UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

XPO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-32172 | 03-0450326 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| Five American Lane, Greenwich, Connecticut (Address of principal executive offices) |

06831 (Zip Code) |

(855) 976-6951

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.001 per share | XPO | New York Stock Exchange |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| Emerging growth company ¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

| Item 7.01. | Regulation FD Disclosure. |

On February 7, 2024, XPO, Inc. (the “Company”) released a slide presentation expected to be used by the Company in connection with certain future investor presentations. A copy of the slide presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The slide presentation should be read together and with the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

The information furnished in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, except to the extent that the registrant specifically incorporates any such information by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Exhibit Description | |

| 99.1 | Investor Presentation, dated February 7, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 7, 2024 | XPO, INC. |

|

| By: | /s/ Kyle Wismans | |

| Kyle Wismans | ||

| Chief Financial Officer | ||

Exhibit 99.1

Investor Overview Q4 2023 February 2024

2 Forward - looking statements This document includes forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, including statements relating to our full year 2024 expectations of gross capex, interest expense, pension income, adjusted effective tax rate, and diluted share count, and future financial targets of North American LTL revenue CAGR, adjusted EBITDA CAGR, adjusted operating ratio improvement, capex as a percentage of revenue, and percentage of outsourced linehaul miles . All statements other than statements of historical fact are, or may be deemed to be, forward - looking statements . In some cases, forward - looking statements can be identified by the use of forward - looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms . These forward - looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances . These forward - looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward - looking statements . Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC, and the following : the effects of business, economic, political, legal, and regulatory impacts or conflicts upon our operations ; supply chain disruptions, the global shortage of certain components such as semiconductor chips, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages ; our ability to align our investments in capital assets, including equipment, service centers, and warehouses and other network facilities, to our customers’ demands ; our ability to implement our cost and revenue initiatives ; the effectiveness of our action plan, and other management actions, to improve our North American LTL business ; our ability to benefit from a sale, spin - off or other divestiture of one or more business units ; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies ; goodwill impairment, including in connection with a business unit sale or other divestiture ; changes in tariffs, trade restrictions, trade agreements, tax policies, the impacts of our defined benefit plans, difficulties in managing or overseeing foreign operations and external agents different liability standards, issues related to compliance with data protection laws, competition laws, and intellectual property laws in countries that we provide services in ; fluctuations in currency exchange rates ; fuel price and fuel surcharge changes ; the expected benefits of the spin - offs of GXO Logistics, Inc . and RXO, Inc . on the size and business diversity of our company ; our ability to develop and implement suitable information technology systems ; the impact of potential cyber - attacks and information technology or data security breaches or failures ; our indebtedness ; our ability to raise debt and equity capital ; fluctuations in fixed and floating interest rates ; seasonal fluctuations ; issues related to our intellectual property rights ; our ability to maintain positive relationships with our network of third - party transportation providers ; our ability to successfully manage the transitions of certain management roles ; our ability to attract and retain key employees, including qualified drivers ; labor matters ; litigation ; risks associated with our self - insured claims ; governmental or political actions ; and competition and pricing pressures . All forward - looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations . Forward - looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward - looking statements except to the extent required by law . Non - GAAP financial measures This presentation contains non - GAAP financial measures . For a description of these non - GAAP financial measures, including a reconciliation to the most comparable measure under GAAP, see the Appendix to this presentation .

