UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number 001-37922

ZTO Express (Cayman) Inc.

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant’s Name into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

Building One, No. 1685 Huazhi Road,

Qingpu District, Shanghai, 201708

People’s Republic of China

(Address of Principal Executive Offices)

Huiping Yan, Chief Financial Officer

Building One, No. 1685 Huazhi Road,

Qingpu District, Shanghai, 201708

People’s Republic of China

Phone: (86 21) 5980 4508

Email: hp.yan@zto.com

(Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

American depositary shares, each representing one Class A ordinary share par value US$0.0001 per share |

ZTO |

|

New York Stock Exchange |

|

Class A ordinary shares, par value US$0.0001 per share |

|

2057 |

|

The Stock Exchange of Hong Kong Limited |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2023, there were 812,866,663 ordinary shares outstanding, par value $0.0001 per share, being the sum of 606,766,663 Class A ordinary shares, and 206,100,000 Class B ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer and large accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer ☒ |

Accelerated Filer ☐ |

Non-Accelerated Filer ☐ |

Emerging Growth Company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☒ |

|

International Financial Reporting Standards as issued |

|

Other ☐ |

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

TABLE OF CONTENTS

|

Page |

|

|

|

|

1 |

||

|

|

|

4 |

||

|

|

|

|

5 |

|

|

|

|

5 |

||

|

|

|

10 |

||

10 |

||

11 |

||

66 |

||

104 |

||

104 |

||

116 |

||

130 |

||

133 |

||

134 |

||

135 |

||

151 |

||

152 |

||

|

|

|

|

154 |

|

|

|

|

154 |

||

154 |

||

154 |

||

155 |

||

155 |

||

155 |

||

155 |

||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

156 |

|

156 |

||

156 |

||

156 |

||

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

156 |

|

157 |

||

157 |

||

|

|

|

|

158 |

|

|

|

|

158 |

||

158 |

||

158 |

||

|

|

|

160 |

||

i

INTRODUCTION

ZTO Express (Cayman) Inc., which we refer to as ZTO, is not a Chinese operating company but rather a Cayman Islands holding company. ZTO conducts its operations in China both through its subsidiaries and through contractual arrangements with ZTO Express Co., Ltd., which we refer to as ZTO Express. PRC laws and regulations restrict and impose conditions on foreign direct investment in companies involved in the provision of domestic mail delivery services. Therefore, we operate that part of our business in China through ZTO Express and its subsidiaries. We rely on contractual arrangements among Shanghai Zhongtongji Network Technology Co. Ltd., or Shanghai Zhongtongji Network, one of our PRC subsidiaries, ZTO Express and the shareholders of ZTO Express to consolidate the financial results of ZTO Express with ours under U.S. GAAP. These contractual arrangements enable us to direct the activities of ZTO Express, receive the economic benefits that could potentially be significant to ZTO Express in consideration for the services provided by Shanghai Zhongtongji Network, and hold an exclusive option to purchase all or part of the equity interests in ZTO Express when and to the extent permitted by PRC law. Because of these contractual arrangements, we are the primary beneficiary of ZTO Express and hence consolidate its financial results with ours under U.S. GAAP. Revenues contributed by ZTO Express accounted for 97.7%, 90.4% and 81.4% of our total revenues for the fiscal years 2021, 2022 and 2023, respectively. As used in this annual report, “ZTO” refers to ZTO Express (Cayman) Inc., and “we,” “us,” “our company” or “our” refer to ZTO Express (Cayman) Inc. and its subsidiaries. Investors in our ADSs and/or Class A ordinary shares thus are not purchasing equity interest in ZTO Express but instead are purchasing equity interest in ZTO Express (Cayman) Inc., a Cayman Islands holding company.

Our corporate structure is subject to risks associated with our contractual arrangements with ZTO Express. The contractual arrangement is perceived as replicating foreign investment in China-based companies where PRC regulations prohibit direct foreign investment in the operating companies. ZTO and its investors may never have a direct ownership interest in ZTO Express or in the businesses that are conducted by ZTO Express or its subsidiaries. Uncertainties with respect to the legal system in the jurisdiction where we operate could limit our ability to enforce these contractual arrangements, and these contractual arrangements have not been tested in a court of law. If the PRC government finds that the agreements that establish the structure for operating our business do not comply with PRC laws and regulations, or if these regulations or their interpretations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. This may result in ZTO Express being deconsolidated, which would materially and adversely affect our operations, and our ADSs and/or Class A ordinary shares may decline significantly in value or become worthless. ZTO, our PRC subsidiaries, ZTO Express, and investors of ZTO face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with ZTO Express and, consequently, significantly affect the financial performance of ZTO Express and our company as a whole. The PRC regulatory authorities could disallow the contractual arrangement, which would likely result in a material adverse change in our operations, and our Class A ordinary shares or our ADSs may decline significantly in value or become worthless. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure.”

We face various legal and operational risks and uncertainties associated with being based in or having the majority of our operations in China and the complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offerings conducted overseas by and foreign investment in China-based issuers, the use of VIEs, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the lack of PCAOB inspection on our auditors, which may impact our ability to conduct certain businesses, accept foreign investments, or remain listed on a United States or other foreign exchange. These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline. For a detailed description of risks related to doing business in China, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China.”

1

ZTO, our Cayman Islands holding company, may transfer cash to our wholly-owned Hong Kong subsidiaries (through intermediate holding companies in the British Virgin Islands) by making capital contributions or providing loans, and our Hong Kong subsidiaries may transfer cash to our PRC subsidiaries by making capital contributions or providing loans to them. Because ZTO and its subsidiaries control ZTO Express through contractual arrangements, they are not able to make direct capital contribution to ZTO Express. However, they may transfer cash to ZTO Express by loans or by making payment to ZTO Express for inter-group transactions. As of December 31, 2023, ZTO had made cumulative capital contribution and loans to its Cayman, BVI, and Hong Kong subsidiaries of RMB20,592.6 million. For the years ended December 31, 2021, 2022 and 2023, no shareholder loans were provided by ZTO to our PRC subsidiaries, no dividends or distributions were made to ZTO by our subsidiaries, and dividends of US$208.4 million, US$202.3 million and US$299.3 million were paid by ZTO to its shareholders. Historically, ZTO paid dividends to its shareholders primarily using proceeds from offshore financing activities. As ZTO is a Cayman Islands holding company with no material operations of its own, its ability to pay dividends may depend upon dividends paid by our PRC subsidiaries in the future. For more detailed discussion of how cash is transferred between ZTO, our subsidiaries and ZTO Express, see “Cash Transfers and Dividend Distribution” at the outset of Part I.

