UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 4, 2023

Organon & Co.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40235 | 46-4838035 | ||

| (State or other jurisdiction | (Commission | (I.R.S. Employer | ||

| of incorporation) | File Number) | Identification No.) | ||

| 30 Hudson Street, Floor 33, Jersey City, NJ |

07302 | |||

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number, including area code: (551) 430-6900 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.01 per share | OGN | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On May 4, 2023, Organon & Co. (the “Company”) issued a press release (the “Earnings Release”) regarding its results for the quarter ended March 31, 2023. The Earnings Release is included as Exhibit 99.1 to this report.

The information contained in this Item 2.02, including Exhibit 99.1 attached hereto, is considered to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that Section. The information in this Current Report shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document. The release contains forward-looking statements regarding the Company and includes a cautionary statement identifying important factors that could cause actual results to differ materially from those anticipated.

| Item 7.01 | Regulation FD Disclosure. |

In connection with the conference call announced in the Earnings Release, on May 4, 2023, the Company made available the Company Information Presentation relating to its financial results for the quarter ended March 31, 2023. The Company Information Presentation may be accessed within the investor relations section of the Company’s website, https://www.organon.com. A copy of the Company Information Presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.2 attached hereto, is considered to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to liability under that Section. The information in this Current Report shall not be incorporated by reference into any filing or other document pursuant to the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document. The Company Information Presentation contains forward-looking statements regarding the Company and includes a cautionary statement identifying important factors that could cause actual results to differ materially from those anticipated.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. | Description | ||

| 99.1 | Press Release, dated May 4, 2023, relating to results of operations and financial condition. | ||

| 99.2 | Company Information Presentation. | ||

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Organon & Co. | |||

| By: | /s/ Matthew Walsh | ||

| Name: | Matthew Walsh | ||

| Title: | Chief Financial Officer | ||

Dated: May 4, 2023

Exhibit 99.1

| Media Contacts: | Karissa Peer | Investor Contacts: | Jennifer Halchak |

| (614) 314-8094 | (201) 275-2711 | ||

| Kate Vossen | Alex Arzeno | ||

| (732) 675-8448 | (203) 550-3972 |

Organon Reports Results for the First Quarter Ended March 31, 2023

| · | First quarter 2023 revenue of $1,538 million |

| · | First quarter 2023 diluted earnings per share of $0.69 and non-GAAP Adjusted diluted earnings per share of $1.08 |

| · | Both reported and non-GAAP Adjusted diluted earnings per share include a negative impact of $0.03 per share for acquired in-process research and development (IPR&D) |

| · | Adjusted EBITDA of $518 million, inclusive of $8 million of acquired IPR&D |

| · | Board of Directors declares quarterly dividend of $0.28 per share |

| · | Voluntary $250 million debt repayment on U.S. dollar-denominated term loan |

| · | Full year 2023 financial guidance ranges affirmed |

Jersey City, N.J., May 4, 2023 – Organon (NYSE: OGN) today announced its results for the first quarter ended March 31, 2023.

"The first quarter of 2023 represents the sixth consecutive quarter of constant currency product sales growth, with all three franchises positively contributing to performance," said Kevin Ali, Organon's CEO. "The Established Brands franchise, which represents two-thirds of our business, continues to demonstrate its durability. The associated predictability of cash flows enables us to take a balanced approach to capital allocation, continuing to deploy capital for strategic investments that will position the company for future growth, as well as to opportunistically reduce debt, as we did during the first quarter." For the first quarter of 2023, total revenue was $1,538 million, a decrease of 2% as-reported and an increase of 3% excluding the impact of foreign currency (ex-FX), compared with the first quarter of 2022.

First Quarter 2023 revenues

| in $ millions | Q1 2023 | Q1 2022 | VPY | VPY ex-FX | ||||||||||||

| Women’s Health | $ | 381 | $ | 378 | 1 | % | 3 | % | ||||||||

| Biosimilars | 116 | 99 | 18 | % | 20 | % | ||||||||||

| Established Brands | 1,002 | 1,053 | (5 | )% | 1 | % | ||||||||||

| Other (1) | 39 | 37 | 3 | % | 2 | % | ||||||||||

| Revenues | $ | 1,538 | $ | 1,567 | (2 | )% | 3 | % | ||||||||

(1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties.

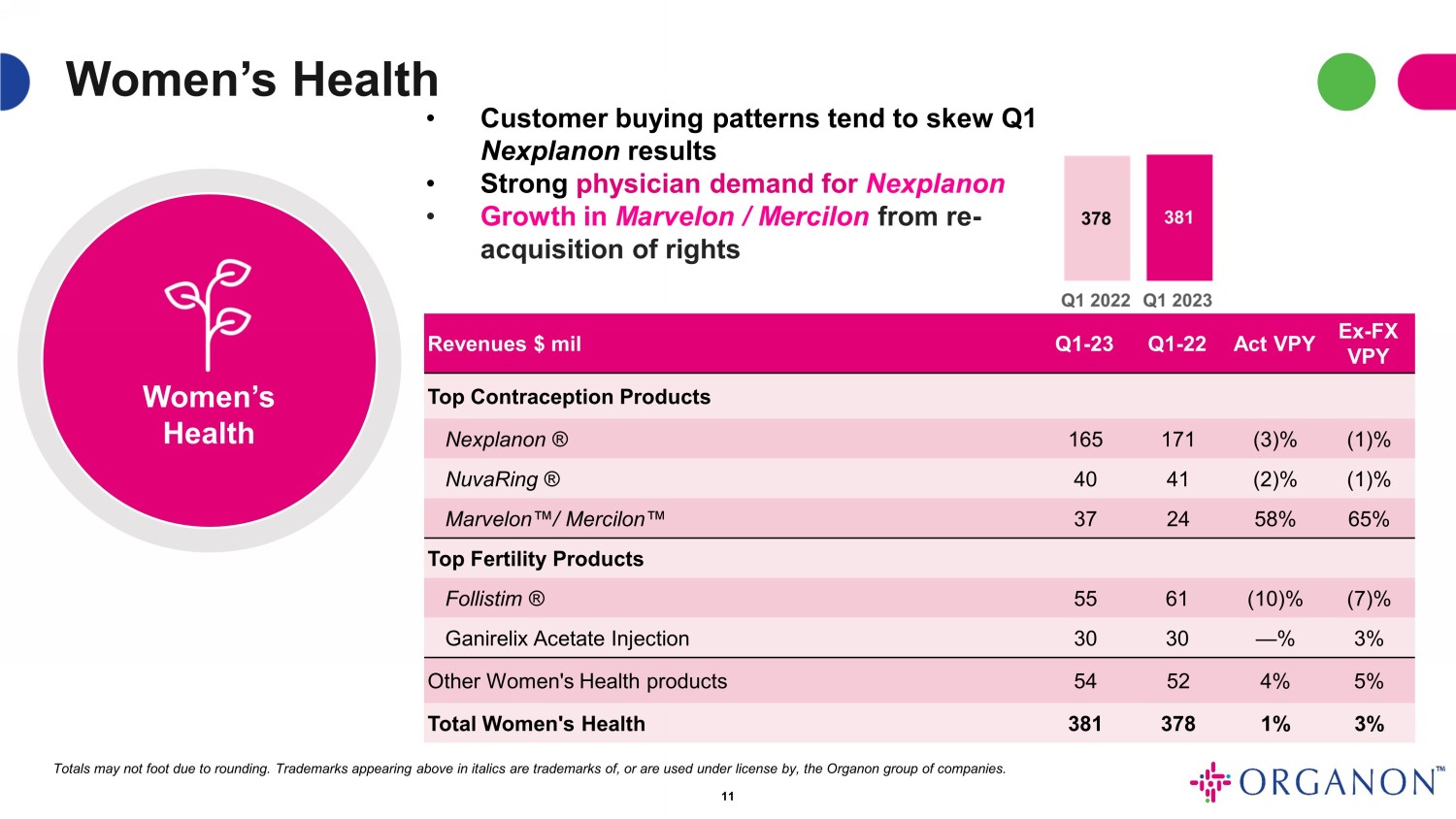

Women’s Health revenue grew 1% on an as-reported basis, and increased 3% ex-FX in the first quarter of 2023 compared with the first quarter of 2022 driven primarily by strong performance in oral contraceptives Marvelon™ (ethinylestradiol, desogestrel) and Mercilon™ (ethinylestradiol, desogestrel) for which Organon gained rights in selected territories in Southeast Asia and China during 2022. During the quarter, Nexplanon® (etonogestrel implant), a long-acting reversible contraceptive declined 1% ex-FX primarily due to the impact of distributors' buying patterns in prior periods. Follistim AQ® (follitropin beta injection) declined 7% ex-FX primarily related to COVID-related disruptions in China that have hampered access to fertility treatments in that market, as well as an unfavorable shift in customer mix and associated discount rates in the United States that was partially offset by strong product demand.

