UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 30, 2024

DAKOTA

GOLD CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 001-41349 | 85-3475290 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

106 Glendale Drive, Suite A, Lead, South Dakota, United States 57754 (Address of principal executive offices) (Zip Code) |

||

|

(605) 906-8363 (Registrant's telephone number, |

||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | DC | NYSE American LLC | ||

| Warrants, each warrant exercisable for one share of the Registrant’s common stock at an exercise price of $2.08 | DC.WS | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

On April 30, 2024, Dakota Gold Corp. (the “Company”) issued a press release announcing the results and publication of the S-K 1300 Initial Assessment and Technical Report Summary for the Company’s Richmond Hill Gold Project (the “Initial Assessment”). The Initial Assessment, dated April 30, 2024, was prepared in accordance with Item 1300 of Regulation S-K. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01 and in the press release is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

A copy of the Initial Assessment is attached as Exhibit 96.1 to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) Exhibits |

| Exhibit No. | Description | |

| 23.1 | Consent of Qualified Person - AKF Mining Services Inc. | |

| 23.2 | Consent of Qualified Person - K-Met Consultants Inc. | |

| 23.3 | Consent of Qualified Person - Global Mineral Resource Services | |

| 23.4 | Consent of Qualified Person - Acuity Geoscience Ltd. | |

| 23.5 | Consent of Qualified Person - RGW Geosciences | |

| 96.1 | S-K 1300 Initial Assessment and Technical Report Summary for Richmond Hill Gold Project | |

| 99.1 | Press Release dated April 30, 2024 | |

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DAKOTA GOLD CORP. | |

| /s/ Shawn Campbell | |

| Name: Shawn Campbell | |

| Title: Chief Financial Officer |

Date: April 30, 2024

Exhibit 23.1

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current Report on Form 8-K dated April 30, 2024 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”), the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated April 30, 2024 as an exhibit and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883 and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned, that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible for authoring, and this consent pertains to, sections 1.1, 1.2, 1.14, 1.15, 1.16, 3, 11.1, 12, 13, 15, 16, 17, 18, 19, 20, 21, 24 & 25.6 of the TRS.

Dated April 30, 2024

| /s/ AKF Mining Services Inc. | |

| AKF Mining Services Inc. |

Exhibit 23.2

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current Report on Form 8-K dated April 30, 2024 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”), the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated April 30, 2024 as an exhibit and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883 and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned, that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible for authoring, and this consent pertains to, sections 1.10, 10, 22.4 & 23.3 of the TRS.

Dated April 30, 2024

| /s/ K-Met Consultants Inc. | |

| K-Met Consultants Inc. |

Exhibit 23.3

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current Report on Form 8-K dated April 30, 2024 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”), the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated April 30, 2024 as an exhibit and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883 and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned, that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible for authoring, and this consent pertains to, sections 1.4, 11 (except 11.1), 22.3 & 23.2 of the TRS.

Dated April 30, 2024

| /s/ Global Mineral Resource Services | |

| Global Mineral Resource Services |

Exhibit 23.4

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current Report on Form 8-K dated April 30, 2024 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”), the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated April 30, 2024 as an exhibit and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883 and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned, that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible for authoring, and this consent pertains to, sections 1.10, 1.11, 7.5, 8, 9, 22.2, 23.1 of the TRS.

Dated April 30, 2024

| /s/ Acuity Geoscience Ltd. | |

| Acuity Geoscience Ltd. |

Exhibit 23.5

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current Report on Form 8-K dated April 30, 2024 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”), the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated April 30, 2024 as an exhibit and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883 and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned, that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible for authoring, and this consent pertains to, sections 1.1, 1.2, 1.4, 1.5, 1.6, 2, 4 to 6, 7.1, 7.2, 7.3, 7.4, 7.6, 21, 22.1, 22.2 & 25.1 to 25.5 of the TRS.

Dated April 30, 2024

| /s/ RGW Geoscience | |

| RGW Geoscience |

Exhibit 96.1

S-K

1300 Initial Assessment and

Technical Report Summary

Richmond Hill Gold Project, South Dakota, U.S.A.

| Prepared for: | Report Date: April 30, 2024 |

Dakota Gold Corp.

106 Glendale Drive, Suite A

Lead, South Dakota, 57754, U.S.A.

Prepared by:

Antonio Loschiavo, P.Eng. (B.C.), AKF

Mining Services Inc.

Kelly McLeod, P.Eng. (B.C.), K-Met Consultants Inc.

Gregory Z. Mosher, P.Geo. (B.C.), Global Mineral Resource Services

Dale A. Sketchley, P.Geo. (B.C.), Acuity Geoscience Ltd.

Robert G. Wilson, P.Geo. (B.C.), RGW Geosciences

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Contents

| 1 | EXECUTIVE SUMMARY | 1-1 | ||

| 1.1 | Introduction | 1-1 | ||

| 1.2 | Project Setting | 1-1 | ||

| 1.3 | Mineral Tenure, Surface Rights, Royalties, and Agreements | 1-1 | ||

| 1.4 | Geology and Mineralization | 1-2 | ||

| 1.5 | History | 1-3 | ||

| 1.6 | Exploration | 1-3 | ||

| 1.7 | Drilling | 1-4 | ||

| 1.8 | Sample Preparation, Analyses, and Security | 1-4 | ||

| 1.9 | Data Verification | 1-5 | ||

| 1.10 | Metallurgy | 1-5 | ||

| 1.11 | Mineral Resources Estimate | 1-6 | ||

| 1.12 | Environmental and Permitting | 1-6 | ||

| 1.13 | Conclusions and Recommendations | 1-7 | ||

| 2 | INTRODUCTION | 2-1 | ||

| 2.1 | Registrant | 2-1 | ||

| 2.2 | Terms of Reference | 2-1 | ||

| 2.3 | Qualified Persons | 2-3 | ||

| 2.4 | Personal Inspections | 2-3 | ||

| 2.5 | Date | 2-4 | ||

| 2.6 | Sources of Information | 2-4 | ||

| 2.7 | Previous Technical Report Summaries | 2-4 | ||

| 2.8 | Units of Measure and Metric Equivalents | 2-4 | ||

| 3 | PROPERTY DESCRIPTION | 3-1 | ||

| 3.1 | Project Location | 3-1 | ||

| 3.2 | Ownership | 3-1 | ||

| 3.3 | Mineral Tenure Holdings | 3-1 | ||

| 3.4 | Richmond Hill Option Agreement | 3-10 | ||

| 3.5 | Surface Rights | 3-11 | ||

| 3.6 | Water Rights | 3-11 | ||

| 3.7 | Royalties | 3-11 | ||

| 3.8 | Permitting | 3-21 | ||

| 3.8.1 | Existing Permitting | 3-21 | ||

| 3.8.2 | Future Permitting | 3-22 | ||

| 3.9 | Potentially Significant Encumbrances | 3-25 | ||

| 3.10 | Violations and Fines | 3-25 | ||

| 3.11 | Significant Factors and Risks That May Affect Access, Title or Work Programs | 3-25 | ||

| 4 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 4-1 | ||

| 4.1 | Access | 4-1 | ||

| 4.2 | Climate | 4-2 | ||

| 4.3 | Local Resources and Infrastructure | 4-2 | ||

| 4.4 | Topography, Elevation, and Vegetation | 4-2 | ||

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 5 | HISTORY | 5-1 | ||

| 5.1 | Explorations | 5-1 | ||

| 5.2 | Mining | 5-4 | ||

| 6 | GEOLOGIC SETTING, DEPOSIT TYPE, AND MINERALIZATION | 6-1 | ||

| 6.1 | Local Geology | 6-1 | ||

| 6.2 | Regional Geology | 6-7 | ||

| 6.2.1 | Landforms and Structures | 6-12 | ||

| 6.2.2 | Northern Black Hills Lithology | 6-12 | ||

| 6.3 | Deposit Type | 6-15 | ||

| 6.4 | Mineralization | 6-15 | ||

| 7 | EXPLORATION | 7-1 | ||

| 7.1 | Airborne Geophysics | 7-1 | ||

| 7.2 | Gravity Compilation and Survey | 7-2 | ||

| 7.3 | Induced Polarization Survey | 7-3 | ||

| 7.4 | Geological Mapping | 7-5 | ||

| 7.5 | Drilling | 7-7 | ||

| 7.5.1 | Summary | 7-7 | ||

| 7.5.2 | Freeport (1981–1983) | 7-7 | ||

| 7.5.3 | St. Joe and Bond Gold (1984–1993) | 7-7 | ||

| 7.5.4 | Coeur (2019–2020) | 7-9 | ||

| 7.5.5 | Dakota Gold (2022–2023) | 7-9 | ||

| 7.5.6 | Opinion | 7-12 | ||

| 7.6 | Hydrogeology and Geotechnical | 7-12 | ||

| 8 | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 8-1 | ||

| 8.1 | Drilling Programs | 8-1 | ||

| 8.2 | Procedures for Historical Drilling Programs from 1981 to 1993 | 8-1 | ||

| 8.2.1 | Freeport (1981–1983) | 8-1 | ||

| 8.2.2 | St. Joe and Bond Gold (1984–1993) | 8-2 | ||

| 8.3 | Procedures for Drilling Programs from 2019 to 2020 | 8-4 | ||

| 8.4 | Procedures for Drilling Programs from 2022 to 2023 | 8-7 | ||

| 8.5 | Opinion | 8-13 | ||

| 9 | DATA VERIFICATION | 9-1 | ||

| 9.1 | Site Visit | 9-1 | ||

| 9.2 | Data Management | 9-1 | ||

| 9.2.1 | Data Sources | 9-1 | ||

| 9.2.2 | Data Verification | 9-2 | ||

| 9.3 | Opinion | 9-4 | ||

| 10 | MINERAL PROCESSING AND METALLURGICAL TESTING | 10-1 | ||

| 10.1 | Historical Metallurgical Reports | 10-1 | ||

| 10.2 | Metallurgical Report—BL1244 | 10-2 | ||

| 10.2.1 | Sample Selection | 10-2 | ||

| 10.2.2 | Head Assays | 10-2 | ||

| 10.2.3 | Mineralogy | 10-3 | ||

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

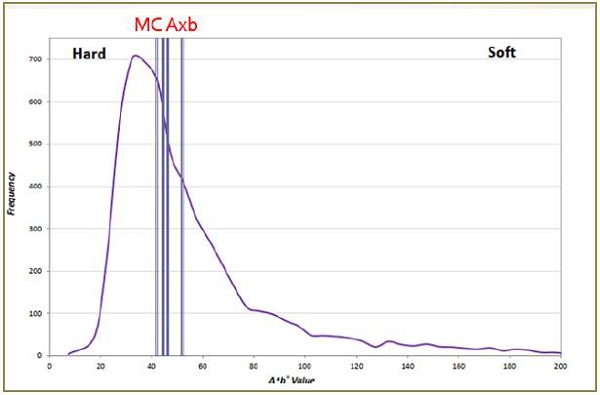

| 10.2.4 | Comminution | 10-4 | ||

| 10.2.5 | Gravity-Recoverable Gold | 10-5 | ||

| 10.2.6 | Flotation Leach Results | 10-5 | ||

| 10.2.7 | Whole-Ore-Leach—Primary Grind Evaluation | 10-6 | ||

| 10.2.8 | Diagnostic Leach | 10-7 | ||

| 10.2.9 | Flotation Leach Flowsheet | 10-8 | ||

| 10.3 | Metallurgical Report—BL1346 | 10-10 | ||

| 10.3.1 | Sample Selection | 10-11 | ||

| 10.3.2 | Mineralogy | 10-11 | ||

| 10.3.3 | Comminution | 10-14 | ||

| 10.3.4 | Whole-Ore-Leach Results | 10-15 | ||

| 10.3.5 | Three-Stage Diagnostic Leach | 10-18 | ||

| 10.3.6 | Preliminary Whole-Ore-Leach Optimization | 10-18 | ||

| 10.3.7 | Flotation Grind Series | 10-18 | ||

| 10.3.8 | Preliminary Flotation Optimization | 10-19 | ||

| 10.3.9 | Mixed and Sulfide Master Composite Flotation | 10-20 | ||

| 10.3.10 | Flotation Leach | 10-21 | ||

| 10.3.11 | Cyanide Destruction | 10-23 | ||

| 10.4 | Summary and Recommendations | 10-24 | ||

| 11 | MINERAL RESOURCE ESTIMATES | 11-1 | ||

| 11.1 | Reasonable Prospects | 11-2 | ||

| 11.2 | Geological Interpretation | 11-2 | ||

| 11.3 | Exploratory Data Analysis | 11-6 | ||

| 11.4 | Assays | 11-7 | ||

| 11.5 | Composites | 11-9 | ||

| 11.6 | Capping | 11-10 | ||

| 11.7 | Bulk Density | 11-13 | ||

| 11.8 | Analysis of Spatial Continuity | 11-14 | ||

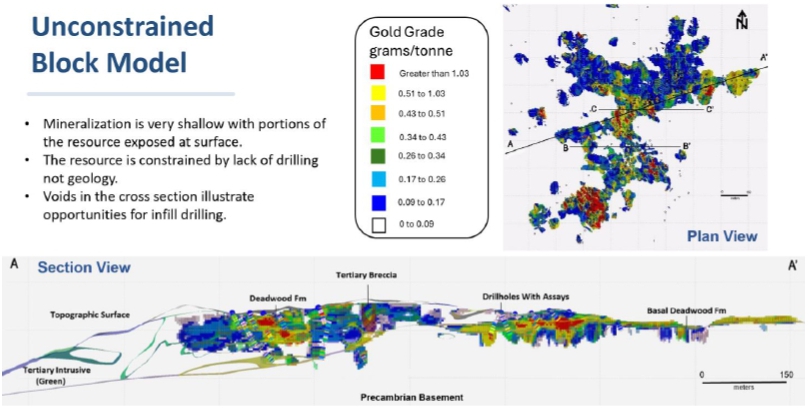

| 11.9 | Block Model | 11-14 | ||

| 11.10 | Interpolation Plan | 11-15 | ||

| 11.11 | Mineral Resource Classification | 11-17 | ||

| 11.12 | Reasonable Prospects | 11-18 | ||

| 11.13 | Mineral Resource Tabulation | 11-20 | ||

| 11.14 | Block Model Validation | 11-22 | ||

| 11.15 | Qualified Person’s Opinion | 11-24 | ||

| 12 | MINERAL RESERVE ESTIMATES | 12-1 | ||

| 13 | MINING METHODS | 13-1 | ||

| 14 | PROCESSING AND RECOVERY METHODS | 14-1 | ||

| 15 | INFRASTRUCTURE | 15-1 | ||

| 16 | MARKET STUDIES AND CONTRACTS | 16-1 | ||

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 17 | ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 17-1 | |

