UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 14, 2023

American Public Education, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33810 | 01-0724376 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

111 W. Congress Street Charles Town, West Virginia |

25414 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 304-724-3700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | APEI | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On March 14, 2023, American Public Education, Inc. (the “Company”) issued a press release reporting financial results for the three and twelve months ended December 31, 2022. A copy of the Company’s press release is attached to this report as Exhibit 99.1 and is incorporated in this report by reference. The Company has scheduled a webcast for 5:00 p.m. ET on March 14, 2023 to discuss its financial results, and slides for that webcast are attached to this report as Exhibit 99.2 and are incorporated in this report by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits | |||

| 99.1 | American Public Education, Inc. press release dated March 14, 2023, reporting financial results for the three and twelve months ended December 31, 2022. | |||

| 99.2 | American Public Education, Inc. slides for March 14, 2023 conference call and Webcast for the three and twelve months ended December 31, 2022. | |||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| American Public Education, Inc. | ||||

| Date: | March 14, 2023 | By: | /s/ Richard W. Sunderland, Jr. | |

| Richard W. Sunderland, Jr., Executive Vice President and Chief Financial Officer |

||||

Exhibit 99.1

American Public Education Reports Fourth Quarter 2022 Results

CHARLES TOWN, WV (March 14, 2023) – American Public Education, Inc. (Nasdaq: APEI) announced financial results for the quarter ended December 31, 2022.

Fourth Quarter Highlights:

| • | Consolidated revenue decreased 1.0% year over year to $152.4 million |

| • | At December 31, 2022, total unrestricted cash and cash equivalents of approximately $102.6 million represents a decrease of $20.0 million from December 31, 2021 |

| • | Net loss available to common stockholders for the period was $6.6 million, compared to net income of $9.4 million for the three months ended December 31, 2021, a decrease in earnings of $16.0 million |

| • | Adjusted EBITDA decreased 48% year-over-year to $15.4 million |

We completed the acquisitions of Rasmussen University (“RU”) and Graduate School USA (“GSUSA”) on September 1, 2021 and January 1, 2022, respectively. Our financial results do not include the financial results of these companies prior to their respective acquisition closing dates. Accordingly, the financial results for the three and twelve months ended December 31, 2022, include results of operations of RU for four months of 2021 and do not include the results of operations of GSUSA. Therefore, the prior year period presented is not directly comparable to the current period.

Financial Results:

Three months ended December 31, 2022 compared to three months ended December 31, 2021:

| • | Total consolidated revenue for 2022 decreased 1.0% to $152.4 million, compared to total revenue of $154.0 million in 2021. The RU Segment revenue decreased by $7.6 million, which was partially offset by the inclusion of GSUSA revenue for the three months ended December 31, 2022 of $5.7 million, and increased revenue in the APUS and Hondros College of Nursing (HCN) segments. GSUSA revenue is not included in the prior year periods. |

| • | Total costs and expenses increased to $152.7 million for the 2022 period, compared to $137.5 million for the same period in 2021. The increase in costs and expenses for the three months ended December 31, 2022, was primarily due to an increase in expenses in the RU Segment of $7.9 million, which included a $2.0 million impairment charge on intangible assets, and the inclusion of GSUSA costs and expenses of $5.7 million. GSUSA costs and expenses are not included in the prior year period. |

| o | Instructional costs and services expenses increased $5.5 million in 2022 to $72.9 million, compared to $67.4 million in 2021, primarily due to the inclusion of the GSUSA instructional costs and services expenses of $3.6 million, as well as increases in both the HCN Segment and APUS Segment expenses of $0.9 million and $0.9 million, respectively. |

| o | Selling and promotional expenses increased $5.6 million to $38.6 million, compared to $33.0 million in 2021, primarily due to an increase in the RU Segment expenses of $4.3 million, and the inclusion of the GSUSA selling and promotional expenses of $1.0 million, for the three months ended December 31, 2022, compared to the prior year period. |

| o | General and administrative expenses increased $3.4 million to $31.2 million, compared to $27.8 million in 2021 mainly due to an increase in the RU Segment expenses of $2.0 million and the inclusion of GSUSA expense of $1.0 million, for the three months ended December 31, 2022, compared to the prior year period. |

| o | Depreciation and amortization expenses decreased to $7.9 million in 2022, or 5.2% of revenue, compared to $8.3 million and 5.4% in 2021, primarily due to the decrease in depreciation expense in our APUS Segment of $0.5 million. |

