UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-32749

FRESENIUS MEDICAL CARE AG

(Exact name of Registrant as specified in its charter)

FRESENIUS MEDICAL CARE AG

(Translation of Registrant’s name into English)

Germany

(Jurisdiction of incorporation or organization)

Else-Kröner-Strasse 1, 61352 Bad Homburg, Germany

(Address of principal executive offices)

Kees van Ophem, +41 79 103 33 53, kees.vanophem1@freseniusmedicalcare.com,

Else-Kröner-Strasse 1, 61352 Bad Homburg, Germany

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

American Depositary Shares representing ordinary shares |

|

FMS |

|

New York Stock Exchange |

Ordinary shares, no par value |

|

N/A |

|

New York Stock Exchange(1) |

| (1) | Not for trading, but only in connection with the registration of American Depositary Shares representing such shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, no par value: 293,413,449

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

|

|

Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☐ U.S. GAAP

☒ International Financial Reporting Standards as issued by the International Accounting Standards Board

☐ Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

☐ Item 17

☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

Table of contents

|

|

|

Page |

Introduction |

|

|

|

|

|

|

|

N/A |

5 |

||

N/A |

5 |

||

|

5 |

||

|

23 |

||

N/A |

76 |

||

|

76 |

||

|

107 |

||

|

154 |

||

|

157 |

||

|

157 |

||

|

159 |

||

|

167 |

||

|

168 |

||

|

|

|

|

N/A |

170 |

||

N/A |

Material modifications to the rights of security holders and use of proceeds |

170 |

|

|

170 |

||

|

Management’s annual report on internal control over financial reporting |

170 |

|

|

170 |

||

|

170 |

||

|

171 |

||

|

171 |

||

|

171 |

||

N/A |

172 |

||

|

Purchase of equity securities by the issuer and affiliated purchasers |

172 |

|

|

172 |

||

|

172 |

||

N/A |

180 |

||

N/A |

Disclosure regarding foreign jurisdictions that prevent inspections |

181 |

|

|

181 |

||

|

181 |

||

|

|

|

|

N/A |

183 |

||

|

183 |

||

|

183 |

i

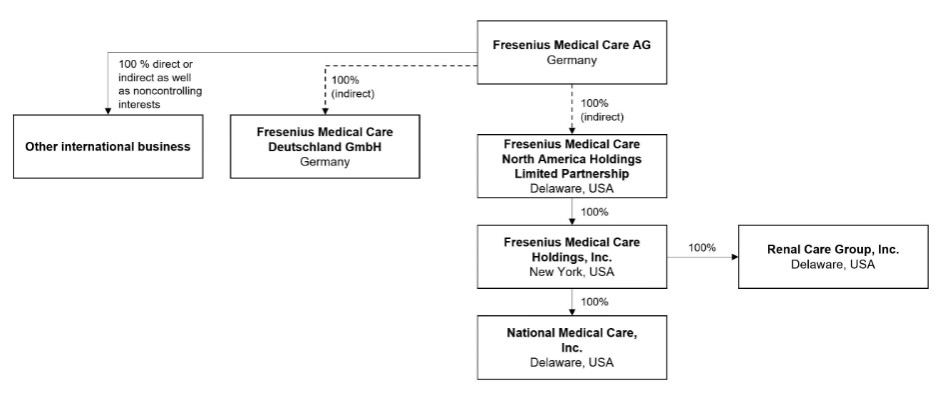

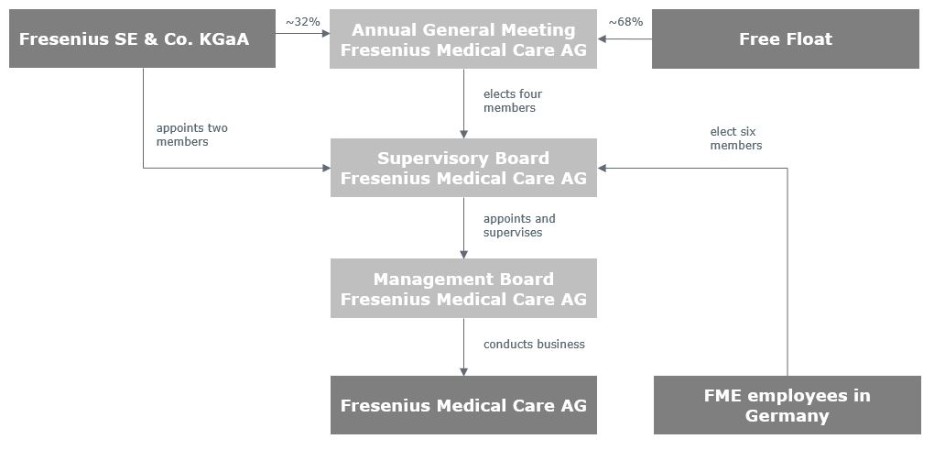

Certain defined terms

In this report, (1) the “Company” refers to (a) Fresenius Medical Care AG & Co. KGaA or Fresenius Medical Care AG & Co. KGaA and its subsidiaries on a consolidated basis prior to the transformation of legal form of the Company from a partnership limited by shares (Kommanditgesellschaft auf Aktien – KGaA) into a German stock corporation (Aktiengesellschaft – AG) (the Conversion) which was approved at an extraordinary general meeting (EGM) of the Company held on July 14, 2023 by the Company’s shareholders and became effective upon registration of the Conversion with the competent commercial register on November 30, 2023 and to (b) Fresenius Medical Care AG or Fresenius Medical Care AG and its subsidiaries on a consolidated basis after the Conversion; (2) “we”, “us” and “our” refer either to the Company or the Company and its subsidiaries on a consolidated basis both before and after the Conversion, as the context requires; (3) “Fresenius Medical Care AG” and “FME AG” refer to the Company as a German stock corporation after the Conversion and “FME AG & Co. KGaA” refers to the Company as a German partnership limited by shares before the Conversion and (4) “FMCH” and “D-GmbH” refer, respectively, to Fresenius Medical Care Holdings, Inc., the holding company for our North American operations, and to Fresenius Medical Care Deutschland GmbH, one of our German subsidiaries. In addition, “Fresenius SE” and “Fresenius SE & Co. KGaA” refer to Fresenius SE & Co. KGaA. Fresenius SE owns 94,380,382 of our shares as of February 8, 2024, 32.2% based on 293,413,449 outstanding shares, as reported herein. In this report, we use Fresenius SE to refer to that company as a partnership limited by shares, effective on and after January 28, 2011, as well as both before and after the conversion of Fresenius AG from a stock corporation into a European Company (Societas Europaea) on July 13, 2007. Each of “Management AG,” “FME Management AG” and the “General Partner” refers to Fresenius Medical Care Management AG (renamed Fresenius Vermögensverwaltung AG), a wholly owned subsidiary of Fresenius SE and FME AG & Co. KGaA’s general partner prior to the Conversion. Management AG ceased to be a General Partner of the Company when the Conversion took effect. “Management Board” and “our Management Board” refer to the members of the management board of Management AG (prior to the Conversion) and members of the management board of FME AG (after the Conversion) and, except as otherwise specified, “Supervisory Board” and “our Supervisory Board” refer to the supervisory board of FME AG & Co. KGaA, before the Conversion, and FME AG, after the Conversion. As a result of the Conversion, Management AG exited the Company and Fresenius SE ceased to control (as defined by International Financial Reporting Standards (IFRS® Accounting Standards) as issued by the International Accounting Standards Board (IASB) 10, Consolidated Financial Statements) the Company. “Ordinary shares” refers to the ordinary shares prior to the conversion in 2013 of our preference shares into ordinary shares. Following such conversion, we refer to our ordinary shares as “shares.”

