UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: March 1, 2024

Commission File Number: 001-33414

Denison Mines Corp.

(Name of registrant)

1100-40 University Avenue

Toronto ON

M5J 1T1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

DENISON MINES CORP. |

|

|

|

/s/ Amanda Willett |

Date: March 1, 2024 |

Amanda Willett |

|

Vice President Legal and Corporate Secretary |

FORM 6-K EXHIBIT INDEX

Exhibit Number |

|

Description |

|

|

|

99.1 |

|

Consolidation Financial Statements for the year ended December 31, 2023 |

99.2 |

|

Management's Discussion and Analysis for the financial year ended December 31, 2023 |

99.3 |

|

|

99.4 |

|

Ontario Form 13-502F1 - Reporting Issuer Participation Fee Form |

99.5 |

|

Alberta Form 13-501F1 - Reporting Issuer Participation Fee Form |

101.INS |

|

XBRL Instance Document |

101.SCH |

|

XBRL Taxonomy Extension Schema |

101.LAB |

|

XBRL Taxonomy Extension Label Linkbase |

101.CAL |

|

XBRL Taxonomy Extension Calculation Linkbase |

101.PRE |

|

XBRL Taxonomy Extension Presentation Linkbase |

101.DEF |

|

XBRL Taxonomy Extension Definition Linkbase |

Exhibit 99.1

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2023

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

Responsibility for Financial Statements

The Company’s management is responsible for the integrity and fairness of presentation of these consolidated financial statements. The consolidated financial statements have been prepared by management, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, for review by the Audit Committee and approval by the Board of Directors.

The preparation of financial statements requires the selection of appropriate accounting policies in accordance with International Financial Reporting Standards and the use of estimates and judgements by management to present fairly and consistently the consolidated financial position of the Company. Estimates are necessary when transactions affecting the current period cannot be finalized with certainty until future information becomes available. In making certain material estimates, the Company’s management has relied on the judgement of independent specialists.

The Company’s management has developed and maintains a system of internal accounting controls to ensure, on a reasonable and cost-effective basis, that the financial information is timely reported and is accurate and reliable in all material respects and that the Company’s assets are appropriately accounted for and adequately safeguarded.

The consolidated financial statements have been audited by KPMG LLP, our independent auditor. Its report outlines the scope of its examination and expresses its opinions on the consolidated financial statements and internal control over financial reporting.

/s/ “David D. Cates” |

|

/s/ “Elizabeth Sidle” |

|

|

|

David D. Cates |

|

Elizabeth Sidle |

President and Chief Executive Officer |

|

Vice President Finance and Chief Financial Officer |

|

|

|

February 29, 2024 |

|

|

|

|

|

Management’s Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining an adequate system of internal control over financial reporting. Management conducted an evaluation of the effectiveness of internal control over financial reporting based on the Internal Control – Integrated Framework, 2013 issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the Company’s internal control over financial reporting was effective as of December 31, 2023.

The effectiveness of the Company’s internal control over financial reporting as at December 31, 2023 has been audited by KPMG LLP, our independent auditor, as stated in its report which appears herein.

Changes to Internal Control over Financial Reporting

There has not been any change in the Company’s internal control over financial reporting during the twelve months ended December 31, 2023 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

2

KPMG LLP

Bay Adelaide Centre

333 Bay Street, Suite 4600

Toronto, ON M5H 2S5

Canada

Tel 416-777-8500

Fax 416-777-8818

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Denison Mines Corp.

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statements of financial position of Denison Mines Corp. (the Company), as of December 31, 2023 and 2022, the related consolidated statements of income and comprehensive income, changes in equity and cash flow for each of the years then ended, and the related notes (collectively, the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023 and 2022, and the financial performance and its cash flows for each of the years then ended, in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company’s internal control over financial reporting as of December 31, 2023, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission, and our report dated February 29, 2024 expressed an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

© 2024 KPMG LLP, an Ontario limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

3

|

Denison Mines Corp. February 29, 2024 |

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of a critical audit matter does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Indicators of impairment for mineral properties

As discussed in Note 10 to the consolidated financial statements, the Company’s mineral properties balance as of December 31, 2023 was $180,813 thousand. As discussed in note 2G. and 3A. to the consolidated financial statements, property, plant and equipment assets are assessed at the end of each reporting period to determine if there is any indication that the asset may be impaired. Mineral property assets are assessed for impairment using the impairment indicators under IFRS 6 - Exploration for and evaluation of mineral resources up until the commercial viability and technical feasibility for the property is established. Judgment is applied in identifying whether or not an indicator exists. Both internal and external sources of information are considered when determining the presence of an impairment indicator. Judgment is required when identifying indicators of impairment which include results from exploration programs during the reporting period, a decline in the reserves and resources by property, and events or changes to the operations.

We identified the evaluation of indicators of impairment for mineral properties as a critical audit matter. Assessing the Company’s evaluation of indicators of impairment involved the application of a higher degree of auditor judgment. Specifically, judgment was required to evaluate the facts and circumstances related to the Company’s mineral properties, including assessing the Company’s changes to the operations and results from exploration programs.

The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectiveness of certain internal controls related to the Company’s impairment indicator assessment process, including controls related to the Company’s impairment indicator review for mineral properties. We considered changes to the operations by assessing the Company’s future plans by comparing them to the budget approved by the Board of Directors and evaluating the time period remaining for the Company’s right to explore them by inspecting governmental filings. We evaluated the results from exploration programs by comparing them to recent exploration results.

/s/ KPMG LLP

Chartered Professional Accountants, Licensed Public Accountants

We have served as the Company’s auditor since 2020.

Toronto, Canada

February 29, 2024

4

KPMG LLP

Bay Adelaide Centre

333 Bay Street, Suite 4600

Toronto, ON M5H 2S5

Canada

Tel 416-777-8500

Fax 416-777-8818

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Denison Mines Corp.

Opinion on Internal Control Over Financial Reporting

We have audited Denison Mines Corp.’s (the Company) internal control over financial reporting as of December 31, 2023, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2023, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated statements of financial position of the Company as of December 31, 2023 and 2022, the related consolidated statements of income and comprehensive income, changes in equity, and cash flow for each of the years then ended, and the related notes (collectively, the consolidated financial statements), and our report dated February 29, 2024 expressed an unqualified opinion on those consolidated financial statements.

