UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2023

Plug Power Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1-34392 | 22-3672377 | ||

| (State or other jurisdiction | (Commission File | (IRS Employer | ||

| of incorporation) | Number) | Identification No.) | ||

| 968 Albany Shaker Road, Latham, New York |

12110 |

|

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (518) 782-7700

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

||

| Common Stock, par value $0.01 per share | PLUG | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2023, Plug Power Inc., a Delaware corporation (the “Company”), issued a press release regarding its financial results for the first quarter ended March 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1. The Company will be hosting a conference call at 8:00 a.m. Eastern Time regarding its financial results for the first quarter ended March 31, 2023. The conference call will be available through the Company's website at www.plugpower.com. A copy of the presentation that will be used during the conference call is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such Exhibits be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 2.02 of this Current Report on Form 8-K is incorporated herein by reference.

The information included in this Item 7.01, Exhibit 99.1, and Exhibit 99.2 of this Current Report on Form 8-K is not deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall this item, Exhibit 99.1, or Exhibit 99.2 be incorporated by reference into the Company’s filings under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such future filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number |

Title | |

| 99.1 | Press Release of Plug Power Inc., dated May 9, 2023. | |

| 99.2 | Presentation of Plug Power Inc., dated May 9, 2023. | |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Plug Power Inc. | ||

| Date: May 9, 2023 | By: | /s/ Paul Middleton |

| Name: Paul Middleton | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

Plug Reports

$210.3MM in Revenue,

up 49% Year Over Year

Reaffirming 2023 Targets, focused on key initiatives to enable revenue growth and path to profitability

| ● | Plug’s Georgia Liquid Green Hydrogen Plant Will Complete Commissioning and Continue to Ramp to Liquid Production throughout Q2: The plant has been brought online in less than a year since issuing the full EPC contract (engineering, procurement and construction contract), marking a new industry standard for the construction timeline of a liquid hydrogen plant. Gaseous hydrogen production has continued at the Georgia plant, with fills of our fleet of high-pressure tube trailers and customer trailers. |

| ● | Green Hydrogen Buildout on Track: Leveraging learnings from Georgia, we have been able to negotiate a lump sum turnkey construction contract for our Texas plant, and we have selected an EPC management company for New York. We are also working on optimizing our project execution strategy in Louisiana with our JV partner. Lastly, the decision on the location of our next plant is in the final stages. We believe these activities put us on track to reach 200 tons-per-day (TPD) under construction and/or commissioning by the end of 2023. |

| ● | Electrolyzer Sales Opportunities Expanding Globally: Deliveries into our 2 giga-watt (GW) backlog in 2023 range across large-scale projects and 1-5 megawatt (MW) containerized solutions. Meaningful traction with our containerized 5MW electrolyzer system continues in both the U.S. and Europe, including multiple repeat orders. We are also at the final stages of negotiating large-scale project opportunities in the US, Europe and Asia-Pacific representing potential bookings over 1GW. |

| ● | Large-Scale Stationary Offering Creates Substantial Revenue Growth Opportunity: Plug continues to see strong demand from electric vehicle (EV) fleet owners given their grid constraints. The different applications for Plug’s stationary power, including data center back-up and prime power, represent up to a trillion-dollar market opportunity. The first units are being deployed in Q2 2023. |

| ● | Scaling New Production Facilities; Gigafactory on Track to Produce 100MW of Electrolyzer per Month by Mid-Q2: We have now produced more 1MW stacks in Q1 2023 than all of 2022. Our Vista fuel cell manufacturing facility in Slingerlands, NY is now producing all GenDrive units for material handling, and we are underway in commissioning the first high-power stationary power manufacturing line. |

| ● | Material Handling Signs New Pedestal Customer STEF in France, Growth remains Robust: STEF is one of the leading cold logistics companies in Europe. Plug is on track to add multiple new pedestal customers in 2023, with plans to deploy in total over 12,000 GenDrive units and 80 new customer sites in 2023. |

| ● | Multiple Non-dilutive Financing Opportunities Available to Support Anticipated Powerful Growth and the Buildout of our Green Hydrogen Network: Plug is evaluating several financing options with counterparties, including but not limited to, the Department of Energy (DOE) Loan Program, strategic project investment partners, and asset-backed loan (ABL) facilities from major banks. Between the current cash position, a $5.7B balance sheet, and interest from multiple capital partners, we believe Plug is well positioned to fund forecasted growth. |

| ● | Progress on 2023 Objectives Mark an Inflection Point for Plug: Green hydrogen production, manufacturing scale, electrolyzer sales, fuel cell product growth and progress on other 2023 objectives have positioned Plug to achieve significant revenue and continued margin expansion throughout the year. |

Plug’s Integrated Model and Strategic Priorities Position Company to Achieve Milestone Growth

Plug’s speed of execution in our first-of-its-kind green hydrogen plants and commercialized fuel cell products remains unmatched. Our learnings from this journey continue to be invaluable as the company engages in multiple significant business activities, many of which are approaching inflection points. With an expected $10T addressable market by 2050, and multibillion-dollar opportunities in the near-term across our various product lines. Plug remains fully committed to executing on our strategic priorities in three key business units:

