UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 Under the

Securities Exchange Act of 1934

For the month of April, 2024

Commission File Number: 001-32482

WHEATON PRECIOUS METALS CORP.

(Exact name of registrant as specified in its charter)

Suite 3500, 1021 West Hastings Street

Vancouver, British Columbia

V6E 0C3

(604) 684-9648

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Exhibit 99.2 to this report on Form 6-K shall be incorporated by reference into the registrant’s Registration Statement on Form S-8 (File No. 333-128128), on Form F-10 (File No. 333-271239) and on Form F-3D (File No. 333-194702) under the Securities Act of 1933, as amended.

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| WHEATON PRECIOUS METALS CORP. | ||

| (Registrant) | ||

| Date: April 5, 2024 | By: | /s/ Curt Bernardi |

| Name: Curt Bernardi | ||

| Title: Senior Vice President, Legal and Strategic Development | ||

Exhibit 99.1

|

Notice

of 2024 Annual and Special Meeting |

NOTICE AND ACCESS NOTIFICATION TO SHAREHOLDERS

You are receiving this notification as Wheaton Precious Metals Corp. (the “Company”) uses the notice and access model for the delivery of its information circular to its shareholders in respect of its annual and special meeting of shareholders to be held on May 10, 2024 (the “Meeting”). Under notice and access, instead of receiving paper copies of the Company’s management information circular for the year ended December 31, 2023 (the “Information Circular”), shareholders are receiving this notice with information on how they may access the Information Circular electronically. However, together with this notification, shareholders continue to receive a proxy or voting instruction form (“VIF”), as applicable, enabling them to vote at the Meeting. The Company has adopted an online virtual meeting platform in addition to the in person meeting location and shareholders are encouraged to participate in the Meeting using this online platform. See important information below on voting at the Meeting using the online platform.

MEETING DATE AND LOCATION

| Important Meeting Information | ||

| Date | è | May 10, 2024 |

| Time | è | 10:30a.m. (PST) |

| Virtual | è | https://virtual-meetings.tsxtrust.com/1596 |

| In person | è | Offices of Cassels, Brock & Blackwell LLP, Suite 2200 HSBC Building, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 |

HOW TO ACCESS THE INFORMATION CIRCULAR

The Information Circular can be viewed online as follows:

| è | The Company’s website: www.wheatonpm.com/Investors/annual-general-meeting |

| è | The Company’s page on SEDAR+: www.sedarplus.ca |

| è | The Company’s filings on United States Securities and Exchange Commission: www.sec.gov |

Shareholders may request paper copies of the Information Circular be sent to them by postal delivery at no cost to them for up to one year from the date the Information Circular was filed on SEDAR by calling toll-free at 1-888-433-6443 or by emailing tsxt-fulfilment@tmx.com. Requests for paper copies must be received at least five business days in advance of the proxy deposit date and time set out in the accompanying proxy or VIF in order to receive the Information Circular in advance of the proxy deposit date and Meeting. The Information Circular will be sent to such shareholders within three business days of their request if such requests are made before the Meeting. Those shareholders with existing instructions on their account to receive a paper copy of meeting materials will receive a paper copy of the Information Circular with this notification. Please note that if you request a paper copy of the Information Circular, you will not receive a new proxy form or VIF, so please keep the original form sent with this notice in order to vote. SHAREHOLDERS ARE REMINDED TO REVIEW THE INFORMATION CIRCULAR PRIOR TO VOTING.

SHAREHOLDERS WILL BE ASKED TO CONSIDER AND VOTE ON THE FOLLOWING MATTERS:

| è | FINANCIAL STATEMENTS: To receive the audited consolidated financial statements for the year ended December 31, 2023 and the report of the auditors thereon. |

| è | ELECTION OF DIRECTORS: To elect the ten director nominees. See the section entitled “Election of Directors” in the Information Circular. |

| è | APPOINTMENT OF AUDITORS: To appoint Deloitte LLP, Independent Registered Public Accounting Firm, as auditors for 2024 and to authorize the directors to fix the auditors’ remuneration. See the section entitled “Appointment of Auditors” in the Information Circular. |

| è | SAY ON PAY: To approve a non-binding advisory resolution on the Company’s approach to executive compensation. See the sections entitled “Executive Compensation” and “Say On Pay Advisory Vote” in the Information Circular. |

| è | OTHER BUSINESS: To transact any other business which may properly come before the Meeting or any adjournment of the Meeting. |

Shareholders with questions about notice and access can call toll free at 1-800-380-8687

-

VOTING – ONLINE VIRTUAL MEETING PLATFORM

All shareholders participating in our online virtual Meeting platform will be able listen to the Meeting live, ask questions online, and for registered shareholders or proxyholders, submit votes in real time. The online Meeting can be accessed at https://virtual-meetings.tsxtrust.com/1596. Registered shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholders) may enter the online Meeting platform by clicking “I have a control number” and entering a valid control number and the password “wheaton2024” (case sensitive) before the start of the Meeting. Non-registered shareholders who wish to vote at the Meeting through the online virtual platform must insert their own name in the space provided on the VIF received from the nominee. In so doing, such non-registered shareholder will be instructing its nominee to appoint such non-registered shareholder as proxyholder. Non-registered shareholders must adhere strictly to the signature and return instructions provided by their nominee. It is not necessary to complete the form in any other respect, since such non-registered shareholder will be voting at the Meeting by voting online through the online virtual Meeting platform. Non-registered shareholders who wish to vote at the Meeting must register as proxyholder by contacting TSX Trust Company at 1-866-751-6315 (in North America) or 1 (416) 682-3860 outside North America or by completing the electronic form located at: https://www.tsxtrust.com/control-number-request by 10:30 a.m. PST on Wednesday, May 8, 2024. TSX Trust Company will then provide the non-registered shareholder with a control number by email after the proxy voting deadline has passed. The control number is the non-registered shareholder’s username for the purposes of logging into the Meeting. More information regarding participating in the Meeting online, including browser requirements, is detailed in the Wheaton Virtual Meeting Guide provided with this notice and access notification or on Wheaton’s website at www.wheatonpm.com/Investors/annual-general-meeting/.

VOTING – PROXY

For shareholders who are unable to attend the online virtual Meeting, they may choose to vote by proxy as follows:

Registered shareholders are asked to return their proxies using the following methods by the proxy deposit date noted on your proxy:

| CANADA AND UNITED STATES | |

| FAX: | 1-416-595-9593. |

| INTERNET: | Go to www.meeting-vote.com and follow the instructions using the 13-digit control number located on the proxy. |

| E-MAIL: | Send to proxyvote@tmx.com. |

| MAIL: |

Complete the form of proxy or any other proper form of proxy, sign it and mail it to:

TSX Trust Company |

Non-registered (or beneficial) shareholders are asked to return their voting instructions using the methods set out on their VIF or business reply envelope, or as set out below, at least one business day in advance of the proxy deposit date noted on your VIF:

| CANADA | UNITED STATES | |||

| MAIL: | Data

Processing Centre P.O. Box 3700, STN INDUSTRIAL PARK Markham, Ontario L3R 9Z9 Canada |

MAIL: | Proxy

Services PO Box 9104 Farmingdale, New York 11735-9533 USA |

|

| TELEPHONE: |

English: 1-800-474-7493 French: 1-800-474-7501 |

TELEPHONE: | 1-800-454-8683 | |

| INTERNET: | Go to www.proxyvote.com and follow the instructions using the 16-digit control number included in your VIF. | INTERNET: | Go to www.proxyvote.com and follow the instructions using the 16-digit control number included in your VIF. | |

| QR CODE: | Vote by scanning the QR code included in your voting instruction form to access the voting site from your mobile device. | QR CODE: | Vote by scanning the QR code included in your voting instruction form to access the voting site from your mobile device. | |