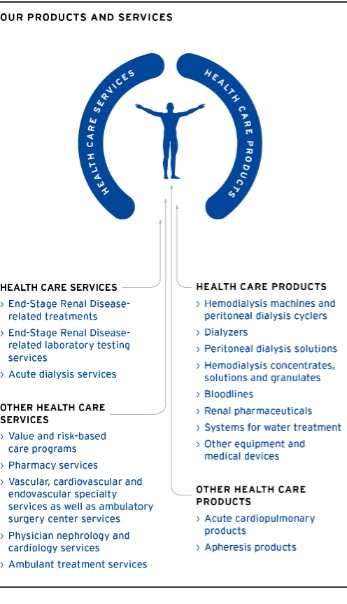

In our new global operating model, the term “Care Enablement” refers to our Care Enablement operating segment, which includes research and development (R&D), manufacturing, supply chain and commercial operations, as well as supporting functions, such as regulatory and quality management. The term “Care Delivery” refers to the Care Delivery operating segment, which is primarily engaged in providing services for the treatment of chronic kidney disease (CKD), end-stage renal disease (ESRD) and other extracorporeal therapies, including value and risk-based care programs, and also includes the pharmaceutical products business and the income from equity method investees related to the sale of certain renal pharmaceuticals from Vifor Fresenius Medical Care Renal Pharma Ltd., which are used in our clinics to provide health care services to our patients. Our Global Medical Office, which seeks to optimize medical treatments and clinical processes within the Company and supports both Care Delivery and Care Enablement, is centrally managed and its profit and loss are allocated to the segments. Similarly, we allocate costs related primarily to headquarters’ overhead charges, including accounting and finance as well as certain human resources, legal and IT costs, as we believe that these costs are attributable to the segments and used in the allocation of resources to Care Delivery and Care Enablement. These costs are allocated at budgeted amounts, with the difference between budgeted and actual figures recorded at the corporate level. However, certain costs, which relate mainly to shareholder activities, management activities as well as global internal audit, are not allocated to a segment but are accounted for as corporate expenses (Corporate). Financing is a corporate function which is not controlled by the operating segments. Therefore, the Company does not include interest expense relating to financing as a segment measurement. In addition, the Company does not include income taxes as it believes taxes are outside the segments’ control. These activities do not fulfill the definition of a segment according to IFRS 8, Operating Segments and are also reported separately as Corporate. See note 29 of the notes to the consolidated financial statements included in this report for a further discussion on our operating segments. We commenced reporting reflecting our new global operating model effective January 1, 2023. Prior to January 1, 2023, discrete financial information was not provided to the chief operating decision maker on the basis of the new structure and the necessary system and reporting changes to effect the new structure were not in place.

The abbreviations “THOUS” and “M” are used to denote the presentation of amounts in thousands and millions, respectively. All references in this report to the notes to our financial statements are to the notes to the consolidated financial statements included in this report.

1

Forward-looking statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). When used in this report, the words “outlook,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “guidance,” “target” and similar expressions are generally intended to identify forward looking statements. Although we believe that the assumptions and expectations reflected in such forward-looking statements are reasonable, forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not be anticipated. Additionally, subsequent events and actual results, financial and otherwise, have differed in the past and, going forward, could differ materially from those set forth in or contemplated by the forward-looking statements contained elsewhere in this report. We have based these forward-looking statements on current estimates and assumptions made to the best of our knowledge. By their nature, such forward-looking statements involve risks, uncertainties, assumptions and other factors which could cause actual results, including our financial condition and profitability, to differ materially, positively or negatively, relative to the results expressly or implicitly described in or suggested by these statements. Moreover, forward-looking estimates or predictions derived from third parties’ studies or information may prove to be inaccurate. Consequently, we cannot give any assurance regarding the future accuracy of the opinions set forth in this report or the actual occurrence of the projected developments described herein. In addition, even if our future results meet the expectations expressed here, those results may not be indicative of our performance in future periods.

These risks, uncertainties, assumptions, and other factors, including associated costs, could cause actual results to differ from our projected results and include, among others, the following:

| ● | changes in governmental and private payor reimbursement for our complete products and services portfolio, including the United States (U.S.) Medicare reimbursement system for dialysis and other health care services, including potentially significant changes to the Patient Protection and Affordable Care Act of 2010 (Pub.L. 111-148), as amended by the Health Care and Education Reconciliation Act (Pub.L. 111-152) (collectively, ACA) that could result from future efforts to revise or repeal the ACA, and changes by regulators to certain reimbursement models, such as the End-Stage Renal Disease Treatment Choices model and the Comprehensive Kidney Care Contracting (CKCC) model, which could significantly impact performance under these models in unanticipated ways; |

| ● | our ability to accurately interpret and comply with complex current and future government regulations applicable to our business including sanctions and export control laws and regulations, laws and regulations in relation to environmental, social and governance topics, the impact of health care, tax and trade law reforms, in particular the Organisation for Economic Co-operation and Development initiatives for the reallocation of taxation rights to market countries (Pillar one) and introduction of a global minimum tax (Pillar two) as well as potential U.S. tax reform, antitrust and competition laws in the countries and localities in which we operate, other government regulation including, in the U.S., the federal Medicare and Medicaid Fraud and Abuse Amendments of 1977, as amended (the Anti-Kickback Statute), the False Claims Act, the federal Physician Self-Referral Law (the Stark Law), the Civil Monetary Penalty Law, the Health Insurance Portability and Accountability Act, the Health Information Technology for Economic and Clinical Health Act, the Foreign Corrupt Practices Act (FCPA) and the Food, Drug and Cosmetic Act, as well as the U.S. Securities and Exchange Commission’s (SEC) proposed rules (if and when adopted) that would require extensive, detailed information about our climate-related risks, and, outside the U.S., inter alia, the European Union (EU) Medical Device Regulation, the EU General Data Protection Regulation, the EU Taxonomy Regulation, the EU Corporate Sustainability Reporting Directive, the German Act on Human Rights Due Diligence in Supply Chains, the two invoice policy, “Buy China” policy, volume-based procurement policies and the Tendering and Bidding Law in China and other related local legislation as well as other comparable regulatory regimes in many of the countries where we supply health care services and/or products; |

| ● | the influence of private payors (including integrated care organizations, commercial insurance and Medicare Advantage plans, also known as Medicare Part C, offered by private health insurers approved by the Centers for Medicare and Medicaid (CMS) to provide their members with Medicare Part A, Part B and usually Part D benefits (Medicare Advantage or MA plans), as well as efforts by these organizations to manage costs by limiting health care benefits, narrowing their networks, reducing provider reimbursement and/or restricting options for patient funding of health insurance premiums, including potential efforts by employer group health plans (EGHPs) and commercial insurers to make dialysis reimbursement payments at a lower “out-of-network” rate as a result of the U.S. Supreme Court’s ruling in Marietta Memorial Hospital Employee Health Benefit Plan, et al. v. DaVita Inc., et al. 142 S. Ct. 1968 (2022), particularly if the U.S. Congress fails to enact legislation that would reverse the potential effects of that decision; |

