UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): | October 3, 2023 |

McEWEN MINING INC.

(Exact name of registrant as specified in its charter)

| Colorado | 001-33190 | 84-0796160 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

150 King Street West, Suite 2800 Toronto, Ontario, Canada |

M5H 1J9 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number including area code: | (866) 441-0690 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | MUX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Financial Statements and Exhibits.

On October 3, 2023, McEwen Mining Inc. (the “Company”) issued a press release to report assay results from the Stock Property, part of the Fox Complex near Timmins, Ontario. A copy of that press release is furnished with this report as Exhibit 99.1. Interested parties are encouraged to read the press release in its entirety because it contains important information not summarized herein.

The information furnished under this Item 7.01, including the referenced exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by reference to such filing.

Item 8.01 Other Events

Regarding the Company’s Los Azules copper project in San Juan, Argentina, the Company is also filing this current report on Form 8-K to provide the SEC (as defined below) Regulation S-K 229.1304 Technical Report Summary Initial Assessment Individual Disclosure for the Los Azules Copper Project, Argentina, effective May 9, 2023 (the "2023 TRS”), relating to mineral resources at that project. The 2023 TRS provides, among other things, an update to the mineral resource estimate in the Company's initial assessment included in the SEC Regulation S-K 229.1304 Initial Assessment Individual Disclosure for the Los Azules Copper Project, Argentina, effective April 1, 2021 (the “2021 TRS”), filed as Exhibit 96.2 to the Company's Annual Report on Form 10-K filed by the Company with the Securities and Exchange Commission (the "SEC") on March 7, 2022, and supersedes the 2021 TRS. A copy of the 2023 TRS is filed as Exhibit 96.1 to this report. Interested parties are encouraged to read the 2023 TRS in its entirety because it contains important information not summarized herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are furnished or filed with this report, as applicable:

| Exhibit No. | Description | |

| 96.1 | Technical Report Summary, effective May 9, 2023 | |

| 99.1 | Press release dated October 3, 2023 | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

Cautionary Statement

With the exception of historical matters, the matters discussed in the press release and 2023 TRS attached as exhibits hereto include forward-looking statements within the meaning of applicable securities laws that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained therein. Such forward-looking statements include, among others, statements regarding future production and cost estimates, exploration, development, construction and production activities. Factors that could cause actual results to differ materially from projections or estimates include, among others, future drilling results, metal prices, economic and market conditions, operating costs, receipt of permits, and receipt of working capital, as well as other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and other filings with the United States Securities and Exchange Commission. Most of these factors are beyond the Company’s ability to predict or control. The Company disclaims any obligation to update any forward-looking statement made in the press release and 2023 TRS attached as exhibits hereto, whether as a result of new information, future events, or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| McEWEN MINING INC. | ||

| Date: October 6, 2023 | By: | /s/ Carmen Diges |

| Carmen Diges, General Counsel | ||

Exhibit 96.1

Table of Contents

| 1.0 | EXECUTIVE SUMMARY | 1-1 |

| 1.1 | OWNERSHIP STRUCTURE | 1-9 |

| 1.2 | LOCATION | 1-10 |

| 1.3 | PROPERTY | 1-13 |

| 1.4 | EXPLORATION & DRILLING | 1-15 |

| 1.5 | MINERAL RESOURCE ESTIMATES | 1-15 |

| 1.6 | MINING | 1-16 |

| 1.7 | METALLURGICAL TESTWORK AND RECOVERY METHODS | 1-17 |

| 1.8 | PROJECT ECONOMICS | 1-20 |

| 1.9 | KEY PROJECT RISKS & OPPORTUNITIES | 1-22 |

| 1.10 | QUALIFIED PERSONS RECOMMENDATIONS AND CONCLUSIONS | 1-24 |

| 2.0 | INTRODUCTION | 2-27 |

| 2.1 | 2023 TECHNICAL REPORT SUMMARY (TRS) UPDATE OVERVIEW | 2-27 |

| 2.2 | QUALIFIED PERSONS | 2-28 |

| 2.3 | PERSONAL INSPECTION OF LOS AZULES PROPERTY | 2-29 |

| 3.0 | PROPERTY DESCRIPTION | 3-31 |

| 3.1 | LOCATION | 3-31 |

| 3.2 | PROPERTY AND TITLE IN ARGENTINA | 3-31 |

| 3.3 | OWNERSHIP OF THE LOS AZULES PROJECT | 3-32 |

| 3.4 | ROYALTIES AND RETENTIONS | 3-43 |

| 3.5 | BACK-IN RIGHTS | 3-43 |

| 3.6 | ENVIRONMENTAL LIABILITIES | 3-43 |

| 3.7 | PERMITTING REQUIREMENTS | 3-44 |

| 3.8 | PERMITTING REGULATIONS | 3-44 |

| 3.9 | GLACIER PROTECTION LEGISLATION | 3-46 |

| 3.10 | ENVIRONMENTAL BASELINE STUDIES | 3-46 |

| 4.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 4-48 |

| 4.1 | ACCESSIBILITY | 4-48 |

| 4.2 | SURFACE RIGHTS | 4-48 |

| 4.3 | CLIMATE AND LENGTH OF OPERATING SEASON | 4-48 |

| 4.4 | LOCAL RESOURCES AND INFRASTRUCTURE | 4-51 |

| 4.5 | TOPOGRAPHY, ELEVATION AND VEGETATION | 4-52 |

| 4.6 | AVAILABILITY OF AREA FOR MINE AND PROCESSING FACILITIES | 4-53 |

| 5.0 | HISTORY | 5-54 |

| 5.1 | PROPERTY HISTORY | 5-54 |

|

|

|

|

| 6.0 | GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT | 6-57 |

| 6.1 | REGIONAL GEOLOGY | 6-57 |

| 6.2 | PROPERTY GEOLOGY | 6-60 |

| 6.3 | OTHER MINERALIZATION | 6-64 |

| 6.4 | DEPOSIT TYPES | 6-65 |

| 7.0 | EXPLORATION | 7-68 |

| 7.1 | EXPLORATION HISTORY | 7-68 |

| 7.2 | GEOLOGICAL MAPPING AND STUDIES | 7-68 |

| 7.3 | GEOPHYSICS | 7-68 |

| 7.4 | SURVEYS AND INVESTIGATIONS | 7-73 |

| 7.5 | FUTURE EXPLORATION | 7-74 |

| 7.6 | DRILLING | 7-75 |

| 8.0 | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 8-85 |

| 8.1 | INTRODUCTION | 8-85 |

| 8.2 | SAMPLING METHODS | 8-85 |

| 8.3 | SAMPLE PREPARATION AND ANALYSES | 8-89 |

| 8.4 | CONTROL SAMPLES | 8-92 |

| 8.5 | CONCLUSIONS | 8-99 |

| 9.0 | DATA VERIFICATION | 9-100 |

| 9.1 | DRILL SITE INSPECTION, LOS AZULES PROJECT SITE | 9-100 |

| 9.2 | CORE LOGGING COMPOUND, LOS AZULES PROJECT SITE | 9-101 |

| 9.3 | CORE WAREHOUSE, CALINGASTA | 9-101 |

| 9.4 | ALEX STEWART ASSAY LAB, MENDOZA | 9-102 |

| 9.5 | GLOBAL DATABASE MANAGER, DATABASE CURATOR & EXPLORATION MANAGER, SAN JUAN | 9-102 |

| 9.6 | CRM (RESOURCE ESTIMATION), SAN FRANCISCO | 9-103 |

| 9.7 | MINE TECHNICAL SERVICES (MTS) DATABASE AUDITS | 9-103 |

| 9.8 | GEOLOGICAL MODELLING | 9-103 |

| 10.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 10-104 |

| 10.1 | INTRODUCTION | 10-104 |

| 10.2 | CURRENT METALLURGICAL TESTWORK PROGRAMS | 10-106 |

| 10.3 | NUTON™ TECHNOLOGY TESTING | 10-129 |

| 10.4 | ADEQUACY OF DATA AND USE | 10-132 |

| 11.0 | MINERAL RESOURCE ESTIMATES | 11-133 |

| 11.1 | INTRODUCTION | 11-133 |

| 11.2 | AVAILABLE DATA | 11-137 |

| 11.3 | GEOLOGIC MODEL | 11-137 |

| 11.4 | COMPOSITING | 11-142 |

|

|

|

|

| 11.5 | EXPLORATORY DATA ANALYSIS | 11-142 |

| 11.6 | BULK DENSITY | 11-155 |

| 11.7 | EVALUATION OF OUTLIER GRADES | 11-156 |

| 11.8 | VARIOGRAPHY | 11-158 |

| 11.9 | MODEL SETUP AND LIMITS | 11-161 |

| 11.10 | INTERPOLATION PARAMETERS | 11-161 |

| 11.11 | VALIDATION | 11-162 |

| 11.12 | RESOURCE CLASSIFICATION | 11-168 |

| 11.13 | MINERAL RESOURCES | 11-171 |

| 11.14 | ADEQUACY STATEMENT ON SECTION 11 | 11-179 |

| 12.0 | MINERAL RESERVE ESTIMATES | 12-180 |

| 13.0 | MINING METHODS | 13-181 |

| 13.1 | INTRODUCTION | 13-181 |

| 13.2 | ECONOMIC PIT LIMIT EVALUATIONS | 13-184 |

| 13.3 | MINING PHASES AND PIT DESIGN | 13-193 |

| 13.4 | LOS AZULES MINE PRODUCTION SCHEDULE | 13-203 |

| 13.5 | MINING EQUIPMENT | 13-205 |

| 13.6 | MINE WORKFORCE | 13-208 |

| 13.7 | HYDROGEOLOGY AND PIT DEWATERING | 13-208 |

| 14.0 | PROCESSING AND RECOVERY METHODS | 14-210 |

| 14.1 | INTRODUCTION | 14-210 |

| 14.2 | HEAP LEACH (SX/EW) PROCESS FLOWSHEET | 14-211 |

| 14.3 | ADEQUACY STATEMENT ON SECTION 14 | 14-221 |

| 15.0 | INFRASTRUCTURE | 15-222 |

| 15.1 | INTRODUCTION | 15-222 |

| 15.2 | ACCESS TO LOS AZULES | 15-223 |

| 15.3 | POWER SUPPLY TO LOS AZULES | 15-229 |

| 15.4 | CAMP FACILITIES | 15-230 |

| 15.5 | TRANSPORTATION | 15-232 |

| 15.6 | WATER CONSUMPTION | 15-233 |

| 15.7 | WATER SUPPLY | 15-234 |

| 16.0 | MARKET STUDIES AND CONTRACTS | 16-237 |

| 16.1 | COPPER MARKET OUTLOOK – SUPPLY VS DEMAND | 16-237 |

| 16.2 | COPPER MARKET OUTLOOK - PRICES | 16-238 |

| 16.3 | MINERAL RESOURCE ESTIMATE | 16-240 |

| 16.4 | MARKETING | 16-240 |

| 16.5 | CATHODE OR CONCENTRATE TRANSPORTATION | 16-241 |

| 16.6 | CONTRACTS | 16-241 |

|

|

|

|

| 17.0 | ENVIRONMENTAL STUDIES, PERMITTING AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 17-242 |

