UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) |

OR | |

þ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

For the fiscal year ended December 31, 2024 |

OR | |

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

OR | |

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

Date of event requiring this shell company report…………… |

|

For the transition period from to |

Commission file number: 1-14251

SAP SE

(Exact name of Registrant as specified in its charter)

SAP EUROPEAN COMPANY

(Translation of Registrant’s name into English)

Federal Republic of Germany

(Jurisdiction of incorporation or organization)

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal Republic of Germany

(Address of principal executive offices)

Wendy Boufford

c/o SAP Labs

3410 Hillview Avenue, Palo Alto, CA, 94304, United States of America

650-849-4000 (Tel),

650-843-2041 (Fax)

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

||

Title of each class (SAP) |

SAP |

Name of each exchange on which registered |

American Depositary Shares, each Representing one Ordinary Share, without nominal value |

|

New York Stock Exchange |

Ordinary Shares, without nominal value |

|

New York Stock Exchange* |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, without nominal value: 1,228,504,232 (as of December 31, 2024)**

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No þ

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.)

Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. þ

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board þ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No þ

* |

Listed not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares representing such ordinary shares pursuant to the requirements of the Securities and Exchange Commission. |

** |

Including 61,914,771 treasury shares. |

|

7 |

|

|

7 |

|

|

8 |

|

|

8 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

|

|

|

15 |

|

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

|

15 |

|

15 |

|

|

15 |

|

|

15 |

|

|

15 |

|

|

15 |

|

|

16 |

|

|

17 |

|

|

22 |

|

|

24 |

|

|

24 |

|

|

24 |

|

|

24 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

28 |

|

|

29 |

|

|

30 |

|

|

31 |

|

|

31 |

|

|

34 |

|

|

34 |

|

|

37 |

|

|

40 |

|

|

40 |

|

|

41 |

|

|

41 |

|

|

42 |

|

|

42 |

|

|

42 |

|

|

43 |

|

|

43 |

|

|

43 |

|

|

45 |

|

|

45 |

|

|

51 |

|

|

51 |

|

|

53 |

|

|

54 |

|

|

54 |

|

|

54 |

|

|

58 |

|

|

58 |

|

|

59 |

|

|

59 |

|

|

60 |

|

|

60 |

|

|

60 |

|

|

62 |

4

|

62 |

|

|

63 |

|

|

63 |

|

|

64 |

|

|

64 |

|

|

65 |

|

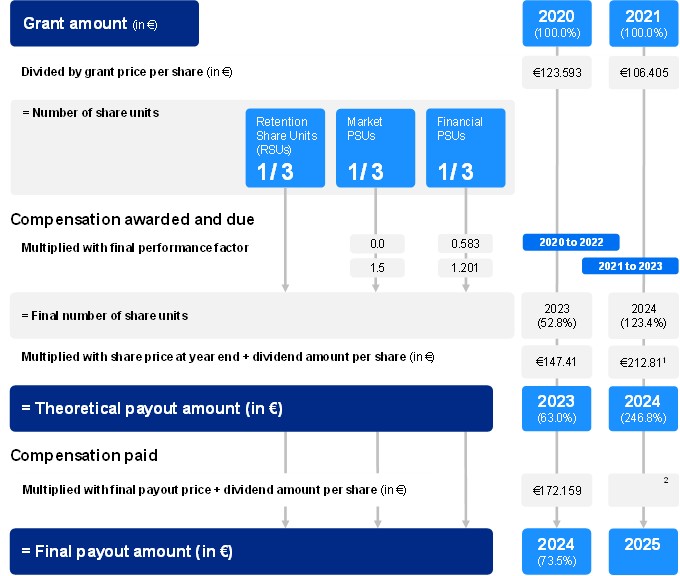

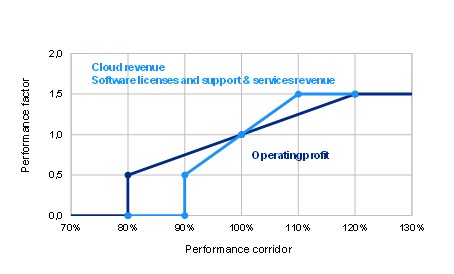

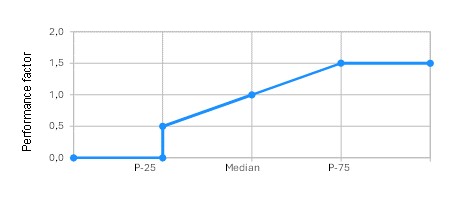

Share - Based Payment Information Relating to Long - Term Incentives |

|

85 |

|

88 |

|

|

94 |

|

|

98 |

|

|

98 |

|

|

99 |

|

|

99 |

|

|

99 |

|

|

99 |

|

|

99 |

|

|

99 |

|

|

99 |

|

|

100 |

|

Consolidated Financial Statements and Financial Statement Schedule |

|

100 |

|

100 |

|

|

100 |

|

|

101 |

|

|

101 |

|

|

101 |

|

|

101 |

|

|

105 |

|

|

106 |

|

|

106 |

|

|

107 |

|

|

110 |

|

|

111 |

|

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

111 |

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

|

111 |

|

111 |

|

|

|

|

|

112 |

|

|

112 |

|

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

|

112 |

|

112 |

|

|

112 |

|

Management's Annual Report on Internal Control Over Financial Reporting |

|

112 |

|

112 |

|

|

113 |

|

|

113 |

|

|

113 |

|

|

113 |

|

|

113 |

|

|

113 |

|

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

|

114 |

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

|

114 |

|

115 |

|

|

115 |

|

|

115 |

|

|

115 |

|

|

115 |

|

|

116 |

|

|

116 |

|

|

117 |

|

|

117 |

5

|

117 |

|

|

117 |

|

|

118 |

|

|

118 |

|

|

118 |

|

ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

|

118 |

|

118 |

|

|

118 |

|

|

118 |

|

|

119 |

|

|

|

|

|

122 |

|

|

122 |

|

|

122 |

|

|

123 |

|

|

124 |

|

|

F-1 |

6

Introduction

SAP SE is a European Company (Societas Europaea, or “SE”) and is referred to in this report, together with its subsidiaries, as SAP, or as “Company,” “Group,” “we,” “our,” or “us.”

In this report: (i) references to “US$,” “$,” or “dollars” are to U.S. dollars; (ii) references to ‘‘€” or “euro” are to the euro. Our financial statements are denominated in euros, which is the currency of our home country, Germany. Certain amounts that appear in this report may not add up because of differences due to rounding. All numbers in SAP’s Consolidated Financial Statements IFRS are presented according to IFRS 5 (unless otherwise noted, figures are based on continuing operations). For more information, see Note D.1.

Unless otherwise specified herein, euro financial data have been converted into dollars at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on December 31, 2024, which was 1.0351 EUR/USD. No representation is made that such euro amounts actually represent such dollar amounts or that such euro amounts could have been or can be converted into dollars at that or any other exchange rate on such date or on any other date. On February 7, 2025, the Noon Buying Rate for converting euro to dollars was US$1.03 per €1.00.

Unless the context otherwise requires, references in this report to ordinary shares are to SAP SE’s ordinary shares, without nominal value. References in this report to “ADRs” are to SAP SE’s American Depositary Receipts, each representing one SAP ordinary share. References in this report to “ADSs” are to SAP SE’s American Depositary Shares, which are the deposited securities evidenced by the ADRs.

