UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): | October 10, 2023 |

McEWEN MINING INC.

(Exact name of registrant as specified in its charter)

| Colorado | 001-33190 | 84-0796160 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

150 King Street West, Suite 2800 Toronto, Ontario, Canada |

M5H 1J9 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number including area code: | (866) 441-0690 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | MUX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into a Material Definitive Agreement |

On October 11, 2023, and McEwen Copper Inc. “McEwen Copper”), a privately-held Alberta, Canada subsidiary of McEwen Mining Inc. (the “Company”), announced consummated agreements pursuant to which a single investor purchased 1,900,000 shares of McEwen Copper common stock from that entity for gross proceeds of ARS $42,000,000 ($119,976,004.80 at a deemed USD/ARS exchange rate of 350.07) (the “Stellantis Private Placement”). The purchaser of the McEwen Copper common stock is FCA Argentina S.A., an Argentinian subsidiary of Stellantis N.V., a public limited liability company organized under the laws of The Netherlands (“Stellantis”).

The Stellantis Private Placement was concluded pursuant to the terms of a Private Placement Subscription Agreement between McEwen Copper and Stellantis dated as of October 10, 2023 (the “Subscription Agreement”). The Stellantis Private Placement closed on October 10, 2023.

In connection with the Stellantis Private Placement, the Company, McEwen Copper, Minera Andes Inc., a subsidiary of the Company, Robert McEwen (collectively, the Company, McEwen Copper, Minera Andes and Mr. McEwen are referred to as the “McEwen Parties”) and Stellantis agreed to Amendment No. 2, dated October 10, 2023 (the “IRA Amendment”), to that certain Investor Rights Agreement, dated February 24, 2023 (the “IRA”). The IRA Amendment provides that the Carbon Neutral Commitment by 2038 in the IRA is not contingent on Stellantis maintaining a certain minimum ownership percentage in McEwen Copper. McEwen Copper intends to implement this commitment independent of Stellantis’ involvement in the Los Azules Project.

In connection with the Stellantis Private Placement, the McEwen Parties entered into Amendment No. 1, dated October 10, 2023 (the “CCCPRA Amendment”), to that certain Copper Cathodes and Concentrates Purchase Rights Agreement, dated February 24, 2023 (the “CCCPRA”). The CCCPRA Amendment provides for a minimum 10,000 tonne per annum copper cathode offtake, subject to certain restrictions and exclusions, and further defined “market price” to be paid by Stellantis on future copper cathode purchases pursuant to the CCCPRA.

On October 10, 2023, McEwen Copper entered into a binding agreement with Nuton LLC, a current shareholder of McEwen Copper and subsidiary of Rio Tinto (“Nuton”), pursuant to which Nuton agreed to invest $10 million to acquire 152,615 shares of McEwen Copper common stock from McEwen Copper (the “Nuton Private Placement”). Additionally, in a separate but related transaction Nuton has also agreed to purchase 232,000 shares of McEwen Copper common stock from the Company in a secondary sale (the “Nuton Secondary Transaction” and together with the Nuton Private Placement, the “Nuton Transactions”). The Nuton Transactions are expected to close by October 19, 2023, and the proceeds are expected to be $4 million to McEwen Copper and $6 million to the Company.

In connection with the Nuton Transactions, McEwen Copper and certain of its affiliates agreed to amend the Nuton Collaboration Agreement, dated August 30, 2022, as amended by Amendment No. 1 to the Nuton Collaboration Agreement, dated March 9, 2023, to extend the period of exclusivity over novel, trade secret or patented copper heap leach technologies until February 1, 2025.

Assuming consummation of each of the transactions discussed above, on a fully diluted basis, the Company would own 47.7% of McEwen Copper common stock and Stellantis and Nuton would own 19.4% and 14.5%, respectively, of McEwen Copper common stock.

Each of the agreements discussed above may contain customary representations, warranties, conditions and agreements in connection with the transactions. They are not intended to provide any other factual information about the Company, McEwen Copper, or any other Company subsidiary. The representations, warranties and covenants contained in the agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

The foregoing agreements relating to the Nuton Transactions are intended to be filed as exhibits to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, anticipated to be filed with the United States Securities and Exchange Commission (“SEC”) on or before November 9, 2023. Interested parties are encouraged to read in their entirety the agreements when they become available, as they contain important information not discussed in this report.

The sales of McEwen Copper common stock was made in transactions not registered with the SEC. Specifically, in the case of the Nuton Secondary Transaction the offers and sales were exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), including under Sections 4(a)(1) and 4(a)(2) of the Securities Act and regulations, interpretive statements and letters issued by the SEC or its staff and decisions of courts thereunder and / or Regulation S under the Securities Act; and in the case of the Stellantis Private Placement and the Nuton Private Placement, pursuant to Section 4(a)(2) of the Securities Act, Regulation S and/or Rule 506 of Regulation D, each promulgated under the Securities Act. Each of the investors in the offerings in the U.S. was an accredited investor as defined in Regulation D. In each transaction exempt under Regulation S, the offers and sales were made in offshore transactions and no directed selling efforts were made in the U.S. In each case, offering restrictions were imposed.

| Item 3.02 | Unregistered Sales of Equity Securities |

The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

| Item 7.01 | Financial Statements and Exhibits. |

On October 11, 2023, the Company issued a press release announcing the completion of the Stellantis Private Placement. On the same date, the Company issued another press release announcing the agreement of Nuton Private Placement and the Nuton Secondary Transaction. Copies of those press releases are furnished with this report as Exhibit 99.1 and Exhibit 99.2.

The information furnished under this Item 7.01, including the referenced exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by reference to such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are furnished or filed with this report, as applicable:

| Exhibit No. | Description | |

| 99.1 | Press release dated October 11, 2023 regarding the Stellantis transaction | |

| 99.2 | Press release dated October 11, 2023 regarding the Nuton transactions | |

| 99.3 | Subscription Agreement | |

| 99.4 | IRA Amendment | |

| 99.5 | CCCPRA Amendment | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

Cautionary Statement

With the exception of historical matters, the matters discussed in the press releases attached as exhibits hereto include forward-looking statements within the meaning of applicable securities laws that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained therein. Such forward-looking statements include, among others, statements regarding future production and cost estimates, exploration, development, construction and production activities. Factors that could cause actual results to differ materially from projections or estimates include, among others, future drilling results, metal prices, economic and market conditions, operating costs, receipt of permits, and receipt of working capital, as well as other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and other filings with the United States Securities and Exchange Commission. Most of these factors are beyond the Company’s ability to predict or control. The Company disclaims any obligation to update any forward-looking statement made in the press releases attached as exhibits hereto, whether as a result of new information, future events, or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| McEWEN MINING INC. | ||

| Date: October 16, 2023 | By: | /s/ Carmen Diges |

| Carmen Diges, General Counsel | ||

Exhibit 99.1

McEwen Copper Closes ARS $42 Billion Investment by Stellantis

TORONTO, Oct. 11, 2023 (GLOBE NEWSWIRE) -- McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce the closing of an additional ARS $42 billion investment by Stellantis, one of the world’s leading automakers and mobility providers with iconic brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, RAM, Vauxhall, Free2Move and Leasys.

Stellantis N.V. (“Stellantis”), which in February 2023 invested ARS $30 billion, has today invested an additional ARS $42 billion in Argentina to acquire shares of McEwen Copper in a private placement of 1,900,000 common shares. The proceeds of the private placement will be used to advance development of the Los Azules copper project in San Juan, Argentina, and for general corporate purposes.

