SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2024

Commission File Number: 001-13382

KINROSS GOLD CORPORATION

(Translation of registrant's name into English)

17th Floor, 25 York Street,

Toronto, Ontario M5J 2V5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40F:

Form 20-F ¨ Form 40-F x

This Current Report on Form 6-K, dated September 10, 2024 is specifically incorporated by reference into Kinross Gold Corporation's Registration Statements on Form S-8 [Registration No. 333-262966 filed on February 24, 2022, Registration No. 333-217099 filed on April 3, 2017 and Registration Nos. 333-180824, 333-180823 and 333-180822 filed on April 19, 2012.]

Page 2

This report on Form 6-K is being furnished for the sole purpose of providing a copy of the Technical Report filed for Kinross Gold Corporation’s Great Bear Project, along with the required certificates and consents as filed on SEDAR, dated September 10, 2024.

INDEX

Table of Contents

SIGNATURES

EXHIBIT INDEX

| 99.1 | Technical Report dated September 10, 2024 with respect to the Great Bear Gold Project, Ontario, Canada (“Technical Report”). |

| 99.2 | Certificate of Nicos Pfeiffer dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.3 | Consent of Nicos Pfeiffer dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.4 | Consent of Nicos Pfeiffer dated September 10, 2024 for the US filing of the Technical Report. |

| 99.5 | Certificate of Graham Long dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.6 | Consent of Graham Long dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.7 | Consent of Graham Long dated September 10, 2024 for the US filing of the Technical Report. |

| 99.8 | Certificate of Yves Breau dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.9 | Consent of Yves Breau dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.10 | Consent of Yves Breau dated September 10, 2024 for the US filing of the Technical Report. |

| 99.11 | Certificate of Agung Prawasono dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.12 | Consent of Agung Prawasono dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.13 | Consent of Agung Prawasono dated September 10, 2024 for the US filing of the Technical Report. |

| 99.14 | Certificate of Arkadius Tarigan dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.15 | Consent of Arkadius Tarigan dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.16 | Consent of Arkadius Tarigan dated September 10, 2024 for the US filing of the Technical Report. |

Page 3

| 99.17 | Certificate of Jerry Ran dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.18 | Consent of Jerry Ran dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.19 | Consent of Jerry Ran dated September 10, 2024 for the US filing of the Technical Report. |

| 99.20 | Certificate of Kevin van Warmerdam dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.21 | Consent of Kevin van Warmerdam dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.22 | Consent of Kevin van Warmerdam dated September 10, 2024 for the US filing of the Technical Report. |

| 99.23 | Certificate of Dennis Renda dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.24 | Consent of Dennis Renda dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.25 | Consent of Dennis Renda dated September 10, 2024 for the US filing of the Technical Report. |

| 99.26 | Certificate of Sheila Daniel dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.27 | Consent of Sheila Daniel dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.28 | Consent of Sheila Daniel dated September 10, 2024 for the US filing of the Technical Report. |

| 99.29 | Certificate of Simon Gautrey dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.30 | Consent of Simon Gautrey dated September 10, 2024 with respect to the Technical report as filed on SEDAR. |

| 99.31 | Consent of Simon Gautrey dated September 10, 2024 for the US filing of the Technical Report. |

Page 4

SIGNATURES

Pursuant to the requirements of Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| KINROSS GOLD CORPORATION | |

| Signed: //Lucas R. Crosby// | |

| Vice President, General Counsel – Corporate | |

| and Corporate Secretary |

September 10, 2024

Exhibit 99.1

Great Bear Gold Project

Ontario, Canada

Voluntary National Instrument 43-101 Technical Report

Preliminary Economic Assessment

Prepared for:

Kinross Gold Corporation

Prepared by:

|

Nicos Pfeiffer, P.Geo. Graham Long, P.Geo. Yves Breau, P.Eng. Agung Prawasono, P.Eng., PMP Arkadius Tarigan, P.Eng. |

Jerry Ran, P.Eng. Kevin van Warmerdam, P.Eng. Dennis Renda, P.Eng. Sheila Daniel, P.Geo. Simon Gautrey, P.Geo. |

| Effective Date: | September 1, 2024 | |

| Signature Date: | September 10, 2024 |

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Contents

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Tables

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Figures

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

TOC

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| 1. | SUMMARY |

| 1.1 | Executive Summary |

This Technical Report (the Technical Report or the Report) has been prepared by Kinross Gold Corporation (Kinross) to disclose the results of a Preliminary Economic Assessment (PEA) on the Great Bear gold project (the Project or the Property), located in northwest Ontario, Canada. Kinross acquired the Project as part of its acquisition of Great Bear Resources Ltd. (Great Bear) in February 2022. Great Bear is a wholly owned subsidiary of Kinross and owns a 100% interest in the Property.

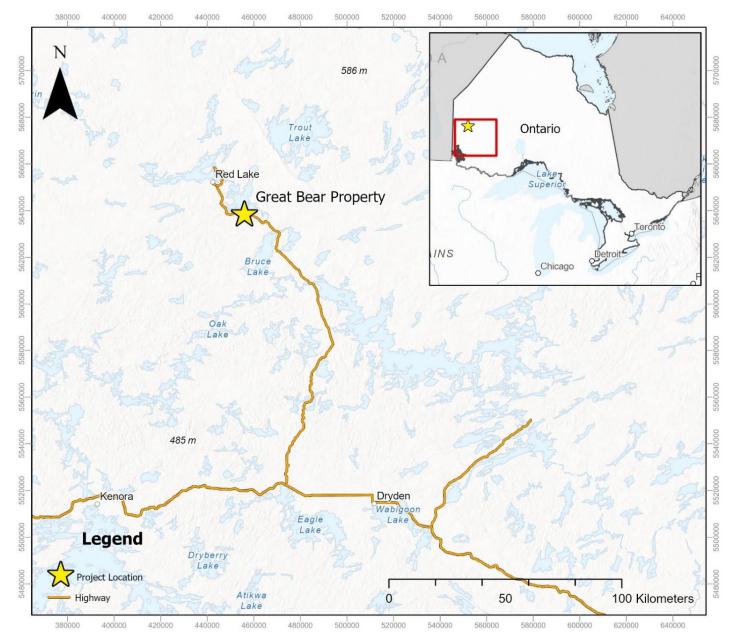

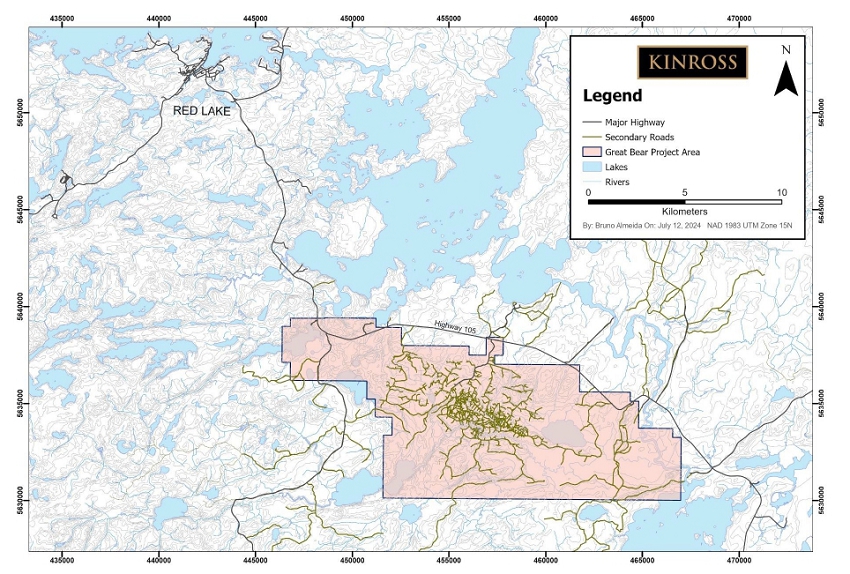

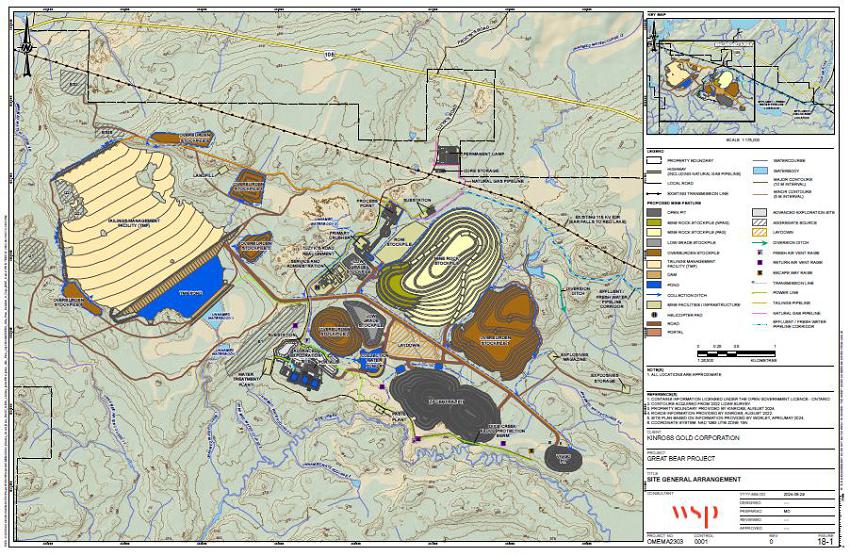

The Project is a gold exploration property located within the Red Lake Mining District of Ontario, an area of historic gold mining and exploration. The Project is located approximately 24 km southeast of the town of Red Lake, Ontario and consists of 380 unpatented mining claims and seven mining leases, totalling 11,852 hectares (ha).

The PEA contemplates a combined open pit and underground mining scenario for the Project that provides approximately 10,000 tonnes per day (tpd) of plant feed to an on-site processing facility over a life-of-mine (LOM) of approximately 12 years.

This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and is considered by Kinross and the Qualified Persons (QP) as meeting the requirements of a Preliminary Economic Assessment as defined in NI 43-101.

The economic analysis contained in this Technical Report is based, in part, on Inferred Mineral Resources, and is preliminary in nature. Inferred Mineral Resources are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized.

Costs prepared or quoted in Canadian dollars (CAD) have been converted to US dollars (USD) at an exchange rate of 0.74 USD to 1.00 CAD. All revenues and costs cited in this Report are expressed in first quarter 2024 USD unless stated otherwise.

Key Project Outcomes

The reader is advised that the results of the PEA summarized in this Report are intended to provide a preliminary view of the Project and potential design options. There is no guarantee that Inferred Mineral Resources can be converted to Indicated or Measured Mineral Resource categories and thus there is no guarantee that the Project outcomes described in this Report will be realized.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

The following list summarizes the key results of this Technical Report and PEA of the Great Bear Project. All values listed are approximate.

| · | As of April 2, 2024, Mineral Resource estimates for the LP, Hinge, and Limb deposits consisting of Measured and Indicated (M&I) Mineral Resources totalling 30.3 million tonnes (Mt) grading 2.81 g/t Au and containing 2.7 million ounces (Moz) of gold and Inferred Mineral Resources totalling 25.5 Mt grading 4.74 g/t Au and containing 3.9 Moz of gold. |

| · | At an assumed cash flow modelling gold price of $1,900/oz, the Project has after-tax Net Present Value (NPV) of $1,898 million at a discount rate of 5% and an after-tax Internal Rate of Return (IRR) of 24%. |

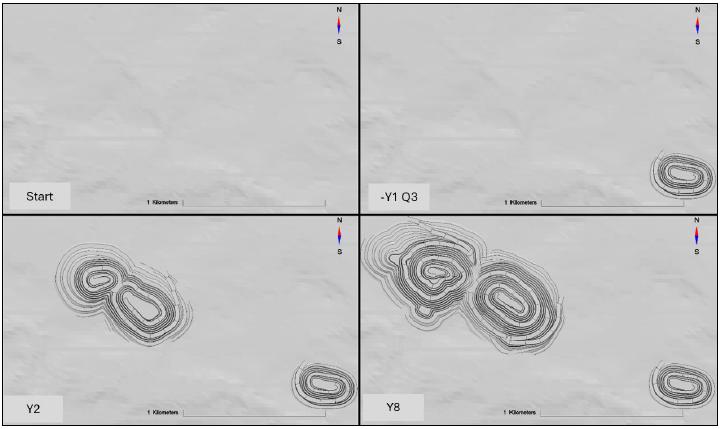

| · | The PEA production schedule consists of 12 years of commercial process plant production. Open pit mining and corresponding initial stockpiling of mineralized material is scheduled to occur from Year -3 of the LOM plan, followed by the introduction of direct feed to the process plant beginning in Year 1 and continuing to the end of Year 8. Underground mining and corresponding initial stockpiling of mineralized material is scheduled to occur from Year -3 of the LOM plan, with processing of all underground mineralized material ending in Year 12 of the LOM plan. |

| · | Steady-state annual processing rate: 10,000 tpd. |

| · | LOM total plant feed: 44.6 Mt at 3.87 g/t Au. |

| · | LOM average metallurgical recovery: 95.7%. |

| · | Peak annual payable gold production of 601,000 oz, average annual payable gold production of 518,000 oz over the first eight years of commercial production, and LOM payable gold production of 5.3 Moz. |

| · | Total initial Project capital cost of $1,429 million, including $248 million in capitalized mine development costs and construction capital of $1,181 million. |

| · | Including capitalized mining costs, LOM sustaining capital costs totalling $1,034 million. |

| · | LOM total unit operating cost: $70.26 per tonne processed including a net smelter return (NSR) royalty of 2%. |

| · | LOM all-in sustaining unit cost (AISC): $812/oz Au. |

| · | LOM gross revenue of $10,085 million and LOM after-tax cash flow of $3,392 million. |

| · | Payback period (after-tax): 2.7 years. |

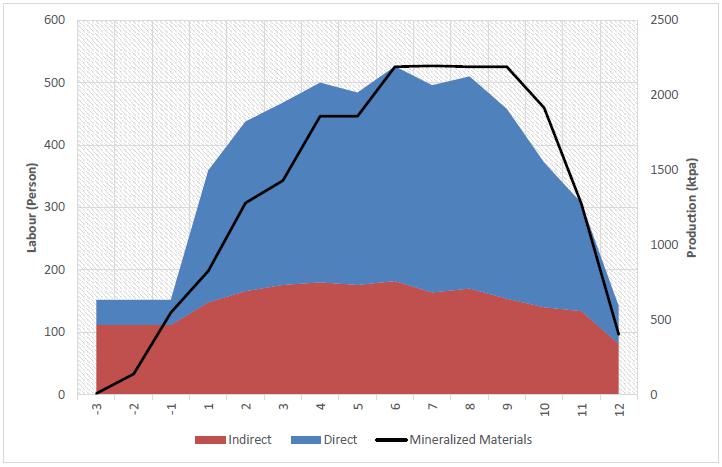

| · | Peak total workforce of 1,098 workers and LOM average total workforce of 903. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| · | A Federal Impact Assessment process is underway for the Project. |

| · | Growth capital of $97 million as a contribution to upgraded grid power supply. |

| · | Reclamation and closure cost of $91 million. |

| · | The Project’s after-tax NPV and after-tax IRR are sensitive to gold price as shown in Table 1-1. |

Table 1-1: After-tax NPV and IRR sensitivity results

| Gold Price | After-tax NPV at 5% | IRR | ||||||||

| (US$/oz) | (US$M) | (%) | ||||||||

| $ | 1,500 | $ | 910 | 14.9 | % | |||||

| $ | 1,700 | $ | 1,416 | 19.9 | % | |||||

| $ | 1,900 | $ | 1,898 | 24.3 | % | |||||

| $ | 2,100 | $ | 2,371 | 28.3 | % | |||||

| $ | 2,300 | $ | 2,846 | 32.1 | % | |||||

| $ | 2,500 | $ | 3,314 | 35.5 | % | |||||

Conclusions

Based on the information presented in this Technical Report and the results of ongoing work on the Project, the QPs offer the following conclusions on the Project by area:

Overall Project Development

| · | Based on the current Mineral Resources, the Project shows sufficient economic potential to merit continued advanced studies. |

| · | Project development activities will focus on continuing the drilling program, executing the Advanced Exploration (AEX) program, advancing permitting, environmental studies, and engineering, and closely collaborating with stakeholders. |

Geology and Mineral Resources

| · | The Mineral Resources at the Property have been estimated for three zones, LP, Hinge, and Limb. As of April 2, 2024, Mineral Resources at the Project consist of: |

| o | Measured and Indicated (M&I) Mineral Resources: 30.3 Mt grading 2.81 g/t Au and containing 2.7 Moz of gold |

| o | Inferred Mineral Resources: 25.5 Mt grading 4.74 g/t Au and containing 3.9 Moz of gold |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| · | Mineral Resources conform to Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definitions Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) Definitions). |

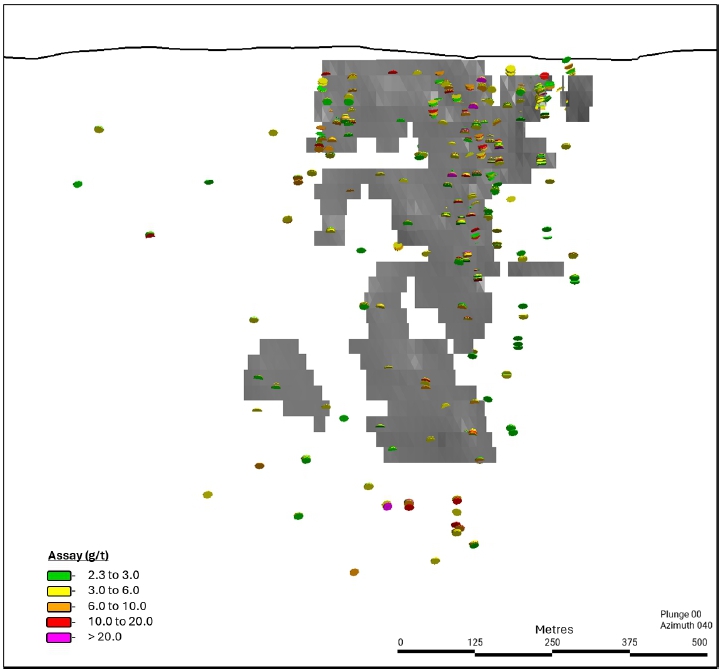

| · | The LP Zone remains the most attractive area for potential increases to Mineral Resources. Drilling programs for this zone continue to be prioritized because of its potential size and relatively high gold grades in the context of the Property. |

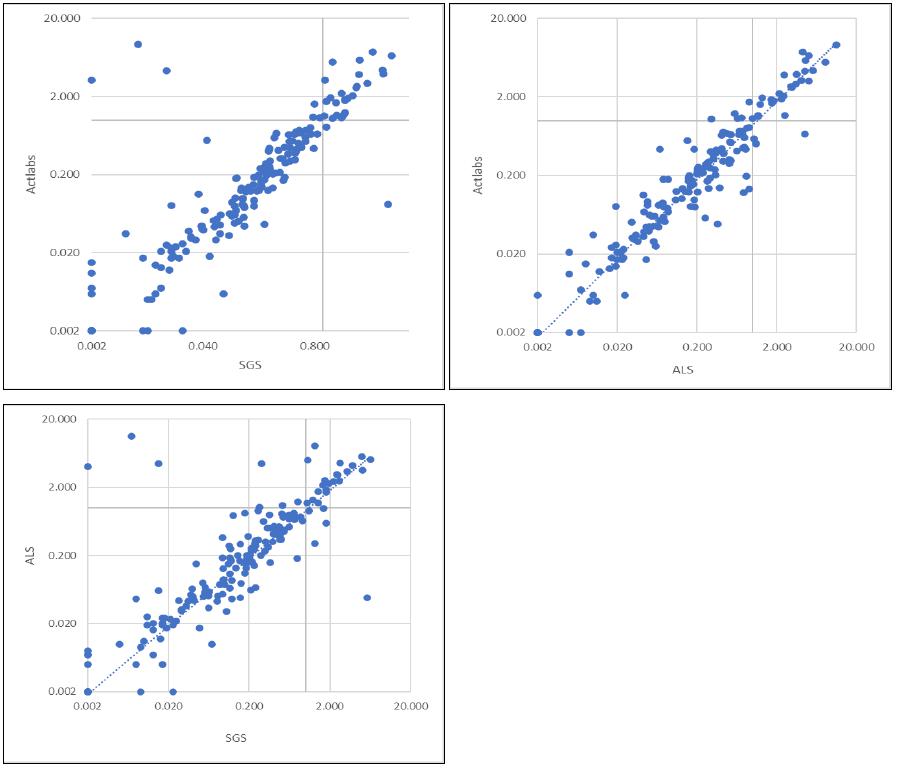

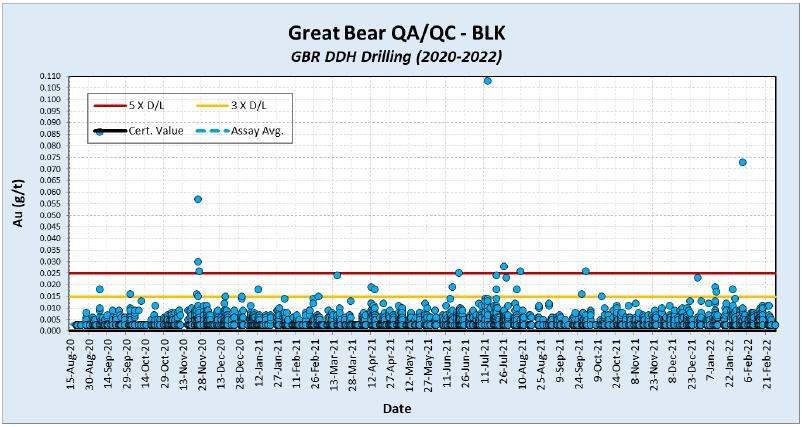

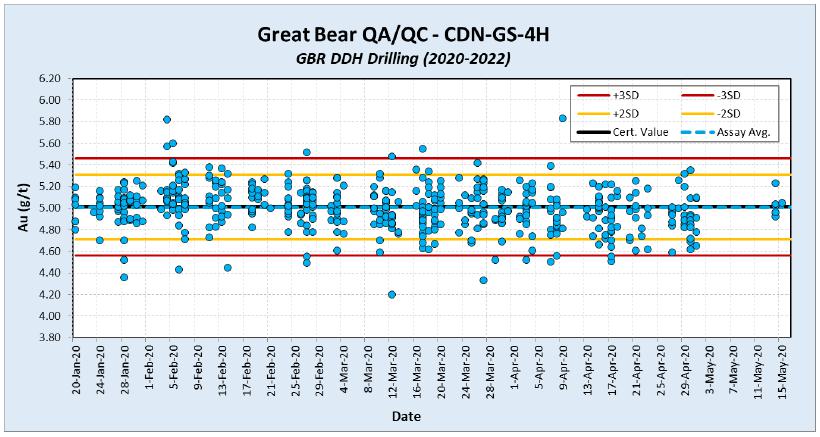

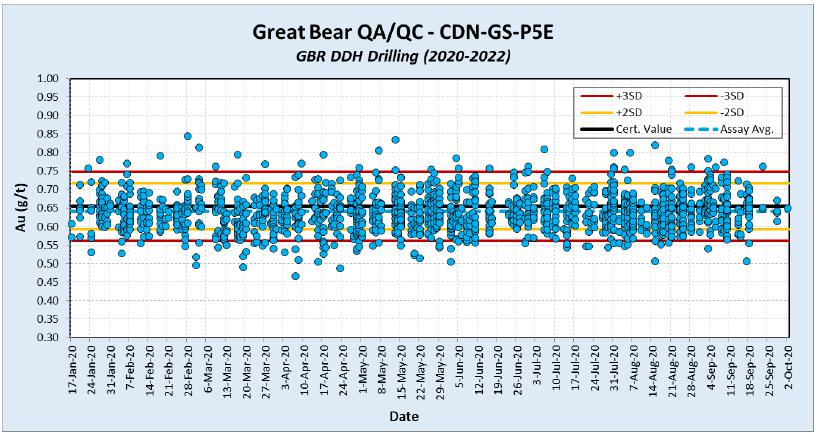

| · | The preparation and analyses of the samples are adequate for this type of deposit and style of gold mineralization. The sample handling and chain of custody, as documented, meet standard industry practice. |