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

| ● | “ADSs” are to our American depositary shares, each of which represents one Class A ordinary share; |

| ● | “ADRs” are to the American depositary receipts that evidence our ADSs; |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, the Hong Kong Special Administrative Region, the Macau Special Administrative Region and the Taiwan Region; |

| ● | “consolidated affiliated entities” are to the VIE and its subsidiaries in China; |

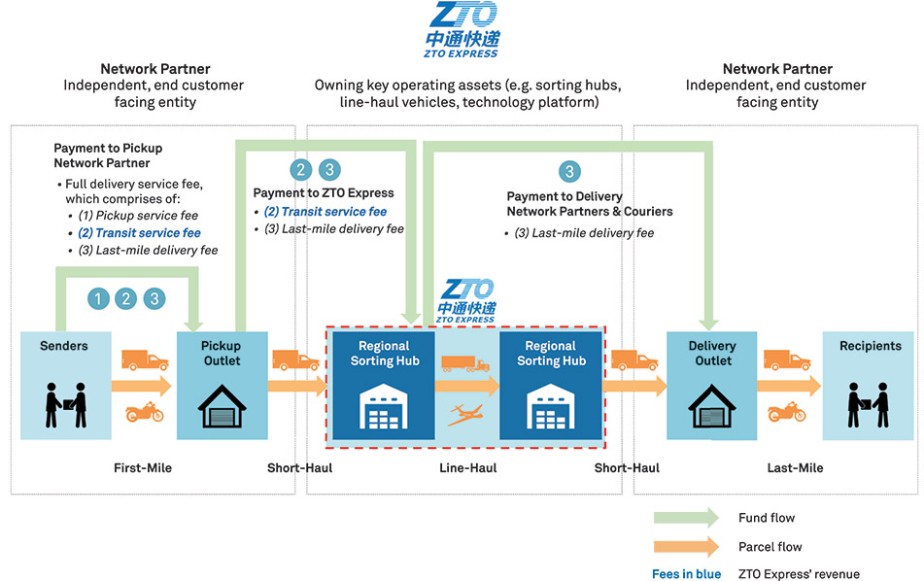

| ● | “delivery service fees” are to service fees directly charged by network partners from parcel senders in connection with express delivery services rendered. The full delivery service fees collected by pickup outlets upfront from the senders typically comprise (i) the pickup service fees; (ii) the network transit fees payable to our company; and (iii) the last-mile delivery fees payable to the delivery outlets operated by other network partners; |

| ● | “Hong Kong” or “HK” are to the Hong Kong Special Administrative Region of the PRC; |

| ● | “HK$” or “Hong Kong dollars” are to the legal currency of Hong Kong; |

| ● | “Hong Kong Listing Rules” are to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended or supplemented from time to time; |

| ● | “Hong Kong Stock Exchange” are to The Stock Exchange of Hong Kong Limited; |

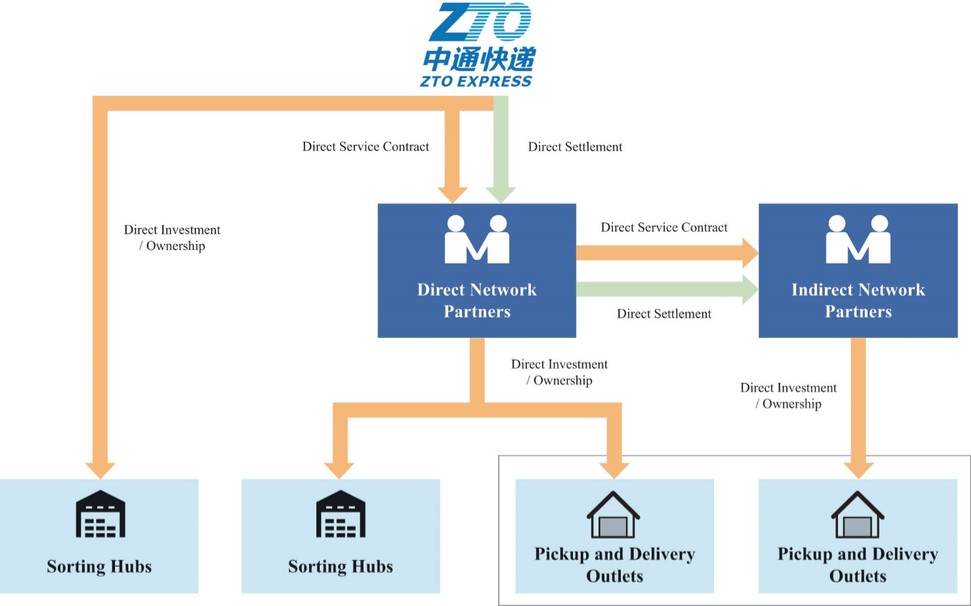

| ● | our “network partners” are to business partners that own and operate pickup and delivery outlets in our network and operate express delivery services under our “Zhongtong” or “ZTO” brand; |

| ● | “network transit fees” are to fees payable by our network partners to us in connection with the services we provide to them, which mainly include parcel sorting and parcel line-haul transportation; |

| ● | “ordinary shares” are to our Class A and Class B ordinary shares, par value US$0.0001 per share; |

| ● | our “parcel volume” in any given period are to the number of parcels collected by our network partners using our waybills in that period; |

| ● | “RMB” or “Renminbi” are to the legal currency of China; |

| ● | “unit cost per parcel” are to the sum of cost of revenues and total operating expenses of the applicable period divided by our total parcel volume during the same period; |

2

| ● | “US$” or “U.S. dollars” are to the legal currency of the United States; |

| ● | “VIE” are to ZTO Express Co., Ltd., a PRC entity in which we do not have equity interests but whose financial results are consolidated into our consolidated financial statements in accordance with U.S. GAAP; |

| ● | “we,” “us,” “our company” or “our” are to ZTO Express (Cayman) Inc. and its subsidiaries. We conduct our operations in China through (i) our PRC subsidiaries and (ii) the VIE, with which we have maintained contractual arrangements, and its subsidiaries. The VIE and its subsidiaries are PRC companies conducting operations in China, and their financial results have been consolidated into our consolidated financial statements under U.S. GAAP for accounting purposes; |

| ● | “ZTO” are to ZTO Express (Cayman) Inc.; and |

| ● | “ZTO Express” are to ZTO Express Co., Ltd. or, depending on the context, ZTO Express Co., Ltd. and its subsidiaries. |

3

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that relate to our current expectations and views of future events. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | our goals and strategies; |

| ● | our future business development, financial conditions and results of operations; |

| ● | the expected growth of the express delivery industry in China; |

| ● | our expectations regarding demand for and market acceptance of our services; |

| ● | our expectations regarding our relationships with network partners, direct and end customers, suppliers and our other stakeholders; |

| ● | competition in our industry; and |

| ● | government policies and regulations relating to our industry. |

You should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Other Sections of this annual report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Our reporting currency is the Renminbi. This annual report contains translations of RMB and Hong Kong dollar amounts into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise stated, all translations of RMB and Hong Kong dollars into U.S. dollars and from U.S. dollars into RMB in this annual report were made at a rate of RMB7.0999 to US$1.00 and HK$7.8109 to US$1.00, the respective exchange rates on December 29, 2023 set forth in the H.10 statistical release of the Federal Reserve Board. We make no representation that any RMB, Hong Kong dollar or U.S. dollar amounts referred to in this annual report could have been, or could be, converted into U.S. dollars, RMB or Hong Kong dollars, as the case may be, at any particular rate or at all.

