UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) | February 21, 2024 |

Bank First Corporation

(Exact name of registrant as specified in its charter)

| Wisconsin | 001-38676 | 39-1435359 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| 402 North 8th Street, Manitowoc, WI | 54220 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number, including area code | (920) 652-3100 |

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | BFC | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for company with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

On February 21, 2024, Bank First Corporation (the “Company”) renewed its share repurchase program, pursuant to which the Company may repurchase up to $30 million of its common stock, par value $0.01 per share, for a period of one (1) year, ending on February 20, 2025. The Company may repurchase shares from time to time in open market transactions or through privately negotiated transactions at the Company’s discretion and in accordance with applicable securities laws. The timing, price, volume and nature of any share repurchases will be based on market conditions and other factors.

The Company also issued its quarterly shareholder newsletter on February 21, 2024. A copy of the newsletter is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference.

Pursuant to General Instruction B.2 of Form 8-K, the information in this Item 7.01 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities under that Section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Registrant under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits |

| Exhibit Number |

Description of Exhibit | |

| 99.1 | Shareholder Newsletter, dated February, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BANK FIRST CORPORATION | ||

| Date: February 21, 2024 | By: | /s/ Kevin M. LeMahieu |

| Kevin M. LeMahieu | ||

| Chief Financial Officer | ||

Exhibit 99.1

SHAREHOLDER NEWS MESSAGE FROM THE CEO To our Shareholders, As we embark on 2024, I want to update you on some of the exciting customer-centric projects we have in store. We aim to ensure that every interaction with our customers, whether in person, over the phone, or online, is efficient and positive. These projects will play a significant role in enhancing the overall customer experience. One of our recent initiatives is the implementation of the G.U.E.S.T. experience in all of our 26 branches. This experience focuses on providing personalized service to our customers. We aim to Greet each customer as they enter our branches, Using their names to show that we know and value them. Our staff will make Eye contact with a Smile, creating a welcoming and comfortable atmosphere. Lastly, we will Thank our customers for their relationship with Bank First. To ensure consistency, we are developing an employee training curriculum that will be implemented across all branches. In addition to our branch enhancements, we are revamping our online and mobile platforms to provide a consistent and fully functional experience across both channels. Our customers will have a seamless and positive experience whenever they engage with our digital platforms. We are creating a single access point that will cater to all their banking needs. One exciting feature of our new digital platforms is the introduction of a new account opening tool. This tool will enable new and existing customers to open accounts within minutes through our digital account opening system. For those who prefer in-person assistance, our staff will be able to open accounts in a fraction of the time it currently takes. I am pleased to announce the successful opening of our Reedsville branch last September and our Green Bay office in January. Additionally, we have completed the remodeling of our Shawano office. In all these projects, we have prioritized working with local contractors who are also Bank customers. We have also used environmentally-friendly building materials and showcased artwork from local artists, further supporting our commitment to the community. Looking ahead, we have plans to construct our first office in Door County, located on the north side of Sturgeon Bay. We will also be replacing our Fond du Lac office on Peters Avenue with a new office on Johnson Street. We also have plans to expand our Cedarburg office and completely remodel our Clintonville branch. To ensure the highest quality, we have engaged architectural companies that are also customers of Bank First to design these projects. The design of each location will enhance our customer experience while providing our staff with the best working environment to deliver the Bank First G.U.E.S.T. experience. We are excited about the progress we have made and the projects we have planned for the year ahead. Thank you for your continued support as we strive to provide exceptional customer experiences which will help drive the success of Bank First. Michael B. Molepske Chairman and CEO - (920) 652-3202 MIKE MOLEPSKE CORPORATION FEBRUARY 2024 Mike Ansay retires from the Board of Directors Michael G. Ansay retired from the Bank First Board of Directors effective January 15, 2024. Mr. Ansay became a director of the Corporation and Bank in February 2010. In 2012, he was appointed as Vice-Chairman and assumed the role of Chairman in January 2013. He served as Chairman of the Board from January 2013 to June 2022, when the role was transitioned to Mike Molepske, Chief Executive Officer of Bank First, to facilitate a smooth transition of leadership in anticipation of Mr. Ansay’s retirement. Ansay’s retirement brings to a close over a decade of remarkable service and visionary leadership to the organization. During his tenure, Bank First significantly expanded its footprint across Wisconsin through both strategic acquisitions and de novo offices in new markets, grew assets more than fivefold from $832 million in 2010 to $4.2 billion today, and solidified its position as one of the top performing banks in the country. “We extend our congratulations and express our gratitude to Mike for his many years of service on the Board,” stated Mike Molepske, Chairman and Chief Executive Officer of Bank First. “His dedication, strategic insight, and remarkable contributions have had a significant impact on the Bank’s success, playing a pivotal role in bringing us to where we stand today.” www.bankfirst.com Ticker: BFC Total assets for the Company were $4.22 billion at December 31, 2023, up from $3.66 billion at December 31, 2022.

