UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-42040

SCHMID Group N.V.

(Exact name of Registrant as specified in its charter)

Not applicable |

|

The Netherlands |

(Translation of registrant’s name into English) |

|

(Jurisdiction of incorporation or organization) |

Robert-Bosch-Str. 32-36, 72250 Freudenstadt, Germany

(Address of principal executive offices)

Julia Natterer

c/o SCHMID Group N.V.

Robert-Bosch-Str. 32-36

72250 Freudenstadt

Germany

Tel: +49 7441 538 0

Email: natterer.ju@schmid-group.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class: |

|

Trading Symbol(s): |

|

Name of each exchange on which registered: |

|

Class A Ordinary Shares, par value €0.01 per share |

|

SHMD |

|

Nasdaq Global Select Market |

Redeemable Warrants, each |

|

SHMD.WS |

|

Nasdaq Global Select Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: On April 30, 2024, the issuer had 42,974,862 ordinary shares, nominal value €0.01 per share, outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

||

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

Non-accelerated filer |

☑ |

Emerging growth company |

☑ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis for accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

i

EXPLANATORY NOTE

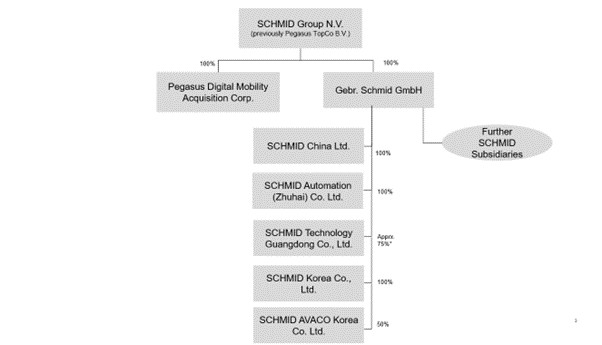

On April 30, 2024 (the “Closing Date”), SCHMID Group N.V. (“Schmid Group” or the “Company”), closed the previously announced business combination (the “Business Combination”) pursuant to the Business Combination Agreement, dated as of May 31, 2023, as amended by a first amendment agreement dated September 26, 2023 (the “First Business Combination Agreement”) and a second amendment agreement dated January 29, 2024, by and among Pegasus Digital Mobility Acquisition Corp., a Cayman Islands exempted company (“Pegasus”), Gebr. Schmid GmbH, a German limited liability company ("Schmid"), Pegasus TopCo B.V., a Dutch private liability company (which was converted into a Dutch public limited liability company, and renamed SCHMID Group N.V., prior to the closing of the Business Combination) (“TopCo”), and Pegasus MergerSub Corp., a Cayman Islands limited liability company and wholly-owned subsidiary of the Schmid Group (“Merger Sub”). References made to Schmid Group pertaining to occurrences predating the Business Combination closing, refer to Gebr. Schmid GmbH, which was the predecessor to SCHMID Group N.V. at the top of the group’s structure.

On the Closing Date, several transactions were completed pursuant to the Business Combination Agreement, including:

| ● | TopCo issued 99 new ordinary shares to its shareholder Pegasus; |

| ● | The shareholders of Schmid, Anette Schmid, Christian Schmid and a Community of Heirs (the “Schmid Shareholders”) purchased all 100 TopCo shares from Pegasus at nominal value; |

| ● | The Schmid Shareholders subscribed to 28,725,000 TopCo shares and an additional 5,000,000 earn-out shares at €0.01 nominal value and in consideration contributed 100% of the Gebr. Schmid shares by transferring them to TopCo; |

| ● | TopCo changed its legal form from a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) to a Dutch public limited liability company (naamloze vennootschap) and was renamed SCHMID Group N.V.; |

| ● | The Schmid Group issued shares in exchange for each Pegasus Class A and B share outstanding, and issued 1,406,361 shares to XJ Harbour HK Limited ("XJ Harbour"); |

| ● | The Schmid Group issued further shares in the amount of 756,964 shares to Pegasus Digital Mobility Sponsor Corp., the sponsor of Pegasus (the "Sponsor"), as payment for approximately USD 8.6 million in liabilities which TopCo assumed before the closing by a debt assumption agreement between Pegasus, the Sponsor and TopCo; and |

| ● | Pegasus merged with Merger Sub, with Pegasus as the surviving company and, after giving effect to the merger, becoming a direct, wholly-owned subsidiary of SCHMID Group. |

Prior to the Business Combination, SCHMID Group N.V. did not conduct any material activities other than those incident to its formation and the matters contemplated by the Business Combination Agreement, such as the making of certain required securities law filings, and the establishment of Merger Sub. Upon the closing of the Business Combination, SCHMID Group N.V. became the direct parent of Schmid, a Germany-based technology provider with extensive expertise in high-tech manufacturing processes.

Class A Shares, and warrants to purchase one Class A Share at a price of $11.50, subject to adjustment, Public Warrants (“Public Warrants”), began trading on the Nasdaq Global Select Market (“Nasdaq”) under the symbols “SHMD” and “SHMD.WS”, respectively, on May 1, 2024.

Unless otherwise indicated, “SCHMID Group”, “the Company”, “we”, “us” and “our” refer to SCHMID Group N.V. after conversion into a Dutch public limited liability company and Pegasus TopCo B.V. prior to the conversion into a Dutch public liability company. References to “€” are to the common currency of the European Monetary Union and references to “U.S. dollars”, “$” or “cents” are to the lawful currency of the United States.

1

FREQUENTLY USED TERMS

Unless otherwise stated in this Annual Report on Form 20-F or the context otherwise requires, references have the following meaning:

“Annual Report” means this annual report of the Company on Form 20-F.

“Board” means the board of directors of the Company.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated May 31, 2023, by and among TopCo, Merger Sub, Pegasus and Gebr. Schmid GmbH, as amended by that First Amendment to Business Combination Agreement dated as of September 26, 2023 and as amended by the Second Amendment to Business Combination Agreement dated as of January 29, 2024, and as it may be further amended from time to time.

“Class A Shares” or the "Shares" means the shares of the Company.

“Closing Date” means April 30, 2024, the date of the closing of the Business Combination.

“Code” means the Internal Revenue Code of 1986, as amended.

"Company" means SCHMID Group N.V.

“Continental” means Continental Stock Transfer & Trust Company, the transfer agent and warrant agent of the Company.

"ET" means embedded traces, a process which we believe the next level technology for high-end PCBs & Substrates.