4

PART I

EXPLANATORY NOTE

ZTO is a Cayman Islands holding company with no equity ownership in ZTO Express, its consolidated affiliated entity. We conduct our operations in China through (i) our PRC subsidiaries and (ii) ZTO Express, with which we have maintained contractual arrangements. Investors in our ADSs thus are not purchasing equity interest in ZTO Express in China but instead are purchasing equity interest in a Cayman Islands holding company. If the PRC government finds that the agreements that establish the structure for operating certain of our businesses do not comply with PRC laws and regulations, or if these regulations or their interpretations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. ZTO, our PRC subsidiaries, ZTO Express, and investors of ZTO face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with ZTO Express and, consequently, significantly affect the financial performance of ZTO Express and our company as a whole. The PRC regulatory authorities could disallow the VIE structure, which would likely result in a material adverse change in our operations, and our Class A ordinary shares or our ADSs may decline significantly in value.

PRC government’s authority in regulating our operations and its oversight and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations in this nature may cause the value of such securities to significantly decline. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight and discretion over our business operation could result in a material adverse change in our operations and the value of our ADSs and ordinary shares.”

Risks and uncertainties arising from the legal system in the jurisdiction where we operate, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in the jurisdiction where we operate, could result in a material adverse change in our operations and the value of our Class A ordinary shares or ADSs. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the legal system in the jurisdiction where we operate could adversely affect us.”

Our Holding Company Structure and Contractual Arrangements

ZTO Express (Cayman) Inc. is a holding company with no material operations of its own. We conduct our operations primarily through our PRC subsidiaries and ZTO Express, the consolidated affiliated entity, and its subsidiaries. Our domestic mail delivery services in China have been conducted through ZTO Express in order to comply with the PRC laws and regulations, which prohibit or restrict control of companies involved in the provision of domestic mail delivery services. Revenues contributed by ZTO Express accounted for 97.7%, 90.4% and 81.4% of our total revenues for the fiscal years 2021, 2022 and 2023, respectively. Investors in our ADSs and/or Class A ordinary shares are not purchasing equity interest in ZTO Express in China but instead are purchasing equity interest in a holding company incorporated in the Cayman Islands.

5

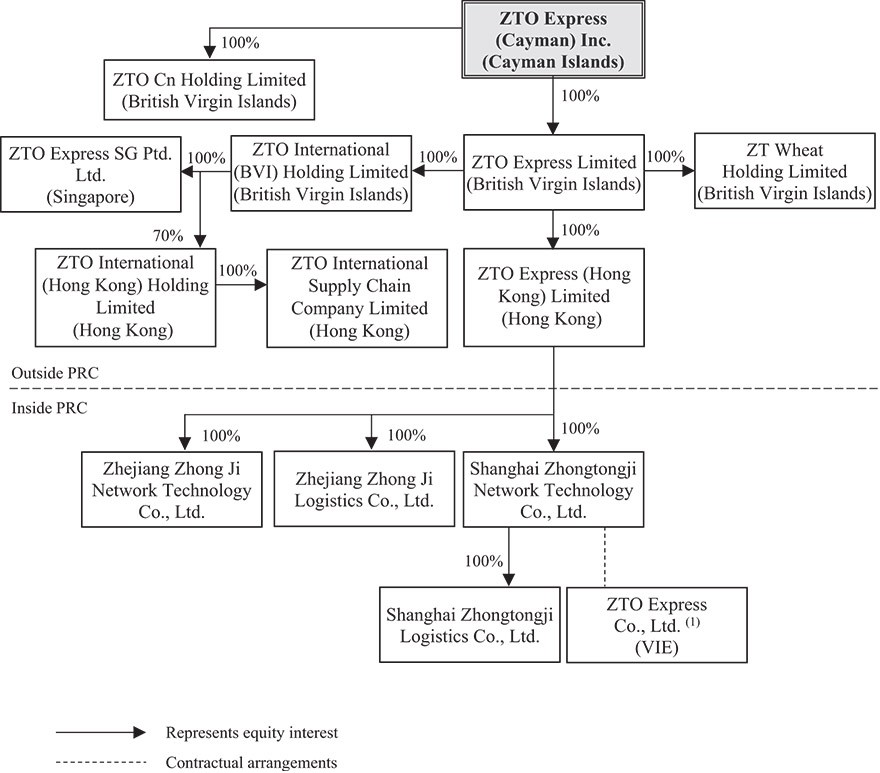

The following chart illustrates our company’s organizational structure, including our principal subsidiaries and the VIE as of March 31, 2024:

(1) |

ZTO Express Co., Ltd., or ZTO Express, is the VIE, with which we have maintained contractual arrangements. To the knowledge of our company, Meisong Lai, Jianfa Lai, Jilei Wang, Xiangliang Hu, Shunchang Zhang, Jianying Teng, Xuebing Shang, Baixi Lan and Jianchang Lai are beneficial owners of the shares of our company and hold 34.35%, 12.00%, 10.00%, 7.05%, 6.00%, 5.02%, 4.40%, 1.40% and 1.06% equity interests in ZTO Express, respectively. Among them, Meisong Lai and Jilei Wang are also directors of our company. The remaining 18.72% equity interest in ZTO Express are held by 34 other shareholders. None of these 34 shareholders hold more than 4.00% of the equity interest in ZTO Express. As of March 31, 2024, ZTO Express directly wholly owned 69 subsidiaries. |

6

A series of contractual agreements, including voting rights proxy agreement, equity pledge agreement, exclusive call option agreement, powers of attorney, spouse consent letters and exclusive consulting and services agreement and its supplemental agreement, have been entered into by and among Shanghai Zhongtongji Network, our wholly owned subsidiary, ZTO Express, the consolidated affiliated entity, and the shareholders of ZTO Express. The following is a summary of the currently effective contractual arrangements:

For more details of these contractual arrangements, see “Item 4. Information on the Company—C. Organizational Structure —Agreements that enable us to direct the activities of ZTO Express” and “—Agreement that allows us to receive economic benefits from ZTO Express.”