Net loans were $3.30 billion, growing $428.1 million on a year-over-year basis. Deposits were $3.43 billion, growing $372.7 million over that same time frame. Year-over-year comparisons were significantly impacted by the Company’s acquisition of Hometown Bancorp, Ltd. (“Hometown”) during the first quarter of 2023. This transaction included $395.8 million in loans, $532.4 million in deposits, and $615.1 million in total assets. Net income for the year ended December 31, 2023, totaled $74.5 million, up from $45.2 million during the year ended December 31, 2022. Earnings per share for 2023 was $7.28, up from $5.58 for 2022. Several unique non-recurring items occurred during 2023 that, netted together, led to this increase in both earnings and earnings per share from 2022 to 2023. First, the Company sold its member interest in UFS, LLC during the fourth quarter of 2023, leading to a gain on sale of $38.9 million. Second, the Company realized net losses of $10.4 million on the sale of securities and other real estate as well as valuation allowances recorded against the carrying values of unsold other real estate during 2023. Finally, as a result of the early pay off of certain debt instruments acquired as part of the Hometown acquisition, $1.4 million in purchase accounting fair-value marks on these debt instruments were added to interest expense during the fourth quarter of 2023. The actions that led to these non-recurring items were intended to position the Company for strong results in 2024 and beyond. Net interest income before provision for loan losses during 2023 totaled $133.5 million, an increase of $29.4 million over 2022. Increasing prevailing interest rates over the previous two years have allowed gross interest income to increase, but competitive pressure on deposit pricing has led to an offsetting increase in gross interest expense. The added scale from the acquisitions of Denmark Bancshares, Inc. (“Denmark”) during the second half of 2022 and Hometown during the first quarter of 2023, which combined to increase assets of the Company by approximately 40%, has been the primary driver of the increase in net interest income. Provisions for credit losses totaled $4.7 million during 2023, up from $2.2 million during 2022. Due to accounting rules associated with acquired loan portfolios, the Hometown transaction required a provision for credit losses of $3.6 million. Continued strong asset quality metrics exhibited within the Company’s loan portfolio allowed for a reduced provision from the prior-year year, net of the impact from the Hometown transaction. Non-interest income totaled $58.1 million for the full year of 2023, up from $19.7 million during the full year of 2022. The previously mentioned gain on the sale of UFS, LLC led to a $38.9 million increase in non-interest income year-over-year. Most other areas of non-interest income saw increases during 2023 compared to 2022, once again due to the increased scale from the acquisitions of Denmark and Hometown. Counteracting those increases, however, was a decline in gains on sales of mortgage loans, from $1.6 million during 2022 to $0.9 million during 2023, and smaller positive valuation adjustments to the mortgage servicing rights asset on the Company’s balance sheet, totaling $2.9 million during 2022 compared to $0.4 million during 2023. Non-interest expense increased by $26.2 million, or 42.2%, from $62.0 million during the year ended December 31, 2022, to $88.1 million during the year ended December 31, 2023. The previously mentioned $10.4 million loss on sales and valuation adjustments related to investments and other real estate led to a portion of this increase. In addition, inflationary pressures and the overall larger scale of operations resulting from the acquisitions of Denmark and Hometown caused significant increases in nearly every category of non-interest expense. Total shareholders’ equity increased by $166.7 million to $619.8 million at December 31, 2023, compared to $453.1 million at December 31, 2022. FOURTHQUARTER KEVIN LEMAHIEU Chief Financial Officer (920) 652-3362 Quarterly Common Stock Cash DividendBank First’s Board of Directors approved a quarterly cash dividend of $0.35 per common share, payable on April 10, 2024, to shareholders of record as of March 27, 2024. This dividend represents a 16.7% and 40.0% increase over the dividend declared for the prior quarter and one year earlier, respectively.