Basis for Opinion

The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

© 2024 KPMG LLP, an Ontario limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

5

|

Denison Mines Corp. February 29, 2024 |

Definition and Limitations of Internal Control Over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ KPMG LLP

Chartered Professional Accountants, Licensed Public Accountants

Toronto,Canada

February 29, 2024

6

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Expressed in thousands of Canadian dollars (“CAD”) except for share amounts) |

|

|

|

|

|

|

|

|

At December 31 |

|

At December 31 |

||

|

|

2023 |

|

2022 |

||

ASSETS |

|

|

|

|

|

|

Current |

|

|

|

|

|

|

Cash and cash equivalents (note 4) |

|

$ |

131,054 |

|

$ |

50,915 |

Trade and other receivables (note 5) |

|

|

1,913 |

|

|

4,143 |

Inventories (note 6) |

|

|

3,580 |

|

|

2,713 |

Investments-equity instruments (note 7) |

|

|

10,400 |

|

|

8,022 |

Prepaid expenses and other |

|

|

1,594 |

|

|

1,367 |

|

|

|

148,541 |

|

|

67,160 |

Non-Current |

|

|

|

|

|

|

Inventories-ore in stockpiles (note 6) |

|

|

2,098 |

|

|

2,098 |

Investments-equity instruments (note 7) |

|

|

117 |

|

|

87 |

Investments-uranium (note 7) |

|

|

276,815 |

|

|

162,536 |

Investments-convertible debentures (note 7) |

|

|

15,565 |

|

|

- |

Investments-joint venture (note 8) |

|

|

17,290 |

|

|

19,305 |

Restricted cash and investments (note 9) |

|

|

11,231 |

|

|

11,105 |

Property, plant and equipment (note 10) |

|

|

254,946 |

|

|

253,505 |

Total assets |

|

$ |

726,603 |

|

$ |

515,796 |

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Current |

|

|

|

|

|

|

Accounts payable and accrued liabilities (note 11) |

|

$ |

10,822 |

|

$ |

10,299 |

Current portion of long-term liabilities: |

|

|

|

|

|

|

Deferred revenue (note 12) |

|

|

4,535 |

|

|

4,915 |

Reclamation obligations (note 13) |

|

|

2,256 |

|

|

2,865 |

Other liabilities (note 15) |

|

|

333 |

|

|

336 |

|

|

|

17,946 |

|

|

18,415 |

Non-Current |

|

|

|

|

|

|

Deferred revenue (note 12) |

|

|

30,423 |

|

|

28,380 |

Reclamation obligations (note 13) |

|

|

32,642 |

|

|

26,594 |

Other liabilities (note 15) |

|

|

1,201 |

|

|

1,441 |

Deferred income tax liability (note 16) |

|

|

2,607 |

|

|

4,950 |

Total liabilities |

|

|

84,819 |

|

|

79,780 |

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Share capital (note 17) |

|

|

1,655,024 |

|

|

1,539,209 |

Contributed surplus (note 18) |

|

|

69,823 |

|

|

70,281 |

Deficit |

|

|

(1,084,881) |

|

|

(1,175,256) |

Accumulated other comprehensive income (note 19) |

|

|

1,818 |

|

|

1,782 |

Total equity |

|

|

641,784 |

|

|

436,016 |

Total liabilities and equity |

|

$ |

726,603 |

|

$ |

515,796 |

Issued and outstanding common shares (note 17) |

|

|

890,970,371 |

|

|

826,325,592 |

Commitments and contingencies (note 24)

Subsequent events (note 26)

The accompanying notes are an integral part of the consolidated financial statements

On behalf of the Board of Directors |

|

|

|

|

|

|

|

|

/s/ ‘Ron F. Hochstein’ |

|

/s/ ‘Patricia M. Volker’ |

|

|

|

Ron F. Hochstein |

|

Patricia M. Volker |

Chair of the Board |

|

Director |

7

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Expressed in thousands of CAD dollars except for share and per share amounts) |

|

|

|

|

|

|

|

|

Year Ended December 31 |

||||

|

|

2023 |

|

2022 |

||

|

|

|

|

|

|

|

REVENUES (note 21) |

|

$ |

1,855 |

|

$ |

8,973 |

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

Operating expenses (note 20 and 21) |

|

|

(3,898) |

|

|

(5,352) |

Exploration (note 21) |

|

|

(9,564) |

|

|

(8,097) |

Evaluation (note 21) |

|

|

(18,622) |

|

|

(22,181) |

General and administrative (note 21) |

|

|

(13,760) |

|

|

(12,538) |

Other income (note 20) |

|

|

136,472 |

|

|

55,244 |

|

|

|

90,628 |

|

|

7,076 |

Income before net finance expense, equity accounting |

|

|

92,483 |

|

|

16,049 |

|

|

|

|

|

|

|

Finance expense, net (note 20) |

|

|

(1,062) |

|

|

(2,859) |

Equity share of loss of joint venture (note 8) |

|

|

(4,400) |

|

|

(2,887) |

Income before taxes |

|

|

87,021 |

|

|

10,303 |

Income tax recovery (note 16): |

|

|

|

|

|

|

Deferred |

|

|

2,343 |

|

|

2,269 |

Net income from continuing operations |

|

|

89,364 |

|

|

12,572 |

Net income from discontinued operations , net of income taxes (note 21) |

|

|

1,011 |

|

|

1,782 |

Net income for the period |

|

$ |

90,375 |

|

$ |

14,354 |

|

|

|

|

|

|

|

Other comprehensive income (note 19): |

|

|

|

|

|

|

Items that are or may be subsequently reclassified to income : |

|

|

|

|

|

|

Foreign currency translation change |

|

|

36 |

|

|

6 |

Comprehensive income for the period |

|

$ |

90,411 |

|

$ |

14,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share: |

|

|

|

|

|

|

Continuing operations |

|

$ |

0.11 |

|

$ |

0.02 |

Discontinued operations |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

|

|

|

|

|

Diluted net income per share: |

|

|

|

|

|

|

Continuing operations |

|

$ |

0.10 |

|

$ |

0.02 |

Discontinued operations |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of shares outstanding (in thousands): |

|

|

|

|

|

|

Basic |

|

|

848,023 |

|

|

818,891 |

Diluted |

|

|

853,969 |

|

|

828,735 |

The accompanying notes are an integral part of the consolidated financial statements