However, the contractual arrangements may not be as effective as direct ownership in providing us with the ability to direct the activities of ZTO Express, and we may incur substantial costs to enforce the terms of the arrangements. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with the VIE and its shareholders for a substantial portion of our business operations, which may not be as effective as direct ownership in providing us with the ability to direct the operational activities” and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—The shareholders of the VIE may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.”

7

There are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules regarding the status of the rights of ZTO with respect to its contractual arrangements with ZTO Express and its shareholders. If we or ZTO Express are/is found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the PRC government finds that the agreements that establish the structure for operating certain of our operations in China do not comply with PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations,” “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—Our current corporate structure, business operations and future capital raising activities may be affected by the PRC Foreign Investment Law, the Overseas Listing Trial Measures and the recently amended PRC Company Law,” “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the legal system in the jurisdiction where we operate could adversely affect us” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight and discretion over our business operation could result in a material adverse change in our operations and the value of our ADSs and ordinary shares.”

Permissions Required from the PRC Authorities for Our Operations

We conduct our business primarily through our PRC subsidiaries, ZTO Express and its subsidiaries in China. Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, our PRC subsidiaries, ZTO Express and its subsidiaries have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company, ZTO Express and its subsidiaries in the PRC, including, among others, the Courier Service Operation Permit and Road Transportation Operation Permit. Given the uncertainties of interpretation and implementation of the laws and regulations and the enforcement practice by the government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Any lack of requisite approvals, licenses or permits applicable to our business operation or those of our network partners may have a material and adverse impact on our business, financial condition and results of operations.”

Permissions Required from the PRC Authorities for Overseas Financing Activities

On February 17, 2023, the China Securities Regulatory Commission, or the CSRC, promulgated the Circular of the People’s Republic of China on Administrative Arrangements for Filing of Overseas Offering and Listing of Domestic Enterprises and the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies together with five relevant guidelines. The Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies became effective on March 31, 2023. Pursuant to these measures, PRC domestic companies that seek to offer and list securities in overseas markets, either in direct or indirect means, are required to fulfill the filing procedure with the CSRC and report the required information. According to the these administrative arrangements, issuers that have already been listed in an overseas market by March 31, 2023, such as our company, are not required to make any immediate filing. However, under the Overseas Listing Trial Measures, such issuers will be required to complete certain filing procedures with the CSRC in connection with future securities offerings and listings outside of China, including follow-on offerings, issuance of convertible bonds, offshore relisting after going-private transactions, and other equivalent offering activities. In addition, such issuers are required to file a report to the CSRC after the occurrence and public disclosure of certain material corporate events, including but not limited to conversion of listing status in overseas markets (such as switching from secondary listing to dual primary listing). There remain substantial uncertainties about the interpretation, application and implementation of the Overseas Listing Trial Measures. If we fail to obtain required approval or complete other review or filing procedures, under the Overseas Listing Trial Measures or otherwise, for any future securities offerings and listings outside of mainland China, we may face sanctions by the CSRC or other PRC regulatory authorities, which may include fines and penalties on our operations in mainland China, limitations on our operating privileges in mainland China, restrictions on or prohibition of the payments or remittance of dividends by our subsidiaries in China, restrictions on or delays to our future financing transactions offshore, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The approval of or filing to the CSRC or other PRC government authorities may be required in connection with our offshore offerings and future capital raising activities under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval” and “—Our business is subject to complex and evolving laws and regulations regarding cybersecurity, privacy, data protection and information security in China. Failure to protect confidential information of our end customers or consumers could damage our reputation and substantially harm our business and results of operations.”

8

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting Oversight Board (United States), or the PCAOB, for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor.

In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of this annual report on Form 20-F for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. As of the date of this annual report, the PCAOB has not issued any new determination that it is unable to inspect or investigate completely registered public accounting firms headquartered in any jurisdiction. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F.

Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the Securities and Exchange Commission, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Cash Transfers and Dividend Distribution

ZTO, our Cayman Islands holding company, may transfer cash to our wholly-owned Hong Kong subsidiaries (through intermediate holding companies in the British Virgin Islands), by making capital contributions or providing loans, and our Hong Kong subsidiaries may transfer cash to our PRC subsidiaries by making capital contributions or providing loans to them.

Because ZTO and its subsidiaries control ZTO Express through contractual arrangements, they are not able to make direct capital contribution to ZTO Express. However, they may transfer cash to ZTO Express by loans or by making payment to ZTO Express for inter-group transactions.

The following table sets forth the amount of the transfers for the periods presented.

|

|

Year Ended December 31, |

||||

|

|

2021 |

|

2022 |

|

2023 |

|

|

(RMB in millions) |

||||

Capital contributions and loans from Parent to Cayman, BVI, and Hong Kong subsidiaries, and collection of loans from Cayman, BVI, and Hong Kong subsidiaries to Parent |

|

1,250 |

|

2,580 |

|

(1,561) |

Capital contributions from Hong Kong subsidiaries to PRC subsidiaries |

|

3,671 |

|

2,282 |

|

840 |

Amounts received by subsidiaries of Parent from ZTO Express* |

|

15,974 |

|

20,739 |

|

17,986 |

Note:

(1) |

* The cash flows between the subsidiaries of Parent and ZTO Express included the following: transportation fees, service fees and rental expenses. |

9

As of December 31, 2023, ZTO had made cumulative capital contribution and loans to its Cayman, BVI, and Hong Kong subsidiaries of RMB20,592.6 million.

In 2021, 2022 and 2023, no shareholder loan was provided by ZTO to our PRC subsidiaries.

For the years ended December 31, 2021, 2022 and 2023, no dividends or distributions were made to ZTO by our subsidiaries. For the years ended December 31, 2021, 2022 and 2023, dividends of US$208.4 million, US$202.3 million and US$299.3 million were paid to shareholders of ZTO of record as of designated record dates.

Historically, ZTO paid dividends to its shareholders primarily using proceeds from offshore financing activities. As ZTO is a Cayman Islands holding company with no material operations of its own, its ability to pay dividends may depend upon dividends paid by our PRC subsidiaries in the future. Our PRC subsidiaries in turn generate income from their own operations, and in addition enjoy substantially all economic benefit and receive service fees from ZTO Express pursuant to the exclusive business cooperation agreement with ZTO Express. Under PRC law, each of our subsidiaries and ZTO Express in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered capital. In addition, each of our subsidiaries and ZTO Express in China may allocate a portion of its after-tax profits based on PRC accounting standards to a surplus fund at its discretion. The statutory reserve funds and the discretionary funds are not distributable as cash dividends. Remittance of dividends by a wholly foreign-owned company out of China is subject to examination by the banks designated by the State Administration of Foreign Exchange and declaration and payment of withholding tax. Additionally, if our PRC subsidiaries and ZTO Express incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends or make other distributions to us. Our PRC subsidiaries did not and will not be able to pay dividends until it generates accumulated profits and meets the requirements for statutory reserve funds. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from loaning to or making additional capital contributions to our PRC subsidiaries and the consolidated affiliated entities in China, which could materially and adversely affect our liquidity and our ability to fund and expand our business” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.” Except these regulatory requirements, there are not any other statutory restrictions and limitations on our ability to distribute earnings from our PRC subsidiaries to the parent company and U.S. investors or the ability of ZTO Express to settle amounts owned under the VIE agreements.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