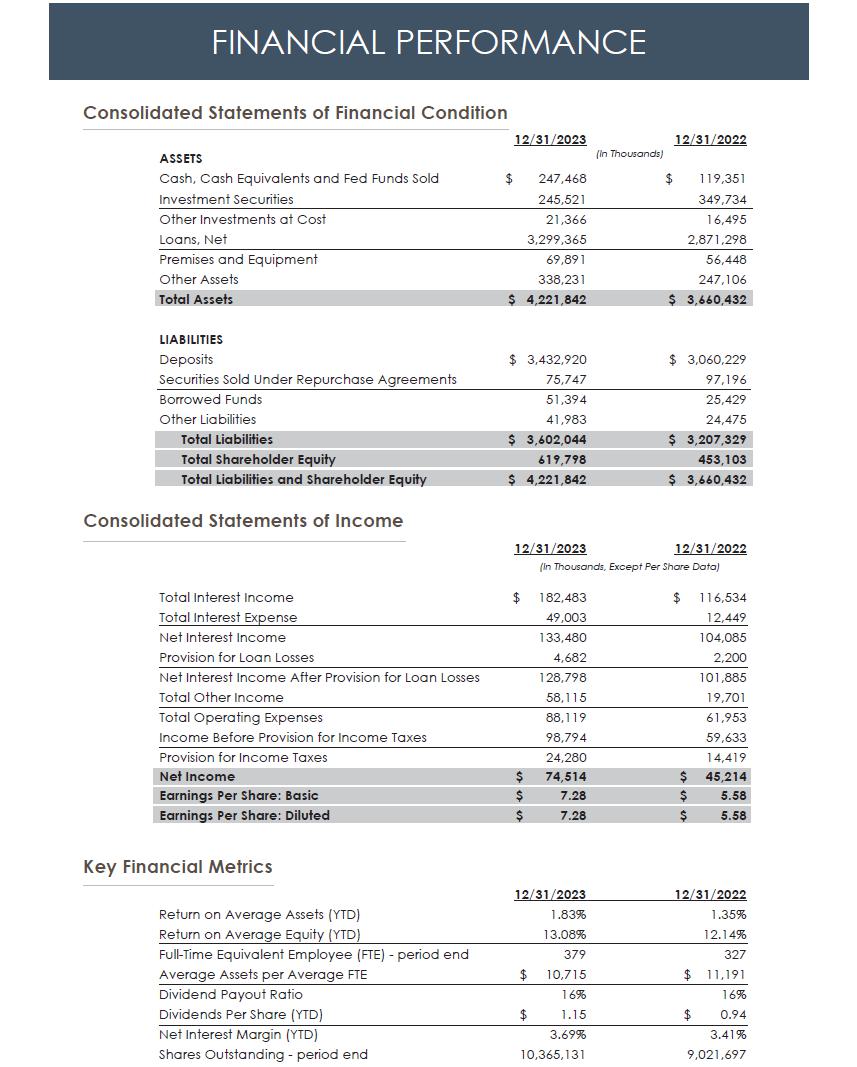

BFC Stock Information Fourth Quarter 2023 High Trade Price $92.50 Low Trade Price $70.00 Average Trade Volume 21,345 FINANCIAL PERFORMANCE Consolidated Statements of Financial Condition 12/31/2023 12/31/2022 ASSETS Cash, Cash Equivalents and Fed Funds Sold $ 247,468 $ 119,351 Investment Securities 245,521 349,734 Other Investments at Cost 21,366 16,495 Loans, Net 3,299,365 2,871,298 Premises and Equipment 69,891 56,448 Other Assets 338,231 247,106 Total Assets $ 4,221,842 $ 3,660,432 LIABILITIES Deposits $ 3,432,920 $ 3,060,229 Securities Sold Under Repurchase Agreements 75,747 97,196 Borrowed Funds 51,394 25,429 Other Liabilities 41,983 24,475 Total Liabilities $ 3,602,044 $ 3,207,329 Total Shareholder Equity 619,798 453,103 Total Liabilities and Shareholder Equity $ 4,221,842 $ 3,660,432 (In Thousands) Consolidated Statements of Income 12/31/2023 12/31/2022 Total Interest Income $ 182,483 $ 116,534 Total Interest Expense 49,003 12,449 Net Interest Income 133,480 104,085 Provision for Loan Losses 4,682 2,200 Net Interest Income After Provision for Loan Losses 128,798 101,885 Total Other Income 58,115 19,701 Total Operating Expenses 88,119 61,953 Income Before Provision for Income Taxes 98,794 59,633 Provision for Income Taxes 24,280 14,419 Net Income $ 74,514 $ 45,214 Earnings Per Share: Basic $ 7.28 $ 5.58 Earnings Per Share: Diluted $ 7.28 $ 5.58 (In Thousands, Except Per Share Data) Key Financial Metrics 12/31/2023 12/31/2022 Return on Average Assets (YTD) 1.83% 1.35% Return on Average Equity (YTD) 13.08% 12.14% Full-Time Equivalent Employee (FTE) - period end 379 327 Average Assets per Average FTE $ 10,715 $ 11,191 Dividend Payout Ratio 16% 16% Dividends Per Share (YTD) $ 1.15 $ 0.94 Net Interest Margin (YTD) 3.69% 3.41% Shares Outstanding - period end 10,365,131 9,021,697 Bank First announces new hires and promotions SCHULTE WINKLER VON HADEN RAHMLOW CAMERANESI FAULKNER CURRAN LUKE SCHULTE recently joined the Bank as Vice President - Business Banking.