8

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Expressed in thousands of CAD dollars) |

|

|

|

|

|

|

|

|

Year Ended December 31 |

||||

|

|

2023 |

|

2022 |

||

Share capital (note 17) |

|

|

|

|

|

|

Balance-beginning of period |

|

$ |

1,539,209 |

|

$ |

1,517,029 |

Shares issued for cash, net of issue costs |

|

|

107,884 |

|

|

19,601 |

Other shares issued, net of issue costs |

|

|

193 |

|

|

169 |

Share options exercised-cash |

|

|

3,534 |

|

|

1,459 |

Share options exercised-transfer from contributed surplus |

|

|

1,474 |

|

|

550 |

Share units exercised-transfer from contributed surplus |

|

|

2,730 |

|

|

401 |

Balance-end of period |

|

|

1,655,024 |

|

|

1,539,209 |

|

|

|

|

|

|

|

Contributed surplus |

|

|

|

|

|

|

Balance-beginning of period |

|

|

70,281 |

|

|

67,496 |

Share-based compensation expense (note 18) |

|

|

3,746 |

|

|

3,736 |

Share options exercised-transfer to share capital |

|

|

(1,474) |

|

|

(550) |

Share units exercised-transfer to share capital |

|

|

(2,730) |

|

|

(401) |

Balance-end of period |

|

|

69,823 |

|

|

70,281 |

|

|

|

|

|

|

|

Deficit |

|

|

|

|

|

|

Balance-beginning of period |

|

|

(1,175,256) |

|

|

(1,189,610) |

Net income |

|

|

90,375 |

|

|

14,354 |

Balance-end of period |

|

|

(1,084,881) |

|

|

(1,175,256) |

|

|

|

|

|

|

|

Accumulated other comprehensive income (note 19) |

|

|

|

|

|

|

Balance-beginning of period |

|

|

1,782 |

|

|

1,776 |

Foreign currency translation |

|

|

36 |

|

|

6 |

Balance-end of period |

|

|

1,818 |

|

|

1,782 |

|

|

|

|

|

|

|

Total Equity |

|

|

|

|

|

|

Balance-beginning of period |

|

$ |

436,016 |

|

$ |

396,691 |

Balance-end of period |

|

$ |

641,784 |

|

$ |

436,016 |

The accompanying notes are an integral part of the consolidated financial statements

9

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF CASH FLOW

(Expressed in thousands of CAD dollars) |

|

|

|

|

|

|

|

|

Year Ended December 31 |

||||

|

|

2023 |

|

2022 |

||

CASH PROVIDED BY (USED IN): |

|

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

Net income for the period |

|

$ |

90,375 |

|

$ |

14,354 |

Adjustments and items not affecting cash and cash equivalents: |

|

|

|

|

|

|

Depletion, depreciation, amortization and accretion |

|

|

9,391 |

|

|

8,667 |

Fair value change losses (gains): |

|

|

|

|

|

|

Investments-equity instruments (notes 7 and 20) |

|

|

9 |

|

|

6,469 |

Investments-uranium (notes 7 and 20) |

|

|

(134,180) |

|

|

(29,422) |

Investments-convertible debentures (notes 7 and 20) |

|

|

(565) |

|

|

— |

Warrants on investment (notes 7 and 20) |

|

|

— |

|

|

(1,625) |

Share purchase warrants liabilities ( note 20) |

|

|

— |

|

|

(20,337) |

Joint venture-equity share of loss (note 8) |

|

|

4,400 |

|

|

2,887 |

Recognition of deferred revenue (note 12) |

|

|

(1,855) |

|

|

(5,987) |

Loss (gain) on property, plant and equipment disposals |

|

|

(1,299) |

|

|

25 |

Post-employment benefit payments (note 16) |

|

|

(105) |

|

|

(95) |

Reclamation obligation income statement adjustment (note 13) |

|

|

3,229 |

|

|

(4,126) |

Reclamation obligation expenditures (note 13) |

|

|

(3,118) |

|

|

(1,348) |

Reclamation liability deposit from joint venture partner (note 13) |

|

|

99 |

|

|

- |

Share-based compensation (note 18) |

|

|

3,746 |

|

|

3,736 |

Foreign exchange gain (note 20) |

|

|

(321) |

|

|

(816) |

Deferred income tax recovery (note 16) |

|

|

(2,343) |

|

|

(2,269) |

Change in non-cash operating working capital items (note 20) |

|

|

1,870 |

|

|

1,743 |

Net cash used in operating activities |

|

|

(30,667) |

|

|

(28,144) |

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

(Decrease)/Increase in restricted cash and investments (note 9) |

|

|

(126) |

|

|

896 |

Purchase of investment in joint venture (note 8) |

|

|

(2,385) |

|

|

(800) |

Purchase of investment-convertible debentures (note 7) |

|

|

(15,000) |

|

|

— |

Additions of property, plant and equipment (note 10) |

|

|

(3,234) |

|

|

(6,869) |

Proceeds on disposal of investment – uranium (note 7) |

|

|

19,901 |

|

|

— |

Proceeds on disposal of property, plant and equipment |

|

|

125 |

|

|

12 |

Net cash used in investing activities |

|

|

(719) |

|

|

(6,761) |

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

|

Issuance of debt obligations (note 15) |

|

|

— |

|

|

158 |

Repayment of debt obligations (note 15) |

|

|

(218) |

|

|

(209) |

Proceeds from share issues, net of issue costs (note 17) |

|

|

107,863 |

|

|

19,551 |

Proceeds from share options exercised (note 17) |

|

|

3,534 |

|

|

1,459 |

Net cash provided by financing activities |

|

|

111,179 |

|

|

20,959 |

|

|

|

|

|

|

|

Increase/(Decrease) in cash and cash equivalents |

|

|

79,793 |

|

|

(13,946) |

Foreign exchange effect on cash and cash equivalents |

|

|

346 |

|

|

863 |

Cash and cash equivalents, beginning of period |

|

|

50,915 |

|

|

63,998 |

Cash and cash equivalents, end of period |

|

$ |

131,054 |

|

$ |

50,915 |

Supplemental cash flow disclosure (note 20)

The accompanying notes are an integral part of the consolidated financial statements

10

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2023 and 2022

(Expressed in CAD dollars except for shares and per share amounts)

1.NATURE OF OPERATIONS

Denison Mines Corp. (“DMC”) and its subsidiary companies and joint arrangements (collectively, “Denison” or the “Company”) are engaged in uranium mining related activities, which can include acquisition, exploration, and development of uranium bearing properties, extraction, processing and selling of, and investing in uranium.