“EU” means the European Union.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

"FCPA" means U.S. Foreign Corrupt Practices Act.

“GDPR” means the European General Data Protection Regulation.

“IAS” means the International Accounting Standard.

“IASB” means the International Accounting Standards Board. “IBR” means the incremental borrowing rate.

“IFRS” means the International Financial Reporting Standards as issued by the IASB.

"mSAP" means modified semi additive processes.

"MergerSub" means Pegasus MergerSub Corp., a Cayman Islands exempted company.

“NASDAQ” means the Nasdaq Stock Exchange in New York.

“NYSE” means the New York Stock Exchange.

“OEMs” means original equipment manufacturers.

2

“Pegasus” means Pegasus Digital Mobility Acquisition Corp., a Cayman Islands exempted company.

“Pegasus Private Placement Warrants” means the 9,750,000 warrants originally issued in the private placement that occurred concurrently with the closing of Pegasus’s IPO.

“Pegasus Public Warrants” means the 11,250,000 public warrants, each of which is a warrant to purchase one Pegasus Class A Ordinary Share at a price of $11.50 per share, subject to adjustment in accordance with the Warrant Agreement.

“Pegasus Warrants” means collectively the Pegasus Public Warrants and the Pegasus Private Placement Warrants.

"PCB" means printed circuit board.

"RMB" means the Chinese Renminbi.

"SAP" means semi-additive processes.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“Schmid” or “SCHMID” means SCHMID Group N.V.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Sponsor” means Pegasus Digital Mobility Sponsor LLC., a Cayman Islands limited liability company, which is the sponsor of Pegasus.

“TopCo” means Pegasus TopCo B.V., a Dutch private liability company (besloten vennootschap met beperkte aansprakelijkheid) which has been converted and renamed to SCHMID Group N.V. on April 30, 2024.

"XJ Harbour" means XJ Harbour HK Limited.

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains or may contain forward-looking statements that involve significant risks and uncertainties. Statements contained in this Annual Report, other than statements of historical fact, including statements about SCHMID’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts are forward-looking statements. Words or phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will” and “would,” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Examples of forward-looking statements in this Annual Report include, but are not limited to, statements regarding SCHMID’s operations, cash flows, financial position and dividend policy.

Forward-looking statements are subject to risks and uncertainties. The risks and uncertainties include, but are not limited to:

| ● | our future financial condition and operating results; |

| ● | our ability to remain in compliance with financial covenants under our financing arrangements; |

| ● | our ability to extend, renew or refinance our existing debt; |

| ● | our liquidity and losses from operations and projected cash flows and related impact on our ability to continue as a going concern; |

| ● | our growth, expansion and acquisition prospects and strategies, the success of such strategies, and the benefits we believe can be derived from such strategies; |

| ● | our ability to effectively manage our inventory and inventory reserves; |

| ● | impairments of our goodwill or other intangible assets; |

| ● | changes in consumer spending patterns and overall levels of consumer spending; |

| ● | our ability to further upgrade our information technology systems and infrastructure, including our accounting processes and functions; |

| ● | our ability to continue to remedy weaknesses in our internal controls; |

| ● | costs as a result of operating as a public company; |

| ● | our assumptions regarding interest rates and inflation; |

| ● | changes affecting currency exchange rates; |

| ● | continuing business disruptions arising from the on-going war in Ukraine and in the aftermath of the coronavirus pandemic; |

| ● | our financial condition and ability to obtain financing in the future to implement our business strategy and fund capital expenditures, acquisitions and other general corporate activities; |

| ● | estimated future capital expenditures needed to preserve our capital base; |

4

| ● | changes in general economic conditions in the Federal Republic of Germany (“Germany”), and the European Union, the United States of America and the People’s Republic of China, including changes in the unemployment rate, the level of energy and consumer prices, wage levels, etc.; |

| ● | the market acceptance of our products by our customers and our ability to adapt to technological changes; |

| ● | the growth in the market for Embedded Traces technology in our products; |

| ● | changes in our competitive environment and in our competition level; |

| ● | the occurrence of accidents, terrorist attacks, natural disasters, fires, environmental damage, or systemic delivery failures; |

| ● | our inability to attract and retain qualified personnel, consultants and collaborators; |

| ● | changes in laws and regulations; |

| ● | our expectations relating to dividend payments and forecasts of our ability to make such payments; and |

| ● | other factors discussed in “Item 3. Key Information — D. Risk Factors” in this Annual Report. |

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors described under the section titled “Item 3. Key Information — D. Risk Factors” in this Annual Report. Accordingly, you should not rely on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Annual Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this Annual Report.

In addition, statements that “Schmid believes” or “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date such statements are made. And while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and you are cautioned not to unduly rely on these statements.

Although we believe the expectations reflected in the forward-looking statements were reasonable at the time made, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither SCHMID nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should carefully consider the cautionary statements contained or referred to in this section in connection with the forward-looking statements contained in this Annual Report and any subsequent written or oral forward-looking statements that may be issued by SCHMID or persons acting on our behalf. Our actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained in this Annual Report as described in “Item 3. Key Information — D. Risk Factors”, “Item 4 —Information on the Company” and “Item 5 — Operating and Financial Review and Prospects”. Given these risks, uncertainties and other important factors, you should not place undue reliance on these forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this Annual Report. Also, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements are made. Except as required by law, we assume no obligation to update any forward-looking statements publicly, whether as a result of new information, future events or otherwise.

5

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Information regarding the directors and executive officers of the Company after the closing of the Business Combination is included in Item 6.A, “Directors and Senior Management” below.

The business address for each of the directors and executive officers of the Company is Robert-Bosch-Str. 32-36, 72250 Freudenstadt, Germany.

B. Advisers

Clifford Chance PmbB, Junghofstrasse 14, 60311 Frankfurt, Germany, has acted as U.S. counsel for Pegasus and is acting as U.S. counsel to the Company following the closing of the Business Combination which occurred on April 30, 2024.

Clifford Chance LLP, Amsterdam Droogbak 1A 1013 GE, Netherlands, has acted as Dutch counsel for Pegasus and is acting as Dutch counsel to the Company following the closing of the Business Combination.

