UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2023

Commission File Number 001-39809

MEDIROM HEALTHCARE TECHNOLOGIES INC.

(Translation of registrant’s name into English)

2-3-1 Daiba, Minato-ku

Tokyo 135-0091, Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Issuance of Press Release

x Form 20-F ¨ Form 40-F On October 25, 2023, MEDIROM Healthcare Technologies Inc. (the “Company”) made available an investor presentation that was used during meetings with members of the investment community. A copy of the presentation is furnished as Exhibit 99.1 hereto.

The presentation furnished in this report as Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, as amended, except to the extent specifically provided in such a filing.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | Investor Presentation of the Company |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MEDIROM Healthcare Technologies Inc. | ||

| Date: October 25, 2023 | ||

| By: | /s/ Fumitoshi Fujiwara |

|

| Name: Fumitoshi Fujiwara | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

NASDAQ: MRM September, 2023

Important Notices IMPORTANT NOTICES AND DISCLAIMERS This investor presentation (this “Investor Presentation”) is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other securities of MEDIROM Hea lt hcare Technologies Inc., a company organized under the laws of Japan (the “Company,” “we,” “us” or “our”). The information contained herein doe s n ot purport to be all inclusive. The data contained herein is derived from various internal and external sources believed to b e r eliable, but there can be no assurance as to the accuracy or completeness of such information. Any data on past performance contained herein is no t an indication as to future performance. Except as required by applicable law, the Company assumes no obligation to update t he information in this Investor Presentation. Nothing herein shall be deemed to constitute investment, legal, tax, financial, ac cou nting or other advice. The communication of this Investor Presentation is restricted by law, and it is not intended for dist rib ution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No representation or wa rranty (whether express or implied) has been made by the Company with respect to the matters set forth in this Investor Pres ent ation. Forward Looking Statements Certain statements included in this Investor Presentation are not historical facts but are forward - looking statements for purpos es of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking stat ements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, busin ess strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In s ome cases, you can identify forward - looking statements by terms such as "may," "will," "should," "design," "target," "aim," "expect," "could," "intend," "plan," "anticipate," "estimate," "believe," "continue," "predict," "project," "potential," "goal" or other words tha t convey the uncertainty of future events or outcomes. You can also identify forward - looking statements by discussions of strategy, plans or intentions. Th ese forward - looking statements include, but are not limited to, statements regarding future revenue, Adjusted EBITDA, Adjusted E BITDA Margin, debt, capital expenditure and cash flow estimates and forecasts of other financial and performance metrics (includin g k ey performance indicators), and projections of market size and opportunity. These statements are based on various assumptions an d on the current expectations of the Company and its management and are not predictions of actual performance. While our management co nsi ders these assumptions and expectations to be reasonable, they are inherently subject to significant business, economic, com pet itive, regulatory and other risks, contingencies and uncertainties, including continuing impact of the COVID - 19 pandemic, and other ris ks, most of which are difficult to predict and many of which are beyond our control. If the risks materialize or our assumpt ion s prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be add itional risks that the Company currently believes are immaterial that could also cause actual results to differ from those c ont ained in the forward - looking statements. In addition, forward looking statements reflect the Company's expectations, plans or forecasts of f uture events and views as of the date of this Investor Presentation. The Company anticipates that subsequent events and devel opm ents will cause these assessments to change. However, while the Company may elect to update these forward - looking statements at some poin t in the future, the Company specifically disclaims any obligation to do so. These forward - looking statements should not be reli ed upon as representing the Company's assessments as of any date subsequent to the date of this Investor Presentation. Market and Industry Data This Investor Presentation contains references to industry market data and certain industry forecasts. Industry market data a nd industry forecasts are obtained from publicly available information and industry publications. Industry publications general ly state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verifie d b y us. Some data is also based on our good faith estimates, which are derived from our review of internal surveys or data, as welI as the independent sources referenced above. Assumptions and estimates of our and our industry's future performance are nece ss arily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause future performance to differ ma terially from our assumptions and estimates. Non - GAAP Financial Measures This Investor Presentation includes key performance indicators and non - GAAP financial metrics that we use to help us evaluate ou r business, identify trends affecting our business, formulate business plans, and make strategic decisions. Adjusted EBITDA and Adjusted EBITDA Margin are financial measures that are calculated and presented on the basis of methodologies other than in accordance wi th generally accepted accounting principles in the United States of America ("GAAP"). Any non - GAAP financial measures used in t his Investor Presentation are in addition to, and not meant to be considered superior to, or a substitute for, the Company's fin anc ial statements prepared in accordance with GAAP. A reconciliation of each of these non - GAAP measures to their nearest GAAP meas ure is set forth in page 28 of this Investor Presentation. The Company believes these non - GAAP measures of financial results provide useful information to management and investors regardi ng certain financial and business trends relating to our financial condition and results of operations. The Company's manage men t uses these non - GAAP measures to compare our performance to that of prior periods for trend analyses and for budgeting and planning pu rposes. These measures are used in monthly financial reports prepared for management and our board of directors. We believe tha t the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating r esults and trends in and in com paring our financial measures with other similar companies, many of which present similar non - GA AP financial measures to investors. Management does not consider these non - GAAP measures in isolation or as an alternative to financial meas ures determined in accordance with GAAP. The principal limitation of these non - GAAP financial measures is that they exclude sign ificant expenses and income that are required by GAAP to be recorded in our financial statements. In addition, they are subject to i nhe rent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or incl ude d in determining these non - GAAP financial measures. Undue reliance should not be placed on these measures as the Company's only measu res of operating performance, nor should such measures be considered in isolation from, or as a substitute for, financial in for mation presented in compliance with GAAP. Non - GAAP financial measures as used in respect of the Company may not be comparable to simila rly titled amounts used by other companies. Additional information with respect to the Company is contained in its filings with the SEC and is available at the SEC's web sit e, http://www.sec.gov , and on the Company's website, https://medirom.co.jp/en/ . MEDIROM HEALTHCARE TECHNOLOGIES INC. 2 事業紹介 リラクゼーション事業 「 Re.Ra.Ku 」を中心に国内 で 312 店舗を運営。 ( 2023 年 1 月末時点) ソフトウェア事業 ハードウェア事業 チャットで生活習慣改善を 特定保健指導を中心に支援。 世界初! 24 時間 365 日充電不 要の活動量計を開発。 Relaxation Salon started 2003 Software launched 2019 Hardware released 2020 Products and Services 3

