UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) April 25, 2024

| Commission | Registrant; State of Incorporation; | IRS Employer | ||

| File Number | Address; and Telephone Number | Identification No. | ||

| 1-9513 |

CMS ENERGY CORPORATION (A Michigan Corporation) |

38-2726431 | ||

| 1-5611 |

CONSUMERS ENERGY COMPANY (A

Michigan Corporation) |

38-0442310 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

||

| CMS Energy Corporation Common Stock, $0.01 par value | CMS | New York Stock Exchange | ||

| CMS Energy Corporation 5.625% Junior Subordinated Notes due 2078 | CMSA | New York Stock Exchange | ||

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2078 | CMSC | New York Stock Exchange | ||

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2079 | CMSD | New York Stock Exchange | ||

| CMS Energy Corporation, Depositary Shares, each representing a 1/1,000th interest in a share of 4.200% Cumulative Redeemable Perpetual Preferred Stock, Series C | CMS PRC | New York Stock Exchange | ||

| Consumers Energy Company Cumulative Preferred Stock, $100 par value: $4.50 Series | CMS-PB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company: CMS Energy Corporation ¨ Consumers Energy Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. CMS Energy Corporation ¨ Consumers Energy Company ¨

Item 2.02. Results of Operations and Financial Condition.

On April 25, 2024, CMS Energy Corporation (“CMS Energy”) issued a News Release, in which it announced its 2024 first quarter results. Attached as Exhibit 99.1 to this report and incorporated herein by reference is a copy of the CMS Energy News Release, furnished as a part of this report.

Exhibit 99.1 contains certain financial measures that are considered “non-GAAP financial measures” as defined in Securities and Exchange Commission rules. Other than forward-looking earnings guidance, Exhibit 99.1 contains a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, or other items. Management views adjusted earnings as a key measure of the company’s present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the company uses adjusted earnings to measure and assess performance. Because CMS Energy is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, reported earnings in future periods, Exhibit 99.1 does not contain reported earnings guidance nor a reconciliation for the comparable future period earnings. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the reported earnings. All references to net income refer to net income available to common stockholders and references to earnings per share are on a diluted basis.

Item 7.01. Regulation FD Disclosure.

The information set forth in the CMS Energy News Release dated April 25, 2024, attached as Exhibit 99.1, is incorporated by reference in response to this Item 7.01.

CMS Energy will hold a webcast to discuss its 2024 first quarter results and provide a business and financial outlook on April 25 at 9:30 a.m. (ET). A copy of the CMS Energy presentation is furnished as Exhibit 99.2 to this report. A webcast of the presentation will be available on the CMS Energy website, www.cmsenergy.com.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Index | |

| 99.1 | CMS Energy News Release dated April 25, 2024 |

| 99.2 | CMS Energy presentation dated April 25, 2024 |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| CMS ENERGY CORPORATION | ||

| Dated: April 25, 2024 | By: | /s/ Rejji P. Hayes |

| Rejji P. Hayes | ||

| Executive Vice President and Chief Financial Officer | ||

| CONSUMERS ENERGY COMPANY | ||

| Dated: April 25, 2024 | By: | /s/ Rejji P. Hayes |

| Rejji P. Hayes | ||

| Executive Vice President and Chief Financial Officer | ||

Exhibit 99.1

CMS Energy Announces First Quarter Results for 2024, Reaffirms 2024 Adjusted EPS Guidance

JACKSON, Mich., April 25, 2024 – CMS Energy announced today reported earnings per share of $0.96 for the first quarter of 2024, compared to $0.69 per share for 2023. The company’s adjusted earnings per share for the first quarter were $0.97, compared to $0.70 per share for 2023 primarily due to higher weather-normalized sales and lower storm restoration costs.

CMS Energy reaffirmed its 2024 adjusted earnings guidance to $3.29 to $3.35 per share (*See below for important information about non-GAAP measures) and long-term adjusted EPS growth of 6 to 8 percent, with continued confidence toward the high end.

“We experienced a warmer than normal winter but remain on track to deliver our full year earnings guidance,” said Garrick Rochow, President and CEO of CMS Energy and Consumers Energy. “I continue to be pleased with our performance, namely in the progress of our electric Reliability Roadmap and economic development efforts while continuing to lead the clean energy transformation, which will be further supported by Michigan’s new clean energy law.”

CMS Energy (NYSE: CMS) is a Michigan-based energy provider featuring Consumers Energy as its primary business. It also owns and operates independent power generation businesses.