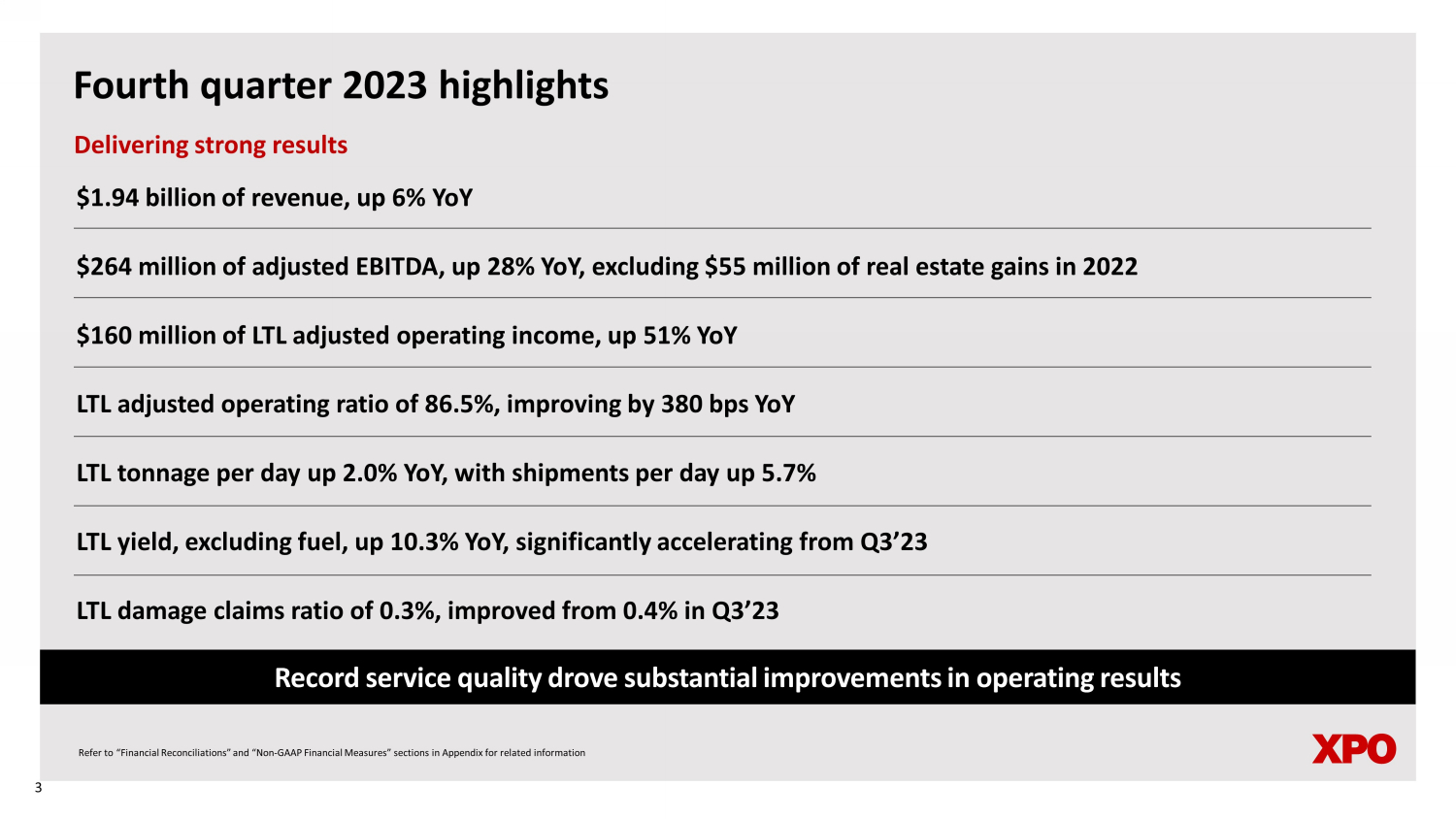

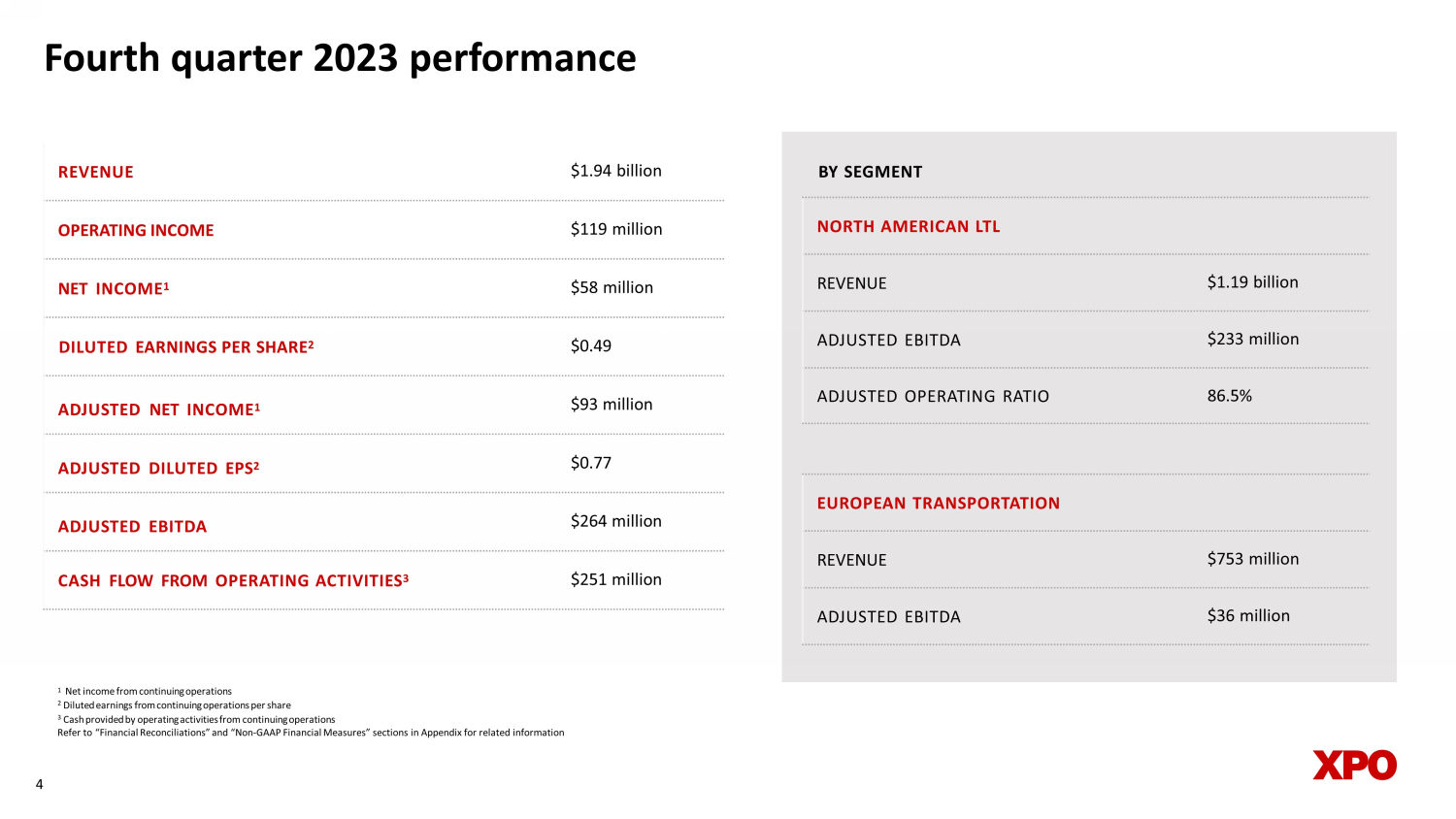

Fourth quarter 2023 highlights $1.94 billion of revenue, up 6% YoY $264 million of adjusted EBITDA, up 28% YoY, excluding $55 million of real estate gains in 2022 $160 million of LTL adjusted operating income, up 51% YoY LTL adjusted operating ratio of 86.5%, improving by 380 bps YoY LTL tonnage per day up 2.0% YoY, with shipments per day up 5.7% LTL yield, excluding fuel, up 10.3% YoY, significantly accelerating from Q3’23 LTL damage claims ratio of 0.3%, improved from 0.4% in Q3’23 Record service quality drove substantial improvements in operating results Delivering strong results Refer to “Financial Reconciliations” and “Non - GAAP Financial Measures” sections in Appendix for related information 3 4 Fourth quarter 2023 performance REVENUE $1.94 billion OPERATING INCOME $119 million NET INCOME 1 $58 million DILUTED EARNINGS PER SHARE 2 $0.49 ADJUSTED NET INCOME 1 $93 million ADJUSTED DILUTED EPS 2 $ 0.77 ADJUSTED EBITDA $ 264 million CASH FLOW FROM OPERATING ACTIVITIES 3 $251 million NORTH AMERICAN LTL REVENUE $1.19 billion ADJUSTED EBITDA $233 million ADJUSTED OPERATING RATIO 86.5% 1 Net income from continuing operations 2 Diluted earnings from continuing operations per share 3 Cash provided by operating activities from continuing operations Refer to “Financial Reconciliations” and “Non - GAAP Financial Measures” sections in Appendix for related information EUROPEAN TRANSPORTATION REVENUE $753 million ADJUSTED EBITDA $36 million BY SEGMENT

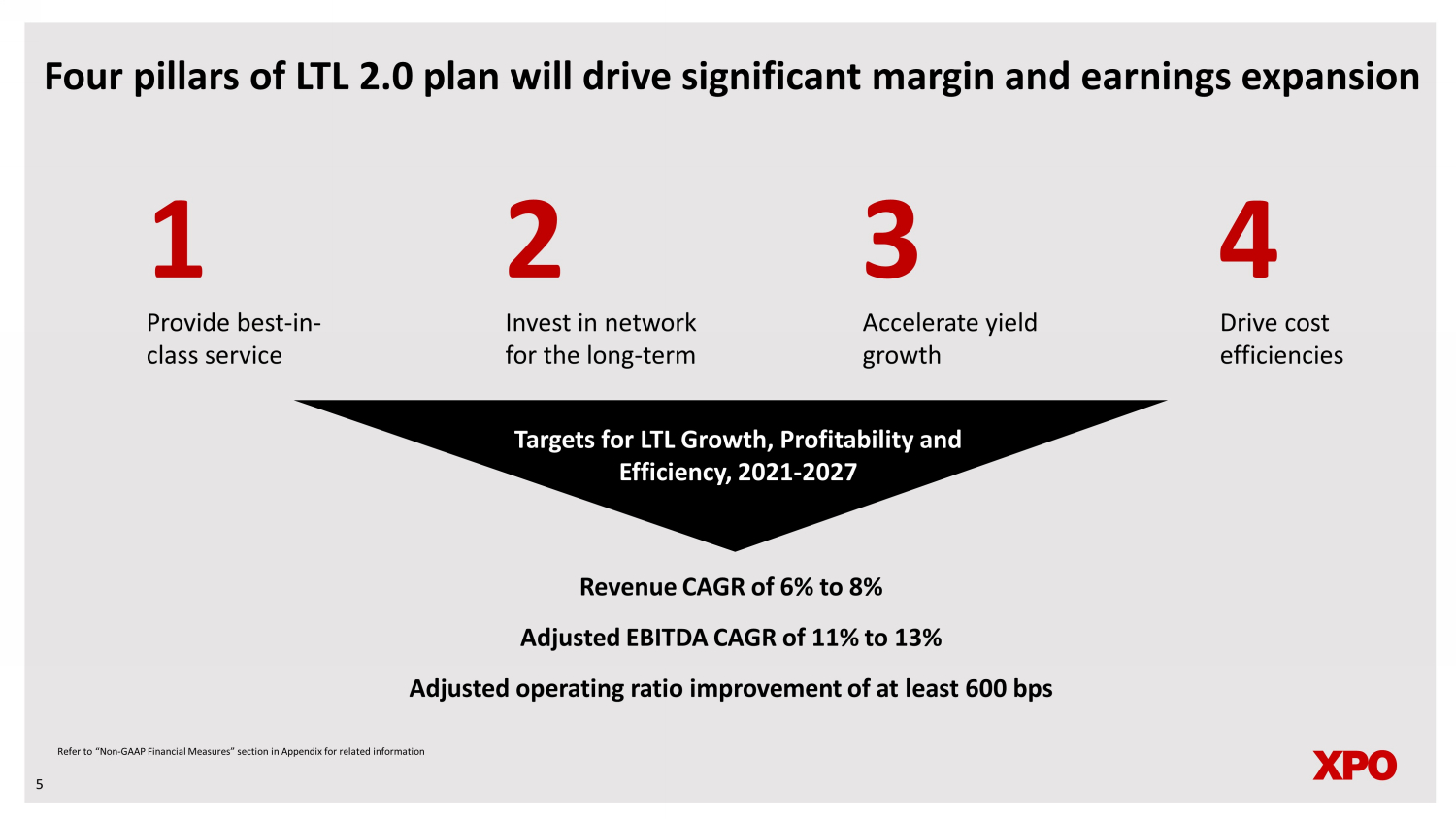

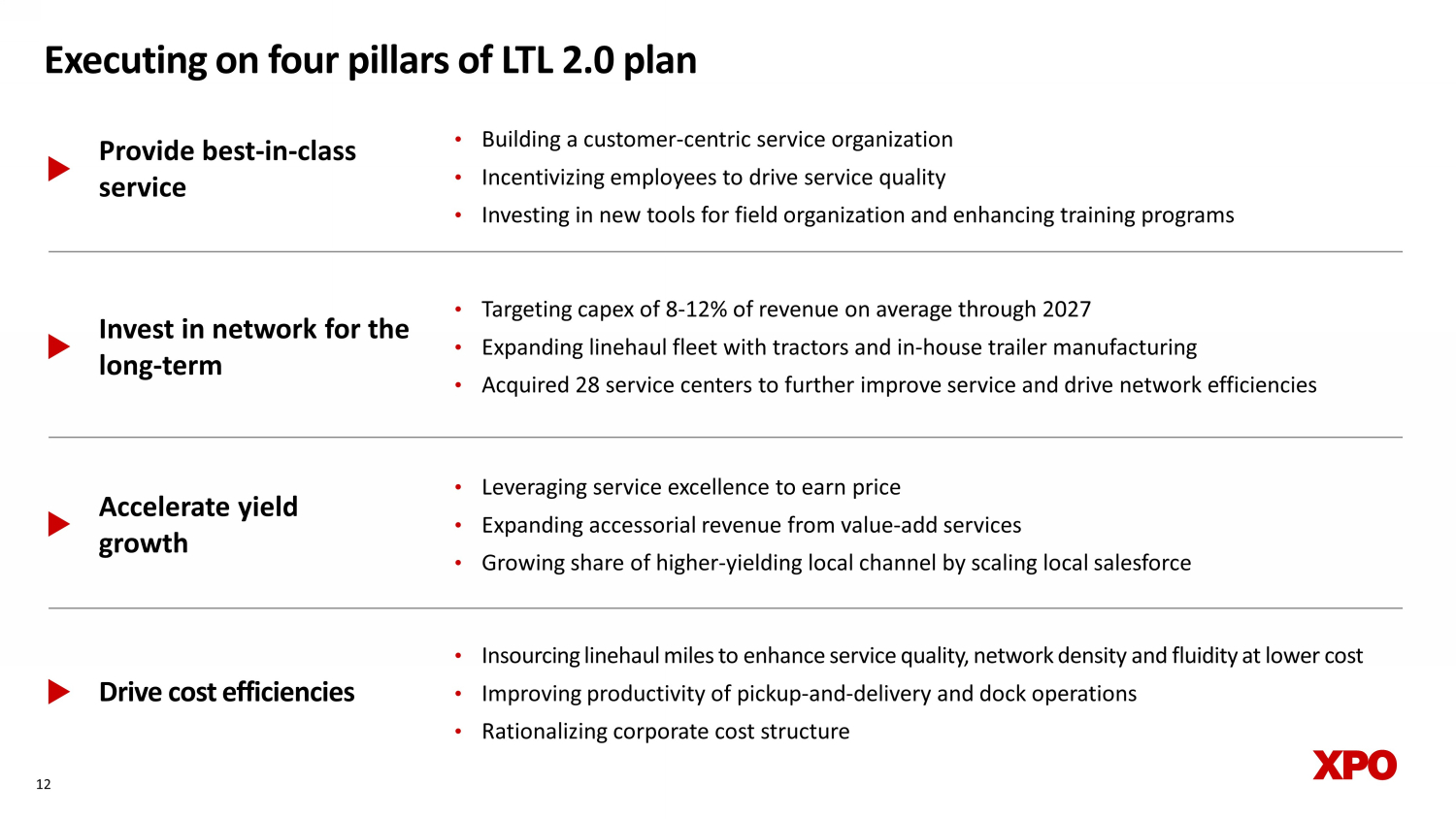

Four pillars of LTL 2.0 plan will drive significant margin and earnings expansion 5 Provide best - in - class service 2 3 4 Invest in network for the long - term Accelerate yield growth Drive cost efficiencies Targets for LTL Growth, Profitability and Efficiency, 2021 - 2027 1 Revenue CAGR of 6% to 8% Adjusted EBITDA CAGR of 11% to 13% Adjusted operating ratio improvement of a t least 600 bps Refer to “Non - GAAP Financial Measures” section in Appendix for related information Strong position in North American LTL 6 6