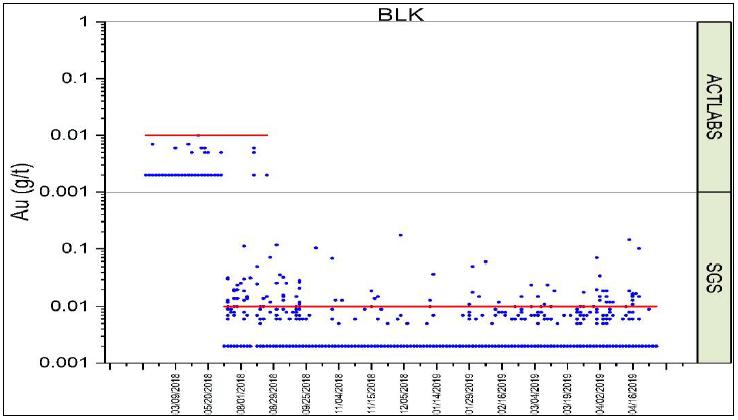

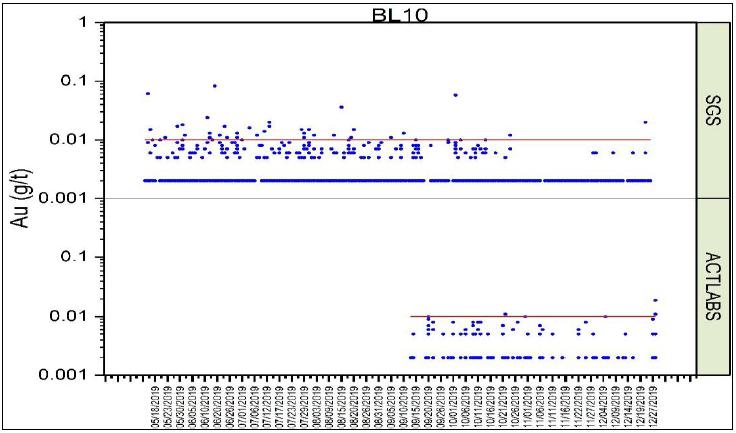

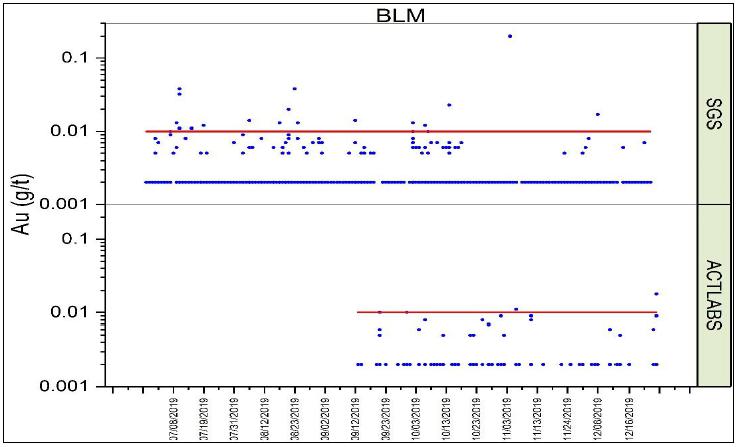

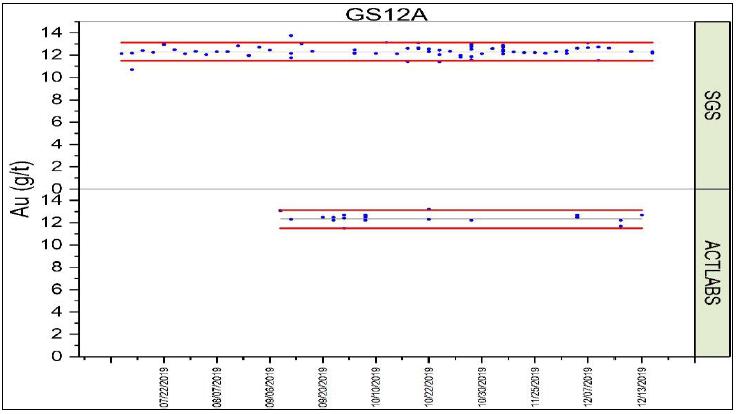

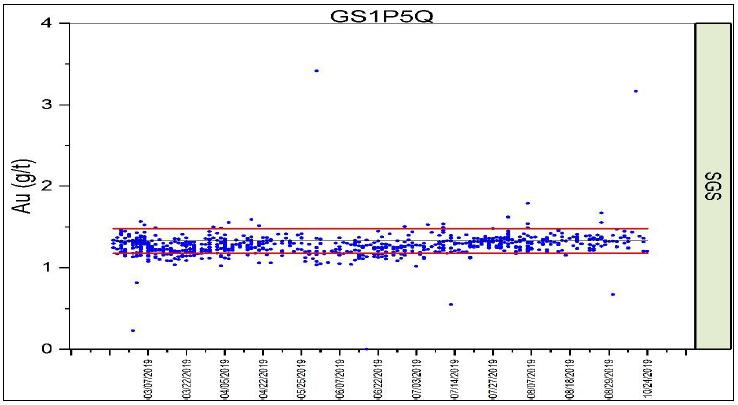

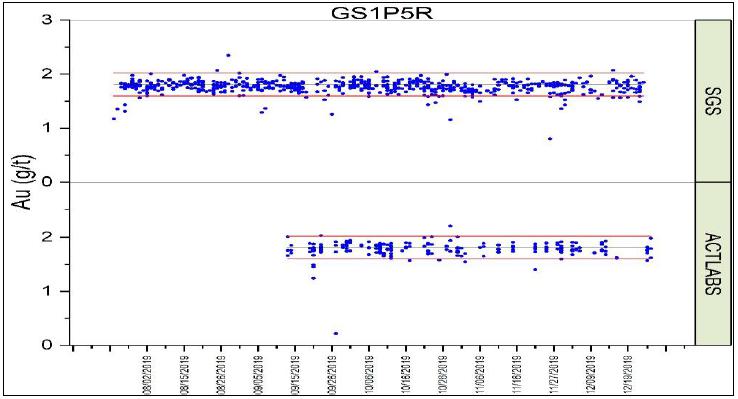

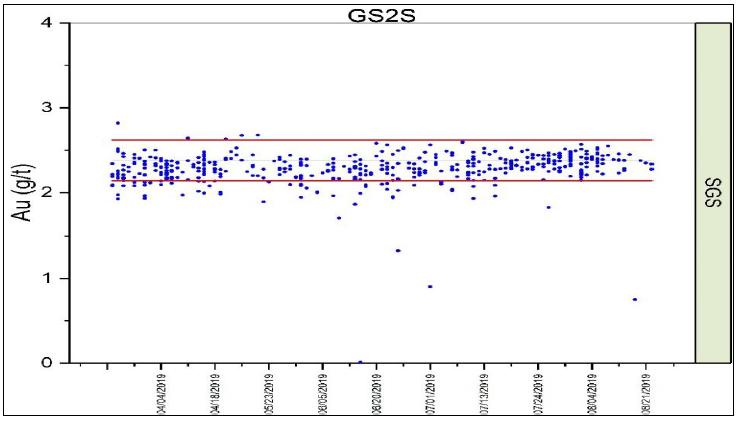

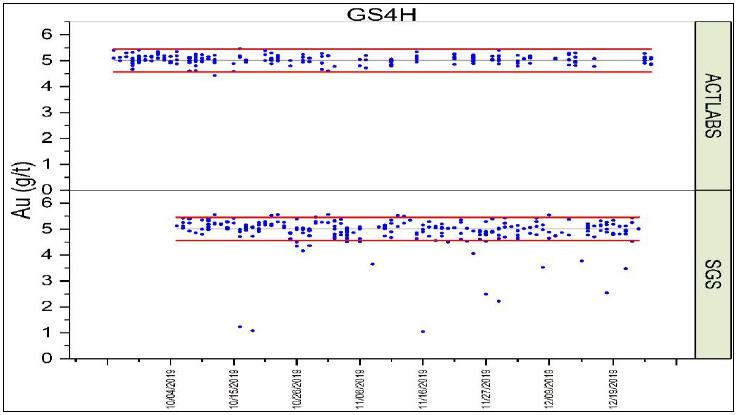

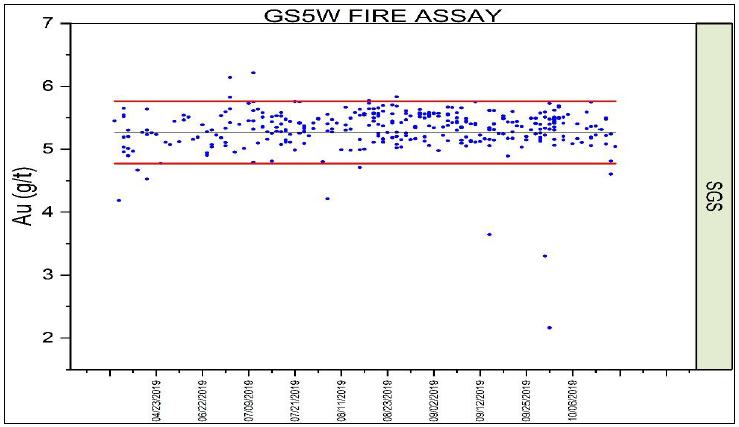

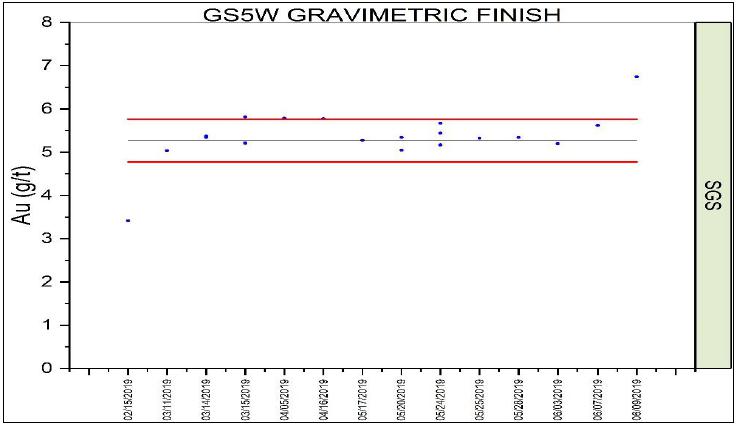

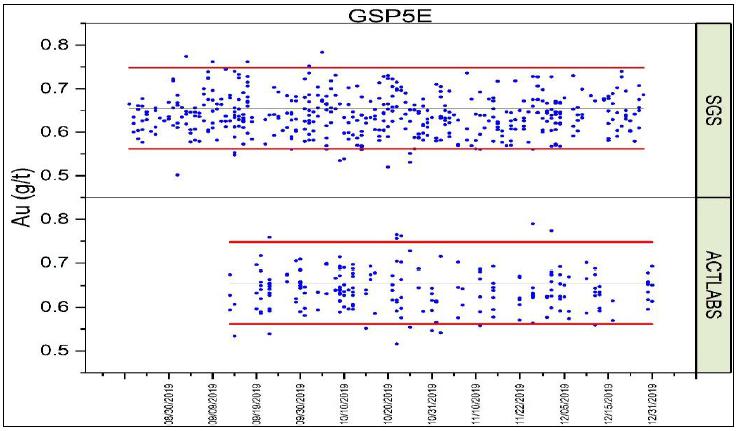

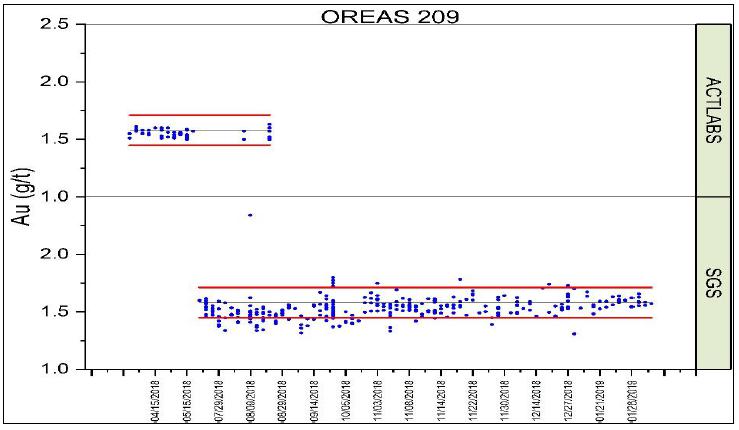

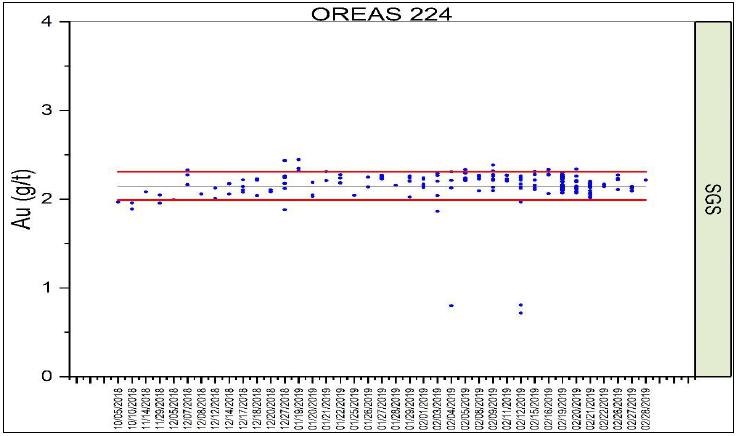

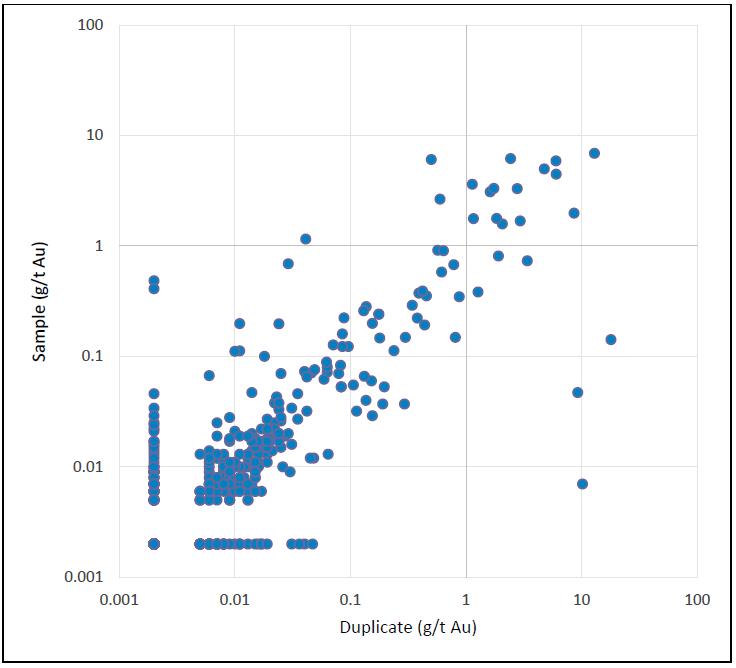

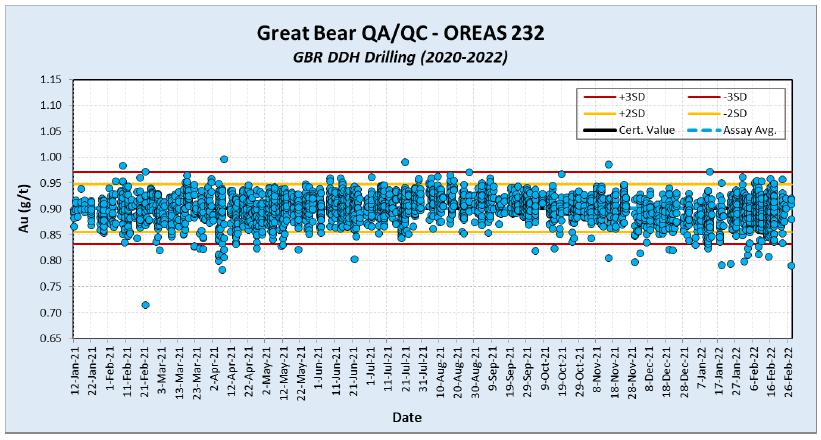

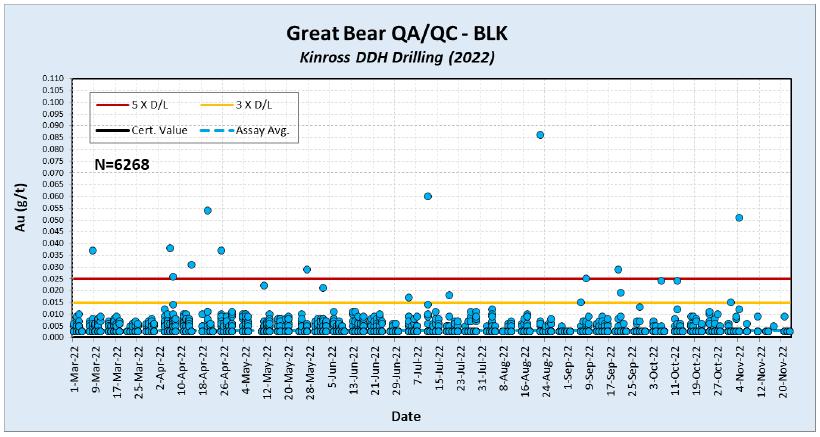

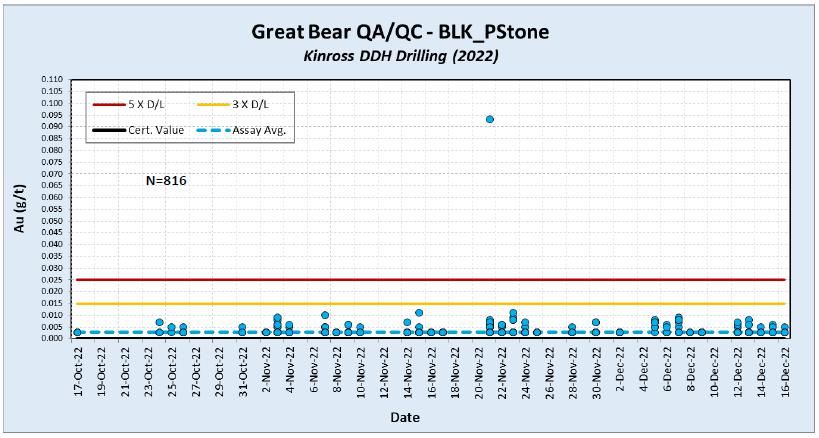

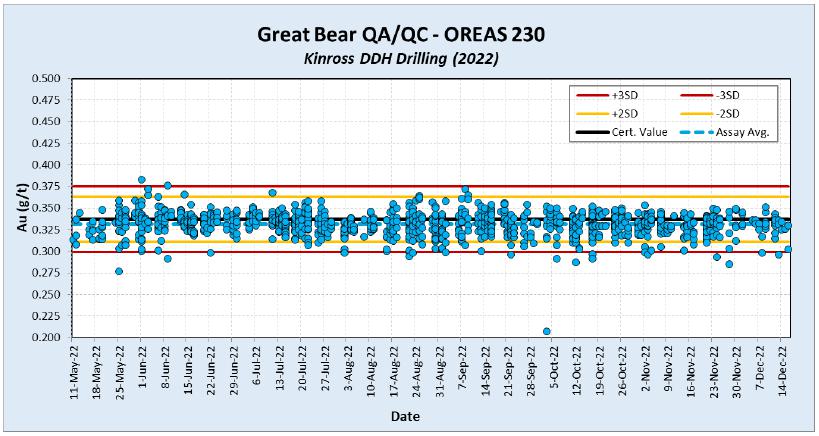

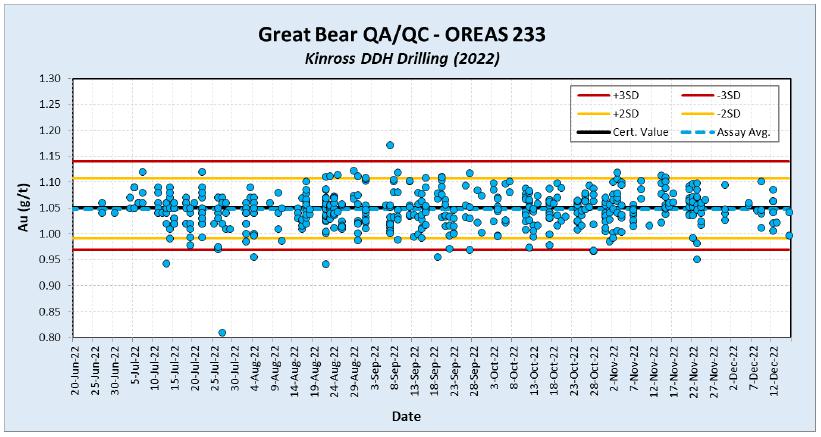

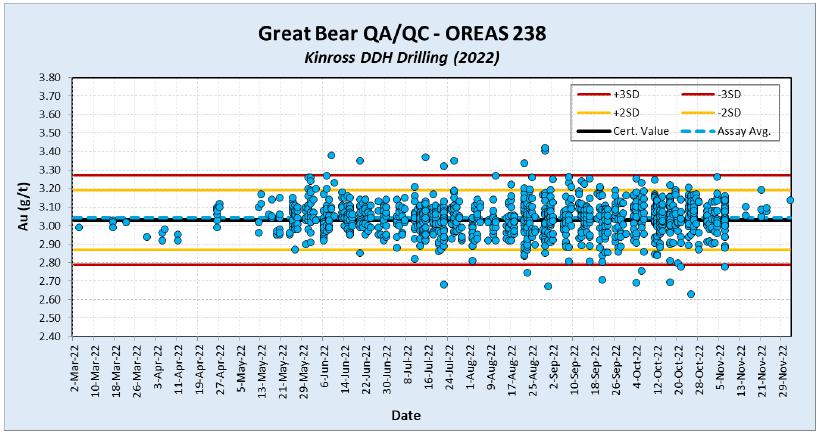

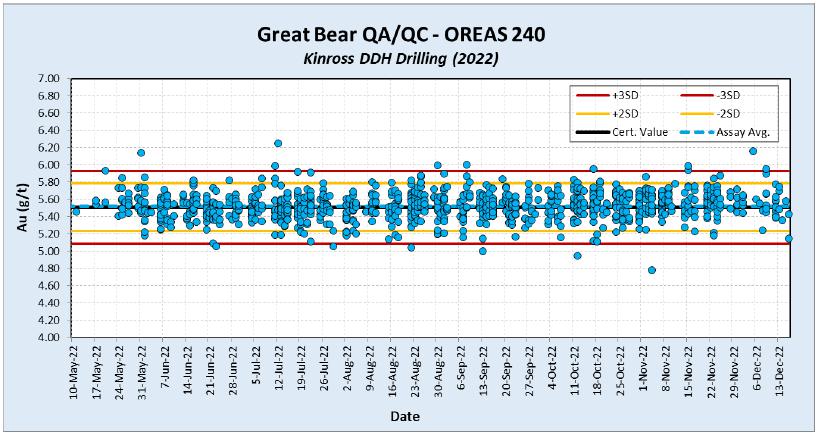

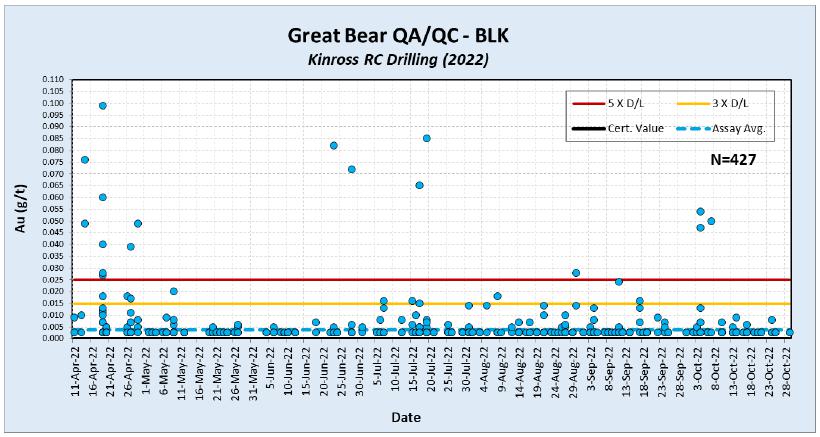

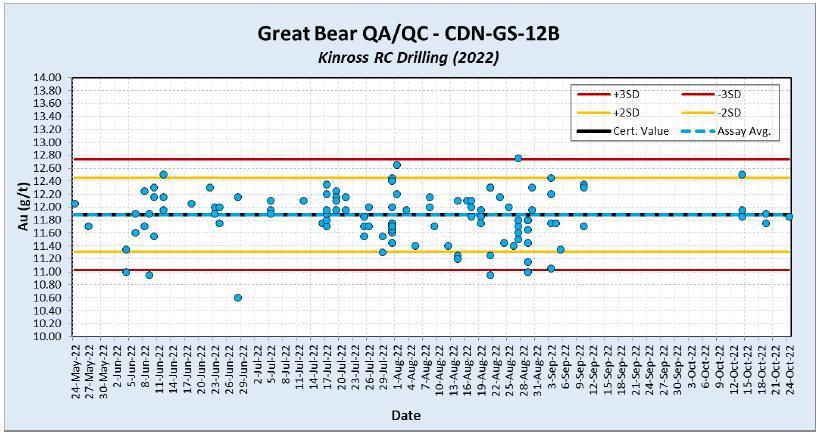

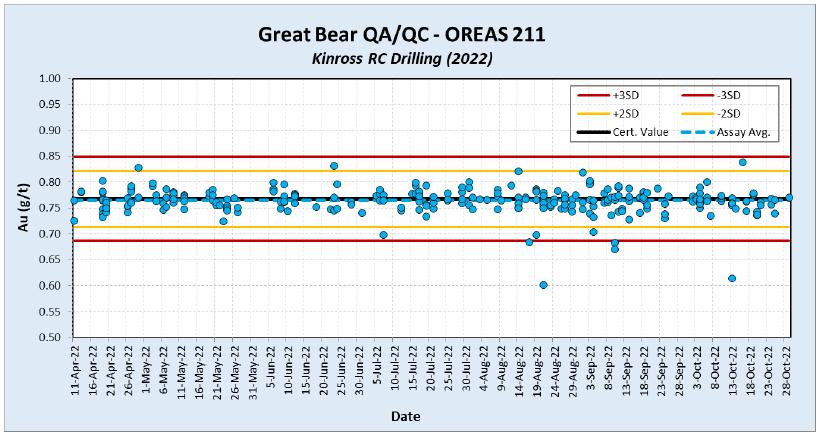

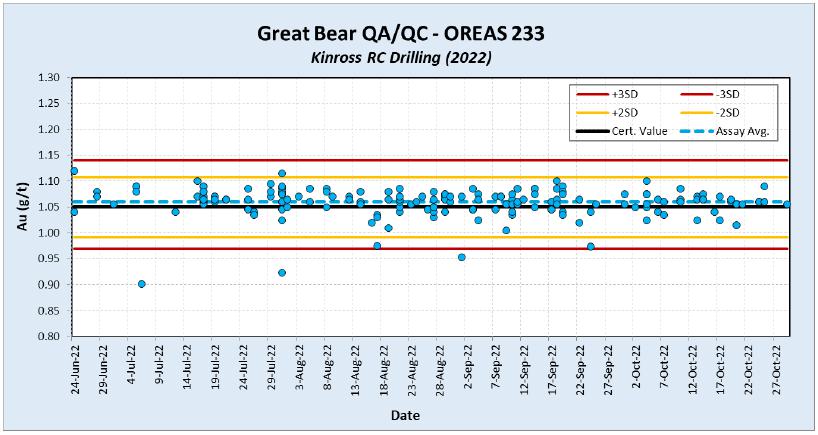

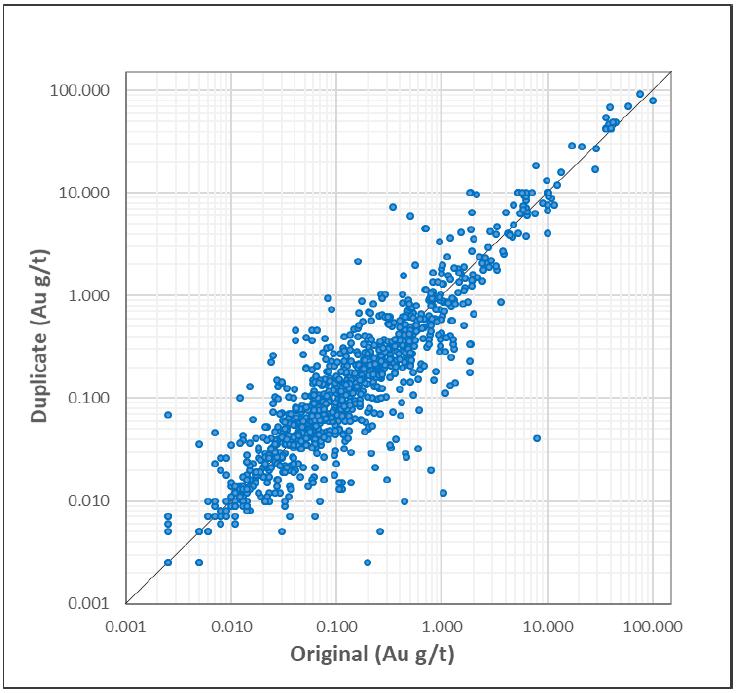

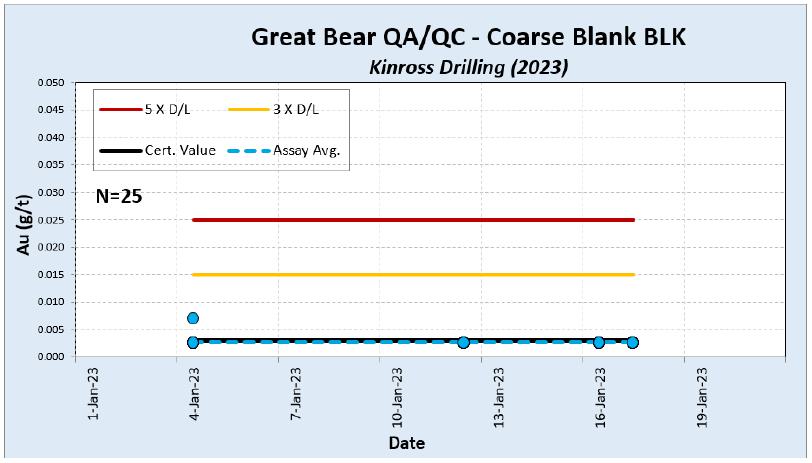

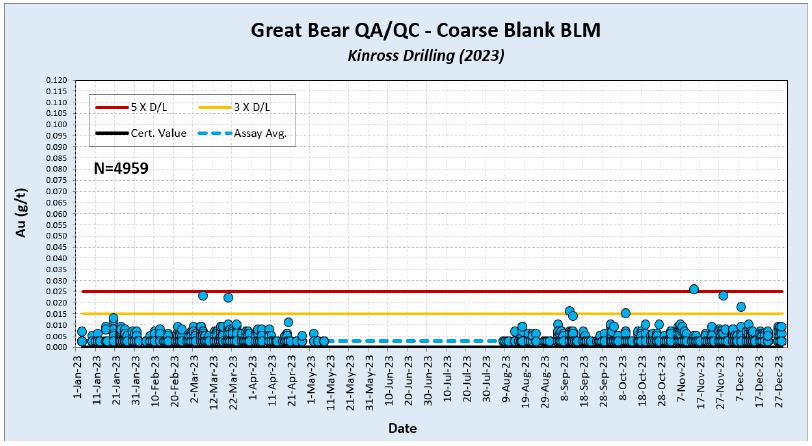

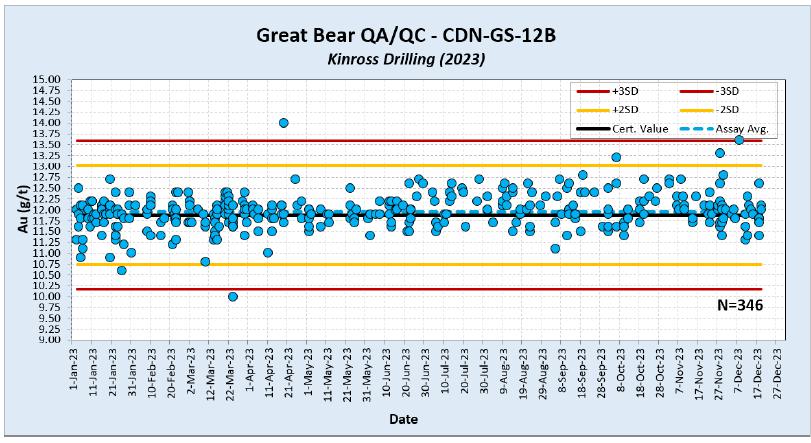

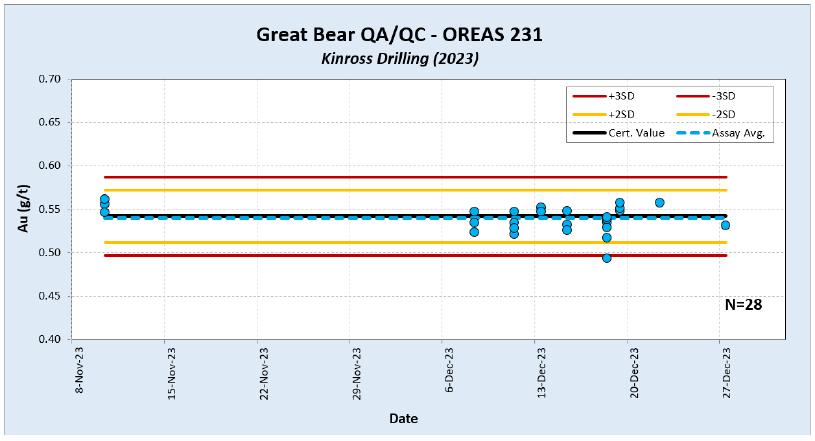

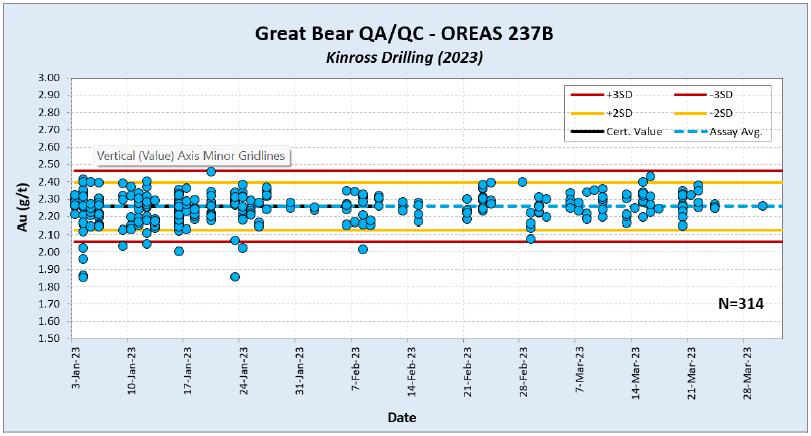

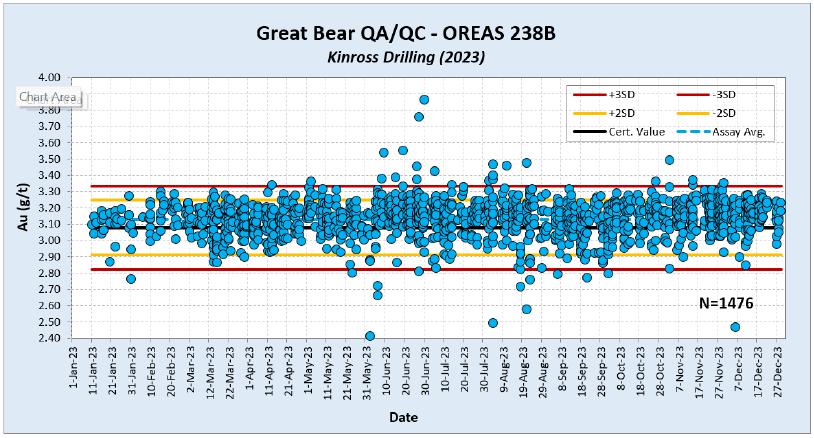

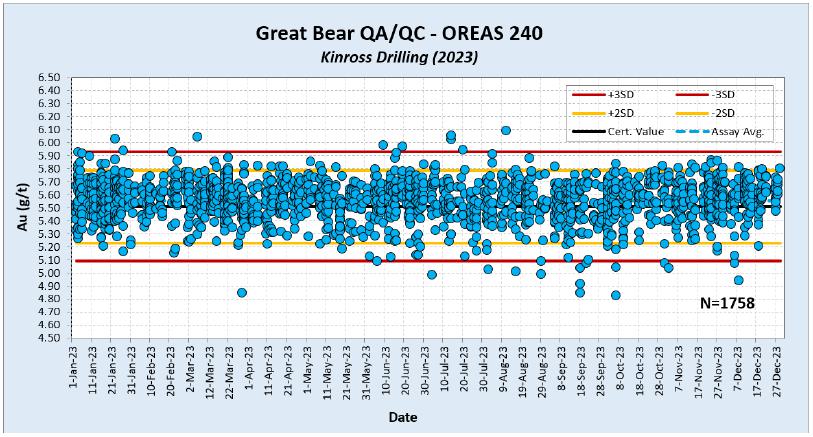

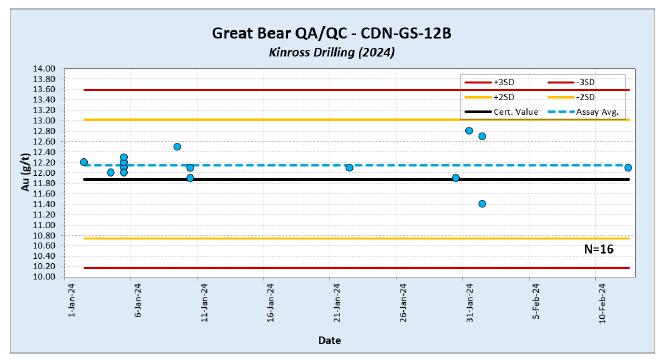

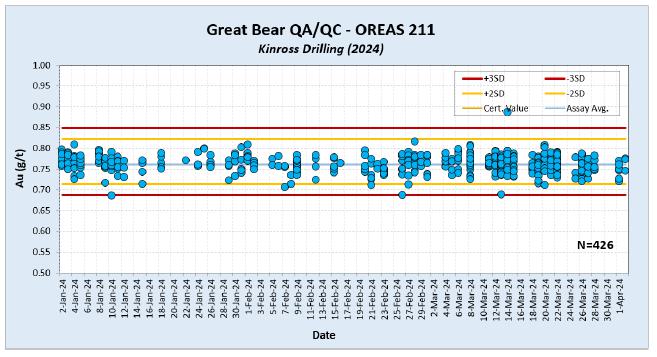

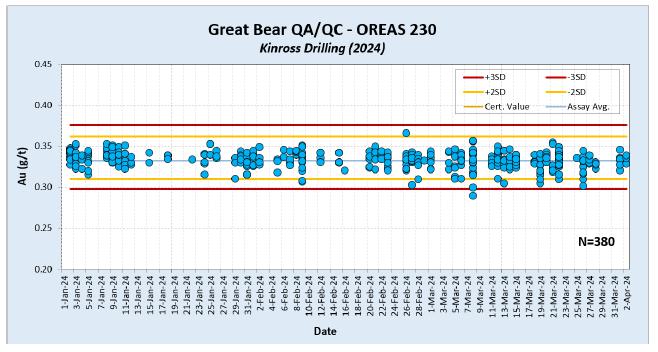

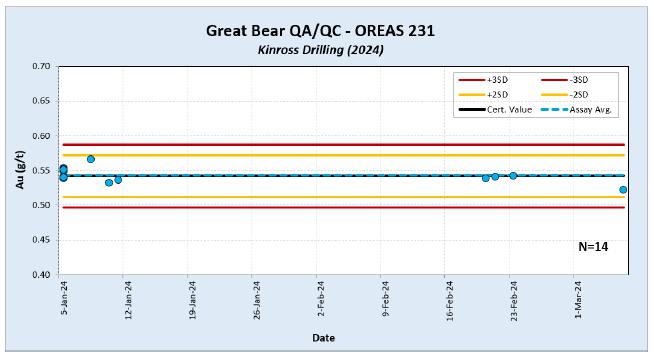

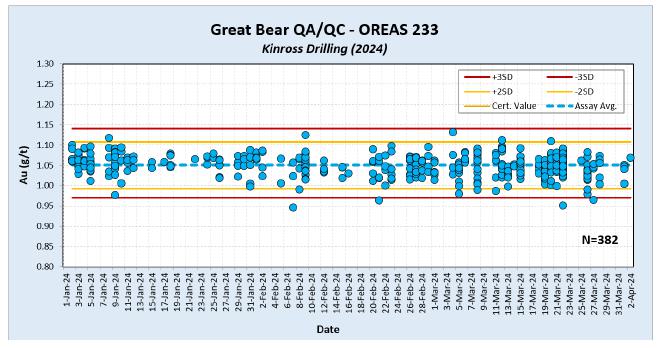

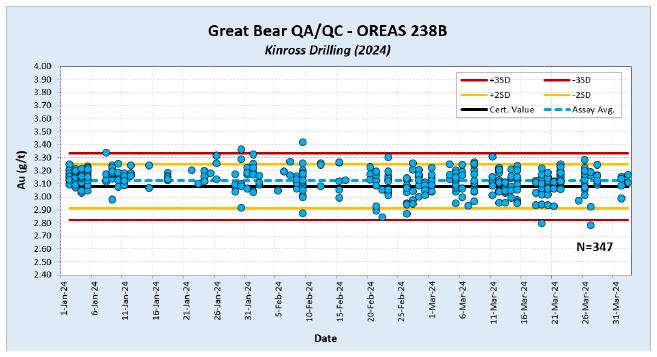

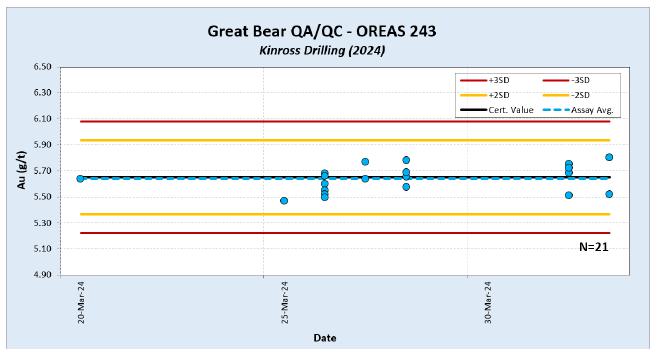

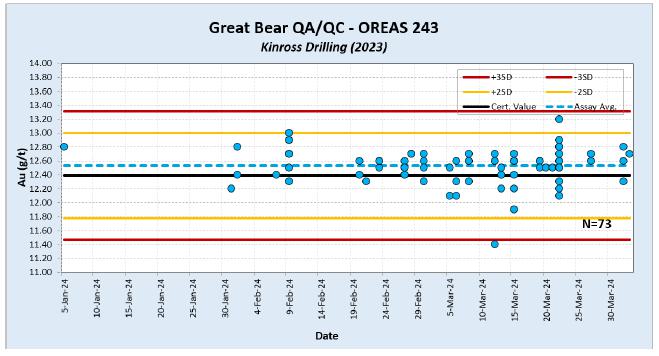

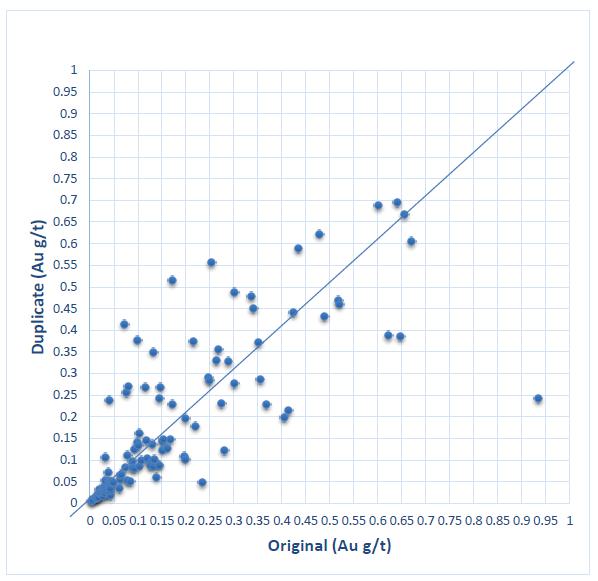

| · | The quality assurance and quality control (QA/QC) programs are in accordance with standard industry practice and CIM Estimation of Mineral Resource & Mineral Reserve Best Practice Guidelines dated November 29, 2019 (MRMR Best Practice Guidelines). Great Bear and Kinross personnel have taken reasonable measures to ensure that the sample analyses completed are sufficiently accurate and precise. Based on the statistical analysis of the QA/QC results, the assay results are of sufficient quality to support Mineral Resource estimation. |