| 17.1 | Results of Environmental Studies | 17-1 | |

| 17.2 | Requirements and Plans for Waste and Tailings Disposal, Site Monitoring, and Water Management During Operations and After Mine Closure | 17-1 | |

| 17.3 | Project Permitting Requirements, Permit Application Status, and Requirements to Post Performance or Reclamation Bonds | 17-3 | |

| 17.4 | Plans, Negotiations, or Agreements with Local Individuals or Groups | 17-3 | |

| 17.5 | Mine Closure, Remediation, and Reclamation Plans, and Associated Costs | 17-3 | |

| 17.6 | Qualified Person’s Opinion on the Adequacy of Current Plans to Address Any Issues Related to Environmental Compliance, Permitting, and Local Individuals or Groups | 17-5 | |

| 17.7 | Descriptions of Any Commitments to Ensure Local Procurement and Hiring | 17-5 | |

| 18 | CAPITAL AND OPERATING COSTS | 18-1 | |

| 19 | ECONOMIC ANALYSIS | 19-1 | |

| 20 | ADJACENT PROPERTIES | 20-1 | |

| 21 | OTHER RELEVANT DATA AND INFORMATION | 21-1 | |

| 21.1 | Homestake Mine Facilities | 21-1 | |

| 21.2 | Sanford Underground Research Facility | 21-1 | |

| 22 | INTERPRETATION AND CONCLUSIONS | 22-1 | |

| 22.1 | Mineral Tenure, Agreements, and Royalties | 22-1 | |

| 22.2 | Sample Preparation, Analyses, Security, and Data Verification | 22-1 | |

| 22.3 | Mineral Resources | 22-2 | |

| 22.4 | Mineral Processing and Metallurgical Testing | 22-3 | |

| 23 | RECOMMENDATIONS | 23-1 | |

| 23.1 | Sample Preparation, Analyses, Security, and Data Verification | 23-1 | |

| 23.2 | Resource Estimation | 23-1 | |

| 23.3 | Mineral Processing and Metallurgical Testing | 23-4 | |

| 24 | REFERENCES | 24-1 | |

| 25 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT | 25-1 | |

| 25.1 | Legal Matters | 25-1 | |

| 25.2 | Tenure | 25-1 | |

| 25.3 | Significant Encumbrances and Permitting | 25-1 | |

| 25.4 | History | 25-1 | |

| 25.5 | Exploration | 25-1 | |

| 25.6 | Environment | 25-2 | |

| 26 | DATE AND SIGNATURE PAGE | 26-1 | |

| Tables |

| Table 1-1: | Richmond Hill Conceptual Pit-Constrained MRE at Variable Cutoff Grades | 1-6 |

| Table 2-1: | Qualified Person Responsibilities | 2-3 |

| Table 3-1: | Richmond Hill Gold Property Claims | 3-5 |

| Table 3-2: | Richmond Hill Gold Claims with Holding Costs and Royalties | 3-13 |

| Table 3-3: | Current Environmental Permits | 3-21 |

| Table 3-4: | Potential Environmental Permits | 3-23 |

| Table 5-1: | Summary of Richmond Hill’s Recent History | 5-2 |

| Table 8-1: | Groups of Drilling Programs at Richmond Hill Gold Project | 8-1 |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| Table 8-2: | Comparison of Contained Resources in Test Areas 1 and 2 at Richmond Hill Gold Project | 8-3 |

| Table 8-3: | Comparison of Gold Grade Distribution between Coeur R20R-4706 and Bond MW3-90-133 | 8-5 |

| Table 10-1: | Historical Metallurgical Reports | 10-1 |

| Table 10-2: | Master Composite Head Assays | 10-3 |

| Table 10-3: | Mineral Content | 10-3 |

| Table 10-4: | Bond Ball Mill Work Index | 10-4 |

| Table 10-5: | Rougher Flotation Results | 10-6 |

| Table 10-6: | Gold Extraction vs. Grind Size | 10-7 |

| Table 10-7: | Gold Extraction vs. Grind Size | 10-8 |

| Table 10-8: | Summary of Results | 10-10 |

| Table 10-9: | Master Composite Head Assays | 10-11 |

| Table 10-10: | Mineral Abundance (wt%) | 10-12 |

| Table 10-11: | Mineral Abundance (wt%) | 10-12 |

| Table 10-12: | Comminution Summary | 10-15 |

| Table 10-13: | Gold Extraction vs. Time | 10-16 |

| Table 10-14: | Three-Stage Diagnostic Leach Tests | 10-18 |

| Table 10-15: | Rougher Flotation Grind Series MC-TT-S | 10-19 |

| Table 10-16: | Rougher Flotation Results | 10-20 |

| Table 10-17: | Rougher Flotation Leach Results | 10-22 |

| Table 10-18: | Summary of Results | 10-25 |

| Table 11-1: | Richmond Hill Conceptual Pit-Constrained MRE at Variable Cutoff Grades | 11-1 |

| Table 11-2: | Data Used for MRE | 11-6 |

| Table 11-3: | Richmond Hill Gold Assay Descriptive Statistics by Lithological Domain | 11-8 |

| Table 11-4: | Richmond Hill Gold Composite Descriptive Statistics by Lithological Domain | 11-9 |

| Table 11-5: | Summary of Capping Levels, Number of Samples, and Impact | 11-10 |

| Table 11-6: | Bulk-Density Average Values by Lithological Domain | 11-14 |

| Table 11-7: | Richmond Hill Gold Variogram Parameters | 11-14 |

| Table 11-8: | Richmond Hill Block Model Parameters | 11-14 |

| Table 11-9: | Richmond Hill Search Ellipse Parameters | 11-15 |

| Table 11-10: | Richmond Hill Resource Classification Criteria | 11-17 |

| Table 11-11: | Richmond Hill Conceptual Pit Parameters | 11-19 |

| Table 11-12: | Richmond Hill Conceptual Pit-Constrained MRE | 11-21 |

| Table 22-1: | Richmond Hill Conceptual Pit-Constrained MRE at Variable Cutoff Grades | 22-2 |

| Table 23-1: | Recommended Drill Holes 2024 | 23-2 |

| Figures |

| Figure 2-1: | Property Location | 2-2 |

| Figure 3-1: | Claims Location | 3-2 |

| Figure 3-2: | Nearby Properties | 3-3 |

| Figure 3-3: | Richmond Hill Gold Claims with Mineral Ownership | 3-4 |

| Figure 3-4: | Claims with Underlying Royalties | 3-20 |

| Figure 4-1: | Richmond Hill Gold Project Access | 4-1 |

| Figure 4-2: | Black Hills Location | 4-3 |

| Figure 4-3: | Richmond Hill Gold Property Location | 4-4 |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

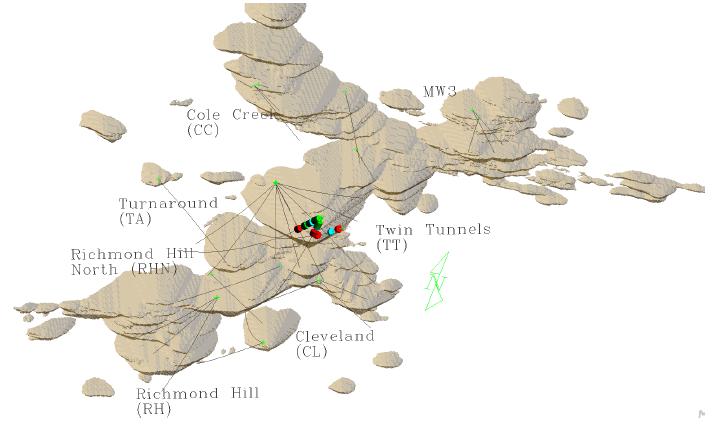

| Figure 6-1: | Exploration Zones | 6-2 |

| Figure 6-2: | Geology of Richmond Hill | 6-3 |

| Figure 6-3: | Richmond Hill Gold Project Target Zones on 0.01 oz/ton Grade Shell Plot | 6-4 |

| Figure 6-4: | Regional Geology of the Black Hills | 6-8 |

| Figure 6-5: | Southwest to Northeast Structural Cross-Sections | 6-9 |

| Figure 6-6: | Black Hills General Stratigraphic Section | 6-11 |

| Figure 6-7: | Precambrian Stratigraphic Section of the Richmond Hill Gold Project Area | 6-13 |

| Figure 7-1: | Airborne Magnetics Survey Flightline Limits | 7-1 |

| Figure 7-2: | Gravity Survey Station Locations | 7-3 |

| Figure 7-3: | Geophysical IP—Resistivity Survey Line Locations | 7-4 |

| Figure 7-4: | Dakota Gold Geologic Fieldwork | 7-6 |

| Figure 7-5: | Richmond Hill Gold Project Drill Collars | 7-8 |

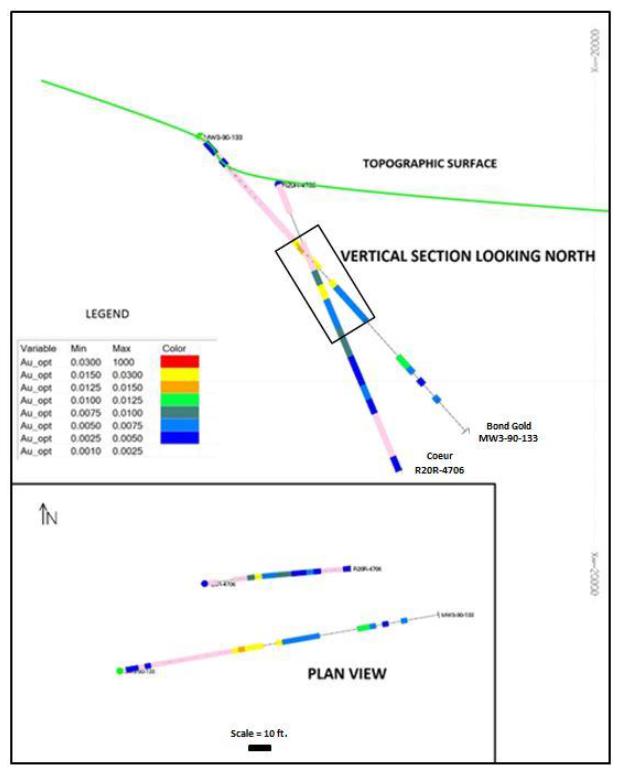

| Figure 8-1: | Comparison of Gold Grade Distribution Between Coeur R20R-4706 and Bond MW3-90-133 | 8-6 |

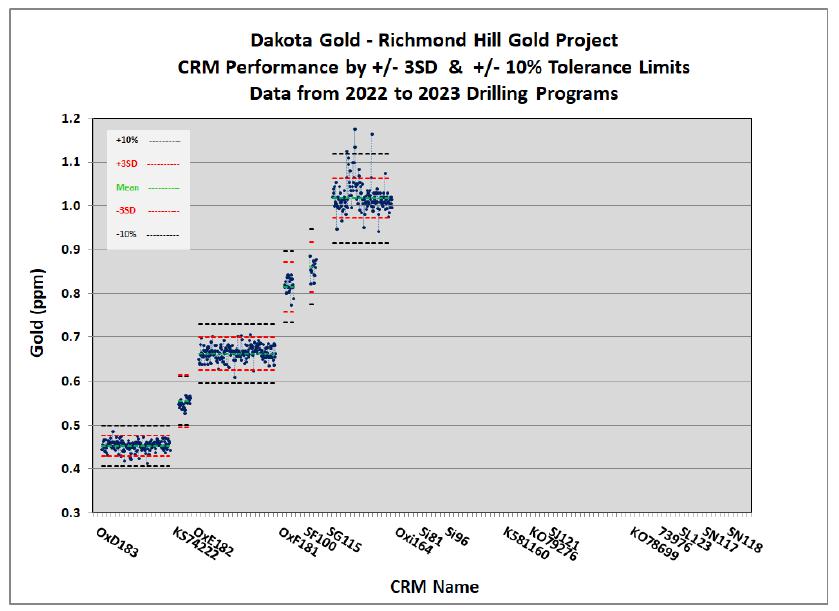

| Figure 8-2: | Quality Control Monitoring of CRM Gold Assays from ALS in the 0.3 to 1.2 ppm Grade Range (February 2024) | 8-10 |

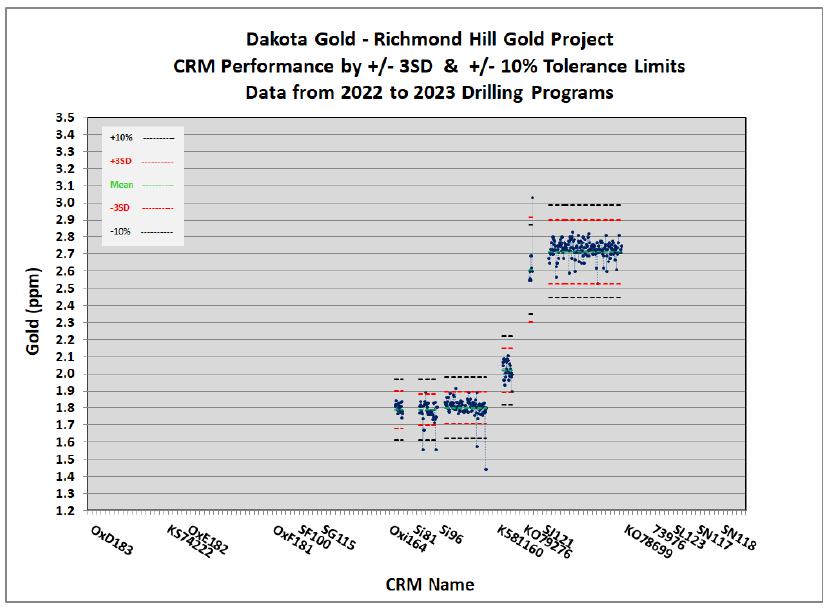

| Figure 8-3: | Quality Control Monitoring of CRM Gold Assays from ALS in the 1.2 to 3.5 ppm Grade Range (February 2024) | 8-11 |