Exhibit 99.2

Table of Contents

| Solicitation of Proxies | 10 |

| Appointment and Revocation of Proxies | 10 |

| Exercise of Discretion by Proxies | 11 |

| Voting Securities and Principal Holders Thereof | 13 |

| Advance Notice By-law | 14 |

| Majority Voting Policy | 14 |

| Board Nominees At A Glance | 15 |

| Director Biographies | 16 |

| Director Experiences, Expertise and Skills | 26 |

| Our Year in Review | 30 |

| Board of Directors | 30 |

| Diversity and Representation of Women at Wheaton | 33 |

| Environment, Social and Governance | 35 |

| Climate Change and Environment | 36 |

| Community Investment Program | 37 |

| Information Systems and Cyber Security | 37 |

| Position Descriptions | 39 |

| Compensation | 41 |

| Committees of the Board | 42 |

| Board Assessments | 44 |

| Director Share Ownership Requirements | 45 |

| Director Compensation Summary | 49 |

| Incentive Plan Awards | 51 |

| Retirement Policy for Directors | 53 |

| Directors’ and Officers’ Liability Insurance | 53 |

| Equity Compensation Plans | 93 |

| Share Option Plan | 93 |

| Performance Share Unit Plan | 95 |

| Restricted Share Plan | 96 |

| Indebtedness of Directors and Executive Officers | 98 |

| Interest of Certain Persons in Matters to be Acted Upon | 98 |

| Interest of Informed Persons in Material Transactions | 98 |

| Say on Pay Advisory Vote | 100 |

| Shareholder Engagement & Contacting the Board of Directors | 101 |

| Additional Information | 102 |

| Directors’ Approval | 102 |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Business of the Meeting

Below is a summary of the matters to be acted upon at the 2024 Annual and Special Meeting of shareholders of Wheaton Precious Metals Corp. (“we”, “us”, “our”, the “Company” or “Wheaton”). This summary does not contain all of the information that you should consider, and you should carefully read the entire management information circular (the “Circular”) before voting. For this year’s Meeting, Wheaton has adopted an online virtual meeting platform in addition to the in-person meeting location and we are encouraging our shareholders to participate in the Meeting using this online platform. See “How Do I Join the Wheaton Online Virtual Meeting?” on page 4 for details.

Ordinary Matters

1 Wheaton’s Financial Statements

Wheaton will place before the Meeting its consolidated financial statements for the year ended December 31, 2023. These financial statements have been mailed to shareholders who requested a copy and are available on Wheaton’s website at www.wheatonpm.com, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

| 2 Election of Directors | Board Recommendation: VOTE FOR EACH NOMINEE |

Shareholders will be asked to elect 10 members to the Board of Directors. Please refer to the section entitled “Election of Directors” on page 14 for director biographies and details on the election process.

| 3 Appointment of Auditors | Board Recommendation: VOTE FOR |

Shareholders will be asked to approve the appointment of Deloitte LLP, Independent Registered Public Accounting Firm, as auditors of Wheaton and to fix their remuneration. Please refer to the section entitled “Appointment of Auditors” on page 99 for details on fees billed by the auditors.

Special Matters

| 4 Say on Pay Advisory Vote | Board Recommendation: VOTE FOR |

Shareholders will be asked to approve a non-binding advisory resolution on the Company’s approach to executive compensation. Please refer to the section entitled “Executive Compensation” on page 54 and “Special Matters – Say on Pay Advisory Vote” on page 100 for details on Wheaton’s executive compensation and the say on pay advisory vote.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

About Wheaton Precious Metals

Wheaton is the world’s premier precious metals streaming company with the highest-quality portfolio of long-life, low-cost assets. We enter into streaming agreements with third-party independent mining companies (“Mining Partners”) to purchase all or a portion of their precious metals or cobalt production and royalty agreements. As consideration, our Mining Partners receive an upfront payment, plus additional payments upon delivery of the metals.

We believe our business model and the quality of our asset portfolio represents a long-term, sustainable option for precious metals investment that offers consistently higher margins with lower risk. We focus on low-cost, long-life mines located in politically stable jurisdictions.

Our current streaming agreements and royalty agreements cover 18 operating mines and 26 development stage projects. We believe that our diversified portfolio of high-quality assets is unparalleled in the industry, providing our investors with:

| à | organic and accretive growth opportunities; |

| à | capital and operating cost predictability; |

| à | commodity price leverage; and |

| à | a competitive and innovative dividend. |

We believe in investing in our local communities and the communities around our Mining Partners’ operations. In collaboration with our Mining Partners, we share the benefits of mining through a multi-faceted Community Investment Program that supports health, education, employment and other community and environmental benefits for the people and communities in which our Mining Partners operate.

Our leadership in sustainability has been recognized by several ESG rating agencies and organizations. Wheaton is rated “AA” by MSCI and is also top rated in the Precious Metals category for Sustainalytics and is included in the ESG Global 50 Top Rated by Sustainalytics. We are also rated Prime by ISS ESG.

|

OUR

VISION |

|

OUR MANDATE |

|

To deliver value through streaming to all of our stakeholders: |

|

To our Shareholders, by delivering low risk, high quality, diversified exposure and growth optionality to precious metals |

|

To our Partners, by crystallizing value for precious metals yet to be produced |

|

To our Neighbours, by promoting responsible mining practices and supporting the communities in which we live and operate |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Our Year in Review – 2023

To assist you in reviewing the proposals to be voted upon at the 2024 Annual and Special Meeting of shareholders of Wheaton, this section provides highlights on Wheaton’s performance, compensation and governance matters. However, this summary does not contain all of the information that you should consider, and you should carefully read the entire Circular before voting.

Achievements During 2023 – Making Accretive Investments for Future Growth (1)

Wheaton continues to be the one of the largest precious metal streaming companies in the world. During 2023, Wheaton had some significant achievements, including:

|

CONSISTENT FINANCIAL RESULTS |

RECORD GROWTH IN HIGH-QUALITY ASSETS |

|

|

Wheaton’s revenue and operating cash flow for 2023 were over US$1 billion and US$751 million respectively |

Wheaton completed eight streaming and royalty transactions in 2023, the largest number of transactions added in one year for Wheaton, representing over one-half of the value of all streaming/royalty transactions in 2023 |

|

|

DELIVERING TO STAKEHOLDERS |

STRONG SUSTAINABILITY FOCUS |

|

|

During 2023 Wheaton paid a record US$272 million in dividends to shareholders, a leader in the mining industry in dividend to revenue ratio and deployed record support to communities around the world through Wheaton’s Community Investment Program |

Wheaton’s ongoing commitment to sustainability included the publication of Wheaton’s fourth Sustainability Report & Inaugural Climate Change Report |

|

Key Executive Compensation Results (2)

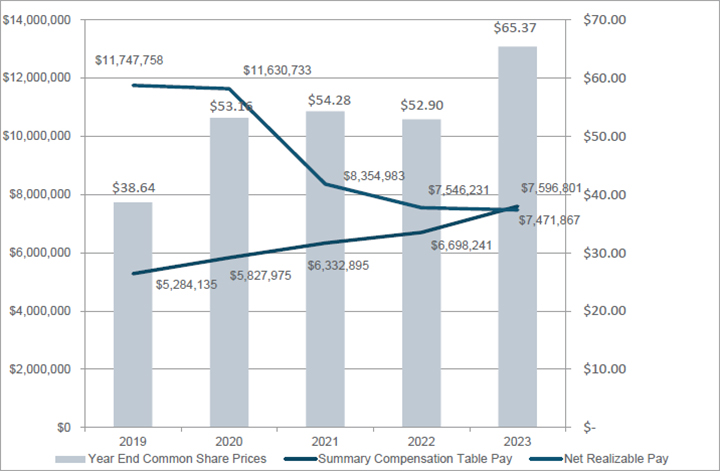

Overall total executive compensation increased for 2023 when compared to 2022. Key executive compensation results were:

|

Base salaries increased by approximately 4% for 2023 |

|

Value of long-term compensation awards paid to CEO increased by approximately 4% in 2023 compared to 2022 |

|

Annual performance-based cash incentive for CEO increased by approximately 44% compared to 2022, reflecting strong corporate performance for 2023 |

|

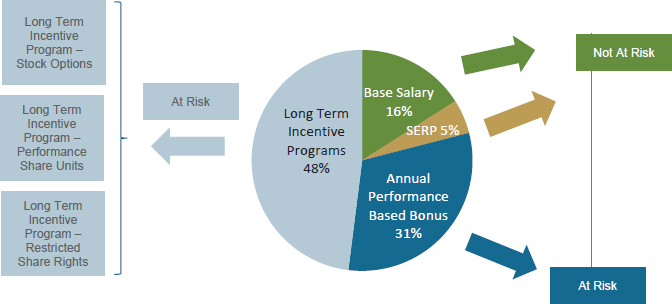

Approximately 79% of CEO compensation was at risk during 2023, consistent with 2022 |

|

Total compensation paid to CEO in 2023 increased by approximately 13% compared to 2022, primarily due to the annual performance-based cash incentive awards for 2023 |

| (1) | Shareholders are directed to the full disclosure on financial results contained in the consolidated financial statements and management’s discussion and analysis for the year ended December 31, 2023. |

| (2) | Shareholders are directed to the full disclosure under Executive Compensation contained in this information circular. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