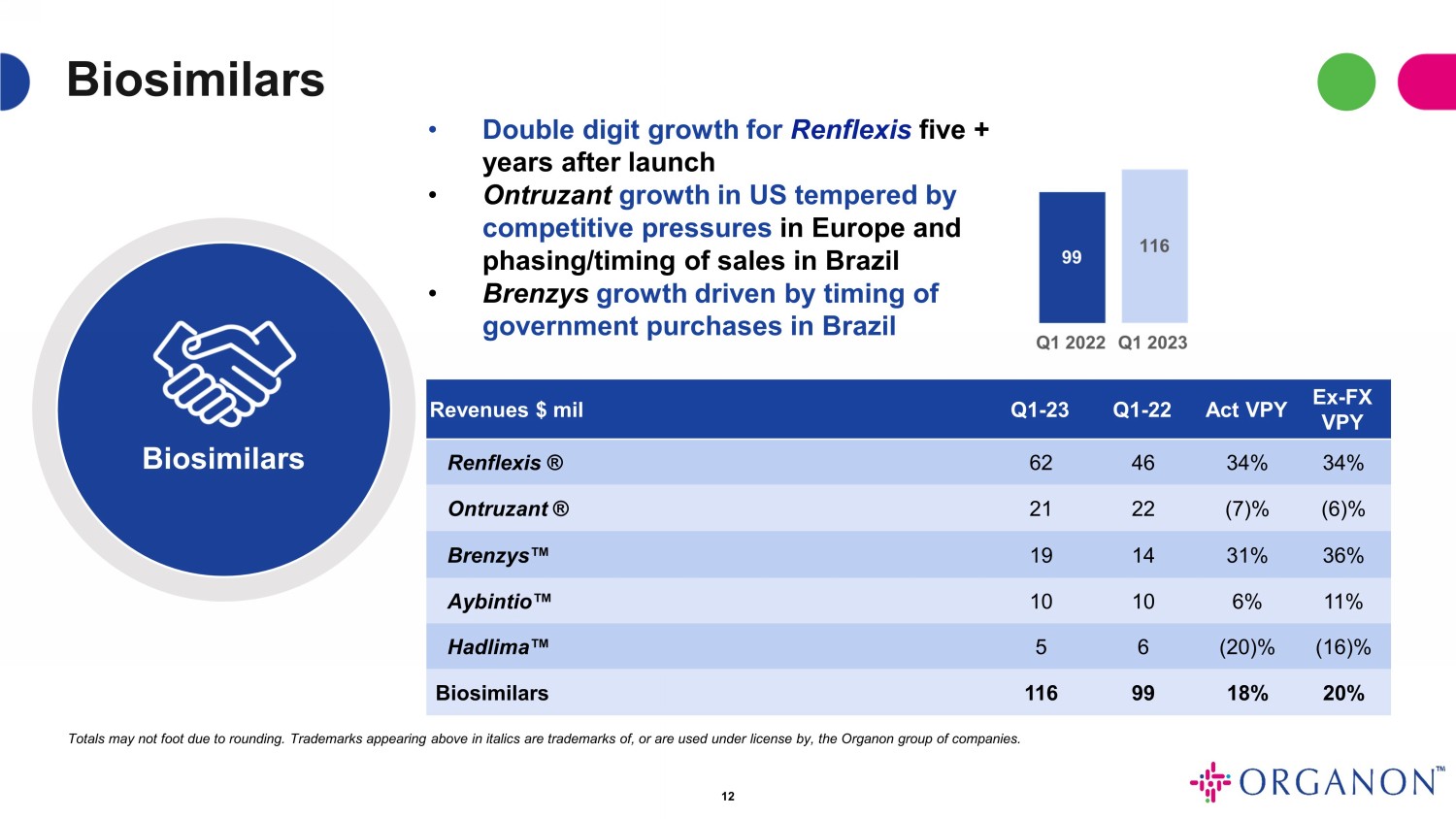

Biosimilars revenue increased 18% as-reported and 20% ex-FX in the first quarter 2023, compared with the first quarter of 2022 primarily driven by Renflexis® (infliximab-abda) which grew 34% ex-FX due to continued demand growth in the United States and Canada as well as Brenzys™ (etanercept) which grew 36% ex-FX as a result of timing of tenders in Brazil. Ongoing competitive pressures in Europe more than offset strong U.S. growth in Ontruzant® (trastuzumab-dttb).

Established Brands revenue decreased 5% as-reported and increased 1% ex-FX in the first quarter of 2023, compared with the first quarter of 2022 despite 1) the impact of Volume Based Procurement (VBP) initiatives in China which as of November 2022 included Zetia® (ezetimibe) (marketed in most countries outside of the United States as Ezetrol™) and 2) supply interruptions of Diprospan™, Celestone Chronodose™, and Celestone Soluspan™ stemming from the company's market action taken in January for those injectable steroid products. Strong performance in China and in the APJ region (Asia Pacific/Japan), primarily in markets outside Japan, were the most significant offsets to these factors

First Quarter 2023 Profitability

| in $ millions, except per share amounts | 2023 | 2022 | VPY | |||||||||

| Revenues | $ | 1,538 | $ | 1,567 | (2 | )% | ||||||

| Cost of sales | 580 | 561 | 3 | % | ||||||||

| Gross profit | 958 | 1,006 | (5 | )% | ||||||||

| Non-GAAP Adjusted gross profit (1) | 1,003 | 1,042 | (4 | )% | ||||||||

| Adjusted EBITDA (1,2) | 518 | 647 | (20 | )% | ||||||||

| Net Income | 177 | 348 | (49 | )% | ||||||||

| Non-GAAP Adjusted net income (1) | 276 | 420 | (34 | )% | ||||||||

| Diluted Earnings per Share (EPS) | 0.69 | 1.36 | (49 | )% | ||||||||

| Non-GAAP Adjusted diluted EPS (1) | 1.08 | 1.65 | (35 | )% | ||||||||

| Acquired in-process research & development (IPR&D) and milestones | 8 | — | NM | |||||||||

| Per share impact to diluted EPS from acquired IPR&D and milestones | 0.03 | — | NM | |||||||||

| 2023 | 2022 | |||||||

| Gross margin | 62.3 | % | 64.2 | % | ||||

| Non-GAAP Adjusted gross margin (1) | 65.2 | % | 66.5 | % | ||||

| Adjusted EBITDA margin (1,2) | 33.7 | % | 41.3 | % | ||||

(1) See Tables 4 and 5 for reconciliations of GAAP to non-GAAP financial measures

(2) Adjusted EBITDA and Adjusted EBITDA margin include $8 million in the first quarter of 2023 related to acquired IPR&D and milestones