Company Highlights MEDIROM HEALTHCARE TECHNOLOGIES INC. Wellness Salon Business » Re.Ra.Ku ® • Over 312 stores throughout Japan (December 31, 2022) • Directly - owned salons – 199 salons (December 31, 2022) • Franchise salons – 113 salons (December 31, 2022) • Winner of several industry awards in Japan » ZACC • High - end hair salon company recognized in the beauty industry for more than 30 years for its high level of professional skills, customer - oriented services, and brand recognition • Acquired 60% of the ownership interest in ZACC in October 2021 and subsequently acquired the remaining 40% in January 2022 Digital Preventative Healthcare Technology » MOTHER Bracelet® • Health monitoring wearable device “Mother Bracelet” was launched in 202 2. • MOTHER Bracelet Ƞ fitness device is designed to track and collect the health data of the wearer, such as calorie consumption, activity and sleep patterns » Lav ® • Medirom’s internally developed on - demand health monitoring smartphone application • Remote weight loss program with ties to benefits from government insurance programs • Digital platform that connects individuals with healthcare professionals 4 Extensive Vocational Facilities & Partnerships We Have Established One Of The Largest Vocational Schools In Japan • Re.Ra.Ku ® therapists support customers in our salons and after their appointments through health management tailored for each customer.

• Provide over 120 in - depth curriculums that range from techniques to salon management. • Teach not only relaxation customer services but also LAV app services. • Professional lecturers that specialize in their area of expertise. 5 Strong affinity between bodywork and spa facilities. Entry Barrier Value Added Services Higher Sales per Customer New bathing facilities in the Kanto region are increasing Only major companies can enter the market. High Entry Barrier Value Added Services Consistent with our Dominant Strategy in Metropolitan Area COMMERCIAL COMPLEX STAND ALONE SALONS Higher repeat ration and unit sales Local community - based Loyal Customer Base Brand Recognition MEDIROM HEALTHCARE TECHNOLOGIES INC.

SPA FACILITIES 2020 2000 Foundation CEO & Founder Kouji EGUCHI Development of Self - Charging Health Monitoring Tracker ( MOTHER Bracelet Ƞ , under development) Starting Device Business 2017 Opening Salons at Spa Facilities Launched MHR: Therapist Dispatch Business 2018 2021 Acquired SAWAN Co.LTD . 312 Salons Latest Opened Salon Spa Re.Ra.Ku ® * # Salons as of December 31, 2021 (MHR: MEDIROM Human Resources Inc.) Launch of On - demand Health Coaching App ( Lav ® ) May 2019 IPO in Dec 2020 Closed $12m American Depositary Shares Offering 6 MEDIROM History Acquired ZACC K.K. (Hair Salons) 2022 2023 Mother Gateway REMONEY 365 Days Health Monitoring MEDIROM HEALTHCARE TECHNOLOGIES INC.

Wellness Salon Business PROVIDING THE HIGH QUALITY, INNOVATIVE PREVENTIVE SOLUTIONS MEDIROM HEALTHCARE TECHNOLOGIES INC. 7 Specialty • Focus on a shoulder blade body work • Weight loss body work Recurring Fee Model ▪ Royalty fees, monthly education fees, management fees and system fees from Franchise salon owners.

Franchise salon owners are contracted to use our services. Bodywork Excellence ▪ Holistic and preventative healthcare services ▪ Recognized therapist training platform Relaxation Salons & Hair Salon Component: Business Snapshot 8 80%+ in 2022 High Repeat Customer Ratio 826K Served 826,231 customers in 2022 Focus on High Density Areas Retail metros/subways, malls, plazas Major cites (Tokyo, Nagoya, Osaka) $50/customer in 2022 vs. the industry standard of ~$40 * MEDIROM HEALTHCARE TECHNOLOGIES INC. *Yano Research Institute Ltd, 2019. Brands • ReRaKu & ReRaKu Spa & Bell Epoc : Standard body works • ReRaKu Pro: For athlete Acquisition of ZACC Hair Salons ▪ Further, to support the opening of new ZACC brand salons by sharing the Company's expertise in franchising, employee independence programs, etc.

Salon Growth Strategy Conversion of Directly - Operated Salons to a Store Investment Model • As of December 31, 2022 we have entered into Salon Sales Agreements to sell 28 previously directly operated salons. . • The Company believes this model will maximize the return on capital investment in its relaxation salon segment. Acquisition of Wellness Salons/Competitors • Already successfully acquired three competitors/relaxation salon brands: Joyhands , Bellepoc and Sawan . • We are one of the top three companies, on a consolidated basis, in the Kanto region, in terms of the number of salons.* • Acquisition of oversea Wellness Salons Vocational Training Facilities • Teaching high quality bodywork techniques, customer services. • Use well trained therapists as LAV app coach. That saves coach resource expenses. • Controllable and well managed therapists keep good quality services both salon and LAV coaching app. 9 *Source: 2019 industry report by Yano Research Institute Ltd. MEDIROM HEALTHCARE TECHNOLOGIES INC.

Digital Preventative Healthcare Technology INFORMATION AND COMMUNICATION TECHNOLOGY (ICT) SOLUTION WITH APP, WEARABLE & RE.RA.KU® TRAINED THERAPISTS MEDIROM HEALTHCARE TECHNOLOGIES INC. 10 Digital Preventative Healthcare Technology: MOTHER Bracelet Ƞ SELF - CHARGING FITNESS TRACKER “MOTHER BRACELET Ƞ ” UNDER CO - DEVELOPMENT WITH MATRIX INDUSTRIES, INC. FEATURES • Steps • Sleep/Sleep Cycle • Heart rate • Activities • Surface Body Temperature • NFC Mifire • Waterproof TARGET MARKET • Hospitals, Nursing Homes and Gyms • Logistics and Transportation Industry (Drivers’ Health Monitoring Needs) • Retail Sale with Crowd - Funding FEATURE - RICH & USER FRIENDLY • Pedometer • SDK (Software Development Kit) • Open to Third Parties 11 MEDIROM HEALTHCARE TECHNOLOGIES INC.