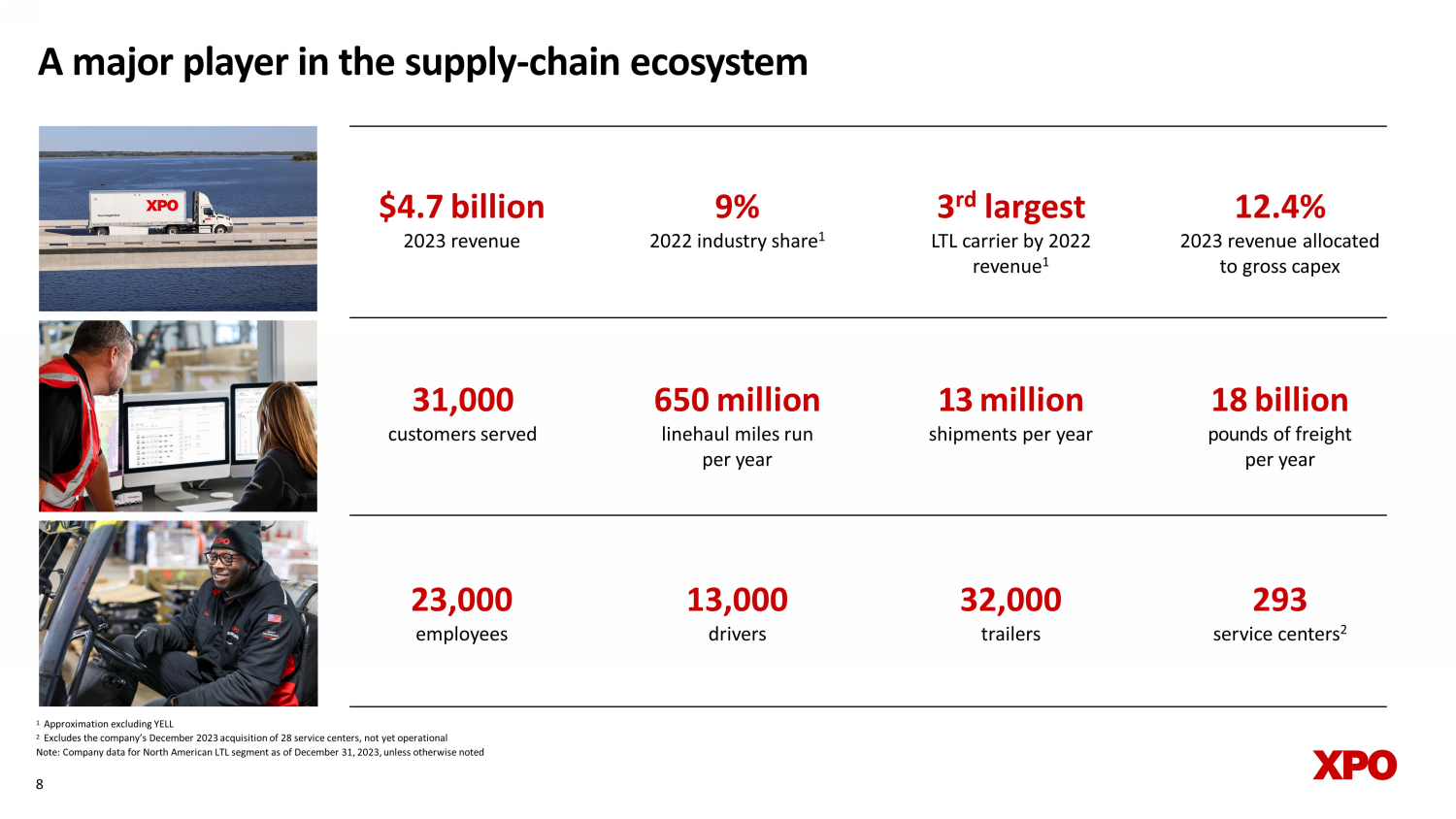

A leading carrier in a compelling industry • $59 billion bedrock industry for the US economy; with 77% of share held by top 10 LTL players • Diverse demand across verticals, with secular growth drivers • Attractive pricing environment, with industry pricing positive YoY each year for over a decade • Strong service quality is key gating factor for yield growth and margin expansion • Industry service center capacity stayed nearly flat for a decade, while demand trended up 1 6% North American LTL industry revenue CAGR Sources: Third - party research; company filings Note: Revenue CAGR for periods 2010 – 2022; industry size and market share from 2022 1 US service centers, includes ARCB, FDX, ODFL, SAIA, XPO and YELL; total number of service centers includes zones with doors 7 A major player in the supply - chain ecosystem 1 Approximation excluding YELL 2 Excludes the company’s December 2023 acquisition of 28 service centers, not yet operational Note: Company data for North American LTL segment as of December 31, 2023, unless otherwise noted 3 rd largest LTL carrier by 2022 revenue 1 12.4% 2023 revenue allocated to gross capex 13 million s hipments per year 31 ,000 customers served $4.7 billion 2023 revenue 9 % 2022 industry share 1 8 13,0 0 0 d rivers 32 ,0 0 0 t railers 18 billion pounds of freight per year 6 5 0 million l inehaul miles run per year 2 3 ,0 0 0 e mployees 293 service centers 2 quarterly (bring back

