UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 3, 2023

Ramaco Resources, Inc.

(Exact name of Registrant as specified in its Charter)

| Delaware | 001-38003 | 38-4018838 |

| (State

or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

250 West Main Street, Suite 1900

Lexington, Kentucky 40507

(Address of principal executive offices)

Registrant’s telephone number, including area code: (859) 244-7455

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | METC | NASDAQ Global Select Market |

| 9.00% Senior Notes due 2026 | METCL | NASDAQ Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On May 3, 2023, Ramaco Resources, Inc. (the “Company”) issued a press release reporting its financial and operating results for the first quarter 2023 (the “Earnings Release”). A copy of the Earnings Release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

None of the information furnished in this Item 2.02 will be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor will it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”).

Item 7.01. Regulation FD Disclosure.

On May 3, 2023, the Company issued a press release and posted a shareholders letter on its website announcing that the Company reported independent findings that its fee owned Brook Mine in Sheridan, Wyoming possesses a significant unconventional deposit of Rare Earth Elements. A copy of the press release and shareholders letter are attached hereto as Exhibits 99.2 and 99.3 to this Current Report on Form 8-K and are incorporated herein by reference

None of the information furnished in this Item 7.01 will be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liability of that section, nor will it be incorporated by reference into any filing under the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Earnings release issued by Ramaco Resources, Inc., dated May 3, 2023. | |

| 99.2 | Press release issued by Ramaco Resources, Inc., dated May 3, 2023. | |

| 99.3 | Shareholders letter posted by Ramaco Resources, Inc., dated May 3, 2023. | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Ramaco Resources, Inc. | ||

| By: | /s/ Randall W. Atkins | |

| Name: Randall W. Atkins | ||

| Title: Chairman and Chief Executive Officer | ||

Date: May 3, 2023

Exhibit 99.1

RAMACO RESOURCES REPORTS

FIRST QUARTER 2023 RESULTS

LEXINGTON, KY., May 3, 2023 -- Ramaco Resources, Inc. (NASDAQ: METC, “Ramaco” or the “Company”), a leading operator and developer of high-quality, low-cost metallurgical coal, today reported financial results for the three months ended March 31, 2023.

FIRST QUARTER 2023 HIGHLIGHTS

| · | The Company had net income of $25.3 million (diluted EPS of $0.57) compared to $14.4 million (diluted EPS of $0.32) in the fourth quarter of 2022. Adjusted earnings before interest, taxes, depreciation, amortization, certain non-operating expenses, and equity-based compensation (“Adjusted EBITDA”), a non-GAAP measure, was $48.3 million for the three months ended March 31, 2023. This compared to $31.9 million of Adjusted EBITDA for the three months ended December 31, 2022. First quarter Adjusted EBITDA and net income were negatively affected by $3 million and $2 million respectively from the Berwind mine idle costs. (See “Reconciliation of Non-GAAP Measure” below.) |

| · | The Company stated that 2.7 million tons or 81% of 2023 forecast production is now contracted. Of this amount, 1.9 million tons is fixed price business at an average of $197 per ton, with the balance priced against a floating index. |

MARKET COMMENTARY / 2023 OUTLOOK

| · | In both a separate press release, and letter to shareholders, the Company reported independent findings from Weir International, Inc. (“Weir”) that its fee owned Brook Mine in Sheridan, Wyoming possesses a significant unconventional deposit of Rare Earth Elements (“REEs”) with cores exhibiting high relative concentrations of heavy REEs (“HREE”) as well as lighter REEs. These HREEs with permanent magnetic properties include Terbium (“Tb”) and Dysprosium (“Dy”). The lighter REEs with magnetic properties include Neodymium (“Nd”) and Praseodymium (“Pr”). We of course recognize that any new mine project, especially one involving emerging technology, is fraught with uncertainty. There is much technical and related work to do before we can determine the commercial feasibility of REE extraction at the Brook Mine. |

| · | The first section at the Berwind No. 1 mine has ramped production in-line with expectations since the Company began mining in March following the July 2022 ignition event. The Board of Directors recently approved advancing production in the second section of the Berwind mine to mid-2023 from 2024. Capital expenditures for this section should total approximately $3 million and it should add ~300,000 tons of incremental annualized production by late 2023. |

| · | Initial surface production recently began at the new Maben low volatile coal mine. The Company also anticipates the imminent startup of its Elk Creek preparation plant expansion project. This is expected to increase processing capacity at Elk Creek from 2 million to 3 million tons per year. |

| · | 2023 production guidance is increased from 3.0 – 3.5 million tons to 3.1 – 3.6 million tons, following strong first quarter results. 2023 sales guidance is increased from 3.2 – 3.7 million tons to 3.3 – 3.8 million tons, representing a 45% increase versus 2022 sales. |

| · | Second quarter of 2023 sales are expected to increase modestly versus first quarter of 2023 levels of 757,000 tons. By the second half of 2023, the Company expects to ramp production and sales to a run-rate of roughly 1 million tons per quarter. |

| · | U.S. metallurgical coal spot pricing is currently down almost 25% from first quarter of 2023 averages on the back of renewed global economic concerns. If indices remain at current levels for the duration of the second quarter, we anticipate our second quarter average realized pricing for company produced coal, excluding transportation charges, to fall roughly 9 – 11% from first quarter levels of $185/ton. |

MANAGEMENT COMMENTARY

Randall Atkins, Ramaco Resources’ Chairman and Chief Executive Officer commented, “Earlier this year I said that our goal in 2023 is simply to execute. After a number of operational setbacks in 2022, as well as ongoing transportation challenges, I am pleased to say that this quarter we executed better than we had expected.

In the first quarter, we achieved both record production of 834,000 tons and record sales of 757,000 tons. In addition, despite continued inflationary pressures, our non-GAAP cash cost of sales, which excludes transportation and idle mine costs, fell from $114 per ton in the fourth quarter of 2022 to $105 per ton in the first quarter of 2023. Elk Creek cash costs declined over 10% sequentially to $90 per ton in the first quarter. We also look forward to the second half production ramp at Berwind helping our overall cash mine costs to decline over the balance of the year.

Our sales team continues to aggressively increase our global footprint. After our inaugural sale to India earlier in the year, I am pleased to report that we have recently added sales to two new countries: Japan and Indonesia. Overall, the Company now has 2.7 million tons contracted, or 81% of forecasted 2023 production. Of this contracted production, 1.9 million tons have been sold at an average fixed price of $197 per ton, with the balance being export sales priced against a floating index.

While overall pricing has fallen on the back of global economic concerns, Ramaco is continuing to focus on what we can control. In terms of our continued commitment to responsibly growing production, I am pleased to note that the first section at the Berwind No. 1 mine restarted early and has been ramping production in-line with expectations. The Board recently approved pulling forward the second section of the Berwind mine to mid-2023 from 2024, which should both add ~300,000 tons of additional production on an annualized basis by late 2023 and continue to reduce overall mine costs. We also add two more milestones this quarter: the first production from our new mine at Maben and a 50% increase of Elk Creek’s preparation plant capacity from 2 to 3 million tons on an annualized basis.

Importantly, I would urge you to all read both our separate press release, as well as my letter to shareholders regarding the potentially transformative work we have been doing at our Brook Mine in Sheridan, Wyoming, to assess what may be among the most promising Rare Earth Element (“REE”) deposits on a worldwide basis. An independent assessment of the deposit has been conducted in conjunction with our reserve engineers at Weir International and the National Energy Technology Laboratory (“NETL”). Our initial conclusion is that the mine may contain one of the largest unconventional deposits of REEs discovered in the United States. Core analysis performed to date shows high relative concentrations of heavy REEs such as Terbium and Dysprosium, as well as lighter REEs with magnetic properties such as Neodymium and Praseodymium.

We of course recognize that any new mine project, especially one involving emerging technology, is fraught with uncertainty. However, given the magnitude of what we have discovered to date, we intend to pursue a thoughtful investigation of this unique opportunity. If that diligence continues on its present course perhaps Ramaco can transform its footprint into becoming both a low cost supplier of strategic REE critical materials from Wyoming as well as continuing as a producer of metallurgical coal in Central Appalachia. We intend to supply regular updates as this REE project unfolds.

