UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2024

SiteOne Landscape Supply, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37760 | 46-4056061 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 300

Colonial Parkway, Suite 600 Roswell, Georgia |

30076 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(470) 277-7000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | SITE | New York Stock Exchange |

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Current Report on Form 8-K is the current version of an investor presentation, which SiteOne Landscape Supply, Inc. (the “Company”) intends to use, possibly with modifications, in making presentations to analysts, existing and potential investors and other interested parties. Interested parties are encouraged to visit the Company’s website to view the latest investor presentation.

The information in this Form 8-K being furnished under Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | June 2024 Investor Presentation | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SITEONE LANDSCAPE SUPPLY, INC. | ||

| By: | /s/ Briley Brisendine | |

| Name: Briley Brisendine | ||

| Title: Executive Vice President, General Counsel and Secretary | ||

Date: June 4, 2024

Exhibit 99.1

William Blair Growth Stock Conference June 2024

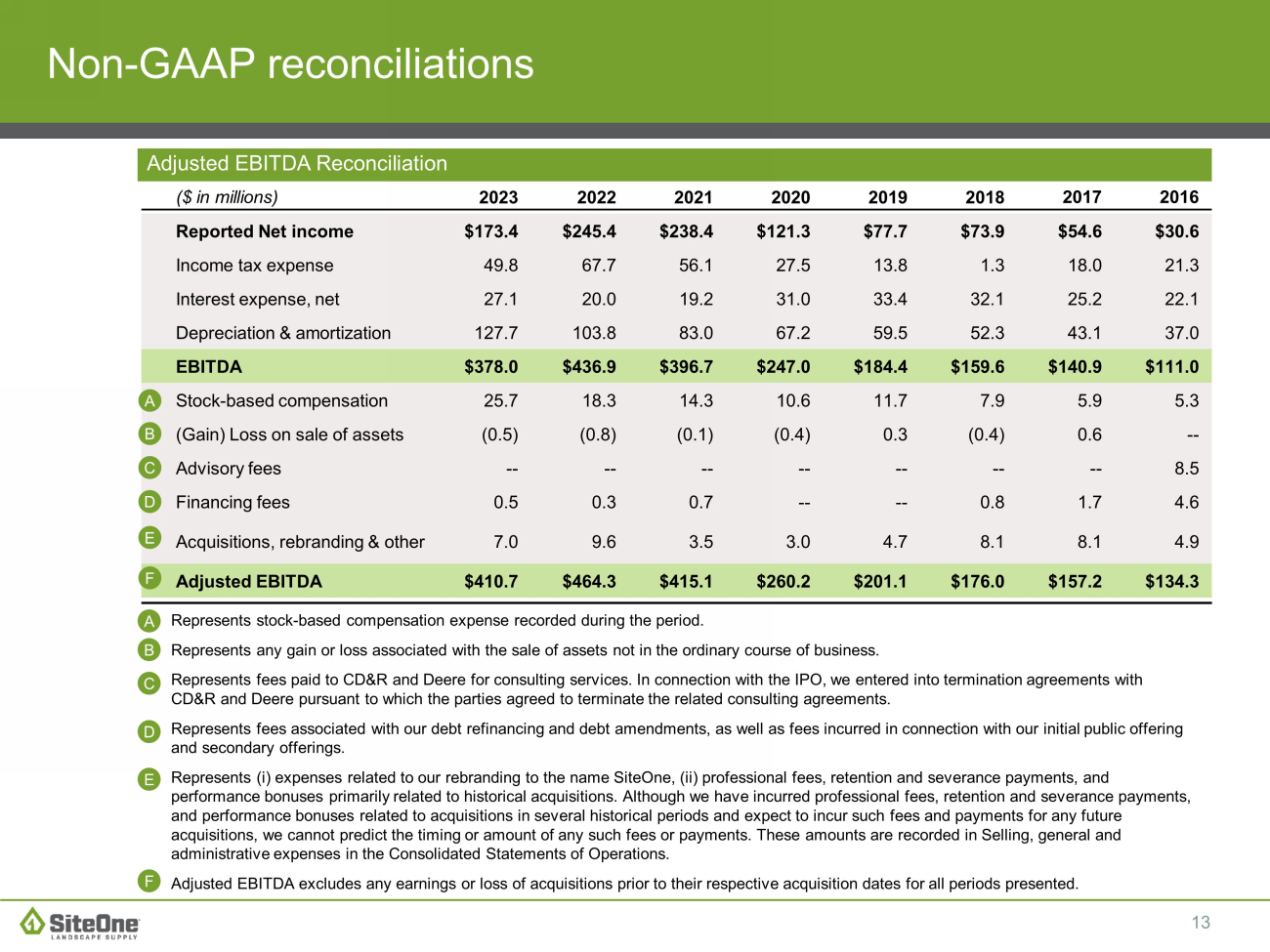

2 Disclaimer Forward - Looking Statements This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 19 95. Forward - looking statements may include, but are not limited to, statements relating to our 2024 Adjusted EBITDA outlook and our share repurchase program. Some of the forward - lookin g statements can be identified by the use of terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “p roj ect,” “potential,” or the negative of these terms, and similar expressions. You should be aware that these forward - looking statements are subject to risks and uncertainties that are beyond our control. Fu rther, any forward - looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward - looking statement to reflect events or circumstan ces after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time that may cause our b usi ness not to develop as we expect, and it is not possible for us to predict all of them. Factors that may cause actual results to differ materially from those expressed or implied by the for ward - looking statements include, but are not limited to, the following: cyclicality in residential and commercial construction markets; general business, financial market and economic co ndi tions; seasonality of our business and its impact on demand for our products; weather and climate conditions; prices for the products we purchase may fluctuate; market variables, includ ing inflation and elevated interest rates for prolonged periods; increases in operating costs; public perceptions that our products and services are not environmentally friendly or that our pra ctices are not sustainable; competitive industry pressures, including competition for our talent base; supply chain disruptions, product or labor shortages, and the loss of key supplier s; inventory management risks; ability to implement our business strategies and achieve our growth objectives; acquisition and integration risks, including increased competition for acquisit ion s; risks associated with our large labor force and our customers’ labor force and labor market disruptions; retention of key personnel; construction defect and product liability claims; impai rme nt of goodwill; adverse credit and financial markets events and conditions; inefficient or ineffective allocation of capital; credit sale risks; performance of individual branches; climate, en vironmental, health and safety laws and regulations; hazardous materials and related materials; laws and government