UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File Number 001-39809

MEDIROM HEALTHCARE TECHNOLOGIES INC.

(Translation of registrant’s name into English)

2-3-1 Daiba, Minato-ku

Tokyo 135-0091, Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Financial Condition and Results of Operations

x Form 20-F ¨ Form 40-F On December 29, 2023, Medirom Healthcare Technologies Inc. (the “Company”) released its interim report, including the related unaudited and unreviewed condensed consolidated financial statements of the Company, for the six months ended June 30, 2023 (the “Interim Report”).

The Interim Report and accompanying condensed consolidated interim financial statements are unreviewed and unaudited, and have been prepared solely by the Company’s management pursuant to the rules and regulations of the U.S. Securities and Exchange Commission for interim financial reporting. Accordingly, these unaudited and unreviewed financial statements do not include all disclosures required by U.S. GAAP for interim financial statements.

This report on Form 6-K is hereby incorporated by reference into the Registration Statement on Form S-8 (File No. 333-274833) of the Company, and in each instance the related prospectuses, as such registration statement and prospectuses may be amended or supplemented from time to time, and to be a part thereof from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | Interim report of the Company for the six months ended June 30, 2023 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MEDIROM Healthcare Technologies Inc. | ||

| Date: December 29, 2023: | By: |

/s/ Fumitoshi Fujiwara |

| Name: Fumitoshi Fujiwara | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

MEDIROM Healthcare Technologies Inc.

Reports Financial Results for the Six Months Ended June 30, 2023 and Provides Corporate Update

New York – December 29, 2023 – MEDIROM Healthcare Technologies Inc. (NasdaqCM: MRM) (“MEDIROM” or the “Company”), a leading holistic health services provider in Japan, today announced its interim financial results for the six months ended June 30, 2023. Provided below is a discussion and analysis of the Company’s financial condition and results of operations, along with the related unaudited and unreviewed condensed consolidated interim financial statements of the Company, for the six months ended June 30, 2023.

The accompanying condensed consolidated interim financial statements are unaudited and unreviewed, and have been prepared solely by the Company’s management pursuant to the rules and regulations of the U.S. Securities and Exchange Commission for interim financial reporting. Accordingly, these unaudited and unreviewed financial statements do not include all disclosures required by U.S. GAAP for interim financial statements.

About MEDIROM Healthcare Technologies Inc.

MEDIROM operates 313 (as of November 30, 2023) relaxation salons across Japan, Re.Ra.Ku®, being its leading brand, and provides healthcare services. In 2015, MEDIROM entered the health-tech business, and launched new healthcare programs using on-demand training app called “Lav®”, which is developed by the company. MEDIROM also entered the device business in 2020 and has been recognizing revenue from selling a smart tracker “MOTHER Bracelet®”. MEDIROM plans to expand the scope of its business to include data analysis utilizing the data it has collected since formation of the company.

URL : https://medirom.co.jp/en

Contacts:

Investor Relations Team

ir@medirom.co.jp

TABLE OF CONTENTS

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENT | 1 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 2 | ||

| Overview | 2 | ||

| Key Financial Definitions and Non-U.S. GAAP Measures | 4 | ||

| Half-year Progress of Key Performance Indicators | 5 | ||

| Factors Impacting our Operating Results | 7 | ||

| Assessment of Impact of the COVID-19 to the Company’s Business Operations | 8 | ||

| Operating Results | 8 | ||

| Liquidity and Capital Resources | 11 | ||

| Critical Accounting Estimate | 13 | ||

| Recent Developments | 13 | ||

| RISK FACTORS | 14 | ||

| INTERIM FINANCIAL STATEMENTS (UNAUDITED AND UNREVIEWED) | F-1 | ||

| Condensed Consolidated Balance Sheets as of June 30, 2023 (Unaudited and Unreviewed) and December 31, 2022 | F-2 | ||

| Condensed Consolidated Statements of Loss for the Six Months Ended June 30, 2023 and 2022 (Unaudited and Unreviewed) | F-3 | ||

| Condensed Consolidated Statements of Shareholders’ Deficit for the Six Months Ended June 30, 2023 and 2022 (Unaudited and Unreviewed) | F-4 | ||

| Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2023 and 2022 (Unaudited and Unreviewed) | F-5 | ||

| Notes to Condensed Consolidated Financial Statements for the Six Months Ended June 30, 2023 and 2022 (Unaudited and Unreviewed) | F-7 | ||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this interim report of the Company for the six months ended June 30, 2023, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “believe”, “expect”, “could”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this interim report under the heading “Risk Factors” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this interim report. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this interim report include:

| · | our ability to attract and retain customers; |

| · | our ability to successfully enter new markets and manage our business expansion; |

| · | our ability to develop or acquire new products and services, improve our existing products and services and increase the value of our products and services in a timely and cost-effective manner; |

| · | our ability to compete in the relaxation salon market; |

| · | our expectations regarding our customer growth rate and the usage of our services; |

| · | our ability to increase our revenues and our revenue growth rate; |

| · | our ability to timely and effectively scale and adapt our existing technology and network infrastructure; |

| · | our ability to successfully acquire and integrate companies and assets; |

| · | our ability to respond to national disasters, such as earthquakes and tsunamis, and to global pandemics, such as COVID-19; |

| · | our future business development, results of operations and financial condition; and |

| · | the regulatory environment in which we operate. |

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this interim report. The forward-looking statements contained in this interim report are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this interim report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this interim report speaks only as of the date of this interim report. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this interim report, whether as a result of new information, future events or otherwise, after the date of this interim report.

1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited and unreviewed condensed consolidated interim financial statements and related notes thereto, included elsewhere in this interim report. The accompanying condensed consolidated interim financial statements are unaudited and unreviewed, and have been prepared solely by the Company’s management pursuant to the rules and regulations of the U.S. Securities and Exchange Commission for interim financial reporting. Accordingly, these unaudited and unreviewed financial statements do not include all disclosures required by U.S. GAAP for interim financial statements.

In addition to historical financial information, the following discussion contains forward-looking statements that reflect our current plans, expectations, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this interim report, particularly in the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

As used this interim report, the terms “the Company”, “Medirom”, “we”, “our” or “us” may, depending upon the context, refer solely to the Company, to one or more of the Company’s consolidated subsidiaries or to all of them taken as a whole.

Our functional currency and reporting currency is the Japanese yen (which we refer to as “JPY” or “¥”). The terms “dollar,” “USD,” “US$” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this interim report of Japanese yen into U.S. dollars have been made at the exchange rate of ¥144.470 = US$1.00, which was the foreign exchange rate on June 30, 2023 as reported by the Board of Governors of the Federal Reserve System (which we refer to as the “U.S. Federal Reserve”) in weekly release. Historical and current exchange rate information may be found at www.federalreserve.gov/releases/h10/.

Overview

We are one of the leading holistic health services providers in Japan. Medirom is a franchiser and operator of healthcare salons across Japan and is a preferred platform partner for large consumer brands, healthcare service providers, and government entities to affect positive health outcomes. Through our well-known retail salon brands, including primarily Re.Ra.Ku®, nascent tech platforms, and targeted health consulting and marketing, we have formed a “healthtech” segment.

We are a joint-stock corporation incorporated in Japan under the Companies Act. Our Company was originally incorporated in Japan in 2000. In 2018, we established three wholly-owned subsidiaries, Bell Epoc Wellness Inc. (“BEW”), JOYHANDS WELLNESS Inc., and Medirom Human Resources Inc. (“MHR”), and acquired our fourth wholly-owned subsidiary, Decollte Wellness Corporation (“DW”). In December 2020, ADSs representing our common shares were listed on The Nasdaq Capital Market. In May 2021, we acquired our fifth wholly-owned subsidiary, SAWAN Co. Ltd (“SAWAN”). In July 2021, in order to speed up the decision-making process, improve business efficiency, and maximize business value, we reorganized and re-designated certain of our then wholly-owned subsidiaries by business functions. As part of the reorganization, DW merged with and into BEW with BEW being the surviving entity. As a result of the merger between DW and BEW, BEW (currently known as Wing Inc.) now operates the salons previously owned by DW. Since July 1, 2021, Wing Inc. has been managing the business operations of the majority of our relaxation salons, excluding those located in spa facilities or under “Ruam Ruam” brand. In addition, we established Bell Epoc Power Partners Inc. (“BJP”), which succeeded to the rights and obligations relating to the salon management entrusted division previously operated by BEW. In October 2021, we acquired 60% of the ownership interest in ZACC Kabushiki Kaisha (“ZACC”), a high-end hair salon company, and acquired the remaining 40% of the ownership interest in ZACC in January 2022.