Giving effect to the pending investment by Nuton LLC, also announced today, Stellantis increases its ownership to 19.4% of McEwen Copper and McEwen Mining owns 47.7% on a fully diluted basis. The Transaction values McEwen Copper at approximately US$800 million.

In connection with the Transaction, McEwen Copper and certain of its affiliates amended the Investor Rights Agreement with Stellantis (the "Stellantis IRA”) and the Copper Cathodes and Concentrates Purchase Rights Agreement (the “CCCPRA”), further described below.

The Stellantis IRA was amended to make the Carbon Neutral Commitment by 2038 not contingent on Stellantis maintaining a certain minimum ownership percentage in McEwen Copper. McEwen Copper intends to implement this commitment independent of Stellantis’ involvement in the Los Azules project.

The CCCPRA was amended to provide for a minimum 10,000 tonne per annum copper cathode offtake, subject to certain restrictions and exclusions, and further defined ‘market price’ to be paid by Stellantis on future copper cathode purchases pursuant to the CCCPRA.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

| McEwen Mining Inc. | Page |

About McEwen Copper

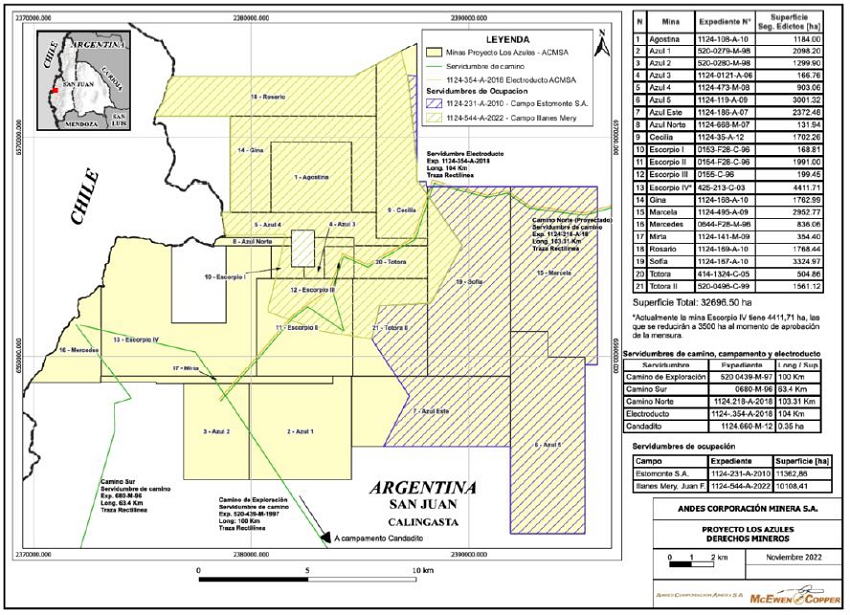

McEwen Copper Inc. holds a 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.9 billion pounds at a grade of 0.40% Cu (Indicated category) and an additional 26.7 billion pounds at a grade of 0.31% Cu (Inferred category). A PEA published in June 2023 estimated a $2.7 billion after-tax NPV8% at $3.75/lb Cu and a 27-year mine life.

After closing the Nuton LLC investment, also announced today, McEwen Copper will have 30,937,615 common shares outstanding, and its shareholders are McEwen Mining Inc. 47.7%, Stellantis 19.4%, Nuton 14.5%, Rob McEwen 12.9%, Victor Smorgon Group 3.2%, and other shareholders 2.3%.

About Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is one of the world’s leading automakers and a mobility provider. Its storied and iconic brands embody the passion of their visionary founders and today’s customers in their innovative products and services, including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. Powered by our diversity, we lead the way the world moves – aspiring to become the greatest sustainable mobility tech company, not the biggest, while creating added value for all stakeholders as well as the communities in which it operates. For more information, visit www.stellantis.com.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

| McEwen Mining Inc. | Page |

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Its Chairman and Chief Owner has personally provided the company with $220 million and takes an annual salary of $1.

|

WEB SITE

CONTACT INFORMATION

150 King Street West

Relationship with Investors:

Mihaela Iancu ext. 320

|

SOCIAL MEDIA |

||

| McEwen Mining | |||

| Facebook: LinkedIn: Twitter: Instagram: |

facebook.com/mcewenmining linkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmining instagram.com/mcewenmining |

||

| McEwen Copper | |||

| Facebook: LinkedIn: Twitter: Instagram: |

facebook.com/ mcewencopper linkedin.com/company/mcewencopper twitter.com/mcewencopper instagram.com/mcewencopper |

||

| Rob McEwen | |||

| Facebook: LinkedIn: Twitter: |

facebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24 twitter.com/robmcewenmux |

||

| McEwen Mining Inc. | Page |

Exhibit 99.2

McEwen Copper Announces an Additional US$10 Million Investment by Nuton, a Rio Tinto Venture

TORONTO, Oct. 11, 2023 (GLOBE NEWSWIRE) -- McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce a binding agreement for an additional $10.0 million investment by Nuton LLC, a Rio Tinto Venture, and existing McEwen Copper shareholder.

Nuton has agreed to invest US$10.0 million to acquire shares of McEwen Copper in a two-part transaction expected to close by October 19th, 2023 (the “Nuton Transaction”) consisting of a private placement of 152,615 McEwen Copper common shares, and the purchase of 232,000 common shares owned by McEwen Mining in a secondary sale. Proceeds of the subscription and purchase are expected to be approximately $4.0 million to McEwen Copper and $6.0 million to McEwen Mining, respectively. The proceeds of the private placement will be used to advance the development of the Los Azules copper project in San Juan, Argentina, and for general corporate purposes.

After closing, Nuton will own 14.5% of McEwen Copper on a fully diluted basis, and McEwen Mining will own 47.7%. The transaction values McEwen Copper at approximately US$800 million.

In connection with the Transaction, McEwen Copper and certain of its affiliates agreed to amend the Nuton Collaboration Agreement to extend the period of exclusivity over novel, trade secret or patented copper heap leach technologies until February 1st, 2025.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Nuton

Nuton is an innovative new venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leach-related technologies and capability – a product of almost 30 years of research and development. Nuton™ Technologies offer the potential to economically unlock copper sulphide resources, copper bearing waste and tailings, and achieve higher copper recoveries on oxide and transitional material, allowing for a significantly increased copper production. One of the key differentiators of Nuton is the potential to deliver leading environmental performance, including more efficient water usage, lower carbon emissions, and the ability to reclaim mine sites by reprocessing mine waste.

| McEwen Mining Inc. | Page |

About McEwen Copper

McEwen Copper Inc. holds a 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.9 billion pounds at a grade of 0.40% Cu (Indicated category) and an additional 26.7 billion pounds at a grade of 0.31% Cu (Inferred category). A PEA published in June 2023 estimated a $2.7 billion after-tax NPV8% at $3.75/lb Cu and a 27-year mine life.

