UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 1, 2024

Applied DNA Sciences, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36745 | 59-2262718 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

50 Health Sciences Drive

Stony Brook, New York 11790

(Address of principal executive offices; zip code)

Registrant’s telephone number, including area code:

631-240-8800

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | APDN | The Nasdaq Stock Market |

| Item 7.01. | Regulation FD Disclosure. |

On May 1, 2024, Applied DNA Sciences, Inc. (the “Company”) utilized a company presentation which may be used in presentations to investors from time to time. A copy of the presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished in this Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Item 7.01 of this Current Report on Form 8-K is not incorporated by reference into any filings of the Company made under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report on Form 8-K, regardless of any general incorporation language in the filing unless specifically stated so therein.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Company Presentation, dated May 1, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 1, 2024 | APPLIED DNA SCIENCES, INC. | |

| By: | /s/ James A. Hayward | |

| Name: | James A. Hayward | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

Cell - Free Enzymatic DNA Empowering the Genetic Medicines Revolution Nasdaq: APDN The statements made by Applied DNA in this presentation may be “forward - looking” in nature within the meaning of Section 27 A of the Securities Act of 1933 , Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 . Forward - looking statements describe Applied DNA’s future plans, projections, strategies, and expectations, and are based on internal Company assumptions and modeling and involve a number of risks and uncertainties, many of which are beyond the control of Applied DNA . Actual results could differ materially from those projected due to its history of net losses, limited financial resources, the substantial doubt about its ability to continue as a going concern, unknown future demand for its biotherapeutics products and services, the unknown amount of revenues and profits that will result from the Linea DNA and/or Linea IVT platforms, limited market acceptance for its supply chain security products and services, our unknown ability to procure additional financing to build our GMP manufacturing facility, the declining demand for Applied DNA’s COVID - 19 testing services, the fact that there has never been a commercial drug product utilizing PCR - produced DNA technology and/or the Linea DNA or Linea IVT platforms approved for therapeutic use, and various other factors detailed from time to time in Applied DNA’s SEC reports and filings, including its Annual Report on Form 10 - K filed on December 7 , 2023 , its Form 10 - Q filed on February 8 , 2024 and other reports it files with the SEC, which are available at www . sec . gov . Applied DNA undertakes no obligation to update publicly any forward - looking statements to reflect new information, events, or circumstances after the date hereof or to reflect the occurrence of unanticipated events, unless otherwise required by law . 2 ©2024 Applied DNA Sciences, Inc.

Safe Harbor Statement Company Overview • Pioneer in large - scale PCR - based DNA manufacturing • 3 interrelated business segments, all leveraging the polymerase chain reaction (PCR) to enable the manufacture and analysis of DNA • Therapeutic DNA Production • Potential for near - term growth in genetic medicine manufacturing • Genetic Testing • Planned Pharmacogenomics (PGx) for New York State and beyond • DNA Tagging and Authentication • A proven technology to secure complex supply chains • Significant IP estate comprised of 99 issued patents, 35 pending patent applications and 15 years of know - how ©2024 Applied DNA Sciences, Inc. 3 ©2024 Applied DNA Sciences, Inc.