2

On May 31, 2023, our board of directors approved a second reorganization (the “Second Reorganization”), which consists of (i) an Incorporation-type Company Split Plan, pursuant to which our Company spun off the Digital Preventative Healthcare business and transfer and assign it to MEDIROM MOTHER Labs Inc., a newly established wholly-owned subsidiary, which is expected to solely conduct the Digital Preventative Healthcare business going forward; and (ii) an Absorption-type Company Split Agreement, pursuant to which our Company spun off the existing salon development department (which is responsible for sourcing and setting up store spaces) and general corporate department (which includes accounting, legal, general affairs, human resources, IT and any other corporate functions) and had Bell & Joy Power Partners Inc., an existing wholly-owned subsidiary, assume such operations going forward (on the same day, Bell & Joy Power Partners Inc. was renamed into MEDIROM Shared Services Inc.). The Second Reorganization became effective on July 3, 2023.

Our principal operating subsidiaries following the consummation of the Second Reorganization are as follows:

| Jurisdiction | Percentage Interest Held | ||||||

| MEDIROM Shared Services Inc. (f/k/a Bell & Joy Power Partners Inc.) | Japan | 100% | |||||

| Wing Inc. | Japan | 100% | |||||

| JOYHANDS WELLNESS Inc. | Japan | 100% | |||||

| Medirom Human Resources Inc. | Japan | 100% | |||||

| SAWAN CO. LTD. | Japan | 100% | |||||

| ZACC Kabushiki Kaisha | Japan | 100% | |||||

| MEDIROM MOTHER Labs Inc. | Japan | 100% | |||||

Our principal business is to own, develop, operate, manage, and support relaxation salons through the franchising and direct ownership of such salons throughout Japan. We seek to be the leading provider of relaxation and bodywork services in the markets we serve and to become the most recognized brand in our industry through the steady and focused expansion of relaxation salons in key markets throughout Japan and potentially abroad.

We operate three synergistic lines of businesses: (1) Relaxation Salon Segment (retail); (2) Luxury Beauty Segment (retail); and (3) Digital Preventative Healthcare Segment (healthtech). By combining brand strength and core retail competencies, including a broad physical footprint in population dense areas across the country, with proprietary technologies and partnerships, our business provides unique, value-added healthcare services to our customers with scale, customization, and cross-network effects that we believe few other companies in the industry can emulate.

As of June 30, 2023, the Relaxation Salon Segment has 314 locations across Japan, located within the country’s major cities. The Relaxation Salon Segment is our core business and accounted for ¥2,903,984 thousand (US$20,101 thousand), or 89.6% of our total revenue for the six months ended June 30, f 2023, and ¥2,816,324 thousand (US$19,494 thousand) or 89.5% for the same period of 2022.

The Luxury Beauty Segment operates high brand beauty salons in the central areas of Tokyo. The Luxury Beauty Segment accounted for ¥276,076 thousand (US$1,911 thousand), or 8.5% of our total revenue for the six months ended June 30, 2023, and ¥288,684 thousand (US$1,998 thousand), or 9.2% of our total revenue for the same period of 2022.

The Digital Preventative Healthcare Segment is a growing business line and accounted for ¥62,730 thousand (US$434 thousand), or 1.9% of our total revenue for the six months ended June 30, 2023, and ¥42,037 thousand (US$291 thousand), or 1.3% for the same period of 2022. The Digital Preventative Healthcare Segment mainly consists of the following operations: government-sponsored Specific Health Guidance program, utilizing our internally-developed on-demand health monitoring smartphone application, Lav®; and our MOTHER Bracelet® which works without charging.

Our current strategy is to grow our business through development of, and to continue to expand the number of our directly-operated salons in a deliberate and measured manner. In addition, we will seek to acquire existing franchised salons that meet our criteria for demographics, site attractiveness, proximity to other salons, and other suitability factors. At the same time, the Company has been implementing a new business model to sell our directly-owned salons to investors while continuously operates the sold salons on behalf of the investors. We believe this new business model can contribute to our revenue growth, profitability, as well as capital efficiency.

3

Key Financial Definitions and Non-U.S. GAAP Measures

Revenue. Revenue consists of the following items: revenue from directly-operated salons, franchise revenue, and other revenues.

Cost of Revenue. The total cost of delivering services to customers consists of the following items: cost of goods sold, subcontract expenses, cost of franchise royalty and affiliation revenue, salon operating cost, salaries for therapists, legal and welfare expenses, provision for paid annual leave, travelling expenses, salon rent, depreciation and amortization, gain/loss from asset retirement obligation, interest expenses for asset retirement obligation, business consignment expenses, and others.

Selling, General and Administrative Expenses. Selling, general and administrative expenses, or SG&A, includes the costs to sell and deliver services and the costs to manage the company as follows: directors’ compensations, salaries and allowances, bonuses, legal welfare expenses, provision for paid annual leave, recruiting expenses, travel expenses, advertising expenses, rent, taxes and duties, commission fees, compensations, depreciation and amortization, provision for doubtful accounts, and others.

Impairment Loss on Long-lived Assets. Long-lived assets include property and equipment, right-of-use lease assets, internal use software, and definite-lived intangible assets. The Company reviews the carrying value of long-lived assets for impairment whenever events or circumstances occur that indicate that the carrying value of the assets may not be recoverable. If the assets are not deemed to be recoverable, an impairment is recorded if the fair value of the asset grouping is less than the carrying value.

Non-U.S. GAAP Measures

Adjusted EBITDA. We define Adjusted EBITDA as net income (loss), adjusted to exclude: (i) dividend and interest income, (ii) interest expense, (iii) gain from bargain purchases, (iv) other, net, (v) income tax expense, (vi) depreciation and amortization, (vii) losses on sales of directly-owned salons to franchisees, (viii) gains (losses) on disposal of property and equipment, and other intangible assets, (ix) impairment loss on long-lived assets and (x) stock-based compensation expense. Management considers Adjusted EBITDA to be a measurement of performance which provides useful information to both management and investors. Adjusted EBITDA should not be considered an alternative to net income or other measurements under GAAP. Adjusted EBITDA is not calculated identically by all companies and, therefore, our measurements of Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

We use Adjusted EBITDA to enhance our understanding of our operating performance, which represents our views concerning our performance in the ordinary, ongoing and customary course of our operations. We historically have found it helpful, and believe that investors have found it helpful, to consider an operating measure that excludes certain expenses relating to transactions not reflective of our core operations. Stock-based compensation expense represents non-cash charges related to equity awards granted by us. Prior to 2021, we did not recognize any stock-based compensation expense. Our management believes the measurement of these amounts can vary considerably from period to period and depend substantially on factors that are not direct consequences of the performance of our Company and are not within our management’s control. Therefore, our management believes that excluding these expenses facilitates comparisons of our operational results and financial performances in different periods, as well as comparisons against similarly determined non-GAAP financial measures of comparable companies.

The information about our operating performance provided by this financial measure is used by our management for a variety of purposes. We regularly communicate Adjusted EBITDA results to our board of directors, and we discuss with the board our interpretation of such results. We also compare our Adjusted EBITDA performance against internal targets as a key factor in evaluating our periodic operating performance at each salon level, segment level, and consolidated level, largely because we believe that this measure is indicative of how the fundamental business is performing and is being managed.

Adjusted EBITDA Margin. Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA for a period by total revenue for the same period.