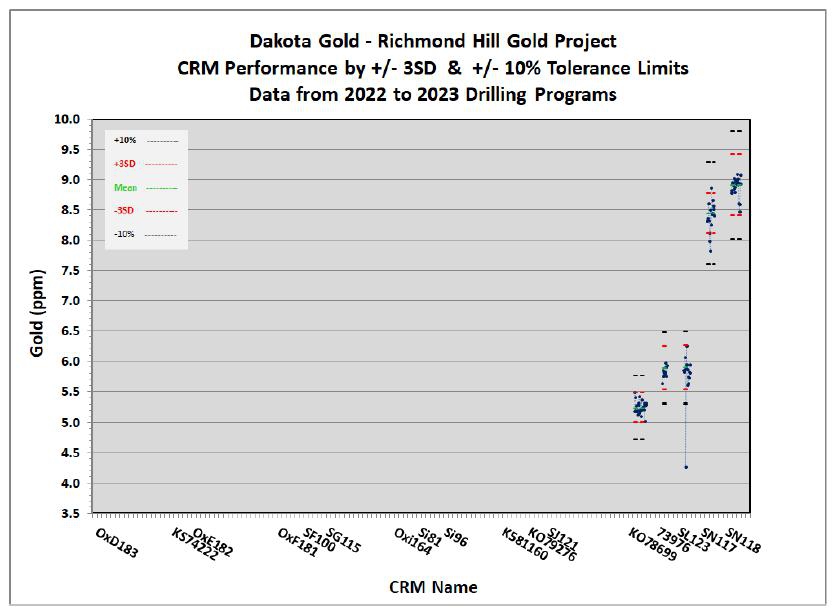

| Figure 8-4: | Quality Control Monitoring of CRM Gold Assays from ALS in the 3.5 to 10.0 ppm Grade Range (February 2024) | 8-12 |

| Figure 10-1: | Drill-Hole Locations | 10-2 |

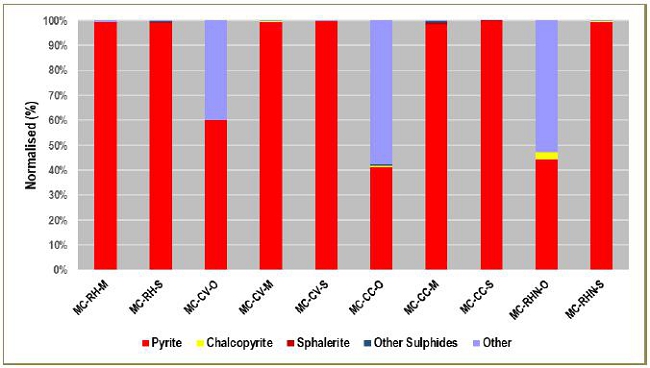

| Figure 10-2: | Sulfur Mineral Content—BaseMet 2023, BL1244 | 10-4 |

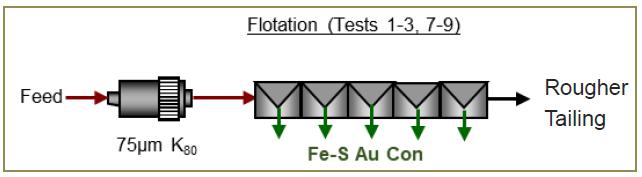

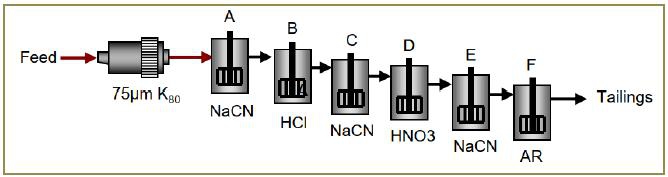

| Figure 10-3: | Rougher Flotation Flowsheet—BaseMet 2023, BL1244 | 10-5 |

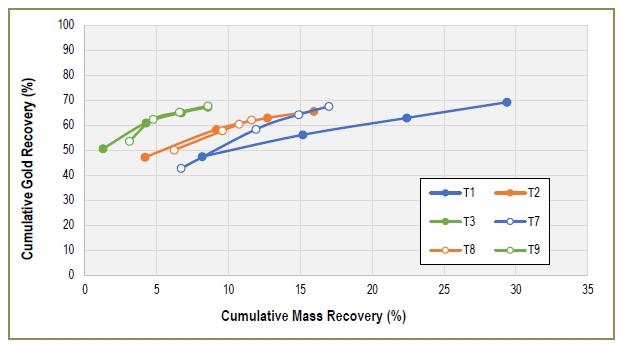

| Figure 10-4: | Rougher Mass vs. Gold Recovery—BaseMet 2023, BL1244 | 10-6 |

| Figure 10-5: | Gold Extraction vs. Time—BaseMet 2023, BL1244 | 10-7 |

| Figure 10-6: | Diagnostic Leach Test Flowsheet—BaseMet 2023, BL1244 | 10-8 |

| Figure 10-7: | Flotation/Leach Flowsheet—BaseMet 2023, BL1244 | 10-9 |

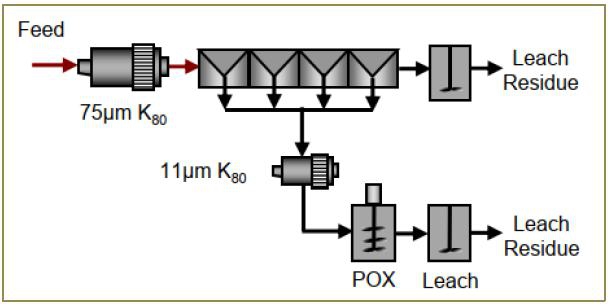

| Figure 10-8: | Flotation/POX/Leach Flowsheet—BaseMet 2023, BL1244 | 10-9 |

| Figure 10-9: | Drill-Hole Locations | 10-10 |

| Figure 10-10: | Sulfur Mineral Content—BaseMet 2023, BL1346 | 10-13 |

| Figure 10-11: | Sulfur Mineral Content—BaseMet 2023, BL1346 | 10-13 |

| Figure 10-12: | Sulfur Mineral Content—BaseMet 2023, BL1346 | 10-14 |

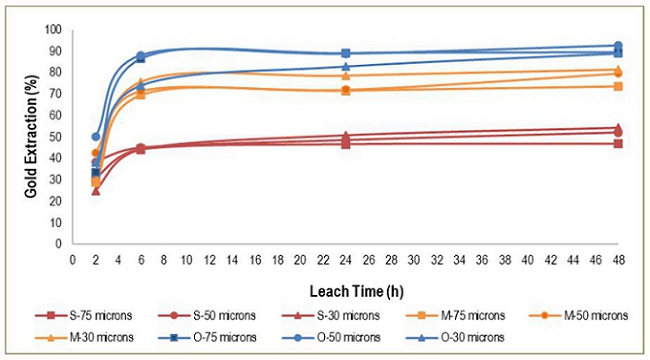

| Figure 10-13: | Gold Extraction vs. Time—BaseMet 2023, BL1346 | 10-17 |

| Figure 10-14: | Gold and Silver Extraction vs. Sulfur Head Grade—BaseMet 2023, BL1346 | 10-17 |

| Figure 10-15: | Gold Rougher Concentrate Recovery vs. Mass Recovery—BaseMet 2023, BL1346 | 10-19 |

| Figure 10-16: | Gold Rougher Concentrate Recovery vs. Mass Recovery—BaseMet 2023, BL1346 | 10-20 |

| Figure 10-17: | Gold Recovery vs. Sulfur Head Grade—BaseMet 2023, BL1346 | 10-21 |

| Figure 10-18: | Gold Recovery vs. Gold Head Grade—BaseMet 2023, BL1346 | 10-21 |

| Figure 10-19: | Float/Leach Flowsheet—BaseMet 2023, BL1346 | 10-22 |

| Figure 10-20: | Overall Gold Extraction—BaseMet 2023, BL1346 | 10-23 |

| Figure 10-21: | Overall Silver Extraction—BaseMet 2023, BL1346 | 10-23 |

| Figure 11-1: | Richmond Hill Lithological Domains | 11-3 |

| Figure 11-2: | Richmond Hill Oxidation Domains | 11-5 |

| Figure 11-3: | Richmond Hill Drill Holes Used for MRE, Plan View | 11-7 |

| Figure 11-4: | Distribution of Gold Assays (oz/ton) by Lithological Domain, Plan View | 11-8 |

| Figure 11-5: | Richmond Hill Sample Length Histogram | 11-9 |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

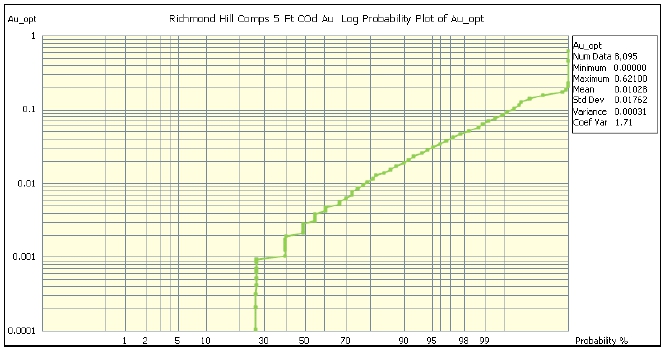

| Figure 11-6: | Au Capping Curve Deadwood (COd) Domain | 11-11 |

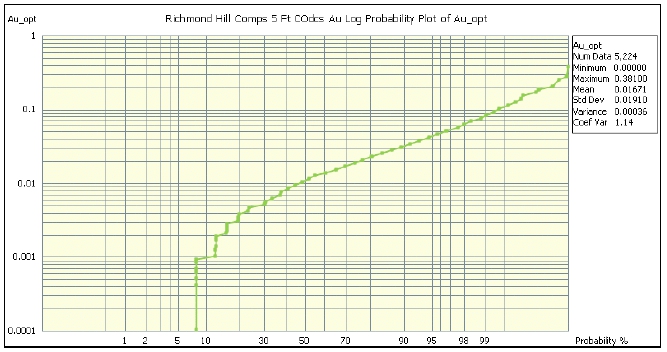

| Figure 11-7: | Au Capping Curve COdcs Domain | 11-11 |

| Figure 11-8: | Au Capping Curve Precambrian (pC) Domain | 11-12 |

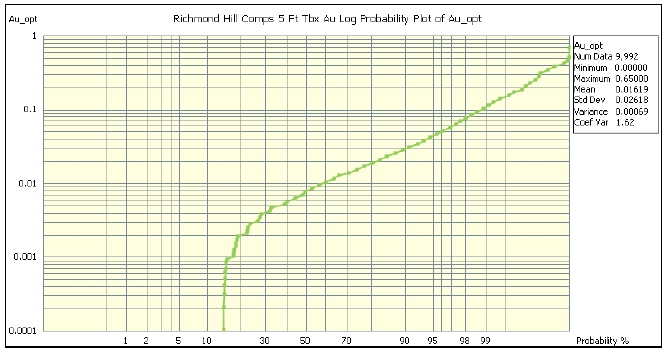

| Figure 11-9: | Au Capping Curve Tertiary Intrusive Breccia (Tbx) | 11-12 |

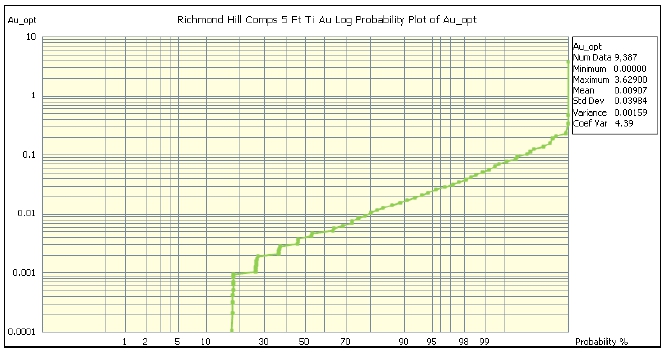

| Figure 11-10: | Au Capping Curve Tertiary Intrusive (Ti) | 11-13 |

| Figure 11-11: | Richmond Hill Block Model, Plan View | 11-16 |

| Figure 11-12: | Richmond Hill Block Model Vertical Cross-Section 12000 N | 11-17 |

| Figure 11-13: | Richmond Hill Block Model Classification, Plan View | 11-18 |

| Figure 11-14: | Richmond Hill Pit-Constrained Block Model, Plan View | 11-20 |

| Figure 11-15: | Swath Plot, Tertiary Breccia (Tbx) Domain | 11-23 |

| Figure 17-1: | LAC’s Reclamation Liability Release Map | 17-4 |

| Figure 23-1: | Recommended Richmond Hill 2024 Diamond Drill-Hole Locations | 23-3 |

Acronyms, Abbreviations, and Units of Measure

Acronyms and Abbreviations

| $ | U.S. dollar |

| 3D | three-dimensional |

| AAS | atomic absorption spectroscopy |

| Ag | silver |

| AKF | AKF Mining Services Inc. |

| AOI | Area of Interest |

| ARD | acid-rock drainage |

| ARSD | Administrative Rules of South Dakota |

| Au | gold |

| B.C. | British Columbia |

| Barrick | Barrick Gold Corporation |

| BaseMet | Base Metallurgical Laboratories |

| BLK | blank |

| BMA | bulk mineral analysis |

| BVMM | Bureau Veritas Metals and Minerals |

| BWi | Bond ball mill work index |

| CC | Cole Creek |

| CDP | crushed duplicate |

| COd | Cambro-Ordovician Deadwood Formation |

| COdcs | Deadwood Formation basal conglomerate-sandstone |

| Core | Central Crystalline Core |

| CRM | certified reference material |

| Cu | copper |

| CUP | Conditional Use Permit |

| CV | Cleveland |

| Dakota Gold | Dakota Gold Corp. |

| DO | dissolved oxygen |

| DTRC | Dakota Territory Resource Corp. |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| DUP | duplicate |

| ERM | Environmental Resources Management |

| EXNI | Exploration Notice of Intent |

| Fe | iron |

| Freeport | Freeport Exploration Company |

| GRG | gravity-recoverable gold |

| Homestake | Homestake Mining Company of California |

| ICP-ES | inductively coupled plasma-emission spectroscopy |

| ID2 | inverse distance squared |

| IP | induced polarization |

| IRR | internal rate of return |

| JV | joint venture |

| K-Met | K-Met Consultants Inc. |

| LAC | LAC Minerals |

| LDL | lower detection limit |

| Magee | Magee Geophysical Surveys LLC |

| MC | master composite |

| Mia | coarse ore index |

| MRE | mineral resource estimate |

| NaCN | sodium cyanide |

| NPV | net present value |

| NSR | net smelter return |

| NWS | National Weather Service |

| OK | ordinary kriging |

| P80 | 80% passing |

| PAX | potassium amyl xanthate |

| pC | undivided Precambrian |

| PDP | pulp duplicate |

| PEA | preliminary economic assessment |

| POX | pressure oxidation |

| Property | Richmond Hill Gold Project |

| QA/QC | quality assurance and quality control |

| Q/C | quality control |

| QP | qualified person |

| RC | reverse circulation |

| RH | Richmond Hill |

| RHN | Richmond Hill North |

| RO | reverse osmosis |

| RQD | rock quality designation |

| S | sulfur |

| SAG | semi-autogenous grinding |

| SCSE | SAG circuit specific energy |

| SD | standard deviation |

| SDBME | South Dakota Board of Minerals & Environment |

| SDDANR | South Dakota Department of Agriculture & Natural Resources |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| SDDENR | South Dakota Department of Environment & Natural Resources |