SAP, Adaptive Server, Advantage Database Server, BusinessObjects, ExpenseIt, PartnerEdge, PowerBuilder, PowerDesigner, Replication Server, SAP Ariba, SAP BusinessObjects Explorer, SAP BW/4HANA, SAP Concur, SAP EarlyWatch, SAP Emarsys, SAP Fieldglass, SAP Fiori, SAP HANA, SAP Jam, SAP LeanIX, SAP Lumira, SAP S/4HANA, SAP SuccessFactors, SAP Vora, Sapphire, SAP Signavio, SQL Anywhere, Taulia, TripIt, TripLink, WalkMe, Web Intelligence and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE (or an SAP affiliate company) in Germany and other countries.

Throughout this report, whenever a reference is made to our website, such reference does not incorporate by reference into this report the information contained on our website.

We intend to make this report and other periodic reports publicly available on our website (www.sap.com) without charge immediately following our filing with the U.S. Securities and Exchange Commission (SEC). Such reports are also available on the website maintained by the SEC (www.sec.gov). We assume no obligation to update or revise any part of this report, whether as a result of new information, future events or otherwise, unless we are required to do so by law.

Forward-Looking Statements

This report contains forward-looking statements and information based on the beliefs of, and assumptions made by, our management using information currently available to them. Any statements contained in this report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements on our current expectations, assumptions, and projections about future conditions and events. As a result, our forward-looking statements and information are subject to uncertainties and risks. A broad range of uncertainties and risks, many of which are beyond our control, could cause our actual results and performance to differ materially from any projections expressed in or implied by our forward-looking statements. The uncertainties and risks include, but are not limited to:

- |

Cybersecurity and Security: Cybersecurity attacks or breaches, and security vulnerabilities in our infrastructure or services or those of our third-party partners could materially impact our business operations, products and service delivery. |

- Technology and Products: Our technology and products may experience undetected defects, coding, or configuration errors, may not integrate as expected, or may not meet customer expectations.

- |

Ethical Behavior: Our global business exposes us to risks related to unethical behavior and non-compliance with policies by employees, other individuals, partners, third parties or entities associated with SAP. |

- International Laws and Regulations: Laws, regulatory requirements and standards in Germany, the United States, and elsewhere continue to be very stringent. Our international business activities and processes expose us to numerous and often conflicting laws and regulations, policies, standards, or other requirements and sometimes even conflicting regulatory requirements.

- |

Market Share and Profit: Our market share and profit could decline due to increased competition, market consolidation, technological innovation, and new business models in the software industry. |

- Global Economic and Political Environment: Uncertainty in the global economy and/or, financial markets, and social and political instability caused by state-based conflicts, terrorist attacks, civil unrest, war, or international hostilities could lead to disruptions in our business.

- Data Protection and Privacy: Non-compliance with increasingly complex and stringent, sometimes even conflicting, applicable data protection and privacy laws or failure to meet the contractual requirements of SAP’s customers with respect to our products and services could lead to civil liabilities and fines, as well as loss of customers.

- |

Cloud Operations: We may not be able to properly protect and safeguard our critical information and assets, business operations, cloud offerings and portfolio presentation, and related infrastructure against cyberattacks, insufficient infrastructure, disruption or deficient performance |

- Innovation: We might not be able to compete effectively if we strategize our solution portfolio ineffectively or if we are unable to keep up with rapid technological and product innovations, enhancements, new business models, and changing market expectations.

7

- Sales and Services: Sales and implementation of SAP software and services, including cloud, are subject to several significant risks sometimes beyond our direct control.

- |

Mergers and Acquisitions: We might not acquire, integrate ordivest companies effectively or successfully. |

- |

Legal and IP: Claims and lawsuits against us, such as for IP infringements, or our inability to obtain or maintain adequate licenses for third-party technology, or if we are unable to adequately protect or enforce our own intellectual property, may result in adverse outcomes. |

- Partner Ecosystem: If we are unable to scale, maintain, and enhance an effective partner ecosystem, revenue might not increase as expected.

We describe these and other risks and uncertainties in the Risk Factors section.

If one or more of these uncertainties or risks materializes, or if management’s underlying assumptions prove incorrect, our actual results could differ materially from those described in or inferred from our forward-looking statements and information.

The words “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “counting on,” “is confident,” “development,” “estimate,” “expect,” “forecast,” “future trends,” “guidance,” “intend,” “may,” “might,” “outlook,” “plan,” “predict,” “project,” “seek,” “should,” “strategy,” “want,” “will,” “would,” and similar expressions as they relate to us are intended to identify such forward-looking statements. Such statements include, for example, those made in the Operating Results (IFRS) subsection; our quantitative and qualitative disclosures about market risk pursuant to the International Financial Reporting Standards (IFRS) accounting standards, namely IFRS 7 and related statements in our Notes to the Consolidated Financial Statements; Expected Developments and Risk Factors sections; and other forward-looking information appearing in other parts of this report.

To fully consider the factors that could affect our future financial results, both this report and our Annual Report should be considered, as well as all our other filings and furnishings with the U.S. Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date specified or the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information that we receive about conditions that existed upon issuance of this report, future events, or otherwise, unless we are required to do so by law.

This report includes statistical data about the IT industry and global economic trends that comes from information published by sources including International Data Corporation (IDC), McKinsey, the European Central Bank (ECB), and the International Monetary Fund (IMF). This type of data represents only the estimates of IDC, McKinsey, the ECB, the IMF, and other sources of industry data. SAP does not adopt or endorse any of the statistical information provided by sources such as IDC, McKinsey, the ECB, the IMF, or other similar sources that is contained in this report. The data from these sources is subject to risks and uncertainties, and subject to change based on various factors, including those described above, in the Risk Factors section, and elsewhere in this report. These and other factors could cause our results to differ materially from those expressed in the estimates made by third parties and SAP. We caution readers not to place undue reliance on this data.

Performance Management System

In the reporting year, we used various measures to manage our performance on our primary financial objectives, which are growth and profitability, and on our primary non-financial objectives, which are customer loyalty, employee engagement, climate performance, and Women in Executive Roles.

Measures to Manage Our Financial Performance

The following are the key measures we use to manage our operating and overall financial performance. Except for free cash flow, we report our key measures at both actual and constant currencies.

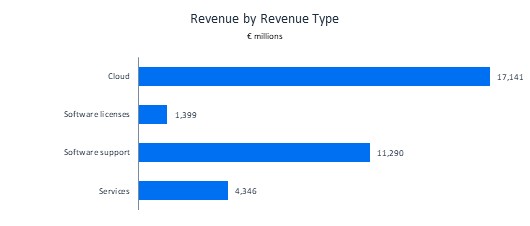

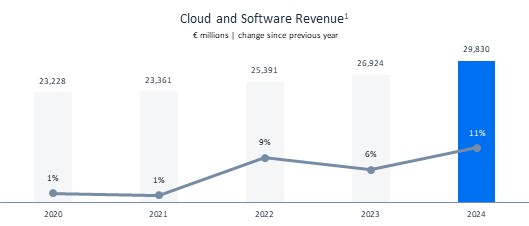

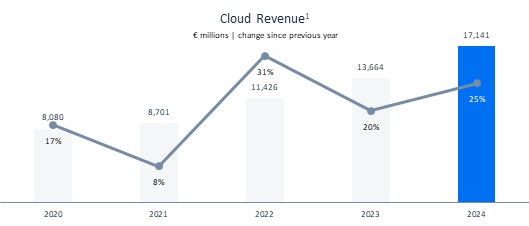

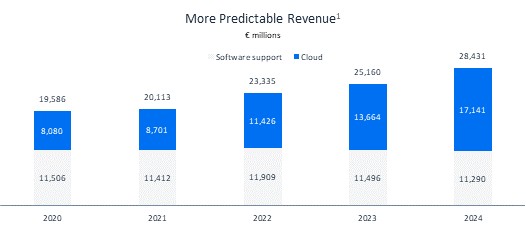

We use cloud revenue, cloud and software revenue, current cloud backlog (CCB), and total revenue to measure our progress toward our growth targets. Cloud revenue comprises the main revenues of our cloud business and is derived from fees earned from providing customers with software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS). Cloud and software revenue includes cloud revenue, software license revenue, and software support revenue. The vast majority of customers who purchase software licenses also enter into related support contracts with us that generate recurring support revenue after the software sale. Cloud revenue is our largest revenue stream, followed by software support revenue. For more information about our revenue measures, see the Notes to the Consolidated Financial Statements 2024, Note (A.1).