4

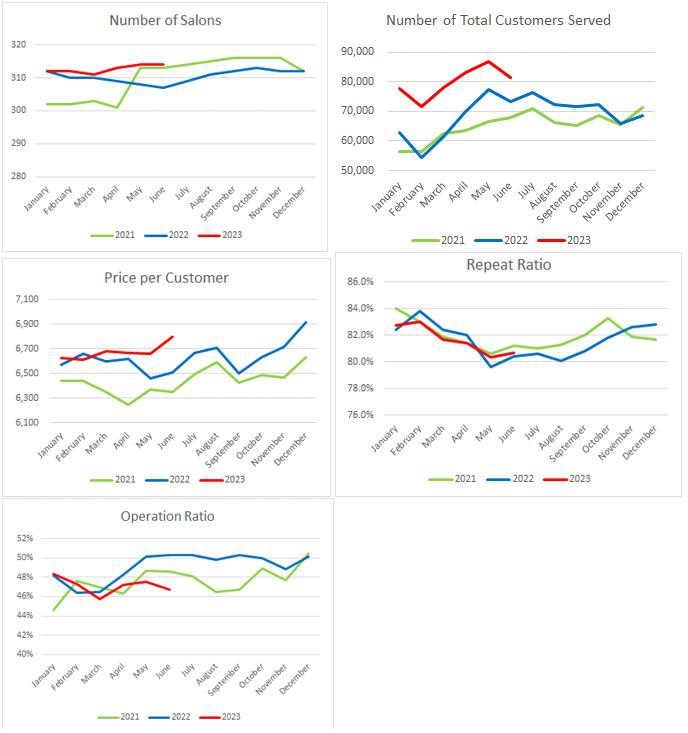

Half-year Progress of Key Performance Indicators

In assessing the performance of our relaxation business, we consider several key performance indicators used by management. We receive monthly performance reports from our system and our relaxation salons which include key performance indicators per salon including sales, number of customers, number of newly-acquired customers, number of repeat customers, sales per customer, and operation ratio. We believe these indicators provide us with useful data with which to measure our performance and to measure the performance of our own and our franchisees’ relaxation salons.

These key indicators include:

| · | Number of Salons. Directly-operated salons, and franchisees’ relaxation salons. |

| · | Number of Salons with Data. The number of relaxation salons for which comparable financial and customer data is available. |

| · | Total Customers Served. The number of customers serviced at relaxation salons. Due to the unavailability of comparative financial and customer data for spa-located salons operated by JOYHANDS WELLNESS and certain other salons in which our point-of-sale system had/has not been installed, data for such salons were excluded until December 2022. Since January 2023, JOYHANDS WELLNESS salons have been gradually rebranded into “Spa Re.Ra.Ku”, and so our point-of-sale system has been installed. As such, data for JOYHANDS WELLNESS salons have been gradually incorporated into our KPI calculations. |

| · | Sales Per Customer. The ratio of total salon sales to number of treated customers at relaxation salons. Due to the unavailability of comparative financial and customer data for spa-located salons operated by JOYHANDS WELLNESS and certain other salons in which our point-of-sale system had/has not been installed, data for such salons were excluded until December 2022. Since January 2023, JOYHANDS WELLNESS salons have been gradually rebranded into “Spa Re.Ra.Ku”, and so our point-of-sale system has been installed. As such, data for JOYHANDS WELLNESS salons have been gradually incorporated into our KPI calculations. |

| · | Repeat Ratio. The ratio of repeat customer visits to total customer visits in the applicable month or other stated period for all relaxation salons for which comparable financial and customer data is available. |

| · | Operation Ratio. The ratio of therapists’ in-service time to total therapists’ working hours (including stand-by time) for the applicable month or other stated period for all relaxation salons for which comparable financial and customer data is available. |

5

The following table sets forth the above key performance indicators from January 2021 to June 2023:

| Number of Salons |

Number of Salons with Data |

Total Customers Served |

Sales Per Customer | Repeat Ratio |

Operation Ratio |

|||||||||||||||||||||

| Jan-21 | 302 | 218 | 56,557 | 6,443 | 84.0 | % | 44.6 | % | ||||||||||||||||||

| Feb-21 | 302 | 218 | 56,370 | 6,443 | 83.0 | % | 47.6 | % | ||||||||||||||||||

| Mar-21 | 303 | 217 | 62,441 | 6,352 | 81.9 | % | 47.0 | % | ||||||||||||||||||

| Apr-21 | 301 | 219 | 63,682 | 6,250 | 81.4 | % | 46.3 | % | ||||||||||||||||||

| May-21 | 313 | 212 | 66,604 | 6,370 | 80.6 | % | 48.7 | % | ||||||||||||||||||

| Jun-21 | 313 | 219 | 68,069 | 6,350 | 81.2 | % | 48.6 | % | ||||||||||||||||||

| Jul-21 | 314 | 220 | 70,912 | 6,498 | 81.0 | % | 48.1 | % | ||||||||||||||||||

| Aug-21 | 315 | 221 | 66,323 | 6,592 | 81.3 | % | 46.5 | % | ||||||||||||||||||

| Sep-21 | 316 | 221 | 65,130 | 6,428 | 82.0 | % | 46.7 | % | ||||||||||||||||||

| Oct-21 | 316 | 221 | 68,608 | 6,486 | 83.3 | % | 48.9 | % | ||||||||||||||||||

| Nov-21 | 316 | 221 | 65,569 | 6,466 | 81.9 | % | 47.7 | % | ||||||||||||||||||

| Dec-21 | 312 | 221 | 71,173 | 6,634 | 81.7 | % | 50.5 | % | ||||||||||||||||||

| Jan-22 | 312 | 221 | 62,747 | 6,570 | 82.4 | % | 48.2 | % | ||||||||||||||||||

| Feb-22 | 310 | 219 | 54,443 | 6,662 | 83.8 | % | 46.4 | % | ||||||||||||||||||

| Mar-22 | 310 | 217 | 61,417 | 6,595 | 82.4 | % | 46.5 | % | ||||||||||||||||||

| Apr-22 | 309 | 232 | 69,986 | 6,616 | 82.0 | % | 48.3 | % | ||||||||||||||||||

| May-22 | 308 | 232 | 77,291 | 6,461 | 79.6 | % | 50.1 | % | ||||||||||||||||||

| Jun-22 | 307 | 231 | 73,259 | 6,511 | 80.4 | % | 50.3 | % | ||||||||||||||||||

| Jul-21 | 309 | 231 | 76,521 | 6,668 | 80.6 | % | 50.3 | % | ||||||||||||||||||

| Aug-22 | 311 | 232 | 72,250 | 6,705 | 80.1 | % | 49.8 | % | ||||||||||||||||||

| Sep-22 | 312 | 233 | 71,770 | 6,505 | 80.8 | % | 50.3 | % | ||||||||||||||||||

| Oct-22 | 313 | 234 | 72,252 | 6,630 | 81.8 | % | 50.0 | % | ||||||||||||||||||

| Nov-22 | 312 | 232 | 65,724 | 6,717 | 82.6 | % | 48.8 | % | ||||||||||||||||||

| Dec-22 | 312 | 231 | 68,571 | 6,913 | 82.8 | % | 50.1 | % | ||||||||||||||||||

| Jan-23 | 312 | 266 | 77,657 | 6,624 | 77.9 | % | 48.3 | % | ||||||||||||||||||

| Feb-23 | 312 | 266 | 71,707 | 6,612 | 78.5 | % | 47.3 | % | ||||||||||||||||||

| Mar-23 | 311 | 273 | 78,063 | 6,680 | 77.4 | % | 45.8 | % | ||||||||||||||||||

| Apr-23 | 313 | 284 | 83,130 | 6,669 | 77.0 | % | 47.2 | % | ||||||||||||||||||

| May-23 | 314 | 284 | 86,895 | 6,660 | 75.7 | % | 47.5 | % | ||||||||||||||||||

| Jun-23 | 314 | 287 | 81,280 | 6,801 | 76.0 | % | 46.7 | % | ||||||||||||||||||

6

Factors Impacting our Operating Results

We expect that our results of operations will be affected by a number of factors and will primarily depend on the global economy, issues related to the COVID-19 pandemic in Japan and elsewhere, general market conditions, customer preference, and the competitive environment.

