UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 8, 2025

Global Net Lease, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 001-37390 | 45-2771978 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 650 Fifth Avenue, 30th Floor | |

| New York, New York | 10019 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (332) 265-2020

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange

on which registered |

||

| Common Stock, $0.01 par value per share | GNL | New York Stock Exchange | ||

| 7.25% Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share | GNL PR A | New York Stock Exchange | ||

| 6.875% Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share | GNL PR B | New York Stock Exchange | ||

| 7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share | GNL PR D | New York Stock Exchange | ||

| 7.375% Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share | GNL PR E | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

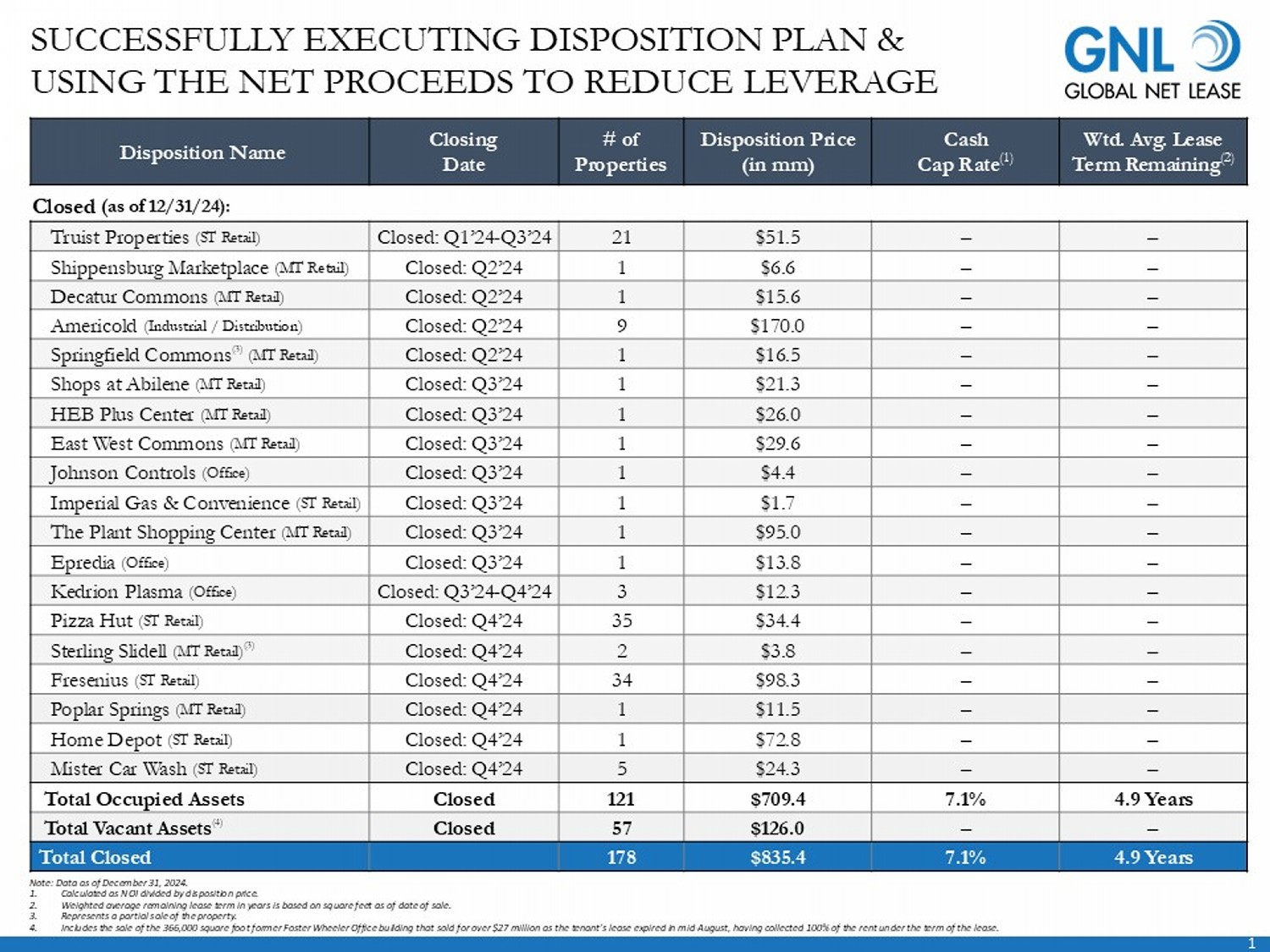

On January 8, 2025, Global Net Lease, Inc. (the “Company”) issued a press release announcing closed transactions on its 2024 strategic disposition plan through December 31, 2024 and prepared a slide covering such progress. The Company plans to post the slide on its website and the Company’s officers and other representatives intend to present such slide at upcoming meetings with investors. Copies of the press release and the slide are furnished as Exhibits 99.1 and 99.2, respectively, of this Current Report on Form 8-K. The information set forth in Item 7.01 of this Current Report on Form 8-K and in the attached Exhibits 99.1 and 99.2 are deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

The statements in this Current Report on Form 8-K that are not historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that could cause the outcome to be materially different. The words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,” “projects,” “potential,” “predicts,” “plans,” “intends,” “would,” “could,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated with realization of the anticipated benefits of the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property management and advisory functions; that any potential future acquisition or disposition by the Company is subject to market conditions, capital availability and timing considerations and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although not all risks and uncertainties, that could cause the Company’s actual results to differ materially from those presented in its forward-looking statements are set forth in the “Risk Factors” and “Quantitative and Qualitative Disclosures About Market Risk” sections in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and all of its other filings with the U.S. Securities and Exchange Commission, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number |