After closing the Stellantis investment, also announced today, and the pending investment by Nuton, McEwen Copper will have 30,937,615 common shares outstanding, and its shareholders are: McEwen Mining Inc. 47.7%, Stellantis 19.4%, Nuton 14.5%, Rob McEwen 12.9%, Victor Smorgon Group 3.2%, and other shareholders 2.3%.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

| McEwen Mining Inc. | Page |

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Its Chairman and Chief Owner has personally provided the company with $220 million and takes an annual salary of $1.

|

WEB SITE

CONTACT INFORMATION

150 King Street West

Relationship with Investors:

Mihaela Iancu ext. 320

|

SOCIAL MEDIA |

||

| McEwen Mining | |||

| Facebook: LinkedIn: Twitter: Instagram: |

facebook.com/mcewenmining linkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmining instagram.com/mcewenmining |

||

| McEwen Copper | |||

| Facebook: LinkedIn: Twitter: Instagram: |

facebook.com/ mcewencopper linkedin.com/company/mcewencopper twitter.com/mcewencopper instagram.com/mcewencopper |

||

| Rob McEwen | |||

| Facebook: LinkedIn: Twitter: |

facebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24 twitter.com/robmcewenmux |

||

| McEwen Mining Inc. | Page |

Exhibit 99.3

McEWEN COPPER INC.

(the “Issuer”)

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT

(COMMON SHARES)

INSTRUCTIONS TO SUBSCRIBER

| 1. | You must complete all the information in the boxes on page ii and sign where indicated with an “X”. |

| 2. | You must complete and sign Exhibit “A” - “Canadian Investor Questionnaire” that starts on page A-1. The purpose of this form is to determine whether you meet the standards for participation in a private placement under applicable Canadian securities laws. In order for the Issuer to satisfy its obligations under applicable Canadian securities laws, you may be required to provide additional evidence to verify the information you have provided in Exhibit “A” - “Canadian Investor Questionnaire” that starts on page A-1. |

| 3. | A completed and signed copy of the Subscription Agreement must be delivered to: |

McEwen Copper Inc.

150 King Street West, S. 2800

Toronto, ON M5H 1J9

| Attention: | Carmen Diges | |

| Email: | cdiges@mcewenmining.com |

-

McEWEN COPPER INC.

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT

The undersigned (the “Subscriber”) hereby subscribes for the number of common shares in the capital of McEwen Copper Inc. (the “Issuer”) set out below, subject to the terms and conditions set forth in the attached “Terms and Conditions of Subscription for Common Shares” (the “Terms and Conditions”), which are hereby agreed between the Subscriber and the Issuer.

| Subscriber Information | Common Shares to be Issued to the Subscriber | |

| FCA Argentina S.A. | Number of Common Shares: 1,900,000 | |

| (Name of Subscriber) | (the “Common Shares”) | |

| Subscription Amount: US$49,400,000 | ||

| (the “Subscription Amount”) | ||

| Miguel Ignacio Prefumo | If the Subscriber is subscribing as an agent on behalf of a beneficial purchaser (check the appropriate box) | |

| Attorney in fact | ||

| Germán

Federico Penelas Attorney in fact |

¨ the Subscriber is a trust company or trust corporation or a registered adviser acting on behalf of a fully managed account and deemed under applicable securities laws to be purchasing as principal, or | |

| ¨ the following information is true and correct and, as applicable, Exhibit “A” hereto has been completed for each beneficial purchaser: | ||

| Carlos María Della Paolera 265, 22nd floor | ||

| C1001ADA, Buenos Aires, Argentina | ||

| (Subscriber’s Address, including postal or zip code) | (Name of Beneficial Purchaser) | |

| 54 11 4310-4000 | (Address of Beneficial Purchaser) | |

| (Telephone Number) | ||

| (Beneficial Purchaser’s Telephone Number) | ||

| francisco.bellucci@stellantis.com; german.penelas@stellantis.com | ||

| (Email Address) | (Beneficial Purchaser’s E-Mail Address) |

| Register the Common Shares as set forth below: | Deliver the Common Shares as set forth below: | |

| FCA Argentina S.A. | McCarthy Tétrault LLP | |

| (Name to Appear on Share Certificate) | Attention: Peter Quon | |

| (Attention - Name) | ||

| (Account Reference, if applicable) | ||

| (Account Reference, if applicable) | ||

| McCarthy Tétrault LLP | ||

| Carlos María Della Paolera 265, 22nd floor | Suite 2400 | |

| C1001ADA, Buenos Aires, Argentina | 745 Thurlow Street | |

| Vancouver BC V6E 0C5 | ||

| (Address, including postal or zip code) | ||

| (Street Address, including postal or zip code – no PO Boxes permitted) | ||

| (Telephone Number) |

-

ACCEPTANCE

The Issuer hereby accepts the Subscription (as defined herein) on the terms and conditions contained in this private placement subscription agreement (this “Agreement”) as of the 10th day of October, 2023.

| McEWEN COPPER INC. | ||

| Per: | /s/ Robert McEwen | |

| Authorized Signatory | ||

TERMS AND CONDITIONS OF

SUBSCRIPTION FOR COMMON SHARES

| 1. | SUBSCRIPTION |

1.1 On the basis of the representations and warranties, and subject to the terms and conditions, set forth in this Agreement, the Subscriber hereby subscribes for the Common Shares for the Subscription Amount shown on page ii of this Agreement (such subscription of the Common Shares being the “Subscription”) by way of a private placement offering (the “Offering”), and the Issuer agrees to issue and deliver the Common Shares to the Subscriber, effective upon the Closing Date.

| 2. | CONSIDERATION |

2.1 Subject to the other terms and conditions hereof, the Subscription Amount shall be paid and satisfied by the assignment by the Subscriber to the Issuer of all of the Subscriber’s rights, title and interest to the ICC (as defined below), and the following six steps shall occur in sequence, with each step immediately following the preceding step, at the Closing:

| (a) | the Subscriber shall deliver an offer to Andes Corporacion Minera S.A. (“ACM”) in the form attached as Exhibit “B” hereto (the “ICC Agreement”), duly executed by the Subscriber, pursuant to which the Subscriber will offer to make an irrevocable capital contribution (aporte irrevocable) (“ICC”) on account of future capital subscription to ACM of an amount in Argentine Pesos equal to the Subscription Amount, converted by applying the Exchange Rate (such converted amount, the “ICC Amount”), |

| (b) | the Issuer shall cause ACM to deliver to the Subscriber an acceptance to the Subscriber’s offer to enter into the ICC Agreement, duly executed by ACM; |

| (c) | the Subscriber shall contribute the ICC Amount by delivering to ACM an e-cheque (cheque electrónico) issued by Santander Valores in favour of FCA Automobiles Argentina S.A., which will duly endorse such e-cheque in favour of the Subscriber which will duly endorse such e-cheque in favour of ACM; |

| (d) | ACM shall deliver to the Subscriber a letter acknowledging receipt of the ICC Amount; |

| (e) | the Subscriber shall deliver an offer to the Issuer in the form attached hereto as Exhibit “C” (the “ICC Assignment Agreement”), duly executed by the Subscriber, and the Issuer shall deliver an acceptance to such offer to enter into the ICC Assignment Agreement, duly executed by the Issuer; |

| (f) | the Subscriber shall deliver a notice to ACM informing ACM of the ICC Assignment Agreement; |

| (g) | the Issuer shall issue and deliver to the Subscriber a share certificate representing the number of Common Shares shown on page ii of this Agreement and deliver a certified copy of the updated central securities register of the Issuer reflecting such issuance; |

(together, the “Closing”).

