UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to

Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of May 2025

Commission File Number 001-11444

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter)

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F o Form 40-F x Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

| MAGNA INTERNATIONAL INC. | ||||

| (Registrant) | ||||

| Date: | May 2, 2025 | |||

| By: | /s/ “Bassem Shakeel” | |||

| Bassem A. Shakeel, | ||||

|

|

Vice-President, Associate General Counsel and Corporate Secretary |

|||

EXHIBITS

Exhibit 99.1

|

PRESS RELEASE |

MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS

| · | Comparing the first quarter of 2025 to the first quarter of 2024: |

| ̵ | Sales decreased 8% to $10.1 billion, as global light vehicle production decreased 3%, which included 8% and 5% declines in Europe and North America, respectively |

| ̵ | Diluted earnings per share of $0.52 and Adjusted diluted earnings per share of $0.78, compared to $0.03 and $1.08, respectively |

| · | First quarter performance was broadly ahead of our expectations driven by strong incremental margins on better than anticipated vehicle production |

| · | Returned $187 million to shareholders through dividends and share repurchases |

| · | Updated 2025 Outlook excludes potential impacts of tariffs including on light vehicle production, full year 2025 range of adjusted net income attributable to shareholders unchanged |

AURORA, Ontario, May 2, 2025 — Magna International Inc. (TSX: MG; NYSE: MGA) today reported financial results for the first quarter ended March 31, 2025.

|

"Our operating results for the first quarter of 2025 exceeded our expectations, with strong incremental margins on better than anticipated vehicle production and, for the balance of the year, we remain confident in our ability to execute on variables within our control in a complex and uncertain industry environment. We are actively advancing several initiatives including operational excellence, restructuring, commercial recoveries, and reduced capital and engineering spending to mitigate the impact of tariffs.

We remain focused on generating long-term free cash flow to invest for profitable growth and drive compelling capital return to shareholders."

- Swamy Kotagiri, Magna’s Chief Executive Officer |

| THREE MONTHS ENDED | ||||||||

| March 31, 2025 | March 31, 2024 | |||||||

| Reported | ||||||||

| Sales | $ | 10,069 | $ | 10,970 | ||||

| Income from operations before income taxes | $ | 225 | $ | 34 | ||||

| Net income attributable to Magna International Inc. | $ | 146 | $ | 9 | ||||

| Diluted earnings per share | $ | 0.52 | $ | 0.03 | ||||

| Non-GAAP Financial Measures(1) | ||||||||

| Adjusted EBIT | $ | 354 | $ | 469 | ||||

| Adjusted diluted earnings per share | $ | 0.78 | $ | 1.08 | ||||

All results are reported in millions of U.S. dollars, except per share figures, which are in U.S. dollars

| (1) | Adjusted EBIT and Adjusted diluted earnings per share are Non-GAAP financial measures that have no standardized meaning under U.S. GAAP, and as a result may not be comparable to the calculation of similar measures by other companies. Further information and a reconciliation of these Non-GAAP financial measures is included in the back of this press release. |

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

THREE MONTHS ENDED MARCH 31, 2025

We posted sales of $10.1 billion for the first quarter of 2025, a decrease of 8% from the first quarter of 2024. The lower sales largely reflects a 3% decrease in global light vehicle production, including 8% and 5% lower production in Europe and North America, respectively, partially offset by 2% higher production in China. In addition, sales were negatively impacted by lower complete vehicle assembly volumes, including as a result of the end of production of the Jaguar I-Pace and E-Pace, the end of production of certain programs and the net weakening of foreign currencies against the U.S. dollar. These were partially offset by the launch of new programs.

Adjusted EBIT decreased to $354 million in the first quarter of 2025 compared to $469 million in the first quarter of 2024. This mainly reflects:

| · | reduced earnings on lower sales; and |

| · | higher net warranty costs associated with our seating business. |

These were partially offset by:

| · | higher net favourable commercial items; |

| · | continued productivity and efficiency improvements; and |

| · | lower net engineering costs, including spending related to our electrification and active safety businesses. |

During the first quarter of 2025, Other expense, net(2) and Amortization of acquired intangibles totaled $79 million (2023 - $384 million) and on an after-tax basis $73 million (2023 - $302 million).

Income from operations before income taxes increased to $225 million for the first quarter of 2025 compared to $34 million in the first quarter of 2024. Excluding Other expense, net and Amortization of acquired intangibles from both periods, income from operations before income taxes decreased $114 million in the first quarter of 2025 compared to the first quarter of 2024, largely reflecting the decrease in Adjusted EBIT.

Net income attributable to Magna International Inc. was $146 million for the first quarter of 2025 compared to $9 million in the first quarter of 2024. Excluding Other expense, net, after tax and Amortization of acquired intangibles from both periods, net income attributable to Magna International Inc. decreased $92 million in the first quarter of 2025 compared to the first quarter of 2024.

Diluted earnings per share were $0.52 in the first quarter of 2025, compared to $0.03 in the comparable period. Adjusted diluted earnings per share were $0.78, compared to $1.08 for the first quarter of 2024.

In the first quarter of 2025, we generated cash from operations before changes in operating assets and liabilities of $547 million and used $470 million in operating assets and liabilities. Investment activities for the first quarter of 2025 included $268 million in fixed asset additions, $148 million in investments, other assets and intangible assets, $4 million for business combinations and $1 million in private equity investments.

RETURN OF CAPITAL TO SHAREHOLDERS

During the three months ended March 31, 2025, we returned $187 million to shareholders, including $136 million in dividends and $51 million in share repurchases.

Our Board of Directors declared a first quarter dividend of $0.485 per Common Share, payable on May 30, 2025 to shareholders of record as of the close of business on May 16, 2025.

| (2) | Other expense, net is comprised of Fisker Inc. [“Fisker”] related impacts (restructuring and impairment of assembly and production assets, the impairment of Fisker warrants), revaluations of certain public company warrants and equity investments, and restructuring activities, during the three months ended March 31, 2024 & 2025. A reconciliation of these Non-GAAP financial measures is included in the back of this press release. |

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

SEGMENT SUMMARY

| For the three months ended March 31, | ||||||||||||||||||||||||

| Sales | Adjusted EBIT | |||||||||||||||||||||||

| ($Millions) | 2025 | 2024 | Change | 2025 | 2024 | Change | ||||||||||||||||||

| Body Exteriors & Structures | $ | 3,966 | $ | 4,429 | $ | (463 | ) | $ | 230 | $ | 298 | $ | (68 | ) | ||||||||||

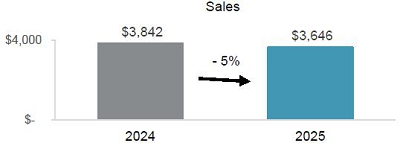

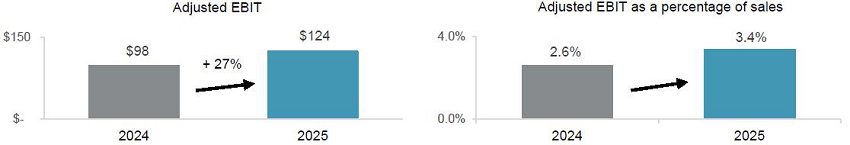

| Power & Vision | 3,646 | 3,842 | (196 | ) | 124 | 98 | 26 | |||||||||||||||||

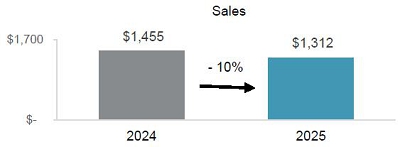

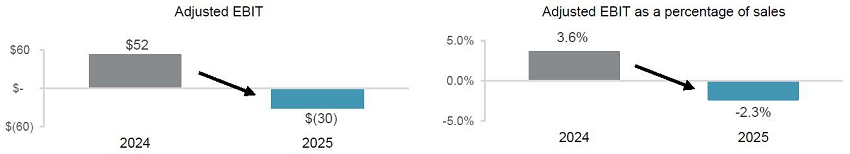

| Seating Systems | 1,312 | 1,455 | (143 | ) | (30 | ) | 52 | (82 | ) | |||||||||||||||