| SDP | sample duplicate |

| SMC | SAG mill comminution |

| St. Joe | St. Joe Gold Corporation |

| SURF | Sanford Underground Research Facility |

| SWD | surface water discharge |

| SWPPP | Stormwater Pollution Prevention Plan |

| TA | Turn Around |

| Tbx | Tertiary hydrothermal breccia |

| Tbx RH | Richmond Hill Tertiary hydrothermal breccia |

| Tbx RHN-NN | Richmond Hill North No Name Tertiary hydrothermal breccia |

| Ti | Tertiary intrusive |

| TT | Twin Tunnels |

| U.S. | United States of America |

| Viable | Viable Resources Inc. |

| WOL | whole ore leach |

Units of Measure

| μm | micrometer (micron) |

| ° | degrees azimuth |

| °F | degrees Fahrenheit |

| % | percent |

| $ | United States dollar |

| ft | foot |

| g | gram |

| g/cm3 | grams per cubic meters |

| g/t | grams per tonne |

| Ga | giga-annum (billion years) |

| gal/min | U.S. gallons per minute |

| h | hour |

| kg | kilogram |

| kg/t | kilogram per tonne |

| km2 | kilometer squared |

| kV | kilovolt |

| kW | kilowatt |

| kWh/m3 | kilowatt hours per cubic meter |

| kWh/t | kilowatt hour per tonne |

| L | liter |

| m3 | cubic meter |

| m | meter |

| Ma | mega-annum (one million years) |

| mg | milligram |

| mg/L | milligram per liter |

| ml | milliliter |

| mm | millimeter |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

|

Moz |

million ounces |

| ms | millisecond |

| Mton | megaton (one million tons) |

| oz | troy ounce |

| oz/t | ounces per tonne |

| oz/ton | ounces per short ton |

| ppm | parts per million |

| t | tonne |

| ton | short ton |

| ton/ft3 | tons per cubic foot |

| t/m3 | tonnes per cubic meter |

| wt% | weight percentage |

| April 30, 2024 | TOC | |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 1 | Executive Summary |

| 1.1 | Introduction |

Dakota Gold Corp. (Dakota Gold) is a Nevada-registered, South Dakota-based gold exploration and development company with a specific focus on revitalizing the Homestake District in Lead, South Dakota. Dakota Gold has 11 gold mineral properties covering over 46,000 acres surrounding the historic Homestake Mine.

Dakota Gold contracted AKF Mining Services Inc. (AKF) to complete a review of historical and current exploration programs to verify and validate the drilling data and produce an S-K 1300 Initial Assessment and Technical Report Summary (Report) on the Richmond Hill Gold Project (the Project or the Property). The Property is coextensive with the Richmond Hill Option Agreement described below; however, the resource described in this Initial Assessment lies within only a portion of the Property. Thus, discussion and analysis in this Initial Assessment will be limited to only that portion of the Property relevant to the resource. The current exploration programs mentioned above also included a metallurgical study to determine the potential recoveries for the various geological zones.

The Project hosts the former Richmond Hill gold mine, operated from 1988 to 1993 as an open pit mine with heap leach facilities.

Mineral resources and mineral reserves are reported using the definitions in the US Securities and Exchange Commission’s Regulation S–K (Subpart 1300).

| 1.2 | Project Setting |

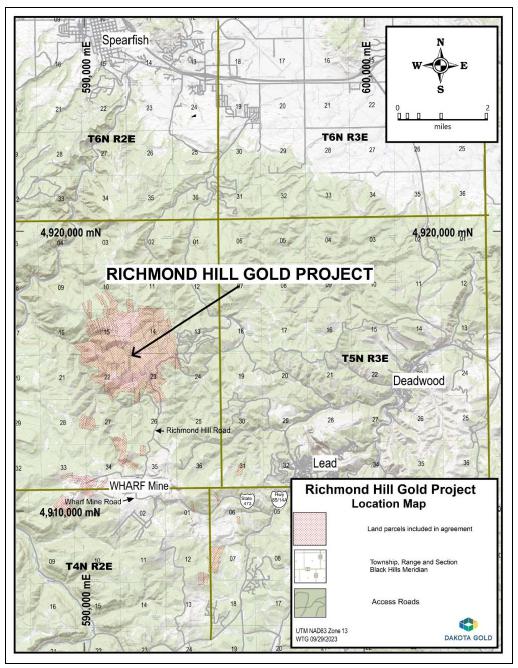

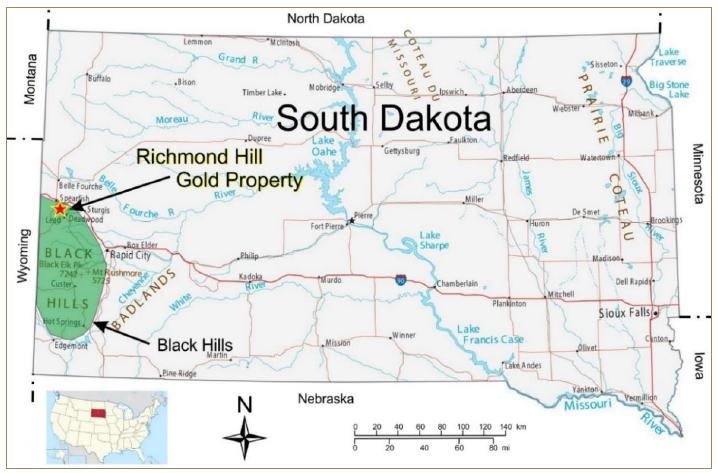

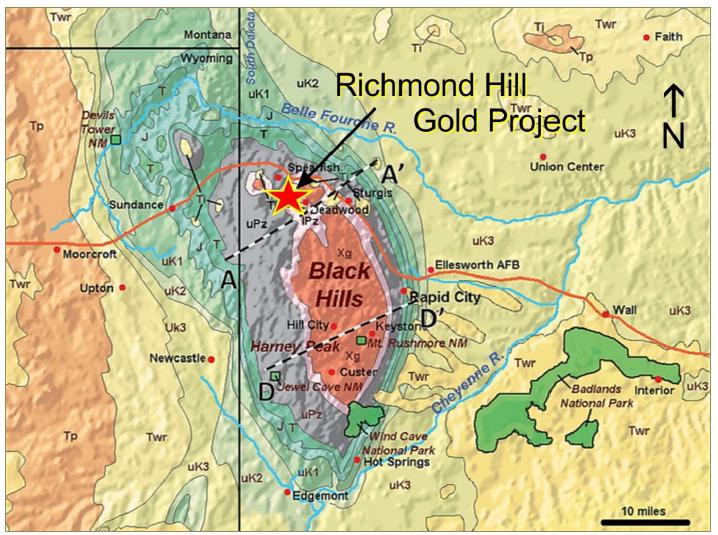

The Project is in the western portion of Lawrence County within the Black Hills of South Dakota, United States of America (US). The Project area is 4 miles northwest of the City of Lead, South Dakota.

The Project is accessed from Lead by travelling southwest on Highway 85/14A, west on State Highway 473, then west on the Wharf Mine Road, and finally north on the Richmond Hill Road. There are various spur roads leading to drill platforms and reclaimed drill pads.

The Black Hills climate in the Project vicinity is one of cool-to-cold snowy winters, and warm-to-hot dry summers, with four full seasons . Any future mining operations could be conducted year-round.

| 1.3 | Mineral Tenure, Surface Rights, Royalties, and Agreements |

The Richmond Hill property included in the option agreement comprises of 94 Lawrence Count, South Dakota, Land parcels and two unpatented mining claims. The 94 land parcels are composed of 246 mineral survey patented load claims and purchased government lots. Twenty-nine (29) of the parcels consisted only of the mineral rights with the surface belonging to various owners.

On October 14, 2021, Dakota Territory Resource Corp. (now Dakota Gold) entered into an option agreement (amended September 8, 2022) to acquire the Project from Barrick Gold Corporation’s (Barrick) wholly owned subsidiaries LAC Minerals (USA) LLC (LAC) and Homestake Mining Company of California (Homestake). In early October 2023, LAC and Homestake merged, and the entire property is now owned by Homestake.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

A summary of the Richmond Hill Option Agreement (as amended) is as follows:

| · | Option to purchase 2,748.67 acres of 100%-owned mineral rights and attendant facilities and patented properties. |

| · | Issue an aggregate of 980,000 shares of Dakota Gold to Barrick through a combination of shares issued at signing, and upon exercise of the option (580,000 shares have been issued to date). |

| · | Assume all property liabilities and bonds. |

| · | Upon execution of the option to Barrick, issue a 1% net smelter return (NSR) from any gold production from the property. |

| · | The term of the amended agreement is 54 months and expires on March 7, 2026. |

At the Report date, Dakota Gold is current with all terms and conditions of the Option Agreement.

Surface rights to the Project area were included in the option agreement. There are five underlying agreements with original claim owners that burden portions of the Project area with 1% to 5% NSR (capped) royalties.

| 1.4 | Geology and Mineralization |

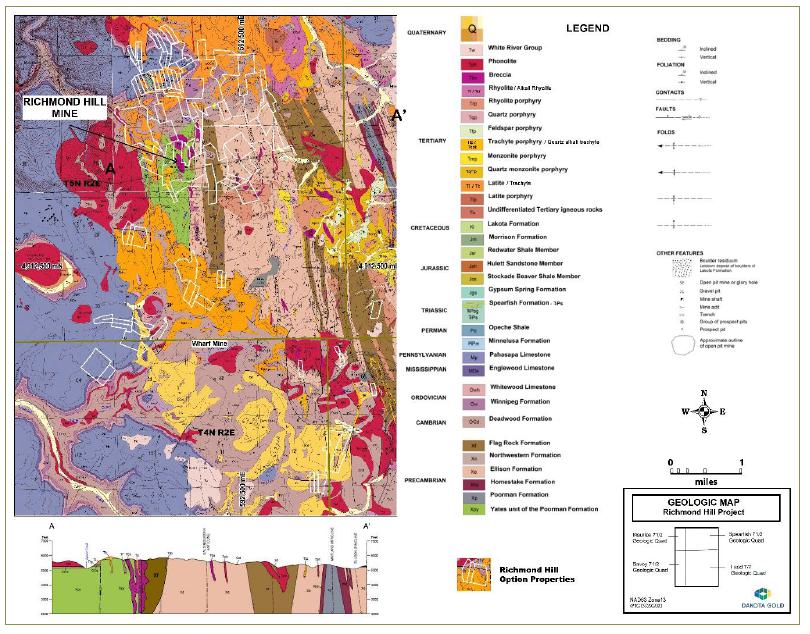

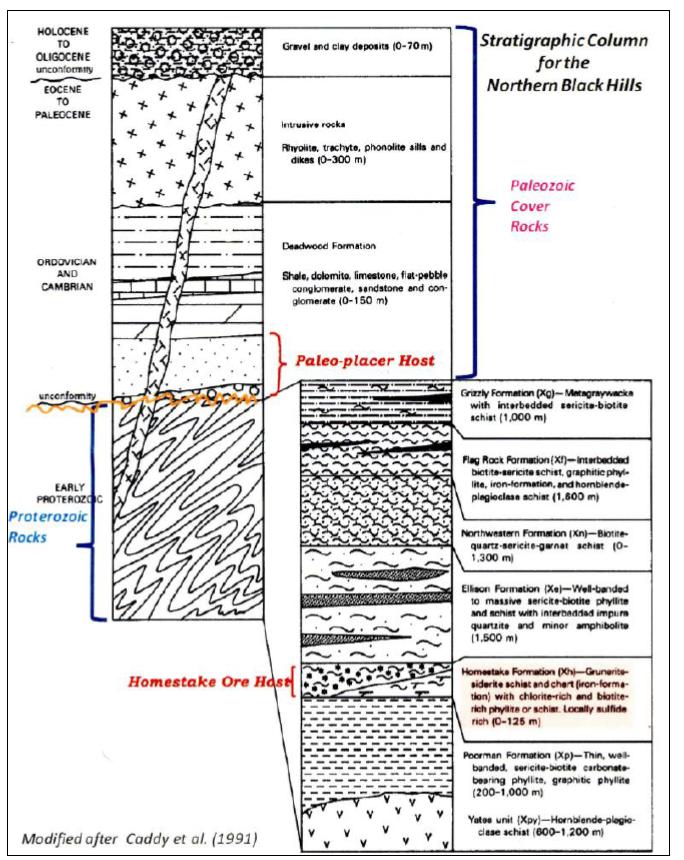

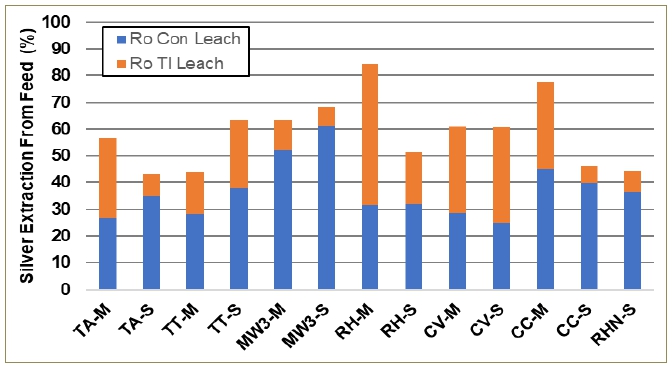

The Project is near the northwest end of the Black Hills which is an oval-shaped north-northwest-striking mountain range approximately 90 by 45 miles in size along the western side of South Dakota and extending into Wyoming. The Black Hills is a domal uplift where erosion has exposed a window of Precambrian igneous and metamorphic rocks flanked by a 6,500 to 7,000 ft deep sequence of Paleozoic to Mesozoic-aged sedimentary rocks dipping off in all directions on the margin of the uplift, all subjected to intrusive activity in the Tertiary.

The Project is on the northwestern portion of the Lead dome, a subsidiary dome north of the main Black Hills uplift. The Lead dome developed in response to a major Tertiary intrusive event that also led to development of the Tertiary-aged gold deposits. These Tertiary intrusive rocks have a wide range of compositions and occur as stocks, sills, dikes, laccoliths, and breccia pipes.