regulations applicable to our business that could negatively impact dema nd for our products; cybersecurity incidents involving our systems or third - party systems; failure or malfunctions in our information technology systems; security of personal information about our customers; intellectual property and other proprietary rights; unanticipated changes in our tax provisions; threats from terrorism, violence, uncertain political conditions, and ge opo litical conflicts such as the ongoing conflict between Russia and Ukraine, the conflict in the Gaza Strip, and the unrest in the Middle East; risks related to our current indebtedness and our ab ility to obtain financing in the future; financial institution disruptions; risks related to our common stock; and other risks, as described in Item 1A, “Risk Factors”, and elsewhere in ou r A nnual Report on Form 10 - K for the fiscal year ended December 31, 2023, as may be updated by subsequent filings under the Securities Exchange Act of 1934, as amended, including F orm s 10 - Q and 8 - K. Non - GAAP Financial Information This presentation includes certain financial information, not prepared in accordance with U.S. GAAP. Because not all companie s c alculate non - GAAP financial information identically (or at all), the presentations herein may not be comparable to other similarly titled measures used by other companies. Further, the se measures should not be considered substitutes for the information contained in the historical financial information of the Company prepared in accordance with U.S. GAAP that is se t f orth herein. We present Adjusted EBITDA in order to evaluate the operating performance and efficiency of our business. Adjusted EBITDA rep res ents EBITDA as further adjusted for items permitted under the covenants of our credit facilities. EBITDA represents our Net income (loss) plus the sum of income tax (benefit) ex pen se, interest expense, net of interest income, and depreciation and amortization. Adjusted EBITDA represents EBITDA as further adjusted for stock - based compensation expense, (gain) loss on sal e of assets, and termination of finance leases not in the ordinary course of business, financing fees, as well as other fees, and expenses related to acquisitions and other non - recurring (income) loss. Adjusted EBITDA does not include pre - acquisition acquired Adjusted EBITDA. Adjusted EBITDA is not a measure of our liquidity or financial performance under U.S. G AAP and should not be considered as an alternative to Net income, operating income or any other performance measures derived in accordance with U.S. GAAP, or as an alternative to cash fl ow from operating activities as a measure of our liquidity. The use of Adjusted EBITDA instead of Net income has limitations as an analytical tool. Because not all companies use identic al calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies, limiting its usefulness as a comparative measure. Net de bt is defined as long - term debt (net of issuance costs and discounts) plus finance leases, net of cash and cash - equivalents on our balance sheet. Leverage Ratio is defined as Net debt to trailing twelve months Adjusted EBITDA. Free Cash Flow is defined as Cash Flow from Operating Activities, less capital expenditures. We define Organic Daily Sales as Organic Sales div ide d by the number of Selling Days in the relevant reporting period. We define Organic Sales as Net sales, including Net sales from newly - opened greenfield branches, but excluding Net sales from acquired branches until they have been under our ownership for at least four full fiscal quarters at the start of the fiscal year. Selling Days are the number of business day s, excluding Saturdays, Sundays, and holidays, that SiteOne branches are open during the relevant reporting period.