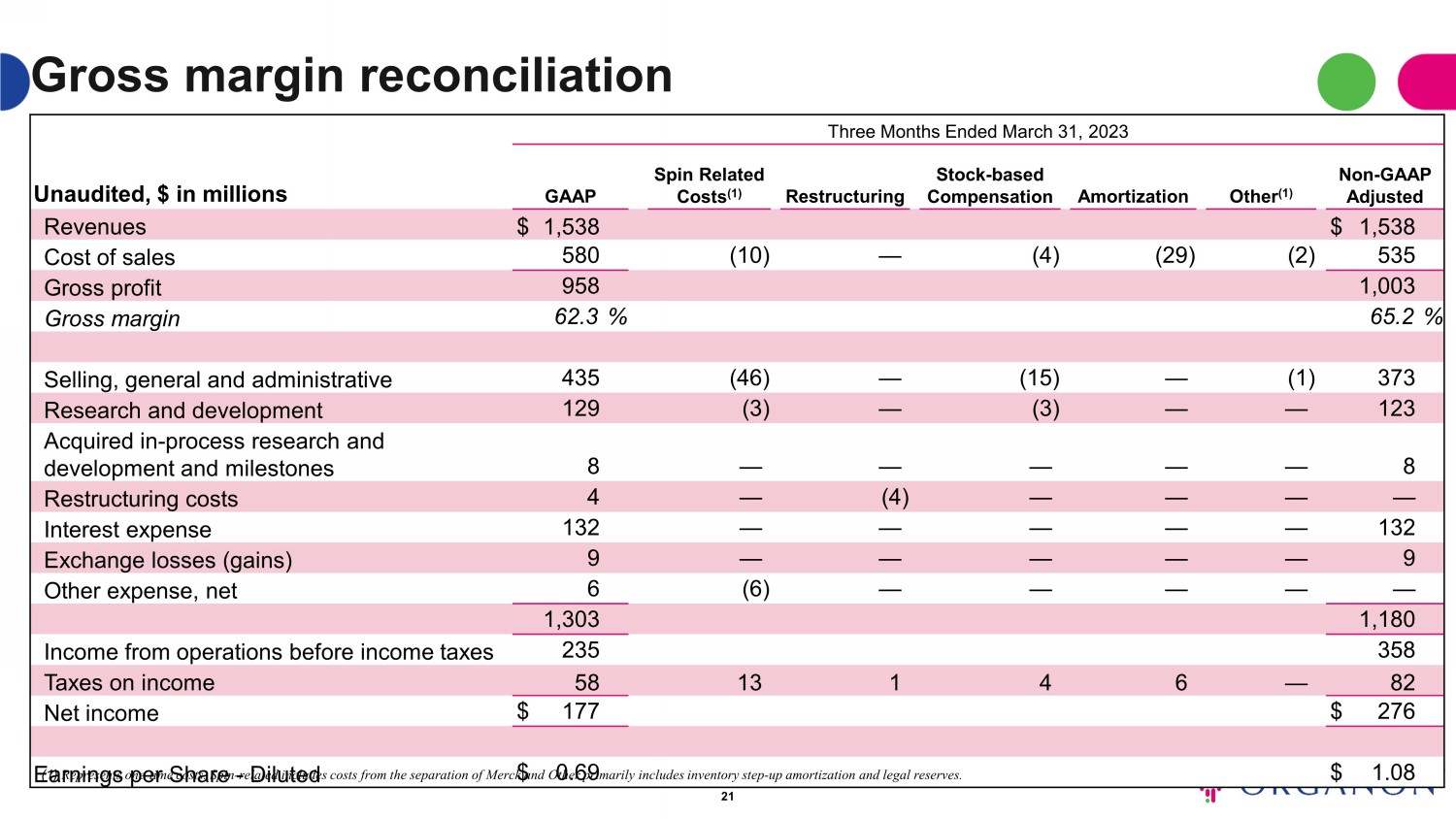

Gross margin was 62.3% as-reported and 65.2% on an adjusted basis in the first quarter of 2023 compared with 64.2% as-reported and 66.5% on an adjusted basis in the first quarter of 2022. The year-over-year decline in gross margin is primarily due to product mix as well as inflationary pressure that impacted distribution and employee-related costs.

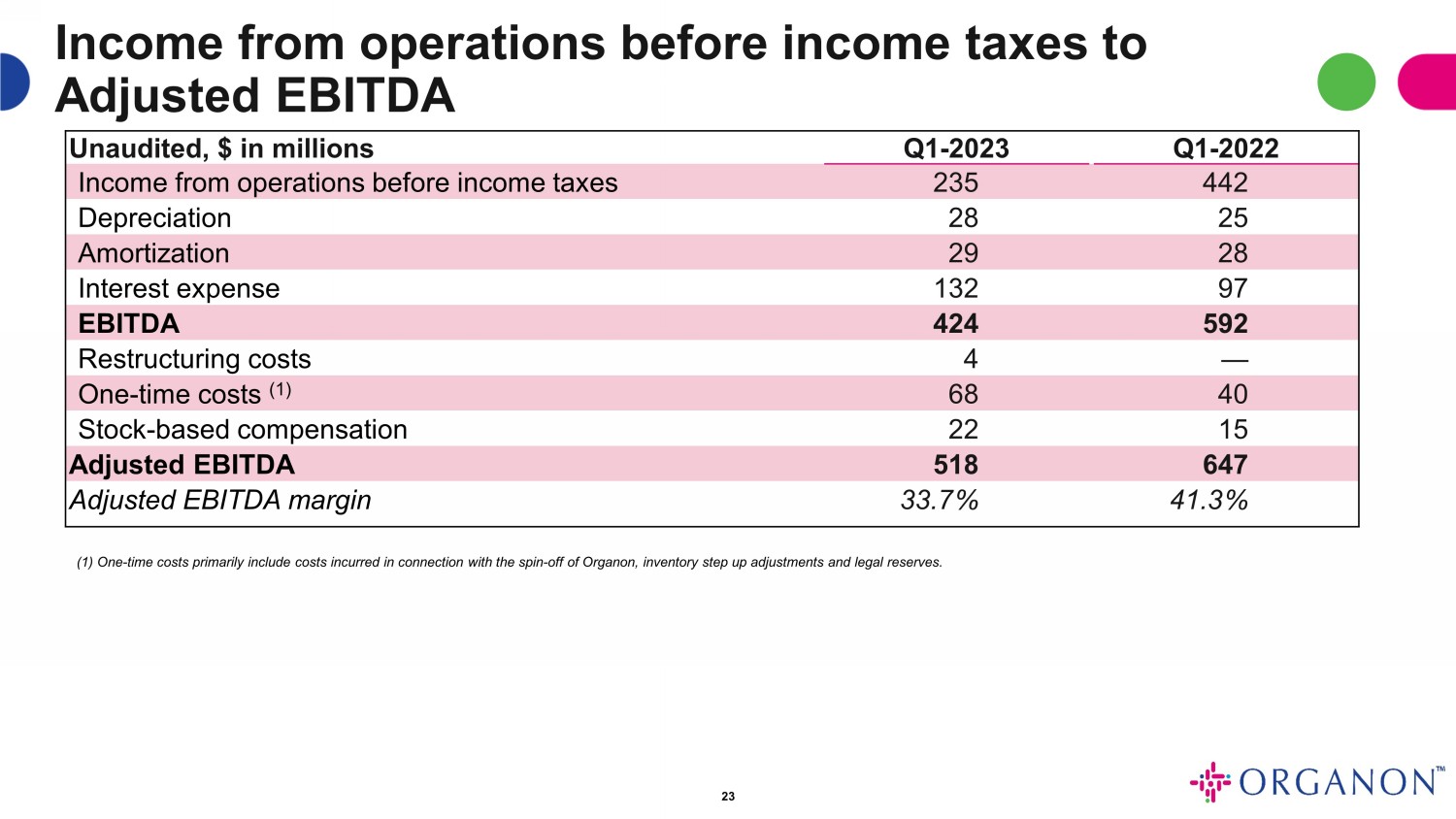

Adjusted EBITDA margin was 33.7% in the first quarter of 2023 compared to 41.3% in the first quarter of 2022. Higher promotional and employee-related costs as well as increasing R&D spend associated with the company's recent acquisitions of clinical stage assets were the primary contributors to the decline in Adjusted EBITDA margin year over year.