The mineral claims are underlain by two major terranes. Precambrian metamorphic rocks underlie the southern portions of the property and consist of metamorphosed volcanic and sedimentary rocks, including mafic metavolcanic rocks, phyllite, iron formation, and quartzite. Overlying the Precambrian rock on the north end of the property is a nearly complete Paleozoic sedimentary section, which includes the Cambrian–Ordovician Deadwood Formation; the Ordovician-to-Mississippian Englewood Formation and Whitewood and Winnipeg Formations; the Mississippian Pahasapa Formation; and the Pennsylvanian Minnelusa Formation. Tertiary igneous rocks of varying composition have extensively intruded into both terranes.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

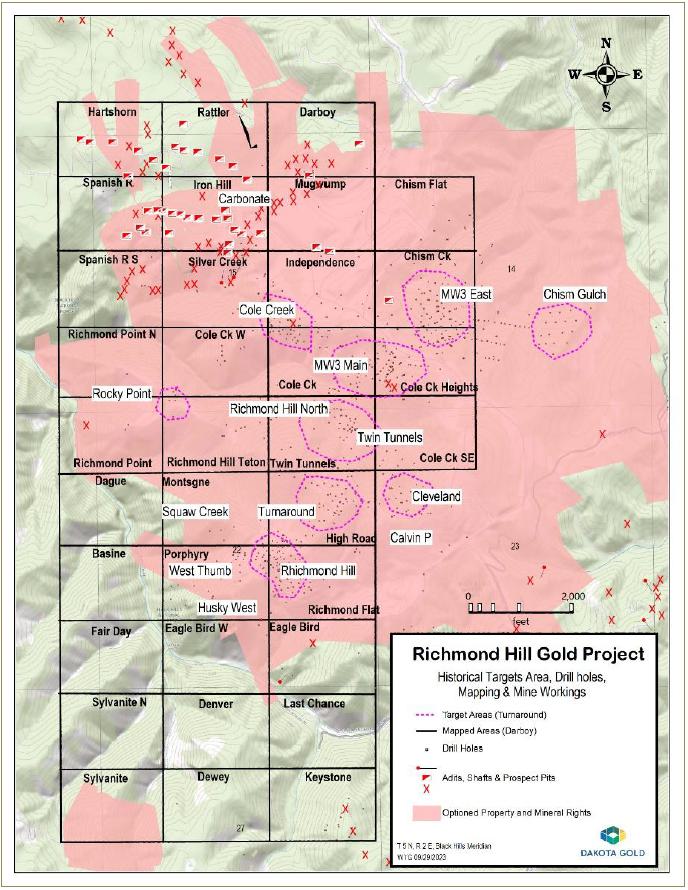

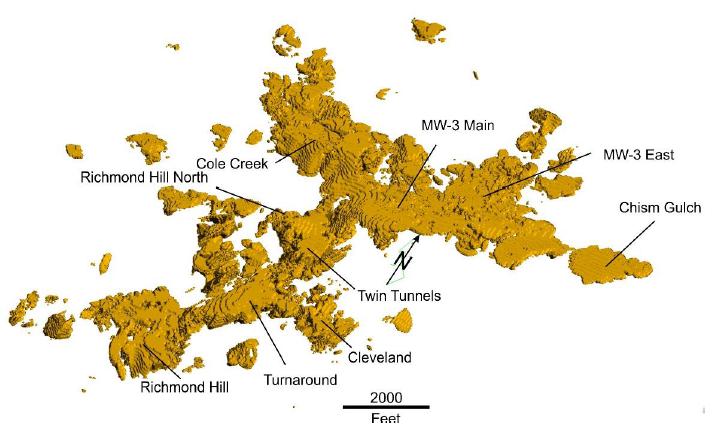

Several gold–silver deposits and prospective areas exist on the Property. Within the Precambrian terrane, Tertiary-aged mineralization occurs within breccia pipes and altered Precambrian rocks, with minor mineralization in the Tertiary intrusive rocks. Examples include the Richmond Hill gold mine area, and the prospective areas—Twin Tunnels, Turnaround, Richmond Hill North, West Thumb, Huskie West, Cleveland, Calvin P, Cole Creek Heights, and Earle.

Within the Paleozoic terrane, mineralization occurs in the Deadwood Formation along two primary horizons containing the most consistent mineralization. Prospective-area examples within the Deadwood are MW-3 Main, MW-3 East, and Cole Creek.

The mineralization at the Project is dominantly replacement style within Tertiary aged breccias of host Precambrian metasedimentary and Cambrian-Ordovician sedimentary rocks. Gold bearing fluids possibly derived from Tertiary intrusions migrated along steeply dipping fractures called verticals, and gold was deposited in favorable structural or chemical traps as replacement deposits. Breccia pipes within Precambrian metasediments and the Cambro-Ordovician Deadwood Formation are the most common gold bearing host rocks. The historic Richmond Hill gold mine produced ore from Tertiary breccias dominantly hosted within Precambrian units that were processed as an open pit, heap leach operation.

Dakota Gold determined that several zones warranted further exploration. After optioning the Property in 2021, Dakota Gold started a property-wide exploration program including geology, geochemical, geophysical, and drilling surveys.

| 1.5 | History |

Gold was first recorded in the Black Hills in 1874 and in 1876 the Homestake lode was discovered; it was mined almost continuously until 2002. Numerous other gold deposits were subsequently discovered in the Black Hills in differing geologic environments, with several turning into significant mining camps.

Prior to Dakota Gold optioning the Richmond Hill Gold Project the area was explored by Viable Resources, Freeport Exploration Company, St. Joe Gold, Bond Gold, and Lac Minerals. Bond Gold received a mining permit for the Richmond Hill gold mine in 1988 and LAC continued to mine the deposit until closure in 1994. LAC was acquired by Barrick in 1994 and completed reclamation activities at the mine.

Dakota Gold optioned the Project area from Barrick in 2021 and carried out various exploration programs on the Project including diamond drilling 57 core holes. In 2023 AKF Mining Services was contracted to verify the drilling database and complete a maiden global resource estimate.

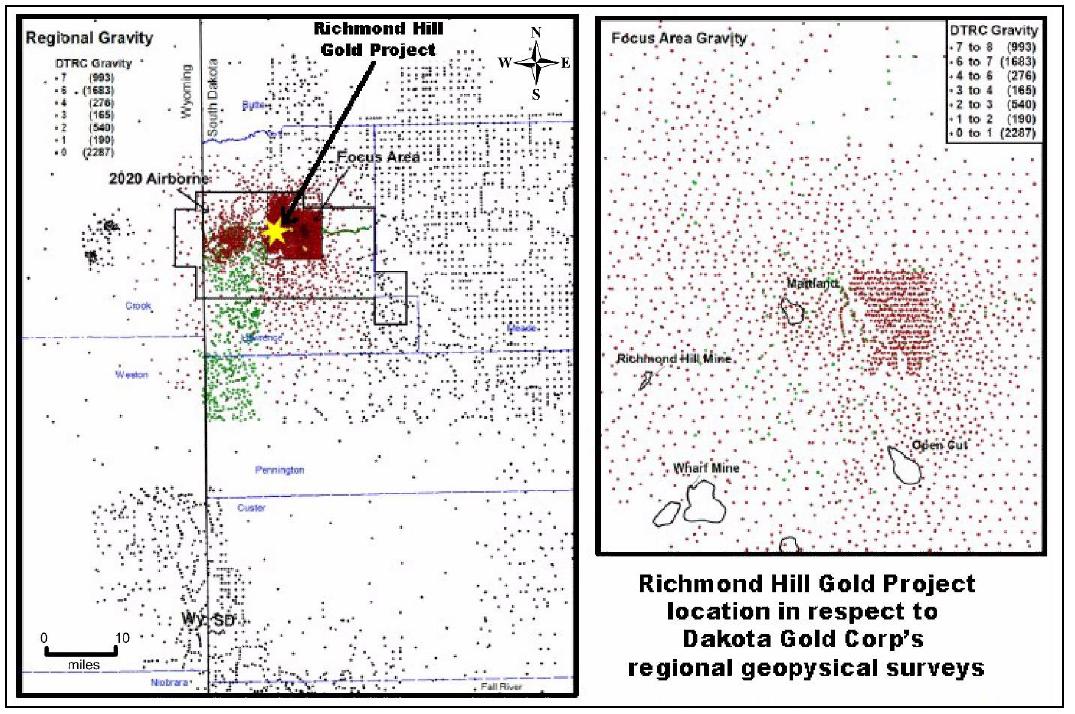

| 1.6 | Exploration |

Prior to Dakota Gold optioning the Project, the company flew a high-resolution helicopter-borne magnetic and gamma-ray spectrometric survey over the Homestake District o. The survey covered an area of 962.4 km2 and included the current Project area, with the objective of mapping Precambrian lithologies and structure as well as Tertiary intrusive rocks and associated alteration in outcrop, subsurface, and beneath cover.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

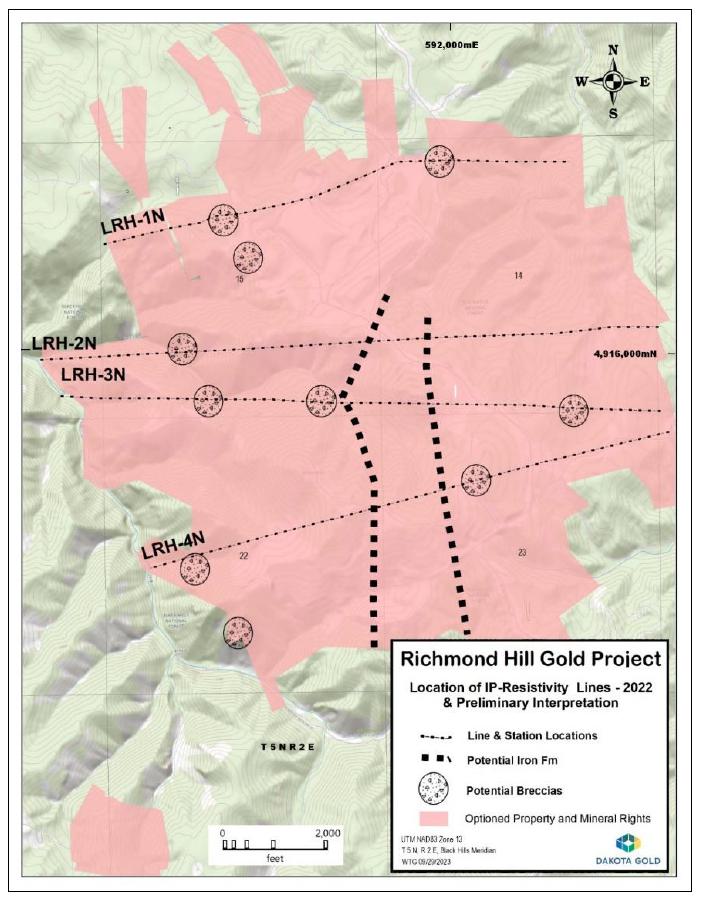

Since optioning the Project in October 2021, Dakota Gold has completed several exploration surveys including gravity, induced polarization, geological mapping, and drilling.

| 1.7 | Drilling |

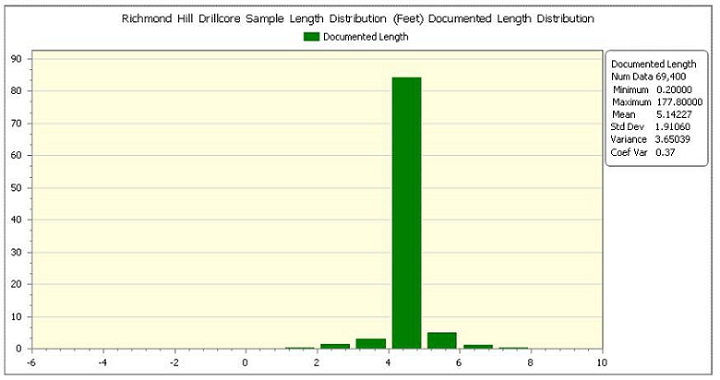

The historical drill database includes 1,055 rotary, reverse-circulation (RC), and core holes. Drilling in 2022 and 2023 consisted of 57 diamond-drill holes representing 103,657 ft of core drilling.

| 1.8 | Sample Preparation, Analyses, and Security |

St. Joe, Bond Gold, LAC, Coeur Mining, and Dakota Gold completed multiple RC and core-drilling programs on the Project from 1981 to 1993, 2019 to 2020, and 2022 to 2023.

Programs completed from 1981 to 1993 and 2019 to 2020 followed standard industry procedures available at that time for sampling, sample shipping and security, sample preparation, and analyzing for gold and silver. RC drill cuttings were obtained from similar-length sample intervals and were reduced to a smaller volume and weight, whereas core was split lengthwise and a representative portion sampled. Samples from 1981 to 1993 programs were shipped to Bondar Clegg in Lakewood, Colorado, and those from 2019 to 2020 programs were shipped to Bureau Veritas Metals and Minerals in Vancouver, British Columbia (B.C.). The security procedures used for the shipments is not known.

Both laboratories processed samples through successive stages of reducing particle sizes and weights to obtain representative subsamples. The samples were assayed for gold by standard lead collector fire assay and either a gravimetric or atomic absorption spectroscopy (AAS) finish, and they were analyzed for silver using an aqua regia digestion and an AAS finish. Check assays were completed for 1981 to 1993 drilling programs using blind pulp samples; field splits were sent back to Bondar Clegg, and pulp samples were sent to Skyline Labs. For the 2019 to 2020 drilling programs, approximately 10% of samples were sent for checking to McClelland Laboratory. Analytical laboratory certificates for the data are available and were reviewed.

The 2022 to 2023 procedures that Dakota Gold followed for core drilling programs were reviewed at site. Core was split lengthwise and half was sampled using geological criteria. Initially a secure company truck shipped samples to ALS in Twin Falls, Idaho; later tracked shipments using secure transportation were done by FedEx to ALS in Winnipeg, Manitoba. The samples were put through successive stages of reducing particle sizes and weights to obtain representative subsamples. They were assayed for gold by standard lead collector fire assay using an AAS finish, and were analyzed for silver by four-acid digestion using an inductively coupled plasma-emission spectroscopy (ICP-ES) finish. Dakota Gold completed a comprehensive quality-control (QC) monitoring program. Analytical laboratory certificates are available and were reviewed.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 1.9 | Data Verification |

All available historical and current data comprising collars, surveys, assays, and lithologies were entered into spreadsheets and compared to the historical database provided by Dakota Gold. Differences were reviewed, investigated, and revised where required. Final data sheets were included into the final database for geological and resource modeling.

