UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024

Commission File Number 001-13422

AGNICO EAGLE MINES LIMITED

(Translation of registrant’s name into English)

145 King Street East, Suite 400, Toronto, Ontario M5C 2Y7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)( 1): ¨

Note: Regulation S-T Rule 101 (b)( 1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(7):¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-___________.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| AGNICO EAGLE MINES LIMITED | |

| (Registrant) |

| Date: 02/20/2024 | By: | /s/ Chris Vollmershausen |

| Chris Vollmershausen | ||

| Executive Vice-President, Legal, General | ||

| Counsel & Corporate Secretary |

Exhibit 99.1

| Stock Symbol: | AEM (NYSE and TSX) |

| For further information: | Investor Relations |

| (416) 947-1212 |

(All amounts expressed in U.S. dollars unless otherwise noted)

AGNICO EAGLE REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS – RECORD

QUARTERLY AND ANNUAL GOLD PRODUCTION AND FREE CASH FLOW; RECORD MINERAL

RESERVES INCREASED 10.5%; UPDATED THREE-YEAR GUIDANCE

Toronto (February 15, 2024) – Agnico Eagle Mines Limited (NYSE:AEM, TSX:AEM) ("Agnico Eagle" or the "Company") today reported financial and operating results for the fourth quarter and full year of 2023, as well as future operating guidance.

"We had a very strong close to 2023, with our fourth quarter results driving a record year in terms of safety, operating and financial performance. We achieved the top end of our gold production guidance range and the mid-point of our cost guidance ranges despite inflationary pressures throughout the year," said Ammar Al-Joundi, Agnico Eagle's President and Chief Executive Officer. "We are extremely pleased with the results that our teams have accomplished with their hard work this year and we have much to look forward to. We are reporting record mineral reserves and a stable production profile at industry leading costs, anchored by the two largest gold operations in Canada, the Detour Lake mine and the Canadian Malartic complex. We continue to advance studies on optimizing our Abitibi platform and we expect to provide additional updates in the first half of 2024. Our track record of executing and delivering results demonstrates the strength of our business and we are well positioned to create long-term value and generate strong returns," added Mr. Al-Joundi.

Fourth quarter and full year 2023 highlights:

| · | Record quarterly gold production – Payable gold production1 in the fourth quarter of 2023 was 903,208 ounces at production costs per ounce of $861, total cash costs per ounce2 of $888 and all-in sustaining costs ("AISC") per ounce3 of $1,227. Gold production in the fourth quarter of 2023 was led by strong production at the Detour Lake mine, the LaRonde complex and the Macassa mine, offsetting lower production at the Fosterville mine |

1 Payable production of a mineral means the quantity of a mineral produced during a period contained in products that have been or will be sold by the Company whether such products are shipped during the period or held as inventory at the end of the period.

2 Total cash costs per ounce is a non-GAAP ratio that is not a standardized financial measure under IFRS and in this news release, unless otherwise specified, is reported on (i) a per ounce of gold produced basis, and (ii) a by-product basis. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation of total cash costs to production costs on both a by- product and a co-product basis, see "Reconciliation of Non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

3 AISC per ounce is a non-GAAP ratio that is not a standardized financial measure under the IFRS and in this news release, unless otherwise specified, is reported on (i) a per ounce of gold produced basis, and (ii) a by-product basis. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation to production costs and for all-in sustaining costs on both a by-product and co-product basis, see "Reconciliation of Non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

| · | Record quarterly cash provided by operating activities and free cash flow – The Company reported a quarterly net loss of $381.0 million or $0.77 per share and adjusted net income4 of $282.3 million or $0.57 per share for the fourth quarter of 2023. Included in the quarterly net loss are impairment charges totaling $667 million (net of tax) or $1.35 per share relating to the Macassa and Pinos Altos mines. Cash provided by operating activities was $1.47 per share ($1.57 per share before working capital adjustments5) and free cash flow5 was $0.61 per share ($0.71 per share before working capital adjustments5) |

| · | Record annual safety performance, annual gold production and free cash flow driven by solid operational performance – Payable gold production in 2023 was 3,439,654 ounces at production costs per ounce of $853, total cash costs per ounce of $865 and AISC per ounce of $1,179. Production for 2023 was at the very top end of the Company's 2023 guidance range of 3.24 million ounces to 3.44 million ounces. Total cash costs per ounce were at the midpoint of the Company's 2023 guidance and AISC per ounce were in the range of the Company's 2023 guidance. Free cash flow for the full year 2023 was $947.4 million ($1,093.8 million before changes in non-cash components of working capital) |

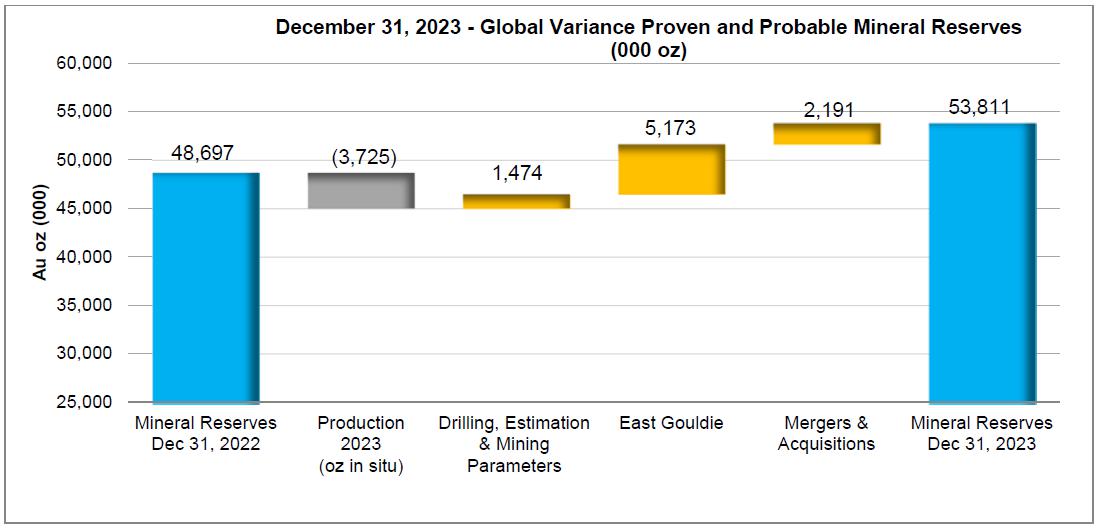

| · | Record gold mineral reserves driven by declaration of initial mineral reserves at East Gouldie – Year-end 2023 gold mineral reserves increased by 10.5% to 53.8 million ounces of gold (1,287 million tonnes grading 1.30 grams per tonne ("g/t") gold). The year-over-year increase in mineral reserves is largely due to the declaration of initial mineral reserves at East Gouldie, the acquisition of the remaining 50% interest in the Canadian Malartic complex and net mineral reserve additions at Macassa. At year-end 2023, measured and indicated mineral resources were 44.0 million ounces (1,189 million tonnes grading 1.15 g/t gold) and inferred mineral resources were 33.1 million ounces (411 million tonnes grading 2.50 g/t gold), including initial underground inferred mineral resources at Detour Lake. For further details, see the Company's exploration news release dated February 15, 2024 |

| · | Stable three-year production outlook – Payable gold production is forecast to be approximately 3.35 to 3.55 million ounces in 2024 and approximately 3.40 to 3.60 million ounces in 2025 (unchanged from prior three-year guidance issued on February 16, 2023 ("Previous Guidance")). Payable gold production is forecast to remain stable in 2026 at an expected range of approximately 3.40 to 3.60 million ounces |

| · | Unit costs reflect easing rate of inflation – Total cash costs per ounce and AISC per ounce in 2024 are forecast to be $875 to $925 and $1,200 to $1,250, respectively. The midpoints of these ranges each represent an approximate 4% increase when compared to the full year 2023 total cash costs per ounce of $865 and AISC per ounce of $1,179. The expected cost increases in 2024 are mostly related to labour, spare parts and maintenance |

| · | Capital expenditures forecast to be approximately $1.65 billion in 2024 – Capital expenditures in 2024 (excluding capitalized exploration) are expected to increase relative to Previous Guidance of $1.40 to 1.60 billion. The expected increase in 2024 is mostly attributable to 100% ownership of Canadian Malartic for the full year, inflation and additional capital expenditures at Detour Lake |

| · | Strategic optimization initiatives improve Canadian production base, with further clarity on the medium term potential to be provided through 2024 – Key developments in 2023 included the declaration of commercial production at Canadian Malartic's Odyssey South deposit, a 12% increase in mill throughput at Detour Lake year-over-year and development of the Near Surface ("NSUR") and Amalgamated Kirkland ("AK") deposits at Macassa. The Company expects to provide updates on additional opportunities that are being evaluated in the Abitibi region in the first half of 2024 |

4 Adjusted net income and adjusted net income per share are non-GAAP measures or ratios that are not standardized financial measures under IFRS. For a description of the composition and usefulness of these non-GAAP measures and a reconciliation to net income see "Reconciliation of Non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