Net income for the first quarter of 2023 was $177 million, or $0.69 per diluted share, compared with $348 million, or $1.36 per diluted share, in the first quarter of 2022. Non-GAAP Adjusted net income was $276 million, or $1.08 per diluted share, compared with $420 million, or $1.65 per diluted share, in 2022. The year over year decline in net income was a result of lower Adjusted EBITDA as well as increased interest expense (related to higher interest rates and interest expense for accelerated amortization of debt fees and discounts as part of the $250 million voluntary prepayment on the U.S. dollar-denominated term loan), a higher effective tax rate and the impact of exchange losses driven by the fluctuations in foreign currency.

Capital Allocation

Today, Organon’s Board of Directors declared a quarterly dividend of $0.28 for each issued and outstanding share of the company's common stock. The dividend is payable on June 15, 2023, to stockholders of record at the close of business on May 15, 2023.

As of March 31, 2023, cash and cash equivalents were $459 million, and debt was $8.7 billion. Total debt as of March 31, 2023 reflects a discretionary first quarter prepayment of $250 million on the company’s U.S. dollar-denominated term loan.

Full Year Guidance

Organon does not provide GAAP financial measures on a forward-looking basis because the company cannot predict with reasonable certainty and without unreasonable effort, the ultimate outcome of legal proceedings, unusual gains and losses, the occurrence of matters creating GAAP tax impacts, and acquisition-related expenses. These items are uncertain, depend on various factors, and could be material to Organon’s results computed in accordance with GAAP. Organon's financial guidance does not assume an estimate for future in-process research and development for business development transactions not yet executed.

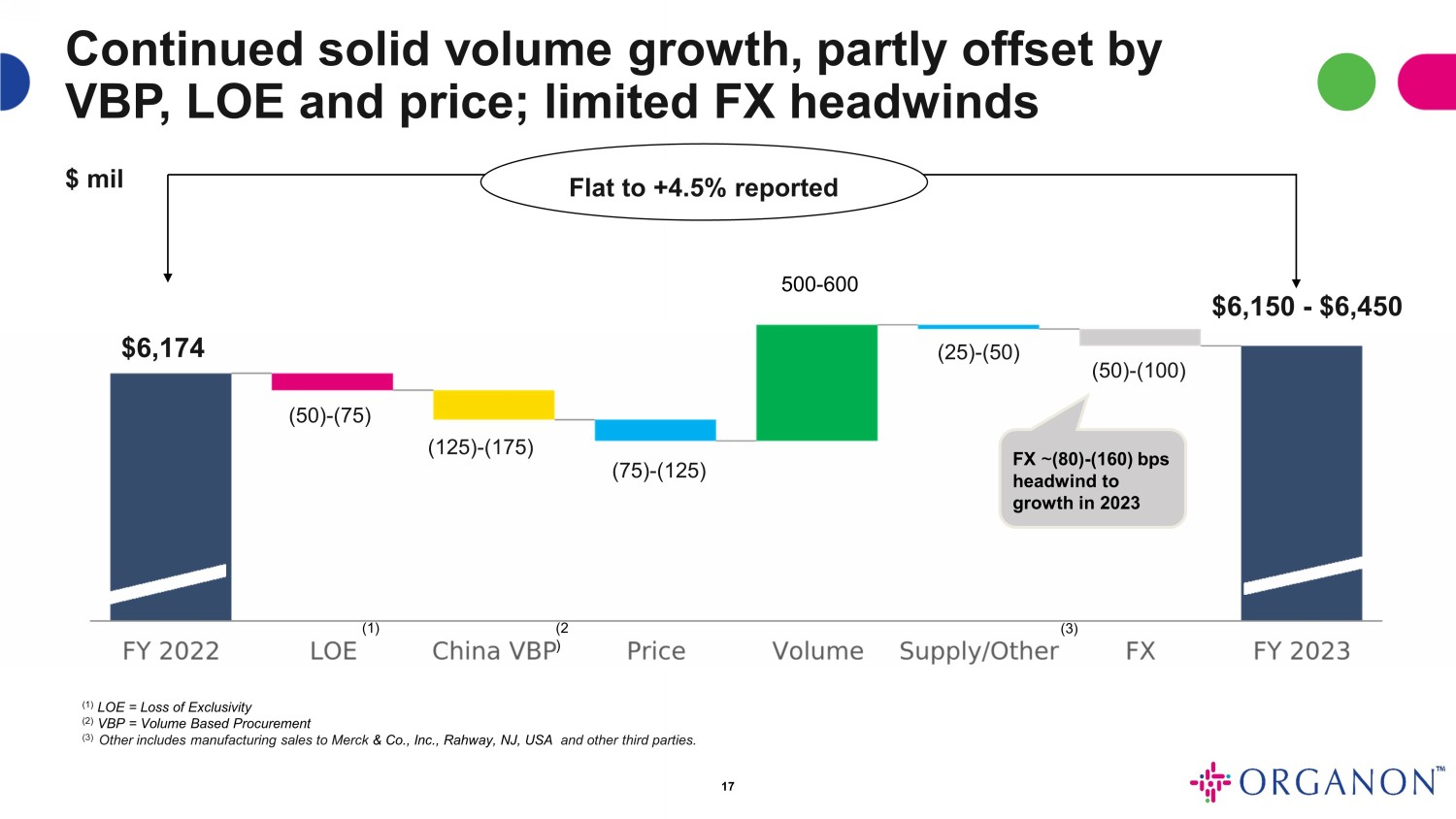

Full year 2023 financial guidance is presented below on a non-GAAP basis.

| Previous guidance as of February 16, 2023 | Current guidance | |

| Revenues | $6.150 billion - $6.450 billion | Unchanged |

| Adjusted gross margin | Low-mid 60% range | Unchanged |

| SG&A (as % of revenue) | Mid 20% range | Unchanged |

| R&D1 (as % of revenue) | Upper single-digit | Unchanged |

| Adjusted EBITDA margin | 31.0%-33.0% | Unchanged |

| Interest | ~$510 million | ~$515 million |

| Depreciation | ~$130 million | Unchanged |

| Effective non-GAAP tax rate | 19.0% - 21.0% | Unchanged |

| Fully diluted weighted average shares outstanding | ~255 million | ~257 million |

| 1 | The range provided for estimated R&D spend includes the company's estimate of approximately $40 million for IPR&D for the full year 2023 which is based on estimated milestones that may be achieved in 2023 by products in the company's current portfolio. Organon's financial guidance does not assume an estimate for future IPR&D for business development transactions not yet executed. |

Webcast Information

Organon will host a conference call at 8:30 a.m. Eastern Time today to discuss its first quarter 2023 financial results. To listen to the event and view the presentation slides via webcast, join from the Organon Investor Relations website at https://www.organon.com/investor-relations/events-and-presentations/. A replay of the webcast will be available approximately two hours after the conclusion of the live event on the company’s website. Institutional investors and analysts interested in participating in the call must register in advance by clicking on this link:

https://conferencingportals.com/event/jgIqShwa

Following registration, participants will receive a confirmation email containing details on how to join the conference call, including dial-in information and a unique passcode and registrant ID. Pre-registration will allow participants to bypass an operator and be placed directly into the call.

About Organon

Organon is a global healthcare company with a focus on improving the health of women throughout their lives. Organon has a portfolio of more than 60 medicines and products across a range of therapeutic areas. Led by the women’s health portfolio coupled with an expanding biosimilars business and stable franchise of established medicines, Organon’s products produce strong cash flows that will support investments in innovation and future growth opportunities in women’s health. In addition, Organon is pursuing opportunities to collaborate with biopharmaceutical innovators looking to commercialize their products by leveraging its scale and presence in fast growing international markets. Organon has a global footprint with significant scale and geographic reach, world-class commercial capabilities, and approximately 10,000 employees with headquarters located in Jersey City, New Jersey.

For more information, visit http://www.organon.com and connect with us on LinkedIn, Instagram, Twitter and Facebook.

