UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

March 8, 2024

Commission File Number: 001-14251

SAP SE

(Exact name of registrant as specified in its charter)

SAP EUROPEAN COMPANY

(Translation of registrant’s name into English)

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal Republic of Germany

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

SAP SE

FORM 6-K

On Feb 29, 2024, SAP SE, a European company (Societas Europaea, SE) organized under the laws of Germany and the European Union (“SAP”), issued its Integrated Report 2023. The Integrated Report 2023 is attached as Exhibit 99.1 hereto and incorporated by reference herein.

Any statements contained in this report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “predict,” “should” and “will” and similar expressions as they relate to SAP are intended to identify such forward-looking statements. SAP undertakes no obligation to publicly update or revise any forward-looking statements. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect SAP’s future financial results are discussed more fully in SAP's filings with the U.S. Securities and Exchange Commission (the “SEC”), including SAP’s most recent Annual Report on Form 20-F filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

The information furnished herewith in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, whether made before or after the date of this report, regardless of any general incorporation by reference language in such filing.

| Exhibit No. | Description | |

| 99.1 | Integrated Report 2023 issued on Feb 29, 2024 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SAP SE | |||

| (Registrant) | |||

| By: | /s/ Christopher Sessar | ||

| Name: | Dr. Christopher Sessar | ||

| Title: | Chief Accounting Officer | ||

| By: | /s/ Julia Zicke | ||

| Name: | Dr. Julia Zicke | ||

| Title: | Head of External Reporting and Accounting Technology | ||

Date: March 8, 2024

EXHIBIT INDEX

| Exhibit No. | Exhibit | |

| 99.1 | Integrated Report 2023 issued on February 29, 2024 |

Exhibit 99.1

|

SAP Integrated Report 2023 | |||||

About This Report

Content

The SAP Integrated Report 2023 presents our annual financial, social, and environmental performance in a single integrated report (“SAP Integrated Report”) available at www.sapintegratedreport.com.

We report on our contribution to the UN Sustainable Development Goals (SDGs) and have embedded the recommended disclosures of the Task Force on Climate-Related Financial Disclosures (TCFD), of the Sustainability Accounting Standards Board (SASB) standards, and of the World Economic Forum (WEF) stakeholder capitalism metrics.

Basis of Presentation

Our combined management report is prepared in accordance with the German Commercial Code and the relevant German Accounting Standards.

The report encompasses SAP SE and all subsidiaries which we control and, hence, include in our consolidated financial statement according to IFRS. Joint arrangements and associates are not included in the sustainability reporting. Any further deviations for the sustainability reporting are specifically mentioned in the respective chapters. Our executive management has confirmed the effectiveness of our internal controls over financial reporting.

The social and environmental data and information included in the SAP Integrated Report is prepared in accordance with the Global Reporting Initiative (GRI) Standards, which require a report to provide a comprehensive picture of its material topics and related impacts and how these are managed. We apply the GRI principles (sustainability context, stakeholder inclusiveness, materiality, and completeness) for defining report content. We also report on SDGs identified as material to our strategy.

Greenhouse gas data is prepared based on the Greenhouse Gas Protocol.

Data

All financial and non-financial data and information for the reporting period is reported utilizing SAP software solutions and sourced from the responsible business units.

The reporting period is fiscal year 2023. The report encompasses SAP SE and all subsidiaries of the SAP Group. To make this report as current as possible, we have included relevant information available up to the auditor’s opinion dated February 21, 2024. The report is available in English and German.

Independent Audit and Assurance

BDO AG Wirtschaftsprüfungsgesellschaft (BDO) has audited our consolidated financial statements and our combined management report. Information relating to the non-financial statement included in SAP’s management report has been audited with limited assurance by BDO. Additionally, BDO has provided assurance on selected sustainability information in accordance with the International Standard on Assurance Engagements (ISAE) 3000, a pertinent standard for the assurance of sustainability reporting. The Independent Auditor’s Report and the Assurance Reports of BDO for the non-financial statement and selected sustainability information are available in the Independent Auditor’s Report section, in the Independent Auditor’s Report on a Limited Assurance Engagement of the Combined Non-Financial Statement, and in the Independent Auditor’s Report on a Limited Assurance Engagement on Sustainability Information section.

|

SAP Integrated Report 2023 | |||||

Concept and Realization

This report was designed by SAP and created with SAP S/4HANA software and the SAP Disclosure Management application.

Contents

| To Our Stakeholders | 4 |

| Combined Management Report | 46 |

| Consolidated Financial Statements IFRS | 154 |

| Further Information about Sustainability | 262 |

| Additional Information | 319 |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

To Our Stakeholders

| Letter from the CEO | 5 |

| SAP Executive Board | 8 |

| Investor Relations | 10 |

| Report by the Supervisory Board | 15 |

| Responsibility Statement | 28 |

| Independent Auditor’s Report | 29 |

| Independent Auditor’s Report on a Limited Assurance Engagement of the Combined Non-Financial Statement | 40 |

| Independent Auditor’s Report on a Limited Assurance Engagement on Sustainability Information | 43 |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Letter from the CEO

Dear Fellow Shareholders,

2023 was another year of exponential developments around the globe. Looking at the geopolitical landscape, new crises surfaced as old ones had not yet settled, and conflicts in multiple regions kept the world on edge. Looking at the climate, record global temperatures and extreme weather events underlined the urgency to accelerate climate action. At the same time, change continued to be the only constant in the tech industry. The year saw incredible leaps especially in generative artificial intelligence (GenAI), and consumer applications rapidly captured the imagination of the global public. It also became clear, though, that the true value of this seminal technology lies in its application to the business world. GenAI will be a powerful tool to transform companies and to make the world economy more sustainable, resilient, and fair overall. At a time when humanity’s challenges become ever more complex, GenAI promises to drastically expand our capacity to find solutions – and to do more with less.

All these global developments have a direct relevance for SAP. Our solutions touch 87% of global commerce and help keep companies, economies, and global business resilient in volatile times. Our sustainability offering enables customers to systematically track key metrics, including carbon emissions, and to take effective action. Meanwhile, SAP is increasingly embedding business AI in all our solutions. We’re doing our part to make the technology a powerful, readily accessible tool for organizations to become more efficient, more sustainable, and more innovative.