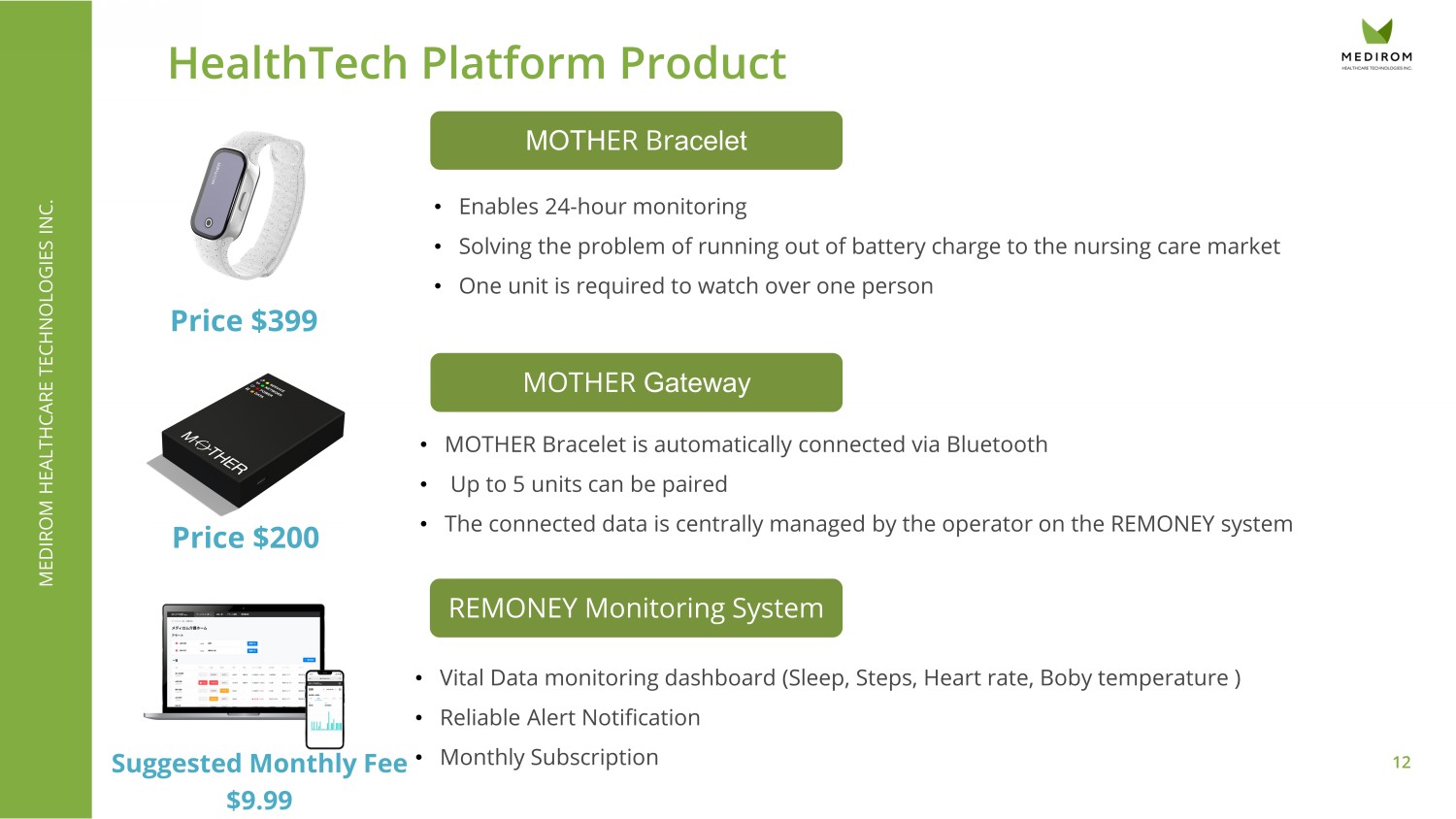

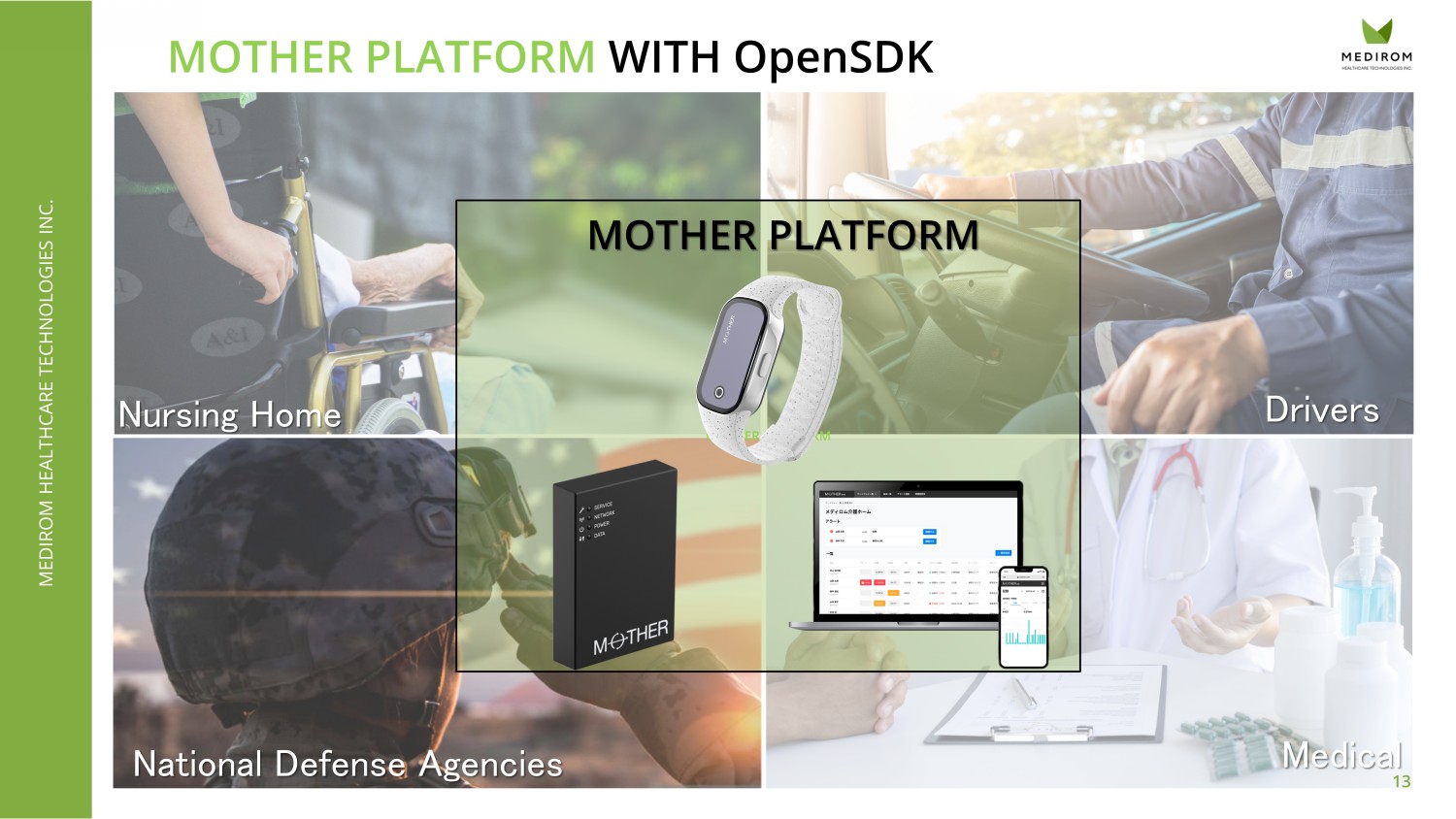

Innovative Fitness Tracker that does not Require Recharging TECHNOLOGY • MATRIX’s Patented Technologies • Thermoelectric Module & Boost Converter 12 MEDIROM HEALTHCARE TECHNOLOGIES INC. MOTH ER Br acelet • Enables 24 - hour monitoring • Solving the problem of running out of battery charge to the nursing care market • One unit is required to watch over one person MOTHER Gateway • MOTHER Bracelet is automatically connected via Bluetooth • Up to 5 units can be paired • The connected data is centrally managed by the operator on the REMONEY system Suggested Monthly Fee $9.99 HealthTech Platform Product Price $200 Price $399 REMONEY Monitoring System • Vital Data monitoring dashboard (Sleep, Steps, Heart rate, Boby temperature ) • Reliable