Our revenues, operating results and financial performance are impacted by a multitude of factors, including, but not limited to:

Business Environment. According to the 2022 Yano Report, the relaxation market continues to see industry consolidation and notable category entrants from low-price, high turnover service providers, athletic and personal training services, and body stretching. We believe that market share will be further transferred to the category leaders in the industry, as smaller, private operators sell their businesses for retirement and/or market competition reasons, which industry trends, as we believe, may benefit us if realized.

Assessment of Impact of the COVID-19. The global outbreak of COVID-19 continued to impact Japan over the first quarter of 2022. This adversely impacted businesses across the nation, particularly in the retail segment in which we operate. During the period, the COVID-19 pandemic has affected our business operations and liquidity position. However, since the second quarter of 2022 to date, though the number of reported cases still has been high, we believe that the recovery trend has been steady.

Continuing Development of our Digital Preventative Healthcare Segment. In our Digital Preventative Healthcare Segment, our involvement in the Specific Health Guidance Program, promoted by the Ministry of Health, Labor and Welfare of Japan continued to grow during the first half of 2023. With respect to our MOTHER Bracelet®, which we believe is the first self-charging wearable activity device in the world, we continued to market and promote the sales of MOTHER Bracelet® in the first half of 2023. In particular, we have been collaborating with our corporate customers to develop and test a platform, which consists of MOTHER Bracelet®, Gateway (a telecommunication tool which contains SIM), and Remony (a centralized monitoring system). Rather than selling MOTHER Bracelet® devices on a stand-alone basis to individual consumers, we believe corporate customers receive much

more benefits by monitoring health data of a large number of MOTHER Bracelet® users (e.g. patients in hospitals, residents in nursing homes, drivers or employees in transportation or construction businesses) all at once through the Remony monitoring system, to which the data are collected and sent from each MOTHER Bracelet® via Gateway. During the first half of 2023, we developed the platform and continued to test the functionalities. Under this platform model, we will, and has started to, bundle our sales of MOTHER Bracelet® with Gateway, and when a corporate customer begins to monitor the health conditions of the users, we also charge monthly fees based on the number of users the customer monitors. This platform has started to generate revenue since September 2023.

Operating Results

Comparison of the Results for the Six Months Ended June 30, 2023 and June 30, 2022

| Consolidated Statement of Income Information: | Six months ended June 30, | Change (2023 vs 2022) | ||||||||||||||||||||||

| (In thousands, except change % data and Adjusted EBITDA margin ) | 2023($) | 2023(¥) | 2022(¥) | $ | ¥ | % | ||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Relaxation Salon | $ | 20,101 | ¥ | 2,903,984 | ¥ | 2,816,324 | $ | 607 | ¥ | 87,660 | 3.1 | % | ||||||||||||

| Luxury Beauty | 1,911 | 276,076 | 288,684 | (87 | ) | (12,608 | ) | (4.4 | )% | |||||||||||||||

| Digital Preventative Healthcare | 434 | 62,730 | 42,037 | 143 | 20,693 | 49.2 | % | |||||||||||||||||

| Total revenue | 22,446 | 3,242,790 | 3,147,045 | 663 | 95,745 | 3.0 | % | |||||||||||||||||

| Cost of revenues and operating expenses: | ||||||||||||||||||||||||

| Cost of revenues | 17,746 | 2,563,831 | 2,331,250 | 1,610 | 232,581 | 10.0 | % | |||||||||||||||||

| Selling, general and administrative expenses | 6,848 | 989,222 | 969,503 | 136 | 19,719 | 2.0 | % | |||||||||||||||||

| Impairment loss on long-lived assets | — | — | 1,173 | (8 | ) | (1,173 | ) | (100.0 | )% | |||||||||||||||

| Total cost of revenues and operating expenses | 24,594 | 3,553,053 | 3,301,926 | 1,738 | 251,127 | 7.6 | % | |||||||||||||||||

| Operating loss | (2,148 | ) | (310,263 | ) | (154,881 | ) | (1,076 | ) | (155,382 | ) | 100.3 | % | ||||||||||||

| Other (expense) income: | ||||||||||||||||||||||||

| Dividend income | — | 2 | 2 | — | — | — | % | |||||||||||||||||

| Interest income | — | 1 | 357 | (2 | ) | (356 | ) | (99.7 | )% | |||||||||||||||

| Interest expense | (117 | ) | (16,859 | ) | (5,707 | ) | (77 | ) | (11,152 | ) | 195.4 | % | ||||||||||||

| Gain from bargain purchases | — | — | — | — | — | % | ||||||||||||||||||

| Other, net | (167 | ) | (24,212 | ) | 1,375 | (177 | ) | (25,587 | ) | (1,860.9 | )% | |||||||||||||

| Total other (expense) income | (284 | ) | (41,068 | ) | (3,973 | ) | (257 | ) | (37,095 | ) | 933.7 | % | ||||||||||||

| Income tax expense | 26 | 3,735 | 22,687 | (131 | ) | (18,952 | ) | (83.5 | )% | |||||||||||||||

| Net loss | (2,458 | ) | (355,066 | ) | (181,541 | ) | (1,201 | ) | (173,525 | ) | 95.6 | % | ||||||||||||

| Adjusted EBITDA( l ) | $ | (1,434 | ) | ¥ | (207,239 | ) | ¥ | (54,270 | ) | $ | (1,059 | ) | ¥ | (152,969 | ) | 281.9 | % | |||||||

| Adjusted EBITDA margin(2) | (6.4 | )% | (6.4 | )% | (1.7 | )% | — | — | (4.7 | )pt. | ||||||||||||||

| (1) | For a reconciliation of Adjusted EBITDA to net income (loss), the most comparable U.S. GAAP measure, see the following table. |

| (2) | Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA for a period by total revenue for the same period. |

| Reconciliation of non-GAAP measures: | Six months ended June 30, | |||||||||||

| (in thousands, except Adjusted EBITDA margin) | 2023($) | 2023(¥) | 2022(¥) | |||||||||

| Net loss | $ | (2,458 | ) | ¥ | (355,066 | ) | ¥ | (181,541 | ) | |||

| Dividend income and interest income | ― | (3 | ) | (359 | ) | |||||||

| Interest expense | 117 | 16,859 | 5,707 | |||||||||

| Other, net | 168 | 24,212 | (1,375 | ) | ||||||||

| Income tax expense (benefit) | 26 | 3,735 | 22,687 | |||||||||

| Operating income | $ | (2,148 | ) | ¥ | (310,263 | ) | ¥ | (154,881 | ) | |||

| Depreciation and amortization | 698 | 100,849 | 90,418 | |||||||||

| Losses on disposal of property and equipment, net and other intangible assets, net | 15 | 2,175 | 9,020 | |||||||||

| Impairment loss on long-lived assets | ― | ― | 1,173 | |||||||||

| Adjusted EBITDA* | $ | (1,434 | ) | ¥ | (207,239 | ) | ¥ | (54,270 | ) | |||

| Adjusted EBITDA margin | (6.4 | )% | (6.4 | )% | (1.7 | )% | ||||||

* We did not recognize (i) gain from bargain purchases, (ii) losses on sales of directly-owned salons to franchisees, or (iii) stock compensation expense in the six months ended June 30, 2022 and 2023.

Revenues

Revenues derived from our Relaxation Salon Segment increased from JPY2,816,324 thousand (US$19,494 thousand) for the six months ended June 30, 2022 to JPY2,903,984 thousand (US$20,101 thousand) for the six months ended June 30, 2023.

Revenue from our Relaxation Salon Segment consists of revenue from directly-operated salons and revenue from franchising. For the six months ended June 30, 2022, our revenue from directly-operated salons was JPY2,235,465 thousand (US$15,473 thousand), which consists of revenue derived from the operations of our directly-operated salon of JPY1,803,620 thousand (US$12,484 thousand) and revenue from the sales of directly-operated salons to investors of JPY431,845 thousand (US$2,989 thousand). Our revenue from directly operated salons for the six months ended June 30, 2023 was JPY2,414,391 thousand (US$16,712 thousand), which consists of revenue derived from the operations of our directly-operated salon of JPY JPY1,906,391 thousand (US$13,196 thousand) and revenue from the sales of directly-owned salons to investors of JPY508,000 thousand (US$3,516 thousand).