| · | The drill core logging and database workflows and checks are appropriate and consistent with industry standards. The data used to support a Mineral Resource estimate are subject to validation using validated industry-standard software that automatically triggers data checks for a range of data entry errors. Verification checks on surveys, collar coordinates, lithology, and assay data are all conducted on a regular basis. |

| · | Verification of the assay and density certificate data to the Mineral Resource database indicates that the Mineral Resource database data used in the Mineral Resource estimate faithfully reproduces the assay certificate information. In the QP’s opinion, the Mineral Resource database, including the density data, is of sufficient quality to support the Mineral Resource estimate. |

| · | For all modelling and resource estimation work, only high confidence drill holes were used (Confidence 1 and 2). To the QP’s knowledge, there are no drilling, sampling, or recovery factors that could materially impact the accuracy and reliability of the results. |

| · | The contained ounces in all zones are relatively insensitive to gold cut-off grades. |

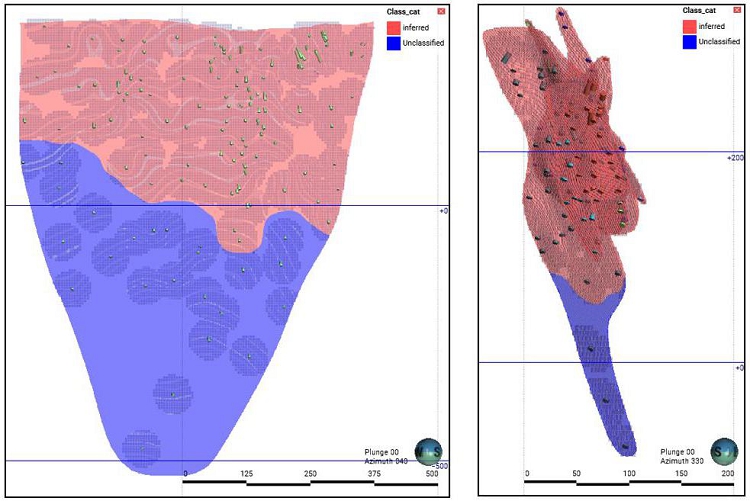

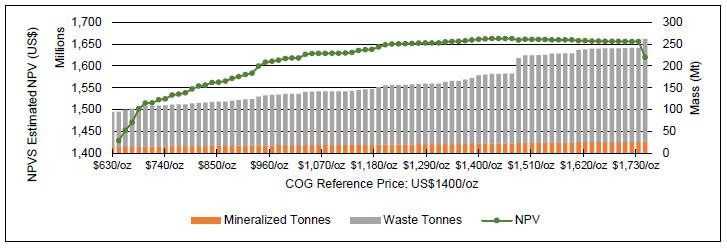

| · | The open pit and underground Mineral Resources were constrained within $1,400/oz gold and $1,500/oz gold optimized pit shells and $1,700/oz gold underground mineable shapes, respectively, and fulfill the CIM (2014) Definitions requirement of “reasonable prospects for eventual economic extraction” (RPEEE). |

| · | Mineral Resource quantities have increased in the Inferred Mineral Resource category due to the results of exploration drilling targeting extensions at depth. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Mine Design and Mining Methods

| · | Mining is projected to take place using both open pit and underground mining methods. |

| · | Based on the available data and knowledge of the study area, far-field stress information is considered suitable for the current level of study. Laboratory testing indicates a strong rock mass and the kinematics for all orientations of the pit walls are very favourable. |

| · | Lateral water flow distribution and inflow variation over the LOM are unknown at this stage of the Project. The dewatering demand for each mining zone is based on assumed fractions of total inflow. Most inflows are expected in the upper zone of the underground mine (less than 500 m depth). |

