UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

(Check One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

| x | ANNUAL REPORT PURSUANT TO SECTION 13(A) OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended: December 31, 2023 | Commission file number: 001-33414 |

DENISON MINES CORP.

(Exact name of registrant as specified in its charter)

Ontario, Canada

(Province or other jurisdiction of incorporation or organization)

1090

(Primary standard industrial classification code number)

98-0622284

(I.R.S. employer identification number)

1100 – 40 University Avenue, Toronto, Ontario M5J 1T1 Canada; Phone number: 416-979-1991

(Address and telephone number of registrant’s principal executive offices)

C T Corporation System

28 Liberty Street

New York, NY 10005

Phone number: 212-894-8940

(Name, address and telephone number of agent for service in the United States)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares | DNN | NYSE American LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Not applicable.

For annual reports, indicate by check mark the information filed with this form:

| x Annual Information Form | x Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 890,970,371 Common Shares as of December 31, 2023.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13(d) or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant has been required to file such reports); and (2) has been subject to such filing requirements in the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ¨

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

EXPLANATORY NOTE

Denison Mines Corp. (the “Company” or the “Registrant”) is an Ontario corporation eligible to file its Annual Report pursuant to Section 13(a) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F. The Registrant is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Registrant are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

DOCUMENTS FILED PURSUANT TO GENERAL INSTRUCTIONS

In accordance with General Instruction B.(3) of Form 40-F, the Registrant hereby incorporates by reference Exhibits 99.1 through 99.3 as set forth in the Exhibit Index attached hereto, which are deemed filed herewith.

In accordance with General Instruction D.(9) of Form 40-F, the Registrant has filed written consents of certain experts named in the foregoing Exhibits as Exhibits 99.4 and 99.8 through 99.30, as set forth in the Exhibit Index attached hereto.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain of the information contained in this Annual Report on Form 40-F, including the documents incorporated herein by reference, may contain “forward-looking information”. Forward-looking information and statements may include, among others, statements regarding the future plans, costs, objectives or performance of the Company, or the assumptions underlying any of the foregoing. In this Annual Report on Form 40-F, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. Forward-looking statements and information are based on information available at the time and/or management’s good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties and other unpredictable factors, many of which are beyond the Company’s control. These risks, uncertainties and assumptions include, but are not limited to, those described under the section “Risk Factors” in the Company’s Annual Information Form for the fiscal year ended December 31, 2023 (the “AIF”), which is filed as Exhibit 99.1 to this Annual Report on Form 40-F, and could cause actual events or results to differ materially from those projected in any forward-looking statements.

The Company’s forward-looking statements contained in the exhibits incorporated by reference into this Annual Report on Form 40-F are made as of the respective dates set forth in such exhibits. In preparing this Annual Report on Form 40-F, the Company has not updated such forward-looking statements to reflect any subsequent information, events or circumstances or otherwise, or any change in management’s beliefs, expectations or opinions that may have occurred prior to the date hereof, nor does the Company assume any obligation to update such forward-looking statements in the future, except as required by applicable laws.

NOTE TO UNITED STATES READERS – DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this Annual Report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States.

The Registrant prepares its consolidated financial statements, which are filed with this Annual Report on Form 40-F, in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board (“IFRS”). IFRS differs in some significant respects from United States generally accepted accounting principles (“U.S. GAAP”), and thus the Registrant’s financial statements may not be comparable to the financial statements of United States companies. These differences between IFRS and U.S. GAAP might be material to the financial information presented in this Annual Report on Form 40-F. In addition, differences may arise in subsequent periods related to changes in IFRS or U.S. GAAP or due to new transactions that the Registrant enters into. The Registrant is not required to prepare a reconciliation of its consolidated financial statements and related footnote disclosures between IFRS and U.S. GAAP and has not quantified such differences.

RESOURCE AND RESERVE ESTIMATES

The information provided under the heading “Cautionary Notes to U.S. Investors Concerning Resource Estimates” contained in the Company’s Annual Information Form is incorporated by reference herein.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report on Form 40-F are in Canadian dollars. The daily exchange rate published by the Bank of Canada for the exchange of Canadian dollars into United States dollars on December 30, 2023, the last business day of calendar year 2023, was CDN$1.00 = U.S.$0.7561.

TAX MATTERS

Purchasing, holding, or disposing of securities of the Registrant may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report on Form 40-F.

CONTROLS AND PROCEDURES

A. Certifications

The required certifications are included in Exhibits 99.5, 99.6, and 99.7 of this Annual Report on Form 40-F.

B. Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures to ensure that information required to be disclosed in the Company’s filings under the Exchange Act, is recorded, processed, summarized and reported in accordance with the requirements specified in the rules and forms of the SEC. The Company carried out an evaluation, under the supervision and with the participation of its management, including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s “disclosure controls and procedures” (as defined in Rule 13a-15(e) or Rule 15d-15(e) under the Exchange Act) as of the end of the period covered by this Annual Report on Form 40-F. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures as of December 31, 2023 are effective to ensure that information required to be disclosed by the Registrant in reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and is accumulated and communicated to the Registrant’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

The Company’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives and, as indicated in the preceding paragraph, the Chief Executive Officer and Chief Financial Officer believe that the Company’s disclosure controls and procedures are effective at that reasonable assurance level, although the Chief Executive Officer and Chief Financial Officer do not expect that the disclosure controls and procedures will prevent or detect all errors and all fraud.

It should be noted that a control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. The Company will continue to periodically review its disclosure controls and procedures and may make such modifications from time to time as it considers necessary.

C. Management’s Annual Report on Internal Control Over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over the Company’s financial reporting (as defined in Rules 13a-15(f) or 15d-15(f) under the Exchange Act). Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of the Company’s financial reporting and the preparation of financial statements for external purposes in accordance with IFRS.

A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Management conducted an assessment of the Company’s internal control over financial reporting based on the framework established by the Committee of Sponsoring Organizations of the Treadway Commission on Internal Control — Integrated Framework (2013). Based on this assessment, management concluded that, as of December 31, 2023, the Company’s internal control over financial reporting is effective.

It should be noted that a control system, no matter how well conceived or operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met. The Company will continue to periodically review its internal control over financial reporting and may make such modifications from time to time as it considers necessary.

D. Attestation Report of the Independent Registered Public Accounting Firm

The effectiveness of the Registrant’s internal control over financial reporting as of December 31, 2023 has been audited by KPMG LLP, an Independent Registered Public Accounting Firm, as stated in their report included with the Registrant’s Audited Financial Statements, which are incorporated by reference as Exhibit 99.3 to this Annual Report on Form 40-F.

E. Changes in Internal Control Over Financial Reporting

There were no changes in the Company’s internal control over financial reporting during the twelve months ended December 31, 2023 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR during the fiscal year ended December 31, 2023, concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

BENEFIT PLAN BLACKOUT PERIODS

Not applicable.