Alert Notification • Monthly Subscription Nursing Home Drivers Medical National Defense Agencies MEDIROM HEALTHCARE TECHNOLOGIES INC. MOTHER PLATFORM WITH OpenSDK MOTHER PLATFORM 13 MOTHER PLATFORM

14 MEDIROM HEALTHCARE TECHNOLOGIES INC.

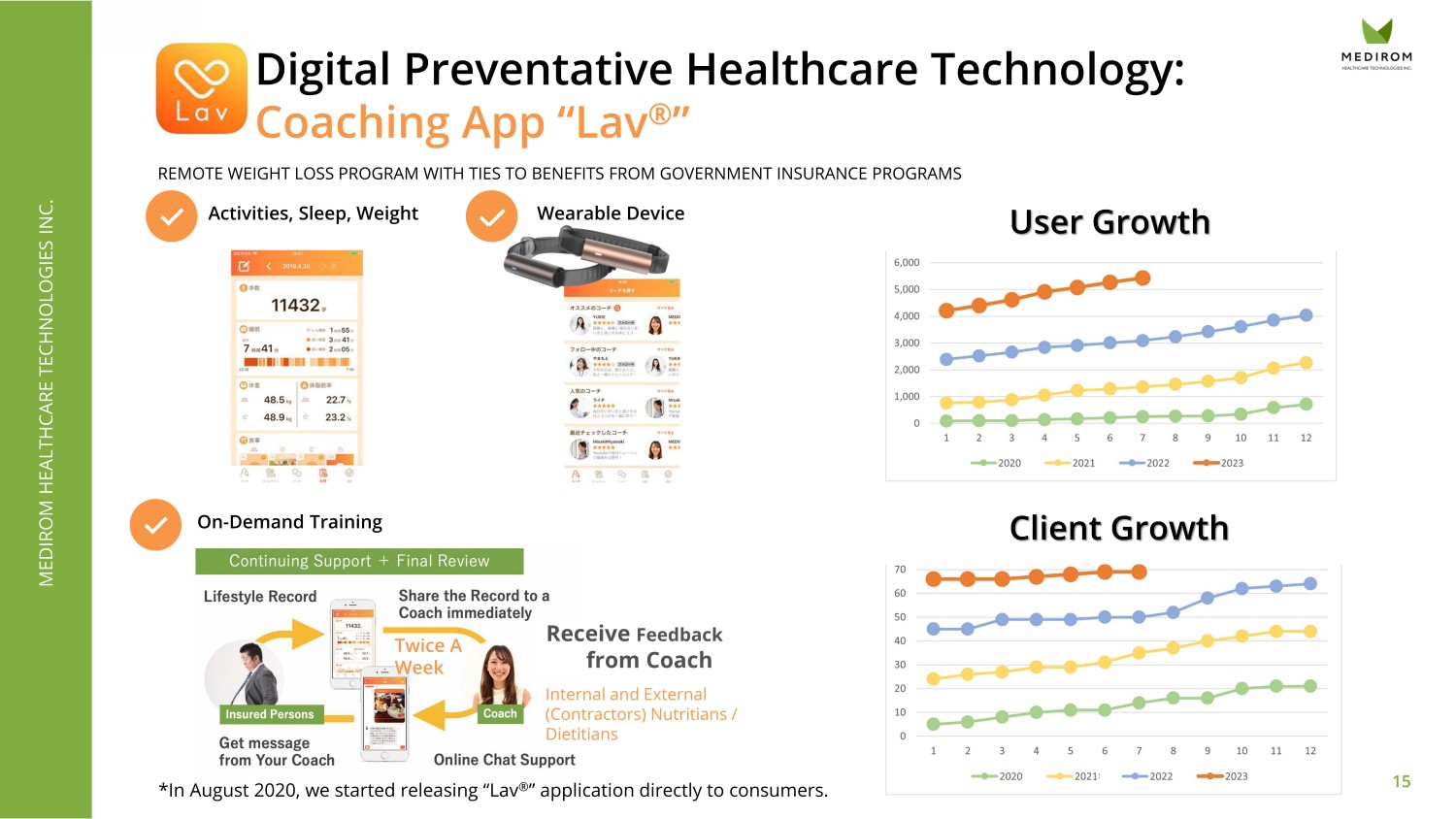

MOTHER PLATFORM FOR THE FUTURE Robots Using Chat GPT and Vital Data Emergency Autonomous Driving Digital Preventative Healthcare Technology: Coaching App “ Lav ® ” REMOTE WEIGHT LOSS PROGRAM WITH TIES TO BENEFITS FROM GOVERNMENT INSURANCE PROGRAMS Wearable Device On - Demand Training Activities, Sleep, Weight Internal and External (Contractors) Nutritians / Dietitians Twice A Week Receive Feedback from Coach *In August 2020, we started releasing “ Lav ® ” application directly to consumers. 15 MEDIROM HEALTHCARE TECHNOLOGIES INC.

