UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 12, 2024

Global Net Lease, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Maryland | 001-37390 | 45-2771978 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 650 Fifth Avenue, 30th Floor | ||

| New York, New York | 10019 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (332) 265-2020

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, $0.01 par value per share | GNL | New York Stock Exchange | ||

| 7.25% Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share | GNL PR A | New York Stock Exchange | ||

| 6.875% Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share | GNL PR B | New York Stock Exchange | ||

| 7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share | GNL PR D | New York Stock Exchange | ||

| 7.375% Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share | GNL PR E | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On December 12, 2024, Global Net Lease, Inc. (the “Company”) issued a press release announcing continued progress on its 2024 strategic disposition plan and prepared slides covering such progress. The Company plans to post the slides on its website and the Company’s officers and other representatives intend to present such slides at upcoming meetings with investors. A copy of the press release and the slides are furnished as Exhibits 99.1 ad 99.2, respectively, of this Current Report on Form 8-K. The information set forth in Item 7.01 of this Current Report on Form 8-K and in the attached Exhibits 99.1 and 99.2 are deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

The statements in this Current Report on Form 8-K that are not historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that could cause the outcome to be materially different. The words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,” “projects,” “potential,” “predicts,” “plans,” “intends,” “would,” “could,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated with realization of the anticipated benefits of the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property management and advisory functions; that any potential future acquisition or disposition by the Company is subject to market conditions, capital availability and timing considerations and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although not all risks and uncertainties, that could cause the Company’s actual results to differ materially from those presented in its forward-looking statements are set forth in the “Risk Factors” and “Quantitative and Qualitative Disclosures About Market Risk” sections in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and all of its other filings with the U.S. Securities and Exchange Commission, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number |

Description | |

| 99.1 | Press Release dated December 12, 2024. | |

| 99.2 | Disposition Plan Slides. | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| GLOBAL NET LEASE, INC. | |||