Finally, as we said before, our goal for 2023 remains to execute on our objectives which are:

| · | To both increase our met coal production and processing capacity and reduce costs. |

| · | To continue to assess our potential REE deposit, with minimal initial capital outlay. |

| · | To pay down the majority of our remaining debt in order to maintain our strong balance sheet. |

| · | To pursue our dual longer-term objectives of combining an increase in profitable production with a steady growth in return of capital to our shareholders.” |

Key operational and financial metrics are presented below:

| Key Metrics | 1Q23 | 4Q22 | Change | 1Q22 | Change | |||||||||||||||

| Total Tons Sold ('000) | 757 | 675 | 12 | % | 583 | 30 | % | |||||||||||||

| Revenue ($mm) | $ | 166.4 | $ | 135.2 | 23 | % | $ | 154.9 | 7 | % | ||||||||||

| Cost of Sales ($mm) | $ | 110.5 | $ | 95.4 | 16 | % | $ | 81.3 | 36 | % | ||||||||||

| Non-GAAP Pricing of Company Produced Tons ($/Ton) | $ | 185 | $ | 182 | 2 | % | $ | 234 | (21 | )% | ||||||||||

| Non-GAAP Cash Cost of Sales - Company Produced ($/Ton)* | $ | 105 | $ | 114 | (8 | )% | $ | 106 | (1 | )% | ||||||||||

| Non-GAAP Cash Margins on Company Produced ($/Ton) | $ | 80 | $ | 68 | 18 | % | $ | 128 | (38 | )% | ||||||||||

| Net Income ($mm) | $ | 25.3 | $ | 14.4 | 76 | % | $ | 41.5 | (39 | )% | ||||||||||

| Diluted Earnings per Share | $ | 0.57 | $ | 0.32 | 75 | % | $ | 0.92 | (39 | )% | ||||||||||

| Adjusted EBITDA ($mm) | $ | 48.3 | $ | 31.9 | 51 | % | $ | 64.1 | (25 | )% | ||||||||||

| Capex ($mm) | $ | 23.5 | $ | 31.6 | (26 | )% | $ | 19.7 | 19 | % | ||||||||||

| Adjusted EBITDA less Capex ($ mm) | $ | 24.7 | $ | 0.3 | 7985 | % | $ | 44.3 | (44 | )% |

* Adjusted to include the royalty savings from the Ramaco Coal transaction for 1Q22. Excludes Berwind idle costs in 1Q23 and 4Q22.

FIRST QUARTER 2023 PERFORMANCE

In the following paragraphs, all references to “quarterly” periods or to “the quarter” refer to the first quarter of 2023, unless specified otherwise.

Year over Year Quarterly Comparison

Overall production in the quarter was 834,000 tons, up 25% from the same period of 2022. The Elk Creek complex produced 611,000 tons. Production from the Berwind and Knox Creek Mining complexes increased from 163,000 tons in the first quarter of 2022 to 223,000 tons this quarter. Overall total sales were a quarterly record of 757,000 tons, up from 583,000 tons in the first quarter of 2022. We saw a meaningful improvement in transportation service in the first quarter, and we applaud the efforts of our railroad partners.

Cash margins on Company produced coal were $80 per ton during the quarter, down 38% from the same period of 2022, based on non-GAAP revenue (FOB mine) and non-GAAP cash cost of sales. Quarterly pricing was $185 per ton of Company produced coal sold, which was 21% lower compared to the first quarter of 2022.

Company produced cash mine costs excluding transportation and idle mine costs were $105 per ton, which was 1% lower than for the same period of 2022. Cash mine costs at Elk Creek were $90 per ton during the quarter. This compared to cash mine costs at Elk Creek of $98 per ton during the same period of 2022. Elk Creek costs are expected to stay near current levels, while overall cash costs are anticipated to move lower, especially in the second half of 2023 as the Berwind Complex ramps production.

Sequential Fourth Quarter Comparison

Overall production of 834,000 tons in the first quarter of 2023 was up 139,000 tons compared with the fourth quarter of 2022, as new mines ramped up production. Total sales volume of 757,000 tons was up 12% from the fourth quarter of 2022 level of 675,000 tons.

Cash margins on Company produced coal were $80 per ton compared to $68 per ton in the fourth quarter of 2022, based on non-GAAP revenue (FOB mine) and non-GAAP cash cost of sales. The increase in margin was mainly due to lower cash costs, with first quarter cash costs of $105 per ton on company produced coal compared to $114 per ton in the fourth quarter of 2022.

BALANCE SHEET AND LIQUIDITY

As of March 31, 2023, the Company had liquidity of $65.4 million, consisting of $36.6 million of cash plus $28.8 million of availability under our revolving credit facility. This compared to liquidity of $49.1 million as of December 31, 2022.

Compared to December 31, 2022, accounts receivable increased by $29.9 million, and inventories increased by $6.0 million. We expect a meaningful decline in inventory in the second half of 2023, on the back of both improved rail service and the 50% increase in processing capacity at the Elk Creek preparation plant.

First quarter capital expenditures totaled $23.5 million. This was a decrease of 26% versus $31.6 million for the fourth quarter of 2022. The decrease was attributable to the completion of the renovation at the Berwind complex preparation plant in the fourth quarter of 2022.

The Company’s effective quarterly tax rate was 18%, excluding discrete items. For the first quarter of 2023, we recognized income tax expense of $5.5 million, as compared with $3.1 million in the fourth quarter of 2022. While the Company anticipates an overall tax rate of 20-25% in 2023, the cash tax rate in 2023 is anticipated to be just 5-10%.

In February 2023, KeyBank, N.A. ("KeyBank") led a syndicate of five banks that increased the Company's overall revolving credit facility to $175 million. Under its terms, this consists of an aggregate revolving commitment of $125 million together with an accordion feature providing an additional $50 million which would be available upon the Company’s request and subject to the terms and conditions of the facility.

The following summarizes key sales, production and financial metrics for the periods noted:

| Three months ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| In thousands, except per ton amounts | 2023 | 2022 | 2022 | |||||||||

| Sales Volume (tons) | ||||||||||||

| Company | 727 | 643 | 573 | |||||||||

| Purchased | 29 | 32 | 10 | |||||||||

| Total | 757 | 675 | 583 | |||||||||

| Company Production (tons) | ||||||||||||

| Elk Creek Mining Complex | 611 | 537 | 503 | |||||||||

| Berwind Mining Complex (includes Knox Creek) | 223 | 158 | 163 | |||||||||

| Total | 834 | 695 | 666 | |||||||||

| Company Produced Financial Metrics (a) | ||||||||||||

| Average revenue per ton | $ | 185 | $ | 182 | $ | 234 | ||||||

| Average cash costs of coal sold* | 105 | 114 | 106 | |||||||||

| Average cash margin per ton | $ | 80 | $ | 68 | $ | 128 | ||||||

| Elk Creek Financial Metrics (a) | ||||||||||||

| Average revenue per ton | $ | 194 | $ | 193 | $ | 236 | ||||||

| Average cash costs of coal sold* | 90 | 101 | 98 | |||||||||

| Average cash margin per ton | $ | 104 | $ | 92 | $ | 138 | ||||||

| Purchased Coal Financial Metrics (a) | ||||||||||||

| Average revenue per ton | $ | 245 | $ | 152 | $ | 354 | ||||||

| Average cash costs of coal sold | 209 | 119 | 300 | |||||||||

| Average cash margin per ton | $ | 36 | $ | 33 | $ | 54 | ||||||

| Capital Expenditures | $ | 23,546 | $ | 31,628 | $ | 19,742 | ||||||

| (a) | Excludes transportation. Cash costs of coal sold are defined and reconciled under “Reconciliation of Non-GAAP Measures.” |

* Adjusted to include the royalty savings from the Ramaco Coal transaction for 1Q22. Excludes Berwind idle costs in 4Q22 and 1Q23.

FINANCIAL GUIDANCE

| Full-Year | Full-Year | |||||||

| (In thousands, except per ton amounts and percentages) | 2023 Guidance | 2022 | ||||||

| Company Production (tons) | ||||||||

| Elk Creek Mining Complex | 2,200 - 2,400 | 2,033 | ||||||

| Berwind & Knox Creek Mining Complex | 900 - 1,200 | 651 | ||||||

| Total | 3,100 - 3,600 | 2,684 | ||||||

| Sales (tons) (a) | 3,300 - 3,800 | 2,450 | ||||||

| Cash Costs Per Ton - Company Produced (b) | $ | 97 - 103 | $ | 105 | ||||

| Other | ||||||||

| Capital Expenditures (c) | $ | 65,000 - 80,000 | $ | 123,012 | ||||

| Selling, general and administrative expense (d) | $ | 34,000 - 37,000 | $ | 31,810 | ||||

| Depreciation, depletion and amortization expense | $ | 48,000 - 52,000 | $ | 41,194 | ||||

| Interest expense, net | $ | 9,000 - 10,000 | $ | 6,829 | ||||

| Effective tax rate (e) | 20 - 25% | 22% | ||||||

| Cash tax rate | 5 - 10% | 11% | ||||||

| Berwind Idle Costs | $ | 3,000 | $ | 9,474 | ||||

| (a) | 2023 guidance includes a small amount of purchased coal. |

| (b) | Adjusted to include the royalty savings from the Ramaco Coal transaction for 2022. Excludes Berwind idle costs. |

| (c) | Excludes Ramaco Coal and Maben purchase price. |

| (d) | Excludes stock-based compensation. |

| (e) | Normalized, to exclude discrete items. |

Committed 2023 Sales Volume(a)

| (In millions, except per ton amounts) | Volume | Average Price | ||||||

| North America, fixed priced | 1.2 | $ | 196 | |||||

| Seaborne, fixed priced | 0.7 | $ | 200 | |||||

| Total, fixed priced | 1.9 | $ | 197 | |||||

| Indexed priced | 0.8 | |||||||

| Total committed tons | 2.7 | |||||||

| (a) | Amounts as of March 31, 2023 and includes a small amount of purchased coal. Totals may not add due to rounding. |

ABOUT RAMACO RESOURCES

Ramaco Resources, Inc. is an operator and developer of high-quality, low-cost metallurgical coal in southern West Virginia, southwestern Virginia and southwestern Pennsylvania. Its executive offices are in Lexington, Kentucky, with operational offices in Charleston, West Virginia and Sheridan, Wyoming. The Company currently has three active mining complexes in Central Appalachia and one mine not yet in production near Sheridan, Wyoming. Contiguous to the Wyoming mine, the Company operates a research and pilot facility related to the production of advanced carbon products and materials from coal. In connection with these activities, it holds a body of roughly 50 intellectual property patents, pending applications, exclusive licensing agreements and various trademarks. News and additional information about Ramaco Resources, including filings with the Securities and Exchange Commission, are available at http://www.ramacoresources.com. For more information, contact investor relations at (859) 244-7455.