10

ITEM 3. KEY INFORMATION

A. Our Selected Consolidated Financial Data

The following summary consolidated statements of comprehensive income data for the years ended December 31, 2021, 2022 and 2023, summary consolidated balance sheet data as of December 31, 2022 and 2023 and summary consolidated cash flow data for the years ended December 31, 2021, 2022 and 2023 have been derived from our audited consolidated financial statements included elsewhere in this annual report. The summary consolidated statements of comprehensive income data for the years ended December 31, 2019 and 2020, the summary consolidated balance sheet data as of December 31, 2019, 2020 and 2021 and the summary consolidated cash flow data for the years ended December 31, 2019 and 2020 have been derived from our audited consolidated financial statements that are not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP.

You should read the summary consolidated financial information in conjunction with our consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report. Our historical results are not necessarily indicative of our results expected for future periods.

|

|

Years Ended December 31, |

||||||||||

|

|

2019 |

|

2020 |

|

2021 |

|

2022 |

|

2023 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

(in thousands, except for share and per share data) |

||||||||||

Selected Consolidated Comprehensive Income Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

22,109,946 |

|

25,214,290 |

|

30,405,839 |

|

35,376,996 |

|

38,418,915 |

|

5,411,191 |

Cost of revenues |

|

(15,488,778) |

|

(19,377,184) |

|

(23,816,462) |

|

(26,337,721) |

|

(26,756,389) |

|

(3,768,559) |

Gross profit |

|

6,621,168 |

|

5,837,106 |

|

6,589,377 |

|

9,039,275 |

|

11,662,526 |

|

1,642,632 |

Operating income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and Administrative |

|

(1,546,227) |

|

(1,663,712) |

|

(1,875,869) |

|

(2,077,372) |

|

(2,425,253) |

|

(341,590) |

Other operating income, net |

|

387,890 |

|

580,973 |

|

789,503 |

|

774,578 |

|

770,651 |

|

108,544 |

Total operating expenses |

|

(1,158,337) |

|

(1,082,739) |

|

(1,086,366) |

|

(1,302,794) |

|

(1,654,602) |

|

(233,046) |

Income from operations |

|

5,462,831 |

|

4,754,367 |

|

5,503,011 |

|

7,736,481 |

|

10,007,924 |

|

1,409,586 |

Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

585,404 |

|

442,697 |

|

363,890 |

|

503,722 |

|

706,765 |

|

99,546 |

Interest expense |

|

— |

|

(35,307) |

|

(126,503) |

|

(190,521) |

|

(289,533) |

|

(40,780) |

(Loss)/gain from fair value changes of financial instruments |

|

— |

|

(877) |

|

52,909 |

|

46,246 |

|

164,517 |

|

23,172 |

(Loss)/gain on disposal of equity investees and subsidiary |

|

(2,860) |

|

1,086 |

|

2,357 |

|

69,598 |

|

5,485 |

|

773 |

Impairment of investment in equity investee |

|

(56,026) |

|

— |

|

— |

|

(26,328) |

|

— |

|

— |

Unrealized gain from investment in equity investee |

|

754,468 |

|

— |

|

— |

|

— |

|

— |

|

— |

Foreign currency exchange gain/(loss) |

|

13,301 |

|

(127,180) |

|

(56,467) |

|

147,254 |

|

93,543 |

|

13,175 |

Income before income tax and share of loss in equity method investments |

|

6,757,118 |

|

5,034,786 |

|

5,739,197 |

|

8,286,452 |

|

10,688,701 |

|

1,505,472 |

Income tax expense |

|

(1,078,295) |

|

(689,833) |

|

(1,005,451) |

|

(1,633,330) |

|

(1,938,600) |

|

(273,046) |

Share of (loss)/gain in equity method investments |

|

(7,556) |

|

(18,507) |

|

(32,419) |

|

5,844 |

|

4,356 |

|

614 |

Net Income |

|

5,671,267 |

|

4,326,446 |

|

4,701,327 |

|

6,658,966 |

|

8,754,457 |

|

1,233,040 |

Net loss/(income) attributable to noncontrolling interests |

|

2,878 |

|

(14,233) |

|

53,500 |

|

150,090 |

|

(5,453) |

|

(768) |

Net income attributable to ZTO Express (Cayman) Inc. |

|

5,674,145 |

|

4,312,213 |

|

4,754,827 |

|

6,809,056 |

|

8,749,004 |

|

1,232,272 |

Net income attributable to ordinary shareholders |

|

5,674,145 |

|

4,312,213 |

|

4,754,827 |

|

6,809,056 |

|

8,749,004 |

|

1,232,272 |

Net earnings per share/ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

7.24 |

|

5.42 |

|

5.80 |

|

8.41 |

|

10.83 |

|

1.53 |

Diluted |

|

7.23 |

|

5.42 |

|

5.80 |

|

8.36 |

|

10.60 |

|

1.49 |

Weighted average shares used in calculating net earnings per ordinary share/ADS |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

784,007,583 |

|

796,097,532 |

|

819,961,265 |

|

809,442,862 |

|

807,739,616 |

|

807,739,616 |

Diluted |

|

784,331,120 |

|

796,147,504 |

|

819,961,265 |

|

820,273,531 |

|

838,948,683 |

|

838,948,683 |

Other comprehensive income (loss), net of tax of nil: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