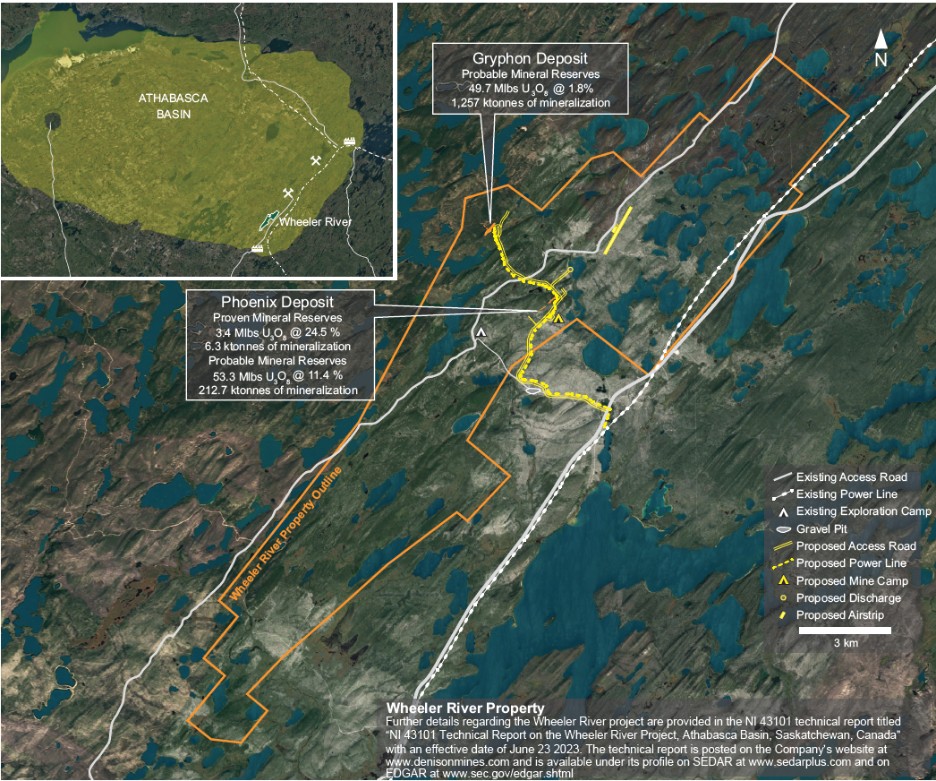

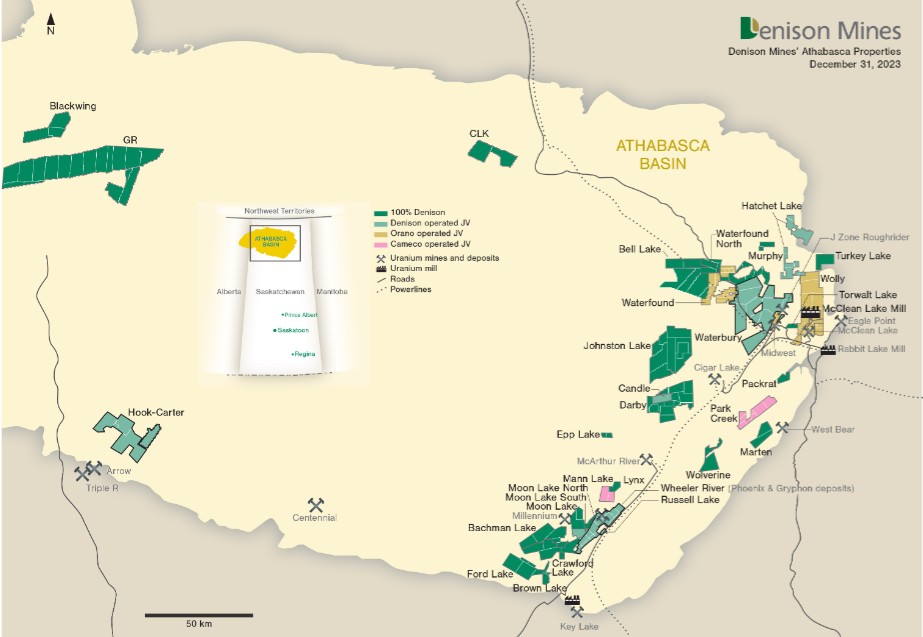

The Company has an effective 95.0% interest in the Wheeler River Joint Venture (“WRJV”), a 69.35% interest in the Waterbury Lake Uranium Limited Partnership (“WLULP”), a 22.5% interest in the McClean Lake Joint Venture (“MLJV”) (which includes the McClean Lake mill) and a 25.17% interest in the Midwest Joint Venture (“MWJV”), each of which are located in the eastern portion of the Athabasca Basin region in northern Saskatchewan, Canada. The McClean Lake mill is contracted to provide toll milling services to the Cigar Lake Joint Venture (“CLJV”) under the terms of a toll milling agreement between the parties (see note 12).

Through its 50% ownership of JCU (Canada) Exploration Company, Limited (“JCU”), Denison holds further indirect interests in various uranium project joint ventures in Canada, including the Millennium project (JCU 30.099%), the Kiggavik project (JCU 33.8118%) and the Christie Lake project (JCU 34.4508%). See note 8 for details.

In addition, Denison’s exploration portfolio includes further interests in properties in the Athabasca Basin region.

DMC is incorporated under the Business Corporations Act (Ontario) and domiciled in Canada. The address of its registered head office is 40 University Avenue, Suite 1100, Toronto, Ontario, Canada, M5J 1T1.

References to “2023” and “2022” refer to the year ended December 31, 2023, and the year ended December 31, 2022 respectively.

2.STATEMENT OF COMPLIANCE, ACCOUNTING POLICIES AND COMPARATIVE NUMBERS

Statement of Compliance

These consolidated financial statements have been prepared in accordance with International Financial Reporting Standard (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

These financial statements were approved by the board of directors for issue on February 29, 2024.

Material accounting policies

These consolidated financial statements are presented in Canadian dollars (“CAD”) and all financial information is presented in CAD, unless otherwise noted.

The preparation of the consolidated financial statements in conformity with IFRS requires management to make judgements, estimates and assumptions that affect the application of accounting policies and the reported amount of assets, liabilities, revenues and expenses. Actual results may vary from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements are disclosed in note 3.

11

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

The Company has considered the amendments to IAS 1: Presentation of Financial Statements, IAS 8: Accounting Policies, Changes in Account Estimates and Errors, IAS 12: Income Taxes and IFRS 17: Reporting Standard for Insurance Contracts, which are effective for annual periods beginning on or after January 1, 2023 and has concluded that these amendments have no impact on the Company’s consolidated financial statements. The material accounting policies used in the preparation of these consolidated financial statements are described below:

A.Consolidation principles

The financial statements of the Company include the accounts of DMC, its subsidiaries and its joint arrangements (see note 25).

Subsidiaries

Subsidiaries are all entities over which the DMC group of entities has control. The group controls an entity where the group is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power to direct the activities of the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the group and are deconsolidated from the date that control ceases. Intercompany transactions, balances and unrealized gains and losses from intercompany transactions are eliminated.

Joint arrangements

A joint arrangement is a contractual arrangement of which the DMC group of entities and another independent party have joint control. Joint arrangements are either joint operations or joint ventures. The classification of a joint arrangement as a joint operation or a joint venture depends upon the rights and obligations of the parties to the arrangement. The Company determines the type of joint arrangement in which it is involved by considering the structure and form of the arrangement, the terms agreed by the parties in the contractual arrangement and other facts and circumstances such as the parties’ rights and obligations arising from the arrangement.