FIRST QUARTER 2023 CONFERENCE CALL

Ramaco Resources will hold its quarterly conference call and webcast at 9:00 AM Eastern Time (ET) on Thursday, May 4, 2023. An accompanying slide deck will be available at https://www.ramacoresources.com/investors-center/events-calendar/ immediately before the conference call.

To participate in the live teleconference on May 4, 2023:

Domestic Live: (800) 274-8461

International Live: (203) 518-9814

Conference ID: METCQ123

Web link: Click Here

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this news release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Ramaco Resources’ expectations or beliefs concerning guidance, future events, anticipated revenue, future demand and production levels, macroeconomic trends, the development of ongoing projects, costs and expectations regarding operating results, and it is possible that the results described in this news release will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Ramaco Resources’ control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. These factors include, without limitation, risks related to the impact of the COVID-19 global pandemic, unexpected delays in our current mine development activities, the ability to successfully ramp up production at the Berwind and Know Creek complexes, the timing of the Elk Creek preparation plant to come online, failure of our sales commitment counterparties to perform, increased government regulation of coal in the United States or internationally, the further decline of demand for coal in export markets and underperformance of the railroads, the expected benefits of the Ramaco Coal and Maben acquisitions to the Company’s shareholders, and the anticipated benefits and impacts of the Ramaco Coal and Maben acquisitions. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, Ramaco Resources does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Ramaco Resources to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in Ramaco Resources’ filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The risk factors and other factors noted in Ramaco Resources’ SEC filings could cause its actual results to differ materially from those contained in any forward-looking statement.

Ramaco Resources, Inc.

Unaudited Consolidated Statements of Operations

| Three months ended March 31, | ||||||||

| In thousands, except per share amounts | 2023 | 2022 | ||||||

| Revenue | $ | 166,360 | $ | 154,882 | ||||

| Costs and expenses | ||||||||

| Cost of sales (exclusive of items shown separately below) | 110,549 | 81,253 | ||||||

| Asset retirement obligations accretion | 350 | 235 | ||||||

| Depreciation, depletion and amortization | 11,852 | 8,680 | ||||||

| Selling, general and administrative | 11,742 | 11,824 | ||||||

| Total costs and expenses | 134,493 | 101,992 | ||||||

| Operating income | 31,867 | 52,890 | ||||||

| Other income, net | 1,247 | 366 | ||||||

| Interest expense, net | (2,309 | ) | (1,130 | ) | ||||

| Income before tax | 30,805 | 52,126 | ||||||

| Income tax expense | 5,548 | 10,655 | ||||||

| Net income | $ | 25,257 | $ | 41,471 | ||||

| Earnings per common share | ||||||||

| Basic earnings per share | $ | 0.57 | $ | 0.94 | ||||

| Diluted earnings per share | $ | 0.57 | $ | 0.92 | ||||

| Basic weighted average shares outstanding | 44,281 | 44,181 | ||||||

| Diluted weighted average shares outstanding | 44,692 | 44,908 | ||||||

Ramaco Resources, Inc.

Unaudited Consolidated Balance Sheets

| In thousands, except per-share amounts | March 31, 2023 | December 31, 2022 | ||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 36,616 | $ | 35,613 | ||||

| Accounts receivable | 71,099 | 41,174 | ||||||

| Inventories | 50,971 | 44,973 | ||||||

| Prepaid expenses and other | 19,005 | 25,729 | ||||||

| Total current assets | 177,691 | 147,489 | ||||||

| Property, plant and equipment, net | 444,075 | 429,842 | ||||||

| Financing lease right-of-use assets, net | 12,443 | 12,905 | ||||||

| Advanced coal royalties | 3,277 | 3,271 | ||||||

| Other | 3,830 | 2,832 | ||||||

| Total Assets | $ | 641,316 | $ | 596,339 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 49,850 | $ | 34,825 | ||||

| Accrued expenses | 33,070 | 41,806 | ||||||

| Asset retirement obligations | 29 | 29 | ||||||

| Current portion of long-term debt | 29,684 | 35,639 | ||||||

| Current portion of related party debt | 30,000 | 40,000 | ||||||

| Current portion of financing lease obligations | 6,114 | 5,969 | ||||||

| Insurance financing liability | 2,415 | 4,577 | ||||||

| Total current liabilities | 151,162 | 162,845 | ||||||

| Asset retirement obligations | 29,206 | 28,856 | ||||||

| Long-term debt, net | 45,567 | 18,757 | ||||||

| Long-term financing lease obligations, net | 3,980 | 4,917 | ||||||

| Senior notes, net | 32,945 | 32,830 | ||||||

| Deferred tax liability, net | 37,791 | 35,637 | ||||||

| Other long-term liabilities | 3,742 | 3,299 | ||||||

| Total liabilities | 304,393 | 287,141 | ||||||

| Commitments and contingencies | — | — | ||||||

| Stockholders' Equity | ||||||||

| Preferred stock, $0.01 par value | — | — | ||||||

| Common stock, $0.01 par value | 444 | 442 | ||||||

| Additional paid-in capital | 171,531 | 168,711 | ||||||

| Retained earnings | 164,948 | 140,045 | ||||||

| Total stockholders' equity | 336,923 | 309,198 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 641,316 | $ | 596,339 | ||||

Ramaco Resources, Inc.

Unaudited Statement of Cash Flows

| Three months ended March 31, | ||||||||

| In thousands | 2023 | 2022 | ||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 25,257 | $ | 41,471 | ||||

| Adjustments to reconcile net income to net cash from operating activities: | ||||||||

| Accretion of asset retirement obligations | 350 | 235 | ||||||

| Depreciation, depletion and amortization | 11,852 | 8,680 | ||||||

| Amortization of debt issuance costs | 149 | 121 | ||||||

| Stock-based compensation | 2,937 | 1,887 | ||||||

| Deferred income taxes | 2,154 | 5,015 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (29,925 | ) | (3,194 | ) | ||||

| Prepaid expenses and other current assets | 4,779 | 1,807 | ||||||

| Inventories | (5,998 | ) | (3,752 | ) | ||||

| Other assets and liabilities | (823 | ) | (591 | ) | ||||

| Accounts payable | 13,902 | 18,653 | ||||||

| Accrued expenses | (3,272 | ) | 7,037 | |||||

| Net cash from operating activities | 21,362 | 77,369 | ||||||

| Cash flow from investing activities: | ||||||||

| Purchases of property, plant and equipment | (23,546 | ) | (19,742 | ) | ||||

| Maben acquisition bond recovery | 1,182 | — | ||||||

| Net cash from investing activities | (22,364 | ) | (19,742 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from borrowings | 45,000 | 1,337 | ||||||

| Payments of dividends | (5,556 | ) | (4,998 | ) | ||||

| Repayment of borrowings | (24,145 | ) | (2,519 | ) | ||||

| Repayment of Ramaco Coal acquisition financing - related party | (10,000 | ) | — | |||||

| Repayments of financed insurance payable | (1,433 | ) | (105 | ) | ||||

| Repayments of financing leased equipment | (1,746 | ) | (1,635 | ) | ||||

| Shares surrendered for withholding taxes payable | (115 | ) | — | |||||

| Net cash from financing activities | 2,005 | (7,920 | ) | |||||

| Net change in cash and cash equivalents and restricted cash | 1,003 | 49,707 | ||||||

| Cash and cash equivalents and restricted cash, beginning of period | 36,473 | 22,806 | ||||||

| Cash and cash equivalents and restricted cash, end of period | $ | 37,476 | $ | 72,513 | ||||

Reconciliation of Non-GAAP Measures

Adjusted EBITDA

Adjusted EBITDA is used as a supplemental non-GAAP financial measure by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. We believe Adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance.

