: (a) the occurrence of any event, change, or other circumstances that could give rise to the termination of the Business Combination Agreement; (b) the outcome of any legal proceedings that may be instituted against the Parties following the announcement of the Business Combination Agreement and the transactions contemplated therein; (c) the inability to complete the proposed Business Combination, including due to failure to obtain approval of the shareholders of Alchemy or members of Cartiga, certain regulatory approvals, or satisfy other conditions to closing in the Business Combination Agreement; (d) the occurrence of any event, change, or other circumstance that could give rise to the termination of the Business Combination Agreement or could otherwise cause the transaction to fail to close; (e) the inability to obtain or maintain the listing of securities on Nasdaq following the proposed Business Combination; (f) the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation of the proposed Business Combination; (g) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of Cartiga to grow and manage growth profitably, and retain its key employees; (h) costs related to the proposed Business Combination; (i) changes in applicable laws or regulations; (j) the possibility that Alchemy or Cartiga may be adversely affected by other economic, business, and/or competitive factors; (k) risks relating to the uncertainty of the projected financial information with respect to Cartiga; (l) risks related to the organic and inorganic growth of Cartiga’s business and the timing of expected business milestones; (m) the amount of redemption requests made by Alchemy’s shareholders; and (n) other risks and uncertainties indicated from time to time in any Prospectus that includes a preliminary proxy statement/prospectus, and if and when available, a definitive proxy statement and final prospectus relating to the proposed Business Combination, including those under “Risk Factors” therein, and in Alchemy’s other filings with the SEC. Alchemy cautions that the foregoing list of factors is not exclusive. The Parties caution readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. The Parties do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in their expectations or any change in events, conditions, or circumstances on which any such statement is based, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Neither Alchemy nor Cartiga gives any assurance that either Cartiga or Alchemy, or the combined company, will achieve its expectations.

Disclaimer © 2025 Cartiga 4 No Offer or Solicitation • This presentation shall not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in respect of the proposed Business Combination, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This presentation does not constitute either advice or a recommendation regarding any securities. No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom. Financial Information; Non - GAAP Financial Measures • Any financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement/prospectus or registration statement to be filed by ALCY with the SEC, and such differences may be material. This presentation also contains non - GAAP financial measures. A reconciliation of these non - GAAP financial measures to the corresponding GAAP measures on a forward - looking basis is not available because the various reconciling items are difficult to predict and subject to constant change.

5 © 2025 Cartiga Our Mission Drives Our Business Our Business The Company benefits from a strong equity base, pioneering products, significant direct origination capabilities, and a proven track record with a long tenured management team x Large, proprietary claims database serves as competitive moat x Scaled, agile platform that drives intake, underwriting, tracking, management reporting, and ROI x Long track record of attractive EBITDA margins Law Firm Finance Backed by Claims & Other Legal Receivables Purchase of Consumer Claim Proceeds To power outstanding results for law firms and their clients Our Mission Cartiga is a leading data driven, tech forward asset management platform for investing in legal claims and law firms, a $300bn+ market representing ~1.4% GDP 1 • Underpenetrated by traditional sources of capital Cartiga leverages proprietary data and advanced analytics to achieve attractive risk adjusted returns by providing capital and other services to law firms and their clients Cartiga originates, manages, and monetizes assets in two primary business segments: 1. Source: Based on Legal Services Sector GDP concentration as per Bureau of Economic Analysis https:/ /www.bea.gov/data/gdp/gdp - industry 6 © 2025 Cartiga 1.