Luke brings an extensive 22 years of experience in the financial industry, with 10 years as a commercial underwriter in insurance and most recently as a commercial lender. In his new role, he will focus on expanding the Bank’s commercial loan portfolio in western Wisconsin. Luke holds a bachelor’s degree with an emphasis in finance and a minor in computer science from UW – Platteville. He holds a Wisconsin license for Property and Casualty, Surety, and Crop Insurance. TROY WINKLER recently joined the Bank as Assistant Vice President – Retail Loan Operations. Troy comes to Bank First with over six years of experience in operations management, including his most recent position as Director of Operations at Info-Pro Lender Services. In his new role, will oversee the retail loan function of Bank First, including underwriting, booking and servicing, as well as processing and quality control. Troy will also ensure the seamless and accurate processing of retail loans while adhering to regulatory compliance standards and delivering exceptional service to the Bank’s valued customers. Troy holds an associate degree in business management and finance from Moraine Park Technical College – Fond du Lac. KYLE VON HADEN has been promoted to Vice President – Special Assets. Kyle joined the Bank in 2019 through its merger with Partnership Bank and has 11 years of banking experience specializing in credit analysis and credit administration, most recently serving as a Business Banker. During his time at Bank First, Kyle has consistently demonstrated a deep understanding of financial services and a commitment to delivering outstanding results. In his new role, Kyle will monitor the Bank’s Special Assets portfolio, managing and mitigating potential risks associated with non-performing loans while assisting in the resolution of complex credit issues. Kyle earned his bachelor’s degree in finance from UW – La Crosse and completed the Graduate School of Banking at UW – Madison. The following four individuals have recently been promoted to the positions of Region President and will join Bank First’s existing Region Presidents, Josh Neeb (Manitowoc County and Sheboygan County Regions) and Bill Bradley (Fox Valley Region). These appointments demonstrate Bank First’s commitment to positioning the organization for continued growth while prioritizing employee development and enhancing the customer experience. The Bank’s Region Presidents will be instrumental in expanding Bank First’s market presence while playing an essential role in coaching and developing their teams. VINCE CAMERANESI joined Bank First in 2012 and has over 30 years of commercial banking experience. In his new role, Vince will provide leadership to the team of bankers in Bank First’s South Region, covering Cambridge, Cedarburg, Pardeeville, Poynette, Watertown, and surrounding markets. Vince holds a bachelor’s degree in finance from UW – Milwaukee and completed the Graduate School of Banking at UW – Madison. GLENN CURRAN joined Bank First in 2018 and has over 23 years of experience in the financial industry, specializing in commercial lending. Glenn will lead the team of bankers in Bank First’s Central Region, covering Iola, Shawano, Waupaca, Wautoma, and surrounding areas. He will also continue to serve customers in the Fox Valley and surrounding communities. Glenn graduated from UW – Oshkosh where he majored in finance and marketing. AARON FAULKNER joined Bank First in 2014 and will lead the team of bankers in the Bank’s Northeast Region which includes Brown and Door Counties and surrounding areas. In addition to his tenure at Bank First, Aaron previously served as Senior Relationship Manager - Business Banking, Mortgage Lender, and Senior Credit Manager at another financial institution. Aaron earned his bachelor’s degree in business from St. Norbert College and a Master of Business Administration from Lakeland College. BRAD RAHMLOW joined Bank First in 2018 and has over 20 years of banking experience. In addition to providing leadership to the Bank’s West Region, Brad is responsible for overseeing and growing Bank First’s agricultural banking business unit, serving farmers and other agricultural support businesses throughout the State of Wisconsin. Brad earned his bachelor’s degree in business administration from UW - Platteville and completed the Graduate School of Banking at UW - Madison. Bank First ribbon cutting events HOWARD OPENING CELEBRATION ON JANUARY 11, 2024. SHAWANO RENOVATION CELEBRATION ON JANUARY 10, 2024. Let’s stay in touch. Follow us!