5 Cash provided by operating activities before working capital adjustments, free cash flow and free cash flow before changes in non-cash components of working capital are non-GAAP measures or ratios that are not standardized financial measures under IFRS. For a description of the composition and usefulness of these non-GAAP measures and a reconciliation to cash provided by operating activities see "Reconciliation of Non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

| · | Odyssey mine at the Canadian Malartic complex – The planned mining rate of 3,500 tonnes per day ("tpd") at Odyssey South was reached earlier than anticipated and sustained through the fourth quarter of 2023. Ramp development has also exceeded target, reaching a depth of 715 metres as at December 31, 2023. The Company is evaluating the potential to accelerate initial production from East Gouldie to 2026 from 2027. Surface construction is progressing as planned, with approximately 65% completed at year-end, and shaft sinking activities continued to ramp up through the quarter. Infill and expansion drilling in 2023 resulted in the declaration of an initial mineral reserve in the central portion of the East Gouldie deposit of 5.17 million ounces of gold (47.0 million tonnes grading 3.42 g/t gold) and the extension of the East Gouldie mineral resource laterally by 870 metres |

| · | Detour Lake – The mill delivered a strong performance in the fourth quarter of 2023, operating at a throughput rate of 71,826 tpd (equivalent to an annualized rate of approximately 26.2 million tonnes per annum ("Mtpa"). With sustained improvements year-over-year, the Company now expects the mill to reach a throughput rate of approximately 76,700 tpd (equivalent to an annualized rate of approximately 28 Mtpa) late in the second half of 2024, previously expected in 2025. At year-end 2023, the Company reported an initial underground inferred mineral resource below and to the west of the existing pit, totaling 1.56 million ounces of gold (21.8 million tonnes grading 2.23 g/t gold) and continues to evaluate the potential for underground mining. Exploration in 2024 is expected to continue to test the west plunge extension of the main deposit. An exploration ramp is also being considered to facilitate drilling that would increase confidence in the continuity of the inferred mineral resource and, potentially, to collect a bulk sample. The Company expects to provide an update on mill optimization efforts, the Detour underground project and ongoing exploration results in the first half of 2024 |

| · | Abitibi region of Quebec and Ontario – Macassa's NSUR and AK deposits have now been incorporated in the Company's production guidance. At Upper Beaver, the Company is conducting a trade-off analysis comparing transporting and processing ore at the LaRonde mill to a standalone central mill for Upper Beaver and satellite deposits. An exploration ramp and shaft are being considered at Upper Beaver in order to upgrade and further explore the deeper portions of the deposit. At Wasamac, the Company is assessing hauling alternatives and the optimal mining rate for transporting and processing ore at the Canadian Malartic mill. The Company expects to complete internal technical evaluations for Upper Beaver and Wasamac in the first half of 2024 |

| · | Amaruq mine at the Meadowbank complex – The Company extended Amaruq's mine life to 2028 (previous mine life was to 2026), adding approximately 500,000 ounces of gold to the expected mining profile, as a result of continuous improvement and cost optimization efforts, positive infill drilling and positive reconciliation to the geological model |

| · | Hope Bay – At the Madrid deposit, the target area in the gap between the Suluk and Patch 7 zones delivered strong drill results in the quarter, including 16.3 g/t gold over 28.6 metres at 385 metres depth and 12.7 g/t gold over 4.6 metres at 677 metres depth. Results confirm the potential to expand gold mineralization in the Madrid deposit at depth and along strike to the south. Based on recent exploration success, the Company is evaluating a larger potential production scenario for Hope Bay. The Company expects to report results from this internal technical evaluation in 2025 |

| · | A quarterly dividend of $0.40 per share has been declared |

Fourth Quarter and Full Year 2023 Results Conference Call and Webcast Tomorrow

Agnico Eagle's senior management will host a conference call on Friday, February 16, 2024 at 11:00 AM (E.S.T.) to discuss the Company's fourth quarter and full year 2023 financial and operating results.

Via Webcast:

A live audio webcast of the conference call will be available on the Company's website www.agnicoeagle.com.

Via URL Entry:

To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3vf5XBm to receive an instant automated call back.

You can also dial direct to be entered to the call by an Operator (see "Via Telephone" details below).

Via Telephone:

For those preferring to listen by telephone, please dial 416-764-8659 or toll-free 1-888-664-6392. To ensure your participation, please call approximately five minutes prior to the scheduled start of the call.

Replay Archive:

Please dial 416-764-8677 or toll-free 1-888-390-0541, access code 178426#. The conference call replay will expire on March 16, 2024.

The webcast, along with presentation slides, will be archived for 180 days on the Company's website.

Fourth Quarter 2023 Production and Cost Results

Production and Cost Results Summary*

| Three Months Ended | Year Ended | |||||||||||||||

| Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | |||||||||||||

| Gold production (ounces) | 903,208 | 799,438 | 3,439,654 | 3,135,007 | ||||||||||||

| Gold sales (ounces) | 874,629 | 788,902 | 3,364,132 | 3,148,593 | ||||||||||||

| Production costs per ounce | $ | 861 | $ | 834 | $ | 853 | $ | 843 | ||||||||

| Total cash costs per ounce | $ | 888 | $ | 863 | $ | 865 | $ | 793 | ||||||||

| AISC per ounce | $ | 1,227 | $ | 1,231 | $ | 1,179 | $ | 1,109 | ||||||||

* Production and Cost Results Summary reflect: (i) Agnico Eagle's 50% interest in the Canadian Malartic complex up to and including March 30, 2023 and 100% thereafter; and (ii) Agnico Eagle's acquisition of the Detour Lake, Macassa and Fosterville mines on February 8, 2022.

Gold Production

| · | Fourth Quarter of 2023 – Gold production increased when compared to the prior year primarily due to additional production from the acquisition of the remaining 50% of the Canadian Malartic complex following the closing of the transaction with Yamana Gold Inc. (the "Yamana Transaction") and higher production from the Macassa and Kittila mines, partially offset by lower production at the Fosterville mine |

| · | Full Year 2023 – Gold production increased when compared to the prior year as a result of the additional production from the acquisition of the remaining 50% of the Canadian Malartic complex, a full year of contribution in 2023 from the Detour Lake, Macassa and Fosterville mines (as compared to 326 days during the year-ended 2022 following the closing of the merger (the "Merger") with Kirkland Lake Gold Ltd. on February 8, 2022) and increased production from the Meadowbank complex, partially offset by lower production at the Fosterville mine and LaRonde complex |

Production Costs per Ounce

| · | Fourth Quarter of 2023 and Full Year 2023 – Production costs per ounce increased when compared to the prior-year period primarily due to higher production costs at most mine sites resulting from inflation, particularly at the Meliadine mine, where there was also higher consumption of ore stockpiles combined with lower gold production, and at the Canadian Malartic complex, where there were higher open pit mining costs combined with lower gold production |

Total Cash Costs per Ounce

| · | Fourth Quarter of 2023 and Full Year 2023 – Total cash costs per ounce increased when compared to the prior-year period primarily due to higher operating costs at most mine sites resulting from inflation and higher royalties arising from higher gold prices and the acquisition of the remaining 50% of the Canadian Malartic complex, partially offset by higher production |

AISC per Ounce

| · | Fourth Quarter of 2023 – AISC per ounce decreased when compared to the prior-year period due to higher production during the period and lower sustaining capital expenditures during the period, partially offset by higher total cash costs per ounce |

| · | Full Year 2023 – AISC per ounce increased when compared to the prior year due to the same reasons affecting the higher total cash costs per ounce in the period and higher sustaining capital expenditures, partially offset by higher production during the period |

Fourth Quarter 2023 Financial Results

Financial Results Summary

| Three Months Ended | Year Ended | |||||||||||||||

| Dec 31, 2023 | Dec 31, 2022** | Dec 31, 2023 | Dec 31, 2022 | |||||||||||||

| Realized gold price ($/ounce)6 | $ | 1,982 | $ | 1,728 | $ | 1,946 | $ | 1,797 | ||||||||

| Net (loss) income ($ millions) | $ | (381.0 | ) | $ | 194.1 | $ | 1,941.3 | $ | 670.2 | |||||||

| Adjusted net income ($ millions) | $ | 282.3 | $ | 174.5 | $ | 1,095.9 | $ | 1,003.6 | ||||||||

| EBITDA ($ millions)7 | $ | 102.6 | $ | 568.6 | $ | 3,980.9 | $ | 2,293.0 | ||||||||

| Adjusted EBITDA ($ millions)7 | $ | 842.5 | $ | 580.6 | $ | 3,236.5 | $ | 2,706.1 | ||||||||

| Cash provided by operating activities ($ millions) | $ | 727.9 | $ | 380.5 | $ | 2,601.6 | $ | 2,096.6 | ||||||||

| Cash provided by operating activities before working capital adjustments ($ millions) | $ | 777.5 | $ | 485.5 | $ | 2,748.0 | $ | 2,115.9 | ||||||||

| Capital expenditures* | $ | 436.7 | $ | 457.2 | $ | 1,600.9 | $ | 1,536.9 | ||||||||

| Free cash flow ($ millions) | $ | 302.1 | $ | (20.3 | ) | $ | 947.4 | $ | 558.4 | |||||||

| Free cash flow before changes in non-cash components of working capital ($ millions) | $ | 351.7 | $ | 84.7 | $ | 1,093.8 | $ | 577.6 | ||||||||

| Net (loss) income per share (basic) | $ | (0.77 | ) | $ | 0.43 | $ | 3.97 | $ | 1.53 | |||||||

| Adjusted net income per share (basic) | $ | 0.57 | $ | 0.38 | $ | 2.24 | $ | 2.29 | ||||||||

| Cash provided by operating activities per share (basic) | $ | 1.47 | $ | 0.84 | $ | 5.32 | $ | 4.79 | ||||||||

| Cash provided by operating activities before working capital adjustments per share (basic) | $ | 1.57 | $ | 1.07 | $ | 5.62 | $ | 4.83 | ||||||||

| Free cash flow per share (basic) | $ | 0.61 | $ | (0.04 | ) | $ | 1.94 | $ | 1.28 | |||||||

| Free cash flow before working capital adjustments per share (basic) | $ | 0.71 | $ | 0.19 | $ | 2.24 | $ | 1.32 | ||||||||

*Includes capitalized exploration

** Certain previously reported line items have been restated to reflect the final purchase price allocation of the Merger.

