UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2023

United States Steel Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 1-16811 | 25-1897152 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

600 Grant Street,

Pittsburgh, PA 15219-2800

(Address of principal executive offices, including zip code)

(412) 433-1121

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered |

| Common Stock, par value $1.00 | X | New York Stock Exchange |

| Common Stock, par value $1.00 | X | Chicago Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On December 18, 2023, representatives of United States Steel Corporation (the “Company”) and Nippon Steel Corporation (“NSC”) will present to investors an investor presentation (the “Investor Presentation”) in connection with the announcement of the Merger Agreement (as defined below). A copy of the investor presentation is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Current Report on Form 8-K that is furnished under this Item 7.01, including the accompanying Exhibit 99.1, is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. The information contained in this Current Report on Form 8-K that is furnished under this Item 7.01, including the accompanying Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

| Item 8.01 | Other Events. |

On December 18, 2023, the Company and NSC issued a joint press release (the “Press Release”) announcing the signing of the Agreement and Plan of Merger, dated as of December 18, 2023 (the “Merger Agreement”), by and among the Company, Nippon Steel North America, Inc., a wholly owned subsidiary of NSC (“Parent”), 2023 Merger Subsidiary, Inc., a wholly owned subsidiary of Parent, and solely as provided in Section 9.13 of the Merger Agreement, NSC. The copy of the Press Release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 99.1 | Investor Presentation, dated December 18, 2023. | |

| 99.2 | Press Release, dated December 18, 2023. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Additional Information and Where to Find It

This Current Report on Form 8-K relates to the proposed transaction between the Company and Parent, a wholly owned subsidiary of NSC. In connection with the proposed transaction, the Company will file relevant materials with the United States Securities and Exchange Commission (“SEC”), including the Company’s proxy statement on Schedule 14A (the “Proxy Statement”). The information in the preliminary Proxy Statement will not be complete and may be changed. The definitive Proxy Statement will be delivered to stockholders of the Company. The Company may also file other documents with the SEC regarding the proposed transaction. This Current Report on Form 8-K is not a substitute for the Proxy Statement or for any other document that may be filed with the SEC in connection with the proposed transaction. The proposed transaction will be submitted to the Company’s stockholders for their consideration. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, NSC AND THE PROPOSED TRANSACTION.

The Company’s stockholders will be able to obtain free copies of the preliminary Proxy Statement and the definitive Proxy Statement (in each case, if and when available), as well as other documents containing important information about the Company, NSC and the proposed transaction once such documents are filed with the SEC, without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the other documents filed with the SEC by the Company can also be obtained, without charge, by directing a request to United States Steel Corporation, 600 Grant Street, Pittsburgh, Pennsylvania 15219, Attention: Corporate Secretary; telephone 412-433-1121, or from the Company’s website www.ussteel.com.

Participants in the Solicitation

NSC, the Company and their directors, and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect of the proposed transaction. Information regarding the directors and executive officers of the Company who may, under the rules of the SEC, be deemed participants in the solicitation of the Company’s stockholders in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement when it is filed with the SEC. Information about these persons is included in each company’s annual proxy statement and in other documents subsequently filed with the SEC, and will be included in the Proxy Statement when filed. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This Current Report on Form 8-K contains information regarding the Company and NSC that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the global economic environment. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control, as well as, statements regarding the proposed transaction and the timing of the completion of the transaction. It is possible that the Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management of the Company or NSC, as applicable, believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company's or NSC’s historical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction that could cause the parties to terminate the Merger Agreement; the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; the possibility that the Company’s stockholders may not approve the proposed transaction; the risks and uncertainties related to securing the necessary stockholder approval; the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock or NSC’s common stock or American Depositary Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company. The Company directs readers to its Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and the other documents it files with the SEC for other risks associated with the Company’s future performance. These documents contain and identify important factors that could cause our actual results to differ materially from those contained in the forward-looking statements. Risks related to NSC’s forward-looking statements include, but are not limited to, changes in regional and global macroeconomic conditions, particularly in Japan, China and the United States; excess capacity and oversupply in the steel industry; unfair trade and pricing practices in NSC’s home markets; the possibility of low steel prices or excess iron ore supply; the possibility of significant increases in market prices of essential raw materials; the possibility of depreciation of the value of the Japanese yen against the U.S. dollar and other major foreign currencies; the loss of market share to substitute materials; NSC’s ability to reduce costs and improve operating efficiency; the possibility of not completing planned alliances, acquisitions or investments, or such alliances, acquisitions or investments not having the anticipated results; natural disasters and accidents or unpredictable events which may disrupt NSC’s supply chain as well as other events that may negatively impact NSC’s business activities; risks relating to CO2 emissions and NSC’s challenge for carbon neutrality; the economic, political, social and legal uncertainty of doing business in emerging economies; the possibility of incurring expenses resulting from any defects in our products or incurring additional costs and reputational harm due to product defects of other steel manufacturers; the possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement claims by third parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well a tax, environmental, health and safety laws; and the possibility of damage to our reputation and business due to data breaches and data theft. All information in this Current Report on Form 8-K is as of the date above. Neither the Company nor NSC undertakes any duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s or NSC’s expectations whether as a result of new information, future events or otherwise, except as required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| UNITED STATES STEEL CORPORATION | |||

| By: | /s/ Jessica T. Graziano | ||

| Name: | Jessica T. Graziano | ||

| Title: | Senior Vice President and Chief Financial Officer | ||

| Date: December 18, 2023 | |||

Exhibit 99.1

1 Nippon Steel Corporation to Acquire U.S. Steel December 18, 2023 Moving Forward Together as the 'Best Steelmaker with World - Leading Capabilities’ 2 Successful Outcome of U. S. Steel’s Strategic Alternatives Review Process Substantial value maximization Timeliness of transaction close High level of closing certainty Strategic alternatives review process guided by:

3 Transaction Overview Transaction Terms • Nippon Steel Corporation (NSC) and U.S. Steel (USS) have entered into a definitive agreement pursuant to which NSC will acquire USS in an all - cash transaction for $55.00 per share • Equity value of approximately $14.1 billion; Enterprise value of $14.9 billion, including the assumption of debt • Transaction represents a ~40% premium to USS’s closing stock price on December 15, 2023 • Transaction provides certainty of value to USS shareholders • Transaction has been unanimously approved by both NSC’s and USS’s Boards of Directors Transaction Financing • Transaction is not subject to any financing conditions • NSC has secured financing for the transaction through bank credit facilities and commitments as well as cash on hand Additional Considerations • USS to continue to operate under the “U.S. Steel” brand name • USS headquarters to remain in Pittsburgh, PA • NSC commits to maintaining strong relationships with USS’s stakeholders, including employees, unions, customers, suppliers and communities, and to honor collective bargaining agreements Expected Closing • Expected to close in the second or third quarter of 2024 • Transaction is subject to USS shareholder approval, receipt of regulatory approvals and other customary closing conditions • Not subject to NSC shareholder approval 4 Strong Strategic Alignment Moving Forward Together as the ‘Best Steelmaker with World - Leading Capabilities’ Pursue world - leading technologies and manufacturing capabilities and contribute to society by providing excellent products and services Deliver on Best for All ® strategy, providing customers with profitable steel solutions while creating a more sustainable future for all stakeholders

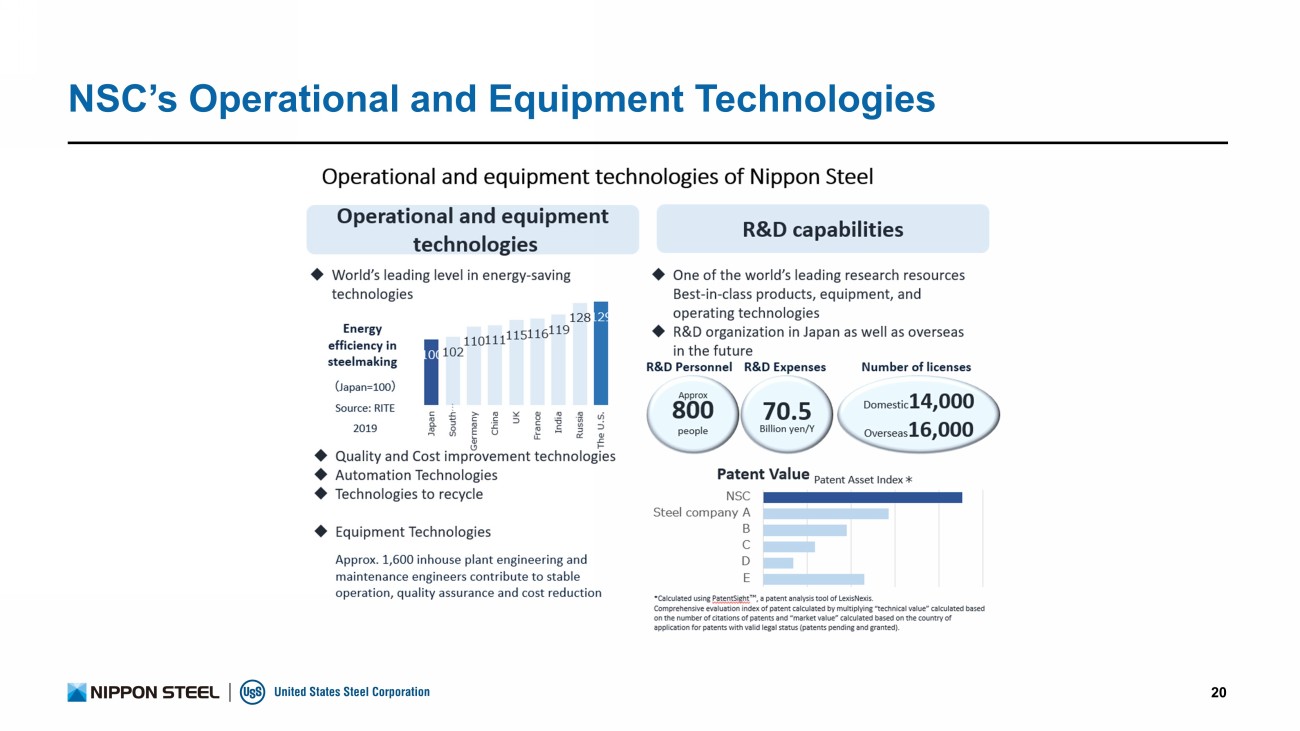

5 Compelling Strategic Rationale Moving Forward Together as the ‘Best Steelmaker with World - Leading Capabilities.’ Combines cutting - edge technologies across NSC and USS to advance innovation and deliver high - grade steel products to meet the growing demand by customers globally. Strengthens NSC's unwavering dedication to its U.S. customer base over four decades. 1 2 Drives the World’s Steel Industry Towards Decarbonization and a Sustainable Society. A shared commitment to decarbonize; recognizes that solving sustainability challenges is a fundamental pillar of a steelmaker’s existence and growth . 3 Commits to Maintaining Strong Stakeholder Relations, While Also Creating Significant Value for Both NSC and USS Shareholders Through Higher Growth and Enhanced Profitability. The combined workforce, including employees represented by the USW, is critical to operations in the United States and globally.