AUDIT COMMITTEE FINANCIAL EXPERT AND AUDIT COMMITTEE QUALIFICATIONS

The Company’s Board of Directors has determined that Ms. Patricia Volker, Chair of the Audit Committee, is an audit committee financial expert within the meaning of paragraph 8(b) of General Instruction B of Form 40-F, and that all three members of the Audit Committee (Ms. Patricia Volker, Mr. Brian Edgar and Mr. David Neuburger) are independent within the meaning of United States and Canadian securities regulations and applicable stock exchange requirements. A description of the education and experience of these persons is set forth in the table below:

| Member Name | Education & experience relevant to performance of audit committee duties |

||

| Patricia Volker, | ● | Chartered Professional Accountant, Chartered Accountant, Certified Management Accountant | |

| Chair of the Audit Committee | ● | Over 17 years of service at the Chartered Professional Accountants of Ontario, the self-regulating body for Ontario’s CPAs | |

| ● | Has served and chaired audit committees of a number of companies | ||

| Brian Edgar | ● | Law degree, with extensive corporate finance experience | |

| ● | Held positions in a public company as Chairman since 2011 and President and Chief Executive Officer from 2005 to 2011. | ||

| ● | Has served on audit committees of a number of public companies | ||

| David Neuburger | ● | Completed Financial Accounting and Managerial Accounting courses as part of a Masters of Business Administration (MBA) Program | |

| ● | Disclosure Committee experience with Cameco Corporation, including review of quarterly and annual financial statements and management’s discussion & analysis | ||

| ● | Has served on another public company audit committee | ||

Through such education and experience, each of these three members has experience overseeing and assessing the performance of companies and public accountants with respect to the preparation, auditing and evaluation of financial statements, and has: (1) an understanding of generally accepted accounting principles and financial statements; (2) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (3) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements; (4) an understanding of internal control over financial reporting; and (5) an understanding of audit committee functions.

The SEC has provided that the designation of an audit committee financial expert does not make him or her an “expert” for any purpose, impose on him or her any duties, obligations or liability that are greater than the duties, obligations or liability imposed on him or her as a member of the Audit Committee and the Board in the absence of such designation, or affect the duties, obligations or liability of any other member of the Audit Committee or Board.

CODE OF ETHICS

The Company has adopted a code of ethics that applies to the Company’s directors, officers and employees, including the Chief Executive Officer, the Chief Financial Officer, the principal accounting officer or controller, persons performing similar functions and other officers, directors and employees of the Company. A current copy of the code of ethics is on the Company’s website at www.denisonmines.com. In the fiscal year ended December 31, 2023, the Company has not made any amendment to a provision of its code of ethics that applies to any of its Chief Executive Officer, Chief Financial Officer, principal accounting officer or controller or persons performing similar functions that relates to one or more of the items set forth in paragraph (9)(b) of General Instruction B to Form 40-F. In the fiscal year ended December 31, 2023, the Company has not granted a waiver (including an implicit waiver) from a provision of its code of ethics to any of its Chief Executive Officer, Chief Financial Officer, principal accounting officer or controller or persons performing similar functions that relates to one or more of the items set forth in paragraph (9)(b) of General Instruction B to Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Our independent registered public accounting firm is KPMG LLP, Toronto, ON, Canada, Auditor Firm ID: 85.

The following table discloses the fees billed to the Company by its external auditor during the last two financial years ended December 31, 2023 and 2022. Services were billed and paid in Canadian dollars and the table below reflects amounts in Canadian dollars.

| Periods Ending (1) | Audit Fees(2) | Audit Related Fees(3) | Tax Fees(4) | All Other Fees(5) | ||||||||||||

| December 31, 2023 | $ | 531,510 | $ | 33,170 | $ | 39,620 | $ | 0 | ||||||||

| December 31, 2022 | $ | 472,630 | $ | 27,820 | $ | 46,580 | $ | 0 | ||||||||

Notes:

| (1) | These amounts include accruals for fees billed outside the period to which the services related. |

| (2) | The aggregate fees billed for audit services of the Company’s consolidated financial statements, including services normally provided by an auditor for statutory or regulatory filings or engagements and other services only the auditor can reasonably provide. The Audit Fees in 2023 and 2022 include fees related to reviews of interim consolidated financial statements (2023: $105,930; 2022: $95,230) and the extensive work required of the auditor to support, and conduct consent procedures in connection with, the Company’s various equity issuances (2023: $96,300; 2022: $80,250). |

| (3) | The aggregate fees billed for specified audit procedures, assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not disclosed in the Audit Fees column. Audit-related fees in 2023 and 2022 were billed for certain specified procedures engagements and the audit of certain subsidiary financial statements. |

| (4) | The aggregate fees billed for tax compliance, tax advice, and tax planning services, such as transfer pricing and tax return preparation. |

| (5) | The aggregate fees billed for professional services other than those listed in the other three columns. |

The Company’s Audit Committee mandate and charter provides that the Audit Committee shall (i) approve, prior to the auditor’s audit, the auditor’s audit plan (including, without limitation, staffing), the scope of the auditor’s review and all related fees, and (ii) pre-approve any non-audit services (including, without limitation, fees therefor) provided to the Company or its subsidiaries by the auditor or any auditor of any such subsidiary and shall consider whether these services are compatible with the auditor’s independence, including, without limitation, the nature and scope of the specific non-audit services to be performed and whether the audit process would require the auditor to review any advice rendered by the auditor in connection with the provision of non-audit services.

The following sets forth the percentage of services described above that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

| 2023 | 2022 | |||||||

| Audit Related Fees: | 100 | % | 100 | % | ||||

| Tax Fees: | 100 | % | 100 | % | ||||

| All Other Fees: | 100 | % | 100 | % | ||||

OFF-BALANCE SHEET ARRANGEMENTS

Not applicable

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

At December 31, 2023, the Company had an estimated aggregate reclamation liability of $34,898,000, which is the present value amount that is expected to be sufficient to cover the projected future costs for reclamation of the Company’s mill and mine operations. This estimated aggregate reclamation liability consists of $19,796,000 for Elliot Lake obligations, $12,215,000 for the McClean Lake and Midwest joint venture obligations and $2,887,000 for Wheeler River and other obligations. The Company maintains a trust fund equal to the estimated reclamation spending for the succeeding six calendar years, less interest expected to accrue on the funds, in respect of its liability for Elliot Lake. At December 31, 2023, the balance in the trust fund was $3,259,000. In addition, as at December 31, 2023, the Company has pledged as collateral $7,972,000 of cash to support its standby letters of credit from the Bank of Nova Scotia for the McClean, Midwest and Wheeler reclamation obligations.

See other information in the section entitled “Contractual Obligations and Contingencies” in the Company’s Management’s Discussion and Analysis of Results of Operations and Financial Condition for the Year ended December 31, 2023, incorporated by reference as Exhibit 99.2 hereof.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The committee members are Ms. Patricia Volker (Chair), Mr. Brian Edgar and Mr. David Neuburger. For further information on these members, see “Audit Committee Financial Expert” above.