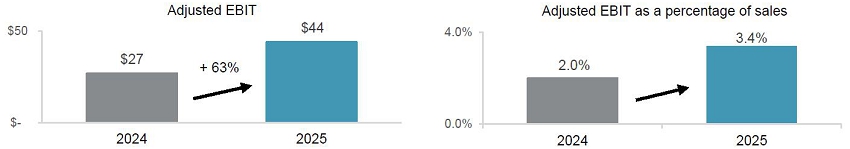

| Complete Vehicles | 1,276 | 1,383 | (107 | ) | 44 | 27 | 17 | |||||||||||||||||

| Corporate and Other | (131 | ) | (139 | ) | 8 | (14 | ) | (6 | ) | (8 | ) | |||||||||||||

| Total Reportable Segments | $ | 10,069 | $ | 10,970 | $ | (901 | ) | $ | 354 | $ | 469 | $ | (115 | ) | ||||||||||

| For the three months ended March 31, | ||||||||||||

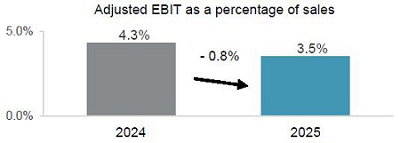

| Adjusted EBIT as a percentage of sales |

||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Body Exteriors & Structures | 5.8 | % | 6.7 | % | (0.9 | )% | ||||||

| Power & Vision | 3.4 | % | 2.6 | % | 0.8 | % | ||||||

| Seating Systems | (2.3 | )% | 3.6 | % | (5.9 | )% | ||||||

| Complete Vehicles | 3.4 | % | 2.0 | % | 1.4 | % | ||||||

| Consolidated Average | 3.5 | % | 4.3 | % | (0.8 | )% | ||||||

For further details on our segment results, please see our Management's Discussion and Analysis of Results of Operations and Financial Position and our Interim Financial Statements.

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

2025 OUTLOOK

We disclose a full-year Outlook annually in February with quarterly updates. The following Outlook is an update to our previous Outlook in February 2025.

Updated 2025 Outlook Assumptions

| Current | Previous | |||

| Light Vehicle Production (millions of units) | ||||

| North America | 15.0 | 15.1 | ||

| Europe | 16.6 | 16.6 | ||

| China | 30.2 | 29.7 | ||

| Average Foreign exchange rates: | ||||

| 1 Canadian dollar equals | U.S. $0.714 | U.S. $0.690 | ||

| 1 euro equals | U.S. $1.111 | U.S. $1.030 |

Light vehicle production assumptions reflect near-term original equipment manufacturer ["OEM"] production release information, including announced production downtime at certain OEM assembly facilities, but do not include the potential impact of tariffs and other trade measures on vehicle costs, vehicle affordability or consumer demand, nor the impact of these on vehicle production.

Updated 2025 Outlook

| Current | Previous | |||

| Segment Sales | ||||

| Body Exteriors & Structures | $15.9 - $16.5 billion | $15.7 - $16.3 billion | ||

| Power & Vision | $14.8 - $15.2 billion | $14.1 - $14.5 billion | ||

| Seating Systems | $5.3 - $5.6 billion | $5.3 - $5.6 billion | ||

| Complete Vehicles | $4.5 - $4.8 billion | $4.0 - $4.3 billion | ||

| Total Sales | $40.0 - $41.6 billion | $38.6 - $40.2 billion | ||

| Adjusted EBIT Margin(3)(4) | 5.1% - 5.6% | 5.3% - 5.8% | ||

| Equity Income (included in EBIT)(4) | $65 - $95 million | $60 - $90 million | ||

| Interest Expense, net | Approximately $210 million | Approximately $210 million | ||

| Income Tax Rate(4)(5) | Approximately 26% | Approximately 25% | ||

| Adjusted Net Income attributable to Magna(4)(6) | $1.3 - $1.5 billion | $1.3 - $1.5 billion | ||

| Capital Spending | $1.7 - $1.8 billion | Approximately $1.8 billion |

Notes:

| (3) | Adjusted EBIT Margin is the ratio of Adjusted EBIT to Total Sales. Refer to the reconciliation of Non-GAAP financial measures in the back of this press release for further information |

| (4) | Excludes unmitigated incremental tariff costs |

| (5) | The Income Tax Rate has been calculated using Adjusted EBIT and is based on current tax legislation |

| (6) | Adjusted Net Income attributable to Magna represents Net Income excluding Other expense, net and Amortization of acquired intangible assets, net of tax |

Our Outlook is intended to provide information about management's current expectations and plans and may not be appropriate for other purposes. Although considered reasonable by Magna as of the date of this document, the 2025 Outlook above and the underlying assumptions may prove to be inaccurate. Accordingly, our actual results could differ materially from our expectations as set forth herein. The risks identified in the “Forward-Looking Statements” section below represent the primary factors which we believe could cause actual results to differ materially from our expectations.

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

KEY DRIVERS OF OUR BUSINESS

Our business and operating results are dependent on light vehicle production by our customers in three key regions – North America, Europe, and China. While we supply systems and components to many OEMs globally, we do not supply systems and components for every vehicle, nor is the value of our content consistent from one vehicle to the next. As a result, customer and program mix relative to market trends, as well as the value of our content on specific vehicle production programs, are also important drivers of our results.

Ordinarily, OEM production volumes are aligned with vehicle sales levels and thus affected by changes in such levels. Aside from vehicle sales levels, production volumes are typically impacted by a range of factors, including: OEM, supplier or sub-supplier disruptions; free trade arrangements and tariffs; relative currency values; commodities prices; supply chains and infrastructure; labour disruptions and the availability and relative cost of skilled labour; regulatory frameworks; and other factors.

Overall vehicle sales levels are significantly affected by changes in consumer confidence levels, which may in turn be impacted by consumer perceptions and general trends related to the job, housing, and stock markets, as well as other macroeconomic and political factors. Other factors which typically impact vehicle sales levels and thus production volumes include: vehicle affordability; interest rates and/or availability of credit; fuel and energy prices; relative currency values; uncertainty as to the pace of EV adoption; and other factors.

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

NON-GAAP FINANCIAL MEASURES RECONCILIATION

In addition to the financial results reported in accordance with U.S. GAAP, this press release contains references to the Non-GAAP financial measures reconciled below. We believe the Non-GAAP financial measures used in this press release are useful to both management and investors in their analysis of the Company’s financial position and results of operations, and to improve comparability between fiscal periods. In particular, management believes that Adjusted EBIT and Adjusted diluted earnings per share are useful measures in assessing the Company’s financial performance by excluding certain items that are not indicative of the Company's core operating performance. The presentation of Non-GAAP financial measures should not be considered in isolation, or as a substitute for the Company’s related financial results prepared in accordance with U.S. GAAP.

Adjusted EBIT

| For the three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Net Income | $ | 153 | $ | 26 | ||||

| Add: | ||||||||

| Amortization of acquired intangible assets | 26 | 28 | ||||||

| Interest expense, net | 50 | 51 | ||||||

| Other expense, net | 53 | 356 | ||||||

| Income taxes | 72 | 8 | ||||||

| Adjusted EBIT | $ | 354 | $ | 469 | ||||

Adjusted EBIT as a percentage of sales ("Adjusted EBIT Margin")

| For the three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Sales | $ | 10,069 | $ | 10,970 | ||||

| Adjusted EBIT | $ | 354 | $ | 469 | ||||

| Adjusted EBIT as a percentage of sales | 3.5 | % | 4.3 | % | ||||

Adjusted diluted earnings per share

| For the three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Net income attributable to Magna International Inc. | $ | 146 | $ | 9 | ||||

| Add (deduct): | ||||||||

| Amortization of acquired intangible assets | 26 | 28 | ||||||

| Other expense, net | 53 | 356 | ||||||

| Tax effect on Amortization of acquired intangible assets and Other expense, net | (6 | ) | (82 | ) | ||||

| Adjusted net income attributable to Magna International Inc. | $ | 219 | $ | 311 | ||||

| Diluted weighted average number of Common Shares outstanding during the period (millions): | 282.0 | 287.1 | ||||||

| Adjusted diluted earnings per share | $ | 0.78 | $ | 1.08 | ||||

Certain of the forward-looking financial measures above are provided on a Non-GAAP basis. We do not provide a reconciliation of such forward-looking measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. To do so would be potentially misleading and not practical given the difficulty of projecting items that are not reflective of on-going operations in any future period. The magnitude of these items, however, may be significant.

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

This press release together with our Management’s Discussion and Analysis of Results of Operations and Financial Position and our Interim Financial Statements are available in the Investor Relations section of our website at www.magna.com/company/investors and filed electronically through the System for Electronic Document Analysis and Retrieval + (SEDAR+) which can be accessed at http://www.sedarplus.ca as well as on the United States Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval System (EDGAR), which can be accessed at www.sec.gov.