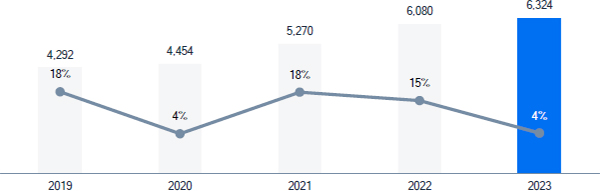

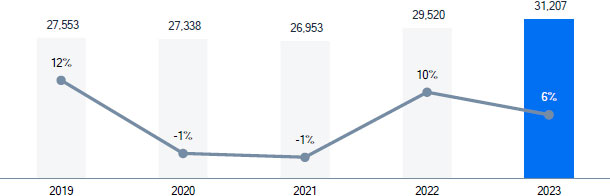

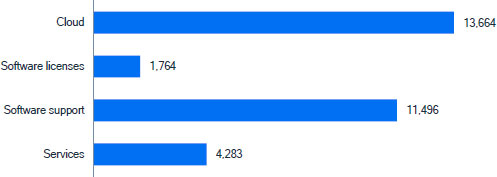

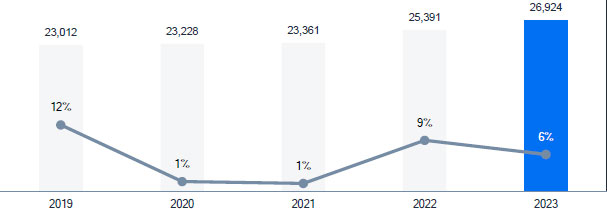

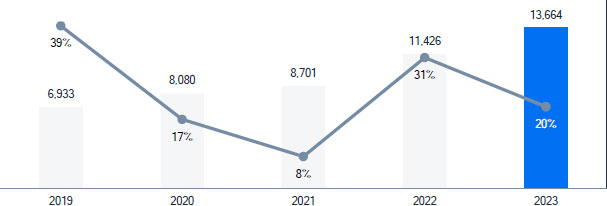

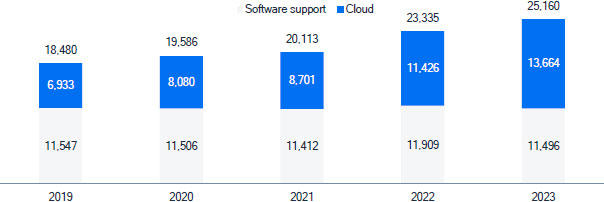

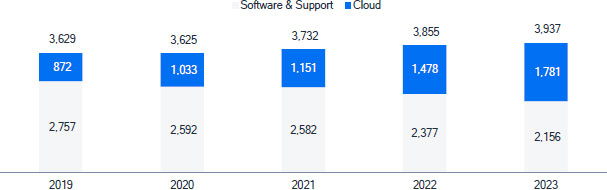

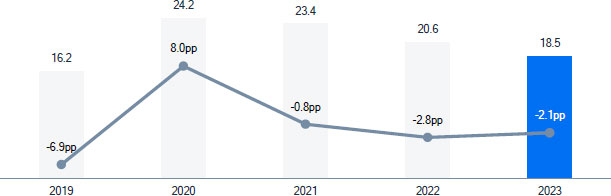

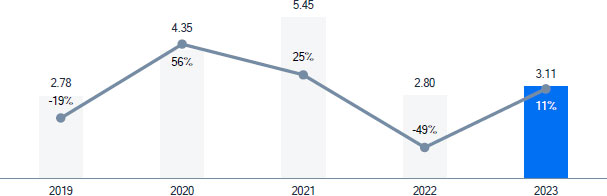

Today, SAP is stronger and more relevant than ever. And this is also visible in our business results: In 2023, we met or exceeded our outlook in all key metrics. Current Cloud Backlog surpassed €13.7 billion, growing 27%1, while Cloud Revenue went up 23%1 to €13.7 billion.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Non-IFRS operating profit expanded by 13%1, exceeding our guidance range. What is more, Total Cloud Backlog increased 39%1 to €44 billion, fostering the Company’s resilience for the years to come.

Our strong portfolio, tightly integrated in both technological and commercial terms, is at the heart of our Company’s growth formula. Hundreds of leading global companies choose “RISE with SAP” every year to move their business processes to the cloud. In March 2023, we introduced “GROW with SAP,” an offering to support the cloud conversion of medium-sized companies. GROW with SAP, too, is proving to be a major success, with over 700 customers signing up in just nine months. In September, then, we launched Joule, SAP’s generative AI co-pilot, to the public. Joule will be infused throughout our cloud portfolio. It will deliver insights from across SAP solutions and beyond, and it will enable users and companies to quickly reach relevant, reliable outcomes in a fast and responsible manner. Strong partnerships and collaborations with leading AI companies – including Nvidia, Microsoft, and OpenAI, as well as Google – will help SAP to further expand the capabilities of our business AI solutions and to maximize their benefit for our customers.

With portfolio transactions, we additionally rounded out our offering. In June, we closed the sale of Qualtrics, aiming to focus our portfolio and to direct investments where they have the biggest impact. And in November, SAP finalized the acquisition of LeanIX, whose enterprise architecture management (EAM) solutions will help ensure that processes, systems, and data yield the right outcome for every SAP customer. In their combination, SAP LeanIX solutions, the SAP Signavio portfolio, and the SAP Cloud ALM solution for application life cycle management form a unique business transformation suite.

Driven by the Company’s excellent results and an overall positive market mood, particularly for tech companies, SAP’s stock soared in 2023. Towards the end of the year that also marked the 25th anniversary of our U.S. stock market listing, SAP stock reached a new all-time high at €148.18 per share. The share price increased 43.2% in total over the course of 2023 – more than double the development of the DAX, which gained 19.1%. The Nasdaq-100 appreciated by 54.9% in the same time frame. SAP also regained its position as the most valuable company among the DAX 40 in February 2023, and ended the year with a market capitalization of €171 billion on December 31, 2023.

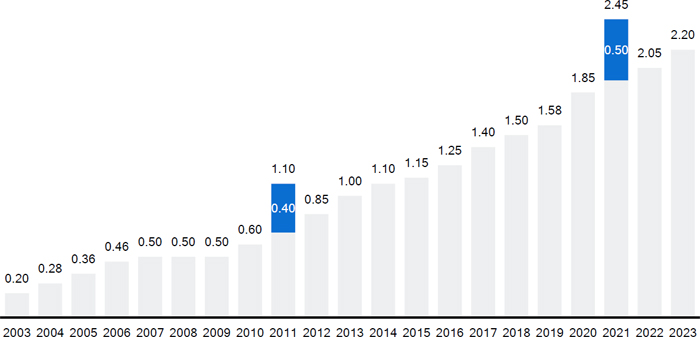

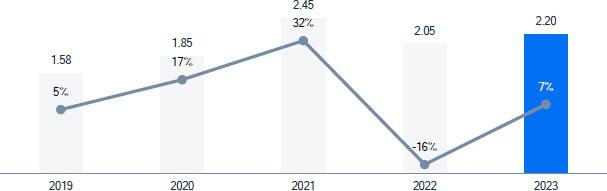

Shareholders will additionally profit from SAP’s strong performance by means of an attractive dividend. Based on the Company’s strong performance in 2023, SAP intends to propose a dividend of €2.202 per share at the annual general meeting in May – up approximately 7% compared to the preceding year. What is more, we announced a €5 billion share repurchase program to be conducted through the end of 2025. In addition to returning capital to shareholders, the program will help to balance out dilution related to employee share programs.

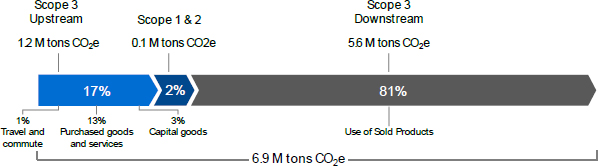

Beyond the convincing financial performance, SAP also met its non-financial goals. In 2023, SAP achieved carbon neutrality in its own operations and continues to focus on achieving net zero by 2030 along our value chain. Further, we intend to make an even bigger contribution to sustainability by helping our customers accelerate their respective journeys. Roughly 1,000 new customers chose SAP’s sustainability solutions in 2023 alone.

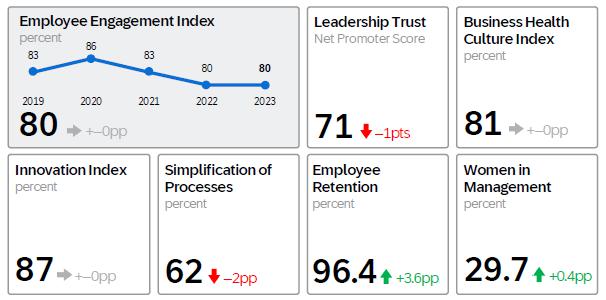

Our Customer Net Promoter Score (NPS) improved 2 points year over year to 9 in 2023, reflecting that customers are increasingly satisfied with our solutions. Meanwhile, our Employee Engagement Index remained stable at 80% and came in at the upper end of our target range, indicating high levels of employee motivation, affinity towards SAP, and excitement about the Company’s future. The proportion of women in management roles increased to 29.7% (2022: 29.4%) and reached 35.2% in the workforce overall.

On behalf of the entire Executive Board, I would like to thank all SAP colleagues for these excellent achievements in a challenging environment. We had promised to quickly turn SAP into a cloud company – a company with double-digit profit growth – and we can comfortably say: we delivered.

As we move into the future, we’re determined to keep leading the way as a top Enterprise Application company and we’re determined to become the #1 Business AI company as well. This is

1 At constant currencies

2 Pending approval of Annual General Meeting of Shareholders

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

why, out of a very strong position, we are accelerating SAP’s development. Over the next two years, we’re going to invest almost €1 billion to develop powerful AI use cases for our customers. And, with a dedicated transformation program, we intend to further intensify the shift of resources to business AI, in line with the significant growth potential we see for SAP. The planned program will also include a restructuring component focusing on reskilling and voluntary exits. A decision affecting colleagues this way is never easy – but we truly believe it is the right next step for the company. We’re setting up SAP for a strong, competitive future that all stakeholders will benefit from.

