UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) April 24, 2024

NRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38302 | 82-2844431 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

1201 Orange Street, Suite 600 Wilmington, Delaware |

19801 | |

| (Address of principal executive offices) | (Zip Code) |

(484) 254-6134

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered |

||

| Common Stock, par value $0.001 per share | NRXP | The Nasdaq Stock Market LLC | ||

| Warrants to purchase one share of Common Stock | NRXPW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.04 | Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

On April 24, 2024, NRx Pharmaceuticals, Inc. (the “Company”) received written notice from counsel for Streeterville Capital, LLC (“Streeterville”) that an alleged event of default occurred with respect to that certain Convertible Promissory Note, dated November 4, 2022, as amended on March 30, 2023, July 10, 2023, February 9, 2024 (as amended, the “Note”), issued by the Company in favor of Streeterville, pursuant to that certain Securities Purchase Agreement dated November 4, 2022 by and between the Company and Streeterville (the “SPA”). The Notice alleges that, among other things, (i) the announcement of the plan to partially spin-off of the Company’s wholly-owned subsidiary, Hope Therapeutics, Inc. (the “Spin-Off”), constituted a “Fundamental Transaction” (as defined in the Note”) for which the Company failed to obtain Streeterville’s prior written consent before undertaking such transaction; and (ii) the Company failed to pay the Minimum Payment, as defined under Section 4 of the Note, by April 8, 2024, following a Redemption Notice issued on April 3, 2024 by Streeterville to the Company, each of which resulted in the failure to cure a Trigger Event and subsequent Event of Default of the Note, and as a result, Streeterville was therefore accelerating all of the outstanding amounts due thereunder. The description of the Notice set forth above does not purport to be complete and is qualified by reference to the Notice, a copy of which is set forth herein as Exhibit 99.1. For more information on the Note and the SPA, see the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on November 9, 2022.

The Company has also learned that Streeterville filed a complaint (the “Complaint”) naming the Company as a defendant in the Third Judicial District Court of Salt Lake County, Utah. The Complaint is seeking, among other things: (i) declaratory relief for an order enjoining the Company from undertaking any Fundamental Transaction, including the Spin-Off, or otherwise issuing common stock or other equity securities (such as the shares of Hope Therapeutics pursuant to the announced Spin-Off); and (ii) repayment of the Note and other unspecified amounts of damages, costs and fees, but no less than $6,537,027, or the amounts currently outstanding under the Note.

The Company disagrees with Streeterville that the Spin-Off constitutes a Fundamental Transaction, and does not believe the claims to valid. As such, the Company intends to vigorously defend against any legal action initiated against it by Streeterville. The Streeterville agreements, as disclosed in the Company’s SEC filings define a “Fundamental Transaction” as one that seeks to “sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of its respective properties or assets to any other person…” In the first place, NRx has not effectuated the proposed HOPE share dividend, so no transaction has occurred. Secondly, HOPE Therapeutics, hardly constitutes “all or substantially all” of NRx’s assets.

Those who wish to understand the issues that lie behind Streeterville’s precipitous action, should refer to the current charges brought against Streeterville by the US Securities and Exchange Commission. In those charges, the SEC refers to Defendant John Fife (the owner of Chicago Venture Partners/Streeterville) as a “recidivist violator of federal securities laws. The SEC charges Fife in various ways with manipulating the stock of microcap companies (such as NRx) for profit and is seeking to restrain such action. In 2007, the SEC charged Mr. Fife and his prior entity Clarion Capital with various violations of securities laws and entered into an agreement with him not to violate securities laws in the future. Fife subsequently sued FINRA to overturn FINRA’s decision to bar and censure him. He is currently appealing that case to the US Supreme Court.

The Company is certain that it did not enter into a “Fundamental Transaction” as alleged by Mr. Fife and provided Mr. Fife with ample evidence of that prior to his declaration of a trigger event. The Company believe’s that Mr. Fife’s declaration of a trigger event is wholly unwarranted and serves as a pretext to attempt to increase the indebtedness of a Company that was servicing its debt to Mr. Fife on a timely and monthly basis. Hence, the Company has retained counsel well-versed in securities litigation with prior experience in the SEC Office of Enforcement to contest Fife’s allegation and to seek sanctions for Fife’s misleading filing. The company is also evaluating a variety of counterclaims, and will assert those counterclaims in the proper venue.

| Item 8.01 | Other Events. |

On April 30, 2024, the Company issued a press release announcing the findings in Phase 2b/3 Clinical Trial of NRX-101 vs. Lurasidone for Treatment of Suicidal Bipolar Depression. A copy of the press release is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Notice by Streeterville Capital, LLC | |

| 99.2 | Press Release dated April 30, 2024 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NRX PHARMACEUTICALS, INC. | ||

| Date: April 30, 2024 | By: | /s/ Stephen Willard |

| Name: | Stephen Willard | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

HANSEN BLACK ANDERSON ASHCRAFT PLLC

April 23, 2024

Via Electronic Mail

Douglas C. Boggs

DLA Piper LLP (US)

500 Eighth Street, NW

Washington, DC 20004

Email:

With a copy to:

NRX Pharmaceuticals, Inc.