| 17.1 | ENVIRONMENTAL BASELINE STUDIES | 17-242 |

| 17.2 | GEOCHEMISTRY | 17-246 |

| 17.3 | ENVIRONMENTAL MANAGEMENT AND MONITORING PLANS | 17-251 |

| 17.4 | PROJECT PERMITTING | 17-252 |

| 17.5 | SOCIAL/COMMUNITY | 17-252 |

| 17.6 | CLOSURE PLANNING | 17-252 |

| 18.0 | CAPITAL AND OPERATING COSTS | 18-259 |

| 18.1 | CAPITAL COST ESTIMATION | 18-259 |

| 18.2 | PROJECT DEVELOPMENT EXECUTION PLAN AND SCHEDULE | 18-262 |

| 18.3 | OPERATING COST ESTIMATION | 18-264 |

| 19.0 | ECONOMIC ANALYSIS | 19-268 |

| 19.1 | CAUTIONARY STATEMENT | 19-268 |

| 19.2 | METHODOLOGY USED | 19-269 |

| 19.3 | FINANCIAL MODEL PARAMETERS | 19-269 |

| 19.4 | ECONOMIC RESULTS | 19-273 |

| 19.5 | SENSITIVITY ANALYSIS | 19-274 |

| 19.6 | MINE LIFE AND CAPITAL PAYBACK | 19-279 |

| 20.0 | ADJACENT PROPERTIES | 20-280 |

| 21.0 | OTHER RELEVANT DATA AND INFORMATION | 21-281 |

| 22.0 | INTERPRETATION AND CONCLUSIONS | 22-282 |

| 22.1 | OVERALL RISKS AND OPPORTUNITIES SUMMARY | 22-282 |

| 22.2 | PHASE 2 UPSIDE POTENTIALS | 22-284 |

| 22.3 | METALLURGY AND MINERAL PROCESSING | 22-289 |

| 22.4 | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 22-291 |

| 22.5 | MINERAL RESOURCE ESTIMATES | 22-292 |

| 22.6 | PIT GEOTECHNICAL | 22-293 |

| 22.7 | MINE PLAN AND MINING METHODS | 22-295 |

| 22.8 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 22-296 |

| 22.9 | PIT DEWATERING AND WATER AVAILABILITY | 22-296 |

| 22.10 | MINE ROCK STORAGE FACILITIES | 22-297 |

| 23.0 | RECOMMENDATIONS | 23-299 |

| 23.1 | OVERALL RECOMMENDATIONS | 23-299 |

| 23.2 | METALLURGY AND MINERAL PROCESSING | 23-301 |

| 23.3 | PIT GEOTECHNICAL | 23-302 |

| 23.4 | PIT DEWATERING AND WATER AVAILABILITY | 23-303 |

| 23.5 | MINE ROCK STORAGE FACILITIES | 23-304 |

|

|

|

|

| 24.0 | REFERENCES | 24-305 |

| 25.0 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT | 25-309 |

| 26.0 | APPENDICES | 26-310 |

| 26.1 | APPENDIX A – UNITS OF MEASURE AND ABBREVIATIONS AND ACRONYMS | 26-310 |

|

|

|

|

List of Tables

| Table 1.1: Project Phase 1 Life of Mine Economic Summary (After Taxes) | 1-2 |

| Table 1.2: Exploration Drilling by Year and by Company | 1-15 |

| Table 1.3: Mineral Resource Summary | 1-16 |

| Table 1.4: Initial Capital Costs by Case | 1-20 |

| Table 1.5: Life of Mine Operating Cost Summary | 1-20 |

| Table 1.6: Project Economic Summary by Case | 1-21 |

| Table 1.7: Average First 8 Years and LOM Cash Costs* | 1-22 |

| Table 1.8: Expected Costs for Feasibility Study Development | 1-26 |

| Table 2.1: Summary of Qualified Persons | 2-29 |

| Table 3.1: Andes Corporación Minera S.A. - Mining Right Descriptions | 3-37 |

| Table 7.1: Exploration Drilling by Year and by Company | 7-75 |

| Table 7.2: Examples of Significant Drilling Results Prior to 2022 | 7-79 |

| Table 7.3: Examples of Significant Copper, Gold and Silver Drilling Results From 2022 Campaign | 7-82 |

| Table 10.1: Event Timings and Associated Lithologies | 10-109 |

| Table 10.2: Event Timings and Material Types in the Ultimate Pit | 10-110 |

| Table 10.3: Event Timings and Material Types in 5 Year Pit | 10-110 |

| Table 10.4: Oxide/LIX Head Assays | 10-112 |

| Table 10.5: Supergene Head Assays | 10-112 |

| Table 10.6: Primary Head Assays | 10-114 |

| Table 10.7: Supergene Bottle Roll Results | 10-115 |

| Table 10.8: Primary Bottle Roll Results | 10-116 |

| Table 10.9: Column Head Assays | 10-118 |

| Table 10.10: Material Shipped to Hazen to undergo Nuton Testing | 10-129 |

| Table 10.11: Bundoora Column Test Matrix | 10-131 |

| Table 10.12: Hazen Column Test Matrix | 10-131 |

| Table 11.1: Indicated Resources for the Los Azules Project | 11-136 |

| Table 11.2: Inferred Resources for the Los Azules Project | 11-136 |

| Table 11.3: Chronological Geological Events used in Model Construction | 11-138 |

|

|

|

|

| Table 11.4: Sequence of Alteration Effecting the Los Azules Deposit | 11-140 |

| Table 11.5: Mineral Zonation Criteria | 11-141 |

| Table 11.6: Geologic Events Altering and Effecting the Los Azules Deposit | 11-141 |

| Table 11.7: Total Copper Statistics by Location and Mineral Zone | 11-147 |

| Table 11.8: Total Copper Statistics by Lithology and Sector | 11-147 |

| Table 11.9: Basic Statistics – CuCN by Mineral Zone | 11-152 |

| Table 11.10: Basic Statistics for Gold Grades by Mineral Zone | 11-154 |

| Table 11.11: Basic Statistics for Silver Grades by Mineral Zone | 11-155 |

| Table 11.12: Basic statistics of Density by Mineral Zone | 11-155 |

| Table 11.13: Potential Effect of Capping on Copper, Gold, and Silver Content | 11-157 |

| Table 11.14: Variogram Model Parameters for Copper, Gold, and Silver | 11-160 |

| Table 11.15: Block Model Origin and Dimensions | 11-161 |

| Table 11.16: Search Strategy for Copper Estimation, Pass 1 to 3 | 11-161 |

| Table 11.17: Search Strategy for Copper Estimation, Pass 4 to 6 | 11-162 |

| Table 11.18: Comparison of Resource and NN Estimates in The Block Model | 11-164 |

| Table 11.19: 2017 Estimate of Los Azules Mineral Resources | 11-171 |

| Table 11.20: NSR Parameters for Leach Recovery | 11-172 |

| Table 11.21: NSR Parameters for Mill/Flotation Process | 11-173 |

| Table 11.22: Open Pit Design Parameters | 11-175 |

| Table 11.23: Indicated Resources for the Los Azules Project | 11-176 |

| Table 11.24: Inferred Resources for the Los Azules Project | 11-176 |

| Table 11.25: Inferred Material under the Cryogenic Geoforms | 11-176 |

| Table 13.1: Heap-Leach Net Smelter Return Inputs for the Preliminary Economic Assessment Mine Plan | 13-185 |

| Table 13.2: Overall Suggested IA Pit Slope Angles, by Overall Pit Depth | 13-188 |

| Table 13.3: Pit Optimization Input Parameters | 13-190 |

| Table 13.4: In-situ Pit Quantities by Resource Classification | 13-194 |

| Table 13.5: Pit Quantities by Phase | 13-202 |

| Table 13.6: MRSF Parameters | 13-205 |

| Table 13.7: Annual Mine Equipment Productive Hours | 13-206 |

|

|

|

|

| Table 13.8: MS Haulage Inputs | 13-206 |

| Table 13.9: Mine Labor | 13-208 |

| Table 14.1: Potential Process Materials Distribution – Leach Only Pit Shell | 14-211 |

| Table 14.2: General Design Criteria | 14-215 |

| Table 14.3: Average Leach Cycle Times | 14-215 |

| Table 14.4: Base Case Leach Pad Plan and Estimated Copper Production – Year 1 through Year 18 | 14-219 |

| Table 14.5: Projected Process Facilities Average Electric Power Usage | 14-221 |

| Table 15.1: Southern Access Road Upgrade Estimate (RyAC, 2023) | 15-229 |

| Table 15.2: Projected Camp Staffing Requirements | 15-231 |

| Table 15.3: Life of Mine Average Water Consumption by Case | 15-234 |

| Table 15.4: Estimated water supply by source | 15-235 |

| Table 17.1: Summary of future environmental and social work plan | 17-245 |

| Table 17.2: Water Quality Standards from Decree 1.426 Law 24.585 | 17-247 |

| Table 17.3: Project Facilities | 17-253 |

| Table 18.1: Initial Capital Costs | 18-259 |

| Table 18.2: Base Case Sustaining Capital Plan | 18-261 |

| Table 18.3: Life of Mine Operating Cost Summary | 18-264 |

| Table 18.4: Mine Operating Costs 175ktpa Base Case | 18-265 |

| Table 18.5: Mine Operating Costs 125ktpa Alternative Case | 18-265 |

| Table 18.6: Life of Mine Operating Cost Summary | 18-266 |

| Table 18.7: Consolidated G&A (San Juan, Calingasta, Los Azules Site) | 18-267 |

| Table 19.1: Common Model Inputs | 19-269 |

| Table 19.2: Life of Mine Capital Cost Summary ($000s) | 19-270 |

| Table 19.3: Life of Mine Operating Cost Summary | 19-271 |

| Table 19.4: Project Economic Summary | 19-273 |

| Table 19.5: Copper Price Sensitivity | 19-274 |

| Table 19.6: CAPEX Sensitivity (Initial + Sustaining) | 19-276 |

| Table 19.7: OPEX Sensitivity | 19-277 |

| Table 22.1: Nuton Opportunity Capital Cost Summary for 35Mtpa Case | 22-285 |

|

|

|

|

| Table 22.2: Nuton Opportunity Operating Cost Summary for 35Mpta case | 22-285 |

| Table 22.3: Nuton™ Opportunity Economic Summaries | 22-286 |

| Table 22.4: Copper Concentrator Opportunity Capital Cost Summary | 22-287 |

| Table 22.5: Life of Mine Leach/Mill OPEX ($/t processed) | 22-288 |

| Table 22.6: Copper Concentrator Opportunity Economic Summary | 22-289 |

| Table 23.1: Expected Costs for Feasibility Study Development | 23-301 |

| Table 26.1: Units of Measure | 26-310 |

| Table 26.2: Abbreviations and Acronyms | 26-313 |

|

|

|

|

List of Figures

| Figure 1.1: C1 Cash Costs by Current Producer and Selected Development Projects | 1-3 |

| Figure 1.2: Estimated Carbon Intensity vs Copper Equivalent Production Centiles 2022-2040 (Scope 1 & 2 Emissions) - Wood Mackenzie 2022 | 1-9 |

| Figure 1.3: Location of Los Azules in the High Andes (Hatch, 2017) | 1-10 |

| Figure 1.4: Overall Site Plan (Samuel, 2023) | 1-12 |

| Figure 1.5: Los Azules Project Property Limits (V&G Report, 2023) | 1-14 |

| Figure 1.6: Simplified Process Flowsheet (Samuel, 2023) | 1-19 |

| Figure 3.1: Los Azules Ownership Structure (McEwen Mining, 2023) | 3-35 |

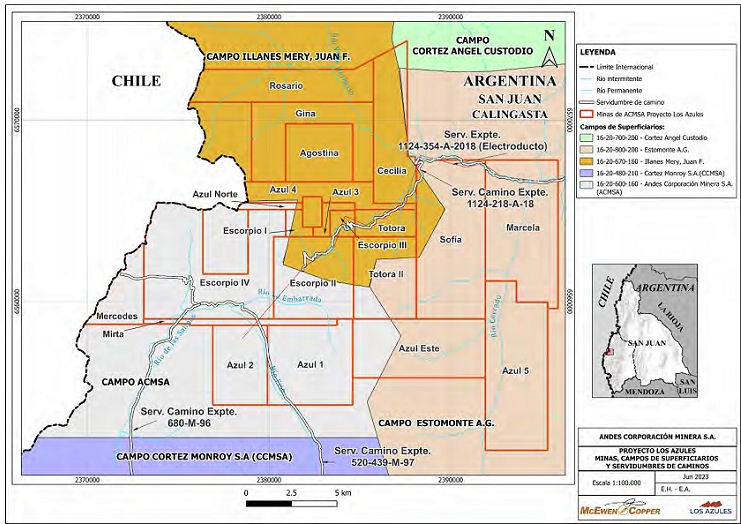

| Figure 3.2: Map of Mineral Claims (Minas), Easements (Servidumbres) and Surface (Superficie) Ownership (Vargas & Galindez/McEwen 2022) | 3-39 |