We will hold a conference call for interested analysts and shareholders to discuss our first quarter ended March 31, 2025 results on Friday, May 2, 2025 at 8:00 a.m. ET. The conference call will be chaired by Swamy Kotagiri, Chief Executive Officer. The number to use for this call from North America is 1-800-715-9871. International callers should use 1-646-307-1963. Please call in at least 10 minutes prior to the call start time. We will also webcast the conference call at www.magna.com. The slide presentation accompanying the conference call as well as our financial review summary will be available on our website Friday prior to the call.

TAGS

Quarterly earnings, financial results, vehicle production

INVESTOR CONTACT

Louis Tonelli, Vice-President, Investor Relations

louis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT

Tracy Fuerst, Vice-President, Corporate Communications & PR

tracy.fuerst@magna.com │ 248.761.7004

TELECONFERENCE CONTACT

Nancy Hansford, Executive Assistant, Investor Relations

nancy.hansford@magna.com │ 905.726.7108

OUR BUSINESS(7)

Magna is more than one of the world’s largest suppliers in the automotive space. We are a mobility technology company built to innovate, with a global, entrepreneurial-minded team of approximately 167,000(8) employees across 342 manufacturing operations and 103 product development, engineering and sales centres spanning 28 countries. With 65+ years of expertise, our ecosystem of interconnected products combined with our complete vehicle expertise uniquely positions us to advance mobility in an expanded transportation landscape.

For further information about Magna (NYSE:MGA; TSX:MG), please visit www.magna.com or follow us on social.

| (7) | Manufacturing operations, product development, engineering and sales centres include certain operations accounted for under the equity method. |

| (8) | Number of employees includes approximately 155,000 employees at our wholly owned or controlled entities and over 12,000 employees at certain operations accounted for under the equity method. |

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute "forward-looking information" or "forward-looking statements" (collectively, "forward-looking statements"). Any such forward-looking statements are intended to provide information about management's current expectations and plans and may not be appropriate for other purposes. Forward-looking statements may include financial and other projections, as well as statements regarding our future plans, strategic objectives or economic performance, or the assumptions underlying any of the foregoing, and other statements that are not recitations of historical fact. We use words such as "may", "would", "could", "should", "will", "likely", "expect", "anticipate", "assume", "believe", "intend", "plan", "aim", "forecast", "outlook", "project", "potential", "estimate", "target" and similar expressions suggesting future outcomes or events to identify forward-looking statements. The following table identifies the material forward-looking statements contained in this document, together with the material potential risks that we currently believe could cause actual results to differ materially from such forward-looking statements. Readers should also consider all of the risk factors which follow below the table:

| Material Forward-Looking Statement | Material Potential Risks Related to Applicable Forward-Looking Statement |

|

Light Vehicle Production

|

· Light vehicle sales levels, including due to: - A decline in consumer confidence - Economic uncertainty - Elevated interest rates and availability of consumer credit - Deteriorating vehicle affordability · Tariffs and/or other actions that erode free trade agreements · Production deferrals, cancellations and volume reductions · Production and supply disruptions · Commodities prices · Availability and relative cost of skilled labour |

|

Total Sales Segment Sales |

· Same risks as for Light Vehicle Production above · Alignment of our product mix with production demand · Customer concentration · Uncertain pace of EV adoption. Including North American electric vehicle program deferrals, cancellations and volume reductions · Shifts in market shares among vehicles or vehicle segments · Shifts in consumer "take rates" for products we sell · Relative currency values |

|

Adjusted EBIT Margin Net Income Attributable to Magna |

· Same risks as for Total Sales and Segment Sales above · Execution of critical program launches · Operational underperformance · Product warranty/recall risks · Production inefficiencies · Unmitigated incremental tariff costs · Restructuring costs and/or impairment charges · Inflation · Ability to secure planned cost recoveries from our customers and/or otherwise offset higher input costs · Price concessions · Risks of conducting business with newer EV-focused OEMs · Commodity cost volatility · Scrap steel price volatility · Tax risks |

| Equity Income |

· Same risks as Adjusted EBIT Margin and Net Income Attributable to Magna · Risks related to conducting business through joint ventures · Risks of doing business in foreign markets · Legal and regulatory proceedings · Changes in law |

Forward-looking statements are based on information currently available to us and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. While we believe we have a reasonable basis for making any such forward-looking statements, they are not a guarantee of future performance or outcomes. In addition to the factors in the table above, whether actual results and developments conform to our expectations and predictions is subject to a number of risks, assumptions, and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict, including, without limitation:

|

Macroeconomic, Geopolitical and Other Risks · unpredictable tariff and trade environment; · trade disputes and threats to free trade agreements; · consumer confidence levels; · increasing economic uncertainty; · interest rates and availability of consumer credit; · geopolitical risks;

Risks Related to the Automotive Industry · program deferrals, cancellations and volume reductions; · economic cyclicality; · regional production volume declines; · deteriorating vehicle affordability; · uncertain pace of EV adoption, including North American electric vehicle program deferrals, cancellations and volume reductions; · intense competition;

Strategic Risks · planning and forecasting challenges · evolution of the vehicle; · evolving business risk profile; · technology and innovation; · investments in mobility and technology companies;

Customer-Related Risks · customer concentration; · market shifts; · growth of EV-focused OEMs; · risks of conducting business with newer EV-focused OEMs; · dependence on outsourcing; · customer cooperation and consolidation; · consumer take rate shifts; · customer purchase orders; · potential OEM production-related disruptions;

Supply Chain Risks · supply base; · supply claims; |

Pricing Risks · quote/pricing assumptions; · customer pricing pressure/contractual arrangements; · commodity cost volatility; · scrap steel/aluminum price volatility;

Warranty/Recall Risks · repair/replace costs; · warranty provisions; · product liability;

Climate Change Risks · transition risks and physical risks; · strategic and other risks;

IT Security/Cybersecurity Risks · IT/cybersecurity breach; · product cybersecurity;

Acquisition Risks · inherent merger and acquisition risks; · acquisition integration and synergies;

Other Business Risks · joint ventures; · intellectual property; · risks of doing business in foreign markets; · relative foreign exchange rates; · pension risks; · tax risks; · returns on capital investments; · financial flexibility; · credit ratings changes; |

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

|

· supply chain disruptions; · regional energy supply and pricing;

Manufacturing/Operational Risks · product launch; · operational underperformance; · restructuring costs; · impairments; · skilled labour attraction/retention; · leadership expertise and succession; |

· stock price fluctuation;

Legal, Regulatory and Other Risks · legal and regulatory proceedings; · changes in laws; and · environmental compliance. |

In evaluating forward-looking statements or forward-looking information, we caution readers not to place undue reliance on any forward-looking statement. Additionally, readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward-looking statements, including the risks, assumptions and uncertainties above which are:

| · | discussed under the "Industry Trends and Risks" heading of our Management’s Discussion and Analysis; and |

| · | set out in our Annual Information Form filed with securities commissions in Canada, our annual report on Form 40-F with the United States Securities and Exchange commission, and subsequent filings. |

Readers should also consider discussion of our risk mitigation activities with respect to certain risk factors, which can be also found in our Annual Information Form. Additional information about Magna, including our Annual Information Form, is available through the System for Electronic Data Analysis and Retrieval + (SEDAR+) at www.sedarplus.ca, as well as on the United States Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval System (EDGAR), which can be accessed at www.sec.gov.

| MAGNA ANNOUNCES FIRST QUARTER 2025 RESULTS | CONNECT WITH MAGNA |

|

Exhibit 99.2

Magna International Inc.

First Quarter Report

2025

MAGNA INTERNATIONAL INC.

Management's Discussion and Analysis of Results of Operations and Financial Position

Unless otherwise noted, all amounts in this Management's Discussion and Analysis of Results of Operations and Financial Position ["MD&A"] are in U.S. dollars and all tabular amounts are in millions of U.S. dollars, except per share figures, which are in U.S. dollars. When we use the terms "we", "us", "our" or "Magna", we are referring to Magna International Inc. and its subsidiaries and jointly controlled entities, unless the context otherwise requires.

This MD&A should be read in conjunction with the unaudited interim consolidated financial statements for the three months ended March 31, 2025 included in this Quarterly Report, and the audited consolidated financial statements and MD&A for the year ended December 31, 2024 included in our 2024 Annual Report to Shareholders.

This MD&A may contain statements that are forward looking. Refer to the "Forward-Looking Statements" section in this MD&A for a more detailed discussion of our use of forward-looking statements.

This MD&A has been prepared as at May 1, 2025.