2023 Compensation At A Glance

Wheaton’s compensation practices have been adopted with the goals of attracting, retaining and motivating key talent, as well as aligning the interests of management with the interests of Wheaton’s shareholders. Wheaton believes that these compensation practices continue to produce strong performance for Wheaton.

| Benchmarking to Well-Selected Comparator Group – the Human Resources Committee selects a comparator group based on objective criteria to benchmark Wheaton’s compensation | è | Page 63 |

| Balanced Approach to Compensation – Wheaton believes in a balanced compensation approach, with base salary, retirement plan, bonus and long-term compensation representing 16%, 5%, 31% and 48% respectively of total CEO compensation in 2023 | è | Page 59 |

| Annual Bonus Tied to Performance – Wheaton has significant performance objectives and a payout depending on the achievement of those objectives, including sustainability | è | Page 65 |

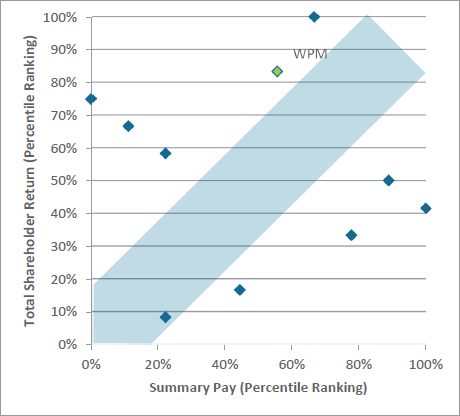

| Pay for Performance Alignment – Wheaton has strong alignment between shareholder return and total pay | è | Page 81 |

| Significant Proportion of Long-Term Compensation – compensation paid to executive officers is designed to reward success in achieving sustained, long-term profitability through the grant of equity awards vesting over multi-year periods | è | Page 72 |

| Executive Share Ownership – senior officers of Wheaton are required to hold common shares equal in value to five times base salary for the CEO and two times base salary for all other senior officers. Effective March 2024, performance share units may no longer be used to satisfy executive share ownership requirements. | è | Page 77 |

| Caps on Compensation – Wheaton has adopted caps on non-equity performance awards and the number of performance share units vesting, each equal to 200% | è | Page 65/74 |

| Claw Back Policy & Risk Management – the Board adopted an executive compensation claw back policy and the Audit Committee and Human Resources Committee identify, review and assess risks specifically associated with compensation policies and practices | è | Page 80 |

| Independent Advice – Wheaton’s third-party compensation consultant provides advice on the competitiveness and appropriateness of executive compensation programs | è | Page 58 |

| Human Resources Committee Discretion – determining whether to award an annual performance bonus is at the Human Resources Committee’s sole discretion | è | Page 65 |

| Anti-Hedging Policy – Wheaton prohibits all officers, directors and Vice-Presidents from entering into hedging transactions with Wheaton common shares | è | Page 81 |

| Employment Agreements – Wheaton has entered into employment agreements with all senior officers | è | Page 90 |

| Double Trigger on Severance Payments – severance payments to senior officers are not triggered unless there is both a change of control of Wheaton and the termination or effective termination of the officer | è | Page 90 |

| Modest Benefits – executive officers generally received perquisites that in the aggregate were no greater than C$50,000 | è | Page 77 |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

2023 Corporate Governance At A Glance

Wheaton recognizes the importance of corporate governance practices for the effective management of the Company. Details on Wheaton corporate governance practices can be found throughout this Circular.

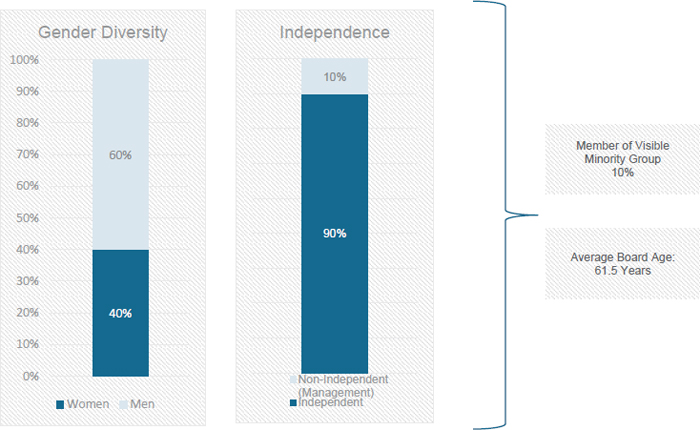

| Independence of the Board – currently 89% of Wheaton directors and 100% of committee members are independent | è | Page 16 |

| Independent Chair – the Chair of the Board of Wheaton is currently Mr. Brack, an independent director, and the role of Chair and CEO are separate | è | Page 31 |

| In Camera/Independent Meetings of the Board – at all Board meetings, independent directors meet without management to allow for more open discussions | è | Page 31 |

| Overboarding – Board members are not allowed to sit on four or more public company boards without the approval of the Board | è | Page 31 |

| Limits on Interlocking – no two Wheaton directors may sit together on two or more public company boards without the approval of the Board | è | Page 32 |

| Majority Voting Policy – the Board has adopted a policy that any director who receives a greater number of votes “withheld” than votes “for” must promptly tender a resignation to the Board | è | Page 14 |

| Terms of Reference – Wheaton has adopted detailed and comprehensive terms of reference for the Board | è | Page 32 |

| Diversity on the Board and at Wheaton – Wheaton currently has 44% female directors; 38% of our Executive and Vice Presidents are women; Wheaton has adopted a target to increase the percentage of gender diverse and visible minorities working at Wheaton, inclusive of leadership, and advance diversity and inclusion initiatives across the Company by 2028 | è | Page 33 |

| Risk Management – the Board has oversight over, and ensures management identifies the principal risks of the business | è | Page 38 |

| Continuing Education – new directors are provided with orientation and education when they join the Board and the Company facilitates ongoing education for all directors | è | Page 39 |

| Code of Business Conducts and Ethics – the Board has adopted and the Governance and Sustainability Committee monitors compliance with the Code of Business Conduct and Ethics | è | Page 39 |

| Whistleblower Policy – Wheaton has adopted a Whistleblower Policy which allows for confidential and anonymous reporting of concerns by employees in respect of financial disclosure or controls | è | Page 40 |

| Regular Assessments – the Board is committed to regular assessments of its effectiveness | è | Page 44 |

| Strong Share Ownership Requirements – all non-executive directors are required to hold common shares with a value equal to three times the amount of the annual retainer paid | è | Page 45 |

| Independent Auditors – Wheaton’s independent auditors are subject to comprehensive independence reviews and mandatory lead audit partner rotations | è | Page 99 |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Notice of 2024 Annual and Special Meeting of Shareholders

| Important Meeting Information | ||

| Date | è | May 10, 2024 |

| Time | è | 10:30a.m. (PST) |

| Virtual | è | https://virtual-meetings.tsxtrust.com/1596 |

| In person | è | Offices of Cassels, Brock & Blackwell LLP, Suite 2200 HSBC Building, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 |

Dear Wheaton Shareholders,

You are invited to attend the Annual and Special Meeting of shareholders (the “Meeting”) of Wheaton Precious Metals Corp. (“Wheaton” or the “Company”) for the following purposes:

| • | To receive the audited consolidated financial statements for the year ended December 31, 2023; |

| • | To elect the ten director nominees; |

| • | To appoint Deloitte LLP, Independent Registered Public Accounting Firm, as auditors for 2024; and |

| • | To approve a non-binding advisory resolution on the Company’s approach to executive compensation. |

Shareholders may also transact any other business which may properly come before the Meeting or any adjournment of the Meeting. Wheaton’s board of directors has by resolution fixed the close of business on March 15, 2024 as the record date. Your vote as a shareholder is important.