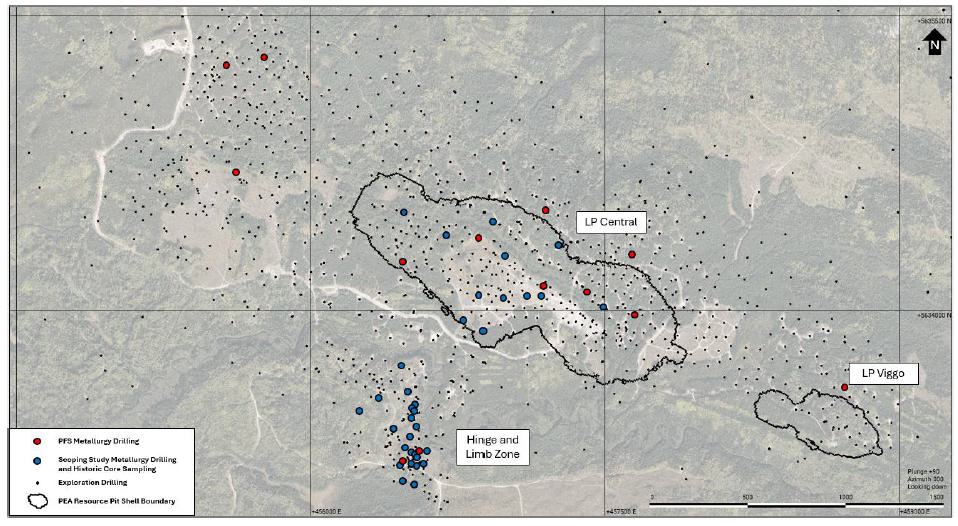

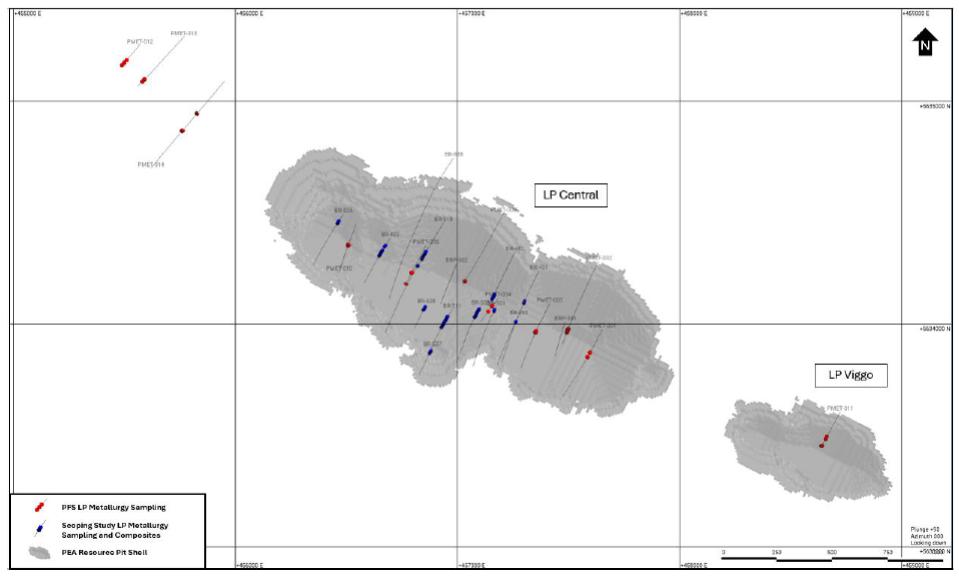

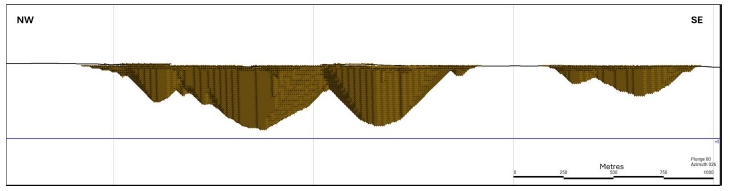

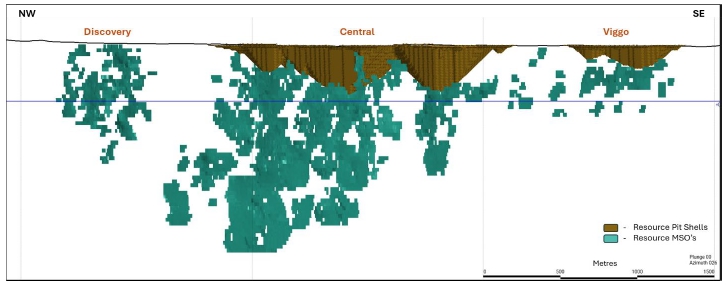

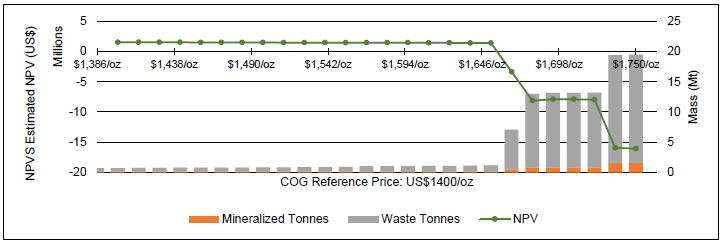

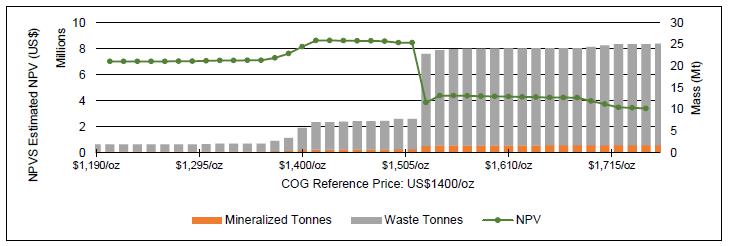

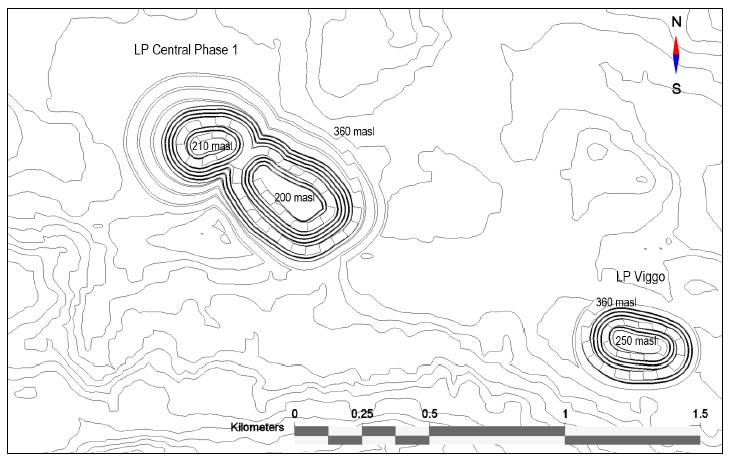

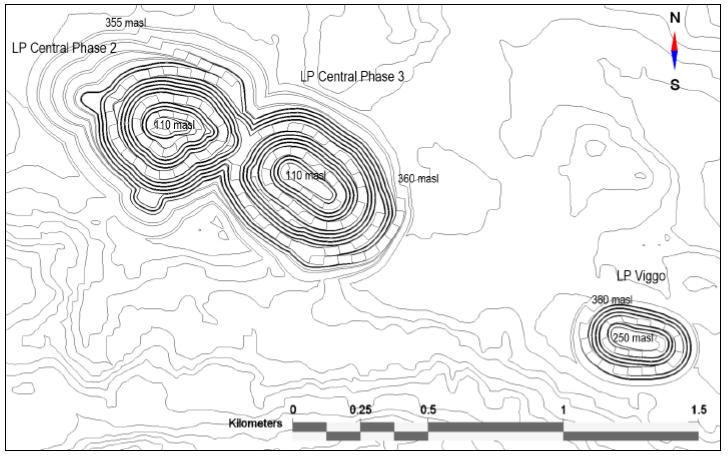

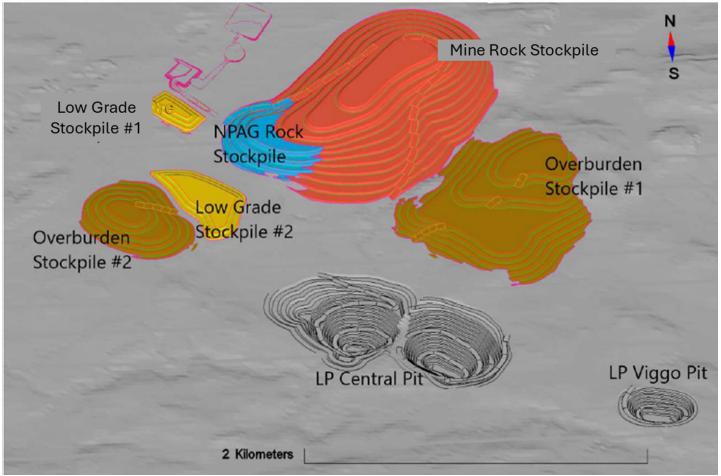

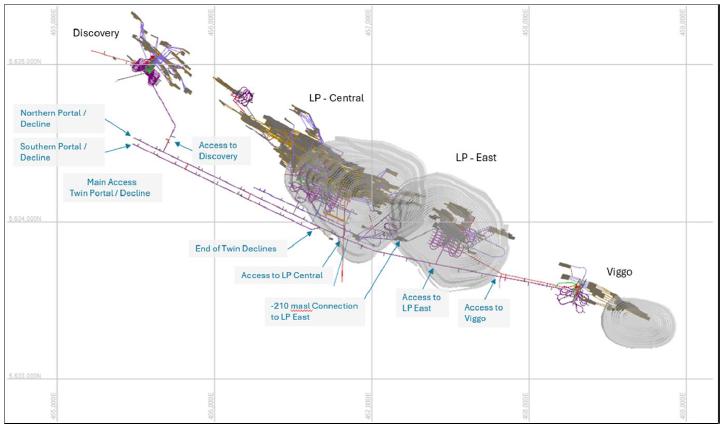

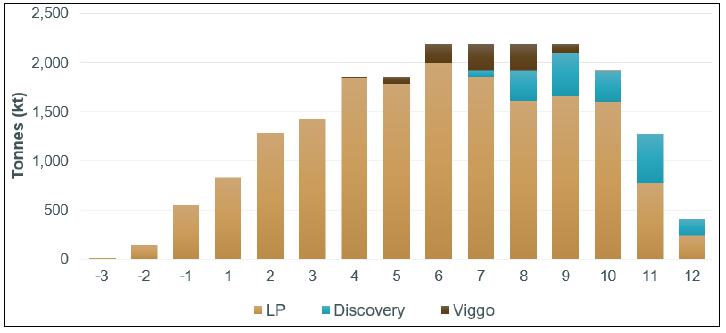

| · | The LP Zone contains three separate open pit mining areas known as LP Central, LP Discovery, and LP Viggo, with independent pit optimizations completed for each of these areas. After the completion of pit limit analysis and assessment versus underground mining, it was determined that only the open pits in the LP Central and LP Viggo areas are economically viable for open pit mining extraction. |

| · | The LP Central pit shell was selected at a revenue (price) factor of 100% or US$1,400/oz. Due to the scarcity of non-potential acid generating (NPAG) material in other areas of the pits and the need for such material in sufficient quantities for construction purposes, the LP Viggo pit shell was selected at a price factor just above US$1,500/oz to increase the NPAG rock yield and the quantity of mineralized material in the LOM plan. As scheduled, the LP Viggo Pit will be excavated in approximately two years and will capture over 5 Mt of NPAG waste rock. |

| · | In the opinion of the QPs, the current open pit and underground designs and LOM plans are reasonable for a PEA stage of study and will benefit from more technical data collection and testing to confirm design inputs, additional drilling to upgrade resources into higher confidence categories, and mine optimization activities. |

Metallurgical Testing and Mineral Processing

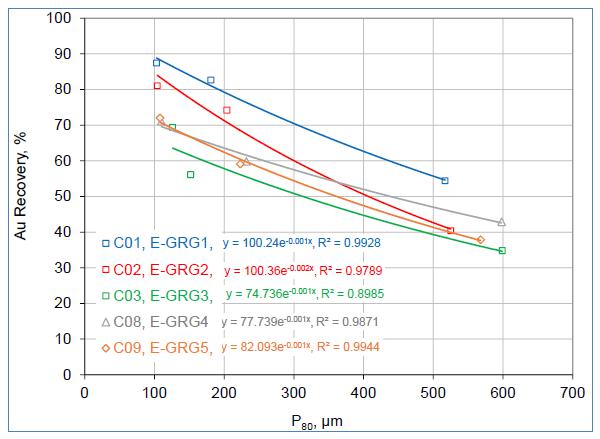

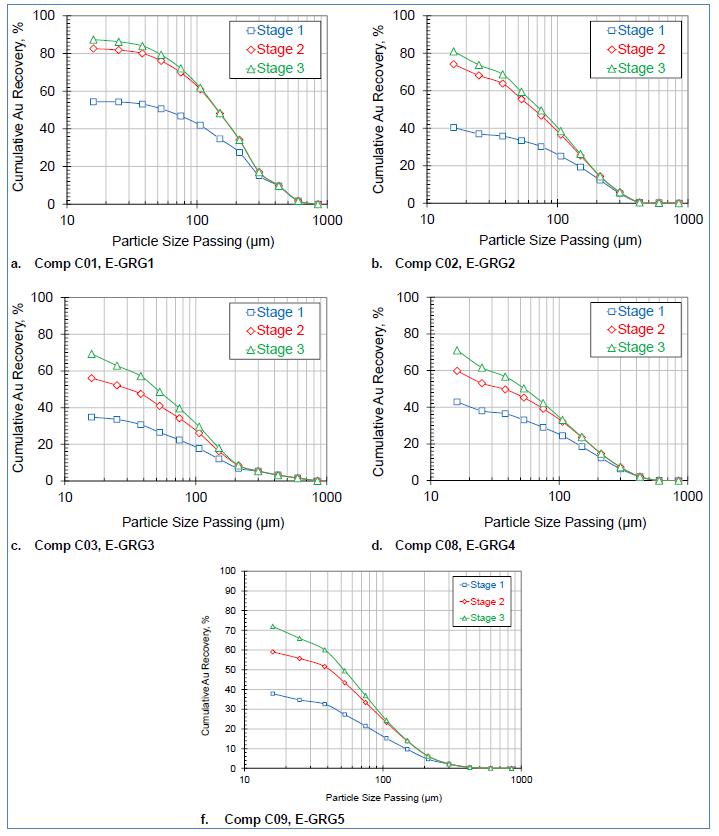

| · | In comparison to the SGS hardness database, Hinge and Limb samples are hard materials whereas the LP mineralization falls in the range of moderately soft materials. Based on extended gravity recoverable gold (E-GRG) testing, the Project’s mineralization is amenable to industrial gravity separation processing. |

| · | Flotation tests for sulphur and sulphide removal yielded positive results, removing an average of 88% of the total sulphur and 91% of the total sulphides from the final tailings. The final tailings sulphur and sulphide grades were less than 0.2% and 0.1%, respectively. |

| · | The anticipated LOM gold recovery for the Project is 95.7%. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| · | As of the effective date of this Technical Report, the QP is not aware of any processing factors or deleterious elements that could have a significant effect on potential economic extraction. |

Infrastructure and Tailings Management

| · | There is expected to be insufficient power available for production from the Hydro One grid between the time the exploration phase of the Project is complete and when grid infrastructure upgrades by Hydro One are completed. Other sources of power will be needed in the interim to meet the needs of the Project (the Bridging Period). During the Bridging Period, the total power requirement for the Project will be approximately 30 megawatts (MW). Of this, approximately 17 MW will be self generated on site by a natural gas (NG) line fuel source, while the existing Hydro One overhead transmission line is expected to contribute approximately 13 MW. |

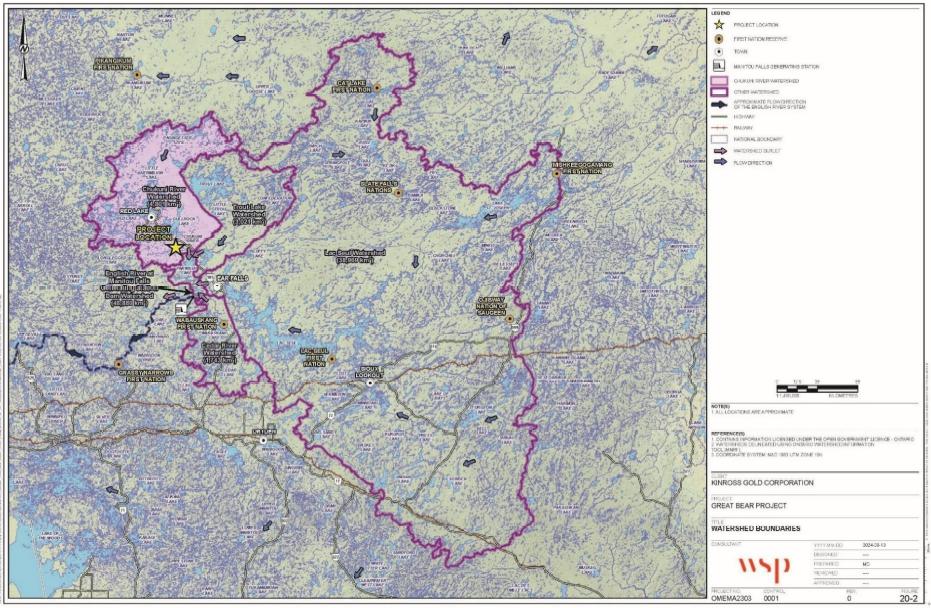

| · | Where possible, to improve the overall water use efficiency and minimize river water extraction, the Project contemplates industrial water use plus water from the Chukuni River to satisfy process and potable water requirements. |

| · | Soft foundation conditions exist in the vicinity of several tailings containment and water control dams. Assumptions have been adopted for the conceptual design of this infrastructure and additional geotechnical studies are ongoing to optimize the design work and further mitigate geotechnical risks. |

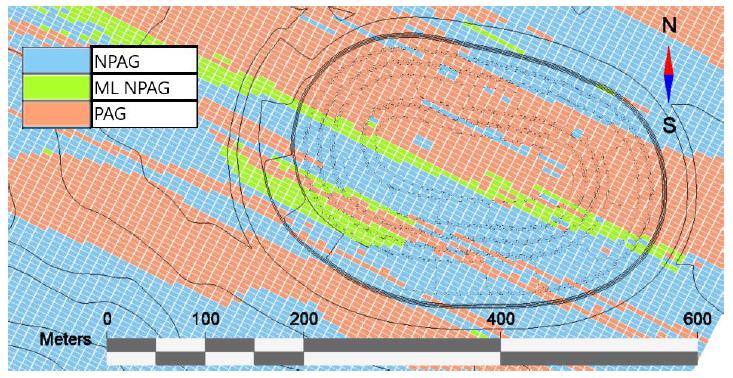

| · | A critical assumption in the Project’s water management plan is that the LP Viggo Pit will be mined out by the start of process plant production. This milestone will allow NPAG rock mined and stockpiled from the LP Viggo Pit to be used in the majority of the Project’s construction activities and allow for contact water and sulphide concentrate tailings to be managed within the mined-out LP Viggo Pit. |

Environment, Permitting, and Social Aspects

| · | Pre-acquisition, Great Bear initiated multi-disciplinary baseline studies in 2021 and these studies are ongoing. |

| · | The Project will require an impact assessment (IA) under the Impact Assessment Act and an Impact Statement is currently in preparation, with the plan to submit to the Impact Assessment Agency of Canada (IAAC) within legislated timelines. |

| · | Lac Seul First Nation and Wabauskang First Nation have indicated an interest in completing an Anishinaabe-led Impact Assessment. Discussions are underway to determine the most efficient manner of integrating information across the Federal and Anishinaabe-led processes that are anticipated to proceed in parallel. |

| · | A Ministry of Natural Resources and Forestry Class environmental assessment (EA) may be required for Resource Stewardship and Facility Development Projects; this will be confirmed through discussions with the Provincial regulator. A cooperation agreement is in place between the Province of Ontario and Government of Canada which will facilitate coordination to reduce duplication of effort in the IA and EA processes if needed. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| · | The Project will require several Provincial and Federal environmental approvals in addition to the IA and EA mentioned above. |

| · | Kinross has been actively engaging with Indigenous communities and organizations including Lac Seul First Nation, Wabauskang First Nation, Asubpeeschoseewagong Netum Anishinabek (ANA), Grassy Narrows First Nation, and Métis Nations of Ontario / Northwest Métis Council (Region 1). These are the same communities listed in the IAAC draft Indigenous Engagement and Partnership Plan. |

| · | Comprehensive geochemical studies for the Project are ongoing. This includes metal leaching and acid rock drainage (ML/ARD) assessment for all Project geologic materials including rock, tailings, and soils (overburden). The Project design considers the results of the test work to date, and includes but is not limited to, the collection of contact waters for management and treatment as needed. Another key management measure is that potentially acid generating tailings will be stored permanently in the mined-out LP Viggo Pit under a water cover to prevent oxidation. |

| · | Water management planning is underway, and the Project has a conceptual plan for managing contact and non-contact water including additional treatment as appropriate. |

| · | A Certified Closure Plan will be prepared for the Project in parallel with other approval processes for the Project as information is updated or becomes available. A conceptual closure plan and cost estimate were developed for the Project. |

Recommendations

Based on the information presented in this Technical Report and the results of ongoing work on the Project, the QPs offer the following recommendations on the Project by area:

Overall Project Development

| 1. | Study the Project with engineering partners and advance the Project through Kinross’ internal stage-gating process in support of permitting and Project development. |

| 2. | The LP, Hinge, and Limb zones continue to warrant follow-up drilling to: |

| i. | improve the understanding of the extent of the deposits along strike and at depth. |

| ii. | complete in-fill and definition drilling in support of upgrading resources into higher confidence categories, inform Mineral Reserve estimation, and help optimize mine designs, short and mid-range mine planning, and the Project’s LOM plan. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| 3. | Concurrent with drilling programs, continue specific technical studies for the Project, including more advanced density, geotechnical, hydrogeologic, hydrologic, and metallurgical test work programs and environmental baseline studies to inform: |

| i. | wet and dry overburden and rock quantity estimates. |

| ii. | the ground and water conditions that are likely to be encountered during construction and operations. |

| iii. | the optimal site layout and infrastructure designs for a combined open pit and underground operation. |

| iv. | the expected metallurgical performance over the Project’s LOM. |

| v. | permitting, closure, and related environmental, social, and governance (ESG) activities. |

| 4. | Execute the AEX program, which includes the establishment of an underground decline and underground mine development to facilitate exploration drilling from underground, test the depth of the deposits, as well as better define the deposits for more advanced Project planning and engineering work. |

Geology and Mineral Resources

| 1. | Continue updating geological mapping and geological models through further data collection and analysis programs. |

| 2. | Specific exploration recommendations for 2024 and beyond include continued diamond drilling for the purposes of: |

| i. | Following down plunge extensions of mineralization in the LP Discovery, LP Central, and LP Viggo areas of the LP Zone and using directional drilling to optimize intercepts when testing targets below 1,000 metres (m) vertically below surface. |

| ii. | Using directional drilling to test for depth extents on the steeply dipping Hinge and Limb zones. |

| iii. | Continuing to follow up on surface geophysics targets that indicate complex folding in and around the Hinge and Limb deposit areas, testing along strike of the LP Zone beyond known mineralization at LP Discovery and LP Viggo, and testing the ground acquired in 2023 that extended the southern property boundary. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| iv. | Upgrading Inferred and Indicated Mineral Resources to higher confidence resource categories to inform advanced technical studies and support the preparation and disclosure of Mineral Reserve estimates. |