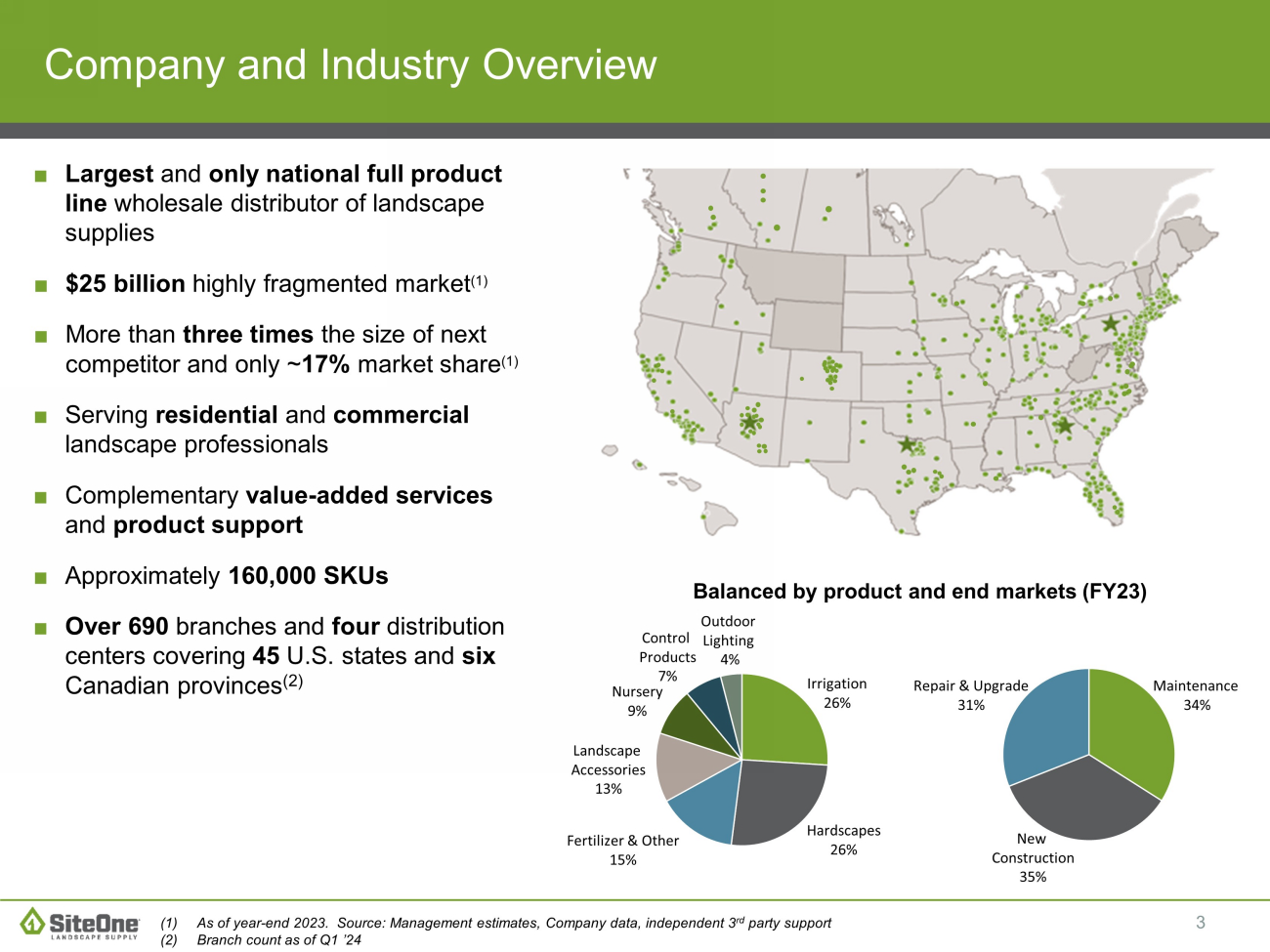

3 Company and Industry Overview ■ Largest and only national full product line wholesale distributor of landscape supplies ■ $25 billion highly fragmented market (1) ■ More than three times the size of next competitor and only ~ 17% market share (1) ■ Serving residential and commercial landscape professionals ■ Complementary value - added services and product support ■ Approximately 160,000 SKUs ■ Over 690 branches and four distribution centers covering 45 U.S. states and six Canadian provinces (2) Balanced by product and end markets (FY23) (1) As of year - end 2023.