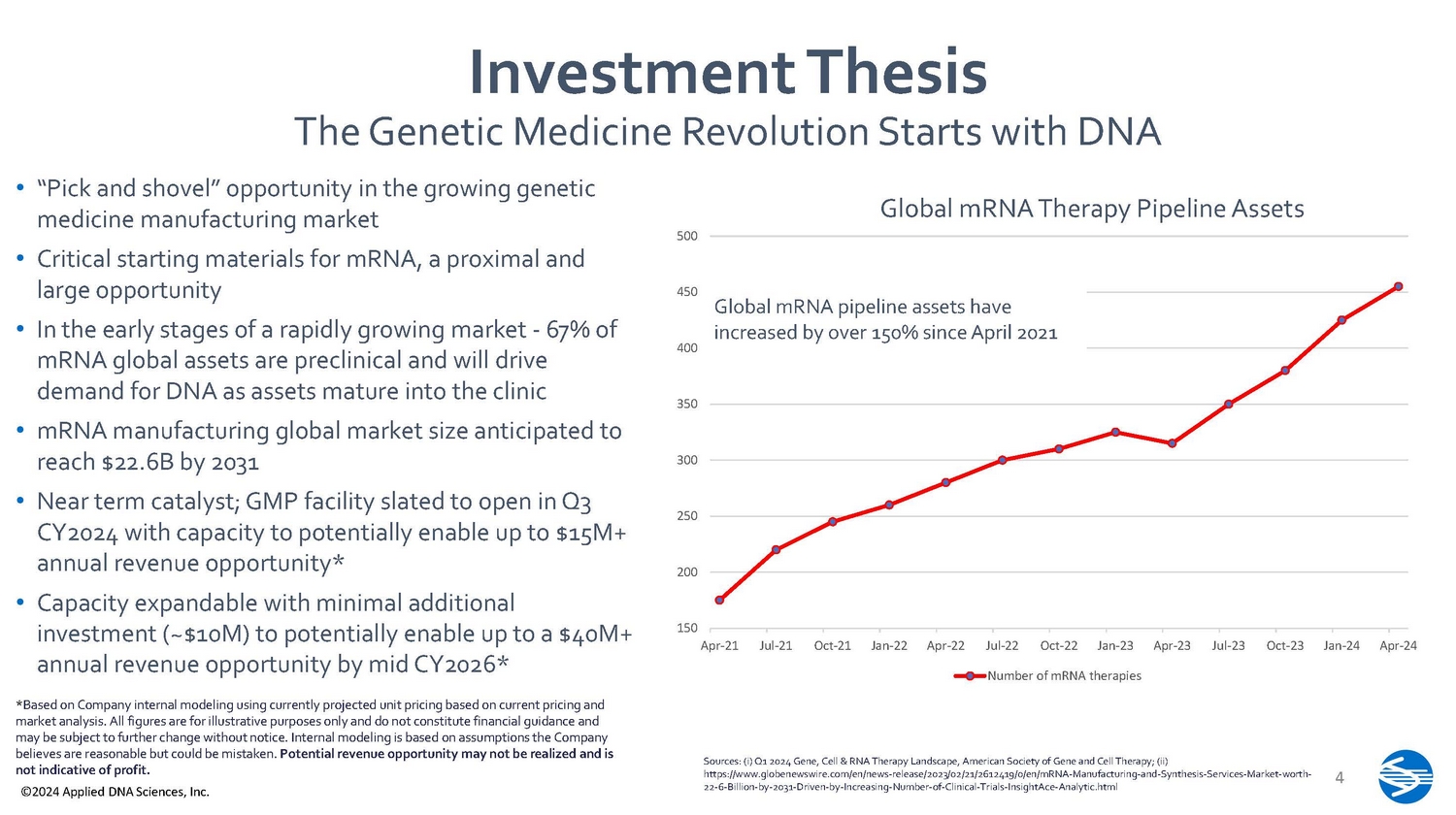

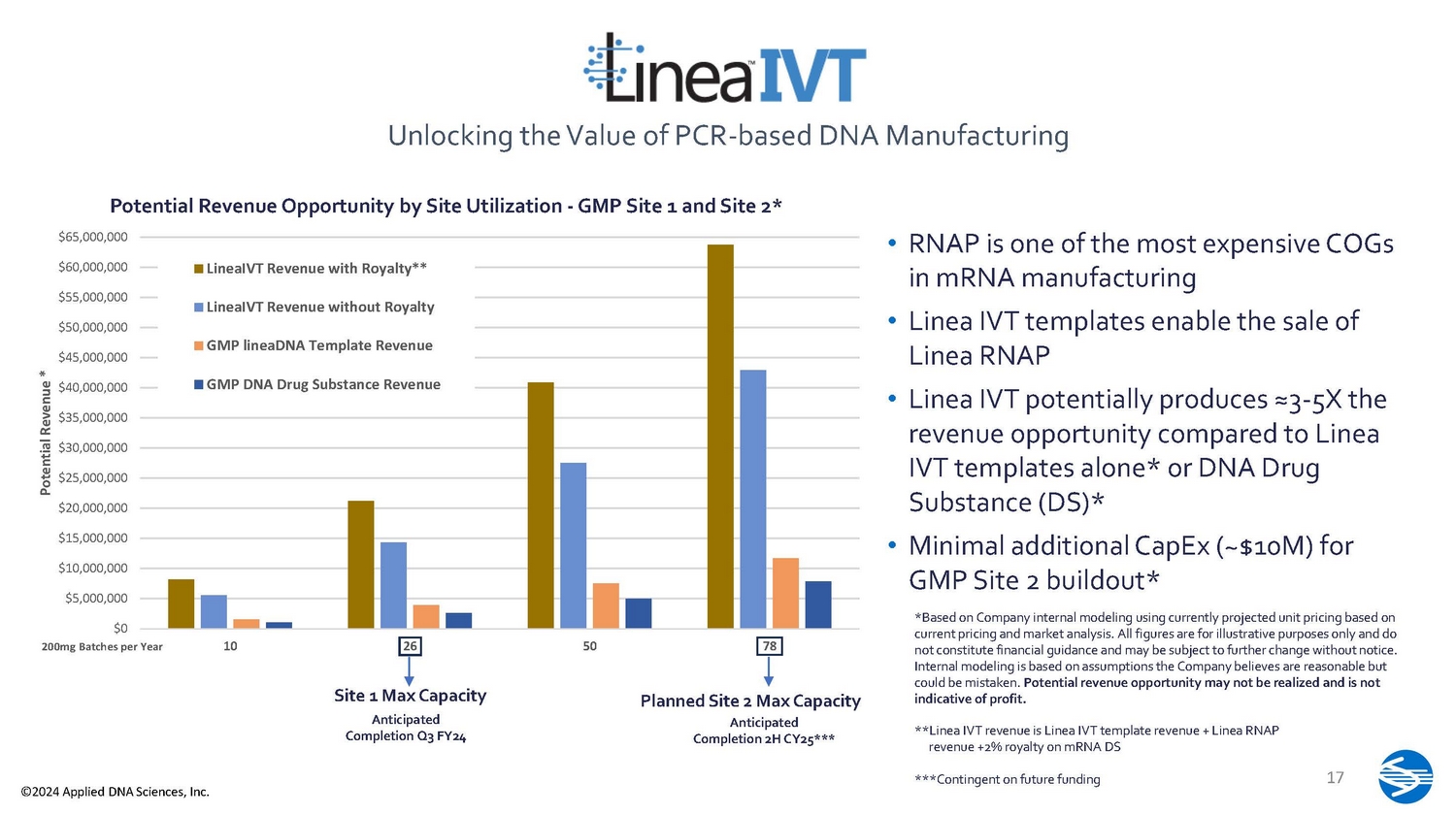

Investment Thesis The Genetic Medicine Revolution Starts with DNA • “Pick and shovel” opportunity in the growing genetic medicine manufacturing market • Critical starting materials for mRNA, a proximal and large opportunity • In the early stages of a rapidly growing market - 67% of mRNA global assets are preclinical and will drive demand for DNA as assets mature into the clinic • mRNA manufacturing global market size anticipated to reach $22.6B by 2031 • Near term catalyst; GMP facility slated to open in Q3 CY2024 with capacity to potentially enable up to $15M+ annual revenue opportunity* • Capacity expandable with minimal additional investment (~$10M) to potentially enable up to a $40M+ annual revenue opportunity by mid CY2026* * Based on Company internal modeling using currently projected unit pricing based on current pricing and market analysis. All figures are for illustrative purposes only and do not constitute financial guidance and may be subject to further change without notice. Internal modeling is based on assumptions the Company believes are reasonable but could be mistaken. Potential revenue opportunity may not be realized and is not indicative of profit. ©2024 Applied DNA Sciences, Inc.

Sources: (i) Q1 2024 Gene, Cell & RNA Therapy Landscape, American Society of Gene and Cell Therapy; (ii) https:// www.globenewswire.com/en/news - release/2023/02/21/2612419/0/en/mRNA - Manufacturing - and - Synthesis - Services - Market - worth - 22 - 6 - Billion - by - 2031 - Driven - by - Increasing - Number - of - Clinical - Trials - InsightAce - Analytic.html 4 150 Ap r - 2 1 200 250 300 350 400 450 500 Ju l - 2 1 O c t - 2 1 Jan - 2 2 Ap r - 2 2 Ju l - 2 2 O c t - 2 2 Jan - 2 3 Ap r - 2 3 Ju l - 2 3 O c t - 2 3 Jan - 2 4 Ap r - 2 4 Number of