UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 13, 2023

Bite Acquisition

Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40055 | 85-3307316 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| 30 West Street, No. 28F New York, New York |

10004 |

| (Address of principal executive offices) | (Zip Code) |

(212) 608-2923

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of common stock, par value $0.0001 per share and one-half of one warrant | BITE.U | NYSE American LLC | ||

| Common stock, par value $0.0001 per share | BITE | NYSE American LLC | ||

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 | BITE WS | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

Attached hereto as Exhibit 99.1 and incorporated herein by reference is an updated form of presentation to be used by Bite Acquisition Corp. (the “Company”) and Above Food Corp., a corporation organized under the laws of Saskatchewan, Canada (“Above Food”), in presentations for certain of the Company’s stockholders and other persons in connection with the transactions contemplated by the Business Combination Agreement, dated April 29, 2023, by and among the Company, Above Food, Above Food Ingredients Inc. (formerly known as 2510169 Alberta Inc.), an Alberta corporation (“TopCo”) and a direct, wholly owned subsidiary of Above Food, and Above Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of TopCo. Such exhibit and the information set forth therein is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act. The submission of the information set forth in this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented in Exhibit 99.1 that is provided solely in connection with Regulation FD.

Additional Information and Where to Find It

In connection with the proposed business combination and related transactions contemplated in connection therewith (the “Proposed Transaction”), TopCo has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 (the “Registration Statement”) containing a preliminary proxy statement of the Company and prospectus of TopCo. After the Registration Statement is declared effective, the Company will mail a definitive proxy statement/prospectus relating to the Proposed Transaction to its stockholders. Company stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and, when available, the definitive proxy statement/prospectus and other documents filed in connection with the Proposed Transaction, as these materials contain or will contain important information about the Company, Above Food, TopCo, Merger Sub and the Proposed Transaction. When available, the definitive proxy statement/prospectus will be mailed to Company stockholders as of a record date to be established for voting on the Proposed Transaction.

The Company’s stockholders can also obtain copies of the preliminary proxy statement/prospectus and the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Bite Acquisition Corp., 30 West Street, No. 28F, New York, NY 10004, Attention: Alberto Ardura González or by email at alberto@biteacquisitioncorp.com.

Participants in Solicitation

The Company, Above Food, and their respective directors and executive officers may be deemed participants in the solicitation of proxies from the Company stockholders with respect to the Proposed Transaction. Company stockholders and other interested persons may obtain, without charge, information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Company stockholders in connection with the Proposed Transaction and other matters to be voted upon at its special meeting of stockholders in the preliminary proxy statement/prospectus for the Proposed Transaction, which is available free of charge at the SEC’s website at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Company stockholders in connection with the Proposed Transaction and other matters to be voted upon at its special meeting of stockholders will be set forth in the proxy statement/prospectus for the Proposed Transaction. Additional information regarding the interests of participants in the solicitation of proxies from the Company’s stockholders with respect to the Proposed Transaction will also be contained in the proxy statement/prospectus for the Proposed Transaction.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements included in this Current Report on Form 8-K that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or events that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on the current expectations of Above Food’s and the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Above Food and the Company. These forward-looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the Proposed Transaction, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company, the expected benefits of the Proposed Transaction or that the approval of the stockholders of the Company or Above Food is not obtained, any of the other conditions to closing are not satisfied or that events or other circumstances give rise to the termination of the business combination agreement relating to the Proposed Transaction; (iii) changes to the structure of the Proposed Transaction that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining the necessary regulatory approvals; (iv) the ability to meet stock exchange listing standards following the consummation of the Proposed Transaction; (v) the risk that the Proposed Transaction disrupts current plans and operations of Above Food as a result of the announcement and consummation of the Proposed Transaction; (vi) failure to realize the anticipated benefits of the Proposed Transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (vii) costs related to the Proposed Transaction; (viii) changes in applicable law or regulations; (ix) risks relating to the uncertainty of the projected financial information with respect to Above Food; (x) the outcome of any legal proceedings that may be instituted against the Company or Above Food; (xi) the effects of competition on Above Food’s future business; (xii) the impact of the COVID-19 pandemic on Above Food’s business; (xiii) the ability of the Company or the combined company to issue equity or equity-linked securities or obtain debt financing in connection with the Proposed Transaction or in the future; (xiv) the enforceability of Above Food’s intellectual property rights, including its copyrights, patents, trademarks and trade secrets, and the potential infringement on the intellectual property rights of others; (xv) Above Food’s ability to execute its planned acquisition strategy, including to successfully integrate completed acquisitions and realize anticipated synergies; and (xvi) those factors discussed under the heading “Risk Factors” in the preliminary Registration Statement filed by TopCo with the SEC on October 16, 2023, and other documents filed, or to be filed, by the Company and/or TopCo with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither the Company nor Above Food presently know or that the Company or Above Food currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s and Above Food’s expectations, plans or forecasts of future events and views as of the date of this Current Report on Form 8-K. The Company and Above Food anticipate that subsequent events and developments may cause the Company’s and Above Food’s assessments to change. However, while the Company and Above Food may elect to update these forward-looking statements at some point in the future, the Company and Above Food specifically disclaim any obligation to do so. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. Accordingly, undue reliance should not be placed upon the forward-looking statements. Certain market data information in this Current Report on Form 8-K is based on the estimates of Above Food and the Company’s management. Above Food and the Company obtained the industry, market and competitive position data used throughout this Current Report on Form 8-K from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties. Above Food and the Company believe their estimates to be accurate as of the date of this Current Report on Form 8-K. However, this information may prove to be inaccurate because of the method by which Above Food or the Company obtained some of the data for its estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data and the voluntary nature of the data gathering process.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Current Report on Form 8-K does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.

No Assurances

There can be no assurance that the Proposed Transaction will be completed, nor can there be any assurance, if the Proposed Transaction is completed, that the potential benefits of combining the companies will be realized.

Item 9.01. Financial Statements and Exhibits

(c) Exhibits:

| Exhibit No. | Description | |

| 99.1 | Investor presentation dated November 2023. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BITE ACQUISITION CORP. | ||

| By: | /s/ Alberto Ardura González | |

| Name: Alberto Ardura González | ||

| Title: Chief Executive Officer and Chairman of the Board | ||

Date: November 13, 2023

Exhibit 99.1

Investor Presentation NOVEMBER 2023 © 2023 Above Food Corp. The Regenerative Ingredient Company We go above.