I would like to thank you, dear fellow shareholders, for your trust in SAP in 2023 – and I am excited about the great opportunities and promising future that lie ahead.

Sincerely,

Christian Klein

CEO, SAP SE

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

SAP Executive Board

|

Christian

Klein

Joined

SAP: 1999

Other

board memberships: |

|

Dominik

Asam

Joined

SAP: 2023

Other board memberships: Supervisory Board, Bertelsmann Management SE and Bertelsmann SE & Co. KGaA, Gütersloh, Germany (not publicly listed) |

|

Dr.-Ing.

Juergen Mueller

Joined

SAP: 2013 |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

|

Scott

Russell

Joined

SAP: 2010

Other board memberships: Board of Directors, Qualtrics International Inc, Provo, UT, USA |

|

Thomas

Saueressig

Joined

SAP: 2004

Other

board memberships: |

|

Gina

Vargiu-Breuer

Joined

SAP: 2024 |

|

Julia

White

Joined

SAP: 2021 |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Investor Relations

Global Economy Without Momentum but Inflationary Pressure Easing Slowly

According to a statement by the German Federal Ministry of Economics and Climate Protection (BMWK), there are increasing signs that the global economy is facing a prolonged phase of below-average growth. The medium-term prospects for economic growth are lower than they have been for decades. After a strong start to 2023, the global economy showed a significant slowdown over the summer. This was mainly due to weak industrial production and the sharp rise in interest rates in most regions of the world. Another dampening factor was the subdued development in China. The economic situation is assessed very similarly by international organizations such as the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD).

Inflation, however, has fallen from last year’s multiyear high. The IMF expects inflation rates to fall from 6.9% in 2023 to 5.8% in 2024, with most countries not coming close to their central banks’ targets before 2025. The OECD expects an average inflation rate of at least 2% in 2024 for both the United States and the euro area and is even forecasting 2.1% for Japan.

Stock Markets Stimulated by Falling Interest Rates

The stock market year 2023 was nevertheless more successful than many had expected in advance: The German blue-chip index DAX ended the year with a rise of over 19% and most stock markets worldwide were also up. The recent slowdown in inflation raised hopes of a looser monetary policy, which had a price-driving effect. The S&P500 index rose 22.8% and the Nasdaq-100 technology index exceeded all expectations with a gain of 53.8%.

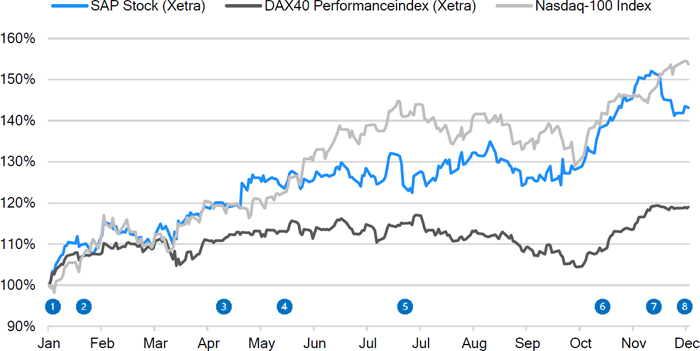

SAP Stock Reaches New All-Time High

The SAP share price continued to improve throughout 2023. Shortly after SAP announced its good results for financial year 2022 at the end of January, the SAP share price rose more than 7% in a single week to €112.58. The successful execution of SAP’s cloud transformation and the resulting improvement in profitability sent clear signals to the market. The positive sentiment solidified over the course of the following months, lifting SAP stock to €115.60 by the time the results for the first quarter were announced. The Q1 numbers and outlook for the full year were once again convincing and pushed the share a further 7% higher to €123.62 within a week. The market already had high expectations for the half-year results at the end of July due to SAP’s performance in the previous quarters, and these expectations were met with the announcement, albeit without providing any further strong stimulus.

With the results for the crucial third quarter, which once again confirmed the successful execution of SAP’s strategy in terms of order entry, sales revenue, and operating profit, SAP stock began a remarkable upward trend. Within six weeks, the share price climbed to a new all-time high of €148.18 on December 8, 2023, in a supportive market environment. The share ended the trading year on December 29 at a closing price of €139.48, representing an increase of 43.1% compared to the previous year’s closing price. SAP’s market capitalization at the end of December was €171.3 billion, making it once again the most valuable company in the German share index. With our intensified Investor Relations activities in North America, we could drive a strong increase in trading volume of the SAP ADR at the New York Stock Exchange. Additionally, SAP was ranked 61st among the 100 most valuable companies in the world according to a study by the management consulting firm EY.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

SAP Stock Versus Major Indices (January 2, 2023, to December 29, 2023)

| 1. | January 2 – Opening price – €97.42 | 5. | July 20 – Financial results Q2 and Half-Year 2023 |

| 2. | January 26 – Financial results Q4 and Full year 2022 | 6. | October 18 – Financial results Q3 2023 |

| 3. | April 21 – Financial results Q1 2023 | 7. | December 18 – Annual High 2023 – €148.18 |

| 4. | May 16 – Dividend payment – €2.05 | 8. | December 29 – Closing price – €139.48 |

Continuous Engagement with the Investment Community

SAP continued its strong engagement with the investment community in 2023. Throughout the year, members of the Executive Board of SAP SE and the Investor Relations (IR) team discussed our latest strategy, its execution and business development, and how SAP was helping customers meet the many challenges faced by companies today, with institutional investors, analysts, and private investors worldwide.

Our event analysis showed that most of the conferences attended consisted of participants with longer investment time horizon and high purchase potential. 85% of the SAP engagements were with asset managers with an investment horizon of 1+ years. The number of days SAP engaged with the buy-side exceeded the industry benchmark and SAP IR interacted with 75% of the Top 100 shareholders throughout the year.

In summary, the IR team, together with senior management, held more than 300 meetings in 2023 to maintain the dialogue with investors and analysts, including one-on-one phone calls, video conferences, and road shows. Members of the Executive Board and the IR team attended more than 20 conferences across an expanded geographical mix. In May, we hosted the Financial Analyst Conference as a part of our SAP® Sapphire® event in Orlando, Florida, United States. In 2023, for the first time since 2020, SAP held the Annual General Meeting of Shareholders (AGM) with physical presence again in Mannheim, Germany.

We continued our dialogue with investors, focusing on environmental, social, and governance (ESG) topics and providing them with insights into our sustainability policies and products. SAP’s leadership in this area has been recognized by leading sustainability rating organizations.

SAP representatives engaged with retail shareholders at virtual and physical events. The IR team and the Treasury team also maintained regular communication with the debt investor community.

We provide a wide range of information online about SAP and its stock. Our communications channels include the LinkedIn channel SAP Investor Relations and the SAP INVESTOR magazine.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Shareholders can reach the IR team directly by telephone hotline and by e-mail at investor@sap.com. We also publish an overview of the latest analyst consensus on the Investor Relations Web site.

In addition, we provide a Webcast for all key investor events at which members of our Executive Board speak, and we post all relevant presentations on the Investor Relations Web site.