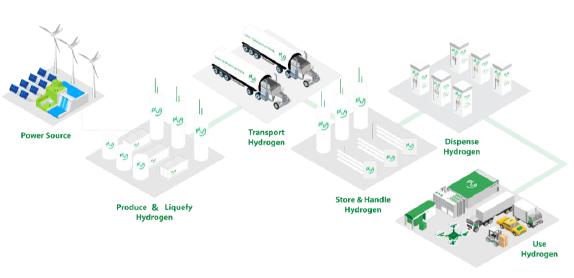

| ● | Plug Energy: Our vertically integrated hydrogen platform strategy has established Plug as a one-stop shop for capital equipment to produce, liquefy, store, and transport hydrogen. The buildout of our global green hydrogen network allows customers to seamlessly integrate hydrogen into their operations across multiple industries. Investments to build these capabilities should allow Plug to drive significant revenue through equipment portfolio sales, and hydrogen fuel delivery to customers. |

| ● | Plug Fuel Cell Applications: We have a track record of innovation in developing industry-leading fuel cell applications for stationary power and mobility, drawing on our experience in material handling. Plug’s technology provides high-efficiency, carbon-free power to a wide range of applications, making it suitable for meeting the decarbonization goals of various industries. As Plug continues to innovate, it remains at the forefront of the next generation of fuel cell applications. |

| ● | Manufacturing: Plug continues to expand our industry leading manufacturing capabilities and supply chains to support exponential growth and cost-down roadmaps. |

Plug has a powerful combination of fuel cell products and top-notch hydrogen energy capabilities, which creates a strong flywheel effect. This effect multiplies demand and accelerates the adoption of fuel cell technology and hydrogen across various end markets. As a result, Plug can leverage portfolio sales opportunities and drive exponential growth. The investments made into this platform positions Plug strongly at a time when the global hydrogen economy is gaining unprecedented policy support. Plug’s unique capabilities and customer base provide us with an exceptional perspective on the trajectory and forthcoming acceleration of the hydrogen economy. Consequently, Plug intends to continue investing in this platform to capitalize on this emerging trend.

2023 Roadmap

| 1. | Gigafactory reaches full capacity of 100MW per month of electrolyzer stacks |

| 2. | Georgia plant reaches 15TPD of liquid hydrogen production |

| 3. | Project development and execution at Louisiana hydrogen plant |

| 4. | Commissioning and constructing an additional 150-170TPD of hydrogen plants to reach 200TPD target |

| 5. | Stationary power manufacturing line begins production at Vista facility and first commercial deliveries take place |

| 6. | 80+ material handling sites and additional pedestal customers |

| 7. | Electrolyzer backlog growth with Plug winning large-scale project mandates globally |

| 8. | Continue sales momentum and backlog growth in liquefier and cryogenic businesses |

Green Hydrogen Generation Network Updates

We expect to commission 200+ TPD by 4Q23 / 1Q24 and 500TPD by year-end 2025. Based on learnings in Georgia, presently it takes six months to get plants from commissioning to full production. Plug’s green hydrogen generation network buildout should accelerate the energy transition while driving meaningful margin enhancement for Plug. To clarify the impact of this strategy, with a forecasted full year average customer demand of 65 tons of hydrogen fuel delivered per day in 2023, Plug would be able to achieve $100 million of gross margin improvement annually by sourcing all hydrogen internally from our plant network. We expect further gross margin expansion toward our financial targets as additional green hydrogen plants come online in 2024 and beyond.

Georgia: Plug has made significant strides in ramping up liquid hydrogen production, with plans to begin production in the second quarter of 2023. In less than a year since the arrival of crews on site, Plug is set to launch the first green hydrogen production plant in the United States, breaking the industry standard timeline of 48 months. All the major equipment, components, and systems, including liquefaction, Plug electrolyzers, rectifiers, liquid hydrogen storage tanks, and power distribution centers, have been delivered and installed. The power loop has been tested and commissioned, with all eight 5MW Plug electrolyzers already well into commissioning. Plug has also successfully completed the commissioning and energizing of its mini-substation plant infrastructure, and is currently producing green hydrogen from its 5MW gas plant. Furthermore, we are fulfilling high-pressure tube trailer fills for multiple customers. Plug is in the design phase of expanding the liquid production capability of the Georgia plant from 15TPD to 30TPD.

This plant represents a major achievement as Plug is turning on the first commercial scale green hydrogen plant in the United States. Learnings from the construction and commercial operations at Georgia are proving to be invaluable as Plug optimizes future plant design, progresses with prospective electrolyzer customers, and diligence with strategic partners.

Olin JV - Louisiana: Plug and Olin announced the launch of a 50/50 JV to begin construction of a 15TPD hydrogen plant in Louisiana. This site broke ground in Q1 2023 and continues to make solid progress with Plug and Olin collaborating on engineering and procurement at the facility. Key construction and commissioning activities are planned to take place during the remainder of 2023.

Alabama, New York: We continue to make progress on our green hydrogen plant in New York to reach 75TPD of capacity to start commissioning in Q4 2023. We have identified an EPC management company for the plant, allowing for construction to commence. Large cryogenic storage is on site, mini-substation construction has begun, with deliveries of rectifiers and PDCs expected in the early summer 2023, and liquefiers and electrolyzers in Q4 2023. Permits related to the substation are now in place, and we are working in collaboration with NYPA and National Grid to energize the substation in the first half of 2024 to achieve liquid production.

Texas: The 45TPD plant in Texas broke ground in Q4 2022. All permits are in place, and long lead time items are scheduled to be completed well before commissioning. On-site activities are picking up as the company has negotiated a lump sum turnkey contract for the plant’s construction. The 345MW wind farm that will power this plant is already operational, and we are targeting liquid hydrogen production mid-year 2024.

Other Projects: Plug is in the process of evaluating multiple sites for either new or expanded production for up to 45TPD of liquid hydrogen production.

