UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) | December 1, 2023 |

| Associated Banc-Corp |

| (Exact name of registrant as specified in its charter) |

| Wisconsin | 001-31343 | 39-1098068 |

| (State or other jurisdiction of incorporation) | (Commission File Number) |

(IRS Employer Identification No.) |

| 433 Main Street, Green Bay, Wisconsin | 54301 |

| (Address of principal executive offices) | (Zip code) |

| Registrant’s telephone number, including area code | (920) 491-7500 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | ASB | The New York Stock Exchange |

| Depositary Shrs, each representing 1/40th intrst in a shr of 5.875% Non-Cum. Perp Pref Stock, Srs E | ASB PrE | The New York Stock Exchange |

| Depositary Shrs, each representing 1/40th intrst in a shr of 5.625% Non-Cum. Perp Pref Stock, Srs F | ASB PrF | The New York Stock Exchange |

| 6.625% Fixed-Rate Reset Subordinated Notes due 2033 | ASBA | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

Associated Banc-Corp (the “Company”) is furnishing herewith its Fall 2023 Shareholder Engagement presentation, attached as Exhibit 99.1 to this Current Report on Form 8-K. The Company intends to use the presentation, in whole or in part, from time to time in one or more meetings with its shareholders and other constituents.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing by the Company under the Securities Act of 1933 or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| 99.1 | Associated Banc-Corp Fall 2023 Shareholder Engagement Presentation |

| 104 | Cover Page Interactive Date File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Associated Banc-Corp | ||

| (Registrant) | ||

| Date: December 1, 2023 | By: | /s/ Randall J. Erickson |

| Randall J. Erickson | ||

| Executive Vice President, General Counsel and Corporate Secretary | ||

Exhibit 99.1

Associated Banc - Corp Fall 2023 Shareholder Engagement 1 Forward - Looking Statements Important note regarding forward - looking statements: Statements made in this presentation which are not purely historical are forward - looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward - looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target,“ “outlook,” “project,” “guidance,” or simila r expressions. Forward - looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward - looking statements. Factors which may cause actual results to differ materially from those contained in such forward - looking statements include those identified in the Company’s most recent Form 10 - K and subsequent Form 10 - Qs and other SEC filings, and such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding.

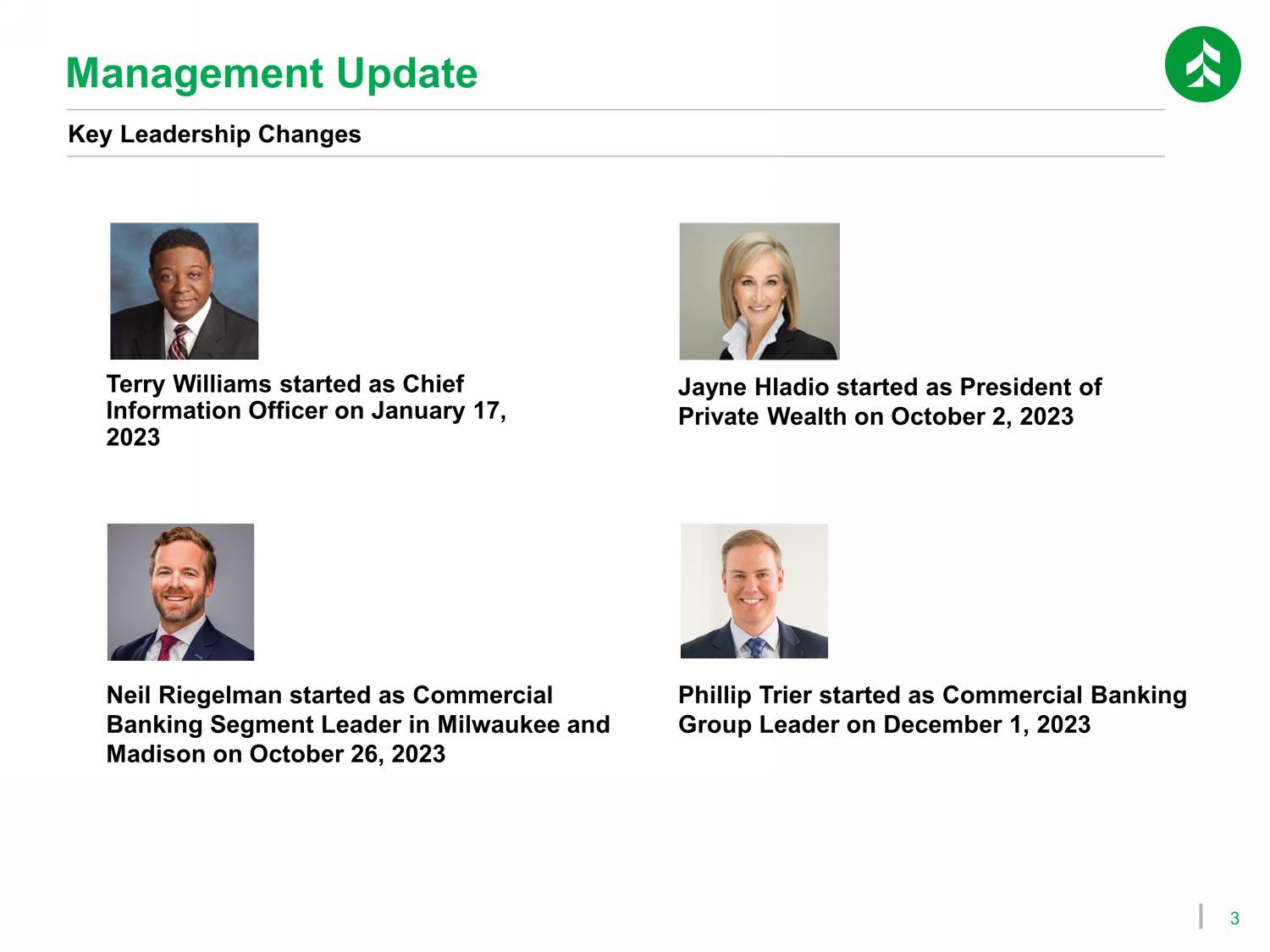

2 Introduction ▪ Follow - up on our outreach from the fall of 2022 and successful 2023 Say on Pay vote ▪ Discuss progress on our strategic initiatives ▪ Highlight our current approach to executive compensation and obtain feedback ▪ Highlight some of our ESG Initiatives ▪ Discuss Key Executive changes since January 1, 2023 ▪ Andy Harmening, President and CEO ▪ Gale Klappa, Director and Chair of the Compensation and Benefits Committee ▪ Derek Meyer, Chief Financial Officer ▪ Angie DeWitt, Chief Human Resources Officer ▪ Randy Erickson, General Counsel ▪ Anita Magnuson, Director of Total Rewards ▪ Jessica Schadrie, Director of ESG ▪ Joy Langreder, Director of Talent Acquisition and Development Reasons for Reaching Out Executive Team Changes Introduce Speakers 3 Management Update Key Leadership Changes Terry Williams started as Chief Information Officer on January 17, 2023 Jayne Hladio started as President of Private Wealth on October 2, 2023 Phillip Trier started as Commercial Banking Group Leader on December 1, 2023 Neil Riegelman started as Commercial Banking Segment Leader in Milwaukee and Madison on October 26, 2023