| Figure 3.3: ACMSA Owned Propiedad Minera (Mining Rights) and Campo Superficiario (Surface Rights) (McEwen, 2022) | 3-41 |

| Figure 3.4: Map of mineral concessions and surface rights (campos) within or adjacent to project area (Vargas & Galindez/McEwen, 2022) | 3-42 |

| Figure 4.1: Monthly Temperature Data Apr-17-Jun-18, Nov-19 (McEwen 2022) | 4-49 |

| Figure 4.2: Monthly Total Precipitation Data – no data recorded Apr-17-Jun-18, Nov-19 (McEwen 2022) | 4-50 |

| Figure 4.3: Monthly Wind Speed Data – no data recorded Apr-17-Jun-18, Nov-19 (McEwen 2022) | 4-51 |

| Figure 6.1: Physiographic features of San Juan Province, Argentina (Rojas 2010) | 6-58 |

| Figure 6.2: Regional geology of the Andean Cordillera of Argentina and Chile (Rojas 2010) | 6-59 |

| Figure 6.3: Model for Los Azules (pink: potassic alteration, green: chloritic alteration, blue: sericitic alteration, yellow: advanced argillic lithocap), (Sillitoe, 2014) | 6-61 |

| Figure 6.4: Early Mineralized Porphyry (magenta) with supergene enrichment zone (red) defined as the Soluble Cu ratio >50%. (McEwen Copper, 2022) | 6-63 |

| Figure 6.5: Kinematic structural interpretation of Los Azules porphyry copper deposit (Pratt 2010) | 6-64 |

| Figure 6.6: Part of the Central Chile Segment of the Miocene-early Pliocene Porphyry Copper Belt (Rojas 2008) | 6-66 |

| Figure 6.7: Diagram Showing Spatial Relationships between a Porphyry Copper System and the Surrounding Environment (Sillitoe 2010) | 6-67 |

|

|

|

|

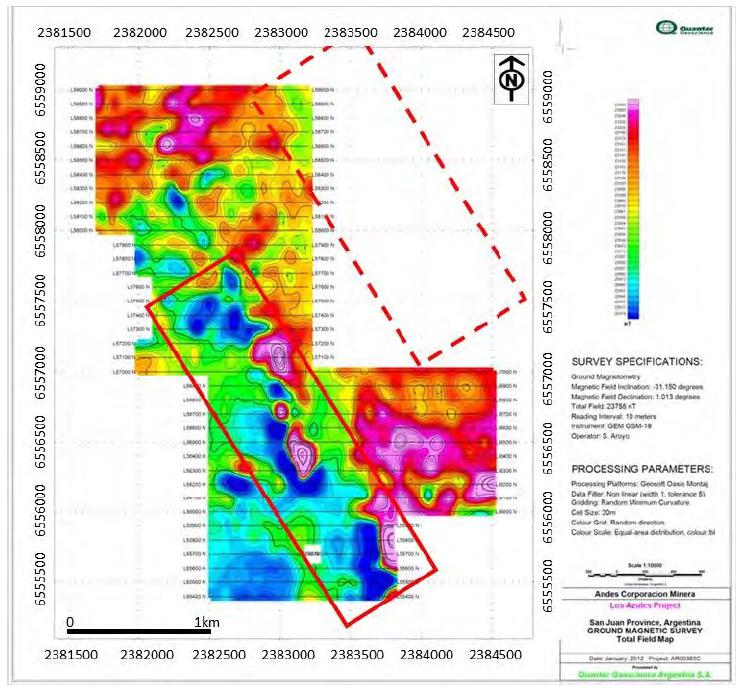

| Figure 7.1: Magnetic Map of Los Azules (Reduced to Pole) and IP lines. (Rojas, 2008 after Xstrata, 2003). Note: Red box indicates the mag low across the Ballena Ridge | 7-70 |

| Figure 7.2: Section 58,400N Showing 2D IP Inversion Anomaly (Southwest Target) (McEwen 2012) | 7-72 |

| Figure 7.3: Total Magnetic Field Map of Los Azules. (Quantec, 2012). Note: Dashed red box indicates the mag low across the Ballena Ridge seen above in Figure 7.1 – the solid red box indicates the discontinuous mag low to the southwest | 7-73 |

| Figure 7.4: Plan Showing Locations of drill holes at Los Azules (CRM 2022) | 7-76 |

| Figure 7.5: Logging and inspection of drill core | 7-77 |

| Figure 7.6: Geotechnical logging and data collection | 7-78 |

| Figure 8.1: Dedicated static photo booth for consistent photography of core | 8-86 |

| Figure 8.2: An example of the labelling of core boxes for photography | 8-86 |

| Figure 8.3: The securing and loading of the core boxes for shipment to Calingasta | 8-87 |

| Figure 8.4: The hyperspectral scanning unit and the hydraulic core splitter | 8-87 |

| Figure 8.5: Showing the sequence of bagging, tagging, sealing, and securing the samples for dispatch | 8-88 |

| Figure 8.6: Total Copper Assays vs Re-Assays | 8-90 |

| Figure 8.7: Cyanide Soluble Copper Assays vs Re-Assays | 8-91 |

| Figure 8.8: Diagnostic charts for standards used at Los Azules 2007-2022 | 8-95 |

| Figure 8.9: Control charts for the blanks at Los Azules 2004-2022 | 8-97 |

| Figure 8.10: QQ plots for core duplicates 2012-2022 | 8-98 |

| Figure 8.11: QQ plot for the pulp duplicates in the 2022 campaign | 8-99 |

| Figure 9.1: Transferring Core to Core Box | 9-100 |

| Figure 9.2: Drill Pad Preparation | 9-101 |

| Figure 9.3: Core storage racks at Calingasta | 9-102 |

| Figure 10.1: Spatial Representation of Phase 1 Metallurgical Samples in the 5 Year Pit (SE, 2023) | 10-107 |

| Figure 10.2: Spatial Representation of Phase 1 Metallurgical Samples in the Ultimate Pit (SE, 2023) | 10-108 |

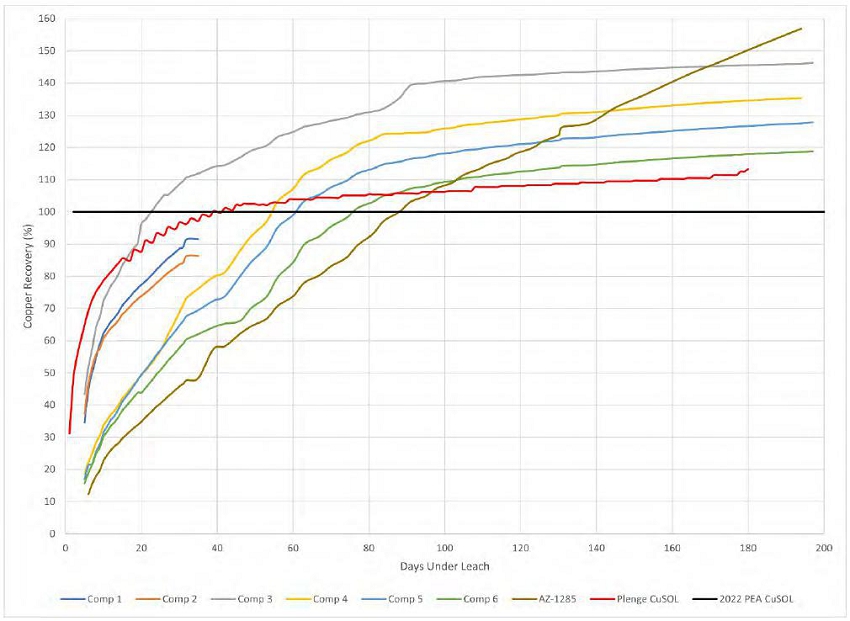

| Figure 10.3: 19 mm Supergene Column Soluble Copper Recovery | 10-120 |

| Figure 10.4: 12.7 mm Supergene Column Soluble Copper Recovery | 10-121 |

|

|

|

|

| Figure 10.5: 19 mm Supergene Column Total Copper Recovery | 10-122 |

| Figure 10.6: 12.7 mm Supergene Column Total Copper Recovery | 10-123 |

| Figure 10.7: 19 mm Column Gross Acid Consumption | 10-124 |

| Figure 10.8: 12.7 mm Column Gross Acid Consumption | 10-125 |

| Figure 10.9: 19 mm pH | 10-126 |

| Figure 10.10: 12.7 mm pH | 10-127 |

| Figure 11.1: Drill Hole Location Map | 11-137 |

| Figure 11.2: Plan view of the lithology model under construction | 11-139 |

| Figure 11.3: Oblique section view of the completed lithological model looking North | 11-140 |

| Figure 11.4: Plan Map of Drilling Showing Location of Central Structure | 11-143 |

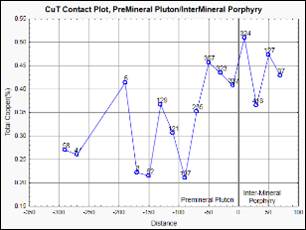

| Figure 11.5: Relationship Between Composite Copper Grades and Structure | 11-144 |

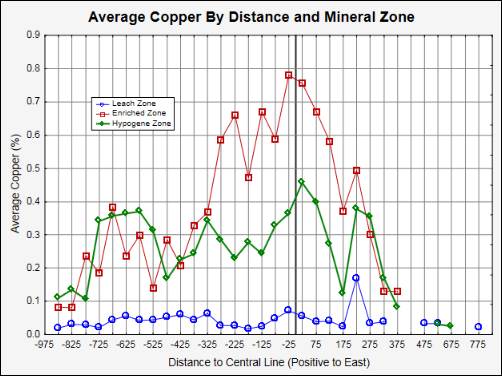

| Figure 11.6: Average Copper by Distance and Mineral Zone | 11-145 |

| Figure 11.7: Average Copper by Mineral Zone, Lithology and Distance | 11-146 |

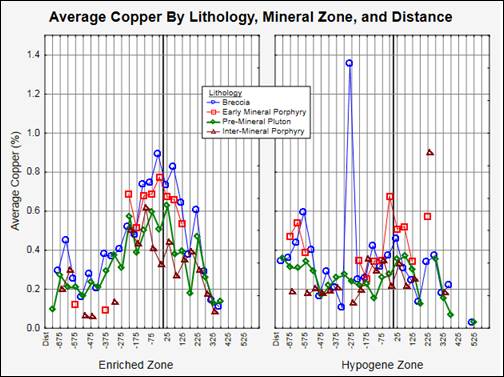

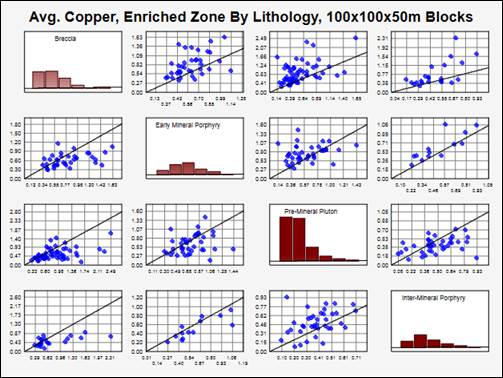

| Figure 11.8: Cross Contact Composite Comparison | 11-149 |

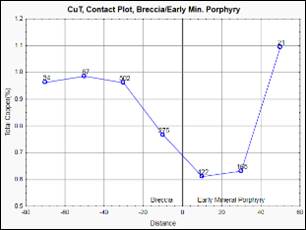

| Figure 11.9: Detailed Cross Contact Composite Grade / Distance Analysis | 11-150 |