Wheaton has adopted an online virtual Meeting platform and we encourage all of our shareholders to participate in the Meeting using this online platform. All eligible shareholders participating in our online virtual Meeting platform will be able listen to the Meeting live and ask questions online. For registered shareholders or proxyholders (including non-registered shareholders who have appointed themselves as proxyholder) participating in our online virtual Meeting, such holders will also be able to submit votes at the Meeting in real time. Further information is provided in the section headed “How Do I Join the Wheaton Online Virtual Meeting?” and “How do I ask a Question at the Meeting?”. Shareholders may also attend the Meeting in person. Any shareholder attending in person will be required to comply with the then-current protocols in place at the offices of Cassels, Brock & Blackwell LLP.

If you are unable to attend the online virtual Meeting or in person, Wheaton encourages all shareholders to vote by proxy in advance of the Meeting date. See “General Proxy Information” in the Company’s management information circular (the “Circular”) for details on how you can vote by proxy. If you are a registered shareholder, please complete and return the enclosed form of proxy by no later than 10:30 a.m. (PST) on May 8, 2024. Non-registered shareholders should follow the voting instructions provided to them in the accompanying materials.

Carefully read the Circular accompanying this notice before voting. Wheaton has delivered the Circular by posting it to the Company’s website (www.wheatonpm.com/Investors/annual-general-meeting/) to help reduce paper use and printing costs. The Circular will also be available at www.sedarplus.ca and www.sec.gov and shareholders may request a paper copy of the Circular (at no cost) by calling toll-free at 1-888-433-6443 or by emailing tsxt-fulfilment@tmx.com. Shareholders can request to receive the Company’s annual and/or interim financial statements and management’s discussion and analysis on the form of proxy or voting instruction form accompanying the Circular. Otherwise they are available upon request to the Company or at www.sedarplus.ca, www.sec.gov, or www.wheatonpm.com.

| By Order of the Board of Directors | |

| “Randy V. J. Smallwood” | |

| Randy V. J. Smallwood, President and Chief Executive Officer | |

| March 21, 2024 |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Voting and Proxy Information

Shareholders of record as of March 15, 2024 may cast their votes in any of the following ways:

| Voting during virtual Meeting by Registered Shareholders and Non-Registered Shareholders or proxyholders: |

|

Online

Vote at https://virtual-meetings.tsxtrust.com/1596

See “How Do I Join the Wheaton Online Virtual Meeting?” on page 4 and the Virtual Meeting Guide provided by TSX Trust for details.

|

|

Proxy Voting in advance by Registered Shareholders:

|

|

Online

Vote at www.meeting-vote.com. You will need the 13-digit control number located on the proxy.

|

|

Send to proxyvote@tmx.com

|

|

|

Return your completed and signed proxy card using the return envelope that was provided to you.

|

|

|

Proxy Voting in advance by Non-Registered Shareholders:

|

|

Online

Vote at www.proxyvote.com. You will need the 16 digit number included in your voting instruction form.

|

|

Phone

Call the telephone number provided on your voting instruction form. You will need the 16 digit number included in your voting instruction form.

|

|

|

Return your completed and signed voting instruction form using the return envelope that was provided.

|

|

|

QR Code

Vote by scanning the QR code included in your voting instruction form to access the voting site from your mobile device.

|

|

| Voting in Person during Meeting by Registered Shareholders and Non-Registered Shareholders or proxyholders: | See “How do I vote if my shares are registered in my name (registered shareholder)?” on page 3 for Registered Shareholders and “Voting by Non-Registered Shareholders” on page 11 for Non-Registered Shareholders. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Commonly Asked Questions and Answers – Voting and Proxies

| Q. | How do I vote if my shares are registered in my name (registered shareholder)? |

| A. | For the Annual and Special Meeting of shareholders (the “Meeting”), Wheaton Precious Metals Corp. (“Wheaton” or the “Company”) is providing registered shareholders with the ability to vote online or in person during the Meeting, or in advance of the Meeting by proxy. If you are eligible to vote and your shares are registered in your name, you are a “registered shareholder” and therefore you can vote your shares as follows: |

| à | Online: see “How Do I Join the Wheaton Online Virtual Meeting?” for details, or |

| à | In Person: at the Meeting you will be able to present yourself to a representative of the scrutineer of the Meeting, TSX Trust Company (“TSX Trust Company”). Your vote will be taken and counted at the Meeting. If you wish to vote in person at the Meeting, do not complete or return the form of proxy, or |

| à | Proxy: by signing and returning your form of proxy by email to proxyvote@tmx.com; by mail in the prepaid envelope provided; by fax to the number indicated on the form; or online as directed below under the question “Where do I send my completed proxy if I am a registered shareholder?”. |

| Q. | How do I vote if my shares are not registered in my name, but are held in the name of a nominee (a bank, trust company, securities broker or other financial institution)? |

| A. | If your shares are not registered in your name, but are held in the name of a nominee that holds your securities on your behalf (usually a broker, a financial institution, a participant, a trustee or administrator of a self-administered retirement savings plan, retirement income fund, education savings plan or other similar self-administered savings or investment plan registered under the Income Tax Act (Canada), or a nominee of any of the foregoing that holds your securities on your behalf), you are a “non-registered” shareholder and your nominee is required to seek instructions from you as to how to vote your shares. Your nominee will have provided you with a package of information including either a form of proxy or a voting instruction form. The Company does not have the names of its non-registered shareholders so you must carefully follow the instructions accompanying the proxy or voting instruction form. If you are a non-registered shareholder, you can vote your shares as follows: |

| à | Online: see “How Do I Join the Wheaton Online Virtual Meeting?” and “How Do I Vote at the Wheaton Online Virtual Meeting?” for details, or |

| à | In Person: by inserting your own name in the space provided (appointee section) on the form of proxy or voting instruction form sent to you by your nominee. Complete the form by following the return instructions provided by your nominee. Do not otherwise complete the form as you will be voting in person at the Meeting. In doing so, you are instructing your nominee to appoint you as a proxyholder. You should present yourself to a representative of TSX Trust Company or the Company upon arrival at the Meeting and bring a picture ID and follow instructions on your proxy card/voting instruction form. Any shareholder attending in person will be required to comply with the then-current protocols in place at the offices of Cassels, Brock & Blackwell LLP. Your email should also confirm that you are a non-registered shareholder and that you have been appointed as a proxyholder. If you attend the Meeting, the Company will have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as a proxyholder, or |

| à | Proxy: by submitting the proxy or voting instruction form as directed by your nominee. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| Q. | How Do I Join the Wheaton Online Virtual Meeting? |

| A. | Joining the Wheaton online virtual Meeting requires that you have access to the internet either through a computer or through a mobile device. Please also refer to the Virtual Meeting Guide provided by TSX Trust with the Meeting Materials for details on how to join the Wheaton online virtual Meeting. |

Attending the Meeting using Wheaton’s online virtual Meeting platform enables all Wheaton shareholders to watch the Meeting live. Wheaton’s registered shareholders and appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholders) can also ask questions and direct votes at the appropriate times during the Meeting. Guests (including non-registered shareholders who have not duly appointed themselves as a proxy holder) may attend the Meeting, but they are not able to ask questions or vote at the Meeting.