Mine Design and Mining Methods

| 1. | Complete geotechnical work including three-dimensional (3D) numerical stress modelling and related assessments to continue to optimize mine designs and mining sequences, refine external dilution assumptions, evaluate crown pillar dimensions, and confirm the siting of key infrastructure and fixed facilities. |

| 2. | Update and calibrate the groundwater model using the actual responses of the groundwater system to the AEX ramp development and additional data obtained from the drilling information. |

| 3. | Further optimize the transition and production ramp-up from the open pit and underground mines by including the latest Mineral Resource data and cost estimates. |

| 4. | Update open pit and underground mining equipment fleet selections and confirm the inputs and assumptions used to determine the underground haul truck fleet requirements. |

Metallurgical Testing and Mineral Processing

| 1. | Complete additional geometallurgical variability test work to better understand the expected variability of process plant feed and operating costs over the LOM. |

| 2. | Additional variability testing should include, at a minimum, crusher work index, semi-autogenous grinding (SAG) mill comminution, Bond ball mill work index, Bond abrasion index, gravity separation tests, and cyanide leaching of gravity tailings. Other variability test work that should be considered may include settling tests (leach feed, leach tails, and flotation tails), cyanide destruction tests, flotation tailings acid generation tests, and tailings rheology tests. |

| 3. | Evaluate the effect of chemical and mineralogical differences between the different zones in more detail; specifically, this will require more samples from the Hinge and Limb zones to be tested so that the metallurgical response of these zones can be adequately assessed and compared to the LP Zone. |

| 4. | Conduct carbon adsorption modelling to confirm the necessary retention time of leach slurry in the carbon adsorption circuit. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Infrastructure and Tailings Management

| 1. | Complete more extensive geotechnical test work across the Project area on both overburden and bedrock materials, incorporating geophysics, drilling, and laboratory testing. |

| 2. | Complete an advanced evaluation of tailings desulphurization options/ technologies to confirm that the planned tailings desulphurization step will sufficiently improve tailings geochemical properties (i.e., acid generating and metal leaching potential), will validate the assumed geochemical assumptions, and effectively mitigate closure liabilities and closure costs. |

| 3. | Update freshwater pipeline and related infrastructure designs and cost estimates for freshwater abstraction from the Chukuni River. |

| 4. | Advance geotechnical and hydrogeological investigations adjacent to and along the proposed alignment of the TMF Pond Dam to support detailed design of the seepage cut-off measures and the modelling of groundwater seepage and groundwater capture. |

Environment, Permitting, and Social Aspects

| 1. | Continue baseline and other environmental studies for input into permitting and engineering studies. |

| 2. | Continue the geochemical studies currently underway to confirm the current understanding of potential acid generating material and how these will be managed. |

| 3. | Continue to advance the Impact Statement process and environmental permitting. |

| 4. | Continue to build relationships with local communities and Indigenous Nations, as well as support the Anishinaabe-led Impact Assessment. |

Proposed Program and Budget

Table 1-2 summarizes preliminary budget estimates for carrying out several of the aforementioned recommendations. The recommendation activities proposed below will be developed in a phased approach. The continued progress of Advanced Exploration is the highest priority item.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Table 1-2: Preliminary budget for recommended actions

| Activity | Detail | Estimated

Cost (US$ thousands) |

||||

| Advanced exploration | Execute AEX program on surface and underground. Including 116,000 m of underground infill drilling and assaying | 284,000 | ||||

| Subtotal Advanced Exploration | 284,000 | |||||

| Surface in-fill and reverse circulation drilling | 150,000 m @ US$173/m | 26,000 | ||||

| Subtotal Exploration | 26,000 | |||||

| Geotechnical studies | Including soils geotechnical drilling | 4,000 | ||||

| Metallurgical test work | 1,000 | |||||

| Environmental baseline and permitting | Federal and Provincial permitting | 9,200 | ||||

| Engineering studies | Continued studies and engineering including project team | 17,400 | ||||

| Contingency | 2,400 | |||||

| Subtotal Engineering & Permitting | 34,000 | |||||

| Total | 344,000 | |||||

Notes: Totals may not sum due to rounding.

| 1.2 | Technical Summary |

Property Description, Location and Land Tenure

The Project is located in northwest Ontario, Canada at latitude 50.8764°N and longitude 93.6398° (Universal Transverse Mercator (UTM) Zone 15N 455665E, 5633910N (NAD83)). Red Lake, the nearest municipality, is 24 km north-northwest of the Property. Red Lake consists of six small communities—Balmertown, Cochenour, Madsen, McKenzie Island, Red Lake, and Starratt-Olsen—and is an enclave within the Unorganized Kenora District. Red Lake is 535 km northwest of Thunder Bay, Ontario and 250 km east of Winnipeg, Manitoba.

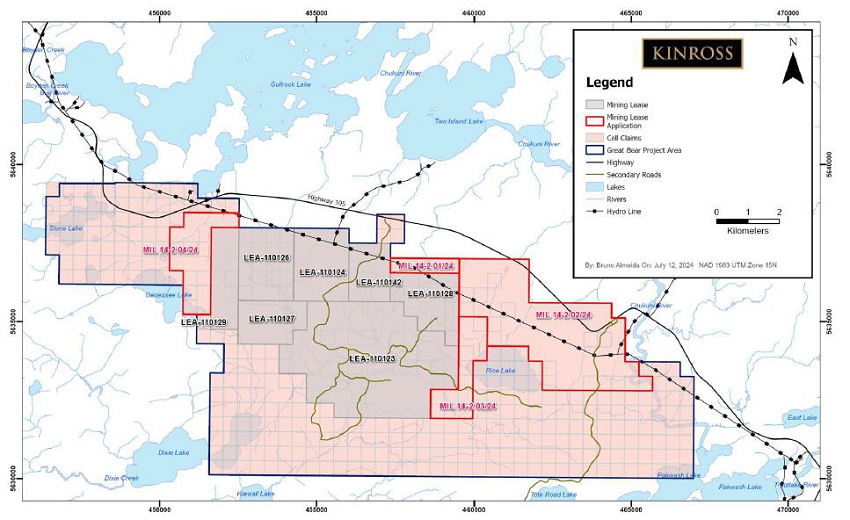

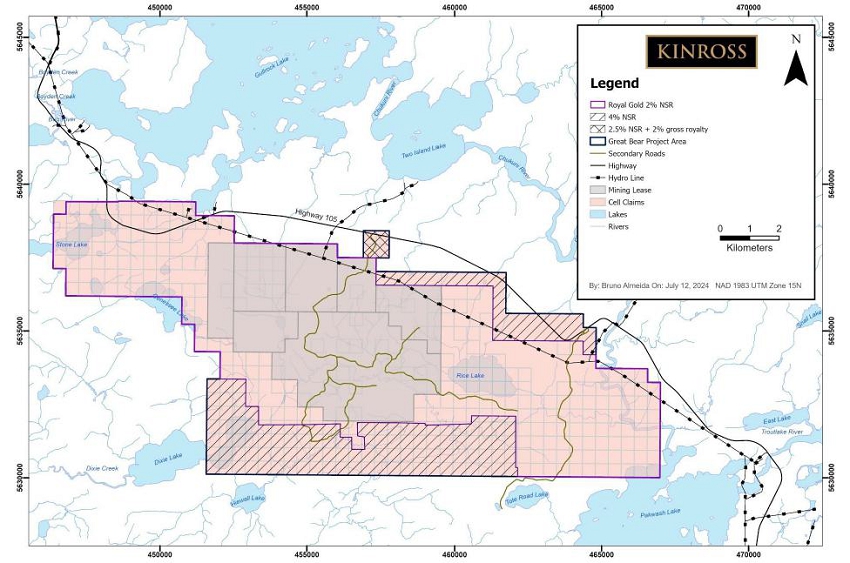

The Property consists of a contiguous block comprising 380 unpatented mining claims and seven mining leases, totalling 11,852 ha. Kinross’ wholly-owned subsidiary Great Bear owns 100% of the claims.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

History

The first exploration work on the Property documented by Geology Ontario dates to 1944, with mapping/prospecting, diamond drilling, and geophysical work continuing to present.

Prior to acquisition by Kinross, a total of 974 diamond drill holes (DDH) for 390,227 m had been completed on the Property (historically named the Dixie Lake Property) between 1944 and February 2022. Other exploration activities included geological mapping, and airborne and ground-based geophysical and geochemical surveys.

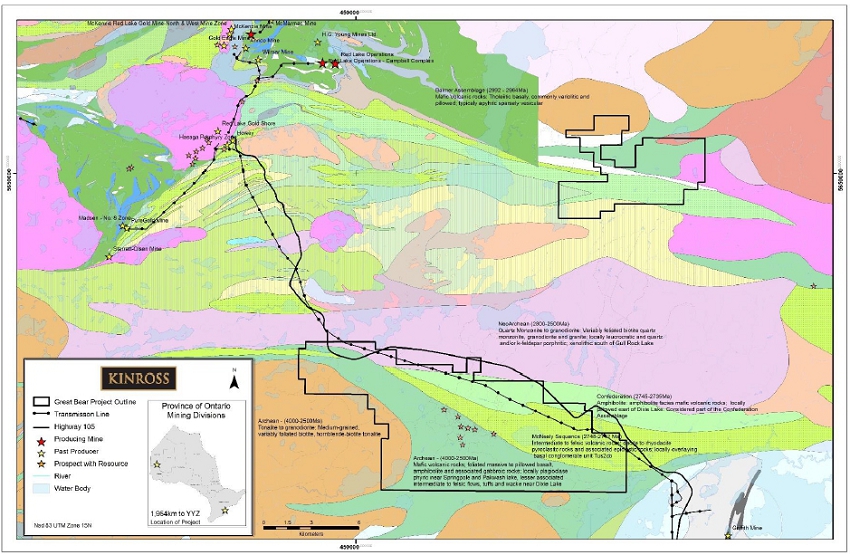

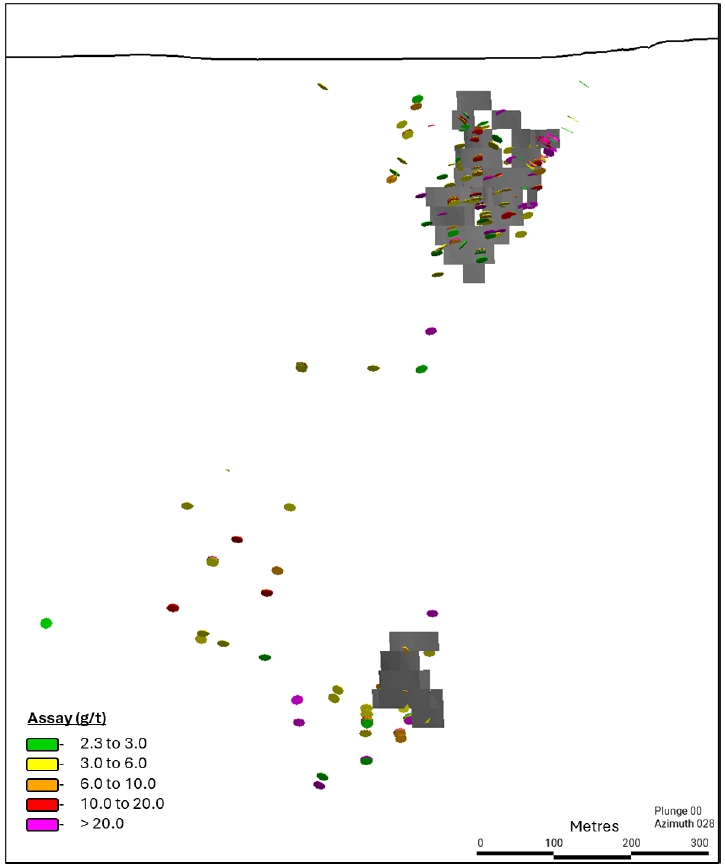

Historically, the most significant drill programs on the Project were completed by Consolidated Silver Standard Mines Ltd. (1988), Teck Resources Ltd. (1989-1990), Alberta Star Mining Corp./Fronteer Development Group Joint Venture (2003-2004), Grandview Gold Inc. (2005-2011), and Great Bear Resources Ltd. (2017-2022). These programs focused on two main target areas historically identified as the 88-4 Zone and the NS Zone. These zones are currently known as the Limb Zone and Hinge Zone respectively. In 2019, Great Bear discovered and subsequently drill-tested the third and largest target on the Property, the LP Zone.

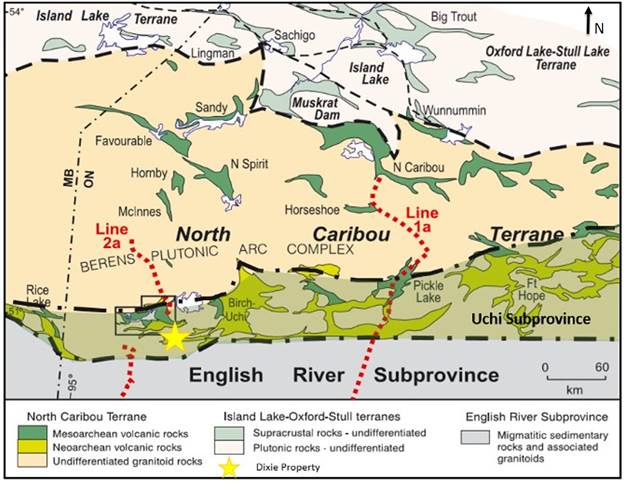

Geology and Mineralization

The Property lies within the Red Lake greenstone belt of the Uchi Subprovince of the Archean Superior Province of the Canadian Shield. The belt is one of the most prolific gold camps in Canada, with gold production over 29 million ounces (Moz) from multiple deposits, including the Campbell-Goldcorp (>23 Moz), Cochenor-Willans (1.2 Moz), and Madsen (2.4 Moz) mines.

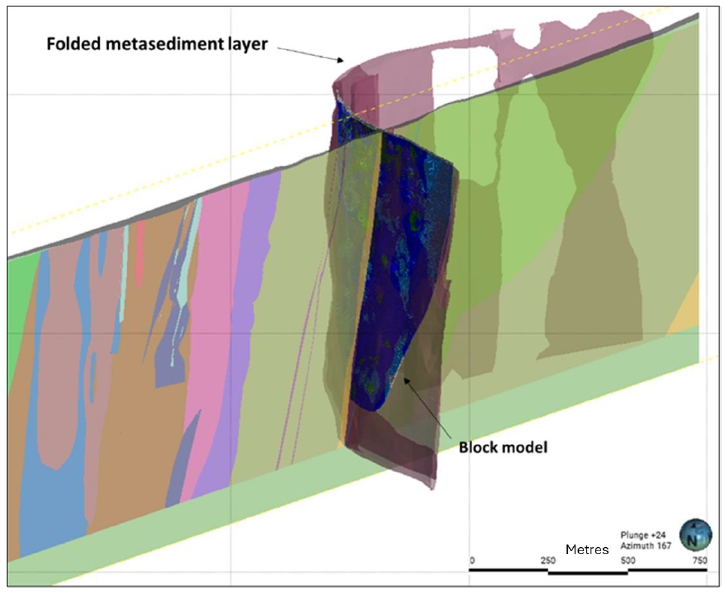

Because of the overburden and lack of outcrop exposure throughout the Property, most of the previous geological interpretation was based on geophysics, limited regional scale mapping, and diamond drilling.

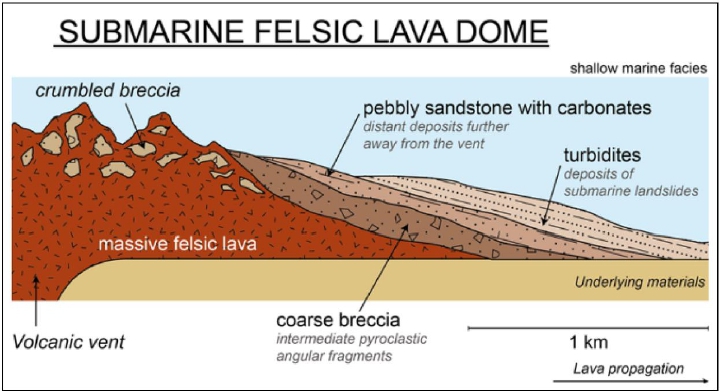

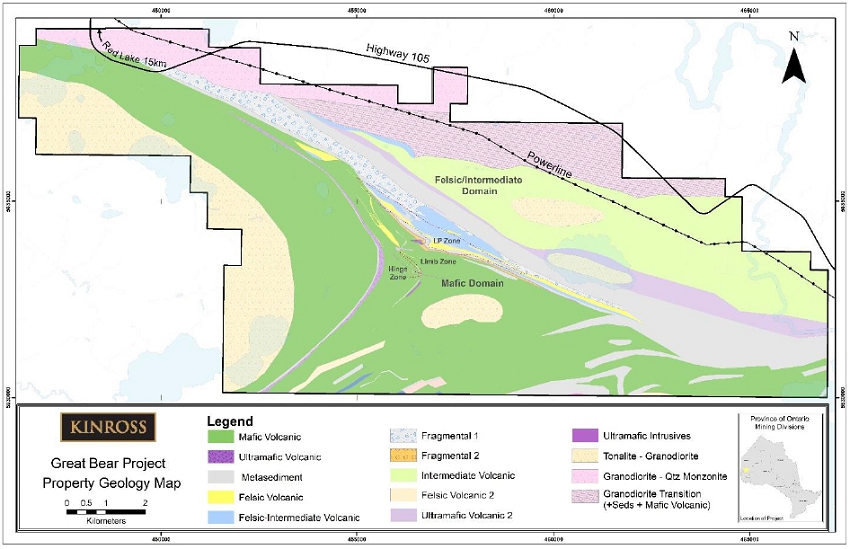

The Property area lies within a regional northwest-southeast trending belt of metavolcanic and metasedimentary rocks which are bounded by intrusive batholiths. The southwestern portion of the Property is within the mafic domain and consists of mafic volcanic flows (high Fe-tholeiites and high Mg-tholeiites) intercalated with argillite, siltstone, iron formation, and minor local felsic volcanics. The younger sequence of intermediate to mafic volcanic and volcanic derived sedimentary rocks is located at the centre of the Property and has a similar stratigraphy to the western and eastern portions of the Property. The felsic domain dominates the northeastern portion of the Property. It consists of porphyritic felsic flows (dacites) and volcaniclastics intercalated with sedimentary rocks. The sequence is interpreted as a deformed felsic flow-dome complex. The mafic domain is in contact with a largely felsic/sedimentary domain in the northeast portion of the Property.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Mafic volcanic dykes and sills are common throughout the Property, ranging from lamprophyre to gabbro/diorite. Intermediate felsic intrusive rocks are also noted throughout the region.

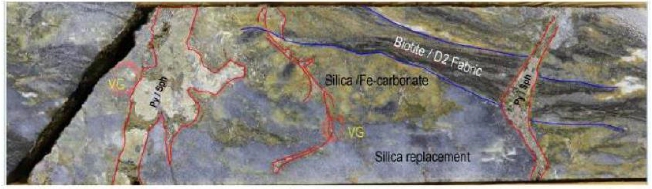

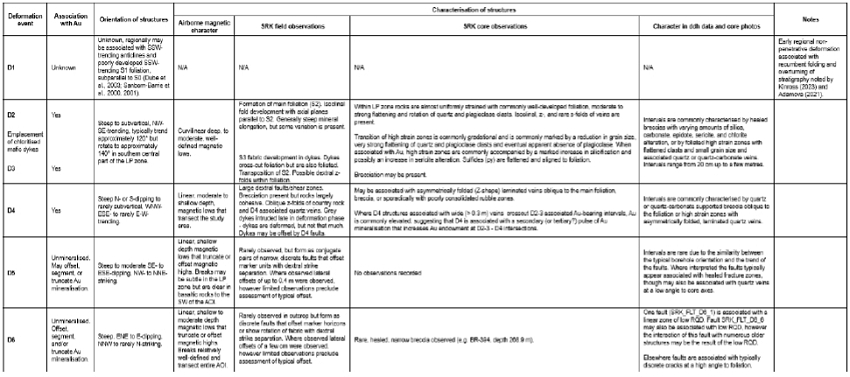

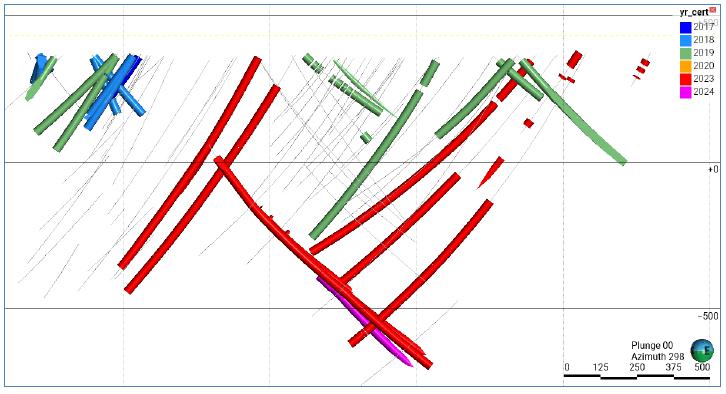

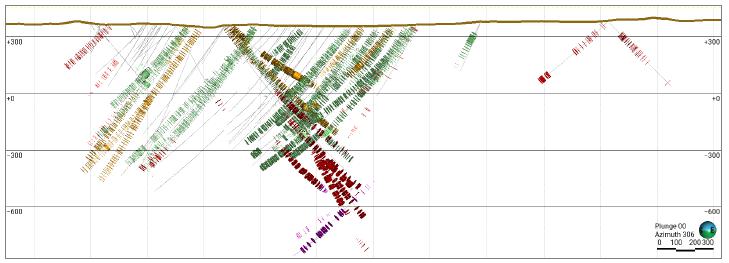

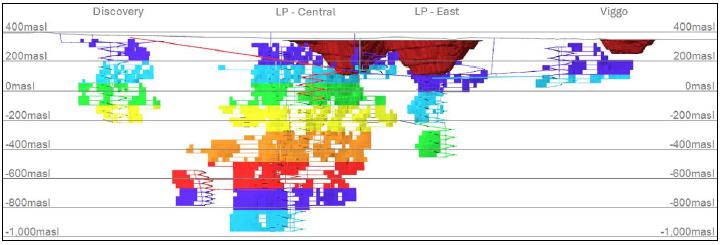

Three dominant styles of mineralization are observed within three target areas on the Property:

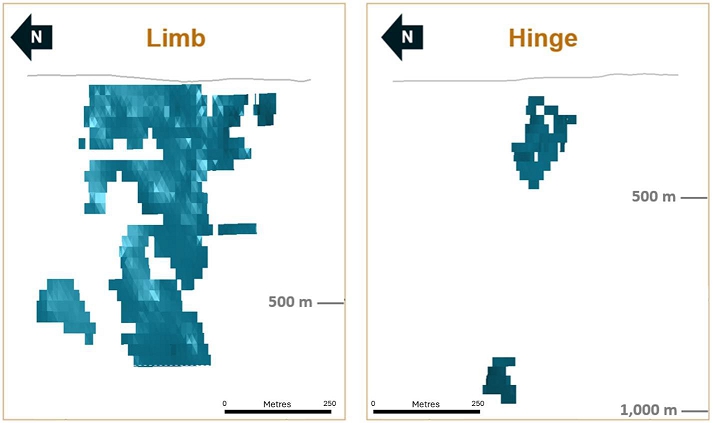

| 1. | Silica-sulphide replacement – Limb Zone |

Mineralization is associated with the rheological and geochemical contact between pillow basalt (Fe-tholeiites) and massive basalt and occurs as replacement of sediments, if present, or as silica flooding and quartz-calcite veining in the absence of sediments. Pyrrhotite (2% to 40%) is the dominant sulphide, with other sulphides including pyrite, arsenopyrite, chalcopyrite, minor sphalerite, and trace magnetite. Visible gold is not uncommon and, where observed, is associated with strong pyrrhotite and weaker arsenopyrite-pyrite mineralization. The zone is approximately 800 m long and has been drilled to a vertical depth exceeding 400 m. Mineralization plunges steeply northwest in a fold limb host dipping steeply to subvertically northeast.

| 2. | Quartz veining – Hinge Zone |

Mineralization is hosted by multiple lithologies including massive basalt (high Mg-tholeiite), argillite, and pillow basalt (high-Fe tholeiite). Individual veins are variable in width ranging from 1 cm to 5 m and can create zones up to 40 m. They are generally mineralized with fine-grained disseminated sulphides including pyrrhotite, pyrite, chalcopyrite, minor arsenopyrite, and trace sphalerite. Visible gold is very common ranging from trace to 5% as pin pricks, centimetre scale clusters, and fracture fill. The Hinge Zone is comprised of several subparallel anastomosing veins formed along the axial trace of a property wide D2 fold.