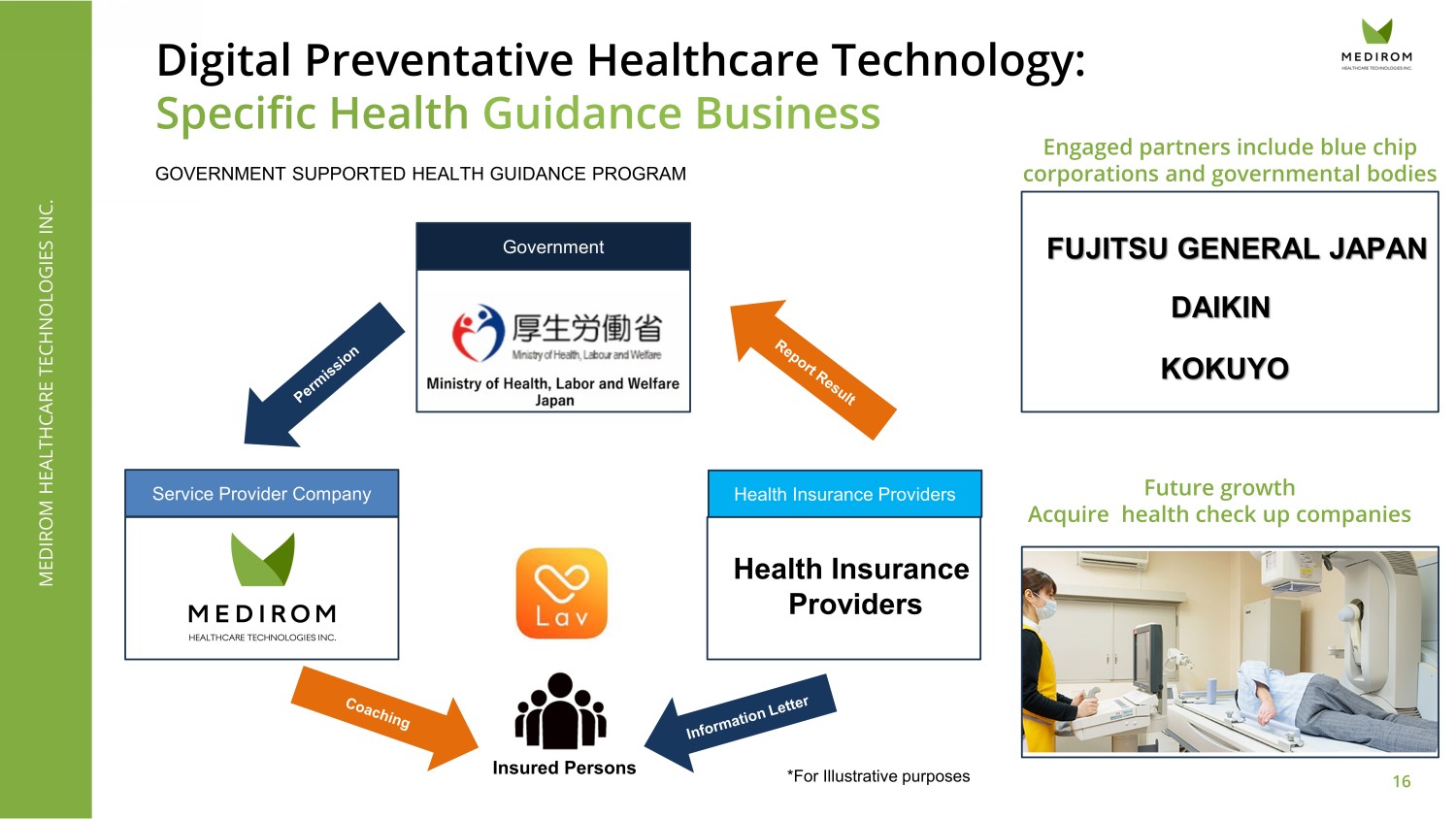

User Growth Client Growth Digital Preventative Healthcare Technology: Specific Health Guidance Business GOVERNMENT SUPPORTED HEALTH GUIDANCE PROGRAM Engaged partners include blue chip corporations and governmental bodies 16 MEDIROM HEALTHCARE TECHNOLOGIES INC.

Service Provider Company Health Insurance Providers Health Insurance Providers Government *For Illustrative purposes Insured Persons Future growth Acquire health check up companies FUJITSU GENERAL JAPAN DAIKIN KOKUYO MEDIROM HEALTHCARE TECHNOLOGIES INC. All in One MOTHER PLATFORM (Mother Bracelet, Mother Gateway and REMONEY) • B2B Business. Focus on the 3M drivers and 10M patients in Japan. • Partnership with strong and well trusted sales companies. • Potential expansion to global market. Healthcare Technology Growth Strategy Specific Health Guidance Business with Coaching App “ Lav ® ” • Focus on 30M patients with lifestyle related disease, such as (Diabetes, High blood pressure and heart failure.) • Target the hospital, nursing homes and health check up companies and install the LAV solutions. • Potential with the Fortune 500 and health well being companies in Japan. 17 Financial Highlights COMPANY YEAR END: DECEMBER 31 MEDIROM HEALTHCARE TECHNOLOGIES INC.