| Date: | December 12, 2024 | By: | /s/ Edward M. Weil, Jr. |

| Name: | Edward M. Weil, Jr. | ||

| Title: | Chief Executive Officer and President (Principal Executive Officer) |

Exhibit 99.1

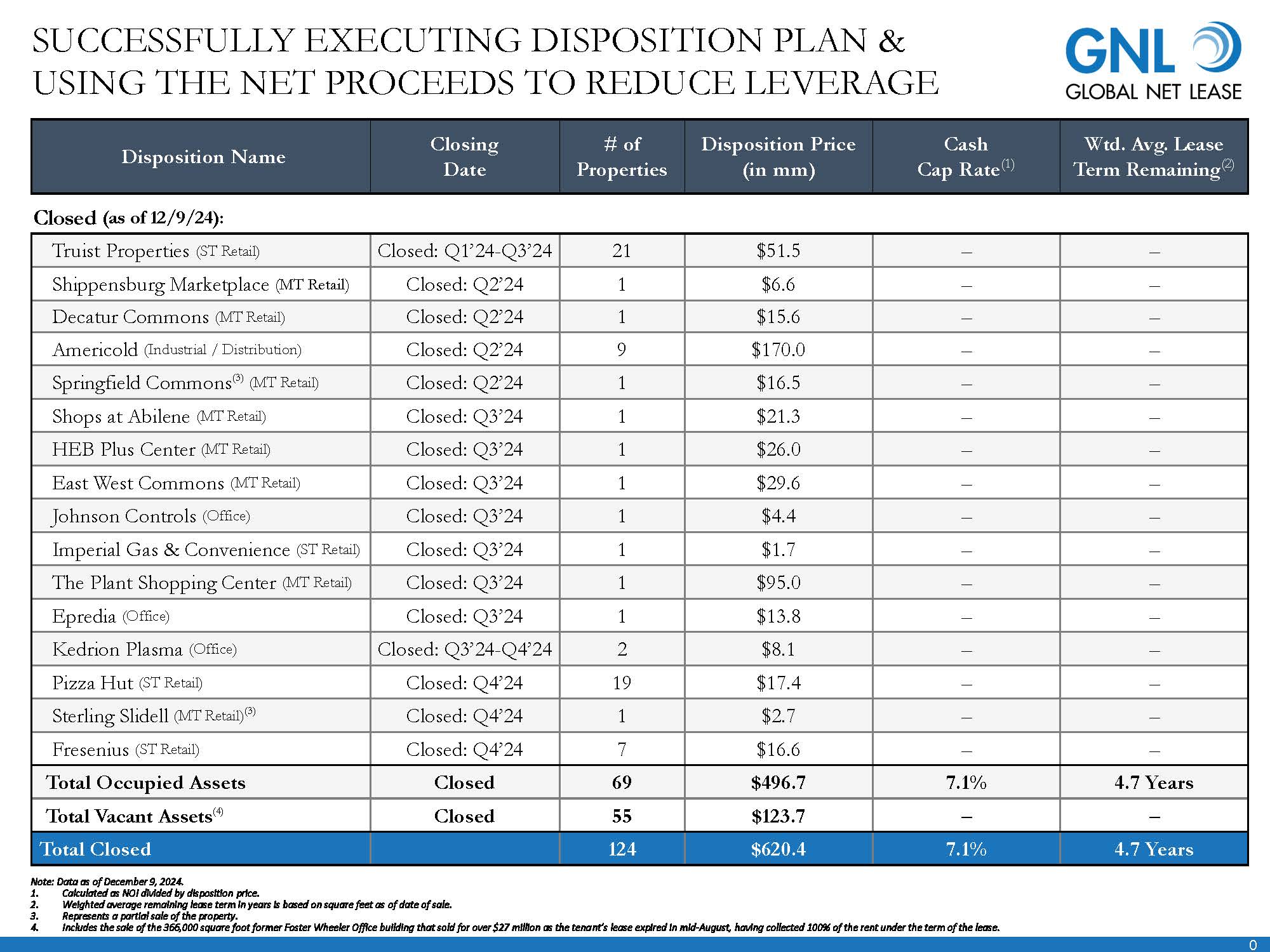

GLOBAL NET LEASE ANNOUNCES $620 MILLION OF CLOSED DISPOSITIONS

AS PART OF STRATEGIC DISPOSITION PLAN

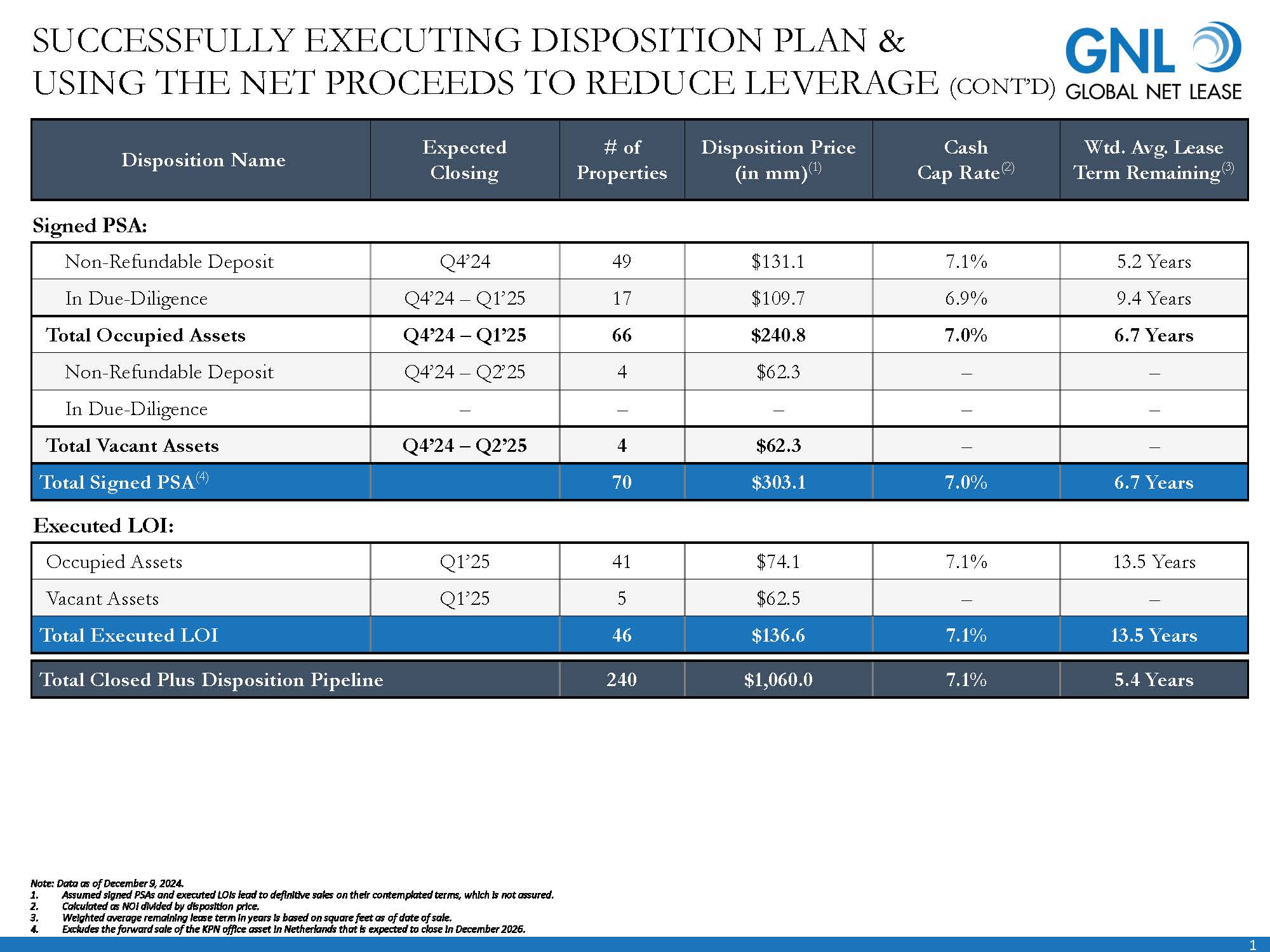

– Including Pipeline, Dispositions Total $1.1 Billion at a 7.1% Cash Cap Rate

on 5.4 Years of Weighted Average Lease Term

NEW YORK – December 12, 2024 – Global Net Lease, Inc. (NYSE: GNL) (“GNL” or the “Company”) today announced continued progress on its strategic disposition plan. Through December 9, 2024, GNL has closed $620 million of dispositions, and, together with its pipeline of potential asset sales, dispositions currently total $1.1 billion1.

“We are pleased with the progress of our disposition plan as we enter the final month of the year,” said Michael Weil, CEO of GNL. “With $620 million in closed dispositions and a substantial amount anticipated to close by year-end, we expect to exceed the upper range of our disposition guidance while approaching the most favorable end of our cash cap rate range of 7.0%. Looking ahead, we currently have over $200 million in asset sales slated to close during the first half of 2025. We believe this achievement underscores the quality of our broader portfolio, with non-core assets achieving favorable cap rates, including a 7.8% cash cap rate on occupied office assets. Our strategic focus on maximizing asset value through dispositions has enabled us to make significant strides in reducing our outstanding debt balance. We remain committed to delivering strong results and positioning GNL for sustained growth through the end of the year and into 2025.”

GNL has furnished slides detailing the progress of its 2024 strategic disposition plan as an exhibit to its Current Report on Form 8-K submitted with the Securities and Exchange Commission on the date hereof.