Cautionary Note Regarding Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures,” which are financial measures that either exclude or include amounts that are correspondingly not excluded or included in the most directly comparable measures calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Specifically, the company makes use of the non-GAAP financial measures Adjusted EBITDA, Adjusted net income, and Adjusted diluted EPS, which are not recognized terms under GAAP and are presented only as a supplement to the company’s GAAP financial statements. This press release also provides certain measures that exclude the impact of foreign exchange. We calculate foreign exchange by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results. The company believes that these non-GAAP financial measures help to enhance an understanding of the company’s financial performance. However, the presentation of these measures has limitations as an analytical tool and should not be considered in isolation, or as a substitute for the company’s results as reported under GAAP. Because not all companies use identical calculations, the presentations of these non-GAAP measures may not be comparable to other similarly titled measures of other companies. You should refer to Table 4 and Table 5 of this press release for relevant definitions and reconciliations of non-GAAP financial measures contained herein to the most directly comparable GAAP measures.

In addition, the company’s full-year 2023 guidance measures (other than revenue) are provided on a non-GAAP basis because the company is unable to reasonably predict certain items contained in the GAAP measures. Such items include, but are not limited to, acquisition related expenses, restructuring and related expenses, stock-based compensation, the ultimate outcome of legal proceedings, unusual gains and losses, the occurrence of matters creating GAAP tax impacts and other items not reflective of the company's ongoing operations.

The company uses non-GAAP financial measures in its operational and financial decision making, and believes that it is useful to exclude certain items in order to focus on what it regards to be a more meaningful representation of the underlying operating performance of the business.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, this press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about management’s expectations about Organon’s future financial performance and prospects. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning. These statements are based upon the current beliefs and expectations of the company’s management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include, but are not limited to, an inability to execute on our business development strategy or realize the benefits of our planned acquisitions; efficacy, safety, or other quality concerns with respect to marketed products, including market actions such as recalls, withdrawals, or declining sales; political and social pressures, or regulatory developments, that adversely impact demand for, availability of, or patient access to contraception or fertility products; general economic factors, including recessionary pressures, interest rate and currency exchange rate fluctuations; general industry conditions and competition; the impact of the ongoing COVID-19 pandemic and emergence of variant strains; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global trends toward health care cost containment; technological advances; new products and patents attained by competitors; challenges inherent in new product development, including obtaining regulatory approval; the company’s ability to accurately predict its future financial results and performance; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; difficulties developing and sustaining relationships with commercial counterparties; dependence on the effectiveness of the company’s patents and other protections for innovative products; and the exposure to litigation, including patent litigation, and/or regulatory actions.

The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the company’s filings with the Securities and Exchange Commission ("SEC"), including the company’s Annual Report on Form 10-K for the year ended December 31, 2022, available at the SEC’s Internet site (www.sec.gov).

TABLE 1

Organon & Co.

Condensed Consolidated Statement of Income

(Unaudited, $ in millions except shares in thousands and per share amounts)

| Three Months Ended March 31, |

||||||||

| 2023 | 2022 | |||||||

| Revenues | $ | 1,538 | $ | 1,567 | ||||

| Costs, Expenses and Other | ||||||||

| Cost of sales | 580 | 561 | ||||||

| Selling, general and administrative | 435 | 371 | ||||||

| Research and development | 129 | 96 | ||||||

| Acquired in-process research and development and milestones | 8 | — | ||||||

| Restructuring costs | 4 | — | ||||||

| Interest expense | 132 | 97 | ||||||

| Exchange losses (gains) | 9 | (4 | ) | |||||

| Other expense, net | 6 | 4 | ||||||

| 1,303 | 1,125 | |||||||

| Income From Operations Before Income Taxes | 235 | 442 | ||||||

| Taxes on Income | 58 | 94 | ||||||

| Net Income | 177 | 348 | ||||||

| Earnings per Share: | ||||||||

| Basic | $ | 0.70 | $ | 1.37 | ||||

| Diluted | $ | 0.69 | $ | 1.36 | ||||

| Weighted Average Shares Outstanding: | ||||||||

| Basic | 254,392 | 253,583 | ||||||

| Diluted | 256,170 | 255,052 | ||||||

TABLE 2

Organon & Co.

Sales by top products

(Unaudited, $ in millions)

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||||||

| U.S. | Int’l | Total | U.S. | Int’l | Total | |||||||||||||||||||

| Women’s Health | ||||||||||||||||||||||||

| Nexplanon/Implanon NXT | $ | 114 | $ | 52 | $ | 165 | $ | 116 | $ | 55 | $ | 171 | ||||||||||||

| Follistim AQ | 26 | 29 | 55 | 30 | 31 | 61 | ||||||||||||||||||

| NuvaRing | 15 | 24 | 40 | 16 | 24 | 41 | ||||||||||||||||||

| Ganirelix Acetate Injection | 6 | 23 | 30 | 8 | 22 | 30 | ||||||||||||||||||

| Marvelon/Mercilon | — | 37 | 37 | — | 24 | 24 | ||||||||||||||||||

| Other Women's Health (1) | 26 | 28 | 54 | 27 | 26 | 52 | ||||||||||||||||||

| Biosimilars | ||||||||||||||||||||||||

| Renflexis | 55 | 7 | 62 | 42 | 4 | 46 | ||||||||||||||||||

| Ontruzant | 13 | 8 | 21 | 7 | 15 | 22 | ||||||||||||||||||

| Brenzys | — | 19 | 19 | — | 14 | 14 | ||||||||||||||||||

| Aybintio | — | 10 | 10 | — | 10 | 10 | ||||||||||||||||||

| Hadlima | — | 5 | 5 | — | 6 | 6 | ||||||||||||||||||

| Established Brands | ||||||||||||||||||||||||

| Cardiovascular | ||||||||||||||||||||||||

| Zetia | 2 | 81 | 83 | 3 | 96 | 99 | ||||||||||||||||||

| Vytorin | 2 | 28 | 29 | 2 | 36 | 38 | ||||||||||||||||||

| Atozet | — | 128 | 128 | — | 119 | 119 | ||||||||||||||||||

| Rosuzet | — | 18 | 18 | — | 22 | 22 | ||||||||||||||||||

| Cozaar/Hyzaar | 2 | 83 | 85 | 8 | 86 | 93 | ||||||||||||||||||

| Other Cardiovascular (1) | 1 | 40 | 41 | 1 | 38 | 39 | ||||||||||||||||||

| Respiratory | ||||||||||||||||||||||||

| Singulair | 3 | 117 | 120 | 3 | 127 | 130 | ||||||||||||||||||

| Nasonex | — | 69 | 69 | 9 | 65 | 75 | ||||||||||||||||||

| Dulera | 38 | 8 | 46 | 31 | 9 | 40 | ||||||||||||||||||

| Clarinex | 1 | 39 | 39 | 1 | 37 | 38 | ||||||||||||||||||

| Other Respiratory (1) | 12 | 5 | 17 | 12 | 11 | 22 | ||||||||||||||||||

| Non-Opioid Pain, Bone and Dermatology | ||||||||||||||||||||||||

| Arcoxia | — | 71 | 71 | — | 60 | 60 | ||||||||||||||||||

| Fosamax | — | 37 | 38 | 1 | 40 | 41 | ||||||||||||||||||

| Diprospan | — | 14 | 14 | — | 31 | 31 | ||||||||||||||||||

| Other Non-Opioid Pain, Bone and Dermatology (1) | 4 | 59 | 63 | 3 | 66 | 69 | ||||||||||||||||||

| Other | ||||||||||||||||||||||||

| Proscar | — | 27 | 27 | — | 24 | 24 | ||||||||||||||||||

| Propecia | 2 | 31 | 33 | 1 | 29 | 30 | ||||||||||||||||||

| Other (1) | 4 | 76 | 80 | 8 | 74 | 83 | ||||||||||||||||||

| Other (2) | — | 39 | 39 | — | 37 | 37 | ||||||||||||||||||

| Revenues | $ | 326 | $ | 1,212 | $ | 1,538 | $ | 329 | $ | 1,238 | $ | 1,567 | ||||||||||||

Totals may not foot due to rounding. Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies.

| (1) | Includes sales of products not listed separately. Revenues from Marvelon/Mercilon were previously reported as part of Other Women's Health. Revenue from an arrangement for the sale of generic etonogestrel/ethinyl estradiol vaginal ring is included in Other Women's Health. |

| (2) | Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties. |

TABLE 3

Organon & Co.