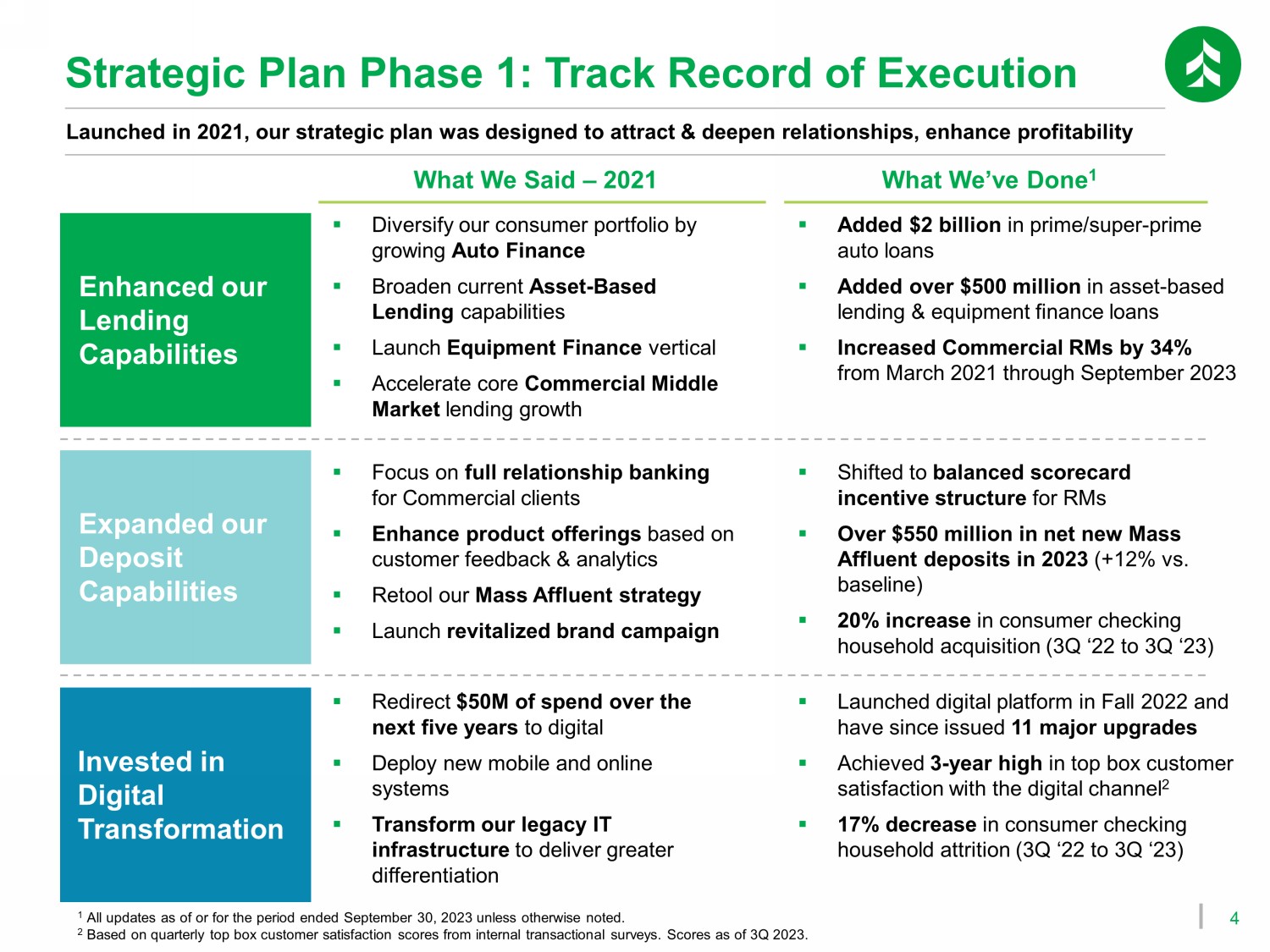

4 Strategic Plan Phase 1: Track Record of Execution Launched in 2021, our strategic plan was designed to attract & deepen relationships, enhance profitability Enhanced our Lending Capabilities Expanded our Deposit Capabilities Invested in Digital Transformation ▪ Diversify our consumer portfolio by growing Auto Finance ▪ Broaden current Asset - Based Lending capabilities ▪ Launch Equipment Finance vertical ▪ Accelerate core Commercial Middle Market lending growth ▪ Focus on full relationship banking for Commercial clients ▪ Enhance product offerings based on customer feedback & analytics ▪ Retool our Mass Affluent strategy ▪ Launch revitalized brand campaign ▪ Redirect $50M of spend over the next five years to digital ▪ Deploy new mobile and online systems ▪ Transform our legacy IT infrastructure to deliver greater differentiation What We Said – 2021 What We’ve Done 1 ▪ Added $2 billion in prime/super - prime auto loans ▪ Added over $500 million in asset - based lending & equipment finance loans ▪ Increased Commercial RMs by 34% from March 2021 through September 2023 ▪ Shifted to balanced scorecard incentive structure for RMs ▪ Over $550 million in net new Mass Affluent deposits in 2023 (+12% vs. baseline) ▪ 20% increase in consumer checking household acquisition (3Q ‘22 to 3Q ‘23) ▪ Launched digital platform in Fall 2022 and have since issued 11 major upgrades ▪ Achieved 3 - year high in top box customer satisfaction with the digital channel 2 ▪ 17% decrease in consumer checking household attrition (3Q ‘22 to 3Q ‘23) 1 All updates as of or for the period ended September 30, 2023 unless otherwise noted. 2 Based on quarterly top box customer satisfaction scores from internal transactional surveys. Scores as of 3Q 2023.

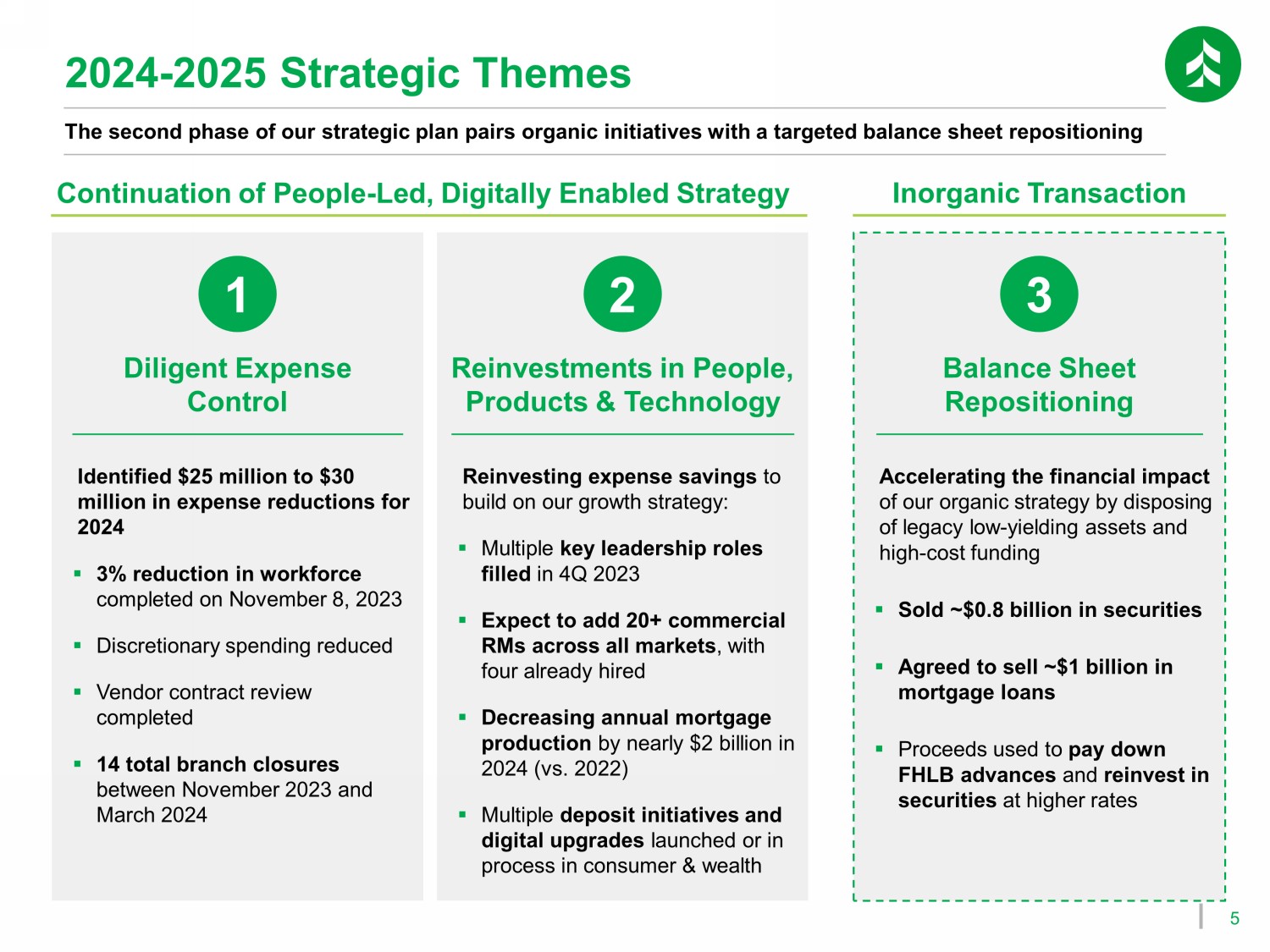

5 2024 - 2025 Strategic Themes The second phase of our strategic plan pairs organic initiatives with a targeted balance sheet repositioning Identified $25 million to $30 million in expense reductions for 2024 ▪ 3% reduction in workforce completed on November 8, 2023 ▪ Discretionary spending reduced ▪ Vendor contract review completed ▪ 14 total branch closures between November 2023 and March 2024 Reinvesting expense savings to build on our growth strategy: ▪ Multiple key leadership roles filled in 4Q 2023 ▪ Expect to add 20+ commercial RMs across all markets , with four already hired ▪ Decreasing annual mortgage production by nearly $2 billion in 2024 (vs.