C. Auditors

For the fiscal years ended December 31, 2023, 2022 and 2021, KPMG AG Wirtschaftsprüfungsgesellschaft, Friedenstraße 10, 81671 Munich, Germany has acted as independent registered public accounting firm for the Company.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business faces significant risks and uncertainties. You should carefully consider all of the information set forth in this Annual Report, including without limitation “Item 5 — Operating and Financial Review and Prospects,” and in other documents we file with or furnish to the SEC, including the following risk factors, before deciding to invest in or to maintain an investment in our securities. Our business, as well as our reputation, financial condition, results of operations and share price, could be materially adversely affected by any of these risks, as well as other risks and uncertainties not currently known to us or not currently considered material. The following risk factors have been organized by category for ease of use; however, many of the risks may have impacts in more than one category.

6

Risk Factors Summary

Our business faces significant risks and uncertainties. You should carefully consider all of the information set forth in this Annual Report and in other documents we file with or furnish to the SEC, including the following risk factors, before deciding to invest in or to maintain an investment in our securities. Our business, as well as our reputation, financial condition, results of operations and share price, could be materially adversely affected by any of these risks, as well as other risks and uncertainties not currently known to us or not currently considered material. These risks include, among others, the following:

| ● | SCHMID’s ability to maintain the listing of our securities on the NASDAQ; |

| ● | Our ability to implement business plans, operating models, forecasts, and other expectations and identify and realize additional business opportunities; |

| ● | Schmid faces intense competition in the markets and industries in which it operates, and Schmid’s competitiveness depends on being successful in new product development and to market its embedded traces technology. |

| ● | The reputation of Schmid’s brand is an important company asset and is key to Schmid’s ability to remain a trusted supplier of specialty products, equipment and services. |

| ● | Schmid’s profitability could suffer if its cost management strategies are unsuccessful, or Schmid’s competitors develop an advantageous cost structure that Schmid cannot match. |

| ● | Schmid’s direct customers and their direct and indirect customers face numerous competitive challenges, which may materially adversely affect their business and as a result Schmid’s business. |

| ● | Schmid’s revenue, earnings, and other operating results have fluctuated in the past and may fluctuate in the future due to the nature of its business. |

| ● | Any disruptions to Schmid’s supply chain, significant increases in material costs, or shortages of critical components, could adversely affect Schmid’s business and result in increased costs. |

| ● | Most of Schmid’s revenue is derived from the electronics business which subjects its revenues and profitability to fluctuations and developments in one global area of business. |

| ● | Economic, financial, geopolitical, epidemiological, or other conditions could result in business disruptions which could seriously harm Schmid’s future revenue and financial condition and increase Schmid’s costs and expenses. |

| ● | Schmid’s operations and assets in foreign jurisdictions may be subject to significant political and economic uncertainties. |

| ● | Schmid’s management has limited experience in operating a public company. |

| ● | Schmid’s ability to obtain additional capital on commercially reasonable terms may be limited. |

| ● | Schmid is generally subject to substantial regulation and laws and unfavorable changes to, or its failure to comply with, these regulations and/or laws could substantially harm its business and operating results. |

7

| ● | Failure of information security and privacy concerns could subject Schmid to penalties, damage Schmid’s reputation and brand, and harm Schmid’s business and results of operations. |

| ● | Schmid may be unable to successfully execute its growth initiatives, business strategies, or operating plans. |

| ● | Schmid’s know-how and innovations, which it relies on for its current and future business, may not be adequately protected. |

| ● | Schmid’s patent applications may not be successful, which may have a material adverse effect on Schmid’s ability to prevent others from commercially exploiting products similar to Schmid’s products. |

Risks Related to Our Business, Technology, and Industry

In the markets and industries in which we operate, we face intense competition and our failure to compete successfully in product development may have an adverse effect on our business, financial condition, and results of operations.

The electronic and photovoltaic industries in which we operate are highly competitive. We encounter competition from numerous and varied competitors in all areas of our business, especially in photovoltaics. For example, the photovoltaic industry includes large Chinese players who often dominate equipment manufacturing as the market is highly commoditized, price driven and under the focus of the Chinese government, which seeks to implement favorable industry policy for local producers. Further, we face competition not only from competitors who manufacture similar products, but also those who may offer a variety of other alternative products. Additionally, industry consolidation may result in larger, more homogeneous, and potentially stronger competitors in the markets in which we compete in the future.

We compete primarily on the basis of product quality, innovation, technology, brand reputation as well as through the services and support we offer. Our competitors may continue to develop their existing portfolios of products, introduce new products and enhance their existing products, which could cause a decline in market acceptance of our products. Our competitors may also improve their manufacturing processes or expand their manufacturing capacity, which could make it more difficult or costly for us to compete successfully. In addition, our competitors could enter into exclusive arrangements with our existing or potential customers or suppliers, which could limit our ability, or make it significantly more costly, to acquire necessary raw materials or to generate sales.

Some of our competitors may have or may obtain greater financial, technical, and marketing resources than we do. This would allow them to devote greater resources to promoting and selling certain products. Unlike many of our competitors who specialize in a single or limited number of product lines, we have a portfolio of businesses and must allocate resources across those businesses. As a result, we may invest less in certain areas of our business than our competitors invest which may lead to a competitive disadvantage.

Further, because some of our competitors are small divisions of large, international businesses, these competitors may have access to greater resources than we do and may therefore be better able to withstand a change in conditions within our industry or the economy as a whole.

Some of our competitors may also incur fewer expenses than we do in creating, marketing, and selling certain products and may face fewer risks in introducing new products to the market. This circumstance results from the nature of our business model, which is based on providing innovative and high-quality products, and therefore may require us to spend a proportionately greater amount on R&D than some of our competitors. If our pricing, marketing resources or other factors are not sufficiently competitive, or if there is an adverse reaction to our product decisions, we may lose market share in certain areas, which could adversely affect our business, financial condition, and results of operations.

8

Additionally, competitors could benefit from favorable tax regimes or additional governmental grants and subsidies. Certain of our competitors in various countries in which we do business, including China, may be owned by or affiliated with members of local governments and political entities. These competitors may receive special treatment with respect to regulatory compliance and product registration, while certain of our products, including those based on new technologies, may be delayed or even prevented from entering into the local market.

Escalating trade tensions, for example between the United States and China, can also lead to restrictions on the import and export of certain goods and technologies to or from certain countries. Further, additional trade import taxes can create disruption in competitiveness. Disruption in the global supply chain due to an escalation of trade tensions, the outbreak of war, a disease epidemic or other unexpected situation can cause certain services, goods and materials to be unavailable or in limited supply and can further limit production capability and result in an inability to produce equipment for customers within an acceptable timeframe and at the needed volume. Such disruptions can have a material impact on our business, results of operations and financial condition. in time and in the needed volume.