The final database is of sufficient quality for geological and resource modeling, as the assay and geological data are acceptable based on procedures described in this Report. In addition, the drill-hole collars and traces are reasonably accurately located for three-dimensional (3D) plotting, and samples are properly assigned to locations along drill holes.

| 1.10 | Metallurgy |

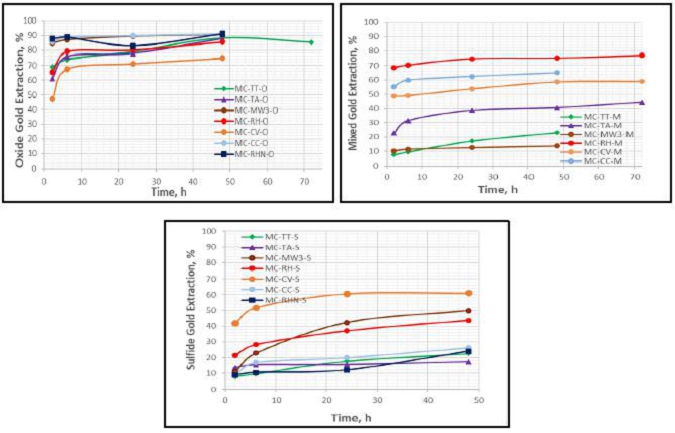

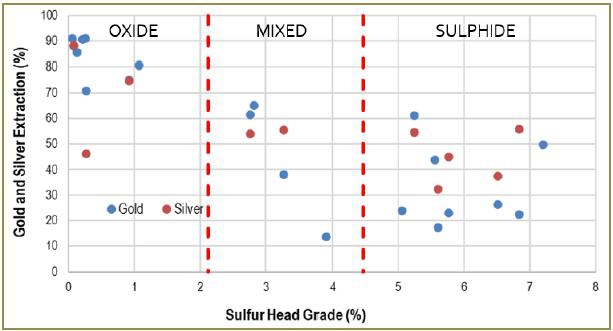

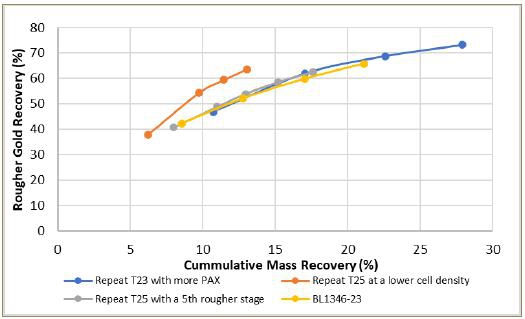

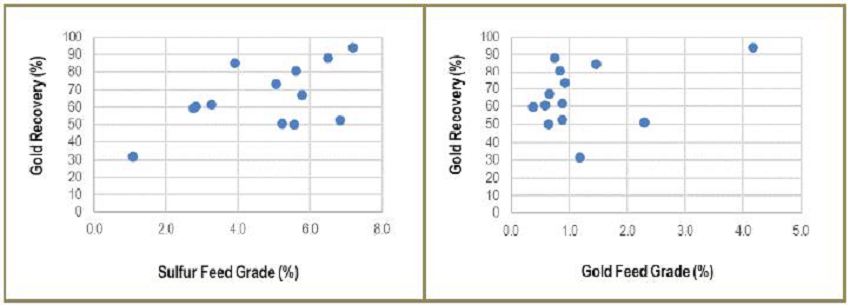

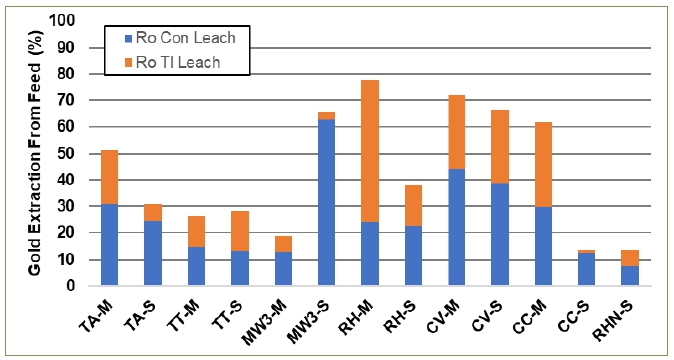

In 2023 two test programs were completed at Base Metallurgical Laboratories (BaseMet)—BL1244 and BL1346 provided the basis from which to conceptualize a preliminary process flowsheet that would produce gold and silver doré, and to evaluate the mineralization's metallurgical performance. Intervals from 29 drill holes representing seven zones were collected for the metallurgical evaluation. The zones include Twin Tunnels, Turn Around, Monitoring Well 3, Richmond Hill, Cleveland, Cole Creek, and Richmond Hill North. In all, 23 master composites (MC) were constructed to represent the oxide, mixed, and sulfide layers within each zone.

The initial investigation into three flowsheets to recover metals from the oxide, mixed, and sulfide layers included whole-ore-leach (WOL), flotation to a rougher concentrate followed by leaching of the rougher concentrate and tailings (float/leach), and flotation with pressure oxidation of the rougher concentrate before leaching (float/pressure oxidation/leach). The oxide MCs responded well to WOL, with an average of 87% Au extraction and 69% Ag extraction after a 48-hour leach. Cyanide consumption was below 0.6 kg/t. WOL for the mixed and sulfide MCs did not achieve similar results.

Rougher flotation followed by rougher concentrate leach and tailings leach tests were completed on the mixed and sulfide MC. The rougher flotation concentrates were reground before leaching, and rougher tailings were leached at the primary grind size of 75 μm. MCs for the tested mixed material ranged from a low of 26.3% to a high of 82.0%, averaging 65.4%. MCs for the tested sulfide material ranged from 24.0% to 66.3%, averaging 42.2%. BL1244 samples were tested with an alternative flowsheet to improve overall extraction using a POX stage before the concentrate leach. The float/POX/leach flowsheet resulted in rougher concentrate gold extraction of approximately 91.6% and 95.9% for the mixed and sulfide MCs, respectively. Assuming 90% rougher gold extraction after oxidation, the BL1346 MCs overall gold extraction for the mixed and sulfide samples would be approximately 77% and 74%, respectively. Processing the mixed and sulfide material using alternative oxidation processes such as Albion, Ecobiome, and Bioleach may provide more economical alternatives. Alternative processing for oxide materials, such heap leaching, may provide a more economical alternative.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 1.11 | Mineral Resources Estimate |

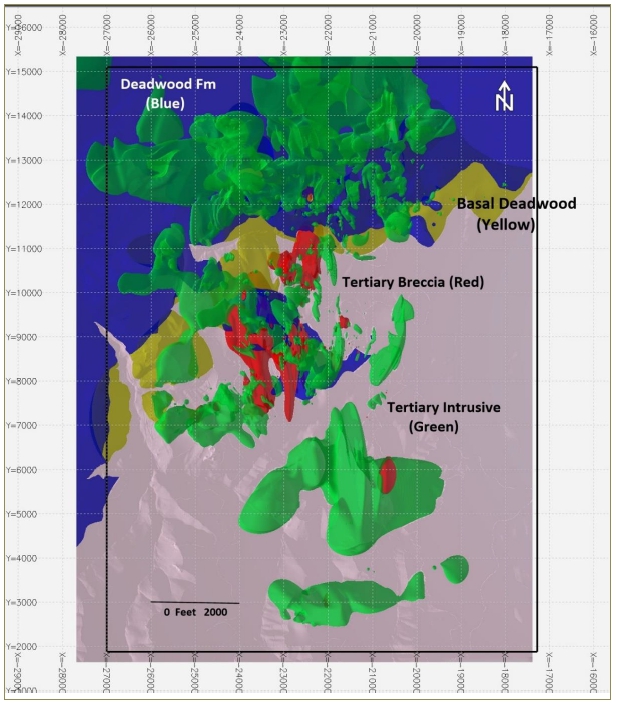

The mineral resource estimate is based on gold grades interpolated from five lithological domains; from youngest to oldest, these are Tertiary hydrothermal breccia, Tertiary intrusive Cambro-Ordovician Deadwood Formation, Deadwood Formation basal conglomerate-sandstone, and undivided Precambrian. These lithological domains were further partitioned into oxidized, mixed, and hypogene (sulfide) as the oxidation state was more significant for metal recovery than the host-rock type. The lithological domains were considered hard boundaries for resource estimation. A future opportunity for Dakota Gold to consider, following a review of the geological model, would be reviewing whether certain intersections of lithological domains could be treated as soft boundaries for interpolating gold grades.

The database used for estimation contained collar, survey, assay, and lithology data for 905 drill holes, including 69,401 assays. The estimate was carried out using ordinary kriging (OK) and blocks measuring 20 x 20 x 20 ft. The estimate was constrained by a conceptual pit to demonstrate reasonable prospects of eventual economic extraction.

Table 1-1 summarizes the mineral resource estimate based on degree of oxidation. The cutoff grade for the base case is 0.01 oz/short ton (ton) Au. Tons and ounces of gold have been rounded to the nearest 1,000.

Table 1-1: Richmond Hill Conceptual Pit-Constrained MRE at Variable Cutoff Grades

| Cutoff Au oz/ton | Redox | Classification | Au oz/ton | Au g/t | Tons | Tonnes | Ounces Au | |||||||||||||||||

| 0.0062 | Oxide | Indicated | 0.0190 | 0.65 | 16,512,000 | 14,979,000 | 314,000 | |||||||||||||||||

| 0.0085 | Mixed | Indicated | 0.0217 | 0.74 | 25,187,000 | 22,849,000 | 547,000 | |||||||||||||||||

| 0.0128 | Hypogene | Indicated | 0.0304 | 1.04 | 15,434,000 | 14,001,000 | 469,000 | |||||||||||||||||

| Total Indicated | 0.0233 | 0.80 | 57,133,000 | 51,829,000 | 1,330,000 | |||||||||||||||||||

| 0.0062 | Oxide | Inferred | 0.0142 | 0.49 | 30,244,000 | 27,437,000 | 429,000 | |||||||||||||||||

| 0.0085 | Mixed | Inferred | 0.0185 | 0.63 | 21,999,000 | 19,957,000 | 407,000 | |||||||||||||||||

| 0.0128 | Hypogene | Inferred | 0.0252 | 0.86 | 11,759,000 | 10,668,000 | 296,000 | |||||||||||||||||

| Total Inferred | 0.0177 | 0.61 | 64,002,000 | 58,062,000 | 1,132,000 | |||||||||||||||||||

| Notes: |

1 Weighted mean of oxide, mixed, and hypogene totals. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the estimated mineral resources will be converted into mineral reserves. Pit-constrained resources are stated at a range of cutoff gold grades depending on oxide state. Oxide recovery = 87%, mixed recovery = 65%, hypogene recovery = 42%. Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding. Mineral resource tonnage and grades are reported as undiluted. MRE is current as of October 5, 2023. Pit-Constrained at $1,900/oz; Royalty = 3.8%; Mill & G&A Cost = $8.00; Mine Cost = $1.80. |

| 1.12 | Environmental and Permitting |

Richmond Hill is currently progressing (successfully) through post-closure management pursuant to approved plans and various permits held by Homestake. As of October 2023, the South Dakota Department of Agriculture & Natural Resources (SDDANR) reports that Homestake complies with all reclamation and post-closure care requirements and with South Dakota’s mining laws and regulations (SDDANR 2023a). Upon exercise of the Richmond Hill Option Agreement, Dakota Gold would assume those requirements and the post-closure financial assurance, which is $40,634,534 at the time of this filing, but subject to periodic SDDANR review and adjustment.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Several permits will be required to develop the Richmond Hill resource, potentially including:

| · | Conditional Use Permit(s) (CUP) from Lawrence County |

| · | An amendment to the existing Richmond Hill Large Scale Mining Permit |

| · | Air- and water-discharge permits |

| · | Solid and hazardous waste permits. |

The Dakota Gold management and consulting team has decades of site-specific technical, environmental, and permitting experience with the Richmond Hill property and permitting in the State of South Dakota. There is also considerable environmental baseline information collected to support historical mine permitting in the 1980s and 1990s and reclamation and closure activities. This information and new and additional or updated data will be used to support new future mine design, development, and permitting efforts.

| 1.13 | Conclusions and Recommendations |

Dakota Gold optioned the Property from Barrick and acquired additional surface and mineral rights to create an exploration project comprising 2,748.67 acres. The Property contains more than a dozen exploration prospective areas, many of which host gold-silver mineralization in Precambrian metavolcanic and metasedimentary rocks or early Paleozoic sedimentary rocks, all of which have been intruded by Tertiary igneous rocks of varying compositions. Up to this Report’s date, Dakota Gold has tested several prospective areas with 103,657 ft of core drilling in 57 holes, revealing that the Property’s gold deposits are formed by structurally controlled, Tertiary-aged mineralizing systems that introduce gold-bearing fluids into permissive rocks containing chemical or physical traps, which allows gold deposition. Drilling conducted during the 2023 program demonstrated major fluid-path structures to be prospective targets for higher-grade mineralization, particularly along the MW3 structural trend and as projected northward under cover in the Carbonate Area.

The Property has several areas to consider for the purpose of generating any future resource:

| · | Additional drilling where the deposit limits have not been defined or lacked sufficient drill-hole density |

| · | Additional metallurgical testwork to understand the variability and attempt to improve recoveries |

| · | Incorporating silver in the resource estimate |

| · | Improve understanding of the geological model with the potential to improve metallurgical recoveries. |

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Drilling to date has not defined the limits of mineralization. Additional future drilling is recommended within the resource area to infill areas of significant mineral potential where insufficient drill-hole density precluded its inclusion in the maiden resource. Additional exposed, under-explored breccia pipes warrant further investigation, as well as additional breccias beneath the Paleozoic and Tertiary cover that remain undiscovered to the North. Shallow oxide mineralization in the Chism Gulch area is open to northward expansion, and the Carbonate Area of the property should be tested for Tertiary-aged replacement mineralization under the cover of the limestone that dominates the surface in that area.

The preliminary metallurgical testwork completed for the Maiden Resource was limited in scope using core from approximately 29 drill holes; the cores were composited into 23 samples for testing. There was a significant scatter in the results, with recoveries ranging from 74.9% to 92.6% for oxides, 18.7% to 82% for mixed oxide–sulfide, and 24% to 66.3% for sulfides. Significant opportunity exists in future resource compilations to run selective tests in specific zones of mineralization within the resource to determine what properties of the various zones of mineralization are affecting recoveries and to test alternative metallurgical treatments to push the lower recoveries toward higher recoveries recorded elsewhere within the resource area.

Silver is present at Richmond Hill; however, silver data sets from historical and current exploration programs have not been included in this S-K 1300 Initial Assessment and Technical Report Summary. Future work is recommended to verify and validate historical silver data, which could potentially add value to ore being processed for gold mineralization.