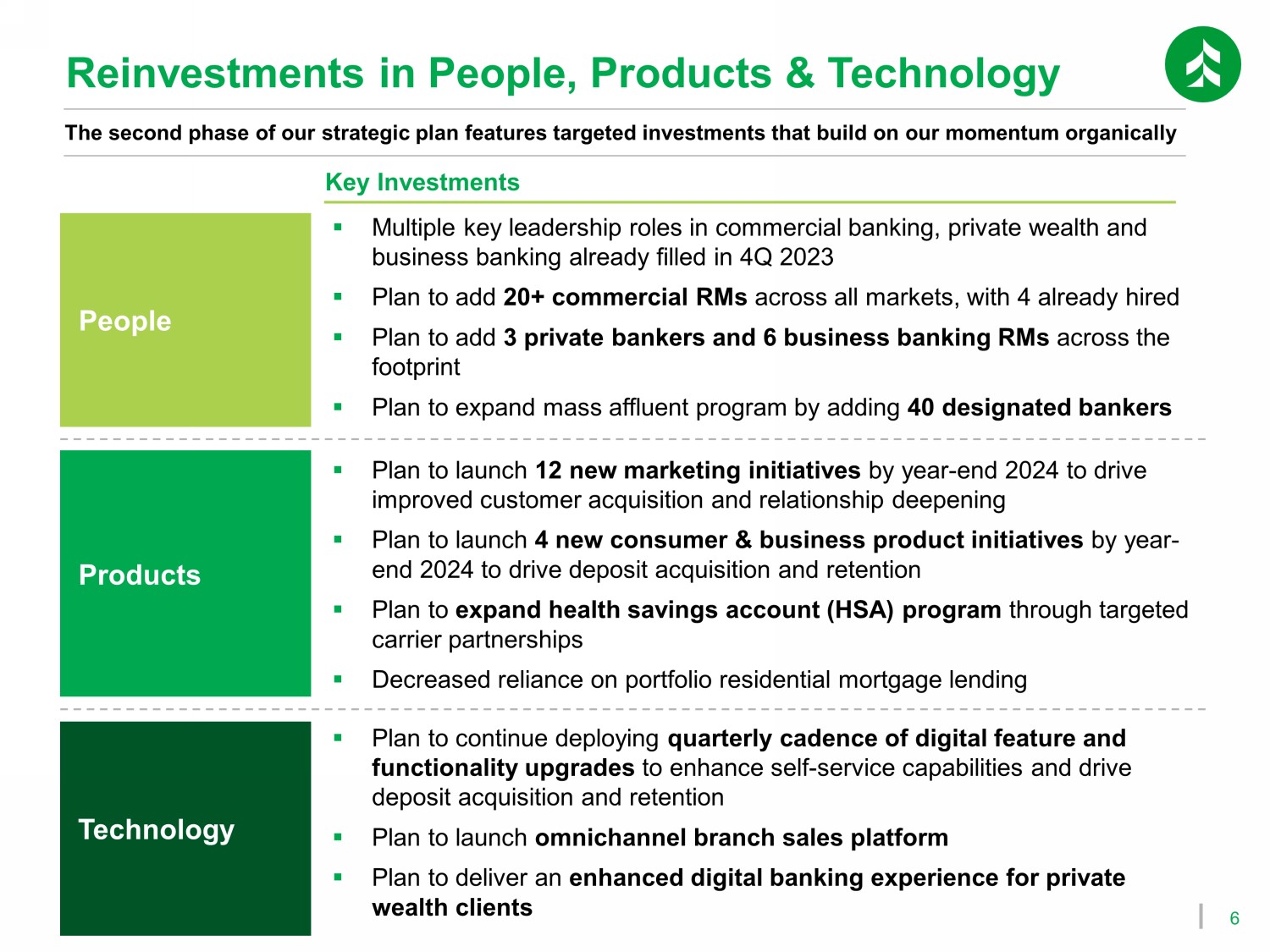

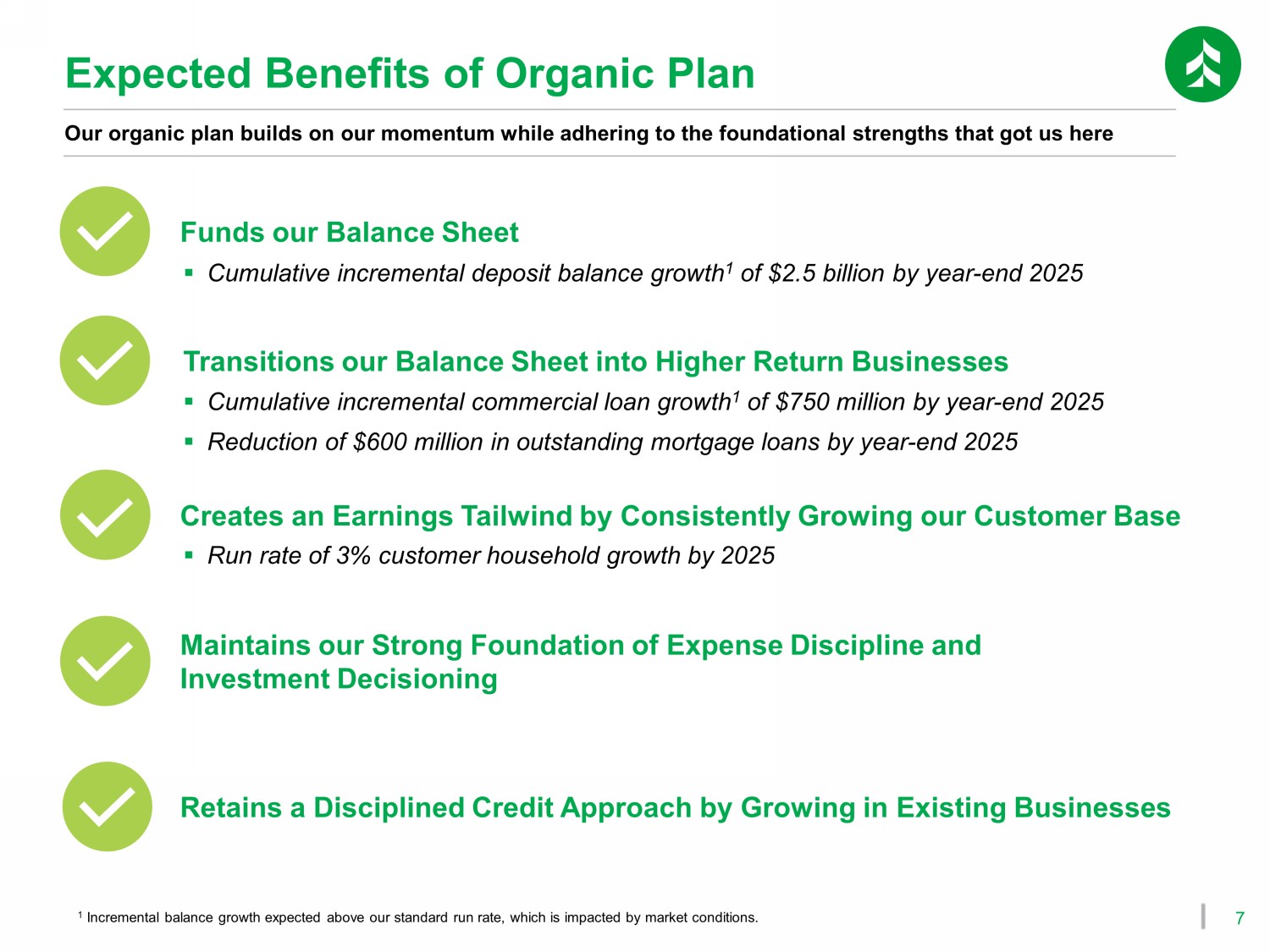

2022) ▪ Multiple deposit initiatives and digital upgrades launched or in process in consumer & wealth Diligent Expense Control Accelerating the financial impact of our organic strategy by disposing of legacy low - yielding assets and high - cost funding ▪ Sold ~$0.8 billion in securities ▪ Agreed to sell ~$1 billion in mortgage loans ▪ Proceeds used to pay down FHLB advances and reinvest in securities at higher rates Balance Sheet Repositioning Inorganic Transaction Continuation of People - Led, Digitally Enabled Strategy Reinvestments in People, Products & Technology 1 2 3 6 The second phase of our strategic plan features targeted investments that build on our momentum organically People Products Technology Key Investments ▪ Multiple key leadership roles in commercial banking, private wealth and business banking already filled in 4Q 2023 ▪ Plan to add 20+ commercial RMs across all markets, with 4 already hired ▪ Plan to add 3 private bankers and 6 business banking RMs across the footprint ▪ Plan to expand mass affluent program by adding 40 designated bankers ▪ Plan to launch 12 new marketing initiatives by year - end 2024 to drive improved customer acquisition and relationship deepening ▪ Plan to launch 4 new consumer & business product initiatives by year - end 2024 to drive deposit acquisition and retention ▪ Plan to expand health savings account (HSA) program through targeted carrier partnerships ▪ Decreased reliance on portfolio residential mortgage lending ▪ Plan to continue deploying quarterly cadence of digital feature and functionality upgrades to enhance self - service capabilities and drive deposit acquisition and retention ▪ Plan to launch omnichannel branch sales platform ▪ Plan to deliver an enhanced digital banking experience for private wealth clients Reinvestments in People, Products & Technology 7 Our organic plan builds on our momentum while adhering to the foundational strengths that got us here Expected Benefits of Organic Plan Transitions our Balance Sheet into Higher Return Businesses Creates an Earnings Tailwind by Consistently Growing our Customer Base Maintains our Strong Foundation of Expense Discipline and Investment Decisioning Retains a Disciplined Credit Approach by Growing in Existing Businesses Funds our Balance Sheet ▪ Cumulative incremental deposit balance growth 1 of $2.5 billion by year - end 2025 ▪ Cumulative incremental commercial loan growth 1 of $750 million by year - end 2025 ▪ Reduction of $600 million in outstanding mortgage loans by year - end 2025 ▪ Run rate of 3% customer household growth by 2025 1 Incremental balance growth expected above our standard run rate, which is impacted by market conditions.