104,004 |

|

(771,291) |

|

(146,533) |

|

155,432 |

|

(104,052) |

|

(14,655) |

Comprehensive income attributable to ZTO Express (Cayman) Inc. |

|

5,778,149 |

|

3,540,922 |

|

4,608,294 |

|

6,964,488 |

|

8,644,952 |

|

1,217,617 |

11

|

|

As of December 31, |

||||||||||

|

|

2019 |

|

2020 |

|

2021 |

|

2022 |

|

2023 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

(in thousands) |

||||||||||

Selected Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

5,270,204 |

|

14,212,778 |

|

9,721,225 |

|

11,692,773 |

|

12,333,884 |

|

1,737,191 |

Short-term investment |

|

11,113,217 |

|

3,690,402 |

|

2,845,319 |

|

5,753,483 |

|

7,454,633 |

|

1,049,963 |

Advances to suppliers |

|

438,272 |

|

589,042 |

|

667,855 |

|

861,573 |

|

821,942 |

|

115,768 |

Prepayments and other current assets |

|

1,964,506 |

|

2,334,688 |

|

3,142,368 |

|

3,146,378 |

|

3,772,377 |

|

531,328 |

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

12,470,632 |

|

18,565,161 |

|

24,929,897 |

|

28,813,204 |

|

32,181,025 |

|

4,532,603 |

Goodwill |

|

4,241,541 |

|

4,241,541 |

|

4,241,541 |

|

4,241,541 |

|

4,241,541 |

|

597,409 |

Total assets |

|

45,890,502 |

|

59,204,750 |

|

62,772,343 |

|

78,523,586 |

|

88,465,221 |

|

12,460,066 |

Liabilities and equity |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Short-term bank borrowings |

|

— |

|

1,432,929 |

|

3,458,717 |

|

5,394,423 |

|

7,765,990 |

|

1,093,817 |

Other current liabilities |

|

3,552,288 |

|

4,487,084 |

|

5,794,380 |

|

6,724,743 |

|

7,236,716 |

|

1,019,271 |

Total liabilities |

|

7,487,105 |

|

10,105,052 |

|

13,844,762 |

|

24,051,116 |

|

28,184,813 |

|

3,969,748 |

Total liabilities and equity |

|

45,890,502 |

|

59,204,750 |

|

62,772,343 |

|

78,523,586 |

|

88,465,221 |

|

12,460,066 |

|

|

Years Ended December 31, |

||||||||||

|

|

2019 |

|

2020 |

|

2021 |

|

2022 |

|

2023 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

(in thousands) |

||||||||||

Selected Consolidated Cash Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

6,304,186 |

|

4,950,749 |

|

7,220,217 |

|

11,479,308 |

|

13,360,967 |

|

1,881,851 |

Net cash used in investing activities |

|

(3,664,213) |

|

(3,549,341) |

|

(8,756,533) |

|

(16,041,890) |

|

(12,252,751) |

|

(1,725,762) |

Net cash (used in) /provided by financing activities |

|

(1,982,306) |

|

8,337,407 |

|

(2,903,985) |

|

7,058,202 |

|

(769,836) |

|

(108,429) |

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

(3,207) |

|

(656,137) |

|

(150,430) |

|

338,106 |

|

109,843 |

|

15,471 |

Net increase/(decrease) in cash, cash equivalents and restricted cash |

|

654,460 |

|

9,082,678 |

|

(4,590,731) |

|

2,833,726 |

|

448,223 |

|

63,131 |

Cash, cash equivalents and restricted cash at beginning of year |

|

4,622,954 |

|

5,277,414 |

|

14,360,092 |

|

9,769,361 |

|

12,603,087 |

|

1,775,107 |

Cash, cash equivalents and restricted cash at end of year |

|

5,277,414 |

|

14,360,092 |

|

9,769,361 |

|

12,603,087 |

|

13,051,310 |

|

1,838,238 |

12

Condensed Consolidating Financial Information of ZTO Express (Cayman) Inc.

The following table presents the condensed consolidating balance sheet data for ZTO Express (Cayman) Inc., the VIE and VIE’s subsidiaries, and other entities as of the dates presented. For the purpose of this presentation, (i) the intercompany transactions among entities within our subsidiaries or among entities within the VIE and VIE’s subsidiaries were eliminated; and (ii) the equity method is used to account for ZTO Express (Cayman) Inc.’s investments in our subsidiaries and our subsidiary’s investment in the VIE, as presented below under “Investments in consolidated subsidiaries, VIE and other equity investees.”

|

|

As of December 31, 2023 |

||||||||

|

|

ZTO Express |

|

|

|

VIE and VIE’s |

|

|

|

Consolidated |

|

|

(Cayman) Inc. |

|

Subsidiaries |

|

subsidiaries |

|

Elimination |

|

Total |

|

|

RMB |

||||||||

|

|

(in thousands) |

||||||||

Assets |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

8,881 |

|

9,516,208 |

|

2,808,795 |

|

— |

|

12,333,884 |

Restricted cash |

|

— |

|

569,244 |

|

117,324 |

|

— |

|

686,568 |

Accounts receivable, net |

|

— |

|

213,351 |

|

359,207 |

|

— |

|

572,558 |

Financing receivables, net |

|

— |

|

180,021 |

|

955,424 |

|

— |

|

1,135,445 |

Short-term investment |

|

1,020,094 |

|

5,886,266 |

|

548,273 |

|

— |

|

7,454,633 |

Inventories |

|

— |

|

7,669 |

|

20,405 |

|

— |

|

28,074 |

Advances to suppliers |

|

— |

|

739,690 |

|

82,252 |

|

— |

|

821,942 |

Prepayments and other current assets |

|

— |

|

1,662,952 |

|

2,109,425 |

|

— |

|

3,772,377 |

Amounts due from related parties outside the consolidated group |

|

— |

|

124,640 |

|

23,427 |

|

— |

|

148,067 |

Investments in equity investees including subsidiaries and VIE, and amounts due from subsidiaries and VIE |

|

64,660,093 |

|

15,134,775 |

|

10,556,052 |

|

(90,350,920) |

|

— |

Investment in equity investees |

|

1,144,479 |

|

2,058,375 |

|

252,265 |

|

— |

|

3,455,119 |

Property and equipment, net |

|

— |

|

26,252,559 |

|

5,928,466 |

|

— |

|

32,181,025 |

Land use rights, net |

|

— |

|

4,402,516 |

|

1,234,585 |

|

— |

|

5,637,101 |

Intangible assets, net |

|

— |

|

23,240 |

|

— |

|

— |

|

23,240 |

Operating lease right-of-use assets |

|

— |

|

36,546 |

|

635,647 |

|

— |

|

672,193 |

Goodwill |

|

— |

|

84,430 |

|

4,157,111 |

|

— |

|

4,241,541 |

Deferred tax assets |

|

— |

|

579,011 |

|

300,761 |

|

— |

|

879,772 |

Long-term investment |

|

69,629 |

|

11,601,252 |

|

500,000 |

|

— |

|

12,170,881 |

Long-term financing receivables, net |

|

— |

|

73,589 |

|

891,191 |

|

— |

|

964,780 |

Other non-current assets |

|

— |

|

567,080 |

|

134,678 |

|

— |

|

701,758 |

Amounts due from related parties outside the consolidated groups-non-current |

|

— |

|

584,263 |

|

— |

|

— |

|

584,263 |

TOTAL ASSETS |

|

66,903,176 |

|

80,297,677 |

|

31,615,288 |

|

(90,350,920) |

|

88,465,221 |

Liabilities |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Short-term bank borrowings |