Description | |

| 99.1 | Press Release dated January 8, 2025. | |

| 99.2 | Disposition Plan Slide. | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| GLOBAL NET LEASE, INC. | |||

| Date: | January 8, 2025 | By: | /s/ Edward M. Weil, Jr. |

| Name: | Edward M. Weil, Jr. | ||

| Title: | Chief Executive Officer and President (Principal Executive Officer) |

Exhibit 99.1

GLOBAL NET LEASE ANNOUNCES $835 MILLION OF CLOSED DISPOSITIONS IN 2024

Closed Dispositions Completed at a 7.1% Cash Cap Rate

Exceeded High-End of $650 Million to $800 Million Disposition Guidance

NEW YORK – January 8, 2025 – Global Net Lease, Inc. (NYSE: GNL) (“GNL” or the “Company”) today announced that closed transactions as part of its 2024 strategic disposition initiative totaled $835 million through December 31, 2024.

“We are pleased with the successful execution of our 2024 strategic disposition plan, through which we reduced our outstanding debt and lowered our Net Debt to Adjusted EBITDA by selling certain non-core assets with near-term debt or lease maturities,” said Michael Weil, CEO of GNL. “The sale of an aggregate of $835 million of assets at a 7.1% cash cap rate exceeded the upper end of our increased disposition guidance and reached the high end of our targeted cap rate range. As a result, we not only reinforced our financial position and enhanced our balance sheet, but also demonstrated our ongoing commitment to providing value to our shareholders. We remain focused on delivering strong results and positioning GNL for continued growth.”

GNL has furnished slides detailing the progress of its 2024 strategic disposition plan as an exhibit to its Current Report on Form 8-K submitted with the Securities and Exchange Commission on the date hereof.

About Global Net Lease, Inc.

Global Net Lease, Inc. is a publicly traded real estate investment trust listed on the NYSE, which focuses on acquiring and managing a global portfolio of income producing net lease assets across the United States, and Western and Northern Europe. Additional information about GNL can be found on its website at www.globalnetlease.com.

Important Notice

The statements in this press release that are not historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that could cause the outcome to be materially different. The words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,” “projects,” “potential,” “predicts,” “plans,” “intends,” “would,” “could,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated with realization of the anticipated benefits of the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property management and advisory functions; that any potential future acquisition or disposition by the Company is subject to market conditions, capital availability and timing considerations and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although not all risks and uncertainties, that could cause the Company’s actual results to differ materially from those presented in its forward-looking statements are set forth in the “Risk Factors” and “Quantitative and Qualitative Disclosures about Market Risk” sections in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and all of its other filings with the U.S. Securities and Exchange Commission, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

Contacts:

Investor Relations

Email: investorrelations@globalnetlease.com

Phone: (332) 265-2020

Exhibit 99.2

0 SUCCESSFULLY EXECUTING DISPOSITION PLAN & USING THE NET PROCEEDS TO REDUCE LEVERAGE Wtd . Avg. Lease Term Remaining (2) Cash Cap Rate (1) Disposition Price (in mm) # of Properties Closing Date Disposition Name Closed (as of 12/31/24): – – $51.5 21 Closed: Q1’24 - Q3’24 Truist Properties (ST Retail) – – $6.6 1 Closed: Q2’24 Shippensburg Marketplace (MT Retail) – – $15.6 1 Closed: Q2’24 Decatur Commons (MT Retail) – – $170.0 9 Closed: Q2’24 Americold (Industrial / Distribution) – – $16.5 1 Closed: Q2’24 Springfield Commons (3) (MT Retail) – – $21.3 1 Closed: Q3’24 Shops at Abilene (MT Retail) – – $26.0 1 Closed: Q3’24 HEB Plus Center (MT Retail) – – $29.6 1 Closed: Q3’24 East West Commons (MT Retail) – – $4.4 1 Closed: Q3’24 Johnson Controls (Office) – – $1.7 1 Closed: Q3’24 Imperial Gas & Convenience (ST Retail) – – $95.0 1 Closed: Q3’24 The Plant Shopping Center (MT Retail) – – $13.8 1 Closed: Q3’24 Epredia (Office) – – $12.3 3 Closed: Q3’24 - Q4’24 Kedrion Plasma (Office) – – $34.4 35 Closed: Q4’24 Pizza Hut (ST Retail) – – $3.8 2 Closed: Q4’24 Sterling Slidell (MT Retail) (3) – – $98.3 34 Closed: Q4’24 Fresenius (ST Retail) – – $11.5 1 Closed: Q4’24 Poplar Springs (MT Retail) – – $72.8 1 Closed: Q4’24 Home Depot (ST Retail) – – $24.3 5 Closed: Q4’24 Mister Car Wash (ST Retail) 4.9 Years 7.1% $709.4 121 Closed Total Occupied Assets – – $126.0 57 Closed Total Vacant Assets (4) 4.9 Years 7.1% $835.4 178 Total Closed Note: Data as of December 31, 2024. 1. Calculated as NOI divided by disposition price. 2. Weighted average remaining lease term in years is based on square feet as of date of sale. 3. Represents a partial sale of the property. 4. Includes the sale of the 366,000 square foot former Foster Wheeler Office building that sold for over $27 million as the tena nt’ s lease expired in mid - August, having collected 100% of the rent under the term of the lease.