HIGHLIGHTS

Comparing the first quarter of 2025 to the first quarter of 2024:

| · | Global light vehicle production decreased 3%, including 5% and 8% declines in North America and Europe, respectively, and a 2% increase in China. |

| · | Total sales decreased 8% to $10.1 billion, largely reflecting lower global light vehicle production, the weakening of currencies against the U.S. dollar, and lower complete vehicle assembly sales as a result of the end of production of the Jaguar I-Pace and Jaguar E-Pace programs. These declines were partially offset by the launch of new programs. |

| · | Diluted earnings per share were $0.52 and adjusted diluted earnings per share(1) were $0.78, compared to $1.08 in the first quarter of 2024. Lower earnings on the sales decline and higher net warranty costs were partially offset by higher net favourable commercial items, the impact of operational excellence and cost initiatives, productivity and efficiency improvements and lower engineering spend. |

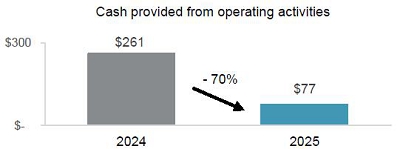

| · | Cash from operating activities decreased $184 million to $77 million. |

In addition, in the first quarter of 2025, we:

| · | Returned $187 million to shareholders, including $136 million in dividends and $51 million in share repurchases; and |

| · | Were recognized with a 2025 Automotive News PACEpilot award for our thermal sensing technology. |

OVERVIEW

OUR BUSINESS(2)

Magna is more than one of the world’s largest suppliers in the automotive space. We are a mobility technology company built to innovate, with a global, entrepreneurial-minded team of approximately 167,000(3) employees across 342 manufacturing operations and 103 product development, engineering and sales centres spanning 28 countries. With 65+ years of expertise, our ecosystem of interconnected products combined with our complete vehicle expertise uniquely positions us to advance mobility in an expanded transportation landscape. For further information about Magna (NYSE:MGA; TSX:MG), please visit www.magna.com or follow us on social.

1 Adjusted diluted earnings per share is a Non-GAAP financial measure. Refer to the section "Use of Non-GAAP Measures".

2 Manufacturing operations, product development, engineering and sales centres include certain operations accounted for under the equity method.

3 Number of employees includes approximately 155,000 employees at our wholly owned or controlled entities and over 12,000 employees at operations accounted for under the equity method.

Magna International Inc. First Quarter Report 2025

INDUSTRY TRENDS & RISKS

Our business and operating results are dependent on light vehicle production by our customers in three key regions – North America, Europe, and China. While we supply systems and components to many original equipment manufacturers ["OEMs"] globally, we do not supply systems and components for every vehicle, nor is the value of our content consistent from one vehicle to the next. As a result, customer and program mix relative to market trends, as well as the value of our content on specific vehicle production programs, are also important drivers of our results.

Ordinarily, OEM production volumes are aligned with vehicle sales levels and thus affected by changes in such levels. Aside from vehicle sales levels, production volumes are typically impacted by a range of factors, including: OEM, supplier or sub-supplier disruptions; free trade arrangements and tariffs; relative currency values; commodities prices; supply chains and infrastructure; labour disruptions and the availability and relative cost of skilled labour; regulatory frameworks; and other factors.

Overall vehicle sales levels are significantly affected by changes in consumer confidence levels, which may in turn be impacted by consumer perceptions and general trends related to the job, housing, and stock markets, as well as other macroeconomic and political factors. Other factors which typically impact vehicle sales levels and thus production volumes include: vehicle affordability; interest rates and/or availability of credit; fuel and energy prices; relative currency values; uncertainty as to the pace of EV adoption; and other factors.

While the foregoing economic, political and other factors are part of the general context in which the global automotive industry operates, there are a number of significant industry trends that are shaping the future of the industry and creating opportunities and risks for automotive suppliers. We continue to implement a business strategy which is rooted in our best assessment as to the rate and direction of change in the automotive industry, including with respect to the imposition of tariffs on vehicles and components or materials incorporated therein and trends related to vehicle electrification and advanced driver assistance systems. Our short and medium-term operational success, as well as our ability to create long-term value through our business strategy, are subject to a number of risks and uncertainties. Significant industry trends, our business strategy and the major risks we face, are discussed in our Annual Information Form ["AIF"] and Annual Report on Form 40-F ["Form 40-F"] in respect of the year ended December 31, 2024. Those industry trends and risk factors remain substantially unchanged in respect of the first quarter ended March 31, 2025, except as follows:

| · | Unpredictable Trade and Tariff Environment: Historical growth in the automotive industry has been aided by the free movement of goods, services and people through stable bilateral and regional trade agreements. Measures implemented by the current U.S administration have created an unpredictable trade environment by imposing or expanding tariffs, and in some cases, modifying or suspending some of the tariffs recently imposed. Such tariffs, together with retaliatory measures, risk increasing our input costs, the prices paid by our customers for our products, as well as the price consumers pay for vehicles. Significant or sustained tariff costs which are not recovered from our customers could have a material adverse effect on our profitability. Additionally, to the extent tariffs erode vehicle affordability, consumer demand for vehicles may decline, prompting a reduction in vehicle production volumes, which is a material driver of our operations, sales and profitability. |

| · | Increasing Economic Uncertainty: Recent tariff and trade measures have triggered volatility in both stock and bond markets, with market behaviour reflecting increased concern regarding the potential for both inflation and economic recession. Consumer confidence and short-term consumer expectations indices declined in March 2025, signalling growing pessimism about future business conditions, employment prospects, and personal financial situations. Macroeconomic and political conditions, consumer confidence levels, interest rates and other factors described in our prior filings are significant factors potentially impacting vehicle sales levels and thus vehicle production levels. In light of increased economic uncertainty, third-party forecasts for vehicle production in North America, Europe and China in 2025 and 2026 have been significantly reduced. Significant or sustained declines in vehicle production volumes in any of our three core markets could have a material adverse effect on our operations, sales, and profitability. Significant or sustained declines in production volumes could also result in us incurring restructuring charges and/or recording impairment charges, either of which could have a material adverse effect on our profitability. Additionally, current economic conditions, including declining production volumes and tariff-related risks, are placing incremental stress on the financial health of automotive suppliers. Sustained stress on our supply base as a result of these or other conditions could lead to, among other things: disruptions in the supply of critical components to us or our customers; and/or temporary shutdowns of our production lines or the production lines of our customers; all of which could have a material adverse effect on our profitability. |

| · | Planning and Forecasting Challenges: Unpredictable government policy-making, the erratic trade and tariff environment, and deteriorating economic conditions are making operational planning and forecasting more challenging for OEMs, Tier 1 suppliers, and other automotive suppliers. In the event of significant volatility in vehicle demand, OEMs could take actions such as: unplanned shutdowns of production lines and/or plants; reductions in their vehicle production plans; and changes to their product mix. Such OEM actions can result in a number of direct and indirect consequences for Tier 1 suppliers like Magna, including: lower sales; significant production inefficiencies resulting from our production lines being stopped/restarted unexpectedly; and unrecoverable costs and changes, including from sub-suppliers that have been adversely affected by production inefficiencies. If prolonged, any such actions could have a material adverse effect on our operations, sales and profitability. Additionally, planning and forecasting uncertainty could result in greater variability between market expectations and our actual financial and operating results which, in turn, could increase volatility in our stock price. |

Magna International Inc. First Quarter Report 2025

| · | Restructuring and Impairment Risks: As a result of recent tariff actions, our customers may be deterred from taking any of the following actions in jurisdictions outside of the United States: awarding or commencing new production programs; continuing or extending production of existing programs; or investing capital for vehicle production. Any significant loss of existing programs and/or failure to secure new program awards, including at our Complete Vehicle Assembly business in Austria, could result in us incurring restructuring, downsizing or other non-recurring costs related to the closure of facilities. Additionally, such customer actions could require us to record impairment charges. Any of the foregoing could have a material adverse effect on our profitability. |

| · | Application of a 2023 Tax Law Interpretation: As a result of the proposed application of a 2023 judicial decision to periods preceding the date of the ruling in a jurisdiction in which we have operations, we may face a reassessment of certain prior tax periods which could require payment of refundable value added tax ("VAT"), as well as interest, penalties and other charges. Although such VAT amounts are refundable, the interest, penalties and other charges are not and could have a material adverse impact on our financial results. Although a tax audit is currently on-going, no formal reassessment has been issued by the applicable tax authority and we continue to explore alternate avenues to resolve this matter. |

USE OF NON-GAAP FINANCIAL MEASURES

In addition to results presented in accordance with accounting principles generally accepted in the United States of America ["U.S. GAAP"], this report includes the use of Adjusted earnings before interest and taxes ["Adjusted EBIT"], Adjusted EBIT as a percentage of sales, Adjusted diluted earnings per share, and Adjusted Return on Invested Capital [collectively, the "Non-GAAP Measures"]. We believe these Non-GAAP financial measures provide additional information that is useful to investors in understanding our underlying performance and trends through the same financial measures employed by our management. Readers should be aware that Non-GAAP Measures have no standardized meaning under U.S. GAAP and accordingly may not be comparable to the calculation of similar measures by other companies. We believe that Adjusted EBIT, Adjusted EBIT as a percentage of sales, Adjusted diluted earnings per share and Adjusted Return on Invested Capital provide useful information to our investors for measuring our operational performance as they exclude certain items that are not reflective of ongoing operating profit and facilitate a comparison with prior periods. The presentation of any Non-GAAP Measures should not be considered in isolation or as a substitute for our related financial results prepared in accordance with U.S. GAAP. Non-GAAP financial measures are presented together with the most directly comparable U.S. GAAP financial measure, and a reconciliation to the most directly comparable U.S. GAAP financial measure, can be found in the "Non-GAAP Financial Measures Reconciliation" section of this MD&A.