As of a specific key date, the CCB is the contractually committed cloud revenue we expect to recognize over the upcoming 12 months. It is therefore a subcomponent of our overall remaining performance obligations, as per IFRS 15.120. For our committed cloud business, we believe the CCB is a valuable indicator of our go-to-market success, as it reflects both new contracts won and existing contracts renewed.

To measure our profitability, we primarily use operating profit (non-IFRS) and free cash flow. Operating profit (non-IFRS) offers insight into our overall operational process efficiency and business performance, while free cash flow provides management with supplemental information for assessing our liquidity needs and position. Free cash flow is used to determine the cash flow remaining after all expenditures required to maintain or expand our organic business have been paid off. In the reporting year, we calculated free cash flow as net cash flows from operating activities adjusted for purchases (other than purchases made in connection with business combinations) of intangible assets and property, plant, and equipment, and for payments of lease liabilities.

8

Besides the key measures mentioned above, SAP also uses various supporting measures to offer further insight into our financial performance. These include Cloud ERP Suite revenue,1 total cloud backlog (TCB),2 share of more predictable revenue,3 cloud gross profit, and effective tax rate (non-IFRS).4 We report most of our supporting measures at both actual and constant currencies.

Measures to Manage Our Non-Financial Performance

The following are the key measures we used to manage our non-financial performance in the reporting year.

We assess customer loyalty annually by means of a survey that tracks our customer net promoter score (NPS). The customer NPS5 is determined based on the “likelihood to recommend” question with its proprietary scoring, expressed on a scale of 0–10. We use this measure because we believe that we can only achieve our financial goals if our customers are loyal to, and satisfied with, SAP and our solutions.

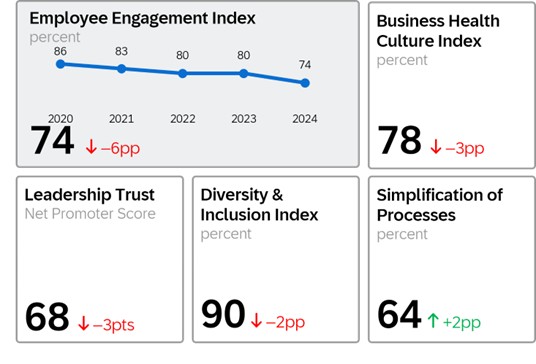

The Employee Engagement Index measures the satisfaction and commitment of our employees, how proud they are of our company, and how strongly they identify with SAP. Applying this measure is recognition that our growth strategy depends on having engaged employees. The index is expressed as a percentage of favorable responses to five questions in our #Unfiltered engagement survey and we report it as the average of the scores retrieved in each of the surveys we run in a fiscal year. The #Unfiltered program is based on a “continuous listening” approach that includes multiple data collections throughout the year. The average scores provide an assessment, for the full year, of our employees’ engagement level.

The Women in Executive Roles (WiER) metric measures the percentage of women in the top three management levels below the Executive Board, namely the Global Executive Level, the Senior Executive Level, and the Executive Level, compared to the total number of individuals across all genders in these levels (calculated in heads).SAP is committed to being an equal opportunity employer, ensuring everyone can thrive based on merit and skill, regardless of their diverse backgrounds. Our priority, with the help of this metric, is to monitor how the Company is progressing on this commitment, especially at the most senior levels of the organization.

The gross greenhouse gas emissions metric is used to measure greenhouse gas emissions along the value chain (Scope 1, Scope 2, and Scope 3 emissions relevant for SAP’s business model) as part of our net-zero commitment. We apply a market-based approach. Renewable energies, for example in the form of self-generated renewable electricity, investments in certified renewable energy certificates, long-term green electricity contracts (power purchase agreements), or renewable electricity purchased by our suppliers and customers can be counted toward the reduction of greenhouse gas emissions. We define, measure, and report our greenhouse gas emissions according to the Greenhouse Gas (GHG) Protocol (in millions of tons of CO2 equivalents). The reporting also fulfills ESRS requirements.

1 We use Cloud ERP Suite revenue as a metric to measure the growth of our portfolio of strategic cloud solutions. Cloud ERP Suite references those offerings that are tightly integrated with our core ERP solutions and are included in key commercial packages, such as RISE with SAP. The following offerings contribute to Cloud ERP Suite revenue: SAP S/4HANA Cloud, SAP Business Technology Platform, and core solutions for HR and payroll, spend management, commerce, customer data solutions, business process transformation, and working capital management.

2 As of a specific key date, the TCB is the total contractually committed cloud revenue we expect to recognize. Thus, TCB and CCB are both subcomponents of our overall remaining performance obligations following IFRS 15.120. For our committed cloud business, we believe that the TCB and the CCB are valuable indicators of our go-to-market success, as they reflect both new contracts won and existing contracts renewed. For more information on how we calculate these numbers, see the Notes to the Consolidated Financial Statements, Note (A.1).

3 The share of more predictable revenue is the total of cloud revenue and software support revenue divided by total revenue.

4 We define our effective tax rate as the ratio of income tax expense (non-IFRS) to profit before tax (non-IFRS), expressed as a percentage.

5 To derive the customer NPS, we start with the percentage of “promoters” of SAP, that is, those giving us a score of 9 or 10 on a scale of 0–10. We then subtract the percentage of “detractors,” that is, those giving us a score of 0–6. The method ignores “passives,” that is, those giving us a score of 7 or 8. Consequently, the range of achievable scores is –100 to +100, with the latter being the best achievable score for customer loyalty as measured by the customer NPS methodology.

9

Value-Based Management

Our holistic view of the performance measures described above, and the associated analyses, together form the foundation of our value-based management. We use planning and control processes to manage the compilation of these key measures and their availability to our decision-makers across various management levels.

SAP’s long-term strategic plans are the point of reference for our short- and medium-term planning and controlling processes. We initially identify future growth and profitability drivers at a highly aggregated level for the entire SAP Group. In a first step, the financial plan’s growth ambition is determined by the Group’s comprehensive product portfolio, which is grouped into solution areas for topline growth, with profitability drivers allocated to functions such as development, marketing, sales, delivery, and administration. In a second step, the planned total revenues and total expenses are generally allocated to the areas of functional responsibility of the individual members of the Executive Board (“Board area”). Budget adjustments may be applied during the year to reflect changes in priorities, to achieve efficiency targets, and to reflect endogenous and exogenous factors. These adjustments, and the assessment of performance, are handled at Board area level. It is then the individual Executive Board member’s responsibility to break down the allocated budget. In a final step, customer-facing revenue targets and cost-of-sales and marketing targets are broken down into sales regions and market units.

We use our detailed annual plans to determine the budget for the respective fiscal year. We also have processes in place to forecast revenue and profit on a quarterly basis, to quantify whether we expect to realize our financial targets, and to identify any deviations from plan. We continuously monitor the affected Board areas in the SAP Group to analyze their developments and define any appropriate actions. Our entire network of planning, control, and reporting processes is implemented in integrated planning and information systems, based on SAP software, across all organizational units so that we can conduct the evaluations and analyses needed to make informed decisions.