Source: Management estimates, Company data, independent 3 rd party support (2) Branch count a s of Q1 ’24 Maintenance 34 % New Construction 35% Repair & Upgrade 31% Landscape Accessories 13% Irrigation 26% Fertilizer & Other 15% Hardscapes 26% Nursery 9% Control Products 7% Outdoor Lighting 4% 4 $134 $157 $176 $201 $260 $415 $464 $411 ■ Lucky Landscape ■ Arizona Stone & Solstice ■ Timberwall ■ Melrose Irrigation Supply ■ Rock & Block ■ Green Brothers ■ Semco Stone ■ Seffner Rock & Gravel $1,648 $1,862 $2,112 $2,358 $2,705 $3,476 $4,015 $4,301 Track Record of Performance and Growth ■ Hydro - Scape ■ Blue Max ■ Bissett ■ Glen Allen ■ Loma Vista ■ East Haven ■ Aspen Valley ■ Stone Forest ■ Angelo's ■ AB Supply ■ Evergreen Partners ■ South Coast Supply ■ Marshall Stone ■ Harmony Gardens Building the Foundation ■ Pete Rose ■ Atlantic Irrigation ■ Village Nurseries ■ Terrazzo & Stone ■ Landscaper’s Choice ■ Auto - Rain ■ All American Stone ■ Landscape Express ■ Kirkwood ■ Stone Center ■ CentralPro ■ C&C Sand and Stone ■ All Around Source: Company data 2018 2016 - ’17 2019 2020 Initial Public Offering 32.0% 31.3% 32.1% Net Sales Gross Margin % Adj. EBITDA Adj. EBITDA Margin % Sales $ +161% GM % +340bps Performance & Growth ($ in Millions) Net Sales Adjusted EBITDA ’16 - ’23 Growth 32.8% ■ Cutting Edge ■ All Pro Horticulture ■ Landscape Depot ■ Fisher’s Depot ■ Stone & Soil Depot ■ Voss Materials ■ Trendset Concrete ■ Design Outdoor ■ Dirt Doctors ■ Daniel Stone 2021 2022 ■ Wittkopf ■ Empire Supplies ■ The Garden Dept ■ Big Rock ■ Alliance Stone ■ Modern Builders ■ BURNCO ■ Hedberg Supply ■ Alpine Materials ■ Dirt and Rock ■ Stone Center of VA 33.3% 8.4% 8.1% FY 2017 8.3% FY 2018 ($ in Millions) Adj. EBITDA $ +206% Adj. EBITDA % +140 bps ’16 - ’23 Growth 8.5% FY 2019 9.6% Acquisitions 2023 34.9% 11.9% FY 2021 FY 2016 2024 ■ JK Enterprise ■ BellStone Masonry ■ Preferred Seed ■ Across the Pond ■ Yard Works ■ Prescott Dirt ■ A&A Stepping Stone ■ River Valley Horticultural ■ Cape Cod Stone ■ Linzel Distributing ■ Jim Stone ■ Stone Plus ■ Kaknes Landscape ■ Madison Block & Stone ■ Telluride Natural Stone ■ Whittlesey Landscape Supplies 35.4% FY 2023 11.6% FY 2020 ■ J&J Materials ■ Triangle Landscape Supplies ■ Adams Wholesale Supply ■ Link Outdoor Lighting ■ Hickory Hill Farm & Garden ■ New England Silica ■ Timothy’s Center for Gardening ■ Pioneer Landscape Centers ■ Regal Chemical ■ JMJ Organics ■ Newsom Seed 34.7% FY 2022 9.5% FY 2017 FY 2018 FY 2019 FY 2021 FY 2016 FY 2023 FY 2020 FY 2022 34.7% ■ Eggemeyer ■ Devil Mountain Wholesale Nursery 5 SiteOne is the Only National Full Product Line Provider in the Industry Market P o s i t i o n #1 #1 #1 #1 #1 % of 20 23 Sa les 30 % 2 2 % 9 % 26 % 1 3 % Key P roducts ■ Sprinklers ■ Controllers ■ Pumps ■ Outdoor lighting ■ Fertilizer ■ Control products ■ Seed ■ Ice melt ■ Trees ■ Shrubs ■ Accent plants ■ Concrete paver & wall systems ■ Natural stone ■ Bulk aggregates ■ Accessories ■ Merchandised accessories ■ Consumables ■ Erosion control ■ Tools & equipment Key S upp li e r s Source: Company data, Management estimates Irrigation & Lighting A grono m ics Nursery Hardscapes Landscape A cc e ss o r i e s Four Verticals Merchandised Products

6 SiteOne Plays a Critical Role in the Professional Landscape Supply Value Chain Thousands of suppliers Hundreds of thousands of customers Large: ~ 46% of 20 23 net sales ■ > $150k in annual purchases Medium: ~3 2 % of 2 023 net sales ■ $25k – $150k in annual purchases Coast - to - coast national netw ork Extensive sales & m a r ke t i n g Rapid product l a un c h e s Few er and larger shipments Superior technical e x p e r t i s e C u s to m e r loyalty program Trade credit, sales leads and training SiteOne provides: SiteOne provides: B r o a d es t product offering Critical Business Partner Small: ~2 2 % of 20 23 net sales ■ < $25 k in annual purchases Full product line distributor Source: Company data, Management estimates 7 SiteOne is Built for Continued Growth and Margin Enhancement Current strategy x Leverage strengths of both large and local company ■ Fully exploit our scale, resources and capabilities ■ Execute local market growth strategies ■ Deliver superior value to our customers and suppliers ■ Close and integrate high value - added acquisitions ■ Entrepreneurial local area teams supported by world - class functional support x Drive commercial and operational performance ■ Category management ■ Supply chain ■ Salesforce performance ■ Operational excellence ■ Marketing and Digital Value creation levers 1) Organic growth 2) Margin expansion 3) Acquisition growth

