UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to

Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 21, 2024

GOLDEN MINERALS COMPANY

(Exact name of registrant as specified in its charter)

| DELAWARE | 1-13627 | 26-4413382 |

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

350 Indiana Street, Suite 650

Golden, Colorado 80401

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (303) 839-5060

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.01 par value | AUMN | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.02 | Termination of a Material Definitive Agreement. |

On March 21, 2024, Golden Minerals Company (the “Company”) received written notice from Barrick Gold Corporation (“Barrick”), notifying the Company of Barrick’s election to terminate the Earn-In Agreement, dated as of April 9, 2020, by and among the Company, several of the Company’s directly and indirectly wholly owned subsidiaries, and Barrick (the “Earn-In Agreement”) under which Barrick acquired an option to earn a 70% interest in the Company’s El Quevar project located in the Salta Province of Argentina.

Pursuant to the terms of the Earn-In Agreement, in order to earn the undivided 70% interest in the El Quevar project, Barrick must: (A) incur a total of $10 million in work expenditures over a total of eight years ($0.5 million per year in years one and two, $1 million per year in years three, four and five, and $2 million per year in years six, seven and eight); (B) deliver to the Company a National Instrument 43-101 compliant pre-feasibility study pursuant to the parameters set forth in the Earn-In Agreement; and (C) deliver a written notice to exercise the Option to the Company within the term of the Earn-In Agreement. Additionally, Barrick may terminate the Earn-In Agreement at any time after spending a minimum of $1 million in work expenditures (the “Expenditure Commitment”) and upon providing 30 days’ notice to the Company.

Barrick has performed the Expenditure Commitment and the termination of the Earn-In Agreement will become effective on April 20, 2024.

The foregoing description of the Earn-In Agreement does not purport to be complete and is qualified in its entirety by reference to the text of the Earn-In Agreement, which was filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020.

| Item 7.01 | Regulation FD Disclosure. |

On March 27, 2024, the Company issued a press release announcing the termination of the Earn-In Agreement. A copy of the press release is attached hereto as Exhibit 99.1.

The information contained in Item 7.01 of this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing by the company under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press release of Golden Minerals Company, dated March 27, 2024, announcing that Barrick has elected to terminate the Earn-In Agreement. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 27, 2024

| Golden Minerals Company | |||

| By: | /s/ Julie Z. Weedman | ||

| Name: | Julie Z. Weedman | ||

| Title: | Senior Vice President and Chief Financial Officer | ||

Exhibit 99.1

Golden Minerals Announces Return of El Quevar Silver Project

GOLDEN, CO - /BUSINESS WIRE/ - March 27, 2024 – Golden Minerals Company (“Golden Minerals,” “Golden” or the “Company”) (NYSE-A: AUMN and TSX: AUMN) announced today that Barrick Gold Corporation (“Barrick”) notified the Company it is withdrawing from an Earn-In Agreement (the “Agreement”) on the El Quevar silver project (Salta province, Argentina) which the two parties signed in April 2020. The termination will be effective on April 20, 2024.

Golden Minerals President and Chief Executive Officer, Warren Rehn, commented today, “The timing of the return of the El Quevar project is fortuitous and quite favorable to the Company as we pivot from production to exploration and development. The El Quevar property is one of the largest contiguous high sulfidation alteration systems in northern Argentina and presents a very prospective opportunity to the Company in further advancing the high-grade Yaxtché silver deposit as well as advancing the newly identified gold prospect just to the south.”

To date, Barrick has spent more than $6.0 million of work expenditures at El Quevar and has completed a five-hole, 1,300-meter drill program that identified a potential gold prospect in the central Eastern part of Quevar’s land package. That report noted the presence of vuggy silica alteration, which is commonly associated with high sulfidation epithermal gold-silver deposits, in all holes. Final assays confirmed potentially economic gold values in vuggy silica in one of the drill holes.

The Agreement offered Barrick the opportunity to earn an undivided 70% interest in the El Quevar project by spending $10.0 million on work expenditures over a total of eight years, which included spending $0.5 million per year in years one and two, $1.0 million per year in years three, four and five, and $2.0 million per year in years six, seven and eight. Additional earn-in terms under the Agreement required Barrick to deliver an NI 43-101-compliant Pre-Feasibility Study describing a potentially profitable operation with mineral resources of not less than 2 million gold equivalent ounces, also within eight years.