mRNA therapies Global mRNA pipeline assets have increased by over 150% since April 2021 Global mRNA Therapy Pipeline Assets ©2024 Applied DNA Sciences, Inc. Personalized mRNA Cancer Vaccines A Unique Opportunity 5 • Growing potential market with over 25 clinical trials for personalized anticancer mRNA vaccines targeting TSAs/neoantigens currently active • Important recent successes • Moderna/Merk successful phase 3 (melanoma) • BioNTech/Genentech successful phase 1 (pancreatic cancer).Phase 2 enrolled Sources: (i) ASGCT Q1 2024 Report; (ii) Wang B, Pei J, Xu S, Liu J, Yu J. Recent advances in mRNA cancer vaccines: meeting challenges and embracing opportunities. Front Immunol. 2023 Sep 6;14:1246682 . d oi: 10.3389/fimmu.2023.1246682. PMID: 37744371; PMCID: PMC10511650; (iii) https://investors.modernatx.com/news/news - details/2023/Moderna - And - Merck - Announce - mRNA - 4157 - V940 - In - Combinati on - with - KeytrudaR - Pembrolizumab - Demonstrated - Continued - Improvement - in - Recurrence - Free - Survival - and - Distant - Metastasis - Free - Survival - in - Patients - with - High - Risk - Stage - IIIIV - Melanoma - Following - Comple/d efault.aspx; (iv) https://investors.biontech.de/news - releases/news - release - details/biontech - expands - late - stage - clinical - oncology - portfolio • Speed of manufacturing is essential • Recent sub - award to LRx under a federal grant to help empower manufacturing of mRNA therapies in < 7 days for pandemic response • Workflow also highly relevant to mRNA cancer vaccines # of RNA Therapies Under Development 6 - 8 Months < 45 days* Conventional Plasmid - based mRNA Production *Based on internal Company data and modeling Better mRNA, Faster Our Solution 6 ©2024 Applied DNA Sciences, Inc.

Platform An Adaptable Enzymatic Manufacturing Technology 7 ©2024 Applied DNA Sciences, Inc.