# # #

CMS Energy will hold a webcast to discuss its 2024 first quarter results and provide a business and financial outlook on Thursday, April 25 at 9:30 a.m. (EDT). To participate in the webcast, go to CMS Energy’s homepage (cmsenergy.com) and select “Events and Presentations.”

Important information for investors about non-GAAP measures and other disclosures.

This news release contains non-Generally Accepted Accounting Principles (non-GAAP) measures, such as adjusted earnings. All references to net income refer to net income available to common stockholders and references to earnings per share are on a diluted basis.

Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, or other items. Management views adjusted earnings as a key measure of the company's present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the company uses adjusted earnings to measure and assess performance. Because the company is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, the company's reported earnings in future periods, the company is not providing reported earnings guidance nor is it providing a reconciliation for the comparable future period earnings. The company's adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the reported earnings.

This news release contains "forward-looking statements." The forward-looking statements are subject to risks and uncertainties that could cause CMS Energy's and Consumers Energy's results to differ materially. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy's and Consumers Energy's Securities and Exchange Commission filings.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

Media Contacts: Katie Carey, 517/740-1739

Investment Analyst Contact: Travis Uphaus, 517/817-9241

Page 1 of 3

CMS ENERGY CORPORATION

Consolidated Statements of Income

(Unaudited)

| In Millions, Except Per Share Amounts | ||||||||

| Three Months Ended | ||||||||

| 3/31/24 | 3/31/23 | |||||||

| Operating revenue | $ | 2,176 | $ | 2,284 | ||||

| Operating expenses | 1,764 | 1,970 | ||||||

| Operating Income | 412 | 314 | ||||||

| Other income | 86 | 56 | ||||||

| Interest charges | 177 | 147 | ||||||

| Income Before Income Taxes | 321 | 223 | ||||||

| Income tax expense | 58 | 29 | ||||||

| Net Income | 263 | 194 | ||||||

| Loss attributable to noncontrolling interests | (24 | ) | (10 | ) | ||||

| Net Income Attributable to CMS Energy | 287 | 204 | ||||||

| Preferred stock dividends | 2 | 2 | ||||||

| Net Income Available to Common Stockholders | $ | 285 | $ | 202 | ||||

| Diluted Earnings Per Average Common Share | $ | 0.96 | $ | 0.69 | ||||

Page 2 of 3

CMS ENERGY CORPORATION

Summarized Consolidated Balance Sheets

(Unaudited)

| In Millions | ||||||||

| As of | ||||||||

| 3/31/24 | 12/31/23 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 802 | $ | 227 | ||||

| Restricted cash and cash equivalents | 59 | 21 | ||||||

| Other current assets | 2,230 | 2,591 | ||||||

| Total current assets | 3,091 | 2,839 | ||||||

| Non-current assets | ||||||||

| Plant, property, and equipment | 25,280 | 25,072 | ||||||

| Other non-current assets | 5,530 | 5,606 | ||||||

| Total Assets | $ | 33,901 | $ | 33,517 | ||||

| Liabilities and Equity | ||||||||

| Current liabilities (1) | $ | 1,523 | $ | 1,822 | ||||

| Non-current liabilities (1) | 8,066 | 7,927 | ||||||

| Capitalization | ||||||||

| Debt and finance leases (excluding securitization debt) (2) | 15,019 | 14,856 | ||||||

| Preferred stock and securities | 224 | 224 | ||||||

| Noncontrolling interests | 560 | 581 | ||||||

| Common stockholders' equity | 7,722 | 7,320 | ||||||

| Total capitalization (excluding securitization debt) | 23,525 | 22,981 | ||||||

| Securitization debt (2) | 787 | 787 | ||||||

| Total Liabilities and Equity | $ | 33,901 | $ | 33,517 | ||||

| (1) | Excludes debt and finance leases. |

| (2) | Includes current and non-current portions. |

CMS ENERGY CORPORATION

Summarized Consolidated Statements of Cash Flows

(Unaudited)

| In Millions | ||||||||

| Three Months Ended | ||||||||

| 3/31/24 | 3/31/23 | |||||||

| Beginning of Period Cash and Cash Equivalents, Including Restricted Amounts | $ | 248 | $ | 182 | ||||

| Net cash provided by operating activities | 956 | 1,040 | ||||||

| Net cash used in investing activities | (637 | ) | (651 | ) | ||||

| Cash flows from operating and investing activities | 319 | 389 | ||||||

| Net cash provided by financing activities | 294 | 27 | ||||||

| Total Cash Flows | $ | 613 | $ | 416 | ||||

| End of Period Cash and Cash Equivalents, Including Restricted Amounts | $ | 861 | $ | 598 | ||||