© 2022 Above Food Corp. We go above. 2 (of 26) ABOUT THIS PRESENTATION This investor presentation (this “Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Bite Acquisition Corp. (“BAC”) and Above Food Corp. (together with its direct and indirect subsidiaries, collectively, the “Company” or “Above Food” or “AF”). The information contained herein does not purport to be all - inclusive or necessarily contain all the information that a prospective investor may desire in investigating a prospective investment in the securities of BAC, AF or Above Food Ingredients Inc. (“PubCo”), and none of BAC, the Company, PubCo or their respective representatives or affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation (and any other information, whether written or oral, that has been or will be provided to you). The information contained herein is preliminary and is subject to update, completion, revision, verification and amendment without notice, and such changes may be material. Because the proposed Business Combination transaction is in a structuring phase, there may be material changes to the structure and terms prior to the offering of any securities. The attached material is provided to you on the understanding that as a sophisticated investor, you will understand and accept its inherent limitations, will not rely on it in making any investment decision with respect to any securities that may be issued, and will use it only for purpose of discussing with your advisors your preliminary interest in investing in BAC, AF or PubCo in connection with the proposed Business Combination. No statement contained herein should be considered binding on any party. This Presentation and the information contained herein (and any other information, whether written or oral, that has been or will be provided to you) constitutes confidential information, is provided to you on the condition that you agree that you will hold it in strict confidence and not reproduce, disclose, forward or distribute it in whole or in part without the prior written consent of BAC and the Company and is intended for the recipient hereof only. Completion of the proposed Business Combination is subject to, among other matters, approval by the Company’s and BAC’s stockholders and the satisfaction of the closing conditions to be set forth in the business combination agreement. No assurances can be given that the proposed Business Combination will be consummated on the terms or in the timeframe currently contemplated, if at all. NO OFFER OR SOLICITATION This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy or a recommendation to purchase any security of BAC, the Company, PubCo or any of their respective affiliates. Any offer to sell securities will be made only pursuant to a definitive subscription or similar agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. No representations or warranties, express or implied are given in, or in respect of, this Presentation. No securities commission or securities regulatory authority in the United States or any other jurisdiction has in any way passed upon the merits of the proposed Business Combination or the accuracy or adequacy of this Presentation. The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should inform themselves of and observe any such restrictions. The recipient acknowledges that it is (i) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (ii) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b - 5 thereunder. FORWARD - LOOKING STATEMENTS This Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target”, or negatives of these terms or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, and projections of market opportunity and market share. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the Company and its management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward - looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political conditions, and in laws and regulations; (ii) the inability of the parties to timely consummate the proposed Business Combination or at all, which may adversely affect the price of BAC’s securities, (iii) the failure to satisfy the conditions to the consummation of the proposed Business Combination, including the requisite approvals of BAC’s and Above Food’s stockholders, the satisfaction of the minimum available cash amount following any redemptions by BAC’s public stockholders, and the receipt of certain governmental and regulatory approvals; (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement relating to the proposed Business Combination, if and when executed; (v) costs related to the proposed Business Combination and the failure to realize the anticipated benefits of the proposed Business Combination or to realize estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions; (vi) the ability to maintain the listing of BAC’s or PubCo’s securities on a national securities exchange; (vii) the outcome of any legal proceedings that may be instituted against BAC, Above Food or PubCo related to the business combination agreement or the proposed Business Combination, (viii) risks related to the uncertainty of Above Food’s projected financial information, (ix) the ability of the combined company to implement business plans, forecasts, and other expectations after the completion of the proposed Business Combination, and the ability of the combined company to identify and realize additional opportunities; (x) changes in the competitive industries in which Above Food operates and variations in operating performance across competitors; (xi) the ability of Above Food to retain existing customers and attract new customers, (xii) the potential inability of Above Food to manage growth effectively, (xiii) the enforceability of Above Food’s intellectual property rights, including its copyrights, patents, trademarks and trade secrets, and the potential infringement on the intellectual property rights of others, (xiv) Above Food’s dependence on senior management and other key employees; (xv) Above Food’s ability to execute its planned acquisition strategy, including to successfully integrate completed acquisitions and realize anticipated synergies; and (xvi) the ability of BAC, the Company or PubCo to issue equity or equity - linked securities in connection with the proposed Business Combination or in the future. The foregoing list of factors is not exhaustive. The recipient should carefully consider the foregoing factors and the other risks and uncertainties which are more fully described in the “Risk Factors” section of the proxy/registration statement discussed below and other documents filed by BAC or PubCo from time to time with the Securities and Exchange Commission (the “SEC”). If any of these risks materialize or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that neither BAC nor the Company presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect BAC and AF’s expectations, plans or forecasts of future events and views as of the date of this Presentation. BAC, the Company, PubCo and their respective representatives and affiliates specifically disclaim any obligation to, and do not intend to, update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. These forward - looking statements should not be relied upon as representing BAC’s, the Company’s, PubCo’s or any of their respective representatives’ or affiliates’ assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements. These forward - looking statements speak only as of the date of this Presentation and none of the Company, BAC, or any of their respective representatives or affiliates have any obligation to update this Presentation. This Presentation contains preliminary information only, is subject to change at any time and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding a potential investment in connection with the proposed Business Combination. D i s c l a i m e r © 2023 Above Food Corp.

We go above. © 2022 Above Food Corp. USE OF PROJECTIONS This Presentation contains projected financial information with respect to AF, namely the Company’s projected and pro forma revenue, revenue CAGR, gross profit, Adjusted EBITDA and Adjusted EBITDA margin for the fiscal year ending January 31, 2024. Such projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. See “Forward - Looking Statements” above. Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation, and the inclusion of such information in this Presentation (and any other information, whether written or oral, that has been or will be provided to you) should not be regarded as a representation by any person that the results reflected in such projections will be achieved. Neither the independent auditors of BAC nor the independent registered public accounting firm of the Company audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation and, accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. IMPORTANT ADDITIONAL INFORMATION In connection with the proposed Business Combination, PubCo filed a proxy/registration statement with the SEC that included a preliminary proxy statement of BAC and constituted a preliminary prospectus of PubCo. The proxy statement and other relevant documents will be mailed to the shareholders of BAC upon the proxy/registration statement being declared effective by the SEC, and it contains important information about the proposed Business Combination and related matters. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the proposed Business Combination. BAC stockholders and other interested persons are advised to read the proxy/registration statement and other documents filed in connection with the proposed Business Combination because these materials will contain important information about the parties to the business combination agreement, the Company, BAC and the proposed Business Combination. Stockholders will also be able to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at www.sec.gov. PARTICIPANTS IN SOLICITATION BAC, the Company, PubCo and their respective directors, managers and officers may be deemed participants in the solicitation of proxies from BAC shareholders in connection with the proposed Business Combination . BAC shareholders and other interested persons may obtain more detailed information regarding the directors and officers of BAC in BAC’s annual report on Form 10 - K for the year ended December 31 , 2022 , which was filed with the SEC on March 31 , 2023 , which is available free of charge at the SEC’s web site at www . sec . gov . Additional information regarding the interests of the persons who may be deemed participants in the solicitation of proxies from BAC's shareholders is available in the preliminary proxy/registration statement filed by PubCo, available on the SEC's website at www . sec . gov . FINANCIAL INFORMATION; NON - GAAP FINANCIAL MEASURES The financial information and data contained herein have been prepared on the basis of a fiscal year ending on January 31 of each year, for example fiscal year ended 2021 ended on January 31, 2021 and fiscal year ended 2022 ended on January 31, 2022, and as such may not be comparable with the financial information and data of other companies, including our competitors, who do not use the same fiscal year end. This Presentation includes certain financial measures not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including, but not limited to, EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin and certain pro forma financial data, in each case presented on a non - GAAP basis, and certain ratios and other metrics derived therefrom. The Company defines Adjusted EBITDA as earnings before interest expense, taxes, depreciation, amortization adjusted for non - recurring items that are infrequent or abnormal to the company’s normal operations resulting from discontinued operations, extraordinary items, unusual or infrequent items, and changes resulting from changes in accounting policies/principles, and Adjusted EBITDA Margin as Adjusted EBITDA divided by revenues. These non - GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly - titled measures used by other companies. The Company believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that these non - GAAP financial measures provide an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors. These non - GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures. This Presentation also includes certain projections of non - GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward - looking non - GAAP financial measures is included. INDUSTRY AND MARKET DATA This Presentation has been prepared by BAC and AF and includes market data and other statistical information from third - party sources, including independent industry publications, governmental publications and other published independent sources. Some data is also based on the estimates of BAC and AF, which are derived from their review of internal sources as well as the third - party sources described above. None of BAC, the Company or any of their respective representatives or affiliates has independently verified the information and cannot guarantee its accuracy and completeness. TRADEMARKS AND TRADE NAMES BAC and AF own or have rights to various trademarks, service marks, trade names and copyrights that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with BAC or AF, or an endorsement or sponsorship by or of BAC or the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ©, TM or SM symbols, but such references are not intended to indicate, in any way, that BAC, or AF or the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Disclaimer (cont’d) We go above. © 2023 Above Food Corp. 3 (of 26)