We are currently in the process of patenting the technology for embedded traces (“ET”) which we believe is the next level technology for high-end PCBs & substrates. We believe we are the only participant in the market that is currently able to supply equipment for ET production and our best estimate, based on third-party data from a leading international consultancy firm, assumes that the ET market for high-end PCB equipment will grow substantially in 2024. If competitors concentrate on the ET as well and develop either better or more cost competitive processes and machinery, we could fail to capture the growth we expect in the ET market, which could have a material adverse effect on our business, financial condition, and results of operations.

The reputation of our brand is an important company asset and is key to our ability to remain a trusted supplier of specialty products, equipment and services.

We have maintained a strong reputation in the electronics and photovoltaics industries for more than 160 years. Our products, equipment and services are associated with long-lasting and reliable high quality.

The reputation of our brand is an important company asset and is key to our ability to remain a trusted supplier of specialty products, equipment and services and to attract and retain customers. Negative publicity regarding our company or actual, alleged, or perceived issues regarding one of our products or services, particularly given the high cost-of-failure nature of our products and services, could harm our relationships with customers and may adversely affect our credibility and our business.

Our business is dependent on the continued acceptance by our customers of our existing products and services and the value placed on them. If these products and services do not maintain market acceptance, our revenues may decrease. A portion of our sales originate from our worldwide customer-oriented services, which is an important element of our business. If we do not devote sufficient resources or are otherwise unsuccessful in assisting our customers effectively with the products sold to them, we could adversely affect our ability to retain existing customers and could discourage prospective customers from adopting our services. We may be unable to respond quickly enough to accommodate short-term increases in demand for customer support. We may also be unable to modify the nature, scope and delivery of our customer support to compete with changes in the support services provided by our competitors. Increased demand for customer support, without corresponding revenue, could increase costs and adversely affect our business, results of operations and financial condition.

We are also continually investing in new product development to expand our offerings beyond our traditional products and services. Market acceptance of any new products or services may be affected by customer confusion surrounding our introduction of new products and services. Our expansion into new offerings may present increased risks and efforts to expand beyond our traditional products and services may not succeed. However, if we do not continue to innovate and provide innovative machinery and technological solutions that are competitive within our industry, we may lose customers, and our revenues and results of operations could suffer.

9

Through our products, we have established ourselves as one of the leaders in quality and innovation in the markets in which we operate. For that reason, our customers are willing to pay above market prices for our machinery and technological solutions. If we do not continue to innovate and provide innovative machinery and technological solutions that are competitive within our industry, our customers may no longer be willing to pay above market price for our machinery and technological solutions or may move to our competitors. Our customers moving to our competitors could have a material adverse effect on our business, financial condition, and results of operations.

In addition, our business is subject to constant and rapid technological change, product obsolescence, price erosion, evolving standards, and raw material price fluctuations. The industry is currently affected by localization and a shift in customers’ businesses. In particular, there is currently a reorganization of the global supply chain underway, with a focus on decreasing dependency on China. The trends and characteristics in these industries may cause significant fluctuations in our results of operations and cash flows and have a material adverse effect on our financial condition. Our growth and success depend upon our ability to enhance our existing products and services and to develop and introduce new products and services to keep pace with such changes and developments and to meet changing customer needs and preferences. However, newer products or services may not achieve market acceptance if current or potential customers do not value the benefits of using our products, do not achieve favorable results using our products, use their budgets for different products, experience difficulties in using our products, or believe that our products are not cutting edge or do not add as much value as our competition’s products. If these newer products and services do not achieve market acceptance, there could be a material adverse effect on our business, financial condition, and results of operations and our profitability could decline. Additionally, changes, including technological changes, in our customers’ products or processes may make our specialty machines unnecessary or reduce the quantity of our specialty machines needed for a given product or process, which would reduce the demand for such. We have had, and may continue to have, customers who find alternative materials or processes and therefore no longer require our products, which could have a material adverse effect on our business, financial condition, and results of operations. Further, our plans for operating our business and leading further growth include adding new products and services. These investments could contribute to losses, and we cannot guarantee whether or when any of these plans will be successful with customers or result in an improvement in profits for our business.

In addition, we may fail to anticipate the impact of new and emerging technology or changes in trends, fail to accurately determine market demand for new products and services, experience cost overruns, delays in delivery or performance problems, or create market confusion by making changes to our existing products and services. If we are not successful in obtaining acceptance for new products or services, demand for our products and services may decline and/or we may not be able to grow our business or growth may occur more slowly than we anticipate. Some of our current or future products or services could also be rendered obsolete as a result of competitive offerings or market shifts. Furthermore, if our customers deviate from the envisaged timeline for the introduction of new technology, the sales of our newer products could be adversely affected. Failure to anticipate or quickly adapt to changes in our customers’ product introduction timelines could have a material adverse effect on our business, financial condition, and results of operations.

Our profitability could suffer if our cost management strategies are unsuccessful, or our competitors develop an advantageous cost structure that we cannot match.

Our ability to improve or maintain our profitability is dependent on our ability to successfully manage our costs. Our cost management strategies include maintaining appropriate alignment between the price of raw materials, the demand for our offerings and our resource capacity and maintaining or improving our sales and marketing and general and administrative costs as a percentage of revenues. If our cost management efforts are not successful, our efficiency may suffer, and we may not achieve desired levels of profitability. In addition, we may not be able to implement our cost management efforts in a manner that permits us to realize the cost savings we anticipate in the time, manner, or amount we currently expect, or at all due to a variety of risks, including, but not limited to, difficulties in integrating shared services within our business, higher than expected employee severance or retention costs, higher than expected overhead expenses, delays in the anticipated timing of activities related to our cost savings plans, and other unexpected costs associated with operating our business. If we are not effective in managing our operating costs in response to changes in demand or pricing, or if we are unable to absorb or pass on increases in the compensation of our employees or costs of raw materials, we may not be able to invest in our business in an amount necessary to achieve our planned rates of growth, and our business, financial condition, and results of operations could be materially adversely affected.