Key Facts About SAP Stock/SAP ADRs

| Listings | |

| Germany | Berlin, Frankfurt, Stuttgart |

| United States (ADRs) | New York Stock Exchange |

| IDs and symbols | |

| WKN/ISIN | 716460/DE0007164600 |

| NYSE (ADRs) | 803054204 (CUSIP) |

| Reuters | SAPG.F or .DE |

| Bloomberg | SAP GR |

| Weight (%) in indexes as at 12/29/20221 | |

| DAX 40 | 9.41 |

| Prime All Share | 9.85 |

| CDAX | 10.50 |

| HDAX | 9.40 |

| TecDax | 9.13 |

| Dow Jones STOXX 50 | 2.90 |

| Dow Jones EURO STOXX 50 | 4.44 |

| 1 Source: STOXX | |

Return on SAP Common Stock — WKN 716460/ISIN DE007164600

| Percent, unless otherwise stated | |||

| Initial investment €10,000 | |||

| Date of investment | 12/31/2013 | 12/31/2018 | 12/31/2022 |

| Period of investment | 10 years | 5 years | 1 year |

| Value as at 12/31/20231 (in €) | 22,385 | 16,045 | 14,470 |

| Average annual return | 8.4% | 9.9% | 44.7% |

| Performance comparators | |||

| DAX 40 Performance — total return index | 5.8% | 9.7% | 20.3% |

| Nasdaq-100 index | 16.7% | 21.6% | 53.8% |

| REX General Bond — total return index | -0.4% | -2.1% | 1.3% |

| S&P 500 Composite — total return index | 12.4% | 14.6% | 20.5% |

| S&P North American Technology Software Index | 20.2% | 22.2% | 55.1% |

| 1 Source: Bloomberg, Dividends reinvested | |||

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Return on SAP ADRs — 803054204 (CUSIP)

| Percent, unless otherwise stated | |||

| Initial investment US$10,000 | |||

| Date of investment | 12/31/2013 | 12/31/2018 | 12/31/2022 |

| Period of investment | 10 years | 5 years | 1 year |

| Value at 12/31/20231 (in US$) | 17,740 | 15,529 | 14,981 |

| Average annual return | 5.9% | 9.2% | 49.8% |

| Performance comparators | |||

| S&P 500 Composite — total return index | 9.9% | 13.7% | 24.2% |

| NASDAQ100 index | 16.7% | 21.6% | 53.8% |

| 1 Source: Bloomberg, Dividends reinvested | |||

Dividend of €2.20 Proposed

It is our policy to pay a dividend totaling 40% or more of IFRS profit after tax.

At the 2024 Annual General Meeting of Shareholders, the Executive Board and the Supervisory Board of SAP SE will recommend a total dividend for fiscal year 2023 of €2.20 (2022: €2.05) representing an increase of €0.15, or 7.3% compared to the dividend paid for fiscal year 2022. The payout ratio would be 43.1%.

Capital Stock Unchanged

SAP’s capital stock as at December 31, 2023, was €1,228,504,232 (2022: €1,228,504,232). It is issued as 1,228,504,232 no-par shares, each with an attribute value of €1 in relation to capital stock.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

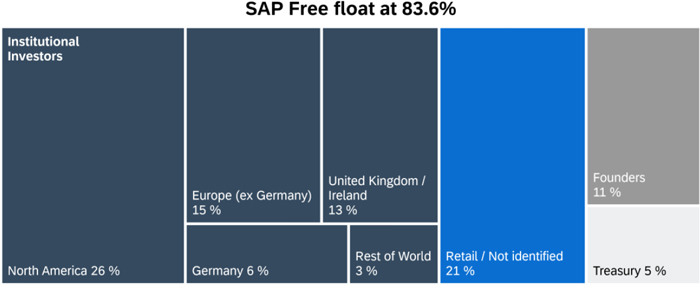

Shareholder Structure

Applying the definition accepted on the Frankfurt Stock Exchange, which excludes treasury stock from the free float, as at December 31, 2023, the free float stood at 83.6% (December 31, 2022: 83.3%).

41% of institutional investors are classified as ESG investors.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Report by the Supervisory Board

Dear Shareholders,

In the following, we would like to inform you about the work of the Supervisory Board in the fiscal year 2023.

Collaboration Between the Supervisory Board and the Executive Board

In the past fiscal year, the Supervisory Board of SAP SE discharged the duties imposed on it by the law and by the Company’s Articles of Incorporation. It advised the Executive Board on an ongoing basis with regard to the running of the Company and it scrutinized and monitored the work of management.

The Supervisory Board received regular, full, and timely reports from the Executive Board, both from members in person and in written documents. The Supervisory Board was also in regular exchange with senior internal officers through its various committees. This ensured that we were always up to date, even between meetings, on the Company’s strategy, planning, business performance, risks, risk management, compliance (in other words, adherence to laws, to the Company’s Articles of Incorporation, and to internal policies), and on transactions of special significance for SAP. In its reports, the Executive Board also informed us in particular where business deviated from plan or target, and why. We questioned and probed the Executive Board’s reports to satisfy ourselves that the information it gave us was plausible. The Executive Board fully met our requirements when it came to providing information.

In addition, the Supervisory Board chairperson and the CEO were in continuous contact, which meant the Supervisory Board chairperson was always apprised without delay of all important events that were significant for assessing SAP’s situation and progress or for the management and governance of the Company. Moreover, the chairperson of the Supervisory Board and the CEO regularly discussed matters related to SAP’s strategy, business performance, risk position, risk management, and compliance. In preparation for the upcoming handover of the Supervisory Board chair position, the deputy chairperson representing the shareholder representatives was increasingly included in these discussions.

Transactions that were submitted to us because they required the approval of the Supervisory Board whether by law, the Articles of Incorporation, or the Supervisory Board’s list of transactions requiring its consent, were approved by us after detailed examination and discussion with the Executive Board.

Supervisory Board Meetings and Resolutions

In the past fiscal year, the Supervisory Board of SAP SE held four ordinary meetings and three extraordinary meetings at which we deliberated and resolved on all matters of relevance to the Company. Our plenary meetings and committee meetings were held as physical meetings, as video or telephone conferences, or as hybrid sessions, where some members attended physically and the remainder online. We also adopted 15resolutions by correspondence vote. The following table provides an overview of the individual members’ attendance at the Supervisory Board’s plenary sessions and committee meetings in the year under review. This report also contains a table that shows which meetings of the Supervisory Board and its committees were held as a physical meeting, as a video or telephone conference, or as a hybrid session.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Meeting Participation of SAP Supervisory Board Members During Fiscal Year 2023

| Plenum | Committees | All Meetings | |||||

| Supervisory Board Members | Meetings | Participation | Meetings | Participation | Meetings | Participation | Participation in % |

| Prof. Dr. h. c. Hasso Plattner | 7 | 7 | 21 | 18 | 28 | 25 | 89% |

| Manuela Asche-Holstein | 7 | 6 | 19 | 18 | 26 | 24 | 92% |

| Aicha Evans | 7 | 6 | 20 | 18 | 27 | 24 | 89% |

| Prof. Dr. Gesche Joost (until 5/11/2023) | 3 | 3 | 5 | 4 | 8 | 7 | 88% |

| Margret Klein-Magar | 7 | 7 | 31 | 30 | 38 | 37 | 97% |

| Monika Kovachka-Dimitrova | 7 | 7 | 16 | 16 | 23 | 23 | 100% |

| Lars Lamadé | 7 | 6 | 16 | 14 | 23 | 20 | 87% |

| Peter Lengler | 7 | 7 | 23 | 23 | 30 | 30 | 100% |

| Jennifer Xin-Zhe Li | 7 | 7 | 24 | 22 | 31 | 29 | 94% |

| Dr. Qi Lu | 7 | 7 | 14 | 12 | 21 | 19 | 90% |

| Gerhard Oswald | 7 | 7 | 26 | 26 | 33 | 33 | 100% |

| Dr. h. c. Punit Renjen (from 5/11/2023) | 4 | 4 | 7 | 7 | 11 | 11 | 100% |

| Christine Regitz | 7 | 7 | 21 | 21 | 28 | 28 | 100% |

| Dr. Friederike Rotsch | 7 | 7 | 23 | 21 | 30 | 28 | 93% |

| Heike Steck | 7 | 7 | 22 | 21 | 29 | 28 | 97% |

| Helmut Stengele1 | 7 | 4 | 0 | 0 | 7 | 4 | 57% |

| Dr. Rouven Westphal | 7 | 7 | 25 | 25 | 32 | 32 | 100% |

| Gunnar Wiedenfels | 7 | 6 | 24 | 18 | 31 | 24 | 77% |

| James Wright | 7 | 7 | 28 | 28 | 35 | 35 | 100% |

1 Currently not a member of any Supervisory Board committee

The Supervisory Board and its committees also regularly convened wholly or partly without the Executive Board as necessary to deliberate on matters that pertained to the Executive Board, required internal discussion among Supervisory Board members alone or did not require the Executive Board’s presence, or to facilitate discussion between the Supervisory Board or its respective committee and the auditor without the Executive Board present. This was the case in three of the plenary sessions and in eight committee meetings in 2023. In addition, the shareholder representatives and the employee representatives independently discussed, at times with the CEO, the topics on the respective agenda before each ordinary meeting. Said deliberations similarly took place as required prior to the extraordinary meetings or prior to circular correspondence votes. The Supervisory Board addressed the following key topics during the year:

Artificial intelligence

One of the main focuses of our discussions with the Executive Board was the topic of artificial intelligence (“AI”). SAP is working intensively to integrate AI in its software solutions to allow customers to reap the enormous potential of using AI. The Supervisory Board supports and continually monitors this process and the measures associated with it. At our meeting on February 22, 2023, for example, the Technology and Strategy Committee reported on how the Executive Board had explained SAP’s AI strategy and its bearing on SAP’s product portfolio to it. When the Supervisory Board met on April 13, 2023, the Executive Board presented the Company’s innovation plans in the field of AI and outlined how SAP would integrate certain AI applications into its products. Our plenary session and committee meetings in July 2023 were held in San Martin, California, USA. These sessions and the supporting program likewise dealt with AI, and included expert presentations covering various aspects of this technology. When the Technology and Strategy Committee met in July 2023, it reviewed the implementation of SAP’s enterprise AI strategy and examined the framework conditions for data consumption by AI applications.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

SAP’s AI strategy was also the subject of intense debate at the plenary meeting in July 2023. Among other things, our discussions focused on the go-to-market strategy and SAP’s current and future investments to expand its AI portfolio. In addition, management explained to us its plans for building up additional AI expertise among SAP’s workforce. The Go-to-Market and Operations Committee analyzed the success of the go-to-market measures for AI at its October meeting.

Cloud Transformation

SAP’s transformation to a cloud company continued to be the subject of ongoing dialog between the Executive Board and Supervisory Board in 2023. We consulted in-depth with the Executive Board on the key initiatives and measures in the Company’s cloud transformation strategy and monitored its implementation. In our April meeting, we examined the challenges in public cloud. When it met in October, the Finance and Investment Committee reviewed SAP’s strategy to realign the product and service portfolio and discussed the cloud gross margin with the Executive Board. The Go-To-Market and Operations Committee likewise dealt with the cloud transformation in the reporting year, specifically the go-to-market strategy and related sales model. In our plenary session on October 26, 2023, the full Supervisory Board and the Executive Board reviewed in-depth the planned second phase of the cloud transformation, including the related goals and implementation measures. In this connection, we also discussed with the Executive Board its proposals for a new Executive Board structure, which it deemed necessary to ensure the successful implementation of the next phase of the transformation and the proposed efficiency measures. The Supervisory Board places great importance on being fully informed about the further cloud transformation, so that it can constructively support its implementation.

New Government Security Committee

The rise in legal requirements in the context of national security and geopolitical developments are becoming increasingly important for SAP as a software provider for the public sector and as an operator of critical infrastructures. The Supervisory Board discussed, on several occasions in 2023, matters relating to the national security of states in which SAP is subject to corresponding regulations. From the Supervisory Board’s perspective, it was essential that a committee on government security be set up to reflect SAP’s business activities in these security-sensitive areas. The Supervisory Board will therefore, in accordance with the legal framework, accompany and monitor these specific Company activities by means of a dedicated committee going forward. The Personnel and Governance Committee discussed the formation of and rules of procedure for this committee at its April 12 and July 26, 2023, meetings and thereafter reported on its deliberations to the full Supervisory Board. The new six-member Government Security Committee was subsequently established, its rules of procedure adopted, and its members elected during the October meeting of the Supervisory Board. The Committee began its work in January 2024.

Sustainability

Due to the comprehensive strategic importance that sustainability has for SAP and its customers, the Supervisory Board addressed the sustainability aspects that are relevant to SAP numerous times throughout the fiscal year 2023. It is important to note here that SAP promotes sustainability in two different ways: by offering solutions that empower SAP customers to become more sustainable enterprises, and by aligning its own business activities with ESG (environmental, social, and governance) goals and targets. The entire spectrum of SAP’s sustainability efforts and sustainability solutions is a cross topic that is monitored and covered by several committees. That is why the Supervisory Board has not formed a pure ESG or sustainability committee. By continuously addressing sustainability issues both in plenary sessions and in the committees, we have been able to build extensive expertise in this area: specifically, the Audit and Compliance Committee monitored the sustainability reporting and the way the reports are created and managed, and the Personnel and Governance Committee dealt with sustainability targets relevant to Executive Board compensation. The Technology and Strategy Committee, meanwhile, concerned itself with sustainability-related products and software as well as IT security, whereas the People and Culture Committee addressed sustainability as it relates to social issues.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

On top of this, the full Supervisory Board was updated on SAP’s current sustainability portfolio and the planned expansion of this product range at its meeting in April. As part of the October meeting, the Supervisory Board had the opportunity to examine the topic of sustainability at SAP based on a detailed meeting document that highlighted, in particular, SAP’s goal to emit zero greenhouse gas emissions from 2030 onwards, general human rights topics, the German Supply Chain Due Diligence Act, and best practices for responsible AI.

Other key topics addressed at our meetings in 2023 notably included the following:

Meeting in February (Meeting to Discuss the Financial Statements)

At our ordinary Supervisory Board meeting on February 22, 2023, we adopted the resolutions required under the current Executive Board compensation package for fiscal 2022 and 2023. To this end, we first determined performance against the defined target for the short-term incentive (STI) 2022, and then set the performance targets for the STI 2023. In addition, we resolved the individual allocation amount for the 2023 tranche of the long-term incentive (LTI) 2020. Finally, we evaluated the appropriateness of the Executive Board members’ compensation for 2022, and in each case found it to be appropriate in terms of amount, structure, objective criteria, and reasonable and appropriate in relation to the Company’s circumstances, also in regard to its profit and outlook. We referred in this regard to a certificate obtained beforehand from an independent compensation consultant. For more information about the STI 2022 and 2023, the LTI 2020, and the other compensation elements for Executive Board members, see the Compensation Report.

We also discussed the upcoming reappointments of, and thus renewals of the contracts with, Julia White, Sabine Bendiek, and Scott Russell at this meeting. In this connection, the Supervisory Board chairperson reported that Sabine Bendiek would not be standing for a further term of office. We thereafter resolved to offer both Scott Russell and Julia White reappointment and renewal of their Executive Board contracts by a further three years until 2027, and to negotiate new contracts with them. We also concerned ourselves with succession planning for Sabine Bendiek.

Next, we passed the proposed resolutions for the SAP SE Annual General Meeting of Shareholders on May 11, 2023. In particular, these proposals included the proposed election of Punit Renjen as a new Supervisory Board member with the intention of establishing him as a successor to the Supervisory Board chair, and the re-election of Jennifer Li and Qi Lu. The auditor for the 2023 financial year had already been elected by the Annual General Meeting of Shareholders on May 18, 2022, in view of the upcoming change of auditor, which is why there was no proposal for a resolution in this regard. Further, we received an Executive Board report on business in 2022 and adopted the budget for 2023 after discussing same extensively with the Executive Board. In addition, the Supervisory Board turned its attention to the SAP SE financial statements and the consolidated financial statements for 2022. On recommendation of the Audit and Compliance Committee, we approved the audit and gave our consent to the financial statements and the consolidated financial statements for 2022.,In addition, we endorsed the Executive Board’s proposal concerning the appropriation of retained earnings for 2022, and approved the compensation report for fiscal 2022. Beyond this, the Executive Board gave us an overview of SAP’s equity investments and donation activities in 2022.

Extraordinary Meeting in March

We held an extraordinary meeting on March 12, 2023, to discuss the sale already underway of SAP’s interest in Qualtrics International Inc. (“Qualtrics”), a U.S.-listed company. The Executive Board and the Finance and Investment Committee explained the economic background of this move to us. In preparation for this meeting, we obtained written answers to questions the Supervisory Board members had submitted in advance regarding the sale of Qualtrics. We ultimately approved the divestiture on recommendation of the Finance and Investment Committee.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Meeting in April

On April 13, 2023, we discussed the aforementioned key topics as well as business in the first quarter, the Executive Board reporting particularly on SAP’s competitive position and on the current tasks in the individual Executive Board portfolios.