Joint operations are contractual arrangements which involve joint control between the parties which have rights to the assets, and obligations for the liabilities, relating to the joint arrangement. The consolidated financial statements of the Company include its share of the assets in such joint operations, together with its share of the liabilities and the revenues and expenses arising jointly or otherwise from those operations. All such amounts are measured in accordance with the terms of each arrangement.

A joint venture is a joint arrangement over which the Company shares joint control and which provides the Company with the rights to the net assets of the joint arrangement. Joint ventures are accounted for using the equity method. Under the equity method, investments in joint ventures are initially recorded at cost and adjusted thereafter to record the Company’s share of post-acquisition earnings or loss of the joint venture as if the joint venture had been consolidated. The carrying value of investments in joint ventures is also increased or decreased to reflect the Company’s share of capital transactions, including amounts recognized in “Other comprehensive income or loss”, and for accounting changes that relate to periods subsequent to the date of acquisition.

B.Foreign currency translation

Functional and presentation currency

Items included in the financial statements of each entity in the DMC group are measured using the currency of the primary economic environment in which the entity operates (“the functional currency”). Primary and secondary indicators are used to determine the functional currency. Primary indicators include the currency that mainly influences sales prices, labour, material and other costs. Secondary indicators include the currency in which funds from financing activities are generated and in which receipts from operating activities are usually retained. Typically, the local currency has been determined to be the functional currency of Denison’s entities.

12

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

The financial statements of entities that have a functional currency different from the presentation currency of DMC (“foreign operations”) are translated into Canadian dollars as follows: assets and liabilities at the closing rate at the date of the statement of financial position, and income and expenses at the average rate of the period (as this is considered a reasonable approximation to actual rates). All resulting changes are recognized in “Other comprehensive income or loss” as cumulative foreign currency translation adjustments.

When the Company disposes of its entire interest in a foreign operation, or loses control, joint control, or significant influence over a foreign operation, the foreign currency gains or losses accumulated in “Other comprehensive income or loss” related to the foreign operation are recognized in the statement of income or loss as translational foreign exchange gains or losses.

Transactions and balances

Foreign currency transactions are translated into an entity’s functional currency using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of foreign currency transactions and from the translation at year-end exchange rates of monetary assets and liabilities denominated in currencies other than an operation’s functional currency are recognized in the statement of income or loss as transactional foreign exchange gains or losses.

C.Financial instruments

Financial assets and financial liabilities are recognized when the Company becomes a party to the contractual provisions of a financial instrument. Financial assets are derecognized when the rights to receive cash flows from the assets have expired or have been transferred and the Company has transferred substantially all risks and rewards of ownership. Financial liabilities are derecognized when the obligations specified in the contract are discharged, cancelled or expire.

At initial recognition, the Company classifies its financial instruments in the following categories:

Financial assets and liabilities at fair value through profit or loss (“FVTPL”)

A financial asset is classified in this category if it is a derivative instrument, an equity instrument for which the Company has not made the irrevocable election to classify as fair value through Other comprehensive income (“FVTOCI”), or a debt instrument that is not held within a business model whose objective includes holding the financial assets in order to collect contractual cash flows that are solely payments of principal and interest. Derivative financial liabilities and contingent consideration liabilities related to business combinations are also classified in this category. Financial instruments in this category are recognized initially and subsequently at fair value. Transaction costs are expensed in the statement of income or loss. Gains and losses arising from changes in fair value are presented in the statement of income or loss – within “Other income (expense)” in the period in which they arise.

Equity investments in shares and warrants, uranium investments, and convertible debentures are classified as financial assets at FVTPL.

Financial assets at amortized cost

A financial asset is classified in this category if it is a debt instrument and / or other similar asset that is held within a business model whose objective is to hold the asset in order to collect the contractual cash flows (i.e. principal and interest). Financial assets in this category are initially recognized at fair value plus transaction costs and subsequently measured at amortized cost using the effective interest method less a provision for impairment. Interest income is recorded in the statement of income or loss through “Finance income”.

Cash and cash equivalents, restricted cash, and trade and other receivables are classified as financial assets at amortized cost.

13

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

Financial liabilities at amortized cost

All financial liabilities that are not recorded as FVTPL are classified in this category and are initially recognized less a discount (when material) to reduce the financial liabilities to fair value and less any directly attributable transaction costs. Subsequently, financial liabilities are measured at amortized cost using the effective interest method. Interest expense is recorded in the statement of income or loss through “Finance expense”.

Accounts payable and accrued liabilities, and debt obligations are classified as financial liabilities at amortized cost.

Refer to the “Fair Value of Financial Instruments” section of note 23 for the Company’s classification of its financial assets and liabilities within the fair value hierarchy.

D.Impairment of financial assets

At each reporting date, the Company assesses the expected credit losses ("ECLS") associated with its financial assets that are not carried at FVTPL. ECLS are calculated based on the difference between the contractual cash flows and the cash flows that the Company expects to receive, discounted, where applicable, based on the asset’s original effective interest rate.

For “Trade receivables”, the Company calculates ECLS based on historical credit loss experience, adjusted for forward-looking factors specific to debtors and the economic environment. In recording an impairment loss, the carrying amount of the asset is reduced by this expected credit loss (“ECL”) either directly or indirectly through the use of an allowance account.

E.Inventories

Expenditures, including depreciation, depletion and amortization of production assets, incurred in the mining and processing activities that will result in future uranium concentrate production, are deferred and accumulated as ore in stockpiles, in-process inventories and concentrate inventories. These amounts are carried at the lower of weighted average cost or net realizable value (“NRV”). NRV is calculated as the estimated future uranium concentrate selling price in the ordinary course of business (net of selling costs) less the estimated costs to complete production of the inventory into a saleable form.

Stockpiles are comprised of coarse ore that has been extracted from the mine and is available for further processing. Mining production costs are added to the stockpile as incurred and removed from the stockpile based upon the weighted average cost per ton of ore produced from mines considered to be in commercial production. The current portion of ore in stockpiles represents the amount expected to be processed in the next twelve months.

In-process and concentrate inventories include the cost of the ore removed from the stockpile, a pro-rata share of the amortization of the associated mineral property, as well as production costs incurred to process the ore into a saleable product. Processing costs typically include labor, chemical reagents and directly attributable mill overhead expenditures. Items are valued at weighted average cost.

Materials and other supplies held for use in the production of inventories are carried at weighted average cost and are not written down below that cost if the finished products in which they will be incorporated are expected to be sold at or above cost. However, when a decline in the price of concentrates indicates that the cost of the finished products exceeds NRV, the materials are written down to NRV. In such circumstances, the replacement cost of the materials may be the best available measure of their NRV.

F.Investments-uranium

The Company’s uranium investments are held for long-term capital appreciation. Investments in uranium are initially recorded at cost, on the date that control of the uranium passes to the Company.