We define Adjusted EBITDA as net income plus net interest expense; equity-based compensation; depreciation, depletion, and amortization expenses; income taxes; certain non-operating expenses (charitable contributions), and accretion of asset retirement obligations. Its most comparable GAAP measure is net income. A reconciliation of net income to Adjusted EBITDA is included below. Adjusted EBITDA is not intended to serve as a substitute for GAAP measures of performance and may not be comparable to similarly-titled measures presented by other companies.

| (In thousands) | Q1 2023 | Q4 2022 | Q1 2022 | |||||||||

| Reconciliation of Net Income to Adjusted EBITDA | ||||||||||||

| Net income | $ | 25,257 | $ | 14,386 | $ | 41,471 | ||||||

| Depreciation, depletion and amortization | 11,852 | 11,296 | 8,680 | |||||||||

| Interest expense, net | 2,309 | 1,506 | 1,130 | |||||||||

| Income tax expense | 5,548 | 3,085 | 10,655 | |||||||||

| EBITDA | 44,966 | 30,273 | 61,936 | |||||||||

| Stock-based compensation | 2,937 | 2,031 | 1,887 | |||||||||

| Accretion of asset retirement obligations | 350 | (370 | ) | 235 | ||||||||

| Adjusted EBITDA | $ | 48,253 | $ | 31,934 | $ | 64,058 | ||||||

Non-GAAP revenue and cash cost per ton

Non-GAAP revenue per ton (FOB mine) is calculated as coal sales revenue less transportation costs, divided by tons sold. Non-GAAP cash cost per ton sold is calculated as cash cost of coal sales less transportation costs and idle mine costs, divided by tons sold. We believe revenue per ton (FOB mine) and cash cost per ton provides useful information to investors as these enable investors to compare revenue per ton and cash cost per ton for the Company against similar measures made by other publicly-traded coal companies and more effectively monitor changes in coal prices and costs from period to period excluding the impact of transportation costs, which are beyond our control. The adjustments made to arrive at these measures are significant in understanding and assessing the Company’s financial performance. Revenue per ton sold (FOB mine) and cash cost per ton are not measures of financial performance in accordance with GAAP and therefore should not be considered as a substitute to revenue and cost of sales under GAAP. The tables below show how we calculate non-GAAP revenue and cash cost per ton:

Non-GAAP revenue per ton

| Three months ended March 31, 2023 | Three months ended March 31, 2022 | |||||||||||||||||||||||

| Company | Purchased | Company | Purchased | |||||||||||||||||||||

| (In thousands, except per ton amounts) | Produced | Coal | Total | Produced | Coal | Total | ||||||||||||||||||

| Revenue | $ | 158,959 | $ | 7,401 | $ | 166,360 | $ | 150,929 | $ | 3,953 | $ | 154,882 | ||||||||||||

| Less: Adjustments to reconcile to Non-GAAP revenue (FOB mine) | ||||||||||||||||||||||||

| Transportation costs | (24,270 | ) | (176 | ) | (24,446 | ) | (17,131 | ) | (239 | ) | (17,370 | ) | ||||||||||||

| Non-GAAP revenue (FOB mine) | $ | 134,689 | $ | 7,225 | $ | 141,914 | $ | 133,798 | $ | 3,714 | $ | 137,512 | ||||||||||||

| Tons sold | 727 | 29 | 757 | 573 | 10 | 583 | ||||||||||||||||||

| Revenue per ton sold (FOB mine) | $ | 185 | $ | 245 | $ | 188 | $ | 234 | $ | 354 | $ | 236 | ||||||||||||

| Three months ended December 31, 2022 | ||||||||||||

| Company | Purchased | |||||||||||

| (In thousands, except per ton amounts) | Produced | Coal | Total | |||||||||

| Revenue | $ | 129,772 | $ | 5,455 | $ | 135,227 | ||||||

| Less: Adjustments to reconcile to Non-GAAP revenue (FOB mine) | ||||||||||||

| Transportation costs | (12,550 | ) | (574 | ) | (13,124 | ) | ||||||

| Non-GAAP revenue (FOB mine) | $ | 117,222 | $ | 4,881 | $ | 122,103 | ||||||

| Tons sold | 643 | 32 | 675 | |||||||||

| Revenue per ton sold (FOB mine) | $ | 182 | $ | 152 | $ | 181 | ||||||

Non-GAAP cash cost per ton

| Three months ended March 31, 2023 | Three months ended March 31, 2022 | |||||||||||||||||||||||

| Company | Purchased | Company | Purchased | |||||||||||||||||||||

| (In thousands, except per ton amounts) | Produced | Coal | Total | Produced | Coal | Total | ||||||||||||||||||

| Cost of sales | $ | 104,246 | $ | 6,303 | $ | 110,549 | $ | 77,863 | $ | 3,390 | $ | 81,253 | ||||||||||||

| Less: Adjustments to reconcile to Non-GAAP cash cost of sales | ||||||||||||||||||||||||

| Transportation costs | (24,347 | ) | (134 | ) | (24,481 | ) | (17,134 | ) | (239 | ) | (17,373 | ) | ||||||||||||

| Idle mine costs | (2,559 | ) | — | (2,559 | ) | — | — | — | ||||||||||||||||

| Non-GAAP cash cost of sales | $ | 77,340 | $ | 6,169 | $ | 83,509 | $ | 60,729 | $ | 3,151 | $ | 63,880 | ||||||||||||

| Tons sold | 727 | 29 | 757 | 573 | 10 | 583 | ||||||||||||||||||

| Cash cost per ton sold | $ | 105 | $ | 209 | $ | 110 | $ | 106 | $ | 300 | $ | 110 | ||||||||||||

| Three months ended December 31, 2022 | ||||||||||||

| Company | Purchased | |||||||||||

| (In thousands, except per ton amounts) | Produced | Coal | Total | |||||||||

| Cost of sales | $ | 91,014 | $ | 4,416 | $ | 95,430 | ||||||

| Less: Adjustments to reconcile to Non-GAAP cash cost of sales | ||||||||||||

| Transportation costs | (12,551 | ) | (574 | ) | (13,125 | ) | ||||||

| Idle mine costs | (4,437 | ) | — | (4,437 | ) | |||||||

| Non-GAAP cash cost of sales | $ | 74,026 | $ | 3,842 | $ | 77,868 | ||||||

| Tons sold | 643 | 32 | 675 | |||||||||

| Cash cost per ton sold | $ | 114 | $ | 119 | $ | 115 | ||||||

We do not provide reconciliations of our outlook for cash cost per ton to cost of sales in reliance on the unreasonable efforts exception provided for under Item 10(e)(1)(i)(B) of Regulation S-K. We are unable, without unreasonable efforts, to forecast certain items required to develop the meaningful comparable GAAP cost of sales. These items typically include non-cash asset retirement obligation accretion expenses, mine idling expenses and other non-recurring indirect mining expenses that are difficult to predict in advance in order to include a GAAP estimate.

# # #

Exhibit 99.2

MAJOR DEPOSITS OF MAGNETIC RARE EARTH ELEMENTS DISCOVERED AT RAMACO RESOURCES MINE IN WYOMING

MINE MAY BE UNITED STATES LARGEST UNCONVENTIONAL DEPOSIT OF REE ELEMENTS CONSIDERED VITAL TO NATION’S STRATEGIC DEFENSE AND ENERGY TRANSITION

May 3, 2023

FOR IMMEDIATE RELEASE

SHERIDAN, WY. — In association with researchers from the Department of Energy’s National Energy Technology Laboratory (“NETL”) and analysts at mining consultancy Weir International, metallurgical coal producer Ramaco Resources, Inc. (“Ramaco”-NASDAQ: METC) today released an independent Exploration Target report with technical assessment of rare earth elements (“REE”) found at its Brook Mine in Wyoming.

Following eighteen months of extensive core drilling and independent chemical analysis, NETL researchers and Ramaco now believe that the Brook Mine property contains perhaps the largest unconventional deposit of REEs discovered in the United States.