-

| 3. | DOCUMENTS REQUIRED FROM SUBSCRIBER |

3.1 The Subscriber must complete, sign and return to the Issuer the following documents:

| (a) | this Agreement; |

| (b) | the Canadian Investor Questionnaire (the “Questionnaire”) attached as Exhibit “A” that starts on page A-1, along with any additional evidence that may be requested by the Issuer to verify the information provided in the Questionnaire; and |

| (c) | such other supporting documentation that the Issuer may request to establish the Subscriber’s eligibility to participate in the Offering. |

The Subscriber acknowledges and agrees that the Issuer will not consider the Subscription for acceptance unless the Subscriber has provided all of such documents to the Issuer.

3.2 As soon as practicable upon any request by the Issuer, the Subscriber will complete, sign and return to the Issuer any additional documents, questionnaires, notices and undertakings the Issuer may reasonably require or otherwise, may be required by any Governmental Authority or Applicable Laws.

| 4. | CLOSING DATE AND CONDITIONS TO CLOSING |

4.1 Subject to the satisfaction of the conditions set forth below in Section 4.2, the date of the Closing (the “Closing Date”) October 10, 2023, or such other date as may be determined by mutual agreement between the Issuer and the Subscriber.

4.2 The Subscription is subject to the following conditions for the benefit of the Subscriber (any of which may be waived by the Subscriber in its sole discretion):

| (a) | the Issuer having obtained all necessary approvals and consents for the Offering, including approval of the Issuer’s shareholders under the Shareholder Agreement in respect of the IRA Amendment and the CCCPRA Amendment, and having delivered a copy of the executed shareholder resolution to the Subscriber; |

| (b) | (i) the Issuer having delivered a notice to the shareholders of the Issuer regarding the proposed issuance of common shares of the Issuer to the Subscriber and the shareholders’ pre-emptive rights to participate in such proposed issuance in accordance with the unanimous shareholder agreement of the Issuer dated August 20, 2021 (the “Shareholder Agreement”); and (ii) the Issuer having delivered to the Subscriber a copy of waivers of such pre-emptive rights from each of the shareholders,; |

| (c) | the Issuer having delivered to the Subscriber: |

| (i) | an original share certificate representing the Common Shares (“Certificate”); |

| (ii) | an amendment to the Investor Rights Agreement, substantially in the form attached hereto as Exhibit “D” (the “IRA Amendment”), duly executed by the Issuer, McEwen Mining Inc. (“MUX”), Minera Andes Inc. (“MAI”) and Robert McEwen; |

-

| (iii) | an amendment to the Copper Cathodes and Concentrates Purchase Rights Agreement, substantially in the form attached hereto as Exhibit “E”, duly executed by ACM, (the “CCCPRA Amendment”); |

| (iv) | a certificate of status for the Issuer dated no earlier than one Business Day prior to the Closing Date; and |

| (v) | a certificate of an officer of the Issuer certifying (A) the articles and by-laws of the Issuer, (B) the satisfaction of the conditions set forth in Section 4.2(b), and (C) and the shareholders’ and directors’ resolutions of the Issuer approving the transactions contemplated by this Agreement; and |

| (vi) | a certificate of an officer of ACM certifying (A) its constating documents; (B) the resolutions of its board of directors approving (1) the entering into and completion of the transactions contemplated under this Agreement and the other Transaction Documents to which it is a party and (2) the acceptance of the offer to enter into the ICC Agreement and the contribution by the Subscriber to ACM of the ICC Amount; (3) resolutions of its sole shareholder approving the acceptance of the offer to enter into the ICC Agreement and the contribution by the Subscriber to ACM of the ICC Amount; |

| (d) | the Subscriber having received a legal opinion prepared by Vargas Galindez dated as of the Closing Date (the “Vargas Opinion”), in form and substance satisfactory to the Subscriber, acting reasonably; |

| (e) | the Subscriber having received a legal opinion prepared by external counsel to the Cayman Subsidiaries dated as of the Closing Date, in form and substance satisfactory to the Subscriber, acting reasonably, with respect to each of the Cayman Subsidiaries’ organizational status, good standing, share capitalization, no outstanding litigation and other matters customary in transactions similar to the transactions contemplated by this Agreement; |

| (f) | the issue and sale of the Common Shares being exempt from the requirement to file a prospectus and the requirement to deliver an offering memorandum under applicable securities laws relating to the sale of the Common Shares, or the Issuer having received such orders, consents or approvals as may be required to permit such sale without the requirement to file a prospectus or deliver an offering memorandum; and |

| (g) | the Subscriber having received written confirmation, in the form attached hereto as Exhibit “F”, signed by Nuton LLC, consenting to the transactions contemplated under this Agreement, the IRA Amendment and the CCCPRA Amendment. |

| 5. | ACKNOWLEDGEMENTS AND AGREEMENTS OF THE SUBSCRIBER |

5.1 The Subscriber acknowledges and agrees that:

| (a) | no prospectus has been filed by the Issuer with any securities commission or any other regulatory authority in connection with the issuance of the Common Shares; |

-

| (b) | the Subscriber has not received, nor has the Subscriber requested nor had any need to receive, or been provided with a prospectus, offering memorandum or any document purporting to describe the business and affairs of the Issuer which has been prepared for review by prospective purchasers to assist in making an investment decision in respect of the Common Shares and that the Subscriber’s decision, or, if applicable, the decision of others for whom the undersigned is contracting hereunder, to enter into this Agreement and to subscribe for the Common Shares is based entirely upon this Agreement and publicly available information concerning the Issuer and not upon any other verbal or written representation as to fact or otherwise made by or on behalf of the Issuer; |

| (c) | the Issuer’s constating documents contain restrictions on the transfer of the Common Shares, which provide that no Common Shares may be transferred without the prior approval of the board of directors of the Issuer; |

| (d) | the Issuer is not a “reporting issuer” as that term is defined in applicable Canadian securities laws, nor will it become a reporting issuer in any jurisdiction in Canada or elsewhere upon completion of the Offering and, as a result: |

| (i) | unless the Issuer becomes a reporting issuer at a later date, the Issuer will not be subject to the continuous disclosure requirements of any securities laws, including any requirement relating to the production and filing of audited financial statements or other financial information, and |

| (ii) | any applicable hold periods under applicable securities laws may never expire, and the Common Shares may be subject to restrictions on resale for an indefinite period of time; |

| (e) | the issuance of the Common Shares will be made pursuant to exemptions from the registration and prospectus requirements of applicable Canadian securities laws and therefore: |

| (i) | the Subscriber is restricted from using those civil remedies which would otherwise be available to the Subscriber under applicable securities laws but for the fact that such issuance is being made pursuant to such exemptions; |

| (ii) | the Subscriber may not receive information about the Issuer that would otherwise be required to be provided to it under applicable securities laws, |

| (iii) | the Issuer is relieved from certain obligations that would otherwise apply under applicable securities laws, |

| (iv) | no securities commission or similar regulatory authority has reviewed or passed on the merits of the Common Shares, |

| (v) | there is no government or other insurance covering the Common Shares, and |

| (vi) | there are risks associated with the purchase of the Common Shares, including that the Subscriber may lose the Subscriber’s entire investment; |

| (f) | an investment in the Issuer is highly speculative and only investors who can afford the loss of their entire investment should consider investing in the Issuer and the Common Shares; |