Registered shareholders and duly appointed proxyholders who wish to participate in the online virtual Meeting may do so:

| à | from their computer, by entering the following URL in their browser: https://virtual-meetings.tsxtrust.com/1596; |

| à | from their mobile device by entering the following URL in their browser: https://virtual-meetings.tsxtrust.com/1596; |

If you choose to participate in the online virtual Meeting as a registered shareholder, you can log into the Meeting by:

| à | Clicking “I have a control number” and entering your valid control number |

| à | Entering the password for the Meeting, which is: wheaton2024 (case sensitive) |

| à | Follow the instructions to access the Meeting and vote when prompted. See “How Do I Vote at the Wheaton Online Virtual Meeting?” |

Guests, including non-registered shareholders who have not duly appointed themselves as a proxyholder, can log into the Meeting by clicking “I am a guest” and completing the online form. Guests will be able to listen to the Meeting, but will not be able to ask questions or vote.

IMPORTANT TECHNICAL REMINDERS FOR JOINING THE MEETING:

| à | You will need the latest versions of Chrome, Safari, Edge or Firefox. Please ensure your browser is compatible by attempting to login in early and do not use Internet Explorer. |

| à | It is important that you are connected to the internet at all times during the meeting in order to vote when balloting commences. You should ensure you have a strong, preferably high-speed, internet connection wherever you intend to participate in the Meeting. |

| à | Internal network security protocols including firewalls and VPN connections may block access to the TSX Trust Virtual Meeting Platform for the Meeting. If you are experiencing any difficulty connecting or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted to security settings of your organization. |

| à | More information regarding participating in the Meeting online, including browser requirements, is detailed in the Wheaton Virtual Meeting Guide available on the Wheaton’s website at www.wheatonpm.com/Investors/annual-general-meeting/. |

| à | The Meeting will begin promptly at 10:30a.m. PST on May 10, 2024, unless otherwise adjourned or postponed. Online check-in will begin one hour prior to the Meeting, at 9:30 a.m. PST. It is recommended that you log in online at least 15 minutes before the Meeting starts to allow ample time for online check-in procedures. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| à | Note that if you lose connectivity once the Meeting has commenced, there may be insufficient time to resolve your issue before ballot voting is completed. Even if you plan to attend the Meeting, you should consider voting your shares in advance so that your vote will be counted in case you later decide not to attend the Meeting or in the event that you experience any technical difficulties and are unable to access the Meeting and vote for any reason. |

| à | In the event of technical malfunction or other significant problem that disrupts the Meeting, the Chair may adjourn, recess, or expedite the Meeting, or take such other action as the Chair determines is appropriate, considering the circumstances. |

| Q. | How Do I Vote at the Wheaton Online Virtual Meeting? |

| A. | How to vote depends on whether you are a registered shareholder or non-registered shareholder. |

Registered shareholders who want to attend the Meeting and vote online during the Meeting should not complete the form of proxy and should instead follow the instructions below:

Step 1: Log in online at https://virtual-meetings.tsxtrust.com/1596 at least 15 minutes before the Meeting starts. See “How Do I Join the Wheaton Online Virtual Meeting?” for further details.

Step 2: Click “I have a control number” and then enter your control number and password wheaton2024 (case sensitive) and complete an online ballot during the Meeting. The control number is located on the form of proxy or in the email notification you received from TSX Trust Company.

If you use your control number to log into the Meeting and you have previously completed and submitted a proxy, there is no need to vote again as your vote has already been recorded. Any vote you cast at the Meeting will revoke any proxy you previously submitted.

Non-registered shareholders who wish to vote at the Meeting through the online virtual Meeting must insert their own name in the space provided on the voting instruction form received from the nominee. In so doing, such non-registered shareholder will be instructing its nominee to appoint such non-registered shareholder as proxyholder. Non-registered shareholders must adhere strictly to the signature and return instructions provided by their nominee. It is not necessary to complete the form in any other respect, since such non-registered shareholder will be voting at the Meeting by voting online through the online virtual Meeting platform. Non-registered shareholders who wish to vote at the Meeting must also register as proxyholder by contacting TSX Trust Company at 1-866-751-6315 (in North America) or 1 (416) 682-3869 outside North America or by completing the electronic form located at: https://www.tsxtrust.com/control-number-request by 10:30a.m. PST on Wednesday, May 8, 2024. TSX Trust Company will then provide the non-registered shareholder with a control number by email after the proxy voting deadline has passed. The control number is the non-registered shareholder’s username for the purposes of logging into the Meeting.

If you are a non-registered shareholder who does not appoint themselves as proxyholder then you may attend the Meeting as a guest, but you will not be able to ask questions or vote at the Meeting.

Once the voting is announced, click the voting icon. To vote, simply select the voting direction from the options and click submit to cast your vote.

Please also refer to the Virtual Meeting Guide provided by TSX Trust with the Meeting Materials for further details on voting at the Wheaton online virtual Meeting.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| Q. | How do I ask a question at the at the Meeting? |

| A. | Wheaton believes that the ability to participate in the Meeting in a meaningful way remains important regardless of whether a shareholder attends in person or virtually. |

For the in person and the virtual online Meeting, registered shareholders and proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholders) will be able to make motions or raise points of order, and will have the ability to raise questions and provide direct feedback to management as follows:

At the Meeting (Online): Eligible shareholders attending the Meeting may ask questions during the Meeting. If you would like to ask a question, select the “ASK A QUESTION” icon to the left of your screen. Type a message in the chat box in the messaging screen. Once you are happy with your message click the Ask Now button. Questions sent via this TSX Trust Virtual Meeting Platform will be moderated before being sent to the Chair. Once sent to the Chair, the question will read by the Chair of the Meeting or a designee of the Chair and responded to by a representative of Wheaton as they would be at a shareholders meeting that was being held in person.

At the Meeting (In Person): Eligible shareholders attending the Meeting in person may ask questions during the Meeting by raising their hand. The Chair or a designee of the Chair will repeat the question to ensure all online participants are able to hear the question. The question will be responded to by a representative of Wheaton at the appropriate time.

To ensure fairness for all attendees, the Chair of the Meeting will decide on the amount of time allocated to each question and will have the right to limit or consolidate questions and to reject questions that do not relate to the business of the Meeting or to the affairs of Wheaton or which are determined to be inappropriate or otherwise out of order.

Please also refer to the Virtual Meeting Guide provided by TSX Trust with the Meeting Materials for further details on asking a question at the Wheaton online virtual Meeting.

| Q. | What if I am experiencing difficulties attending the Online Virtual Meeting? |

| A. | If you have questions regarding the online virtual Meeting platform or require assistance accessing the Meeting website, you may contact tsxtvgminfo@tmx.com. If you attend the Meeting, you must remain connected to the Internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure Internet connectivity for the duration of the Meeting. Note that if you lose connectivity once the Meeting has commenced, there may be insufficient time to resolve your issue before voting is completed. Therefore, even if you currently plan to attend the Meeting and vote during the live webcast, you should consider voting your shares in advance or by proxy so that your vote will be counted in the event you experience any technical difficulties or are otherwise unable to access the Meeting. In the event of technical malfunction or other significant problem that disrupts the Meeting, the chair of the Meeting may adjourn, recess, or expedite the Meeting, or take such other action as the chair of the Meeting determines is appropriate, considering the circumstances. |

Please also refer to the Virtual Meeting Guide provided by TSX Trust with the Meeting Materials if you have questions or difficulties accessing the online virtual Meeting platform.