“IRR” represents the gross annual compounded pre tax internal rate of return on Invested Capital based on cash flows from date of investment on such Invested Capital. “Invested Capital” includes follow - on and other staged investments, if applicable, however excludes any impact from investments that have not been realized, are ongoing and are not subject to charge - off based on Cartiga’s policies and procedures. IRRs are net of realized losses. Cartiga At A Glance $250M+ Contributed equity capital from blue chip investor base $1.6B+ Lifetime originations 20+ Year track record 20%+ Blended asset - level IRR 1 on realized litigation investments $20B+ Estimated total lifetime settlement values ~95 / ~20 Total Employees / Origination Officers driving organic growth, de - emphasizing commoditized broker ecosystem $185M + FY 2024 Realizations from Litigation Investments 8,000+ Attorneys that the Company has invested with subject to proprietary scoring 250,000+ Fundings of individual litigation - linked assets in proprietary database Company Originations Key Metrics 7 © 2025 Cartiga The Solution Pervasive Industry Imbalance Creates Cartiga’s Opportunity Cartiga levels the playing field for law firms and plaintiffs seeking justice by alleviating long - standing systemic challenges ï Information asymmetry between insurers & clients ï Insurance company’s “Low - ball” 1 st offer puts it back on the customer to sue the well - capitalized insurer in order to receive a fair outcome ï Fo o P t l e a r intiffs with limited financial staying power The Problem ✓ Capital ✓ Technology ✓ Data - driven insights Big Insurance Big Insurance Funded Plaintiff & Attorney Unfunded Plaintiff & Attorney Data Advantage

8 © 2025 Cartiga 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% % of US GDP Advertising & Marketing Pharmaceuticals (Mfg) Agriculture (Farming) Telecommunications Food Processing Legal Services Hotels & Accommodations Median Bond Market (%) (2) Equity Market (%) (3) Private Equity (%) (4) Private Credit (%) (5) Banking Exposure (%) (1) Aerospace & Defense Publishing & Media Visible White - Space within the Legal Services Industry Legal Services has low penetration into financial markets despite outsized GDP contribution Source: Federal Reserve, SEC filings, Treasury reports, PE/VC industry associations, and market analyses 1. 2. 3. 4. 5. Banking exposure represents percentage of total US banking assets deployed to each sector Bond market share represents percentage of outstanding US corporate bonds issued by companies in each sector Equity market share represents market capitalization of public companies in each sector as percentage of total US public market cap Private equity share represents percentage of total PE assets under management invested in each sector Private credit share represents percentage of total private debt funds deployed to each sector Proven Technology Platform Delivers Successful Outcomes 20 years as an industry innovator, now with scaled database and tech platform driving business Attorney Jurisdiction Defense Lawyer Medical Injury Limits Accident Type Proprietary Claims and Outcomes Database Case Type Insurance Counterparty Data Science & Analytics 10M+ data points from 250,000+ outcomes x Better financial forecasting x More predictable cash flows x Attorney scoring to drive selection and pricing Law Firms Consumers Powerful Outcomes for All Stakeholders Decision support tools enable optimization © 2025 Cartiga 9