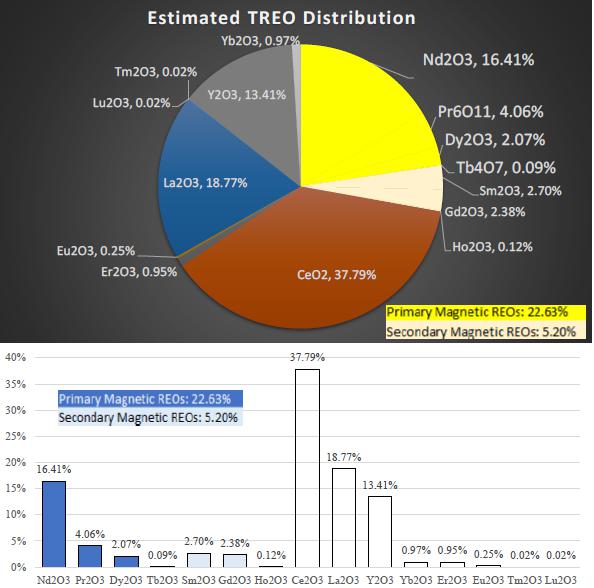

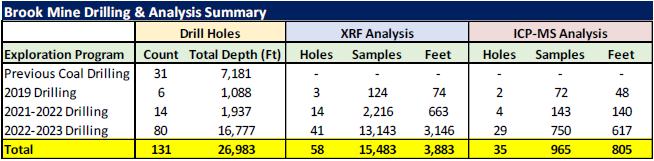

In particular, the mine ranks among the highest relative concentrations yet discovered of magnetic REEs (“MREE”) such as “heavy” REEs Terbium and Dysprosium, as well as lighter REEs such as Neodymium and Praseodymium. Initial estimates are that approximately 28% of deposit concentrations may be in the form of MREEs.

NETL analysis shows that core samples from the Brook Mine represent highly promising, world-class MREE and HREE accumulations. These deposits contain these valuable REEs on par with conventional REE deposits, but with much less of the low-value lanthanum and cerium that must be removed by separations. Based on this data, the Brook Mine could rank among the more promising deposits on a worldwide basis, including Chinese HREE deposits.

A copy of Weir International’s Exploration Target report and a shareholder letter on the discovery from Ramaco CEO and Chairman Randall Atkins can be found at www.ramacoresources.com. Exhibits from the report are also included in this release.

There is currently only one active mine for magnetic REEs in the United States, located near the Mojave Desert in California. Magnetic REE materials are used in electric vehicle motors, advanced military technology, medical devices, and much more.

The Brook Mine comprises over 15,800 acres outside of Sheridan, Wyoming, one of the largest privately controlled mineral reserves in the Western United States. Roughly 4,500 acres were permitted for mining in 2020, which is where the initial assessment program has been conducted. Mining at the Brook Mine could begin as early as the fourth quarter of 2023, following additional mining development and assessment. The additional 11,300 acres will be also assessed and could provide opportunity to increase the scale of the overall development in the future.

China currently produces the vast majority of REEs, which are increasingly important in defense, industrial, and consumer technologies. Congress and the Department of Energy have earmarked billions of dollars toward this goal, and a bipartisan bill introduced earlier this year would establish tax credits to support the production of magnetic REEs like those found at the Brook Mine.

The majority of REE deposits outside of China are associated with “conventional” mines and found in igneous hard rock deposits, which makes them both difficult and expensive to mine and process. In contrast, the REEs from the Brook Mine are characterized as “unconventional” because they are largely found in clay strata located above and below the coal seams themselves. It is expected they can be mined using normal surface mining techniques and processed in a more economic and environmental manner than conventional REE mines.

“The coal seams can contain significant quantity of REEs, making the coal seams an attractive source for these valuable minerals on an ash-basis,” said a report from Weir International. “The REEs are believed to have been incorporated into the coal during its formation and are found in association with clay minerals and organic matter in the coal seams. Interburden between the coal seams also contain elevated levels of REEs, primarily in clays, carbonaceous clays and siltstones and not necessarily associated to the coal seams.… Ramaco’s sample collection, preparation, security, and testing protocols are well documented and suffice to provide consistent, reliable, and verifiable data.”

Ramaco plans to analyze the appropriate mining, processing and mineral development plan for the REEs, along with a comprehensive economic analysis. Ramaco’s Board of Directors has authorized continued assessment of this opportunity, and additional testing results will be released periodically.

“We view this as an exciting and perhaps transformative new direction for our company,” said Ramaco CEO and Chairman Randall Atkins. “We will approach the potential to develop critical minerals with the same conservative capital expenditure and development discipline that we have applied to our core metallurgical coal business. We are also well positioned to allocate initial capital to begin a step-by-step development program.

“We of course recognize that any new mine project, especially one involving emerging technology, is fraught with uncertainty,” said Atkins. “There is much work to do, before we can determine the commercial feasibility of REE extraction at the Brook Mine. But we will evaluate the overall business proposition of developing these REE critical minerals to their highest value proposition to Ramaco, and frankly also to the country.”

“If additional diligence continues to confirm the opportunity, then Ramaco can expand its national footprint into becoming both a low-cost supplier of strategic REE critical materials from Wyoming, as well as continuing as a producer of metallurgical coal in Central Appalachia,” said Atkins. “We will supply periodic updates as this REE project unfolds.”

TECHNICAL HIGHLIGHTS

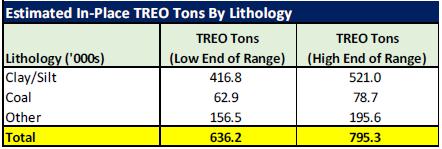

| • | Weir estimates a range of between 181,000 and 226,000 tons of magnetic rare earth oxide ("REO") at the Brook Mine site. |

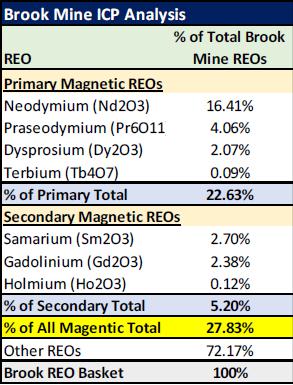

| • | A total of 131 core holes targeting the REE mineralization have been drilled to date, with 58 of the core holes having been scanned using x-ray fluorescence. An analysis of 965 test samples have been conducted using inductively coupled plasma (“ICP”) spectroscopy of the elemental composition of different cores, which tests form the basis of analysis by Weir International. |

| • | The results from ICP scan observations show an average of 28% percent overall concentration of both the four primary magnetic REEs as well as other magnetic concentrations. |

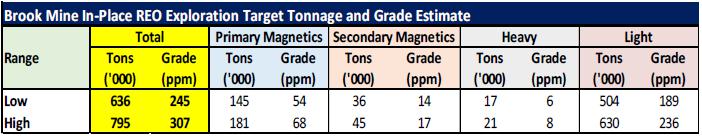

| • | The current exploration target encompasses a range between roughly 636,000 and 795,000 in place tons of 100% total rare earth oxide ("TREO") with all concentration grades. Core drilling and chemical test analysis will continue on an ongoing basis to further delineate the deposit. |

| • | As shown in Exhibit 1 below, the Brook Mine samples plot in the highest quartile relative to other REE ore bodies worldwide, with promisivity of the Brook Mine REE deposits falling along the promising to highly promising spectrum for the full range of REEs, including the four highly valued REEs with magnetic properties. |

About Ramaco Resources, Inc.

Ramaco Resources, Inc. is an operator and developer of high-quality, low-cost metallurgical coal in southern West Virginia, southwestern Virginia and southwestern Pennsylvania. Its executive offices are in Lexington, Kentucky, with operational offices in Charleston, West Virginia and Sheridan, Wyoming. The Company currently has three active mining complexes in Central Appalachia.

About Ramaco Carbon

Ramaco Carbon, a subsidiary of Ramaco Resources, Inc., is a carbon technology company based in Sheridan, Wyoming. It is pioneering more valuable and environmental uses for coal, primarily as a feedstock in the creation of advanced carbon products and materials such as rare earth elements, carbon fibers, graphene, and graphite. In addition to research partnerships with top laboratories, it operates a research and pilot facility related to the production of advanced carbon products and materials from coal in Wyoming, and holds a body of intellectual property patents, pending applications, exclusive licensing agreements and various trademarks. Ramaco Carbon has also been involved in the exploration of critical minerals from coal and related formations.

Ramaco Media Contact: press@ramacometc.com

Ramaco Investor Contact: info@ramacometc.com

Exhibit 1:

Global REE Deposits Per NETL:

Source: NETL

Exhibit 2:

In-Place REO Exploration Target Tonnage and Grade Estimate

Source: Weir International, Inc.

Exhibit 3:

Estimated Brook Mine TREO Distribution by Oxide

Source: Weir International, Inc.

Exhibit 4:

Brook Mine ICP Analysis of REOs

Source: Weir International, Inc.

Exhibit 5:

Brook Mine Drilling & Analysis Summary

Source: Weir International, Inc.

Exhibit 6:

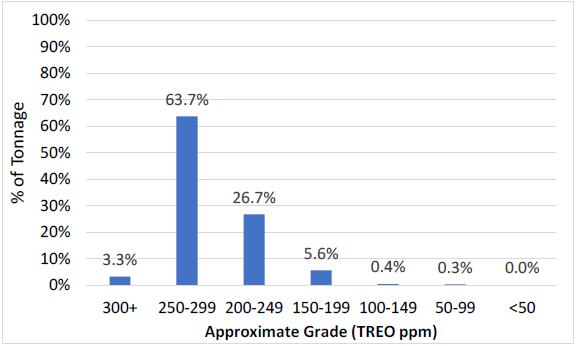

Estimated TREO Grade Distribution

Source: Weir International, Inc.

