UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 10, 2024

WISA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38608 | 30-1135279 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

|

15268 NW Greenbrier Pkwy Beaverton, OR |

97006 | |

| (Address of registrant’s principal executive office) | (Zip code) |

(408) 627-4716

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

||

| Common Stock, par value $0.0001 per share | WISA | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of this Current Report on Form 8-K (this “Form 8-K”), the information contained in Item 5.03 of this Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws.

As previously reported in a Current Report on Form 8-K filed by WiSA Technologies, Inc. (the “Company”) on March 16, 2024, at a special meeting of the Company’s stockholders held on March 15, 2024, the stockholders of the Company voted to approve an amendment to the Company’s certificate of incorporation, as amended (“Certificate of Incorporation”), to effect a reverse stock split of all outstanding shares of Company’s common stock, par value $0.0001 per share (the “Common Stock”) at a ratio in the range of one-for-five to one-for-one hundred and fifty, to be determined in the sole discretion of the board of directors of the Company (the “Board”). On April 4, 2024, the Board approved a one-for-one hundred and fifty reverse stock split (the “Reverse Stock Split”) of its outstanding shares of Common Stock and authorized the filing of a certificate of amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Certificate of Amendment”) to effect the Reverse Stock Split. On April 12, 2024, the Company filed the Certificate of Amendment to effect the Reverse Stock Split, effective as of 5:00 p.m. Eastern Time on April 12, 2024 (the “Effective Time”). The Common Stock is expected to begin trading on the Nasdaq Capital Market (“Nasdaq”) on a split-adjusted basis at the start of trading on April 15, 2024.

As a result of the Reverse Stock Split, every one hundred and fifty (150) shares of Common Stock issued and outstanding as of the Effective Time will be converted into one (1) share of Common Stock (the “New Common Stock”). The New Common Stock will have a new CUSIP number of 86633R 609. The Reverse Stock Split does not affect the total number of shares of capital stock, including the Common Stock, that the Company is authorized to issue, which shall remain as set forth pursuant to the Certificate of Incorporation. No fractional shares of New Common Stock will be issued in connection with the Reverse Stock Split, all of which shares of New Common Stock shall be rounded up to the nearest whole number of such shares.

The Company’s outstanding securities, including equity awards will be adjusted as a result of the Reverse Stock Split, as required by the terms of such securities.

VStock Transfer, LLC, the Company transfer agent, will send instructions to stockholders, if any, of record, who hold stock certificates regarding the exchange of certificates for New Common Stock. Stockholders who hold their shares of Common Stock in book-entry form or in brokerage accounts or "street name" are not required to take any action to effect the exchange of their shares of Common Stock following the Reverse Stock Split.

The foregoing summary of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. Our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "will," "expects," "anticipates," "aims," "potential" "future," "intends," "plans," "believes," "estimates," "continue," "likely to," and other similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements, including statements herein on the Effective Time and the date that trading of the Common Stock will begin on a split-adjusted basis, are not historical facts and are based on current expectations, estimates and projections about the Company’s business which, in part, is based on assumptions made by its management. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict, many of which are beyond the Company’s control, including, among other things, the Company’s ability to maintain the listing of its securities on Nasdaq, and those other risks that may be included in the periodic reports and other filings that the Company files from time to time with the SEC, which may cause the Company’s actual results, performance and achievements to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this Form 8-K, except as required by applicable law.

Item 8.01. Other Information.

On April 10, 2024, the Company issued a press release with respect to the Reverse Stock Split. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

Description | |

| 3.1 | Certificate of Amendment to Certificate of Incorporation of WiSA Technologies, Inc., filed with the Secretary of State of the State of Delaware on April 12, 2024 | |

| 99.1 | Press Release dated April 10, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: April 12, 2024 | WISA TECHNOLOGIES, INC. | |