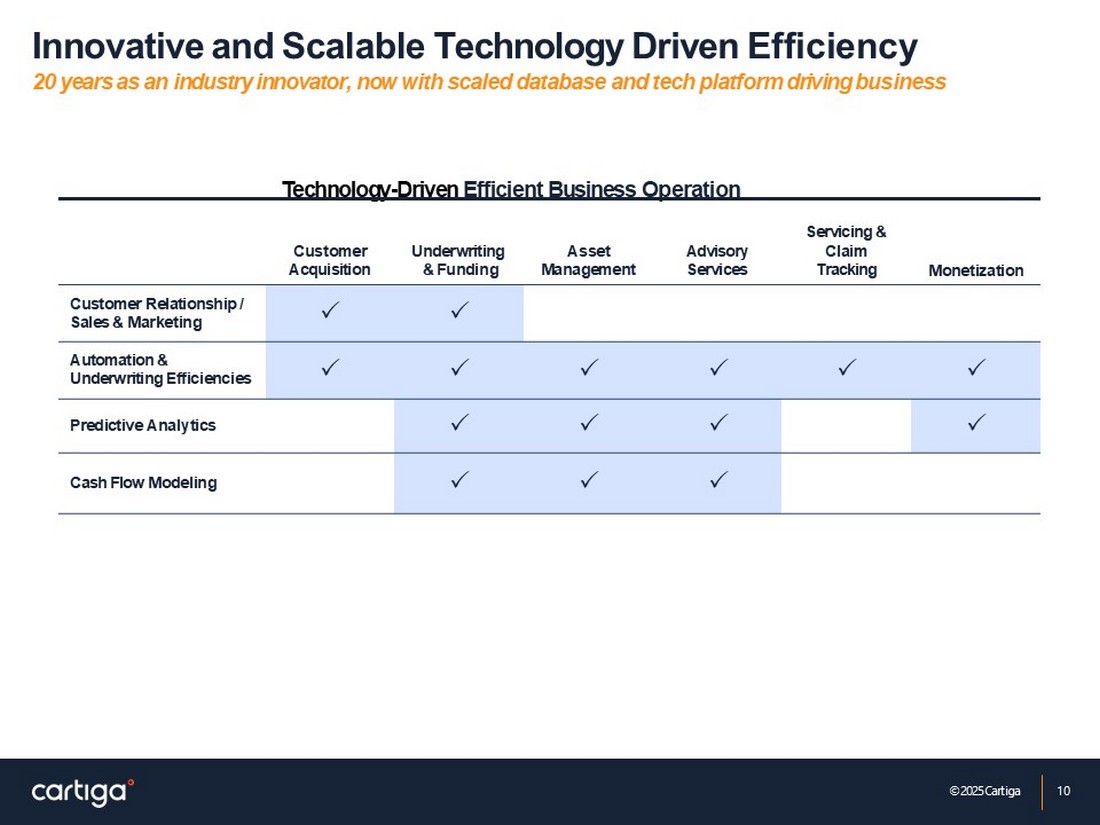

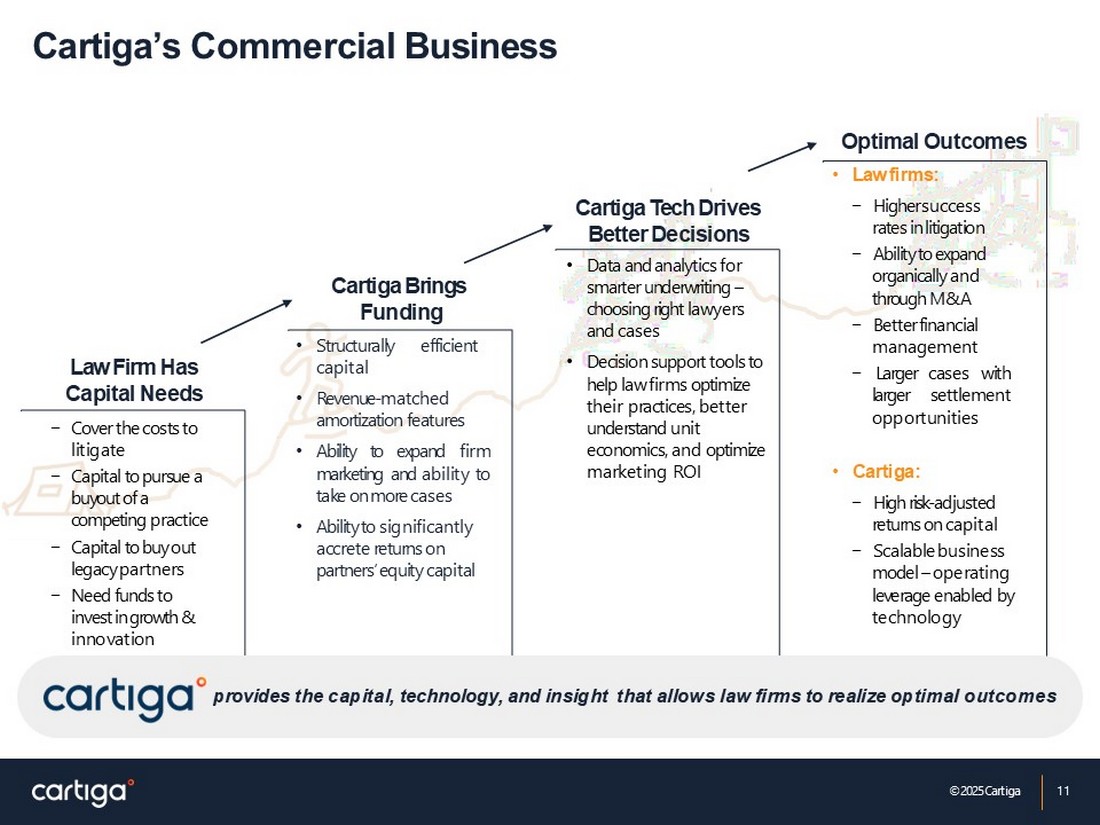

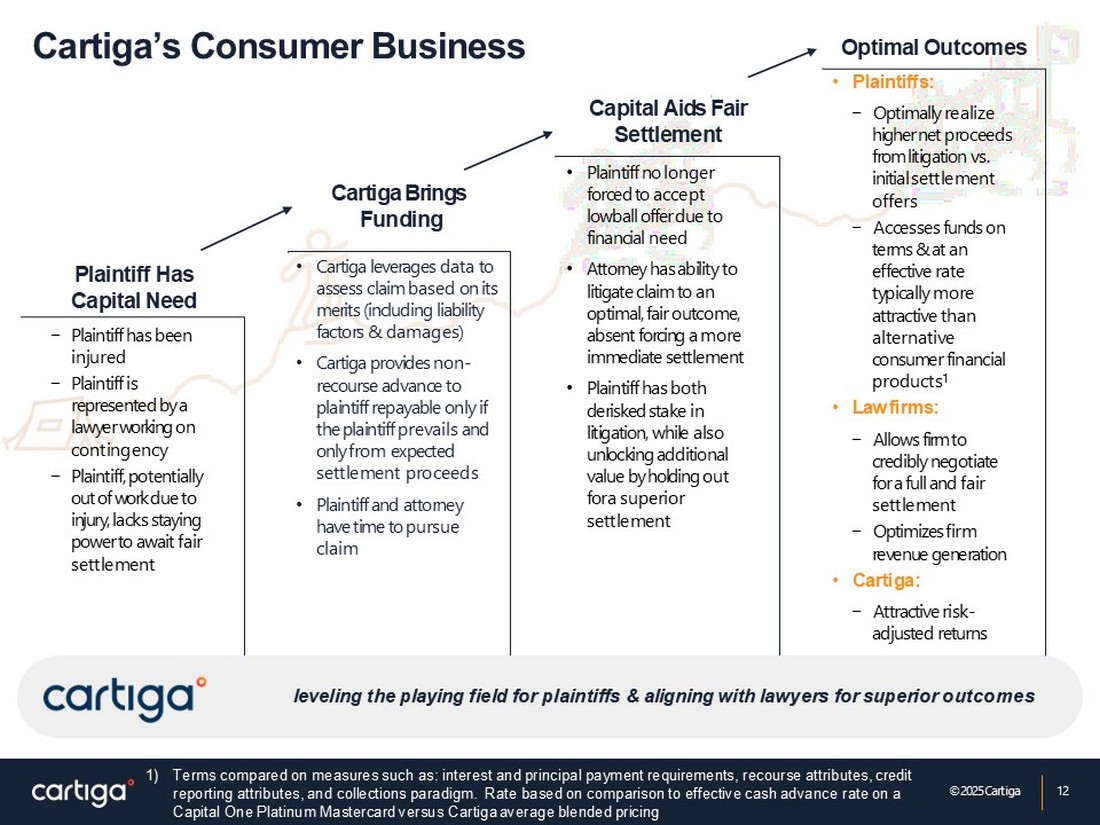

Innovative and Scalable Technology Driven Efficiency 20 years as an industry innovator, now with scaled database and tech platform driving business © 2025 Cartiga 10 Technology - Driven Efficient Business Operation Monetization Servicing & Claim Tracking Advisory Services Asset Management Underwriting & Funding Customer Acquisition Customer Relationship / Sales & Marketing Automation & Underwriting Efficiencies Predictive Analytics Cash Flow Modeling provides the capital, technology, and insight that allows law firms to realize optimal outcomes Cartiga’s Commercial Business Law Firm Has Capital Needs Cartiga Brings Funding Cartiga Tech Drives Better Decisions Optimal Outcomes − Cover the costs to litigate − Capital to pursue a buyout of a competing practice − Capital to buy out legacy partners − Need funds to invest in growth & innovation • Structurally efficient capital • Revenue - matched amortization features • Ability to expand firm marketing and ability to take on more cases • Ability to significantly