CORPORATE GOVERNANCE

The Company is listed on the Toronto Stock Exchange (the “TSX”) and is required to describe its practices and policies with regard to corporate governance with specific reference to the corporate governance guidelines of the Canadian Securities Administrators on an annual basis by way of a corporate governance statement contained in the Company’s Annual Information Form or Information Circular. The Company is also listed on the NYSE American LLC (the “NYSE American”) and additionally complies as necessary with the rules and guidelines of the NYSE American as well as the SEC. The Company reviews its governance practices on an ongoing basis to ensure it is in compliance with the applicable laws, rules and guidelines both in Canada and in the United States.

The Company’s Board of Directors (the “Board”) is responsible for the Company’s corporate governance policies and has separately designated a standing Corporate Governance and Nominating Committee. The Board has determined that the members of the Corporate Governance and Nominating Committee are independent, based on the criteria for independence and unrelatedness prescribed by the Sarbanes-Oxley Act of 2002, Section 10A(m)(3), and the rules of the NYSE American. Corporate governance relates to the activities of the Board, the members of which are elected by and are accountable to the shareholders, and takes into account the role of the senior officers who are appointed by the Board and who are charged with the day to day administration of the Company. The Board is committed to sound corporate governance practices that are both in the interest of its shareholders and contribute to effective and efficient decision making.

NYSE AMERICAN CORPORATE GOVERNANCE

The Company’s common shares are listed on the NYSE American. Section 110 of the NYSE American Company Guide permits the NYSE American to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE American listing criteria, and to grant exemptions from the NYSE American listing criteria based on these considerations. An issuer seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to the NYSE American standards is as follows:

Shareholder Meeting Quorum Requirement: The NYSE American minimum quorum requirement for a shareholder meeting is one-third of the shares issued and outstanding and entitled to vote for a meeting of a listed company’s shareholders. The TSX does not specify a quorum requirement for a meeting of a listed company’s shareholders. The Company’s current required quorum at any meeting of shareholders as set forth in the Company’s by-laws is two persons present, each being a shareholder entitled to vote at the meeting or a duly appointed proxyholder for an absent shareholder so entitled, holding or representing in aggregate not less than 10% of the shares of the Company entitled to be voted at the meeting. The Company’s current quorum requirement is not prohibited by, and does not constitute a breach of, the Business Corporations Act (Ontario) (the “OBCA”), applicable Canadian securities laws or the rules and policies of the TSX.

Proxy Solicitation Requirement: The NYSE American requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings of a listed company, and requires that these proxies be solicited pursuant to a proxy statement that conforms to the proxy rules of the U.S. Securities and Exchange Commission. The Company is a foreign private issuer as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with the OBCA, applicable Canadian securities laws and the rules and policies of the TSX.

Shareholder Approval Requirements: The NYSE American requires a listed company to obtain the approval of its shareholders for certain types of securities issuances. One is the sale of common shares (or securities convertible into common shares) at a discount to officers or directors. The TSX rules require shareholder approval for the issuance of shares to insiders in private placements where insiders are being issued more than 10% of the presently issued and outstanding shares. The NYSE American also requires shareholder approval of private placements that may result in the issuance of common shares (or securities convertible into common shares) equal to 20% or more of presently outstanding shares for less than the greater of book or market value of the shares. There is no such requirement under Ontario law. The TSX rules require shareholder approval for private placements that materially affect control, or where more than 25% of presently issued and outstanding shares will be issued at a discount to market. The Company will seek a waiver from the NYSE American shareholder approval requirement should a dilutive securities issuance trigger such NYSE American shareholder approval requirement in circumstances where such securities issuance does not trigger a shareholder approval requirement under the rules of the TSX.

The foregoing are consistent with the laws, customs and practices in Canada.

In addition, the Company may from time-to-time seek relief from the NYSE American corporate governance requirements on specific transactions under Section 110 of the NYSE American Company Guide by providing written certification from independent local counsel that the non-complying practice is not prohibited by its home country law, in which case, the Company shall make the disclosure of such transactions available on its website at www.denisonmines.com. Information contained on, or accessible through, our website is not part of this Annual Report on Form 40-F.

MINE SAFETY DISCLOSURE

Not applicable.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

Not applicable.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an Annual Report on Form 40-F arises; or transactions in said securities.

B. Consent to Service of Process

The Company has previously filed with the SEC a Form F-X in connection with its common shares. Any change to the name or address of the Company’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report on Form 40-F to be signed on its behalf by the undersigned, thereto duly authorized.

| Registrant: DENISON MINES CORP. | ||

| By: | /s/ David D. Cates | |

| Title: | President and Chief Executive Officer | |

| Date: | March 28, 2024 | |

EXHIBIT INDEX

| 99.25 | Consent of Ecometrix Incorporated | |

| 99.26 | Consent of Jeffery Martin, P.Eng. | |

| 99.27 | Consent of Hatch Ltd. | |

| 99.28 | Consent of William McCombe, P.Eng. | |

| 99.29 | Consent of CanCost Consulting | |

| 99.30 | Consent of Geoffrey Wilkie, P. Eng. | |

| 101 | Interactive Data File (formatted as Inline XBRL) | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

Exhibit 97.1

1. Introduction

1.1 Adopted. Upon the recommendation of the Compensation Committee of the Board of Directors (the “Board”) of Denison Mines Corp. (the “Company”), the Board has adopted this Clawback Policy effective October 2, 2023 (the “Effective Date”).

1.2 Purpose. The purpose of this Policy is to provide for the recoupment of certain incentive compensation pursuant to Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, in the manner required by Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 promulgated thereunder, and the Applicable Listing Standards (as defined below) (collectively, the “Dodd-Frank Rules”).

1.3 Administration. This Policy shall be administered by the Compensation Committee. Any determinations made by the Compensation Committee shall be final and binding on all affected individuals.

2. Definitions

2.1 “Accounting Restatement” shall mean an accounting restatement of the Company’s financial statements due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement (i) to correct an error in previously issued financial statements that is material to the previously issued financial statements (i.e., a “Big R” restatement), or (ii) that corrects an error that is not material to previously issued financial statements, but that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (i.e., a “little r” restatement).

2.2 “Affiliate” shall mean each entity that directly or indirectly controls, is controlled by, or is under common control with the Company.

2.3 “Applicable Listing Standards” shall mean Sec. 1003(h) of the NYSE American LLC Company Guide.

2.4 “Clawback Eligible Incentive Compensation” shall mean Incentive-Based Compensation Received by a Covered Executive (i) on or after the Effective Date, (ii) after beginning service as a Covered Executive, (iii) if such individual served as a Covered Executive at any time during the performance period for such Incentive-Based Compensation (irrespective of whether such individual continued to serve as a Covered Executive upon or following the Restatement Trigger Date), (iv) while the Company has a class of securities listed on a national securities exchange or a national securities association in the United States of America, and (v) during the applicable Clawback Period. For the avoidance of doubt, Incentive-Based Compensation Received by a Covered Executive on or after the Effective Date could, by the terms of this Policy, include amounts approved, awarded, or granted prior to such Effective Date.

2.5 “Clawback Period” shall mean, with respect to any Accounting Restatement, the three completed fiscal years of the Company immediately preceding the Restatement Trigger Date and any transition period (that results from a change in the Company’s fiscal year) within or immediately following those three completed fiscal years (except that a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of at least nine months shall count as a completed fiscal year).