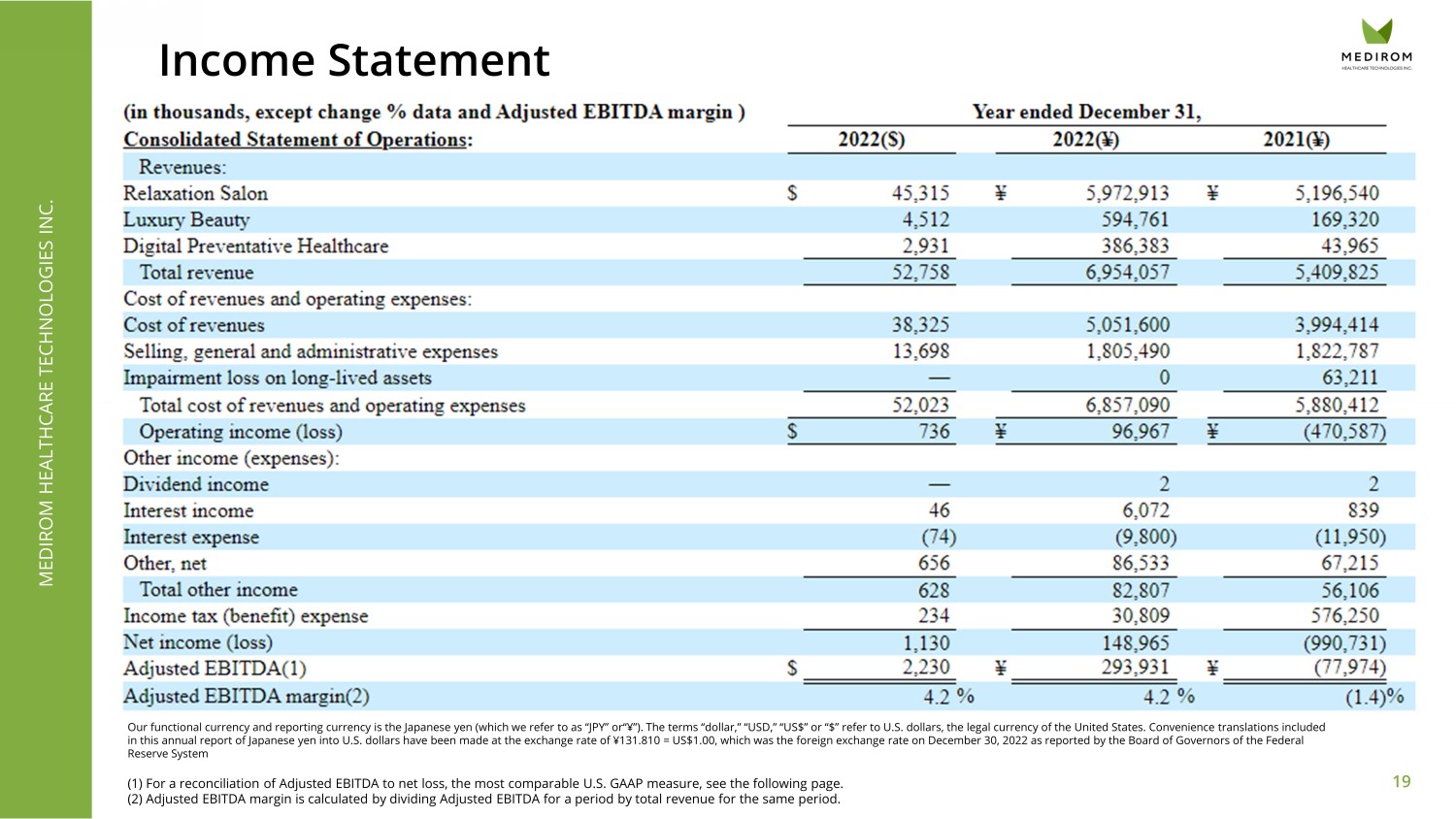

$35.2 $30.1 $45.0 $52.7 $0 $10 $20 $30 $40 $50 $60 2019 2020 2021 2022 Millions in USD Revenue Our functional currency and reporting currency is the Japanese yen (which we refer to as “JPY” or“¥”). The terms “dollar,” “U SD, ” “US$” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this annual report of Japanese yen into U.S. dollars have been made at the exchange rate of ¥131.810 = US$1.00, which was the foreign exchange rate on December 30, 2022 as reported by the Board of Governors of the Federal Reserve System (1) For a reconciliation of Adjusted EBITDA to net loss, the most comparable U.S. GAAP measure, see the following page. (2) Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA for a period by total revenue for the same period. 19 $1.2 - $4.8 - $0.7 $2.6 -$6 -$5 -$4 -$3 -$2 -$1 $0 $1 $2 $3 2019 2020 2021 2022 EBITDA MEDIROM HEALTHCARE TECHNOLOGIES INC. Income Statement Our functional currency and reporting currency is the Japanese yen (which we refer to as “JPY” or“¥”).

The terms “dollar,” “U SD, ” “US$” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this annual report of Japanese yen into U.S. dollars have been made at the exchange rate of ¥131.810 = US$1.00, which was the foreign exchange rate on December 30, 2022 as reported by the Board of Governors of the Federal Reserve System 20 MEDIROM HEALTHCARE TECHNOLOGIES INC.