accrete returns on partners’ equity capital • Data and analytics for smarter underwriting – choosing right lawyers and cases • Decision support tools to help law firms optimize their practices, better understand unit economics, and optimize marketing ROI • Law firms: − Higher success rates in litigation − Ability to expand organically and through M&A − Better financial management − Larger cases with larger settlement opportunities • Cartiga: − High risk - adjusted returns on capital − Scalable business model – operating leverage enabled by technology © 2025 Cartiga 11 12 © 2025 Cartiga leveling the playing field for plaintiffs & aligning with lawyers for superior outcomes Cartiga’s Consumer Business Plaintiff Has Capital Need Cartiga Brings Funding Optimal Outcomes − Plaintiff has been injured − Plaintiff is represented by a lawyer working on contingency − Plaintiff, potentially out of work due to injury, lacks staying power to await fair settlement • Cartiga leverages data to assess claim based on its merits (including liability factors & damages) • Cartiga provides non - recourse advance to plaintiff repayable only if the plaintiff prevails and only from expected settlement proceeds • Plaintiff and attorney have time to pursue claim • Plaintiff no longer forced to accept lowball offer due to financial need • Attorney has ability to litigate claim to an optimal, fair outcome, absent forcing a more immediate settlement • Plaintiff has both derisked stake in litigation, while also unlocking additional value by holding out for a superior settlement • Plaintiffs: − Optimally realize higher net proceeds from litigation vs. initial settlement offers − Accesses funds on terms & at an effective rate typically more attractive than alternative consumer financial products 1 • Law firms: − Allows firm to credibly negotiate for a full and fair settlement − Optimizes firm revenue generation • Cartiga: − Attractive risk - adjusted returns Capital Aids Fair Settlement 1) Terms compared on measures such as: interest and principal payment requirements, recourse attributes, credit reporting attributes, and collections paradigm. Rate based on comparison to effective cash advance rate on a Capital One Platinum Mastercard versus Cartiga average blended pricing