10

It may be possible for our current or future competitors to gain an advantage in product technology, manufacturing technology, or process technology, which may allow them to offer products or services that have a significant advantage over our offerings. Advantages could be in price, capacity, performance, reliability, serviceability, industry standards or formats, brand and marketing, or other attributes. If we do not compete successfully by developing and deploying new cost-effective products, processes, and technologies on a timely basis and by adapting to changes in our industry and the global economy, there could be a material adverse effect on our business, financial condition, and results of operations. Similarly, our products are used by manufacturers of component parts for a variety of industries. To the extent these industries become more sensitive to input costs, we may face price pressure. Our ability to respond to such pressures depends on the strength and viability of our internal cost management and pricing programs. Any failure of these programs could have a material adverse effect on our business, financial condition, and results of operations.

If we fail to continuously develop new, improved and more cost-effective technologies and products, this could have a material adverse effect on our business, financial condition and results of operations.

We depend on our continued ability to develop new, improved and more cost-effective technologies and products, to produce the same in a cost-effective manner and to commercialize and distribute new products successfully. The trend towards commoditization and standardization in some of our markets is further increasing the importance of research and development as we need to offer specialized products that are offering higher value to customers in order to achieve satisfactory margins.

We may not be able to successfully and constantly adapt, expand and improve our research and development activities, product portfolio and our marketing strategy in a timely manner and to the necessary extent, or may lack the capacity to invest the required level of human or financial resources in the development of new products required to respond to the existing trends and future changes. Competitors, in particular those with greater financial resources, might be able to outperform us by developing new technologies or products with favorable characteristics. In addition, the market for a newly developed technology or product may unexpectedly decline or could even disappear. In such case, all or part of our investments in the development of the relevant technology or product, which might be substantial, may be lost.

If we fail to continuously develop new, improved and more cost-effective technologies and products and to constantly adapt our research and development activities, product portfolio and marketing strategy to new trends and technological changes, this could have a material adverse effect on our business, financial condition and results of operations.

Our direct customers and their direct and indirect customers face numerous competitive challenges, which may materially adversely affect their business and ours.

Factors adversely affecting our direct customers and their direct and indirect customers may also adversely affect us. These factors include recessionary periods in their markets, their inability to adapt to rapidly changing technology and evolving industry standards, their inability to develop, market, or gain commercial acceptance of their products, some of which are new and untested and their products becoming commoditized or obsolete. Our customers are also subject to a highly competitive consumer products industry, which may have shorter product lifecycles, shifting end-user preferences, and higher revenue volatility.

If our customers or our customers’ direct and indirect customers in the ultimate end-markets are unsuccessful in addressing these competitive challenges, their businesses may be materially adversely affected, reducing the demand for our offerings, decreasing our revenues, or altering our production cycles and inventory management, each of which could have a material adverse effect on our business, financial condition, and results of operations.

Our revenue, earnings, and other operating results have fluctuated in the past and may fluctuate in the future.

If demand for our products fluctuates as a result of economic conditions or for other reasons, our revenue and profitability could be impacted. Our future operating results will depend on many factors, including the following:

| ● | business, political, and macroeconomic changes, and the overall global economy; |

11

| ● | wars or epidemic events; |

| ● | changes in consumer confidence caused by many factors, including changes in interest rates, credit markets, expectations for inflation, unemployment levels, and energy or other commodity prices; |

| ● | fluctuations in demand for our customers’ and their customers’ products; |

| ● | our ability to forecast our customers’ demand for our products accurately; |

| ● | our ability to anticipate secular trends that affect demand for our products and the degree to which those trends materialize; |

| ● | our customers’ ability to manage the inventory that they hold and to forecast accurately their demand for our products; |

| ● | our ability to achieve cost savings and improve yields and margins on our new and existing products; and |

| ● | our ability to utilize our capacity efficiently or acquire additional capacity in response to customer demand. |

It is likely that our future operating results could be adversely affected by one or more of the factors set forth above or other similar factors. If our future operating results are below the expectations of stock market analysts or our investors, our stock price may decline.

Any disruptions to our supply chain, significant increase in material costs, or shortages of critical components, could adversely affect our business and result in increased costs.

Any disruptions to our supply chain, significant increases in the cost of materials or shortages of critical components, could adversely affect our business and result in increased costs. Such a disruption could occur as a result of any number of events, including, but not limited to: market shortages due to surge in demand for any particular part or component, increases in prices or impact of inflation, the imposition of regulations, quotas or embargoes on components, labor stoppages, transportation delays or failures affecting the supply chain and shipment of materials and finished goods, supply bottlenecks resulting from plant closures and production adjustments due to public health crises, such as pandemics and epidemics, third-party interference in the integrity of the parts and components sourced through the supply chain, the unavailability of raw materials, severe weather conditions, adverse effects of climate change, natural disasters, geopolitical developments, war or terrorism, and disruptions in utilities and other services. In addition, any future updates or modifications to the anticipated design of Schmid products may increase the number of parts and components we would be required to source and increase the complexity of our supply chain management. Failure to effectively manage the supply of parts and components could materially and adversely affect our results of operations, financial condition and prospects.

12

Any continued decline or disruption in the photovoltaics, and electronics markets or any economic downturn or uncertainty, in particular in Europe and Asia, could materially adversely affect our business, results of operations, and financial condition.

In recent years, we have generated a large percentage of our revenue in China and Europe. Any continued decline or disruptions in those markets, especially in respect to the photovoltaics and electronics market, could have a direct impact on our business. Trends in nearshoring global semiconductor supply chains could also directly impact our business as customers may choose to move to competitors whose production facilities are closer to their factories. We have also historically been impacted by economic declines or disruptions in those markets, for example the outbreak of the COVID-19 pandemic which led to severe interruptions to business operations generally and within China in particular. Any similar decline or disruption in the future could materially adversely affect our business, results of operations, and financial condition.

Our performance also depends on the financial health and strength of our customers, which in turn is dependent on the economic conditions of the markets in which we and our customers operate. Declines or uncertainties in Europe, the United States, China and other global economies may lead customers to delay or reduce purchases of our products and services as they take measures to reduce their operating costs, including by delaying the development or launch of new products and brands and/or reducing R&D spending generally.

We are also sensitive to general trends and changes in the key markets we serve. Some of these markets, including the market for substrate manufacturing, exhibit a degree of cyclicality. Decisions to purchase our products and equipment are largely the result of the performance of these and other end-markets. If demand for output in these end-markets decreases, demand for our offerings will decrease as well. Demand for the products produced by customers in our end-markets is impacted by numerous factors, including macroeconomic conditions, prices of commodities, rates of infrastructure spending, consumer confidence and spending, labor conditions, and fuel costs, among others. For example, public skepticism of autonomous driving may negatively impact the demand for high-frequency sensors, which could result in decreased demand for our products. Increases or decreases in these variables globally may significantly impact the demand for our offerings and could have a material adverse effect on our business, financial condition, and results of operations. If we are unable to accurately predict demand in our end-markets or of the customers we serve, we may be unable to meet our customers’ needs, resulting in the loss of potential sales.