-

| (g) | any subscription monies paid by the Subscriber for the Common Shares is being raised as “seed” or “risk” capital for the Issuer, which is in a speculative stage, and there is no market for the Common Shares whatsoever; |

| (h) | none of the Common Shares have been or will be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or under any securities or “blue sky” laws of any state of the United States, and, unless so registered, may not be offered or sold in the United States or, directly or indirectly, to any U.S. Person (as defined in Section 6.2) except in accordance with the provisions of Regulation S under the 1933 Act (“Regulation S”), pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act, and in each case only in accordance with any other applicable state, provincial and foreign securities laws; |

| (i) | the Issuer has not undertaken, and will have no obligation, to register any of the Common Shares under the 1933 Act or any other securities laws; |

| (j) | the Issuer will refuse to register the transfer of any of the Common Shares to a U.S. Person not made pursuant to an effective registration statement under the 1933 Act or pursuant to an available exemption from the registration requirements of the 1933 Act, and in each case will only register such transfer in accordance with Applicable Laws; |

| (k) | it will hold harmless the Issuer from any loss or damage it may suffer as a result of the Subscriber’s failure to correctly complete this Agreement or the Questionnaire; |

| (l) | it and its advisor(s) have had a reasonable opportunity to ask questions of, and receive answers from, the Issuer in connection with the distribution of the Common Shares hereunder, and to obtain additional information, to the extent possessed or obtainable by the Issuer without unreasonable effort or expense; |

| (m) | the books and records of the Issuer were available upon reasonable notice for inspection, subject to certain confidentiality restrictions, by the Subscriber during reasonable business hours at the Issuer’s principal place of business, and all documents, records and books in connection with the distribution of the Common Shares hereunder have been made available by the Issuer for inspection by the Subscriber, its legal counsel and/or its advisor(s) if requested by the Subscriber; |

| (n) | any resale, assignment, transfer, hypothecation or pledge of any of the Common Shares by the Subscriber will be subject to: (i) resale restrictions contained in the securities laws applicable to the Issuer, the Subscriber and any proposed transferee; and (ii) the Issuer’s constating documents and it is the responsibility of the Subscriber to find out what those restrictions are and to comply with such restrictions before selling any of the Common Shares; |

| (o) | it consents to the placement of a legend or legends on the Certificate and any other document evidencing any of the Common Shares setting forth the restrictions on transferability and sale thereof contained in this Agreement, including the following: |

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO RESTRICTIONS ON TRANSFER CONTAINED IN THE CONSTATING DOCUMENTS OR UNANIMOUS SHAREHOLDER AGREEMENT OF THE COMPANY.

-

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THE SECURITIES REPRESENTED HEREBY MUST NOT TRADE THE SECURITIES BEFORE THE DATE THAT IS FOUR MONTHS AND A DAY AFTER THE LATER OF (I) OCTOBER 10, 2023 AND (II) THE DATE THAT THE COMPANY BECOMES A REPORTING ISSUER IN ANY PROVINCE OR TERRITORY IN CANADA.”;

| (p) | it has been advised to consult its own legal, tax and other advisors with respect to the Offering and the risks of an investment in the Common Shares and with respect to applicable resale restrictions, and it is solely responsible (and the Issuer is not in any way responsible) for compliance with: |

| (i) | any Applicable Laws of the jurisdiction in which the Subscriber is resident in connection with the distribution of the Common Shares hereunder, and |

| (ii) | any applicable resale restrictions; |

| (q) | there may be material tax consequences to the Subscriber of an acquisition or disposition of the Common Shares and the Issuer gives no opinion and makes no representation to the Subscriber with respect to the tax consequences to the Subscriber under federal, state, provincial, local or foreign tax laws that may apply to the Subscriber’s acquisition or disposition of any of the Common Shares; |

| (r) | the Issuer is relying on one of the “Accredited Investor” exemption or the “Minimum Amount Investment” exemption from the prospectus requirements as set out in National Instrument 45-106 – Prospectus Exemptions (“NI 45-106”) adopted by the Canadian Securities Administrators or subsection 73.4(2) of the Securities Act (Ontario), as applicable, which, among other restrictions, impose: (i) a transfer restriction on the Common Shares to the effect that, for so long as the Issuer is not a reporting issuer, the Common Shares are subject to restrictions on transfer that are contained in the Issuer’s constating documents; and (ii) a requirement to legend the Certificate representing the Common Shares to reflect such transfer restriction; |

| (s) | there is no market for any of the Common Shares and no market for any of the Common Shares may ever exist; and |

| (t) | this Agreement is not enforceable by the Subscriber unless it has been accepted by the Issuer and the Issuer reserves the right to reject this Subscription for any reason. |

| 6. | REPRESENTATIONS AND WARRANTIES OF THE SUBSCRIBER |

6.1 The Subscriber hereby represents and warrants to the Issuer (which representations and warranties will survive the Closing) that:

| (a) | the Subscriber is not a U.S. Person; |

| (b) | the Subscriber is resident in the jurisdiction set out on page ii of this Agreement; |

| (c) | if the Subscriber is resident outside of Canada: |

-

| (i) | the Subscriber is knowledgeable of, or has been independently advised as to, the applicable securities laws having application in the jurisdiction in which the Subscriber is resident (the “International Jurisdiction”) which would apply to the offer and sale of the Common Shares, |

| (ii) | the Subscriber is acquiring the Common Shares pursuant to exemptions from prospectus or equivalent requirements under applicable securities laws or, if such is not applicable, the Subscriber is permitted to acquire the Common Shares under the Applicable Laws of the International Jurisdiction without the need to rely on any exemptions, |

| (iii) | the Applicable Laws of the authorities in the International Jurisdiction do not require the Issuer to make any filings or seek any approvals of any kind from any securities regulator in the International Jurisdiction in connection with the offer, issue, sale or resale of any of the Common Shares, |

| (iv) | the acquisition of the Common Shares by the Subscriber does not trigger: |

| (A) | any obligation to prepare and file a prospectus or similar document, or any other report with respect to such purchase, in the International Jurisdiction, or |

| (B) | any continuous disclosure reporting obligation of the Issuer in the International Jurisdiction, and |

| (v) | the Subscriber will, if requested by the Issuer, deliver to the Issuer a certificate or opinion of local counsel from the International Jurisdiction which will confirm the matters referred to in subparagraphs (ii), (iii) and (iv), above, to the satisfaction of the Issuer, acting reasonably; |

| (d) | the Subscriber has the legal capacity and competence to enter into and execute this Agreement and to take all actions required pursuant hereto and, if the Subscriber is a corporate entity, it is duly incorporated and validly subsisting under the laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to authorize execution and performance of this Agreement on behalf of the Subscriber; |

| (e) | the entering into of this Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or, if applicable, the constating documents of, the Subscriber or of any agreement, written or oral, to which the Subscriber may be a party or by which the Subscriber is or may be bound; |

| (f) | the Subscriber has duly executed and delivered this Agreement and it constitutes a valid and binding agreement of the Subscriber enforceable against the Subscriber in accordance with its terms; |

| (g) | the Subscriber has received and carefully read this Agreement; |

| (h) | the Subscriber acknowledges receipt of a copy of the unanimous shareholder agreement of the Issuer and acknowledges that it is a condition of becoming a shareholder of the Issuer that the Subscriber must become a party to such unanimous shareholder agreement; |