| o | Costs and expenses in 2022 also include $4.3 million of M&A-related professional fees, of which $3.9 million were transition fees associated with onboarding outsourced marketing services. |

| • | Interest expense was $7.4 million in 2022, compared to interest expense of $3.1 million in 2021. The increase was mainly due to the accelerated amortization of debt issuance costs of $3.9 million recognized from a debt prepayment that occurred in the December 2022. |

| • | The net loss available to common stockholders was $6.6 million in 2022, compared to net income available to common stockholders of $9.4 million in 2021, primarily driven by increases in costs discussed above. |

| • | The net loss per diluted common share was $0.35, compared to net income per diluted common share of $0.50 in 2021. |

| • | Adjusted EBITDA was $15.4 million in 2022, compared to $29.3 million in 2021. |

Balance Sheet and Liquidity:

| • | Total unrestricted cash and cash equivalents as of December 31, 2022 was approximately $102.6 million, compared to $122.6 million as of December 31, 2021, representing a decrease of $20.0 million. The decrease in cash was mainly due to net cash utilized for debt repayment of $34.2 million and cash invested in capital expenditures of $16.4 million, which was partially offset by an increase in net cash provided by operating activities to $29.2 million. |

| • | In the fourth quarter, we issued $40.0 million in preferred stock and used the proceeds to prepay long term debt. Together with the proceeds from the preferred stock issuance and available cash, $65.0 million in principal was prepaid. |

| • | As of December 31, 2022, approximately $26.0 million, of which $16.5 million is older than 60 days from the course start date, was due from the Army. |

Registrations and Enrollment:

| 2022 | 2021 | % Change | |

| American Public University System1 | |||

| For the three months ended December 31 Net Course Registrations |

87,200 | 86,600 | 1% |

| For the year ended December 31 Net Course Registrations |

350,400 | 345,300 | 1% |

| Rasmussen University2 | |||

| For the three months ended December 31 Total Student Enrollment |

15,600 | 17,100 | (9)% |

| Hondros College of Nursing3 | |||

| For the three months ended December 31 Total Student Enrollment |

2,600 | 2,500 | 4% |

1APUS Net Course Registrations represents the approximate aggregate number of courses for which students remain enrolled after the date by which they may drop a course without financial penalty.

Excludes students in doctoral programs.

2Rasmussen Student Enrollment represents students in an active status as of the full-term census or billing date.

3HCN Student Enrollment represents the approximate number of students enrolled in a course after the date by which students may drop a course without financial penalty.

First Quarter 2023 Outlook:

The following statements are based on APEI’s current expectations. These statements are forward-looking and actual results may differ materially. APEI undertakes no obligation to update publicly any forward-looking statements for any reason unless required by law. Refer to APEI’s earnings conference call and presentation for further details.

| First Quarter 2023 Guidance | ||||||||

| (Approximate) | (% Yr/Yr Change) | |||||||

| APUS Net course registrations | 96,300 | 2.4 | % | |||||

| HCN Student enrollment | 2,700 | 10 | % | |||||

| RU Student enrollment | 14,300 | -12 | % | |||||

| - Nursing | 6,800 | -19 | % | |||||

| - Non-Nursing | 7,500 | -4 | % | |||||

| ($ in millions except EPS) | ||||||||

| APEI Consolidated revenue | $155.1 to $157.1 | 0% to 2% | ||||||

| APEI Net loss available to common | -$9.7 to -$8.4 | n.m. | ||||||

| APEI Adjusted EBITDA | $2.4 to $4.1 | -86% to -76% | ||||||

| APEI Diluted EPS | -$0.51 to -$0.44 | n.m | ||||||

Non-GAAP Financial Measures:

This press release contains the non-GAAP financial measures of EBITDA (earnings before interest, taxes, depreciation, and amortization) and Adjusted EBITDA (EBITDA less non-cash expenses such as stock compensation and non-recurring expenses). APEI believes that the use of these measures is useful because they allow investors to better evaluate APEI’s operating profit and cash generation capabilities.

For the three months ended December 31, 2022 and 2021, adjusted EBITDA excludes non-cash compensation expense, loss on disposals of long-lived assets, and M&A-related professional fees.