| Q. | What if I am a non-registered shareholder and do not give voting instructions to my nominee? |

| A. | If you are not attending the online virtual Meeting or in person, as a non-registered shareholder, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your nominee by the deadline provided in the materials you receive from your nominee. If you do not provide voting instructions to your nominee, your shares may not be voted in accordance with your wishes. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| Q. | What happens if the Meeting format, location, time or date needs to be changed? |

| A. | We are committed to keeping you informed. We will notify shareholders of a change without sending additional soliciting materials or updating proxy-related materials by: (i) issuing a news release announcing the change in the date, time, location or format; (ii) filing the news release on SEDAR+; and (iii) informing all the parties involved in the proxy voting infrastructure (such as intermediaries, transfer agents, and proxy service providers) of the change. |

| Q. | Who is soliciting my vote/proxy? |

| A. | The management of Wheaton is soliciting your vote/proxy in connection with its Meeting. It is expected that the solicitation will be primarily by mail, however, proxies may also be solicited personally by regular employees of the Company and the Company may use the services of an outside proxy solicitation agency to solicit proxies. The costs of solicitation will be borne by the Company. |

| Q. | Who is entitled to vote? |

| A. | You are entitled to vote if you were a holder of common shares of Wheaton as of the close of business on March 15, 2024. Each common share is entitled to one vote. |

| Q. | When are proxies due? |

Duly completed and executed proxies must be received by the Company’s transfer agent at the address indicated on the enclosed envelope no later than 10:30 a.m. (PST) on May 8, 2024, or no later than 48 hours before the time of any adjourned Meeting (excluding Saturdays, Sundays and holidays).

| Q. | How many votes are required to pass a matter on the agenda? |

| A. | A simple majority of the votes cast, during the online virtual Meeting, in person or represented by proxy, is required for each of the matters specified in this Circular. |

| Q. | Should I sign the form of proxy enclosed with the Notice of Meeting? |

| A. | If you are a registered shareholder and are not attending the online virtual Meeting or in person, you must sign the enclosed form of proxy for it to be valid. If you are a non-registered shareholder, and not attending the online virtual Meeting or in person, please read the instructions provided by your nominee. |

| Q. | What if my shares are registered in more than one name or in the name of a company and I wish to vote by proxy? |

| A. | If the shares are registered in more than one name, all those persons in whose name the shares are registered must sign the form of proxy. If the shares are registered in the name of a company or any name other than your own, you should provide documentation that proves you are authorized to sign the form of proxy. If you have any questions as to what documentation is required, contact TSX Trust Company prior to submitting your form of proxy. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| Q. | Can I appoint someone other than the individuals named in the enclosed form of proxy to vote my shares? |

| A. | Yes, you have the right to appoint some other person of your choice who need not be a shareholder of the Company to attend and act on your behalf at the online virtual Meeting or in person. If you wish to appoint a person other than those named in the enclosed form of proxy, then strike out those printed names appearing on the form of proxy and insert the name of your chosen proxyholder in the space provided. It is important to ensure that any other person you appoint is attending the Meeting and is aware that his or her appointment has been made to vote your shares. Appointed proxyholders should, if attending the virtual online Meeting, be registered as proxyholder with TSX Trust Company in order to receive a control number, as described under How Do I Vote at the Wheaton Online Virtual Meeting? and follow the instructions under How Do I Join the Wheaton Online Virtual Meeting?”. For appointed proxyholders who are attending the Meeting in person, on arrival at the Meeting, they should present themselves to a representative of TSX Trust Company or the Company. |

| Q. | Where do I send my completed proxy if I am a registered shareholder? |

| A. | You should send your completed proxy to: |

|

by mail to: TSX Trust Company Proxy Dept., P.O. Box 721 Agincourt, Ontario M1S 0A1 |

by fax to: 1-416-595-9593 |

| by internet to: www.meeting-vote.com | by email to: proxyvote@tmx.com |

| Q. | Where do I send my completed proxy if I am a non-registered shareholder? |

| A. | You should send your completed proxy using the methods set out on your voting instruction form or business reply envelope. |

| Q. | Can I change my mind once I send my proxy? |

| A. | If you are a registered shareholder and have returned a form of proxy, you may revoke it by: |

| 1. | completing and signing another form of proxy bearing a later date, and delivering it to TSX Trust Company; or |

| 2. | delivering a written statement, signed by you or your authorized attorney to: |

| (a) | the registered office of Wheaton Precious Metals Corp. c/o Cassels Brock & Blackwell LLP, 40 Temperance Street, Suite 3200, Bay Adelaide-Centre – North Tower, Toronto, Ontario M5H 0B4; Attention: Mark T. Bennett, at any time up to and including May 8, 2024 or, if the Meeting is adjourned, the business day preceding the day to which the Meeting is adjourned; or |

| (b) | the Chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or, if the Meeting is adjourned, the day to which the Meeting is adjourned. |

If you are a non-registered shareholder, contact your nominee.

| Q. | What if amendments are made to these matters or if other matters are brought before the Meeting? |

| A. | If you attend the virtual online Meeting or in person and are eligible to vote, you may vote on such matters as you choose. If you have completed and returned the form or proxy, the person named in the form of proxy will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Annual and Special Meeting of Shareholders of Wheaton, and to other matters which may properly come before the Meeting. As of the date of this Circular, the management of the Company knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| Q. | What if I am a registered shareholder and do not submit a proxy? |

| A. | As a registered shareholder, if you do not submit a proxy prior to 48 hours before the Meeting (excluding Saturdays, Sundays and holidays) or you do not attend and vote at the online virtual Meeting or in person, your shares will not be voted on any matter that comes before the Meeting. |

| Q. | Who counts the votes? |

| A. | A scrutineer, employed by the Company’s registrar and transfer agent, TSX Trust Company, will act as scrutineer and will count the votes and report the results to the Company. |

| Q. | What is an advisory vote on Say on Pay? |

| A. | “Say on Pay” is a non-binding advisory resolution to accept the Company’s approach to executive compensation. The purpose of the Say on Pay advisory vote is to give shareholders a formal opportunity to provide their views on the executive compensation plans of the Company. The advisory vote is non-binding on the Company and it remains the duty of the Board of Directors to develop and implement appropriate executive compensation policies for the Company. In the event that a significant number of shareholders oppose the resolution, the Board of Directors will endeavour to consult with its shareholders as appropriate (particularly those who are known to have voted against it) to understand their concerns and will review the Company’s approach to compensation in the context of those concerns. The Board of Directors will consider disclosing to shareholders as soon as is practicable, and no later than in the management information circular for its next annual meeting, a summary of any comments received from shareholders in the engagement process and any changes to the compensation plans made or to be made by the Board of Directors (or why no changes will be made). See “Special Matters – Say On Pay Advisory Vote” on page 100. |

| Q. | If I need to contact TSX Trust Company, the Company’s registrar and transfer agent, how do I reach them? |

A. You can contact the Company’s registrar and transfer agent:

|

by mail at: TSX Trust Company 301 - 100 Adelaide Street West Toronto, Ontario M5H 4H1

|

by telephone at: toll free within North America: 1-800-387-0825 outside North America: 416-682-3860 by internet at: www.tsxtrust.com by email at: shareholderinquiries@tmx.com |

| Q. | How do I give feedback on the Company’s executive compensation program, its governance practices or other aspects of this Circular? |

| A. | We value shareholder, employee and other interested party opinions, concerns and other feedback and invite you to communicate directly with the Board of Directors, the Human Resources Committee or the Governance and Sustainability Committee, as appropriate. Contact information is provided under the heading “Shareholder Engagement & Contacting the Board of Directors” on page 101. |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

General Proxy Information

Solicitation of Proxies

This Circular is furnished to the holders (the “shareholders”) of common shares (the “Common Shares”) in connection with the solicitation of proxies by the management of Wheaton Precious Metals Corp. (“we”, “our”, “us”, “Wheaton” or the “Company”) for use at the annual and special meeting of shareholders (the “Meeting”) of the Company to be held at the time and place and for the purposes set forth in the accompanying Notice of Meeting. References in this Circular to the Meeting include any adjournment or adjournments thereof. It is expected that the solicitation will be primarily by mail, however, proxies may also be solicited personally by regular employees of the Company and the Company may use the services of an outside proxy solicitation agency to solicit proxies. The costs of solicitation will be borne by the Company.