Revenue from franchising was JPY580,859 thousand (US$4,021 thousand) in the six months ended June 30, 2022, and JPY489,593 thousand (US$3,389 thousand) in the six months ended June 30, 2023. This decrease was primarily due to the continued implementation of our strategy to acquire certain franchised salons which became our directly-owned salons.

The primary factors for the increase in revenues from Relaxation Salon Segment in the six months ended June 30, 2023 compared to the same period in 2022 were increase in the number of customers per salon and increase in the sales per customer, which was primarily driven by an increase in the average service time per customer and our new pricing strategy. In addition, during the six months ended June 30, 2023, we sold (or brokered) 13 salons (of which eight were sales of our previously directly-operated salons, two were buyback and resale of previously sold salons, and three were brokerage transactions where we brokered the sales of previously sold salons between third party investors) to investors for an aggregate of proceeds of JPY508,000 thousand (US$3,516 thousand).

Average sales per customer was JPY6,676 in the six months ended June 30, 2023, increased from JPY6,563 in the six months ended June 30, 2022, primary due to an increase in average service minutes per customer as a result of our marketing campaigns and related efforts and a decrease in or discontinuation of certain promotional discounts. Only the figures in 2023 include visitors to our JOYHANDS WELLNESS salons located in spa facilities. The figures in 2022 and 2023 exclude visitors to other newly developed salons for which data is not available.

Revenue from our Preventative Healthcare Segment increased by 49.2% to JPY62,730 thousand (US$434 thousand) in six months ended June 30, 2023 from JPY42,037 thousand (US$291 thousand) in the six months ended June 30, 2022, primarily due to 67.9% revenue growth in the Health Guidance Program to JPY35,752 thousand (US$247 thousand) in the six months ended June 30, 2023 from JPY21,296 thousand (US$147 thousand) in the six months ended June 30, 2022. Such increase was primarily due to increased number of beneficiary subscribers who participated in the program from 752 participants in the six months ended June 30, 2022 to 1,363 participants in the six months ended June 30, 2023 driven by increased number of contracts with health insurance associations from 50 as of June 30, 2022 to 69 as of June 30, 2023. In addition, revenue from sale of MOTHER Bracelet® increased by 30.1% to JPY26,978 thousand (US$187 thousand) in six months ended June 30, 2023 from JPY20,742 thousand (US$144 thousand) in the six months ended June 30, 2022. Such increase was primarily due to increased number of MOTHER Bracelet® sold to customers from 668 units in the six months ended June 30, 2022 to 1,081 units in the six months ended June 30, 2023.Revenue from our Luxury Beauty Segment was JPY276,076 thousand (US$1,911 thousand) in six months ended June 30, 2023, compared with JPY288,684 thousand (US$1,998 thousand) in the six months ended June 30, 2022. The primary factor for the decrease was resignation of certain key hairdressers who had been contributing to revenue a lot and we failed to fill the decreased number of customers lost due to their resignation.

Cost of Revenues

For the six months ended June 30, 2022 and 2023, the cost of revenues was JPY2,331,250 thousand (US$16,137 thousand) and JPY2,563,831 thousand (US$17,746 thousand), respectively. The cost to revenue ratio increased from 74.1% for the six months ended June 30, 2022 to 79.1% for the comparable period in 2023, primarily due to the increases in cost of sales of salons caused by increased number of buyback and resale of salons, and accelerated new salon openings, which caused increases in salon operation costs, while newly developed salons typically take time to generate enough revenue to cover the operation costs.

Selling, General, and Administration Expenses

For the six months ended June 30, 2022 and 2023, the selling, general, and administration expenses were JPY969,503 thousand (US$6,711 thousand) and JPY989,222 thousand (US$6,848 thousand), respectively. The increase in the six month period in 2023 was primarily due to increased expenses for operating activities such as recruiting, travel, advertising in connection with accelerated new salon openings, and increased professional fees, partially offset by decrease in rent expense and R&D expense. The percentage of selling, general, and administration expenses out of our total revenue in the six months ended June 30, 2022 and 2023 was 30.8% and 30.3%, respectively.

Interest Expense

Interest expense increased to JPY16,859 thousand (US$117 thousand)in the six months ended June 30, 2023 compared to JPY5,707 thousand (US$40 thousand) for the same period in 2022, primarily due to additional interest expense for the convertible bonds issued in December 2022, partially offset by repayment of other bank loans.

Other (Expense) Income—Net

Other income decreased from JPY1,375 thousand (US$10 thousand) in the six months ended June 30, 2022 to net other expense of JPY24,212 thousand (US$168 thousand) in the six months ended June 30, 2023, primarily due to increased miscellaneous expenses.

Income Tax Expense

Income tax expense decreased to JPY3,735 thousand (US$26 thousand) for the six months ended June 30, 2023 from JPY22,687 thousand (US$157 thousand). This was mainly due to a reduction on capital effective on May 31, 2023, which allows us to be fully free from corporate income tax burden in case that our taxable income during the period is negative. The reductions on our common shares and additional paid in capital effectively on May 31, 2023 was approved at our annual shareholders’ meeting held on March 31, 2023.

Net Income and Adjusted EBITDA

Our consolidated net loss in the six months ended June 30, 2023 was JPY355,066 thousand (US$2,458 thousand), or (10.9)% of our consolidated revenue, while our consolidated net loss for the comparable period in 2022 was JPY181,541 thousand (US$1,257 thousand), or (5.8)% of our consolidated revenue, as a result of the key factors described above. Our Adjusted EBITDA decreased from a loss of JPY(54,270) thousand (US$(376) thousand) in the six months ended June 30, 2022 to a loss of JPY(207,239) thousand (US$(1,434) thousand) for the comparable period in 2023, resulting in Adjusted EBITDA margins of (1.7)%, and (6.4)% for the six months ended June 30, 2022 and 2023, respectively.

Liquidity and Capital Resources

Liquidity is a measure of our ability to meet potential cash requirements. As of June 30, 2023, our cash and cash equivalents were JPY117,728 thousand (US$815 thousand) to settle current liabilities of approximately JPY3,270,224 thousand (US$22,636 thousand). If, however, we do not have sufficient liquidity to meet current obligations, it will be necessary for us to secure additional equity or debt financing. We generally funded our operations with cash flow from operations, and, when needed, with borrowings from Japanese financial institutions. Our principal uses for liquidity have been to fund development of new salons, acquisitions of salons or relaxation businesses from franchisees or third parties, inventories procurement for MOTHER Bracelet®, and for working capital purposes. Furthermore, we expect that we will be required to raise additional funds to finance our operations in the future. No assurances can be made that we will be successful in obtaining additional equity or debt financing, or that we will achieve positive cash flow.

Going concern

In the six months ended June 30, 2023, we had negative cash flows from operations. In addition, we incurred a net loss of approximately JPY181,541thousand (US$1,257 thousand) and JPY355,066 thousand (US$2,458 thousand) for the six months ended June 30, 2022 and the six months ended June 30, 2023, respectively, and, as of June 30, 2023, we had an accumulated deficit of approximately JPY669,629 thousand (US$4,635 thousand) and working capital deficit of approximately JPY1,707,191 thousand (US$11,817 thousand) (including cash of approximately JPY117,728 thousand (US$815 thousand)).

We require additional financing for working capital and the continuing development of MOTHER Bracelet®, as well as to repay our bank loans and debts. As a result of our continuing net losses, our continuance as a going concern is dependent upon our ability to obtain adequate financing to pay our current obligations, finance our development activities, and reach profitable levels of operation. It is not possible to predict whether any financing efforts will be successful or if we will obtain the necessary financing. We have previously been successful in raising the necessary financing to continue our operations in the normal course through bank borrowing, proceeds from issuance of convertible debt and the sales of our directly-operated salons.