2.6 “Company Group” shall mean the Company and its Affiliates.

2.7 “Covered Executive” shall mean any “executive officer” of the Company as defined under Applicable Listing Standards.

2.8 “Erroneously Awarded Compensation” shall mean the amount of Clawback Eligible Incentive Compensation that exceeds the amount of Incentive-Based Compensation that otherwise would have been Received had it been determined based on the restated amounts, computed without regard to any taxes paid. With respect to any compensation plan or program that takes into account Incentive-Based Compensation, the amount contributed to a notional account that exceeds the amount that otherwise would have been contributed had it been determined based on the restated amount, computed without regard to any taxes paid, shall be considered Erroneously Awarded Compensation, along with earnings accrued on that notional amount.

2.9 “Exchange” shall mean The NYSE American LLC.

2.10 “Financial Reporting Measures” shall mean measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and all other measures that are derived wholly or in part from such measures. Share price and total shareholder return (and any measures that are derived wholly or in part from share price or total shareholder return) shall for purposes of this Policy be considered Financial Reporting Measures. For the avoidance of doubt, a measure need not be presented in the Company’s financial statements or included in a filing with the U.S. Securities and Exchange Commission (the “SEC”) in order to be considered a Financial Reporting Measure.

2.11 “Incentive-Based Compensation” shall mean any compensation that is granted, earned or vested based wholly or in part upon the attainment of a Financial Reporting Measure.

2.12 “Received” shall mean the deemed receipt of Incentive-Based Compensation. Incentive-Based Compensation shall be deemed received in the Company’s fiscal period during which the Financial Reporting Measure specified in the applicable Incentive-Based Compensation award is attained, even if payment or grant of the Incentive-Based Compensation occurs after the end of that period.

2.13 “Restatement Trigger Date” shall mean the earlier to occur of (i) the date the Board, a committee of the Board, or the officer(s) of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement, or (ii) the date a court, regulator or other legally authorized body directs the Company to prepare an Accounting Restatement. 2.1 Denison values the integrity of its relationships with government agencies, officials, political parties, leaders and candidates throughout the world and expects its Employees and every other person or entity representing Denison to conduct themselves properly when dealing with Public Officials.

3. Recoupment of Erroneously Awarded Compensation

3.1 Policy. Upon the occurrence of a Restatement Trigger Date, the Company shall recoup Erroneously Awarded Compensation reasonably promptly, in the manner described below. For the avoidance of doubt, the Company’s obligation to recover Erroneously Awarded Compensation under this Policy is not dependent on if or when restated financial statements are filed following the Restatement Trigger Date.

3.2 Process. The Compensation Committee shall use the following process for recoupment:

(i) First, the Compensation Committee will determine the amount of any Erroneously Awarded Compensation for each Covered Executive in connection with an Accounting Restatement. For Incentive-Based Compensation based on (or derived from) share price or total shareholder return where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in the applicable Accounting Restatement, the amount shall be determined by the Compensation Committee based on a reasonable estimate of the effect of the Accounting Restatement on the share price or total shareholder return upon which the Incentive-Based Compensation was Received (in which case, the Company shall maintain documentation of such determination of that reasonable estimate and provide such documentation to the Exchange).

(ii) Second, the Compensation Committee will provide each affected Covered Executive with a written notice stating the amount of the Erroneously Awarded Compensation, a demand for recoupment, and the means of recoupment that the Company will accept.

3.3 Means of Recoupment. The Compensation Committee shall have discretion to determine the appropriate means of recoupment of Erroneously Awarded Compensation, which may include without limitation: (i) recoupment of cash or Company shares, (ii) forfeiture of unvested cash or equity awards (including those subject to service-based and/or performance-based vesting conditions), (iii) cancellation of outstanding vested cash or equity awards (including those for which service-based and/or performance-based vesting conditions have been satisfied), (iv) offset of other amounts owed to the Covered Executive or forfeiture of deferred compensation, (v) reduction of future compensation, and (vi) any other remedial or recovery action permitted by law. The Company Group makes no guarantee as to the treatment of such amounts for the Covered Executive’s income tax purposes or with respect to any other statutory withholdings and shall have no liability with respect thereto. For the avoidance of doubt, appropriate means of recoupment may include amounts approved, awarded, or granted prior to the Effective Date. Except as set forth in Section 3.5 below, in no event may the Company Group accept an amount that is less than the amount of Erroneously Awarded Compensation in satisfaction of a Covered Executive’s obligations hereunder. Notwithstanding the foregoing, any Employee can make a payment when demanded to do so if they believe it necessary in order to preserve their health, safety or well-being or that of another Employee. Afterwards, they must properly document the amount of, purpose of, and circumstances surrounding the payment and report it to the Chief Executive Officer who shall report the same to the Audit Committee.

3.4 Failure to Repay. To the extent that a Covered Executive fails to repay all Erroneously Awarded Compensation to the Company Group when due (as determined in accordance with Section 3.2 above), the Company shall, or shall cause one or more other members of the Company Group to, take all actions reasonable and appropriate to recoup such Erroneously Awarded Compensation from the applicable Covered Executive. The applicable Covered Executive shall be required to reimburse the Company Group for any and all expenses reasonably incurred (including legal fees) by the Company Group in recouping such Erroneously Awarded Compensation.

3.5 Exceptions. Notwithstanding anything herein to the contrary, the Company shall not be required to recoup Erroneously Awarded Compensation if one of the following conditions is met and the Compensation Committee determines that recoupment would be impracticable:

(i) The direct expense paid to a third party to assist in enforcing this Policy against a Covered Executive would exceed the amount to be recouped, after the Company has made a reasonable attempt to recoup the applicable Erroneously Awarded Compensation, documented such attempts, and provided such documentation to the Exchange; or

(ii) Recoupment would violate home country law where that law was adopted prior to November 28, 2022, provided that, before determining that it would be impracticable to recoup any amount of Erroneously Awarded Compensation based on violation of home country law, the Company has obtained an opinion of home country counsel, acceptable to the Exchange, that recoupment would result in such a violation and a copy of the opinion is provided to the Exchange.

4. Reporting and Disclosure

4.1 The Company shall file all disclosures with respect to this Policy in accordance with the requirements of the Dodd-Frank Rules.

5. Administration

5.1 Indemnification Prohibition. Notwithstanding any provisions to the contrary in an employment agreement or indemnification agreement between the Company and a Covered Executive, no member of the Company Group shall be permitted to indemnify any current or former Covered Executive against (i) the loss of any Erroneously Awarded Compensation that is recouped pursuant to the terms of this Policy, or (ii) any claims relating to the Company Group’s enforcement of its rights under this Policy. The Company may not pay or reimburse any Covered Executive for the cost of third-party insurance purchased by a Covered Executive to fund potential recoupment obligations under this Policy.