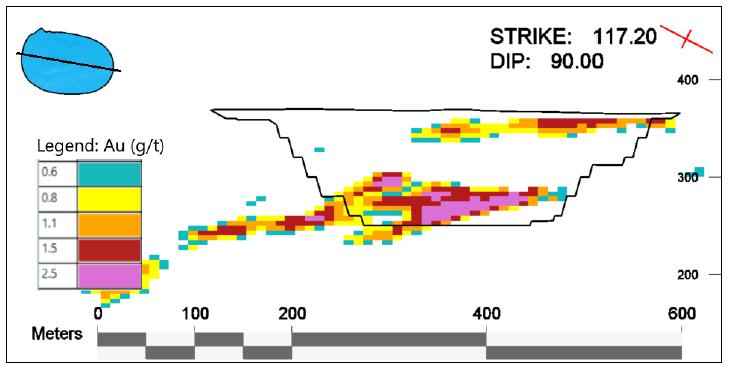

| 3. | Disseminated gold within high strain – LP Zone |

Mineralization occurs within a wide zone of high strain and increased metamorphic grade. The strain zone is very continuous for over 4 km and is slightly oblique to stratigraphy, intersecting multiple lithologies. The higher-grade gold mineralization appears to be controlled by the intersection of this strain zone and a metasediment unit. Recent drilling results indicate that it occurs within 50 m to 100 m of the metasedimentary/felsic volcanic contact. At least three gold mineralizing events have been recognized, including foliation parallel free gold in host rock, transposed quartz veins, and later quartz veins with visible gold that are slightly oblique to foliation.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Exploration

Due to overburden and lack of outcrop in the area, exploration targets were interpreted from geophysical and surface geochemical surveys. These exploration tools include airborne magnetic and electromagnetic (EM) surveys, ground magnetics, very low frequency electromagnetic (VLF-EM), horizontal loop/Max-Min EM, induced polarization (IP), soil, mobile metal ion (MMI), and rock sampling. Anomalies and conductors from the geophysical surveys predominantly coincide with iron formation, graphitic argillites, and sulphide-bearing (pyrite and/or pyrrhotite) argillites, or mafic volcanics. The geochemical surveys, which were typically completed over the geophysical surveys, were then used to vector in on the most prospective targets for diamond drilling.

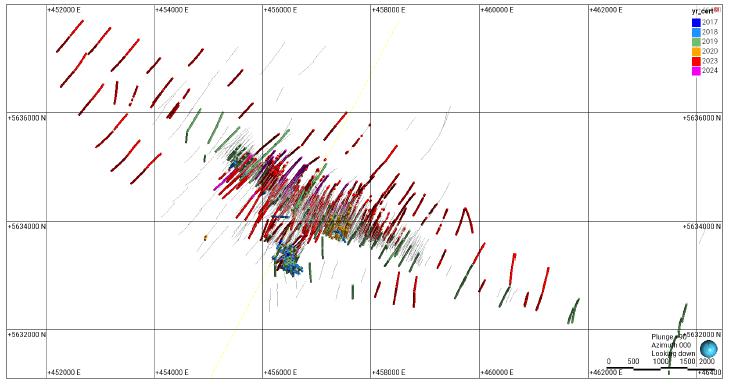

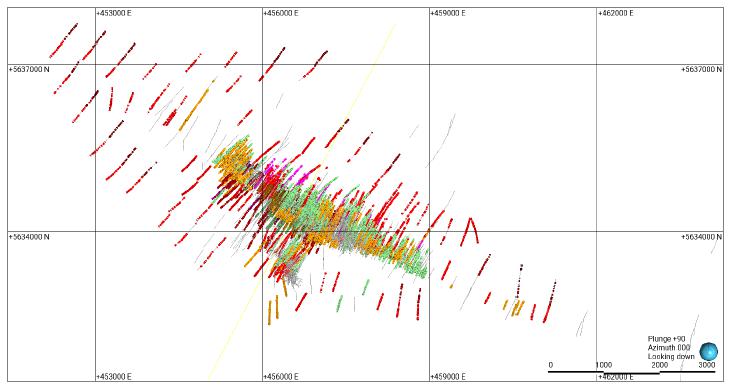

Diamond drilling has been carried out since 1944 and totals 1,636 DDH for approximately 800,165 m. Of these, Kinross has drilled 620 DDH for approximately 428,876 m. In addition, Kinross has drilled a total of 433 reverse circulation (RC) holes for approximately 34,530 m.

The objective of the recent drill program since the initial year-end 2022 Mineral Resource estimate was five-fold:

| 1. | Test the extents of known drill targets. |

| 2. | Expand economic mineralization to meet Inferred Mineral Resource classification status. |

| 3. | Carry out condemnation drilling to identify areas that may be used for capital development. |

| 4. | Continue drill testing the deep extension of the mineralization at a greater than one kilometre depth. |

| 5. | Assess underlying ground conditions and pit studies with geotechnical drilling. |

Mineral Resources

Mineral Resources are stated in accordance with CIM (2014) Definitions as incorporated by reference into NI 43-101. Mineral Resources are estimated for the LP Zone and satellite Hinge and Limb zones and have an effective date of April 2, 2024 (Table 1-3).

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Table 1-3: Summary of Project Mineral Resources – April 2, 2024

| Tonnes | Grade | Gold Ounces | |||||||||||

| Classification | (000) | (g/t Au) | (000) | ||||||||||

| Measured | 1,556 | 3.04 | 152 | ||||||||||

| Indicated | 28,711 | 2.80 | 2,586 | ||||||||||

| TOTAL M&I | 30,267 | 2.81 | 2,738 | ||||||||||

| Inferred | 25,480 | 4.74 | 3,884 | ||||||||||

Notes:

| 1. | Mineral Resources estimated according to CIM (2014) Definitions. |

| 2. | Mineral Resources estimated at a gold price of US$1,700 per ounce. |

| 3. | Open pit Mineral Resources are reported within optimized pit shells at a cut-off grade of 0.55 g/t Au. |

| 4. | Underground Mineral Resources are reported within underground reporting shapes at cut-off grades of 2.3 g/t Au for the LP Zone, 2.5 g/t Au for the Limb Zone, and 2.4 g/t for the Hinge Zone. An incremental cut-off grade of 1.7 g/t Au was used at the LP Zone for areas that do not require additional development. |

| 5. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 6. | Numbers may not add due to rounding. |

The QP is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

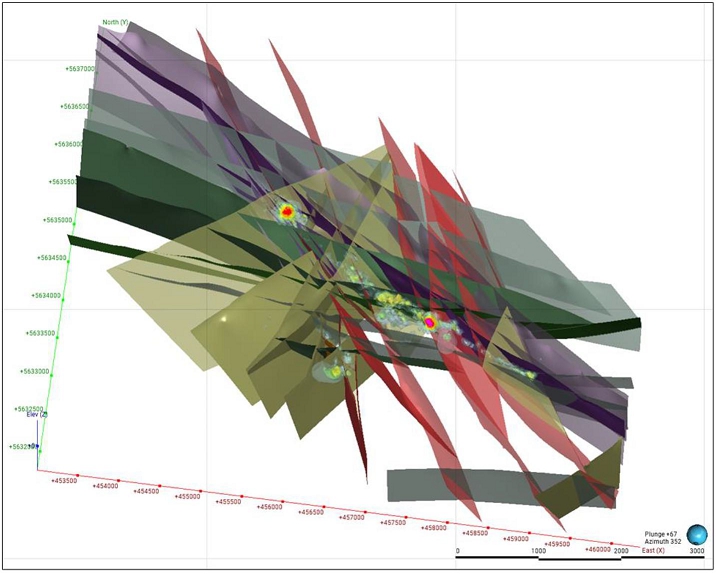

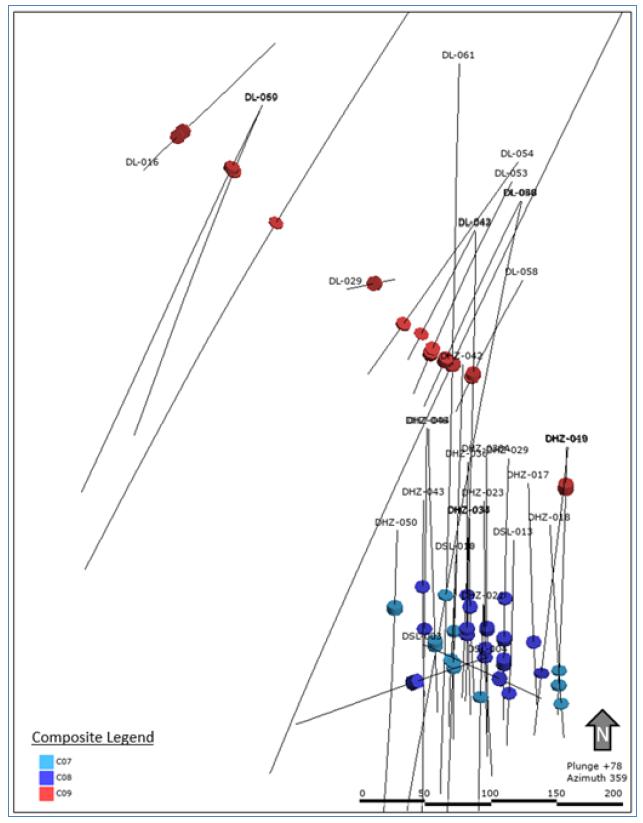

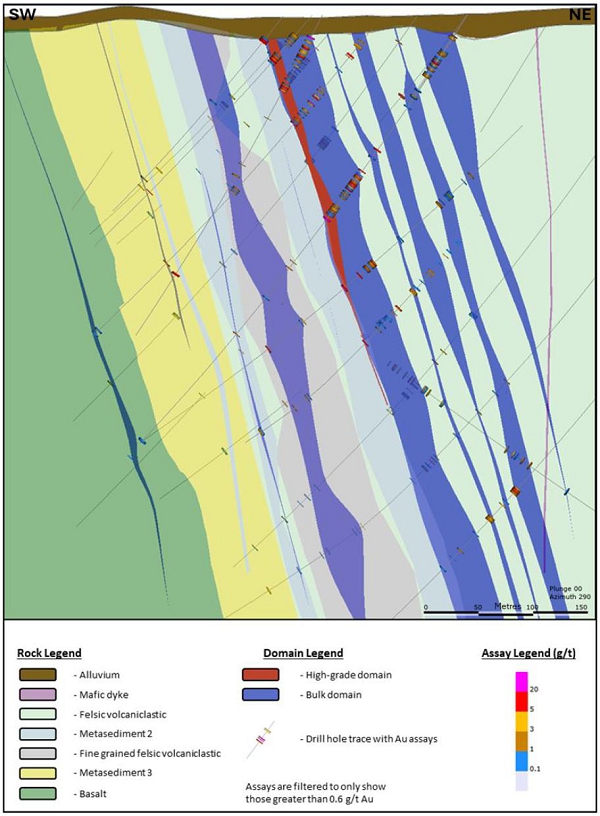

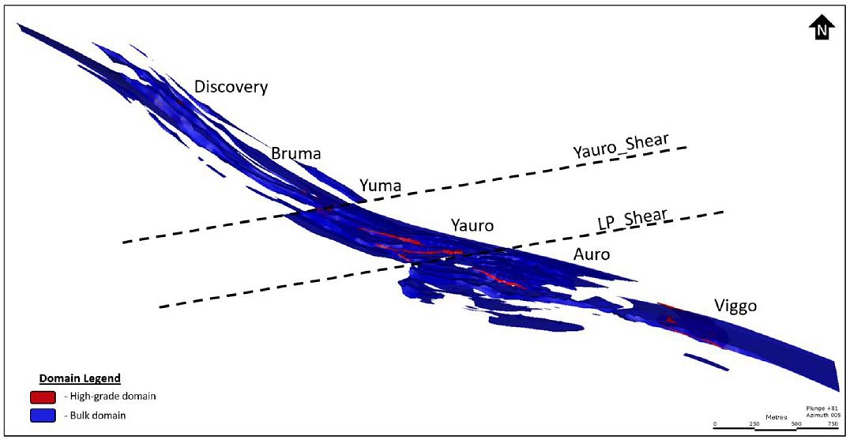

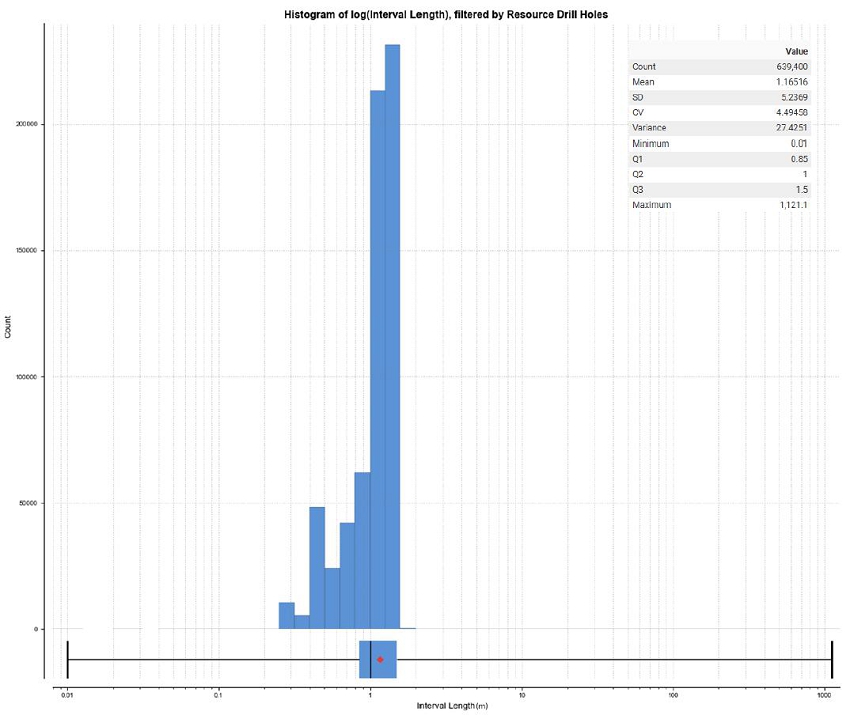

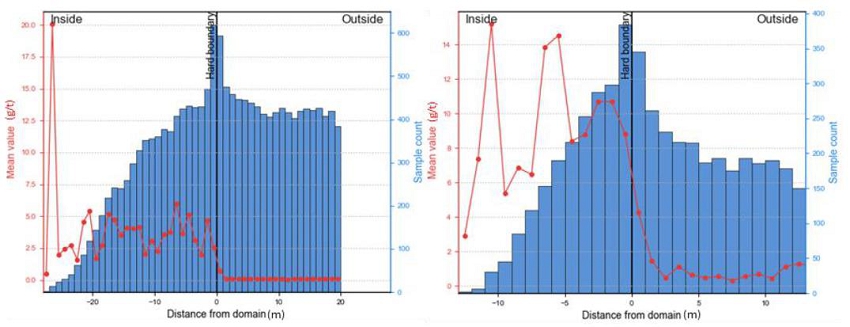

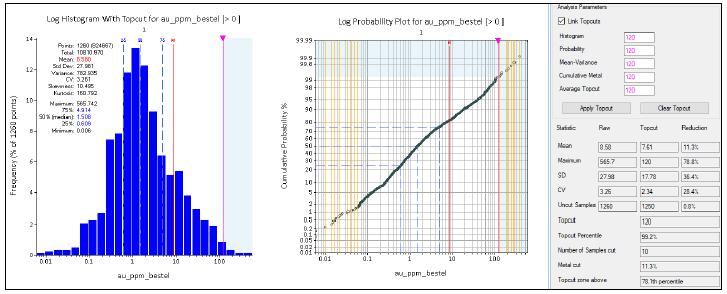

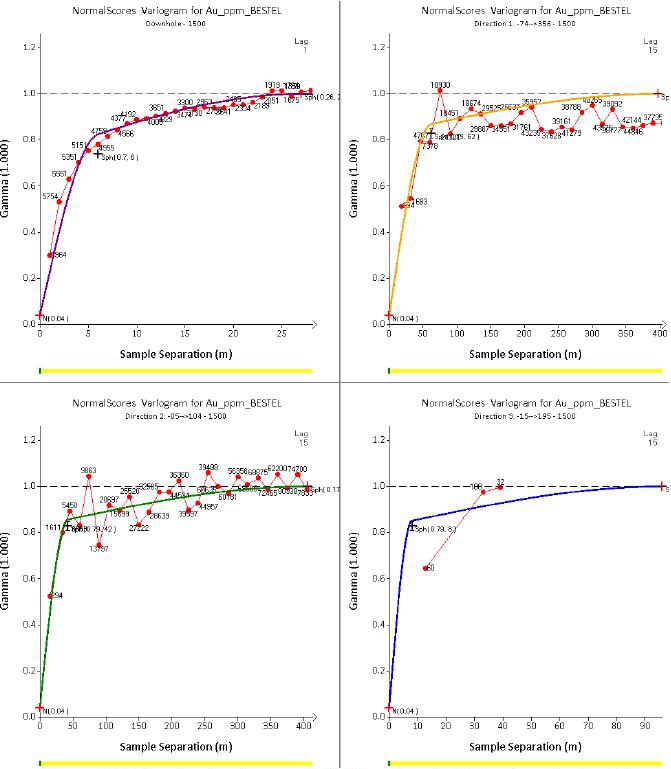

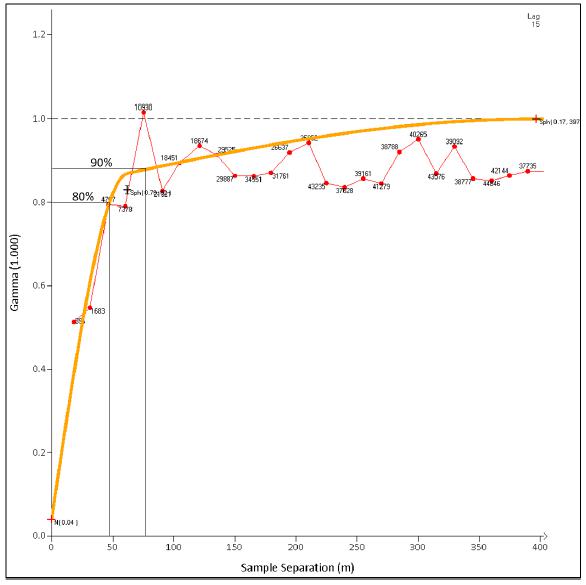

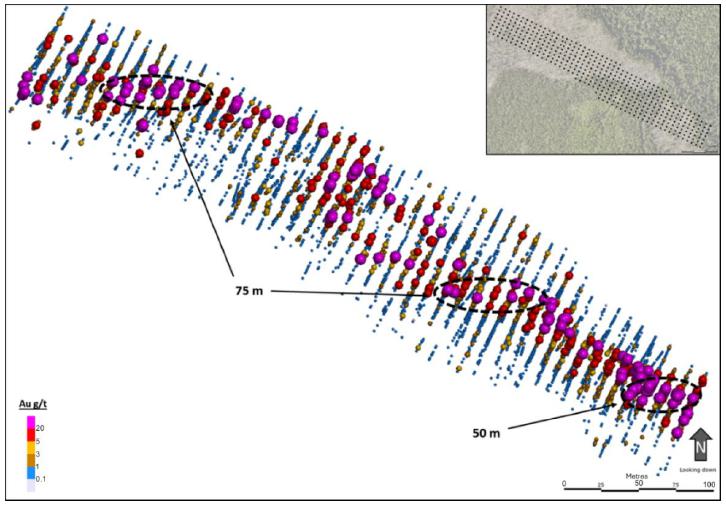

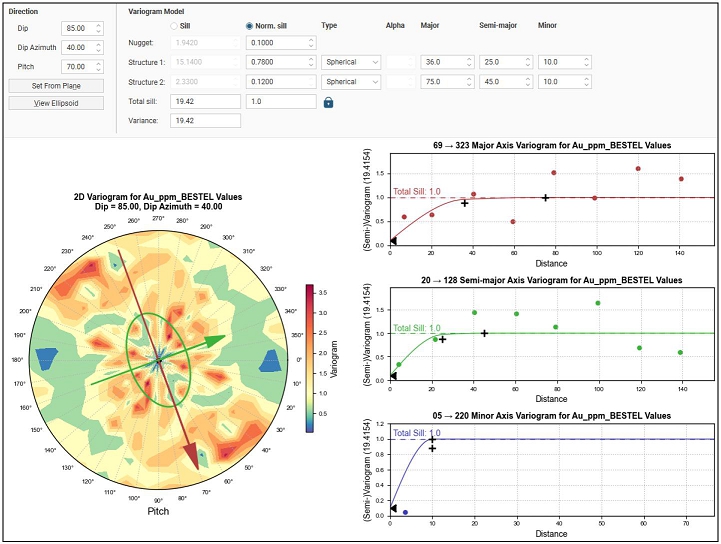

For the LP Zone, Snowden Supervisor v 8.14.2 (Supervisor) was used for geostatistical analysis, Leapfrog Geo 2023.1.2 (Leapfrog) was used to generate estimation domains, and Vulcan 2023.2 (Vulcan) was used for compositing and estimation. The bulk estimation domains were interpolated by ordinary kriging (OK), while the high-grade estimation domains and background domain were interpolated using inverse distance cubed (ID3). Validation of the 2024 Great Bear LP Zone model against grade control data using the ground truth estimation showed a less than 5% difference at a 0.0 g/t Au cut-off grade in ounces of gold. The 2024 Great Bear LP Zone model classification criteria are based upon the geostatistical drill hole spacing analysis supported by historic exploration and deposit growth drilling, as well as the recent 2023 and 2024 drill campaign designed to upgrade unclassified material to Inferred status between the 500 m and 1,000 m depth at the LP Zone.