Magna International Inc. First Quarter Report 2025

RESULTS OF OPERATIONS

AVERAGE FOREIGN EXCHANGE

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| 1 Canadian dollar equals U.S. dollars | 0.697 | 0.741 | - | 6 | % | |||||||

| 1 euro equals U.S. dollars | 1.053 | 1.085 | - | 3 | % | |||||||

| 1 Chinese renminbi equals U.S. dollars | 0.138 | 0.139 | - | 1 | % | |||||||

The preceding table reflects the average foreign exchange rates between the most common currencies in which we conduct business and our U.S. dollar reporting currency.

The results of operations for which the functional currency is not the U.S. dollar are translated into U.S. dollars using the average exchange rates for the relevant period. Throughout this MD&A, reference is made to the impact of translation of foreign operations on reported U.S. dollar amounts where relevant.

Our results can also be affected by the impact of movements in exchange rates on foreign currency transactions (such as raw material purchases or sales denominated in foreign currencies). However, as a result of hedging programs employed by us, foreign currency transactions in the current period have not been fully impacted by movements in exchange rates. We record foreign currency transactions at the hedged rate where applicable.

Finally, foreign exchange gains and losses on revaluation and/or settlement of monetary items denominated in a currency other than an operation's functional currency impact reported results. These gains and losses are recorded in selling, general and administrative expense.

LIGHT VEHICLE PRODUCTION VOLUMES

Our operating results are mostly dependent on light vehicle production in the regions reflected in the table below:

Light Vehicle Production Volumes (thousands of units)

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| North America | 3,780 | 3,976 | - | 5 | % | |||||||

| Europe | 4,192 | 4,567 | - | 8 | % | |||||||

| China | 6,541 | 6,434 | + | 2 | % | |||||||

| Other | 6,600 | 6,713 | - | 2 | % | |||||||

| Global | 21,113 | 21,690 | - | 3 | % | |||||||

Magna International Inc. First Quarter Report 2025

RESULTS OF OPERATIONS – FOR THE THREE MONTHS ENDED MARCH 31, 2025

SALES

Sales decreased 8% or $901 million to $10.07 billion for the first quarter of 2025 compared to $10.97 billion for the first quarter of 2024 primarily due to:

| · | lower global light vehicle production; |

| · | lower complete vehicle assembly volumes, including the end of production of the Jaguar I-Pace and Jaguar E-Pace; |

| · | the end of production of certain programs; |

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $205 million; |

| · | divestitures, net of acquisitions, during 2024, which decreased sales by $58 million; and |

| · | net customer price concessions subsequent to the first quarter of 2024. |

These factors were partially offset by:

| · | the launch of new programs during or subsequent to the first quarter of 2024, including the Mercedes-Benz G-Class, GMC Acadia and Chevrolet Traverse; |

| · | commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis; and |

| · | customer price increases to partially recover certain higher production input costs. |

COST OF GOODS SOLD

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Material | $ | 6,229 | $ | 6,776 | $ | (547 | ) | |||||

| Direct labour | 727 | 826 | (99 | ) | ||||||||

| Overhead | 1,871 | 2,040 | (169 | ) | ||||||||

| Cost of goods sold | $ | 8,827 | $ | 9,642 | $ | (815 | ) | |||||

Cost of goods sold decreased $815 million to $8.83 billion for the first quarter of 2025 compared to $9.64 billion for the first quarter of 2024, primarily due to:

| · | lower material, direct labour and overhead associated with lower production and complete vehicle assembly sales on certain programs; |

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar costs of goods sold by $180 million; |

| · | productivity and efficiency improvements; |

| · | a decrease in material, direct labour and overhead costs associated with lower engineering sales; |

| · | divestitures, net of acquisitions, during or subsequent to the first quarter of 2024, which decreased cost of goods sold by $50 million; |

| · | commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis; and |

| · | lower net engineering costs, including spending related to our electrification and active safety business. |

These factors were partially offset by:

| · | an increase in net warranty costs of $23 million; |

| · | higher production input costs net of customer recoveries, primarily for labour; |

| · | higher pre-operating costs incurred at new facilities; |

| · | higher costs relating to the imposition of tariffs by the United States and the related international retaliatory measures during the first quarter of 2025; and |

| · | higher restructuring costs. |

Magna International Inc. First Quarter Report 2025

DEPRECIATION

Depreciation decreased $8 million to $369 million for the first quarter of 2025 compared to $377 million for the first quarter of 2024 primarily due to the end of production of certain programs and the net weakening of foreign currencies against the U.S. dollar, which decreased depreciation by $8 million. These factors were partially offset by increased capital deployed at new and existing facilities including to support the launch of programs.

AMORTIZATION OF ACQUIRED INTANGIBLE ASSETS

Amortization of acquired intangible assets decreased $2 million to $26 million for the first quarter of 2025 compared to $28 million for the first quarter of 2024 primarily due to the impairment of acquired intangible assets at two European lighting facilities in our Power & Vision segment during the fourth quarter of 2024 and the net weakening of foreign currencies against the U.S. dollar, which decreased amortization of acquired intangible assets by $1 million.

SELLING, GENERAL AND ADMINISTRATIVE ["SG&A"]

SG&A expense increased $23 million to $539 million for the first quarter of 2025 compared to $516 million for the first quarter of 2024, primarily as a result of:

| · | net transactional foreign exchange losses in the first quarter of 2025 compared to net foreign exchange gains in the first quarter of 2024; |

| · | higher costs to accelerate our operational excellence initiatives; |

| · | a gain on the sale of an equity-method investment during the first quarter of 2024; and |

| · | higher restructuring costs. |

These factors were partially offset by:

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased SG&A by $12 million; |

| · | divestitures, net of acquisitions during or subsequent to the first quarter of 2024; |

| · | lower investments in research, development and new mobility; |

| · | lower labour and benefit costs; and |

| · | a decrease in incentive compensation. |

INTEREST EXPENSE, NET

During the first quarter of 2025, we recorded net interest expense of $50 million compared to $51 million for the first quarter of 2024. The $1 million decrease is primarily a result of lower interest expense on decreased short-term borrowings at lower interest rates. These factors were partially offset by lower interest income earned on cash and investments due to reduced cash balances and lower interest rates; and higher interest expense on Senior Notes issued during the first and second quarter of 2024 at higher interest rates than the Senior Notes repaid during the second quarter of 2024.

EQUITY INCOME

Equity income decreased $14 million to $20 million for the first quarter of 2025 compared to $34 million for the first quarter of 2024, primarily as a result of:

| · | commercial items in the first quarters of 2025 and 2024, which had a net unfavourable impact on a year-over-year basis; |

| · | net transactional foreign exchange losses in the first quarter of 2025 compared to net foreign exchange gains in the first quarter of 2024; and |

| · | reduced earnings on lower sales. |

These factors were partially offset by lower launch costs.

Magna International Inc. First Quarter Report 2025

OTHER EXPENSE, NET

| For the three months | ||||||||

| ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Restructuring activities (1) | $ | 44 | $ | 38 | ||||

| Investments (2) | 9 | 2 | ||||||

| Impacts related to Fisker Inc. ["Fisker"] (3) | — | 316 | ||||||

| $ | 53 | $ | 356 | |||||

| (1) | Restructuring activities |

In the first quarter of 2025, we recorded restructuring charges of $33 million [$33 million after tax] in our Complete Vehicles segment, and $11 million [$11 million after tax] in our Power & Vision segment.