Non-IFRS Financial Measures Cited in This Report

Explanation of Non-IFRS Measures

We disclose certain financial measures that are not prepared in accordance with IFRS and are therefore considered non-IFRS financial measures. Our non-IFRS financial measures may not correspond to non-IFRS financial measures that other companies report. The non-IFRS financial measures that we report should only be considered in addition to, and not as substitutes for, nor as superior to, our IFRS financial measures.

We believe that the supplemental historical and prospective non-IFRS financial information we disclose is useful to investors because it is used by our management, in addition to financial data prepared in accordance with IFRS, to gain a more transparent understanding of our past performance and our anticipated future results.

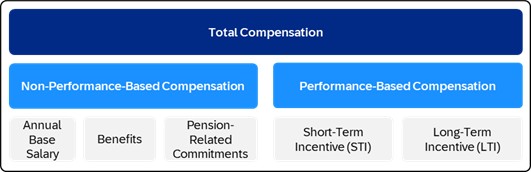

We use the non-IFRS measures consistently in our internal planning and forecasting, reporting, and compensation, as well as in our external communications, as follows:

- Our management primarily uses the non-IFRS measures, rather than the IFRS measures, as the basis for making financial, strategic, and operating decisions.

- |

The variable components of our Executive Board members’ and employees’ remuneration are based on non-IFRS numbers such as operating profit (non-IFRS) and operating margin (non-IFRS) rather than on the respective IFRS measures. An additional variable component used is CCB. |

- The annual budgeting process for all management units is based on operating profit (non-IFRS) numbers rather than the respective IFRS financial measure.

- All forecast and performance reviews with all senior managers globally are based on the non-IFRS measures, rather than the respective IFRS financial measures.

- Our internal performance targets and the guidance we provide to the capital markets are based on profit (non-IFRS) measures rather than the respective IFRS financial measures.

Our non-IFRS financial measures reflect adjustments based on the items below, as well as adjustments for the related income tax effects.

Operating Expense (Non-IFRS)

Numbers that are identified as operating expenses (non-IFRS) have been adjusted by excluding the following expenses:

- Acquisition-related charges

| ■ | Amortization expense/impairment charges for intangibles acquired in business combinations, including goodwill, and certain stand-alone acquisitions of intellectual property (including purchased in-process research and development) |

| ■ | Settlements of preexisting business relationships in connection with a business combination |

| ■ | Acquisition-related third-party expenses |

- Restructuring expenses in accordance with IFRS

- Expenses for regulatory compliance matters associated with the provision for (potential) penalties arising from certain ongoing governmental investigations into our business operations, which are described in the Notes to the Consolidated Financial Statements 2024, Note (G.3), and are limited to the scope of IAS 37.

10

We exclude certain acquisition-related expenses for the purpose of calculating operating profit (non-IFRS) and operating margin (non-IFRS) when evaluating SAP’s continuing operational performance, because these expenses generally cannot be changed or influenced by management after the relevant acquisition other than by disposing of the acquired assets. Since management at levels below the Executive Board does not influence these expenses, we generally do not consider these expenses for the purpose of evaluating the performance of management units. We also exclude restructuring expenses because they are volatile and generally cannot be influenced by management at levels below the Executive Board. Furthermore, we exclude expenses for regulatory compliance matters (as these expenses are non-recurring and relate to conduct that took place in prior performance periods) so that users of our consolidated financial statements and the Combined Management Report can see the information that our management uses to manage the business.

Non-Operating Income, Net (Non-IFRS)

Numbers that are identified as non-operating income, net (non-IFRS) have been adjusted by excluding the following effects:

- Acquisition-related charges

| ■ | Net disposal gains and losses arising from the sale of intangibles acquired in business combinations |

Consistent with the adjustments we make to our operating expenses (non-IFRS) by excluding amortization expenses and impairment charges for intangibles acquired in business combinations, we adjust our non-operating income, net (non-IFRS) by excluding disposal gains and losses arising from the sale of these intangibles. These net disposal gains and losses are not indicative of SAP’s operations. We believe that by excluding these gains and losses we improve our period-over-period comparability.

Financial Income, Net (Non-IFRS)

Numbers that are identified as financial income, net (non-IFRS) have been adjusted by excluding the following gains and losses:

- Gains and losses from equity securities, net

| ■ | Includes realized and unrealized effects from the disposal of equity securities, ongoing mark-to-market adjustments on marketable equity investments, changes in fair value of non-marketable equity securities, and others. |

Excluding gains and losses from equity securities, net, improves the period-over-period comparability by reducing volatility caused by share price fluctuation, market developments, and other factors beyond our control.

Effective Tax Rate (Non-IFRS)

The effective tax rate (non-IFRS) is presented for supplemental informational purposes only. We do not provide an outlook for the effective tax rate (IFRS) due to the uncertainty and potential variability of gains and losses associated with equity investments, which are reconciling items between the two effective tax rates (non-IFRS and IFRS). These items cannot be provided without unreasonable efforts, but they could have a significant impact on our future effective tax rate (IFRS).

Constant Currencies Information

We believe it is important for investors to have information that provides insight into the development of our sales. Revenue measures determined under IFRS provide information that is useful in this regard. However, both sales volume and currency effects impact period-over-period changes in sales revenue. We do not sell standardized units of products and services so we cannot provide relevant information on sales volume by providing data on the changes in product and service units sold. To provide additional information that may be useful to investors in breaking down and evaluating changes in sales volume, we present information about our revenue and about various values and components relating to operating profit that are adjusted for foreign currency effects. We calculate constant currency measures by translating foreign currencies using the average exchange rates from the comparative period instead of the current period. Constant currency values for our current cloud backlog and total cloud backlog measures use the closing exchange rate from the previous year’s corresponding key date instead of the average exchange rate.

Free Cash Flow

Among other measures, we use free cash flow to manage our overall financial performance. We define free cash flow as net cash from operating activities adjusted for purchases of intangible assets and property, plant, and equipment, and for payments of lease liabilities.

11

Starting in 2025, our definition of free cash flow will be updated to include proceeds from the sale of intangible assets and property, plant, and equipment, which better reflects the way our management evaluates the remaining cash flow generated by our operating activities after investments into long-term assets and leasing. Further impacting our free cash flow, starting 2025, we will no longer include interest paid and interest received in net cash flows from operating activities. Interest paid will be presented under cash flows from financing activities, and interest received under cash flows from investing activities. Had these changes been applied in the reporting year, SAP’s free cash flow would have been €4,222 million (2023: €5,116 million)6.

Usefulness of Non-IFRS Measures

We believe that our non-IFRS measures are useful to investors for the following reasons:

- Our non-IFRS measures provide investors with insight into management’s decision-making because management uses these measures to run our business and make financial, strategic, and operating decisions. We exclude the expense adjustments outlined above when making decisions to allocate resources. In addition, we use these non-IFRS measures to facilitate comparisons of SAP’s operating performance from period to period.

- The non-IFRS measures provide investors with additional information that enables a comparison of year-over-year operating and non-operating performance by excluding certain direct effects of acquisitions, restructuring plans, regulatory compliance matters, and gains and losses from equity securities, net.

- Non-IFRS and non-GAAP (Generally Accepted Accounting Principles) measures are widely used in the software industry. In many cases, our non-IFRS measures may facilitate comparisons with our competitors’ corresponding non-IFRS and non-GAAP measures.