The Property is near a long-standing gold-mining center and within easy commuting distance of several communities where labor and supplies may be sourced. There is no reason to expect that a mine at the Richmond Hill Gold Project could not operate on a year-round schedule.

| April 30, 2024 | Page | 1- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 2 | Introduction |

| 2.1 | Registrant |

Dakota Gold Corp. (Dakota Gold is a Nevada-incorporated company with a head office in Lead, South Dakota. Dakota Gold is a gold exploration and development company focused on revitalizing the Homestake District in South Dakota. Dakota Gold has multiple gold mineral projects surrounding the historic Homestake mine, including the Richmond Hill Gold Project, which is the subject of this technical report summary. In addition to several prospect areas, the Project hosts the former Richmond Hill gold mine that operated from 1988 to 1993 as an open pit mine with heap leach facilities. The Project location is shown in Figure 2-1.

| 2.2 | Terms of Reference |

Dakota Gold contracted AKF Mining Services Inc. (AKF) of Vancouver, British Columbia (B.C.), to prepare an S-K 1300-compliant Initial Assessment and Technical Report for the Richmond Hill Gold Project (the Project). Mineral resources are reported using the definitions in Regulation S–K 1300 under Item 1300. Unless otherwise noted, all measurement units used in this Report are United States (US) customary units, and currency is expressed in United States dollars ($) as identified in the text.

AKF completed a review of historical and current exploration programs to verify and validate the drilling data and produce a maiden global mineral resource estimate for the Project. AKF contracted qualified persons (QP) to perform a quality assurance and quality control (QA/QC) examination of drilling results and create a geological model from which the maiden global mineral resource could be calculated. Further, Dakota Gold initiated a metallurgical study to determine the potential recoveries that might be obtained from a best-fit processing plant. As the Registrant, Dakota Gold has not previously filed a technical report summary on the Project.

| April 30, 2024 | Page | 2- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Source: Carter et al. (2002)

Figure 2-1: Property Location

| April 30, 2024 | Page | 2- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 2.3 | Qualified Persons |

This Report was prepared by the following Qualified Persons (QPs):

| · | Mr. Antonio Loschiavo, P.Eng., AKF Mining Services Inc. |

| · | Ms. Kelly McLeod, P.Eng., K-Met Consultants Inc. |

| · | Mr. Gregory Z. Mosher, P.Geo., Global Mineral Resource Services |

| · | Mr. Dale A. Sketchley, P.Geo., Acuity Geoscience Ltd. |

| · | Mr. Robert G. Wilson, P.Geo., RGW Geosciences. |

The QPs are responsible or co-responsible for the report chapters given in Table 2-1.

Table 2-1: Qualified Person Responsibilities

| Name | Company | Chapters Authored |

| Antonio Loschiavo | AKF Mining Services Inc. | Chapters 1.1, 1.2, 1.14, 1.15, 1.16, 3, 11.1 12, 13, 15, 16, 17, 18, 19, 20, 21, 24, & 25.6 |

| Kelly McLeod | K-Met Consultants Inc. | Chapters 1.10, 10, 22.4, & 23.3 |

| Gregory Z. Mosher | Global Mineral Resource Services | Chapters 1.4, 11 (except 11.1), 22.3, & 23.2 |

| Dale A. Sketchley | Acuity Geoscience Ltd. | Chapters 1.10, 1.11, 7.5, 8, 9, 22.2, 23.1 |

| Robert G. Wilson | RGW Geoscience | Chapters 1.1, 1.2, 1.4, 1.5, 1.6, 2, 4 to 6, 7.1, 7.2, 7.3, 74, 7.6, 21, 22.1, 22.2, & 25.1 to 25.5. |

| 2.4 | Personal Inspections |

On October 3, 2023, QPs Mr. Loschiavo, Mr. Mosher, Mr. Sketchley, and Mr. Wilson conducted a site visit of the Project and observed two operating diamond drill rigs, including core handling procedures in the field as well as visiting the secure core storage building. On October 4 and 5, the QPs visited the core logging and processing facilities in Lead, South Dakota, and examined diamond drill core, the core logging and photographing procedures, and witnessed core cutting and sampling. The QPs also visited the secure storage locker where historical Project documents are kept.

Head QP Loschiavo has been working on the Project since 2021, with frequent field visits to the claims. Most of the field visits were to evaluate the existing infrastructure, i.e., dumps, water treatment system, historical leach pads, current drilling pads, and core logging facility. Most of the time, it was to facilitate the historical data collection. This consisted of Homestake Adams Research and Cultural Center (HARCC) facility, Barrick’s archive storage warehouse in Central City, and storage lockers.

QP Ms. McLeod has not visited the Project but has coordinated metallurgical laboratory testing of composite drill-core samples for gold and silver recovery. A site visit is not generally undertaken for early-stage projects with no on-site process-related infrastructure.

| April 30, 2024 | Page | 2- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 2.5 | Date |

Information in this Report is current as of October 6, 2023.

| 2.6 | Sources of Information |

Reports and documents cited in Chapters 24 and 25 were used to support the preparation of this Report.

| 2.7 | Previous Technical Report Summaries |

Dakota Gold has not previously filed a technical report summary on the Project.

| 2.8 | Units of Measure and Metric Equivalents |

All units of measure used in this Report are United States (US) customary units unless otherwise noted:

Currency

Currency is expressed in United States dollars ($).

Units of Measure and Metric Equivalents

All units of measure used in this Report are United States (US) customary units unless otherwise noted:

Linear Measure

| 1 centimeter | = 0.3937 inches | |

| 1 meter | = 3.2808 feet | = 1.0936 yards |

| 1 kilometer | = 0.6214 miles |

Area Measure

| 1 hectare | = 2.471 acres | = 0.0039 square miles |

Capacity Measure (liquid)

| 1 liter | = 0.2642 United States (US) gallons |

Weight

| 1 tonne | = 1.1023 tons | = 2,205 pounds |

| 1 kilogram | = 2.205 pounds | |

| 1 troy ounce (oz) | = 31.1034768 grams |

| April 30, 2024 | Page | 2- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| 3 | Property Description |

Dakota Gold’s Richmond Hill Gold Project comprises 2,746.67 acres of surface and mineral rights with attendant facilities. The Project includes the past-producing Richmond Hill mine and the historic mines of the Carbonate District, as well as multiple prospective areas where gold has been drill-intersected.

| 3.1 | Project Location |

The Project is in the western portion of Lawrence County, South Dakota (Figure 2-1), approximately 2.2 miles northwest of Lead, South Dakota.

The center of the main claim block for the Project is at approximately 44° 23’ N latitude and 103° 51’ W longitude. The former Richmond Hill mine is approximately 44° 22’ 45” N latitude and 103° 51’ 30” W longitude.

| 3.2 | Ownership |

St. Joe Gold Corporation (St. Joe) developed the former Richmond Hill gold mine in 1987. Bond Gold Corporation (Bond Gold) acquired the St. Joe Gold Corporation gold division in 1988. The mine was permitted, and construction of the mine facilities began in April 1988 under the ownership of Bond Gold. In 1989, LAC Minerals (USA) LLC (LAC) acquired Bond Gold. Barrick Gold Corporation (Barrick) acquired LAC Minerals in November 1994. The Homestake Mining (Homestake) merged with Barrick in 2001. LAC and Homestake merged in October 2023, and St. Joe, Bond Gold, LAC, and Homestake remain Barrick's wholly owned subsidiary companies. All other third party property owners (James E. Peterson) forming the Richmond Hill Gold Project area are held by Barrick under agreement through one or more of Barrick’s subsidiaries.

Dakota Gold entered into a three-year option agreement with Barrick in 2021 to acquire the Richmond Hill Project, with the mineral tenure primarily held in the names of LAC and Homestake (see discussion in 3.3 and 3.4). In 2022, the option was amended to extend the option period until March 7, 2026.

| 3.3 | Mineral Tenure Holdings |

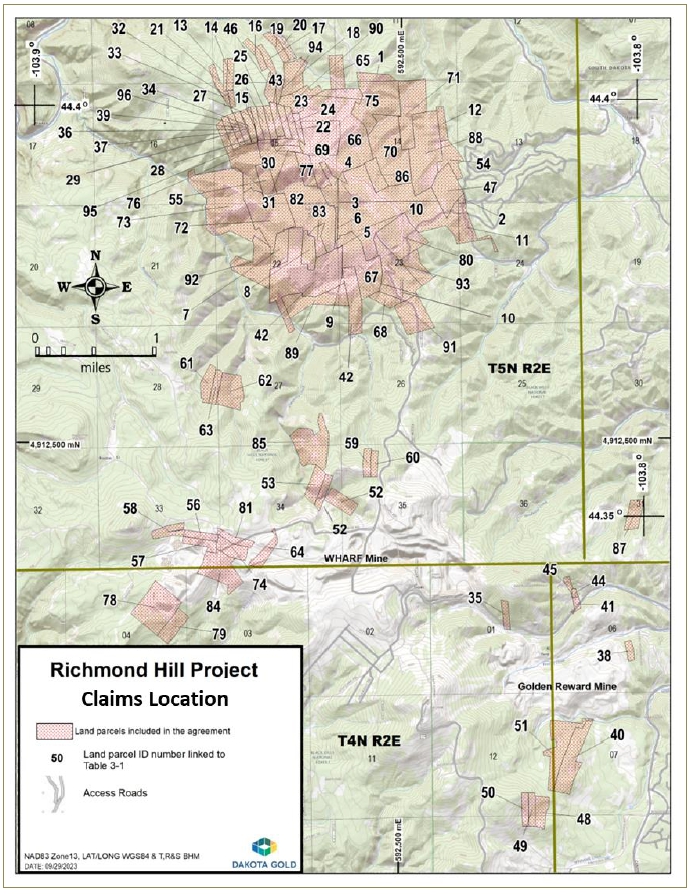

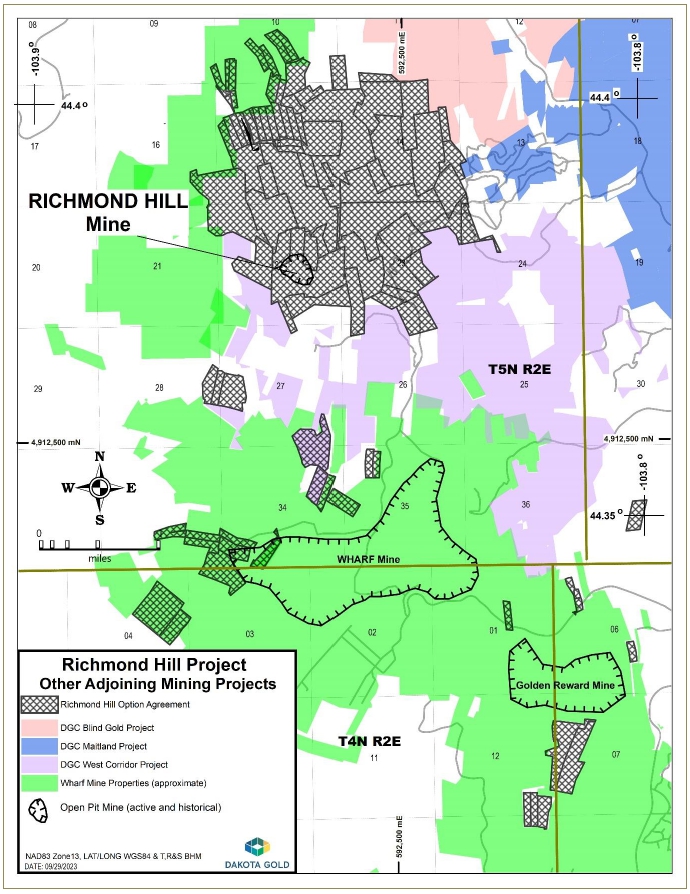

Within the western portion of Lawrence County, South Dakota the Property covers portions of Sections 9 to 11, 13 to 16, 21 to 24, 26 to 28, 33, and 34, Township 5 North, Range 2 East, Black Hills Meridian, plus portions of Sections 1, 3, 4, 12, and 13, Township 4 North, Range 2 East, Black Hills Meridian, and a portion of Section 31, Township 5 North, Range 3 East, Black Hills Meridian, plus portions of Sections 6 and 7, Township 4 North, Range 3 East, Black Hills Meridian (Dakota Gold n.d. c 2023) (Figure 3-1). The Property is contiguous with Dakota Gold’s West Corridor and Blind Gold Properties and is approximately half a mile north of the producing Wharf Gold mine owned by Coeur Mining (Figure 3-2).