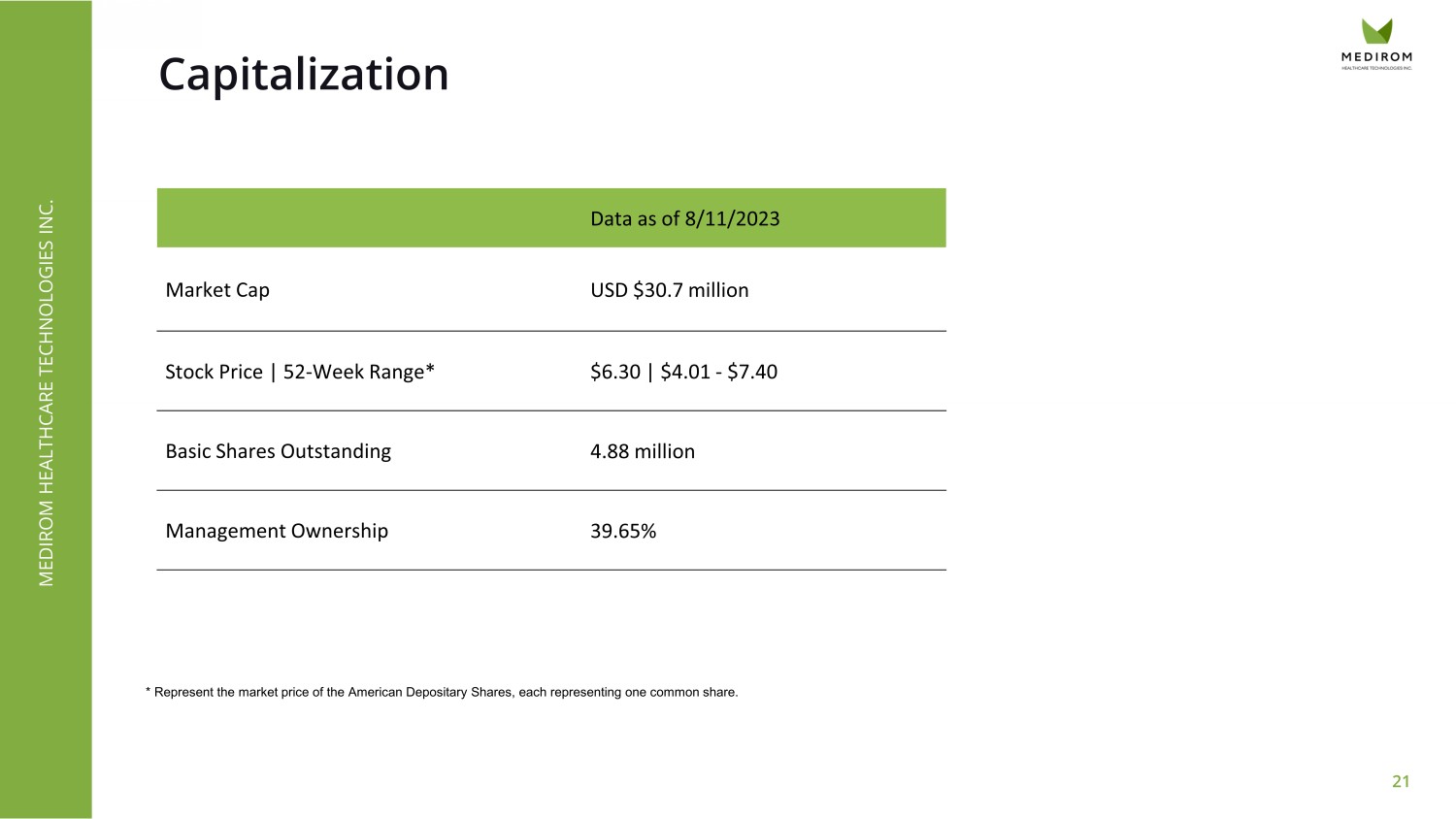

Reconciliation of Adjusted EBITDA Capitalization 21 Data as of 8/11/2023 Market Cap USD $30.7 million Stock Price | 52 - Week Range* $6.30 | $4.01 - $7.40 Basic Shares Outstanding 4.88 million Management Ownership 39.65% MEDIROM HEALTHCARE TECHNOLOGIES INC. * Represent the market price of the American Depositary Shares, each representing one common share.

Key Management Team and Board Kouji Eguchi Founder, CEO and Director Fumitoshi Fujiwara CFO and Director Tomoya Ogawa Outside Director Akira Nojima Outside Director MEDIROM HEALTHCARE TECHNOLOGIES INC. 1996 Joined Jack Co., 1999 Served as executive managing director at Pricedown.com, Inc. 2000 Established Reraku (current MEDIROM Healthcare Technologies Inc.) Became Representative Director (present post). 2010 Director of the Association of Japan Relaxation Industry (present post). 2000 Executive Officer and CFO in Spiral Star Co., Ltd. 2002 Established AC Capital, Inc. Representative Director Managing Partner 2009 Established Eaglestone Capital Management Inc. Representative Director Management Partner (present post). 2017 Executive officer in MEDIROM Healthcare Technologies Inc. 1997 Recruit Co., Ltd 2014 Director of Academy of Beauty Business 2020 Independent director & board of directors 2007 Abe, Ikubo & Katayama Law Firm 2010 General manager at DeNA Inc. 2012 Director of Akatsuki Inc.

2014 Independent director & board of directors 22 Investment Highlights Accretive M&A with Low - Hanging Fruit – Proven Track Record of M&A • Targeting M&A opportunities with both direct and indirect financing (not hostile mergers) with strategy of full integration of corporate functions (back - office operations etc.). • Located in Japan, MEDIROM is the first publicly listed Japanese company in the industry. • MEDIROM intends to leverage its experience from successful M&A historical acquisition. 23 Further Enhance Relationships & Capabilities • MOTHER Patient Monitoring System for Health Care Facilities. • Advancing Emergency Autonomous Driving through Driver Health Monitoring • Government - sponsored Specific Health Guidance Program. • Engaged partners include blue chip corporations and governmental bodies for LAV. Technological Advancement MEDIROM HEALTHCARE TECHNOLOGIES INC. • Experienced engineers for Apps, back - end server, AWS. • Telemedicine System . Develop efficient core chat system. • MATRIX’s Patented Technologies: Thermoelectric Module & Boost Converter. Core Business • Stable revenue growth in wellness salon business (62% growth from 2020 to 2021 and 22% growth from 2021 to 2022) • Average number of customers per salon has been stable, but the number of salons increased by 14 salons from January 2021 to August 2023 and the average sales per customer increased by approx. 4 USD from 49 USD in January 2021 to 53 USD in August 2023 MEDIROM Healthcare Technologies Inc. 2 - 3 - 1, Daiba , Minato - ku, Tokyo, JAPAN 135 - 0091 ir@medirom.co.jp www.medirom.co.jp/en/ir Thank You! NASDAQ: MRM September, 2023

Appendix FOR ADDITIONAL INFORMATION MEDIROM HEALTHCARE TECHNOLOGIES INC.

H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ 2,127,479 3,282,346 3,147,045 3,807,012 3,341,617 5,409,825 6,954,057 USD $16,140,498 24,902,102 23,875,616 28,882,573 25,351,771 41,042,599 52,758,190 H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ 1,421,413 2,585,421 2,524,149 2,872,145 2,026,806 4,006,834 5,396,294 USD $ 10,783,802 19,614,756 19,149,905 21,790,039 15,376,724 30,398,559 40,939,944 Directly - Owned Salon Revenue H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ 689,148 669,878 580,859 583,139 1,289,141 1,359,026 1,163,998 USD $ 5,228,344 5,082,149 4,406,790 4,424,088 9,780,297 10,310,492 8,830,878 Franchise Revenue H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ 5,728 719,325 522,228 744,826 (123,037) 725,053 1,267,054 USD $ 43,456 5,457,287 3,961,976 5,650,755 (933,442) 5,500,743 9,612,730 Directly - Owned Salon Gross Profit H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ 353,690 314,050 301,636 216,629 544,039 667,740 518,265 USD $ 2,683,332 2,382,596 2,288,415 1,643,494 4,127,449 5,065,928 3,931,910 Franchise Gross Profit Convenience Translations 26 Total Revenue Convenience translations included in this presentation of Japanese yen into U.S. dollars have been made at the exchange rate of ¥131.810 = US$1.00, which was the foreign exchange rate on December 30, 2022 as reported by the Board of Governors of the Federal Reserve System MEDIROM HEALTHCARE TECHNOLOGIES INC.