|

— |

|

400,000 |

|

7,365,990 |

|

— |

|

7,765,990 |

Accounts payable |

|

— |

|

664,358 |

|

1,892,652 |

|

— |

|

2,557,010 |

Advances from customers |

|

— |

|

36,626 |

|

1,709,101 |

|

— |

|

1,745,727 |

Income tax payable |

|

— |

|

134,963 |

|

198,294 |

|

— |

|

333,257 |

Amounts due to related parties outside the consolidated group |

|

— |

|

37,662 |

|

197,021 |

|

— |

|

234,683 |

Amounts due to related parties within the consolidated group |

|

— |

|

13,302,933 |

|

— |

|

(13,302,933) |

|

— |

Operating lease liabilities, current |

|

— |

|

4,978 |

|

181,275 |

|

— |

|

186,253 |

Dividends payable |

|

1,548 |

|

— |

|

— |

|

— |

|

1,548 |

Other current liabilities |

|

70,333 |

|

2,735,803 |

|

4,430,580 |

|

— |

|

7,236,716 |

Non-current operating lease liabilities |

|

— |

|

31,568 |

|

424,311 |

|

— |

|

455,879 |

Deferred tax liabilities |

|

— |

|

556,229 |

|

81,971 |

|

— |

|

638,200 |

Convertible senior bond |

|

7,029,550 |

|

— |

|

— |

|

— |

|

7,029,550 |

TOTAL LIABILITIES |

|

7,101,431 |

|

17,905,120 |

|

16,481,195 |

|

(13,302,933) |

|

28,184,813 |

Equity |

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

525 |

|

17,845,730 |

|

600,000 |

|

(18,445,730) |

|

525 |

Additional paid-in capital |

|

24,201,745 |

|

600,000 |

|

3,918,356 |

|

(4,518,356) |

|

24,201,745 |

Treasury shares, at cost |

|

(510,986) |

|

— |

|

— |

|

— |

|

(510,986) |

Retained earnings |

|

36,301,185 |

|

44,419,495 |

|

10,620,516 |

|

(55,040,011) |

|

36,301,185 |

Accumulated other comprehensive loss |

|

(190,724) |

|

(956,110) |

|

— |

|

956,110 |

|

(190,724) |

Non-controlling interests |

|

— |

|

483,442 |

|

(4,779) |

|

— |

|

478,663 |

Total Equity |

|

59,801,745 |

|

62,392,557 |

|

15,134,093 |

|

(77,047,987) |

|

60,280,408 |

TOTAL LIABILITIES AND EQUITY |

|

66,903,176 |

|

80,297,677 |

|

31,615,288 |

|

(90,350,920) |

|

88,465,221 |

13

|

|

As of December 31, 2022 |

||||||||

|

|

ZTO Express |

|

|

|

VIE and VIE’s |

|

|

|

Consolidated |

|

|

(Cayman) Inc. |

|

Subsidiaries |

|

subsidiaries |

|

Elimination |

|

Total |

|

|

RMB |

||||||||

|

|

(in thousands) |

||||||||

Assets |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

70,937 |

|

8,869,361 |

|

2,752,475 |

|

— |

|

11,692,773 |

Restricted cash |

|

— |

|

895,483 |

|

— |

|

— |

|

895,483 |

Accounts receivable, net |

|

— |

|

197,573 |

|

621,395 |

|

— |

|

818,968 |

Financing receivables, net |

|

— |

|

104,295 |

|

847,054 |

|

— |

|

951,349 |

Short-term investment |

|

2,487,775 |

|

2,995,363 |

|

270,345 |

|

— |

|

5,753,483 |

Inventories |

|

— |

|

12,386 |

|

28,151 |

|

— |

|

40,537 |

Advances to suppliers |

|

— |

|

810,023 |

|

51,550 |

|

— |

|

861,573 |

Prepayments and other current assets |

|

— |

|

1,948,516 |

|

1,197,862 |

|

— |

|

3,146,378 |

Amounts due from related parties outside the consolidated group |

|

— |

|

288,745 |

|

25,738 |

|

— |

|

314,483 |

Investments in equity investees including subsidiaries and VIE, and amounts due from subsidiaries and VIE |

|

57,207,495 |

|

13,136,215 |

|

6,554,502 |

|

(76,898,212) |

|

— |

Investment in equity investees |

|

1,116,085 |

|

2,490,767 |

|

343,692 |

|

— |

|

3,950,544 |

Property and equipment, net |

|

— |

|

22,897,182 |

|

5,916,022 |

|

— |

|

28,813,204 |

Land use rights, net |

|

— |

|

4,225,420 |

|

1,217,531 |

|

— |

|

5,442,951 |

Intangible assets, net |

|

— |

|

29,437 |

|

— |

|

— |

|

29,437 |

Operating lease right-of-use assets |

|

— |

|

101,696 |

|

706,810 |

|

— |

|

808,506 |

Goodwill |

|

— |

|

84,430 |

|

4,157,111 |

|

— |

|

4,241,541 |

Deferred tax assets |

|

— |

|

313,539 |

|

436,558 |

|

— |

|

750,097 |

Long-term investment |

|

— |

|

6,622,660 |

|

699,885 |

|

— |

|

7,322,545 |

Long-term financing receivables, net |

|

— |

|

166,948 |

|

1,128,807 |

|

— |

|

1,295,755 |

Other non-current assets |

|

— |

|

434,390 |

|

382,449 |

|

— |

|

816,839 |

Amounts due from related parties outside the consolidated groups-non-current |

|

— |

|

577,140 |

|

— |

|

— |

|

577,140 |

TOTAL ASSETS |

|

60,882,292 |

|

67,201,569 |

|

27,337,937 |

|

(76,898,212) |

|

78,523,586 |

Liabilities |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Short-term bank borrowings |