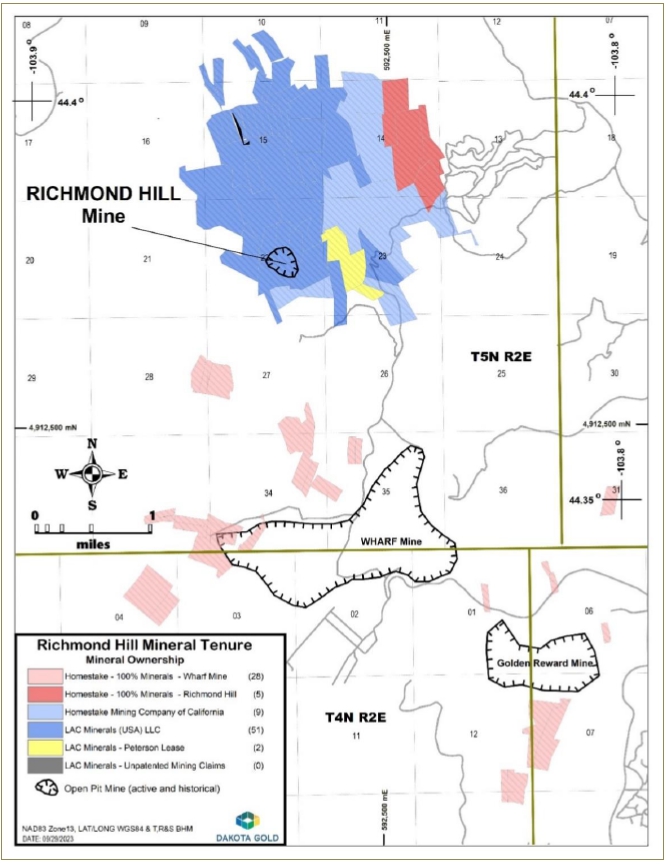

The Richmond Hill property in the option agreement comprises 94 Lawrence Count, South Dakota, Land parcels and two unpatented mining claims. The 94 land parcels comprise 246 mineral survey patented load claims and purchased government lots. Twenty-nine (29) parcels consisted only of the mineral rights, with the surface belonging to various owners (Figure 3-3).Table 3-1 contains a claims listing.

| April 30, 2024 | Page | 3- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Source: Dakota Gold (2024)

Figure 3-1: Claims Location

| April 30, 2024 | Page | 3- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Source: Dakota Gold (2024)

Figure 3-2: Nearby Properties

| April 30, 2024 | Page | 3- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Source: Dakota Gold (2024)

Figure 3-3: Richmond Hill Gold Claims with Mineral Ownership

| April 30, 2024 | Page | 3- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

Table 3-1: Richmond Hill Gold Property Claims

| MAP ID |

County Tax Parcel ID | Mineral Property Type | Mineral Survey # |

Patented Lode or Government Lot |

Property Owner |

| 1 | 16000-00502-110-10 | Patented Mineral Properties | Govt. Lot 10 | Homestake Mining Company of California | |

| 2 | 16000-00502-130-12 | Patented Mineral Properties | Govt. Lot 12 | Homestake Mining Company of California | |

| 3 | 16000-00502-140-02 | Patented Mineral Properties | Govt. Lot 2 | Homestake Mining Company of California | |

| Govt. Lot 3 | |||||

| Govt. Lot 4 | |||||

| Govt. Lot 7 | |||||

| Govt. Lot 8 | |||||

| Govt. Lot 9 | |||||

| Govt. Lot 10 | |||||

| 4 | 16000-00502-150-00 | Patented Mineral Properties | Govt. Lot 3 | LAC Minerals (USA) LLC | |

| Govt. Lot 9 | |||||

| Govt. Lot 10 | |||||

| Govt. Lot 12 | |||||

| Govt. Lot 13 | |||||

| 5 | 16000-00502-150-10 | Patented Mineral Properties | Tract 0102-A | LAC Minerals (USA) LLC | |

| Tract 0102-B | |||||

| Tract 0103-B | |||||

| Tract 0103-A | |||||

| 6 | 16000-00502-220-01 | Patented Mineral Properties | Govt. Lot 1 | LAC Minerals (USA) LLC | |

| 7 | 16000-00502-220-04 | Patented Mineral Properties | Govt. Lot 2 | LAC Minerals (USA) LLC | |

| Govt. Lot 4 | |||||

| 8 | 16000-00502-220-10 | Patented Mineral Properties | Govt. Lot 5 | LAC Minerals (USA) LLC | |

| 9 | 16000-00502-230-00 | Patented Mineral Properties | Govt. Lot 9 | LAC Minerals (USA) LLC | |

| Govt. Lot 10 | |||||

| 10 | 16000-00502-230-01 | Patented Mineral Properties | Govt. Lot 1 | Homestake Mining Company of California | |

| Govt. Lot 2 | |||||

| Govt. Lot 3 | |||||

| Govt. Lot 4 | |||||

| Govt. Lot 5 | |||||

| Govt. Lot 6 | |||||

| Govt. Lot 7 | |||||

| Govt. Lot 8 | |||||

| 11 | 16000-00502-240-12 | Patented Mineral Properties | Govt. Lot 12 | Homestake Mining Company of California | |

| Govt. Lot 13 | |||||

| Govt. Lot 14 | |||||

| 12 | 26280-00348-000-00 | Minerals Only | 348 | Old Reliable | Homestake Mining Company of California |

| 13 | 26280-00407-000-00 | Patented Mineral Properties | 407 | Enterprise | LAC Minerals (USA) LLC |

| 14 | 26280-00408-000-10 | Patented Mineral Properties | 408 | Surprise | LAC Minerals (USA) LLC |

| 15 | 26280-00417-000-00 | Patented Mineral Properties | 417 | Carbonate | LAC Minerals (USA) LLC |

| 16 | 26280-00425-000-00 | Patented Mineral Properties | 425 | Jay Gould | LAC Minerals (USA) LLC |

| 17 | 26280-00426-000-00 | Patented Mineral Properties | 426 | Garfield | LAC Minerals (USA) LLC |

| 18 | 26280-00428-000-00 | Patented Mineral Properties | 428 | Far West | LAC Minerals (USA) LLC |

| 19 | 26280-00437-000-00 | Patented Mineral Properties | 437 | Katie | LAC Minerals (USA) LLC |

| 20 | 26280-00438-000-00 | Patented Mineral Properties | 438 | Arthur | LAC Minerals (USA) LLC |

| 21 | 26280-00440-000-00 | Patented Mineral Properties | 440 | Hartshorn | LAC Minerals (USA) LLC |

| 22 | 26280-00441-000-00 | Patented Mineral Properties | 441 | Minnie | LAC Minerals (USA) LLC |

| 23 | 26280-00442-000-00 | Patented Mineral Properties | 442A | Ultimo | LAC Minerals (USA) LLC |

| April 30, 2024 | Page | 3- |

|

|

Dakota Gold Corp.

S-K 1300 Initial Assessment And Technical Report Summary Richmond Hill Gold Project, South Dakota, U.S.A. |

| MAP ID |

County Tax Parcel ID | Mineral Property Type | Mineral Survey # |

Patented Lode or Government Lot |

Property Owner |

| 24 | 26280-00443-000-00 | Patented Mineral Properties | 443 | Tidiout | LAC Minerals (USA) LLC |

| 25 | 26280-00447-000-00 | Patented Mineral Properties | 447A | Utica | LAC Minerals (USA) LLC |

| 26 | 26280-00448-000-00 | Patented Mineral Properties | 448A | Antietam | LAC Minerals (USA) LLC |

| 27 | 26280-00449-000-10 | Patented Mineral Properties | 449 | Blue Bird | LAC Minerals (USA) LLC |

| 28 | 26280-00450-000-00 | Patented Mineral Properties | 450 | Carbonate Fraction #1 | LAC Minerals (USA) LLC |

| 29 | 26280-00451-000-00 | Patented Mineral Properties | 451 | Carbonate Fraction #2 | LAC Minerals (USA) LLC |

| 30 | 26280-00465-000-00 | Patented Mineral Properties | 465 | Mutual | LAC Minerals (USA) LLC |

| 31 | 26280-00466-000-00 | Patented Mineral Properties | 466 | Washington | LAC Minerals (USA) LLC |

| 32 | 26280-00473-000-00 | Patented Mineral Properties | 473 | May Queen | LAC Minerals (USA) LLC |

| 33 | 26280-00474-000-00 | Patented Mineral Properties | 474 | Hercules | LAC Minerals (USA) LLC |

| 34 | 26280-00489-000-00 | Patented Mineral Properties | 489 | Adelphi | LAC Minerals (USA) LLC |

| 35 | 26280-00675-000-00 | Minerals Only | 675 | General Grant | Homestake Mining Company of California |

| 36 | 26280-00679-000-00 | Patented Mineral Properties | 679 | Spanish | LAC Minerals (USA) LLC |

| 37 | 26280-00680-000-00 | Patented Mineral Properties | 680 | Richmond | LAC Minerals (USA) LLC |

| 38 | 26340-00839-000-00 | Minerals Only | 839 | Boss | Homestake Mining Company of California |

| 39 | 26340-00874-000-00 | Patented Mineral Properties | 874 | Brooklyn | LAC Minerals (USA) LLC |

| 40 | 26340-00930-000-00 | Minerals Only | 930 | Big Sam | Homestake Mining Company of California |

| 930 | Francis | ||||

| 930 | Marseillase | ||||

| 930 | Minnie | ||||

| 930 | Ruby Hill | ||||

| 930 | Glenwood | ||||

| 41 | 26340-00935-000-20 | Minerals Only | 935 | South Lyon | Homestake Mining Company of California |

| 44 | 26342-00935-010-00 | ||||

| 45 | 26342-00935-020-00 | ||||

| 42 | 26340-00977-000-00 | Patented Mineral Properties | 977 | J.M. | LAC Minerals (USA) LLC |

| 977 | Todd | ||||

| 977 | Earle | ||||

| 977 | Minnie C | ||||

| 977 | Lyda B | ||||

| 977 | Sister | ||||

| 977 | Arthur L | ||||

| 977 | Cass | ||||

| 977 | Newell | ||||

| 977 | Calvin P | ||||

| 977 | Emma | ||||

| 977 | Virginia | ||||

| 977 | Juliett | ||||

| 977 | Donald W | ||||

| 977 | Helen | ||||

| 977 | Atwood | ||||

| 977 | Little Bonanze | ||||

| 977 | Ella | ||||

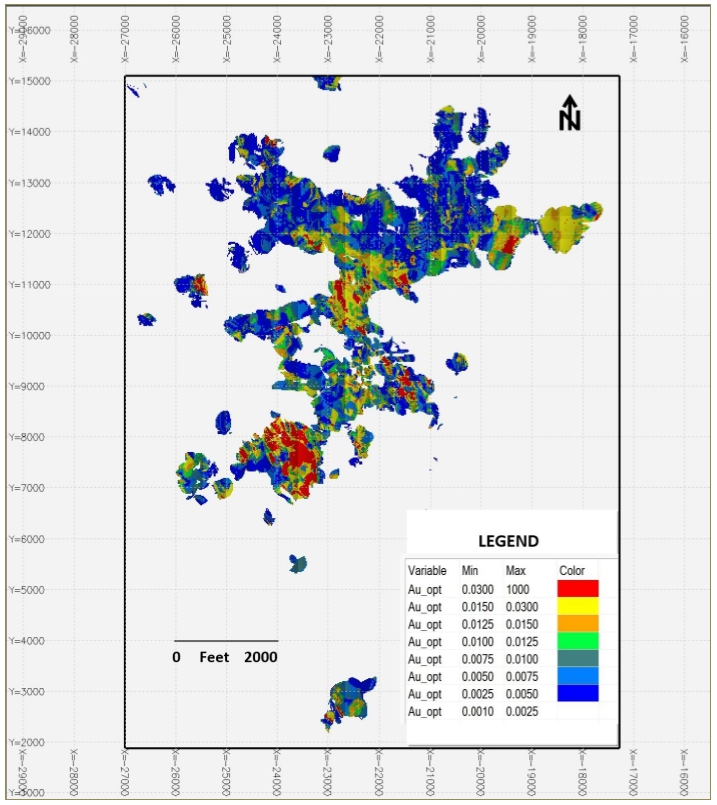

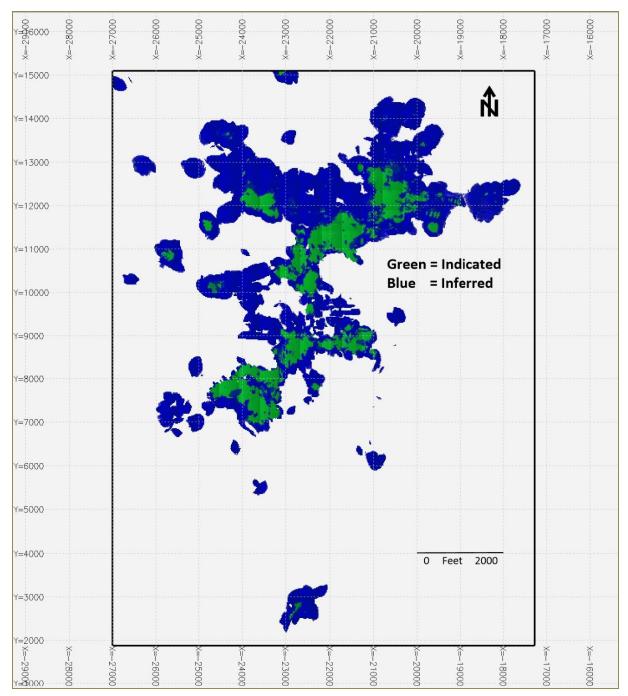

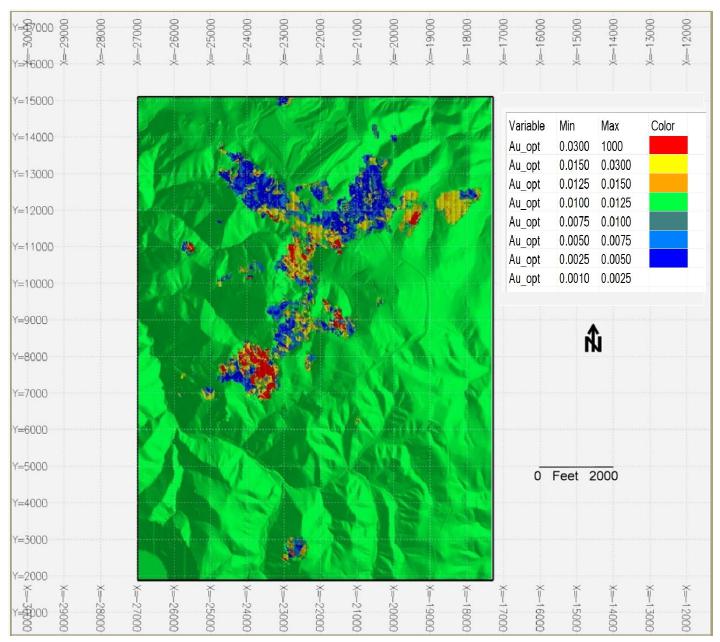

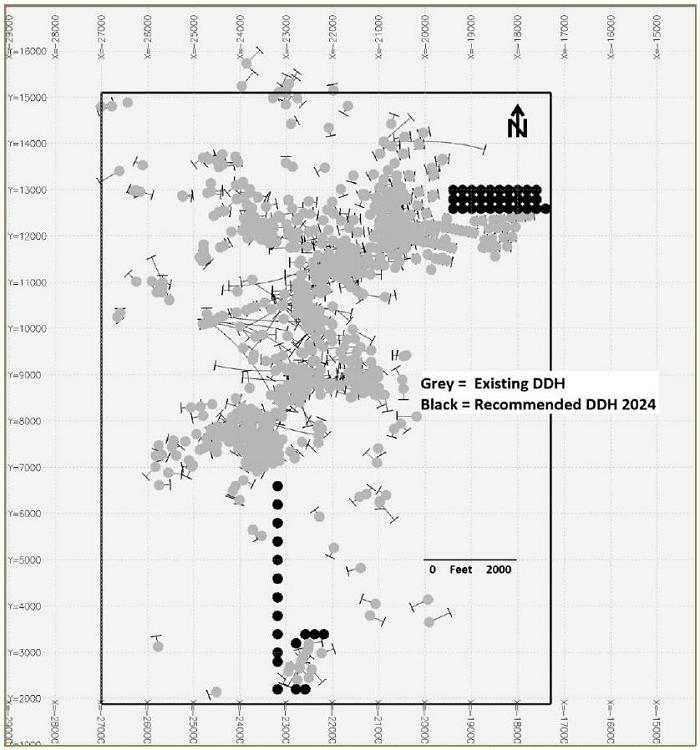

| 977 | Ralph K |