Great Bear’s Hinge and Limb zones are satellite deposits located approximately 750 m southwest of the main LP Zone. The resource inventory was built using Snowden Supervisor v8.14.3.1 for geostatistical analysis and Leapfrog Geo/Edge 2023.2 for geological and domain modelling, compositing, and estimation. The Limb Zone estimation domains comprise a mineralized zone within metasediments with silica and sulphide replacement hosted in the north limb of the fold. The Hinge Zone estimation domains encompass quartz veins within a tholeiitic basalt in the axial plane of the fold. The main vein at Limb was interpolated using OK and the remaining lenses, using ID3. The model classification criteria are based on drilling spacing analysis and vary between the zones given the differences in the mineralization and its continuity between the two.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

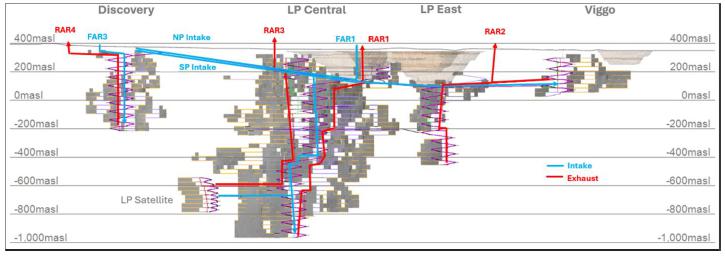

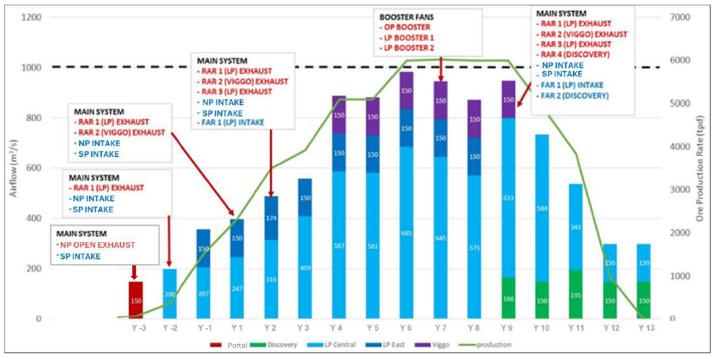

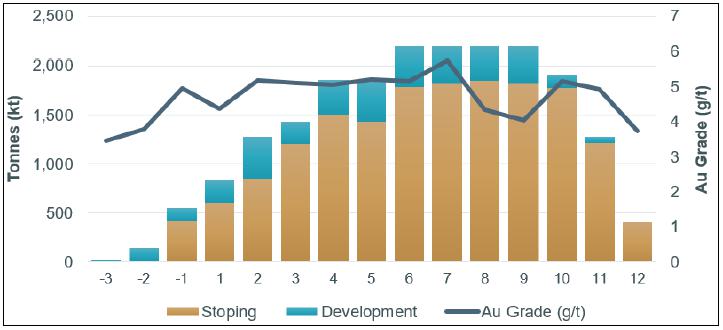

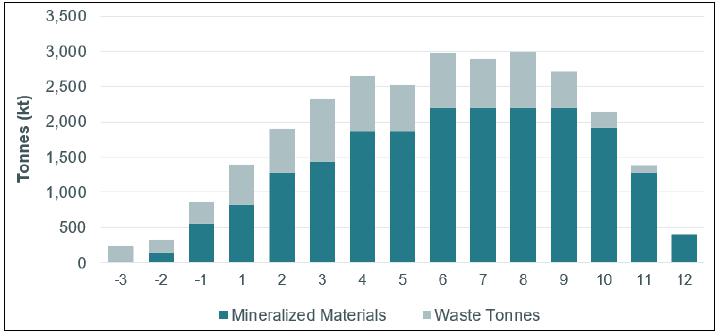

Mine Design and Mining Methods

The PEA contemplates extraction of the deposits at Great Bear using a combination of conventional open pit and underground mining methods. Open pit and underground extraction are proposed to occur in parallel. Surface mining pre-production for construction purposes begins in Year -3. Plant feed will be stockpiled until the process plant begins commissioning in the second half of Year -1. Open pit operations will feed the process plant directly from the mine for eight years and continue with processing of stockpiles for an additional four years. The underground operations are planned to be a feed source for the process plant for approximately 12 years. The combined open pit and underground production is expected to sustain a processing rate of 10,000 tpd for approximately 12 years. Over the LOM, the Project is expected to produce a total of 44.7 Mt of mineralized material producing 5.3 Moz of gold and with an average annual gold production of 482 koz from Year 1 to Year 10.

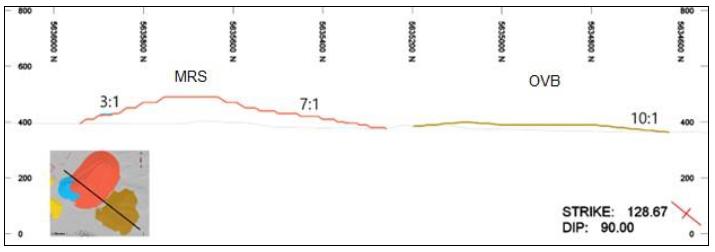

Laboratory testing indicates a strong rock mass with a mean unconfined compressive strength (UCS) ranging between 128 MPa and 164 MPa in the main rock types. The open pits will expose overburden ranging from fine sand to glacio-lacustrine clays.

At the peak of the operation, the open pits are expected to generate approximately 9,000 tpd of plant feed. In total, the open pits extract approximately 24 Mt of mineralized material and 164 Mt of waste overburden and rock. The Project’s open pit designs include one pit phase at the LP Viggo zone and three pit phases at the LP Central zone. A combined semi-bulk and selective loading unit fleet was selected for the open pit operation.

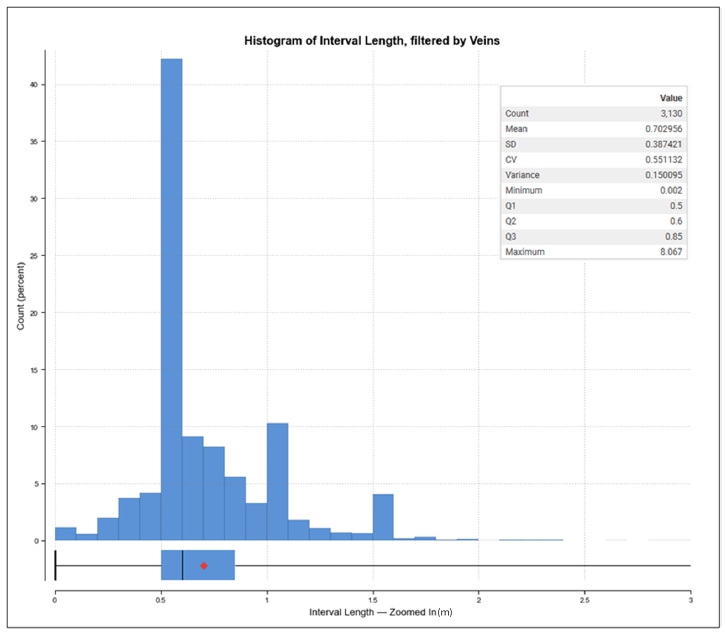

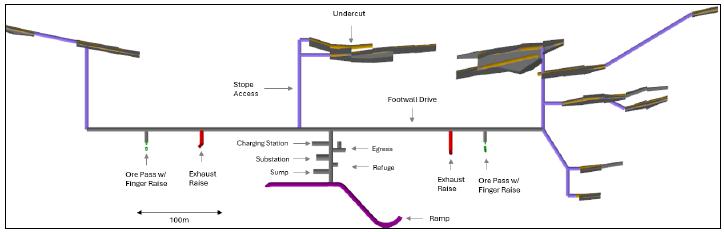

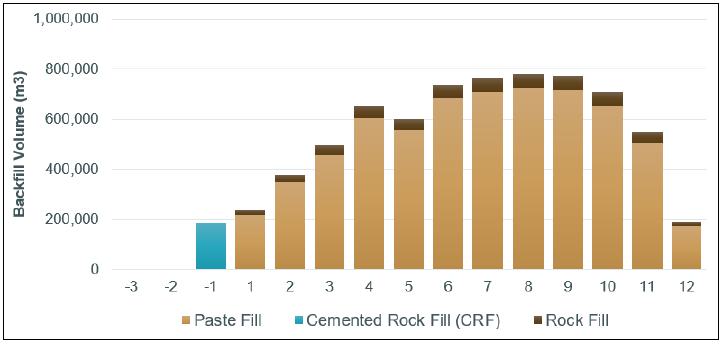

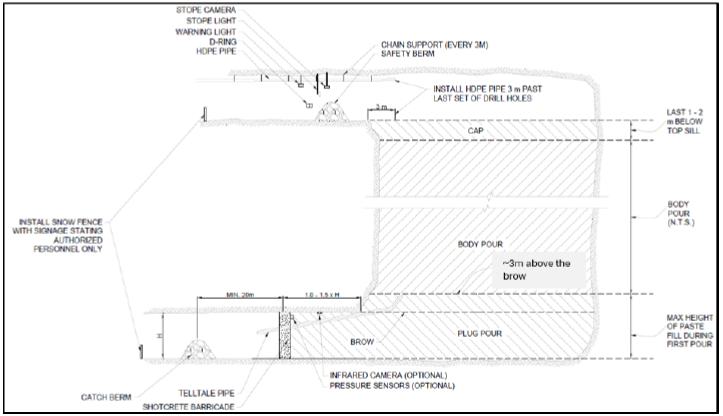

The Project’s primary underground mining method is longhole open stoping with paste backfill and cemented rock fill (CRF), with sublevel intervals of 30 m, and average stope widths of approximately 4 m to 5 m and stope strike lengths of 25 m. Stope minimum mining widths range from 3.0 m to 3.7 m, based on a minimum vein width of 2.5 m, plus total unplanned dilution ranging from 0.5 m to 1.2 m. Mining recovery assumptions include a 95% extraction factor for typical stopes with top and bottom cuts.

The main access to the underground mine is planned to be through underground portals and twin declines. The main materials handling approach includes load haul dump (LHD) units and mine trucks on sublevels for haulage to the surface re-handling point.

First stope production is expected to begin in Year -1 and will continue for an additional 12 years with a peak production rate of approximately 6,000 tpd. Underground production over the LOM is estimated at 20.3 Mt of mineralized material with an average grade of 4.92 Au g/t, containing approximately 3.2 Moz of gold.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Mineral Processing and Metallurgical Testing

Previous to Kinross acquiring the Project, preliminary test work was conducted on composites from the LP, Hinge, and Limb zones of the Great Bear deposit to provide an initial understanding of gold dissolution using standard cyanidation methods. Additional cyanidation tests were conducted to evaluate the impacts of grind size, cyanide concentration, and lead nitrate addition on gold leaching.

Following Kinross’ acquisition of the Project, a more comprehensive test program was initiated that included a wide range of characterization tests comprised of chemical head analysis, mineralogy, gold deportment, comminution, and gold recovery testing.

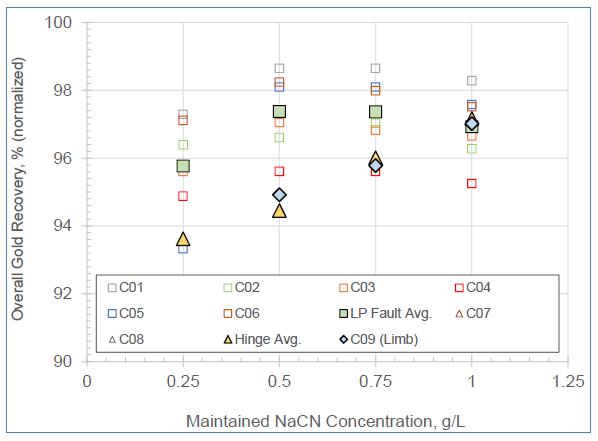

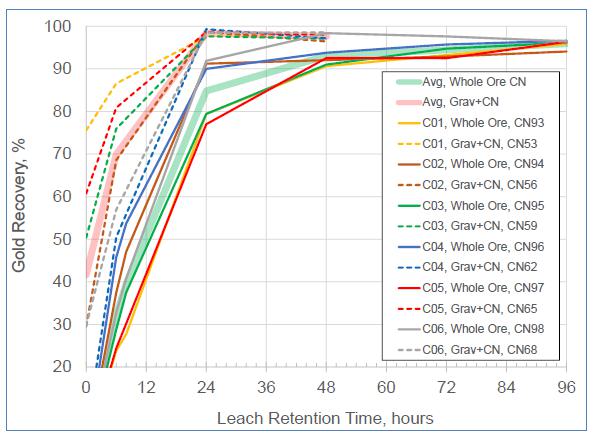

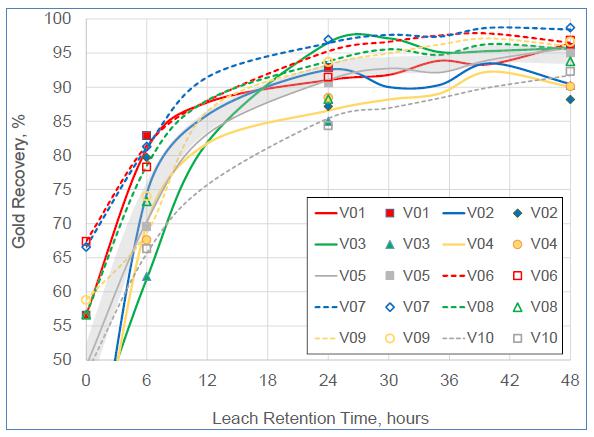

Results from investigative test work led to the selection of a process comprising gravity separation followed by cyanidation of the gravity separation tailings. A grind size of P80 75 µm was selected for the flowsheet. Variability test work was conducted on the ten variability samples using the selected process, optimal conditions determined in optimization testing, and with a leach retention time of up to 48 hours. The variability test work indicated that leaching was largely complete after 24 hours, with only a small amount of additional gold extraction after 48 hours. A leach retention time of 40 hours was selected for the conceptual flowsheet. Overall gold extractions in the variability test work ranged from 88.2% to 96.9%, with gravity recovery ranging from 23.2% to 67.4%.

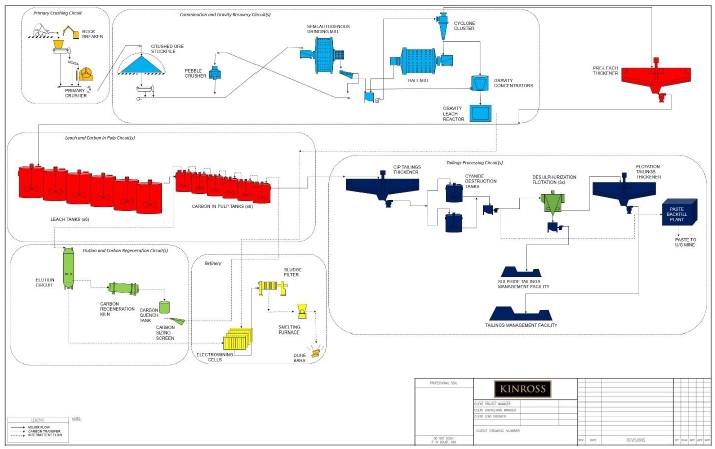

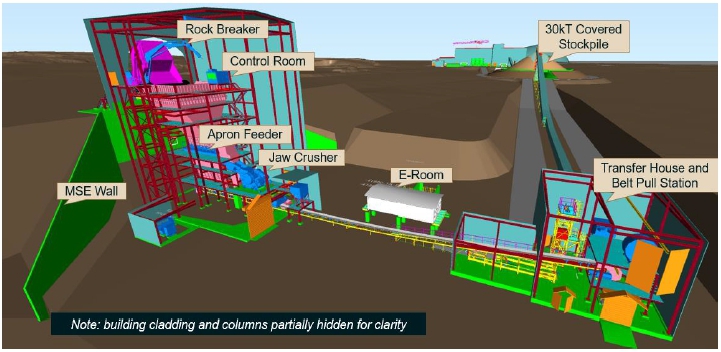

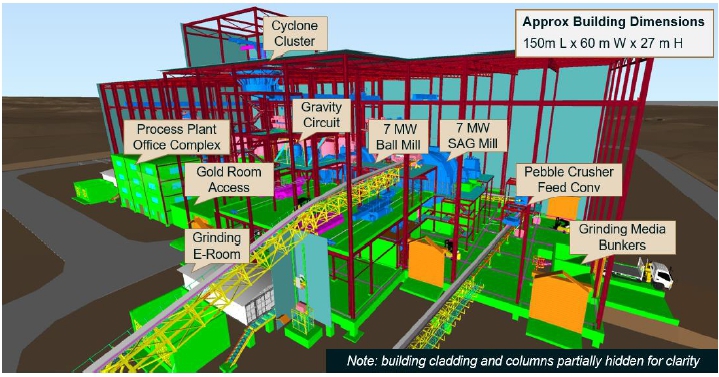

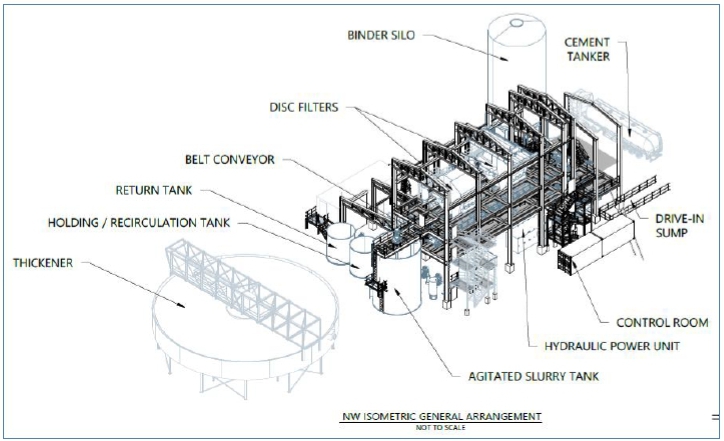

The process plant design assumes a processing rate of approximately 10,000 tpd. The proposed process flowsheet includes primary crushing, SAG and ball milling, pebble crushing, gravity concentration, cyanide leaching followed by carbon adsorption in a carbon-in-pulp (CIP) circuit, carbon elution, electrowinning, and smelting to produce doré bars. Tailings handling will consist of cyanide destruction, tailings desulphurization using flotation, tailings thickening, and conventional slurried tailings disposal. The concentrate from the desulphurization flotation circuit is planned to be sent to a sulphide concentrate management facility in the mined-out LP Viggo Pit, while the tailings from the desulphurization circuit will be dewatered and then pumped to a separate TMF. The Project design assumes a portion of the detoxified tailings will be pumped to a paste backfill plant for use as backfill in the underground mine.

Infrastructure and Tailings Management

Site access is provided through an existing forestry road (Tuzyk’s Road) that branches off Highway 105.

The main power supply for the Project is expected to come from the existing 115 kV overhead powerline from the Hydro One transmission powerline, with on-site distribution via a 34.5 kV distribution line. Pending grid infrastructure upgrades by Hydro One, the substation will be adapted to deliver full capacity for the operations phase. In the interim period (Bridging Phase), it is assumed that a thermal power plant installed at site will be supplied by a natural gas pipeline.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

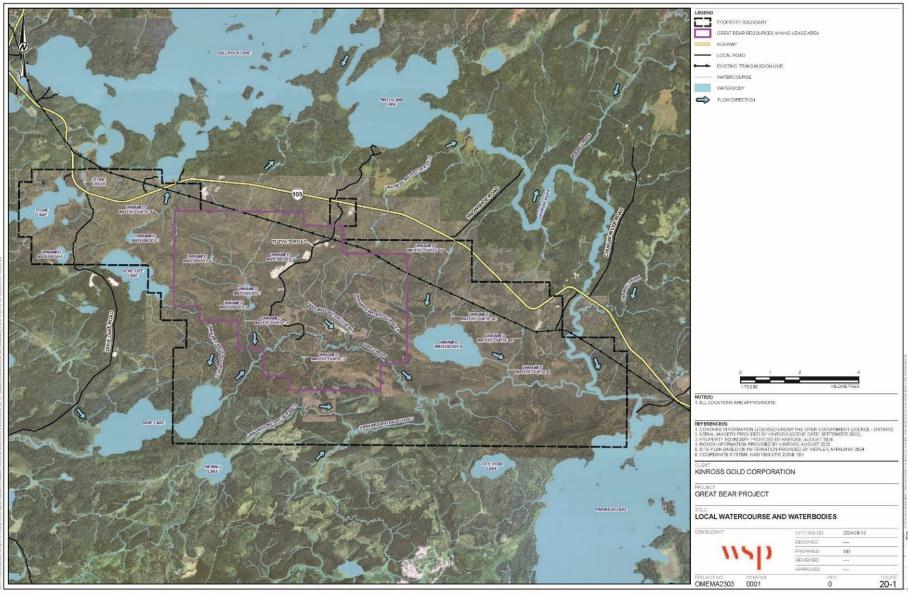

The Chukuni River is planned to be the primary source of fresh water for the Project, however, the Project is designed to recycle as much process water as possible.

The Project’s infrastructure design assumes a centralized Service and Administration Area (SAA) that includes an administration/dry building, a truck shop/truck wash building, emergency and security facilities, warehouses, and tire maintenance and fueling facilities. A paste backfill plant is contemplated, located on surface, southwest of the LP Central Pit. The Project design assumes an accommodations facility will be located adjacent to and east of Tuzyk’s Road to accommodate construction and operations demand.

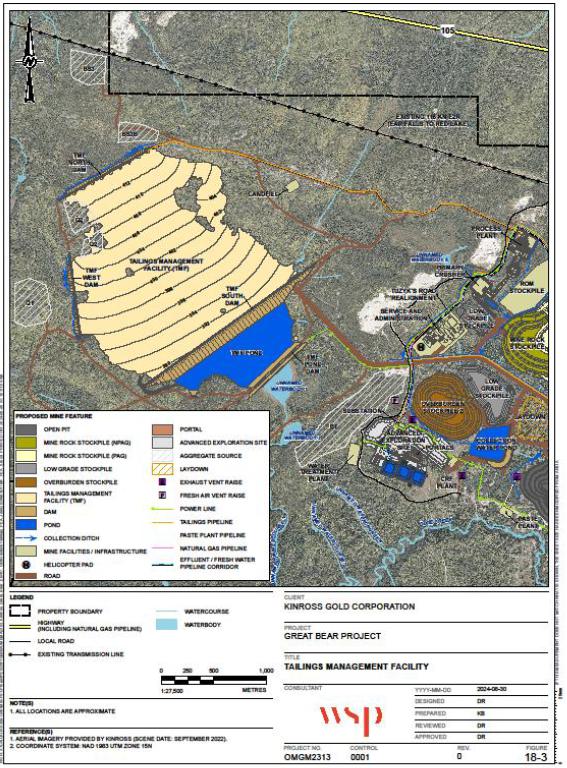

Non-sulphide and concentrate tailings streams are expected to be stored in the TMF and the LP Viggo Pit facility, respectively. The TMF perimeter containment is proposed to be a series of granular dams which contain the tailings solids. Surface run-off and process water captured in the TMF Pond are planned to be contained to the south by the TMF Pond Dam. The TMF Pond Dam design incorporates a cut-off wall to reduce seepage through the dam fill and foundation. Seepage will be collected downstream of the TMF North, TMF West, and TMF Pond dams and pumped back into the TMF. Water in the TMF Pond is planned to be re-circulated to the process plant via a fixed intake or pumped to the WTP.

Surface water is planned to be managed using a series of channels, ponds, and pipelines and pumping infrastructure across the Project area.

NPAG rock mined and stockpiled from the LP Viggo Pit is expected to be used in the majority of the Project’s construction activities and allow for contact water and sulphide concentrate tailings to be managed within the mined-out LP Viggo Pit. The Project design assumes that surplus soil and rock will be stored in engineered stockpiles located to the north and northwest of the LP Central Pit.

Environment, Permitting, and Social Aspects

The Project will require federal review under the Impact Assessment Act and an Impact Statement is currently in preparation. A Provincial Class environmental assessment (EA) may be required; this will be confirmed through discussions with the Provincial regulator. The Project will also require several Provincial and Federal environmental approvals.

Kinross has actively engaged with Indigenous communities and organizations. Indigenous knowledge will also be used to inform Project design decisions, review alternatives methods, and to support development of mitigation measures for the Project as available. Lac Seul First Nation and Wabauskang First Nation have indicated an interest in completing an Anishinaabe-led Impact Assessment. Discussions are underway to determine the most efficient manner of integrating information across the Federal and Anishinaabe-led processes that are anticipated to proceed in parallel.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Multi-disciplinary baseline studies were initiated in 2021 and these are ongoing and will support environmental assessments and permitting. Some species at risk occur on the Property, i.e., little brown myotis and tri-coloured bat (endangered bat species), wolverine (threatened), and eastern whip-poor-will and bank swallow (threatened bird species).

Archaeology studies have been completed for the Project site and local vicinity and three locations have been identified for additional archaeological investigations in 2024. Proposed Project development currently avoids these locations and a surrounding 100 m buffer has been applied pending additional information and dialogue with local Indigenous communities. There are no known archaeological sites that will be directly or indirectly affected by the Project.

Comprehensive geochemical studies are underway for the Project and are ongoing. The Project design considers the results of the test work to date. Water management planning is also underway, and the Project has a conceptual plan for managing contact and non-contact water. Studies are ongoing to better define the tailings management facility water management strategy.

A Certified Closure Plan will be prepared for the Project in parallel with other approval processes for the Project as information is updated or becomes available. A conceptual closure plan and cost estimate have been developed for the Project.