Net Income

| · | Fourth Quarter of 2023 |

| ◦ | Net loss was $381.0 million ($0.77 per share). This result includes the following items (net of tax): impairment losses of $667.4 million ($1.35 per share), derivative gains on financial instruments of $50.7 million ($0.10 per share), non-recurring tax adjustment and change in tax rate and foreign currency translation losses on deferred tax liabilities of $26.4 million ($0.05 per share), net asset disposals losses of $16.2 million ($0.03 per share) and foreign exchange and other losses of $4.0 million ($0.01 per share) |

| ◦ | Excluding the above items results in adjusted net income of $282.3 million or $0.57 per share for the fourth quarter of 2023 |

| ◦ | Included in the fourth quarter of 2023 net loss, and not adjusted above, is a non-cash stock option expense of $2.4 million ($0.01 per share) |

6 Realized gold price is calculated as gold revenues from mining operations divided by the volume of gold ounces sold.

7 "EBITDA" means earnings before interest, taxes, depreciation, and amortization. EBITDA and adjusted EBITDA are non-GAAP measures or ratios that are not standardized financial measures under IFRS. For a description of the composition and usefulness of these non-GAAP measures and a reconciliation to net income see "Reconciliation of Non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

| ◦ | Net loss of $381.0 million in the fourth quarter of 2023 compared to net income of $194.1 million in the prior-year period primarily due to impairment losses and higher amortization related to the acquisition of the remaining 50% of the Canadian Malartic complex, partially offset by stronger mine operating margins8 from higher realized gold prices and higher sales volumes resulting from the acquisition of the remaining 50% of the Canadian Malartic complex, and lower exploration and corporate development costs |

| · | Full Year 2023 – Net income increased compared to the prior year primarily due to a remeasurement gain at the Canadian Malartic complex resulting from the application of purchase accounting relating to a business combination attained in stages, which requires the remeasurement of the Company's previously held 50% interest in the Canadian Malartic complex to fair value, higher realized gold prices and higher sales volumes, partially offset by impairment losses and higher amortization |

Impairments

In the fourth quarter of 2023, an impairment loss (net of tax) of $667 million was incurred in connection with the impairment review performed in accordance with the requirements of International Financial Reporting Standards ("IFRS"), of which $594 million related to the Macassa mine and $73 million related to the Pinos Altos mine. Since acquiring the Macassa mine as a result of the Merger, the Company has taken steps to improve the operational performance of the mine. The Macassa mine realized better operating performance and productivity in 2023 as compared to the pre-Merger period, driven in part, by the completion of the #4 Shaft project that increased the ore hoisting capacity to approximately 4,000 tpd and improvements to the ventilation in the deeper portion of the mine. Despite these improvements, an impairment loss (net of tax) of $594 million was realized in the quarter, with $421 million of the loss relating to goodwill and $173 million relating to non-current assets of the Macassa mine.

Goodwill relating to the Macassa mine was recognized at the date of the Merger as part of the purchase price allocation. Goodwill is not an amortizable asset under IFRS and as such, once recognized is susceptible to future impairment. Continued work on the mineral resource model has resulted in more ore tonnes but at lower grades which, coupled with inflationary pressures on costs and capital expenditures, resulted in a fair value that was lower than Macassa's carrying value as at December 31, 2023. The Macassa mine has produced over 6 million ounces of gold since 1933, and the Company continues to see geological potential at Macassa as demonstrated by the mineral reserves replacement of 171% of its mining depletion in 2023 and encouraging drill results on the property. In addition, the mineralized structures along strike and at depth of the South Mine complex and Main Break are prospective for ongoing expansion of the mineral resource base at the site. Overall, the Company believes that the Macassa mine has the potential to maintain production in excess of 300,000 ounces of gold per year based on expected exploration results.

The Pinos Altos mine has been in operation since 2009 and is approaching the end of its mine life. An impairment loss (net of tax) of $73 million was realized in the quarter due to inflationary pressures on costs and the additional ground support required at the underground mine, and the strengthening of the Mexican peso relative to the U.S. dollar. Exploration is ongoing with the goal of discovering and expanding other satellite zones near the Pinos Altos mine.

Adjusted EBITDA

| · | Fourth Quarter of 2023 – Adjusted EBITDA increased when compared to the prior-year period primarily due to stronger mine operating margins from higher realized gold prices and higher sales volumes resulting from the acquisition of the remaining 50% of the Canadian Malartic complex and lower exploration and corporate development costs |

8 Operating margin is a non-GAAP measure that is not a standardized measure under IFRS. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation to net income see "Summary of Operations Key Performance Indicators" and "Note Regarding Certain Measures of Performance", respectively, below.

| · | Full Year 2023 – Adjusted EBITDA increased when compared to the prior year primarily due to the reasons set out above, and as a result of a full year of contribution in 2023 from the Detour Lake, Macassa and Fosterville mines (as compared to 326 days during the year-ended 2022 following the closing of the Merger) |

Cash Provided by Operating Activities

| · | Fourth Quarter of 2023 – Cash provided by operating activities and cash provided by operating activities before working capital adjustments increased when compared to the prior-year period primarily due to higher revenues from higher sales volumes from the acquisition of the remaining 50% of the Canadian Malartic complex and higher realized gold prices, partially offset by higher production costs |

| · | Full Year 2023 – Cash provided by operating activities and cash provided by operating activities before working capital adjustments increased when compared to the prior year primarily due to higher revenues from the acquisition of the remaining 50% of the Canadian Malartic complex, higher sales volumes from a full year of contribution in 2023 from the Detour Lake, Macassa and Fosterville mines (as compared to 326 days during the year-ended December 31, 2022 following the closing of the Merger) and from higher realized gold prices |

Free Cash Flow Before Changes in Non-Cash Components of Working Capital

| · | Fourth Quarter of 2023 and Full Year 2023 – Free cash flow before changes in non-cash components of working capital was a record and increased when compared to the prior-year period due to the reasons described above relating to cash provided by operating activities, partially offset by higher additions to property, plant and mine development |

Capital Expenditures

The following table sets out a summary of capital expenditures (including sustaining capital expenditures9 and development capital expenditures9) and capitalized exploration in the fourth quarter of 2023 and the full year 2023.

| Summary of Capital Expenditures | ||||||||||||||||

| (In thousands of U.S. dollars) | ||||||||||||||||

| Capital Expenditures* | Capitalized Exploration | |||||||||||||||

| Three Months Ended | Year Ended | Three Months Ended | Year Ended | |||||||||||||

| Dec 31, 2023 | Dec 31, 2023 | Dec 31, 2023 | Dec 31, 2023 | |||||||||||||

| Sustaining Capital Expenditures | ||||||||||||||||

| LaRonde complex | 24,829 | 81,043 | 429 | 2,038 | ||||||||||||

| Canadian Malartic complex** | 18,809 | 91,028 | — | — | ||||||||||||

| Goldex mine | 11,530 | 25,908 | 737 | 1,295 | ||||||||||||

| Detour Lake mine | 67,123 | 249,765 | — | — | ||||||||||||

| Macassa mine | 15,334 | 43,333 | 554 | 1,696 | ||||||||||||

| Meliadine mine | 19,034 | 67,947 | 2,210 | 7,328 | ||||||||||||

| Meadowbank complex | 21,297 | 121,653 | — | — | ||||||||||||

| Hope Bay project | — | 147 | — | — | ||||||||||||

| Fosterville mine | 8,978 | 33,751 | 344 | 895 | ||||||||||||

| Kittila mine | 15,789 | 47,355 | 725 | 2,184 | ||||||||||||

| Pinos Altos mine | 6,612 | 28,449 | 429 | 1,692 | ||||||||||||

| La India mine | — | 100 | (6 | ) | — | |||||||||||

| Total Sustaining Capital Expenditures | 209,335 | $ | 790,479 | $ | 5,422 | $ | 17,128 | |||||||||

| Development Capital Expenditures | ||||||||||||||||

| LaRonde complex | 17,637 | 68,930 | — | — | ||||||||||||

| Canadian Malartic complex** | 47,607 | 160,513 | 2,902 | 9,447 | ||||||||||||

| Goldex mine | 2,808 | 22,032 | 42 | 2,459 | ||||||||||||

| Akasaba West project | 7,880 | 34,945 | — | — | ||||||||||||

| Detour Lake mine | 59,100 | 140,388 | 7,571 | 32,515 | ||||||||||||

| Macassa mine | 21,322 | 75,125 | 4,798 | 26,105 | ||||||||||||

| Meliadine mine | 22,571 | 106,953 | 3,419 | 11,927 | ||||||||||||

| Meadowbank complex | (277 | ) | 80 | — | — | |||||||||||

| Hope Bay project | 128 | 4,426 | — | — | ||||||||||||

| Fosterville mine | 11,873 | 33,575 | 4,718 | 19,218 | ||||||||||||

| Kittila mine | 3,026 | 26,410 | 2,151 | 5,053 | ||||||||||||

| Pinos Altos mine | 213 | 4,196 | (848 | ) | 1,101 | |||||||||||

| Other | 2,423 | 7,023 | 840 | 840 | ||||||||||||

| Total Development Capital Expenditures | $ | 196,311 | $ | 684,596 | $ | 25,593 | $ | 108,665 | ||||||||

| Total Capital Expenditures | $ | 405,646 | $ | 1,475,075 | $ | 31,015 | $ | 125,793 |

* Excludes capitalized exploration

**The information set out in this table reflects the Company's 50% interest in the Canadian Malartic complex up to and including March 30, 2023 and 100% interest thereafter.

9 Sustaining capital expenditures and development capital expenditures are non-GAAP measures that are not standardized financial measures under IFRS. For a discussion of the composition and usefulness of these non-GAAP measures and a reconciliation to additions to property, plant and mine development per the consolidated statements of cash flows, see "Reconciliation of Non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

Investment Grade Balance Sheet Remains Strong

As at December 31, 2023, the Company's long-term debt was $1,843.1 million, a decrease of $99.5 million when compared to the prior quarter, reflecting a repayment of the Company's unsecured revolving bank credit facility. As at December 31, 2023, no amounts were outstanding under the Credit Facility.

Cash and cash equivalents decreased slightly when compared to the prior quarter primarily due to higher cash used in financing activities related to the repayment of the Company's unsecured revolving bank credit facility.