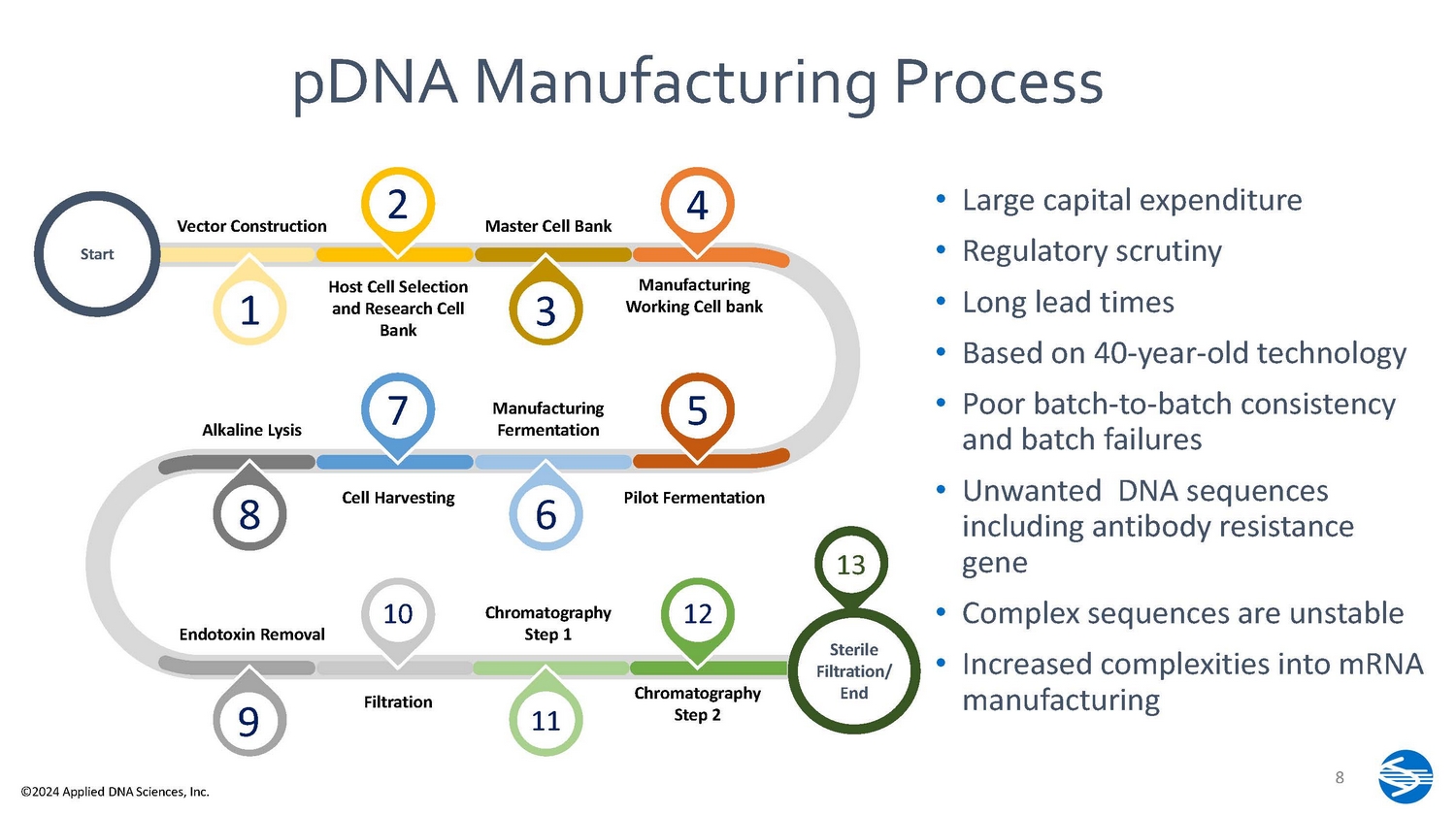

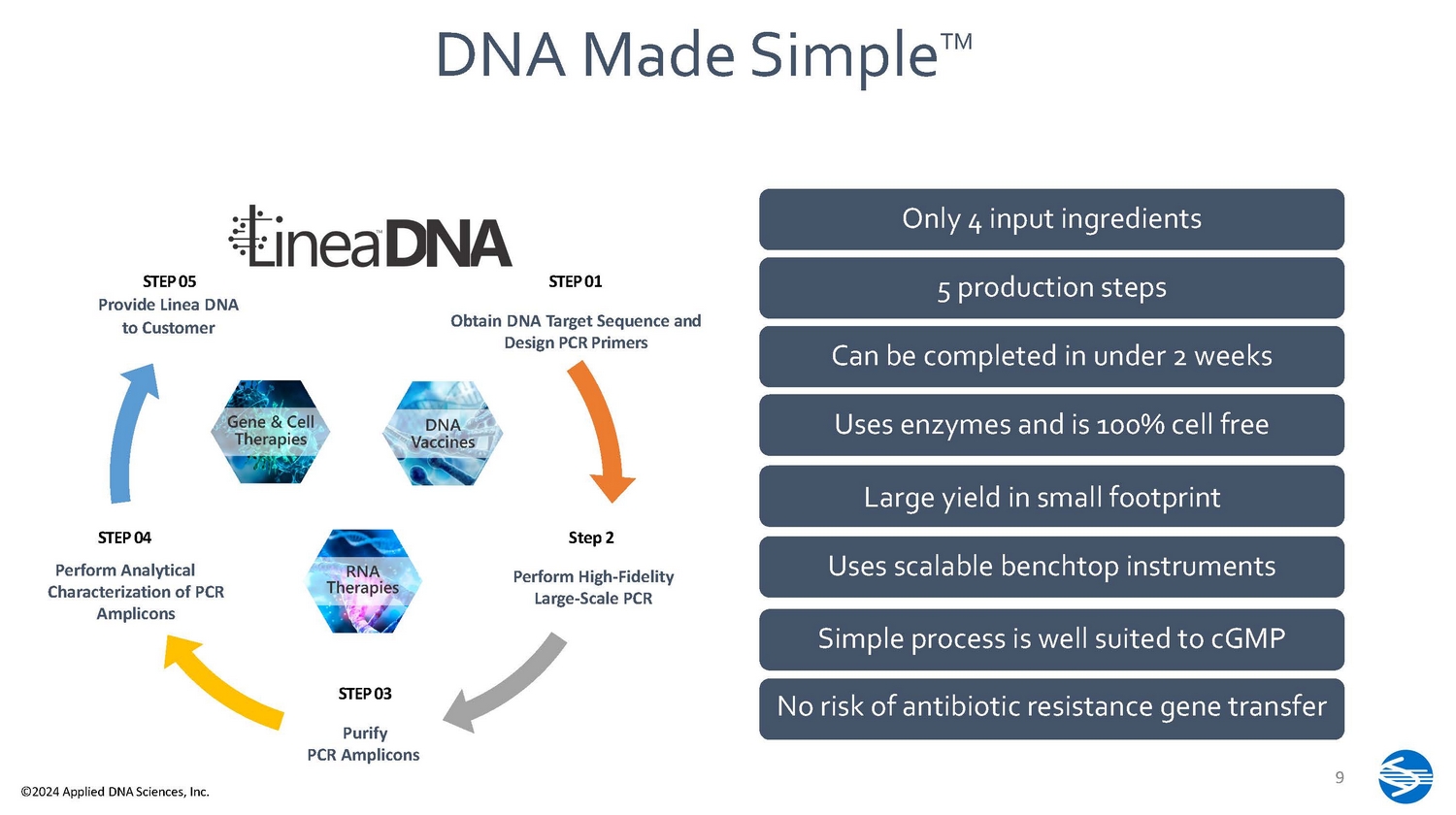

• Large capital expenditure • Regulatory scrutiny • Long lead times • Based on 40 - year - old technology • Increased complexities into mRNA manufacturing S ta rt 8 ©2024 Applied DNA Sciences, Inc. Sterile F ilt r a ti o n/ End Vector Construction Master Cell Bank Host Cell Selection and Research Cell Bank Manufacturing Working Cell bank Alkaline Lysis Ma nu f ac tu r ing Fermentation Cell Harvesting Endotoxin Removal C h r om at og r a p h y Step 1 Filtration C h r om at og r a p h y Step 2 1 2 4 3 7 8 6 9 10 11 5 • Poor batch - to - batch consistency and batch failures Pilot Fermentation 13 • Unwanted DNA sequences including antibody resistance gene 12 • Complex sequences are unstable pDNA Manufacturing Process STEP 01 Obtain DNA Target Sequence and Design PCR Primers STEP 05 Provide Linea DNA to Customer STEP 04 Perform Analytical Characterization of PCR Amplicons Step 2 Perform High - Fidelity Large - Scale PCR STEP 03 Purify PCR Amplicons Only 4 input ingredients 5 production steps Can be completed in under 2 weeks Uses