| By: | /s/ Brett Moyer | |

| Brett Moyer | ||

| Chief Executive Officer | ||

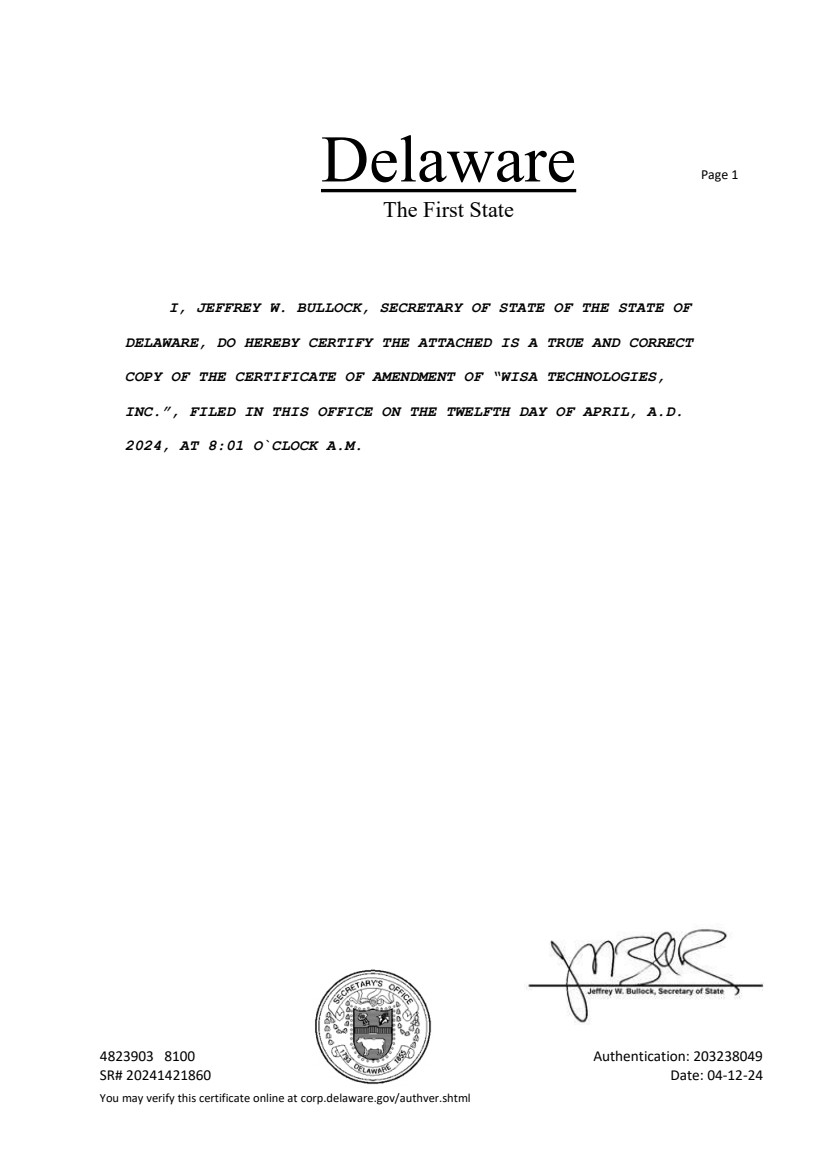

Exhibit 3.1

|

Delaware The First State Page 1 4823903 8100 Authentication: 203238049 SR# 20241421860 Date: 04-12-24 You may verify this certificate online at corp.delaware.gov/authver.shtml I, JEFFREY W. BULLOCK, SECRETARY OF STATE OF THE STATE OF DELAWARE, DO HEREBY CERTIFY THE ATTACHED IS A TRUE AND CORRECT COPY OF THE CERTIFICATE OF AMENDMENT OF “WISA TECHNOLOGIES, INC.”, FILED IN THIS OFFICE ON THE TWELFTH DAY OF APRIL, A.D. 2024, AT 8:01 O`CLOCK A.M. |

CERTIFICATE OF AMENDMENT OF

CERTIFICATE OF INCORPORATION OF

WISA TECHNOLOGIES, INC.

WiSA Technologies, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify that:

FIRST: The name of the Corporation is WiSA Technologies, Inc.

SECOND: This Certificate of Amendment (this “Certificate of Amendment”) amends the provisions of the Corporation’s Certificate of Incorporation, as amended, and any amendments thereto (the “Certificate of Incorporation”), last amended by a certificate of amendment to the Certificate of Incorporation filed with the Secretary of State on March 25, 2024.

THIRD: Article Fourth of the Certificate of Incorporation is hereby amended by inserting the following provision below the last sentence in Article Fourth of the Certificate of Incorporation:

“Upon the filing of this Amendment with the Secretary of State of the State of Delaware (the “2024 Effective Time”), each one hundred and fifty (150) outstanding shares of Common Stock outstanding immediately prior to the 2024 Effective Time (the “2024 Old Common Stock”) shall be combined and converted into one (1) share of Common Stock (the “2024 New Common Stock”) based on a ratio of one share of 2024 New Common Stock for each one hundred and fifty shares of 2024 Old Common Stock (the “2024 Reverse Split Ratio”). This reverse stock split (the “2024 Reverse Split”) of the outstanding shares of Common Stock shall not affect the total number of shares of capital stock, including the Common Stock, that the Company is authorized to issue, which shall remain as set forth under this Article Fourth.

The 2024 Reverse Split shall occur without any further action on the part of the Corporation or the holders of shares of 2024 New Common Stock and whether or not certificates representing such holders’ shares prior to the Reverse Split are surrendered for cancellation. No fractional interest in a share of 2024 New Common Stock shall be deliverable upon the 2024 Reverse Split, all of which shares of 2024 New Common Stock be rounded up to the nearest whole number of such shares. All references to “Common Stock” in these Articles shall be to the 2024 New Common Stock.