In evaluating our ability to continue as a going concern, management considered the conditions and events which could raise substantial doubt about our ability to continue as a going concern for one year after the unaudited and unreviewed condensed consolidated financial statements for the six months ended June 30, 2023 are issued. Management considered our current financial condition and liquidity sources, including current funds available, forecasted future cash flows, and our conditional and unconditional obligations due. As such, we expect that our cash and cash equivalents as of June 30, 2023 of JPY117,728 thousand (US$815 thousand) will not be sufficient to fund our operating expenses, capital expenditure requirements, and debt service obligations for the 12 months after the date of this interim report and that we would require additional capital in the future. Management believes that we will be able to obtain necessary financing through short-term borrowings from banks, the continuing sales of directly-operated salons to investors, or from third party investors who may invest in in our subsidiary as minority shareholders (see “—Recent Development—Financing for MEDIROM MOTHER Labs Inc.” below). However, there are no assurances that we will be successful in raising sufficient financing. These circumstances raise a material uncertainty related to events or conditions that cast substantial doubt on our ability to continue as a going concern, and therefore, we may be unable to realize our assets and discharge our liabilities in the normal course of business.

Cash Flows

The following table sets forth a summary of our cash flows for the periods indicated.

| Consolidated Statement of Cash Flow Information: | Six months ended June 30, | |||||||||||

| (In thousands) | 2023($) | 2023(¥) | 2022(¥) | |||||||||

| Net loss | $ | (2,458 | ) | ¥ | (355,066 | ) | ¥ | (181,541 | ) | |||

| Net cash used in operating activities | (4,223 | ) | (610,037 | ) | (286,383 | ) | ||||||

| Net cash generated from (used in) investing activities | 1,216 | 175,653 | 77,277 | |||||||||

| Net cash used in financing activities | (369 | ) | (53,342 | ) | (60,793 | ) | ||||||

| Net decrease of cash and cash equivalents during the period | (3,376 | ) | (487,726 | ) | (269,899 | ) | ||||||

| Cash and cash equivalents at beginning of period | $ | 4,191 | ¥ | 605,454 | ¥ | 370,617 | ||||||

| Cash and cash equivalents at end of period | $ | 815 | ¥ | 117,728 | ¥ | 100,718 | ||||||

Operating Activities

Net cash flows used in operating activities decreased from a usage of JPY286,383 thousand (US$1,982 thousand) in the six months ended June 30, 2022 to JPY610,037 thousand (US$4,223 thousand) during the six months ended June 30, 2023, primarily due to payments of accounts payable-other and accrued expenses, decrease in advances received, increase in accounts receivable-trade, increase in inventories, and payments of income tax payable, partially offset by decrease in accounts receivable-other, decrease in security deposits, increase in other current liabilities.

Investing Activities

Net cash flows generated from investing activities increased from JPY77,277 thousand (US$535 thousand) in the six months ended June 30, 2022 to JPY175,653 thousand (US$1,216 thousand) in the six months ended June 30, 2023, since no acquisition of business occurred in the six months ended June 30, 2023, while we paid consideration for the acquisition of business in the six months ended June 30, 2022.

Financing Activities

Net cash flows used in financing activities improved from JPY60,793 thousand (US$421 thousand) in the six months ended June 30, 2022 to JPY53,342 thousand (US$369 thousand) in the six months ended June 30, 2023, since we had decreased amount of repayments of long-term borrowings.

Credit Facilities and Corporate Bonds

As of June 30, 2023, we have 17 business loans outstanding from four Japanese financial institutions. The balance on the outstanding loans as of June 30, 2023 was JPY697,976 thousand (US$4,831 thousand), with a fair value of JPY696,547 thousand (US$4,821 thousand) presented on the balance sheet, with interest rates ranging from 0.21% to 3.30%, and a weighted average interest rate of 0.32%. The loans mature at various dates through 2035. Our Chief Executive Officer and a director, Kouji Eguchi, is a guarantor with respect to eight of our 17 outstanding loans for a total amount of JPY223,006 thousand (US$1,544 thousand). Mr. Kazuyoshi Takahashi (“Mr. Takahashi”), the representative director of ZACC, is also the guarantor for four bank loans on behalf of ZACC, which were borrowed by ZACC from two banks prior to the acquisition of ZACC, but he has not been released from the guarantor position after the acquisition. As of June 30, 2023, the outstanding amount of the loans guaranteed by Mr. Takahashi was JPY66,025 thousand (US$457 thousand).

As of June 30, 2023, we also have convertible corporate bonds in the principal amount of JPY500,000 thousand (US$3,461 thousand) outstanding. The bonds were issued to Kufu Company Inc., a Japanese company, in December 2022, at an interest rate of 5% per annum. The bonds are unsecured, and will mature on December 28, 2027, unless earlier redeemed or converted. At any time between the six-month anniversary date of December 28, 2022 and before the close of business on December 28, 2027, Kufu Company Inc., as the bond holder, may convert the bonds at its option, in whole or in part, into our common shares. The bond holder may also exercise its put option to demand the redemption of the bonds by us, in whole or in part, any time after the six-month anniversary date of December 28, 2022.

In addition, we have a fundamental funding and treasury policy of (i) maintaining a balanced ratio of debt to equity, and (ii) aligning our repayment of loans with our cash flow from business. Our primary use of funds from our loans is capital expenditures on newly opened Company-owned salons. Therefore, we have sought debt financing with longer than three-year terms and equal monthly repayment amounts of principal and interest in order to align our debt repayment schedule with our cash flow from our salon business operations. In order to avoid interest rate risk during the terms of the loans, we usually borrow money with fixed interest rates, and do not enter into hedging arrangements. Since our primary business operations are in Japan, our borrowings have been made to date only in Japanese yen with Japanese financial institutions.

Critical Accounting Estimates

There have been no changes to our critical accounting policies and estimates as described in our Annual Report on Form 20-F for the year ended December 31, 2022, which was filed with the SEC on May 30, 2023.

Recent Developments

Updates regarding bank borrowings

On August 7, 2023, one of our subsidiaries entered into a credit facility agreement with a lender, which provides for an aggregate of ¥200,000 thousand in credit maturing on May 31, 2024. The credit facility is guaranteed by our Company and has an interest rate of 1.475% per annum. The credit agreement contains customary covenants restricting such subsidiary’s ability to incur debt, incur liens, and undergo certain fundamental changes, as well as maintain a certain level of liquidity specified in the contractual agreement. The credit agreement also contains customary events of default. As of June 30, 2023, there was no balance outstanding on this credit facility.

Additionally, on September 13, 2023, we entered into a term loan agreement with a lender for an aggregate principal amount of ¥200,000 thousand. The term loan will mature on March 29, 2024 and bears an interest rate of 1.2% per annum, payable upon maturity.

Updates regarding the Settlement Act

Pursuant to the Settlement Act, issuers of prepaid cards are required to maintain net assets of more than ¥100 million. As of June 30, 2023, our net assets have fallen below JPY100 million under Japanese GAAP (“JGAAP”) on a standalone basis, and we have not regained compliance with this requirement as of the date of this interim report. We are awaiting further guidance from the regulatory authority to date.

Updates regarding our pricing strategies

Since October 1, 2022, we have started trial renewal of our primary service lines at six of our directly-operated salons to test market acceptance of our new pricing structure, which reflects increases in wages and other operating expenses. In line with our new pricing plan, we have implemented the new pricing at all of our directly-operated salons under Re.Ra.Ku brand by the end of the six months ended June 30, 2023. We also increased our prices at our directly-operated salons under RuamRuam brand in the end of April 2023.

Financing for MEDIROM MOTHER Labs Inc.