|

— |

|

— |

|

5,394,423 |

|

— |

|

5,394,423 |

Accounts payable |

|

— |

|

594,928 |

|

1,607,764 |

|

— |

|

2,202,692 |

Notes payable |

|

— |

|

200,000 |

|

— |

|

— |

|

200,000 |

Advances from customers |

|

— |

|

18,781 |

|

1,355,910 |

|

— |

|

1,374,691 |

Income tax payable |

|

— |

|

62,449 |

|

165,973 |

|

— |

|

228,422 |

Amounts due to related parties outside the consolidated group |

|

— |

|

9,368 |

|

39,770 |

|

— |

|

49,138 |

Amounts due to related parties within the consolidated group |

|

— |

|

12,365,223 |

|

— |

|

(12,365,223) |

|

— |

Operating lease liabilities, current |

|

— |

|

12,919 |

|

216,799 |

|

— |

|

229,718 |

Dividends payable |

|

1,497 |

|

— |

|

— |

|

— |

|

1,497 |

Other current liabilities |

|

63,273 |

|

1,752,693 |

|

4,908,777 |

|

— |

|

6,724,743 |

Non-current operating lease liabilities |

|

— |

|

87,720 |

|

422,629 |

|

— |

|

510,349 |

Deferred tax liabilities |

|

— |

|

254,128 |

|

92,344 |

|

— |

|

346,472 |

Convertible senior bond |

|

6,788,971 |

|

— |

|

— |

|

— |

|

6,788,971 |

TOTAL LIABILITIES |

|

6,853,741 |

|

15,358,209 |

|

14,204,389 |

|

(12,365,223) |

|

24,051,116 |

Equity |

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

535 |

|

17,155,492 |

|

600,000 |

|

(17,755,492) |

|

535 |

Additional paid-in capital |

|

26,717,727 |

|

600,000 |

|

3,918,356 |

|

(4,518,356) |

|

26,717,727 |

Treasury shares, at cost |

|

(2,062,530) |

|

— |

|

— |

|

— |

|

(2,062,530) |

Retained earnings |

|

29,459,491 |

|

32,950,608 |

|

8,617,859 |

|

(41,568,467) |

|

29,459,491 |

Accumulated other comprehensive loss |

|

(86,672) |

|

690,674 |

|

— |

|

(690,674) |

|

(86,672) |

Non-controlling interests |

|

— |

|

446,586 |

|

(2,667) |

|

— |

|

443,919 |

Total Equity |

|

54,028,551 |

|

51,843,360 |

|

13,133,548 |

|

(64,532,989) |

|

54,472,470 |

TOTAL LIABILITIES AND EQUITY |

|

60,882,292 |

|

67,201,569 |

|

27,337,937 |

|

(76,898,212) |

|

78,523,586 |

14

|

|

As of December 31, 2021 |

||||||||

|

|

ZTO Express |

|

|

|

VIE and VIE’s |

|

|

|

Consolidated |

|

|

(Cayman) Inc. |

|

Subsidiaries |

|

subsidiaries |

|

Elimination |

|

Total |

|

|

RMB |

||||||||

|

|

(in thousands) |

||||||||

Assets |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

621,034 |

|

8,169,249 |

|

930,942 |

|

— |

|

9,721,225 |

Restricted cash |

|

— |

|

27,736 |

|

— |

|

— |

|

27,736 |

Accounts receivable, net |

|

— |

|

262,167 |

|

671,277 |

|

— |

|

933,444 |

Financing receivables, net |

|

— |

|

133,541 |

|

977,920 |

|

— |

|

1,111,461 |

Short-term investment |

|

196,462 |

|

2,328,857 |

|

320,000 |

|

— |

|

2,845,319 |

Inventories |

|

— |

|

52,747 |

|

30,214 |

|

— |

|

82,961 |

Advances to suppliers |

|

— |

|

612,842 |

|

55,013 |

|

— |

|

667,855 |

Prepayments and other current assets |

|

— |

|

1,218,172 |

|

1,924,196 |

|

— |

|

3,142,368 |

Amounts due from related parties outside the consolidated group |

|

— |

|

96,288 |

|

37,702 |

|

— |

|

133,990 |

Investments in equity investees including subsidiaries and VIE, and amounts due from subsidiaries and VIE |

|

47,472,836 |

|

10,685,659 |

|

402,488 |

|

(58,560,983) |

|

— |

Investment in equity investees |

|

1,027,241 |

|

2,402,827 |

|

300,380 |

|

— |

|

3,730,448 |

Property and equipment, net |

|

— |

|

19,063,363 |

|

5,866,534 |

|

— |

|

24,929,897 |

Land use rights, net |

|

— |

|

4,141,241 |

|

1,194,308 |

|

— |

|

5,335,549 |

Intangible assets, net |

|

— |

|

35,634 |

|

— |

|

— |

|

35,634 |

Operating lease right-of-use assets |

|

— |

|

26,407 |

|

870,831 |

|

— |

|

897,238 |

Goodwill |

|

— |

|

84,430 |

|

4,157,111 |

|

— |

|

4,241,541 |

Deferred tax assets |

|

— |

|

284,139 |

|

650,709 |

|

— |

|

934,848 |

Long-term investment |

|

— |

|

1,214,500 |

|

— |

|

— |

|

1,214,500 |

Long-term financing receivables, net |

|

— |

|

295,953 |

|

1,117,003 |

|

— |

|

1,412,956 |

Other non-current assets |

|

— |

|

377,643 |

|

384,630 |

|

— |

|

762,273 |

Amounts due from related parties outside the consolidated groups-non-current |

|

— |

|

611,100 |

|

— |

|

— |

|

611,100 |

TOTAL ASSETS |

|

49,317,573 |

|

52,124,495 |

|

19,891,258 |

|

(58,560,983) |

|

62,772,343 |

Liabilities |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Short-term bank borrowings |

|

637,260 |

|

— |

|

2,821,457 |

|

— |

|

3,458,717 |

Accounts payable |

|

— |

|

400,880 |

|

1,556,649 |

|

— |

|

1,957,529 |

Notes payable |

|

— |

|

45,000 |

|

129,920 |

|

— |

|

174,920 |

Advances from customers |

|

— |

|

12,752 |

|

1,213,797 |

|

— |

|

1,226,549 |

Income tax payable |

|

— |

|

86,789 |

|

— |

|

— |

|

86,789 |

Amounts due to related parties outside the consolidated group |

|

— |

|

8,352 |

|

14,434 |

|

— |

|

22,786 |

Amounts due to related parties within the consolidated group |

|

— |

|

3,095,386 |

|

— |

|

(3,095,386) |

|

— |

Operating lease liabilities, current |

|

— |

|

12,022 |

|

238,973 |

|

— |

|

250,995 |

Acquisition consideration payables |

|

— |

|

22,942 |

|

— |

|

— |

|

22,942 |

Dividends payable |

|

708 |

|

— |

|

— |

|

— |

|

708 |

Other current liabilities |

|

42,358 |

|

3,196,742 |

|

2,555,280 |

|

— |

|

5,794,380 |

Non-current operating lease liabilities |

|

— |

|

22,351 |

|

533,740 |

|

— |

|

556,091 |

Deferred tax liabilities |

|

— |

|

179,813 |

|

112,543 |

|

— |

|

292,356 |

TOTAL LIABILITIES |

|

680,326 |

|

7,083,029 |

|

9,176,793 |

|

(3,095,386) |

|

13,844,762 |

Equity |

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

535 |

|

15,084,658 |

|

600,000 |

|

(15,684,658) |

|

535 |

Additional paid-in capital |

|

28,229,026 |

|

600,000 |

|

3,923,412 |

|

(4,523,412) |

|

28,229,026 |

Treasury shares, at cost |

|

(2,067,009) |

|

— |

|

— |

|

— |

|

(2,067,009) |

Retained earnings |

|

22,716,799 |

|

28,414,359 |

|

6,162,247 |

|