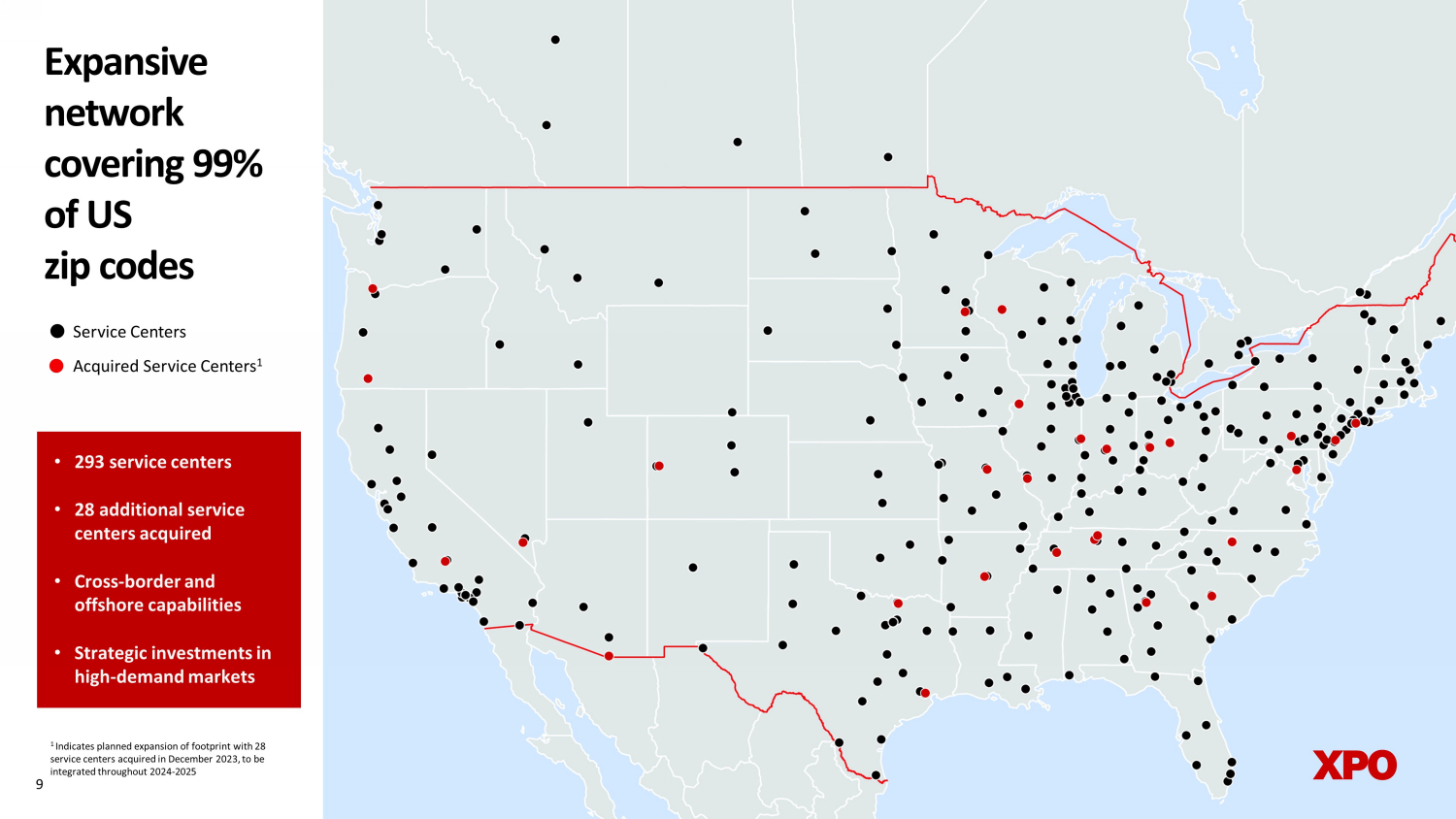

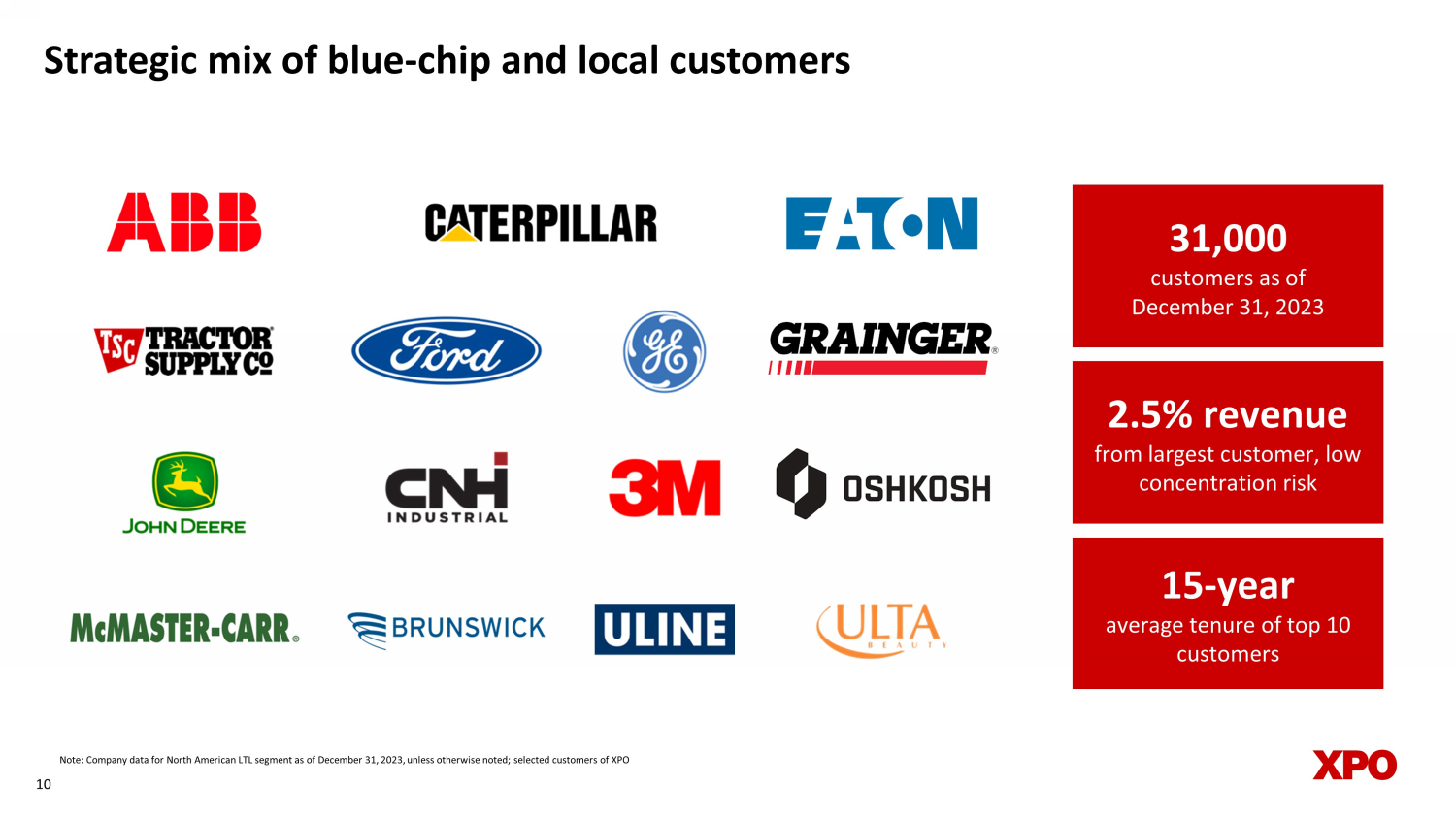

9 Expansive network covering 99% of US zip codes • 293 service centers • 28 additional service centers acquired • Cross - border and offshore capabilities • Strategic investments in high - demand markets 1 Indicates planned expansion of footprint with 28 service centers acquired in December 2023, to be integrated throughout 2024 - 2025 Acquired Service Centers 1 Service Centers Strategic mix of blue - chip and local customers 10 2.5% revenue from largest customer, low concentration risk 15 - y ear average t enure of t op 10 customers 31,000 customers as of December 31, 2023 Note: Company data for North American LTL segment as of December 31, 2023, unless otherwise noted; selected customers of XPO

LTL growth plan and levers 11

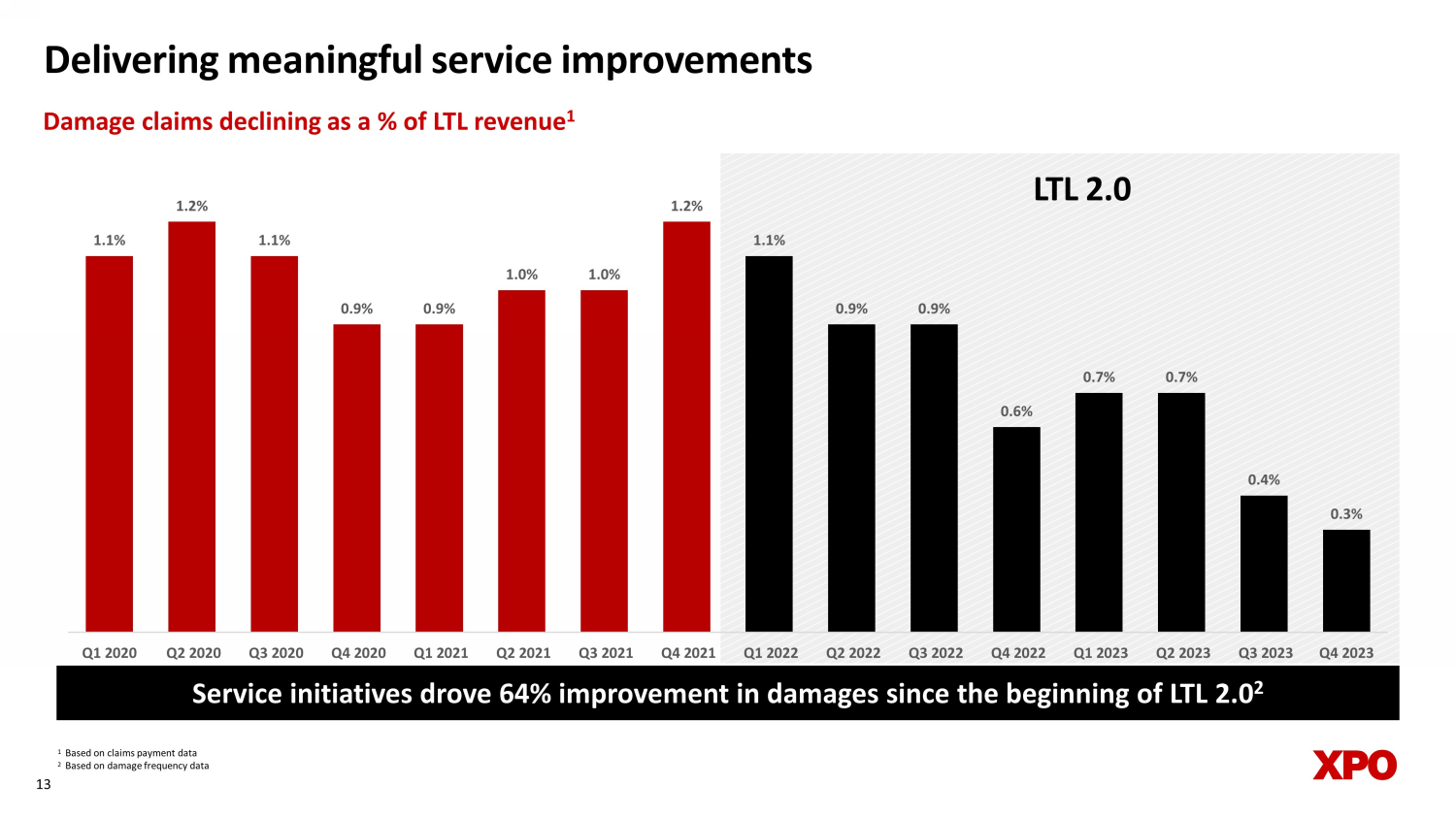

Provide best - in - class service Accelerate yield growth Drive cost efficiencies • Leveraging service excellence to earn price • Expanding accessorial revenue from value - add services • Growing share of higher - yielding local channel by scaling local salesforce • Insourcing linehaul miles to enhance service quality, network density and fluidity at lower cost • Improving productivity of pickup - and - delivery and dock operations • Rationalizing corporate cost structure 12 Executing on four pillars of LTL 2.0 plan • Building a customer - centric service organization • Incentivizing employees to drive service quality • Investing in new tools for field organization and enhancing training programs Invest in network for the long - term • Targeting capex of 8 - 12% of revenue on average through 2027 • Expanding linehaul fleet with tractors and in - house trailer manufacturing • Acquired 28 service centers to further improve service and drive network efficiencies 1 Based on claims payment data 2 Based on damage frequency data 13 Service initiatives drove 64% improvement in damages since the beginning of LTL 2.0 2 LTL 2.0 Delivering meaningful service improvements 1.1% 1.2% 1.1% 0.9% 0.9% 1.0% 1.0% 1.2% 1.1% 0.9% 0.9% 0.6% 0.7% 0.7% 0.4% 0.3% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Damage claims declining as a % of LTL revenue 1