In the first quarter of 2024, we recorded restructuring charges of $26 million [$20 million after tax] in our Complete Vehicles segment, and $12 million [$12 million after tax] in our Body Exteriors & Structures segment.

| (2) | Investments |

| For the three months | ||||||||

| ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Revaluation of public company warrants | $ | 8 | $ | — | ||||

| Revaluation of public and private equity investments | 1 | 2 | ||||||

| Other expense, net | 9 | 2 | ||||||

| Tax effect | (1 | ) | (1 | ) | ||||

| Net loss attributable to Magna | $ | 8 | $ | 1 | ||||

| (3) | Impacts related to Fisker |

During the first quarter of 2024, we recorded impairment charges on our Fisker related net assets, including our Fisker warrants, which were received in connection with the agreements with Fisker for platform sharing, engineering and manufacturing of the Fisker Ocean SUV. We also recorded restructuring charges during the first quarter of 2024 related to our Fisker related assembly operations.

| For the three months | ||||||||

| ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Impairment of Fisker related net assets | $ | — | $ | 261 | ||||

| Impairment of Fisker warrants | — | 33 | ||||||

| Additional restructuring related to Complete Vehicles | — | 22 | ||||||

| Other expense, net | — | 316 | ||||||

| Tax effect | — | (69 | ) | |||||

| Net loss attributable to Magna | $ | — | $ | 247 | ||||

Magna International Inc. First Quarter Report 2025

INCOME FROM OPERATIONS BEFORE INCOME TAXES

Income from operations before income taxes was $225 million for the first quarter of 2025 compared to $34 million for the first quarter of 2024. This $191 million increase is a result of the following changes, each as discussed above:

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Sales | $ | 10,069 | $ | 10,970 | $ | (901 | ) | |||||

| Costs and expenses | ||||||||||||

| Cost of goods sold | 8,827 | 9,642 | (815 | ) | ||||||||

| Selling, general & administrative | 539 | 516 | 23 | |||||||||

| Depreciation | 369 | 377 | (8 | ) | ||||||||

| Amortization of acquired intangible assets | 26 | 28 | (2 | ) | ||||||||

| Interest expense, net | 50 | 51 | (1 | ) | ||||||||

| Equity income | (20 | ) | (34 | ) | 14 | |||||||

| Other expense, net | 53 | 356 | (303 | ) | ||||||||

| Income from operations before income taxes | $ | 225 | $ | 34 | $ | 191 | ||||||

INCOME TAXES

| For the three months ended March 31, | ||||||||||||||||

| 2025 | 2024 | |||||||||||||||

| Income Taxes as reported | $ | 72 | 32.0 | % | $ | 8 | 23.5 | % | ||||||||

| Tax effect on Other expense, net and | ||||||||||||||||

| Amortization of acquired intangible assets | 6 | (6.3 | ) | 82 | (2.0 | ) | ||||||||||

| $ | 78 | 25.7 | % | $ | 90 | 21.5 | % | |||||||||

Excluding the tax effect on Other expense, net and Amortization of acquired intangible assets, our effective income tax rate increased to 25.7% for the first quarter of 2025 compared to 21.5% for the first quarter of 2024 primarily due to higher losses not benefited in Europe, unfavourable foreign exchange adjustments recognized for U.S. GAAP purposes, and a change in mix of earnings. These factors were partially offset by higher favourable changes in our reserves for uncertain tax positions.

Magna International Inc. First Quarter Report 2025

INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

Income attributable to non-controlling interests was $7 million for the first quarter of 2025 compared to $17 million for the first quarter of 2024. This $10 million decrease was primarily due to lower earnings at our non-wholly owned operations in China.

NET INCOME ATTRIBUTABLE TO MAGNA INTERNATIONAL INC.

Net income attributable to Magna International Inc. was $146 million for the first quarter of 2025 compared to $9 million for the first quarter of 2024. This $137 million increase was as a result of increases in income from operations before income taxes of $191 million and income attributable to non-controlling interests of $10 million, respectively, partially offset by a increase in income taxes of $64 million.

EARNINGS PER SHARE

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Earnings per Common Share | ||||||||||||

| Basic | $ | 0.52 | $ | 0.03 | — | |||||||

| Diluted | $ | 0.52 | $ | 0.03 | — | |||||||

| Weighted average number of Common Shares outstanding (millions) | ||||||||||||

| Basic | 282.0 | 286.9 | - | 2 | % | |||||||

| Diluted | 282.0 | 287.1 | - | 2 | % | |||||||

| Adjusted diluted earnings per share | $ | 0.78 | $ | 1.08 | - | 28 | % | |||||

Diluted earnings per share was $0.52 for the first quarter of 2025 compared to diluted earnings per share of $0.03 for the first quarter of 2024. The $0.49 increase was substantially as a result of higher net income attributable to Magna International Inc., as discussed above, and a decrease in the weighted average number of diluted shares outstanding subsequent to the first quarter of 2024. The decrease in the weighted average number of diluted shares outstanding was primarily due to the purchase and cancellation of Common Shares, during or subsequent to the first quarter of 2024, pursuant to our normal course issuer bids.

Other expense, net, and the Amortization of acquired intangible assets, each after tax, negatively impacted diluted earnings per share by $0.26 in the first quarter of 2025 and $1.05 in the first quarter of 2024, respectively. Adjusted diluted earnings per share, as reconciled in the "Non-GAAP Financial Measures Reconciliation" section, was $0.78 for the first quarter of 2025 compared to $1.08 for the first quarter of 2024, a decrease of $0.30.

Magna International Inc. First Quarter Report 2025

NON-GAAP PERFORMANCE MEASURES – FOR THE THREE MONTHS ENDED MARCH 31, 2025

ADJUSTED EBIT AS A PERCENTAGE OF SALES

The table below shows the change in Magna's Sales and Adjusted EBIT by segment and the impact each segment's changes had on Magna's Adjusted EBIT as a percentage of sales for the first quarter of 2025 compared to the first quarter of 2024:

| Adjusted EBIT | ||||||||||||

| Adjusted | as a percentage | |||||||||||

| Sales | EBIT | of sales | ||||||||||

| First quarter of 2024 | $ | 10,970 | $ | 469 | 4.3 | % | ||||||

| Increase (decrease) related to: | ||||||||||||

| Body Exteriors & Structures | (463 | ) | (68 | ) | - | 0.5 | % | |||||

| Power & Vision | (196 | ) | 26 | + | 0.4 | % | ||||||

| Seating Systems | (143 | ) | (82 | ) | - | 0.8 | % | |||||

| Complete Vehicles | (107 | ) | 17 | + | 0.2 | % | ||||||

| Corporate and Other | 8 | (8 | ) | - | 0.1 | % | ||||||

| First quarter of 2025 | $ | 10,069 | $ | 354 | 3.5 | % | ||||||

Adjusted EBIT as a percentage of sales decreased to 3.5% for the first quarter of 2025 compared to 4.3% for the first quarter of 2024 primarily due to:

| · | reduced earnings on lower sales; |

| · | higher net warranty costs; |

| · | net transactional foreign exchange losses in the first quarter of 2025 compared to net transactional foreign exchange gains in the first quarter of 2024; |

| · | reduced earnings on lower assembly volumes; |

| · | lower equity income; |

| · | higher restructuring costs; |

| · | higher pre-operating costs incurred at new facilities; and |

| · | higher costs relating to the imposition of tariffs by the United States and the related international retaliatory measures during the first quarter of 2025. |

These factors were partially offset by:

| · | commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis; |

| · | productivity and efficiency improvements; |

| · | lower net engineering costs, including spending related to our electrification and active safety business; and |

| · | higher customer recoveries partially offset by higher production input costs, primarily for labour. |

Magna International Inc. First Quarter Report 2025

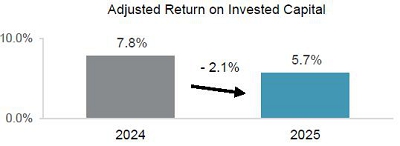

ADJUSTED RETURN ON INVESTED CAPITAL

Adjusted Return on Invested Capital decreased to 5.7% for the first quarter of 2025 compared to 7.8% for the first quarter of 2024 as a result of a decrease in Adjusted After-tax operating profits, partially offset by lower Average Invested Capital.