These non-GAAP measures should not be considered in isolation or as an alternative to measures determined in accordance with generally accepted accounting principles in the United States (GAAP). The principal limitation of our non-GAAP measures are that they exclude expenses that are required by GAAP to be recorded. In addition, non-GAAP measures are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses are excluded.

APEI is presenting EBITDA and adjusted EBITDA in connection with its GAAP results and urges investors to review the reconciliation of EBITDA and adjusted EBITDA to the comparable GAAP financial measures that is included in the tables following this press release (under the captions “GAAP Net Income to Adjusted EBITDA,” and “GAAP Outlook Net Income to Outlook Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business.

Webcast:

A live webcast of the APEI’s fourth quarter 2022 earnings conference call will be held today at 5:00 p.m. Eastern time. This webcast will be open to listeners who log in through the APEI’s investor relations website, www.apei.com.

A replay of the live webcast will also be available starting approximately one hour after the conclusion of the live webcast. The replay will be archived and available to listeners through APEI’s investor relations website for one year.

About American Public Education

American Public Education, Inc. (Nasdaq: APEI), through its institutions American Public University System (APUS), Rasmussen University, Hondros College of Nursing, and Graduate School USA (GSUSA), provides education that transforms lives, advances careers, and improves communities.

APUS, which operates through American Military University and American Public University, is the leading educator to active-duty military and veteran students* and serves approximately 88,900 adult learners worldwide via accessible and affordable higher education.

Rasmussen University is a 120-year-old nursing and health sciences-focused institution that serves approximately 14,300 students across its 22 campuses in six states and online. It also has schools of Business, Technology, Design, Early Education and Justice Studies.

Hondros College of Nursing focuses on educating pre-licensure nursing students at eight campuses (six in Ohio, one in Indiana, and one in Michigan). It is the largest educator of PN (LPN) nurses in the state of Ohio** and serves approximately 2,700 total students. Graduate School USA is a leading training provider to the federal workforce with an extensive portfolio of government agency customers. It serves the federal workforce through customized contract training (B2G) to federal agencies and through open enrollment (B2C) to government professionals.

Both APUS and Rasmussen are institutionally accredited by the Higher Learning Commission (HLC), an institutional accreditation agency recognized by the U.S. Department of Education. Hondros is accredited by the Accrediting Bureau of Health Education Schools (ABHES). GSUSA is accredited by the Accrediting Council for Continuing Education & Training (ACCET). For additional information, visit www.apei.com.

*Based on FY 2019 Department of Defense tuition assistance and Veterans Administration student enrollment data, as reported by Military Times, 2020.

**Based on information compiled by the National Council of State Boards of Nursing and Ohio Board of Nursing.

Forward Looking Statements

Statements made in this press release regarding APEI or its subsidiaries that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates and projections about APEI and the industry. In some cases, forward-looking statements can be identified by words such as “anticipate,” “believe,” “seek,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “should,” “will,” “would,” and similar words or their opposites. Forward-looking statements include, without limitation, statements regarding expectations for APEI’s composite score, impacts of the transition to ArmyIgnitED 2.0, growth, registration and enrollments, revenues, expenses, net income, margin, adjusted EBITDA and EBITDA, brand repositioning, NCLEX pass rates, and plans with respect to recent, current and future initiatives.

Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, among others, risks related to: APEI’s dependence on the effectiveness of its ability to attract students who persist in its institutions’ programs, the inability to effectively market the Company’s programs or expand into new markets, impacts of the transition to new systems for soldiers to request tuition assistance or the reduction, elimination, or suspension of or changes to tuition assistance, effects of changes the Company makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed, the inability to adjust to future market demands, continued strong competition in the education market, failure to comply with regulatory and accrediting agency requirements or to maintain institutional accreditation, the loss of eligibility to participate in Title IV programs or ability to process Title IV financial aid, the impact of recent regulatory rulemakings, the failure to meet applicable NCLEX pass rates, difficulties involving business combinations and acquisitions, obligations related to our debt and preferred stock, inability to attract, retain, and develop skilled personnel, impacts of changes in management, dependence on and the need to continue to invest in the Company’s technology infrastructure, and the risk factors described in the risk factor section and elsewhere in the Company’s annual report on Form 10-K and in the Company’s other SEC filings. You should not place any undue reliance on any forward-looking statements. The Company undertakes no obligation to update publicly any forward-looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future.