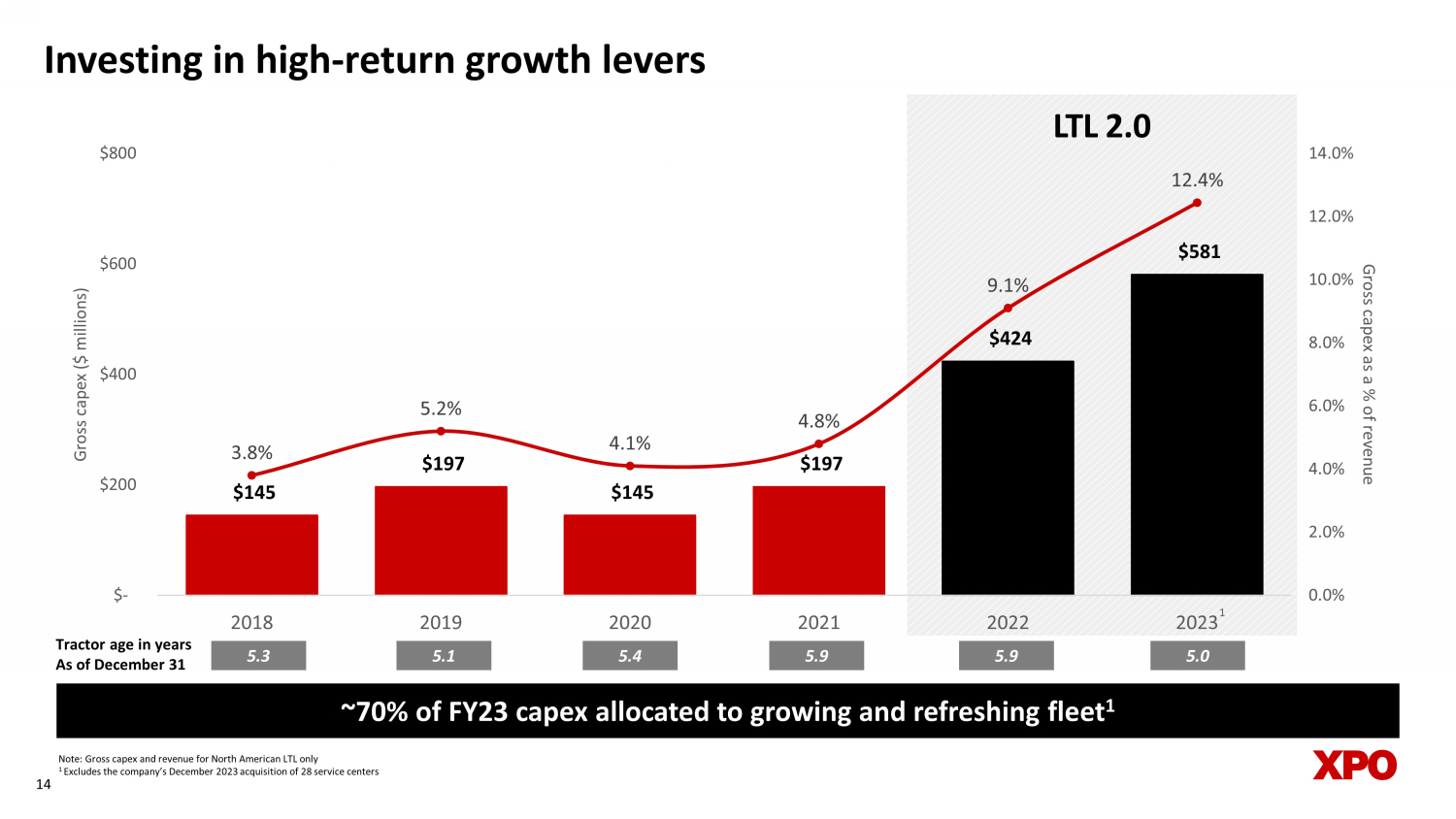

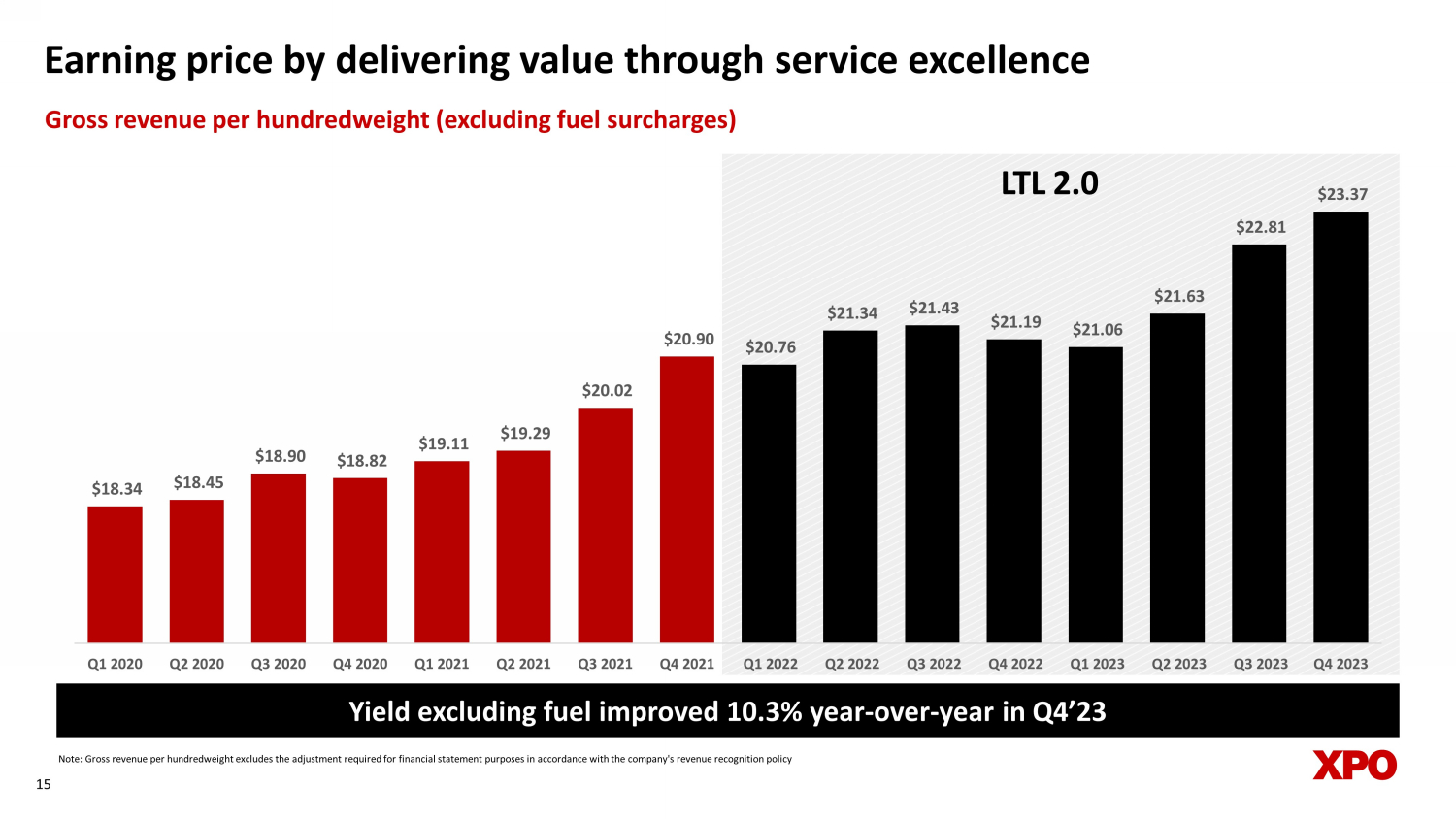

Investing in high - return growth levers 14 Tractor age in years As of December 31 5.3 5.1 5.4 5.9 5.9 Note: Gross capex and revenue for North American LTL only 1 Excludes the company’s December 2023 acquisition of 28 service centers 5.0 LTL 2.0 $145 $197 $145 $197 $424 $581 3.8% 5.2% 4.1% 4.8% 9.1% 12.4% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% $- $200 $400 $600 $800 2018 2019 2020 2021 2022 2023 Gross capex as a % of revenue Gross capex ($ millions) 1 ~70% of FY23 capex allocated to growing and refreshing fleet 1 Earning price by delivering value through service excellence 15 Note: Gross revenue per hundredweight excludes the adjustment required for financial statement purposes in accordance with th e c ompany's revenue recognition policy Yield excluding fuel improved 10.3% year - over - year in Q4’23 Gross revenue per hundredweight (excluding fuel surcharges) $18.34 $18.45 $18.90 $18.82 $19.11 $19.29 $20.02 $20.90 $20.76 $21.34 $21.43 $21.19 $21.06 $21.63 $22.81 $23.37 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 LTL 2.0