About Global Net Lease, Inc.

Global Net Lease, Inc. is a publicly traded real estate investment trust listed on the NYSE, which focuses on acquiring and managing a global portfolio of income producing net lease assets across the United States, and Western and Northern Europe. Additional information about GNL can be found on its website at www.globalnetlease.com.

Important Notice

The statements in this press release that are not historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that could cause the outcome to be materially different. The words such as "may," "will," "seeks," "anticipates," "believes," "expects," "estimates," "projects," “potential,” “predicts,” "plans," "intends," “would,” “could,” "should" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated with realization of the anticipated benefits of the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property management and advisory functions; that any potential future acquisition or disposition by the Company is subject to market conditions, capital availability and timing considerations and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although not all risks and uncertainties, that could cause the Company’s actual results to differ materially from those presented in its forward-looking statements are set forth in the Risk Factors and “Quantitative and Qualitative Disclosures about Market Risk” sections in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and all of its other filings with the U.S. Securities and Exchange Commission, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

Contacts:

Investor Relations

Email: investorrelations@globalnetlease.com

Phone: (332) 265-2020

Footnotes:

1 Disposition data as of December 9, 2024, includes transactions that are either closed or are pipeline transactions under agreement or letter of intent, and assumes purchase agreements and letters of intent lead to closing based on their contemplated terms, which cannot be assured.

Exhibit 99.2