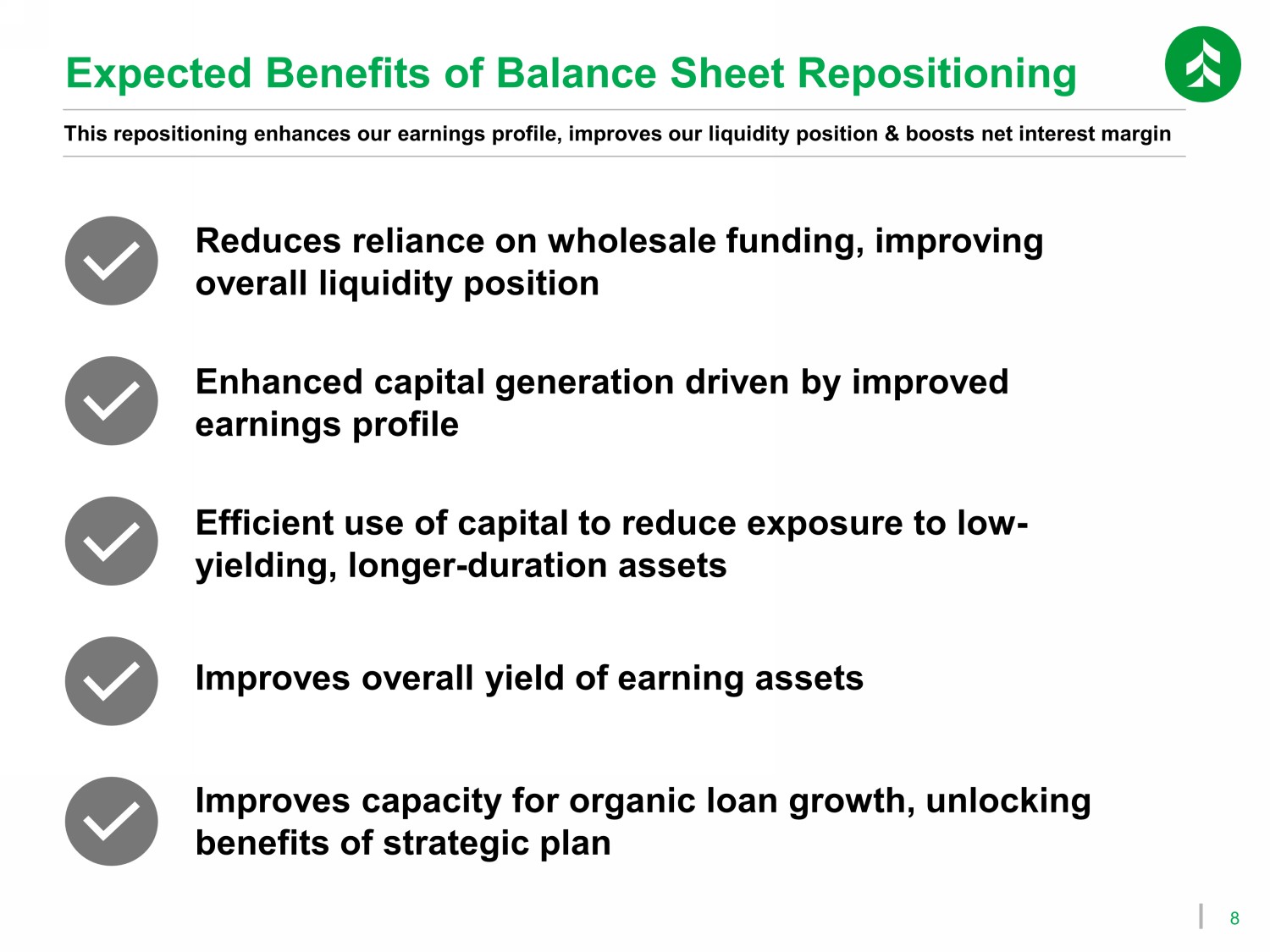

8 Expected Benefits of Balance Sheet Repositioning Improves capacity for organic loan growth, unlocking benefits of strategic plan Reduces reliance on wholesale funding, improving overall liquidity position Enhanced capital generation driven by improved earnings profile Efficient use of capital to reduce exposure to low - yielding, longer - duration assets Improves overall yield of earning assets This repositioning enhances our earnings profile, improves our liquidity position & boosts net interest margin Open discussion on areas of investor interest

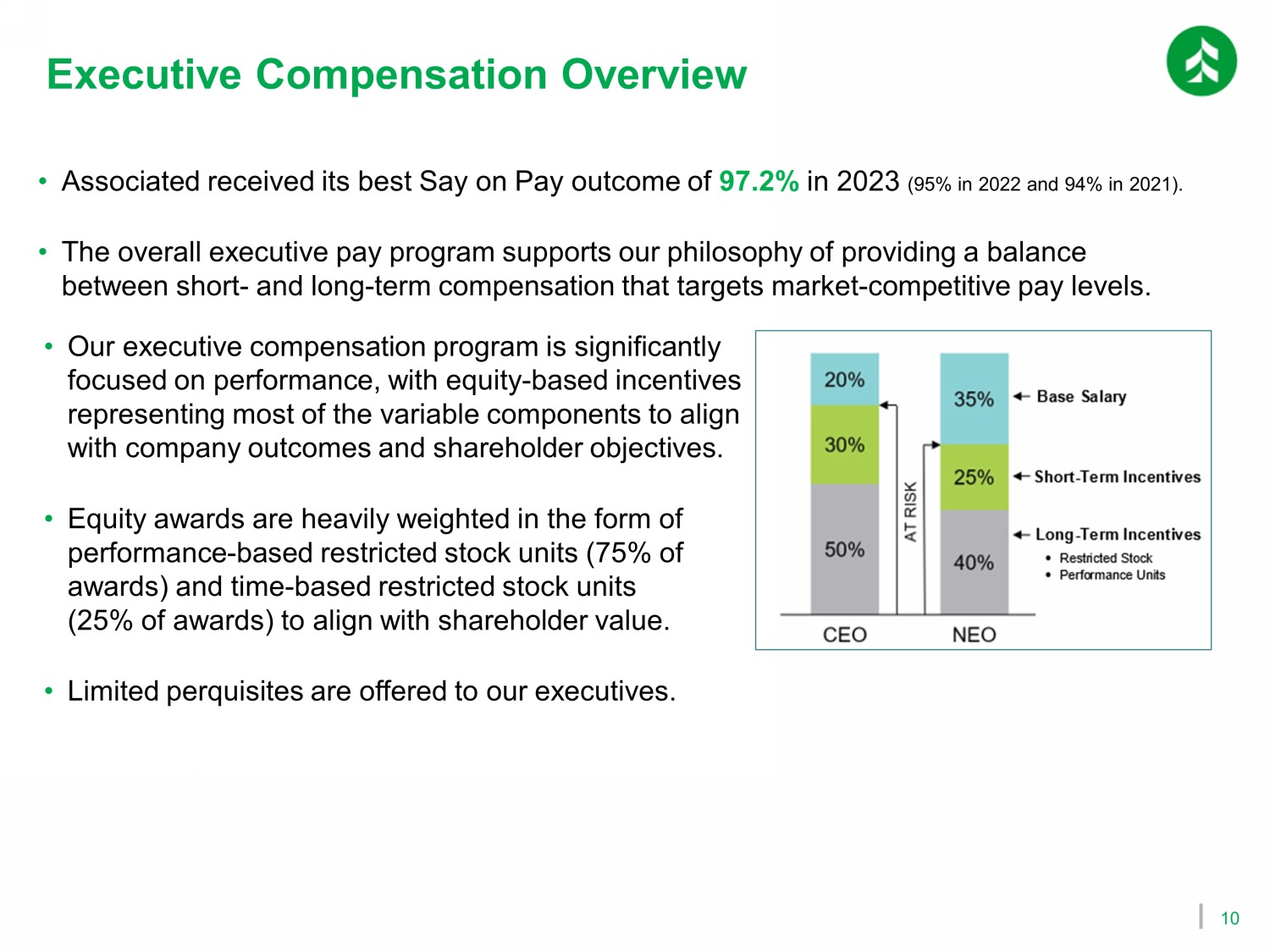

10 Executive Compensation Overview • Our executive compensation program is significantly focused on performance, with equity - based incentives representing most of the variable components to align with company outcomes and shareholder objectives. • Equity awards are heavily weighted in the form of performance - based restricted stock units (75% of awards) and time - based restricted stock units (25% of awards) to align with shareholder value. • Limited perquisites are offered to our executives. • Associated received its best Say on Pay outcome of 97.2% in 2023 (95% in 2022 and 94% in 2021). • The overall executive pay program supports our philosophy of providing a balance between short - and long - term compensation that targets market - competitive pay levels.