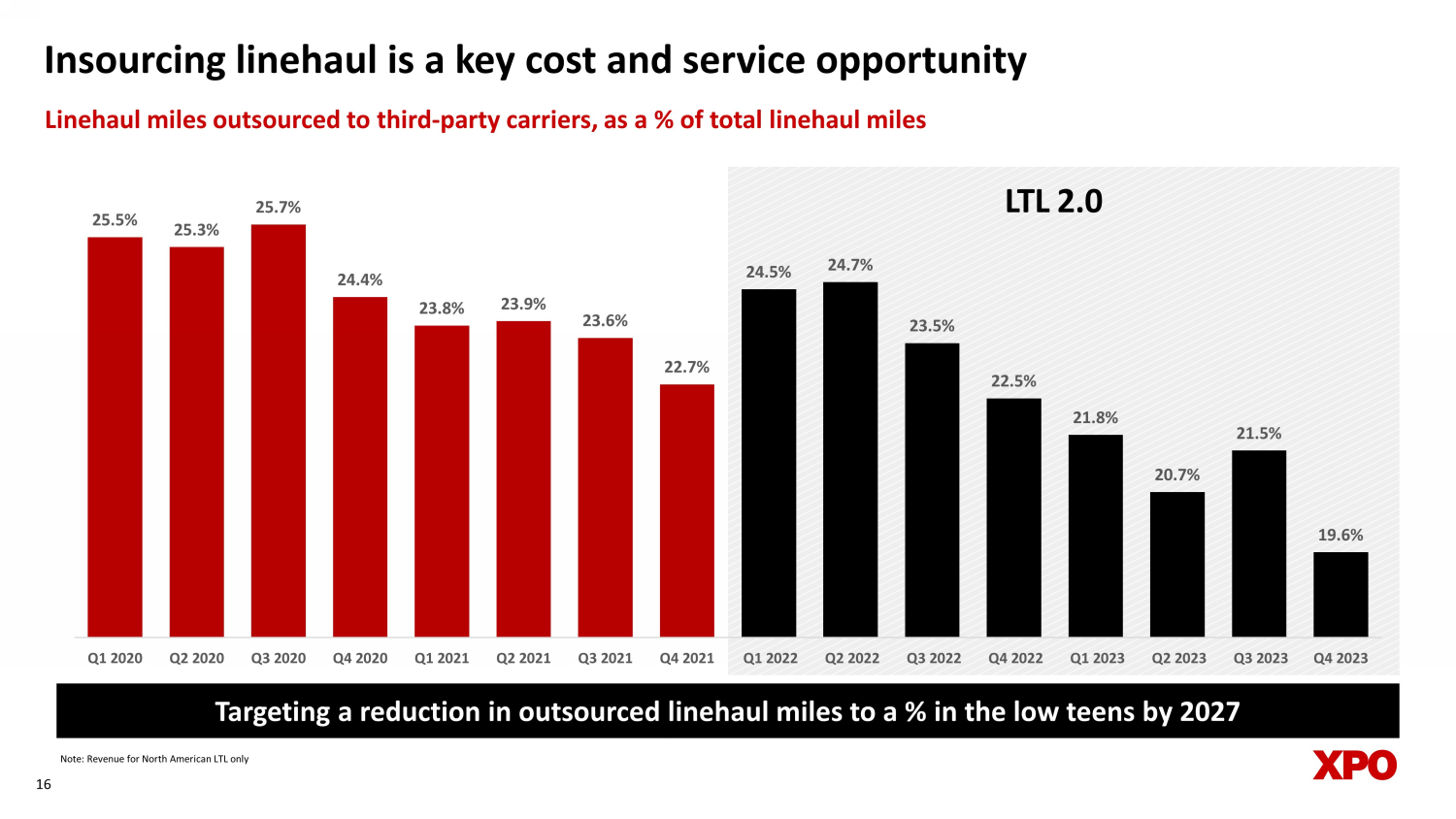

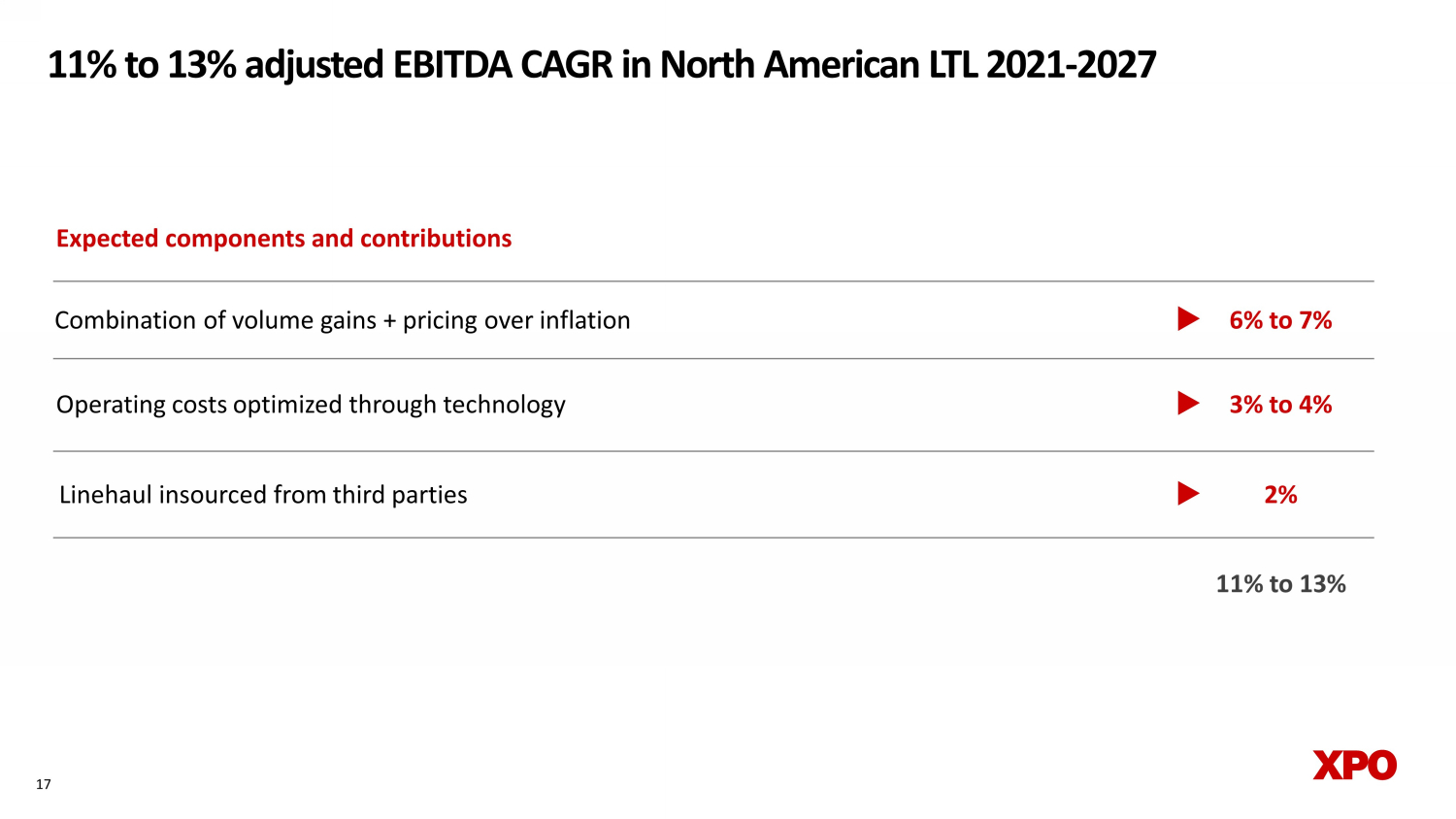

Insourcing linehaul is a key cost and service opportunity 16 Targeting a reduction in outsourced linehaul miles to a % in the low teens by 2027 Note: R evenue for North American LTL only 25.5% 25.3% 25.7% 24.4% 23.8% 23.9% 23.6% 22.7% 24.5% 24.7% 23.5% 22.5% 21.8% 20.7% 21.5% 19.6% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 LTL 2.0 Linehaul miles outsourced to third - party carriers, as a % of total linehaul miles 17 11% to 13% adjusted EBITDA CAGR in North American LTL 2021 - 2027 Combination of volume gains + pricing over inflation 6% to 7% 3% to 4% 2% Operating costs optimized through technology Linehaul insourced from third parties Expected components and contributions 11% to 13%