We are currently seeking external financings for MEDIROM MOTHER Labs Inc. (“MML”), our newly established wholly-owned subsidiary focusing on Digital Preventative Healthcare business, from third-party investors, by selling up to 12% of our ownership interest in MML to them. As of the date of this interim report, we have entered into five share transfer agreements, pursuant to which we have agreed to sell and transfer an aggregate of 1,669 shares in MML, or approximately 3.3% of its total shares outstanding, to certain third party investors, for a total consideration of ¥150,210 thousand (US$ 1,040 thousand). Under the share transfer agreements, we have the right to repurchase all transferred shares at the original transfer price if the investors do not agree to participate in the next equity financing that MML may conduct in 2024. We will remain as the controlling shareholder of MML following the consummation of the sales and transfer of the MML shares and use the proceeds for the development and marketing of our MOTHER Bracelets® and LAV® app. Information disclosed herein shall not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other securities of our Company.

RISK FACTORS

The following descriptions of risk factors includes any material changes to, and supersedes the description of risk factors associated with, the Company’s business previously disclosed in Part I, Item 3.D. of our Annual Report on Form 20-F for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission under the heading “Risk Factors.” Our business, financial condition and operating results can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly cause our actual results of operations and financial condition to vary materially from the past, or from anticipated future, results of operations and financial condition. Any of these factors, in whole or in part, could materially and adversely affect our business, financial condition, results of operations and common stock price.

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding any statement in this Form 6-K or elsewhere. The following information should be read in conjunction with the unaudited and unreviewed condensed consolidated financial statements and the related notes under the heading “Interim Financial Statements (Unaudited and Unreviewed)” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” of this interim report.

The following discussion reflects our current judgment regarding the most significant risks we face. These risks can and will change in the future.

Summary Risk Factors

Investing in our company involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our company. These risks include the following:

Risks Related to Our Company and Our Business

Risks and uncertainties related to our Company and our business include, but are not limited to, the following:

| ● | We may not achieve our development goals, which could adversely affect our operations and financial results; |

| ● | We are implementing new growth strategies, priorities and initiatives and any inability to execute and evolve our strategy over time could adversely impact our financial condition and results of operations; |

| ● | Sale of our salons could depend heavily on a number of factors, and as a result, our annual revenue from salon sales may vary from year on year; |

| ● | We are actively expanding mainly in Japan and overseas markets, and we may be adversely affected if Japanese and global economic conditions and financial markets deteriorate; |

| ● | We have experienced growth in our Digital Preventative Healthcare Segment, however we may not achieve or sustain profitability; |

| ● | Our MOTHER Bracelet® consists of various components, and component inflation may increase our cost; |

| ● | Our system-wide relaxation salon base is geographically concentrated in the Tokyo metropolitan area of Japan, and we could be negatively affected by conditions specific to that region; |

| ● | Our success depends substantially on the value of our brands; |

| ● | The failure to enforce and maintain our trademarks and protect our other intellectual property could materially adversely affect our business, including our ability to establish and maintain brand awareness; |

| ● | We may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current shareholders’ ownership interests; |

| ● | If we fail to obtain necessary funds for our operations, we will be unable to maintain and improve our services, other businesses, and technology, and we will be unable to develop and commercialize our services, other businesses, and technologies; |

| ● | Our level of indebtedness could materially and adversely affect our business, financial condition and results of operations; |

| ● | Our outstanding debt agreements may limit our flexibility in operating and expanding our business; |

| ● | We depend on key members of our management and advisory team and will need to add and retain additional leading experts; |

| ● | We may suffer losses from liabilities or other claims if our services cause harm to customers; |

| ● | Our prepaid cards are heavily regulated under Japanese law and violations of the relevant law could subject us to sanctions; |

| ● | If we or our franchisees face labor shortages or increased labor costs, our results of operations and our growth could be adversely affected; |

| ● | We are exposed to the risk of natural disasters, unusual weather conditions, pandemic outbreaks such as COVID-19, political events, war and terrorism that could disrupt business and result in lower sales, increased operating costs and capital expenditures; |

| ● | As we expand our businesses internationally, we will become subject to foreign laws and regulations, and we could be adversely affected by violations of these laws as well as the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery and anti-kickback laws; and |

| ● | There is a risk that we will be a passive foreign investment company (which we refer to as "PFIC") for the current or any future taxable year, which could result in material adverse U.S. federal income tax consequences if you are a U.S. holder. |

Risks Related to Our Relationships with Franchisees

Risks and uncertainties related to our relationships with franchisees include, but are not limited to, the following:

| ● | The financial performance of our franchisees can negatively impact our business; |

| ● | We have limited control with respect to the operations of our franchisees, which could have a negative impact on our business; |

| ● | We rely on franchise agreements that could be breached and may be difficult to enforce, which could result in franchisees improperly managing relaxation salons; |

| ● | We rely in part on the financial health of our franchisees. If we do not screen and monitor them appropriately, it could adversely affect our operations and financial results if they experience financial hardship; |

| ● | Franchisee turnover could affect our ability to recruit new franchisees; |

| ● | Premature termination of franchise agreements can cause losses; |

| ● | The interests of our franchisees may conflict with ours in the future and we could face liability from our franchisees or related to our relationship with our franchisees; and |

| ● | We are subject to various Japanese laws that may affect our relationship with our franchisees. |

Risks Related to Our Industry

Risks and uncertainties related to our industry include, but are not limited to, the following:

| ● | We are vulnerable to changes in consumer preferences and economic conditions that could harm our business, financial condition, results of operations and cash flow; |

| ● | We may not be able to compete successfully with other relaxation salon businesses, which could materially and adversely affect our results of operations; and |

| ● | We face significant competition and continuous technological change. |

Risks Related to Ownership of the ADSs

Risks and uncertainties related to our ownership of the American Depositary Shares (the “ADSs”) include, but are not limited to, the following:

| ● | We are an “emerging growth company” and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common shares and ADSs may be less attractive to investors; |

| ● | As a “foreign private issuer” we are permitted, and intend, to follow certain home country corporate governance and other practices instead of otherwise applicable SEC and NASDAQ requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers; |

| ● | ADSs representing our common shares are listed on the Nasdaq Capital Market. As such, we must meet the Nasdaq Capital Market’s continued listing requirements and other Nasdaq rules, or we may risk delisting. Delisting could negatively affect the price of our ADSs, which could make it more difficult for us to sell securities in a financing and for you to sell your ADSs. |

| ● | Our Chief Executive Officer owns a “golden share” with key veto rights, thereby limiting a shareholder’s ability to influence our business and affairs; |

| ● | The requirements of being a U.S. public company may strain our resources and divert management’s attention; |

| ● | If we fail to maintain an effective system of internal control to remediate our material weakness over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud; |

| ● | We cannot assure you that the ADSs will remain liquid or that it will remain listed on NASDAQ; |

| ● | The price of the ADSs may fluctuate substantially; and |

| ● | We do not intend to pay dividends on our common shares for the foreseeable future. |

Risks Related to Japan

Risks and uncertainties related to Japan include, but are not limited to, the following:

| ● | We are incorporated in Japan, and it may be more difficult to enforce judgments against us that are obtained in courts outside of Japan; |

| ● | Substantially all of our revenues are generated in Japan, but an increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results; and |

| ● | Our business relationships cover enterprises and professionals located outside of Japan, to which our expense may be paid in foreign currency, and our foreign currency exposures give rise to market risk associated with exchange rate movements of the Japanese yen against the U.S. dollar, and vice versa. |

| ● | Rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions. |

General Risk Factors

Other general risk factors include, but are not limited to, the following:

| ● | Third party claims with respect to intellectual property assets, if decided against us, may result in competing uses or require adoption of new, non-infringing intellectual property, which may in turn adversely affect sales and revenues; and |

| ● | Information technology system failures or breaches of our network security could interrupt our operations and adversely affect our business. |

Risks Related to Our Company and Our Business

We may not achieve our development goals, which could adversely affect our operations and financial results.