We go above. © 2022 Above Food Corp. Above Food is the Regenerative Ingredient Company We go above. © 2023 Above Food Corp. 4 (of 26) Well situated to take advantage of macro forces Producing high quality, traceable food ingredients Innovating regenerative farming practices – at scale Leveraging hard asset base with significant operating leverage Scaled business with global distribution We go above.

© 2022 Above Food Corp. How We Define Regenerative We go above. © 2023 Above Food Corp. 5 (of 26) Agricultural practices and processes that build better soil.

DONATO SFERRA CO - FOUNDER CHIEF CORPORATE DEVELOPMENT OFFICER EXEC VP - 20+ years experience in Finance, Investment Banking, and Financial Corporate Development - Has guided dozens of companies in nascent industries to public markets as an investment banker and venture investor MARTIN WILLIAMS CO - FOUNDER PRESIDENT & CHIEF INNOVATION OFFICER ABOVE FOOD BRANDS - 20+ years CPG experience in Innovation, Marketing, Operations, and Product Development - 12 years advising Fortune 500 CPG companies on Innovation and GTM Strategy TYLER WEST CO - FOUNDER CEO & PRESIDENT, PURELY CANADA FOODS - Previous experience in building scaled Ingredient Custody Companies across Canada, and the Northern Plains of the United States - A decade of leadership experience in agri - business JASON ZHAO CHIEF FINANCIAL OFFICER - 20+ years experience in Corporate Finance, Public Practice Accounting, and Business Valuation - Jason is a Chartered Professional Accountant and has a Chartered Business Valuators designation LIONEL KAMBEITZ C O - F O U N D E R CEO EXECUTIVE CHAIRMAN - 35 years executive experience in Production Agriculture, Ag - Tech Manufacturing, Energy, Innovative Design, and Inventions - 5th generation farming family. Real people who know how to produce real food Proven Leadership Across the Value Chain 6 © 2022 Above Food Corp. We go above. © 2023 Above Food Corp. 6 (of 26)

Sponsor and Strategic Investors Overview OVERVIEW AND HIGHLIGHTS MANAGEMENT TEAM & STRATEGIC INVESTORS BIOS Bite Acquisition Corporation (“Bite”) is a Special Purpose Acquisition Company (“SPAC”), or blank - check vehicle, incorporated with the intent of effecting a merger with a private company, aligned with its thesis and with strong enough merits to maximize value to its different stakeholders . Bite listed its shares publicly with the New York Stock Exchange, in February of 2021 , raising US $ 200 MM . Bite’s current Funds in Trust are $ 30 MM . Felipe Gómez Chief Executive Officer – Grupo Vida* (Strategic Investor) Felipe has more than 25 years of experience at Grupo Vida, one of the largest oat companies in the Americas . From 2012 - 2014 , he served as President of the Board at the Chamber of the Food Industry of Jalisco (CIAJ), supporting several companies in the food sector . Felipe holds an MBA from Instituto Tecnológico Autónomo de México (ITAM) . Agustin Tristan Chief Executive Officer – Lexington Capital* (Strategic Investor) Agustin has started and run 10 + companies throughout his 15 + years of experience and has made several investments in Food & Agriculture, Water and Real Estate . He also worked with Goldman Sachs for five years in the New York office . Agustin holds a Bachelors in Industrial Engineering and an MBA from the University of Alabama . The Sponsor team and the group of Strategic Investors comprise seasoned Wall Street and Main Street veterans alike, bringing meaningful work experience in some of the most prolific companies in the world . SPONSOR & STRATEGIC INVESTORS TRACK RECORD * We go above. Alberto Ardura Chief Executive Officer and Chairman of the Board – Bite Alberto has over 35 years of experience on different Corporate Finance, Capital Markets and Client Coverage roles across Latin America, including former Head of Latin America Capital Markets and Corporate Finance at Deutsche Bank, Nomura Securities (both NYC based), and CEO of Merrill Lynch Mexico . OR I ON SE A Enterprises INC © 2023 Above Food Corp.

7 (of 26) *Strategic Investor Above Food is Well Positioned to Take Advantage of Macro Tailwinds FOOD I N S EC U R I T Y ~800M people still go hungry, with this number only increasing 1 SUPPLY CHAIN DISRUPTIONS ~25M Tons of grain were stuck in port in Ukraine 2 BETTER - FOR - YOU CONSUMER DEMAND 52% of consumers are eating more plant - based foods motivated by their health and the planet’s health 5 REGENERATIVE AND SUSTAINABILITY Animal - based protein generates over 9x more GHG than plant - based protein 4 We go above. 1. Source: Actionagainsthunger.org , 2022 2. Source: Fortune , 2022 3. Source: Nielsen IQ and FMI GHG impact of a 0.25lb beef patty vs. a 0.25lb Beyond Meat patty. 5. Source: Nielse n, 2021 4. Source: University of Michigan , 2018; compares © 2023 Above Food Corp.