Limitations of Non-IFRS Measures

Without being analyzed in conjunction with the corresponding IFRS measures, the non-IFRS measures are not indicative of our present and future performance primarily for the following reasons:

| - | While our profit (non-IFRS) numbers reflect the elimination of certain acquisition-related expenses, no eliminations are made for the additional revenue or other income that results from the acquisitions. |

| - | The acquisition-related amortization expense that we eliminate in deriving our profit (non-IFRS) numbers is a recurring expense that will impact our financial performance in future years. |

| - | The remaining acquisition-related charges that we eliminate in deriving our profit (non-IFRS) numbers are likely to recur if SAP enters into business combinations in the future. Similarly, the restructuring expenses that we eliminate in deriving our profit (non-IFRS) numbers are likely to recur if SAP performs restructurings in the future. |

| - | The expense adjustment for acquisition-related charges does not arise from a common conceptual basis. This is because the expense adjustment aims to improve comparability between post-acquisition periods and pre-acquisition periods. This should particularly be considered when evaluating our operating profit (non-IFRS) and operating margin (non-IFRS) numbers, as these combine our revenue and expenses (non-IFRS) despite the absence of a common conceptual basis. |

| - | Our restructuring charges and the realized net gains from equity securities resulted in significant cash outflows in the past and could do so in the future. |

| - | Expenses ascribed to regulatory compliance matters may include penalties and legal costs, all of which would impact the operating cash flows of the business. |

| - | The gains and losses from equity securities, net, that we eliminate in deriving our financial income, net (non-IFRS) numbers are recurring effects that have impacted our financial performance in the past and will do so in the future. Similarly, the acquisition-related effects related to the sale of intangibles arising from business combinations that we eliminate in deriving our non-operating income, net (non-IFRS) have impacted our financial performance in the past and could do so in the future. |

We believe that constant currency measures have limitations, particularly as the currency effects that are eliminated constitute a significant element of our revenue and expenses and could materially impact our performance.We therefore limit our use of constant currency measures to the analysis of changes in volume as one element of the full change in a financial measure. We do not evaluate our results and performance without considering operating profit (non-IFRS) at both nominal and constant currencies on the one hand, and changes in operating expenses, operating profit, or other measures of financial performance prepared in accordance with IFRS on the other. We caution the readers of our financial reports to follow a similar approach by considering actual and constant currency non-IFRS measures only in addition to, and not as a substitute for,nor as superior to, changes in revenue, operating expenses, operating profit, or other measures of financial performance prepared in accordance with IFRS.

Despite these limitations, we believe that the presentation of our non-IFRS measures and the corresponding IFRS measures, together with the relevant reconciliations, provides useful information to management and investors about present and future business trends relating to our financial condition and results of operations.

6 In the reporting year, free cash flow was €4,113 million (2023: €5,093 million). Under our revised definition, which applies from 2025, free cash flow would have been €4,222 million (2023: €5,116 million). The revised definition excludes the net impact of interest paid and received (2024: €13 million, 2023: €76 million) and includes the proceeds from the sale of intangible assets and property, plant, and equipment (2024: €122 million, 2023: €99 million).