Contacts:

Ryan Koren

AVP, Investor Relations & Corporate Development (In thousands, except per share data)

(610) 428-7376

###

American Public Education, Inc.

Consolidated Statement of Income

| Three Months Ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| (unaudited) | ||||||||

| Revenues | $ | 152,438 | $ | 154,000 | ||||

| Costs and expenses: | ||||||||

| Instructional costs and services | 72,868 | 67,365 | ||||||

| Selling and promotional | 38,567 | 32,967 | ||||||

| General and administrative | 31,173 | 27,800 | ||||||

| Loss on disposals of long-lived assets | 214 | 1,100 | ||||||

| Impairment of goodwill and intangible assets | 2,000 | — | ||||||

| Depreciation and amortization | 7,878 | 8,271 | ||||||

| Total costs and expenses | 152,700 | 137,503 | ||||||

| Income from operations before interest and income taxes | (262 | ) | 16,497 | |||||

| Interest (expense) income | (7,389 | ) | (3,110 | ) | ||||

| Income before income taxes | (7,651 | ) | 13,387 | |||||

| Income tax expense | (1,124 | ) | 4,002 | |||||

| Equity investment loss | (8 | ) | (4 | ) | ||||

| Net (loss) income | $ | (6,535 | ) | $ | 9,381 | |||

| Preferred stock dividends | 48 | - | ||||||

| Net (loss) income available to common shareholders | (6,583 | ) | 9,381 | |||||

| Net income per common share: | ||||||||

| Basic | $ | (0.35 | ) | $ | 0.50 | |||

| Diluted | $ | (0.35 | ) | $ | 0.50 | |||

| Weighted average number of common shares: | ||||||||

| Basic | 18,892 | 18,712 | ||||||

| Diluted | 18,976 | 18,854 | ||||||

| Three Months Ended | ||||||||

| Segment Information: | December 31, | |||||||

| 2022 | 2021 | |||||||

| Revenues: | ||||||||

| APUS Segment | $ | 73,399 | $ | 73,379 | ||||

| RU Segment | $ | 60,719 | $ | 68,351 | ||||

| HCN Segment | $ | 12,642 | $ | 12,297 | ||||

| Corporate and other1 | $ | 5,678 | $ | (27 | ) | |||

| Income (loss) from operations before interest and income taxes: | ||||||||

| APUS Segment | $ | 19,114 | $ | 20,081 | ||||

| RU Segment | $ | (12,996 | ) | $ | 2,629 | |||

| HCN Segment | $ | (993 | ) | $ | 481 | |||

| Corporate and other | $ | (5,387 | ) | $ | (6,694 | ) | ||

| Twelve Months Ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| (unaudited) | ||||||||

| Revenues | $ | 606,328 | $ | 418,803 | ||||

| Costs and expenses: | ||||||||

| Instructional costs and services | 288,472 | 172,622 | ||||||

| Selling and promotional | 154,649 | 93,317 | ||||||

| General and administrative | 120,352 | 103,379 | ||||||

| Loss on disposals of long-lived assets | 1,176 | 1,282 | ||||||

| Impairment of goodwill and intangible assets | 146,900 | — | ||||||

| Depreciation and amortization | 32,127 | 17,832 | ||||||

| Total costs and expenses | 743,676 | 388,432 | ||||||

| (Loss) income from operations before interest and income taxes | (137,348 | ) | 30,371 | |||||

| Gain on acquisition | 3,828 | — | ||||||

| Interest (expense) income | (17,728 | ) | (4,277 | ) | ||||

| Income before income taxes | (151,248 | ) | 26,094 | |||||

| Income tax expense | (36,276 | ) | 7,511 | |||||

| Equity investment loss | (21 | ) | (831 | ) | ||||

| Net (loss) income | $ | (114,993 | ) | $ | 17,752 | |||

| Preferred stock dividends | 48 | - | ||||||

| Net (loss) income available to common shareholders | (115,041 | ) | 17,752 | |||||