6 Building on USS’s Strengths Social and Stakeholder Capital: Extensive U.S. Client Base, Established Brand Value Manufacturing Capital: Robust facilities organically combining iron ore mines, BFs and EAFs Natural Capital: Low - cost iron ore mines with abundant reserves Human Capital: Excellent management team, dedicated employees, strong union relationships Intellectual Capital: R&D and technology bases across the U.S.

Financial Capital: Strong financial structure (Debt/Equity Ratio <0.1), Sufficient retirement benefit reserves 7 * * * Acquisition Aligns with NSC’s Global Strategy 66 Mt/Y 20 Mt/Y 86 Mt/Y G lobal crude steel production capacity Manufacturing Base Upstream Japan, India, Brazil, Thailand, Sweden , United States, and others Downstream 16 C ountries Manufacturing Base United States, Slovakia *Simple aggregate of nominal capacities of companies in which NSC has at least 30% stake **As of end of March 2023 Integrated Steel Mill Downstream Base USS NSC Accelerates Progress Towards Strategic Goal of 100 Mt of Annual Global Crude Steel Production Global Crude steel production capacity * ( Mt/Y ) 2014 2022** Strategic Goal Domestic 52 47 Overseas 6 19 > 60 Global 58 66 > 100 United States: Strong Demand for High - Grade Steel ASEAN: Home Market Japan India: Driving Growth 8 Combines Cutting - Edge Technologies to Advance Innovation in Steelmaking Synergies primarily driven by bringing together advanced production technology and know - how between USS and NSC Product Technologies • Automotive sheets (high - grade), Processing technologies and solutions • Electrical steel sheets (high - grade) • Highly corrosion - resistant coated steel sheet for construction materials (high - grade) • Nickel - coated steel sheets • Automotive sheets • Electrical steel sheets • Highly corrosion - resistant plated steel sheet for building materials Operational and Equipment Technologies • Quality and Cost improvement technologies • Energy - saving technologies • Automation Technologies • Technologies to recycle • Equipment Technologies • State - of - the - art thin - slab continuous casting and hot - rolling facilities • Maintenance technologies for aged facilities R&D Capabilities • One of the world’s leading research resources • Best - in - class products, equipment, and operating technologies • R&D organization in Japan as well as overseas in the future • Deep history of R&D, particularly with automotive customers • Value - added, sustainably produced steels, including verdeXTM and induXTM • R&D facilities in Munhall, PA, Troy, MI, Kosice, Slovakia, and Houston, TX 9 NSC’s Offerings in Electrical Steel and Automotive Flat Steel Technologies Ultra - high Tensile Steel Sheets for Autos Electric Steel Sheets N O (non - oriented) G O (grain oriented) Highly Corrosion - resistant Coated Steel Sheet for Construction Materials Nickel Coated Steel Sheets • Lightweight, strong, easy processing • Possesses both cold high - tensile and hot stamping high - tensile technologies • Materials with five to ten times higher corrosion resistance than galvanized coated steel sheets • Contributing to lifecycle cost reduction and longer service lifespan when used in outside facilities e.g.) solar panel mounts • Used for battery cell cases for electric vehicles, etc. • Thinner wall thickness realizes weight reduction equivalent to aluminum • High - temperature strength of iron can reduce fire spread • Steel product that can motor’s enhance energy efficiency • Achieving at the same time mutually conflicting motors’ features: high efficiency, high torque, high rotation, lightweight and compact • Eco - friendly material that can improve energy efficiency of transformers used in power plants, power grids, etc. 9

10 USS’s State - of - the - Art Mini - Mill Big River Steel Big River 2 • EAF :2 ( 3.3Mt/Y ) • RH Degasser : 1 • CSP ( Compact Strip Process ) :1 • Compact Hot Mill :1 • Galvanizing line :1 ( 525kt/Y ) • Non - grain oriented electrical steel line :1 ( 200kt/Y ) • Under construction o Galv /galvalume :1 ( 325kt/Y ) o Paint line :1 ( 165kt/Y ) • EAF :2 ( 3Mt/Y ) • ESP ( Endless casting & rolling line ) :1 • Galvanizing line :2 ( 1mt/Y ) • 62% of project execution has been completed* • 92% of project spend has been committed * • Production to start in the second half of 2024; full financial contribution by 2026* • Location: Osceola , Arkansas • GHG emissions intensity: 0.4t - CO2/t - steel (Scope 1 & 2) • 250MW Driver solar field will add renewable power to BRS EAF electrical supply Note: Tons data is in net tons *As of USS Q3 2023 earnings call 11 NSC: Operating in the U.S. For Nearly 40 Years Developed deep understanding of the U.S. industry and mutual trust with U.S. stakeholders 2 4 2 7 3 5 8 1 Approximately 4,000 employees in NSC’s production base in the U.S. Product Group company Equity Ratio Capacity State Sheets 1 1984 Establishment 100% 0.60 Mt/Y WV Founded as a JV with Wheeling - Pittsburgh steel, became a wholly - owned subsidiary in 2008 2 2013 Capital participation 50% 0.44 Mt/Y WA, CA, etc. JV with Bluescope 3 2014 Acquisition 50 % 5.3 Mt/Y AL JV with Arcelor – acquired from Thyssenkrupp Bar & Wire 4 IPF 1996 E stablishment 100% 0.04 Mt/Y IN 5 Suzuki Garphyttan 2008 Investment 100% IN Pipes & Tubing 6 Nippon Steel Pipe America 1989 Establishment 80% 0.08 Mt/Y IN Wheels 7 2011 Acquisition 80% 0.20 Mt/Y PA Integrated EAF mill; founded in 1795 as Freedom Forge Crank - shaft 8 1990 E stablishment 80% 4.00 M Units KY 6