8 Source: Company data.

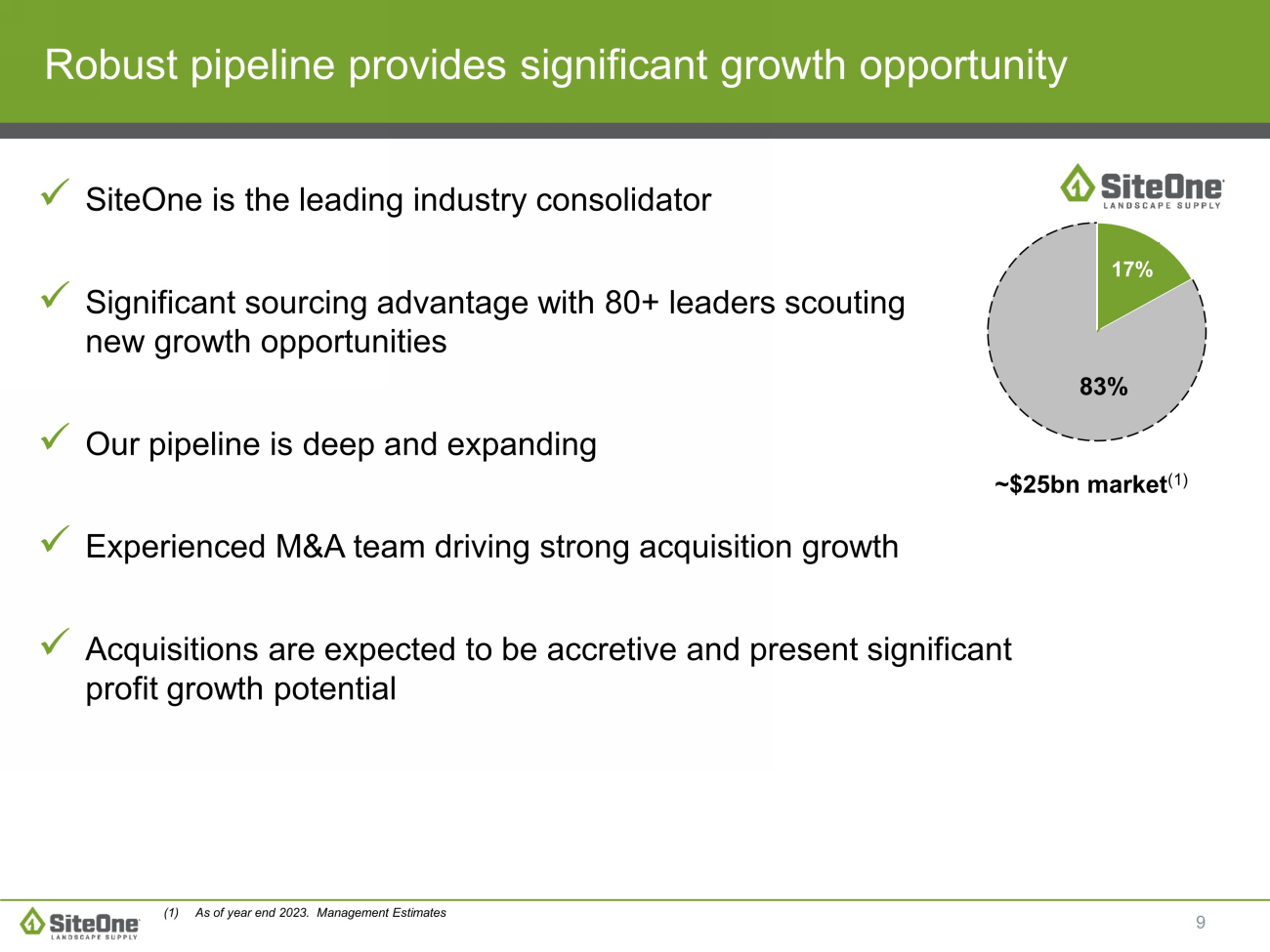

A Unique Team of Top Industry & Functional Talent 9 x SiteOne is the leading industry consolidator x Significant sourcing advantage with 80+ leaders scouting new growth opportunities x Our pipeline is deep and expanding x Experienced M&A team driving strong acquisition growth x Acquisitions are expected to be accretive and present significant profit growth potential Robust pipeline provides significant growth opportunity 17% (1) As of year end 2023.

Management Estimates ~$25bn market (1) 83% 10 Current Trends Q1 2024* Q2 Trend* Comments Organic Daily Sales x Up 1% x Down ~4 - 5% General slowing across product categories and geographies Volume x Up 5% x Down ~1% Slower end market demand Price x Down 4% x Down ~3 - 4% Persistent commodity price deflation * Year - over - year percentage change x Experiencing softening volume and persistent commodity pricing deflation since First Quarter 2024 earnings call 11 x Continue to drive organic growth and gross margin initiatives to help mitigate the market headwinds x Reduce SG&A to align with demand x Execute Pioneer integration and turnaround plan x Continue to add high - performing acquisitions x Improve cash flow through strong inventory management SiteOne Actions

12 Proven management team Compelling and sustainable growth strategy Uniquely attractive industry Clear market leader Value - creating acquisitions Operational and commercial excellence Investment highlights 13 ($ in millions) 2023 2022 2021 2020 2019 2018 2017 2016 Reported Net income $173.4 $245.4 $238.4 $121.3 $77.7 $73.9 $54.6 $30.6 Income tax expense 49.8 67.7 56.1 27.5 13.8 1.3 18.0 21.3 Interest expense, net 27.1 20.0 19.2 31.0 33.4 32.1 25.2 22.1 Depreciation & amortization 127.7 103.8 83.0 67.2 59.5 52.3 43.1 37.0 EBITDA $378.0 $436.9 $396.7 $247.0 $184.4 $159.6 $140.9 $111.0 Stock - based compensation 25.7 18.3 14.3 10.6 11.7 7.9 5.9 5.3 (Gain) Loss on sale of assets (0.5) (0.8) (0.1) (0.4) 0.3 (0.4) 0.6 -- Advisory fees -- -- -- -- -- -- -- 8.5 Financing fees 0.5 0.3 0.7 -- -- 0.8 1.7 4.6 Acquisitions, rebranding & other 7.0 9.6 3.5 3.0 4.7 8.1 8.1 4.9 Adjusted EBITDA $410.7 $464.3 $415.1 $260.2 $201.1 $176.0 $157.2 $134.3 Non - GAAP reconciliations Represents stock - based compensation expense recorded during the period. Represents any gain or loss associated with the sale of assets not in the ordinary course of business. Represents fees paid to CD&R and Deere for consulting services. In connection with the IPO, we entered into termination agree men ts with CD&R and Deere pursuant to which the parties agreed to terminate the related consulting agreements. Represents fees associated with our debt refinancing and debt amendments, as well as fees incurred in connection with our ini tia l public offering and secondary offerings. Represents ( i ) expenses related to our rebranding to the name SiteOne, (ii) professional fees, retention and severance payments, and performance bonuses primarily related to historical acquisitions. Although we have incurred professional fees, retention and sev erance payments, and performance bonuses related to acquisitions in several historical periods and expect to incur such fees and payments for any future acquisitions, we cannot predict the timing or amount of any such fees or payments. These amounts are recorded in Selling, gen era l and administrative expenses in the Consolidated Statements of Operations. Adjusted EBITDA excludes any earnings or loss of acquisitions prior to their respective acquisition dates for all periods pre sen ted. A B C D A B C D E E F F Adjusted EBITDA Reconciliation