Average Invested Capital decreased $292 million to $18.58 billion for the first quarter of 2025 compared to $18.87 billion for the first quarter of 2024, primarily due to:

| · | the net weakening of foreign currencies against the U.S. dollar; |

| · | a decrease in average operating assets and liabilities; |

| · | long-lived asset impairments during or subsequent to the first quarter of 2024; |

| · | divestitures, net of acquisitions, during or subsequent to the first quarter of 2024; and |

| · | lower net investments in public and private equity companies and public company warrants. |

These factors were partially offset by average investment in fixed assets in excess of average depreciation expense on fixed assets.

Magna International Inc. First Quarter Report 2025

SEGMENT ANALYSIS

We are a global automotive supplier that has complete vehicle engineering and contract manufacturing expertise, as well as product capabilities which include body, chassis, exterior, seating, powertrain, active driver assistance, electronics, mechatronics, mirrors, lighting and roof systems.

Our reporting segments are: Body Exteriors & Structures; Power & Vision; Seating Systems; and Complete Vehicles.

| For the three months ended March 31, | ||||||||||||||||||||||||

| Sales | Adjusted EBIT | |||||||||||||||||||||||

| 2025 | 2024 | Change | 2025 | 2024 | Change | |||||||||||||||||||

| Body Exteriors & Structures | $ | 3,966 | $ | 4,429 | $ | (463 | ) | $ | 230 | $ | 298 | $ | (68 | ) | ||||||||||

| Power & Vision | 3,646 | 3,842 | (196 | ) | 124 | 98 | 26 | |||||||||||||||||

| Seating Systems | 1,312 | 1,455 | (143 | ) | (30 | ) | 52 | (82 | ) | |||||||||||||||

| Complete Vehicles | 1,276 | 1,383 | (107 | ) | 44 | 27 | 17 | |||||||||||||||||

| Corporate and Other | (131 | ) | (139 | ) | 8 | (14 | ) | (6 | ) | (8 | ) | |||||||||||||

| Total reportable segments | $ | 10,069 | $ | 10,970 | $ | (901 | ) | $ | 354 | $ | 469 | $ | (115 | ) | ||||||||||

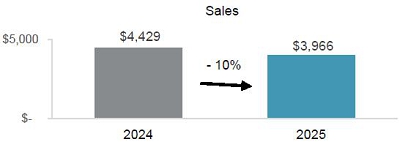

BODY EXTERIORS & STRUCTURES

| For the three months | ||||||||||||||||

| ended March 31, | ||||||||||||||||

| 2025 | 2024 | Change | ||||||||||||||

| Sales | $ | 3,966 | $ | 4,429 | $ | (463 | ) | - | 10 | % | ||||||

| Adjusted EBIT | $ | 230 | $ | 298 | $ | (68 | ) | - | 23 | % | ||||||

| Adjusted EBIT as a percentage of sales | 5.8 | % | 6.7 | % | - | 0.9 | % | |||||||||

Sales – Body Exteriors & Structures

Sales decreased 10% or $463 million to $3.97 billion for the first quarter of 2025 compared to $4.43 billion for the first quarter of 2024 primarily due to:

| · | lower production on certain programs; |

| · | the end of production of certain programs, including the: |

| · | Chevrolet Malibu; and |

| · | Ford Edge; |

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $77 million; |

| · | divestitures subsequent to the first quarter of 2024, which decreased sales by $62 million; and |

| · | net customer price concessions subsequent to the first quarter of 2024. |

These factors were partially offset by:

| · | the launch of programs during or subsequent to the first quarter of 2024, including the: |

| · | GMC Acadia and Chevrolet Traverse; |

| · | Jeep Wagoneer S; |

| · | Chevrolet Equinox; and |

| · | Chevrolet BrightDrop; and |

| · | commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis. |

Magna International Inc. First Quarter Report 2025

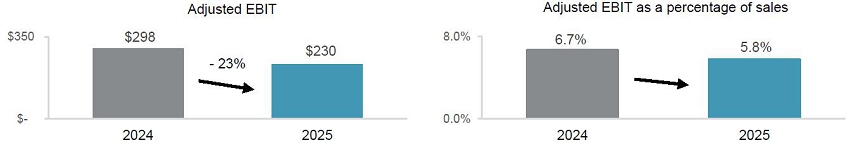

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Body Exteriors & Structures

Adjusted EBIT decreased $68 million to $230 million for the first quarter of 2025 compared to $298 million for the first quarter of 2024 and Adjusted EBIT as a percentage of sales decreased to 5.8% from 6.7%. These decreases were primarily due to:

| · | reduced earnings on lower sales; |

| · | net transactional foreign exchange losses in the first quarter of 2025 compared to net transactional foreign exchange gains in the first quarter of 2024; |

| · | higher pre-operating costs incurred at new facilities; |

| · | higher production input costs net of customer recoveries, primarily for labour; and |

| · | higher restructuring costs. |

These factors were partially offset by:

| · | commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis; and |

| · | productivity and efficiency improvements. |

POWER & VISION

| For the three months | ||||||||||||||||

| ended March 31, | ||||||||||||||||

| 2025 | 2024 | Change | ||||||||||||||

| Sales | $ | 3,646 | $ | 3,842 | $ | (196 | ) | - | 5 | % | ||||||

| Adjusted EBIT | $ | 124 | $ | 98 | $ | 26 | + | 27 | % | |||||||

| Adjusted EBIT as a percentage of sales | 3.4 | % | 2.6 | % | + | 0.8 | % | |||||||||

Sales – Power & Vision

Sales decreased 5% or $196 million to $3.65 billion for the first quarter of 2025 compared to $3.84 billion for the first quarter of 2024 primarily due to:

| · | lower production on certain programs; |

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $73 million; |

| · | the end of production of certain programs, including the: |

| · | Toyota Highlander; |

| · | Mini Clubman; and |

| · | Audi A5; and |

| · | net customer price concessions subsequent to the first quarter of 2024. |

Magna International Inc. First Quarter Report 2025

These factors were partially offset by:

| · | the launch of programs during or subsequent to the first quarter of 2024, including the: |

| · | Mercedes-Benz G-Class; |

| · | Mini Cooper; |

| · | Chevrolet Equinox; and |

| · | Jetour X70; and |

| · | customer price increases to partially recover certain higher production input costs. |

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Power & Vision

Adjusted EBIT increased $26 million to $124 million for the first quarter of 2025 compared to $98 million for the first quarter of 2024 and Adjusted EBIT as a percentage of sales increased to 3.4% from 2.6%. These increases were primarily as a result of:

| · | higher customer recoveries and lower production input costs, primarily for certain commodities; |

| · | commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis; |

| · | lower net engineering costs, including spending related to our electrification and active safety businesses; |

| · | productivity and efficiency improvements; |

| · | lower launch costs; and |

| · | lower net warranty costs of $7 million. |

These factors were partially offset by:

| · | reduced earnings on lower sales; |

| · | lower equity income; |

| · | net transactional foreign exchange losses in the first quarter of 2025 compared to net transactional foreign exchange gains in the first quarter of 2024; |

| · | higher restructuring costs; and |

| · | higher costs relating to the imposition of tariffs by the United States and the related international retaliatory measures during the first quarter of 2025. |

SEATING SYSTEMS

| For the three months | ||||||||||||||||

| ended March 31, | ||||||||||||||||

| 2025 | 2024 | Change | ||||||||||||||

| Sales | $ | 1,312 | $ | 1,455 | $ | (143 | ) | - | 10 | % | ||||||

| Adjusted EBIT | $ | (30 | ) | $ | 52 | $ | (82 | ) | — | |||||||

| Adjusted EBIT as a percentage of sales | (2.3 | )% | 3.6 | % | - | 5.9 | % | |||||||||

Magna International Inc. First Quarter Report 2025

Sales – Seating Systems

Sales decreased 10% or $143 million to $1.31 billion for the first quarter of 2025 compared to $1.46 billion for the first quarter of 2024 primarily due to:

| · | lower production on certain programs; |

| · | the end of production of certain programs, including the: |

| · | Ford Edge; and |

| · | VW Transporter; |

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $21 million; and |

| · | net customer price concessions subsequent to the first quarter of 2024. |

These factors were partially offset by:

| · | the launch of programs during or subsequent to the first quarter of 2024, including the: |

| · | GMC Acadia and Chevrolet Traverse; |

| · | BYD Qin L DM-i; |

| · | Skoda Kodiaq; and |

| · | Skoda Elroq. |

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Seating Systems

Adjusted EBIT decreased $82 million to a loss of $30 million for the first quarter of 2025 compared to income of $52 million for the first quarter of 2024 and Adjusted EBIT as a percentage of sales decreased to -2.3% from 3.6%. These decreases were primarily due to:

| · | reduced earnings on lower sales; |

| · | higher net warranty costs of $30 million; |

| · | lower customer recoveries related to business in Argentina and higher production input costs, primarily relating to labour and certain commodities; |

| · | higher costs relating to the imposition of tariffs by the United States and the related international retaliatory measures during the first quarter of 2025; and |

| · | higher restructuring costs. |

These factors were partially offset by productivity and efficiency improvements.