12 Accelerates technological development and commercialization by combining both companies’ technologies ~2030 • Hydrogen injection into blast furnaces • Reduction of CO2 emissions in existing processes • Establishment of an efficient production framework ~2050 • Three breakthrough technologies: 1. Hydrogen injection into blast furnaces 2. High - grade steel production in large - size EAF 3. Hydrogen direct reduction of iron • CCUS * and other carbon offset measures [Scope of scenario] Domestic: SCOPE1+2 (Receipt of raw materials to product shipment + CO 2 emitted by power suppliers) Driving the World’s Steel Industry Towards Decarbonization 2013 2030 2050 Vision CCUS 102 35 2018 2030 2050 Vision CCUS ~2030 • Expansion of EAF production capacity • Optimization of production ~2050 • Future mini mill development • DRI with natural gas • Development of cutting - edge technologies 1. CCUS* 2. DRI with hydrogen 3.

Electric grid improvements * Carbon Capture, Utilization and Storage Both companies share a commitment to decarbonization and are strategically investing to achieve targets Target : Carbon Neutral by 2050 Target : Net Zero by 2050 Total CO2 Emissions (million t - CO2/ yr ) CO2 Emissions / Ton of Steel (t - CO2/t - steel) 2013 Benchmark - 30% Carbon Neutral 2018 Benchmark - 20% Net Zero 13 Aligns with USS’s Best for All ® strategy Customers Employees / Unionized Workers Environment / Sustainability Shareholders • All - cash transaction represents a ~40% premium to USS’s closing stock price on December 15 and allows for certainty of value to USS shareholders • Transaction delivers value to NSC shareholders, while enhancing USS’s earning potential and synergies • Continue to innovate and provide exceptional service to all existing customers • Deliver products through best - in - class technologies to serve customers in North America and around the globe • Aligned on the importance of supporting and investing in employees • USS’s collective bargaining agreements that are in place with its unions will continue to be honored and these relationships will continue uninterrupted • Drives decarbonization by uniting and leveraging NSC and USS technologies • Shared commitment to decarbonization Transaction is in Best Interest of All Stakeholders 14 14 Question & Answer

15 15 Closing Remarks

16 16 Appendix

17 NSC Overview One of the World’s Leading Steel Manufacturers At a Glance: Headquarters: Chiyoda - ku , Tokyo Employees: ~106,000 Fiscal 2022 Revenue: ¥ 7,976 bn Fiscal 2022 Business Profit: ¥ 916 bn Core Sectors: • Automobiles • Shipbuilding • Energy • Household appliances • Containers • Industrial machinery • Civil engineering • Construction Areas of Operation • Japan, US, India, Thailand, Indonesia, Vietnam, Brazil, Mexico, Sweden, China and others • Integrated steelworks in Japan, US, India, Thailand, Brazil and Sweden Patents: ~14,000 (Japan) ~16,000 (Overseas) R&D Spend*: ¥70.5 bn ¥7,245.5 bn Steelmaking and Steel Fabrication ¥352.2 bn Engineering and Construction ¥274.5 bn Chemicals and Materials ¥292.5 bn System Solutions FY2022 consolidated revenue ¥7,976 bn* Sales composition by region Japan International 59% 41% Regional composition: Asia 58% Europe 13% North America 12% South America 10% Middle East 5% Africa 2% Pacific 0.4% Crude steel production capacity: (mm.

tons/ year) Japan 47.0 India 9.8 South America 4.4 ASEAN 3.5 Europe 1.3 North and Central America 0.2 *FY2022 consolidated revenue includes adjustments of (¥189.2) million *Year ended March 31, 2023 18 NSC’s Global Operations * * * 2018 acquisition 2019 acquisition 2014 acquisition 2022 acquisition 2006 Began to consolidate as an equity method affiliate 2011 acquisition I ntegrated steel mill Downstream base In Japan 6 Works 13 Areas Overseas 15 Countries 51 Companies Manufacturing Bases Global Crude steel production capacity * ( Mt/Y ) 2014 2022* Future vision Japan 52 47 Overseas 6 19 > 60 Global 58 66 > 100 Key Initiatives toward 100 million tons • USS +20 metric tons • Expanding production in India (Will be 30 MMt in 2030) *Sum of the nominal full production capacity of companies in which the Company has 30% or more of equity interests, which is the same methodology as the World Steel Association’s crude steel production statistics 19 NSC’s Carbon - Neutral Technologies