14

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

Cost includes the purchase price and any directly attributable transaction costs. Subsequent to initial recognition, investments in uranium are measured at fair value at each reporting period end. Fair value is determined based on the most recent month-end spot price for uranium published by UxC LLC (“UxC”) and converted to Canadian dollars using the foreign exchange rate at the date of the consolidated statement of financial position. Related fair value gains and losses recognized subsequent to initial recognition are recorded in the consolidated statement of income (loss) as a component of “Other income (expense)” in the period in which they arise.

G.Property, plant and equipment

Plant and equipment

Plant and equipment are recorded at acquisition or production cost and carried net of depreciation and impairments. Cost includes expenditures incurred by the Company that are directly attributable to the acquisition of the asset. Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost can be measured reliably. The carrying amount of a replaced asset is derecognized when replaced. Repairs and maintenance costs are charged to the statement of income and loss during the period in which they are incurred.

Depreciation is calculated on a straight line or unit of production basis as appropriate. Where a straight-line methodology is used, the assets are depreciated to their estimated residual value over an estimated useful life which ranges from three to twenty years depending upon the asset type. Where a unit of production methodology is used, the assets are depreciated to their estimated residual value over the useful life defined by management’s best estimate of recoverable reserves and resources in the current estimated mine plan. When assets are retired or sold, the resulting gains or losses are reflected in the statement of income or loss as a component of “Other income (expense)”. The Company allocates the amount initially recognized in respect of an item of plant and equipment to its significant parts and depreciates separately each such part over its useful life. Residual values, methods of depreciation and useful lives of the assets are reviewed at least annually and adjusted if appropriate.

Where straight-line depreciation is utilized, the range of useful lives for various asset classes is generally as follows:

Buildings |

|

15 - 20 years; |

Production machinery and equipment |

|

5 - 7 years; |

Other assets |

|

3 - 5 years. |

Mineral property acquisition, exploration, evaluation and development costs

Costs relating to mineral and / or exploration rights acquired through a business combination or asset acquisition are capitalized and reported as part of “Property, plant and equipment”.

Exploration and Evaluation expenditures are expensed as incurred.

Once commercial viability and technical feasibility for a project has been established, the project is classified as a “Development Stage” mineral property, an impairment test is performed on the transition, and all further development costs are capitalized to the asset.

Once a development stage mineral property goes into commercial production, the project is classified as “Producing” and the accumulated costs are amortized over the estimated recoverable reserves and resources in the current mine plan using a unit of production basis.

Proceeds received from the sale of an interest in a property are credited against the carrying value of the property, with any difference recorded in the statement of income or loss as a gain or loss on sale within “Other income (expense)”.

15

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

Lease assets (and lease obligations)

At the inception of a contract, the Company assesses whether a contract is, or contains, a lease. A contract is, or contains, a lease, if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. To assess whether a contract conveys the right to control the use of an identified asset, the Company assesses whether:

| ● | the contract involves the use of an identified asset – this may be specified explicitly or implicitly and should be physically distinct or represent substantially all of the capacity of a physically distinct asset. If the supplier has a substantive substitution right, then the asset is not identified; |

| ● | the Company has the right to obtain substantially all of the economic benefits from the use of the asset throughout the period of use; and |

| ● | the Company has the right to direct the use of the asset. The Company has this right when it has the decision-making rights that are most relevant to changing how and for what purpose the asset is used. In rare cases where the decision about how and for what purpose the asset is used is predetermined, the Company has the right to direct the use of the asset if either (a) the Company has the right to operate the asset; or (b) the Company designed the asset in a way that predetermines how and for what purpose it will be used. |

If the contract contains a lease, the Company accounts for the lease and non-lease components separately. For the lease component, a right-of-use asset and a corresponding lease liability are set-up at the date at which the leased asset is available for use by the Company. The right-of-use asset is depreciated over the shorter of the asset’s useful life and the lease term on a straight-line basis.

The lease payments associated with the lease liability are discounted using either the interest rate implicit in the lease, if available, or the Company’s incremental borrowing rate. Each lease payment is allocated between the liability and the finance cost (i.e. accretion) so as to produce a constant rate of interest on the remaining lease liability balance.

H.Impairment of non-financial assets

After application of the equity method to joint ventures, at each reporting date the Company determines whether there is objective evidence that the investment in the joint venture is impaired. If there is such evidence, the Company calculates the amount of impairment as the difference between the recoverable amount of the associate or joint venture and it’s carrying value, and then recognizes the loss within “Equity share of loss” in the statement of income or loss.

Property, plant and equipment assets are assessed at the end of each reporting period to determine if there is any indication that the asset may be impaired. If any such indication exists, an estimate of the recoverable amount of the asset is made. For the purpose of measuring recoverable amounts, assets are grouped at the lowest level, or cash generating unit (“CGU”), for which there are separately identifiable cash inflows. The recoverable amount is the higher of an asset’s fair value less costs of disposal and value in use (being the present value of the expected future cash flows of the relevant asset or CGU, as determined by management). An impairment loss is recognized for the amount by which the CGU’s carrying amount exceeds its recoverable amount.

Mineral property assets are assessed for impairment using the impairment indicators under IFRS 6 “Exploration for and Evaluation of Mineral Resources” up until the commercial viability and technical feasibility for the property is established. From that point onwards, mineral property assets are tested for impairment using the impairment indicators of IAS 36 “Impairment of Assets”.

16

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

I.Employee benefits

Share-based compensation

The Company uses a fair value-based method of accounting for share options to employees and to non-employees. The fair value is determined using the Black-Scholes option pricing model on the date of the grant. The cost is recognized on a graded method basis, adjusted for expected forfeitures, over the applicable vesting period as an increase in share-based compensation expense and the contributed surplus account. When such share options are exercised, the proceeds received by the Company, together with the respective amount from contributed surplus, are credited to share capital.

The Company also has a share unit plan pursuant to which it may grant share units to employees – the share units are equity-settled awards. The Company determines the fair value of the awards on the date of grant. The cost is recognized on a graded method basis, adjusted for expected forfeitures, over the applicable vesting period, as an increase in share-based compensation expense and the contributed surplus account. When such share units are settled for common shares, the applicable amounts of contributed surplus are credited to share capital.

J.Reclamation provisions

Reclamation provisions, which are legal and constructive obligations related to the retirement of tangible long-lived assets, are recognized when such obligations are incurred, and a reasonable estimate of the value can be determined. These obligations are measured initially at the present value of expected cash flows using a pre-tax discount rate reflecting risks specific to the liability and the resulting costs are capitalized and added to the carrying value of the related assets. In subsequent periods, the liability is adjusted for the accretion of the discount and the expense is recorded in the statement of income or loss. Changes in the amount or timing of the underlying future cash flows or changes in the discount rate are immediately recognized as an increase or decrease in the carrying amounts of the related asset, if one exists, and liability. These costs are amortized to the results of operations over the life of the asset. Reductions in the amount of the liability are first applied against the amount of the net reclamation asset with any excess value being recorded in the statement of income or loss.