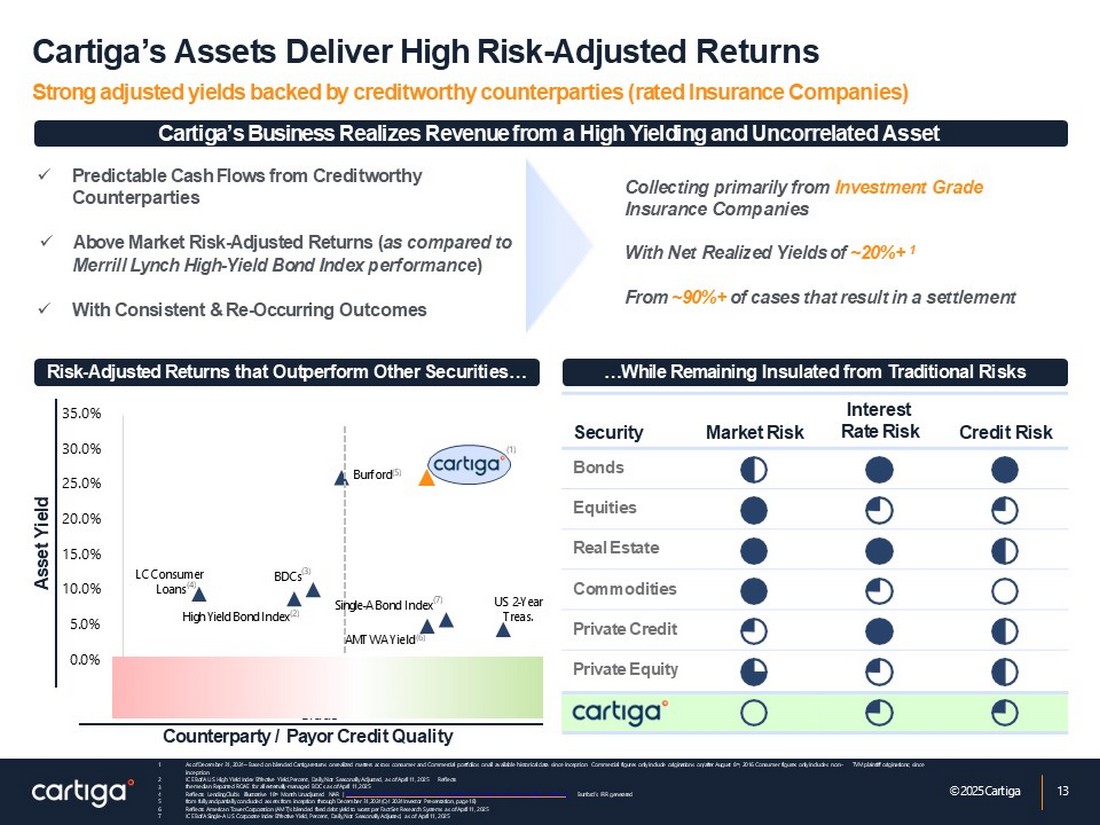

13 © 2025 Cartiga US 2 - Year Treas. 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Cartiga’s Assets Deliver High Risk - Adjusted Returns Strong adjusted yields backed by creditworthy counterparties (rated Insurance Companies) Cartiga’s Business Realizes Revenue from a High Yielding and Uncorrelated Asset Risk - Adjusted Returns that Outperform Other Securities… …While Remaining Insulated from Traditional Risks AA AAA Speculative Consumer Non - Investment Subprime Investment Grade Grade Counterparty / Payor Credit Quality Credit Risk Interest Rate Risk Market Risk Security Bonds Equities Real Estate Commodities Private Credit Private Equity x Predictable Cash Flows from Creditworthy Counterparties x Above Market Risk - Adjusted Returns ( as compared to Merrill Lynch High - Yield Bond Index performance ) x With Consistent & Re - Occurring Outcomes Asset Yield Collecting primarily from Investment Grade Insurance Companies With Net Realized Yields of ~20%+ 1 From ~90%+ of cases that result in a settlement 1. 2. 3. 4. 5. 6. 7. As of December 31, 2024 – Based on blended Cartiga returns on realized matters across consumer and Commercial portfolios on all available historical data since inception. Commercial figures only include originations on/after August 8 th , 2016. Consumer figures only includes non - TVM plaintiff originations; since inception ICE BofA US High Yield Index Effective Yield, Percent, Daily, Not Seasonally Adjusted, as of April 11, 2025 Reflects the median Reported ROAE for all externally - managed BDCs as of April 11, 2025 Reflects LendingClub’s illustrative 18 th Month Unadjusted NAR | https://www.lendingclub.com/resource - center/institutional - investing/what - is - net - annualized - return - na r Burford’s IRR generated from fully and partially concluded assets from inception through December 31, 2024 (Q4 2024 Investor Presentation, page 18) Reflects American Tower Corporation (AMT)’s blended fixed debt yield to worst per FactSet Research Systems as of April 11, 2025 ICE BofA Single - A US Corporate Index Effective Yield, Percent, Daily, Not Seasonally Adjusted, as of April 11, 2025 (1) LC Consumer Loans (4) High Yield Bond Index (2) BDCs (3) Burford (5) Single - A Bond Index (7) AMT WA Yield (6)