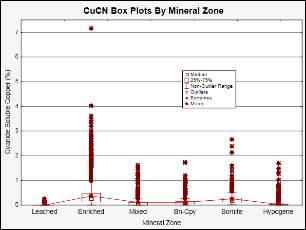

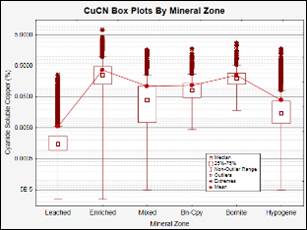

| Figure 11.10: Box Plots of CuCN by Mineral Zone | 11-151 |

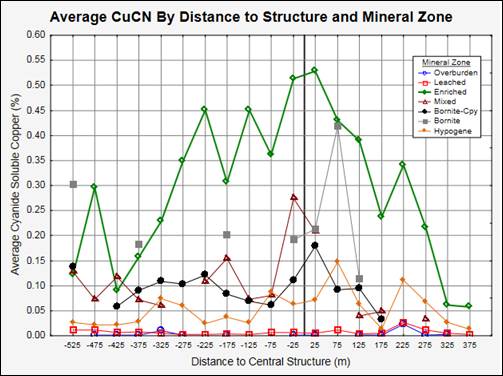

| Figure 11.11: Average CuCN grades by Distance from Central Structure | 11-151 |

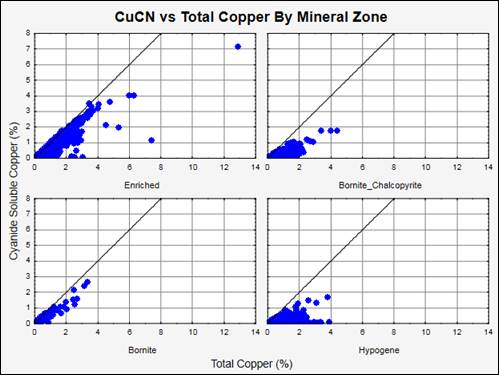

| Figure 11.12: Scatter plots of Total Copper VS Cyanide Soluble Copper | 11-152 |

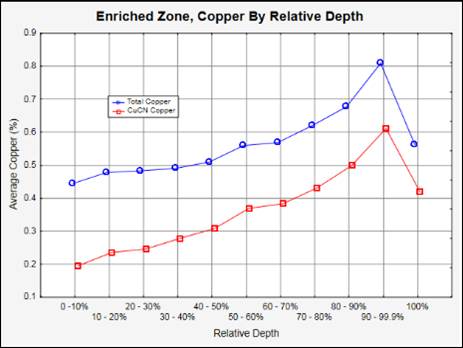

| Figure 11.13: Graph Showing Relationship Between Copper Grades and Depth | 11-153 |

| Figure 11.14: Scatter plots of Precious Metals vs Total Copper | 11-154 |

| Figure 11.15: Experimental Data and Modeled Variogram | 11-159 |

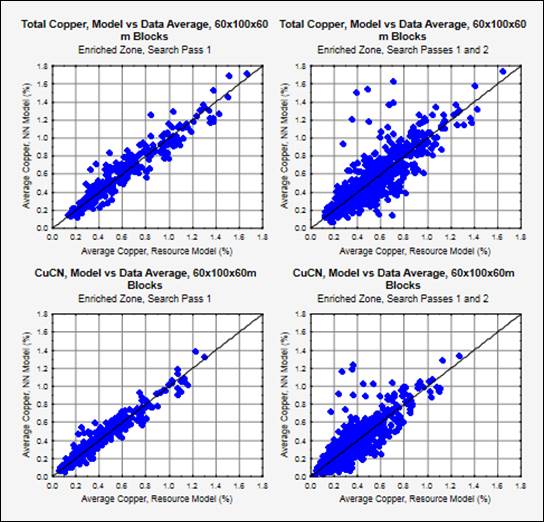

| Figure 11.16: Scatter Plots of Large Block Comparison of Samples VS Model Grades | 11-165 |

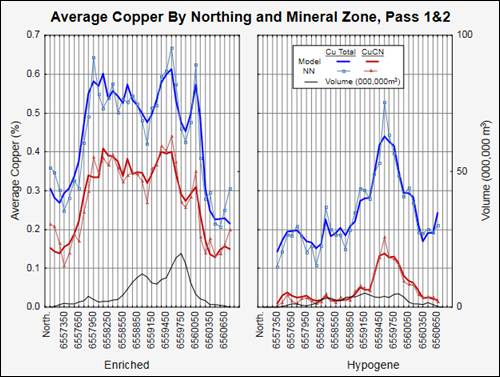

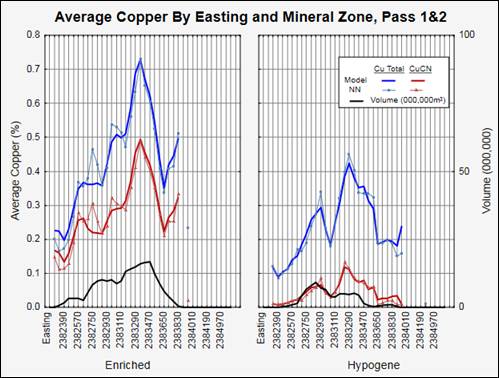

| Figure 11.17: East-West Swath Plots of Total and Cyanide Soluble Copper Grades in the NN Model | 11-166 |

| Figure 11.18: North-South Swath Plots of Total and Cyanide Soluble Copper Grades in the NN Model | 11-167 |

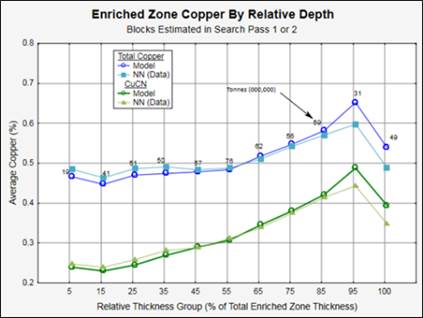

| Figure 11.19: Total and Cyanide Soluble Copper Related to Depth from the Top of the Enriched Zone | 11-168 |

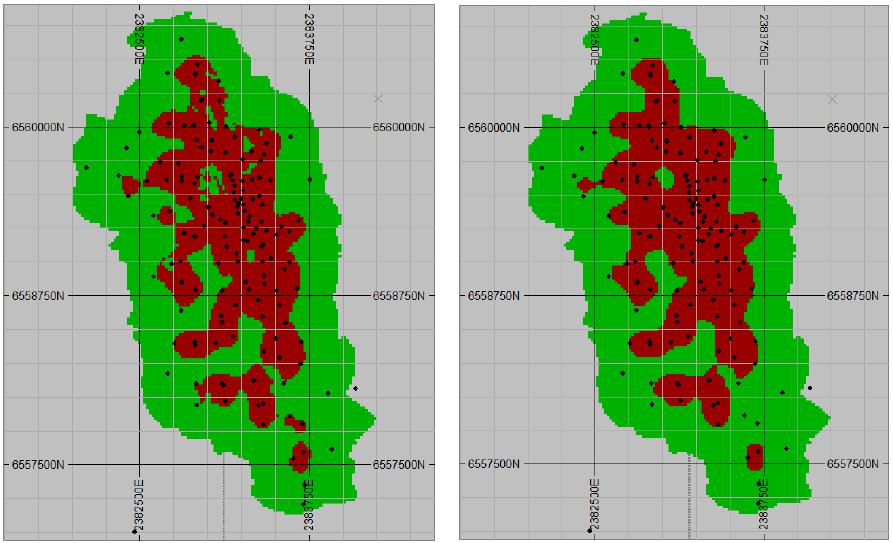

| Figure 11.20: Comparison of Indicated and Inferred limits before and after Smoothing | 11-170 |

| Figure 11.21: Plan View of the Resource Pit with Geoforms Outlines | 11-171 |

| Figure 11.22: Plan View of the Resource Pits with Slope Angles | 11-175 |

|

|

|

|

| Figure 11.23: Grade / Tonnage Curves for Leach NSR | 11-178 |

| Figure 11.24: Grade / Tonnage Curves for Mill NSR | 11-179 |

| Figure 13.1: Long Section through the Los Azules Mineralization Looking East – with Mining Phase Outlines | 13-182 |

| Figure 13.2: Cross Section through the Los Azules Mineralization Looking North West– with Mining Phase Outlines | 13-183 |

| Figure 13.3: Cryogenic Landform Locations on the Los Azules Property, with 50 m Topography Contours | 13-186 |

| Figure 13.4: Factor of Safety with Slope Angle and Pit Depth | 13-187 |

| Figure 13.5: Slope Zones for ultimate selected pit shell | 13-189 |

| Figure 13.6: Pit-by-Pit graph Economic Pit Optimization for the 175 ktpa production case | 13-192 |

| Figure 13.7: Pit Area Prior to Mining, with 50 m Topography Contours | 13-195 |

| Figure 13.8: Largest Selected Leach Only Pit, with 50 m Topography Contours | 13-196 |

| Figure 13.9: Cross Section Plan | 13-198 |

| Figure 13.10: Cross Section 1 with Pit Phasing and Leach NSR Values | 13-199 |

| Figure 13.11: Cross Section 2 with Pit Phasing and Leach NSR Values | 13-200 |

| Figure 13.12: Cross Section 3 with Pit Phasing and Leach NSR Values | 13-201 |

| Figure 13.13: Los Azules Mine Production Schedule | 13-204 |

| Figure 13.14: Fleet Size for the Primary Mining Fleet | 13-207 |

| Figure 14.1: Heap Leach Process Flowsheet | 14-212 |

| Figure 14.2: Heap Leach Pad General Layout | 14-217 |

| Figure 14.3: PLS Collection | 14-218 |

| Figure 15.1: Regional Infrastructure (Google Earth 2022) | 15-223 |

| Figure 15.2: Existing Access & Infrastructure (ACMSA, 2022) | 15-224 |

| Figure 15.3: Access Roads Photos (McEwen, 2023) | 15-225 |

| Figure 15.4: Site Access Road Profiles (McEwen) | 15-227 |

| Figure 15.5: Southern Access Road Route & Design Basis Sections (RyAC, 2023) | 15-228 |

| Figure 15.6: Mine Camp Concept - Isometric view showing Solar Arc | 15-231 |

| Figure 15.7: Mine Camp Concept - Oblique View | 15-232 |

| Figure 15.8: The Rio Salinas at the Proposed Campsite | 15-236 |

|

|

|

|

| Figure 16.1: Future Copper Market Demand Scenarios (from S&P Global) | 16-238 |

| Figure 16.2: Long-term Copper Pricing (CIBC, May 2023) | 16-239 |

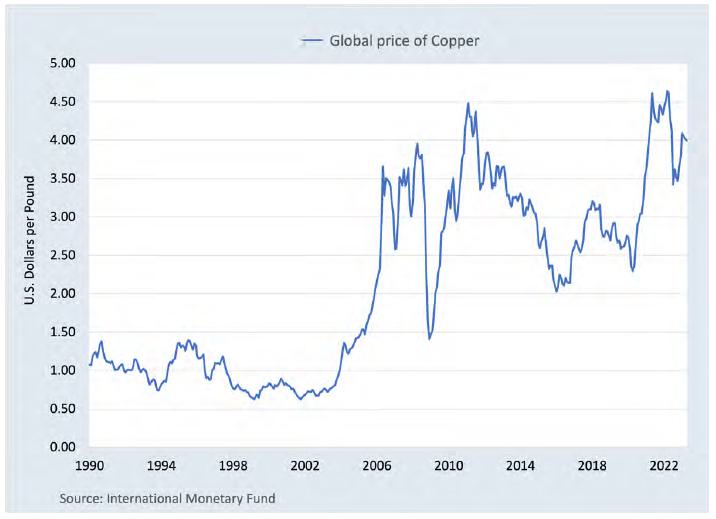

| Figure 16.3: Copper Prices 1990 to Present (source: International Monetary Fund) | 16-240 |

| Figure 18.1: Conceptual Project Execution Schedule | 18-263 |

| Figure 18.2: Mine Operating Cost Breakdown | 18-265 |

| Figure 19.1: LOM Operating Costs per Tonne Mineralized Material (Samuel Engineering 2023) | 19-271 |

| Figure 19.2: Copper Price per Pound Sensitivity on NPV @ 8% (Pre-tax, 175k Cu Case) (Samuel Engineering 2023) | 19-275 |

| Figure 19.3: Copper Price per Pound Sensitivity on IRR (Pre-tax) (Samuel Engineering 2023) | 19-276 |