2

| ● | the impact of worldwide pandemics (for example, the severe acute respiratory syndrome coronavirus 2 and the related Coronavirus disease (COVID-19) pandemic), including, without limitation, a significant increase in mortality of patients with chronic kidney diseases as well as an increase in persons experiencing renal failure, the impacts of global viruses on our patients, caregivers, employees, suppliers, supply chain, business and operations, and consequences of economic downturns resulting from global pandemics; |

| ● | our ability to attract and retain skilled employees (including certain additional personnel necessary to perform internally the essential services we previously received and continue to receive under transitional services agreements from FSE) and risks that personnel shortages and competition for labor, high turnover rates and meaningfully higher personnel costs as well as legislative, union, or other labor-related activities or changes have and will continue to result in significant increases in our operating costs, decreases in productivity and partial suspension of operations and to impact our ability to address additional treatments and growth recovery; |

| ● | the increase in raw material, energy, labor and other costs, including an impact from these cost increases on our cost savings initiatives and increases due to geopolitical conflicts in certain regions (for example, impacts related to the war between Russia and Ukraine (Ukraine War)) as well as the impact that inflation may have on a potential impairment of our goodwill, investments or other assets as noted above; |

| ● | the outcome of government and internal investigations as well as litigation; |

| ● | launch of new technology, introduction of generic or new pharmaceuticals and medical devices that compete with our products or services, advances in medical therapies, including the increased utilization of pharmaceuticals that reduce the progression of chronic kidney disease and its precursors, and new market entrants that compete with our businesses (further information regarding the impact of certain pharmaceuticals that reduce the progression of chronic kidney disease and our analysis of their impact on our cash flow projections and goodwill sensitivity assessments can be found in note 2 a) of the notes to the consolidated financial statements included in this report); |

| ● | product liability risks and the risk of recalls of our products by regulators; |

| ● | our ability to continue to grow our health care services and products businesses, organically and through acquisitions, including, with respect to acquisitions, the effects of increased enforcement of antitrust and competition laws, and to implement our strategy; |

| ● | the impact of currency and interest rate fluctuations, including the heightened risk of fluctuations as a result of geopolitical conflicts in certain regions, the impact of the current macroeconomic inflationary environment on interest rates and a related effect on our borrowing costs; |

| ● | potential impairment of our goodwill, investments or other assets due to decreases in the recoverable amount of those assets relative to their book value, particularly as a result of sovereign rating agency downgrades coupled with an economic downturn in various regions or as a result of geopolitical conflicts in certain regions; |

| ● | our ability to protect our information technology systems and protected health information against cyber security attacks or prevent other data privacy or security breaches of our data or the data of our third parties and the potential effects on our reputation, customer or vendor relationships, or competitiveness of any cybersecurity incidents we may incur, as well as our ability to effectively capture efficiency goals and align with contractual and other requirements related to data offshoring activities; |

| ● | changes in our costs of purchasing and utilization patterns for pharmaceuticals and our other health care products and supplies, the inability to procure raw materials or disruptions in our supply chain; |

| ● | potential increases in tariffs and trade barriers that could result from withdrawal by single or multiple countries from multilateral trade agreements or the imposition of sanctions, retaliatory tariffs and other countermeasures in the wake of trade disputes and geopolitical conflicts in certain regions; |

3

| ● | collectability of our receivables, which depends primarily on the efficacy of our billing practices, the financial stability and liquidity of our governmental and private payors and payor strategies to delay, dispute or thwart the collection process; |

| ● | our ability to secure contracts and achieve cost savings and desired clinical outcomes in various health care risk management programs in which we participate or intend to participate; |

| ● | the greater size, market power, experience and product offerings of certain competitors in certain geographic regions and business lines; |

| ● | the use of accounting estimates, judgments and accounting pronouncement interpretations in our consolidated financial statements; |

| ● | our ability to achieve projected cost savings within the proposed timeframe as part of the previously announced transformation of our operating structure and steps to achieve cost savings (FME25 Program) as well as the possibility that changing or increasing responsibilities of our employees as a result of this transformation could require additional resources in the short-term; |

| ● | our ability to improve our financial performance through the divestiture of non-core and dilutive assets; and |

| ● | our ability to achieve projected price increases for our products and corresponding services. |

Important factors that could contribute to such differences are noted in Item 3.D, “Key Information – Risk factors,” Item 4B, “Information on the Company – Business overview,” and the notes to our audited consolidated financial statements included in this report.

Our business is also subject to other risks and uncertainties that we describe from time to time in our periodic public filings which can be accessed at the SEC website at www.sec.gov. Developments in any of these areas could cause our results to differ materially from the results that we or others have projected or may project.

The actual accounting policies, the judgments made in the selection and application of these policies, as well as the sensitivities of reported results to changes in accounting policies, assumptions and estimates, are additional factors to be considered along with our financial statements and the discussion under “Results of operations” in Item 5 below, “Operating and financial review and prospects.” For a discussion of our critical accounting policies, see note 2 of the notes to the consolidated financial statements included in this report.

Rounding adjustments applied to individual numbers and percentages shown in this and other reports may result in these figures differing immaterially from their absolute values. Some figures (including percentages) in this report have been rounded in accordance with commercial rounding conventions. In some instances, such rounded figures and percentages may not add up to 100% or to the totals or subtotals contained in this report. Furthermore, totals and subtotals in tables may differ slightly from unrounded figures contained in this report due to rounding in accordance with commercial rounding conventions. A dash (–) indicates that no data were reported for a specific line item in the relevant financial year or period, while a zero (0) is used when the pertinent figure, after rounding, amounts to zero.

Market and industry data

Except as otherwise specified herein, all patient and market data in this report have been derived using our internal information tool called “Market & Competitor Survey” (MCS). See Item 4.B, “Information on the Company - Business Overview – Major Markets and Competitive Position.”

4

Part I

Item 1. |

Identity of directors, senior management and advisors |

Not applicable

Item 2.Offer statistics and expected timetable

Not applicable

Item 3.Key information

We conduct our business on a global basis in various currencies with major operations located in the U.S. and Germany. We prepare our consolidated financial statements utilizing the euro as our reporting currency. We have converted the balance sheets of our non-euro denominated operations into euro at the exchange rates prevailing at the balance sheet date. Revenues and expenses are translated at the average exchange rates for the respective period, as shown.

A summary of the spot and average exchange rates for the euro to U.S. dollars for the last three years is set forth below. The European Central Bank (ECB) determines such rates (Reference Rates) based on the regular daily averaging of rates between central banks within and outside the European banking system. The ECB normally publishes the Reference Rates daily around 4 p.m. Central European Time (CET).