-

| (i) | the Subscriber is aware that an investment in the Issuer is speculative and involves certain risks, including the possible loss of the entire investment; |

| (j) | the Subscriber is not aware of any advertisement of any of the Common Shares and is not acquiring the Common Shares as a result of any form of general solicitation or general advertising, including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media, or broadcast over radio or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising; |

| (k) | the Subscriber has made an independent examination and investigation of an investment in the Common Shares and the Issuer and agrees that the Issuer will not be responsible in any way for the Subscriber’s decision to invest in the Common Shares and the Issuer; |

| (l) | no person has made to the Subscriber any written or oral representations: |

| (i) | that any person will resell or repurchase any of the Common Shares, |

| (ii) | that any person will refund the purchase price of any of the Common Shares, or |

| (iii) | as to the future price or value of any of the Common Shares; and |

| (m) | there is no person acting or purporting to act in connection with the Offering for or on behalf of the Subscriber who is entitled to any brokerage or finder’s fee payable by the Issuer. If any such person establishes a claim that any fee or other compensation is payable by the Issuer in connection with this subscription for the Common Shares, the Subscriber or any beneficial purchaser for whom the undersigned is acting covenants to indemnify and hold harmless the Issuer with respect thereto and with respect to all costs reasonably incurred in the defence thereof. |

6.2 In this Agreement, the term “U.S. Person” has the meaning ascribed thereto in Regulation S, and for the purpose of this Agreement includes: (i) any person in the United States; (ii) any natural person resident in the United States; (iii) any partnership or corporation organized or incorporated under the laws of the United States; (iv) any partnership or corporation organized outside the United States by a U.S. Person principally for the purpose of investing in securities not registered under the 1933 Act, unless it is organized or incorporated, and owned, by accredited investors who are not natural persons, estates or trusts; or (v) any estate or trust of which any executor, administrator or trustee is a U.S. Person.

| 7. | REPRESENTATIONS AND WARRANTIES WILL BE RELIED UPON |

7.1 The Subscriber acknowledges that its representations and warranties contained herein and in the Questionnaire are made by it with the intention that such representations and warranties will be relied upon by the Issuer in determining the Subscriber’s eligibility to subscribe for the Common Shares under Applicable Laws, or (if applicable) the eligibility of others on whose behalf the Subscriber is contracting hereunder to subscribe for the Common Shares under Applicable Laws. The Subscriber further agrees that, as at the Closing, it will be representing and warranting that its representations and warranties contained herein and in the Questionnaire are true and correct as at the Closing with the same force and effect as if they had been made by the Subscriber on the Closing, and that they will survive the subscription by the Subscriber of the Common Shares and will continue in full force and effect notwithstanding any subsequent disposition by the Subscriber of the Common Shares.

-

| 8. | REPRESENTATIONS AND WARRANTIES OF THE ISSUER |

8.1 The Issuer hereby represents and warrants to the Subscriber (which representations and warranties will survive the Closing) that:

| (a) | each of the Issuer and the Material Subsidiaries (as defined herein) is validly subsisting under the laws of its jurisdiction of incorporation, licensed, registered or qualified as an extra-provincial or foreign corporation in all jurisdictions where the character of its properties owned or leased or the nature of the activities conducted by it make such licensing, registration or qualification necessary and carries and shall carry on its business in the ordinary course and in compliance in all material respects with all Applicable Laws of each such jurisdiction; |

| (b) | on the Closing Date, the Issuer will have taken all corporate steps and proceedings necessary to duly approve the transactions contemplated under this Agreement, including its execution and delivery, and the execution and delivery of the IRA Amendment and each other agreement contemplated by this Agreement; |

| (c) | on the Closing Date the Issuer will have caused ACM to have taken, all corporate steps and proceedings necessary to duly approve the transactions contemplated under this Agreement, including the execution and delivery of the CCCPRA Amendment and each other agreement contemplated by this Agreement to which ACM is a party; |

| (d) | the Issuer is not in breach of any securities laws; |

| (e) | at the time of closing on the Closing Date, the Common Shares will be duly and validly created, authorized and issued; will be validly issued as fully paid as non-assessable Common Shares in the capital of the Issuer; |

| (f) | the issuance and delivery of the Common Shares by the Issuer to the Subscriber does not and will not constitute a breach of or default under the constating documents of the Issuer or any law, regulation, order or ruling applicable to the Issuer or any agreement, contract or indenture to which the Issuer is a party or by which it is bound; |

| (g) | for the purposes of the transactions contemplated herein, the Issuer has provided notice to the shareholders of the Issuer under the pre-emptive rights provisions of the Shareholder Agreement (and Issuer has provided a copy of such notice to the Subscriber) and the relevant exercise period has expired without any shareholders exercising their pre-emptive rights; |

| (h) | the Issuer is authorized to issue an unlimited number of Common Shares and an unlimited number of Class B common shares; and as of the date of this Agreement, 28,885,000 Common Shares are issued and outstanding and no Class B common shares are issued and outstanding; |

| (i) | as of the Closing Date, there exist no options, warrants, rights of conversion or other rights, contracts or commitments that could require the Issuer to issue any Common Shares or other securities other than the pre-emptive rights set out in the Shareholder Agreement and the 40,000 options that the Issuer has agreed to grant to Michael Meding upon the completion of an initial public offering of the Issuer, pursuant to the employment agreement between the Issuer and Michael Meding dated February 7, 2022; |

-

| (j) | except for Michael Meding and Alex Aguado, the Issuer has no employees and other than Stephen McGibbon, the Issuer has no independent contractors, and neither of such employees are entitled to any bonus, increase in compensation or other benefit that is contingent on the Closing. The Issuer has provided copies of the employment agreements between the Issuer and each of Michael Meding and Alex Aguado, and there are no other agreements, whether written or oral, between either of such employees and the Issuer; |

| (k) | the issuance and sale of the Common Shares by the Issuer and the fulfilment of the terms hereof does not and will not conflict with or constitute a breach of or default under (i) the constating documents of the Issuer or its Material Subsidiaries (as defined below), (ii) any Applicable Laws, order or ruling or (ii) any agreement, contract or indenture, including any covenants or provisions respecting the Issuer’s right to issue additional equity, or any pre-emptive right or similar rights therein, to which the Issuer or any of its Material Subsidiaries (as defined below) is a party or by which it is bound, or to which any of the property or assets of the Issuer or any of its Material Subsidiaries (as defined below) is subject; |

| (l) | each of this Agreement, the IRA Amendment, the CCCPRA Amendment and each other agreement of the Issuer and its affiliates contemplated hereby, when signed by the Issuer or such affiliates, as the case may be, constitutes a binding and enforceable obligation of the Issuer or such affiliates, as applicable, enforceable in accordance with its respective terms; |

| (m) | Exhibit “G” accurately shows (i) each direct and indirect subsidiary of the Issuer (collectively, “Material Subsidiaries”); (ii) the registered and beneficial holders of all of the issued and outstanding shares in the capital of each of the Material Subsidiaries; and (iii) the numbers and classes of shares currently held by each such holder and the percentage in the outstanding capital of each Material Subsidiary. The Issuer has no assets other than the holding of the shares of each of the Material Subsidiaries; |

| (n) | International Copper Mining Inc. has no assets other than the holding of the shares of each of Los Azules Mining Inc. and San Juan Copper Inc., and neither of Los Azules Mining Inc. and San Juan Copper Inc. has assets other than shares of ACM; and none of International Copper Mining Inc., Los Azules Mining Inc. and San Juan Copper Inc. (together, the “Cayman Subsidiaries”) operated or engaged in, or operates or engages in, any business activities, operations or management other than business activities, operations or management related to the Los Azules Project; |

| (o) | the Issuer has not operated or engaged in, and is not operating or engaged in, any business activities or operations other than those related to the Los Azules Project and the Elder Creek Project; |

| (p) | except for the Shareholder Agreement and the Nuton collaboration agreement dated August 30, 2022, as amended (the “Nuton Collaboration Agreement”) by and among the Issuer, MUX, Robert McEwen and Nuton LLC and the copper Cathodes and Concentrates Purchase Rights Agreement dated March 9, 2023 between Nuton LLC and ACM, none of the shareholders of the Issuer (other than the Subscriber) have any agreements or side letters with the Issuer granting such shareholders any rights in respect of the Issuer, including the right to nominate directors for appointment to the board of directors of the Issuer or any approval rights with respect to any transactions of the Issuer or the Material Subsidiaries (including, without limitation, granting of offtake, royalty, stream or similar rights with respect to the Los Azules Project); |