Sales by geographic area

(Unaudited, $ in millions)

| Three Months Ended March 31, |

||||||||

| 2023 | 2022 | |||||||

| Europe and Canada | $ | 400 | $ | 436 | ||||

| United States | 326 | 329 | ||||||

| Asia Pacific and Japan | 324 | 314 | ||||||

| China | 225 | 236 | ||||||

| Latin America, Middle East, Russia and Africa | 214 | 209 | ||||||

| Other (1) | 49 | 43 | ||||||

| Revenues | $ | 1,538 | $ | 1,567 | ||||

(1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties.

TABLE 4

Reconciliation of GAAP Gross Margin to Non-GAAP Adjusted Gross Profit and Adjusted Gross Margin

(Unaudited, $ in millions)

| Three Months Ended March 31, 2023 | ||||||||||||||||||||||||||||

| GAAP | Spin Related Costs(1) |

Restructuring | Stock-based Compensation |

Amortization | Other(1) | Non-GAAP Adjusted |

||||||||||||||||||||||

| Revenues | $ | 1,538 | $ | 1,538 | ||||||||||||||||||||||||

| Cost of sales | 580 | (10 | ) | — | (4 | ) | (29 | ) | (2 | ) | 535 | |||||||||||||||||

| Gross profit | 958 | 1,003 | ||||||||||||||||||||||||||

| Gross margin | 62.3 | % | 65.2 | % | ||||||||||||||||||||||||

| Selling, general and administrative | 435 | (46 | ) | — | (15 | ) | — | (1 | ) | 373 | ||||||||||||||||||

| Research and development | 129 | (3 | ) | — | (3 | ) | — | — | 123 | |||||||||||||||||||

| Acquired in-process research and development and milestones | 8 | — | — | — | — | — | 8 | |||||||||||||||||||||

| Restructuring costs | 4 | — | (4 | ) | — | — | — | — | ||||||||||||||||||||

| Interest expense | 132 | — | — | — | — | — | 132 | |||||||||||||||||||||

| Exchange losses (gains) | 9 | — | — | — | — | — | 9 | |||||||||||||||||||||

| Other expense, net | 6 | (6 | ) | — | — | — | — | — | ||||||||||||||||||||

| 1,303 | 1,180 | |||||||||||||||||||||||||||

| Income from operations before income taxes | 235 | 358 | ||||||||||||||||||||||||||

| Taxes on income | 58 | 13 | 1 | 4 | 6 | — | 82 | |||||||||||||||||||||

| Net income | $ | 177 | $ | 276 | ||||||||||||||||||||||||

| Earnings per Share - Diluted | $ | 0.69 | $ | 1.08 | ||||||||||||||||||||||||

(1) Represents one-time costs. Spin-related includes costs from the separation of Merck and Other primarily includes inventory step-up amortization and legal reserves.

| Three Months Ended March 31, 2022 | ||||||||||||||||||||||||||||

| GAAP | Spin Related Costs(1) |

Restructuring | Stock-based Compensation |

Amortization | Other(1) | Non-GAAP Adjusted |

||||||||||||||||||||||

| Revenues | $ | 1,567 | $ | 1,567 | ||||||||||||||||||||||||

| Cost of sales | 561 | (4 | ) | — | (3 | ) | (28 | ) | (1 | ) | 525 | |||||||||||||||||

| Gross profit | 1,006 | 1,042 | ||||||||||||||||||||||||||

| Gross margin | 64.2 | % | 66.5 | % | ||||||||||||||||||||||||

| Selling, general and administrative | 371 | (25 | ) | — | (10 | ) | — | — | 336 | |||||||||||||||||||

| Research and development | 96 | (3 | ) | — | (2 | ) | — | (1 | ) | 90 | ||||||||||||||||||

| Restructuring costs | — | — | — | — | — | — | — | |||||||||||||||||||||

| Interest expense | 97 | — | — | — | — | — | 97 | |||||||||||||||||||||

| Exchange losses (gains) | (4 | ) | — | — | — | — | — | (4 | ) | |||||||||||||||||||

| Other expense, net | 4 | (6 | ) | — | — | — | — | (2 | ) | |||||||||||||||||||

| 1,125 | 1,042 | |||||||||||||||||||||||||||

| Income from operations before income taxes | 442 | 525 | ||||||||||||||||||||||||||

| Taxes on income | 94 | 4 | — | 2 | 5 | — | 105 | |||||||||||||||||||||

| Net income | $ | 348 | $ | 420 | ||||||||||||||||||||||||

| Earnings per Share - Diluted | $ | 1.36 | $ | 1.65 | ||||||||||||||||||||||||

(1) Represents one-time costs. Spin-related includes costs from the separation of Merck and Other primarily includes inventory step-up amortization and legal reserves.

TABLE 5

Organon & Co.

Reconciliation of GAAP Income from Operations Before Income Taxes to Adjusted EBITDA

(Unaudited, $ in millions)

| Three Months Ended March 31, |

||||||||

| 2023 | 2022 | |||||||

| Income from operations before income taxes | $ | 235 | $ | 442 | ||||

| Depreciation | 28 | 25 | ||||||

| Amortization | 29 | 28 | ||||||

| Interest expense | 132 | 97 | ||||||

| EBITDA | $ | 424 | $ | 592 | ||||

| Restructuring costs | 4 | — | ||||||

| One-time costs (1) | 68 | 40 | ||||||

| Stock-based compensation | 22 | 15 | ||||||

| Adjusted EBITDA | $ | 518 | $ | 647 | ||||

| Adjusted EBITDA margin | 33.7 | % | 41.3 | % | ||||

(1) One-time costs primarily include costs incurred in connection with the spin-off of Organon, inventory step up adjustments and legal reserves.

Exhibit 99.2

First Quarter 2023 Earnings Organon Disclaimer statement Cautionary Note Regarding Forward - Looking Statements Except for historical information, this press release includes “forward - looking statements” within the meaning of the safe harbo r provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about management’s expectations about Organon’s future financia l p erformance and prospects. Forward - looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “w ill” or words of similar meaning. These statements are based upon the current beliefs and expectations of the company’s management and are subject to significant risks and uncertai nti es. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward - looking statements. Risks and uncertainties include, but are not limited to, an inability to execute on our business development strategy or real ize the benefits of our planned acquisitions; efficacy, safety, or other quality concerns with respect to marketed products, including market actions such as recalls, withdrawals, or declin ing sales; political and social pressures, or regulatory developments, that adversely impact demand for, availability of, or patient access to contraception or fertility products; g ene ral economic factors, including recessionary pressures, interest rate and currency exchange rate fluctuations; general industry conditions and competition; the impact of the ongoing CO VID - 19 pandemic and emergence of variant strains; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global tr ends toward health care cost containment; technological advances; new products and patents attained by competitors; challenges inherent in new product development, including obtaini ng regulatory approval; the company’s ability to accurately predict its future financial results and performance; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; difficulties developing and sustaining relationships with commercial counterparties; dependence on the effectiveness of the company’s pate nts and other protections for innovative products; and the exposure to litigation, including patent litigation, and/o r regulatory actions. The company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, f uture events or otherwise. Additional factors that could cause results to differ materially from those described in the forward - looking statements can be found in the company’s fi lings with the Securities and Exchange Commission ("SEC"), including the company’s Annual Report on Form 10 - K for the year ended December 31, 2022, available at the SEC’s Internet site ( www.sec.gov ). 2 Disclaimer statement, cont.