Attn: Jonathan C. Javitt and Pat Flynn

1201 North Market Street, Suite 111

Wilmington, Delaware 19801

Email:

Re: Notice of Acceleration

Dear Mr. Boggs:

This law firm represents and writes on behalf of Streeterville Capital, LLC, its successors and/or assigns (the "Lender"). I write in connection with that certain Convertible Promissory Note (the "Note") dated November 4, 2022 issued by NRX Pharmaceuticals, Inc., a Delaware corporation ("Borrower"), in favor of Lender, in the original principal amount of $11,020,000.00, as amended by that certain Amendment to Convertible Promissory Note dated March 30, 2023 ("Amendment #1"), that certain Amendment #2 to Convertible Promissory Note dated July 10, 2023 ("Amendment #2"), and that certain Amendment #3 to Convertible Promissory Note dated February 9, 2024 ("Amendment #3," and together with Amendment #1 and Amendment #2, the "Amendments"). The Note was issued pursuant to that certain Securities Purchase Agreement dated November 4, 2022 by and between Borrower and Lender (the "Purchase Agreement"). Borrower and Lender also entered into that certain Forbearance and Standstill Agreement dated March 15, 2024 (the "Forbearance Agreement"). Capitalized terms used in this letter without definition shall have the meanings given to them in the Note, Amendments, Purchase Agreement and Forbearance Agreement.

www.hbaaLAW.com

| MAIN 801.922.5000 ½ FAX 801.922.5019 | 3051 West Maple Loop Drive, Suite 325, Lehi, Utah 84043 |

NRX Pharmaceuticals, Inc.

April 23, 2024

Event of Default

Pursuant to Section 4.1 of the Note, a Trigger Event occurs if Borrower fails to pay any principal, interest, fees, charges, or any other amount when due and payable in accordance with the terms of the Note, as amended by the Amendments and Forbearance Agreement. Pursuant to Amendment #3 and the Forbearance Agreement, Borrower is liable for the payment of all Minimum Payments required under Section 4 of Amendment #3, and Borrower shall make such payments to Lender in cash only on or before the third (3rd) Trading Day immediately following the applicable Redemption Date. Lender submitted a Redemption Notice on April 3, 2024. Borrower was obligated to satisfy such Redemption Notice by April 8, 2024. Because Borrower failed to satisfy the April 3 Redemption Notice when due, a Trigger Event occurred pursuant to Section 4.1 of the Note, as amended, as of April 8, 2024.

As of the date hereof, Borrower has failed to cure the Trigger Event by paying the Minimum Payment pursuant to Lender's April 3, 2024 Redemption Notice. As a result thereof, the Trigger Event has automatically become an Event of Default. Pursuant to Section 4.4 of the Note, we hereby notify you that Lender has accelerated the Note, with the Outstanding Balance becoming immediately due and payable in cash at the Mandatory Default Amount. We hereby demand that Borrower immediately pay the Outstanding Balance in cash at the Mandatory Default Amount. Please contact Lender representative Mr. Chris Stalcup at cstalcup@chicagoventure.com to make payment arrangements.

This letter is sent without waiver of or prejudice to any rights, claims, alternative arguments or positions, causes of action, defenses or remedies of Lender or any other party, whether arising under agreement or applicable law or otherwise, all of which are expressly reserved. Notwithstanding anything to the contrary herein, Lender reserves all rights and remedies available to it under the Note, Amendments, Forbearance Agreement, and other Transaction Documents with respect to any Trigger Event or Event of Default thereunder.

If you have any questions regarding the foregoing, please contact the undersigned at jhansen@hbaa.law or at 801-922-5001.

[remainder of page intentionally left blank]

NRX Pharmaceuticals, Inc.

April 23, 2024

| Sincerely, | |

| /s/ Jonathan K. Hansen, Esq. | |

| Jonathan K. Hansen, Esq. |

JKH:ac

| cc: |

John M. Fife Chris Stalcup |

Dallas Rosevear, Esq.