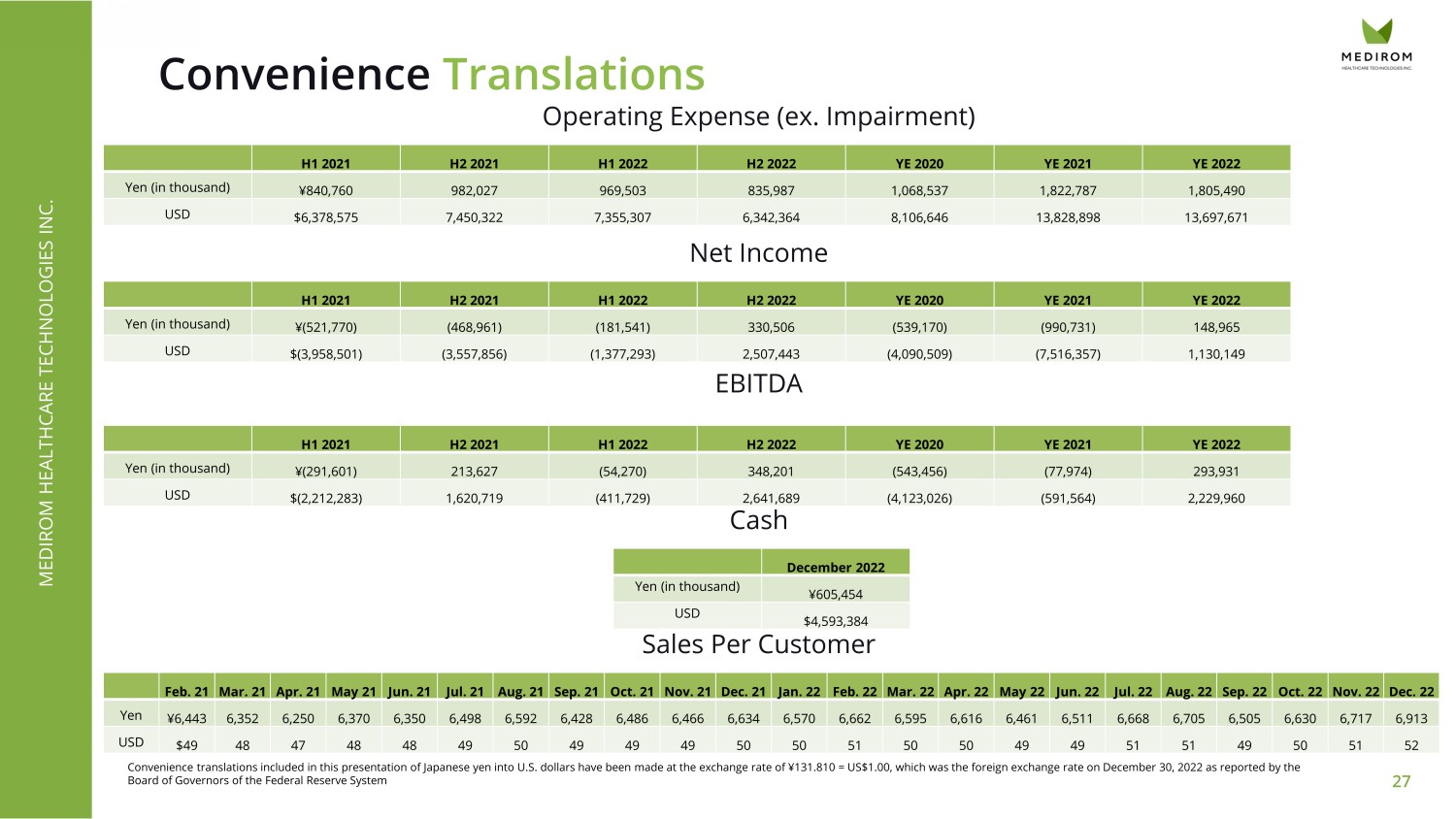

H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ 840,760 982,027 969,503 835,987 1,068,537 1,822,787 1,805,490 USD $ 6,378,575 7,450,322 7,355,307 6,342,364 8,106,646 13,828,898 13,697,671 Operating Expense (ex. Impairment) H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ (521,770) (468,961) (181,541) 330,506 (539,170) (990,731) 148,965 USD $ (3,958,501) (3,557,856) (1,377,293) 2,507,443 (4,090,509) (7,516,357) 1,130,149 Net Income H1 2021 H2 2021 H1 2022 H2 2022 YE 2020 YE 2021 YE 2022 Yen (in thousand) ¥ (291,601) 213,627 (54,270) 348,201 (543,456) (77,974) 293,931 USD $ (2,212,283) 1,620,719 (411,729) 2,641,689 (4,123,026) (591,564) 2,229,960 EBITDA December 2022 Yen (in thousand) ¥ 605,454 USD $ 4,593,384 Cash Feb. 21 Mar. 21 Apr. 21 May 21 Jun. 21 Jul. 21 Aug. 21 Sep. 21 Oct. 21 Nov. 21 Dec. 21 Jan. 22 Feb. 22 Mar. 22 Apr. 22 May 22 Jun. 22 Jul. 22 Aug. 22 Sep. 22 Oct. 22 Nov. 22 Dec. 22 Yen ¥ 6,443 6,352 6,250 6,370 6,350 6,498 6,592 6,428 6,486 6,466 6,634 6,570 6,662 6,595 6,616 6,461 6,511 6,668 6,705 6,505 6,630 6,717 6,913 USD $49 48 47 48 48 49 50 49 49 49 50 50 51 50 50 49 49 51 51 49 50 51 52 Sales Per Customer Convenience Translations 27 Convenience translations included in this presentation of Japanese yen into U.S. dollars have been made at the exchange rate of ¥131.810 = US$1.00, which was the foreign exchange rate on December 30, 2022 as reported by the Board of Governors of the Federal Reserve System MEDIROM HEALTHCARE TECHNOLOGIES INC.