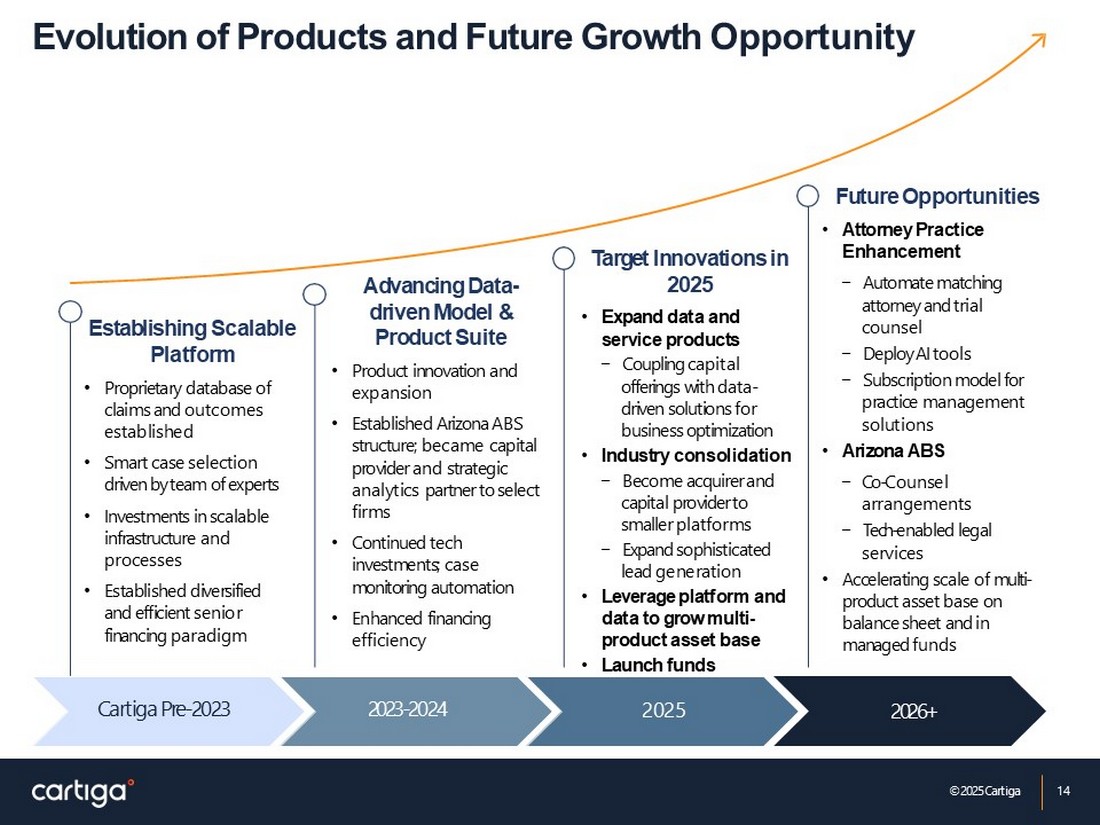

Evolution of Products and Future Growth Opportunity Cartiga Pre - 2023 2023 - 2024 2026+ Target Innovations in 2025 • Expand data and service products − Coupling capital offerings with data - driven solutions for business optimization • Industry consolidation − Become acquirer and capital provider to smaller platforms − Expand sophisticated lead generation • Leverage platform and data to grow multi - product asset base • Launch funds 2025 Advancing Data - driven Model & Product Suite • Product innovation and expansion • Established Arizona ABS structure; became capital provider and strategic analytics partner to select firms • Continued tech investments; case monitoring automation • Enhanced financing efficiency Establishing Scalable Platform • Proprietary database of claims and outcomes established • Smart case selection driven by team of experts • Investments in scalable infrastructure and processes • Established diversified and efficient senior financing paradigm Future Opportunities • Attorney Practice Enhancement − Automate matching attorney and trial counsel − Deploy AI tools − Subscription model for practice management solutions • Arizona ABS − Co - Counsel arrangements − Tech - enabled legal services • Accelerating scale of multi - product asset base on balance sheet and in managed funds © 2025 Cartiga 14 Attractive asset class with compelling risk - adjusted returns – Typically 20 - 25%+ Established, best practice, multi - product offering driven by organic originations – Organic origination flow driven by scaled national sales force Data moat and technology leadership – Scaled platform underpinned by historical outcomes data plus significant investment in data science World class management team with a proven 20+ year track record – Management and technical team with significant domain expertise and record of innovation Key Investment Highlights Diversified portfolio with predictable cash flows – Diversified by industry, claim type, counterparty, duration, and investment structure © 2025 Cartiga 15

Thank You