enzymes and is 100% cell free Large yield in small footprint Uses scalable benchtop instruments Simple process is well suited to cGMP DNA M ade S i m pl e TM No risk of antibiotic resistance gene transfer 9 ©2024 Applied DNA Sciences, Inc.

©2024 Applied DNA Sciences, Inc. Our Demonstrated Success Across Genetic Medicine Modalities On co l o g y DN A Va c ci ne s GeneTherapy CAR - T Manufacture 1 Neoantigen DNA Vaccine 2 Protective Prophylactic DNA Vaccine 3 LNP/DNA IM Administration 4 AAV ITR - Transgene Production 4 1 - Kaštánková I, et al . Enzymatically produced piggyBac transposon vectors for efficient non - viral manufacturing of CD19 - specific CAR T cells. Mol Ther Methods Clin Dev. 2021 Aug 26;23:119 - 127. doi: 10.1016/j.omtm.2021.08.006. PMID: 34631931 2 - Conforti, A., Salvatori, E., Lione, L. et al. Linear DNA amplicons as a novel cancer vaccine strategy. J Exp Clin Cancer Res 41, 195 (2022). https://doi.org/10.1186/s13046 - 022 - 02402 - 5 3 - Mathias, M., Diel, D., Hayward, J. et al. A Linear SARS - CoV - 2 DNA Vaccine Candidate Reduces Virus Shedding in Ferrets. bioRxiv 2002.09.29.510112.