Stephen Willard

Exhibit 99.2

NRx Pharmaceuticals (Nasdaq:NRXP) Announces Promising Findings in Phase 2b/3 Clinical Trial of NRX-101 vs. Lurasidone for Treatment of Suicidal Bipolar Depression

| · | NRX-101 is first oral antidepressant to show 33% advantage in sustained remission in suicidality (not statistically significant at this sample size) and 75% advantage in relief from Akathisia relative to lurasidone - never previously shown with an oral antidepressant. Suicidality signal met the study’s promising zone criteria and the akathisia signal approached statistical significance (P=0.076) |

| · | Both NRX-101 and lurasidone, an accepted standard of care in Bipolar Depression, demonstrated approximately 50% reduction in symptoms of depression |

| · | These data are comparable to previous statistically-significant finding of reduced suicidality and in the published STABIL-B trial and support an approval pathway via a 300-person registrational trial with sustained remission in suicidality as the primary endpoint |

| · | Company believes that an oral antidepressant that demonstrates reduction in suicidality has potential to become standard of care for treatment of bipolar depression. |

| · | Data from this study expand the potential utility of NRx-101 to treat both patients with suicidal bipolar depression (who will require prior use of ketamine) and those without subacute suicidality (nearly 7 million patients in the US). |

RADNOR, Pa., April 30, 2024 /PRNewswire/ – NRx Pharmaceuticals, Inc. (Nasdaq: NRXP) (“NRx Pharmaceuticals”, the “Company”), a clinical stage pharmaceutical company today that its Breakthrough Therapy designated investigational drug NRX-101 vs lurasidone demonstrated a promising, though not yet statistically significant 33% reduction in suicidality together with a 70% reduction (P=.076) reduction in symptoms of akathisia – a side effect of antidepressants that is closely linked to suicide and considered a medical emergency. Because of the high-risk nature of these patients, a placebo group could not be employed, and NRX-101, a fixed dose combination of D-cycloserine (DCS) and lurasidone, was compared to lurasidone alone (the standard of care). In the Company’s previously published STABIL-B trial (STABIL-B ), NRX-101 was demonstrated to be superior to lurasidone in reducing both depression and suicidality after ketamine while showing a trend towards reducing akathisia (a side effect involving restlessness and agitation that is considered a warning sign of impending suicide). In this trial, without prior use of ketamine, NRX-101 and lurasidone were comparable in their effect on depression. The trial was a randomized, prospective, double-blind study conducted at multiple sites in the Unites States whose protocol and statistical analysis plan may be viewed on www.clinicaltrials.gov (NCT03395392).

“We are gratified by these results, which extend the findings of the STABIL-B trial in suggesting that NRX-101 has the potential to be the first oral antidepressant to decrease potential for suicide, whereas all currently approved oral antidepressants are known to increase the risk of suicide,” said Prof. Jonathan Javitt, MD, MPH, the Company’s Chairman and Chief Scientist. “Should these findings be confirmed in a registrational trial of 300 patients, NRX-101 has the potential to represent a paradigm-changing blockbuster drug. The finding of a dramatic difference in akathisia was also seen in the STABIL-B trial and provides important mechanistic support for the difference seen on the Columbia Suicide Severity Rating Scale. Many of the patients who tragically die from suicide in bipolar depression are taking traditional antidepressants at the time of their death, a tragedy we have seen within the families of our investors and board members, as well as the many patients we have known. If today’s findings are replicated in a registration-sized trial, we will change the world for patients who currently have a 50% lifetime risk of suicide attempt, a 20% lifetime risk of death by suicide, and whose only approved treatment option today is electroshock therapy.”

“These findings are consistent with our original Phase 2 objectives and promising zone methodology in terms of a demonstrable advantage of NRX-101 compared to the standard of care in treating patients with bipolar depression who are known to be at high risk of suicide. We originally proposed to test suicidality, rather than depression as the primary endpoint for this trial and took the advice of senior FDA leadership that demonstrating a difference in suicidality might be too challenging. Today’s findings demonstrate that differences in suicidality and akathisia can be demonstrated compared to best available antidepressant therapy in a properly sized registration trial and that superiority over placebo on the depression scale may readily be demonstrated in a less acute patient population where it would be safe to do so,” said Dr. Philip Lavin, the study’s Lead Methodologist. Dr. Lavin is one of the world’s most widely published statisticians who has led the approval/clearance of more than 80 drugs, devices, and biologics.

In the current study, without prior use of ketamine, NRX-101 and lurasidone exhibited comparable antidepressant effects, each reducing depression (the primary endpoint) on the Montgomery Asberg Depression Rating Scale (MADRS) by about 50% from baseline. Lurasidone is known to reduce symptoms of depression by approximately 4 points in multiple registration trials compared to placebo.