Appendix 18

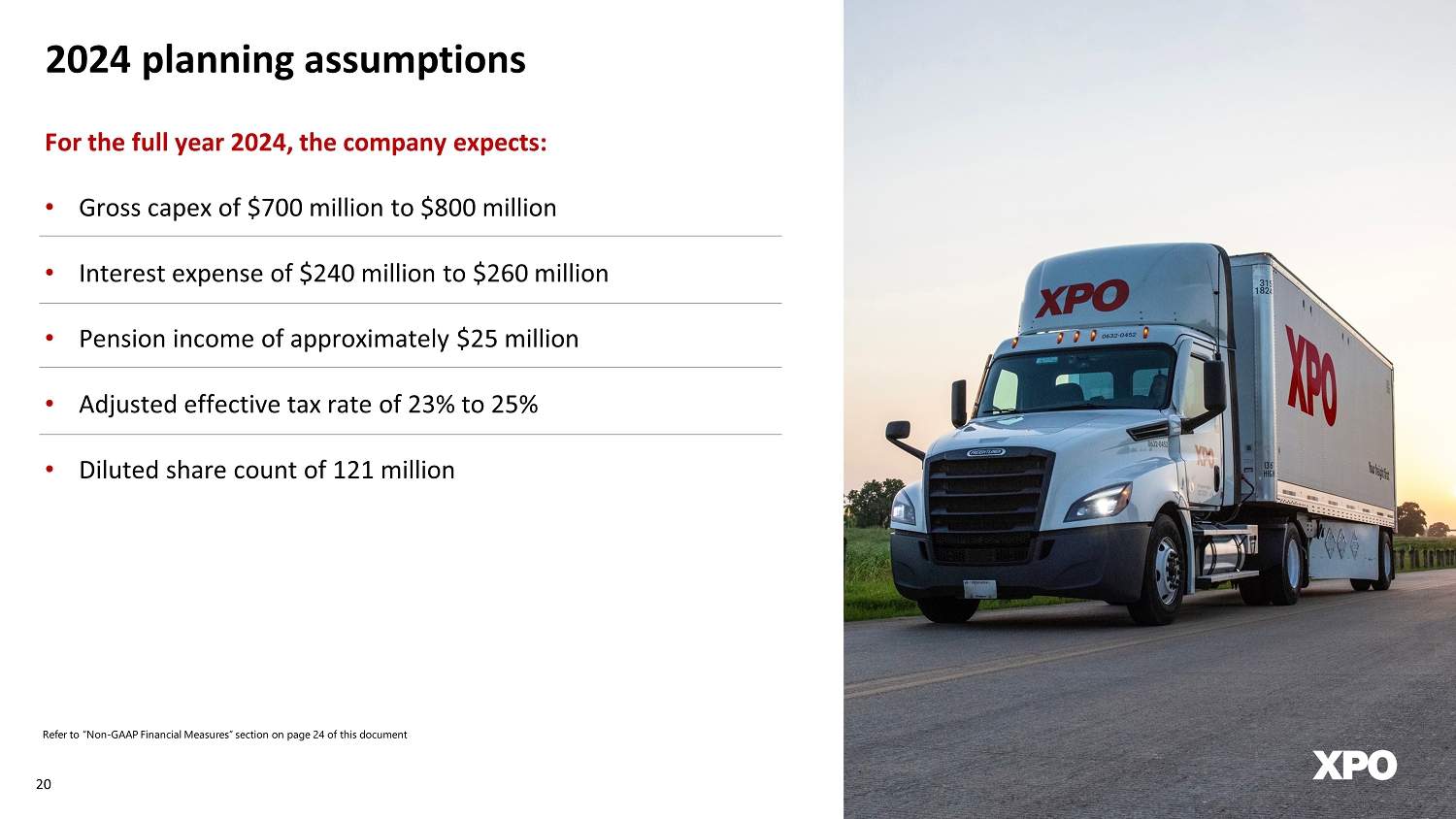

European Transportation segment • In France: the #1 full truckload (FTL) broker and the #1 pallet network (LTL) provider • In Iberia (Spain and Portugal): the #1 FTL broker and the #1 LTL provider • In the UK: a top - tier dedicated truckload provider, and the largest single - owner LTL network • Serves a diverse base of customers with consumer, trade and industrial markets, including many sector leaders that have long - tenured relationships with XPO • Range of services includes dedicated truckload, LTL, FTL brokerage, managed transportation, last mile and freight forwarding, as well as multimodal solutions that are customized to reduce CO 2 e emissions Unique pan - European transportation platform holds leading positions in key geographies 19 19 20 For the full year 2024, the company expects: • Gross capex of $700 million to $800 million • Interest expense of $240 million to $260 million • Pension income of approximately $25 million • Adjusted effective tax rate of 23% to 25% • Diluted share count of 121 million 2024 planning assumptions

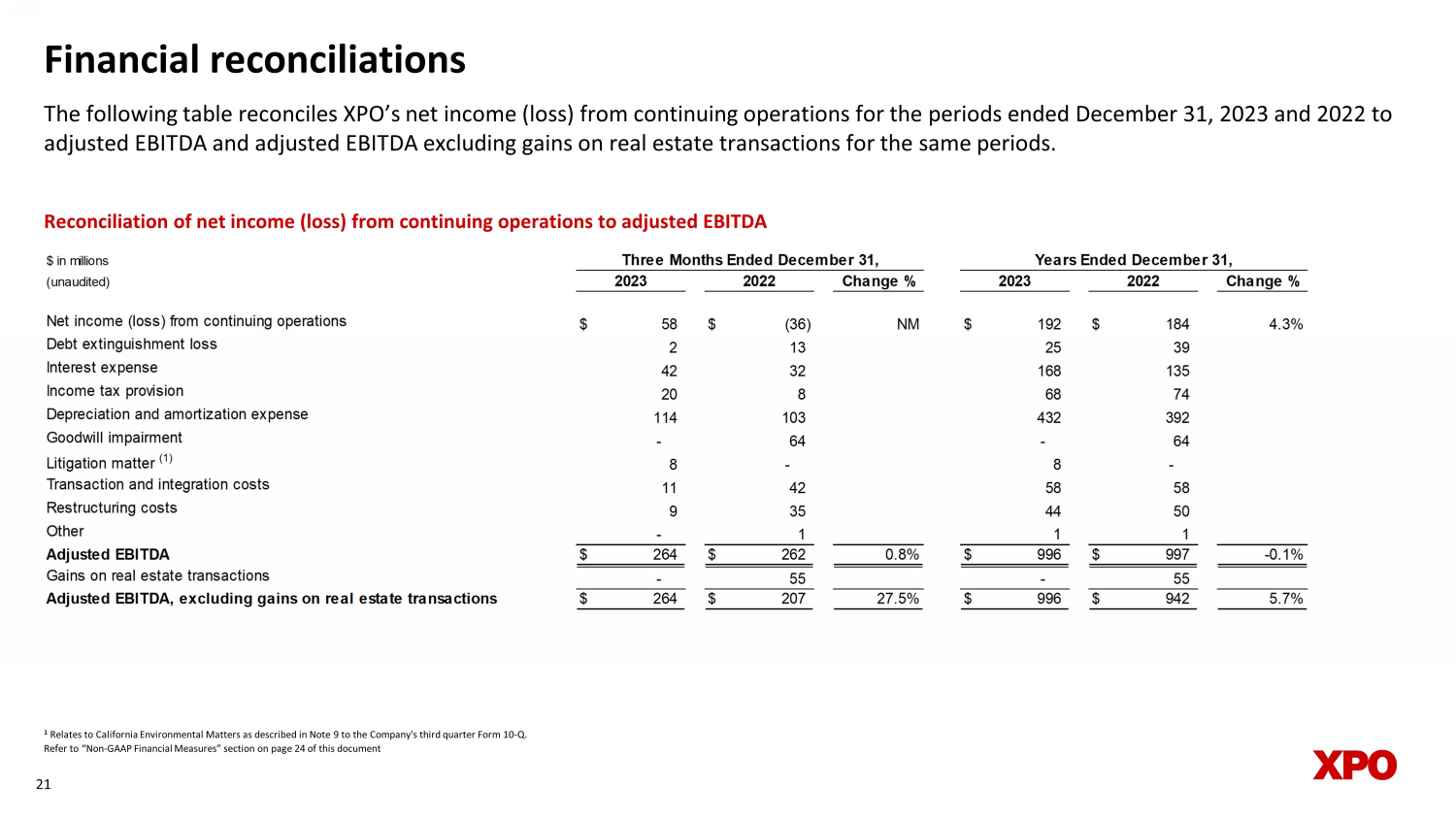

Financial reconciliations The following table reconciles XPO’s net income (loss) from continuing operations for the periods ended December 31, 2023 and 20 22 to adjusted EBITDA and adjusted EBITDA excluding gains on real estate transactions for the same periods. 21 Reconciliation of net income (loss) from continuing operations to adjusted EBITDA 1 Relates to California Environmental Matters as described in Note 9 to the Company's third quarter Form 10 - Q. Refer to “Non - GAAP Financial Measures” section on page 24 of this document $ in millions (unaudited) Change % Change % Net income (loss) from continuing operations $ 58 $ (36) NM $ 192 $ 184 4.3% Debt extinguishment loss 2 13 25 39 Interest expense 42 32 168 135 Income tax provision 20 8 68 74 Depreciation and amortization expense 114 103 432 392 Goodwill impairment - 64 - 64 Litigation matter (1) 8 - 8 - Transaction and integration costs 11 42 58 58 Restructuring costs 9 35 44 50 Other - 1 1 1 Adjusted EBITDA $ 264 $ 262 0.8% $ 996 $ 997 -0.1% Gains on real estate transactions - 55 - 55 Adjusted EBITDA, excluding gains on real estate transactions $ 264 $ 207 27.5% $ 996 $ 942 5.7% Three Months Ended December 31, Years Ended December 31, 2023 2022 2023 2022 Financial reconciliations (cont.) The following table reconciles XPO’s net income (loss) from continuing operations for the periods ended December 31, 2023 and 20 22, to adjusted net income from continuing operations for the same periods.