5.2 Acknowledgment. To the extent required by the Compensation Committee, each Covered Executive shall be required to sign and return to the Company the acknowledgement form attached hereto as Exhibit A pursuant to which such Covered Executive will agree to be bound by the terms of, and comply with, this Policy. For the avoidance of doubt, each Covered Executive will be fully bound by, and must comply with, the Policy, whether or not such Covered Executive has executed and returned such acknowledgment form to the Company.

5.3 Interpretation. The Compensation Committee is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable for the administration of this Policy. The Board intends that this Policy be interpreted consistent with the Dodd-Frank Rules.

5.4 Amendment; Termination. The Board may amend or terminate this Policy from time to time in its discretion, including as and when it determines that it is legally required to do so by any applicable securities laws, SEC rule or the rules of any securities exchange or national securities association in the United States of America on which the Company’s securities are listed.

5.5 Other Recoupment Rights. The Board intends that this Policy be applied to the fullest extent of the law. The Board and/or Compensation Committee may require that any employment agreement, equity award, cash incentive award, or any other agreement entered into be conditioned upon the Covered Executive’s agreement to abide by the terms of this Policy. Any right of recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company Group, whether arising under applicable law, regulation or rule, pursuant to the terms of any other policy of the Company Group, pursuant to any employment agreement, equity award, cash incentive award, or other agreement applicable to a Covered Executive, or otherwise (the “Separate Clawback Rights”). Notwithstanding the foregoing, there shall be no duplication of recovery of the same Erroneously Awarded Compensation under this Policy and the Separate Clawback Rights, unless required by applicable law.

5.6 Successors. This Policy shall be binding and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

Adopted by the Board of Directors on November 8, 2023.

Exhibit A

Denison Mines Corp.

CLAWBACK POLICY

ACKNOWLEDGEMENT FORM

By signing below, the undersigned acknowledges and confirms that the undersigned has received and reviewed a copy of Denison Mines Corp.’s Clawback Policy (the “Policy”). Capitalized terms used but not otherwise defined in this Acknowledgement Form (this “Acknowledgement Form”) shall have the meanings ascribed to such terms in the Policy.

By signing this Acknowledgement Form, the undersigned acknowledges and agrees that the undersigned is and will continue to be subject to the Policy and that the Policy will apply both during and after the undersigned’s employment with the Company Group. Further, by signing below, the undersigned agrees to abide by the terms of the Policy, including, without limitation, by returning any Erroneously Awarded Compensation to the Company Group reasonably promptly to the extent required by, and in a manner permitted by, the Policy, as determined by the Compensation Committee of the Company’s Board of Directors in its sole discretion.

| Sign: | ||

| Name: | [Employee] | |

| Date: | ||

Exhibit 99.1

Denison Mines Corp.

2023 Annual Information Form

March 28, 2024

About this Annual Information Form

This annual information form (“AIF”) is dated March 28, 2024. Information in this AIF is stated as at December 31, 2023 unless specified otherwise.

In this AIF, references to the “Company” or “Denison” refer to Denison Mines Corp., its subsidiaries and affiliates, or any one of them, as applicable.

This AIF has been prepared in accordance with Canadian securities laws and contains information regarding Denison’s history, business, mineral reserves and resources, the regulatory environment in which Denison does business, the risks that Denison faces and other important information for Denison’s shareholders.

Financial Information

Unless otherwise specified, all dollar amounts referred to in this AIF are stated in Canadian dollars (“CAD”). References to “US$” or “USD” mean United States dollars.

Financial information is generally derived from consolidated financial statements that have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

| Table of Contents | |

| About this AIF | 1 |

| About Denison | 5 |

| Developments over the Last 3 Years | 8 |

| The Uranium Industry 2023 | 19 |

| Mineral Resources and Mineral Reserves | 23 |

| Mineral Properties | 27 |

| Athabasca Exploration: Sampling, Analysis and Data Verification | 92 |

| Denison Operations | 98 |

| Denison Legacy Mines | 103 |

| Environmental, Health, Safety and Sustainability Matters | 103 |

| Government Regulation | 108 |

| Risk Factors | 115 |

| Denison’s Securities | 135 |

| Denison’s Directors & Management | 137 |

| Legal and Regulatory Proceedings | 142 |

| Material Contracts | 142 |

| Names and Interests of Experts | 144 |

| Additional Information | 145 |

| Audit Committee Mandate | A-1 |

| Glossary of Terms | B-1 |

Caution about Forward-Looking Information

Certain information contained in this AIF and the documents incorporated by reference concerning the business, operations and financial performance and condition of Denison constitutes forward-looking information within the meaning of the United States Private Securities Litigation Reform Act of 1995 and similar Canadian legislation.

Generally, the use of words and phrases like “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes”, or the negatives and/or variations of such words and phrases, or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” “be taken”, “occur”, “be achieved” or “has the potential to” and similar expressions are intended to identify forward-looking information.

Forward-looking information involves known and unknown risks, uncertainties, material assumptions and other factors that may cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Denison believes that the expectations and assumptions reflected in this forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct. Forward-looking information should not be unduly relied upon. This information speaks only as of the date of this AIF, and Denison will not necessarily update this information, unless required by securities laws.

| 2023 Annual Information Form |

|

Examples of Forward-Looking Information

This AIF contains forward-looking information in a number of places, including statements pertaining to Denison’s:

| · | expectations regarding capital and uses of capital | |

| · | operational and business outlook, including exploration, evaluation and development plans and objectives | |

| · | plans for capital expenditure programs, exploration and development expenditures and reclamation costs and timing | |

| · | results of its exploration programs | |

| · | results of the Phoenix FS and Gryphon PFS Update and plans with respect to the EA, regulatory and development process (as terms are defined below) | |

| · | results of its Waterbury PEA (as defined below) and related plans and objectives | |

| · | estimates of its mineral reserves and mineral resources | |

| · | expectations regarding future uranium prices and/or applicable foreign exchange rates | |

| · | expectations regarding the process for and receipt of regulatory approvals, permits and licences under governmental and other applicable regulatory regimes | |

| · | expectations about 2024 and future market prices, production costs, nuclear energy and global uranium supply and demand | |

| · | expectations regarding ongoing joint arrangements and Denison’s share of same | |

| · | expectations regarding additions to its mineral reserves and resources through acquisitions and exploration | |

| · | expectations regarding toll milling revenues generated by McClean Lake mill, and the relationships with its contractual partners with respect thereto | |

| · | future royalty and tax payments and rates | |

| · | expectations regarding possible impacts of litigation and regulatory actions |

Statements relating to “mineral resources” are deemed to be forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral resources described can be profitably produced in the future.