Capital and Operating Costs

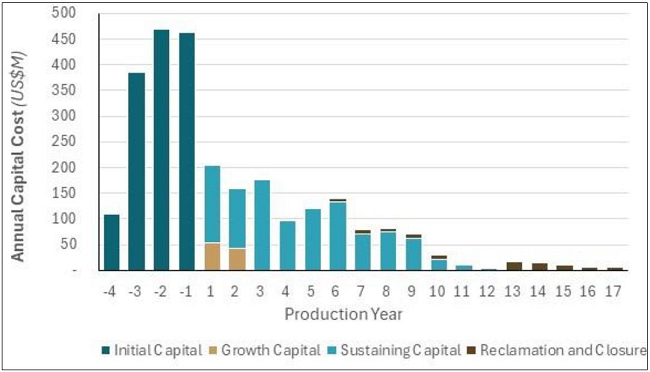

Capital cost estimates address the scope of the Project’s mine, 10,000 tpd processing facilities, site infrastructure and ancillary buildings, and include estimates of:

| · | Direct field costs to execute the Project, including construction, installation and commissioning of all structures, utilities, materials, and equipment. |

| · | Indirect costs associated with design, construction, and commissioning. |

| · | Provisions for contingency. |

| · | Owner’s costs. |

| · | Mining costs during Project construction. |

Capital cost estimates are expressed in Q1 2024 US dollars with no allowances for escalation, currency fluctuation, or interest. Costs quoted in Canadian dollars were converted to US dollars at an exchange rate of 0.74 USD to 1.00 CAD.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

As summarized in Table 1-4, the Project’s total Initial Capital Cost is estimated to be $1,429 million. This is comprised of $1,181 million in construction capital and $248 million in capitalized mine development costs before commercial production.

Table 1-4: Summary of Project initial capital cost estimate

| Area | Description | Cost (US$M) |

||||

| Direct Capital Costs | ||||||

| Infrastructure | 239 | |||||

| Underground Infrastructure | 49 | |||||

| Power | 47 | |||||

| Mine Equipment | 85 | |||||

| Processing | 217 | |||||

| Tailings Management Facility | 52 | |||||

| Total Direct Costs | 689 | |||||

| Indirects and Owner’s Cost | 276 | |||||

| Contingency | 216 | |||||

| Total Construction Capital Cost | 1,181 | |||||

| Capitalized Open Pit Mining | 105 | |||||

| Capitalized Underground Development | 143 | |||||

| Total Capitalized Mine Development | 248 | |||||

| Total Initial Project Capital | 1,429 | |||||

LOM sustaining capital costs have been estimated from Year 1 onward and are summarized in Table 1-5.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Table 1-5: Summary of sustaining capital cost estimates

| Area | LOM Cost (US$M) |

|||

| Open Pit Fleet Sustaining | 20 | |||

| Open Pit Mine Equipment | 107 | |||

| Infrastructure | 33 | |||

| Underground Mine Equipment | 202 | |||

| Underground Infrastructure | 144 | |||

| Processing | 26 | |||

| Tailings Management Facility | 21 | |||

| Capitalized Open Pit Mining | 202 | |||

| Capitalized Underground Development | 279 | |||

| Total Sustaining Capital | 1,034 | |||

The Project’s reclamation and closure costs total approximately $91 million over the LOM, distributed annually from the middle of the LOM (Year 6) until post-closure.

The estimated total and unit operating costs over the LOM are summarized in Table 1-6.

Table 1-6: Summary of Project operating costs

| Cost Area | LOM Total (US$M) |

Unit

Cost (US$/t processed) 2 |

||||||

| Open Pit Mining1 | 371 | 8.32 | ||||||

| Underground Mining1 | 1,395 | 31.26 | ||||||

| Processing | 770 | 17.25 | ||||||

| General & Administrative | 398 | 8.91 | ||||||

| Royalties, Charges & Other | 202 | 4.52 | ||||||

| Total | 3,136 | 70.26 | ||||||

| Tonnes Processed (Mt) | 44.6 | |||||||

Notes:

| 1. | Average LOM open pit mining cost amounts to $3.59/open pit tonne mined including capitalized mine development; average LOM underground mining cost amounts to $68.70/underground plant feed tonne mined excluding capitalized mine development. |

| 2. | Mining costs are averaged over the total mineralized material fed to the process plant from open pit and underground. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| 1.3 | Economic Analysis |

The economic analysis presented in this Technical Report contains forward-looking information regarding Mineral Resource estimates, commodity prices, exchange rates, proposed production plans, projected mining and metallurgical recoveries, costs, and Project schedule aspects and are subject to known and unknown risks, uncertainties, and other factors, many of which cannot be controlled or predicted and may cause actual results to differ materially from those presented. More details on the assumptions used and the factors applied when developing the forward-looking information, as well as certain risk factors that could cause actual results to differ materially from the forward-looking information are provided in the relevant sections of this Technical Report. The reader is cautioned that this Technical Report is based in part, on Inferred Mineral Resources, and the economic analysis presented is preliminary in nature. Inferred Mineral Resources are considered too geologically speculative to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. The QP notes that there is no certainty that the economic forecasts presented or the assumptions on which this Technical Report is based will be realized.

The economic analysis of the Project was carried out using a discounted cash flow approach on a pre-tax and after-tax basis, based on a long-term gold price of $1,900/oz in United States currency and cost estimates prepared in Canadian currency. An exchange rate of 0.74 USD per 1.00 CAD was assumed to convert CAD market price projections and particular components of the capital cost estimates into US Dollars (USD).

The IRR on the total investment that is presented in the economic analysis was calculated assuming 100% equity financing, except on financing for the open pit fleet, though Kinross may decide in the future to finance part of the Project with debt financing.

The after-tax NPV was calculated from the cash flows generated by the Project, assuming a discount rate of 5%.

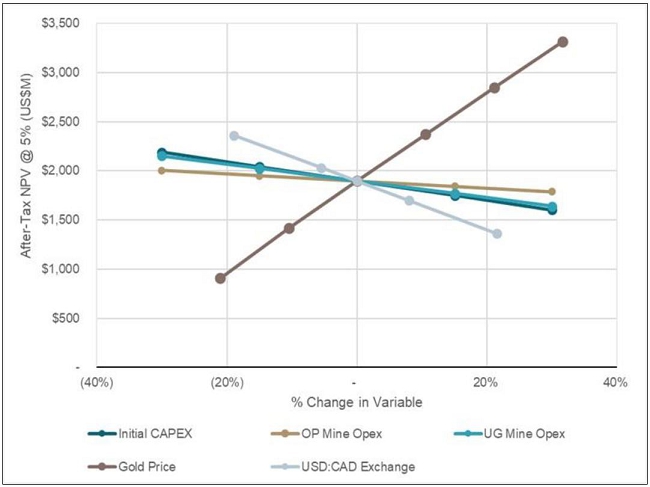

An after-tax sensitivity analysis has been performed to assess the impact of variations in the Project’s economic assumptions, i.e., capital costs, exchange rate, gold price, gold head grade, metallurgical recoveries, and operating costs.

Economic Criteria

All values presented in this section are approximate.

Physicals

| · | Project Life: |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| o | Three years of pre-commercial production mining for construction material and stockpiling of initial process plant feed |

| o | 12 years of commercial process plant production |

| o | Eight years of open pit mining |

| o | 12 years of underground mining |

| o | Four years of open pit and underground stockpiles processing |

| · | Open pit mining operations |

| o | LOM Total Mined: | 187.9 Mt |

| o | LOM Total Plant Feed Mined: | 24.3 Mt at 2.99 g/t of Au |

| o | Stripping Ratio: | 6.7 (waste:plant feed) |

| o | Peak Mining Rate (all materials): | 26.2 Mtpa |

| · | Underground mining operations |

| o | LOM Total Mined: | 28.1 Mt |

| o | LOM Total Plant Feed Mined: | 20.3 Mt at 4.92 g/t of Au |

| o | Peak Mining Rate (plant feed): | 2.2 Mtpa |

| · | Processing |

| o | Annual Processing Rate: | 10 ktpd |

| o | LOM Total Plant Feed: | 44.6 Mt at 3.87 g/t of Au |

| o | LOM Contained Gold: | 5.5 Moz |

| o | LOM Average Metallurgical Recovery: | 95.7% |

| o | LOM Recovered Gold: | 5.3 Moz |

Revenue

| · | For this economic analysis, revenue is estimated based on a constant LOM gold price of $1,900/oz. |

| · | To account for insurance, transportation, and refining charges, a constant unit cost of $3.35/oz Au was assumed over the LOM and is based on actual costs from other Kinross operations. |

| · | LOM gross revenue of $10,085 million. |

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| · | LOM NSR revenue of $10,067 million, after accounting for insurance, transportation, and refining charges. |

Capital Costs

| · | Total initial construction capital cost: $1,181 million, including $216 million in contingency. |

| · | Total capitalized mine development costs prior to commercial production: $248 million. |

| · | Total Initial Project Capital, including capital development: $1,429 million |

| · | LOM sustaining capital costs: $1,034 million |

| · | Total reclamation and closure costs: $91 million |

| · | Growth capital for power supply transition: $97 million |

Operating Costs

| · | LOM operating costs: $3,136 million, including $202 million in royalties and other charges and excluding $33 million in other one-time operating costs |

| · | LOM unit operating cost: $70.26/t processed |

| · | LOM unit cash cost: $594/oz Au |

| · | LOM unit AISC: $812/oz Au |

Taxation

| · | LOM total taxes paid of approximately $856 million. |

Exclusions

The economic analysis does not consider the following components:

| · | Escalation or inflation over the LOM |

| · | Financing costs excluding open pit financing |

| · | Corporate overhead costs |

| · | Advanced Exploration costs |

| · | Any costs set out in or deriving from any Impact Benefit Agreement with Indigenous Nations |

An after-tax cash flow summary is presented in Table 1-7. All costs are presented in Q1 2024 USD millions.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Table 1-7: After-tax cash flow summary

| US$

and Metric Units |

LOM

Total or Average |

|||||||||||||||||||||||||||||||||||||||||||||

| Project Timeline | Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | ||||||||||||||||||||||||

| Commercial Production Timeline | Years | -4 | -3 | -2 | -1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | ||||||||||||||||||||||||

| Market Prices | ||||||||||||||||||||||||||||||||||||||||||||||

| Exchange Rate | CAD:USD | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | 0.74 | x | |

| Gold | US$/oz | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | |||||||||||||||||||||||

| Physicals | ||||||||||||||||||||||||||||||||||||||||||||||

| Open Pit | ||||||||||||||||||||||||||||||||||||||||||||||

| Mineralized Material Mined | kt | 24,320 | - | 142 | 723 | 773 | 3,349 | 3,697 | 3,188 | 3,383 | 3,219 | 2,077 | 2,416 | 1,352 | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Au Grade, Mined | g/t | 2.99 | - | 1.44 | 1.52 | 1.97 | 3.77 | 3.52 | 2.61 | 2.37 | 2.67 | 1.92 | 3.13 | 5.70 | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Waste Mined | kt | 163,575 | - | 3,305 | 9,338 | 16,967 | 22,151 | 20,268 | 22,974 | 19,995 | 17,931 | 17,015 | 11,714 | 1,917 | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Underground | ||||||||||||||||||||||||||||||||||||||||||||||

| Mineralized Material Mined | kt | 20,306 | - | 8 | 138 | 548 | 827 | 1,280 | 1,430 | 1,860 | 1,860 | 2,190 | 2,196 | 2,190 | 2,190 | 1,915 | 1,275 | 402 | - | - | - | - | - | |||||||||||||||||||||||

| Au Grade, Mined | g/t | 4.92 | - | 3.47 | 3.79 | 4.95 | 4.39 | 5.18 | 5.11 | 5.06 | 5.20 | 5.17 | 5.74 | 4.35 | 4.05 | 5.16 | 4.93 | 3.74 | - | - | - | - | - | |||||||||||||||||||||||

| Total Development | m | 169,338 | - | 2,084 | 5,038 | 6,645 | 12,564 | 16,935 | 16,349 | 17,221 | 17,094 | 18,163 | 17,128 | 17,535 | 14,154 | 5,905 | 2,523 | - | - | - | - | - | - | |||||||||||||||||||||||

| Processing | ||||||||||||||||||||||||||||||||||||||||||||||

| Total Mineralized Material Processed | kt | 44,627 | - | - | - | 1,196 | 3,433 | 3,650 | 3,660 | 3,650 | 3,650 | 3,650 | 3,660 | 3,650 | 3,650 | 3,650 | 3,660 | 3,468 | - | - | - | - | - | |||||||||||||||||||||||

| Au Grade, Processed | g/t | 3.87 | - | - | - | 3.99 | 4.57 | 4.79 | 4.40 | 4.37 | 4.64 | 4.09 | 5.31 | 4.81 | 2.85 | 3.15 | 2.23 | 1.04 | - | - | - | - | - | |||||||||||||||||||||||

| Contained Gold, Processed | koz | 5,549 | - | - | - | 154 | 505 | 563 | 518 | 513 | 545 | 480 | 625 | 564 | 335 | 370 | 262 | 116 | - | - | - | - | - | |||||||||||||||||||||||

| Average Recovery, Gold | % | 95.7 | % | - | - | - | 86.6 | % | 95.2 | % | 96.2 | % | 96.1 | % | 96.1 | % | 96.2 | % | 96.1 | % | 96.3 | % | 96.2 | % | 95.7 | % | 95.8 | % | 95.4 | % | 93.6 | % | - | - | - | - | - | |||||||||

| Recovered Gold | koz | 5,309 | - | - | - | 133 | 481 | 541 | 498 | 493 | 524 | 461 | 601 | 543 | 320 | 355 | 250 | 109 | - | - | - | - | - | |||||||||||||||||||||||

| Payable Gold | koz | 5,308 | - | - | - | 133 | 480 | 541 | 498 | 493 | 524 | 461 | 601 | 543 | 320 | 355 | 250 | 109 | - | - | - | - | - | |||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||||||||||||||||

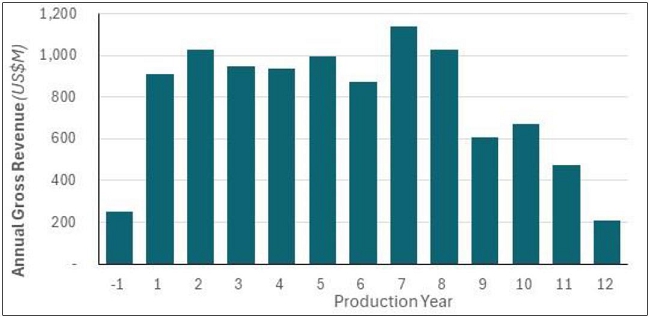

| Gross Revenue | US$ 000s | 10,084,929 | - | - | - | 252,552 | 912,834 | 1,027,841 | 946,357 | 936,554 | 995,329 | 875,115 | 1,142,524 | 1,030,832 | 608,588 | 673,899 | 475,477 | 207,028 | - | - | - | - | - | |||||||||||||||||||||||

| Offsite Insurance / Transport / Refining | US$ 000s | 17,781 | - | - | - | 445 | 1,609 | 1,812 | 1,669 | 1,651 | 1,755 | 1,543 | 2,014 | 1,818 | 1,073 | 1,188 | 838 | 365 | - | - | - | - | - | |||||||||||||||||||||||

| Net Smelter Return | US$ 000s | 10,067,148 | - | - | - | 252,107 | 911,225 | 1,026,029 | 944,688 | 934,903 | 993,574 | 873,572 | 1,140,509 | 1,029,015 | 607,515 | 672,711 | 474,638 | 206,663 | - | - | - | - | - | |||||||||||||||||||||||

| Operating Expenditures | ||||||||||||||||||||||||||||||||||||||||||||||

| Total Mining Cost | US$ 000s | 1,766,284 | - | 1,731 | 24,018 | 38,315 | 155,100 | 170,337 | 118,127 | 193,045 | 160,908 | 153,383 | 205,031 | 161,037 | 143,376 | 118,037 | 84,999 | 38,840 | - | - | - | - | - | |||||||||||||||||||||||

| Processing Cost | US$ 000s | 769,696 | - | - | - | 33,692 | 70,501 | 70,967 | 59,609 | 59,522 | 59,541 | 59,486 | 59,690 | 59,557 | 59,365 | 59,395 | 59,388 | 58,982 | - | - | - | - | - | |||||||||||||||||||||||

| G&A Cost | US$ 000s | 397,762 | - | - | - | 25,147 | 35,357 | 35,502 | 34,813 | 34,812 | 34,811 | 34,810 | 34,810 | 34,810 | 30,235 | 29,971 | 19,852 | 12,830 | - | - | - | - | - | |||||||||||||||||||||||

| Royalties and Charges | US$ 000s | 201,874 | - | - | - | 5,055 | 18,273 | 20,575 | 18,944 | 18,747 | 19,924 | 17,517 | 22,870 | 20,635 | 12,182 | 13,490 | 9,518 | 4,144 | - | - | - | - | - | |||||||||||||||||||||||

| Total Operating Costs | US$ 000s | 3,135,616 | - | 1,731 | 24,018 | 102,211 | 279,230 | 297,381 | 231,493 | 306,126 | 275,184 | 265,197 | 322,402 | 276,039 | 245,159 | 220,893 | 173,757 | 114,796 | - | - | - | - | - | |||||||||||||||||||||||

| Other Operating Costs | US$ 000s | 33,036 | 4,601 | 11,328 | 3,130 | 13,977 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Capital Expenditures | ||||||||||||||||||||||||||||||||||||||||||||||

| Initial Capex | US$ 000s | 1,181,493 | 108,929 | 342,266 | 388,878 | 341,420 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Capitalized Mine Development | US$ 000s | 247,529 | - | 43,900 | 81,589 | 122,040 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Total Initial Capex and Cap. Mine Dev | US$ 000s | 1,429,022 | 108,929 | 386,165 | 470,468 | 463,460 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Growth Capital | US$ 000s | 96,667 | - | - | - | - | 53,704 | 42,963 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Sustaining Capital (Excluding Capitalized Mining) | US$ 000s | 553,373 | - | - | - | - | 120,317 | 76,750 | 69,658 | 52,668 | 48,491 | 38,366 | 44,652 | 41,696 | 37,677 | 13,188 | 6,414 | 3,496 | - | - | - | - | - | |||||||||||||||||||||||

| Capitalized Mine Development (Sustaining) | US$ 000s | 480,885 | - | - | - | - | 30,638 | 38,536 | 105,815 | 42,752 | 72,572 | 94,466 | 26,370 | 32,648 | 24,144 | 8,855 | 4,088 | - | - | - | - | - | - | |||||||||||||||||||||||

| Reclamation and Closure | US$ 000s | 90,740 | - | - | - | - | - | - | - | - | - | 7,349 | 7,349 | 7,349 | 8,386 | 8,386 | 1,037 | - | 15,974 | 14,974 | 9,702 | 5,117 | 5,117 | |||||||||||||||||||||||

| Changes in Working Capital | US$ 000s | - | (8,953 | ) | (18,436 | ) | (2,859 | ) | 5,336 | 13,901 | 4,665 | 4,298 | 1,606 | 209 | 1,265 | (1,224 | ) | (195 | ) | 517 | 1,234 | 95 | (267 | ) | (1,191 | ) | - | - | - | - | ||||||||||||||||

| Cash Flow | ||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax Cash Flow | US$ 000s | 4,247,810 | (104,577 | ) | (380,788 | ) | (494,756 | ) | (332,877 | ) | 413,435 | 565,734 | 533,424 | 531,751 | 597,119 | 466,929 | 740,960 | 671,478 | 291,632 | 420,154 | 289,247 | 88,638 | (14,783 | ) | (14,974 | ) | (9,702 | ) | (5,117 | ) | (5,117 | ) | ||||||||||||||

| Cash Taxes | US$ 000s | 855,937 | - | - | - | 513 | 9,822 | 11,604 | 20,453 | 51,268 | 60,993 | 72,626 | 176,311 | 192,916 | 74,190 | 109,220 | 69,405 | 6,617 | - | - | - | - | - | |||||||||||||||||||||||

| After Tax Cash Flow | US$ 000s | 3,391,873 | (104,577 | ) | (380,788 | ) | (494,756 | ) | (333,389 | ) | 403,613 | 554,130 | 512,971 | 480,483 | 536,126 | 394,303 | 564,649 | 478,562 | 217,442 | 310,934 | 219,842 | 82,020 | (14,783 | ) | (14,974 | ) | (9,702 | ) | (5,117 | ) | (5,117 | ) | ||||||||||||||

| Cumulative After Tax Cash Flow | US$ 000s | - | (104,577 | ) | (485,365 | ) | (980,121 | ) | (1,313,511 | ) | (909,898 | ) | (355,768 | ) | 157,204 | 637,687 | 1,173,813 | 1,568,116 | 2,132,765 | 2,611,327 | 2,828,769 | 3,139,704 | 3,359,545 | 3,441,566 | 3,426,783 | 3,411,809 | 3,402,106 | 3,396,990 | 3,391,873 | |||||||||||||||||

| Metrics | ||||||||||||||||||||||||||||||||||||||||||||||

| NPV (5%) | US$ 000s | 1,898 | ||||||||||||||||||||||||||||||||||||||||||||

| IRR | % | 24.3 | % | |||||||||||||||||||||||||||||||||||||||||||

| Payback Period | Years | 2.7 | ||||||||||||||||||||||||||||||||||||||||||||

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Cash Flow Analysis Results

Table 1-8 summarizes the results of the after-tax cash flow analysis of the Project.

Table 1-8: Summary of results of after-tax cash flow analysis

| Description | Unit | Value | |||

| After-tax Free Cash Flow | US$M | 3,392 | |||

| NPV (@ 5% disc.) | US$M | 1,898 | |||

| IRR | % | 24.3 | |||

| Payback Period | years | 2.7 | |||

Sensitivity Analysis Results

The sensitivity of the Project’s after-tax NPV and IRR to gold price and discount rate is summarized in Table 1-9 and Table 1-10.

Table 1-9: After-tax NPV and IRR sensitivity results

| Gold Price | After-tax NPV at 5% | IRR | |||||

| (US$/oz) | (US$M) | (%) | |||||

| 1,500 | 910 | 14.9 | |||||

| 1,700 | 1,416 | 19.9 | |||||

| 1,900 | 1,898 | 24.3 | |||||

| 2,100 | 2,371 | 28.3 | |||||

| 2,300 | 2,846 | 32.1 | |||||

| 2,500 | 3,314 | 35.5 | |||||

Table 1-10: After-tax NPV sensitivity results discount rate variations

| Discount Rate | |||||||||||||||

| - | 2.5% | 5.0% | 7.5% | 10.0% | |||||||||||

| NPV ($M) | 3,392 | 2,542 | 1,898 | 1,405 | 1,025 | ||||||||||

The sensitivity of the Project’s after-tax NPV to other key variables is depicted in Figure 1-1.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

Figure 1-1: Sensitivity of the after-tax NPV to selected economic variables This Technical Report has been prepared by Kinross to disclose the results of a PEA on the Great Bear gold project, located in northwest Ontario, Canada.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| 2. | INTRODUCTION |

Kinross is engaged in gold mining and related activities, including exploration and acquisition of gold-bearing properties, the extraction and processing of gold-containing ore, and reclamation of gold mining properties and is listed on the Toronto Stock Exchange and New York Stock Exchange. Kinross acquired the Project as part of its acquisition of Great Bear in February 2022. Great Bear is a wholly-owned subsidiary of Kinross and owns a 100% interest in the Property.

The Project is a development stage property located within the Red Lake Mining District of Ontario, an area of historic gold mining and exploration. The Project is located approximately 24 km southeast of the town of Red Lake, Ontario and consists of 380 unpatented mining claims and seven mining leases, totalling 11,852 ha.

The PEA contemplates a combined open pit and underground mining scenario for the Project that provides approximately 10,000 tpd of plant feed to an on-site processing facility over a LOM of approximately 12 years.

This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and is considered by Kinross as meeting the requirements of a PEA as defined in NI 43-101.

The economic analysis contained in this Technical Report is based, in part, on Inferred Mineral Resources, and is preliminary in nature. Inferred Mineral Resources are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized.

Page

|

Kinross Gold Corporation Great Bear Gold Project Ontario, Canada NI 43-101 Technical Report |

| 2.1 | Qualified Persons |

The QPs responsible for the content presented in this Technical Report are listed in Table 2-1.

Table 2-1: Qualified persons and technical report section responsibilities

| QP Name, Designation, Title | Organization | Site

Visit Dates |

Section Responsibility | |||

| Nicos Pfeiffer, P.Geo., Vice President, Geology & Technical Evaluations | Kinross | July 17, 2024 | Overall preparation of the Technical Report, in particular Sections 2 to 5, 14, 15, 19, 23, and 24 | |||

| Graham Long, P.Geo., Vice President, Exploration | Kinross | December 6-7, 2023 | Sections 6 to 12 | |||