20 NSC’s Operational and Equipment Technologies 21 History of NSC and Steel Making in Japan Brief History of Steelmaking in Japan: • 1901 : State - owned Yawata Steelworks inauguration , the first modern steelworks in Japan (L ocated in the premises of the present Kyushu Steelworks of NSC ) • 1857 : Western - style steel making started in Kamaishi (L ocated near the premises of the present North Nippon Steelworks of NSC )

22 Additional Information and Where to Find It This presentation relates to the proposed transaction between the United States Steel Corporation (“ U. S. Steel ”) and NSC. In connection with the proposed transaction, U. S. Steel will file relevant materials with the United States Securities and Exchange Commission (“ SEC ”), including U. S. Steel’s proxy statement on Schedule 14A (the “ Proxy Statement ”). The information in the preliminary Proxy Statement will not be complete and may be changed. The definitive Proxy Statement will be delivered to stockholders of U. S. Steel. U. S. Steel may also file other doc uments with the SEC regarding the proposed transaction. This presentation is not a substitute for the Proxy Statement or for any other document t hat may be filed with the SEC in connection with the proposed transaction. The proposed transaction will be submitted to U. S. Steel’s stockholders f or their consideration. BEFORE MAKING ANY VOTING DECISION, U. S. STEEL’S STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT U. S. STEEL, NSC AND THE PROPOSED TRANSACTION. U. S. Steel’s stockholders will be able to obtain free copies of the preliminary Proxy Statement and the definitive Proxy Sta tem ent (in each case, if and when available), as well as other documents containing important information about U. S. Steel, NSC and the proposed tran sac tion once such documents are filed with the SEC, without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the oth er documents filed with the SEC by U. S. Steel can also be obtained, without charge, by directing a request to United States Steel Corpora tio n, 600 Grant Street, Pittsburgh, Pennsylvania 15219, Attention: Corporate Secretary; telephone 412 - 433 - 1121, or from U. S. Steel’s website www.usstee l.com.

23 Participants in the Solicitation NSC, U. S. Steel and their directors, and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from U. S. Steel’s stockholders in respect of the proposed transaction. Information regarding the directors and executive officers of U. S. Ste el who may, under the rules of the SEC, be deemed participants in the solicitation of U. S. Steel’s stockholders in connection with the proposed transaction, including a descr ipt ion of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement when it is filed with the SEC. Information about these perso ns is included in each company’s annual proxy statement and in other documents subsequently filed with the SEC, and will be included in the Proxy Statement when filed. Fr ee copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

24 Forward - Looking Statements This presentation contains information regarding U. S. Steel and NSC that may constitute “forward - looking statements,” as that t erm is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward - looking statements to be covered by the safe harbor pr ovisions for forward - looking statements in those sections. Generally, we have identified such forward - looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “for ecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future op erating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operation al cash improvements and changes in the global economic environment, as well as statements regarding the proposed transaction, including the timing of the completion of the transaction. However, the absence of these wor ds or similar expressions does not mean that a statement is not forward - looking. Forward - looking statements include all statements that are not historical facts, but instead represent only U. S. Steel’s beliefs reg ard ing future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of U. S. Steel’s or NSC’s control. It is possible that U . S . Steel’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward - looking statements. Management of U. S. Steel or NSC, as applicable, believes that these forward - looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward - looking statements because such statement s speak only as of the date when made. In addition, forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from U. S. Steel's or NSC’s h ist orical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing , r eceipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction that could cause the parties to terminate the definitive agreement and plan of merger relating to the pr opo sed transaction (the “Merger Agreement”); the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; the possibility that U. S. Steel’s stockholder s m ay not approve the proposed transaction; the risks and uncertainties related to securing the necessary stockholder approval; the risk that the parties to the Merger Agreement may not be able to satisfy the conditions t o t he proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the propos ed transaction that may impact U. S. Steel’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on th e m arket price of U. S. Steel’s common stock or NSC’s common stock or American Depositary Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation re lat ing to the proposed transaction; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of U. S. Steel or NSC to retain customers and retain and hire key pe rso nnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transacti on could distract management of U. S. Steel. U. S. Steel directs readers to its Form 10 - K for the year ended December 31, 2022 and Quarterly Report on Form 10 - Q for the quarter ended September 30, 2023, and the other documents it files with the SEC for other risks associated with U. S. Steel’s future performance. These documents contain and identify important factors that could cause actual results to differ materially from those contai ned in the forward - looking statements. Risks related to NSC’s forward - looking statements include, but are not limited to, changes in regional and global macroeconomic conditions, particularly in Japan, China and th e U nited States; excess capacity and oversupply in the steel industry; unfair trade and pricing practices in regional markets; the possibility of low steel prices or excess iron ore supply; the possibility of significant inc reases in market prices of essential raw materials; the possibility of depreciation of the value of the Japanese yen against the U.S. dollar and other major foreign currencies; the loss of market share to substitute materials; NS C’s ability to reduce costs and improve operating efficiency; the possibility of not completing planned alliances, acquisitions or investments, or such alliances, acquisitions or investments not having the anticipated res ult s; natural disasters and accidents or unpredictable events which may disrupt NSC’s supply chain as well as other events that may negatively impact NSC’s business activities; risks relating to CO2 emissions and NSC’s ch allenge for carbon neutrality; the economic, political, social and legal uncertainty of doing business in emerging economies; the possibility of incurring expenses resulting from any defects in our products or incurring ad ditional costs and reputational harm due to product defects of other steel manufacturers; the possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement clai ms by third parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well a tax, environmental, health and safety laws; and the possibility of damage to our reputation and b usi ness due to data breaches and data theft. All information in this presentation is as of the date above. Neither U. S. Steel nor NSC undertakes any duty to update any forward - looking statement to conform the statement to actu al results or changes in U. S. Steel’s or NSC’s expectations whether as a result of new information, future events or otherwise, except as required by law.