Exchange rates |

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2021 |

|

|

spot exchange |

|

spot exchange |

|

average exchange |

|

average exchange |

|

average exchange |

|

|

rate in € |

|

rate in € |

|

rate in € |

|

rate in € |

|

rate in € |

1 U.S. dollar |

|

0.90498 |

|

0.93756 |

|

0.92484 |

|

0.94962 |

|

0.84549 |

B. |

Capitalization and indebtedness |

Not applicable

C. |

Reasons for the offer and use of proceeds |

Not applicable

D. |

Risk factors |

Before you invest in our securities, you should be aware that the occurrence of any of the events described in the following risk factors or elsewhere in this report, and other events that we have not predicted or assessed could affect the outcome of forward-looking statements included in this report and/or have a material adverse impact on our business, financial condition and results of operations. If the events described below or other unpredicted events occur, then the trading price of our securities could decline and you may lose all or part of your investment.

5

Risks relating to legal and regulatory matters

We operate in a highly regulated industry such that the potential for legislative reform provides uncertainty and potential threats to our operating models and results.

The delivery of health care services and products is highly regulated in most of the countries in which we operate. Proposals for legislative reform in these countries are often introduced to improve access to care, address quality of care issues and manage costs of the health care system. In the U.S., there have been efforts to pursue significant changes to existing health care programs, including efforts to repeal or replace the ACA which, while unsuccessful to date, continue. On June 17, 2021, the U.S. Supreme Court reversed lower court rulings that declared the ACA to be unconstitutional, holding that the states and other plaintiffs in the case did not have standing to challenge the law. If future efforts to limit or repeal the ACA are successful, such efforts could have significant effects on our businesses, both positive and negative, but the outcomes are impossible to predict.

In October 2017, the Trump administration discontinued making cost-sharing reduction (CSR) reimbursements to insurers, arguing that Congress failed to appropriate funding. In response, many state departments of insurance either allowed or required insurers to mitigate their losses by increasing the 2018 premiums on their ACA plans. Many insurers also mitigated the impact to themselves by “silver loading,” a practice whereby the premiums for silver-level plans were increased to offset the loss of CSR payments. Silver loading may also have mitigated the impact of premium increases to some low-income consumers by increasing their premium tax credits. In 2019 and 2020, all states either permitted or required silver loading. In 2017, several insurers sued the U.S. federal government to reinstate CSR payments. On June 21, 2021, the U.S. Supreme Court denied requests from multiple insurers to review lower court decisions that held they were not entitled to full unpaid CSR payments. As a result, insurers are entitled to the unpaid CSRs, but the total amount they are owed must be offset by any excess premium tax credits received from premium increases for 2018 and beyond. The Biden administration’s budget request to the Congress for the fiscal year (FY) 2023 included appropriations for CSR payments, although the Consolidated Appropriations Act of 2023, which will fund the federal government during FY 2023, did not include specific CSR appropriations and we cannot predict the extent to which silver-loading will continue or how the ongoing litigation over the U.S. federal government’s obligation to pay the CSRs might be resolved. While the Biden administration again requested appropriations for CSR payments in its FY 2024 budget request, the Congress has yet to finalize any of its FY 2024 appropriations bills as of January 2024. As a result, a reduction in the availability of insurance through insurance exchanges established by the ACA could reduce the number of our commercially insured patients and shift such patients to Medicare and Medicaid. In addition, the United States Supreme Court’s recent ruling in Marietta Memorial Hospital Employee Health Benefit Plan, et al. v. DaVita Inc. et al. 142 S. Ct. 1968 (2022) (Marietta) will make it easier for health plans to design plan benefits for Medicare eligible ESRD patients in a way that makes private health insurance relatively less attractive to ESRD patients and Medicare relatively more attractive. In the Marietta case, the questions presented involved whether the health plan violated the Medicare Secondary Payor Act (MSPA) by “taking into account” that plan beneficiaries are eligible for Medicare and/or by “differentiating” between the benefits that the plan offers to patients with dialysis versus others. On June 21, 2022, the United States Supreme Court reversed the Sixth Circuit decision and held that the EGHP for Marietta Memorial Hospital did not violate the MSPA.

In December 2023, six bipartisan members of the House reintroduced the Restore Protections for Dialysis Patients Act (H.R. 6860), which would address the Marietta decision. The bill includes updated language which would restore the understanding of the Medicare Secondary Payer Act prior to the Marietta decision and ensure that patients cannot be discriminated against because of their need for dialysis. However, we cannot predict whether the U.S. Congress will enact this or any other proposed legislation that would reverse the potential effects of the Marietta decision. Because Medicare and Medicaid reimbursement rates are generally lower than the reimbursement rates paid by commercial insurers, a shift of commercially insured patients to Medicare and Medicaid could have a material adverse impact on our business, financial condition and results of operations. The Marietta ruling may also result in certain EGHPs reducing the benefits offered for dialysis, which could, depending on the number of patients impacted, have a material and adverse impact on our business, financial condition and results of operation. See “Changes in reimbursement, payor mix and/or governmental regulations for health care could materially decrease our revenues and operating profit” below.

6

Changes in reimbursement, payor mix and/or governmental regulations for health care could materially decrease our revenues and operating profit.

We receive reimbursement for our health care services from both public, government-sponsored payors and private, commercial payors. A large portion of our businesses is reimbursed by government payors, in particular the Medicare and Medicaid programs in the U.S. For the fiscal years ended December 31, 2023 and 2022, approximately 25% and 26%, respectively, of our consolidated revenues resulted from Medicare and Medicaid reimbursement. The Medicare and Medicaid programs change their payment methodologies and funding from time to time in ways that are driven by changes in statute, economic conditions, and policy. For example, the Budget Control Act of 2011 (BCA) effected a 2% reduction to Medicare payments and subsequent activity in Congress, namely a $1.2 trillion sequester (across-the-board spending cuts) in discretionary programs, took effect on April 1, 2013, and continues in force. The 2% sequestration was temporarily suspended several times subsequent to May 1, 2020 as part of the U.S. government’s efforts to address the COVID-19 pandemic. In March 2021, President Biden signed the American Rescue Plan Act of 2021 (the American Rescue Plan Act) which resulted, according to Congressional Budget Office estimates, in budget deficits that required a 4% reduction in Medicare program payments for 2022 under the Statutory Pay-As-You-Go Act of 2010 (Statutory PAYGO). In December 2021, Congress passed and President Biden signed into law the Protecting Medicare and American Farmers from Sequester Cuts Act impacting payments for all Medicare Fee-for-Service claims and extending the sequestration suspension through March 31, 2022 with a 1% reduction effective thereafter from April 1 to June 30, 2022 and a return to the full 2% sequester on July 1, 2022. The Protecting Medicare and American Farmers from Sequester Cuts Act deferred until 2023 the 4% reduction in Medicare program payments that would have been triggered by Statutory PAYGO as a result of the budgetary impact of the American Rescue Plan Act. However, the Consolidated Appropriations Act of 2023 again suspended Statutory PAYGO reductions for 2023 and 2024. Spending cuts pursuant to U.S. sequestration have adversely affected our operating results in the past and, with the suspension having been lifted, will continue to do so. In addition, options to restructure the Medicare program in the direction of a defined contribution, “premium support” model and to shift Medicaid funding to a block grant or per capita arrangement, with greater flexibility for the states, have been proposed or considered from time to time. Changes in payment methodologies and funding or payment requirements of (without limitation) the End-Stage Renal Disease Prospective Payment System (ESRD PPS), the Physician Fee Schedule, the Clinical Laboratory Fee Schedule, and the Ambulatory Surgical Center Payment System may have material effects on our operating results. We may also experience changes in the interpretation of government regulations by the courts. We have very little opportunity to influence or predict the magnitude of many of those changes. For further information regarding Medicare and Medicaid reimbursement, including new payment models proposed by executive order in July 2019 which are intended to encourage identification and earlier treatment of kidney disease as well as increased home dialysis and transplants, see Item 4B, “Information on the Company — Business Overview — Regulatory and Legal Matters — Reimbursement” and Item 5, “Operating and Financial Review and Prospects — II. Financial condition and results of operations — Overview.”