About El Quevar and Next Steps

Golden Minerals has previously defined a high-grade silver deposit at El Quevar’s Yaxtché deposit, totaling 2.9 million tonnes of Indicated material containing 45.3 million ounces (“oz”) of silver at an average grade of 482 grams per tonne (“gpt”), plus 0.3 million tonnes of Inferred material containing 4.1 million oz of silver at an average grade of 417 gpt1. The Yaxtché deposit encompasses less than one percent of Quevar’s vast 57,000-hectare land area. Most of the area outside the Yaxtché deposit has yet to be explored and the Yaxtché deposit itself is open to both the east and west.

The Company views the return of the El Quevar project very positively. Quevar’s land package now holds a potential gold prospect whose drilling was funded by Barrick. Meanwhile, most of Quevar’s holding costs have been funded by Barrick since April 2020 as well.

Golden Minerals intends to further advance the El Quevar project and update its resource, subject to the availability of capital. The Company’s focus will be on updating the Preliminary Economic Assessment for the Yaxtché silver deposit and in step-out drilling to follow up on the gold intercept drilled in 2022 by Barrick.

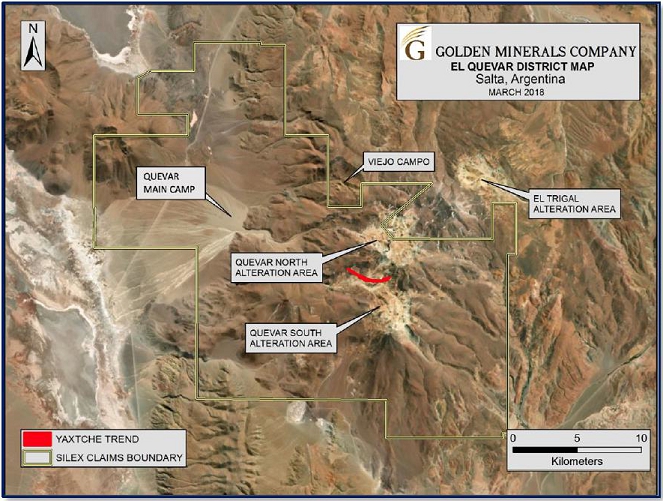

The following district map shows the El Quevar project and the Yaxtché deposit within it.

Page 1 of 3

G O L D E N M I N E R A L S C O M P A N Y

350 Indiana Street – Suite 650 – Golden, Colorado 80401 – Telephone (303) 839-5060

Endnotes

1 February 2018. Resources prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure of Mineral Projects (“NI 43-101”). Amec Foster Wheeler E&C Services, Inc., a Wood Group PLC company. “NI 43-101 Technical Report on Updated Mineral Resource Estimate”, February 26, 2018. Cutoff grade 250 g/t Ag.

About Golden Minerals

Golden Minerals is a precious metals mining exploration company based in Golden, Colorado. The Company is primarily focused on advancing its Yoquivo property in Mexico and advancing its El Quevar silver property in Argentina. The Company is also focused on acquiring and advancing selected mining properties in North America and Argentina.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the Company’s views on the return of the El Quevar project; the potential gold prospect of the Quevar land package; the assumptions and estimates contained in the February 2018 NI 43-101 mineral resource estimate; and the Company’s intention to further advance the El Quevar project and update the Preliminary Economic Assessment for the Yaxtché silver deposit. These statements are subject to risks and uncertainties, including the potential future re-suspension of non-essential activities in Mexico; increases in costs and declines in general economic conditions; changes in political conditions, in tax, royalty, environmental and other laws in the United States, Mexico or Argentina and other market conditions; and fluctuations in silver and gold prices. Golden Minerals assumes no obligation to update this information. Additional risks relating to Golden Minerals may be found in the periodic and current reports filed with the SEC by Golden Minerals, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Page 2 of 3

G O L D E N M I N E R A L S C O M P A N Y

350 Indiana Street – Suite 650 – Golden, Colorado 80401 – Telephone (303) 839-5060

For additional information, please visit http://www.goldenminerals.com/ or contact:

Golden Minerals Company

Karen Winkler, Director of Investor Relations

(303) 839-5060

SOURCE: Golden Minerals Company

Page3 of 3

G O L D E N M I N E R A L S C O M P A N Y

350 Indiana Street – Suite 650 – Golden, Colorado 80401 – Telephone (303) 839-5060