The following table sets out the calculation of net debt10, which decreased by $82.6 million when compared to the prior quarter.

| Net Debt Summary | ||||||||

| (in millions of U.S. dollars) | ||||||||

| As at | As at | |||||||

| Dec 31, 2023 | Sep 30, 2023 | |||||||

| Current portion of long-term debt | $ | 100.0 | $ | 100.0 | ||||

| Non-current portion of long-term debt | 1,743.1 | 1,842.6 | ||||||

| Long-term debt | $ | 1,843.1 | $ | 1,942.6 | ||||

| Less: cash and cash equivalents | (338.6 | ) | (355.5 | ) | ||||

| Net debt | $ | 1,504.5 | $ | 1,587.1 | ||||

In addition to the quarterly dividend, the Company believes that its normal course issuer bid ("NCIB") provides a flexible tool as part the Company's overall capital allocation program and objectives and generates value for shareholders. In the fourth quarter of 2023, no purchases were made under the NCIB. In the full year 2023, the Company repurchased 100,000 common shares for an aggregate of $4.8 million under the NCIB. The NCIB permits the Company to purchase up to $500.0 million of its common shares subject to a maximum of 5% of its issued and outstanding common shares. Purchases under the NCIB may continue for up to one year from the commencement day on May 4, 2023.

Credit Facility

As at December 31, 2023, available liquidity under the Company's unsecured revolving bank credit facility was approximately $1.2 billion, not including the uncommitted $600.0 million accordion feature.

On February 12, 2024, the Company replaced its $1.2 billion unsecured revolving bank credit facility with a new $2.0 billion unsecured revolving bank credit facility, including an increased uncommitted accordion feature of $1 billion, and having a maturity date of February 12, 2029. In addition to the increased size and extended term of the new unsecured revolving bank credit facility, the new credit facility includes enhancements to its terms and conditions that reinforces the Company's credit profile and improves its financial flexibility while strengthening its financial position. At the same time, the Company’s $600.0 million term loan was amended to reflect the same enhancements to the terms and conditions as are in the new unsecured revolving credit facility. The investment grade credit ratings issued by Moody's of Baa2 with a Positive Outlook and Fitch Ratings at BBB+ with a Stable Outlook reflect the Company's strong business and credit profile, while maintaining low leverage and conservative financial policies and recognizing the benefits of the Company's size and scale and operations in favourable mining jurisdictions. The Company remains committed to maintaining strong financial health and an investment grade balance sheet.

10 Net debt is a non-GAAP measure that is not a standardized financial measure under IFRS. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation to long-term debt, see "Reconciliation of non-GAAP Financial Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

Hedges

The Company continues to benefit from a stronger U.S. dollar against the currencies in the jurisdictions in which it operates, the Canadian dollar, Euro, Australian dollar and Mexican peso. Approximately 67% of the Company's estimated Canadian dollar exposure for 2024 is hedged at an average floor price above 1.34 C$/US$. Approximately 24% of the Company's estimated Euro exposure for 2024 is hedged at an average floor price of approximately 1.09 US$/EUR. Approximately 63% of the Company's estimated Australian dollar exposure for 2024 is hedged at an average floor price of approximately 1.47 A$/US$. The Company's full year 2024 cost guidance is based on assumed exchange rates of 1.34 C$/US$, 1.10 US$/EUR, 1.45 A$/US$ and 16.50 MXP/US$.

Including the diesel purchased for the Company's Nunavut operations that was delivered in the 2023 sealift, approximately 50% of the Company's diesel exposure for 2024 is hedged at an average benchmark price of $0.72 per litre (excluding transportation and taxes), which is expected to reduce the Company's exposure to diesel price volatility in 2024. The Company's full year 2024 cost guidance is based on an assumed diesel benchmark price of $0.80 per litre (excluding transportation and taxes).

The Company will continue to monitor market conditions and anticipates continuing to opportunistically add to its operating currency and diesel hedges to strategically support its key input costs. Current hedging positions are not factored into 2024 and future guidance.

Dividend Record and Payment Dates for the First Quarter of 2024

Agnico Eagle's Board of Directors has declared a quarterly cash dividend of $0.40 per common share, payable on March 15, 2024 to shareholders of record as of March 1, 2024. Agnico Eagle has declared a cash dividend every year since 1983.

Expected Dividend Record and Payment Dates for the 2024 Fiscal Year

| Record Date | Payment Date |

| March 1, 2024* | March 15, 2024* |

| May 31, 2024 | June 14, 2024 |

| August 30, 2024 | September 16, 2024 |

| November 29, 2024 | December 16, 2024 |

*Declared

Dividend Reinvestment Plan

See the following link for information on the Company's dividend reinvestment plan: Dividend Reinvestment Plan

International Dividend Currency Exchange

For information on the Company's international dividend currency exchange program, please contact Computershare Trust Company of Canada by phone at 1-800-564-6253 or online at www.investorcentre.com or www.computershare.com/investor.

Environment, Social and Governance Highlights

Record quarterly and annual safety performance

| · | The Company is committed to maintaining consistently high health and safety standards. In 2020, the Company launched the "Towards Zero Accidents initiative" to reduce workplace injuries and reach its goal of zero accidents. This program has helped the Company to improve its safety performance year over year and to register in 2023 its best quarterly and annual safety performance in its 66-year history, with a Global Injury Frequency11 (employees and contractors) at 1.8 and 2.15, respectively. This represents a 35% improvement to the Company's 2022 safety performance |

Community Relations, Governance and People

| · | Reconciliation Action Plan with Indigenous Peoples – The Company expects to publish its first Reconciliation Action Plan and begin implementation in the second half of 2024. This plan aims at responding to, among other things, the United Nations Declaration on the Rights of Indigenous People, builds upon the Company's various Indigenous programs and initiatives, and weaves these activities into a comprehensive strategy. Significant progress was made in 2023 on developing the Reconciliation Action Plan, with more than 200 employees, stakeholders and rights holders being consulted during the year. In addition, employees at the Company's Canadian operations completed over 3,200 hours of cultural awareness training and engaged in over 135 activities aimed at raising awareness of Indigenous Peoples' history and culture |

| · | Employee Engagement – The Company continued to see year-over-year increases in employee satisfaction and solicited their input via the Great Place to Work Survey. The Company believes employee satisfaction and engagement are key drivers of its high employee retention rate across the regions where it operates |

| · | Forbes' Canada's Best Employers – Recognized this year on Forbes' list, which is an annual ranking based on employees and other professionals recommending the Company as a desirable employer |

| · | Dr. Leanne Baker program – 2023 marked the second year of the Dr. Leanne Baker Scholarship and Development Program to support women working for Agnico Eagle and facilitate their advancement into leadership positions. The first cohort of six women completed the program and the second cohort of eight women completed their first year of the two year program |

| · | Donations |

| ◦ | In the fourth quarter of 2023, the Company committed approximately C$5 million to a multiyear program supporting health and welfare in Nunavut through initiatives like food security and "on the land" traditional activities |

| ◦ | In the fourth quarter of 2023, the Company made a 10-year, C$3 million commitment to the Canadian Cancer Society to improve the lives of people affected by cancer living in rural and remote communities in Northern Ontario. The commitment will create the 'Canadian Cancer Society Agnico Eagle Cancer Access and Navigation Hub', which provides improved access for Northern Ontario Indigenous populations to receive culturally appropriate and relevant cancer resources and support |

Towards Sustainable Mining

| · | The Company's operating sites successfully completed their Towards Sustainable Mining internal audits. Implementation of the Towards Sustainable Mining program is progressing well at Detour Lake, Macassa and Fosterville |

11 Global Injury Frequency is based on per million hours worked

Meliadine Extension Permit

| · | The Company previously submitted an amendment to the existing project certificate for the Meliadine mine which included the extension of the Type A Water license (which expires in 2031), the addition of tailings, water and waste management infrastructure at the Pump, F-Zone, Wesmeg and Discovery deposits, a wind farm project and the potential extension of the mine life at Meliadine by 11 years beyond the current mine life (the "Extension Project") |

| · | In November 2023, the Nunavut Impact Review Board ("NIRB") provided a recommendation against the proposed amendment to the Meliadine mine's permit for the Extension Project. The Company was disappointed by the NIRB's recommendation and has withdrawn the amendment to the Meliadine mine's permit for the Extension Project. As most of the current life of mine components were already approved under the existing project certificate (approved in 2015) and in order to avoid further delays, in January 2024, the Company submitted a proposal to the Nunavut Water Board to amend the current Type A Water license to include tailings, water and waste management infrastructure at the Pump, F-Zone, Wesmeg and Discovery deposits |

| · | The Company has engaged in positive dialogue with the NIRB since the recommendation against the Extension Project. The Company will consider resubmitting a new proposal for the extension of the mine life at Meliadine in the future |

Gold Mineral Reserves Increase 10.5% to Record 53.8 Moz at Year-End 2023

At December 31, 2023, the Company's proven and probable mineral reserve estimate totalled 53.8 million ounces of gold (1,287 million tonnes grading 1.30 g/t gold). This represents a 10.5% (5.1 million ounce) increase in contained ounces of gold compared to the proven and probable mineral reserve estimate of 48.7 million ounces of gold (1,186 million tonnes grading 1.28 g/t gold) at year-end 2022 (see the Company's news release dated February 16, 2023 for details regarding the Company's December 31, 2022 proven and probable mineral reserve estimate).

The year-over-year increase in mineral reserves at December 31, 2023 is largely due to a substantial new mineral reserve addition of 5.2 million ounces of gold at the East Gouldie deposit at the Odyssey mine. The acquisition of the remaining 50% interest in the Canadian Malartic complex as part of the Yamana Transaction also contributed to adding 1.5 million ounces of gold in mineral reserves.

Mineral reserves were calculated using a gold price of $1,400 per ounce for all operating assets except the Detour Lake open pit for which a gold price of $1,300 per ounce was used, and using variable assumptions for the pipeline projects. (see "Assumptions used for the December 31, 2023 mineral reserve and mineral resource estimates reported by the Company" below for more details).

Gold Mineral Resources

At December 31, 2023, the Company's measured and indicated mineral resource estimate totalled 44.0 million ounces of gold (1,189 million tonnes grading 1.15 g/t gold). This represents a 0.6% (0.3 million ounce) decrease in contained ounces of gold compared to the measured and indicated mineral resource estimate at year-end 2022 (see the Company's news release dated February 16, 2023 for details regarding the Company's December 31, 2022 measured and indicated mineral resource estimate).