Our patients make decisions about their insurance coverage among options that, depending on their personal circumstances and location, may include Medicare, Medicaid, employer group health coverage, exchange plans and other commercial coverage. As of January 1, 2021, for the first time, all ESRD patients are eligible to enroll in Medicare Advantage plans. As a result, some patients with commercial coverage, and other patients with Medicare coverage, may elect to move to Medicare Advantage plans. Government reimbursement programs, including Medicare and Medicaid, generally pay less than commercial insurance, and Medicare Advantage plans generally pay less than other commercial plans. In addition, we may experience higher write-offs of Medicare deductibles and other cost-sharing amounts due to secondary uninsured and underinsured patients, resulting in an increase in uncollectible accounts. As a result, the payments we receive from private payors generate a substantial portion of the profits we report. For further information, see the table “U.S. patient service revenue” detailing the percentage generated from government reimbursement and private payors in the U.S. in Item 4B, “Information on the Company — Business overview.”

Any of the following events, among others, could have a material adverse impact on our business, financial condition and results of operations:

| ● | we may be subject to rejections of or reductions in reimbursement from private payors, including, for example, through their use of lower allowed charges rather than rates based on our billed charges; |

| ● | we may experience a reduction in our ability to obtain and retain commercially insured patients to utilize our health care services; |

7

| ● | efforts by private payors to continue to control the cost of and/or the eligibility for access to health care services, including relative to insurance products on and off the health care exchanges established by the ACA and potential efforts by employer group health plans and commercial insurers to limit benefits or reduce reimbursement for our services or eliminate reimbursement for some of our services; |

| ● | a portion of our business that is currently reimbursed by private insurers or hospitals may become reimbursed by integrated care organizations, which may use payment methodologies that reduce reimbursement for our services. There can be no assurance that we can achieve future price increases from private insurers and integrated care organizations offering private insurance coverage to our patients; |

| ● | if legislative or regulatory efforts or litigation to restrict or eliminate the charitable funding of patient insurance premiums are successful, our patients with coverage under publicly funded programs like Medicare may be unable to continue to pay the premiums for that coverage and may become uninsured for dialysis services. In addition, a portion of our patients who are currently covered by private insurers may be unable to continue to pay the premiums for that coverage and may become uninsured for dialysis services or may elect to transition to government funded reimbursement programs that reimburse us at lower rates for our services. See Item 4B, “Information on the Company – Business Overview – Regulatory and Legal Matters – Reimbursement – Potential changes impacting our private payors” for further information; |

| ● | termination of the public health emergency originally declared in January 2020 with respect to the COVID-19 pandemic, which occurred on May 11, 2023 and, commencing April 1, 2023, state termination of Medicaid coverage that was expanded during the public health emergency, either or both of which, among other consequences, could reduce Medicaid coverage for many Americans, resulting in an increase in the uninsured patient population including dialysis patients; or |

| ● | if we are unable to secure appropriate reimbursement arrangements for the pharmaceuticals we provide in our dialysis clinics, we could experience a material adverse effect on our operating results. An increased utilization of bundled pharmaceuticals, as part of the ESRD PPS, or decreases in reimbursement for pharmaceuticals outside the bundled rate may result in a material adverse impact on our results of operations. |

For further information, see Item 4B, “Information on the Company — Business Overview — Regulatory and Legal Matters — Reimbursement.”

In addition to the foregoing factors, the health care insurance industry is experiencing continuing consolidation among insurers and pharmacy benefit managers, including increasing buyer power and impacts on referral streams. Such consolidation could have a material adverse effect on our ability to negotiate favorable coverage terms and reimbursement rates.

If we do not comply with the numerous governmental regulations applicable to our business, we could suffer adverse legal consequences, including exclusion from government health care programs or termination of our authority to conduct business, any of which would result in a material decrease in our revenue; this regulatory environment also exposes us to claims and litigation, including “whistleblower” suits.

Our operations in both our health care services business and our products business are subject to extensive governmental regulation in virtually every country in which we operate. We are also subject to other laws of general applicability, including antitrust laws. The applicable regulations, which differ from country to country, cover areas that include:

| ● | regulatory approvals for products or product improvements; |

| ● | regulatory approvals and oversight of clinical and certain non-clinical R&D activities; |

| ● | the quality, safety and efficacy of medical and pharmaceutical products and supplies; |

| ● | the operation and licensure of manufacturing facilities, laboratories, dialysis clinics, ambulatory surgery centers and other health care facilities; |

| ● | product labeling, advertising and other promotion; |

8

| ● | accurate reporting and billing for government and third-party reimbursement, including accurate and complete medical records to support such billing and, in the U.S., the obligation to report and return overpayments within 60 days of the time that the overpayment is identified and quantified; |

| ● | the discounting of reimbursed drug and medical device products and the reporting of drug prices to government authorities; |

| ● | limits on our ability to make acquisitions or certain investments and the terms of those transactions; |

| ● | the collection, dissemination, access, use, security and privacy of protected health information or other protected data; and |

| ● | compensation of medical directors and other financial arrangements with physicians and other referral sources. |

Failure to comply with one or more of these laws or regulations may give rise to a number of adverse legal consequences. These include, in particular, loss or suspension of federal certifications, loss or suspension of licenses under the laws of any state or governmental authority from which we generate substantial revenues, monetary and administrative penalties, product recalls, increased costs for compliance with government orders, complete or partial exclusion from government reimbursement programs, refunds of payments received from government payors and government health care program beneficiaries due to failures to meet applicable requirements or complete or partial curtailment of our authority to conduct business. Any of these consequences could have a material adverse impact on our business, financial condition and results of operations.

Our medical devices and drug products are subject to detailed, rigorous and frequently changing regulation by numerous national, supranational, federal and state authorities. In addition, our facilities and procedures and those of our suppliers are subject to periodic inspection by various regulatory authorities which may suspend, revoke, or adversely amend the authority necessary for research, manufacture, marketing or sale of our products and those of our suppliers. We and our suppliers must incur expense and spend time and effort to ensure compliance with these complex regulations, and if such compliance is not maintained, we and our suppliers could be subject to significant adverse administrative and judicial enforcement actions in the future. These possible enforcement actions could include warning letters, injunctions, civil penalties, seizures of our products, and criminal prosecutions as well as dissemination of information to the public about such enforcement actions. These actions could result in, among other things, substantial modifications to our business practices and operations; refunds; a total or partial shutdown of production while the alleged violation is remedied; and recalls, withdrawals or suspensions of current products from the market. Any of these events, in combination or alone, could disrupt our business and have a material adverse impact on our business, financial condition and results of operations.