Exhibit 7:

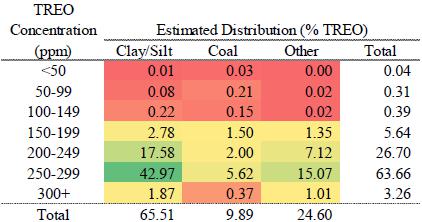

Brook Mine Estimated TREO Concentration & Distribution (%)

Source: Weir International, Inc.

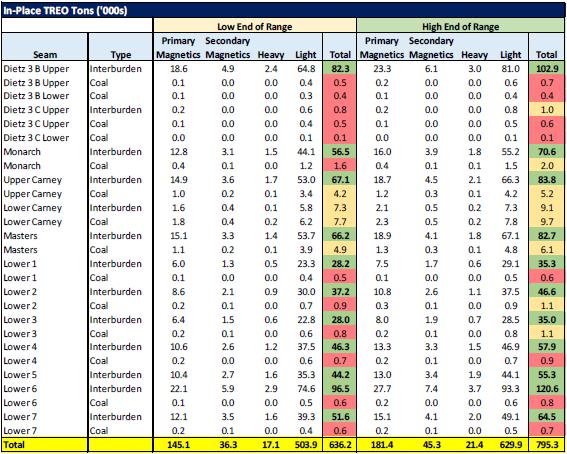

Exhibit 8:

In Place TREO Tons ('000s)

Source: Weir International, Inc.

Exhibit 9:

Brook Mine Estimated In-Place TREO Tons By Lithology

Source: Weir International, Inc.

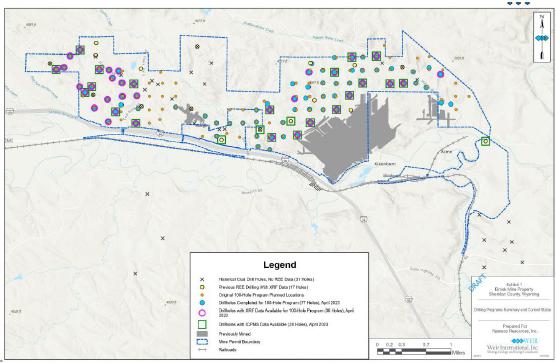

Exhibit 10:

Current Brook Mine Drilling Program

Source: Weir International, Inc.

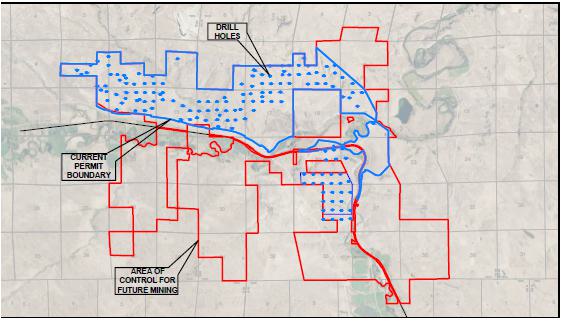

Exhibit 11:

Current Brook Mine Overall Area of Control

Source: WWC Engineering

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this news release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Ramaco Resources’ expectations or beliefs concerning guidance, future events, anticipated revenue, future demand and production levels, macroeconomic trends, the development of ongoing projects, costs and expectations regarding operating results, and it is possible that the results described in this news release will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Ramaco Resources’ control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. These factors include, without limitation, risks related to the timing of the mining discussed in this release and the Company's ability to successfully pursue such mining. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, Ramaco Resources does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Ramaco Resources to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in Ramaco Resources’ filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The risk factors and other factors noted in Ramaco Resources’ SEC filings could cause its actual results to differ materially from those contained in any forward-looking statement.

Exhibit 99.3

May 3, 2023

Dear Shareholders,

I try not to write shareholder letters unless there is something interesting to impart. Today there is.

To cut to the chase, over the past several years we have been working to determine a geological assessment of the rare earth element (“REE”) potential of our fee-owned Brook Mine near Sheridan, Wyoming. We explored this first under our research partnership with the Department of Energy’s National Energy Technology Laboratory (“NETL”) and more recently also with our independent reserve geologist, Weir International, Inc. (“Weir”).

Based upon extensive and on-going core drilling and independent chemical analysis, NETL and Ramaco now believe that the Brook Mine contains the largest unconventional deposit of REEs discovered to date in the United States. It has also been determined to hold meaningful amounts of valuable individual REEs with magnetic properties, the most important being neodymium and praseodymium as well as heavier HREEs such as terbium and dysprosium. Indeed, the mine may also be one of the most significant deposits of magnetic REEs discovered in the United States.

Weir estimates from initial testing shows the Brook Mine site contains a range of approximately 640,000-800,000 tons of in place 100% TREO (total rare earth oxide) with no cutoff in concentration. Of these totals, a range of between 181,000 and 226,000 tons or roughly 28% are magnetic REEs. The reserves are also low in any form of radioactive materials such as thorium. The deposits are found at reasonably shallow depths primarily in softer clay and related strata above and below our coal seams.

These current observations are made from an assessment of 4,500 acres, less than one third of the total 15,800-acre area of the Brook Mine. That area however is already permitted, and mining could be fast tracked to be initiated later this year. More drilling and testing will continue to determine the ultimate size and character of the REE opportunity over the entire area, including the property that has not yet been assessed.

An additional 11,300 contiguous acres can be permitted in the future to potentially both increase and scale the size of the opportunity. We believe that the coals and intervening clay like strata layers contained within this additional unpermitted acreage were geologically deposited in similar ways as those contained within the current permit boundary.

We are attaching to this letter an Exploration Target report independently prepared by Weir which sets forth the geological and chemical findings determined to date along with additional background detail. Weir’s technical report can also be found on our website at www.ramacoresources.com.

There is a line from the play Hamilton that “It’s nice to have Washington on your side.” As background, several years ago, as part of our research partnership with NETL we provided them older drill coring from the Brook Mine as part of their national assessment program on REEs. After their testing and analysis, NETL informed us that our property might contain meaningful concentrations of REEs. As a result, over the past 18 months we have been engaged in an extensive core drilling and chemical analysis program to further assess the resource and reserve definition of the REEs and to collect samples for on-going metallurgical testing.

We are now evaluating the overall business proposition of developing these critical minerals to their highest value proposition to Ramaco, and frankly also to the country. Ramaco’s Board has authorized the continued further quantitative and qualitative assessment on both the REE deposits and various processing and refining techniques working alongside NETL. Ramaco will provide quarterly updates on our progress from both an assessment and development perspective.

We of course recognize that any new mine project, especially one involving emerging technology, is fraught with uncertainty. There is much work to do before we can determine the ultimate commercial feasibility of REE extraction at the Brook Mine.

However, if that assessment proves up the viability of the project, we view this as an important new direction for Ramaco and an opportunity for transition. We could ultimately combine the mining and development of valuable critical and strategic REE minerals in the West, with our current core business of metallurgical coal production in Appalachia.

We would approach this unique new activity with the same conservative capital expenditure and development discipline that we have applied to our metallurgical coal business. Because of growing cash flow generation from our portfolio of metallurgical coal production, we are well positioned to allocate initial capital to begin a step-by-step development program. It is our current thinking that the ultimate overall project development would be financed incrementally from internal cash flow.

The majority of REE deposits outside of China are associated with “conventional” mines and found in igneous hard rock deposits, which makes them both difficult and expensive to mine and process. The geological analysis to date confirms that the Brook Mine’s “unconventional” REE deposits are found primarily in clay, claystone, carbonaceous shale and siltstone strata located above and below our coal seams. These are relatively shallow deposits found in softer organic material. It is therefore expected they can be mined using normal surface mining techniques and processed in a more economic and environmental manner than conventional REE mines.

We have now drilled approximately 131 core holes targeting the mineralization and have conducted chemical tests on over 965 core samples from 35 distinct core holes located across the Brook Mine. This analysis was performed using portable x-ray fluorescence (“XRF”) devices on site and by independent laboratories using an analytic technique called inductively coupled plasma (“ICP”) chemical spectroscopy.

The Brook Mine has also been found to have over 90% of its distributed REE concentrations in the average of 200-300 parts per million (ppm) range spread across all acreage that has been tested, with higher concentrations of over 2,700 ppm found in isolated locations. To date, all core holes have tested positive for REE concentrations drilled across the breath of the property.

Although the amount of overall REE ppm concentrations are lower than found in “conventional” hard rock minerals, the overall level of concentrations is both consistent as well as higher than ppm concentrations usually found in other “unconventional” deposits. Indeed, in China, which possesses the world’s largest quantities of known REEs, the highest value commercial REEs are mined from unconventional ionic adsorption clay deposits. This is because the cost of mining, processing and refinement is meaningfully lower than from conventional hard minerals.