Alternatively, we may manufacture excess products, resulting in increased inventories and overcapacity in our manufacturing facilities, increasing our incremental production costs and decreasing our operating margins. In addition, mergers or consolidations among our customers could reduce the number of our customers and potential customers. Consolidation in certain industries that we serve might also adversely affect or otherwise impact our revenues even if these events do not reduce the activities of the consolidated entities. When entities consolidate, overlapping services previously purchased separately are usually purchased only once by the consolidated entity, leading to loss of revenues. In addition, consolidated entities can better negotiate pricing terms while reducing spending on other services that were previously purchased by one of the merged or consolidated entities which may be deemed unnecessary or cancelled. Any such developments among our customers could have material adverse effect on our business, financial condition, and results of operations.

Most of our revenue is derived from our electronics business and while we believe that the business we operate in will grow significantly in the future, this may not materialize which could mean that we fail to reach our 2024 projected revenues and EBITDA.

While we focus on several sectors such as electronics and photovoltaics, the majority of our revenue is achieved from our business with electronics customers. If one or more of the products and services we offer in this business area does not continue to remain profitable or we fail to maintain the quality of the products we offer for any reason, our business, financial condition, and results of operations may be materially adversely affected.

13

In particular, in our best estimate, based on third-party data from a leading international consultancy firm, the ET market for high-end PCB equipment will grow substantially in 2024. If the high-end PCB equipment market develops differently, for instance if traditional process technologies or other new technologies continue to capture most or all of the high-end PCB equipment market, we would not be able to grow our own revenues through our ET process technology, which could have a material adverse effect on our business, financial condition, and results of operations.

Our future business plans are formulated on the expectation of positive long-term trends and drivers in the market in which we operate. Key drivers of this growth are technology such as mobile devices and wearables as well as automotive and mobility innovations. If our expectations and estimates are not correct or do not materialize in the manner in which we anticipate, this could have a negative impact on our future business plans and results of operations. In particular, our current projections for our revenues and EBITDA for fiscal year 2024 are based on our current assessment of the macroeconomic conditions in our key target markets and in particular the development of the electronics businesses and significant customer orders. While we based our projections on market trends and discussions with key customers as well as our order backlog as of December 31, 2023, the forecasted revenues and EBITDA may not materialize as we project due to various external factors or delays in order timing or other factors such as competitors receiving orders which we have forecasted to be received by us in 2024.

Difficult and volatile conditions in the capital, credit and commodities markets and in the overall economy could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Difficult global economic conditions, including concerns about sovereign debt and significant volatility in the capital, credit, and commodities markets, could have a material adverse effect on our business, financial condition, results of operations, and cash flows. These global economic factors, combined with low levels of business and consumer confidence and high levels of unemployment, precipitated a slow recovery from the global recession and from time to time create a concern about a return to recessionary conditions. These difficult conditions and the overall economy can affect our business in several ways. For example:

| ● | as a result of the volatility in commodity prices, we may encounter difficulty in achieving sustained market acceptance of past or future price increases, which could have a material adverse effect on our business, financial condition, results of operations, and cash flows; |

| ● | under difficult market conditions, there can be no assurance that borrowings under our revolving credit facility would be available or sufficient, and in such a case, we may not be able to successfully obtain additional financing on reasonable terms, or at all; |

| ● | in order to respond to market conditions, we may need to seek waivers from certain provisions in financing agreements, and in such case, there can be no assurance that we can obtain such waivers at a reasonable cost, if at all; |

| ● | market conditions could cause the counterparties to the derivative financial instruments we may use to hedge our exposure to interest rate, commodity, or currency fluctuations to experience financial difficulties and, as a result, our efforts to hedge these exposures could prove unsuccessful and, furthermore, our ability to engage in additional hedging activities may decrease or become more costly; and |

| ● | market conditions could result in our key customers experiencing financial difficulties and/or electing to limit spending, which in turn could result in decreased sales and earnings for us. |

14

In general, downturns in economic conditions can cause fluctuations in demand for our and our customers’ products, product prices, volumes, and margins. Future economic conditions may not be favorable to our industry and future growth in demand for our products, if any, may not be sufficient to alleviate any existing or future conditions of excess industry capacity. A decline in the demand for our products or a shift to lower margin products due to deteriorating economic conditions could have a material adverse effect on our business, financial condition, and results of operations and could also result in impairments of certain of our assets. We do not know if market conditions or the state of the overall economy will maintain its current course, improve, or decline in the near future. We cannot provide assurance that any decline in economic conditions or economic downturn in one or more of the geographic regions in which we sell our products would not have a material adverse effect on our business, financial condition, and results of operations.

Foreign currency exchange rate fluctuations and volatility in global currency markets could have a material adverse effect on our business, financial condition, and results of operations.

Our combined financial statements are presented in Euros. Our international sales and operations expose us to fluctuations in foreign currency exchange rates. These movements in exchange rates may cause our revenues and expenses to fluctuate, impacting our profitability and cash flows and our results generally.

A significant part of our costs and revenues is denominated in currencies other than the Euro, with the significant majority of our non-Euro denominated revenues being in RMB and a significant majority of our costs being denominated in Euro. Because a majority of our revenues and costs are denominated in currencies other than the Euro, changes in foreign currency exchange rates, in particular a depreciation of the Euro against the RMB, could reduce our ability to service our debt.

These risks related to exchange rate fluctuations and currency volatility may increase in future periods as our operations outside of Europe continue to expand. Consequently, our business, financial condition, and results of operations may be materially adversely affected by fluctuations in currency exchange rates.

Natural disasters, catastrophes, fire, or other unexpected events could have a material adverse effect on our business, financial condition, and results of operations.

Many of our business activities involve substantial investments in manufacturing facilities. These facilities could be materially damaged by natural disasters, such as floods, tornadoes, hurricanes, and earthquakes, or by catastrophes, fire or other unexpected events such as adverse weather conditions or other disruptions to our facilities, supply chain, or our customers’ facilities. We could incur uninsured losses and liabilities arising from any such events, including damage to our reputation, and/or suffer severe impairments to our operational capacity, which could have a material adverse impact on our business, financial condition, and results of operations.