Exhibit 99.2

Nippon Steel Corporation (NSC) to Acquire U. S. Steel, Moving Forward Together as the ‘Best Steelmaker with World-Leading Capabilities’

NSC to acquire U. S. Steel for $55.00 per share in an all-cash transaction representing 40% premium, providing certain and immediate value to U. S. Steel shareholders

Brings together two storied companies with rich histories of providing excellent products and services and contributing to the development of society

Combines world-leading technologies and manufacturing capabilities to better serve customers in the United States and globally

Strengthens a diversified and competitive steel industry in the United States to the benefit of customers through investment collaboration between two global steel innovators

NSC to honor all collective bargaining agreements with United Steelworkers Union as part of commitment to maintaining strong stakeholder relations

Drives the global steel industry towards decarbonization and a sustainable world

U. S. Steel to retain its iconic name and headquarters in Pittsburgh, PA

Transaction represents culmination of U. S. Steel’s robust strategic alternatives process

Creates significant value for both NSC and U. S. Steel shareholders

Joint conference call at 8:00 a.m. ET to discuss details of the transaction

Chiyoda-ku, Tokyo, Japan, and Pittsburgh, Pennsylvania, USA, December 18, 2023 – Nippon Steel Corporation (NSC) (TSE: 5401), Japan’s largest steelmaker and one of the world’s leading steel manufacturers, and United States Steel Corporation (NYSE: X) ("U. S. Steel”), a leading steel producer with competitive advantages in low-cost iron ore, mini mill steelmaking, and best-in-class finishing capabilities, today announced that they have entered into a definitive agreement pursuant to which NSC will acquire U. S. Steel in an all-cash transaction at $55.00 per share, representing an equity value of approximately $14.1 billion plus the assumption of debt, for a total enterprise value of $14.9 billion. The $55.00 per share purchase price represents a 40% premium to U. S. Steel’s closing stock price on December 15, 2023. The transaction has been unanimously approved by the Board of Directors of both NSC and U. S. Steel.

NSC’s acquisition of U. S. Steel will enhance its world-leading manufacturing and technology capabilities and enable it to expand the geographic areas in which NSC can better serve all of its stakeholders, including customers and society at large. The transaction will further diversify NSC’s global footprint by significantly expanding its current production in the United States, adding to its primary geographies of Japan, ASEAN, and India. As a result of NSC’s acquisition of U. S. Steel, its expected total annual crude steel capacity will reach 86 million tonnes – accelerating progress towards NSC’s strategic goal of 100 million tonnes of global crude steel capacity annually.

NSC President Eiji Hashimoto, said “We are excited that this transaction brings together two companies with world-leading technologies and manufacturing capabilities, demonstrating our mission to serve customers worldwide, as well as our commitment to building a more environmentally friendly society through the decarbonization of steel. NSC has long admired U. S. Steel with deep respect for its advanced technologies, rich history, and talented workforce and we believe we can jointly take on the challenge of raising our aspirations to even greater heights. The transaction builds on our presence in the United States and we are committed to honoring all of U. S. Steel’s existing union contracts. We look forward to collaborating closely with the U. S. Steel team to bring together the best of our companies and move forward together as the ‘Best Steelmaker with World-Leading Capabilities’.”

NSC Executive Vice President Takahiro Mori said, “We believe this transaction is in the best interests of our two companies, providing strong, immediate value for U. S. Steel shareholders while enhancing NSC’s long-term growth prospects. We have a strong balance sheet and are confident in our ability to unlock the potential of bringing together NSC and U. S. Steel through advancement in steelmaking, creating long-term value for our companies’ stakeholders, including our customers, employees, suppliers, communities, and shareholders.”

President and Chief Executive Officer of U. S. Steel, David B. Burritt said, “NSC has a proven track record of acquiring, operating, and investing in steel mill facilities globally – and we are confident that, like our strategy, this combination is truly Best for All. This transaction realizes the tremendous value today in our company and is the result of our Board of Directors’ comprehensive and thorough strategic alternatives process. For our U. S. Steel employees, who I continue to be thankful for, the transaction combines like-minded steel companies with an unwavering focus on safety, shared goals, values, and strategies underpinned by rich histories. For customers, U. S. Steel and NSC create a truly global steel company with combined capabilities and innovation capable of meeting our customers’ evolving needs. Today’s announcement also benefits the United States – ensuring a competitive, domestic steel industry, while strengthening our presence globally. Our shared decarbonization focus is expected to enhance and accelerate our ability to provide customers with innovative steel solutions to meet sustainability goals.”