Electrolyzer Pipeline Expansion to Convert into Significant Revenue Growth in Coming Quarter

Plug’s sales funnel for electrolyzers stands at more than $30 billion with approximately 50% of that related to e-fuels, including green ammonia and methanol. Our backlog is in excess of 2GW across large-scale projects and 1-5MW containerized solutions, positioning Plug to deliver a breakout year in our electrolyzer business in 2023. We expect revenue in 2023 will be driven by a mix of 1-5MW containerized solutions and executing on existing large-scale projects primarily in the US and Europe.

In addition, the booking outlook in 2023 remains robust both for our electrolyzer product and project business. We are seeing a meaningful order book for our 5MW containerized product both in the US and European markets, including sizable orders from existing customers. We are also at the final stages of negotiating large-scale project opportunities in the US, Europe and Asia-Pacific representing potential bookings over 1GW. Plug’s learnings from our Georgia plant, development at our other green hydrogen sites, and manufacturing scale should provide us with a unique competitive advantage as we partner with our customers on these substantial electrolyzer opportunities across various end markets.

Plug’s Fuel Cell Stationary Application Sees First Commercial Operations in 2023

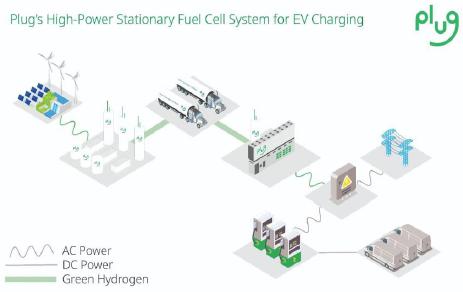

Plug has been actively developing its large-scale stationary products, with back-up power, green EV charging, and prime power applications representing significant addressable markets. In 2023, we plan to deploy over 20MW of these products.

Moreover, we see significant demand for our green hydrogen in the application of a 1MW stationary unit for applications that have insufficient grid power, such as power fleet electric vehicles. We anticipate that this application will not only create immediate sales opportunities but also a continuous revenue stream for green hydrogen. Many of these applications use up to 1T of green hydrogen per day.

Our largest market opportunity is in utility-scale grid support, and we are expanding our business with utilities interested in this solution. We have long-term plans to use stationary units as both prime power and peaker plants. The anticipated rapid growth of global green hydrogen production would allow for the quick integration of fuel cell stationary power into the global prime and peak power market. Through our partnership with SK Group, SK Plug Hyverse, we plan to deploy 200MW or more per year of stationary products in South Korea for this purpose.

We are deploying the first units in the second quarter.

Material Handling Continues Expansion, Signs New Pedestal Customer STEF, and Launches Turnkey Solution for Midsize Fleets

Pedestal customers are continuing to grow their business in the US and Europe, with plans for more than 80 new sites in 2023. Plug is also having conversations with non-pedestal customers about expanding their footprint with GenDrive technology and is targeting three new pedestal accounts in North America in 2023.

Additionally, Plug is pleased to announce signing STEF as a new pedestal customer out of France. Plug plans on two sites with STEF in 2023. STEF is the European leader for temperature sensitive logistics, operating for nearly 100 years at the heart of the food supply chain. STEF plans to begin with installation of one site in Paris, France and another in Madrid, Spain, before expanding further into their network of over 100 sites. Plug has plans for eight new sites with European customers in 2023. The company continues to target at least one additional European pedestal customer in the coming year.

Furthermore, Plug has expanded its GenKey offering to enable fuel cell adoption for warehouses that operate fewer than 100 electric forklifts. This move has grown the material handling total available market by 1 million forklifts through the deployment of the Company’s new lower-cost solution. The new offering includes several benefits, including low-cost green hydrogen supply from Plug’s hydrogen production plants, a modular and more flexible hydrogen storage solution, and freedom from grid constraints.

World-Class Global Manufacturing Facilities Reaching Full Capacity in the Near-Term

Plug is actively expanding our manufacturing and supply chain capabilities to support anticipated growth and drive down costs. Our industry-leading facilities allow us to achieve economies of scale, resulting in lower per unit costs as we continue to execute our strategy and grow exponentially.

The Innovation Center and Gigafactory in Rochester, NY is already online and ramping up production towards its annual run rate of 2.5GW of total capacity and 1.5GW of electrolyzer capacity. The factory is expected to reach its 100MW per month target for electrolyzers in May 2023. The factory design allows for continued expansion and automation, which will enable Plug to drive down costs and increase throughput over time with additional equipment. The company plans to organically expand its PEM stack manufacturing capacity in Rochester beyond 2.5GW per year.

Additionally, we are nearing completion on the balance of the manufacturing lines at our Vista Fuel Cell Manufacturing Facility in Slingerlands, NY. We began manufacturing GenDrive fuel cell systems at Vista in Q4 2022 and expect to soon finish the manufacturing line for our stationary product. Our advanced automation allows for increased scale and efficiency in the assembly of our entire fuel cell product line. The Vista facility will span 350,000 square feet, with the ability to expand to 1 million square feet to meet the growing demand for our fuel cell products.

Plug Europe: Building Plug’s Hydrogen Ecosystem

Momentum in Europe continues with key activities positioning Plug as the leader in turnkey hydrogen solutions in the EU. Multiple developments across Plug’s business units highlight the growing demand in the European market for green hydrogen and fuel cell applications.