Our number of relaxation salons has increased from 312 as of December 31, 2022 to 314 as of June 30, 2023. We intend to continue our growth either through developing additional directly-operated salons or through new salon development by acquisition, both in existing markets and in new markets, particularly in Japan. Such rapid development involves substantial risks, including the risk of:

| ● | the inability to identify suitable franchisees; |

| ● | limited availability of financing for our Company and for franchisees at acceptable rates and terms; |

| ● | development costs exceeding budgeted or contracted amounts; |

| ● | delays in completion of construction; |

| ● | the inability to identify, or the unavailability of, suitable sites at acceptable cost and other leasing or purchase terms; |

| ● | developed properties not achieving desired revenue or cash flow levels once opened; |

| ● | the negative impact of a new salon upon sales at nearby existing salons; |

| ● | the challenge of developing in areas where competitors are more established or have greater penetration or access to suitable development sites; |

| ● | incurring substantial unrecoverable costs in the event a development project is abandoned prior to completion; |

| ● | impairment charges resulting from underperforming salons or decisions to curtail or cease investment in certain locations or markets; |

| ● | in new geographic markets where we have limited or no existing locations, the inability to successfully expand or acquire critical market presence for our brands, acquire name recognition, successfully market our products or attract new customers; |

| ● | operating cost levels that reduce the demand for, or raise the cost of, developing new salons; |

| ● | the challenge of identifying, recruiting and training qualified salon management; |

| ● | the inability to obtain all required permits; |

| ● | changes in laws, regulations and interpretations; and |

| ● | general economic and business conditions. |

Although we manage our growth and development activities to help reduce such risks, we cannot provide assurance that our present or future growth and development activities will perform in accordance with our expectations. Our inability to expand in accordance with our plans or to manage the risks associated with our growth could have a material adverse effect on our results of operations and financial condition.

We are implementing new growth strategies, priorities and initiatives and any inability to execute and evolve our strategy over time could adversely impact our financial condition and results of operations.

We seek to accelerate the growth of our acquisition model while at the same time improve the performance of directly-operated salons. Our success also depends, in part, on our ability to grow our franchise model, including attracting and retaining qualified franchisees. Our ability to open new relaxation salons is dependent upon a number of factors, many of which are beyond our control, including our and our franchisees’ ability to:

| ● | identify available and suitable relaxation salon sites; |

| ● | successfully compete for relaxation salon sites; |

| ● | reach acceptable agreements regarding the lease or purchase of locations; |

| ● | obtain or have available the financing required to acquire and operate a relaxation salon, including construction and opening costs, which includes access to build-to-suit leases at favorable interest and capitalization rates; |

| ● | respond to unforeseen engineering or environmental problems with leased premises; |

| ● | avoid the impact of inclement weather, natural disasters and other calamities; |

| ● | hire, train and retain the skilled management and other employees necessary to meet staffing needs; |

| ● | obtain, in a timely manner and for an acceptable cost, required licenses, permits and regulatory approvals and respond effectively to any changes in law and regulations that adversely affect our and our franchisees’ costs or ability to open new relaxation salons; and |

| ● | control construction cost increases for new relaxation salons. |

The growth of our acquisition model will take time to execute and may create additional costs, expose us to additional legal and compliance risks, cause disruption to our current business and impact our short-term operating results. Further, in order to enhance services to its franchisees, we may need to invest in certain new capabilities and/or services.

Our success also depends, in part, on our ability to improve sales, as well as both cost of service and product and operating margins at our directly-operated salons. Same-store sales are affected by average ticket and same-store guest visits. A variety of factors affect same-store guest visits, including the guest experience, salon locations, staffing and retention of therapists and salon leaders, price competition, current economic conditions, marketing programs and weather conditions. These factors may cause our same-store sales to differ materially from prior periods and from our expectations.

As part of our longer-term growth strategy, we plan to enter new geographical markets, including the United States and Southeast Asia, where we have little or no prior operating or franchising experience. The challenges of entering new markets include: difficulties in hiring experienced personnel; unfamiliarity with local real estate markets and demographics; consumer unfamiliarity with our brand; and different competitive and economic conditions, consumer tastes and discretionary spending patterns that are more difficult to predict or satisfy than in our existing markets. Consumer recognition of our brand has been important in the success of both directly-operated and franchised relaxation salons in our existing markets. Relaxation salons that we open in new markets may take longer to reach expected sales and profit levels and may have higher construction, occupancy and operating costs than existing relaxation salons, thereby negatively affecting our operating results. Any failure on our part to recognize or respond to these challenges may adversely affect the success of any new relaxation salons. Expanding our franchise system could require the implementation, expense and management of enhanced business support systems, management information systems and financial controls as well as additional staffing, franchise support and capital expenditures and working capital.

Sale of our salons could depend heavily on a number of factors, and as a result, our annual revenue from sale of salons may vary from year on year.

In December 2021, we began implementation of our new strategy to sell certain of our owned salons to investors and charge management fees from such sold salons. For the six months ended June 30, 2023, our revenue from the sales of directly-owned salons to investors were JPY508,000 thousand (US$3,516 thousand), which increased compared to the revenue of JPY431,845 thousand (US$2,989 thousand) for the same period ended June 30, 2022. Our revenue from salon sales will depend on a number of factors including the interest of potential investors, financial market conditions, available interest rates, and expected return of other comparable types of investments, none of which we will have control over. In addition, our management fees from the sold salons will depend on the actual contractual terms subject to our negotiation with potential investors in the future.

Furthermore, our ability to successfully implement this strategy will depend on our ability to maintain highly profitable salons, revitalize less profitable salons, and otherwise keep salons inventory in good level. The failure to continue to implement this growth strategy will adversely affect our business, financial condition and results of operations.

We are actively expanding mainly in Japan and overseas markets, and we may be adversely affected if Japanese and global economic conditions and financial markets deteriorate.

We seek to proactively expand our business overseas in the future including into new regions for us, particularly the United States and Southeast Asia. We also intend to explore growth opportunities in other markets where we assess primarily on low cost of entry, friendly franchising or partnership relationships and believe there is an economic staying power of our relaxation salon brand locally. We remain opportunistic on strategic mergers and acquisitions, joint ventures, and partnerships in these international markets. As a result, our financial condition and results of operations may be materially affected by general economic conditions and financial markets in Japan and foreign countries, which would be influenced by the changes of various factors. These factors include fiscal and monetary policies, and laws, regulations and policies on financial markets. In the event of an economic downturn in Japan or the United States, consumer spending habits could be adversely affected, and we could experience lower than expected net sales, which

could force us to delay or slow our growth strategy and have a material adverse effect on our business, financial condition, profitability and cash flows. In addition, we could be impacted by labor shortages in Japan or other markets. The deterioration of Japanese and global economic conditions, or financial market turmoil, could result in a worsening of our liquidity and capital conditions, an increase in our credit costs, and, as a result, adversely affect our business, financial condition and results of operations.

We have experienced growth in our Digital Preventative Healthcare Segment, however we may not achieve or sustain profitability.

Over 85% of our revenue is generated in Japan from the Relaxation Salon Segment. Revenue from our Digital Preventative Healthcare Segment, including applications Lav® supporting the Specific Health Guidance Program and our MOTHER Bracelet®, increased to JPY62,730 thousand (US$434 thousand) for the six months ended June 30, 2023, as compared to a total revenue of JPY42,037 thousand (US$291 thousand million) for the six months ended June 30, 2022. However, we cannot guarantee that these businesses or any other businesses we develop will achieve or increase market acceptance. The degree of market acceptance of our businesses will depend on a number of factors, including the competitive landscape and the adequacy and success of distribution, sales and marketing efforts. Customers, third party payors or advertisers in general may be unwilling to accept, utilize or recommend any of our businesses.

Furthermore, the manufacturing of our MOTHER Bracelet® involves a number of third parties, including patent license, and we may be adversely affected by business relationships with such third parties or their financial soundness. In particular, the self-charging functionality of our MOTHER Bracelet® is derived from the core semiconductor provided by Matrix Industries, Inc. (“Matrix”), a startup based in California, United States. In addition, we currently rely on third party manufacturer in Japan to manufacture MOTHER Bracelet®. Should a natural disaster, a labor strike, or any other accident or incident occur at the factory or the manufacturer significantly increase the assembly price, our sales or profitability could be adversely affected. As a result, we are unable to predict the extent of future losses or the time required to achieve profitability in that business unit, if at all.