8 (of 26) TRACEABILITY AND TRANSPARENCY 79% of consumers reported they had more trust and were more loyal to manufacturers and brands that provided ingredient and sourcing information 3 $ 200B+ Opportunity Established market expected to grow across categories Sizable, Global Addressable Market Plant Protein Ingredients $15B 7% CAGR 2020 - 2027 Whole Grains $58B 7% CAGR 2022 - 2026 Plant - Based Dairy Al t e r n a t i v e s $70B 14% CAGR 2023 - 2030 P l a n t - B a s ed Snacking $59B 9% CAGR 2022 - 2026 P l a n t - B a s ed Pet Food $26B 9% CAGR 2022 - 2032 1 We go above. Note: All values in USD. below sources: Plant - Based Pet Food: Future Market Insights Whole Grains: Strategyr Plant Protein Ingredients: Market Research Future 1. Total market opportunity calculated from a combination of the Plant - Based Dairy: Fortune Business Insights Plant - Based Snacks: Industry Arc © 2023 Above Food Corp. 9 (of 26)

Above’s Regenerative Seed - to - Fork Platform Delivers Traceability and Supply Certainty We go above. HARD ASSETS 1. Based on updated management model and forecast for FY 2024 ; fiscal year end January 31 and figures include organic growth and closed acquisitions only . 2. Includes Atlantic Natural Foods, Inc . (ANF) gross margin forecast from management model . 3. One with full patent protection and three with provisional patent protection. © 2023 Above Food Corp. SEGMENT Specialty Ingredients Optical Sorting, Sizing & Milling Disruptive Ag Agronomy & Origination Private Label CPG Manufacturing 10 (of 26) 29 COUNTRIES IN D I S T R I B U T I O N 300 C U S T O M E R S 300K METRIC TONNES PER YEAR 10 260 6 M A N U F A C T U R I N G C U S T O M E R S M A N U F A C T U R I N G PLATFORMS PLATFROMS 29 COUNTRIES IN D I S T R I B U T I O N 35K POINTS OF D I S T R I B U T I O N 4 3 PATENTED T E C H N O L O G I E S We go above.

© 2023 Above Food Corp. FY 2016 FY 2020 FY 2021 FY 2022 FY 2023 • Founded Purely Canada Food Corp focused on Disruptive Ag • Strengthened the management team for growth • Significant revenue growth • Strengthened corporate governance • Created “Above Food Corp.” as parent co. A C Q UI RE D • Acquired additional ag - tech and Ingredient manufacturing assets KI N D E R S L E Y AVONLEA ES T A B L I S H ED ES T A B L I S H ED A C Q UI RE D ORGANIC GROWTH INORGANIC GROWTH FY 2024E • Acquired seed, soil and genetic optimization capabilities 2 • Acquired additional consumer product manufacturing capabilities Main Achievements | Company Timeline • Acquired additional ingredient manufacturing assets • Acquired Regenerative Organic Certified supply chain, and consumer products 11 (of 26) DISCOVERY SEED LAB 2 ACQUIRED 1. Upon the consummation of the Above Food and Bite business combination, Above Food may acquire the remaining interest not held back. 2. Close of NRGENE transaction subject to close of Above Food and BITE business combination, 1 Purpose Built Hard Assets with Operating Leverage PORT LAJORD* AVONLEA KINDERSLEY We go above.

*Lease - to - own arrangement to acquire asset for $35M CAD, which is below fair market value of $55M CAD per latest appraisal 1. 100+ railcars owned. RAIL FLEET 179 separations for enshrining and protecting the identity of primary ingredients Owned assets enable value - add processing and margin expansion Utilizing 300+ 1 railcars for point - to - delivery surety and enhanced margins 21,000 ft of rail spur for greater control and storage of fleet Favorable geographic locations for quality grains Regenerative production IP better position us for large scale farming partnerships © 2023 Above Food Corp. GROWER BASE 12 (of 26)

Soil Nutrient Analysis Driving Fertility Reduction Plant Tissue Analysis Soil Genomic Analysis Biomass Index Count Microbiological Count Seed Nutrient Density Analysis Bio - Marking/Genetic Fingerprinting Trait Identity Genetic Profiling Seed Genetic Optimization Soil Analysis for Qualified and Quantified Carbon Sequestration Our Regenerative Value Chain Starts with Soil, Seed and Trait Genetic Optimization Regenerative Objectives We go above. © 2023 Above Food Corp. 13 (of 26)

We go above. 14 © 2022 Above Food Corp. S O I L PLANT NUTRIENT ANALYSIS SOIL GENOMIC ANALYSIS SOIL NUTRIENT ANALYSIS Facilitating & Delivering ● Reduction of fertilizer ● Quantification of captured CO 2 ● Identification of soil disease We go above. …The Possible Soil Optimization Capability © 2023 Above Food Corp. 14 (of 26)

Facilitating & Delivering ● Germination & Vigor Testing ● Seed Borne Disease Testing ● Bio - marking/Genetic Fingerprinting ● Glyphosate Testing ● Nutrient Density Testing ● GMO Determination ● Grading and Quality Testing ● Trait Identity Genetics We go above. SEED …The Possible Seed Optimization Capability © 2023 Above Food Corp. 15 (of 26)