Material Risks

Denison’s actual results could differ materially from those anticipated. Management has identified the following risk factors which could have a material impact on the Company or the trading price of its common shares (“Shares”):

| · | the capital intensive nature of the mining industry and the uncertainty of funding | |

| · | history and periods of negative cash flow | |

| · | global financial conditions, including market volatility and global inflation, and related operational risks | |

| · | the speculative nature of exploration and development projects | |

| · | the risks of, and market impacts on, developing mineral properties | |

| · | risks associated with the selection of novel mining methods | |

| · | dependence on obtaining licenses, and other regulatory and policy risks | |

| · | uncertainty regarding engagement with Canada’s First Nations and Métis | |

| · | pandemic or other health related disruptions | |

| · | environment, health, safety and other regulatory compliance risks |

| 2023 Annual Information Form |

|

| · | health and safety risks | |

| · | the imprecision of mineral reserve and resource estimates | |

| · | impacts of fluctuations in global demand and changes in international trade restrictions | |

| · | the impact of uranium price volatility on the valuation of Denison’s assets, including mineral reserves and resources, and the market price of its Shares | |

| · | uncertainty regarding public acceptance of nuclear energy and competition from other energy sources | |

| · | volatility in the market price of the Company’s Shares | |

| · | the risk of dilution from future equity financings | |

| · | dependence on other operators of the Company’s projects | |

| · | reliance on contractors, experts and other third parties | |

| · | devaluation of any physical uranium held by the Company, and risk of losses, due to fluctuations in the price of uranium and/or foreign exchange rates | |

| · | reliance on uranium storage facilities | |

| · | the risk of failure to realize benefits from transactions | |

| · | the risk of Denison’s inability to exploit, expand or replace mineral reserves and mineral resources | |

| · | competition for properties | |

| · | risk of challenges to property title and/or contractual interests in Denison’s properties | |

| · | the risk of failure by Denison to meet its obligations to its creditors | |

| · | change of control restrictions | |

| · | uncertainty as to reclamation and decommissioning liabilities and timing | |

| · | potential for technological innovation rendering Denison’s products and services obsolete | |

| · | liabilities inherent in mining operations and the adequacy of insurance coverage | |

| · | containment management of waste materials | |

| · | the ability of Denison to ensure compliance with anti-bribery and anti-corruption laws | |

| · | the uncertainty regarding risks posed by climate change | |

| · | the reliance of the Company on its information systems and the risk of cyber-attacks on those systems | |

| · | maintenance of key infrastructure and equipment | |

| · | dependence on key personnel | |

| · | potential conflicts of interest for the Company’s directors who are engaged in similar businesses | |

| · | limitations of disclosure and internal controls | |

| · | the potential influence of Denison’s largest Shareholder, Korea Electric Power Corporation (“KEPCO”) and its subsidiary, Korea Hydro & Nuclear Power (“KHNP”) | |

| · | Risks for United States investors |

The risk factors listed above are discussed in more detail later in this AIF (see “Risk Factors”). The risk factors discussed in this AIF are not, and should not be construed as being, exhaustive.

Material assumptions

The forward-looking statements in this AIF and the documents incorporated by reference are based on material assumptions made by management of the Company, including the following, which may prove to be incorrect:

| 2023 Annual Information Form |

|

| · | the budget for 2024, including plans for exploration and evaluation activities and estimated costs, as well as the assumptions regarding market conditions and other factors upon which Denison’s expenditure expectations have been based |

| · | Denison’s ability to execute its business plans for 2024 and beyond |

| · | the ability of the Company to, and the means by which it can, raise additional capital to advance other exploration, evaluation, and project development objectives |

| · | Denison’s ability to obtain all necessary regulatory approvals, permits and licences for its planned activities under governmental and other applicable regulatory regimes |

| · | expectations regarding the demand for, and supply of, uranium, the outlook for long-term contracting, changes in regulations, public perception of nuclear power, and the construction of new and relicensing of existing nuclear power plants |

| · | expectations regarding spot and long-term prices and realized prices for uranium |

| · | expectations regarding Denison’s holdings of physical uranium, including that the physical uranium holdings will be advantageous for project financing efforts and/or in securing future long-term uranium supply agreements |

| · | expectations regarding tax rates, currency exchange rates and interest rates |

| · | Denison’s decommissioning and reclamation obligations and the status and ongoing maintenance of agreements with third parties with respect thereto |

| · | mineral reserve and resource estimates, and the assumptions upon which they are based |

| · | Denison’s, and its contractors’, ability to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain required regulatory approvals |

| · | Denison’s operations are not significantly disrupted as a result of social or political activism, natural disasters, public health emergencies, governmental or political actions, litigation or arbitration proceedings, equipment or infrastructure failure, labour shortages, transportation disruptions or accidents, or other development or exploration risks |

Cautionary Notes to U.S. Investors Concerning Resource and Reserve Estimates

As a foreign private issuer reporting under the multijurisdictional disclosure system adopted by the United States, the Company has prepared this AIF in accordance with Canadian securities laws and standards for reporting of mineral resource estimates, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “measured mineral resources,” “indicated mineral resources,” “inferred mineral resources,” and “mineral resources” used or referenced in this AIF are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). The Securities and Exchange Commission (the “SEC”) recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC’s definitions of “proven mineral reserves” and “probable mineral reserves” are “substantially similar” to the corresponding definitions under the CIM Standards definition that are required under NI 43-101. Investors are cautioned that while the above terms are “substantially similar” to the corresponding CIM Standards definition, there are differences between the definitions under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”) and the CIM Standards definition. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under the U.S. Exchange Act. For the above reasons, information contained in the AIF and other documents incorporated by reference herein containing descriptions of mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. Additionally, investors are cautioned that “inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies, except in limited circumstances. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. The term “resource” does not equate to the term “reserves”. Investors should not assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. Investors are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable.

| 2023 Annual Information Form |

|

|

|

About Denison

Denison Mines Corp. is engaged in uranium exploration, development and mining. The registered and head office of Denison is located at 1100 – 40 University Avenue, Toronto, Ontario, M5J 1T1, Canada. Denison’s website address is www.denisonmines.com.

The Shares are listed on the Toronto Stock Exchange (“TSX”) under the symbol “DML” and on the NYSE American under the symbol “DNN.”

Computershare Investor Services Inc. acts as the registrar and transfer agent for the Shares. The address for Computershare Investor Services Inc. is 100 University Avenue, 8th Floor, Toronto, ON, M5J 2Y1, Canada, and the telephone number is 1-800-564-6253.

Denison is a reporting issuer in each of the Canadian provinces and territories. The Shares are also registered under the U.S. Exchange Act, and Denison files periodic reports with the SEC.

Acknowledgement

Denison respectfully acknowledges that its business operates in Canada on lands that are in the traditional territory of Indigenous peoples. Denison’s activities encompass the entire mining life cycle, from early-stage exploration to advanced project evaluation, construction, operation, closure and restoration – with the potential for activities to span many decades. As such, Denison is committed to collaborating with Indigenous peoples and communities to build long-term, respectful, trusting, and mutually beneficial relationships and aspires to avoid any adverse impacts of Denison’s activities and operations.

Denison has adopted an Indigenous Peoples Policy, which reflects the Company’s recognition of the important role of Canadian business in the process of reconciliation with Indigenous peoples in Canada and outlines the Company’s commitment to take action towards advancing reconciliation. A copy of the Indigenous Peoples Policy is available on Denison’s website, in Déne, Cree, English and French languages.