We operate many facilities and engage with other business associates to help carry out our health care activities. In such a widespread, global system, it is often difficult to maintain the desired level of oversight and control over the thousands of individuals employed by many affiliated companies and their business associates. We rely on our management structure, regulatory and legal resources and the effective operation of our compliance programs to direct, manage and monitor our operations, including the activities of our employees and their agents, to comply with government regulations. We cannot assure that our internal control policies and procedures will always protect us from intentional or inadvertent acts of our employees or agents that contravene our compliance policies or violate applicable laws. If employees were to deliberately, recklessly or inadvertently fail to adhere to these regulations, then our authority to conduct business could be terminated and our operations could be significantly curtailed. Any such terminations or reductions could materially reduce our revenues. If we fail to identify in our diligence process or to promptly remediate any non-compliant business practices in companies that we acquire, we could be subject to penalties, claims for repayment or other sanctions. Any such terminations or reductions could materially reduce our revenues, with a resulting material adverse impact on our business, financial condition and results of operations. See also “Risks relating to internal control and compliance — We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws,” below.

By virtue of this regulatory environment, our business activities and practices are subject to extensive review by regulatory authorities and private parties, and continuing audits, subpoenas, other inquiries, claims and litigation relating to our compliance with applicable laws and regulations. We may not always be aware that an inquiry or action has begun, particularly in the case of “qui tam” or “whistleblower” actions brought by private plaintiffs under the False Claims Act, which are initially filed under seal. We are the subject of a number of governmental inquiries and civil suits by governmental and private plaintiffs. For information about certain of these pending investigations and lawsuits, see note 25 of the notes to our consolidated financial statements included in this report.

9

In addition, future legislative or regulatory changes could affect procedures or decision making for approving medical devices or pharmaceuticals. Any such legislation or regulations, if enacted or promulgated, could result in a delay or denial of regulatory approval for our products. If any of our products do not receive regulatory approval, or there is a delay in obtaining approval, this also could have a material adverse impact on our business, financial condition and results of operations.

Cyber-attacks or other privacy and data security incidents could disrupt our business and expose us to significant losses, liability and reputational damage.

We and our third-party service providers routinely process, store and transmit large amounts of data in our operations, including sensitive personal information as well as proprietary or confidential information relating to our business or third parties. We may be subject to breaches of the information technology security systems we use both internally and externally with third-party service providers.

Cyber-attacks may penetrate our and our third-party service providers’ security controls and result in the misappropriation or compromise of sensitive personal information or proprietary or confidential information, including such information which is stored or transmitted on the systems used by certain of our or their products, to create system disruptions, cause shutdowns (including disruptions to our production plants), or deploy viruses, worms, ransomware, denial-of-service attacks and other malicious software programs that attack our systems. We and our third-party service providers handle the personal information of our patients and beneficiaries, Patient Personal Data (PPD), throughout the U.S. and other parts of the world. We or our business associates may experience a breach under the U.S. Health Insurance Portability and Accountability Act Privacy and Security Rules, the EU’s General Data Protection Regulation and or other similar laws (Data Protection Laws), including the following events:

| ● | impermissible use, access, or disclosure of unsecured PPD, |

| ● | a breach under Data Protection Laws when we or our business associates neglect to implement the required administrative, technical and physical safeguards of its electronic systems and devices, or |

| ● | a data breach that results in impermissible use, access or disclosure of personal identifying information of our employees, patients and beneficiaries. |

Our IT systems have been attacked in the past, resulting in certain patient data being illegally published. For information regarding our cybersecurity risk management and governance, as well as a cybersecurity incident that we incurred in September 2023, see Item 16K. “Cybersecurity.”

When appropriate, we have filed complaints against the unknown attackers with the relevant authorities and we contacted the patients who were affected by the illegal data publication as well as other relevant regulatory agencies and stakeholders. While there has not been any material impact to our financial condition and results of operations as a result of these attacks, future cyber-attacks against our IT systems may result in a loss of financial data or interruptions of our operations that could have a material adverse impact on our business, financial condition and results of operations in the future. The Ukraine War has increased the risk of cyber-attacks against our systems and data.

10

As we increase the amount of sensitive personal information or financial data that we store and share digitally, our exposure to these privacy and data breaches and cyber-attack risks increases (particularly as medical records are a high-value target), including the risk of undetected attacks, damage, loss or unauthorized disclosure or access, and the cost of attempting to protect against these risks also increases. The 2022 Physician Fee Schedule issued by CMS has extended coverage of certain Medicare telehealth services through calendar year 2023 and the Consolidated Appropriations Act of 2023 further extended such coverage through December 31, 2024. In addition, the Consolidated Appropriations Act, 2022, an omnibus funding bill signed by President Biden on March 15, 2022, temporarily extended certain Medicare telehealth flexibilities, which are central to enabling Medicare beneficiaries’ access to a broad range of services via telehealth from any location, for 151 days beginning on the first day after the end of the “public health emergency” period established for COVID-19, which occurred on May 11, 2023, and the CMS Physician Fee Schedule for calendar year (CY) 2023 further extended the availability of telehealth services for Medicare beneficiaries through December 2024. While the availability of telehealth services is convenient and improves access to medical care, increased reliance on, and utilization of, telemedicine for delivery of health care services could also increase the risk of privacy violations and our vulnerability to data breaches and cyber-attacks. There are no assurances that our security technologies, processes and procedures that we or our outside service providers have implemented to protect sensitive personal information and proprietary or confidential information and to build security into the design of our products will be effective. Any failure to keep our information technology systems, financial data and our patients’ and customers’ sensitive information secure from attack, damage, loss or unauthorized disclosure or access, whether as a result of our action or inaction or that of our third-party business associates or vendors that utilize and store such personal information on our behalf, could materially adversely affect our reputation and ability to continue normal operations, expose us to mandatory public disclosure requirements, litigation and governmental enforcement proceedings, material fines, penalties and/or remediation costs, and compensatory, special, punitive and statutory damages, consent orders and other adverse actions, any of which could have a material adverse impact on our business, financial condition and results of operations.

If certain of our investments or value and risk-based care programs with health care organizations and health care providers are found to have violated the law, our business could be adversely affected.