-

| (q) | there are no circumstances, developments or events that would constitute or reasonably be expected to constitute a material adverse effect in respect of any of the Issuer or the Material Subsidiaries; |

| (r) | there are no: (i) Claims pending or, to the knowledge of the Issuer, threatened against any of the Issuer or the Material Subsidiaries before or by any governmental authority; and (ii) outstanding judgments, orders, decrees, writs, injunctions, decisions, rulings or awards against any of the Issuer or the Material Subsidiaries or affecting any of the Issuer, the Material Subsidiaries, the Los Azules Project or the Elder Creek Project; |

| (s) | the articles, bylaws, minute books, share registers and other corporate records of the Issuer and the Material Subsidiaries have been maintained in accordance with Applicable Laws and contain complete and accurate records of all matters required to be dealt with in such books and records, in each case, in all material respects; |

| (t) | the Issuer owns all of the issued and outstanding securities of the Material Subsidiaries, free and clear of any encumbrances and defects, and has no other subsidiaries. All of the outstanding equity interests in the Material Subsidiaries have been duly authorized and validly issued and all of such equity interests are outstanding as fully paid and non-assessable shares. There exist no options, warrants, purchase rights, or other contracts or commitments that would require the Issuer or any other person to sell, transfer or otherwise dispose of any equity interests of the Material Subsidiaries or for the issue or allotment of any unissued shares in the capital of the Material Subsidiaries or any other security convertible into or exchangeable for any such shares. None of the Issuer or the Material Subsidiaries has any obligations (including any obligation to provide any guarantee, security, support, indemnification, assumption or endorsement of or any similar commitment with respect to the obligations, liabilities or indebtedness of any other person) including, without limitation, the obligations of MUX under the amended and restated credit agreement dated May 19, 2023 between MUX and Evanachan Limited; |

| (u) | each of the Material Subsidiaries has been duly incorporated or established and is validly existing and in good standing under the laws of its respective jurisdiction of organization with all requisite corporate power and authority to own, use, lease and operate its properties and conduct its business in the manner currently conducted, and is duly qualified to transact business in each jurisdiction where it carries its business; |

| (v) | the Issuer and its Material Subsidiaries (i) are conducting their business operations in material compliance with Applicable Laws, including without limitation those of the country, state, province, municipality or other local or foreign jurisdiction in which such entity carries on business or conducts its activities; (ii) have received and hold all material permits, by-laws, licenses, waivers, exemptions, consents, certificates, registrations, rights, rights of way, entitlements and other approvals which are required from any governmental or regulatory authority or any other person necessary to the conduct of their business and activities as currently conducted, and to the conduct of their business as proposed to be conducted pursuant to the use of funds proposal underlying the proposed placement, including but not limited to those required under applicable mining and environmental laws (“Authorizations”); and (iii) are in material compliance with all terms and conditions of such Authorizations, and such Authorizations are in full force and effect in all material respects; and (iv) have not received any notice of the modification, suspension, revocation, cancellation or non-renewal of, or any intention to modify, suspend, revoke, cancel or not renew or any proceeding relating to the modification, suspension, revocation, cancellation or non-renewal of any such Authorizations, and no Authorizations will be subject to modification, suspension, revocation, cancellation or non-renewal as a result of the execution and delivery of this Agreement or the Closing; |

-

| (w) | except to the extent qualified by the Vargas Opinion, which the Subscriber acknowledges having received, the Issuer and each of its Material Subsidiaries (i) own, hold or lease all such properties as are necessary to the conduct of their respective businesses as currently operated, and to the conduct of their business as proposed to be conducted pursuant to the use of funds proposal underlying the proposed placement; and (ii) have good and marketable title under Applicable Laws to all real property and good and marketable title to all personal property owned by them that constitute the Los Azules Project and the Elder Creek Project and to all material personal property owned by them in the conduct of their business on the Los Azules Project and the Elder Creek Project, in each case free and clear of all liens, encumbrances and defects; and any real property and buildings to be held under lease or sublease by the Issuer and the Material Subsidiaries are held by them under valid, subsisting and enforceable leases; (A) the “Los Azules Project” means the Los Azules project owned by ACM and located in the San Juan Province, Argentina, which involves exploration, development and other operations on the mineral properties, claims and any other mineral rights listed in, and depicted by the map in, Exhibit “H” hereto, and which includes the project described in the technical report entitled “SEC S-K 229.1304 Initial Assessment Individual Disclosure for the Los Azules Project, Argentina” with an effective reporting date of September 1, 2017 prepared by Mining Plus; and (B) the “Elder Creek Project” means the project commonly known as the Elder Creek project, which is owned by NPGUS LLC and located near Elder Creek, Nevada, USA, which involves exploration, development and other operations on the mineral properties, claims and any other mineral rights comprising such project; |

| (x) | except to the extent qualified by the opinion of Vargas Opinion, all interests in material mining claims, concessions, exploration, reconnaissance, exploitation or extraction rights, surface rights, subsurface rights or similar rights, (“Mining Claims”) that are held by the Issuer or any of the Material Subsidiaries, held by way of Authorizations or otherwise, are in good standing, are valid and enforceable, are free and clear of any encumbrances and no royalty is payable in respect of any of them, except as disclosed in the Vargas Opinion; |

| (y) | no other material property rights are necessary for the conduct of the business as currently conducted, or for the conduct of the business as proposed to be conducted pursuant to the use of funds proposal underlying the proposed placement, in each case by the Issuer and the Material Subsidiaries; |

| (z) | except as provided in the Vargas Opinion, there are no material restrictions on the ability of the Issuer and the Material Subsidiaries to use, transfer or otherwise exploit any such property rights; |

| (aa) | except as set out in the Vargas Opinion, there are no Claims to which the Issuer or any of its Material Subsidiaries is a party or of which any property, including Authorizations and Mining Claims, of the Issuer or any of its Material Subsidiaries is the subject; and, no such proceedings are threatened or pending by governmental authorities or any other person; there is no agreement, judgment, injunction, order or decree binding upon the Issuer or its Material Subsidiaries that has or would reasonably be expected to have the effect of prohibiting, restricting or materially impairing any business practice of the Issuer or its Material Subsidiaries; |