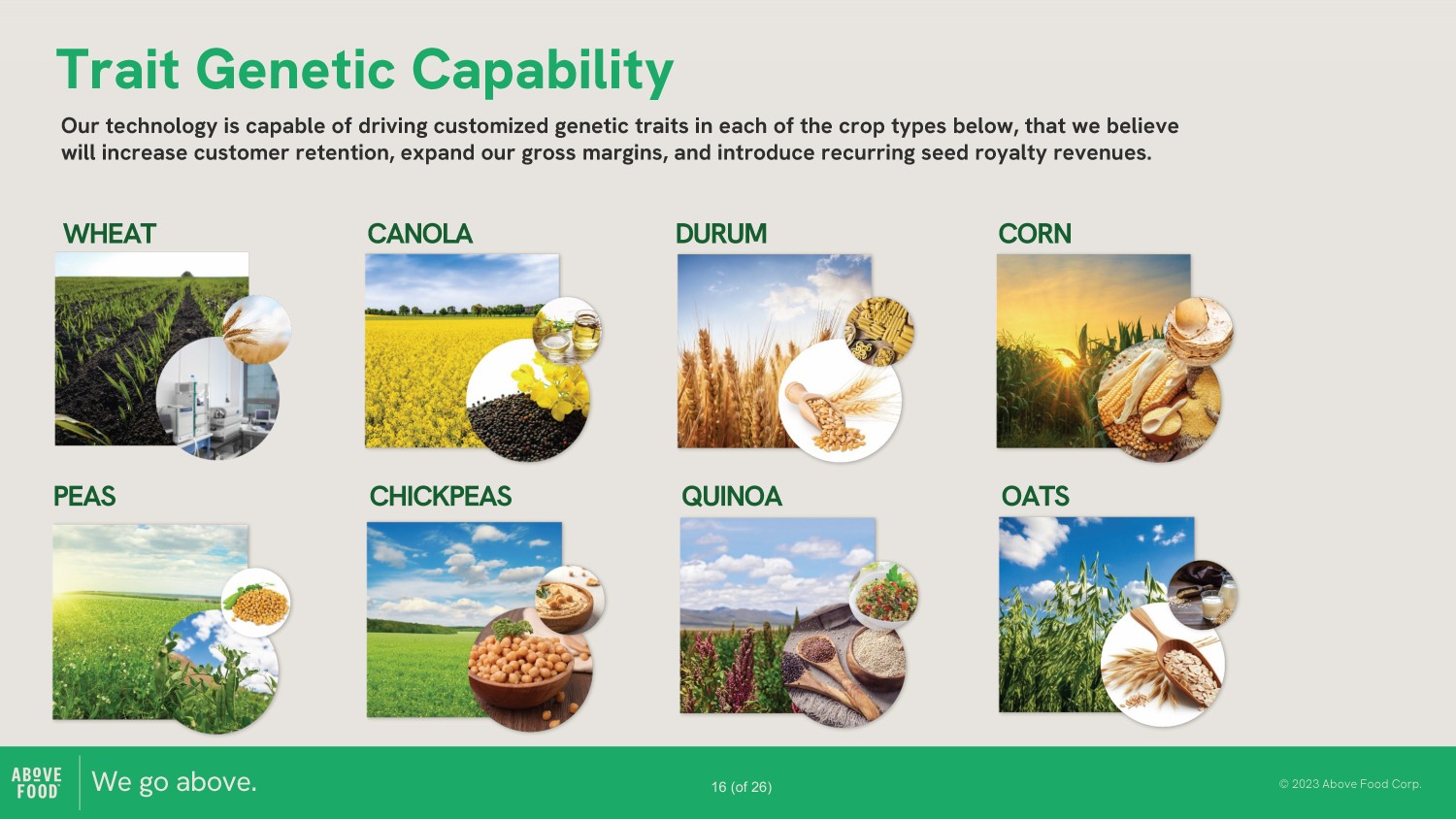

We go above. Trait Genetic Capability Our technology is capable of driving customized genetic traits in each of the crop types below, that we believe will increase customer retention, expand our gross margins, and introduce recurring seed royalty revenues. WH E A T CAN O L A D U R U M C O R N © 2023 Above Food Corp. 16 (of 26) QUI N O A O A T S PE A S C H I CK P E AS Food - Tech & Sophisticated Commercial Capabilities P r o p r i e t a r y Ingredient Production Platforms Three Distinct Supply Chains with Valuable Certifications Cost Effective Private Label Manufacturing and Distribution We go above.

© 2023 Above Food Corp. Traceability System from Seed - to - Fork Tracking Distinct Attributes 17 (of 26)

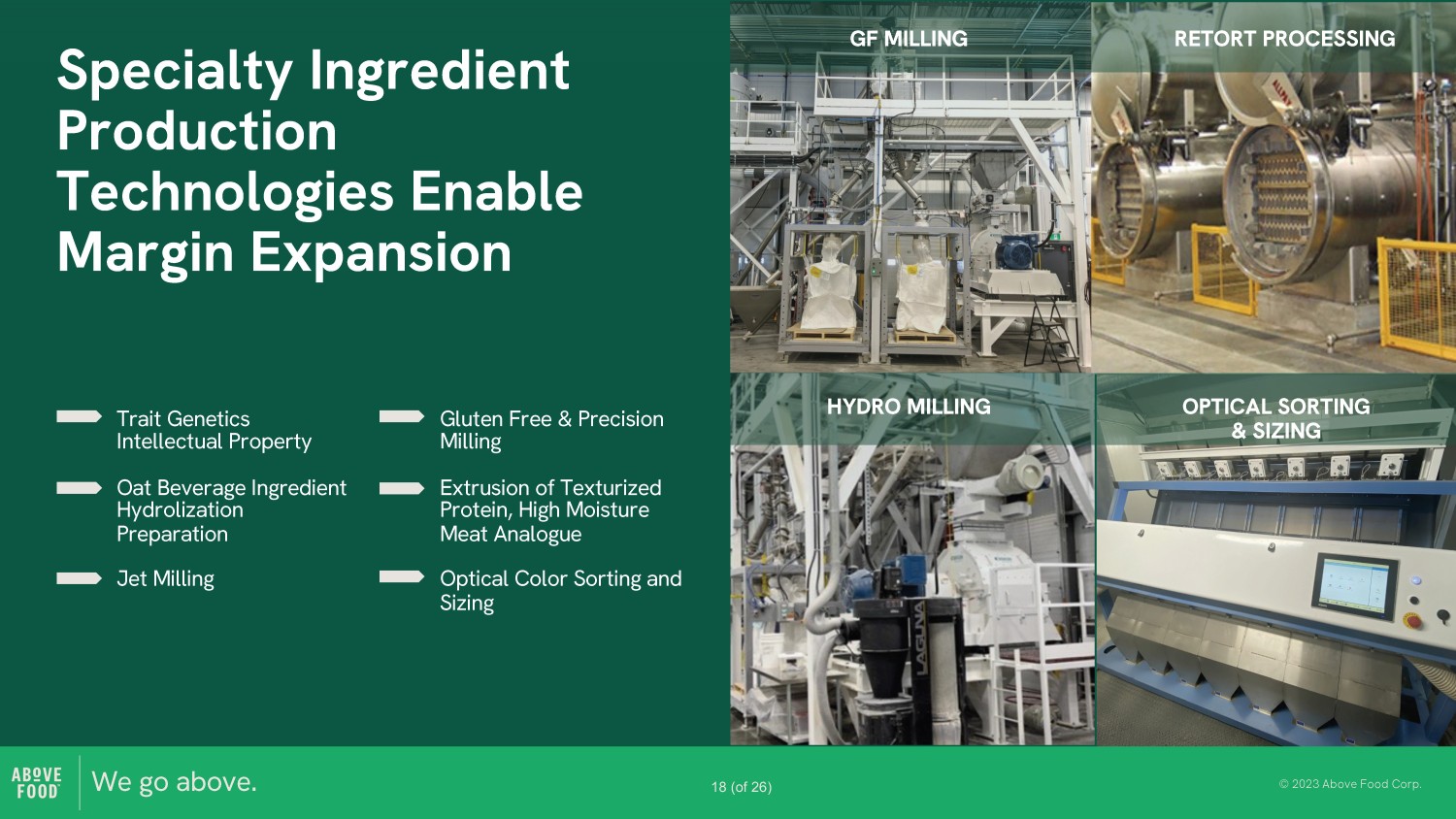

Specialty Ingredient Production Technologies Enable Margin Expansion GF MILLING RETORT PROCESSING Trait Genetics Intellectual Property Oat Beverage Ingredient Hydrolization Preparation Jet Milling Gluten Free & Precision Milling Extrusion of Texturized Protein, High Moisture Meat Analogue Optical Color Sorting and Sizing HYDRO MILLING OPTICAL SORTING & SIZING We go above. © 2023 Above Food Corp. 18 (of 26)

Private Label Solutions Private Label Manufacturing, Facilitated in Part Through Differentiated Brands Six owned manufacturing platforms and 120 unique product formulations We go above. © 2023 Above Food Corp.