Key activities include:

| ● | Uniper has selected Plug to supply electrolyzers for Uniper’s Maasvlakte site at the Port of Rotterdam. Uniper will commission 100MW of Plug electrolyzer capacity by 2026, expanding that capacity to 500MW by 2030. |

| ● | Plug has delivered three containerized electrolyzers to Andrea Ganzair, marking its first delivered electrolyzer systems in the EU. |

| ● | Plug is a member of the GravitHy consortium, which aims to create a 2Mt per year direct reduced iron plant in the south of France. The project may require up to 650MW of electrolyzer capacity to support its operations. |

| ● | Plug is actively developing three projects in Spain and Portugal as part of its JV with ACCIONA, including the site of its first green hydrogen production plant in Spain, scheduled to commission in 2H 2024. |

| ● | Plug is making progress on its 35TPD green hydrogen plant at the Port of Antwerp, with inbound interest exceeding 10 times the plant's capacity. |

| ● | Plug's 50/50 JV with Renault, HYVIA, successfully completed homologation of the FCEV version of the Master Van. The JV plans to ship up to 500 FCEV-LCVs to customers in 2023 and sell 100,000 vehicles cumulatively by 2030. In Q1 2023, Plug and HYVIA deployed an onsite containerized electrolyzer to produce hydrogen for vehicle testing. |

| ● | Plug is evaluating potential project sites in multiple locations with low-cost renewable electricity to produce low-cost green hydrogen and transport it to demand centers across the EU to support decarbonization efforts. |

Summary of First Quarter Financials

Revenue was $210.3M in the first quarter of 2023, compared to $140.8M for the first quarter of 2022. Overall, company gross margin of negative 33% increased 3% sequentially, and was down 8% year over year. Gross margin on equipment, related infrastructure and other was 13% in the first quarter, up 3% sequentially. Plug delivered 62MW of electrolyzers in Q1 of 2023, more than all of 2022, while adding 14 material handling sites. The equipment line item now consists of a blended margin from both more mature fuel cell applications for the material handling business, as well as rapidly scaling new product lines including electrolyzers, on road mobility, stationary power and cryogenic equipment and liquefiers. Given continued ramping at our new manufacturing facilities, the Company experienced higher fixed costs absorption in the quarter. We expect to see continuous improvement throughout the year as we reach full production capacity at our new manufacturing sites.

As expected, fuel margin remained under pressure due to increased hydrogen molecule cost associated with historically higher natural gas prices and continued supplier disruptions. Cost of fuel per kg delivered by third parties was down 13% sequentially in the first quarter of 2023, and we expect this downward trend and tailwind to continue in the balance of the year as natural gas has remained below $3. This dynamic, along with our green hydrogen plant commissioning gives us increasing confidence in the margin improvement expected for fuel delivered to customers.

Capital and Financing Strategy

Plug is evaluating multiple sources of low-cost and non-dilutive capital, as it continues to build out a global green hydrogen generation network. Currently, Plug is completing the second stage of due diligence with the DOE Loan Program Office. Concurrently, we are evaluating asset-backed loan (ABL) facilities from major banks. Finally, Plug continues to receive interest from strategic partners and infrastructure funds regarding interest to partner in our hydrogen plants, which could help accelerate our next generation of hydrogen plant development. Financing decisions around these opportunities will likely be made in the second half of this year. Plug has a strong unleveraged balance sheet and a profitable green hydrogen project pipeline which collectively create a strong liquidity position, giving us a significant runway to continue our plant buildout and scale our business. Longer-term capital needs are likely to be covered with operating cash flow and traditional project financing as the company and the green hydrogen industry continue to grow.

Delivering on 2023 Roadmap and Margin Expansion Remains Key Corporate Focus

Plug remains focused on building a global green hydrogen ecosystem and delivering on its growth objectives, margin expansion and path to profitability. We look forward to updating you all on our next call.

Conference Call Information

Join the call:

| ● | Date: May 9, 2023 |

| ● | Time: 8:00 am ET |

| ● | Toll-free: 1-800-750-5857 or 1-212-231-2900 |

| ● | Direct webcast: https://viavid.webcasts.com/starthere.jsp?ei=1614940&tp_key=df4cc70b65 |

The webcast can also be accessed directly from the Plug homepage (www.plugpower.com). A playback of the call will be available online for a period of time following the call.

About Plug

Plug is building the hydrogen economy as the leading provider of comprehensive hydrogen fuel cell (HFC) turnkey solutions. The Company’s innovative technology powers electric motors with hydrogen fuel cells amid an ongoing paradigm shift in the power, energy, and transportation industries to address climate change and energy security, while providing efficiency gains and meeting sustainability goals. Plug created the first commercially viable market for hydrogen fuel cell (HFC) technology. As a result, the Company has deployed more than 60,000 fuel cell systems for e-mobility, more than anyone else in the world, and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. Plug delivers a significant value proposition to end-customers, including meaningful environmental benefits, efficiency gains, fast fueling, and lower operational costs.

Plug’s vertically integrated GenKey solution ties together all critical elements to power, fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart. The Company is now leveraging its know-how, modular product architecture and foundational customers to rapidly expand into other key markets including zero-emission on-road vehicles, robotics, and data centers.

Source: Plug Power, Inc.