12

Reconciliation of IFRS to Non-IFRS Financial Measures for 2024 and 2023

Reconciliation of Non-IFRS Revenue

€ millions, unless otherwise stated |

|

2024 |

|

2023 |

||||

|

|

IFRS |

|

Currency |

|

Non-IFRS |

|

IFRS |

|

|

|

|

Impact |

|

Constant |

|

|

|

|

|

|

|

|

Currency |

|

|

Revenue Numbers |

|

|

|

|

|

|

|

|

Cloud |

|

17,141 |

|

72 |

|

17,212 |

|

13,664 |

Software licenses |

|

1,399 |

|

1 |

|

1,400 |

|

1,764 |

Software support |

|

11,290 |

|

53 |

|

11,343 |

|

11,496 |

Software licenses and support |

|

12,689 |

|

54 |

|

12,743 |

|

13,261 |

Cloud and software |

|

29,830 |

|

126 |

|

29,955 |

|

26,924 |

Services |

|

4,346 |

|

9 |

|

4,355 |

|

4,283 |

Total revenue |

|

34,176 |

|

135 |

|

34,310 |

|

31,207 |

Reconciliation of Non-IFRS Operating Expenses

€ millions, unless otherwise stated |

|

2024 |

|

2023 |

||||||||||||

|

|

IFRS |

|

Adj. |

|

Non-IFRS |

|

Currency |

|

Non-IFRS |

|

IFRS |

|

Adj. |

|

Non-IFRS |

|

|

|

|

|

|

|

|

Impact |

|

Constant |

|

|

|

|

|

|

Operating Expense Numbers |

|

|

|

|

|

|

|

|

|

Currency |

|

|

|

|

|

|

Cost of cloud |

|

-4,660 |

|

78 |

|

-4,582 |

|

|

|

|

|

-3,884 |

|

42 |

|

-3,842 |

Cost of software licenses and support |

|

-1,262 |

|

0 |

|

-1,262 |

|

|

|

|

|

-1,383 |

|

26 |

|

-1,356 |

Cost of cloud and software |

|

-5,922 |

|

78 |

|

-5,844 |

|

|

|

|

|

-5,267 |

|

68 |

|

-5,199 |

Cost of services |

|

-3,321 |

|

1 |

|

-3,321 |

|

|

|

|

|

-3,407 |

|

2 |

|

-3,405 |

Total cost of revenue |

|

-9,243 |

|

79 |

|

-9,165 |

|

|

|

|

|

-8,674 |

|

70 |

|

-8,604 |

Gross profit |

|

24,932 |

|

79 |

|

25,011 |

|

112 |

|

25,124 |

|

22,534 |

|

70 |

|

22,603 |

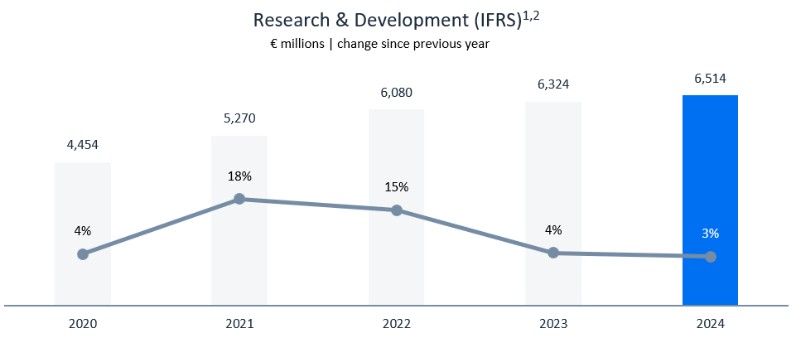

Research and development |

|

-6,514 |

|

5 |

|

-6,508 |

|

|

|

|

|

-6,324 |

|

7 |

|

-6,316 |

Sales and marketing |

|

-9,090 |

|

234 |

|

-8,856 |

|

|

|

|

|

-8,828 |

|

412 |

|

-8,415 |

General and administration |

|

-1,435 |

|

27 |

|

-1,409 |

|

|

|

|

|

-1,364 |

|

11 |

|

-1,354 |

Restructuring |

|

-3,144 |

|

3,144 |

|

0 |

|

|

|

|

|

-215 |

|

215 |

|

0 |

Other operating income/expense, net |

|

-85 |

|

0 |

|

-85 |

|

|

|

|

|

-4 |

|

0 |

|

-4 |

Total operating expenses |

|

-29,511 |

|

3,489 |

|

-26,022 |

|

-56 |

|

-26,079 |

|

-25,408 |

|

715 |

|

-24,693 |

13

Reconciliation of Non-IFRS Profit Numbers, Income Tax Expense, and Key Ratios

€ millions, unless otherwise stated |

|

2024 |

|

2023 |

||||||||||||

|

|

IFRS |

|

Adj. |

|

Non-IFRS |

|

Currency |

|

Non-IFRS |

|

IFRS |

|

Adj. |

|

Non-IFRS |

|

|

|

|

|

|

|

|

Impact |

|

Constant |

|

|

|

|

|

|

Profit Numbers |

|

|

|

|

|

|

|

|

|

Currency |

|

|

|

|

|

|

Operating profit (loss) |

|

4,665 |

|

3,489 |

|

8,153 |

|

78 |

|

8,232 |

|

5,799 |

|

715 |

|

6,514 |

Other non-operating income/expense, net |

|

-298 |

|

0 |

|

-298 |

|

|

|

|

|

-3 |

|

0 |

|

-3 |

Finance income |

|

1,429 |

|

-777 |

|

652 |

|

|

|

|

|

857 |

|

-380 |

|

477 |

Finance costs |

|

-1,031 |

|

316 |

|

-715 |

|

|

|

|

|

-1,313 |

|

525 |

|

-788 |

Financial income, net |

|

398 |

|

-461 |

|

-63 |

|

|

|

|

|

-456 |

|

145 |

|

-311 |

Profit (loss) before tax from continuing operations |

|

4,764 |

|

3,028 |

|

7,792 |

|

|

|

|

|

5,341 |

|

860 |

|

6,201 |

Income tax expense |

|

-1,614 |

|

-899 |

|

-2,513 |

|

|

|

|

|

-1,741 |

|

-139 |

|

-1,880 |

Profit (loss) after tax from continuing operations |

|

3,150 |

|

2,129 |

|

5,279 |

|

|

|

|

|

3,600 |

|

721 |

|

4,321 |

Attributable to owners of parent |

|

3,124 |

|

2,162 |

|

5,286 |

|

|

|

|

|

3,634 |

|

704 |

|

4,338 |

Attributable to non-controlling interests |

|

26 |

|

-33 |

|

-7 |

|

|

|

|

|

-33 |

|

16 |

|

-17 |

Profit (loss) after tax1 |

|

3,150 |

|

2,129 |

|

5,279 |

|

|

|

|

|

5,964 |

|

139 |

|

6,103 |

Attributable to owners of parent1 |

|

3,124 |

|

2,162 |

|

5,286 |

|

|

|

|

|

6,139 |

|

297 |

|

6,436 |

Attributable to non-controlling interests1 |

|

26 |

|

-33 |

|

-7 |

|

|

|

|

|

-175 |

|

-158 |

|

-333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

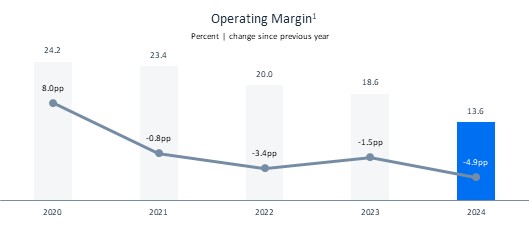

Operating margin (in %) |

|

13.6 |

|

|

|

23.9 |

|

|

|

24.0 |

|

18.6 |

|

|

|

20.9 |

Effective tax rate (in %) |

|

33.9 |

|

|

|

32.3 |

|

|

|

|

|

32.6 |

|

|

|

30.3 |

Earnings per share, basic (in €) from continuing operations |

|

2.68 |

|

|

|

4.53 |

|

|

|

|

|

3.11 |

|

|

|

3.72 |

Earnings per share, basic (in €)1 |

|

2.68 |

|

|

|

4.53 |

|

|

|

|

|

5.26 |

|

|

|

5.51 |

1 From continuing and discontinued operations.

Reconciliation of Operating Cash Flow from Continuing Operations to Free Cash Flow

€ millions |

|

2024 |

|

2023 |

Net cash flows from operating activities – continuing operations |

|

5,220 |

|

6,210 |

Purchase of intangible assets and property, plant, and equipment |

|

-797 |

|

-785 |

Payments of lease liabilities |

|

-310 |

|

-332 |

Free cash flow |

|

4,113 |

|

5,093 |

|

|

|

|

|

Net cash flows from investing activities – continuing operations |

|

-656 |

|

-4,603 |

Net cash flows from financing activities – continuing operations |

|

-3,412 |

|

-7,758 |

Non-IFRS Operating Expense Adjustments by Functional Areas

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

€ millions |

|

2024 |

|

2023 |

||||||||||||||||

|

|

IFRS |

|

Acquisition- |

|

Restructuring |

|

RCM1 |

|

Non-IFRS |

|

IFRS |

|

Acquisition- |

|

Restructuring |

|

RCM1 |

|

Non-IFRS |

|

|

|

|

Related |

|

|

|

|

|

|

|

|

|

Related |

|

|

|

|

|

|

Cost of cloud |

|

-4,660 |

|

78 |

|

0 |

|

0 |

|

-4,582 |

|

-3,884 |

|

42 |

|

0 |

|

0 |

|

-3,842 |

Cost of software licenses and support |

|

-1,262 |

|

0 |

|

0 |

|

0 |

|

-1,262 |

|

-1,383 |

|

26 |

|

0 |

|

0 |

|

-1,356 |

Cost of services |

|

-3,321 |

|

1 |

|

0 |

|

0 |

|

-3,321 |

|

-3,407 |

|

2 |

|

0 |

|

0 |

|

-3,405 |

Research and development |

|

-6,514 |

|

5 |

|

0 |

|

0 |

|

-6,508 |

|

-6,324 |

|

7 |

|

0 |

|

0 |

|

-6,316 |

Sales and marketing |

|

-9,090 |

|

255 |

|

0 |

|

-22 |

|

-8,856 |

|

-8,828 |

|

257 |

|

0 |

|

155 |

|

-8,415 |

General and administration |

|

-1,435 |

|

16 |

|

0 |

|

11 |

|

-1,409 |

|

-1,364 |

|

11 |

|

0 |

|

0 |

|

-1,354 |

Restructuring |

|

-3,144 |

|

0 |

|

3,144 |

|

0 |

|

0 |

|

-215 |

|

0 |

|

215 |

|

0 |

|

0 |

Other operating income/expense, net |

|

-85 |

|

0 |

|

0 |

|

0 |

|

-85 |

|

-4 |

|

0 |

|

0 |

|

0 |

|

-4 |

Total operating expenses |

|

-29,511 |

|

356 |

|

3,144 |

|

-11 |

|

-26,022 |

|

-25,408 |

|

345 |

|

215 |

|

155 |

|

-24,693 |

1 Regulatory compliance matters.

14

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Exchange Rates

The sales prices for our ordinary shares traded on German stock exchanges are denominated in euro. Fluctuations in the exchange rate between the euro and the U.S. dollar affect the dollar equivalent of the euro price of the ordinary shares traded on the German stock exchanges and, as a result, may affect the price of the ADRs traded on the New York Stock Exchange (NYSE) in the United States. See “Item 9. The Offer and Listing” for a description of the ADRs. In addition, SAP SE pays cash dividends, if any, in euro. As a result, any exchange rate fluctuations will also affect the dollar amounts received by the holders of ADRs on the conversion into dollars of cash dividends paid in euro on the ordinary shares represented by the ADRs. Deutsche Bank Trust Company Americas is the depositary (the Depositary) for SAP SE’s ADR program. The deposit agreement with respect to the ADRs requires the Depositary to convert any dividend payments from euro into dollars as promptly as practicable upon receipt. For additional information on the Depositary and the fees associated with SAP’s ADR program see “Item 12. Description of Securities Other Than Equity Securities — American Depositary Shares.”