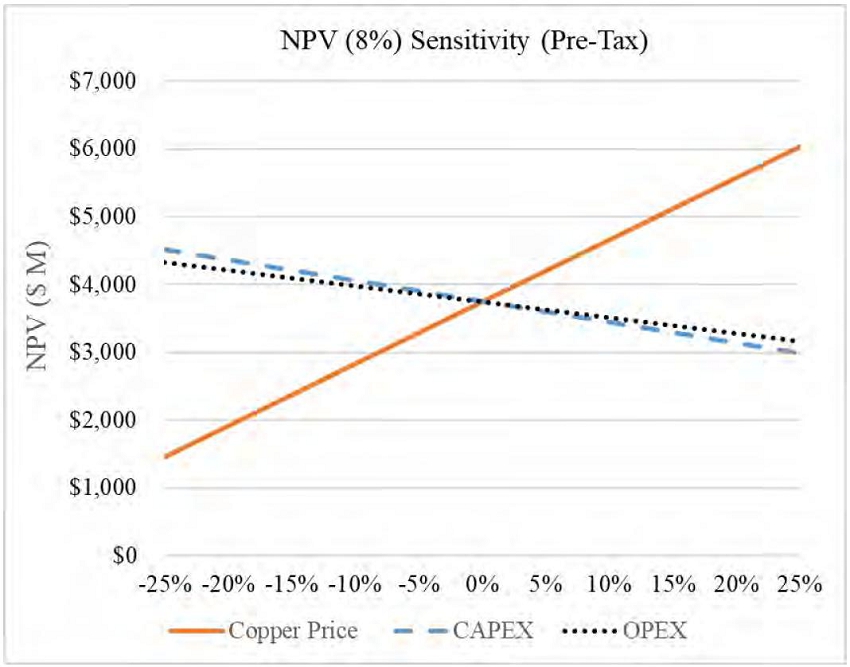

| Figure 19.4: Multiple % Sensitivity on NPV @ 8% (Pre-tax) (Samuel Engineering 2023) | 19-277 |

| Figure 19.5: Multiple % Sensitivity on NPV @ 8% (Post-tax) (Samuel Engineering 2023) | 19-278 |

| Figure 19.6: Multiple % Sensitivity on IRR (Pre-tax) (Samuel Engineering 2023) | 19-279 |

| Figure 20.1: Regional Adjacent Properties | 20-280 |

| Figure 23.1: Feasibility Study Development Timeline | 23-300 |

|

|

|

|

| 1.0 | EXECUTIVE SUMMARY |

The Los Azules Project is among the largest undeveloped copper deposits on the globe. Los Azules presents a multi-generational opportunity to design, build and operate a copper mine that is globally significant, technologically advanced, embraces regenerative design principles, and minimizes carbon footprint.

This report is a Technical Report Summary (TRS) which summarizes the findings of the Preliminary Study completed for the Los Azules Project in accordance with The United States Securities Exchange Commission (SEC) 17 CFR Part §229.1300 (S-K 1300) Standard Instructions for Regulation S-K subpart 1300 SEC S-K §229. 1304 and §229.601(b)(96). This TRS is intended to meet the requirements of S-K 1300 as considered for an Initial Assessment (IA) level of study and disclosure as defined in the regulations and supporting reference documents. The purpose of this TRS is to report the study results, updated mineral resources, additional technical work completed, and the subject project estimated costs and economic potential. The effective date of this report is May 9, 2023, concurrent with the updated final resource estimates published herein.

This TRS supersedes the current report on file titled: SEC S-K 229.1304 INITIAL ASSESSMENT INDIVIDUAL DISCLOSURE FOR THE LOS AZULES PROJECT, ARGENTINA, prepared by Mining Plus US Corporation with an effective date of April 01, 2021 (report revision date of February 25, 2022).

All currency shown in this report is expressed in May 2023 United States Dollars unless otherwise noted. Metric units of measure are used unless otherwise specified.

This Technical Report Summary is prepared for McEwen Mining Inc. (McEwen Mining) trading under the symbol NYSE/TSX: MUX for the purposes of disclosing current updates and information related to its 51.9% owned subsidiary McEwen Copper Inc. (McEwen Copper), which controls the Los Azules copper property located in Argentina. Los Azules is an exploration and development project presently consisting of a large porphyry copper deposit located in the Andes Cordilleran region of San Juan Province, Argentina near the border with Chile (the “Project”).

The Project is at the exploration stage of investigation; consequently, this study is preliminary in nature and includes Inferred mineral resources in one of the conceptual mine plans and mine production schedules presented. Inferred mineral resources are considered too speculative geologically and in other technical aspects to enable them to be categorized as mineral reserves under the standards set forth in S-K 1300. There is no certainty that the estimates in this IA will be realized.

McEwen Mining is obligated to report material information pursuant to its dual listings on the New York Stock Exchange (NYSE) and Toronto Stock Exchange (TSX). A corresponding Technical Report was also completed in accordance with Canadian National Instrument 43-101 (NI 43-101) based on the same information and data. Information related to the project described under the NI 43-101 reporting rules is included in this report for clarity and to avoid confusion between reports. Two open pit based mine plans were developed and are described in this TRS; one includes only material classified as Measured & Indicated Resources as required by S-K 1300 and a second mine plan including inferred resources within the pit comparable to what is reported in the corresponding NI 43-101 report.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

This 2023 IA incorporates an updated development strategy with the following two phases: Phase 1 considers mining and processing resources associated with the oxide and supergene copper mineralization in the near surface portion of the deposit using heap leaching methods. Phase 2 of the project considers the continued development of the deposit’s primary copper mineralization found beneath the supergene copper layer. The focus of this 2023 IA is the initial Phase 1 project with limited concepts presented for Phase 2. For clarity, the economic outcomes for the cases presented in this report include only Phase 1.

The Phase 1 implementation scheme for the Project is an open pit mine initially processing materials with crushing, bio-heap leaching and solvent extraction and electrowinning (SX/EW) facilities to produce LME Grade A copper cathodes for sale in Argentina or for export. Phase 1 preliminary mining plans excluding Inferred Mineral Resources extract a total of 8.2 billion pounds (3,732 ktonnes) of contained copper from the Measured & Indicated resources, of which 6.0 billion lbs. (2,721 ktonnes) is recoverable to copper cathodes. The total copper recovery expected is approximately 73% and considers scale-up efficiencies and production distribution over a two-year timeframe from placement of material on the leach pad.

Based on consensus estimates and independent analysis, long-term metal pricing used in this report (except for mineral resource estimation) and project economic analysis are Copper (Cu) - $3.75/pound; Gold (Au) - $1,700/ounce; and Silver (Ag) - $20.00/ounce. The 2023 updated financial outcomes for the Phase 1 initial project mine and facilities are shown in Table 1.1 below (expressed in Q1 2023 United States Dollars, after taxes).

| Table 1.1: Project Phase 1 Life of Mine Economic Summary (After Taxes) | |||

| Project Metric | Units |

Base Case |

NI 43-101 |

| Mine Life (including stockpile) | Yr | 17 | 27 |

| Strip Ratio | 1.29 | 1.16 | |

| Copper Production – cathode Cu | ktonnes | 2,721 | 3,938 |

| Initial Capital Cost | USD Millions | $2,448 | $2,462 |

| Sustaining Capital Cost | USD Millions | $1,878 | $2,243 |

| C1 Costs (Life of Mine) | USD/lb Cu | $0.93 | $1.07 |

| All-in Sustaining Costs (AISC) | USD/lb Cu | $1.54 | $1.64 |

| Internal Rate of Return (IRR) | % | 21.5% | 21.2% |

| Net Present Value (NPV) @ 8% | USD Millions | $2,234 | $2,659 |

| Pay Back Period | Yr | 3.4 | 3.2 |

C1 cash costs are defined as the cash cost incurred at each processing stage, from mining through to recoverable copper delivered to the market, net of any by-product credits. C1 cash costs per pound of copper produced and all-in sustaining costs per pound of copper produced are non-GAAP ratios. If it were in production today, the average C1 cash costs at Los Azules would be in the lowest cost quartile among copper producers. Figure 1.1 shows global cost data from S&P Capital IQ and SE showing how the Los Azules Base Case and Alternative Case average C1 cash costs compare to producing copper mines in 2022.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

(Source: S&P Capital IQ Mine Economics Market Intelligence 2022 Data, SE Analysis)

Figure 1.1: C1 Cash Costs by Current Producer and Selected Development Projects

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

The opportunity to process primary sulfides directly through a heap leach rather than building a traditional copper concentrator in the future is the envisioned approach to the Los Azules development plan. The primary sulfides are currently not considered economically suitable for commercial heap leaching operation.

Continuing the benefits of a hydrometallurgical approach is the preferred path of the project for Phase 2, along with ongoing development work efforts. Metallurgical work evaluating NutonTM bio-leaching technology is being developed to potentially replace the need for a future milling operation in favor of continued leaching and copper cathode production for the life of the mining operations. Potential scenarios for the future operations employing the NutonTM bio-leaching technology are presented and discussed in Section 22.2.1 of this report.

Although Nuton LLC, a Rio Tinto Venture, has completed larger scale testing at several global project sites and has developed proprietary modeling techniques to predict results, there are no commercial applications of the Nuton™ technology operating at the time of this report. Based on preliminary small-scale testing by Nuton and economic modeling inputs, these options provide the opportunity to extend the mine life to more than 50 years in some instances and increasing copper produced by more than 30% while adding significant additional value at lower LOM operating costs.

A significant testing program will be required to validate these preliminary estimates; therefore, these results are not considered suitable for inclusion at this time in the initial project phase cases presented and are only included as a demonstration of the potential future opportunity.

A conventional mill and flotation/concentrator option was considered to process primary copper mineralization to demonstrate economic viability employing conventional methods and support reserves estimation confidence. Details for this option can be found in Section 22.2.2.

The next steps for the Los Azules Project are continuing with infill resource drilling, variability and confirmatory metallurgical testing, environmental baseline studies, and commencing critical preliminary engineering such as hydrogeologic field investigations and geotechnical drilling at the heap leach pad site, tailings dam site and within the pit wall slopes to support a feasibility study.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

A NEW VISION AND APPROACH

Copper is a key ingredient in the solutions to global climate change, including initiatives in the automotive sector as the industry transitions to electric cars and the energy sector as it moves to more renewable forms. Los Azules aspires to be the world’s first Regenerative Copper Mine, providing valuable materials for a renewably powered world.