Cautionary Note on Forward-Looking Statements

This communication contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks and uncertainties about Plug Power Inc. ("Plug"), including but not limited to statements about Plug's ability to obtain financing or financing with acceptable terms through the Department of Energy, asset-backed loans, or otherwise, Plug’s forecasted revenue, margin expansion, and cash runway, Plug’s expected financial targets and growth, including with respect to revenue, gross margin, expenses, and fuel margin, Plug’s ability to achieve the goals outlined in its 2023 roadmap, including anticipated Gigafactory outputs, expected outputs from its newly commissioned Georgia plant, project development at its Louisiana site, commissioning and construction of additional hydrogen plants, expected production at its Vista facility, plans to add material handling sites and pedestal customers, expected electrolyzer backlog growth, and sales momentum, statements regarding the expected timing, output, and benefits of its liquid hydrogen plant in Georgia, Plug’s strategy, timing of execution, and expected benefits of its Louisiana plant and joint venture, anticipated project opportunities in the US, Europe and Asia-Pacific, expected continued demand for electric vehicles and other Plug products, the expected timing for deployment of its stationary power solutions, the expectation that it will add multiple new pedestal customers in 2023, the ability to continue to expand manufacturing capabilities and improve supply chain issues, the ability to portfolio sales opportunities and drive exponential growth, the anticipated project timing for Plug’s Alabama, New York site and Texas site. Plug’s ability to generate additional projects to support its green hydrogen output goals, the expected sales funnel and total addressable markets for its products, the timing for deployment of Plug’s large-scale stationary products and projects in South Korea, the expected benefits of Plug’s GenKey solutions, Plug’s ability to achieve economies of scale, Plug’s ability to further grow and scale its hydrogen plants, Plug’s ability to achieve its goals of expansion in European markets, including hydrogen output targets, expected product sales, market growth, and decarbonization efforts, the expectation that Plug will successfully achieve its green hydrogen generation targets and specific tons-per-day targets for 2023, 2024, and 2025, and Plug’s statement regarding its expected additional pedestal customers in Europe. You are cautioned that such statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times that, or by which, such performance or results will have been achieved. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in these statements, including that we continue to incur losses and might never achieve or maintain profitability, that we will need to raise additional capital to fund our operations and such capital may not be available to us, global economic uncertainty, including inflationary pressures, fluctuating interest rates, bank failure, and supply chain disruptions, that our lack of extensive experience in manufacturing and marketing of certain of our products may impact our ability to manufacture and market products on a profitable and large-scale commercial basis, loss related to an inability to remediate the material weaknesses identified in internal control over financial reporting as of December 31, 2022 and 2021, or inability to otherwise maintain an effective system of internal control over financial reporting, and our dependency on information technology on our operations and the failure of such technology. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Plug in general, see Plug’s public filings with the Securities and Exchange Commission, including the “Risk Factors” section of Plug’s Annual Report on Form 10-K for the year ended December 31, 2022. Readers are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. We disclaim any obligation to update forward-looking statements except as may be required by law.

Plug Investor Contact

Roberto Friedlander

investors@plugpower.com

Plug Media Contact

Caitlin Coffee

Allison+Partners

PlugPR@allisonpr.com

Plug Power Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 474,861 | $ | 690,630 | ||||

| Restricted cash | 175,978 | 158,958 | ||||||

| Available-for-sale securities, at fair value (amortized cost of $1,045,731 and allowance for credit losses of $0 at March 31, 2023 and amortized cost of $1,355,614 and allowance for credit losses of $0 at December 31, 2022 | 1,028,371 | 1,332,943 | ||||||

| Equity securities | 139,911 | 134,836 | ||||||

| Accounts receivable | 127,720 | 129,450 | ||||||

| Inventory | 775,649 | 645,636 | ||||||

| Contract assets | 99,012 | 62,456 | ||||||

| Prepaid expenses and other current assets | 155,822 | 150,389 | ||||||

| Total current assets | 2,977,324 | 3,305,298 | ||||||

| Restricted cash | 722,467 | 699,756 | ||||||

| Property, plant, and equipment, net | 874,659 | 719,793 | ||||||

| Right of use assets related to finance leases, net | 56,708 | 53,742 | ||||||

| Right of use assets related to operating leases, net | 371,472 | 360,287 | ||||||

| Equipment related to power purchase agreements and fuel delivered to customers, net | 98,301 | 89,293 | ||||||

| Contract assets | 25,418 | 41,831 | ||||||

| Goodwill | 249,871 | 248,607 | ||||||

| Intangible assets, net | 203,740 | 207,725 | ||||||

| Investments in non-consolidated entities and non-marketable equity securities | 67,350 | 31,250 | ||||||

| Other assets | 6,783 | 6,694 | ||||||

| Total assets | $ | 5,654,093 | $ | 5,764,276 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 188,149 | $ | 191,895 | ||||

| Accrued expenses | 167,754 | 156,430 | ||||||

| Deferred revenue and other contract liabilities | 137,357 | 131,813 | ||||||

| Operating lease liabilities | 52,859 | 48,861 | ||||||

| Finance lease liabilities | 8,622 | 8,149 | ||||||

| Finance obligations | 63,370 | 58,925 | ||||||

| Current portion of long-term debt | 5,228 | 5,142 | ||||||

| Contingent consideration, loss accrual for service contracts, and other current liabilities | 54,201 | 34,060 | ||||||

| Total current liabilities | 677,540 | 635,275 | ||||||

| Deferred revenue and other contract liabilities | 82,793 | 98,085 | ||||||

| Operating lease liabilities | 274,940 | 271,504 | ||||||

| Finance lease liabilities | 39,404 | 37,988 | ||||||

| Finance obligations | 279,444 | 270,315 | ||||||

| Convertible senior notes, net | 194,250 | 193,919 | ||||||

| Long-term debt | 3,799 | 3,925 | ||||||

| Contingent consideration, loss accrual for service contracts, and other liabilities | 180,273 | 193,051 | ||||||

| Total liabilities | 1,732,443 | 1,704,062 | ||||||

| Stockholders’ equity: | ||||||||

| Common stock, $0.01 par value per share; 1,500,000,000 shares authorized; Issued (including shares in treasury): 611,951,626 at March 31, 2023 and 608,421,785 at December 31, 2022 | 6,120 | 6,084 | ||||||

| Additional paid-in capital | 7,360,887 | 7,297,306 | ||||||

| Accumulated other comprehensive loss | (19,034 | ) | (26,004 | ) | ||||

| Accumulated deficit | (3,327,472 | ) | (3,120,911 | ) | ||||

| Less common stock in treasury: 18,245,914 at March 31, 2023 and 18,076,127 at December 31, 2022 | (98,851 | ) | (96,261 | ) | ||||

| Total stockholders’ equity | 3,921,650 | 4,060,214 | ||||||

| Total liabilities and stockholders’ equity | $ | 5,654,093 | $ | 5,764,276 | ||||