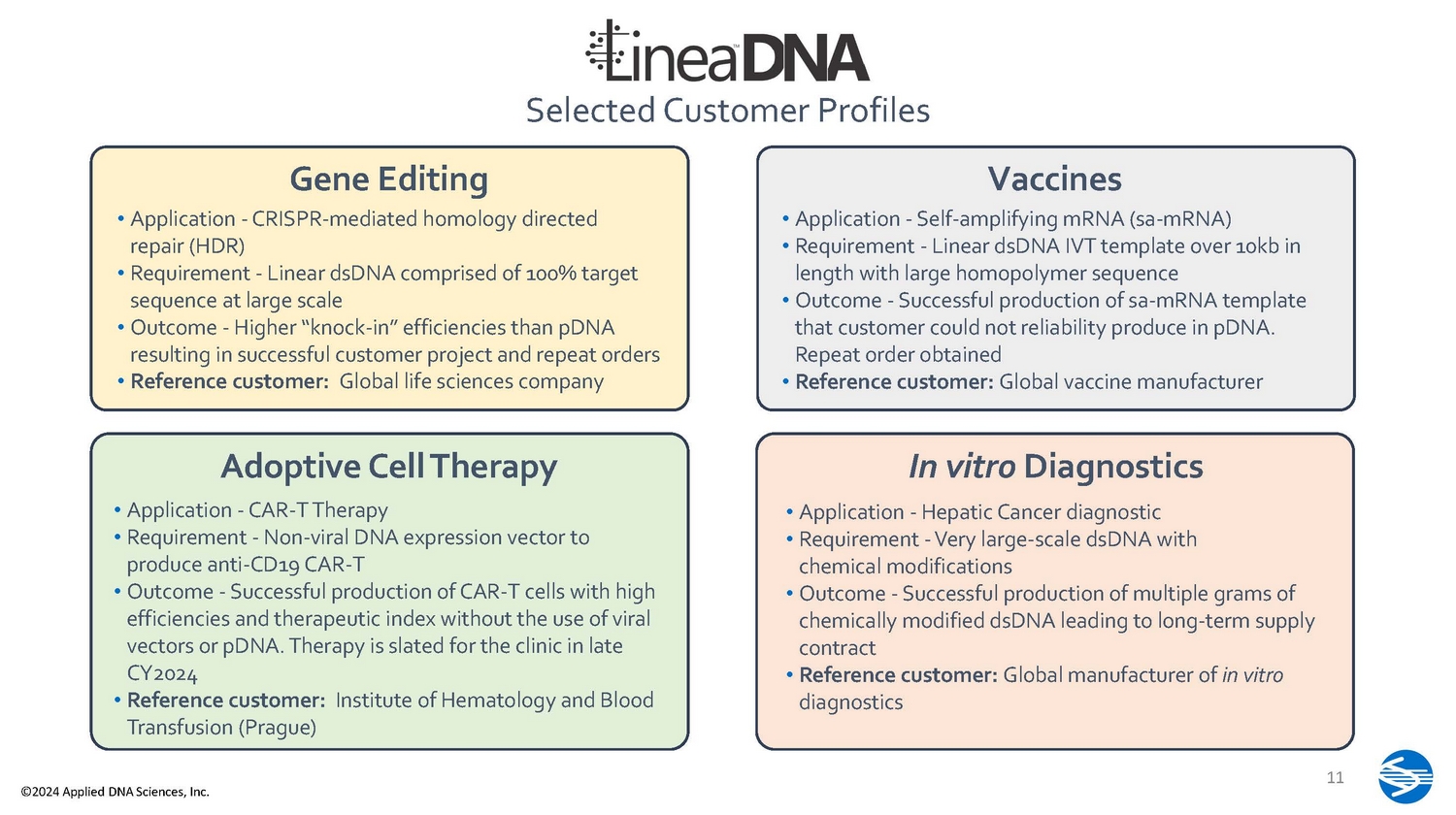

https://doi.org/10.1101/2022.09.29.510112 4 – Internal company data 10 Selected Customer Profiles Vaccines • Application - Self - amplifying mRNA (sa - mRNA) • Requirement - Linear dsDNA IVT template over 10kb in length with large homopolymer sequence • Outcome - Successful production of sa - mRNA template that customer could not reliability produce in pDNA. Repeat order obtained • Reference customer: Global vaccine manufacturer In vitro Diagnostics • Application - Hepatic Cancer diagnostic • Requirement - Very large - scale dsDNA with chemical modifications • Outcome - Successful production of multiple grams of chemically modified dsDNA leading to long - term supply contract • Reference customer: Global manufacturer of in vitro diagnostics Gene Editing • Application - CRISPR - mediated homology directed repair (HDR) • Requirement - Linear dsDNA comprised of 100% target sequence at large scale • Outcome - Higher “knock - in” efficiencies than pDNA resulting in successful customer project and repeat orders • Reference customer: Global life sciences company Adoptive Cell Therapy • Application - CAR - T Therapy • Requirement - Non - viral DNA expression vector to produce anti - CD19 CAR - T • Outcome - Successful production of CAR - T cells with high efficiencies and therapeutic index without the use of viral vectors or pDNA. Therapy is slated for the clinic in late CY2024 • Reference customer: Institute of Hematology and Blood Transfusion (Prague) 11 ©2024 Applied DNA Sciences, Inc.

Better RNA…Faster 12 ©2024 Applied DNA Sciences, Inc.

Long lead times increase mRNA production timeline Struggles with complex DNA sequences such as Poly(A) tails Requires expensive enzymatic linearization and additional filtration steps Problematic inflammatory byproduct of conventional IVT dsRNA removal is essential for safe and effective mRNA products Increased regulatory scrutiny Currently mitigated via expensive and complex purification methods Defined by WHO as a hazardous byproduct that must be removed Increased regulatory scrutiny and QC issue Bacterially derived pDNA is currently the starting material for mRNA One Platform - 2 mRNA Manufacturing Issues Solved 13 ©2024 Applied DNA Sciences, Inc.

Two Next Generation Technologies for Better mRNA • Secured via acquisition of Spindle Biotech Inc. in July 2023 • Proprietary fusion enzyme comprised of a high fidelity RNAP and DNA binding domain • Chemically binds to Linea DNA IVT templates allowing unique IVT conditions that mitigate dsRNA contamination • No impact on RNA fidelity • Scale - up manufacturing underway (Alphazyme/Maravai) • Pending IP in key global markets IVT Templates • Leverages platform advantages for 100% enzymatic production of IVT templates • Potentially reduces time from DNA sequence to mRNA by up to 75% under GMP • Homopolymers are added enzymatically providing homogeneous poly(a) sequence in mRNA • Chemical modification needed to enable Linea RNAP to be easily added Embedded Video 14 ©2024 Applied DNA Sciences, Inc.