Page 3 of 3

CMS ENERGY CORPORATION

Reconciliation of GAAP Net Income to Non-GAAP Adjusted Net Income

(Unaudited)

| In Millions, Except Per Share Amounts | ||||||||

| Three Months Ended | ||||||||

| 3/31/24 | 3/31/23 | |||||||

| Net Income Available to Common Stockholders | $ | 285 | $ | 202 | ||||

| Reconciling items: | ||||||||

| Other exclusions from adjusted earnings** | 4 | 3 | ||||||

| Tax impact | (1 | ) | (1 | ) | ||||

| Voluntary separation program | * | - | ||||||

| Tax impact | (*) | - | ||||||

| Adjusted net income – non-GAAP | $ | 288 | $ | 204 | ||||

| Average Common Shares Outstanding - Diluted | 297.2 | 291.2 | ||||||

| Diluted Earnings Per Average Common Share | ||||||||

| Reported net income per share | $ | 0.96 | $ | 0.69 | ||||

| Reconciling items: | ||||||||

| Other exclusions from adjusted earnings** | 0.01 | 0.01 | ||||||

| Tax impact | (*) | (*) | ||||||

| Voluntary separation program | * | - | ||||||

| Tax impact | (*) | - | ||||||

| Adjusted net income per share – non-GAAP | $ | 0.97 | $ | 0.70 | ||||

* Less than $0.5 million or $0.01 per share.

** Includes restructuring costs and business optimization initiative.

Management views adjusted (non-Generally Accepted Accounting Principles) earnings as a key measure of the Company's present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the Company uses adjusted earnings to measure and assess performance. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, or other items. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for reported earnings.

Exhibit 99.2

First Quarter 2024 Results & Outlook April 25, 2024

2 Enter “so what” if necessary – Century Gothic, Bold, Size 18 or smaller This presentation is made as of the date hereof and contains “forward - looking statements” as defined in Rule 3b - 6 of the Securit ies Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward - looking statements are subject to risks and uncertainties. All forward - lo oking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commissi on filings. Forward - looking statements should be read in conjunction with “FORWARD - LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s most recent Form 10 - K and as updated in reports CMS Energy and Consumers Energy file with the Securities and Exchange Commission. CMS Energy’s and Cons ume rs Energy’s “FORWARD - LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors th at could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no ob ligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof. The presentation also includes non - GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com . Investors and others should note that CMS Energy routinely posts important information on its website and considers the Inves tor Relations section, www.cmsenergy.com/investor - relations , a channel of distribution. Presentation endnotes are included after the appendix. 2 3 Investment Thesis . . . . . . is simple, clean and lean.

4 Reliability and Decarbonization Opportunities . . . . . . a s we harden our system and lead the Clean Energy Transformation .

5 Expansive Economic Development Efforts . . . . . . drive meaningful growth across Michigan and reduce customer rates.

6 Financial Results & Outlook . . . . . . o n track to deliver in 2024 and beyond.

7 2024 Adjusted EPS . . . . . . continued confidence toward the high end. . . . managing through COVID - 19 risks.