The year-over-year decrease in measured and indicated mineral resources is primarily due to the upgrade of mineral resources at East Gouldie to mineral reserves, largely offset by the successful conversion of inferred mineral resources into measured and indicated mineral resources and the acquisition of the remaining 50% interest in the Canadian Malartic complex and the Wasamac project as a result of the Yamana Transaction.

At December 31, 2023, the Company's inferred mineral resource estimate totalled 33.1 million ounces of gold (411 million tonnes grading 2.50 g/t gold). This represents a 26% (6.8 million ounce) increase in contained ounces of gold compared to the inferred mineral resource estimate a year earlier (see the Company's news release dated February 16, 2023 for details regarding the Company's December 31, 2022 inferred mineral resource estimate).

The year-over-year increase in inferred mineral resources is primarily due to the acquisition of the remaining 50% interest in the Canadian Malartic complex and the Wasamac project as part of the Yamana Transaction as well as an initial underground inferred mineral resource at Detour Lake.

For detailed mineral reserves and mineral resources data, including the economic parameters used to estimate the mineral reserves and mineral resources, see "Detailed Mineral Reserve and Mineral Resource Data (as at December 31, 2023)" and "Assumptions used for the December 31, 2023 mineral reserve and mineral resource estimates reported by the Company" below, as well as the Company's exploration news release dated February 15, 2024.

Update on Key Value Drivers and Pipeline Projects

Highlights on key value drivers (Odyssey project, Detour Lake mine and optimization of assets and infrastructure in the Abitibi region of Quebec), the Hope Bay project and the San Nicolás project are set out below. Details on certain mine expansion projects (Macassa new ventilation system, Meliadine Phase 2 expansion and Amaruq underground) are set out in the applicable operational sections of this news release.

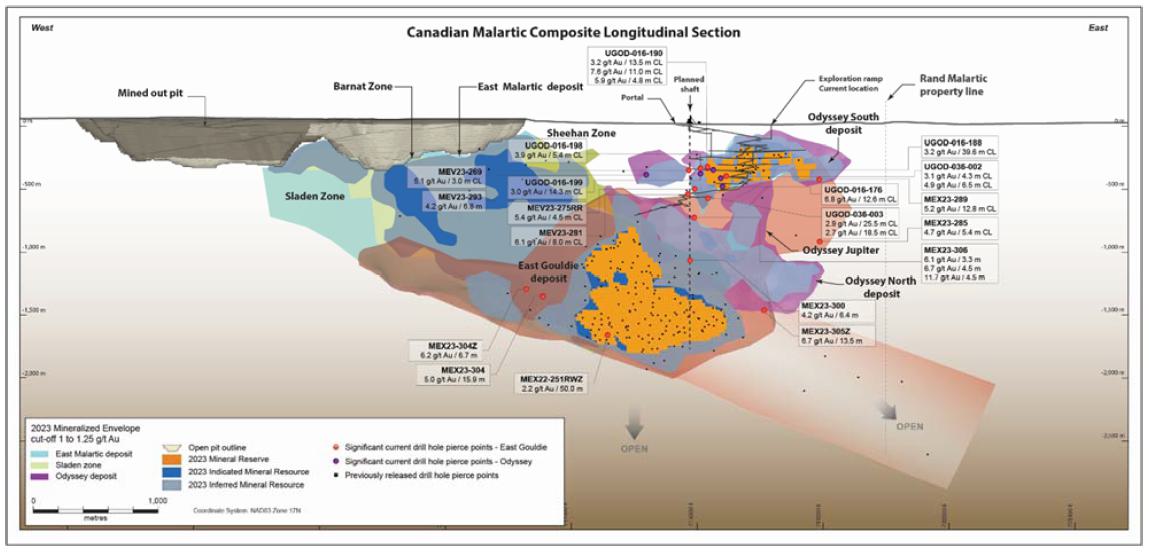

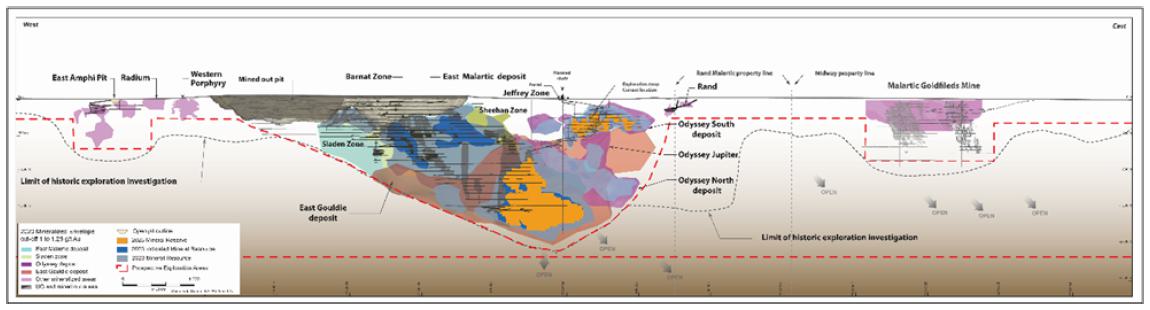

Odyssey Project

Successful infill drilling in 2023 at the Odyssey mine continued to improve the confidence in the mine plan and resulted in the declaration of initial mineral reserves of 5.2 million ounces of gold (47 million tonnes grading 3.42 g/t gold) in the central portion of the East Gouldie deposit as at December 31, 2023. The aggressive exploration program in 2023 also continued to demonstrate geological upside potential, with expansion drilling resulting in the extension of the East Gouldie inferred mineral resource laterally to the west by approximately 870 metres. Recent drilling results demonstrate that the corridor remains open to the east with high potential to categorize a large area as inferred mineral resources by year-end 2024. Highlight intercepts include 6.2 g/t gold over 6.7 metres at 1,300 metres depth to the west and 6.7 g/t gold over 13.5 metres at 1,470 metres depth to the east of the deposit. In 2024, the Company will continue to test the east and west extensions of the East Gouldie deposit, with the objective of potentially adding a new mining front. For further details on the exploration results at Odyssey, see the Company's exploration news release dated February 15, 2024.

At Odyssey South, the planned mining rate of 3,500 tpd was reached in October 2023 and sustained through the fourth quarter of 2023. Gold production from underground was approximately 20,000 ounces in the fourth quarter of 2023, which is the expected quarterly production rate for 2024 to 2026. Stope reconciliation at Odyssey South remains positive, largely from the contribution of the internal zones. At year-end 2023, an additional 150,000 ounces of gold included in the mineral reserve estimate are attributed to the Odyssey South deposit and internal zones as the understanding of these two mineralized areas improves with ongoing drilling and mine development. The Company continues to advance the delineation drilling to help improve the predictability and modeling of these zones.

Underground development was ahead of plan in the fourth quarter of 2023. A record 1,236 metres of development was achieved in October 2023, which is above with the target rate for 2024 of 1,200 metres per month. Scoops, jumbos and cable bolters are now consistently being operated remotely, which drives improvements in development cycle time and overall development productivity. In the first quarter of 2024, the Company expects to test remotely operated trucks and a battery operated scoop.

Advancing the main ramp remains the key development focus. The Company achieved a lateral development rate of 165 metres per month in 2023, exceeding the target rate of 140 metres per month. As at December 31, 2023, the ramp was at a depth of 715 metres and the Company now expects to reach the first level of the top of the East Gouldie deposit at a depth of 750 metres in the first quarter of 2024. As a result, the Company is evaluating the potential to accelerate initial production from East Gouldie to 2026.

Shaft sinking activities continued to ramp-up through the fourth quarter of 2023. Equipment reliability issues were resolved, with the sinking rate improving to 1.5 metres per day in December 2023 and expected to be approximately at the target of 2.0 metres per day in the first quarter of 2024. As at December 31, 2023, the shaft had reached a depth of approximately 233 metres. To help advance the shaft sinking, the Company has completed pre-sinking of the shaft from Levels 26 to 36 and is now advancing pre-sinking between Levels 54 to 64. The Company still expects to complete excavation of the shaft in 2027.

Surface construction progressed as planned and on budget in the fourth quarter of 2023 and approximately 65% of the project surface construction was completed as at December 31, 2023. The service hoist is expected to be operational to a temporary loading station at Level 102 (1,050 metres below surface) by 2025. The paste backfill plant operated above design capacity of 4,000 tpd in the fourth quarter of 2023 and the conceptual engineering for the second phase of the paste plant has been initiated. In the second phase, which is expected to be completed in 2027, the paste backfill plant will be expanded to a capacity of approximately 20,000 tpd.

In regional exploration during the fourth quarter of 2023, drilling targeted the adjacent Camflo property to the north and potential mineralization analogous to the Odyssey South and Odyssey North deposits on the Rand Malartic property to the east. The Company believes that a long-term exploration strategy of surface and underground drilling on the recently consolidated lands at the Canadian Malartic complex has the potential to lead to significant discoveries.