The 2024 Reverse Split will be effectuated on a stockholder-by-stockholder (as opposed to certificate-by-certificate) basis, except that the 2024 Reverse Split will be effectuated on a certificate-by-certificate basis for shares held by registered holders. For shares held in certificated form, certificates dated as of a date prior to the 2024 Effective Time representing outstanding shares of 2024 Old Common Stock shall, after the 2024 Effective Time, represent a number of shares of 2024 New Common Stock as is reflected on the face of such certificates for the 2024 Old Common Stock, divided by the 2024 Reverse Split Ratio and rounded up to the nearest whole number. The Corporation shall not be obligated to issue new certificates evidencing the shares of 2024 New Common Stock outstanding as a result of the 2024 Reverse Split unless and until the certificates evidencing the shares held by a holder prior to the 2024 Reverse Split are either delivered to the Corporation or its transfer agent, or the holder notifies the Corporation or its transfer agent that such certificates have been lost, stolen or destroyed and executes an agreement satisfactory to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such certificates.”

FOURTH: This Certificate of Amendment was duly adopted in accordance with the provisions of Sections 212 and 242 of the General Corporation Law of the State of Delaware.

FIFTH: This Certificate of Amendment shall be effective as of 5:00 p.m., New York Time on the date written below.

SIXTH: All other provisions of the Certificate of Incorporation shall remain in full force and effect.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its officer thereunto duly authorized this 12th day of April, 2024.

| WISA TECHNOLOGIES, INC. | ||

| By: | /s/ Brett Moyer | |

| Brett Moyer, Chairman, | ||

| President and Chief Executive Officer | ||

Exhibit 99.1

FOR IMMEDIATE RELEASE

WiSA Technologies Announces Reverse Stock Split

BEAVERTON, OR — (April 10, 2024)— WiSA Technologies, Inc. (Nasdaq: WISA, the “Company,” “we," "us” or “our") a leading innovator in wireless audio technology for intelligent devices and next-generation home entertainment systems, today announced that on April 4, 2024, the Company’s Board of Directors approved a 1-for-150 reverse split (the "Reverse Stock Split") of the Company’s common stock (the "Common Stock"). On April 12, 2024, the Company plans to file a certificate of amendment to the Company’s certificate of incorporation, as amended, with the Secretary of State of the State of Delaware to effect the Reverse Stock Split as of 5:00 p.m. Eastern Time on that date. On April 15, 2024 the Common Stock will begin trading on the Nasdaq Capital Market (“Nasdaq”) on a split-adjusted basis at the start of trading on April 15, 2024 and will have a new CUSIP number of 86633R609.

Information to Stockholders

VStock Transfer, LLC, the Company transfer agent, will send instructions to stockholders of record who hold stock certificates regarding the exchange of certificates for Common Stock. Stockholders who hold their shares of Common Stock in book-entry form or in brokerage accounts or "street name" are not required to take any action to effect the exchange of their shares of Common Stock following the Reverse Stock Split. VStock Transfer, LLC may be reached for questions at (212) 828-8436.

About WiSA Technologies, Inc.

WiSA Technologies, Inc. (NASDAQ: WISA) is a leading provider of immersive, wireless sound technology for intelligent devices and next-generation home entertainment systems. Working with leading CE brands and manufacturers such as Harman International, a division of Samsung; LG; Hisense; TCL; Bang & Olufsen; Platin Audio; and others, the company delivers immersive wireless sound experiences for high-definition content, including movies and video, music, sports, gaming/esports, and more. WiSA Technologies, Inc. is a founding member of WiSA™ (the Wireless Speaker and Audio Association) whose mission is to define wireless audio interoperability standards as well as work with leading consumer electronics companies, technology providers, retailers, and ecosystem partners to evangelize and market spatial audio technologies driven by WiSA Technologies, Inc. The company is headquartered in Beaverton, OR with sales teams in Taiwan, China, Japan, Korea, and California.

Safe Harbor Statement

This press release contains forward-looking statements, which are not historical facts, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements, including statements herein on the effective date of the Reverse Stock Split and the date that trading of the Common Stock will begin on a split-adjusted basis, are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Readers are cautioned not to place undue reliance on these forward-looking statements. Actual results may differ materially from those indicated by these forward-looking statements as a result of risks and uncertainties including, but not limited to, our ability to maintain the listing of our Common Stock on Nasdaq; our current liquidity position and the need to obtain additional financing to support ongoing operations; our ability to continue as a going concern; general market, economic and other conditions; our ability to manage costs and execute on our operational and budget plans; our ability to achieve our financial goals; and other risks as more fully described in our filings with the Securities and Exchange Commission. The information in this press release is provided only as of the date of this press release, and we undertake no obligation to update any forward-looking statements contained in this press release based on new information, future events, or otherwise, except as required by law.

Contact Information

David Barnard, LHA Investor Relations, (415) 433-3777, wisa@lhai.com