For details on the impact of exchange rate fluctuations see “Item 5. Operating and Financial Review and Prospects — Foreign Currency Exchange Rate Exposure”.

Dividends

Dividend Distribution Policy

Dividends are jointly proposed by SAP SE’s Supervisory Board (Aufsichtsrat) and Executive Board (Vorstand) based on SAP SE’s year-end stand-alone statutory financial statements, subject to approval by the Annual General Meeting of Shareholders. Dividends are officially declared for the prior year at SAP SE’s Annual General Meeting of Shareholders. SAP SE’s Annual General Meeting of Shareholders usually convenes during the second quarter of each year. Following joint market standards in Europe for corporate actions processing, dividends are remitted to the custodian bank on behalf of the shareholders on the third business day following the Annual General Meeting of Shareholders. Record holders of the ADRs on the dividend record date will be entitled to receive payment of the dividend declared in respect of the year for which it is declared. Cash dividends payable to such holders will be paid to the Depositary in euro and, subject to certain exceptions, will be converted by the Depositary into U.S. dollars.

Dividends paid to holders of the ADRs may be subject to German withholding tax. See “Item 10. Additional Information — Taxation,” for further information.

15

Annual Dividends Paid and Proposed

The following table sets forth in euro the annual dividends paid or proposed to be paid per ordinary share in respect of each of the years indicated. One SAP ADR currently represents one SAP SE ordinary share. Accordingly, the final dividend per ADR is equal to the dividend for one SAP SE ordinary share and is dependent on the euro/U.S. dollar exchange rate. The table does not reflect tax credits that may be available to German taxpayers who receive dividend payments. If you own our ordinary shares or ADRs and if you are a U.S. resident, refer to “Item 10. Additional Information — Taxation,” for further information.

|

|

Dividend Paid per Ordinary Share |

|

||

Year Ended December 31, |

|

€ |

|

US$ |

|

2020 |

|

1.85 |

|

2.26 |

1 |

2021 |

|

2.45 |

4 |

2.61 |

1 |

2022 |

|

2.05 |

|

2.23 |

1 |

2023 |

|

2.20 |

|

2.37 |

1 |

2024 (proposed) |

|

2.35 |

2 |

2.43 |

2, 3 |

1 Translated for the convenience of the reader from euro into U.S. dollars at the Noon Buying Rate for converting euro into U.S. dollars on the dividend payment date. The Depositary is required to convert any dividend payments received from SAP as promptly as practicable upon receipt.

2 Subject to approval at the Annual General Meeting of Shareholders of SAP SE currently scheduled to be held on May 13, 2025.

3 Translated for the convenience of the reader from euro into U.S. dollars at the Noon Buying Rate for converting euro into U.S. dollars on February 7, 2025 of US$1.03 per €1.00. The dividend paid may differ due to changes in the exchange rate.

4 Includes special increase of €0.50 to celebrate SAP's 50th anniversary.

The amount of dividends paid on the ordinary shares depends on the amount of non - IFRS profits to be distributed by SAP SE, which depends in part upon our financial performance. The Executive Board and the Supervisory Board of SAP SE will recommend to the Annual General Meeting of Shareholders in May 2025 that the total dividend be €2,35 per share. In addition, the amount of dividends received by holders of ADRs may be affected by fluctuations in exchange rates (see “Item 3. Key Information — Exchange Rates”). The timing, declaration, amount and payment of any future dividend will depend upon our future earnings, capital needs and other relevant factors, in each case as proposed by the Executive Board and the Supervisory Board of SAP SE and approved by the Annual General Meeting of Shareholders.

16

Risk Factors

Our operations and financial results are subject to various risks and uncertainties, including those described below, that could adversely affect our business, financial condition, results of operations, cash flows, and the trading price of our ADRs and ordinary shares.

Economic, Political, Social, and Regulatory Risks

Global Economic and Political Environment: Uncertainty in the global economy and/or financial markets, and social and political instability caused by state-based conflicts, terrorist attacks, civil unrest, war, or international hostilities could lead to disruptions in our business.

As a global company, we are influenced by multiple external factors that are difficult to predict, may develop quickly, and are beyond our influence and control. These include, among others: crises affecting credit or liquidity markets; regional or global recessions; sharp fluctuations in commodity prices, currency exchange rates or interest rates; inflation or deflation; sovereign debt and bank debt rating downgrades; restructurings or defaults; adverse geopolitical events (such as Russia’s invasion of Ukraine and the Israel - Hamas conflict); rising military tensions around the world (such as the China-Taiwan tensions) and in particular within Europe’s borders; global policy including in the United States, the European Union (EU), Russia, and China; and global pandemic diseases such as COVID-19.

Any of these events could have an adverse effect on our reputation, business, competitive or financial position, profit, and cash flows.

International Laws and Regulations: Laws, regulatory requirements and standards in Germany, the United States, and elsewhere continue to be very stringent. Our international business activities and processes expose us to numerous and often conflicting laws and regulations, policies, standards, or other requirements, and sometimes even conflicting regulatory requirements.

The SAP Group has a global presence and operates in most countries of the world. As a European company domiciled in Germany with securities listed in Germany and the United States, we are subject to European, German, U.S., and other governance-related regulatory requirements of the countries we operate in.

Our business is subject to numerous risks inherent to international business operations and associated consequences, such as changes in tax laws, changes in external reporting standards, and the interpretation of the complex tax rules in certain countries, including but not limited to conflict and overlap among tax regimes as well as the introduction of new tax concepts that harm digitalized business models; discriminatory, protectionist, or conflicting fiscal policies and tax laws; import and export regulations and trade sanctions; counter or even conflicting sanctions; embargoes, including but not limited to country-specific software certification requirements; and newly emerging cybersecurity and environmental, social, and governance (ESG) compliance and disclosure laws.

As we expand into new countries and markets or extend our business activities in these markets, including emerging and high-risk markets, these risks could intensify. The application of the respective local laws and regulations to our business is sometimes unclear, subject to change over time, and often conflicting among jurisdictions. Additionally, these laws and government approaches to enforcement continue to change and evolve, just as our products and services continually evolve. Compliance with these varying laws and regulations (including, and in particular, global anti-trust regulations) could involve significant costs or require changes in our products or business practices. Non-compliance could result in the imposition of penalties or cessation of orders due to alleged non-compliant activity. Governmental authorities could use considerable discretion in applying these statutes and any imposition of sanctions against us could be material.

Any of these events could have a material adverse effect on our operations globally or in one or more countries or regions, which could have a material adverse effect on our business, financial position, profit, and cash flows.

Legal and IP: Claims and lawsuits against us, such as for IP infringements or breaches of contract, or our inability to obtain or maintain adequate licenses for third-party technology, or if we are unable to protect or enforce our own intellectual property, may result in adverse outcomes.

We have in the past, and believe that we will continue to be subject to, claims and lawsuits, including intellectual property infringement claims, as our solution portfolio grows; as we acquire companies with increased use of third-party code including open source code; as we expand into new industries with our offerings, resulting in greater overlap in the functional scope of offerings; and as non-practicing entities that do not design, manufacture, or distribute products assert intellectual property infringement claims.

Moreover, protecting and defending our intellectual property is crucial to our success. The outcome of litigation and other claims or lawsuits is intrinsically uncertain.