Guiding regenerative principles were developed to reframe the approach to sustainable innovation within the mining industry and set forth high-reaching goals that are being explored for all facets of the mining processes considered for Los Azules. The project development seeks to significantly reduce the environmental footprint of mining operations and their associated greenhouse gas emissions by integrating the latest renewable and environmentally responsible technologies and processes. The project aims to obtain 100% of its energy from renewable sources (wind, hydro, and solar) in a combination of offsite and onsite installations. Where possible, the project is also seeking to have long-term net positive impacts on the greater Andean ecosystem, the lives of miners, and the citizens of nearby communities, while contributing positively to the local and national economy of Argentina.

The project concepts allow for early adoption of emerging technologies under development and are anticipated to be commercially viable over the mine life. By being ‘future ready’ the project will be poised to adopt newly emerging technologies and infrastructure opportunities

Key project initiatives aimed at achieving these goals are described below.

Respecting the Lands We Use

The Los Azules Project is committed to responsible stewardship of the land and minimizing disturbance of local glacial morphologies and wetlands (“vegas” in the local terminology) wherever possible. Careful consideration of how activities are conducted and where they are located is a key aspect to meeting these commitments, both in the short and long term. Minimizing land use and disturbance by consolidating uses to the extent possible is considered in the site layouts, individual site areas, facilities/buildings, and access to the mine site.

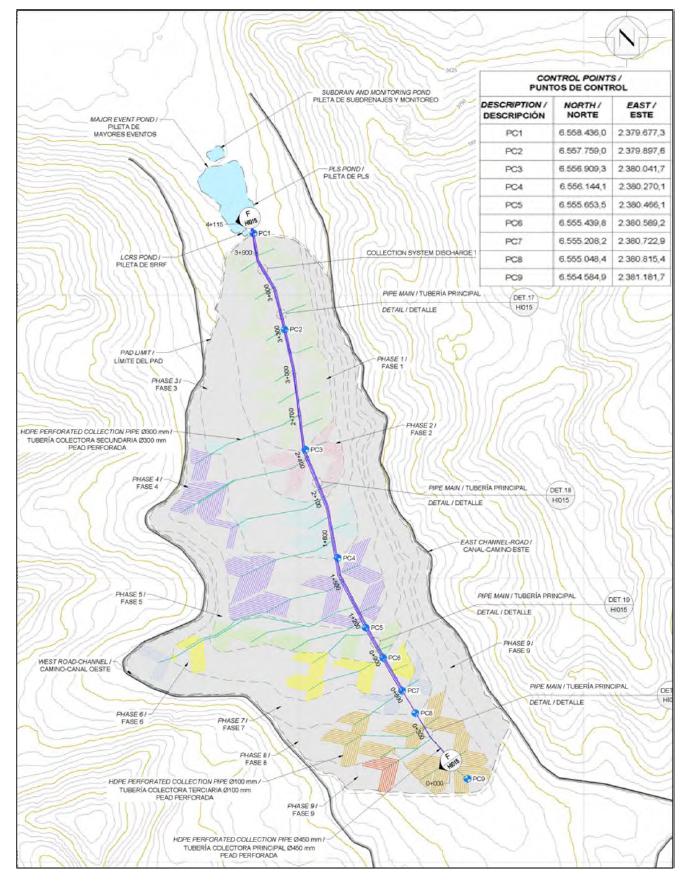

Although the vegas in the pit and leach pad areas will be impacted, minimizing the footprint of the site facilities, re-routing, and diverting water courses to downstream connections are key design feature for the mine and leaching areas water management plans to minimize these impacts. The leach pad design includes an underdrainage for non-contact water coming from upstream sources to flow through the same valley and to the Rio Salinas. Longer term, the water courses will be restored during reclamation of the mine site at the completion of activities to bring the area as close to its original state as possible.

Transforming Water Use and Quality

Climate change, population growth and the industrial and agricultural use of water are some of the factors that affect water availability. In addition, the expansion of urban infrastructure exerts pressure on the quantity and quality of natural water courses. Long-term water solutions must be flexible, adaptable, and environmentally sustainable, working within the ‘carrying capacity’ of its place and climate. Increasing the efficiency of water use is equivalent to increasing productivity or, in other words, reducing the intensity of use by maximizing the value of uses and, in this way, improving allocation among different competing utilization.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

Selecting a hydrometallurgical process option for Los Azules could reduce effective water usage by 75% to 80% over a milling/concentrator alternative. Additionally, alternatives for improving precipitation/snow capture, site dust control, reuse/recycle and passive water treatment strategies are being developed at Los Azules.

Transforming the Energy/Carbon Nexus

An extensive review of power generation and supply options for the project was undertaken to consider the options for renewable energy. YPF Sociedad Anónima (“YPF S.A.” or “YPF”) owns and operates power generation facilities in Argentina based on wind, solar, geothermal, and hydroelectric sources through its subsidiary YPF-LUZ. YPF-LUZ has a rate structure based on 100% renewables sourced power generation that can be used as the project basis, eliminating hydrocarbon-based generation and associated emissions. The YPF-LUZ electric power supply option was selected for the Los Azules Project at a small premium over other hydrocarbon-based power options.

In addition to energy supply, the reduction of energy consumption is also a key aspect to regenerative mining.

Processing with the End Game in Mind

Given the context above, the most appropriate technology selection for Los Azules to minimize water usage is a hydrometallurgical approach, which is the basis for the Phase 1 project development. The hydrometallurgical option also provides lower overall project impacts from:

| · | Reduced energy usage by 35% over a concentration alternative to produce copper cathodes. The electric load reduction is about 25%. |

| · | Lower transport requirements for product based on copper content of cathodes (99.99% Cu) versus concentrates (25%-35% Cu) and concentrate smelting options located outside of Argentina/South America. |

| · | More efficient and minimized use of land for heap leach pad versus tailings storage facilities from concentration tailings discharge. |

| · | On-site generation of sulfuric acid, using by-product sulfur supplied from local Argentinian sources, employing waste heat capture for on-site power generation and process heating – reduces grid based electric power requirements and eliminates hydrocarbon-based alternatives. |

| · | Establishment of the infrastructure to be a rapid adopter of emerging heap leaching technologies for primary copper mineral resources when encountered – avoiding the future need for concentration methods as is the current industry practice. |

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

Moving Rock and Decarbonizing Mining Operations

Maximizing electrification, coupled with renewable power supply is aimed at significantly reducing environmental impacts.

The initial mining concepts will use trolley-assisted diesel-electric mine haulage and support equipment initially to significantly reduce diesel emissions. However, the project will select equipment and methods to rapidly transition to fossil fuel-free alternatives as rapidly as the technology and manufacturing capacities allow. The transition would also include in-pit conveying alternatives to minimize fleet requirements. The ultimate vision is a fully electric mine and the elimination of emissions associated with fossil-fuels.

A Mining Camp for Maximum Livability – the healthiest, greenest mine camp in the world.

The long-term permanent mine camp has been strategically located to optimize multiple variables. Worker safety, comfort, well-being, as well as the distance from the mine operations and access to the main road are major considerations. In addition, the specific layout and orientation have been selected to support passive heating and cooling strategies and solar energy generation, which are key considerations.

The Los Azules camp and mine will be forming a microgrid in a remote location, although Los Azules in closer to basic infrastructure than most other mines in the region. Even though the camp will be connected to offsite energy production, it is being sized for net-positive energy production, making it a candidate for International Living Future Institute’s (ILFI) Net Zero Energy certification (living-future.org), the world’s most rigorous green building standards. The camp will pursue ILFI certification based on the alignment with the Living Building Certification “Water Petal”.

The camp will also be designed to provide space for growing food in a self-sustaining environment. Finally, the camp will provide waste management systems to provide reuse of waste materials, either through direct reusing, recycling, composting, and eliminating single-use plastics and packaging.

Minimizing the Carbon Footprint from Mine to Market

Copper mining emits an average 2.3-2.5 tonnes of carbon dioxide equivalent per tonne of copper metal produced (t CO2-e/t Cu), while smelting adds another 1.65 tonnes (Source: “Metals recycling to be a key plank for cutting emissions” by Pratima Desai, Reuters, July 14, 2021). By employing modern, low emission technologies, the Los Azules Project intends to improve upon the standards set forth by “The Copper Mark” and set a new standard for CO2 emissions per unit of copper produced.

The Greenhouse Gas (“GHG”) Protocol Corporate Standard classifies a company’s GHG emissions into three ‘scopes’. Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy. Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

Figure 1.2 Estimated Carbon Intensity versus Copper Equivalent Production Centiles 2022-2040 for mine site emission chart presents the relative estimated emissions for copper assets on an equivalent copper basis as obtained from the Emissions Benchmarking Tool – (Metals)™, a product of Wood Mackenzie Limited (“WoodMac”). The WoodMac database includes 394 individual global mining assets and covers Scope 1 and 2 emissions determined using the published methodology on their website. The highlighted assets represent comparable major Argentinian projects as included in the WoodMac modeled information. The Los Azules Project metrics in the WoodMac data (red line highlighted) reflects the estimated emissions for the prior project concept. The WoodMac average Scope 1 and Scope 2 emissions intensity for all 394 included assets the period between 2022 and 2040 is 1,980 kg CO2-e/t Cu Eq. (kilograms of Carbon Dioxide Equivalent per tonne of Copper Equivalent produced). Carbon Dioxide Equivalent means having the same global warming potential as any another greenhouse gas. For the 57 copper SX/EW assets included, the average Scope 1 and Scope 2 emissions intensity for the period between 2022 and 2040 is 1,723 kg CO2-e/t Cu Eq.

Based on the current project concepts considered for implementation at Los Azules, notably:

| · | Electrical energy sourced from 100% renewables (YPF Luz basis), |

| · | Incorporation of site and mine electrification concepts (trolley assist for mine haulage, battery electric vehicles where possible), |

| · | Regenerative design concepts for support infrastructure, and |

| · | Hydrometallurgical extraction processes to produce copper cathodes. |

The carbon intensity per unit of copper equivalent production (Cu Eq) was estimated by Whittle Consulting Pty Ltd (“WCPL”) using the GHG Protocol Corporate Accounting and Reporting Revised Standard principles (published by the World Resources Institute (WRI), a U.S.-based environmental NGO, and the World Business Council for Sustainable Development (WBCSD), a Geneva-based coalition of 170 international companies) which provides requirements and guidance for companies and other organizations preparing a corporate-level GHG emissions inventory).

WCPL’s estimations based on the preliminary information developed, the predicted carbon intensity for the Los Azules initial Base Case project is estimated to be to be 670 kg CO2e/tCu Eq for Scope 1 & 2 emissions. The estimated Scope 1-3 emissions for the Base Cases is approximately 902 kg CO2e/tCu Eq, assuming transport of copper cathodes to port facilities in either Chile or Argentina.

Figure 1.2 also shows the relative position of the Los Azules base case developed in 2023 and the prior Los Azules 2017 Project concept against the WoodMac average Scope 1 & 2 emissions intensity for all 394 included assets. Of significant importance is the improvement in the project compared to the prior concept and the project position in the lower 10% range of projects globally. Full electrification could drive emissions even more towards the lowest in the industry.

Continued implementation of newer and less impactful technologies, fully electric mine and equipment, EV use for materials and supplies transport to site, and broader employment of regeneration applications throughout the mine site to further off-set carbon emissions is expected to deliver on McEwen Copper’s commitment to achieve net-zero carbon emissions from the Los Azules Project by 2038, well ahead of its peers.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

Figure 1.2: Estimated Carbon Intensity vs Copper Equivalent Production Centiles 2022-2040 (Scope 1 & 2 Emissions) - Wood Mackenzie 2022

NOTE: “The data and information provided by Wood Mackenzie should not be interpreted as advice and you should not rely on it for any purpose. You may not copy or use this data and information except as expressly permitted by Wood Mackenzie in writing. To the fullest extent permitted by law, Wood Mackenzie accepts no responsibility for your use of this data and information except as specified in a written agreement you have entered with Wood Mackenzie for the provision of such data and information.”

| 1.1 | OWNERSHIP STRUCTURE |

This subsection was prepared by J. Sorensen, FAusIMM, Samuel Engineering (Source Q1 2023 public filings).