Denison’s Head Office is located in the traditional territory of many nations, including the Mississaugas of the Credit, the Anishnabeg, the Chippewa, the Haudenosaunee and the Wendat peoples, and is now home to many diverse First Nations, Inuit and Métis peoples. Denison also acknowledges that Toronto is covered by Treaty 13 with the Mississaugas of the Credit.

Denison’s mining and mineral exploration operations in Saskatchewan, including its office in Saskatoon and various project interests in northern Saskatchewan, are located in regions covered by Treaty 6, Treaty 8 and Treaty 10, which encompass the traditional lands of the Cree, Dakota, Déne, Lakota, Nakota, Saulteaux, within the homeland of the Métis and within Nuhenéné.

Denison’s flagship Wheeler River Uranium Project, in particular, is located in northern Saskatchewan within the boundaries of Treaty 10, in the traditional territory of English River First Nation, in the homeland of the Métis and within Nuhenéné.

Denison’s legacy mines operations in the Elliot Lake region of northern Ontario are located within the boundaries of the Robinson Huron Treaty of 1850, signatories to which include the Serpent River First Nation.

| 2023 Annual Information Form |

|

Denison’s Team

At the end of 2023, Denison had a total of 64 active employees, all of whom were employed in Canada. None of the Company’s employees are unionized.

Denison’s Structure

Denison conducts its business through a number of subsidiaries and joint arrangements. The following is a diagram depicting the corporate structure of Denison, its active subsidiaries and corporate and partnership joint arrangements as at December 31, 2023, including the name, jurisdiction of incorporation and proportion of ownership interest in each.

JCU (Canada) Exploration Company, Ltd. (“JCU”) is owned by Denison (50%) and UEX Corporation (“UEX”, 50%). Denison and UEX are parties to a shareholders agreement governing the management of JCU and UEX, a wholly-owned subsidiary of Uranium Energy Corp., was appointed manager for JCU pursuant to the terms of such shareholders agreement.

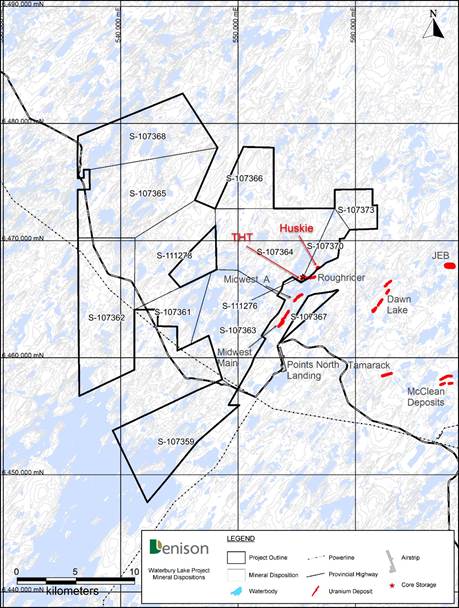

The Waterbury Lake Uranium Limited Partnership (“WLULP”) is held by Denison (69.33%) and Korea Waterbury Uranium Limited Partnership (“KWULP”) (30.65%) as limited partners and Waterbury Lake Uranium Corporation (“WLUC”) (0.02%), as general partner, with Denison’s aggregate interest in the partnership being 69.35%.

The Formation of Denison Mines Corp.

The Denison name has a long history in the Canadian uranium mining industry. Based on company archives, the Company’s involvement in the uranium mining industry dates back to 1954, when a predecessor to modern Denison acquired uranium claims in the Elliot Lake region of Ontario, Canada.

| 2023 Annual Information Form |

|

Denison Mines Corp. was established by articles of amalgamation as International Uranium Corporation (“IUC”) effective May 9, 1997 pursuant to the Business Corporations Act (Ontario) (the “OBCA”). On December 1, 2006, IUC combined its business and operations with Denison Mines Inc. (“DMI”), by plan of arrangement under the OBCA (the “IUC Arrangement”). Pursuant to the IUC Arrangement, all of the issued and outstanding shares of DMI were acquired in exchange for IUC’s shares. Effective December 1, 2006, IUC’s articles were amended to change its name to “Denison Mines Corp.”

Denison subsequently completed a plan of arrangement with Energy Fuels Inc. in 2012 and filed articles of amalgamation on January 1, 2014, July 1, 2014 and July 3, 2014 in connection with Denison’s acquisitions of JNR Resources Inc. and Fission Energy Corp. (“Fission”).

Denison Overview

Uranium Exploration and Development

Denison’s uranium property interests are held directly by the Company and/or indirectly through DMI, Denison Waterbury Corp. and Denison AB Holdings Corp.

|

Denison’s Key Assets – Focused in the Athabasca Basin Region of Saskatchewan:

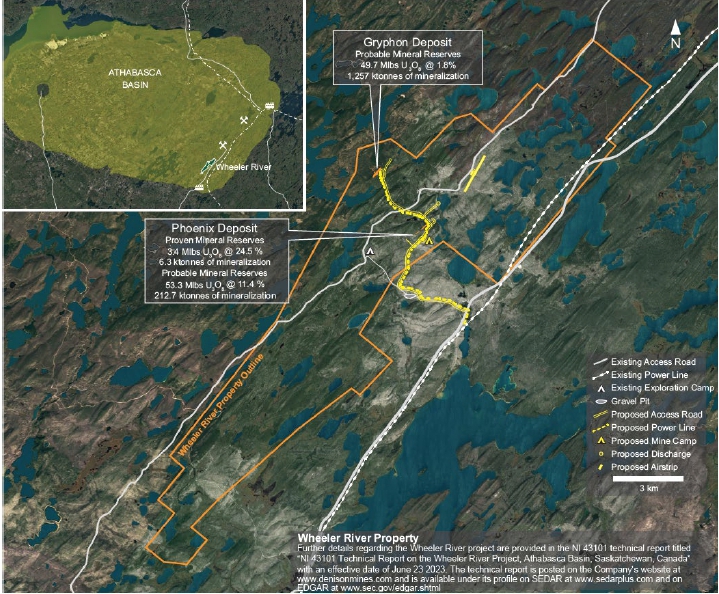

· An effective 95% interest in, and operator of, the Wheeler River Uranium project (“Wheeler” or “Wheeler River”), which is host to the high-grade Phoenix and Gryphon uranium deposits – together representing the largest undeveloped uranium project in the infrastructure rich eastern Athabasca Basin.

· A 69.35% interest in, and operator of, the Waterbury Lake project, which includes the Tthe Heldeth Túé (“THT”, formerly J Zone) and Huskie deposits.

· A 22.50% interest in the McClean Lake uranium processing facility and uranium deposits, through its interest in the McClean Lake Joint Venture (“MLJV”) operated by Orano Canada Inc. (“Orano Canada”).

· A 25.17% interest in the Midwest uranium project, which is host to the Midwest Main and Midwest A deposits, through its interest in the Midwest Joint Venture (“MWJV”) operated by Orano Canada.

· Through its 50% ownership of JCU, interests in various uranium project joint ventures in Canada, including the Millennium project (JCU 30.099%), the Kiggavik project (JCU 33.8118%) and Christie Lake (JCU 34.4508%).