Cautionary Note Regarding Non - GAAP Financial Measures This press release contains “non - GAAP financial measures,” which are financial measures that either exclude or include amounts t hat are correspondingly not excluded or included in the most directly comparable measures calculated and presented in accordance with U.S. generally acce pte d accounting principles (“GAAP”). Specifically, the company makes use of the non - GAAP financial measures Adjusted EBITDA, Adjusted Net Income, and Adjusted dilute d EPS, which are not recognized terms under GAAP and are presented only as a supplement to the company’s GAAP financial statements. This press rel eas e also provides certain measures that exclude the impact of foreign exchange. We calculate foreign exchange by converting our current - period local curre ncy financial results using the prior period average currency rates and comparing these adjusted amounts to our current - period results. The company believes that thes e non - GAAP financial measures help to enhance an understanding of the company’s financial performance. However, the presentation of these measures has limi tat ions as an analytical tool and should not be considered in isolation, or as a substitute for the company’s results as reported under GAAP. Because not all c omp anies use identical calculations, the presentations of these non - GAAP measures may not be comparable to other similarly titled measures of other companies. You should refer to Table 4 and Table 5 of this press release for relevant definitions and reconciliations of non - GAAP financial measures contained herein to the most dire ctly comparable GAAP measures. In addition, the company’s full - year 2023 guidance measures (other than revenue) are provided on a non - GAAP basis because the co mpany is unable to reasonably predict certain items contained in the GAAP measures. Such items include, but are not limited to, acquisition related expense s, restructuring and related expenses, stock - based compensation, the ultimate outcome of legal proceedings, unusual gains and losses, the occurrence of matters creatin g GAAP tax impacts and other items not reflective of the company's ongoing operations. The company uses non - GAAP financial measures in its operational and financial decision making, and believes that it is useful to exclude certain items in order to focus on what it regards to be a more meaningful representation of the underlying operating performance of the business. 3 First quarter 2023 highlights 4 • Revenue of $1.5 billion , up 3% ex - FX • All three franchises grew, ex - FX • Adjusted EBITDA of $518 million • Diluted EPS of $0.69; Adjusted Diluted EPS of $1.08 • $250 million voluntary debt repayment • Expansion of Women's Health portfolio with strategic investment in Claria Medical, Inc. See Slides 21 - 23 of this presentation for a reconciliation of non - GAAP measures.

Each franchise contributed to growth Women's Health Biosimilars Established Brands • Growth of 3% ex - FX driven by Marvelon / Mercilion • Fertility volume growth offset by channel mix in U.S. and COVID - related lockdowns in China early in the year • Strong physician demand for Nexplanon • Double digit growth ex - FX • Continued uptake in Renflexis and Ontruzant in U.S. • Franchise continues to demonstrate stability • Delivered 1% growth ex - FX despite VBP in China and supply constraints related to market action 5 Nexplanon ® growth inflected since spin - off LTM view normalizes for tender phasing ex - US and inventory adjustments in the U.S. $ mil 6 % Product Sales Growth *LTM * LTM: “Last 12 Months” | % Growth expressed at constant currency Pre - spin

Each franchise contributed to growth Women's Health Biosimilars Established Brands • Growth of 3% ex - FX driven by Marvelon / Mercilion • Fertility volume growth offset by channel mix in U.S. and COVID - related lockdowns in China early in the year • Strong physician demand for Nexplanon • Double digit growth ex - FX • Continued uptake in Renflexis and Ontruzant in U.S. • Franchise continues to demonstrate stability • Delivered 1% growth ex - FX despite VBP in China and supply constraints related to market action 7 Established Brands sizeable and stable base of revenue, drives durable cash flow $ mil 8 % Product Sales Growth *LTM Pre - spin * LTM: “Last 12 Months” | % Growth expressed at constant currency

- 2% reported +3% ex - FX $ mil 9 Minimal LOE and VBP impact; strong volume growth (1) LOE = Loss of Exclusivity (2) VBP = Volume Based Procurement (3) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties.

(1) (2) ~0 ~(30) ~100 ~(5) ~(70) ~(30) $1,567 $1,538 (3) FX ~ (450) bps headwind to growth in Q1 China grew despite VBP impact; strong APJ growth $ mil Q1 - 23 Q1 - 22 Actual VPY Ex - FX VPY Europe and Canada 400 436 (8)% (4)% United States 326 329 (1)% (1)% Asia Pacific and Japan 324 314 3% 12% China 225 236 (5)% 3% Latin America, Middle East, Russia and Africa 214 209 3% 3% Other (1) 49 43 14% 16% Total Revenues 1,538 1,567 (2)% 3% 10 ~80% of Q1 sales generated ex - US (1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties.

Women’s Health Women’s Health Revenues $ mil Q1 - 23 Q1 - 22 Act VPY Ex - FX VPY Top Contraception Products Nexplanon ® 165 171 (3)% (1)% NuvaRing ® 40 41 (2)% (1)% Marvelon Œ / Mercilon Œ 37 24 58% 65% Top Fertility Products Follistim ® 55 61 (10)% (7)% Ganirelix Acetate Injection 30 30 — % 3% Other Women's Health products 54 52 4% 5% Total Women's Health 381 378 1% 3% 11 • Customer buying patterns tend to skew Q1 Nexplanon results • Strong physician demand for Nexplanon • Growth in Marvelon / Mercilon from re - acquisition of rights Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies .

Biosimilars Biosimilars Revenues $ mil Q1 - 23 Q1 - 22 Act VPY Ex - FX VPY Renflexis ® 62 46 34% 34% Ontruzant ® 21 22 (7)% (6)% Brenzys Œ 19 14 31% 36% Aybintio Œ 10 10 6% 11% Hadlima Œ 5 6 (20)% (16)% Biosimilars 116 99 18% 20% 12 • Double digit growth for Renflexis five + years after launch • Ontruzant growth in US tempered by competitive pressures in Europe and phasing/timing of sales in Brazil • Brenzys growth driven by timing of government purchases in Brazil Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies .

Established Brands Established Brands Revenues $ mil Q1 - 23 Q1 - 22 Act VPY Ex - FX VPY Cardiovascular 384 410 (6)% — % Respiratory 292 305 (4)% 1% Non - Opioid Pain, Bone & Dermatology 186 201 (8)% (3)% Other 141 136 3% 10% Total Est. Brands 1,002 1,053 (5)% 1% 13 • Modest growth despite VBP and market action • Strong growth in China and APJ regions • Expect generally flat performance in 2023 on a constant currency basis Totals may not foot due to rounding .

P&L reflects upcoming launches and pipeline development $ mil Q1 - 23 Q1 - 22 Actual VPY Revenue 1,538 1,567 (2) % Cost of sales 580 561 3 % Gross profit 958 1,006 (5) % Non - GAAP Adjusted Gross profit (1) 1,003 1,042 (4) % Selling, general and administrative 435 371 17 % R&D 129 96 34 % Acquired IPR&D and milestones 8 — NM Total research and development 137 96 43 % Adjusted EBITDA (2) 518 647 (20) % Diluted Earnings per Share (EPS) (3) 0.69 1.36 (49) % Non - GAAP adjusted diluted EPS (3) 1.08 1.65 (35) % Per share impact to diluted EPS from acquired IPR&D and milestones 0.03 — NM Gross margin 62.3 % 64.2 % Non - GAAP Adjusted Gross margin (1) 65.2 % 66.5 % Adjusted EBITDA margin (2) 33.7 % 41.3 % 14 (1) See Slide 21 of this presentation for a reconciliation of Gross Profit to Adjusted Gross Profit. (2) See Slide 23 of this presentation for a reconciliation of EBITDA and Adjusted EBITDA measures. (3) See Slide 21 of this presentation for a reconciliation of diluted EPS to non - GAAP adjusted diluted EPS.