| Net (loss) income per common share: | ||||||||

| Basic | $ | (6.10 | ) | $ | 0.98 | |||

| Diluted | $ | (6.08 | ) | $ | 0.97 | |||

| Weighted average number of common shares: | ||||||||

| Basic | 18,859 | 18,085 | ||||||

| Diluted | 18,914 | 18,255 | ||||||

| Twelve Months Ended | ||||||||

| Segment Information: | December 31, | |||||||

| 2022 | 2021 | |||||||

| Revenues: | ||||||||

| APUS Segment | $ | 285,128 | $ | 283,700 | ||||

| RU Segment | $ | 253,257 | $ | 89,483 | ||||

| HCN Segment | $ | 47,078 | $ | 45,803 | ||||

| Corporate and other1 | $ | 20,865 | $ | (183 | ) | |||

| (Loss) income from operations before interest and income taxes: | ||||||||

| APUS Segment | $ | 58,452 | $ | 51,050 | ||||

| RU Segment | $ | (166,557 | ) | $ | 1,630 | |||

| HCN Segment | $ | (4,011 | ) | $ | 1,829 | |||

| Corporate and other | $ | (25,232 | ) | $ | (24,138 | ) | ||

The RU Segment reflects the operations of RU, which was acquired on the RU Closing Date. The Company did not consolidate the financial results of the RU Segment prior to the RU Closing Date.

1. Corporate and Other includes tuition and contract training revenue earned by GSUSA from the GSUSA Closing Date through December 31, 2022. Contract training revenue represents both individual and customized training programs and is recognized when the services are performed. Additionally, the APUS Segment charges the HCN Segment and corporate employees for the value of courses taken by HCN Segment employees and corporate employees at APUS. The elimination of this intersegment revenue is included within Corporate and Other.

GAAP Net Income to Adjusted EBITDA:

The following table sets forth the reconciliation of the Company’s reported GAAP net income to the calculation of adjusted EBITDA for the three and twelve months ended December 31, 2022 and 2021:

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| (in thousands, except per share data) | 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Net (loss) income | $ | (6,535 | ) | $ | 9,381 | (114,993 | ) | 17,752 | ||||||||

| Income tax expense (benefit) | (1,124 | ) | 4,002 | (36,276 | ) | 7,511 | ||||||||||

| Interest expense (income) | 7,389 | 3,110 | 17,728 | 4,277 | ||||||||||||

| Equity investment loss | 8 | 4 | 21 | 831 | ||||||||||||

| Depreciation and amortization | 7,878 | 8,271 | 32,127 | 17,832 | ||||||||||||

| EBITDA | 7,616 | 24,768 | (101,393 | ) | 48,203 | |||||||||||

| Impairment of goodwill and intangible assets | 2,000 | - | 146,900 | - | ||||||||||||

| Adjustment to gain on acquisition | - | - | (3,828 | ) | - | |||||||||||

| Stock Compensation | 1,306 | 1,685 | 8,009 | 7,654 | ||||||||||||

| Loss on disposals of long-lived assets | 214 | 1,100 | 1,176 | 1,282 | ||||||||||||

| M&A - related professional and integration fees | 4,264 | 1,791 | 5,866 | 7,574 | ||||||||||||

| Adjusted EBITDA | $ | 15,400 | $ | 29,344 | 56,730 | 64,713 | ||||||||||

GAAP Net Income to Adjusted EBITDA:

The following table sets forth the reconciliation of the Company’s forecast GAAP net income to the calculation of adjusted EBITDA for the three months ending March 31, 2023:

| Three Months Ending | ||||||||

| March 31, 2023 | ||||||||

| (in thousands, except per share data) | Low | High | ||||||

| Net loss available to common | $ | (9,680 | ) | $ | (8,388 | ) | ||

| Preferred dividends | 1,455 | 1,455 | ||||||

| Net loss | (8,225 | ) | (6,933 | ) | ||||

| Income tax expense (benefit) | (2,597 | ) | (2,189 | ) | ||||

| Interest expense (income) | 2,355 | 2,355 | ||||||

| Depreciation and amortization | 6,793 | 6,793 | ||||||

| EBITDA | (1,674 | ) | 26 | |||||

| Stock Compensation | 1,771 | 1,771 | ||||||

| Integration Expenses | 2,335 | 2,335 | ||||||

| Adjusted EBITDA | $ | 2,432 | $ | 4,132 | ||||

Exbhibit 99.2

PRESENTED BY Angela Selden President and CEO Richard Sunderland, CPA Executive VP and CFO American Public Education, Inc.