McEwen Mining was organized under the laws of the State of Colorado on July 24, 1979, and is listed on the New York Stock Exchange (NYSE) and on the Toronto Stock Exchange (TSX) under the symbol MUX. The Company’s head office is in Toronto, Canada. As of May 2023, the Company owns a 51.9% interest in the Los Azules copper deposit in San Juan, Argentina through its subsidiary, McEwen Copper Inc. (“McEwen Copper”) which owns a 100% interest in the Los Azules Copper Project in San Juan, Argentina, and the Elder Creek Exploration Project in Nevada, USA.

McEwen Copper has 28,885,000 common shares outstanding, and its shareholders are: McEwen Mining Inc. 51.9%, FCA Argentina S.A. (Stellantis) 14.2%, Nuton LLC (Rio Tinto) 14.2%, Robert R. McEwen 13.8%, Victor Smorgon Group 3.5%, and other shareholders 2.4%.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

| 1.2 | LOCATION |

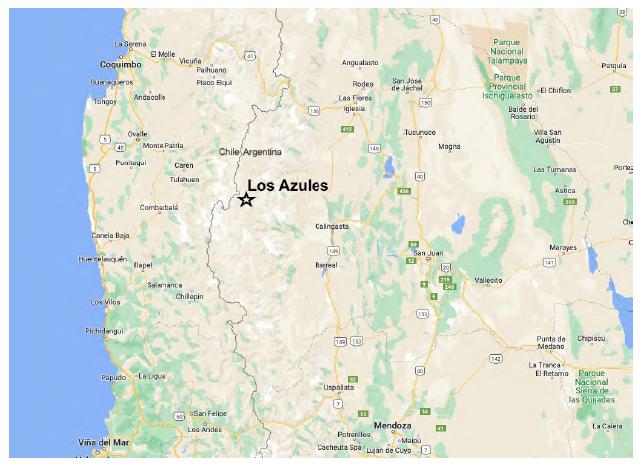

The Los Azules Project is a porphyry copper development project located in the Andes Cordilleran region of San Juan Province, Argentina along the border with Chile. The Project falls within the Calingasta Department of the San Juan Province. The Project is approximately 80 km west-northwest of the town of Calingasta, in the San Juan Province of Argentina at approximately 31° 06’ 25” south latitude and 70° 13’ 25” west longitude. The mine development is located approximately 6 km east of the border with Chile (Figure 1.3). Calingasta is located 173 km by road west of the city of San Juan along Route 12.

Figure 1.3: Location of Los Azules in the High Andes (Hatch, 2017)

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

The terrain elevation at the project site ranges between 3,200 meters above sea level (masl) at the proposed camp location and up to 4,500 masl on the high peaks in proximity to the Project. The proposed pit and facilities are located between 3,200 and 3,600 masl. The Project area is remote, and no infrastructure is present. There are no nearby towns, Indigenous residents, or settlements. Seasonal exploration work typically commences in October or November and terminates in April or May. Exploration operations are supported by means of two temporary camps within the Project site area.

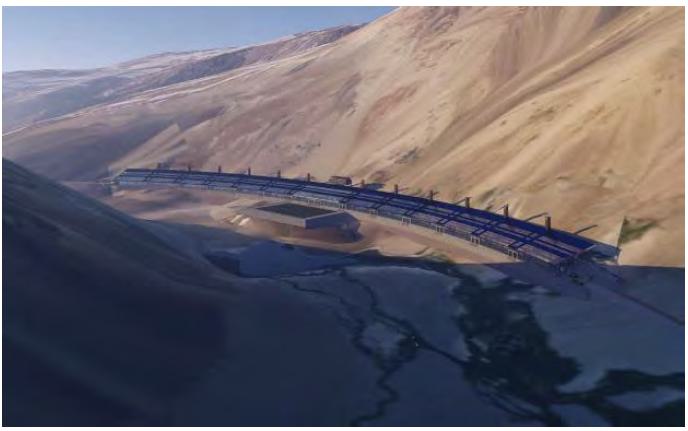

The facilities and site arrangements contemplated for the Los Azules Project are shown in Figure 1.4. Facilities are located to stay within the surface and mining rights currently held by McEwen Copper.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-03 | 1- |

Figure 1.4: Overall Site Plan (Samuel, 2023)

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

There are no covered or uncovered “white glaciers” (classic ice glaciers) in the Project, although there are several small rock glaciers (or cryogenic geoforms) near the Project area that are not impacted by exploration or the proposed future development activities.

A preliminary seismic risk assessment of the Los Azules site was completed in April 2019. The area where the Los Azules Project is located corresponds to Seismic Zone 4, considered very high. The highest seismic event recorded near the Project was magnitude 7.5 in 1977 affecting the entire province of San Juan.

Drill core storage and processing facilities are in the town of Calingasta. These facilities will be upgraded during the next phases of work to increase the storage capacity and provide for accommodations and staging of workers traveling to/from the project site.

The nearest mining projects to the Los Azules Project site are the Altar copper-gold project site owned by Aldebaran Resources Inc. located approximately 40 km south and the El Pachon copper-gold project site owned by Glencore plc located approximately 90 km south of Los Azules. To the north, the distance to Filo del Sol owned by Filo Corp. and Josemaria owned by Lundin Mining is approximately 300 km.

| 1.3 | PROPERTY |

The information in this section relies upon a legal review and opinion report Re: “Incorporation and good standing status of Andes Corporación Minera S.A. (ACMSA) and of its mining rights” dated January 11th, 2023, by Abogado (lawyer) Jose Vargas Gei of Vargas & Galindez (V&G), a Mendoza based legal firm.

The Los Azules Project is comprised of properties (the “Properties”) owned by Andes Corporación Minera S.A. (ACSMA), an Argentine subsidiary of McEwen Mining through its ownership in McEwen Copper. ACMSA is duly registered before the Dirección de Personas Jurídicas of the province of Mendoza, by Resolution #2025 dated November 2nd, 2005.

There are two types of tenure under Argentine mining regulations: Cateos (Exploration Permits) and Minas (Mining Permits). Exploration Permits are licenses which allow the property holder to explore the property for a period following a grant that is proportional to the size of the property. Mining Permits are licenses which allow the holder to exploit the property subject to regulatory environmental approval. To convert an exploration permit (Cateo) to a mining concession (Mina), some or all the area of a cateo must be declared as MD (Manfestación de Descubrimiento) and then converted to a Mina. Minas are mining concessions which permit mining on a commercial basis.

McEwen Copper controls approximately 31,746 ha of mining rights (Minas) around the Los Azules deposit. In addition, McEwen Copper owns sufficient surface rights for the Project pursuant to an agreement with CCM S.A., on March 3rd, 2010, whereby ACMSA acquired the surface rights set out in Figure 1.5 (18,000 hectares in green outline).

The international border with Chile forms the limits of the owned property on the west side (shown as a black dashed line Figure 1.5). The surface rights limits of the property are represented by the green line in Figure 1.5. Based on the V&G review and opinion, ACMSA has good and valid, legal, and beneficial title to the mining rights shown in Figure 1.5.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

Figure 1.5: Los Azules Project Property Limits (V&G Report, 2023)

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

| 1.4 | EXPLORATION & DRILLING |

Exploration at Los Azules commenced in the mid-1990’s and has included various studies of geology, geophysics, and geochemistry, as well as drilling with both reverse circulation and diamond core drills, sampling and analysis of surface and drill core samples, and road construction. Drilling programs have been undertaken at Los Azules between 1998 and 2023 by three different mineral exploration companies including BMG, MIM Argentina (now Glencore) and Minera Andes/McEwen Mining and McEwen Copper. Drilling included reverse circulation programs mostly for gold exploration and diamond drilling focusing on supergene and hypogene porphyry-style copper mineralization. Descriptions of these programs are detailed in the following sections. Table 1.2 provides a summary of the drilling information.

| Table 1.2: Exploration Drilling by Year and by Company | |||

| Year | Company | No. of holes | Meters |

| 1998 –1999 | Battle Mountain Gold | 24 | 5,681 |

| 2004 | Glencore Xstrata (MIM) | 4 | 864 |

| 2003 – 2011 | Minera Andes | 127 | 34,270 |

| 2011 – 2023 | McEwen Mining | 284 | 75,849 |

| Total | 439(1) | 116,664 | |

| 1. | This table includes all drilling that has occurred on the property. Some holes were redrilled due to drilling difficulties and are not included in the database. Holes that were started in one season and completed the following season are counted in the year they were started, but the meters drilled in each season are shown for the respective seasons. The drilling reflects all holes to the effective date of May 9th, 2023. |

| 1.5 | MINERAL RESOURCE ESTIMATES |

The mineral resources have been classified according to guidelines and logic summarized within disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, as embodied by the Committee for Reserves International Reporting Standards (“CRIRSCO”) referred to in S-K 1300. Resources were classified as Indicated or Inferred by considering geology, sampling, and grade estimation aspects of the model.

The extent of mineralization along strike exceeds 4 km and the distance across strike is approximately 2.2 km. The deposit is open at depth. Over the approximately 2.5 km strike length where mineralization is strongest, the average drill spacing is approximately 150 meters to 200 meters but there are localized areas where drilling is on 100-meter spacing. The assay database considers 162 drillholes and 56,528 meters of assay interval data. Resource estimation work was performed using Datamine Studio modeling software.

As of the date of publication, 47 holes and approximately 18,318 meters of drilling (mostly infill) have been completed but were not included in the database for resource estimation, data for which was cut off on date December 31st, 2022.

The Indicated and Inferred resources for the enriched and primary zones are presented in Table 1.3. Mineral resources are determined using an NSR cut-off value to cover the processing cost for each recovery methodology. For supergene and primary material going to the leach pile, the cutoff was $2.74/t. For supergene going to the mill, the cutoff was $5.46/t and primary material going to the mill was $5.43/t. The resource is further constrained by a pit shell that demonstrates the reasonable prospects of eventual economic extraction (RPEEE) of this material.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

Generalized technical and economic parameters include a long-term copper price of $4.00/lb, and a variable resource pit slope between 20° and 42°, depending on depth. Other parameters used in the resource pit development are detailed in Section 11.13.

Resources are reported in two categories related to processing amenability: 1) materials that are suited for processing in a commercially proven conventional, ambient conditions, copper bio-leaching scheme (Leach); and 2) materials that are better suited to processing either in a more advanced bio-leaching scheme such as NutonTM technology or traditional milling/concentrator approach (Leach+ or Mill).

| Table 1.3: Mineral Resource Summary | ||||||||||

| Million tonnes (M tonnes) |

Average Grade | Contained Metal | ||||||||

| Cu% - tot. |

Cu% - sol. |

Au (g/t) |

Ag (g/t) |

Cu (Blbs.) |

Au (Moz.) |

Ag (Moz.) |

||||

| Indicated | Supergene | Leach | 944.2 | 0.46 | 0.30 | - | - | 9.54 | - | - |

| Mill or Leach+ | 73.0 | 0.13 | - | 0.09 | 1.10 | 0.21 | 0.20 | 2.58 | ||

| Primary | Mill or Leach+ | 218.1 | 0.25 | - | 0.036 | 1.06 | 1.19 | 0.25 | 7.43 | |

| Total | Mill or Leach+ | 291.1 | 0.22 | - | 0.049 | 1.07 | 1.40 | 0.46 | 10.01 | |

| Total Indicated | Leach, Mill or Leach+ | 1,235.3 | 0.40 | 10.94 | 0.46 | 10.01 | ||||

| Inferred | Supergene | Leach | 695.7 | 0.32 | 0.19 | - | - | 4.91 | - | - |

| Mill or Leach+ | 525.6 | 0.30 | - | 0.05 | 1.44 | 3.45 | 0.87 | 24.40 | ||

| Primary | Mill or Leach+ | 3,288.0 | 0.25 | - | 0.03 | 1.18 | 18.35 | 3.37 | 124.67 | |

| Total | Mill or Leach+ | 3,813.6 | 0.26 | - | 0.035 | 1.22 | 21.79 | 4.24 | 149.07 | |

| Total Inferred | Leach, Mill or Leach+ | 4,509.3 | 0.31 | 26.70 | 4.24 | 149.07 | ||||

Note: Mineral Resources do have demonstrated economic viability. No values are presented where the process recovery method does not consider this aspect of the materials.

| 1.6 | MINING |

The Los Azules Deposit grades, geometry, and depth make it suitable for conventional, large-scale truck-shovel open pit mining methods. This includes the use of equipment such as blasthole drills, diesel hydraulic excavators, electric shovels, large off-highway haul trucks, and associated operations support equipment.