The Company’s activities are subject to numerous governmental laws and regulations. Estimates of future reclamation liabilities for asset decommissioning and site restoration are recognized in the period when such liabilities are incurred. These estimates are updated on a periodic basis and are subject to changing laws, regulatory requirements, changing technology and other factors which will be recognized when appropriate. Liabilities related to site restoration include long-term treatment and monitoring costs and incorporate total expected costs net of recoveries. Expenditures incurred to dismantle facilities, restore, and monitor closed resource properties are charged against the related reclamation liability.

K.Current and deferred income tax

Current income tax payable is based on taxable income for the period. Taxable income differs from income as reported in the statement of income or loss because it excludes items of income or expense that are taxable or deductible in other periods and it further excludes items that are never taxable or deductible. The Company’s liability for current tax is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

17

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

Deferred income taxes are accounted for using the balance sheet liability method. Deferred income tax assets and liabilities are computed based on temporary differences between the financial statement carrying values of the existing assets and liabilities and their respective income tax bases used in the computation of taxable income. Computed deferred tax liabilities are generally recognized for all taxable temporary differences and deferred tax assets are recognized to the extent that it is probable that taxable income will be available against which deductible temporary differences can be utilized. Such assets and liabilities are not recognized if the temporary difference arises from goodwill or from the initial recognition (other than in a business combination) of other assets and liabilities in a transaction that affects neither the taxable income nor the accounting income. Deferred tax liabilities are recognized for taxable temporary differences arising on investments in subsidiaries and investments, and interests in joint ventures, except where the Company is able to control the reversal of the temporary differences and it is probable that the temporary differences will not reverse in the foreseeable future. The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is no longer probable that sufficient taxable earnings will be available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the period when the liability is settled or the asset realized, based on tax rates and tax laws that have been enacted or substantively enacted by the balance sheet date. Deferred tax is charged or credited to the statement of income or loss (or comprehensive income or loss in some specific cases), except when it relates to items charged or credited directly to equity, in which case the deferred tax is also recorded within equity.

Income tax assets and liabilities are offset when there is a legally enforceable right to offset the assets and liabilities and when they relate to income taxes levied by the same tax authority on either the same taxable entity or different taxable entities where there is an intention to settle the balance on a net basis.

L.Flow-through common shares

The Company’s Canadian exploration activities have been financed in part through the issuance of flow-through common shares, whereby the Canadian income tax deductions relating to these expenditures are claimable by the subscribers and not by the Company. The proceeds from issuing flow-through shares are allocated between the offering of shares and the sale of tax benefits. The allocation is based on the difference (“premium”) between the quoted price of the Company’s existing shares and the amount the investor pays for the actual flow-through shares. A liability is recognized for the premium when the shares are issued and is extinguished when the tax effect of the temporary differences, resulting from the renunciation of the tax deduction to the flow-through shareholders, is recorded - with the difference between the liability and the value of the tax assets renounced being recorded as a deferred tax expense. The tax effect of the renunciation is recorded at the time the Company makes the renunciation to its subscribers – which may differ from the effective date of renunciation. If the flow-through shares are not issued at a premium, a liability is not established, and on renunciation the full value of the tax assets renounced is recorded as a deferred tax expense.

18

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

M.Revenue recognition

Revenue from pre-sold toll milling services

Revenue from the pre-sale of toll milling arrangement cash flows is recognized as the toll milling services are provided. At contract inception, the Company estimates the expected transaction price of the toll milling services being sold based on available information and calculates an average per unit transaction price that applies over the life of the contract. This unit price is used to draw-down the deferred revenue balance as the toll milling services occur. When changes occur to the expected timing, or volume of toll milling services, the per unit transaction price is adjusted to reflect the change (such review to be done annually, at a minimum), and a cumulative catch-up adjustment is made to reflect the updated rate. The amount of the upfront payment received from the toll milling pre-sale arrangements includes a significant financing component due to the longer-term nature of such agreements. As such, the Company also recognizes accretion expense on the deferred revenue balance which is recorded in the statement of income or loss through “Finance expense, net”.

Revenue from environmental services (i.e. Closed Mines group)

Environmental service contracts represent a series of distinct performance obligations that are substantially the same and have the same pattern of transfer of control to the customer. The transaction price is estimated at contract inception and is recognized over the life of the contract as control is transferred to the customer. Variable consideration, where applicable, is estimated at contract inception using either the expected value method or the most likely amount method. If it is highly probable that a subsequent reversal of revenue will not occur when the uncertainty has been resolved, the Company will recognize as revenue the estimated transaction price, including the estimate of the variable portion, upon transfer of control to the customer, otherwise the variable portion of the transaction price will be constrained, and will not be recognized as revenue until the uncertainty has been resolved.

N.Earnings (loss) per share

Basic earnings (loss) per share (“EPS”) is calculated by dividing the net income or loss for the period attributable to equity owners of DMC by the weighted average number of common shares outstanding during the period.

Diluted EPS is calculated by adjusting the weighted average number of common shares outstanding for dilutive instruments. The number of shares included with respect to options, warrants and similar instruments is computed using the treasury stock method.

O.Discontinued operations

A discontinued operation is a component of the Company that has either been disposed of, abandoned, or that is classified as held for sale and: (i) represents a separate major line of business or geographical area of operations; (ii) is part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations; or (iii) is a subsidiary acquired exclusively with a view to resale. A component of the Company is comprised of operations and cash flows that can be clearly distinguished, operationally and for financial reporting purposes, from the rest of the Company. Further, a discontinued operation must be a component of the Company that was a cash generating unit ("CGU") while being held for use. Disposal groups to be abandoned include those that are to be used to the end of their economic life and those that are to be closed rather than sold.

Net income or loss of a discontinued operation and any gain or loss on disposal are combined and presented as net income or loss from discontinued operations, net of tax, in the statement of income or loss.

At the end of August, 2023, the Company’s long-term third party Closed Mine services contract came to an end and the Company ceased providing such third party care and maintenance services (see note 21). The Company is treating the Closed Mines segment as a discontinued operation as a result of the termination of this contract and the subsequent decision to no longer provide such services.

19

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

3.CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of consolidated financial statements in accordance with IFRS requires the use of certain critical accounting estimates and judgements that affect the amounts reported. It also requires management to exercise judgement in applying the Company’s accounting policies. These judgements and estimates are based on management’s best knowledge of the relevant facts and circumstances taking into account previous experience. Although the Company regularly reviews the estimates and judgements made that affect these financial statements, actual results may be materially different.