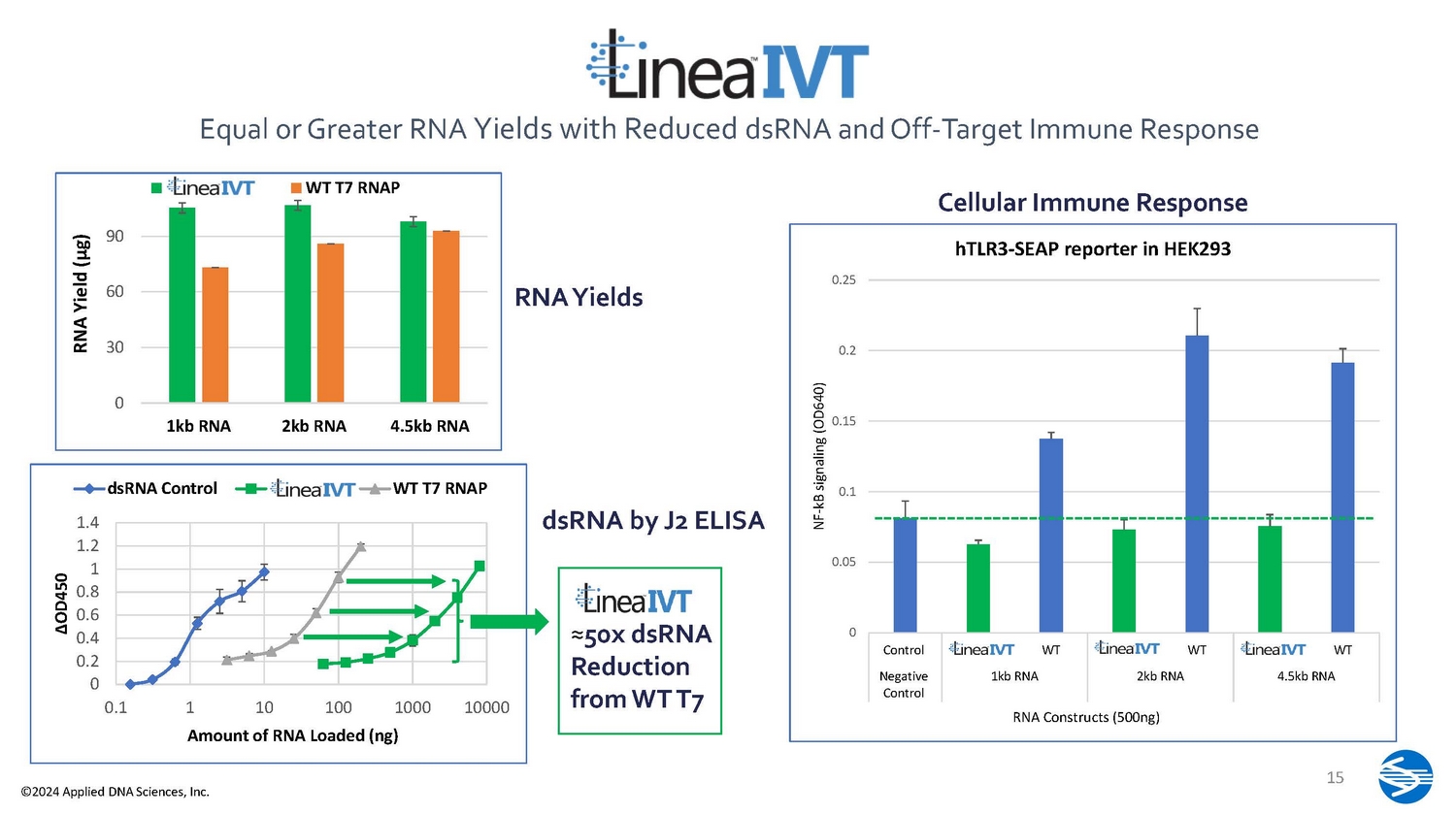

0 30 60 90 1kb RNA 2kb RNA 4.5kb RNA RNA Yield (µg) Linea IVT…. WT T7 RNAP 1.4 1.2 1 0.8 0.6 0.4 0.2 0 0.1 10000 Δ OD450 1 1 0 10 0 1000 Amount of RNA Loaded (ng) dsRNA Control Linea IVT WT T7 RNAP ≈ 50x dsRNA Reduction from WT T7 dsRNA by J2 ELISA RNA Yields Equal or Greater RNA Yields with Reduced dsRNA and Off - Target Immune Response 0 0.05 0.1 0.15 0.2 0.25 Control Linea IVT WT Linea IVT WT Linea IVT WT Ne g a t i v e Control 4.5kb RNA NF - kB signaling (OD640) 1kb RNA 2kb RNA RNA Constructs (500ng) hTLR3 - SEAP reporter in HEK293 Cellular Immune Response 15 ©2024 Applied DNA Sciences, Inc.

• Strain development • Cloning • Master cell banking • Multiple chromatography steps • Host DNA concerns • Requires expensive restriction enzymes • Additional purification steps • Added workflow complexity 6 - 8 Months < 45 days* Conventional Plasmid - based mRNA Production Better mRNA, Faster • Additional purification time and expense • Decreased mRNA yields • Expensive equipment Removes multiple problematic and complex steps necessitated by pDNA Complex and expensive chromatography step potentially removed *Based on internal Company data and modeling 16 ©2024 Applied DNA Sciences, Inc.