-

| (bb) | no dispute between the Issuer or the Material Subsidiaries and any local, native or indigenous group exists or to the knowledge of the Issuer is threatened or reasonably likely with respect to the Los Azules Project and the Elder Creek Project or the business activities of the Issuer and the Material Subsidiaries; |

| (cc) | the Issuer’s draft unaudited financial statements for the periods ending December 31, 2021 and December 31, 2022, copies of which the Issuer has provided to the Subscriber, have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and present fairly the consolidated financial position and results of operation and changes in the financial position of the Issuer and its Material Subsidiaries and such accounts fairly present in all material respects the financial condition, financial performance and cash flows of the Issuer for the periods ended December 31, 2021 and December 31, 2022; neither the Issuer nor the Material Subsidiaries have any material liabilities, obligations, indebtedness or commitments, whether accrued, absolute, contingent or otherwise required to be disclosed under IFRS, which are not disclosed in the Issuer’s financial statements, and the Issuer and the Material Subsidiaries have conducted their respective businesses in the ordinary course since December 31, 2022 until the Closing Date; |

| (dd) | the audited consolidated financial statements for ACM for the period ending December 31, 2022, a copy of which has been provided to the Subscriber, are prepared in accordance with Argentine GAAP and present fairly the consolidated financial position and results of operation and changes in the financial position of ACM and its subsidiaries and such accounts fairly present in all material respects the financial condition, financial performance and cash flows of ACM for the periods indicated; as at the Closing Date, neither ACM nor its subsidiaries have any material liabilities, obligations, indebtedness or commitments, whether accrued, absolute, contingent or otherwise required to be disclosed under Argentine GAAP, which are not disclosed in ACM’s financial statements and each of ACM and its subsidiaries have conducted their respective businesses in the ordinary course since December 31, 2022 until the Closing Date; |

| (ee) | the Issuer and the Material Subsidiaries have filed all Tax Returns required to be filed under Applicable Laws when due and all such Tax Returns were correct and complete in all respects; |

| (ff) | any deductions taken or claimed in computing the income of any of the Issuer or the Material Subsidiaries for Tax purposes have been taken or claimed in accordance with Applicable Law; |

| (gg) | there are no Encumbrances on any of the assets of the Issuer or of the Material Subsidiaries that arose in connection with any failure (or any alleged failure) to pay any Tax when due; |

| (hh) | all Taxes required to be paid under Applicable Laws have been paid by each of the Issuer and the Material Subsidiaries or an adequate reserve under IFRS has been recorded in respect thereof in the accounting records of the Issuer or the Material Subsidiaries, and each of the Issuer and the Material Subsidiaries has made adequate and timely installments of all Taxes required to be made by it under Applicable Laws. Neither the Issuer nor any of the Material Subsidiaries has incurred any liability, whether actual or contingent, for Taxes or engaged in any transaction or event that would result in any liability, whether actual or contingent, for Taxes or realized any income or gain for Tax purposes otherwise than in the usual and ordinary course of its business; |

-

| (ii) | there are no notices of assessment or reassessment of, or notices of audits, investigations or Claims with respect to, unpaid liabilities for Taxes issued by any Tax Authority which have been received by any of the Issuer or the Material Subsidiaries. There are no assessments, proceedings, investigations, audits or Claims now pending or, to the knowledge of the Issuer, threatened against any of the Issuer or the Material Subsidiaries in respect of any Taxes and there are no matters under discussion, investigation, audit or appeal with any Tax Authority in respect of any of the Issuer or the Material Subsidiaries. The Issuer is not aware of any contingent liability of any of the Issuer or the Material Subsidiaries for Taxes or any grounds that could prompt an assessment or reassessment for Taxes; |

| (jj) | each of the Issuer and the Material Subsidiaries has deducted, withheld, collected and remitted within the time limits required by Applicable Laws all amounts required by Applicable Laws to have been deducted, withheld, collected and remitted in connection with amounts paid or owing to any employee, independent contractor, creditor, shareholder or other third party; |

| (kk) | none of the Issuer or the Material Subsidiaries are party to any agreement, waiver or arrangement with any Tax Authority that relates to any extension of time with respect to the filing of any Tax Return, any payment of Taxes or any assessment; |

| (ll) | no facts, circumstances or events exist or have existed that have resulted in, or may result in, the application of any of sections 15, 17, 67, 78 to 80.04 of the Tax Act (or any similar provision of an Applicable Law of any province or territory of Canada) to any of the Issuer or the Material Subsidiaries; |

| (mm) | none of the Issuer or the Material Subsidiaries are subject to liability for Taxes of any other person. None of the Issuer or the Material Subsidiaries have acquired property from any person in circumstances where any such company could become liable for Taxes of such person. None of the Issuer or the Material Subsidiaries have entered into any agreement with, or provided any undertaking to, any person pursuant to which it has assumed liability for the payment of income Taxes owing by such person; |

| (nn) | none of the Issuer or the Material Subsidiaries has ever been required to file any Tax Return with, and has never been liable to pay any Taxes to, any Tax Authority in any jurisdiction in which it is not currently filing any Tax Returns. No Claim has ever been made by a Tax Authority in a jurisdiction where any of the Issuer or the Material Subsidiaries does not file Tax Returns that the Issuer or the Material Subsidiaries is or may be subject to the imposition of any Tax by that jurisdiction; |

| (oo) | any of the Issuer or the Material Subsidiaries that are required to be registered (i) with the Canada Revenue Agency under Subdivision d of Division V of Part IX of the Excise Tax Act (Canada) for the purposes of goods and services sales tax and the harmonized sales tax (“GST/HST”), or (ii) under any Applicable Law of a province in respect of sales tax are so registered, and any such registration numbers have been provided to the Subscriber. Any input tax credits, rebates and similar refunds claimed by the Issuer or the Material Subsidiaries for GST/HST or provincial sales tax purposes were calculated in accordance with Applicable Laws; |

-

| (pp) | the Issuer and the Material Subsidiaries have complied with all information reporting and record keeping requirements under Applicable Laws, including retention and maintenance of required records with respect thereto; |

| (qq) | neither the Issuer nor any of the Material Subsidiaries have owned any (i) real or immovable property situated in Canada (as defined in the Tax Act), (ii) Canadian resource properties (as defined in the Tax Act), (iii) timber resource properties (as defined in the Tax Act), or (iv) options in respect or, or interests in, or for civil law, a right in, property described in any of (i) to (iii), whether or not the property exists; |

| (rr) | none of the Issuer or the Material Subsidiaries have engaged in any “reportable transaction” as defined in subsection 237.3(1) of the Tax Act or any “notifiable transaction” as defined in proposed subsection 237.4(1) of the Tax Act (as such provisions are proposed to be amended or introduced), as applicable, by the legislative proposals released by the Minister of Finance (Canada) on August 9, 2022; |

| (ss) | all transactions entered into by the Issuer and the Material Subsidiaries have been entered into on an arm’s length basis and the consideration (if any) charged, received or paid by the Issuer or the Material Subsidiaries, as the case may be, on all transactions entered into by it has been equal to the consideration which might have been expected to be charged, received or paid, as applicable, been independent persons dealing at arm’s length and no notice or inquiry by any Tax Authority has been made in connection with any such transactions. The Issuer and the Material Subsidiaries have complied in all material respects with relevant transfer pricing laws (including section 247 of the Tax Act), including preparing contemporaneous documentation and other documents contemplated thereby; |

| (tt) | none of the Issuer or the Material Subsidiaries have applied for, filed for, or otherwise claimed any COVID-19 Relief; |