Fourth Quarter 2022 Results March 14, 2023 Safe Harbor Statement Please note that statements made in this presentation regarding American Public Education, Inc . and its subsidiaries (the “Company”) that are not historical facts may be forward - looking statements based on current expectations, assumptions, estimates and projections about the Company and the industry . These forward - looking statements are subject to risks and uncertainties that could cause actual future events or results to differ materially from those expressed or implied by such statements . Forward - looking statements may be able to be identified by words such as anticipate, believe, seek, could, estimate, expect, intend, may, plan, should, will, would, transition, interest, on track, entering and similar words or their opposites . Forward - looking statements include, without limitation, expectations regarding growth, registrations, enrollments, revenues, expenses, net income, margin, earnings per share, adjusted EBITDA and EBITDA, brand repositioning, and NCLEX pass rates . Actual results could differ materially from those expressed or implied by forward - looking statements as a result of various factors, including risks related to dependence on the effectiveness of the Company’s ability to attract students who persist in its institutions’ programs, the inability to effectively market the Company’s programs or expand into new markets, impacts of the transition to new systems for soldiers to request tuition assistance or the reduction, elimination, or suspension of or changes to tuition assistance, effects of changes the Company makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed, the inability to adjust to future market demands, continued strong competition in the education market, failure to comply with regulatory and accrediting agency requirements or to maintain institutional accreditation, the loss of eligibility to participate in Title IV programs or ability to process Title IV financial aid, the impact of recent regulatory rulemakings, the failure to meet applicable NCLEX pass rates, difficulties involving business combinations and acquisitions, obligations related to our debt and preferred stock, inability to attract, retain, and develop skilled personnel, impacts of changes in management, dependence on and the need to continue to invest in the Company’s technology infrastructure, and the risk factors described in the risk factor section and elsewhere in the Company’s annual report on Form 10 - K and in the Company’s other SEC filings . You should not place any undue reliance on any forward - looking statements . The Company undertakes no obligation to update publicly any forward - looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future . 2 Executive Summary 3 □ APEI delivered $15.4 million and $56.7 million of Adjusted EBITDA for 4Q’22 and full year 2022, respectively, in line with guidance □ 2022 enrollment momentum in 3 out of 4 education units expected to continue in 2023 • APUS: Continued growth in the military, focus on margin expansion, selective price increases, increased marketing efficiency, brand re - positioning and strong cash flow generation • HCN: Continue robust start growth and price increase in 2Q’23 • GSUSA: Platform to grow our career learning business □ 2023 is a rebuilding year at Rasmussen • 4Q’22 organizational and operational realignment in place to drive sustainable growth, align resources more directly to improve NCLEX pass rates and reduce operating costs • Unexpected leadership departures and assumptions of new duties associated with the reorganization in late 4Q’22 had negative impacts on 1H’23 starts.

Elevated 16 - year Rasmussen veteran to Chief Operations Officer • Identified NCLEX improvement opportunities and implementing solutions □ APEI continues to see Rasmussen as a unique and valuable asset • Educating new nurses to fill 225,000 per year US supply/demand gap for next eight years • Highly leveraged on - ground operating model that scales with enrollment 1) Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization less non - cash expenses such as stock compensation and non - recurring expenses) is a non - GAAP financial measure.

Refer to appendix for GAAP to non - GAAP reconciliation Highlights Guidance Summary • 1Q’23 registrations of approximately 2.4% growth versus prior year period, or approximately 96.3K enrollments • Strong military registrations, green shoots in new non - military offset partly by returning non - military and veteran declines • 2023 focus is on increasing retention and brand awareness; implementing select price increases to offset inflationary costs; and increased marketing efficiency APUS Registration and Education Unit Update 4Q'22 Forecast 1Q’23 and Education Unit Update 4 • 4Q'22 net course registrations increase driven by strong military growth: • 4Q'22 military registrations +4% compared to 4Q’21 • 4Q'22 Army registrations +7% compared to 4Q’21 • ArmyIgnitED transition to version 2.0 has been substantially completed without enrollment incident to date 92.9K 82.6K 83.1K 86.6K 345.3K 94.0K 83.5K 85.8K 87.2K 350.4K 1Q 2Q 3Q 4Q Full Year APUS Net Course Registrations +1% +1% +3% +1% +1% 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 94.0K 1Q 2.4% Forecast Period 96.3k 2022 2023 • 4Q'22 HCN enrollment growth of 4% versus prior year comparable period, +10% 2 - year CAGR, all - time high enrollment • Welcomed first Detroit Michigan cohort as planned and with strong demand HCN Enrollment and Education Unit Update 5 4Q'22 Forecast 1Q’23 and Education Unit Update • 1Q’23 HCN enrollment growth of 10% versus prior year comparable period, reaching record enrollment figures • 2Q’23 price increase initiated • HCN forecasted to stabilize cost structure 2,270 2,380 2,320 2,510 2,460 2,440 2,410 2,600 1Q 2Q 3Q 4Q HCN Enrollment +8% +3% +4% +4% 2021 2022 2021 2022 2021 2022 2021 2022 2,460 2,700 1Q +10% Forecast Period 2022 2023