A number of the dialysis clinics and health care centers that we operate are owned, or managed, by entities in which one or more hospitals, physicians or physician practice groups hold an interest. Physician owners, who are usually nephrologists, may also provide medical director services and physician owners may refer patients to those centers or other centers we own and operate or to other physicians who refer patients to those centers or other centers we own and operate. We also have arrangements with physician practices to collaborate on our value and risk-based care programs with public and private payors. In the past, certain parties have attempted to utilize our disclosure of these arrangements as the basis for qui tam proceedings under the Anti-Kickback Statute and the Stark Law. Such attempts have not been successful to date. Because our relationships with physicians are governed by the federal and state anti-kickback statutes and other state fraud and abuse laws, we have structured our arrangements to comply with many of the criteria for safe harbor protection and waivers under the Anti-Kickback Statute; however, these arrangements do not always satisfy all elements of applicable safe harbors. While we have established comprehensive compliance policies, procedures and programs to ensure ethical and compliant business operations, if one or more of our arrangements, including value and risk-based care programs, were found to be in violation of the Anti-Kickback Statute, the Stark Law, analogous state laws, or other similar laws worldwide, we could be required to restructure or terminate them. We could also be required to repay to Medicare, Medicaid as well as other federal health care program amounts pursuant to any prohibited referrals, and we could be subject to criminal and monetary penalties and exclusion from federal and state health care programs. Imposition of any of these penalties could have a material adverse impact on our business, financial condition and results of operations. See note 25 of the notes to our consolidated financial statements included in this report.

We are exposed to product liability, patent infringement and other claims which could result in significant costs and liability which we may not be able to insure on acceptable terms in the future.

Health care companies are typically subject to claims alleging negligence, product liability, breach of warranty, malpractice and other legal theories that may involve large claims and significant defense costs whether or not liability is ultimately imposed. Health care products may also be subject to recalls, statutory or regulatory shipping holds and intellectual property rights (for example patents or trademarks) infringement claims which, in addition to monetary penalties, may restrict our ability to sell or use our products. We cannot assure that such claims will not be asserted against us, or, for example, that significant adverse verdicts will not be reached against us or that large scale recalls of our products will not become necessary. In addition, the laws of some of the countries in which we operate provide legal rights to users of pharmaceutical products that could increase the risk of product liability claims. Product liability and intellectual property rights infringement claims, other actions for negligence or breach of contract and product recalls or related sanctions could result in significant costs. These costs could have a material adverse impact on our business, financial condition and results of operations.

11

While we have been able to obtain liability insurance in the past to partially cover our business risks, we cannot assure that such insurance will be available in the future either on acceptable terms or at all, or that our insurance carriers will not dispute their coverage obligations. In addition, FMCH, our largest subsidiary, is partially self-insured for professional, product and general liability, auto liability and worker’s compensation claims, up to pre-determined levels above which our third-party insurance applies. A successful claim for which we are self-insured or in excess of the limits of our insurance coverage could have a material adverse impact on our business, financial condition and results of operations. We and certain of our insurers are in litigation against each other relating to such insurers’ coverage obligations under applicable policies. Liability claims, regardless of their merit or eventual outcome, also may have a material adverse effect on our business and result in a loss of customer confidence in us or our products, which could have a material adverse impact on our business, financial condition and results of operations. For information about certain of these pending investigations and lawsuits, see note 25 of the notes to our consolidated financial statements included in this report.

Risks relating to internal control and compliance

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws.

The U.S. FCPA and similar worldwide anti-corruption laws generally prohibit companies and their intermediaries from making improper payments to public officials for the purpose of obtaining or retaining business. Our internal policies mandate compliance with these anti-corruption laws. We operate many facilities throughout the U.S. and other parts of the world. Our widespread, global operations have thousands of persons employed by many affiliated companies, and we rely on our management structure, regulatory and legal resources and effective operation of our compliance program to direct, manage and monitor the activities of these employees and third-party intermediaries. On March 29, 2019, we entered into a non-prosecution agreement (NPA) with the U.S. Department of Justice (DOJ) and a separate agreement with the SEC in connection with its Cease and Desist Order (SEC Order) intended to resolve fully and finalize the U.S. government allegations against us arising from DOJ and SEC investigations into conduct in countries outside the U.S. that violated the FCPA or other anti-bribery laws, and we agreed to the appointment of an independent compliance monitor (the Monitor). The Monitor certified to our implementation of an effective anti-corruption compliance program on December 30, 2022, and submitted her final certification report on January 31, 2023. The DOJ and SEC have accepted the Monitor’s certification and the NPA and SEC Order expired on March 1, 2023 and March 29, 2023, respectively. While we continue to make significant investments in our compliance and financial controls and in our compliance, legal and financial organizations (including certain remaining recommendations of the Monitor), and are fully committed to compliance with the FCPA and other applicable anti-bribery laws, we cannot ensure that our internal control policies and procedures always will protect us from deliberate, reckless or inadvertent acts of our employees or third-party intermediaries that contravene our compliance policies or violate applicable laws. Our continued expansion, including in developing countries, could increase the risk of such violations in the future. Violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse impact on our business, financial condition and results of operations.

In 2015, we self-reported to the German prosecutor conduct with a potential nexus to Germany and continued to cooperate with government authorities in Germany in their review of the conduct that prompted our and the United States government investigations.

For further information, see note 25 of the notes to our consolidated financial statements included in this report.

Risks relating to our business activities and industry

We are subject to risks associated with public health crises and epidemics/pandemics, such as the global COVID-19 pandemic.

Our global operations expose us to risks associated with public health crises and epidemics/pandemics, such as the global COVID-19 pandemic. Given the already compromised health condition of our typical dialysis patients, our patients represent a heightened at-risk population, particularly, but not limited to, during a public health crisis such as the COVID-19 pandemic which has led to increases in mortality rates in our patient population resulting in an adverse impact on our operations. The COVID-19 pandemic, specifically, has resulted in a material deterioration of the conditions for the global economy and financial markets have been materially affected, all of which have adversely affected and are expected to continue to adversely affect our business, results of operations and financial condition. See “We could be adversely affected if we experience shortages of goods or material price increases from our suppliers, or an inability to access new and improved products and technology” below. Going forward, the prolonged effects attributable to the COVID-19 pandemic on the macroeconomic and operational environment may continue to have an adverse impact on our operations and increase our expenses, including as a result of impacts associated with preventive and precautionary measures that we, our suppliers, customers and other businesses or governments continue to implement or impose on a local, regional, national or international level.

12

As noted above, our patients represent a heightened at-risk population. Our in-center and home hemodialysis (HHD) patients must receive their life-saving dialysis treatment several days a week for three to four hours at a time, and our peritoneal dialysis patients must dialyze daily, which presents unique challenges for patients and their care teams. During the height of the COVID-19 pandemic, we experienced negative impacts on employee absenteeism, turnover and the recruiting cycle for new employees, which adversely affected our production and clinical services operations and could continue to do so. In our dialysis clinics we are challenged to maintain sufficient clinical staff, including nurses, social workers, dietitians, care technicians and available space to treat all of our patients, including those who are or may be infected with COVID-19, in a manner that does not unnecessarily expose our care teams or other patients for whom we provide dialysis services and have experienced clinical personnel shortages. We have incurred, and expect to continue to incur, extra costs in establishing isolated treatment areas for actual and suspected COVID-positive patients, implementing expanded personal protective equipment protocols and other precautions as well as identifying, containing and addressing the impact of COVID-19 infections on our staff and patients. It appears that COVID-19 has resulted in an increase in persons experiencing temporary renal failure in many areas in which we operate. We expect to continue to experience additional staffing shortages as well as incur additional staffing costs required to meet the resulting increased demand for dialysis treatment and/or to provide equipment and medical staff needed for emergency treatments, for example in hospitals. Increased mortality rates in either the pre-ESRD patient population or in our ESRD patient population, compared to their historical averages, have and could continue to materially and adversely affect our operating results. Patients suffering from ESRD generally have co-morbidities that often place them at increased risk with COVID-19 and the COVID-19 pandemic has resulted in more of our dialysis patients requiring hospitalization, a trend which could continue as new variants arise, which could materially and adversely affect our financial results, including those of our value-based and shared risk products and services.