We believe the REE mineral and related strata material will be capable of being mined using traditional low-cost surface mining techniques. The general “softness” of the clay and other strata located above and below the coal seams, also means that the mined material should be able to be processed in a both substantially more economic, as well as environmental manner than “conventional” REEs. To process REEs found in hard rock minerals such as monazite, bastnaesite, xenotime requires both heavy crushing and grinding, as well as the use of highly caustic chemical and acid processing.

The cumulative cost and environmental aspects of both the processing and refinement of REEs has a critical bearing on the ultimate economic value of the deposit. This development path takes the REEs from a mineral deposit then to a concentrate, to an oxide and finally to a metal or magnet. In the case of the Brook Mine, we currently believe that processing these unconventional REEs into a concentrate may involve forms of physical separation similar to our metallurgical coal preparation plants in Appalachia and only require the use of mild solvents.

In the mining business, if one is fortunate enough to discover an unexpected mineral deposit of this unique value and dimension, it is hubris to claim that you knew what you were looking for. In our case though, perhaps we might get some credit for showing the curiosity over the past ten years that there might be more to the possible uses of coal than conventional wisdom suggests.

During that time, Ramaco, along with our partners at the National Labs such as NETL and Oak Ridge — as well as other research institutes, universities, and strategic groups — have explored the research and development of alternative uses of coal, which we like to refer to as “carbon ore”. Aside from power combustion or steel production, we have felt that carbon ore could be used as a feedstock to make higher value advanced carbon products and materials, or as a source of critical minerals.

Perhaps fate loves irony. We have often used the phrase, “Coal is too valuable to burn.” Coal and its contiguous strata may become a source of valuable and strategically needed rare earth elements for this country. This discovery might provide an interesting new path for a much-maligned, as well as one of our nation’s most abundant natural resources.

| All the best- | |

| Randall W. Atkins | |

| Chairman and Chief Executive Officer |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this letter constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Ramaco Resources’ expectations or beliefs concerning guidance, future events, anticipated revenue, future demand and production levels, macroeconomic trends, the development of ongoing projects, costs and expectations regarding operating results, and it is possible that the results described in this letter will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Ramaco Resources’ control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. These factors include, without limitation, risks related to the timing of the mining discussed in this letter and the Company's ability to successfully pursue such mining. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, Ramaco Resources does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Ramaco Resources to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in Ramaco Resources’ filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The risk factors and other factors noted in Ramaco Resources’ SEC filings could cause its actual results to differ materially from those contained in any forward-looking statement.