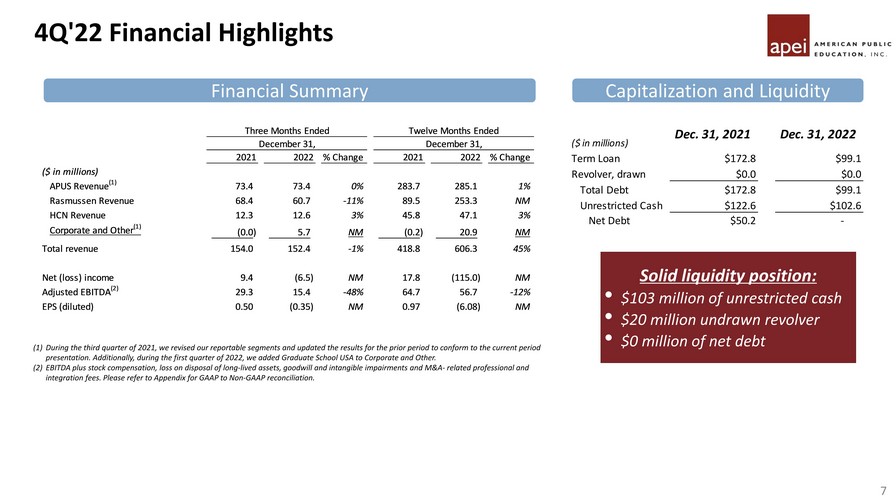

8,300 8,200 8,300 7,700 8,700 7,600 8,400 6,800 8,700 7,700 8,000 7,300 8,400 8,000 7,800 7,500 17,000 15,900 16,300 15,000 17,100 15,600 16,200 14,300 2Q 2021 2Q 2022 3Q 2021 3Q 2022 4Q 2021 4Q 2022 1Q 2022 1Q 2023 Rasmussen Enrollment Non-nursing Nursing Rasmussen Enrollment and Education Unit Update 6 • Strong 4Q’22 Rasmussen positive start growth vs 4Q’21, first in six quarters • 4Q'22 nursing enrollment contracted by 12% compared to 4Q’21 • impacted by caps/enrollment policies in select markets • 4Q’22 non - nursing enrollment contracted by 5% compared to 4Q’21 • Online enrollments up • Implemented organizational and operational realignment • Unexpected senior leadership departures in late 4Q’22 4Q'22 Forecast 1Q’23 and Education Unit Update • Selective price increases implemented • 4Q’22 organizational realignment created disruption in 4Q and 1Q’23 • Rehired leader responsible for strong 4Q’22 starts as the Chief Operations Officer • Centers for Educational Readiness and Nursing Excellence defined and implemented initiatives for clinical availability and improved NCLEX success Forecast Period 4Q'22 Financial Highlights Financial Summary Capitalization and Liquidity (1) During the third quarter of 2021, we revised our reportable segments and updated the results for the prior period to conform to the current period presentation.

Additionally, during the first quarter of 2022, we added Graduate School USA to Corporate and Other. (2) EBITDA plus stock compensation, loss on disposal of long - lived assets, goodwill and intangible impairments and M&A - related prof essional and integration fees. Please refer to Appendix for GAAP to Non - GAAP reconciliation. 7 Solid liquidity position: • $103 million of unrestricted cash • $20 million undrawn revolver • $0 million of net debt Three Months Ended Twelve Months Ended December 31, December 31, 2021 2022 % Change 2021 2022 % Change ($ in millions) APUS Revenue (1) 73.4 73.4 0% 283.7 285.1 1% Rasmussen Revenue 68.4 60.7 -11% 89.5 253.3 NM HCN Revenue 12.3 12.6 3% 45.8 47.1 3% Corporate and Other (1) (0.0) 5.7 NM (0.2) 20.9 NM Total revenue 154.0 152.4 -1% 418.8 606.3 45% Net (loss) income 9.4 (6.5) NM 17.8 (115.0) NM Adjusted EBITDA (2) 29.3 15.4 -48% 64.7 56.7 -12% EPS (diluted) 0.50 (0.35) NM 0.97 (6.08) NM These statements are based on current expectations.