As a result of these and potentially other factors, and given the evolving nature of the virus, as exemplified by the development and proliferation of several variants of the virus, the COVID-19 pandemic could further negatively affect our results. For further information, see Item 5. “Operating and financial review and prospects — II. Financial condition and results of operations — Company Structure,” below. It is uncertain how COVID-19 will further affect our global operations generally if these impacts persist or are exacerbated over an extended period of time. Any of these impacts could have a continued material adverse effect on our business, financial condition and results of operations.

In addition, to the extent that the COVID-19 pandemic adversely affects our business, net assets, financial condition and results of operations, it could also have the effect of heightening many of the other risks described in this report.

If physicians and other referral sources cease referring patients to our health care service businesses and facilities or cease purchasing or prescribing our products, our revenues would decrease.

In providing services within our health care business, we depend upon patients choosing our health care facilities as the location for their care. Patients may select a facility based, in whole or in part, on the recommendation of their physician. Physicians and other clinicians typically consider a number of factors when recommending a particular dialysis facility, dialysis home program, pharmacy, physician practice, vascular surgery center, or cardiac catheterization center to an ESRD patient, including the quality of care, the competency of staff, convenient scheduling, and location and physical condition. Physicians may change their recommendations, which may result in the movement of new or existing patients to competing facilities, including facilities established by the physicians themselves. At most of our dialysis clinics and home programs, a relatively small number of physicians often account for the referral of all or a significant portion of the patient base. We have no ability to dictate these recommendations and referrals. If a significant number of physicians or other referral sources cease referring their patients to our facilities and home programs or stop purchasing or prescribing our dialysis products, this would reduce our health care revenue and could materially adversely affect our overall operations.

As a company with operations spanning 150 countries, we face specific risks from our global operations.

We operate dialysis clinics in around 50 countries and sell a range of products and services to customers in approximately 150 countries. Our global operations are subject to a number of risks, including but not limited to the following:

| ● | the economic and political situation in certain countries or regions could deteriorate, become unstable, or lead to armed conflict, as exemplified by the Ukraine War; |

| ● | geopolitical factors could intensify fluctuations in exchange rates, currency devaluations, and/or material increases in interest rates (for example, as a reaction from central banks to high inflation), any of which could adversely affect profitability and all of which have been heightened by the Ukraine War; |

13

| ● | sovereign rating agency downgrades coupled with an economic downturn in various regions or as a result of geopolitical conflicts in certain regions (for example, the Ukraine War) could result in impairment of our goodwill, investments or other assets due to decreases in the recoverable amount of those assets relative to their book value; |

| ● | we could face difficulties in enforcing and collecting accounts receivable under some countries’ legal systems; |

| ● | local regulations could restrict our ability to obtain a direct ownership interest in dialysis clinics or other operations; |

| ● | some countries or economic unions may impose charges or restrictions, such as local content requirements, which restrict the importation of our products or give local manufacturers an advantage in tenders or provide large discounts to providers for certain purchases of our products; |

| ● | potential increases in tariffs and trade barriers could occur upon any withdrawal by the U.S. or other countries from multilateral trade agreements or the imposition of sanctions, retaliatory tariffs and other countermeasures in the wake of trade disputes and geopolitical conflicts and wars in certain regions (for example the Ukraine War); |

| ● | we could experience transportation delays or interruptions or higher energy costs or energy shortages, such as Russia’s restriction of energy exports to Europe imposed in connection with the Ukraine War; |

| ● | growth and expansion into emerging markets could cause us difficulty due to greater regulatory barriers than in the U.S. or Western Europe, the necessity of adapting to new regulatory systems, and problems related to entering new markets with different economic, social, legal and political systems and conditions; and |

| ● | we may not prevail in competitive contract tenders. |

Any one or more of these or other factors relevant to global operations could increase our costs, reduce our revenues, or disrupt our operations, with possible material adverse impact on our business and financial condition.

Certain countries in which we market, manufacture or sell our products do not have laws which protect our intellectual property to the same degree as those in the U.S. or elsewhere and our competitors may gain market position by designing products that infringe upon our intellectual property rights. An inability to protect our intellectual property in these countries could have an adverse effect on our business, results of operations and financial condition.

We conduct humanitarian-related business and provide life-sustaining health care products and services directly or indirectly in sanctioned countries, such as Russia, Belarus, Iran and Syria. We believe our humanitarian-related business is permitted by applicable sanctions regimes (or, in some cases is excluded from such regimes), and in light of the humanitarian nature of our products and services and the patient communities that benefit from our products, we expect to continue such activities, provided they continue to be permissible under or excluded from applicable export control and economic sanctions laws and regulations. Life-sustaining health care products are usually not subject to trade sanctions/export controls. However, as a result of the escalation of EU, U.S. and other countries’ trade sanctions targeting Russia and Belarus, certain spare parts and components for our products fall under product categories subject to restrictions. Sanctions programs often, but do not always, provide for certain exemptions or availability of licensure for medical or pharmaceutical purposes. Furthermore, product registration procedures may be affected in case technology/technical information on products or components to be submitted in such procedures is or becomes subject to export or transfer restrictions for a relevant country and in case relevant licenses cannot be obtained, which ultimately may also have an impact on marketability of affected products. At this time, we expect that such risk would mostly be limited to product registration procedures in Russia and Belarus as a result of the escalation of EU, U.S. and other countries’ trade sanctions targeting Russia and Belarus, but it may also affect Eurasian Economic Union (EAEU) product registration procedures in other EAEU member states in case these involve an information exchange with Russian/Belarusian authorities of restricted technology/technical information and in case relevant licenses cannot be obtained. A violation of applicable economic sanctions or export controls laws and regulations could subject us to enforcement actions. Possible enforcement actions vary between jurisdictions and depend on the factual circumstances of the given violation, but could include criminal penalties, imprisonment of responsible individuals, administrative or civil penalties, restricted access to certain markets and reputational harm, among others. Our internal control policies and procedures may not protect us from deliberate, reckless or inadvertent acts of our employees or agents that contravene our compliance policies or violate applicable laws.

14

If we fail to estimate, price for and manage medical costs in an effective manner, the profitability of our value and risk-based care programs could decline and could materially and adversely affect our results of operations, financial position and cash flows.

Through our value and risk-based care programs, we assume the risk of both medical and administrative costs for certain patients in return for fixed periodic payments or potential reimbursement based on our achievement against set benchmark targets from governmental and commercial insurers. Specifically in the U.S., our participation in various value and risk-based care programs includes the CMS CKCC model and capitation, risk-based or shared savings agreements with commercial insurers in which FMCH receives fixed periodic payments or set benchmark targets to cover all or a defined portion of the medical costs of a defined population of patients. For information on the value-based programs in which we participate, see Item 4B, “Information on the Company — Business overview — Other health care services — Value and risk-based care programs.”