Detour Lake Mine

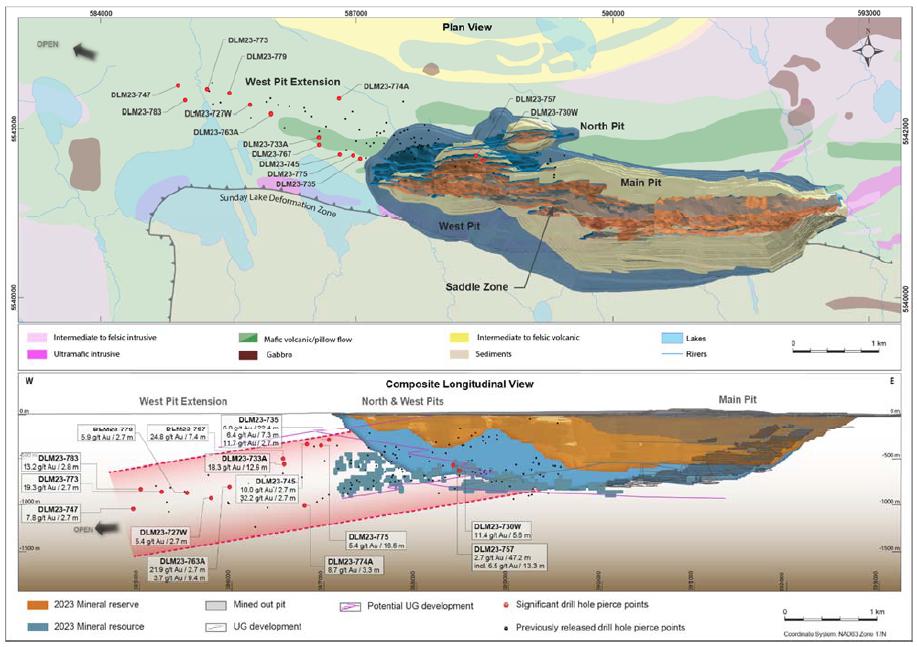

In the fourth quarter of 2023, the mill delivered its second best quarterly mill throughput, operating at a rate of 71,826 tpd (equivalent to an annualized rate of approximately 26.2 Mtpa), despite a lower than anticipated runtime of 90% related to an unplanned power outage and plugged cyclone feed pump lines. Several initiatives aimed at enhancing runtime and mill throughput are underway. These efforts include a comprehensive review of maintenance practices related to the higher throughput and the optimization of the crusher, SAG mill and ball mill circuits. With sustained improvements year-over-year, the Company now expects the mill to reach a throughput rate of approximately 76,700 tpd (equivalent to an annualized rate of approximately 28 Mtpa) in the second half of 2024, compared to 2025 previously. The Company also sees the potential to reach a mill throughput rate of 79,450 tpd (equivalent to an annualized rate of approximately 29 Mtpa) in 2026 through the implementation of advanced process control (expert systems) and further runtime improvements. An internal analysis to better define these opportunities is expected to be completed in 2024.

In 2023, the exploration program at Detour Lake successfully defined continuity of mineralization below and west of the mineral reserves pit. This resulted in the addition of 1.56 million ounces of gold (21.8 million tonnes grading 2.23 g/t gold) in inferred mineral resources outside the mineral resource pit. Work is ongoing to determine the optimal transition point from open pit to underground mining. This transition point will help determine the mineral resources currently included in the resource pit that could instead be mined from underground. The resulting larger mineable underground mineral resource is expected to form the basis for an underground project at Detour Lake.

The preliminary underground mine concept under evaluation adopts many of the design criteria and parameters of the Company's existing operating mines in the region. The Company is currently evaluating a number of bulk mining scenarios. Mine development and production is envisioned to be done via ramp. Haulage of ore and waste by conveyor is a potential approach given the orebody plunging to the West. The mine could also utilize a combination of conventional and automated production equipment, similar to the equipment currently employed at the Company's Odyssey mine.

In 2024, exploration will continue to test and extend the west plunge of the main deposit. The Company is considering building an exploration ramp to increase confidence in the mineralization's continuity in the inferred resource envelope and to potentially collect a bulk sample. The Company expects to provide an update on mill optimization efforts, the Detour underground project and ongoing exploration results in the first half of 2024.

Optimization of Other Assets and Infrastructure in the Abitibi Region

At Macassa, mining of the NSUR and AK deposits through existing infrastructure was one of the first strategic optimization opportunities identified at the time of the Merger. At year-end 2023, the NSUR and AK deposits contributed approximately 23,000 ounces of gold in mineral reserves (0.12 million tonnes grading 5.93 g/t gold) and approximately 160,000 ounces of gold in mineral reserves (0.74 million tonnes grading 6.69 g/t gold) to the Macassa complex, respectively. Both deposits have now been incorporated into Macassa's production guidance for 2024 to 2026.

The NSUR and AK deposits are accessible from an existing surface ramp at Macassa (the "Portal"). A traditional truck and scoop tram approach has been selected for underground mucking and hauling, similar to the approach at LaRonde Zone 5 ("LZ5"). The deposits will be mined using long-hole open stoping and the stopes will be backfilled using cemented rockfill. At Macassa, the mill is expected to reach its nominal capacity of 1,650 tpd in mid-2024. The LZ5 processing facility at the LaRonde complex, approximately 130 kilometres away, can accommodate the processing of ore from the NSUR and AK deposits starting in the second half of 2024, thus avoiding capital expenditures that would otherwise be required for a mill expansion at Macassa. Production from the NSUR deposit is planned to be processed at the Macassa mill in the first half of 2024 and at the LZ5 processing facility in the second half of 2024. Production from the AK deposit, which is expected to begin in the second half of 2024 with the extraction of a 25,000 tonne bulk sample, is also planned to be processed at the LZ5 processing facility. Ore will be hauled by truck from the NSUR and AK deposits to the LZ5 processing facility. Production from these two deposits is forecast to be approximately 19,000 ounces of gold in 2024 and between 35,000 ounces to 50,000 ounces of gold from 2025 to 2028. The Company believes that the AK area remains prospective for future mineral resource growth.

At Upper Beaver, the Company continued to advance internal studies in the fourth quarter of 2023 to assess potential production opportunities, including comparison of transporting and processing ore at the LaRonde mill to a standalone central mill for Upper Beaver and satellite deposits. The Upper Beaver gold-copper deposit is expected to be mined by conventional underground methods, such as long hole open stoping with stopes to be backfilled with paste and waste rock. The Company is evaluating scenarios with a mining rate of approximately 5,000 tpd and production between 200,000 ounces and 230,000 ounces of gold per year and approximately 9 million to 10 million pounds of copper per year. Under these scenarios, initial production could potentially commence as early as 2030. The Company is also considering the construction of an exploration ramp and shaft in order to be used to upgrade mineral resources and further explore the deeper portions of the deposit. The exploration ramp and shaft would be considered permanent infrastructure and sized accordingly to accommodate the potential production phase in the event the project is approved for development.

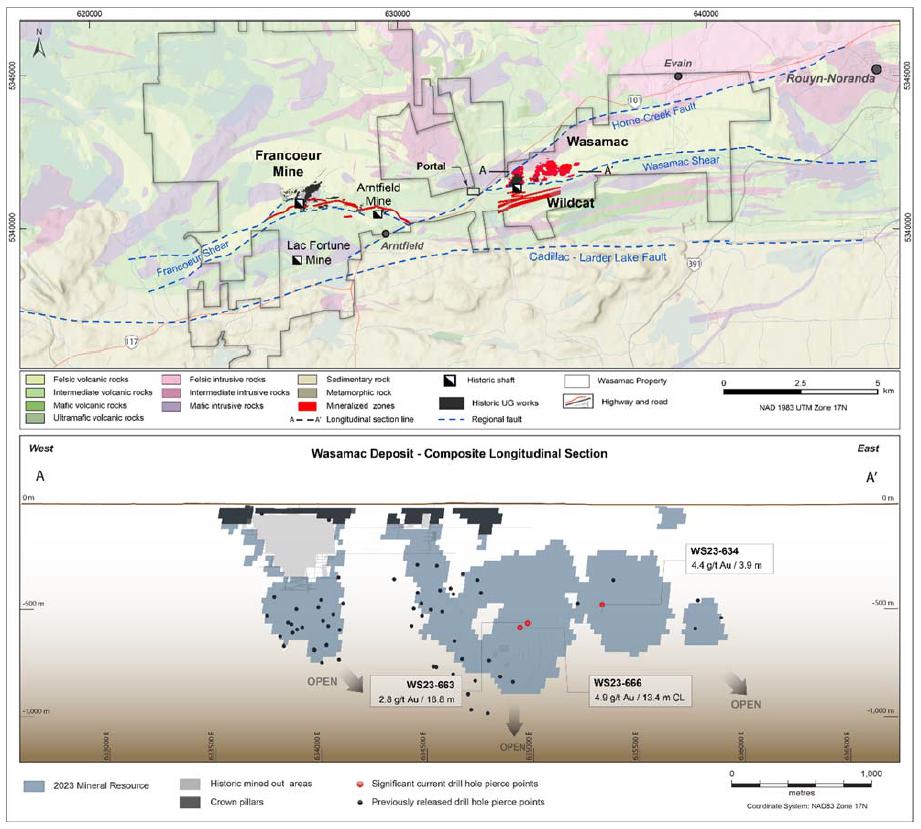

At Wasamac, the Company continues to assess various scenarios to define the optimal mining rate and milling strategy for the project. While these evaluations continue, the Company has decided to not include the historical mineral reserve estimate at Wasamac in the Company's mineral reserve estimate. Rather, the Company has classified the Wasamac project entirely as mineral resources. The measured and indicated mineral resource estimate at year-end 2023 for the Wasamac project totalled 2.2 million ounces of gold (27.8 million tonnes grading 2.43 g/t) and inferred mineral resources were 0.8 million ounces of gold (9.2 million tonnes grading 2.66 g/t). Exploration activities in 2024 will focus on testing the eastern extension of the Wasamac deposit in the Wasa shear zone and exploring for Wasamac-style mineralization at Francoeur.

Hope Bay – Step-Out Drilling Continues to Extend Madrid's High-Grade Patch 7 Zone at Depth and Laterally

At Hope Bay, exploration drilling in 2023 totalled more than 125,000 metres with work focused on the Madrid area and Doris gold deposits and resulted in an increase in inferred mineral resources to 2.11 million ounces (12.1 million tonnes grading 5.41 g/t) as at December 31, 2023 from 1.95 million ounces (11.0 million tonnes grading 5.49 g/t) as at December 31, 2022. Exploration drilling added approximately 336,000 ounces of inferred mineral resources mostly from Madrid's Patch 7 zone, which partially offset a reduction of 177,000 ounces of inferred mineral resources by project-wide conversion to indicated mineral resources and improvement of mining parameters.

At Madrid, the target area in the gap between the Suluk and Patch 7 zones delivered strong drill results with recent highlights of 16.3 g/t gold over 28.6 metres at 385 metres depth and 12.7 g/t gold over 4.6 metres at 677 metres depth. Results confirm the potential to expand gold mineralization in the Madrid deposit at depth and along strike to the south, which will be a key focus of the 2024 drilling program.