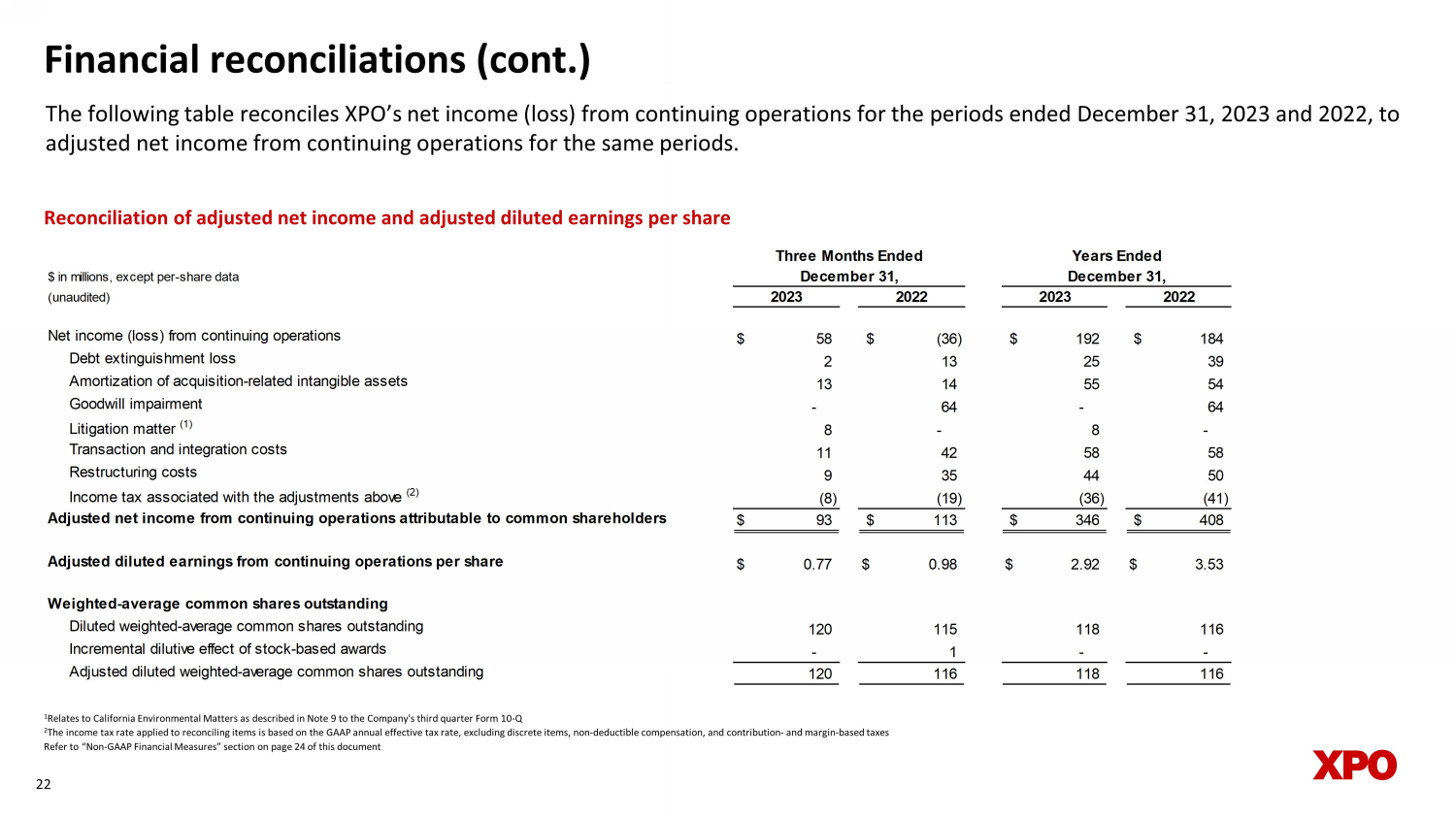

22 1 Relates to California Environmental Matters as described in Note 9 to the Company's third quarter Form 10 - Q 2 The income tax rate applied to reconciling items is based on the GAAP annual effective tax rate, excluding discrete items, no n - d eductible compensation, and contribution - and margin - based taxes Refer to “Non - GAAP Financial Measures” section on page 24 of this document Reconciliation of adjusted net income and adjusted diluted earnings per share $ in millions, except per-share data (unaudited) Net income (loss) from continuing operations $ 58 $ (36) $ 192 $ 184 Debt extinguishment loss 2 13 25 39 Amortization of acquisition-related intangible assets 13 14 55 54 Goodwill impairment - 64 - 64 Litigation matter (1) 8 - 8 - Transaction and integration costs 11 42 58 58 Restructuring costs 9 35 44 50 Income tax associated with the adjustments above (2) (8) (19) (36) (41) Adjusted net income from continuing operations attributable to common shareholders $ 93 $ 113 $ 346 $ 408 Adjusted diluted earnings from continuing operations per share $ 0.77 $ 0.98 $ 2.92 $ 3.53 Weighted-average common shares outstanding Diluted weighted-average common shares outstanding 120 115 118 116 Incremental dilutive effect of stock-based awards - 1 - - Adjusted diluted weighted-average common shares outstanding 120 116 118 116 Three Months Ended Years Ended December 31, December 31, 2023 2022 2023 2022 Financial reconciliations (cont.) The following table reconciles XPO’s operating income attributable to its North American less - than - truckload (LTL) segment for t he periods ended December 31, 2023 and 2022, to adjusted operating income, adjusted operating ratio and adjusted EBITDA.

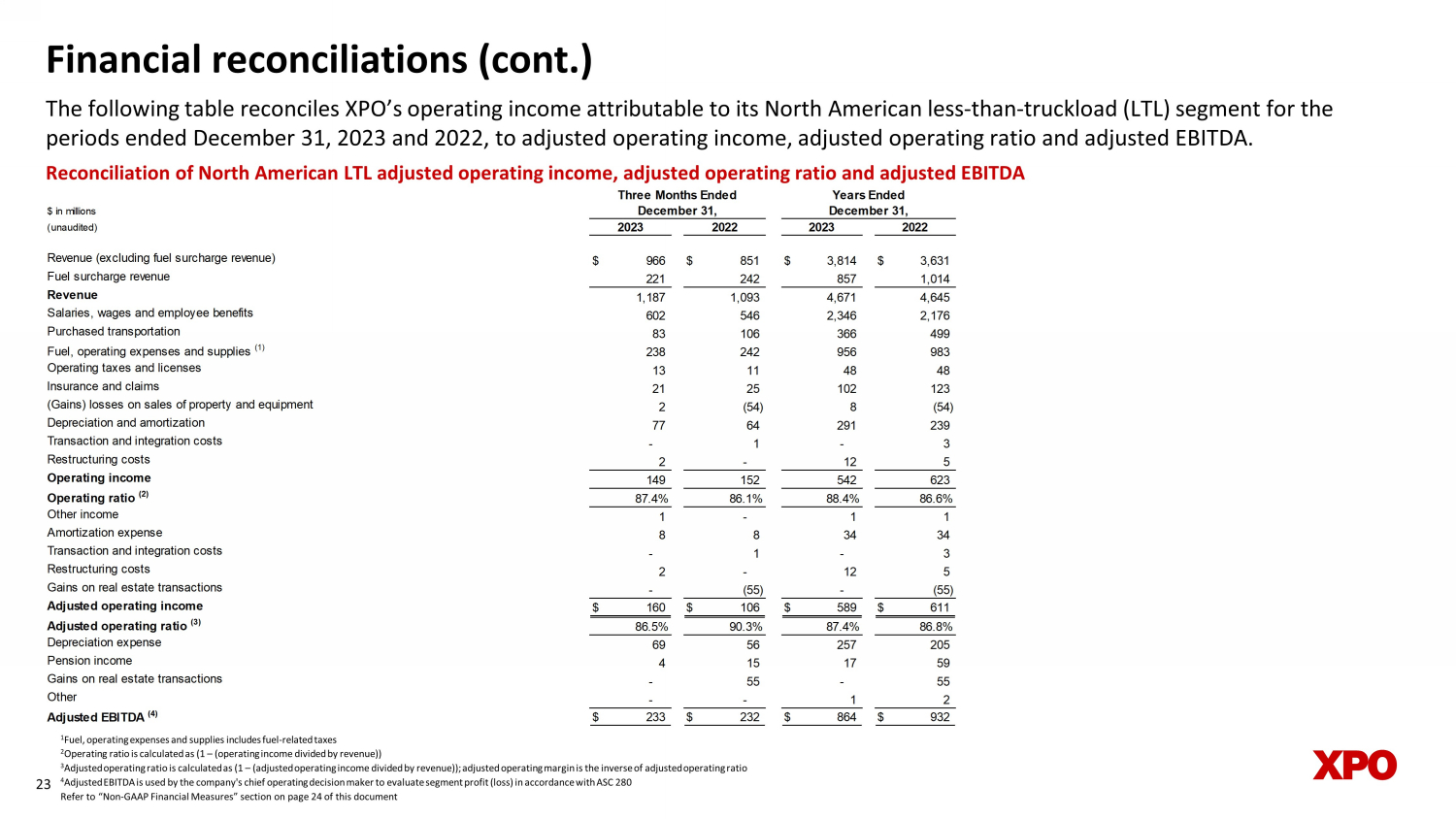

23 Reconciliation of N orth American LTL adjusted operating income, adjusted operating ratio and adjusted EBITDA 1 Fuel, operating expenses and supplies includes fuel - related taxes 2 Operating ratio is calculated as (1 – (operating income divided by revenue)) 3 Adjusted operating ratio is calculated as (1 – (adjusted operating income divided by revenue)); adjusted operating margin is the inverse of adjusted operating ratio 4 Adjusted EBITDA is used by the company's chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280 Refer to “Non - GAAP Financial Measures” section on page 24 of this document $ in millions (unaudited) Revenue (excluding fuel surcharge revenue) $ 966 $ 851 $ 3,814 $ 3,631 Fuel surcharge revenue 221 242 857 1,014 Revenue 1,187 1,093 4,671 4,645 Salaries, wages and employee benefits 602 546 2,346 2,176 Purchased transportation 83 106 366 499 Fuel, operating expenses and supplies (1) 238 242 956 983 Operating taxes and licenses 13 11 48 48 Insurance and claims 21 25 102 123 (Gains) losses on sales of property and equipment 2 (54) 8 (54) Depreciation and amortization 77 64 291 239 Transaction and integration costs - 1 - 3 Restructuring costs 2 - 12 5 Operating income 149 152 542 623 Operating ratio (2) 87.4% 86.1% 88.4% 86.6% Other income 1 - 1 1 Amortization expense 8 8 34 34 Transaction and integration costs - 1 - 3 Restructuring costs 2 - 12 5 Gains on real estate transactions - (55) - (55) Adjusted operating income $ 160 $ 106 $ 589 $ 611 Adjusted operating ratio (3) 86.5% 90.3% 87.4% 86.8% Depreciation expense 69 56 257 205 Pension income 4 15 17 59 Gains on real estate transactions - 55 - 55 Other - - 1 2 Adjusted EBITDA (4) $ 233 $ 232 $ 864 $ 932 Years Ended December 31, 2023 20222023 2022 Three Months Ended December 31, Non - GAAP financial measures As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non - GAAP financial measures contained in this document to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this document . This document contains the following non - GAAP financial measures : adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis ; adjusted EBITDA excluding gains on real estate transactions on a consolidated basis ; adjusted net income from continuing operations ; adjusted diluted earnings from continuing operations per share ("adjusted EPS") ; adjusted operating income for our North American Less - Than - Truckload segment ; and adjusted operating ratio for our North American Less - Than - Truckload segment . We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate these non - GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies . These non - GAAP financial measures should only be used as supplemental measures of our operating performance . Adjusted EBITDA, adjusted EBITDA excluding gains on real estate transactions, adjusted net income from continuing operations, adjusted EPS, adjusted operating income and adjusted operating ratio include adjustments for transaction and integration costs, as well as restructuring costs, and other adjustments as set forth in the attached tables . Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin - off and may include transaction costs, consulting fees, stock - based compensation, retention awards, internal salaries and wages (to the extent the individuals are assigned full - time to integration and transformation activities) and certain costs related to integrating and converging IT systems . Restructuring costs primarily relate to severance costs associated with business optimization initiatives . Management uses these non - GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance . We believe that adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), goodwill impairment charge, tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . We believe that adjusted net income from continuing operations and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities, including amortization of acquisition - related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables . We believe that adjusted operating income and adjusted operating ratio improve the comparability of our operating results from period to period by removing the impact of certain transaction and integration costs and restructuring costs, as well as amortization expenses . With respect to our financial targets for the six - year period 2021 through 2027 of North American less - than - truckload adjusted EBITDA CAGR, and adjusted operating ratio, a reconciliation of these non - GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non - GAAP target measures . The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward - looking statement of income and statement of cash flows in accordance with GAAP that would be required to produce such a reconciliation . 24