Magna International Inc. First Quarter Report 2025

COMPLETE VEHICLES

| For the three months | |||||||||||||||

| ended March 31, | |||||||||||||||

| 2025 | 2024 | Change | |||||||||||||

| Complete Vehicle Assembly Volumes (thousands of units)(i) | 17.4 | 22.3 | - | 4.9 | - | 22 | % | ||||||||

| Sales | $ | 1,276 | $ | 1,383 | $ | (107 | ) | - | 8 | % | |||||

| Adjusted EBIT | $ | 44 | $ | 27 | $ | 17 | + | 63 | % | ||||||

| Adjusted EBIT as a percentage of sales | 3.4 | % | 2.0 | % | + | 1.4 | % | ||||||||

(i) Vehicles produced at our Complete Vehicle operations are included in Europe Light Vehicle Production volumes.

Sales – Complete Vehicles

Sales decreased 8% or $107 million to $1.28 billion for the first quarter of 2025 compared to $1.38 billion for the first quarter of 2024 and assembly volumes decreased 21%. The decrease in sales is primarily a result of lower assembly volumes, including the end of production of the Jaguar I-Pace and Jaguar E-Pace, and a $38 million decrease in reported U.S. dollar sales as a result of the weakening of the euro against the U.S. dollar. These factors were partially offset by the launch of the electric version of the Mercedes-Benz G-Class subsequent to the first quarter of 2024 and commercial items in the first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis.

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Complete Vehicles

Adjusted EBIT increased $17 million to $44 million for the first quarter of 2025 compared to $27 million for the first quarter of 2024 and Adjusted EBIT as a percentage of sales increased to 3.4% from 2.0%. These increases were primarily due to:

| · | productivity and efficiency improvements; |

| · | commercial items in first quarters of 2025 and 2024, which had a net favourable impact on a year-over-year basis; and |

| · | higher engineering margins. |

These factors were partially offset by reduced earnings on lower assembly volumes.

Magna International Inc. First Quarter Report 2025

CORPORATE AND OTHER

Adjusted EBIT was a loss of $14 million for the first quarter of 2025 compared to a loss of $6 million for the first quarter of 2024. The $8 million decrease in Adjusted EBIT was primarily the result of:

| · | a gain on the sale of an equity-method investment during the first quarter of 2024; |

| · | a decrease in fees received from our divisions; |

| · | lower net transactional foreign exchange gains in the first quarter of 2025 compared to the first quarter of 2024; and |

| · | higher labour and benefit costs. |

These factors were partially offset by:

| · | lower investments in research, development and new mobility; and |

| · | a decrease in incentive compensation. |

Magna International Inc. First Quarter Report 2025

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

OPERATING ACTIVITIES

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Net income | $ | 153 | $ | 26 | ||||||||

| Items not involving current cash flows | 394 | 565 | ||||||||||

| 547 | 591 | $ | (44 | ) | ||||||||

| Changes in operating assets and liabilities | (470 | ) | (330 | ) | (140 | ) | ||||||

| Cash provided from operating activities | $ | 77 | $ | 261 | $ | (184 | ) | |||||

Cash provided from operating activities

Comparing the first quarter of 2025 to 2024, cash provided from operating activities decreased $184 million primarily as a result of:

| · | a $989 million decrease in cash received from customers; |

| · | a $30 million increase in cash taxes; and |

| · | lower dividends received from equity investments of $22 million. |

These factors were partially offset by:

| · | a $721 million decrease in cash paid for materials and overhead; |

| · | a $136 million decrease in cash paid for labour; and |

| · | a $1 million decrease in cash interest paid. |

Changes in operating assets and liabilities

Consistent with the seasonality of our business, we invested in operating assets and liabilities during the first quarter of 2025. During the first quarter of 2025, we used $470 million for operating assets and liabilities primarily as a result of higher operating activity in the month of March 2025 compared to the month of December 2024. Specifically, we used cash for operating assets and liabilities for:

| · | a $741 million increase in production and other receivables; |

| · | a $86 million increase in tooling investment for current and upcoming program launches; |

| · | a $65 million decrease in taxes payable; and |

| · | a $10 million increase in prepaids and other. |

These factors were partially offset by:

| · | a $184 million increase in other accrued liabilities; |

| · | a $180 million increase in accounts payable; |

| · | a $59 million decrease in production inventory; and |

| · | a $7 million increase in accrued wages and salaries. |

Magna International Inc. First Quarter Report 2025

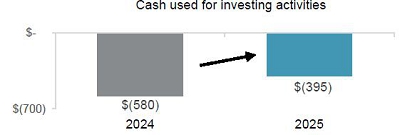

INVESTING ACTIVITIES

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Fixed asset additions | $ | (268 | ) | $ | (493 | ) | ||||||

| Increase in investments, other assets and intangible assets | (148 | ) | (125 | ) | ||||||||

| Increase in public and private equity investments | (1 | ) | (23 | ) | ||||||||

| Fixed assets, investments, other assets and intangible assets additions | (417 | ) | (641 | ) | ||||||||

| Proceeds from dispositions | 26 | 87 | ||||||||||

| Net cash inflow from disposal of facilities | — | 4 | ||||||||||

| Acquisitions | (4 | ) | (30 | ) | ||||||||

| Cash used for investing activities | $ | (395 | ) | $ | (580 | ) | $ | 185 | ||||

Cash used for investing activities in the first quarter of 2025 was $185 million lower compared to the first quarter of 2024. The change between the first quarter of 2025 and the first quarter of 2024 was primarily due to a $225 million decrease in cash used for fixed assets, a $26 million decrease in cash used for acquisitions, and a $22 million decrease in cash used for investments in public and private equity investments. These factors were partially offset by lower proceeds from dispositions, primarily related to the sale of an equity-method investment during the first quarter of 2024 and a $23 million increase in cash used for investments, other assets and intangible assets.

FINANCING ACTIVITIES

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Increase in short-term borrowings | $ | 328 | $ | 341 | ||||||||

| Issues of debt | 1 | 425 | ||||||||||

| Issue of Common Shares on exercise of stock options | — | 30 | ||||||||||

| Tax withholdings on vesting of equity awards | (4 | ) | (4 | ) | ||||||||

| Repayments of debt | (7 | ) | (9 | ) | ||||||||

| Repurchase of Common Shares | (51 | ) | (3 | ) | ||||||||

| Dividends paid | (136 | ) | (134 | ) | ||||||||

| Cash provided from financing activities | $ | 131 | $ | 646 | $ | (515 | ) | |||||

Short-term borrowings increased $328 million during the first quarter of 2025 primarily due to $250 million and $76 million increases in notes outstanding under the U.S. and euro commercial paper programs, respectively.

During the first quarter of 2025, we repurchased 1.3 million Common Shares under normal course issuer bids for aggregate cash consideration of $51 million.

Cash dividends paid per Common Share were $0.485 for the first quarter of 2025 compared to $0.475 for the first quarter of 2024.

Magna International Inc. First Quarter Report 2025

FINANCING RESOURCES

| As at March 31, 2025 |

As at December 31, 2024 |

Change | ||||||||||

| Liabilities | ||||||||||||

| Short-term borrowings | $ | 614 | $ | 271 | ||||||||

| Long-term debt due within one year | 1,005 | 708 | ||||||||||

| Current portion of operating lease liabilities | 305 | 293 | ||||||||||

| Long-term debt | 3,892 | 4,134 | ||||||||||

| Operating lease liabilities | 1,742 | 1,662 | ||||||||||

| $ | 7,558 | $ | 7,068 | $ | 490 | |||||||

Financial liabilities increased $490 million to $7.56 billion as at March 31, 2025 primarily as a result of an increase in notes outstanding under the U.S. and euro-commercial paper programs.

CASH RESOURCES

In the first quarter of 2025, our cash resources decreased by $0.2 billion to $1.1 billion, primarily as a result of a decrease in cash provided from financing and operating activities, which is partially offset by an increase in cash used for investing activities and cash provided from increase in notes outstanding, as discussed above. In addition to our cash resources at March 31, 2025, we had term and operating lines of credit totaling $4.8 billion, of which $3.6 billion was unused and available.