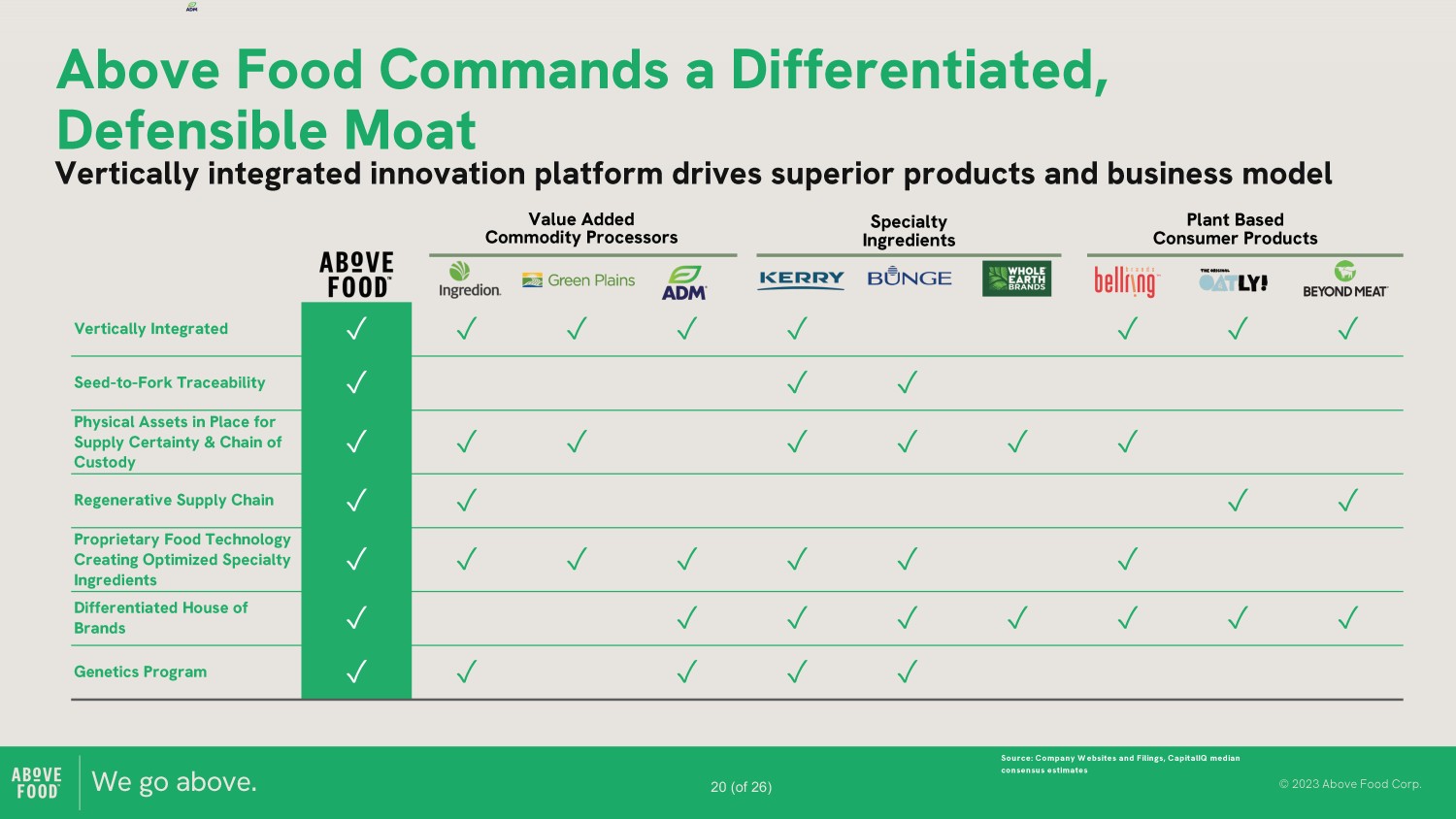

19 (of 26) Market Making Brands SP E C I A L T Y GRAINS SN A C K S S I M P LE M E A L S SO U PS CANNED SEAFOOD A L T E R N A T I V E S BA K I N G MIXES EGG R E P L A C E M E N T S Vertically Integrated ض ض ض ض ض ض ض ض Seed - to - Fork Traceability ض ض ض Physical Assets in Place for Supply Certainty & Chain of Custody ض ض ض ض ض ض ض Regenerative Supply Chain ض ض ض ض Proprietary Food Technology Creating Optimized Specialty Ingredients ض ض ض ض ض ض ض Differentiated House of Brands ض ض ض ض ض ض ض ض Genetics Program ض ض ض ض ض Above Food Commands a Differentiated, Defensible Moat Vertically integrated innovation platform drives superior products and business model Value Added Commodity Processors Plant Based Consumer Products We go above. Source: Company W ebsites and Filings, CapitalIQ median consensus estimates © 2023 Above Food Corp. Specialty In g r e d i e n t s 20 (of 26)

Rapidly Growing Business with Significant Operating Leverage 29 % CA G R x $107 We go above. FY 2023A FY 2024E FY 2021A FY 2022A Notes: 2. Includes $700 of other revenue, ($4) mm of 2020 - 2023. based on ANF Management ‘s Pro - forma model. © 2023 Above Food Corp. 21 (of 26) Fiscal year ended January 31 st of year noted. eliminations and $0.1 mm of adjustments. FY 2021 - FY 2023 include actual results for acquisitions closed 3. Atlantic Natural Foods, Inc. (ANF) revenues are CURRENT YEAR D i s r u p t i v e A g S p e c i a l t y I n g r e d i e n t s C P G AN F Source: Management Model and Forecast as of October 10, 2023. 1. Converted from C$ to US$ at 0.74x. Operating leverage to enable margin Annual Revenue by Segment (USD $ millions) 1 . FYE Jan 31 $331 With ANF expansion $309 $22 3 Core assets capable of driving ~$650M USD in revenue with maintenance Capex only $293 $4 $4 $107 Shift of revenue mix to higher value, higher margin business segments and product $149 $107 platforms Good visibility into forecasted revenue due to forward contracting with our customers $113 $73 $40 $92 $57 $182 2 $198 We go above.