Extraordinary Meeting in May

The Supervisory Board held an extraordinary meeting following the Annual General Meeting of Shareholders on May 11, 2023. After welcoming the newly-elected member Punit Renjen, we appointed him as second deputy chairperson of the Supervisory Board and, due to the new election or re-election of the Supervisory Board members concerned, approved the proposed changes to the composition of the committees. The Executive Board then explained to us the planned adjustments to the Company’s 2025 financial ambition, which was announced at the SAP Sapphire customer event in Orlando, and the expectations of investors in this regard. Next, the Executive Board presented its proposal to establish a €5 billion share buyback program that would run until the end of 2025. According to the proposal, the program would be carried out on the basis of the appropriate authorization by the Annual General Meeting, and various intra-group financing measures would be undertaken to implement it. After joint deliberation, we approved the Executive Board’s proposal. As the last item on the agenda, we discussed how to deal with potential fines against SAP in connection with ongoing compliance investigations, when it came to the compensation of the Executive Board members currently in office. We particularly took into account that the compliance incidents in question had occurred before the current members of the Executive Board were appointed. The Supervisory Board’s investigations into these compliance incidents therefore do not pertain to current Executive Board members.

Meeting in July

As previously mentioned above, AI was a key topic in our July meeting. The Executive Board also reported on business in the second quarter, and we discussed with management potential markets to focus on in future and various marketing-related matters. Next, an analyst from a U.S. investment management company explained the difference between SAP and other major software companies from his perspective as an analyst and the main criteria he used to arrive at this opinion. Based on this information, the Supervisory Board and the Executive Board then discussed the strategic direction of the Company with the goal of better meeting the capital markets’ expectations. In addition, the Audit and Compliance Committee and the law firm tasked by the Supervisory Board updated us on the ongoing compliance matters, particularly the negotiations with the U.S. Department of Justice and the U.S. Securities and Exchange Commission (SEC), and informed us on how to proceed. We also approved an amendment of the Rules of Procedure of the Supervisory Board to include rules on dealing with conflicts of interests, and passed two resolutions on Executive Board compensation serving to neutralize the impact of the Qualtrics sale on the key performance indicators (KPIs) for the STI 2023 and for the 2021, 2022, and 2023 tranches of the LTI 2020.

Meeting in October

At our meeting on October 26, 2023, the individual Executive Board members first reported on business performance in the third quarter for their respective Board area. Next, we took an in-depth look at SAP’s transformation, focusing on the goals, the measures planned by the Executive Board to improve the process, and the new structure of responsibilities at Executive Board level. The Supervisory Board thereafter discussed various HR and compensation matters without the Executive Board being present. Topics notably included the adjustment of Executive Board service contracts to the new compensation system, and the adoption of a clawback policy, which standardizes the cases in which the Company can reclaim variable compensation already paid out to certain top executives, including members of the Executive Board. SAP was required to adopt and implement this directive by December 31, 2023, due to new regulations of the SEC and the New York Stock Exchange (NYSE). Going forward, the new clawback policy will complement the clawback provisions that already exist in the Executive Board contracts. We then dealt with the regular review of the independence of the shareholder representatives on the Supervisory Board.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Based on the findings from our own examination, we determined that all shareholder representatives were independent in the meaning of the German Corporate Governance Code (GCGC) and were therefore to be named as such in the Corporate Governance Statement. We also ascertained –in accordance with the recommendations in the GCGC – that more than half of the shareholder representatives are independent from the Company and the Executive Board. Thereafter, we resolved on what we believe to be the appropriate number of independent shareholder representative members, and determined that the Supervisory Board has an appropriate number of independent members in the meaning of the GCGC, also when the shareholder structure is taken into account. Lastly, the Supervisory Board adopted the regular declaration of compliance and approved an amendment to the non-IFRS definition for the financial year 2024.

Extraordinary Meeting in December

An extraordinary Supervisory Board meeting was held on December 10, 2023, during which the Supervisory Board focused on the forthcoming settlement agreements with the U.S. Department of Justice (U.S. DOJ), the SEC, and the South Africa National Prosecution Authority in relation to the compliance violations in South Africa and other countries. The Supervisory Board gave its consent to the detailed content of the settlement agreements negotiated with the said authorities at the meeting.

Resolutions by Correspondence Vote

We adopted, besides the above resolutions, several resolutions by correspondence which the relevant Committees had deliberated on in advance and recommended to us, as follows:

| – | February: Approval of the Corporate Governance Statement for 2022 |

| – | March: Reappointment of Scott Russell and Julia White for a further three years until the end of January 2027 and February 2027, respectively, and agreement to the terms and conditions of their new Executive Board appointment contracts |

| – | May: a) Resolution on the appropriation of retained earnings as amended for fiscal year 2022; b) Approval of a lump-sum payment into Julia White’s U.S. pension plan, on recommendation of the Personnel and Governance Committee |

| – | July: Resolution to increase the volume of a Group-internal financing measure adopted by the Supervisory Board at its meeting in May 2023 |

| – | August: a) Resolution on the new conditions of the Directors and Officers Insurance (DSO); b) Resolution on the appointment of Gina Vargiu-Breuer to the Executive Board and as new head of HR as of February 2, 2024; c) Consent to changes to the SAP Executive Board portfolios |

| – | September: a) Consent to the planned acquisition of LeanIX; b) Resolution on how to handle the effect of potential fines on Executive Board members’ compensation; c) Resolution on the associated declaration of compliance for 2022; d) Resolutions on changes to the composition of the Nomination Committee and the Go-To-Market and Operations Committee |

| – | October: Approval of a long-term collaboration contract as part of SAP’s sponsoring activities |

| – | November: Resolution on applying a new non-IFRS definition to Executive Board compensation as of January 1, 2024, whereby the still-pending LTI tranches 2022 and 2023 remain unaffected and are to be calculated according to the previous non-IFRS definition. |

| – | December: Resolution to eliminate the impact of the LeanIX acquisition on the KPIs for the STI 2023 and for the tranches 2021, 2022, and 2023 of the LTI 2020 |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Format of Meetings in Fiscal 2023

| Committees | ||||||||

| Plenum | Personnel

and Governance |

Audit

and Compliance |

Technology

and Strategy |

Nomination | People

and Culture |

Finance

and Investment |

Go-To- Market and Operations |

|

| Total number of meetings | 7 | 6 | 14 | 6 | 4 | 4 | 10 | 4 |

| Thereof physical meetings | 1 | 0 | 1 | 0 | 0 | 0 | 3 | 0 |

| Thereof hybrid sessions | 5 | 5 | 71, 2 | 61 | 0 | 0 | 42 | 4 |

| Thereof telephone/video conferences | 1 | 1 | 6 | 0 | 4 | 4 | 3 | 0 |

1 Thereof two joint meetings between the Technology and Strategy Committee and the Audit and Compliance Committee

2 Thereof two joint meetings between the Finance and Investment Committee and the Audit and Compliance Committee

The Work of the Supervisory Board Committees

The committees made a key contribution to the work of the Supervisory Board in 2023, notably by preparing relevant agenda items and resolutions for Supervisory Board meetings, by approving resolution proposals, and by regularly reporting on their deliberations and on their decisions taken. The following committees were in place in the year under review:

Personnel and Governance Committee, Audit and Compliance Committee, Finance and Investment Committee, Technology and Strategy Committee, People and Culture Committee, Nomination Committee, Go-To-Market and Operations Committee

Each of the aforementioned committees was active in 2023. For more information about the Supervisory Board committees, particularly their respective composition, tasks, and responsibilities, see the Corporate Governance Statement and the Corporate Governance section of SAP’s Web site.