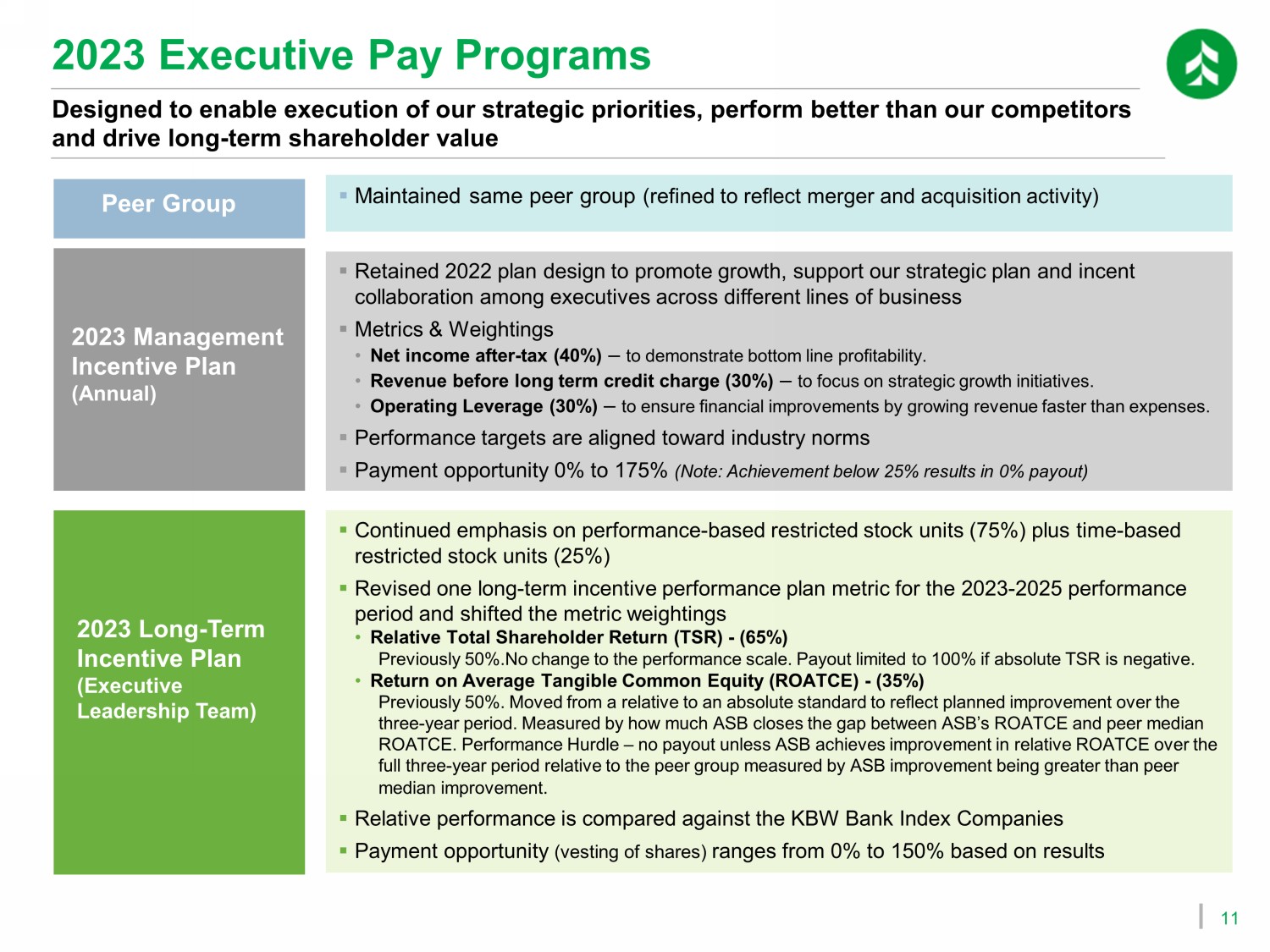

No Image 11 2023 Executive Pay Programs Designed to enable execution of our strategic priorities, perform better than our competitors and drive long - term shareholder value Peer Group 2023 Management Incentive Plan (Annual) 2023 Long - Term Incentive Plan (Executive Leadership Team) ▪ Maintained same peer group (refined to reflect merger and acquisition activity ) ▪ Retained 2022 plan design to promote growth, support our strategic plan and incent collaboration among executives across different lines of business ▪ Metrics & Weightings • N et income after - t ax (40%) – to demonstrate bottom line profitability. • Revenue before long term credit charge (30%) – to focus on strategic growth initiatives. • Operating Leverage (30%) – to ensure financial improvements by growing revenue faster than expenses. ▪ Performance targets are aligned toward industry norms ▪ Payment opportunity 0% to 175% (Note: Achievement below 25% results in 0% payout) ▪ Continued emphasis on performance - based restricted stock units ( 75 %) plus time - based restricted stock units (25%) ▪ Revised one long - term incentive performance plan metric for the 2023 - 2025 performance period and shifted the metric weightings • Relative Total Shareholder Return (TSR) - (65%) Previously 50%.No change to the performance scale. Payout limited to 100% if absolute TSR is negative. • Return on Average Tangible Common Equity (ROATCE) - (35%) Previously 50%. Moved from a relative to an absolute standard to reflect planned improvement over the three - year period. Measured by how much ASB closes the gap between ASB’s ROATCE and peer median ROATCE. Performance Hurdle – no payout unless ASB achieves improvement in relative ROATCE over the full three - year period relative to the peer group measured by ASB improvement being greater than peer median improvement .

▪ Relative performance is compared against the KBW Bank Index Companies ▪ Payment opportunity (vesting of shares) ranges from 0% to 150% based on results 12 Shareholder Friendly Pay Practices x Solid incentive plan governance x Double trigger change in control is applied for equity vesting x Robust clawback policy x Stock ownership requirements include a salary multiple and a post - vesting holding period x Dividend equivalents on unvested stock are not paid until the end of the performance period x Independent compensation consultant reporting directly to the Compensation Committee Ꭓ No hedging or pledging of company shares Ꭓ No excise tax gross - ups for NEOs (except in connection with relocation expenses) Ꭓ No repricing of stock options and SARs without shareholder approval Ꭓ NEOs do not have employment agreements Ensuring good corporate governance 13 Human Capital Overview Our Approach Attract • Increased recruitment marketing • Expanded diversity outreach • Focus on colleague experience, education and partnership Engage • In - person and video town halls and support of inaugural Day of Service • Improved engagement scores • DEI evolution: increases in CRG participation and POC %, new Council structure and established DEI objectives for all LOBs Develop • Improvements to succession planning • Focus on Individual Development Plans • Implemented Career Coach Retain • Trending improvement in every retention category • Significant effort in digital transformation with WorkDay • Ongoing review of compensation foundations and benefits strategy Summary of 2023 Progress