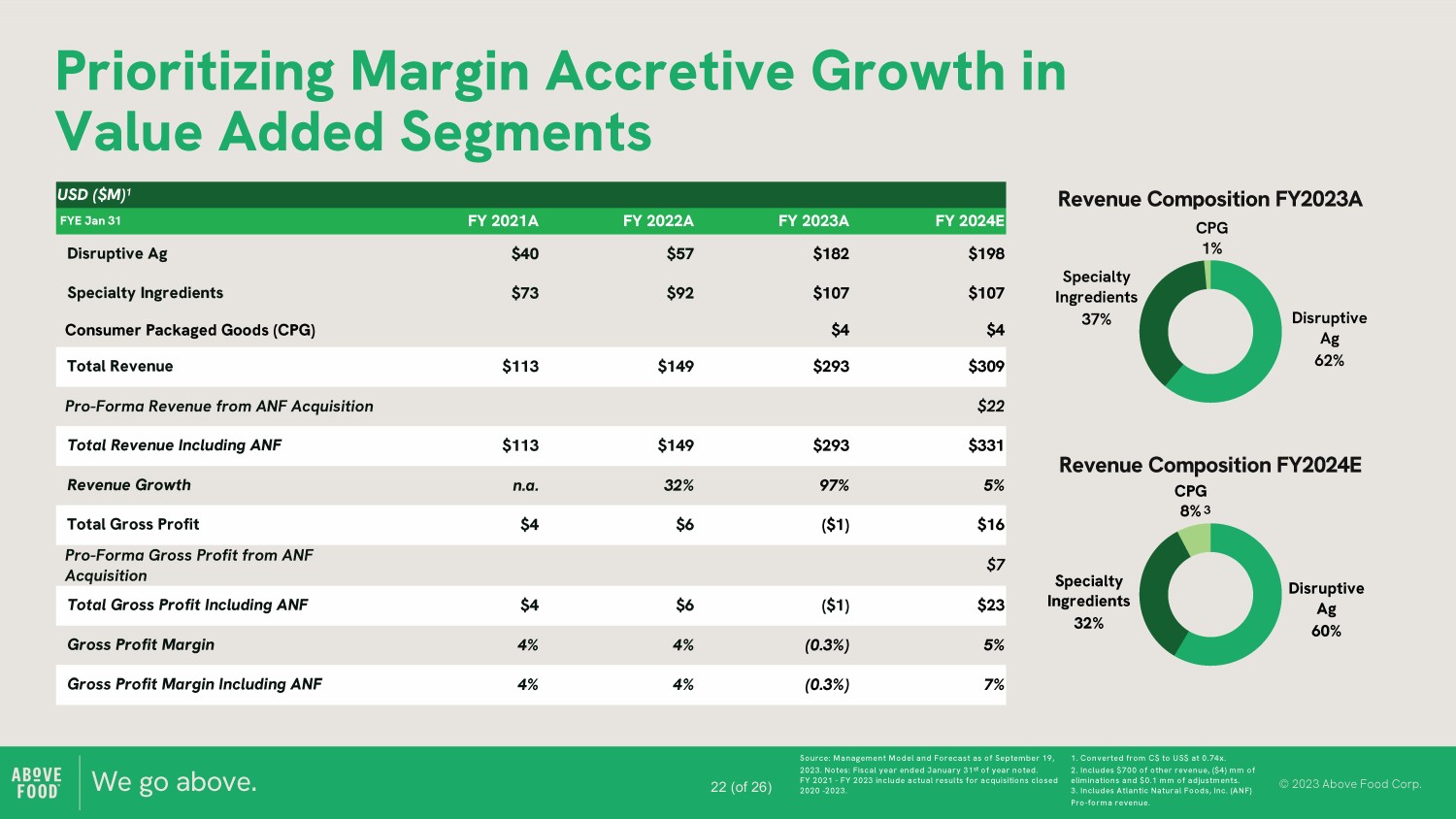

© 2022 Above Food Corp. USD ($M) 1 FYE Jan 31 FY 2021A FY 2022A FY 2023A FY 2024E Disruptive Ag $40 $57 $182 $198 Specialty Ingredients $73 $92 $107 $107 Consumer Packaged Goods (CPG) $4 $4 Total Revenue $113 $149 $293 $309 Pro - Forma Revenue from ANF Acquisition $22 Total Revenue Including ANF $113 $149 $293 $331 Revenue Growth n . a. 32% 97% 5% Total Gross Profit $4 $6 ($1) $16 Pro - Forma Gross Profit from ANF $7 Prioritizing Margin Accretive Growth in Value Added Segments D i s r u p t i v e Ag 60% Acquisition Specialty Total Gross Profit Including ANF $4 $6 ($1) $23 Ingredients 32% Gross Profit Margin 4% 4% ( 0 . 3%) 5% Gross Profit Margin Including ANF 4% 4% ( 0 . 3%) 7% D i s r u p tive Ag 62% Specialty I n g r e d ien ts 37% Revenue Composition FY2023A C P G 1% We go above. 2020 - 2023. Source: Management Model and Forecast as of September 19, 1. Converted from C$ to US$ at 0.74x. 2023. Notes: Fiscal year ended January 31 st of year noted. 2. Includes $700 of other revenue, ($4) mm of FY 2021 - FY 2023 include actual results for acquisitions closed eliminations and $0.1 mm of adjustments. 3. Includes Atlantic Natural Foods, Inc. (ANF) Pro - forma revenue. © 2023 Above Food Corp.