Significant estimates and judgements made by management relate to:

A.Mineral property impairment reviews and impairment adjustments

At each reporting date, the Company assesses whether there is an indicator that its mineral properties may be impaired. Judgement is applied in identifying whether or not an indicator exists. Impairment indicators exist when facts and circumstances suggest that the carrying amount of a mineral property may exceed its recoverable amount. Both internal and external sources of information are considered when determining the presence of an impairment indicator or an indicator of reversal of a previous impairment. Judgment is required when identifying indicators of impairment which include results from exploration programs during the reporting period, a decline in the reserves and resources by property, and events or changes to the operations such as: a) unfavourable changes in the property or project economics; b) environmental restrictions on development; c) the period for which the Company has the right to explore in the specific area has expired or will expire in the next 12 months and is not expected to be renewed; and d) substantive expenditure on further exploration for and evaluation of mineral resources in the specific area is neither budgeted nor planned. Judgment is also required when considering whether significant positive changes in any of these items indicate a previous impairment may have reversed.

When an indicator is identified, the Company determines the recoverable amount of the property, which is the higher of an asset’s fair value less costs of disposal or value in use. An impairment loss is recognized if the carrying value exceeds the recoverable amount. The recoverable amount of a mineral property may be determined by reference to estimated future operating results and discounted net cash flows, current market valuations of similar properties or a combination of the above. In undertaking this review, management of the Company is required to make significant estimates of, amongst other things: reserve and resource amounts, future production and sale volumes, forecast commodity prices, future operating, capital and reclamation costs to the end of the mine’s life and current market valuations from observable market data which may not be directly comparable. These estimates are subject to various risks and uncertainties, which may ultimately have an effect on the expected recoverable amount of a specific mineral property asset. Changes in these estimates could have a material impact on the carrying value of the mineral property amounts and the impairment losses recognized.

B.Reclamation obligations

Asset retirement obligations are recorded as a liability when the asset is initially constructed, or a constructive or legal obligation exists. The valuation of the liability typically involves identifying costs to be incurred in the future and discounting them to the present using an appropriate discount rate for the liability. The determination of future costs involves a number of estimates relating to timing, type of costs, mine closure plans, and review of potential methods and technical advancements. Furthermore, due to uncertainties concerning environmental remediation, the ultimate cost of the Company’s decommissioning liability could differ materially from amounts provided. The estimate of the Company’s obligation is subject to change due to amendments to applicable laws and regulations and as new information concerning the Company’s operations becomes available. The Company is not able to determine the impact on its financial position, if any, of environmental laws and regulations that may be enacted in the future.

20

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

4.CASH AND CASH EQUIVALENTS

The cash and cash equivalent balance consists of:

|

|

|

|

|

|

|

|

|

At December 31 |

|

At December 31 |

||

(in thousands) |

|

2023 |

|

2022 |

||

|

|

|

|

|

|

|

Cash |

|

$ |

2,650 |

|

$ |

1,801 |

Cash in MLJV and MWJV |

|

|

1,036 |

|

|

1,263 |

Cash equivalents |

|

|

127,368 |

|

|

47,851 |

|

|

$ |

131,054 |

|

$ |

50,915 |

Cash equivalents consist of various investment savings account instruments and money market funds, all of which are short term in nature, highly liquid and readily convertible into cash.

5.TRADE AND OTHER RECEIVABLES

The trade and other receivables balance consists of:

|

|

|

|

|

||

|

|

At December 31 |

|

At December 31 |

||

(in thousands) |

|

2023 |

|

2022 |

||

|

|

|

|

|

|

|

Trade receivables |

|

$ |

899 |

|

$ |

3,184 |

Receivables in MLJV and MWJV |

|

|

623 |

|

|

508 |

Sales tax receivables |

|

|

364 |

|

|

428 |

Sundry receivables |

|

|

27 |

|

|

23 |

|

|

$ |

1,913 |

|

$ |

4,143 |

6.INVENTORIES

The inventories balance consists of:

|

|

|

|

|

|

|

|

|

At December 31 |

|

At December 31 |

||

(in thousands) |

|

2023 |

|

2022 |

||

|

|

|

|

|

|

|

Inventory of ore in stockpiles |

|

$ |

2,098 |

|

$ |

2,098 |

Mine and mill supplies in MLJV |

|

|

3,580 |

|

|

2,713 |

|

|

$ |

5,678 |

|

$ |

4,811 |

|

|

|

|

|

|

|

Inventories-by balance sheet presentation: |

|

|

|

|

|

|

Current |

|

$ |

3,580 |

|

$ |

2,713 |

Long term-ore in stockpiles |

|

|

2,098 |

|

|

2,098 |

|

|

$ |

5,678 |

|

$ |

4,811 |

Long-term ore in stockpile inventory represents an estimate of the amount of ore on the stockpile in excess of the next twelve months of planned mill production.

21

|

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS |

7.INVESTMENTS

The investments balance consists of:

|

|

|

|

|

|

|

|

|

At December 31 |

|

At December 31 |

||

(in thousands) |

|

2023 |

|

2022 |

||

|

|

|

|

|

|

|

Investments: |

|

|

|

|

|

|

Equity instruments |

|

|

|

|

|

|

Shares |

|

$ |

10,390 |

|

$ |

8,022 |

Warrants |

|

|

127 |

|

|

87 |

Convertible Debentures |

|

|

15,565 |

|

|

— |

Physical Uranium |

|

|

276,815 |

|

|

162,536 |

|

|

$ |

302,897 |

|

$ |

170,645 |

|

|

|

|

|

|

|

Investments-by balance sheet presentation: |

|

|

|

|

|

|

Current |

|

$ |

10,400 |

|

$ |

8,022 |

Long-term |

|

|

292,497 |

|

|

162,623 |

|

|

$ |

302,897 |

|

$ |

170,645 |

The investments continuity summary is as follows:

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Equity |

|

|

Convertible |

|

Physical |

|

Total |

|||

(in thousands) |

|

Instruments |

|

|

Debentures |

|

Uranium |

|

Investments |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance-January 1, 2022 |

|

$ |

14,578 |

|

$ |

— |

|

$ |

133,114 |

|

$ |

147,692 |

Change in fair value gain to profit and (loss) (note 20) |

|

|

(6,469) |

|

|

— |

|

|

29,422 |

|

|

22,953 |

Balance-December 31, 2022 |

|

$ |

8,109 |

|

$ |

— |

|

$ |

162,536 |

|

$ |

170,645 |

Purchase of investments |

|

|

2,417 |

|

|

15,000 |

|

|

— |

|

|

17,417 |

Sale of investments |

|

|

— |

|

|

— |

|

|

(19,901) |

|

|

(19,901) |