· An extensive portfolio of exploration properties located in the Athabasca Basin. |

Toll Milling

Denison is a party to a toll-milling arrangement through its 22.5% interest in the MLJV, whereby ore is processed for the Cigar Lake Joint Venture (“CLJV”) at the McClean Lake processing facility (the “Cigar Toll Milling”). In February 2017, Denison completed a transaction (the “Ecora Transaction”) with Ecora Resources PLC (“Ecora”), formerly known as Anglo Pacific Group PLC, and its wholly owned subsidiary Centaurus Royalties Ltd. to raise gross proceeds to Denison of $43,500,000. The Ecora Transaction monetized Denison’s future share of the Cigar Toll Milling, providing Denison with the financial flexibility to advance its interests in the Athabasca Basin, including the Wheeler River project.

| 2023 Annual Information Form |

|

While the Ecora Transaction monetized certain future toll milling receipts from the Cigar Toll Milling, Denison retains a 22.50% strategic ownership stake in the MLJV and McClean Lake processing facility. See “Denison’s Operations – Cigar Lake Toll Milling – Ecora Transaction”.

Developments Over the Last Three Years

2021…

Project Developments – Proposed Phoenix ISR Operation

In February, Denison announced completion of its 2021 assessments and de-risking plans for the in-situ recovery (“ISR”) mining method planned for Wheeler River’s Phoenix deposit (“Phoenix”). The Wheeler River Joint Venture (“WRJV”) approved a $24.0 million budget for 2021 (100% basis, Denison’s share $19.4 million), to fund activities including the advancement of engineering studies, metallurgical testing, and a 2021 ISR field program. The budget also supported the resumption of activities related to the Environmental Assessment process (the “EA”) for Wheeler River being undertaken in accordance with the requirements of the Canadian Environmental Assessment Act, 2012 and the Saskatchewan Environmental Assessment Act, which had been temporarily suspended in 2020 amidst the significant social and economic disruption resulting from the COVID-19 pandemic and the Company’s commitment to ensure employee safety, support public health efforts to limit transmission of COVID-19, and exercise prudent financial discipline. The results of the 2021 ISR field program supported the permitting and preparation of the FFT (defined below) and the EA and FS processes.

In July, Denison announced, as part of its 2021 ISR field program, it had completed the installation of a five-spot large-diameter commercial scale well (“CSW”) test pattern in the Phase 1 area of Phoenix Zone A (“Phase 1”), to facilitate further hydrogeologic testing and assessment of down-hole permeability enhancement tools. In addition, nine of eleven planned monitoring wells (“MWs”) were installed within the Phase 1 area, to facilitate ongoing observation of the current and future hydrogeological test work – allowing for detailed hydrogeological assessment and water quality sampling.

In August, Denison reported positive interim results from the ongoing ISR metallurgical test program. Test work consistently supported an ISR mining uranium head-grade for Phoenix in excess of the 10 g/L assumed in the Pre-Feasibility Study for the Wheeler River project completed in 2018 (“2018 PFS”). Accordingly, the Company adapted its plans for the remaining metallurgical test work to reflect a 50% increase in the head-grade of uranium bearing solution (“UBS”) to be recovered from the ISR mining wellfield, of 15 grams per litre (“g/L”).

In October, the Company announced the initial results of the highly successful ISR field test program. The program results were highlighted by: (a) achieving commercial-scale production flow rates consistent with those assumed in the 2018 PFS; (b) demonstrating hydraulic control of injected solution during the ion tracer test; (c) establishing breakthrough times between injection and recovery wells consistent with previously prepared estimates; and (d) demonstrating the ability to remediate the five-spot CSW test pattern.

| 2023 Annual Information Form |

|

Given consistently positive results from field and laboratory testing, Denison and the WRJV approved the initiation of the formal FS report process for the Phoenix ISR project, and appointed Wood Canada Limited (“Wood”) as independent lead author of the FS.

For further information, see “Mineral Properties - Wheeler River - Evaluation Activities” below.

Project Developments – Wheeler River Regional Exploration

In January, the Company reported the results from its 2020 regional exploration program at Wheeler River, which included the discovery of new high-grade unconformity-hosted uranium mineralization along the K West conductive trend on the western side of the Wheeler River property, approximately four kilometers north-northwest of Phoenix. The uranium mineralization discovered is interpreted to straddle the unconformity contact of the underlying basement rocks and the overlying Athabasca sandstone. In addition to high-grade uranium, the assay results were highlighted by the presence of high-grade nickel.

In February, the Company reported the results from the 2020 exploration and expansion drilling program focused on the area proximal to Phoenix. As part of this program, 19 drill holes were completed for a total of approximately 7,400 metres – all of which were located at, but outside of the extents of the mineral resources currently defined for, Phoenix. The results from the program were highlighted by the intersection of high-grade uranium mineralization in Zone C, where no mineral resource is currently estimated, including: 5.69% U3O8 over 5.0 metres in WR-328D1, located approximately 22 metres northeast of historical mineralized hole WR-368 (1.59% U3O8 over 2.0 metres); and 8.84% U3O8 over 2.5 metres in WR-767D1, located approximately 35 metres to the northeast of WR-328D1.

In July, drill hole GWR-045 was completed as part of the ISR field test program as a MW to the northwest of the CSW test pattern. Based on the mineral resources currently estimated for Phoenix, GWR-045 was expected to intersect low-grade uranium mineralization on the northwest margin of the deposit, approximately 5 metres outside of the boundary of the Phoenix Zone A high-grade resource domain. However, the drill hole intersected a thick interval of high-grade unconformity-associated uranium mineralization grading of 22.0% eU3O8 over 8.6 metres. See “Developments Over the Last Three Years – 2022…” for detail of follow-up drilling results.

Other Project Developments

In April, Denison announced that new high-grade unconformity-hosted uranium mineralization was discovered during the winter 2021 exploration program completed at McClean Lake. The exploration program was operated by Orano Canada, 77.5% owner and operator of the MLJV. Three of the final four drill holes completed during the winter 2021 program returned uranium mineralization at the McClean South target area. Based on subsequently received assay results, the results were highlighted by drill hole MCS-34, which returned 8.67% U3O8 over 13.5 metres (including 78.43% U3O8 over 1.1 metres).

In November, Denison and Orano Canada announced the successful completion of a five-year test mining program deploying the patented Surface Access Borehole Resource Extraction (“SABRE”) mining method on the McClean Lake property. The program was highlighted by the completion of the final stage of the program from May to September 2021 with four mining cavities successfully excavated to produce approximately 1,500 tonnes of high-value ore ranging in grade from 4% U3O8 to 11% U3O8. The program was concluded with no safety, environmental or radiological incidents and confirmed the ability to achieve key operating objectives associated with the test program – including targets for cavity diameter, rates of recovery, and mine production rates. The majority of the ore recovered from the test mining program was transferred to the McClean Lake mill, resulting in the production of approximately 176,000 pounds of U3O8 (Denison’s share: approximately 40,000 pounds of U3O8) in the fourth quarter of 2021.

| 2023 Annual Information Form |

|

Financing Developments