Besides the matters described above, the committees focused primarily on the following topics in 2023:

| – |

The Personnel and Governance Committee held six meetings in the reporting year. In particular, the Committee, in fulfillment of the tasks assigned to it, extensively prepared the Supervisory Board’s deliberations and resolutions described above on Executive Board compensation and on the new Government Security Committee, and approved resolution proposals. The Committee adopted a total of three resolutions by correspondence vote. In two sessions in January 2023, the Committee dealt with the renewal of Scott Russell and Julia White’s Executive Board contracts, and with the introduction of compensation for the Lead Independent Director after it had become apparent that this role involves considerable additional time and effort. In addition, the Committee consented to the secondary employment of an Executive Board member and examined the German Federal Labor Court’s ruling on SAP’s Employee Involvement Agreement. The Committee approved, by way of correspondence vote, the conclusion of a consulting contract by Luka Mucic. Following his departure from the SAP Supervisory Board at the end of March 2023, Luka Mucic was to remain a member of the Qualtrics Executive Board until SAP had fully divested Qualtrics. The consulting contract was to serve as the legal basis for this membership. When it met in April, the Committee resolved an update to the contractual non-compete clause in Executive Board contracts that was to be introduced in connection with the conversion of those contracts to the new compensation system. In addition, the Committee dealt with the search for candidates to replace Sabine Bendiek as head of the Executive Board’s HR portfolio. The Committee subsequently agreed on the candidate proposed by the Supervisory Board for this portfolio when it met in July. As well as discussing various compensation matters, the Committee’s |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

| October 25, 2023, meeting focused particularly on a change in the non-IFRS definition for fiscal 2024 and on the creation of a new Supervisory Board office. The Committee also held an extraordinary meeting on December 6, 2023, to deliberate on the candidate to be proposed to the Supervisory Board as a new Executive Board member for the Product & Engineering area. It came to the conclusion that Muhammad Alam was its favorite candidate. In January 2024, the Committee prepared the Supervisory Board’s resolution to elect Muhammad Alam to the Executive Board effective April 1, 2024, once the details of his Executive Board contract had been negotiated. The proposed resolution took into account the new SAP Executive Board structure that was announced on January 9, 2024. |

| – | The Audit and Compliance Committee held 12 meetings in 2023 – two of which jointly with the Finance and Investment Committee and two jointly with the Technology and Strategy Committee. Said schedule included one telephone conference per quarter to vote on the quarterly reporting, and one session per quarter to address regular and topical agenda items. In addition, in November and December 2023, the Committee resolved both times internally on the System and Organization Controls (SOC). The SOC involves software-related certifications and risk analyses that enable companies to conduct an impartial investigation in accordance with a framework established by the American Institute of Certified Public Accountants (AICPA), which the companies and their customers both require in the context of their financial reporting. In its ordinary meetings, the Committee also had the opportunity to engage with the auditor without the Executive Board present, which was an integral part of the meeting agenda. The Committee comprehensively prepared the resolutions of the Supervisory Board for all topics assigned to it, as described above. Regular agenda items included the course of business in the respective quarter, the accounting processes, the preparation of end-of-quarter closings, and the quarterly reports due for publication. In addition, the Committee chairperson was in regular contact with the auditor. Other recurring meeting topics included the monitoring of SAP’s risk management system, internal control system, non-financial reporting, and compliance system (including specific compliance issues, the status of corresponding SAP-internal investigations, and case-related collaboration with authorities). The Committee also dealt regularly with the monitoring of SAP’s cybersecurity processes that the Executive Board had established and continually optimizes to ensure compliance of all activities in this area. At its February 2023 meeting, the Committee prepared the Supervisory Board’s resolutions on the financial statements of SAP SE and the SAP Group for 2022 in the run-up to the Annual General Meeting of Shareholders, which were adopted by the Supervisory Board at the audit meeting. Other material topics dealt with by the Committee beyond the regular meeting topics in its ordinary meetings and those described in the “Sustainability” section of this report included quarter-specific matters and the amendments to the non-IFRS definition for fiscal 2024. Further, the Committee monitored the progress of selected lawsuits involving SAP. The Audit and Compliance Committee also received regular updates on how BDO AG Wirtschaftsprüfungsgesellschaft (BDO) was performing its tasks as the new auditor for SAP’s financial statements and consolidated financial statements. In addition, the Committee continually monitored the quality of the auditor and the management report. To this end – in addition to evaluating satisfaction surveys for the prior year’s audit by the previous auditor – the Committee obtained and referred to the report from the current auditor on its internal quality assurance standards and to any material findings from internal quality audits, external quality controls, and peer reviews, and from any investigations conducted by the government or regulators into the auditor’s audits. At its meeting in July, the Committee discussed the audit focus for 2023 with the auditor. As reported in more detail below, the Committee also held two joint meetings with the Finance and Investment Committee in February and December 2023 to discuss the Group annual plan for 2023 and the preliminary Group annual plan for 2024. The joint meetings with the Technology and Strategy Committee in April and October focused on SAP’s cybersecurity framework, which had been enhanced based on the results of the assessment by NIST (National Institute of Standards and Technology, a department of the U.S. Department of Commerce). Beyond this, the Committees reviewed the status of the SOC certifications for fiscal 2023, and the Audit and Compliance Committee approved the certification services to be provided by BDO. The auditor attended the Audit and Compliance Committee meetings except for the joint meetings with the Finance and Investment Committee |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

| and the Technology and Strategy Committee, and reported in depth on its audit work and on its quarterly reviews of selected cloud and software agreements. |

| – | The Finance and Investment Committee held four regular meetings and four extraordinary meetings in 2023. In addition, it held a joint meeting with the Audit and Compliance Committee in February 2023 and again in December 2023. The Committee devoted considerable time at several meetings to discussing business development and investor relations, and to discussing an analysis of management efficiency. At an extraordinary meeting in January 2023, the Committee and the Executive Board examined the different options for selling SAP’s interest in Qualtrics. In the joint meeting with the Audit and Compliance Committee in February 2023, the members of both Committees discussed the annual budget for 2023 and recommended its approval to the Supervisory Board. In the Finance and Investment Committee meeting that followed, the members were updated on the Group’s liquidity situation and on productivity in the development organization. The Committee held an extraordinary meeting in March where, after careful consideration, it resolved to recommend the divestiture of Qualtrics to the Supervisory Board. At its meeting in April, the Committee and the Executive Board discussed selected capital market topics. In addition, the Committee was updated on the investments in the venture capital area, which were being carried out in cooperation with the fund manager Sapphire Ventures, and the strategic aspects of these activities. It also reviewed SAP’s product strategy and the management of SAP’s product portfolio. In July, the Committee discussed SAP’s global strategy for the use and expansion of its data centers, as well as SAP’s sovereign cloud offerings and share-based compensation plans. Beyond this, the Executive Board reported on selected RISE with SAP contracts as well as the strategy to extend existing customer contracts, and gave the Committee members advance notice of the Company’s plans to acquire LeanIX, a provider of cloud-based IT management software. The Committee deliberated on this acquisition at length at its meeting in September, where it subsequently resolved its recommendation to the Supervisory Board. At its October meeting, the Committee discussed key treasury topics. In December 2023, the Committee held a second joint meeting with the Audit and Compliance Committee, at which the Executive Board presented the preliminary Group annual plan for 2024. This meeting was held in preparation for the Supervisory Board meeting in February 2024, at which the full Supervisory Board resolved to approve the Group annual plan for 2024. |

| – | The Technology and Strategy Committee held six meetings in 2023, which included two joint meetings with the Audit and Compliance Committee as described above. The Committee discussed the outlook for key technology trends in the software industry in the years to come and SAP’s corporate and product strategies. At the February meeting, the Executive Board presented management’s strategy for the Customer Experience product segment – which encompasses everything an organization does to deliver superior customer outcomes – placing particular focus on customer relationship management (CRM) and SAP’s various analytics applications in this domain. In April, the Committee turned its attention to SAP’s solutions for business network growth areas, business process optimization, and sustainability. In October 2023, the Committee dealt with matters related to data integration and data management, and reviewed the Company’s innovation strategy for SAP Datasphere and the product’s generative AI capabilities. At their joint meeting in October 2023, the Finance and Investment Committee and the Technology and Strategy Committee deliberated on cybersecurity and the priorities to be set for it. |

| – |

The People and Culture Committee met four times in the reporting year. At its February meeting, the Committee deliberated at length on the results of the employee survey that had been conducted in the fall of 2022, notably those relating to employee engagement, as well as feedback about management, and discussed the measures to be derived from this insight as a result. Beyond this, it focused on SAP’s training business, which had undergone a radical transformation since 2021 aimed at reaching one million active users by the end of 2023. In March, the Committee looked at the progress made in the initiative to promote a standardized performance management concept that supports the envisioned performance-based compensation and incentive system and integrated planning of annual targets for employees. In July 2023, the managers responsible for the People Compliance process at SAP introduced themselves to the Committee and, after explaining that the focus of their efforts was on |