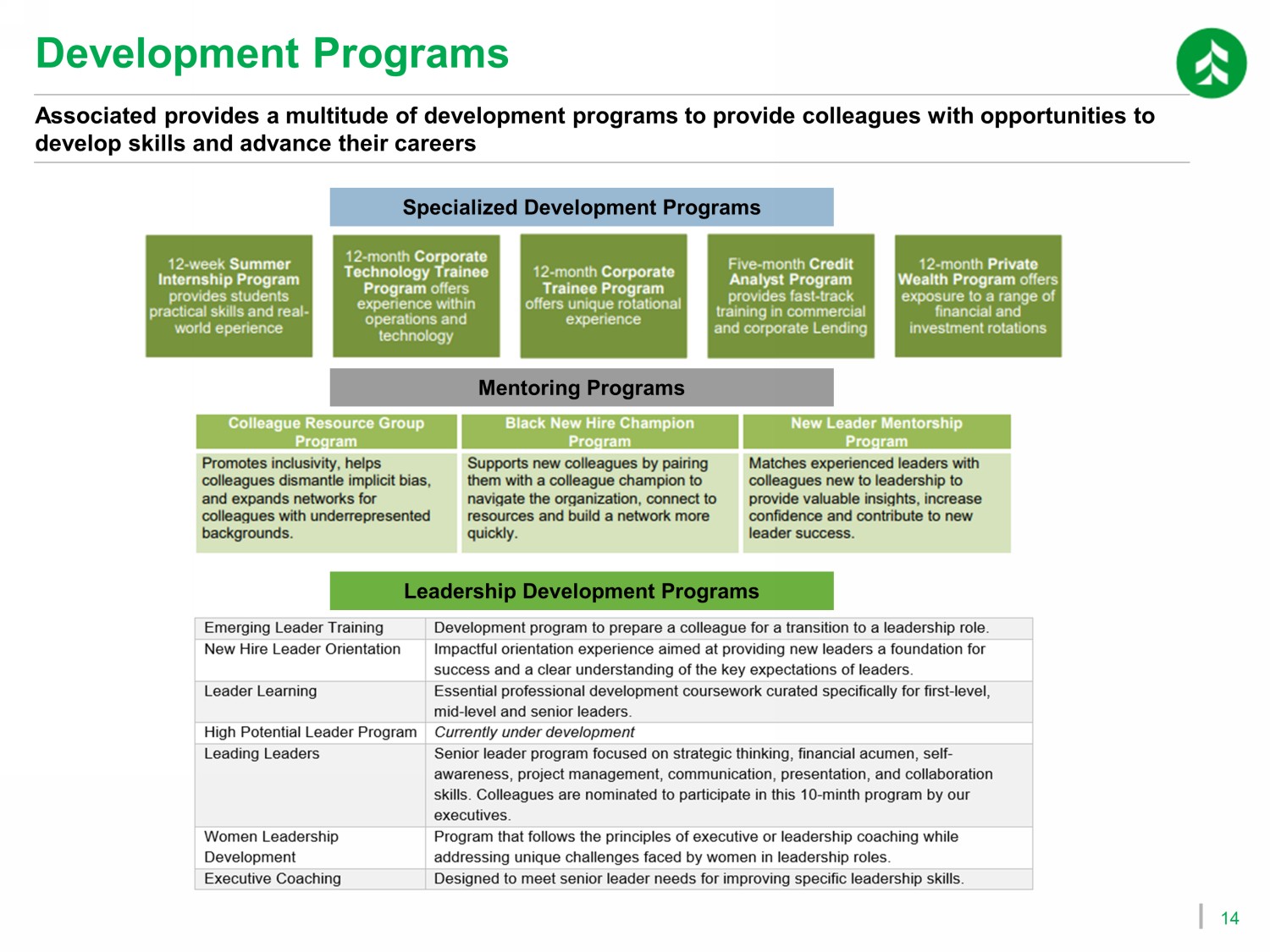

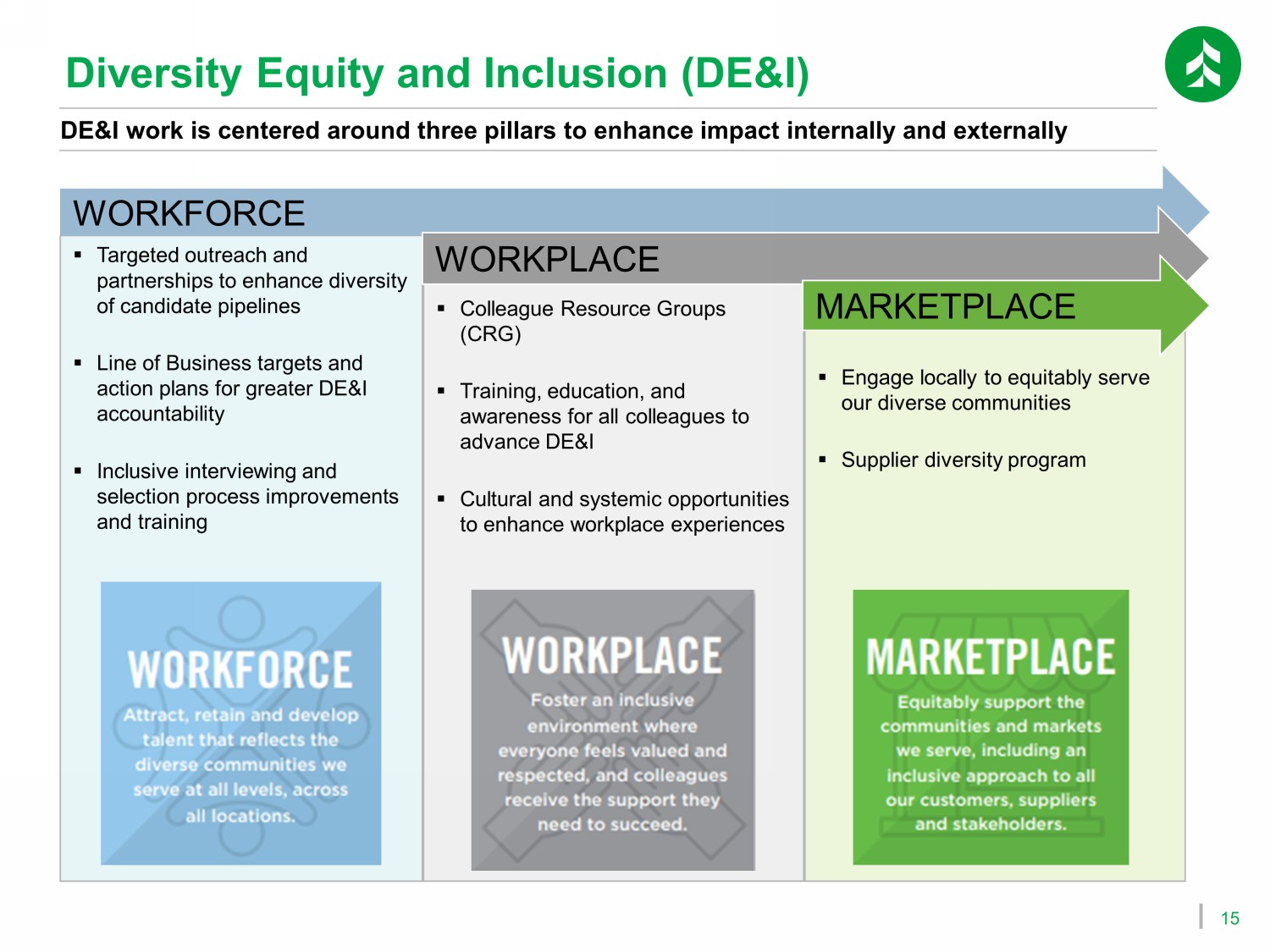

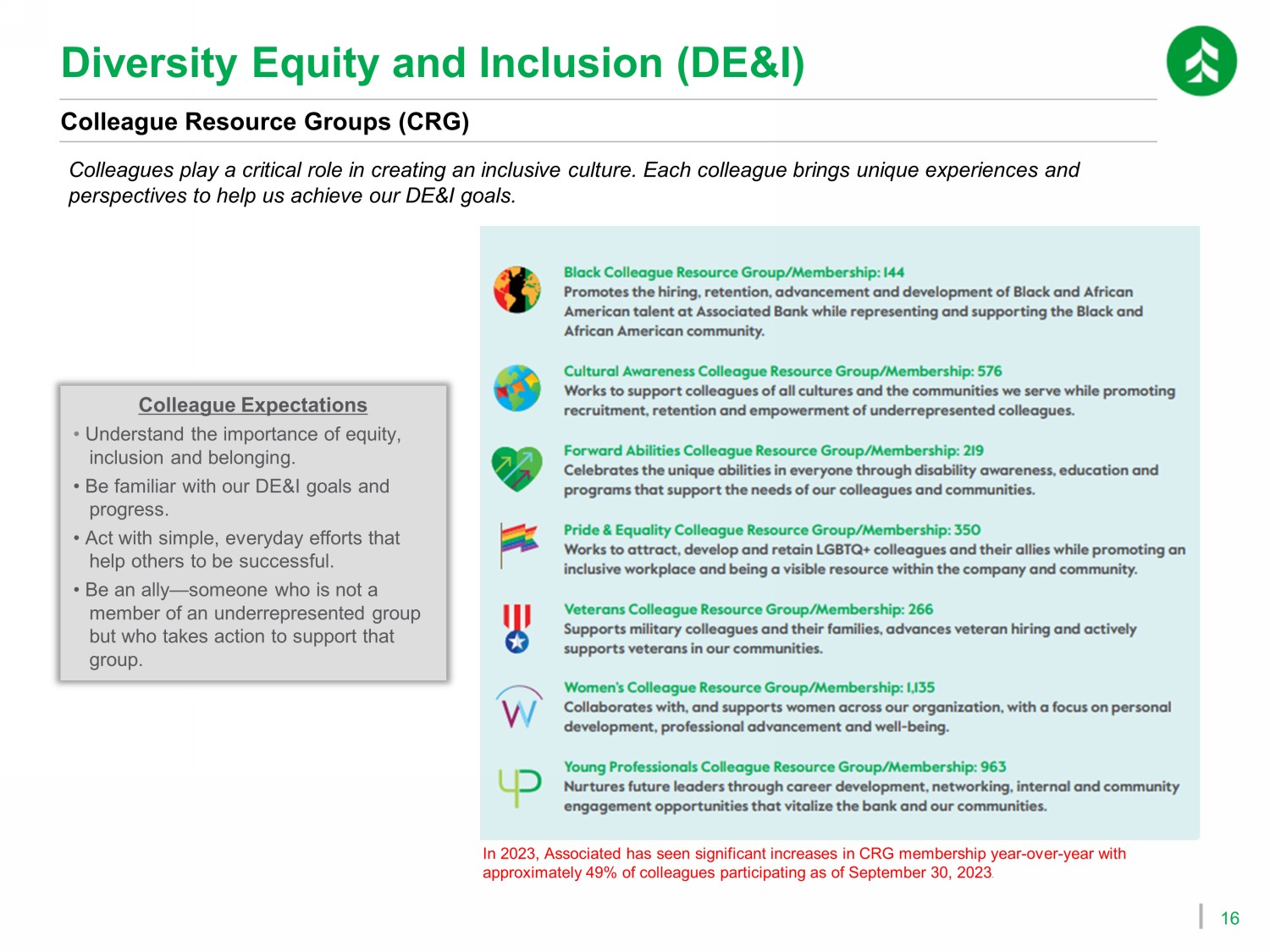

14 Development Programs Associated provides a multitude of development programs to provide colleagues with opportunities to develop skills and advance their careers Specialized Development Programs Mentoring Programs Leadership Development Programs 15 ▪ Colleague Resource Groups (CRG) ▪ Training, education, and awareness for all colleagues to advance DE&I ▪ Cultural and systemic opportunities to enhance workplace experiences Diversity Equity and Inclusion (DE&I) ▪ Targeted outreach and partnerships to enhance diversity of candidate pipelines ▪ Line of Business targets and action plans for greater DE&I accountability ▪ Inclusive interviewing and selection process improvements and training ▪ Engage locally to equitably serve our diverse communities ▪ Supplier diversity program WORKFORCE WORKPLACE MARKETPLACE DE&I work is centered around three pillars to enhance impact internally and externally 16 Diversity Equity and Inclusion (DE&I) Colleague Resource Groups (CRG) Colleague Expectations • Understand the importance of equity, inclusion and belonging.