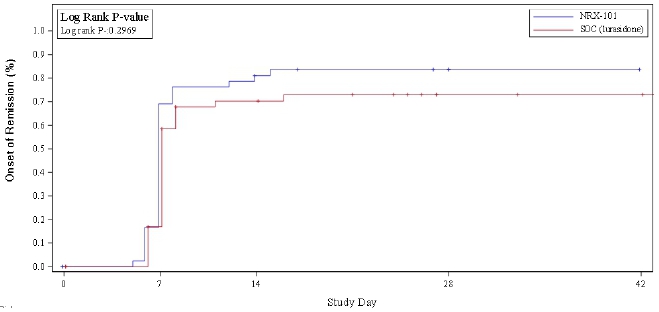

Analysis of suicidality using the Columbia Suicide Severity Rating Scale (C-SSRS) demonstrated a sustained 33% advantage in remission from suicidality favoring NRX-101 (see figure). This difference was not statistically significant at the phase 2 sample size but met the study’s original promising zone criteria and, if sustained in a registration trial of 300 or more patients, would be powered to yield a statistically significant result. The reduction in suicidality is comparable to that demonstrated after ketamine, both in the Company’s STABIL-B trial and in an independently conducted trial comparing DCS to placebo after ketamine (Chen, et. al.). A meaningful remission in suicidality has not been demonstrated with any prior oral antidepressant drug – indeed, antidepressant drugs carry a Black Box warning of increased suicide risk.

Reduction in akathisia was first identified in the laboratory as a distinguishing feature of DCS and is the basis of the approved claims in the Company’s Composition of Matter patents. Akathisia is often characterized as a state of agitation and motor restlessness that is associated with particularly impulsive and tragically effective attempts at suicide, such as hanging, shooting, jumping from buildings and in front of vehicles and trains. In this trial, a 75% relative difference was seen on the Barnes Akathisia Rating Scale (BARS), with two-sided P=0.076, which would be expected to achieve significance in a properly powered registration-sized trial. While reduction in akathisia is not proposed as a primary labeled indication, continued finding of a statistically significant reduction in this side effect would be highly supportive of a demonstrated primary endpoint of reduced suicidality and would provide clinical corroboration.

Based on these findings and widespread adoption of ketamine as initial treatment for suicidal depression, the Company believes that NRX-101 may become the drug of choice for potentiating the effect of ketamine in patients with acute and subacute suicidality. The FDA recently affirmed to the Company that the Special Protocol Agreement for this indication remains in place, subject to the Company filing a New Drug Approval for ketamine, which is expected by July 2024. Moreover the Company aims to explore the role of NRX-101 as primary treatment for the much larger population (approximately 7 million in the US) of patients with bipolar depression who do not have active suicidality and, therefore, do not require prior treatment with intravenous ketamine.

About NRx Pharmaceuticals

NRx Pharmaceuticals is a clinical-stage biopharmaceutical company developing therapeutics based on its NMDA platform for the treatment of central nervous system disorders, specifically suicidal bipolar depression, chronic pain and PTSD. The Company is developing NRX-101, an FDA-designated investigational Breakthrough Therapy for suicidal treatment-resistant bipolar depression and chronic pain. NRx has partnered with Alvogen and Lotus around the development and marketing of NRX-101 for the treatment of suicidal bipolar depression. NRX-101 additionally has potential to act as a non-opioid treatment for chronic pain, as well as a treatment for complicated UTI.

NRx has recently announced plans to submit a New Drug Application for HTX-100 (IV ketamine), through Hope Therapeutics, in the treatment of suicidal depression, based on results of well-controlled clinical trials conducted under the auspices of the US National Institutes of Health and newly obtained data from French health authorities, licensed under a data sharing agreement. NRx was awarded Fast Track Designation for development of ketamine (NRX-100) by the US FDA as part of a protocol to treat patients with acute suicidality.

About HOPE Therapeutics, Inc.

HOPE Therapeutics, Inc. (www.hopetherapeutics.com) is a Specialty Pharmaceutical Company, wholly-owned by NRX Pharmaceuticals focused on development and marketing of an FDA-approved form of intravenous ketamine for the treatment of acute suicidality and depression together with a digital therapeutic-enabled platform designed to augment and preserve the clinical benefit of NMDA-targeted drug therapy.

Notice Regarding Forward-Looking Statements

The information contained herein includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. These statements include, among others, statements regarding the proposed public offering and the timing and the use of the proceeds from the offering. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as "may," "will," "should," "would," "expect," "plan," "believe," "intend," "look forward," and other similar expressions among others. These statements relate to future events or to the Company’s future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to the Company’s operations, results of operations, growth strategy and liquidity. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Investors and security holders are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. Except as may be required by applicable law, The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, whether as a result of new information, future events or otherwise.

For further information:

CORPORATE CONTACTS:

Jeremy Feffer, LifeSci Advisors, Inc.

jfeffer@lifesciadvisors.com

Matthew Duffy

Chief Business Officer, NRx Pharmaceuticals,

Co-CEO, HOPE Therapeutics, Inc.

mduffy@nrxpharma.com