The board of directors of the Company (the “Board”) has fixed the close of business on March 15, 2024 as the record date, being the date for the determination of the registered holders of Common Shares entitled to receive notice of, and to vote at, the Meeting. Duly completed and executed proxies must be received by the Company’s transfer agent at the address indicated on the enclosed envelope no later than 10:30 a.m. (PST) on May 8, 2024, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned Meeting (the “Proxy Deposit Date”). Late proxies may be accepted or rejected by the Chair of the Meeting in his sole discretion, and the Chair is under no obligation to accept or reject any late proxy.

Unless otherwise stated, the information contained in this Circular is as of March 20, 2024. All dollar amounts referenced herein, unless otherwise indicated, are generally expressed in Canadian dollars and referred to as “C$”. Amounts expressed in United States dollars are referred to as “US$”. Unless otherwise stated, any United States dollar amounts in this Circular which have been converted from Canadian dollars have been converted at an exchange rate of C$1.00 = US$0.7561, the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2023.

Appointment and Revocation of Proxies

The persons named in the enclosed form of proxy are officers or directors of the Company. A shareholder desiring to appoint some other person, who need not be a shareholder, to represent such shareholder at the Meeting, may do so by inserting such person’s name in the blank space provided in the enclosed form of proxy or by completing another proper form of proxy and, in either case, depositing the completed and executed proxy at the office of the Company’s transfer agent indicated on the enclosed envelope no later than the Proxy Deposit Date.

A shareholder forwarding the enclosed proxy may indicate the manner in which the appointee is to vote with respect to any specific item by checking the appropriate space. If the shareholder giving the proxy wishes to confer a discretionary authority with respect to any item of business, then the space opposite the item is to be left blank. The Common Shares represented by the proxy submitted by a shareholder will be voted in accordance with the directions, if any, given in the proxy.

A proxy given pursuant to this solicitation may be revoked by an instrument in writing executed by a shareholder or by a shareholder’s attorney authorized in writing (or, if the shareholder is a corporation, by a duly authorized officer or attorney) and deposited either at the registered office of the Company (Wheaton Precious Metals Corp. c/o Cassels Brock & Blackwell LLP, 40 Temperance Street, Suite 3200, Bay Adelaide-Centre – North Tower, Toronto, Ontario M5H 0B4; Attention: Mark T. Bennett) at any time up to and including the last business day preceding the day of the Meeting or with the Chair of the Meeting on the day of the Meeting prior to the commencement of the Meeting or in any other manner permitted by law.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Exercise of Discretion by Proxies

The persons named in the enclosed form of proxy will vote the Common Shares in respect of which they are appointed in accordance with the direction of the shareholders appointing them. In the absence of such direction, such Common Shares will be voted in the discretion of the person named in the proxy. However, under New York Stock Exchange (“NYSE”) rules, a broker who has not received specific voting instructions from the beneficial owner may not vote the Common Shares in its discretion on behalf of such beneficial owner on “non-routine” proposals, including the election of directors and items set out under “Special Matters” on page 100. Thus, such Common Shares will be included in determining the presence of a quorum at the Meeting and will be votes “cast” for purposes of other proposals but will not be considered votes “cast” for purposes of voting on the election of directors or other non-routine matters.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of printing of this Circular, management knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters which are not now known to management should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the named proxies.

Voting by Non-Registered Shareholders

Only registered shareholders of the Company or the persons they appoint as their proxies are permitted to vote at the Meeting. Most shareholders of the Company are “non-registered” shareholders (“Non-Registered Shareholders”) because the Common Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. Common Shares beneficially owned by a Non-Registered Shareholder are registered either: (i) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (ii) in the name of a clearing agency (such as CDS Clearing and Depository Services Inc. or The Depository Trust & Clearing Corporation) of which the Intermediary is a participant. In accordance with applicable securities law requirements, the Company is required to distribute copies of this Circular and the form of proxy (which includes a place to request copies of the Company’s annual and/or interim financial statements and MD&A or to waive the receipt of the annual and/or interim financial statements and MD&A). In accordance with National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer, the Company has elected to deliver this Circular to shareholders by (i) distributing a notification of meeting along with the form of proxy to the clearing agencies and Intermediaries (the “Mailed Materials”) for distribution to Non-Registered Shareholders; and (ii) posting this Circular on the Company’s website (www.wheatonpm.com/Investors/annual-general-meeting/). See “Notice and Access” on page 12 for further information.

Intermediaries are required to forward the Mailed Materials to Non-Registered Shareholders unless a Non-Registered Shareholder has waived the right to receive them. Intermediaries often use service companies to forward the Mailed Materials distributed by the Company to Non-Registered Shareholders. Wheaton intends to pay for distribution to objecting Non-Registered Shareholders. Generally, Non-Registered Shareholders who have not waived the right to receive the Mailed Materials will either:

| (a) | be given a voting instruction form which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow. Typically, the voting instruction form will consist of a one page pre-printed form. Sometimes, instead of the one page pre-printed form, the voting instruction form will consist of a regular printed proxy form accompanied by a page of instructions which contains a removable label with a bar-code and other information. In order for the form of proxy to validly constitute a voting instruction form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. See above “Exercise of Discretion by Proxies” for broker discretion in the absence of non-registered shareholder direction; or |

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

| (b) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with the Company, c/o TSX Trust Company, Attention: Proxy Department, P.O. Box 721, Agincourt, Ontario, M1S 0A1 or by facsimile at (416) 595-9593. |

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the Common Shares of the Company they beneficially own. Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the persons named in the form of proxy and insert the Non-Registered Shareholder or such other person’s name in the blank space provided. Appointed proxyholders should, if attending the virtual online Meeting, be registered as proxyholder with TSX Trust Company in order to receive a control number, as described under How Do I Vote at the Wheaton Online Virtual Meeting? and follow the instructions under How Do I Join the Wheaton Online Virtual Meeting?”. For appointed proxyholders who are attending the Meeting in person, on arrival at the Meeting, they should present themselves to a representative of TSX Trust Company or the Company.

In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or voting instruction form is to be delivered.

A Non-Registered Shareholder may revoke a voting instruction form or a waiver of the right to receive Mailed Materials and to vote which has been given to an Intermediary at any time by written notice to the Intermediary provided that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive Mailed Materials and to vote which is not received by the Intermediary at least seven days prior to the Meeting.

Notice and Access

Under Canadian securities laws, reporting issuers are permitted to advise their shareholders of the availability of proxy-related materials, including this Circular on an easily accessible website, rather than mailing physical copies pursuant to the “Notice and Access” rules.

The use of this alternative means of delivery is more environmentally friendly as it helps reduce paper use, the Company’s carbon footprint and the Company’s printing costs. The Company has therefore decided to deliver this Circular to shareholders by posting it on its website (www.wheatonpm.com/Investors/annual-general-meeting/). This Circular will also be available on SEDAR+ at www.sedarplus.ca and on the United States Securities and Exchange Commission website at www.sec.gov. All shareholders will also receive a notice document which will contain information on how to obtain electronic and paper copies of this Circular in advance of the Meeting.

Shareholders who wish to receive paper copies of the Circular may request copies by calling toll-free at 1-888-433-6443 or by emailing tsxt-fulfilment@tsx.com.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Requests for paper copies must be received at least five business days in advance of the proxy deposit date and time set out in the accompanying proxy or voting instruction form in order to receive this Circular in advance of the proxy deposit date and Meeting. This Circular will be sent to such shareholders within three business days of their request if such requests are made before the Meeting. Those shareholders with existing instructions on their account to receive a paper copy of meeting materials will receive a paper copy of this Circular.