• Be familiar with our DE&I goals and progress. • Act with simple, everyday efforts that help others to be successful. • Be an ally — someone who is not a member of an underrepresented group but who takes action to support that group. Colleagues play a critical role in creating an inclusive culture. Each colleague brings unique experiences and perspectives to help us achieve our DE&I goals. In 2023, Associated has seen significant increases in CRG membership year - over - year with approximately 49% of colleagues participating as of September 30, 2023 .

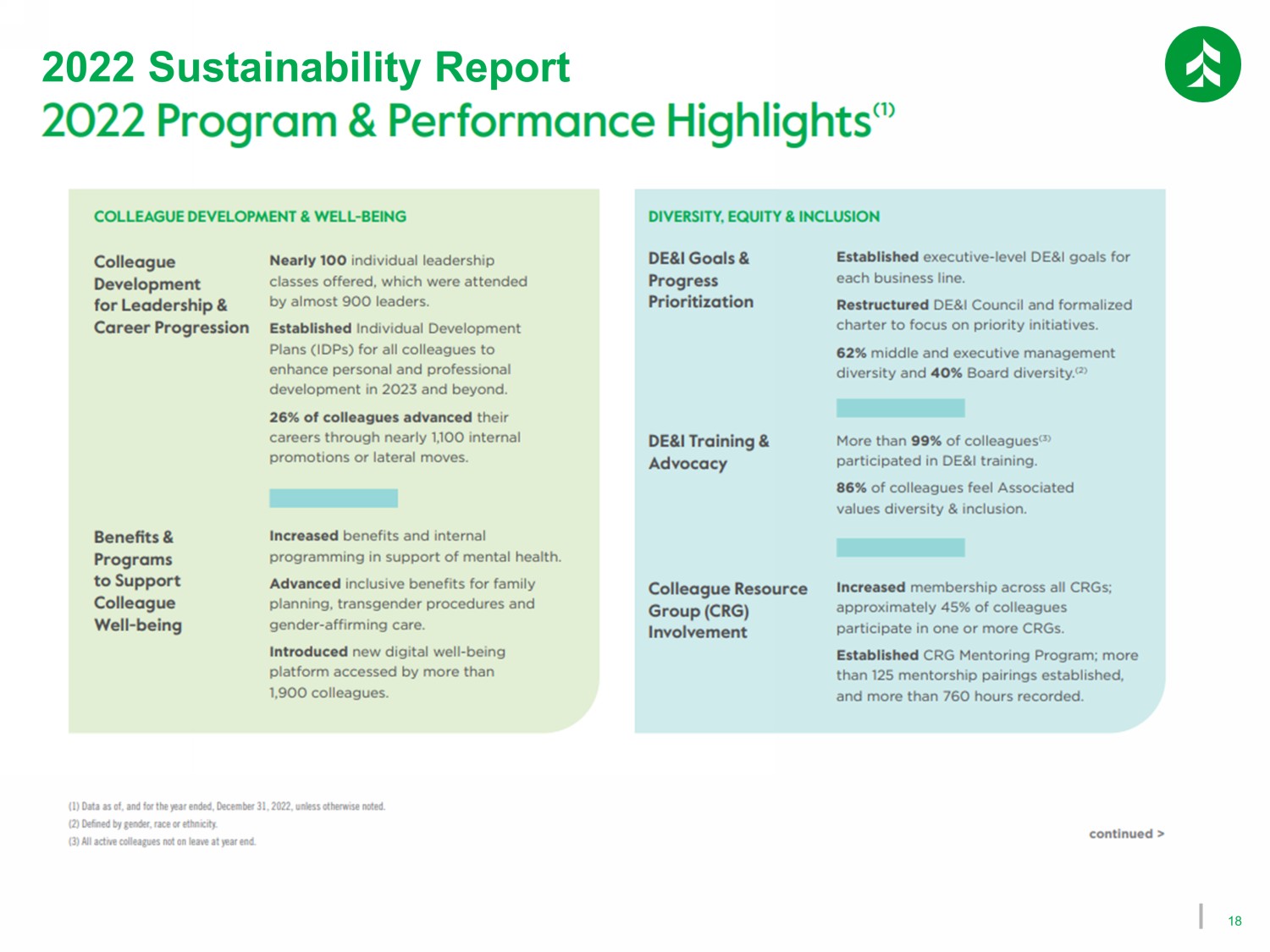

17 ESG at Associated Bank We understand that providing valuable insights around Associated’s actions and strategies in our Environment, Social and Governance space help our stakeholders make better informed investment decisions. We have identified and prioritized initiatives that will help us manage and measure our progress in 2023 and beyond. ESG at Associated Business Ethics, Business Conduct and Compliance Climate Change Customer Experience Cybersecurity and Consumer Privacy Human Capital 19 2022 Sustainability Report continued