These statements are forward - looking and actual results may differ materially. (1) APUS Net course registrations represent the approximate aggregate number of courses for which students remain enrolled after the date by which they may drop a course without financial penalty. (2) HCN and Rasmussen student enrollment represents the total number of students enrolled in a course after the date by which stu den ts may drop a course without financial penalty. (3) Please refer to Appendix for GAAP to Non - GAAP reconciliation APEI’s 1Q’23 Outlook 8 First Quarter 2023 Guidance Full Year 2021 Guidance (Approximate) (% Yr/Yr Change) APUS Net course registrations 1 96,300 2.4% HCN Student enrollment 2 2,700 10% RU Student enrollment 2 14,300 -12% - Nursing 6,800 -19% - Non-Nursing 7,500 -4% ($ in millions except EPS) APEI Consolidated revenue $155.1 to $157.1 0% to 2% APEI Net loss available to common -$9.7 to -$8.4 n.m. APEI Adjusted EBITDA 3 $2.4 to $4.1 -86% to -76% APEI Diluted EPS -$0.51 to -$0.44 n.m.

Thank You

Appendix: Enrollment and Registration Summary 10 4Q 2022 4Q 2021 % Change APUS Registrations 87,200 86,600 1% Total Rasmussen Enrollment 15,600 17,100 -9% Rasmussen Nursing Enrollment 7,600 8,700 -12% Rasmussen Non-Nursing Enrollment 8,000 8,400 -5% HCN Enrollment 2,600 2,510 4% American Public Education is presenting adjusted EBITDA in connection with its GAAP results and urges investors to review the reconciliation of adjusted net income to the comparable GAAP financial measure that is included in the table below (under the caption “GAAP Net Income to Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . Appendix: Disclosures 11 GAAP Net Income to Adjusted EBITDA: (in thousands, except per share data) Net (loss) income $ (6,535) $ 9,381 (114,993) 17,752 Income tax expense (benefit) (1,124) 4,002 (36,276) 7,511 Interest expense (income) 7,389 3,110 17,728 4,277 Equity investment loss 8 4 21 831 Depreciation and amortization 7,878 8,271 32,127 17,832 EBITDA 7,616 24,768 (101,393) 48,203 Impairment of goodwill and intangible assets 2,000 - 146,900 - Adjustment to gain on acquisition - - (3,828) - Stock Compensation 1,306 1,685 8,009 7,654 Loss on disposals of long-lived assets 214 1,100 1,176 1,282 M&A - related professional and integration fees 4,264 1,791 5,866 7,574 Adjusted EBITDA $ 15,400 $ 29,344 56,730 64,713 Twelve Months Ended December 31, 2022 2021 The following table sets forth the reconciliation of the Company’s reported GAAP net income to the calculation of adjusted EBITDA for the three and twelve months ended December 31, 2022 and 2021: Three Months Ended December 31, 2022 2021 American Public Education is presenting adjusted EBITDA in connection with its GAAP outlook and urges investors to review the reconciliation of projected adjusted net income to the comparable GAAP financial measure that is included in the table below (under the caption “GAAP Outlook Net Income to Outlook Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . Appendix: Disclosures (continued) 12 GAAP Net Income to Adjusted EBITDA: (in thousands, except per share data) Net loss available to common $ (9,680) $ (8,388) Preferred dividends 1,455 1,455 Net loss (8,225) (6,933) Income tax expense (benefit) (2,597) (2,189) Interest expense (income) 2,355 2,355 Depreciation and amortization 6,793 6,793 EBITDA (1,674) 26 Stock Compensation 1,771 1,771 Integration Expenses 2,335 2,335 Adjusted EBITDA $ 2,432 $ 4,132 March 31, 2023 Low High The following table sets forth the reconciliation of the Company’s forecast GAAP net income to the calculation of adjusted EBITDA for the three months ending March 31, 2023: Three Months Ending