15 Net Leverage of ~4.0x; $450M voluntary prepayments since spin Voluntary debt repayment of $250M in first quarter $ mil Jun 2021 Dec 2021 Dec 2022 Mar 2023 Cash (available to Organon) (1) 330 737 706 459 Gross Debt (2) 9,348 9,134 8,913 8,711 Net Debt (2) 9,018 8,397 8,207 8,252 (1) The June 30, 2021 Cash and cash equivalents balance was $730 million. Cash (available to Organon) excludes $400 million fro m Merck, which was used for the purchase of inventory from Merck upon exit of certain Interim Operating Model arrangements. (2) Debt figures are net of discounts and unamortized fees of $135 million, $124 million, $105 million and $97 million as of Jun e 30, 2021, December 31, 2021, December 31, 2022 and March 31, 2023, respectively.

On target to generate > $1B of free cash flow before one - time charges in 2023 16 (1) Free cash flow represents net cash flows provided by operating activities plus capital expenditures, acquired in - process researc h and development, and the effect of exchange rate changes on cash and cash equivalents. in $ millions Q1 2023 Adjusted EBITDA $518 Less: Net cash interest expense (65) Less: Cash taxes (61) Less: Change in NWC (207) Less: CapEx (23) Free Cash Flow Before One Time Costs $162 Less: One time costs (82) Free Cash Flow (1) $80 Largely driven by: • Accrual drawdown for employee - related incentive payments (~$110M) • Typical seasonal fluctuation in cash - cycle working capital (~$80M or ~ 4% movement in net working capital)

[Organon] Confidential $ mil 17 Continued solid volume growth, partly offset by VBP, LOE and price; limited FX headwinds 500 - 600 (3) $6,174 $6,150 - $6,450 (50) - (75) (125) - (175) (75) - (125) (25) - (50) (50) - (100) (1) LOE = Loss of Exclusivity (2) VBP = Volume Based Procurement (3) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties.

(1) (2 ) Flat to +4.5% reported FX ~ (80) - (160) bps headwind to growth in 2023 FY 2023 guidance ranges 18 Provided on a Non - GAAP basis, except Revenues Prior guidance Current guidance Revenue $6.150 - $6.450 billion Unchanged Adjusted gross margin Low - mid 60% range Unchanged SG&A (as % of revenues) Mid 20% range Unchanged R&D (as % of revenues) Upper single - digit Unchanged Adjusted EBITDA margin 31.0% - 33.0% Unchanged Interest expense ~$510 million ~$515 million Depreciation ~$130 million Unchanged Effective non - GAAP tax rate 19.0% - 21.0% Unchanged Fully diluted weighted avg.

Q&A

Appendix

shares outstanding ~255 million ~257 million Gross margin reconciliation 21 Three Months Ended March 31, 2023 Unaudited, $ in millions GAAP Spin Related Costs (1) Restructuring Stock - based Compensation Amortization Other (1) Non - GAAP Adjusted Revenues $ 1,538 $ 1,538 Cost of sales 580 (10) — (4) (29) (2) 535 Gross profit 958 1,003 Gross margin 62.3 % 65.2 % Selling, general and administrative 435 (46) — (15) — (1) 373 Research and development 129 (3) — (3) — — 123 Acquired in - process research and development and milestones 8 — — — — — 8 Restructuring costs 4 — (4) — — — — Interest expense 132 — — — — — 132 Exchange losses (gains) 9 — — — — — 9 Other expense, net 6 (6) — — — — — 1,303 1,180 Income from operations before income taxes 235 358 Taxes on income 58 13 1 4 6 — 82 Net income $ 177 $ 276 Earnings per Share - Diluted $ 0.69 $ 1.08 ( 1 ) Represents one - time costs . Spin - related includes costs from the separation of Merck and Other primarily includes inventory step - up amortization and legal reserves .

Gross margin reconciliation 22 Three Months Ended March 31, 2022 Unaudited, $ in millions GAAP Spin Related Costs (1) Restructuring Stock - based Compensation Amortization Other (1) Non - GAAP Adjusted Revenues $ 1,567 $ 1,567 Cost of sales 561 (4) — (3) (28) (1) 525 Gross profit 1,006 1,042 Gross margin 64.2 % 66.5 % Selling, general and administrative 371 (25) — (10) — — 336 Research and development 96 (3) — (2) — (1) 90 Interest expense 97 — — — — — 97 Exchange losses (gains) (4) — — — — — (4) Other expense, net 4 (6) — — — — (2) 1,125 1,042 Income from operations before income taxes 442 525 Taxes on income 94 4 — 2 5 — 105 Net income $ 348 $ 420 Earnings per Share - Diluted $ 1.36 $ 1.65 ( 1 ) Represents one - time costs . Spin - related includes costs from the separation of Merck and Other primarily includes inventory step - up amortization and legal reserves .

Income from operations before income taxes to Adjusted EBITDA Unaudited, $ in millions Q1 - 2023 Q1 - 2022 Income from operations before income taxes 235 442 Depreciation 28 25 Amortization 29 28 Interest expense 132 97 EBITDA 424 592 Restructuring costs 4 — One - time costs (1) 68 40 Stock - based compensation 22 15 Adjusted EBITDA 518 647 Adjusted EBITDA margin 33.7 % 41.3 % 23 ( 1 ) One - time costs primarily include costs incurred in connection with the spin - off of Organon, inventory step up adjustments and legal reserves .

Franchise performance $ mil Q1 - 2023 Q1 - 2022 Actual VPY Ex - FX VPY Women’s Health 381 378 1% 3% Biosimilars 116 99 18% 20% Est. Brands 1,002 1,053 (5)% 1% Other (1) 39 37 3% 2% Total Revenues 1,538 1,567 (2)% 3% (1) Other includes manufacturing sales to Merck & Co., Inc., Rahway, NJ, USA and other third parties. 24 Number of products 13 5 49 Women’s Health Biosimilars Established Brands Broad and diverse portfolio 25 TM TM

Free cash flow providing opportunity for meaningful business development in growth pillars 26 Commercialized/soon to be commercialized asset Building a pipeline Licensing Agreement for Xaciato Œ (clindamycin phosphate vaginal gel, 2%) March 2022 Bacterial Vaginosis Gel FDA - approved for BV in females 12 and over, the most common cause of vaginits worldwide estimated to affect approximately 21 million women in the US. (1) Marvelon Œ (desogestrel and ethinyl estradiol) and Mercilon Œ (desogestrel and ethinyl estradiol) February 2022 Contraception Expanding portfolio - recapturing commercial rights to certain currently marketed products in Asia Acquisition of Alydia Health/JADA® System June 2021 Medical Device Postpartum hemorrhage - one of the most common complications of birth, requiring pharmacologic treatment in up to 10% of mothers (2) Claria Medical January 2023 Medical Device Being studied for use during minimally invasive laparoscopic hysterectomy - one of the most commonly performed surgeries for women Cirqle Biomedical July 2022 Contraception Expanding portfolio - preclinical, non - hormonal contraceptive candidate, large, unmet need for non - hormonal contraception Licensing Agreement for biosimilar candidates referencing Perjeta (3) and Prolia (3) /Xgeva (3) through Shanghai Henlius June 2022 Biosimilar Candidates for Osteoporosis and Breast Cancer Exclusive global commercialization rights except for China; including Hong Kong, Macau and Taiwan Licensing Agreement for Ebopiprant July 2021 Pre - term Labor 15 million babies (11.1% of all live births) born pre - term every year (4) Forendo Pharma December 2021 Endometriosis Clinical stage / Phase 2a/2b - chronic condition that affects up to 1 in 10 of reproductive age women / girls globally (5) (1) Centers for Disease Control and Prevention Bacterial Vaginosis CDC Fact Sheet: https://www.cdc.gov/std/bv/stdfact - bacterial - vaginosis (2) Widmer M et al. "Heat - Stable Carbetocin versus Oxytocin to Prevent Hemorrhage after Vaginal Birth." N Engl J Med 2018; 379:743 - 752 (3) Perjeta is a trademark registered in the U.S. in the name of Genentech, Inc.; Prolia and Xgeva are trademarks registered in the U.S. in the name of Amgen Inc (4) WHO Key Facts, 2018: https://www.who.int/news - room/fact - sheets/detail/preterm - birth (5) WHO Key Facts, 2023: .https://www.who.int/news - room/fact - sheets/detail/endometriosis