Voting Securities and Principal Holders Thereof

As of March 15, 2024, 453,069,254 Common Shares were issued and outstanding. Each Common Share entitles the holder thereof to one vote on all matters to be acted upon at the Meeting. The record date for the determination of shareholders entitled to receive notice of, and to vote at, the Meeting has been fixed at March 15, 2024. In accordance with the provisions of the Business Corporations Act (Ontario) (the “Act”), the Company will prepare a list of holders of Common Shares as of such record date. Each holder of Common Shares named in the list will be entitled to vote the shares shown opposite his or her name on the list at the Meeting. All such holders of record of Common Shares are entitled either to attend and vote thereat in person the Common Shares held by them or, provided a completed and executed proxy shall have been delivered to the Company’s transfer agent within the time specified in the attached Notice of Meeting, to attend and vote thereat by proxy the Common Shares held by them.

To the knowledge of the directors and executive officers of the Company, based upon publicly available information as of March 20, 2024, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities of the Company carrying more than 10% of the voting rights attached to any class of voting securities of the Company.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Election of Directors

The Company’s Articles of Continuance and rules and laws applicable to the Company provide that the Board consist of a minimum of three and a maximum of ten directors. The Board currently consists of nine directors. The Company’s shareholders have previously passed a special resolution authorizing the directors of the Company to set the number of directors to be elected at a shareholders meeting.

At the Meeting, shareholders will be asked to approve an ordinary resolution for the election of the ten persons named hereunder as directors of the Company (the “Nominees”). Unless authority to do so is withheld, the persons named in the accompanying proxy intend to vote for the election of the Nominees. Management does not contemplate that any of the Nominees will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, it is intended that discretionary authority shall be exercised by the persons named in the accompanying proxy to vote the proxy for the election of any other person or persons in place of any Nominee or Nominees unable to serve. Each director elected will hold office until the close of the first annual meeting of shareholders of the Company following his election or until his successor is duly elected or appointed unless his office is earlier vacated in accordance with the by-laws of the Company. Each of the Nominees, was elected at the last annual and special meeting of the Company’s shareholders held on May 12, 2023, other than Mr. Venkatakrishnan who is standing for election for the first time at the Meeting.

Advance Notice By-law

Under the Company’s By-law No. 3 Advance Notice of Nominations of Directors (the “Advance Notice Policy”) a director nomination must be made, in the case of an annual meeting of shareholders, not less than 30 nor more than 65 days prior to the date of the annual meeting of shareholders, and in the case of a special meeting of shareholders (which is not also an annual meeting of shareholders) called for the purpose of electing directors (whether or not called for other purposes), not later than the close of business on the fifteenth (15th) day following the day on which the first public announcement of the date of the special meeting of shareholders was made. An adjournment or postponement of a meeting of shareholders does not commence a new time period for the giving of a shareholder’s nomination under the Advance Notice Policy. The Advance Notice Policy also sets forth the information that a shareholder must include in the notice to the Company. Please see the Advance Notice Policy which is available on SEDAR+ at www.sedarplus.ca and on the Company’s website under the Corporate Governance heading for full details. As of the date of this Circular, no director nominations have been made by shareholders in connection with the Meeting under the terms of the Advance Notice Policy, and as such the only nominations for directors at the Meeting are the Nominees.

Majority Voting Policy

The Board has adopted a policy which requires that any director nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election, promptly tender his or her resignation to the Board, to be effective upon acceptance by the Board. The Governance and Sustainability Committee will review the circumstances of the election and make a recommendation to the Board as to whether or not to accept the tendered resignation. The Board must determine whether or not to accept the tendered resignation as soon as reasonably possible and in any event within 90 days of the election. The Board will accept the tendered resignation absent exceptional circumstances and the resignation will be effective when accepted by the Board, and the Company will promptly issue a news release with the Board’s decision. If the Board determines not to accept a resignation, the news release will state the reasons for that decision. Subject to any corporate law restrictions, the Board may fill any resulting vacancy through the appointment of a new director. The director nominee in question may not participate in any committee or Board votes concerning his or her resignation. This policy does not apply in circumstances involving contested director elections.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Board Nominees At A Glance

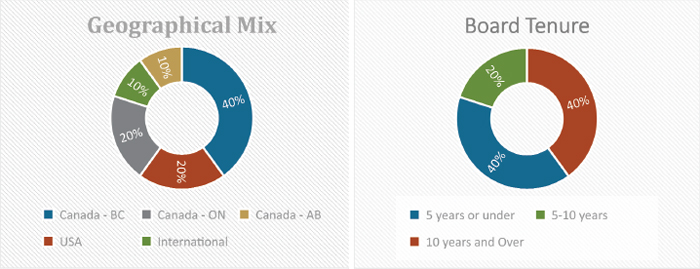

Wheaton recognizes the importance of diversity, representation and commitment at the Board level. The information below provides an overview of the Nominees, with further details throughout this Circular.

| 2023 Board Meetings | 2023 Required Committee Meetings | |

| 9 Meetings | 13 Meetings | |

| 97% attendance (1) | 98% attendance (1) |

(1) See Directors’ Biographies below for details on attendance.

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

Director Nominee Biographies

Biographies for each Nominee are set out below. These biographies include an assessment of the areas of expertise of each of the Nominees. Full descriptions of these areas of expertise are included under “Director Experiences, Expertise and Skills” on page 26. Where indicated, additional information is available in the endnotes to these biographies.

|

George L. Brack, Chair Age: 62 Director Since: November 24, 2009 (14 years) |

Independent

Residence: British Columbia, Canada Principal Occupation: Corporate Director

|

|

|

Wheaton Committees • None

|

Areas of Expertise (1) • Managing or leading growth • International • CEO/President • Industry expertise |

• Compensation • Investment banking/M&A • Financial literacy • Governance/Board • Risk management |

|

| Mr. Brack is the Chair of the Wheaton Board. He retired as Lead Independent Director of Capstone Mining Corp. in May 2023 and served as the non-Executive Chair from 2011-2022. In addition to his current board role, during the past 20 years, Mr. Brack served as a director on the boards of directors of Alio Gold Inc., ValOro Resources Inc. (now Defiance Silver Corp. and formerly Geologix Explorations Inc.), Aurizon Mines Ltd., Newstrike Capital Inc., NovaGold Resources Inc., Red Back Mining Inc. and chaired the board of Alexco Resources Corp. He has served on audit committees and has been both a member and the chair of compensation/human resource committees, corporate governance committees and special committees responding to takeover offers (Aurizon, Red Back and NovaGold). Mr. Brack’s 35-year career in the mining industry focused on exploration, corporate development and investment banking, specifically identifying, evaluating and executing strategic mergers and acquisitions, and raising equity capital. Until 2009, he was Managing Director and Industry Head, Mining at Scotia Capital. Prior to joining Scotia in 2006, Mr. Brack spent seven years as President of Macquarie North America Ltd. and lead its northern hemisphere mining industry mergers and acquisitions advisory business. Previously, Mr. Brack was Vice President, Corporate Development at Placer Dome Inc., Vice President in the mining investment banking group at CIBC Wood Gundy and worked on the corporate development team at Rio Algom. Mr. Brack earned an MBA at York University, a B.A.Sc. in Geological Engineering at the University of Toronto and the CFA designation. | |||

| Public Directorships | Public Committee Appointments | ||

| • None | • None | ||

| 2023 Voting Results | 2023 Board and Committee Meetings Attended (2)(3)(4) | ||

|

• Votes For: 322,284,673 (97.61%) • Votes Withheld: 7,878,957 (2.39%) |

• Board: 9 out of 9 (100%) | ||

| 2023 Continuing Education | |||

|

• National Association of Corporate Directors (“NACD”), Directors Daily (daily news briefings and updates for corporate directors, 2023) (Daily) • World Gold Council Presentation – Gold 247, February 8, 2023, Cayman Islands |

• Wheaton Precious Metals – Kevin Mitnick Security Training, June 7, 2023, Webinar • Wheaton Precious Metals, Cyber Security Awareness Training: 2024 Common Threats, December 1, 2023

|

||

| WHEATON 2024 MANAGEMENT INFORMATION CIRCULAR | [ |

|

Jaimie Donovan Age: 46 Director Since: May 13, 2022 (2 years) |

Independent

Residence: Ontario, Canada Principal Occupation: Corporate Director

|

|||

|

Wheaton Committees • Audit Committee |