• RNAP is one of the most expensive COGs in mRNA manufacturing • Linea IVT templates enable the sale of Linea RNAP • Linea IVT potentially produces ≈3 - 5X the revenue opportunity compared to Linea IVT templates alone* or DNA Drug Substance (DS)* • Minimal additional CapEx (~$10M) for GMP Site 2 buildout* *Based on Company internal modeling using currently projected unit pricing based on current pricing and market analysis. All figures are for illustrative purposes only and do not constitute financial guidance and may be subject to further change without notice. Internal modeling is based on assumptions the Company believes are reasonable but could be mistaken. Potential revenue opportunity may not be realized and is not indicative of profit. Unlocking the Value of PCR - based DNA Manufacturing **Linea IVT revenue is Linea IVT template revenue + Linea RNAP revenue +2% royalty on mRNA DS $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 $40,000,000 $45,000,000 $50,000,000 $55,000,000 $60,000,000 $65,000,000 10 26 50 78 Potential Revenue * 200mg Batches per Year Potential Revenue Opportunity by Site Utilization - GMP Site 1 and Site 2* LineaIVT Revenue with Royalty** LineaIVT Revenue without Royalty GMP lineaDNA Template Revenue GMP DNA Drug Substance Revenue Site 1 Max Capacity Anticipated Completion Q3 FY24 Planned Site 2 Max Capacity Anticipated Completion 2H CY25*** 17 ***Contingent on future funding ©2024 Applied DNA Sciences, Inc.

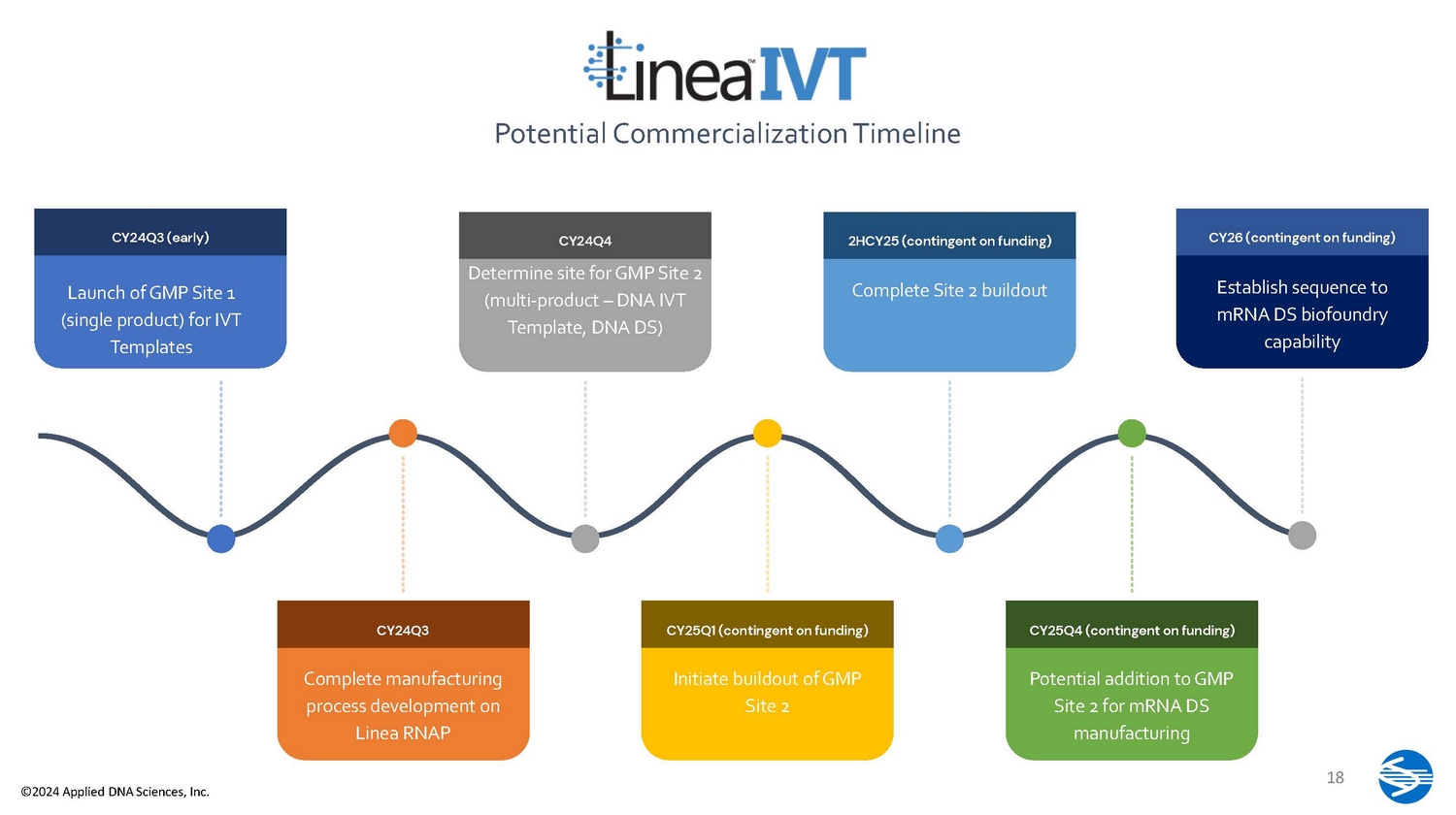

CY24Q3 (early) Launch of GMP Site 1 (single product) for IVT Templates CY24Q3 Complete manufacturing process development on Linea RNAP CY24Q4 Determine site for GMP Site 2 (multi - product – DNA IVT Template, DNA DS) CY25Q1 (contingent on funding) Initiate buildout of GMP Site 2 2HCY25 (contingent on funding) Complete Site 2 buildout CY25Q4 (contingent on funding) Potential addition to GMP Site 2 for mRNA DS manufacturing Potential Commercialization Timeline CY26 (contingent on funding) 18 ©2024 Applied DNA Sciences, Inc. Establish sequence to mRNA DS biofoundry capability

Thank you! Nasdaq: APDN