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

| preventing employee misconduct vis-à-vis others, gave an in-depth overview of the underlying compliance processes and related information. Another topic of interest at this meeting was the progress being made in strategic personnel planning. The Committee was presented in this regard with a detailed overview of the past and expected demographic development of the SAP SE workforce, and discussed the skills and expertise the Company would require of employees in the future. When it met in October, the Committee revisited the topic of performance management, particularly in view of the upcoming global rollout of the new concept. Moreover, the Committee discussed SAP’s plans to require more in-office presence of its staff. |

| – | The Nomination Committee met five times in 2023. On January 15, 2023, for example, the Committee discussed potential candidates for election to the Supervisory Board by the Annual General Meeting of Shareholders in May 2023. In particular, the Committee members discussed the potential successor to Hasso Plattner as Supervisory Board chairperson, ultimately deciding that Punit Renjen was their preferred candidate. When it met again on January 25, the Committee resolved its final recommendation to the Supervisory Board to elect Jennifer Li, Qi Lu, and Punit Renjen to the Supervisory Board. Since four Supervisory Board members will reach the end of their term of office in 2024, the Committee spent its August 2023 meeting deliberating on candidates for re-election or election as new members. It also discussed the skills that Hasso Plattner’s successor should possess, and agreed that the person should have extensive technology knowledge. Based on the process it had agreed upon in August for nominating candidates, the Committee met again in October 2023 to agree on how to approach the ones they had shortlisted. On December 6, 2023, the Committee agreed on the candidates to be proposed to the Annual General Meeting of Shareholders in May 2024 for the Supervisory Board seat being vacated by the departing Hasso Plattner. |

| – | The Go-To-Market and Operations Committee likewise met four times in the reporting year. At the Committee’s meeting in February, the Executive Board presented its marketing plans for SAP S/4HANA Cloud, public edition as well as its planned changes to the internal go-to-market concept for 2023 target achievement, particularly with regard to roles and incentives. In April 2023, the Executive Board presented a plan designed to further improve the measurable usage of our software by customers and simultaneously increase demand, especially in the cloud environment. In addition, the largest planned events for the remainder of the year were presented. When the Committee met in July 2023, the Executive Advisory Board, an advisory body comprised of managers from more than 20 SAP customers from various regions and industries, presented feedback on the customer journey – that is, on the individual phases that a customer goes through before the purchase and until after the delivery of a product. In addition, the Executive Board presented a growth plan aimed at boosting growth and ensuring constant pipeline population – that is, the number of software sales that are lined up. The last item discussed at this meeting was a status report presented on new customer acquisition, also in comparison to SAP’s peers. The Committee’s meeting in October reviewed an update on the growth plan presented to it in July and discussed the further expansion of SAP’s partner network. |

The work of the committees and their regular reports in the plenary sessions ensured that we were kept fully informed of all matters covered by the committees and were able to discuss them thoroughly.

Conflicts of Interest

Members of the Supervisory Board and of the Executive Board had no conflicts of interest that recommendations E.1 and E.2 of the CGCG require to be disclosed to the Supervisory Board. Rather, they were avoided by the Supervisory Board member concerned not taking part in the relevant discussions or voting on the matter in question in the event of a possible, selective conflict of interest. Insofar as Supervisory Board members hold executive positions in companies or have material equity in companies that currently have business dealings with SAP, we do not see any impairment of their independence. The scope of the business relationships in question is relatively small and, moreover, the transactions take place at arm’s length.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

Training and Professional Development

The members of the Supervisory Board were once again offered various training and professional development opportunities throughout the year, with appropriate support from the Company. Where it made sense, presentations and training offerings were recorded and placed on a specially configured training platform to enable the remaining Supervisory Board members to take part in them as well. The members of the Audit and Compliance Committee were invited to a short seminar in April 2023 on “Current aspects of non-financial reporting.” In May 2023, a course on “Innovation at SAP” was offered that focused on AI, large language models (models that are trained on huge data volumes), and on the metaverse, a digital space that is created by interacting with virtual, augmented, and physical reality. In November, several Supervisory Board members took part in a virtual deep dive on Customer Experience at SAP. On-boarding courses and leaflets are available for new Supervisory Board members to familiarize themselves with their tasks and responsibilities when they assume office. New members also have the opportunity to meet individually with members of the Executive Board to discuss the topics relevant to their new portfolio.

SAP SE and Consolidated Financial Reports for 2023

BDO audited the SAP SE and consolidated financial reports for 2023. The Annual General Meeting of Shareholders on May 18, 2022, elected BDO as the SAP SE and SAP Group auditor for fiscal year 2023. The Supervisory Board had proposed the appointment of BDO on the recommendation of the Audit and Compliance Committee. Prior to the proposed resolution being put to the Annual General Meeting of Shareholders, BDO had confirmed to the chairperson of the Supervisory Board and the Audit and Compliance Committee that circumstances did not exist that might prejudice or raise any doubt concerning its independence as the Company’s auditor. In that connection, BDO informed us of the volume of the services that were not part of the audit which it had either provided to the Group in the past year or was engaged to provide in the year to come. The Supervisory Board has agreed with BDO that the auditor should report to the Supervisory Board and record in the auditor’s report any fact found during the audit that is inconsistent with the declaration given by the Executive Board and the Supervisory Board concerning implementation of the German Corporate Governance Code. BDO examined the SAP SE financial statements prepared in accordance with the German Commercial Code, the consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRSs) as required by the German Commercial Code, section 315e, and the combined SAP Group and SAP SE management report prepared in accordance with the German Commercial Code, and certified them without qualification. The auditor thus confirmed that, in its opinion and based on its audit in accordance with the applicable accounting principles, the SAP SE and consolidated financial statements give a true and fair view of the net assets, financial position, and results of operations of SAP SE and the SAP Group. The auditor also confirmed that the combined SAP SE and SAP Group management report is consistent with the corresponding financial statements and as a whole gives a suitable view of the position of SAP SE and the SAP Group and of foreseeable opportunities and risks. In accordance with section 317 (3a) of the German Commercial Code, the auditor also examined and confirmed that the renderings of the financial statements, the management report, the consolidated financial statements, and the combined management report contained in the files submitted on an electronic data carrier, which can be accessed by the issuer on the secure client portal, and prepared for the purposes of disclosure comply in all material respects with the requirements of section 328 (1) of the German Commercial Code regarding the electronic reporting format (“ESEF format”). BDO had completed its audit of SAP’s internal control over financial reporting and certified without qualification that it complies with the applicable U.S. standards. The auditor stated in its opinion that it considers SAP’s internal controls with respect to the consolidated financial statements to be effective in all material respects. Additionally, it provided assurance on the non-financial declaration and the disclosures contained therein on the topics identified as material – namely, the environment, employees, human rights, corruption and bribery, customer loyalty, and data privacy and data security – in the combined management report, and on the separate examination of the compensation report and review of selected qualitative and quantitative sustainability disclosures outside of the financial statements and management report. All Audit and Compliance Committee members and Supervisory Board members received – initially in the form of drafts that were identical to the final documents – the documents concerning the financial statements mentioned above, the audit reports prepared by BDO, and the Executive Board’s proposal concerning the appropriation of retained earnings in good time.

|

SAP Integrated Report 2023 | |||||

| To

Our Stakeholders |

Combined

Management Report |

Consolidated

Financial Statements IFRS |

Further

Information about Sustainability |

Additional Information |

||

On February 21, 2024, the Executive Board prepared the financial accounts of SAP SE and the SAP Group for 2023, comprising the SAP SE financial statements, the consolidated financial statements, and the combined management report, and submitted them without delay to the Supervisory Board.