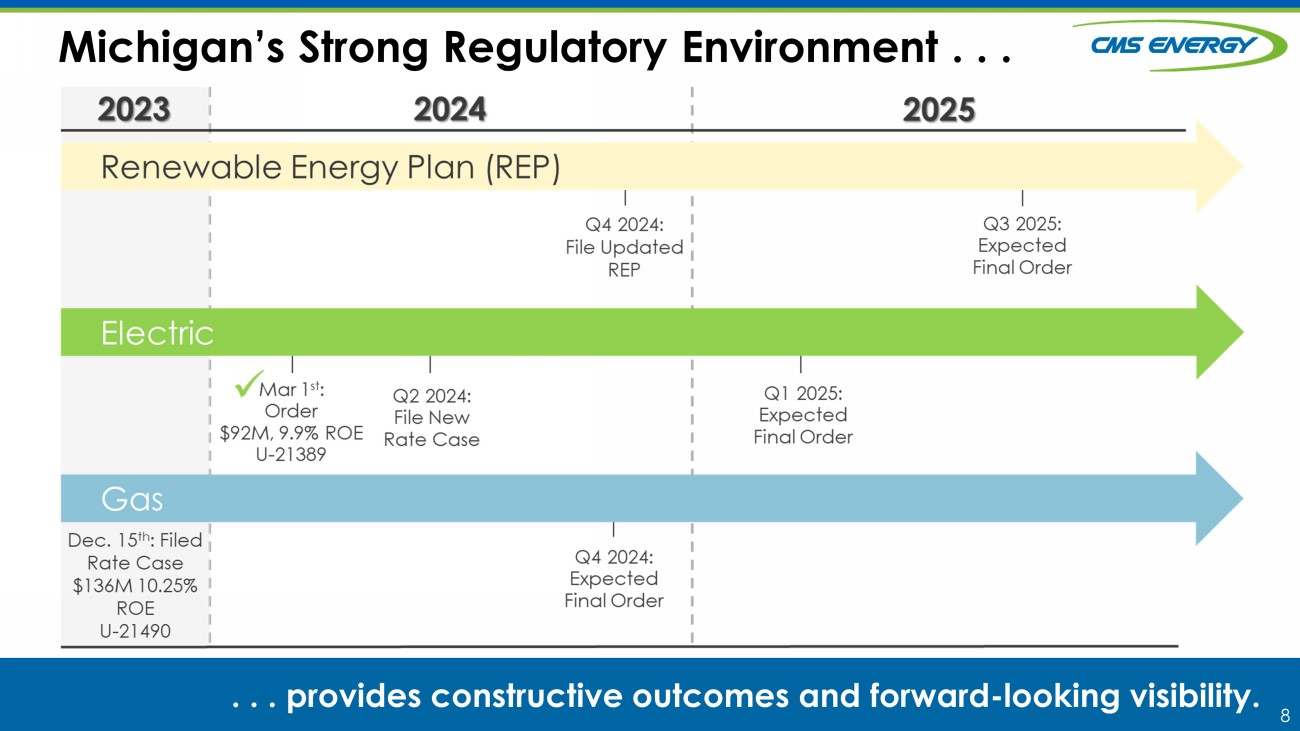

8 Michigan’s Strong Regulatory Environment . . . . . . p rovides constructive outcomes and forward - looking visibility.

9 Strong Balance Sheet . . . . . . m aintains credit metrics and solid investment - grade ratings.

10 Industry - Leading Financial Performance . . . . . . for over two decades, regardless of conditions.

12 12 Appendix

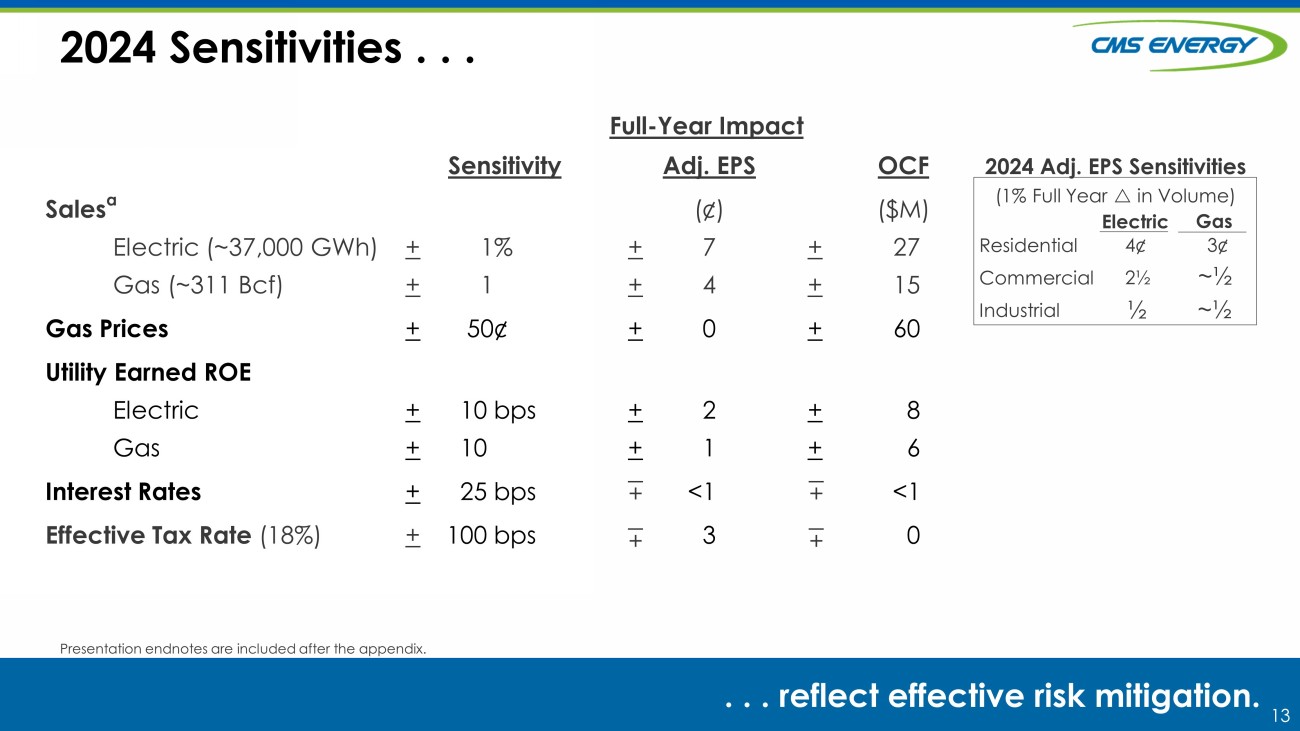

11 11 Q&A Thank You! 13 2024 Sensitivities . . . . . . r eflect effective risk mitigation. Presentation endnotes are included after the appendix. Full - Year Impact Sensitivity Adj. EPS OCF Sales a Electric (~37,000 GWh) Gas (~311 Bcf) + + 1% 1 + + ( ¢) 7 4 + + ($M) 27 15 Gas Prices + 50 ¢ + 0 + 60 Utility Earned ROE Electric Gas + + 10 bps 10 + + 2 1 + + 8 6 Interest Rates + 25 bps <1 <1 Effective Tax Rate (18%) + 100 bps 3 0 + + + + Electric Residential Commercial Industrial 4¢ 2½ 3¢ (1% Full Year in Volume) 2024 Adj. EPS Sensitivities Gas ½ ~½ ~½ 14 2024 Planned Financings . . . . . . fund customer investments and provide ample liquidity.

15 Updated Customer Investment Plan . . . . . . delivers benefits for customers and investors.

16 16 ENDNOTES

17 Slide 3: a RRA state regulatory energy rankings, May 2023. Regulatory Research Associates, a group within S&P Global Commodity Insights Slide 5: a New or expanding load since 2015 as of April 2024 Slide 6: a $17B utility capital investment plan (2024 - 2028), up $1.5B from prior plan (2023 - 2027) Slide 7: a Adjusted EPS; See GAAP reconciliation on slide 19 Slide 10: a Excludes discontinued operations Slide 13: a Reflects 2024 sales forecast; weather - normalized Slide 14 : a Excludes tax - exempt remarketing in October 2024 b $1,791M in unreserved revolvers + $776M of unrestricted cash; excludes cash unavailable for debt retirement, such as held at NorthStar subs Slide 15: a Assumes $24.6B rate base in 2023, $35.2B in 2028, CAGR b Over plan period years 2024 - 2028 Presentation Endnotes 17 18 GAAP Reconciliation CMS Energy provides historical financial results on both a reported (GAAP) and adjusted (non - GAAP) basis and provides forward - lo oking guidance on an adjusted basis.