Strategic Benefits

| - | Moving Forward Together as the ‘Best Steelmaker with World-Leading Capabilities’. The transaction combines cutting-edge technologies across NSC and U. S. Steel to advance innovation and deliver high-grade steel products, such as electrical steel and automotive flat steel to customers around the world. NSC and U. S. Steel will share their world-leading technologies and manufacturing capabilities to be at the forefront of innovation and digital transformation in steelmaking for the benefit of customers. U. S. Steel is a proven innovator in energy efficiency, with Big River Steel operating one of the most advanced, state-of-the-art sustainable mills in North America. Synergies from the transaction will be primarily driven by bringing together advanced production technology and know-how between U. S. Steel and NSC, including in cost-effective operations, energy savings, and recycling. NSC’s technology and products will further advance the technical capabilities of U. S. Steel’s Mined, Melted and Made in America portfolio of products, better supporting the evolving demand of customers in the United States. |

| - | Strengthens Ability to Address Growing Demand for High-Grade Steel in U.S. and Globally. U. S. Steel has long been one of America’s steel industry leaders, while NSC has been serving U.S. customers successfully for decades. Together with U. S. Steel, NSC will be well-positioned to capitalize on the growing demand for high-grade steel, automotive and electrical steel, and provide excellent products and services. Further, NSC is committed to serving customers in the United States and deliver high-performance steel products to meet the needs of every application. |

| - | Drives the Global Steel Industry Towards Decarbonization and a Sustainable World. NSC and U. S. Steel share a commitment to decarbonize by 2050 and recognize that solving sustainability challenges is a fundamental pillar of a steelmaker’s existence and growth. A key area of collaboration post-transaction will be to continue to advance this goal and drive alternative technologies in decarbonization. NSC is developing three breakthrough technologies to progress towards its goal of achieving carbon neutrality by 2050, including hydrogen injecting technology into blast furnaces, high grade steel production in large size electric arc furnaces, and hydrogen use in direct iron reduction process. U. S. Steel is similarly focused on reducing its carbon footprint, including continuously striving to use less energy in its existing operations, integrating electric arc furnace capabilities into its footprint, and is constructing a second state-of-the-art mini mill in Arkansas. |

| - | Honors All Agreements between U. S. Steel and the United Steelworkers Union: NSC has a strong track record of safety in the workplace and working collaboratively with unions. All of U. S. Steel’s commitments with its employees, including all collective bargaining agreements in place with its unions, will be honored and NSC is committed to maintaining these relationships uninterrupted. |

| - | Commits to Maintaining Strong Stakeholder Relations, Including with Employees, Customers, Suppliers and Communities. The combined workforce is critical to operations in the United States and globally. Following the closing of the transaction, U. S. Steel will retain its iconic name, brand, and headquarters in Pittsburgh, PA. NSC is committed to continuity in strong relationships with U. S. Steel’s suppliers, customers, the surrounding communities, and people that support U. S. Steel’s operations and is committed to being a productive member of these communities. |

| - | Creates Significant Value for Both NSC and U. S. Steel Shareholders. The transaction accelerates NSC’s growth as ‘Best Steelmaker with World-Leading Capabilities’, poised to deliver higher growth, enhanced profitability, and long-term value for NSC shareholders. The all-cash offer also provides strong value creation and certainty of value for U. S. Steel shareholders. This transaction is the successful outcome of a comprehensive and robust strategic review conducted by U. S. Steel and its Board of Directors. The $55.00 per share purchase price represents a 40% premium to U. S. Steel’s closing stock price on December 15, 2023. |

Transaction Details

The transaction is expected to close in the second or third quarter of calendar year 2024, subject to approval by U. S. Steel’s shareholders, receipt of customary regulatory approvals and other customary closing conditions. NSC plans to fund the transaction through proceeds mainly from borrowings from certain Japanese banks and has already secured financing commitments. The transaction is not subject to any financing conditions.

Advisors

Citi is acting as financial advisor to NSC. Ropes & Gray LLP is acting as legal advisor to NSC. Barclays Capital Inc., Goldman Sachs & Co. LLC and Evercore are acting as financial advisors to U. S. Steel. Milbank LLP and Wachtell, Lipton, Rosen & Katz are acting as legal advisors to U. S. Steel.

Conference Call

NSC and U. S. Steel will hold a conference call to discuss the proposed acquisition with analysts and investors today, December 18, 2023 at 8:00am EST in the U. S. (10:00pm JST in Japan). To listen to the webcast of the conference call and to access the slide presentation, visit the U. S. Steel website, www.ussteel.com, and click on the “Investors” section. A replay will be available after the call on U. S. Steel’s investor relations website: https://investors.ussteel.com/.

Find out more about the proposed transaction at www.BestDealforAmericanSteel.com.

About NSC

NSC is Japan’s largest steelmaker and one of the world’s leading steel manufacturers. NSC has a global crude steel production capacity of approximately 66 million tonnes and employs approximately 100,000 people in the world. NSC’s manufacturing base is in Japan and the company has presence in 15 additional countries including: United States, India, Thailand, Indonesia, Vietnam, Brazil, Mexico, Sweden, China and others. NSC established a joint venture in the United States around 40 years ago and has focused on building cooperative and good relationships with employees, labor unions, suppliers, customers, and communities. As the ‘Best Steelmaker with World-Leading Capabilities,’ NSC pursues world-leading technologies and manufacturing capabilities and contributes to society by providing excellent products and services. For more information, please visit: https://www.nipponsteel.com.