|

TECHNICAL REPORT SUMMARY BROOK MINE PROPERTY RARE EARTH ELEMENT EXPLORATION TARGET PREPARED FOR RAMACO RESOURCE, INC. MAY 2023 PROJECT NO. 6371.3 Mining, Geology and Energy Consultants Weir International, Inc. WEIR |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page i Notice Weir International, Inc. (WEIR) was retained by Ramaco Resources, Inc. (Ramaco, NASDAQ: METC) to prepare this Technical Report Summary (TRS) related to Ramaco’s Rare Earth Element (REE) Exploration Target. This report provides a statement of Ramaco’s REE Exploration Target located within its mineral holdings at the planned Brook Mine near Sheridan, Wyoming. This TRS has been prepared in accordance with the United States Securities and Exchange Commission (SEC), Regulation S-K 1300 for Mining Property Disclosure (S-K 1300) and 17 Code of Federal Regulations (CFR) § 229.601(b)(96)(iii)(B) reporting requirements. This report was prepared for the sole use of Ramaco, and its affiliates and is effective as of April 30, 2023. This report was prepared by WEIR personnel who meet the SEC’s definition of Qualified Persons (QPs), with sufficient experience in the relevant type of mineralization and deposit under consideration in this report. In preparing this report, WEIR relied upon data, written reports and statements provided by Ramaco. WEIR has taken all appropriate steps, in its professional opinion, to ensure the information provided by Ramaco is reasonable and reliable for use in this report. The accuracy of Exploration Target estimates is, in part, a function of the quality and quantity of available data at the time this report was prepared. Estimates presented herein are considered reasonable, however, the estimates should be accepted with the understanding that with additional data and analysis subsequent to the date of this report, the estimates may necessitate revision, which may be material. Certain information to be set forth in this report may contain “forward-looking information”. These statements are not guarantees of future performance and undue reliance should not be placed on these estimates. The assumptions used to develop forward-looking information and the risks that could cause the actual results to differ materially are detailed in the body of this report. WEIR and its personnel are not affiliates of Ramaco or any other entity with ownership, royalty or other interest in the subject property of this report. WEIR hereby consents to the use of Ramaco’s REE Exploration Target estimates, as of April 30, 2023. Qualified Person: /s/ Weir International Date: May 2, 2023 Address: Weir International, Inc. 1431 Opus Place, Suite 210 Downers Grove, Illinois 60515 |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page ii TABLE OF CONTENTS Page 1.0 Executive Summary 1 1.1 Property Description 1 1.2 Geological Setting and Mineralization 3 1.3 Development and Operations 3 1.4 Exploration 3 1.5 Exploration Target Tonnage Estimate 5 1.6 Conclusions and Recommendations 6 2.0 Introduction 8 2.1 Registrant 8 2.2 Terms of Reference and Purpose 8 2.3 Sources of Information and Data 9 2.4 Details of the Personal Inspection of the Property 10 2.5 Previous Technical Report Summary 10 3.0 Property Description 11 3.1 Property Location 11 3.2 Property Area 11 3.3 Property Control 12 3.4 Mineral Control 15 3.5 Significant Property Encumbrances and Permit Status 20 3.6 Significant Property Factors and Risks 21 3.7 Royalty Interest 21 4.0 Accessibility, Climate, Local Resources, Infrastructure, and Physiography 22 4.1 Topography, Elevation, and Vegetation 22 4.2 Property Access 22 4.3 Climate and Operating Season 22 4.4 Infrastructure 23 5.0 History 24 5.1 Previous Operations 24 5.2 Previous Exploration and Development 25 6.0 Geological Setting, Mineralization, and Deposit 26 6.1 Regional, Local, and Property Geology 26 6.1.1 Regional Geology 26 6.1.2 Local Geology 26 6.1.3 Property Geology 27 6.2 Mineral Deposit Type 27 6.3 Geological Model 27 6.4 Stratigraphic Column and Cross Section 29 7.0 Exploration 33 7.1 Drilling 33 7.1.1 Planned Drilling 36 |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page iii 7.0 Exploration (continued) 7.2 Non-Drilling Exploration 37 7.3 Hydrogeological Data 37 7.4 Geotechnical Data 37 7.5 Other Relevant Drilling Data 37 7.6 Exploration Target 37 7.6.1 Assumptions, Parameters, and Methods 38 7.6.2 Estimates of Exploration Target Tonnage and Grade 40 7.6.3 Uncertainty in Estimates of Tonnage 44 7.7 Additional Commodities or Mineral Equivalent 46 8.0 Sample Preparation, Analyses, and Security 47 8.1 Sample Preparation Methods, Analysis, and Quality Control 47 9.0 Data Verification 51 9.1 Data Verification Procedures 51 9.2 Data Verification Limitations 52 9.3 Adequacy of Data 52 10.0 Mineral Processing and Metallurgical Testing 54 11.0 Mineral Resource Estimates 55 12.0 Mineral Reserve Estimates 56 13.0 Mining Methods 57 14.0 Processing and Recovery Methods 58 15.0 Infrastructure 59 16.0 Market Studies 60 17.0 Environmental Studies, Permitting, and Local Individuals or Groups Agreements 61 18.0 Capital and Operating Costs 62 19.0 Economic Analysis 63 20.0 Adjacent Properties 64 21.0 Other Relevant Data and Information 65 22.0 Interpretations and Conclusions 66 23.0 Recommendations 67 24.0 References 68 25.0 Reliance on Information Provided by the Registrant 69 FIGURES Figure 1.1-1 General Location Map 2 Figure 6.4-1 Brook Mine Property Stratigraphic Column 30 Figure 6.4-2 Typical Stratigraphic Cross Sections 31 Figure 6.4-3 Block Model Cross Sections with Average TREE Values 32 Figure 7.1-1 Comparative Analysis of Promisivity 34 Figure 7.1-2 Drill hole Locations 35 Figure 7.6-1 Estimated TREO Grade Distribution 41 Figure 7.6-2 Estimated REO Tonnage by Zone 41 Figure 7.6-3 Estimated TREO Distribution by Oxide 42 Figure 7.6-4 Estimated TREO Distribution by Lithology Type 43 Figure 7.6-5 Map of Exploration Target Composited TREO Grade 44 Figure 8.1-1 LaCeY versus TREE Regression Analysis 48 |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page iv TABLES Table 1.4-1 Drilling Programs 4 Table 1.5-1 Rare Earth Elements 5 Table 1.5-2 In-Place REO Exploration Target Tonnage and Grade Estimates 6 Table 2.2-1 Rare Earth Elements 9 Table 3.3-1 REE Exploration Target Property Control 13 Table 3.4-1 REE Exploration Target Mineral Control 16 Table 6.3-1 Stratigraphic Model Interpolators 28 Table 7.1-1 Drilling Programs 35 Table 7.6-1 REE to REO Conversions 38 Table 7.6-2 Rare Earth Elements 39 Table 7.6-3 In-Place REO Exploration Target Tonnage and Grade Estimate 40 Table 7.6-4 TREO Distribution by Lithology Group 43 Table 8.1-1 ICP Testing Laboratories 49 Table 8.1-2 ICP Assay Reporting Limits 50 Table 25.1 Information Relied Upon from Registrant 69 APPENDIX Appendix A REE Exploration Target, Geological Cross Sections Appendix B Drill Hole Database |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page 1 1.0 EXECUTIVE SUMMARY WEIR was retained by Ramaco Resources, Inc. (Ramaco) to prepare a Technical Report Summary (TRS) related to Ramaco’s Rare Earth Element (REE) Exploration Target. This report has been prepared in accordance with the United States Securities and Exchange Commission (SEC), Regulation S-K 1300 for Mining Property Disclosure (S-K 1300) and 17 Code of Federal Regulations (CFR) § 229.601(b)(96)(iii)(B) reporting requirements. 1.1 PROPERTY DESCRIPTION The REE Exploration Target is located within Ramaco’s mineral holdings at its planned Brook Mine Property located approximately seven miles north of Sheridan, Wyoming in Sheridan County. The Burlington Northern Railroad and Interstate 90 are located along the southern boundary of the current Brook Mine permit area. The Brook Mine Property is situated in the Sheridan Coal Field in the northwestern portion of the Powder River Basin (PRB) coal producing region of the of the United States (see Figure 1.1-1). The United States Geological Survey (USGS) 7.5-minute quadrangle maps are Acme, Hultz Draw, Monarch, and Sheridan. The Brook Mine Property consists of approximately 15,800 acres of Ramaco owned and leased mineral holdings located in Sheridan County, Wyoming. Ramaco acquired the Brook Mine Property in 2011 from the Sheridan-Wyoming Coal Company. When Ramaco began development of the Brook Mine Property as a thermal coal resource in 2012, Ramaco originally permitted approximately 4,600 acres that it regarded as the optimal area for a new surface coal mine. As Ramaco began further core drilling exploration in 2021 and 2022 relative to REE exploration, Ramaco decided to continue to drill in areas within the original permit boundary in order to leverage the existing drilling core available for sampling. As such, the REE Exploration Target is limited to the current permit boundary of the Brook Mine Property. Ramaco has indicated its intention to proceed with additional drilling and assessment of additional areas of the Brook Mine Property to assess the potential for expanding its REE Exploration Target beyond the current permit boundary. |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page 2 Figure 1.1-1 General Location Map |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page 3 1.2 GEOLOGICAL SETTING AND MINERALIZATION The Sheridan Coal Field is within the northwestern portion of the PRB. The regional geology of this area is characterized by a sequence of sedimentary rocks that formed during the Late Cretaceous to early Paleocene Period. The stratigraphic sequence consists of interbedded sandstones, mudstones, and coal seams that were deposited in fluvial, deltaic, and lacustrine environments. The primary coal seams that may be associated with REEs on the Brook Mine Property, in descending stratigraphic order, are the Dietz 1, Dietz 2, Dietz 3, Monarch, Upper Carney, Lower Carney, and Masters. There are also seven unnamed minor coal seams below the Masters Seam. The REEs are believed to have been incorporated into the coal during its formation and are found in association with clay minerals and organic matter in the coal seams. Interburden between the coal seams also contain elevated levels of REEs, primarily in clays, carbonaceous clays, shales, and siltstones not necessarily associated with the coal seams. 1.3 DEVELOPMENT AND OPERATIONS The REE Exploration Target is currently in an exploration stage. The current phase of exploration drilling, sampling, and analysis is planned to be completed by October 2023. Ramaco anticipates that once the ongoing 100-hole exploration program is completed, it will continue drilling on the current area, and other areas of the Brook Mine Property (beyond the area defined in this Exploration Target). This additional exploration plan is yet to be finalized. 1.4 EXPLORATION Drilling has served as the primary form of exploration on the REE Exploration Target area. A Total of 131 drill holes have served to define the Exploration Target. This drilling data consists of 31 coal exploration drill holes, drilled by a previous property owner, as well as 100 holes drilled by Ramaco. A geological model was built using all 131 exploration drill holes. Approximately 121 of these drill holes are within the currently permitted REE Exploration Target area. |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page 4 In addition to detailed geological logging, drill core obtained by Ramaco was subjected to both X-Ray Fluorescence (XRF) and Inductively Coupled Plasma - Mass Spectrometry (ICP) REE quality laboratory analysis. A summary of the drilling data available to date for the Brook Mine Property is summarized in Table 1.4-1 as follows: Table 1.4-1 Drilling Programs As the XRF data collected does not provide reliable measurements of all REE concentrations, it is not incorporated into the quantitative analysis of this report. XRF data is only used procedurally to assist in identifying zones to be sent for ICP confirmatory analysis. Aside from the exclusion of these XRF scanning results, no data collected as a result of known exploration programs to date has been omitted from the input, analysis, or results reported in this TRS. While all 131 drill holes detailed above are incorporated into the geological structure model used to define the Exploration Target, it is the 965 ICP assays from 35 drill holes that support the estimates of REE tonnage and grade. These ICP quality data points provide sufficient coverage of the property to allow for the estimation of in-place REE tonnage and grade. It is WEIR’s opinion that the adequacy of sample preparation, security, and analytical procedures for holes that were drilled by Ramaco, after acquiring the property, are acceptable and that these analytical procedures meet typical industry standards. The adequacy of sample preparation, security, and analytical procedures are generally unknown for holes that were drilled prior to Ramaco acquiring the property. However, the geologist’s logs for these holes contain sampling descriptions and lithologic descriptions that are sufficiently detailed to ascertain that an experienced geologist supervised the drilling and sampling. Drill Downhole Hole Geophysical Deviation Geologist's Exploration Program Count Depth (Ft) Rotary Core Header Logs Log Log Holes Samples Feet Holes Samples Feet Previous Coal Drilling 31 7,181 - 31 31 - - 3 - - - - - - 2019 Drilling 6 1,088 - 6 6 - - 6 3 124 74 2 72 48 2021-2022 Drilling 14 1,937 - 14 14 14 - 14 14 2,216 663 4 143 140 2022-2023 Drilling(1) 80 16,777 - 80 80 - - 80 41 13,143 3,146 29 750 617 Total 131 26,983 131 131 14 103 58 15,483 3,883 35 965 805 (1) Through April 22, 2023 Drill Holes XRF Analysis ICP Analysis Quality Analysis Base Data Hole Type |

|

Technical Report Summary Brook Mine Property - Rare Earth Element Exploration Target Prepared for Ramaco Resources, Inc. May 2, 2023 Page 5 1.5 EXPLORATION TARGET TONNAGE ESTIMATE The REEs and relative categorizations, as defined for purposes of this TRS, are summarized in Table 1.5-1 as follows: Table 1.5-1 Rare Earth Elements Symbol Element Atomic Number Heavy/ Light Primary Magnetic Secondary Magnetic Critical Mineral (1) Sc Scandium 21 - - - Yes Y Yttrium 39 - - - Yes La Lanthanum 57 Light - - Yes Ce Cerium 58 Light - - Yes Pr Praseodymium 59 Light Yes - Yes Nd Neodymium 60 Light Yes - Yes Pm Promethium 61 - - - - Sm Samarium 62 Light - Yes Yes Eu Europium 63 - - - Yes Gd Gadolinium 64 - - Yes Yes Tb Terbium 65 - Yes - Yes Dy Dysprosium 66 - Yes - Yes Ho Holmium 67 Heavy - Yes Yes Er Erbium 68 Heavy - - Yes Tm Thulium 69 Heavy - - Yes Yb Ytterbium 70 Heavy - - Yes Lu Lutetium 71 Heavy - - Yes (1) U.S. Geological Survey WEIR’s evaluation of Ramaco’s REE Exploration Target was conducted in accordance with Regulation S-K 1300, and WEIR notes that: • Ranges of tonnage and grade of the Exploration Target are conceptual in nature • There has been insufficient exploration of Ramaco’s property to reasonably estimate a Mineral Resource • It is uncertain if further exploration will result in the estimation of a Mineral Resource • The Exploration Target does not represent, and should not be construed to be, an estimate of a Mineral Resource or Mineral Reserve The geological model described in Section 6.3 served as the basis for the development of the Brook Mine Property Exploration Target tonnage and grade estimates. Tonnage is reported as in-place Rare Earth Oxide (REO) weights. |

|