17

We are subject to risks and associated consequences in the following areas, among others: dependency in the aggregate on third-party technology, including cloud and Web services, that we embed in our products or that we resell to our customers; integration of open source software components from third parties into our software and the implications derived from it; inability to prevent third parties from obtaining, using, or selling without authorization what we regard as our proprietary technology and information; and the possibility that third parties might reverse-engineer or otherwise obtain and use technology and information that we regard as proprietary. Moreover, the laws and courts of certain countries might not offer effective means to enforce our legal or intellectual property rights. Finally, SAP might face significant adverse rulings in commercial disputes, or might not be able to collect or otherwise enforce all judgments awarded to it in legal proceedings. The outcome of litigation and other claims or lawsuits is intrinsically uncertain. Management’s view of the litigation might also change in the future. Actual outcomes of litigation and other claims or lawsuits could differ from the assessments made by management in prior periods, which are the basis for our accounting for these litigations and claims under IFRS.

Any of these events could have a material adverse effect on our reputation, business, competitive or financial position, profit, or cash flows.

Data Protection and Privacy: Non-compliance with increasingly complex and stringent, sometimes even conflicting, applicable data protection and privacy laws, or failure to meet the contractual requirements of SAP’s customers with respect to our products and services, could lead to civil liabilities and fines, as well as loss of customers.

As a global software and service provider, SAP is required to comply with local laws wherever it does business. One of the relevant European data protection laws is the General Data Protection Regulation. International data transfers to third countries that do not provide for an adequate level of data protection require additional safeguards, including transfer risk assessments, to justify a transfer from the EU to a third country under the new EU standard contractual clauses. In addition, other countries establish safeguards to justify data transfers to further countries, by implementing their own standard contractual clauses.

Furthermore, data protection and privacy laws, regulations, and other standards around the world are evolving to better protect individuals’ personal information when it comes to marketing activities and to tracking online behavior. Examples include the EU’s Data Act, Digital Services Act, AI Act, and e-Privacy Directive, the Turkish Personal Data Protection Law, China’s Personal Information Protection Law, and Saudi Arabia’s Personal Data Protection Law, which also imposes requirements regarding data localization. This may impose additional burdens for SAP due to increasing compliance standards that could restrict the use and adoption of SAP’s products and services (particularly cloud services) and make it more challenging and complex to meet customer expectations. These changing criteria also impact the compliant use of new technology, such as machine learning and Artificial Intelligence for product development and deployment of intelligent applications.

Non-compliance with applicable data protection and privacy laws by SAP or any of the subprocessors engaged by SAP while processing personal data could lead to risks. These include, among others: mandatory disclosure of breaches to affected individuals, customers, and data protection supervisory authorities; investigations and administrative measures by data protection supervisory authorities, such as the instruction to alter or stop non-compliant data processing activities, including the instruction to stop using non-compliant subprocessors; or the possibility of damage claims by customers and individuals, contract terminations, and potential fines.

In addition, the German Federal Office for the Protection of the Constitution and security industry experts continue to warn of risks related to a globally growing number of cybersecurity attacks aimed at obtaining or violating company data including personal data.

Any of these events could have a material adverse effect on our reputation, business, financial performance, competitive or financial position, revenue, profit, and cash flows.

Corporate Governance and Compliance Risks

Ethical Behavior: Our global business exposes us to risks related to unethical behavior and non-compliance with policies by employees, other individuals, partners, third parties, or entities associated with SAP.

SAP’s leadership position in the global market is founded on the long-term and sustainable trust of our stakeholders worldwide. Our overarching approach is one of corporate transparency, open communication with financial markets, regulators, and authorities, and adherence to recognized standards of business integrity. This commitment to recognized standards of business integrity is formalized in SAP’s Global Code of Ethical Business Conduct (CoEBC) and supporting guidelines.

We are subject to risks and associated consequences in the following areas, among others: non-compliance with our policies; violation of compliance-related rules, regulations, and legal requirements including, but not limited to, antitrust, anticorruption, and antibribery legislation in Germany, the U.S. Foreign Corrupt Practices Act, the UK Bribery Act, and other applicable laws; collusion with external third parties; fraud and corruption; public sector transactions in territories exposed to a high risk of corruption; or increased exposure and impact on business activities in highly regulated industries, all of which may lead to civil or criminal charges, fines, or claims by affected parties as well as reputational damage.

In recent years, SAP’s Office of Ethics & Compliance (OEC), together with the assistance of an external law firm, investigated non-compliance with SAP’s policies and procedures or applicable laws. These investigations culminated in January 2024 in settlement agreements with the U.S. Securities and Exchange Commission (U.S. SEC) and the U.S. Department of Justice (U.S. DOJ), as well as with authorities in South Africa. During the investigations, SAP fully cooperated with law enforcement authorities and took immediate steps to discipline the employees involved, including terminating the employment of all those implicated in potential law violations. Since these allegations were first made, SAP has also significantly strengthened its compliance program and related internal controls in accordance with DOJ and regulatory expectations and requirements. Separately, in December 2024, SAP’s Brazilian subsidiary reached a settlement with the Office of the Comptroller General of the State of Minas Gerais (CGE) and the State of Minas Gerais Public Prosecutor’s Office (MPMG) in Brazil. SAP fully cooperated with the CGE and MPMG, applied appropriate consequence management, and enhanced its compliance program.

18

Any of these events could have a material adverse effect on our reputation, business, competitive or financial position, profit, or cash flows.

Operational Business Risks

Sales and Services: Sales and implementation of SAP software and services, including cloud, are subject to several significant risks sometimes beyond our direct control.

A core element of our business is the successful implementation of software and service solutions. The implementation of SAP software and cloud-based service deliveries is led by SAP, by partners, by customers, or by a combination thereof.

We are subject to risks and associated consequences in the following areas, among others: implementation risks caused by insufficient or incorrect information provided by customers, insufficient customer expectation management, including scope, integration capabilities and aspects, and a lack of purposeful selection, implementation, or utilization of SAP solutions; a lack of customer commitments and respective engagements; challenges to achieve a seamlessly integrated, sufficiently automated and aligned service delivery; unrenderable services committed during the sales stage; inadequate contracting and consumption models based on subscription models for services, support, and application management; deviations from standard terms and conditions; or statements concerning solution developments that might be misperceived by customers as commitments on future software functionalities.

Any of these events could have an adverse effect on our reputation, business, competitive or financial position, profit, and cash flows.

Partner Ecosystem: If we are unable to scale, maintain, and enhance an effective partner ecosystem, revenue might not increase as expected.

An open and vibrant partner ecosystem is a fundamental pillar of our success and growth strategy. We have entered into partnership agreements that drive co-innovation on our platforms, profitably expand our routes to market to optimize market coverage, optimize cloud delivery, and provide high-quality services capacity in all market segments. Partners play a key role in driving market adoption of our entire solutions portfolio, by co-innovating on our platforms, embedding our technology, and reselling or implementing our software.

We are subject to risks and associated consequences in the following areas, among others: failure to establish and enable a network of qualified and fully committed partners; failure of partners to develop sufficient innovative solutions and content on our platforms or to provide high-quality products or services to meet customer expectations; failure of partners to embed our solutions sufficiently enough to profitably drive product adoption; failure of partners to adhere to applicable legal and compliance regulations; failure of partners to transform their business model in accordance with the transformation of SAP’s business model in a timely manner; and failure of partners to comply with contract terms in embargoed or high-risk countries.

If any of these risks materialize, this might adversely affect the demand for our products and services as well as the partner’s loyalty and ability to deliver. As a result, we might not be able to scale our business to compete successfully with other vendors, which could have an adverse effect on our reputation, business, competitive or financial position, profit, and cash flows.

Cloud Operations: We may not be able to properly protect and safeguard our critical information and assets, business operations, cloud offerings and portfolio presentation, and related infrastructure against cyberattacks, insufficient infrastructure, disruption, or deficient performance.