One copper cathode production rate case was assessed during the mine engineering and planning process. This 175k tpa Cu cathode production scenario is the ‘base case’.

The ultimate pit shell limit and intermediate pit shells (or phases) were developed with the use of Geovia Whittle™ pit optimization software. Using Net Smelter Return (NSR), surface restrictions / constraints, pit slope geotechnical parameters, mining parameters, and production rates resulted in a series of economic pit optimizations that were evaluated to define pushbacks and the ultimate pit. The Los Azules Deposit also contains mineralized material that may be economic for producing a milled copper concentrate product, but this material was not considered for base case pit optimization or mine schedule.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

Open pit mining would take place in phases from an initial starter pit, allowing for a shorter pre-strip and earlier access to mineralized material for leaching. For the 175k tpa Cu cathode production base case, the material mined over the two-year pre-production period is 115M tonnes of which 17.4M tonnes is mineralized material that is either stockpiled or crushed and placed on the heap leach pad. There is a ramp-up in annual production to year 5, when peak annual material movement is reached at 130M tonnes. Material movement tonnage stays at approximately 130M tonnes through to year 11 and declines to 50M tonnes in year 17.

Approximately 58.6M tonnes of lower grade mineralized material is stockpiled during these periods of which 41.8M tonnes is reclaimed and placed into the crusher feed in years 15-17. The remaining 16.8M tonnes is predominantly primary copper mineralization and will be processed in the Phase 2 project.

| 1.7 | METALLURGICAL TESTWORK AND RECOVERY METHODS |

Copper mineralization is complex and varied at Los Azules, consisting primarily of chalcocite, chalcopyrite, bornite and covellite with little oxide mineralization, typically chalcocite dominant with some covellite in the supergene materials and chalcopyrite dominant with some bornite in the primary materials. Metallurgical characterization testing has been completed as part of this study in the form of sequential assay (sulfuric acid and cyanide steps) for the resources considered, column testing and bottle roll testing. The sequential assay method used at Los Azules for both the resource assay and metallurgical programs provides an indication of the copper mineralization present in the form of acid soluble copper (CuAS) and cyanide soluble copper (CuCN), both assays combined provide an approximation for leachable/soluble copper (CuSOL) component of the total copper assay (CuT).

Historical testing for McEwen Copper was conducted on samples from the resource in several phases. C. H. Plenge Laboratory (Plenge) in Lima, Peru, performed several scoping level investigations from 2008 to 2012. A mineral liberation analysis (MLA) was completed at Thompson Creek Metals Company in Challis, Idaho; in 2012 on rougher flotation samples from the Plenge lock-cycle testing. Additional samples from the resource were tested at the SGS Research Limited (SGS) to support a Preliminary Economic Assessment (PEA) by Hatch in 2017.

The current metallurgical program consists of three concurrent phases of work, aimed at supporting a feasibility study level of investigation in future. In the current Phase 1 program work, existing drill core was selected for testing by lithology and material type to reflect economically processable material in the resource for this study. Phases 2 and 3 will utilize new metallurgical core obtained from the ongoing drilling program to investigate the potential metallurgical variability of the deposit and focus on the initial 3-5 years of material to be mined.

As of the effective date of this report, the initial columns for the current Phase 1 program are still on-going pending final analyses. As such, results are considered preliminary until tail assays can be obtained to provide a calculated head assay and related recovery.

Heap leach copper extraction is derived by two (2) different methods, one for leachable/soluble copper (CuSOL) and residual copper (CuRES) as derived from sequential copper assay methodology. The projected extraction for CuSOL is 100% for leachable/soluble recovery and 15% for CuRES. Residual copper assay is the difference between total assayed copper (CuT) and CuSOL. For the 19mm column tests in the current program, the total copper extraction ranged from 86% to 72% in 180 days and averaged 80% overall.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

Copper recovered to cathodes considers a heap efficiency and inventory factor of 90% of the long-term extractable copper extended over a two-year leach cycle period based on general experience. Soluble copper recovery exceeding 100% implies partial leaching of material which was not categorized as “soluble” based on the sequential assaying method and data available. Based on the resource assay data and column results, the apparent soluble copper (CuSOL) recovery to cathodes is approximately 107%, with total copper (CuT) recovery at 73%.

Based on current bottle roll results and the current column consumption, an average gross acid consumption is 18 kg/t of material. Net acid consumption is a function of recoverable copper with acid produced as a result of the electrowinning process and calculated in the process cost model annually.

The Phase 1 project Base Case option considers a processing facility to nominally produce 175,000 tonnes per annum (tpa) of copper cathodes from higher grade, highly leachable (soluble) copper content materials. An expansion of the mining rates and materials handling facilities is required by Year 4 to and again in Year 7 to maintain copper production as the copper grade drops. An additional solvent extraction train will be required in Year 8. This initial processing facility will function through to the completion of mining for the initial project phase in Year 15 with lower grade stockpile reprocessing and residual leaching operations to Year 18.

All Primary copper mineralized material mined during the initial project phases will be stockpiled for future processing routes that may include a mill/concentrator or alternative bio-leaching technologies.

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

Figure 1.6: Simplified Process Flowsheet (Samuel, 2023)

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

| 1.8 | PROJECT ECONOMICS |

The project initial capital costs are based on budgetary cost quotations and regional contractor estimates for major equipment and facilities obtained in Q4 2022 and Q1 2023. The capital costs for the project are summarized below and should be viewed with an expected level of accuracy for a preliminary analysis at +40%/-20% consistent with AACE International Recommended Practice No. 47R-11 for an Estimate Class 5. Owner’s Costs include the initial mine fleet, preproduction stripping costs and preoperational costs for early crushing and material placement on the leach pad.

| Table 1.4: Initial Capital Costs by Case | |

|

Capital Cost |

Base Case |

| WBS Area | Total (USD) |

| 100 - Mining | $65,600,000 |

| 200 - Ore Storage & Handling | $234,500,000 |

| 400 - Heap Leaching | $158,500,000 |

| 500 – SX/EW Facilities | $250,400,000 |

| 600 - Acid Plant | $94,900,000 |

| 800 - Ancillary Facilities | $23,300,000 |

| 900 - Site Development & Yard Utilities | $126,700,000 |

| 2000 – Off-Sites | $167,400,000 |

| Total Direct Costs | $1,121,300,000 |

| Common Indirect Costs | $379,300,000 |

| Owners Costs | $454,000,000 |

| Subtotal | $1,954,600,000 |

| Contingency | $493,700,000 |

| Total Capital Cost | $2,448,300,000 |

The project life of mine direct operating costs per tonne processed and per pound of copper produced are summarized below. Costs vary with open pit development, feed head grades, acid requirements in leaching, power consumption increases over time and actual copper production.

| Table 1.5: Life of Mine Operating Cost Summary | |||

| OPEX SUMMARY | Life of Mine | Units |

Base Case |

| Mining OPEX | Per Lb Cu | $/lb Cu | $0.47 |

| Per tonne processed | $/t | $4.13 | |

| Processing OPEX | Per Lb Cu | $/lb Cu | $0.32 |

| Per tonne processed | $/t | $2.84 | |

| G&A | Per Lb Cu | $/lb Cu | $0.12 |

| Per tonne processed | $/t | $1.02 | |

| Selling Costs | Per Lb Cu | $/lb Cu | $0.02 |

| Per tonne processed | $/t | $0.17 | |

| TOTAL OPEX (C1 Costs)* | Per Lb Cu | $/lb Cu | $0.93 |

| Per tonne processed | $/t | $8.16 | |

*Note: Numbers may not add exactly due to rounding

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

Based on consensus estimates and independent analysis, long-term metal pricing used in this report (except for mineral resource estimation) and project economic analysis are Copper (Cu) - $3.75/pound; Gold (Au) - $1,700/ounce; and Silver (Ag) - $20.00/ounce. The 2023 updated financial outcomes for the Phase 1 initial project mine and facilities are shown in Table 1.6 below (expressed in Q1 2023 United States Dollars). C1 cash costs are defined as the cash cost incurred at each processing stage, from mining through to recoverable copper delivered to the market, net of any by-product credits. C1 cash costs per pound of copper produced and all-in sustaining costs per pound of copper produced are non-GAAP ratios.

| Table 1.6: Project Economic Summary by Case | ||

| Project Metric | Units |

Base Case |

| Mine Life (including stockpile rehandle) | Years | 17 |

| Processing Life | Years | 18 |

| Tonnes Processed | Thousand tonnes | 702.3 |

| Tonnes Waste Mined | Thousand tonnes | 906.8 |

| Strip Ratio | 1.29 | |

| Total Copper Grade | % Cu | 0.518% |

| Soluble Copper Grade (CuSOL) | % CuSOL | 0.362% |

| Copper Recovery (Total Copper) | % | 72.8% |

| Soluble Copper Recovery1 | % | 107% |

| Copper Production (LOM avg.)2 | tonnes/yr | 159,800 |

| Copper Production (Yr 1-5) | tonnes/yr | 185,500 |

| Copper Production – cathode Cu | Thousand tonnes | 2,721 |

| Initial Capital Cost | USD Millions | $2,448 |

| Sustaining Capital Cost | USD Millions | $1,878 |

| Closure Costs | USD Millions | $180 |

| C1 Costs (Life of Mine) | USD/lb Cu | $0.93 |

| All-in Sustaining Costs (AISC) | USD/lb Cu | $1.54 |

| Initial Capex/tpa (LOM avg.) | USD/tpa Cu | $15,295 |

| LOM Capex/LOM tonnes Cu | USD/tonne Cu | $1,590 |

| Before Taxes | ||

| Net Cumulative Cashflow | USD Millions | $10,702 |

| Internal Rate of Return (IRR) | % | 27.0% |

| Net Present Value (NPV) @ 8% | USD Millions | $3,747 |

| After Taxes | ||

| Net Cumulative Cashflow | USD Millions | $6,940 |

| Internal Rate of Return (IRR) | % | 21.5% |

| Net Present Value (NPV) @ 8% | USD Millions | $2,234 |

| Pay Back Period | Years | 3.4 |

Notes:

| 1. | Soluble copper recovery exceeding 100% implies partial leaching of material which was not categorized as “soluble” based on the sequential assaying method and data available. |

| 2. | Life of Mine production averages include low grade stockpile rehandling and leaching production at the end of mining material from the open pit for each case. |

| Project Los Azules – S-K 1300 Technical Report Summary | Project No.: 21139-01 | 1- |

A summary of the 8 Year and LOM Cash Cost can be seen in Table 1.7.

| Table 1.7: Average First 8 Years and LOM Cash Costs* | |||

| Category | UoM | 175k tpa Cu Production Case | |

| First 8 years | LOM | ||

| Gross Revenue | US$/lb Cu | 3.75 | 3.75 |

| Selling Expenses | US$/lb Cu | (0.02) | (0.02) |