About U. S. Steel

Founded in 1901, U. S. Steel is a leading steel manufacturer. With an unwavering focus on safety, the Company’s customer-centric Best for All® strategy is advancing a more secure, sustainable future for U. S. Steel and its stakeholders. With a renewed emphasis on innovation, U. S. Steel serves the automotive, construction, appliance, energy, containers, and packaging industries with high value-added steel products. The Company also maintains advanced iron ore production and has an annual raw steelmaking capability of 22.4 million net tons. U. S. Steel is headquartered in Pittsburgh, Pennsylvania, with world-class operations across the United States and in Central Europe. For more information, please visit: www.ussteel.com.

NSC Contacts

Media

pr_contact@jp.nipponsteel.com

Kayo Kikuchi / +81-3-6867-2977 / kikuchi.26s.kayo@jp.nipponsteel.com

Masato Suzuki / +81-3-6867-2135 / suzuki.s4f.masato@jp.nipponsteel.com

Investors

ir@jp.nipponsteel.com

Yuichiro Kaneko / +81-80-9022-6867 / kaneko.yc3.yuichiro@jp.nipponsteel.com

Yohei Kato / +81-80-2131-0188 / kato.rk5.yohei@jp.nipponsteel.com

General Inquiries (U.S.)

Nippon Steel North America, Inc. / +1 (713) 654 7111

U.S. Media Contacts

NSCMedia@teneo.com

Robert Mead / +1 (917) 327 9828 / Robert.Mead@teneo.com

Monika Driscoll / +1 (929) 388 9442 / Monika.Driscoll@teneo.com

Tucker Elcock / +1 (917) 208 4652 / Tucker.Elcock@teneo.com

U. S. Steel Contacts

Media

Tara Carraro

Senior Vice President, Chief Communications Officer

T- 412-433-1300

E- media@uss.com

Kelly Sullivan / Ed Trissel

Joele Frank, Wilkinson Brimmer Katcher

T- 212-355-4449

Investors

Emily Chieng

Investor Relations Officer

T – (412-618-9554)

E – ecchieng@uss.com

+++

Additional Information and Where to Find It

This press release relates to the proposed transaction between the United States Steel Corporation (the “Company”) and NSC. In connection with the proposed transaction, the Company will file relevant materials with the United States Securities and Exchange Commission (“SEC”), including the Company’s proxy statement on Schedule 14A (the “Proxy Statement”). The information in the preliminary Proxy Statement will not be complete and may be changed. The definitive Proxy Statement will be delivered to stockholders of the Company. The Company may also file other documents with the SEC regarding the proposed transaction. This press release is not a substitute for the Proxy Statement or for any other document that may be filed with the SEC in connection with the proposed transaction. The proposed transaction will be submitted to the Company’s stockholders for their consideration. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, NSC AND THE PROPOSED TRANSACTION.

The Company’s stockholders will be able to obtain free copies of the preliminary Proxy Statement and the definitive Proxy Statement (in each case, if and when available), as well as other documents containing important information about the Company, NSC and the proposed transaction once such documents are filed with the SEC, without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the other documents filed with the SEC by the Company can also be obtained, without charge, by directing a request to United States Steel Corporation, 600 Grant Street, Pittsburgh, Pennsylvania 15219, Attention: Corporate Secretary; telephone412-433-1121, or from the Company’s website www.ussteel.com.

Participants in the Solicitation

NSC, the Company and their directors, and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect of the proposed transaction. Information regarding the directors and executive officers of the Company who may, under the rules of the SEC, be deemed participants in the solicitation of the Company’s stockholders in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement when it is filed with the SEC. Information about these persons is included in each company’s annual proxy statement and in other documents subsequently filed with the SEC, and will be included in the Proxy Statement when filed. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This press release contains information regarding the Company and NSC that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the global economic environment, as well as statements regarding the proposed transaction, including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management of the Company or NSC, as applicable, believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company's or NSC’s historical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction that could cause the parties to terminate the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”); the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; the possibility that the Company’s stockholders may not approve the proposed transaction; the risks and uncertainties related to securing the necessary stockholder approval; the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock or NSC’s common stock or American Depositary Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company. The Company directs readers to its Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and the other documents it files with the SEC for other risks associated with the Company’s future performance. These documents contain and identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements. Risks related to NSC’s forward-looking statements include, but are not limited to, changes in regional and global macroeconomic conditions, particularly in Japan, China and the United States; excess capacity and oversupply in the steel industry; unfair trade and pricing practices in NSC’s regional markets; the possibility of low steel prices or excess iron ore supply; the possibility of significant increases in market prices of essential raw materials; the possibility of depreciation of the value of the Japanese yen against the U.S. dollar and other major foreign currencies; the loss of market share to substitute materials; NSC’s ability to reduce costs and improve operating efficiency; the possibility of not completing planned alliances, acquisitions or investments, or such alliances, acquisitions or investments not having the anticipated results; natural disasters and accidents or unpredictable events which may disrupt NSC’s supply chain as well as other events that may negatively impact NSC’s business activities; risks relating to CO2 emissions and NSC’s challenge for carbon neutrality; the economic, political, social and legal uncertainty of doing business in emerging economies; the possibility of incurring expenses resulting from any defects in our products or incurring additional costs and reputational harm due to product defects of other steel manufacturers; the possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement claims by third parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well a tax, environmental, health and safety laws; and the possibility of damage to our reputation and business due to data breaches and data theft. All information in this press release is as of the date above. Neither the Company nor NSC undertakes any duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s or NSC’s expectations whether as a result of new information, future events or otherwise, except as required by law.