During an oral presentation, references to “earnings” are on an adjusted basis. All references to net income refer to net income ava ila ble to common stockholders and references to earnings per share are on a diluted basis. Adjustments could include items such as discontinued operations, asset sales, impa irm ents, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items f rom prior years, unrealized gains or losses from mark - to - market adjustments, or other items. Management views adjusted earnings as a key measure of the company’s present operating fi nancial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the company uses adjusted earnings to measure a nd assess performance. Because the company is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavo rab ly, the company's reported earnings in future periods, the company is not providing reported earnings guidance nor is it providing a reconciliation for the comparable futu re period earnings. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the r epo rted earnings. 18 CMS ENERGY CORPORATION Reconciliation of GAAP Net Income to Non - GAAP Adjusted Net Income (Unaudited) Net Income Available to Common Stockholders $ 285 $ 202 Reconciling items: Other exclusions from adjusted earnings** 4 3 Tax impact (1) (1) Voluntary separation program * - Tax impact (*) - Adjusted net income – non-GAAP $ 288 $ 204 Average Common Shares Outstanding - Diluted 297.2 291.2 Diluted Earnings Per Average Common Share Reported net income per share $ 0.96 $ 0.69 Reconciling items: Other exclusions from adjusted earnings** 0.01 0.01 Tax impact (*) (*) Voluntary separation program * - Tax impact (*) - Adjusted net income per share – non-GAAP $ 0.97 $ 0.70 * Less than $0.5 million or $0.01 per share.

**Includes restructuring costs and business optimization initiative. Management views adjusted (non-Generally Accepted Accounting Principles) earnings as a key measure of the Company's present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the Company uses adjusted earnings to measure and assess performance. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, or other items. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for reported earnings. In Millions, Except Per Share Amounts Three Months Ended 3/31/24 3/31/23 19