Any natural disaster, catastrophe, fire, or other unexpected event could result in personal injury and loss of life, damage to property, and contamination of the environment, which may result in a shutdown of our facilities, suspension of operations, and the imposition of civil or criminal fines, penalties and other sanctions, cleanup costs, and claims by governmental entities or third parties. We are dependent on the continued operation of our production facilities, and the loss or shutdown of operations over an extended period at any of our other major operating facilities could have a material adverse effect on our business, financial condition, and results of operations.

If we fail to retain existing key customers, or if our key customers fail to grow their own sales in the future, our business, results of operations, and financial condition could be materially adversely affected.

We have a concentrated customer base and are dependent on a small number of significant customers in the technology sector for a large percentage of our sales and revenue. For fiscal year 2023, the two largest customers measured in terms of sales volume represented approximately 38% of our revenues and the ten largest customers represented approximately 71% of our revenues. For the fiscal year 2021, we had more than 60 customers and in 2022 we had more than 70 customers with an approximately similar number of customers in 2023. If we fail to retain these key customers or if we fail to replace orders in one period from key customers with orders from other customers in subsequent periods our own results could be materially adversely impacted.

15

After introducing our products into their operations, our customers often become highly dependent on our continued provision of products and services. This means that a part of our revenue is derived from subsequent business following the original customer purchase. If such customers were to switch to other providers, we would lose revenue from both initial business as well as subsequent business from follow-on sales and services.

Further, our key customers may fail to grow their own sales in the future which may result in withdrawing from business with us. Loss of any such customer or any disruption in our relationship with such customers could result in decreased revenues. If we are unable to replace revenue generated by one or more of our major customers, our revenue may significantly decrease, which would have a material adverse effect on our business, financial condition, and results of operations.

Our business, financial condition, and results of operations could be adversely affected by decreases in the average selling prices of products.

Decreases in the average selling prices of our products may have a material adverse effect on our business, financial condition, and results of operations. Our ability to maintain or increase our profitability will continue to be dependent, in large part, upon our ability to offset decreases in average selling prices by improving production efficiency or by shifting to higher margin products. In the past, we have elected to discontinue selling certain products as a result of sustained material decreases in the selling price of such products and our inability to effectively offset such decrease through shifts in operations. If we are unable to respond effectively to decreases in the average selling prices of our products in the future, our business, financial condition, and results of operations could be materially adversely affected. Further, while we may elect to discontinue products that are significantly affected by such price decreases, we can provide no assurance that any such discontinuation will mitigate the related declines in our financial condition.

We may be required to record an impairment charge on our accounts receivable if we are unable to collect the outstanding balances from our customers.

We typically pre-finance a large portion of development services and resources for manufacturing customer-specific products and frequently sell products and services to customers on credit. While we carry out credit checks for our customers and generally require down payments for orders, there is a risk of delay for payments of the remaining amounts or that customers do not fulfil their payment obligations in full. We estimate the collectability of our accounts receivable based on our analysis of the accounts receivable, historical bad debts, customer creditworthiness, and current economic trends. We continuously monitor collections from our customers and maintain adequate impairment allowance for doubtful accounts. However, if the bad debts significantly exceed our impairment allowance, we may be required to record an impairment charge and our business, financial condition, and results of operations could be materially adversely affected.

Economic, financial, geopolitical, epidemiological, or other conditions could result in business disruptions which could seriously harm our future revenue and financial condition and increase our costs and expenses.

Concerns over inflation, geopolitical issues, the U.S. financial markets, foreign exchange rates, capital and exchange controls, unstable global credit markets and financial conditions, the COVID-19 pandemic, supply chain disruptions and economic issues have led to periods of significant economic instability, declines in consumer confidence and discretionary spending, diminished expectations for the global economy and expectations of slower global economic growth going forward, and increased unemployment rates. Our general business strategy may be adversely affected by any such economic downturn, volatile business environment and continued unstable or unpredictable economic and market conditions. If these conditions continue to deteriorate or do not improve, it may make any necessary debt or equity financing more difficult to complete, more costly and more dilutive. In addition, there is a risk that one or more of our current or future service providers, manufacturers, suppliers and other partners could be negatively affected by difficult economic times, which could adversely affect our ability to attain our operating goals on schedule and on budget or meet our business and financial objectives.

16

Our operations, and those of third-party contractors and consultants upon which we rely, could be subject to wildfires, earthquakes, tsunamis, power shortages or outages, floods or monsoons, public health crises, such as pandemics and epidemics, political crises, such as terrorism, war (including trade wars), political instability or other conflicts, and other natural or man-made disasters or other events outside of our control that could disrupt our business. In February 2022, armed conflict escalated between Russia and Ukraine. The sanctions announced by the United States and other countries, following Russia’s invasion of Ukraine, against Russia to date include restrictions on selling or importing goods, services or technology in or from affected regions and travel bans and asset freezes impacting connected individuals and political, military, business and financial organizations in Russia. It is not possible to predict further actions by the United States and other countries and the broader consequences of this war, which could include further sanctions, embargoes, regional instability, geopolitical shifts and adverse effects on macroeconomic conditions, currency exchange rates and financial markets, all of which could impact our business, financial condition and results of operations.

The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. Our ability to obtain supplies and materials for the production of our products could be disrupted if the operations of our suppliers are affected by a man-made or natural disaster or other business interruption. Damage or extended periods of interruption to our corporate, development or research facilities due to fire, natural disaster, power loss, communications failure, unauthorized entry or other events could cause us to cease or delay the marketing or development of some or all of our products and services. Although we maintain property damage and business interruption insurance coverage, our business, financial condition, and results of operations may be seriously harmed should the losses we suffer as a result of such property damage and/or business interruption substantially exceed our insurance coverage and we are required to make up for this shortfall.

Risks Related to our Operations

Our global operations subject us to increased risks.