Plug Power Inc. and Subsidiaries

Consolidated Statement of Operations

(In thousands, except share and per share amounts)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2023 | 2022 | |||||||

| Net revenue: | ||||||||

| Sales of equipment, related infrastructure and other | $ | 182,094 | $ | 108,847 | ||||

| Services performed on fuel cell systems and related infrastructure | 9,097 | 8,240 | ||||||

| Power purchase agreements | 7,937 | 10,037 | ||||||

| Fuel delivered to customers and related equipment | 10,142 | 13,429 | ||||||

| Other | 1,016 | 251 | ||||||

| Net revenue | 210,286 | 140,804 | ||||||

| Cost of revenue: | ||||||||

| Sales of equipment, related infrastructure and other | 158,320 | 88,828 | ||||||

| Services performed on fuel cell systems and related infrastructure | 12,221 | 13,875 | ||||||

| Provision for loss contracts related to service | 6,889 | 2,048 | ||||||

| Power purchase agreements | 46,816 | 31,753 | ||||||

| Fuel delivered to customers and related equipment | 54,501 | 39,272 | ||||||

| Other | 935 | 377 | ||||||

| Total cost of revenue | 279,682 | 176,153 | ||||||

| Gross loss | (69,396 | ) | (35,349 | ) | ||||

| Operating expenses: | ||||||||

| Research and development | 26,535 | 20,461 | ||||||

| Selling, general and administrative | 104,016 | 80,890 | ||||||

| Impairment of long-lived assets | 1,083 | — | ||||||

| Change in fair value of contingent consideration | 8,769 | 2,461 | ||||||

| Total operating expenses | 140,403 | 103,812 | ||||||

| Operating loss | (209,799 | ) | (139,161 | ) | ||||

| Interest income | 17,632 | 2,054 | ||||||

| Interest expense | (10,650 | ) | (8,648 | ) | ||||

| Other expense, net | (4,771 | ) | (1,309 | ) | ||||

| Realized loss on investments, net | (1 | ) | (847 | ) | ||||

| Change in fair value of equity securities | 5,075 | (5,159 | ) | |||||

| Loss on equity method investments | (5,317 | ) | (3,833 | ) | ||||

| Loss before income taxes | $ | (207,831 | ) | $ | (156,903 | ) | ||

| Income tax benefit | (1,270 | ) | (414 | ) | ||||

| Net loss | $ | (206,561 | ) | $ | (156,489 | ) | ||

| Net loss per share: | ||||||||

| Basic and diluted | $ | (0.35 | ) | $ | (0.27 | ) | ||

| Weighted average number of common stock outstanding | 589,205,165 | 577,866,983 | ||||||

Plug Power Inc. and Subsidiaries

Consolidated Statement of Cash Flows

(In thousands)

(Unaudited)

| Three months ended March 31, |

||||||||

| 2023 | 2022 | |||||||

| Operating activities | ||||||||

| Net loss | $ | (206,561 | ) | $ | (156,489 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation of long-lived assets | 9,789 | 2,842 | ||||||

| Amortization of intangible assets | 4,959 | 5,190 | ||||||

| Stock-based compensation | 43,302 | 43,386 | ||||||

| Amortization of debt issuance costs and discount on convertible senior notes | 621 | 661 | ||||||

| Provision for common stock warrants | 14,175 | 1,852 | ||||||

| Deferred income tax benefit | (947 | ) | (414 | ) | ||||

| Impairment of long-lived assets | 1,083 | - | ||||||

| Loss/(benefit) on service contracts | 221 | (7,297 | ) | |||||

| Fair value adjustment to contingent consideration | 8,769 | (2,461 | ) | |||||

| Net realized loss on investments | 1 | 847 | ||||||

| (Accretion)/amortization of premium on available-for-sale securities | (5,945 | ) | 2,290 | |||||

| Lease origination costs | (2,660 | ) | (1,613 | ) | ||||

| Change in fair value for equity securities | (5,075 | ) | 5,159 | |||||

| Loss on equity method investments | 5,317 | 3,833 | ||||||

| Changes in operating assets and liabilities that provide (use) cash: | ||||||||

| Accounts receivable | 1,730 | 36,170 | ||||||

| Inventory | (129,572 | ) | (63,702 | ) | ||||

| Contract assets | (14,677 | ) | 44 | |||||

| Prepaid expenses and other assets | (5,522 | ) | (27,107 | ) | ||||

| Accounts payable, accrued expenses, and other liabilities | 13,821 | (25,096 | ) | |||||

| Deferred revenue and other contract liabilities | (9,748 | ) | (28,014 | ) | ||||

| Net cash used in operating activities | (276,919 | ) | (209,919 | ) | ||||

| Investing activities | ||||||||

| Purchases of property, plant and equipment | (168,565 | ) | (78,394 | ) | ||||

| Purchases of equipment related to power purchase agreements and equipment related to fuel delivered to customers | (11,389 | ) | (6,796 | ) | ||||

| Purchase of available-for-sale securities | - | (114,173 | ) | |||||

| Proceeds from sales of available-for-sale securities | - | 469,563 | ||||||

| Proceeds from maturities of available-for-sale securities | 315,827 | 67,430 | ||||||