Recent exploration results are expected to support a larger production scenario at Hope Bay. The Company continues to advance the internal evaluation and anticipates reporting results from this internal evaluation in 2025.

San Nicolás Copper Project

In the fourth quarter of 2023, Minas de San Nicolás, which is jointly owned by the Company and Teck Resources Limited, continued to advance the San Nicolás project in Zacatecas State, Mexico, including with respect to stakeholder engagement on the permitting process. The partners also continued to advance the feasibility study, with the intention to initiate detailed engineering and further optimization work later in 2024, and plan to be complete in 2025. Project approval would be expected to follow, subject to receipt of permits and the results of the feasibility study. In January 2024, Minas de San Nicolás submitted its application for an Environmental Impact Assessment permit, which is an important milestone in advancing the development of the San Nicolás project.

2024 to 2026 Guidance Estimates Stable Gold Production; Unit Costs for 2024 Remain Industry Leading

The Company is announcing its detailed production and cost guidance for 2024 and mine by mine production forecasts for 2024 through 2026. The 2024 gold production guidance range remains unchanged from the Previous Guidance, while 2024 total cash costs per ounce and AISC per ounce guidance increased approximately 4% compared to the full year 2023 results, below the rate of inflation. The 2024 production and cost guidance is summarized below and a detailed description of the three-year guidance plan is set below.

| 2024 Guidance Summary | ||||||||||||

| (In millions other than per ounce measures or as otherwise stated) | ||||||||||||

| 2024 | 2024 | |||||||||||

| Range | Mid-Point | |||||||||||

| Gold Production (ounces) | 3,350,000 | 3,550,000 | 3,450,000 | |||||||||

| Total cash costs per ounce12 | $ | 875 | $ | 925 | $ | 900 | ||||||

| AISC per ounce12 | $ | 1,200 | $ | 1,250 | $ | 1,225 | ||||||

| Exploration and corporate development | $ | 220 | $ | 240 | $ | 230 | ||||||

| Depreciation and amortization expense | $ | 1,560 | $ | 1,610 | $ | 1,585 | ||||||

| General & administrative expense | $ | 175 | $ | 195 | $ | 185 | ||||||

| Other costs | $ | 75 | $ | 90 | $ | 83 | ||||||

| Tax rate (%) | 33 | % | 38 | % | 35 | % | ||||||

| Cash taxes | $ | 400 | $ | 500 | $ | 450 | ||||||

| Capital expenditures (excluding capitalized exploration) | $ | 1,600 | $ | 1,700 | $ | 1,650 | ||||||

| Capitalized exploration | $ | 105 | $ | 115 | $ | 110 | ||||||

Updated Three-Year Guidance Plan

Mine by mine production and cost guidance for 2024 and mine by mine gold production forecasts for 2025 and 2026 are set out in the table below. Opportunities to further optimize and improve gold production and unit cost forecasts from 2024 through 2026 continue to be evaluated.

| Estimated Payable Gold Production (ounces) | ||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | |||||||||||||||||||||||||

| Actual | Forecast Range | Forecast Range | Forecast Range | |||||||||||||||||||||||||

| LaRonde complex | 306,648 | 285,000 | 305,000 | 300,000 | 320,000 | 330,000 | 350,000 | |||||||||||||||||||||

| Canadian Malartic complex* | 603,955 | 615,000 | 645,000 | 600,000 | 630,000 | 545,000 | 575,000 | |||||||||||||||||||||

| Goldex | 140,983 | 125,000 | 135,000 | 125,000 | 135,000 | 125,000 | 135,000 | |||||||||||||||||||||

| Detour Lake | 677,446 | 675,000 | 705,000 | 710,000 | 740,000 | 745,000 | 775,000 | |||||||||||||||||||||

| Macassa | 228,535 | 265,000 | 285,000 | 320,000 | 340,000 | 330,000 | 350,000 | |||||||||||||||||||||

| Abitibi Gold Belt | 1,957,567 | 1,965,000 | 2,075,000 | 2,055,000 | 2,165,000 | 2,075,000 | 2,185,000 | |||||||||||||||||||||

| Meliadine | 364,141 | 360,000 | 380,000 | 375,000 | 395,000 | 400,000 | 420,000 | |||||||||||||||||||||

| Meadowbank complex | 431,666 | 480,000 | 500,000 | 485,000 | 505,000 | 440,000 | 460,000 | |||||||||||||||||||||

| Nunavut | 795,807 | 840,000 | 880,000 | 860,000 | 900,000 | 840,000 | 880,000 | |||||||||||||||||||||

| Fosterville | 277,694 | 200,000 | 220,000 | 140,000 | 160,000 | 140,000 | 160,000 | |||||||||||||||||||||

| Kittila | 234,402 | 220,000 | 240,000 | 220,000 | 240,000 | 230,000 | 250,000 | |||||||||||||||||||||

| Pinos Altos | 98,280 | 100,000 | 105,000 | 125,000 | 135,000 | 115,000 | 125,000 | |||||||||||||||||||||

| La India | 75,904 | 25,000 | 30,000 | — | — | — | — | |||||||||||||||||||||

| Total Gold Production | 3,439,654 | 3,350,000 | 3,550,000 | 3,400,000 | 3,600,000 | 3,400,000 | 3,600,000 | |||||||||||||||||||||

*2023 actual production reflects the Company's 50% interest in the Canadian Malartic complex up to and including March 30, 2023 and 100% interest thereafter.

12 The Company's guidance for total cash costs per ounce and AISC per ounce is forward-looking non-GAAP information. For a description of the composition and usefulness of this non-GAAP measure, see "Note Regarding Certain Measures of Performance" below.

Gold production for 2024 is forecast to be approximately 3.35 to 3.55 million ounces, unchanged from the Previous Guidance. Additional production from operating improvements at the LaRonde and Meadowbank complexes and the Kittila mine (operating at 2 Mtpa) are expected to be offset by revisions to the mine plans at Canadian Malartic, due to the deferral of the restart of pre-crushing low grade ore, and at Fosterville, due to lower gold grades in the remaining area of the Swan zone.

Gold production is forecast to remain stable through 2026 based on mid-point estimates when compared to 2023 gold production of 3.44 million ounces. Gold production is forecast to be approximately 3.40 to 3.60 million ounces of gold in in 2025 and 2026.

| Production Costs per Ounce |

Total Cash Costs per Ounce on a By- Product Basis of Gold Produced |

|||||||||||

| 2023 | 2023 | 2024* | ||||||||||

| ($ per ounce) | Actual | Actual | Forecast | |||||||||

| LaRonde complex | $ | 977 | $ | 911 | $ | 931 | ||||||

| Canadian Malartic complex | 771 | 824 | 926 | |||||||||

| Goldex | 795 | 820 | 871 | |||||||||

| Detour Lake | 669 | 735 | 734 | |||||||||

| Macassa | 678 | 731 | 856 | |||||||||

| Abitibi Gold Belt | 759 | 795 | 848 | |||||||||

| Meliadine | 944 | 980 | 960 | |||||||||

| Meadowbank complex | 1,214 | 1,176 | 1,029 | |||||||||

| Nunavut | 1,090 | 1,086 | 999 | |||||||||

| Fosterville | 473 | 488 | 698 | |||||||||

| Kittila | 878 | 871 | 954 | |||||||||

| Pinos Altos | 1,495 | 1,229 | 1,268 | |||||||||

| La India | 1,271 | 1,241 | 1,365 | |||||||||

| Weighted Average Total | $ | 853 | $ | 865 | $ | 900 | ||||||

*Forecast total cash costs per ounce are based on the mid-point of 2024 production guidance as set out in the table above.

Total cash costs per ounce in 2024 are expected to be between $875 and $925. The higher costs, when compared to the full year 2023 total cash costs per ounce of $865, are largely a result of higher labour, spare parts and maintenance costs. The Company expects stable unit costs through 2026, excluding inflation.

AISC per ounce in 2024 are expected to be between $1,200 and $1,250. The higher costs, when compared to the full year 2023 AISC per ounce of $1,179, are largely a result of higher total cash costs per ounce and higher sustaining capital expenditures. AISC per ounce are expected to remain stable through 2026, excluding inflation.

The Company remains focused on reducing costs through productivity improvements and innovation initiatives at all of its operations and the realization of operational synergies not currently factored into the cost guidance.

Currency and commodity price assumptions used for 2024 cost estimates and sensitivities are set out in the table below:

| Currency and commodity price assumptions used for 2024 cost estimates and sensitivities | ||||

| Commodity and currency price assumptions | ||||

| C$/US$ | 1.34 | |||

| US$/EUR | 1.10 | |||

| MXP/US$ | 16.50 | |||

| A$/US$ | 1.45 | |||

| Diesel ($/ltr) | $ | 0.80 | ||

| Silver ($/oz) | $ | 23.00 | ||

| Copper ($/lb) | $ | 3.80 | ||

| Zinc ($/lb) | $ | 1.10 | ||

| Approximate impact on total cash costs per ounce basis* | ||||

| 10% change in C$/US$ | $ | 50 | ||

| 10% change in US$/EUR | $ | 5 | ||

| 10% change in MXP/US$ | $ | 1 | ||

| 10% change in A$/US$ | $ | 3 | ||

| 10% change in diesel price | $ | 8 | ||

| 10% change in silver price | $ | 2 | ||

| 10% change in copper price | $ | 1 | ||

| 10% change in zinc price | $ | <1 | ||

*Excludes the impact of current hedging positions

Exploration and Corporate Development

Exploration and corporate development expenses in 2024 are expected to be between $220 million and $240 million, based on a mid-point forecast of $151.1 million for expensed exploration and $77.7 million in project studies and other expenses.

Depreciation Guidance

Depreciation and amortization expense in 2024 is expected to be between $1.56 and $1.61 billion.

General & Administrative Cost Guidance

General and administrative expenses in 2024 are expected to be between $135 and $145 million, excluding share-based compensation. Share based compensation expense in 2024 is expected to be between $40 and $50 million.