We have global operations and, accordingly, our business is subject to risks resulting from differing legal and regulatory requirements, political, social, and economic conditions, and unforeseeable developments in a variety of jurisdictions. We have a significant presence in several major regions, including certain emerging markets such China, and we plan to continue and diversify global expansion. Our global operations are subject to the following risks, among others:

| ● | political instability, including regime changes, and corruption; |

| ● | acts of terrorism and military actions in response to such acts; |

| ● | unexpected changes in regulatory environments and government interference in the economy; |

| ● | changes to economic sanctions laws and regulations, including regulatory exemptions that currently authorize certain of our limited dealings involving sanctioned countries; |

| ● | increasingly stringent laws related to privacy and consumer and data protection, including the EU General Data Protection Regulation and US State privacy and security breach notification laws; |

| ● | international trade disputes that could result in tariffs or other protectionist measures; |

| ● | social unrest, crime, strikes, riots and civil disturbances; |

| ● | varying tax regimes, including with respect to the imposition of confiscatory taxes, other unexpected taxes, or withholding taxes on remittances and other payments by our partnerships or subsidiaries; |

| ● | differing labor regulations, particularly in Germany and China where we have a significant number of employees; |

17

| ● | rising wages and rates of inflation; |

| ● | fluctuations in foreign currency exchange rates and foreign exchange controls and restrictions on repatriation of funds; |

| ● | the outbreak of disease pandemics and responsive governmental measures; |

| ● | inability to collect payments, or seek recourse under, or comply with ambiguous or vague commercial or other laws; |

| ● | difficulty in obtaining, or denial of, export licenses or delay or interruption of the transportation of our products; |

| ● | differing protections for intellectual property rights; |

| ● | increased risk of cybersecurity incidents and cyberattacks from third-party and state actors and privacy violations; |

| ● | difficulties in attracting and retaining qualified management and employees; |

| ● | increased credit risk and different financial conditions of customers and distributors may necessitate longer payment cycles of accounts receivable or result in increased bad debt write-offs (including due to bankruptcy) or additions to reserves; |

| ● | differing business practices, which may require us to enter into agreements that include non-standard terms; and |

| ● | difficulties in penetrating new markets due to entrenched competitors, lack of recognition of our brand, and lack of local acceptance of our products and services. |

Our overall success as a global business depends, in part, on our ability to anticipate and effectively manage these risks, but there can be no assurance that we will be able to do so without incurring unexpected costs. If we are not able to manage the risks related to our international operations, our business, financial condition, and results of operations may be materially adversely affected.

Our business in various markets requires us to respond to rapid changes in market conditions in these countries. Our overall success as a global business depends, in part, upon our ability to succeed in different legal, regulatory, economic, social, and political conditions. We may not succeed in developing and implementing policies and strategies which will be effective in each location where we do business.

Furthermore, any of the foregoing factors or any combination thereof could have a material adverse effect on our business, financial condition, and results of operations.

We may also face difficulties managing and administering an internationally dispersed business. In particular, the management of our personnel across several countries can present logistical and managerial challenges. Additionally, international operations present challenges related to operating under different business cultures and languages. We may have to comply with unexpected changes in foreign laws and regulatory requirements, which could negatively impact our operations and ability to manage our global financial resources. Export controls or other regulatory restrictions could prevent us from shipping our products into and from some markets. Moreover, we may not be able to adequately protect our trademarks and other intellectual property overseas due to uncertainty of laws and enforcement in several countries.

18

Changes in tax regulations in Germany or the United States and other jurisdictions, including under and with respect to bilateral and multilateral tax treaties, or the interpretation thereof, could significantly reduce the financial performance of our foreign operations or the magnitude of their contributions to our overall financial performance. In addition, the interpretation and application of consumer and data protection laws in the United States, Europe, and elsewhere are often uncertain, contradictory, and in flux. It is possible that any such newly introduced or amended laws are interpreted and applied in a manner that is inconsistent with our data practices. If so, this could result in government-imposed fines or orders requiring that we change our data practices, which could have an adverse effect on our business. Complying with these various laws could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.

We are not insured against all potential risks.

To the extent available, we maintain insurance coverage that we believe is customary in our industry, covering our respective properties, operations, personnel, and businesses. Such insurance does not, however, provide coverage for all liabilities, including certain hazards incidental to our business, and we can provide no assurance that our insurance coverage will be adequate to cover claims that may arise or that we will be able to maintain adequate insurance at rates we consider reasonable. For example, the occurrence of a significant business interruption in the operation of one or more of our key facilities, countries, business partners, or systems could result in liability to us that is not insured and therefore could have a material adverse effect on our business, financial condition, and results of operations. In addition, our products are used in or integrated with many high-risk end-products and therefore if such products were involved in a disaster or catastrophic accident, we could be involved in litigation arising out of such incidents and susceptible to significant expenses or losses.

In the event of a total or partial loss affecting any of our property, certain items of equipment and inventory may not be easily replaced. Accordingly, even though there may be insurance coverage, the extended period needed to obtain replacement units or inventory may cause significant delays, which may have a material adverse effect on our business, financial condition, and results of operations. In addition, certain zoning laws and regulations may prevent rebuilding substantially the same facilities in the event of a casualty, which may have a material adverse effect on our business, financial condition, and results of operations.

As a result, we cannot assure you that we are insured against all potential risks or for those risks that are covered by insurance that the insurance proceeds will compensate us fully for our losses, which could result in a material adverse effect on our business, financial condition, and results of operations.

Our ability to use and operate certain portions of our facilities may be limited by the validity of, or a default or termination under, our real property leases.

Certain portions of our facilities are leased from third-party landlords, and we continue to lease facilities in the future. The invalidity of, or default or termination under, any of our leases may interfere with our ability to use and operate all or a portion of certain of our facilities, which may have a material adverse effect on our business, financial condition, and results of operations.

19

Our operations and assets in foreign jurisdictions may be subject to significant political and economic uncertainties.

We operate and have subsidiaries and partners in various jurisdictions such as China, Taiwan, South Korea, Malaysia and the United States. Changes in laws and regulations, or their interpretation, or the imposition of unexpected or confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency, or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, financial condition, and results of operations of our subsidiaries. For example, under its current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The foreign economies may differ from the economies of Germany or the U.S. in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange, and allocation of resources. While such economies may have experienced significant growth in the past 30 years, growth may have been uneven, both geographically and among various sectors of the economy. Such economies may not continue to grow and if there is growth, such growth may not be steady and uniform. If there is a slowdown, such slowdown may have a negative effect on our business and operations in such economies as well as on our business in general. We can provide no assurance that the various macroeconomic measures and monetary policies adopted by the foreign governments to guide economic growth and the allocation of resources will be effective in sustaining the growth rate of the respective foreign economies. If growth of such economies stagnates or there is an economic downturn, our business, financial condition, and results of operations may be materially adversely affected.