| Purchase of equity securities | - | (4,990 | ) | |||||

| Net cash paid for acquisitions | - | (26,473 | ) | |||||

| Cash paid for non-consolidated entities and non-marketable equity securities | (40,077 | ) | (32,253 | ) | ||||

| Net cash provided by investing activities | 95,796 | 273,914 | ||||||

| Financing activities | ||||||||

| Payments of contingent consideration | (2,000 | ) | (2,667 | ) | ||||

| Payments of tax withholding on behalf of employees for net stock settlement of stock-based compensation | (2,590 | ) | (1,465 | ) | ||||

| Proceeds from exercise of stock options | 674 | 291 | ||||||

| Principal payments on long-term debt | (330 | ) | (19,246 | ) | ||||

| Proceeds from finance obligations | 27,927 | 17,273 | ||||||

| Principal repayments of finance obligations and finance leases | (16,500 | ) | (12,427 | ) | ||||

| Net cash provided by (used in) financing activities | 7,181 | (18,241 | ) | |||||

| Effect of exchange rate changes on cash | (2,096 | ) | 634 | |||||

| (Decrease)/increase in cash and cash equivalents | (215,769 | ) | 14,345 | |||||

| Increase in restricted cash | 39,731 | 32,043 | ||||||

| Cash, cash equivalents, and restricted cash beginning of period | 1,549,344 | 3,132,194 | ||||||

| Cash, cash equivalents, and restricted cash end of period | $ | 1,373,306 | $ | 3,178,582 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for interest, net of capitalized interest of $2.0 million | $ | 7,869 | $ | 5,731 | ||||