18 2022 Sustainability Report

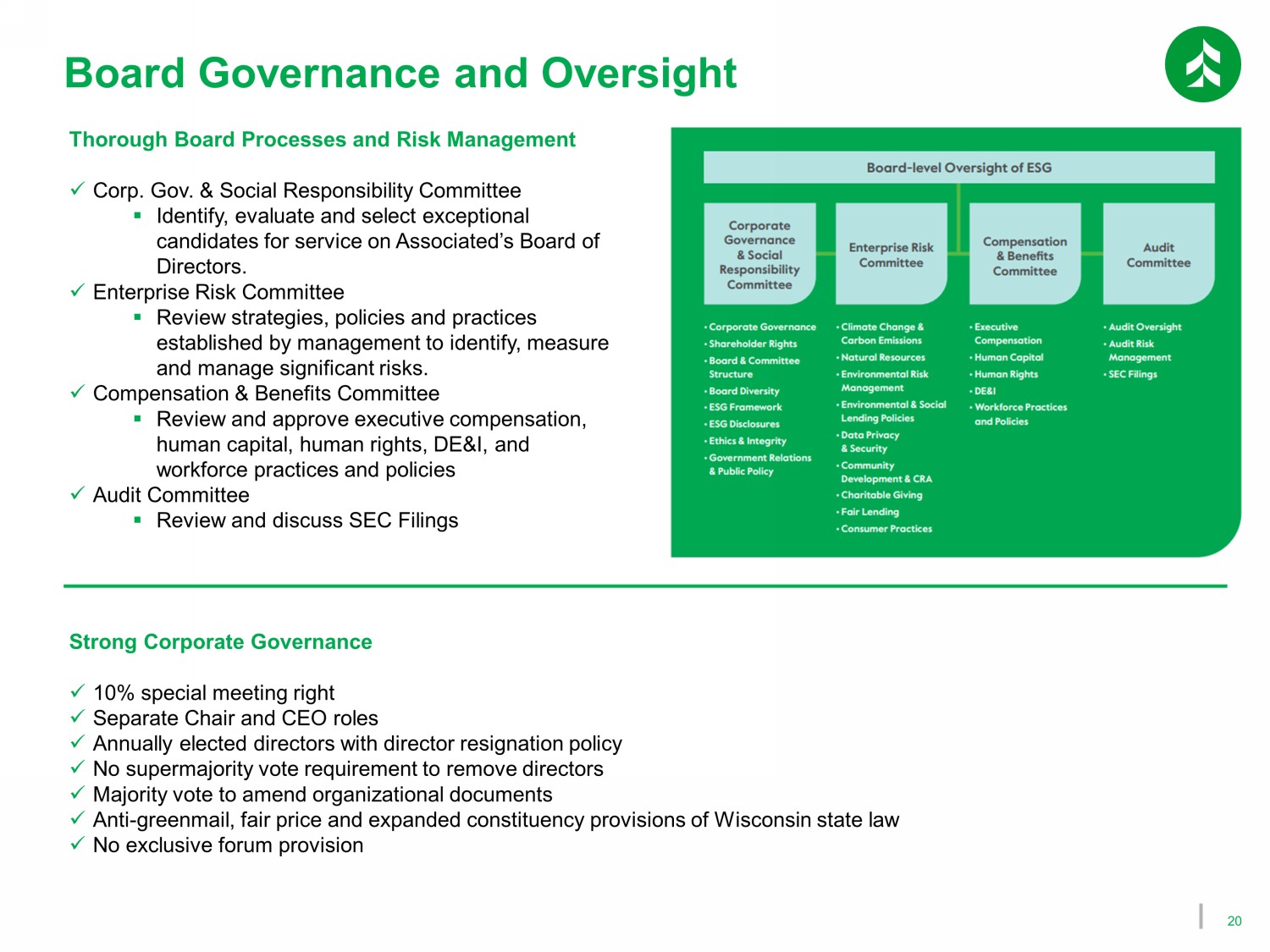

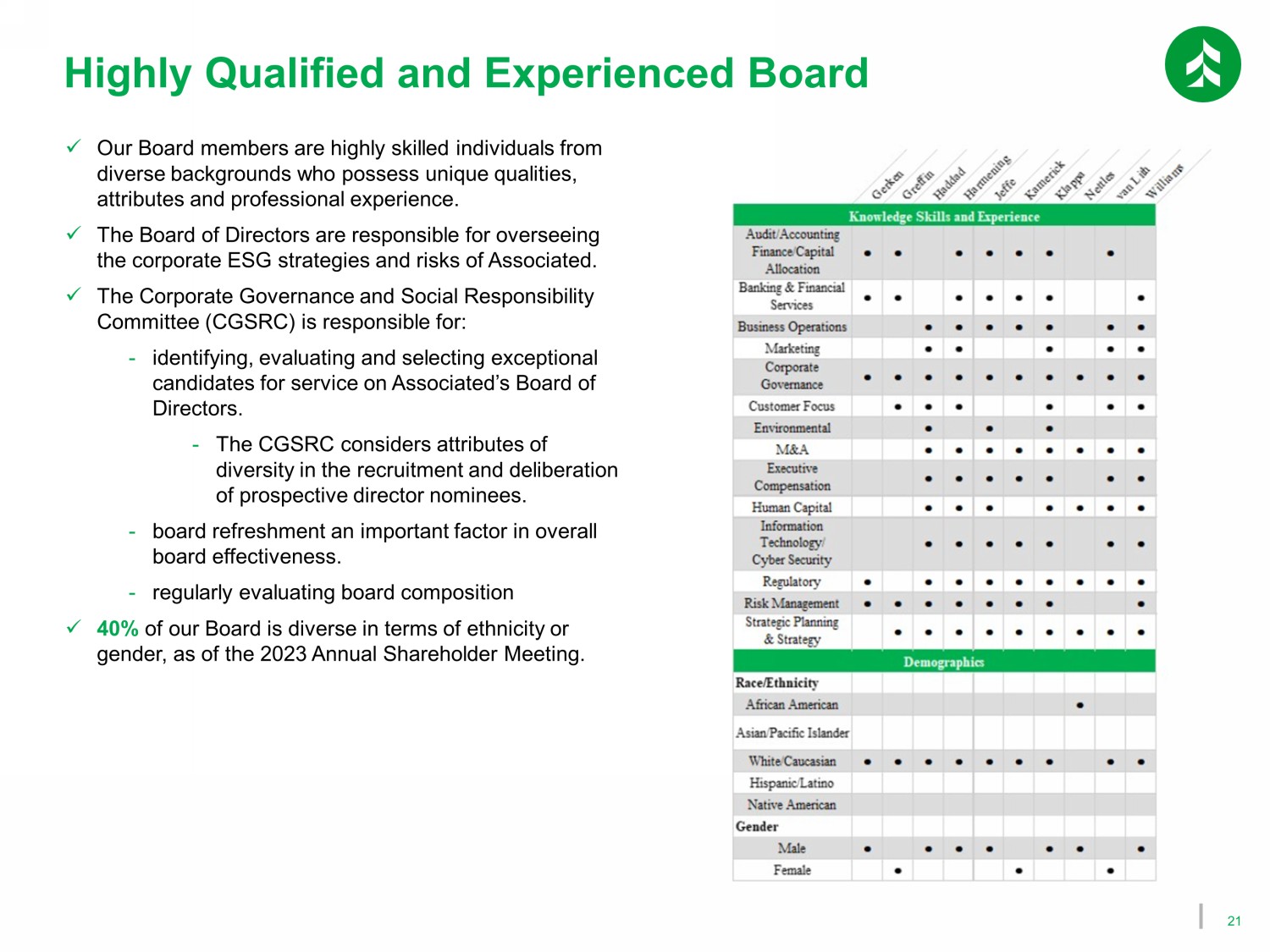

20 Board Governance and Oversight Strong Corporate Governance x 10% special meeting right x Separate Chair and CEO roles x Annually elected directors with director resignation policy x No supermajority vote requirement to remove directors x Majority vote to amend organizational documents x Anti - greenmail, fair price and expanded constituency provisions of Wisconsin state law x No exclusive forum provision Thorough Board Processes and Risk Management x Corp. Gov. & Social Responsibility Committee ▪ Identify, evaluate and select exceptional candidates for service on Associated’s Board of Directors. x Enterprise Risk Committee ▪ Review strategies, policies and practices established by management to identify, measure and manage significant risks. x Compensation & Benefits Committee ▪ Review and approve executive compensation, human capital, human rights, DE&I, and workforce practices and policies x Audit Committee ▪ Review and discuss SEC Filings 21 Highly Qualified and Experienced Board x Our Board members are highly skilled individuals from diverse backgrounds who possess unique qualities, attributes and professional experience.

x The Board of Directors are responsible for overseeing the corporate ESG strategies and risks of Associated. x The Corporate Governance and Social Responsibility Committee (CGSRC) is responsible for: - identifying, evaluating and selecting exceptional candidates for service on Associated’s Board of Directors. - The CGSRC considers attributes of diversity in the recruitment and deliberation of prospective director nominees. - board refreshment an important factor in overall board effectiveness. - regularly evaluating board composition x 40% of our Board is diverse in terms of ethnicity or gender, as of the 2023 Annual Shareholder Meeting.

APPENDIX

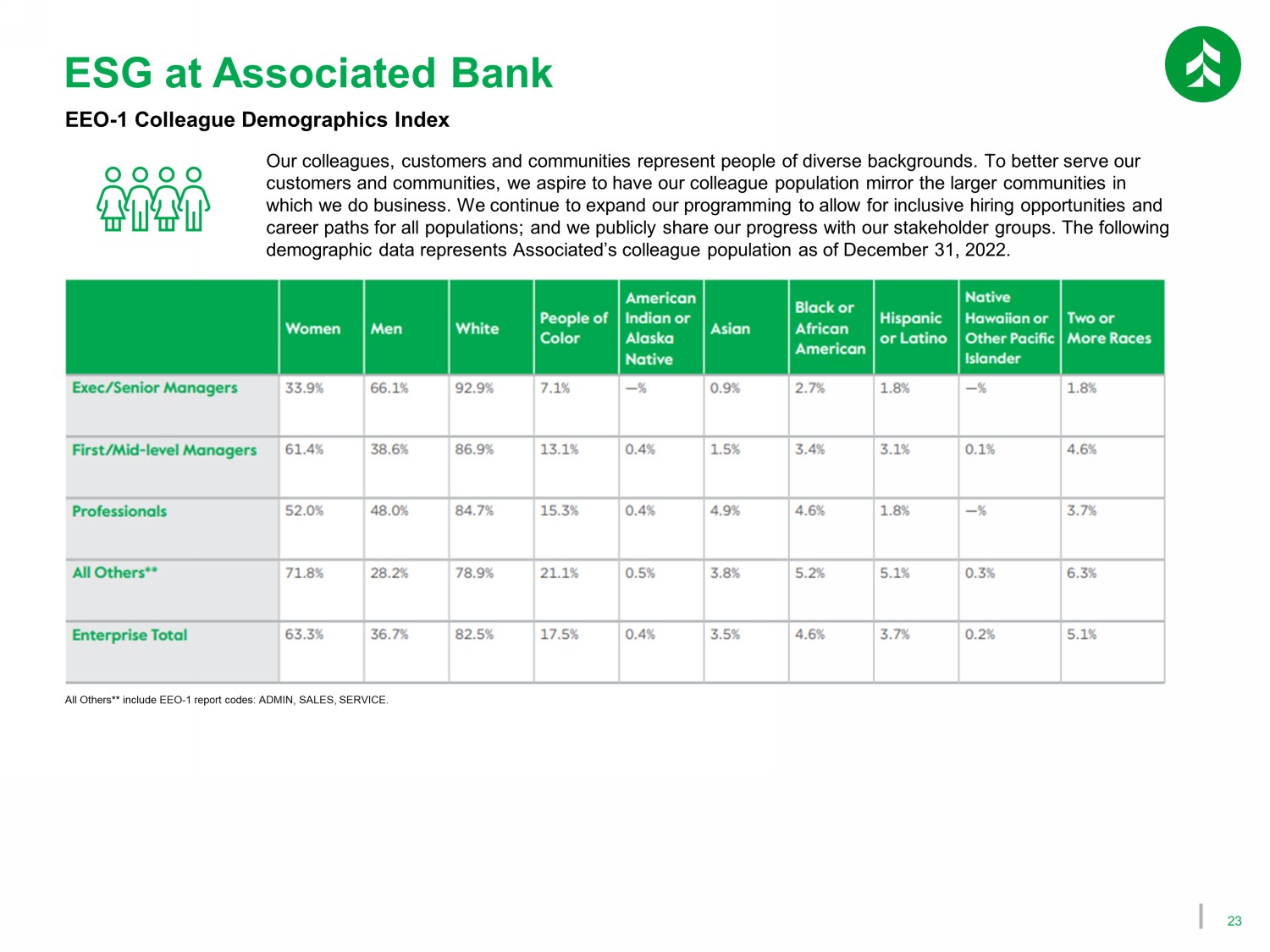

23 ESG at Associated Bank Our colleagues, customers and communities represent people of diverse backgrounds. To better serve our customers and communities, we aspire to have our colleague population mirror the larger communities in which we do business. We continue to expand our programming to allow for inclusive hiring opportunities and career paths for all populations; and we publicly share our progress with our stakeholder groups. The following demographic data represents Associated’s colleague population as of December 31, 2022. All Others** include EEO - 1 report codes: ADMIN, SALES, SERVICE. EEO - 1 Colleague Demographics Index