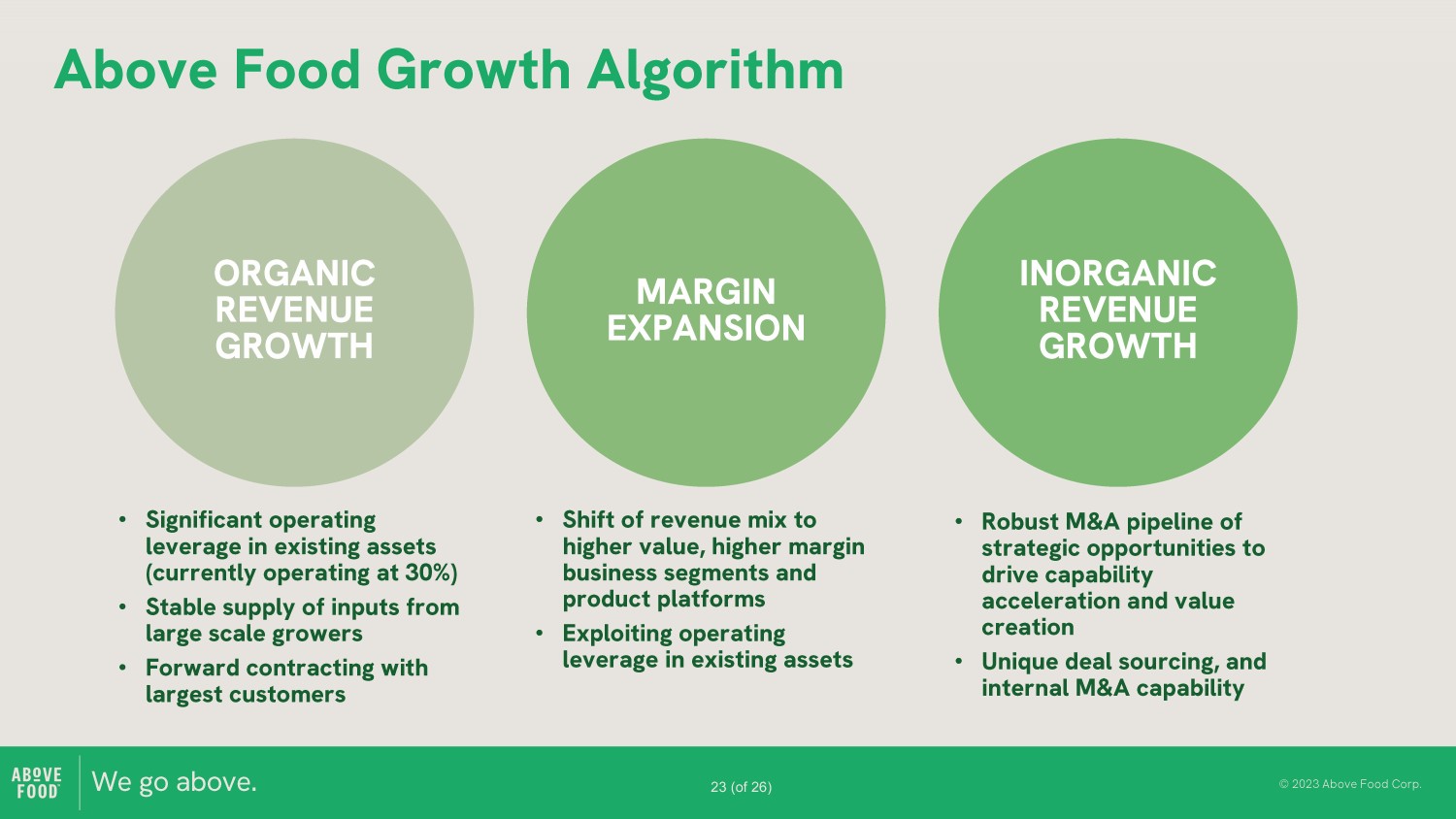

22 (of 26) Revenue Composition FY2024E CPG 8% 3 • Significant operating leverage in existing assets (currently operating at 30%) • Stable supply of inputs from large scale growers • Forward contracting with largest customers • Robust M&A pipeline of strategic opportunities to drive capability acceleration and value creation • Unique deal sourcing, and internal M&A capability • Shift of revenue mix to higher value, higher margin business segments and product platforms • Exploiting operating leverage in existing assets Above Food Growth Algorithm O R G A N I C RE V E N U E G R O W T H IN O R G AN IC REVENUE GROWTH MARGIN EX P A N S I O N We go above. © 2023 Above Food Corp. 23 (of 26)

Transaction Overview US$34M of cash to balance sheet will go towards executing Above Food’s (“AF”) business plan and roll - up strategy 1,2 Bite expects to raise US$25M via a common equity PIPE prior to transaction closing Existing shareholders of Above Food to own ~70% of the PF company 3 Transaction expected to close in Q1 of CY 2024 TRANSACTION OVERVIEW SOURCES & USES (USD $M) Sources Uses $206 34. 5 10 Existing AF Shareholders Bite Trust 1 PIPE Equity 2 Strategic Investors 4 $206 Existing AF Shareholders 10 Cash to Balance Sheet 25 Est. Transaction Expenses 9.5 Total Sources $250.5 Total Uses $250.5 IILLUSTRATIVE PRO FORMA OWNERSHIP 2,3 We go above. 1. Assumes ~67% redemptions of current $30M in trust by Bite public shareholders. 2. Assumes $25mm PIPE equity to be raised prior to transaction closing 3. Based on total number of common shares outstanding at close of the proposed Business Combination. Analysis excludes impact of 1.1M sponsor earnout shares and ~6.1M seller earnout shares vesting in two equal tranches with first tranche vesting at $12.50 or if FY 2024 EBITDA is greater than or equal to $21.2M and second tranche vesting at $15.00 or if FY2025 EBITDA is greater than or equal to $32.9M. Also excludes impact of a post - closing, equity incentive plan, 10M public warrants to be outstanding at closing with a strike price of $11.50 per share, ~0.4M private warrants to be outstanding at closing with a strike price of $11.50 per share, and ~2.5M additional warrants to be outstanding at closing with a strike price of $13.48. to be outstanding at closing with a strike price of $11.50 per share, and ~2.5M additional warrants to be outstanding at closing with a strike price of $13.48. 4. Reflects $9.5M convertible bridge financing that converts to equity at transaction closing. 5. Available Revolving Credit Facility of $50M CAD/$37M USD 6. Converted from C$ to US$ at 0.7466x. Existing Above Food Shareholders 70% Sponsor 16% PIPE I n ve s t o r s 2 8% Bite Public Sha r e holde r s 1 3% Strategic I n ve s t o r s 4 3% 24 (of 26) © 2023 Above Food Corp. CAD $ Millions USD $ Millions 6 $2.3 $1.7 Year ended January 31st, 2023 Cash Debt: Outstanding Revolving Credit Facility 5 Term Debt $47 . 5 $16 . 0 $ 35 . 5 $ 11 . 9 Convertible Notes $7 . 8 $5 . 8 Capital Leases $38 . 5 $28 . 7 Total Debt (Excluding Capital Leases) $71. 3 $53. 2 Total Debt (Including Capital Leases) $109. 9 $82.

1 HISTORICAL CAPITALIZATION AS OF 1/31/23 Investment Highlights Ingredient supplier to sophisticated CPG businesses across the world; long - standing relationships based on superior performance Owned manufacturing for consumer products drives private label business Secured grain, seeds and pulses through our Traceability Suppliers Platform Expanding capabilities through accretive M&A strategy High growth business with global distribution Seed - to - Fork platform presents barriers to entry and enables greater control of margins and the supply chain Pioneer in regenerative farming techniques Macro tailwinds driving sizable and growing total addressable market Traceability and transparency across value chain We go above. © 2023 Above Food Corp. 25 (of 26)

The Regenerative Ingredient Company © 2023 Above Food Corp. 26 (of 26)

A p p e n d i x 27 We go above. © 2023 Above Food Corp.

We go above. 28 We go above. © 2023 Above Food Corp. PE A S C H I C K PE A S DURUM CORN WHEAT CANOLA QUINOA OATS Higher fractionate Decreased fat to Reduced milling Reduced milling Increased natural Higher protein & Higher protein, Higher protein & protein & reduced improve milling costs & increase costs to increase enzymes, reducing resistance to soil improved more flavour Targeted Trait Improvement beany taste process protein functionality processing margins baking costs & adding shelf stability disease agronomics Million Acres P lanted North America 4.00 1 0.53 2 7.78 3,4 99.78 7 61.85 7 24.26 5,6 - 4.47 7 Europe - 0.79 2 - 38.33 7 188.54 7 - - 13.34 7 South America 0.61 2 0.20 2 - 72.99 7 21.23 7 - 0.47 2 2.10 7 Total Million Acres Planted 4.61 1,2 1.52 2 7.78 3,4 211.10 7 271.62 7 24.26 5,6 0.47 2 19.91 7 Targeted Trait Market Penetration 10% 25% 10% 1% 1% 25% 75% 10% Recurring Seed Royalty Agreements Target Seed Royalty Customers Largest North & South American & European seed distribution companies who distribute seed through crop input and specialty seed retailers. Supply Chain Margin Increases Targeted Supply Chain Customer Scaled food processing, production, and ingredient companies who are reducing their production costs and offering their customers improved nutritional and/or taste functionality. Targeted Trait Delivery Timeline The development and identification of the proposed genetic trait and the related introgression will take an average of three years. Targeted Genetic Traits Improvement Driving customized genetic traits that we believe increases customer retention, supply chain margins and generates recurring seed royalty revenues. Ag Canada Food and Agriculture Organization of the United Nations 2021 StatCan 1. 2. 3. 4. United States Department of Agriculture StatCan US Canola Association 5. 6. 7. USDA World Agricultural Production Report, September 2023