Exhibit 99.2

Copyright 2021, Plug Power Inc. Plug Power’s Q1 2023 Earnings Call May 9, 2023

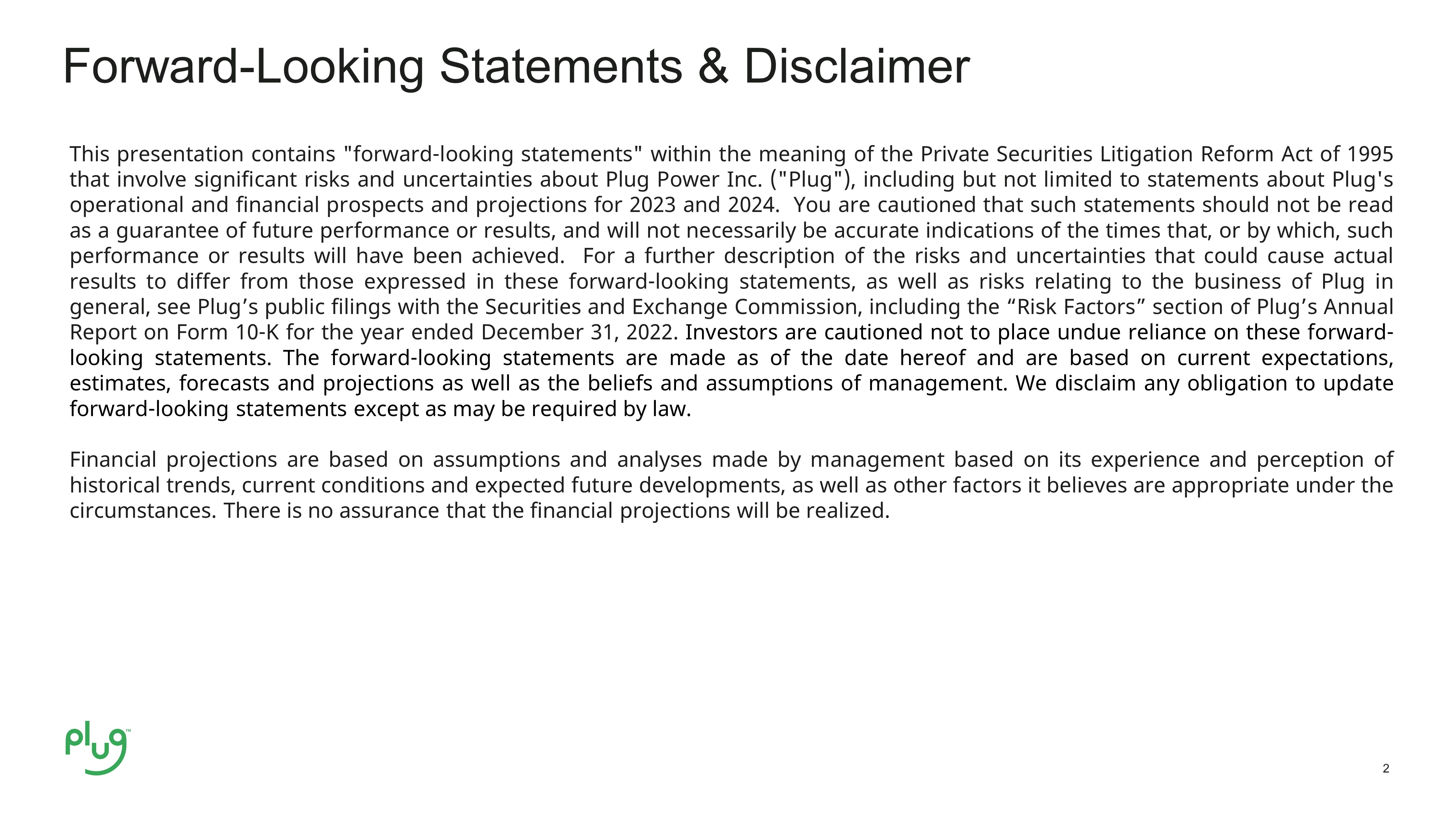

2 This presentation contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks and uncertainties about Plug Power Inc . ("Plug"), including but not limited to statements about Plug's operational and financial prospects and projections for 2023 and 2024 . You are cautioned that such statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times that, or by which, such performance or results will have been achieved . For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward - looking statements, as well as risks relating to the business of Plug in general, see Plug’s public filings with the Securities and Exchange Commission, including the “Risk Factors” section of Plug’s Annual Report on Form 10 - K for the year ended December 31 , 2022 . Investors are cautioned not to place undue reliance on these forward - looking statements . The forward - looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management . We disclaim any obligation to update forward - looking statements except as may be required by law . Financial projections are based on assumptions and analyses made by management based on its experience and perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances . There is no assurance that the financial projections will be realized .

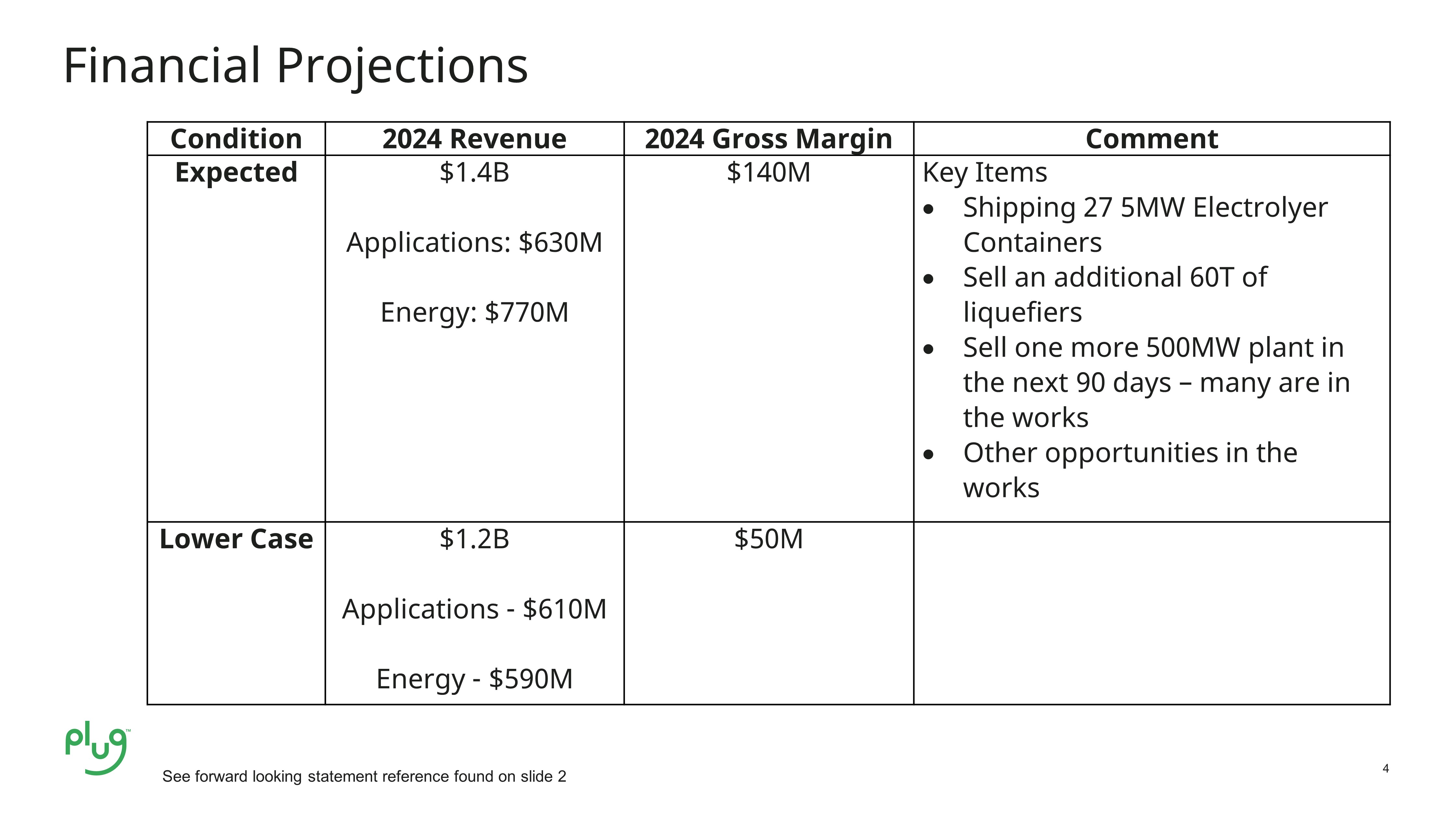

Forward - Looking Statements & Disclaimer 3 3 • Successful Execution of the Electrolyzer Business systems • Building systems at Scale • Building Green Hydrogen Plants beyond Georgia • Start Ramp of Stationary Products for further expansion in 2024 • Multiple Financing Solutions for the Hydrogen Plants to Preserve Cash • Plant Equity and Debt • No dilution of present shareholders • Continual Focus on Government Policy Key 2023 Message - Execution 4 Financial Projections Condition 2024 Revenue 2024 Gross Margin Comment Expected $1.4B Applications: $630M Energy: $770M $140M Key Items Shipping 27 5MW Electrolyer Containers Sell an additional 60T of liquefiers Sell one more 500MW plant in the next 90 days – many are in the works Other opportunities in the works Lower Case $1.2B Applications - $610M Energy - $590M $50M See forward looking statement reference found on slide 2