Other Cost Guidance

Additional other expenses in 2024 are expected to be approximately $75 to $90 million. This includes $60 to $65 million related to site maintenance costs primarily at Hope Bay and Northern Territory in Australia, $5 to $10 million related to the ore sorting project at Detour Lake and $10 to $15 million related to sustainable development activities.

Tax Guidance

For 2024, the Company expects its effective tax rates to be:

| · | Canada – 35% to 40% |

| · | Mexico – 35% to 40% |

| · | Australia – 30% |

| · | Finland – 20% |

The Company's overall effective tax rate is expected to be approximately 33% to 38% for the full year 2024.

The Company estimates potential consolidated cash taxes of approximately $400 million to $500 million in 2024 at prevailing gold prices. The expected cash taxes for 2024 have increased from prior years as the Company has utilized the majority of its Canadian corporate tax pools that are deductible at a rate of 100% as of year-end 2023.

Capital Expenditures Guidance

In 2024, estimated capital expenditures are expected to be between $1.6 billion and $1.7 billion and capitalized exploration expenditures are expected to be between $105 million and $115 million.

The estimated mid-point for capital expenditures (excluding capitalized exploration) for 2024 is approximately $1.65 billion, which includes approximately $916.0 million of sustaining capital expenditures at the Company's operating mines and approximately $737.0 million of development capital expenditures.

The Company's capital expenditure forecast for 2024 is higher than the full year 2023 capital expenditures of $1.48 billion (which included $790.5 million of sustaining capital expenditures and $684.6 million of development capital expenditures) and capitalized exploration of $125.8 million. The increase in capital expenditures when compared to 2023 is largely due to the increase in ownership of Canadian Malartic to 100% as of the second quarter of 2023 and increased capital expenditures at Detour Lake, primarily due to additional maintenance and mobile equipment purchases and mine infrastructure costs and inflation. While the 2024 capital expenditures includes the advancement of studies and preliminary work for regional pipeline projects, additional spending at these projects will depend on the approval and timing of these projects.

Estimated 2024 Capital Expenditures

(In thousands of US dollars)

| Capital Expenditures | Capitalized Exploration | |||||||||||||||||||

| Sustaining Capital |

Development Capital |

Sustaining | Non- Sustaining |

Total | ||||||||||||||||

| LaRonde complex | $ | 86,100 | $ | 68,200 | $ | 2,300 | $ | — | $ | 156,600 | ||||||||||

| Canadian Malartic complex | 135,900 | 167,500 | — | 7,100 | 310,500 | |||||||||||||||

| Goldex mine | 52,800 | 7,700 | 2,900 | — | 63,400 | |||||||||||||||

| Detour Lake mine | 274,800 | 201,100 | — | 20,300 | 496,200 | |||||||||||||||

| Macassa mine | 59,400 | 97,800 | 2,100 | 32,900 | 192,200 | |||||||||||||||

| Abitibi Gold Belt | 609,000 | 542,300 | 7,300 | 60,300 | 1,218,900 | |||||||||||||||

| Meliadine mine | 70,200 | 82,400 | 5,500 | 13,200 | 171,300 | |||||||||||||||

| Meadowbank complex | 94,000 | — | — | — | 94,000 | |||||||||||||||

| Nunavut | 164,200 | 82,400 | 5,500 | 13,200 | 265,300 | |||||||||||||||

| Fosterville mine | 35,800 | 41,100 | — | 11,000 | 87,900 | |||||||||||||||

| Kittila mine | 87,200 | 2,900 | 1,900 | 5,400 | 97,400 | |||||||||||||||

| Pinos Altos mine | 19,800 | 15,400 | 1,800 | 500 | 37,500 | |||||||||||||||

| San Nicolas project | — | 17,000 | — | — | 17,000 | |||||||||||||||

| Other | — | 35,900 | — | 1,700 | 37,600 | |||||||||||||||

| Total Capital Expenditures | $ | 916,000 | $ | 737,000 | $ | 16,500 | $ | 92,100 | $ | 1,761,600 | ||||||||||

The Company is working towards maintaining capital expenditures at similar levels (excluding inflation) through 2026.

Updated Three Year Operational Guidance Plan

Since the Previous Guidance, there have been several operating developments resulting in changes to the updated three-year production profile. Descriptions of these changes as well as initial 2026 guidance are set out below.

ABITIBI REGION, QUEBEC

| LaRonde Complex Forecast | 2023 | 2024 | 2025 | 2026 | ||||||||||||||||

| Previous Guidance (mid-point) (oz) | 275,000 | 280,000 | 310,000 | n.a. | ||||||||||||||||

| Current Guidance (mid-point) (oz) | 306,648 (actual) | 295,000 | 310,000 | 340,000 | ||||||||||||||||

| LaRonde Complex Forecast 2024 | Ore Milled ('000 tonnes) |

Gold (g/t) | Gold Mill Recovery (%) |

Silver (g/t) | Silver Mill Recovery (%) |

|||||||||||||||

| 2,686 | 3.62 | 94.4 | % | 10.01 | 72.6 | % | ||||||||||||||

| Production and Minesite Costs per Tonne13 |

Zinc (%) | Zinc Mill Recovery (%) |

Copper (%) | Copper Mill Recovery (%) |

||||||||||||||||

| C$ | 154.20 | 0.46 | % | 71.0 | % | 0.12 | % | 83.1 | % | |||||||||||

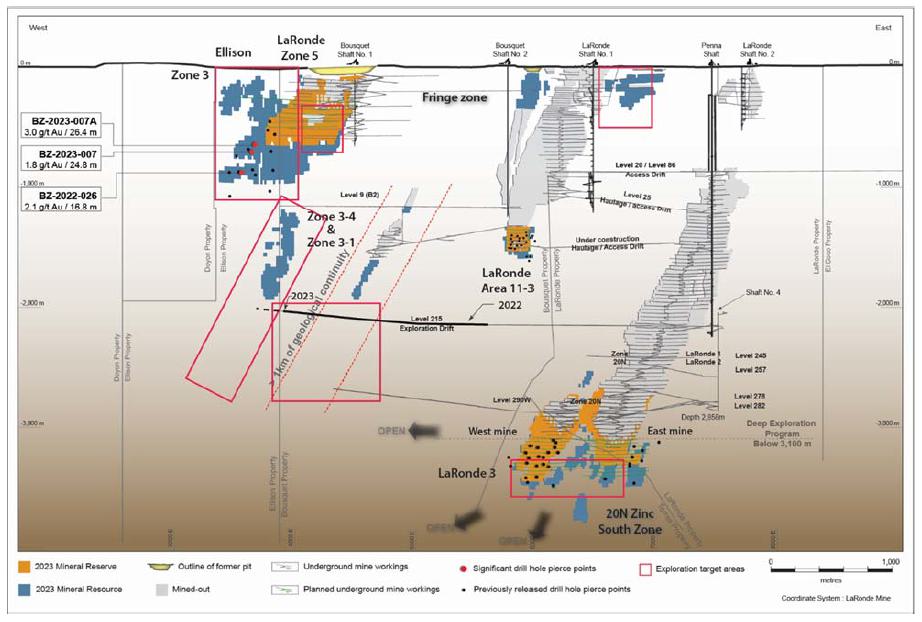

At the LaRonde complex, the production forecast is higher in 2024 when compared to Previous Guidance primarily due to higher productivity achieved than initially anticipated during the transition to pillarless mining at the LaRonde mine. Gold production is expected to increase to 310,000 ounces in 2025 and reach an annual run-rate of approximately 340,000 ounces per year in 2026, primarily due to higher gold grades at the LaRonde mine, an increase in the mining rate at the LZ5 mine to 3,800 tpd and the addition of satellite zones. The Company is also evaluating the potential to bring new sources of ore into production, including the LZ5 deep, Ellison and Fringe zones.

The LZ5 processing facility is expected to be in care and maintenance until the second half of 2024 as the Company completes an upgrade to the CIL tanks. The Company expects to restart the LZ5 processing facility in the second half of 2024 to process ore from the LZ5 mine and the AK deposit at Macassa. The Company continues to assess options to leverage the excess mill capacity at LZ5 as set out in the Update on Key Value Drivers and Pipeline Projects section above.

The LaRonde mine has planned a shutdown of 14 days in the third quarter of 2024 in order to rebuild the loading station at level 206 of the Penna shaft.

| Canadian Malartic Complex Forecast | 2023 | 2024 | 2025 | 2026 | ||||||||||||

| Previous Guidance (mid-point) (oz) | 585,000 | 660,000 | 610,000 | n.a. | ||||||||||||

| Current Guidance (mid-point) (oz) | 603,955 (actual) | 630,000 | 615,000 | 560,000 | ||||||||||||

| Canadian Malartic Complex Forecast 2024 |

Ore Milled |

Gold (g/t) |

Gold Mill |

Production and Minesite Costs per Tonne |

||||||||||||

| 18,952 | 1.13 | 91.5 | % | C$ | 41.80 | |||||||||||

13 Minesite costs per tonne is a non-GAAP measure that is not standardized under IFRS. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation to production costs see "Reconciliation of Non-GAAP Performance Measures" and "Note Regarding Certain Measures of Performance", respectively, below.

At the Canadian Malartic complex, the production forecast is lower in 2024 when compared to Previous Guidance primarily due to the Company's decision to defer the reintroduction of pre-crushing low grade ore to increase mill throughput to 2025 from 2024. The Company continues to optimize the ore processing plan to enhance the financial metrics and cash flow during the transition to the underground Odyssey project. The mill throughput is now forecast to remain at approximately 52,000 tpd in 2024.

In 2024, production is expected to be sourced from the Barnat pit and the Odyssey mine, complemented by ore from the low grade stockpiles. The Odyssey mine is expected to contribute approximately 80,000 ounces of payable gold to the Canadian Malartic complex in 2024, 2025 and 2026.

| Goldex Forecast | 2023 | 2024 | 2025 | 2026 | ||||||||||||

| Previous Guidance (mid-point) (oz) | 135,000 | 130,000 | 125,000 | n.a. | ||||||||||||