UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 20, 2022

ARROW ELECTRONICS, INC.

(Exact Name of Registrant as Specified in Charter)

| NEW YORK | 1-4482 | 11-1806155 |

| (State or Other Jurisdiction | (Commission File | (IRS Employer |

| of Incorporation) | Number) | Identification No.) |

| 9201 East Dry Creek Road, Centennial, CO | 80112 |

| (Address of Principal Executive Offices) |

Registrant's telephone number, including area code: (303) 824-4000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 20.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of the exchange on which registered | ||

| Common Stock, $1 par value | ARW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into a Material Definitive Agreement.

Amendment of EMEA Securitization Facility

As described by Arrow Electronics, Inc. (the “Company”) in its Current Report on Form 8-K filed with the Securities and Exchange Commission on January 30, 2020, certain subsidiaries of the Company established a multi-jurisdictional asset-backed securitization (such transaction, together with the agreements and the other documents related thereto (as amended or otherwise modified prior to the hereinafter defined EMEA Amendment No. 1), the “Original EMEA Securitization”).

In connection with the Original EMEA Securitization, among other related agreements, and that certain Omnibus Deed of Amendment No. 1 dated December 23, 2021 (the “EMEA Amendment No. 1”) which effectuated certain regulatory updates (the Original EMEA Securitization as amended by EMEA Amendment No. 1, collectively, the “Existing EMEA Securitization”), the parties thereto delivered and entered into (i) a Master Framework Agreement dated as of January 27, 2020, among the Company, Arrow EMEA Funding Corp B.V., a bankruptcy remote special purpose vehicle established in connection with the Original EMEA Securitization, (the “SPV”), Arrow Central Europe GmbH, an indirect wholly owned subsidiary of the Company (the “German Originator”), Arrow Electronics FC B.V., an indirect wholly owned subsidiary of the Company (the “Subordinated Lender”), and Arrow Electronics (UK) Limited, an indirect wholly owned subsidiary of the Company (together with the German Originator, collectively, the “Originators”) (as amended or otherwise modified prior to the hereinafter defined EMEA Amendment No. 2, the “Existing MFA”) and (ii) a Receivables Transfer Agreement dated as of January 27, 2020, among the SPV, as the seller, BNP Paribas, as the administrative agent, purchaser agent, and a committed purchaser, and the Originators, each as an agent servicer and SPV servicer (as amended or otherwise modified prior to the hereinafter defined EMEA Amendment No. 2, the “Existing RTA”).

On September 20, 2022, the Company further amended and otherwise modified the Existing EMEA Securitization, including particularly the Existing MFA and Existing RTA, by entering into (i) an Omnibus Deed of Amendment No. 2 together with the SPV, the Originators, the Company, the Subordinated Lender, the administrative agent, the purchaser agent, the paying agent, the security trustee, and certain credit providers (“EMEA Amendment No. 2”, and the Existing EMEA Securitization as amended or otherwise modified by EMEA Amendment No. 2, the “EMEA Securitization”); and (ii) certain other related agreements (together with EMEA Amendment No. 2, the “EMEA Amendment No. 2 Documents”).

After giving effect to the EMEA Amendment No. 2 Documents, the Existing MFA and Existing RTA have been modified such that (i) the available commitment of the Existing EMEA Securitization has increased from €400 million to €600 million; (ii) the EMEA Securitization may satisfy the criteria for a simple, transparent and standardized (STS) securitization under European securitization regulations; (iii) the scheduled maturity of the Existing EMEA Securitization has been extended from January 27, 2023, to December 15, 2025; and (iv) certain other regulatory updates have been made.

The foregoing description of EMEA Amendment No. 2 does not purport to be complete, and is qualified in its entirety by reference to the full consolidated text of the omnibus deeds of amendment and the respective annexes thereto, which is filed in consolidated form as Exhibit 10.1 to this Current Report on Form 8-K.

Amendment of U.S. Securitization Facility

On September 20, 2022, the Company entered into Amendment No. 34 (the “U.S. Securitization Amendment”) to that certain Transfer and Administration Agreement dated as of March 21, 2001, by and among the parties from time to time party thereto, which governs the Company’s existing domestic accounts-receivables securitization facility (as amended or otherwise modified prior to the U.S. Securitization Amendment, the “Existing U.S. Securitization Facility”, and the Existing U.S. Securitization Facility as amended by the U.S. Securitization Amendment, the “U.S. Securitization Facility”). Pursuant to the U.S. Securitization Amendment, (i) the size of the Existing U.S. Securitization Facility was increased from $1,250,000,000 to $1,500,000,000; (ii) the maturity of the Existing U.S. Securitization Facility was extended from March 15, 2024, to September 20, 2025; and (iii) the parties made certain regulatory updates to the Existing U.S. Securitization Facility. The following banks are participating in the U.S. Securitization Facility: Bank of America, Mizuho, PNC, Wells Fargo, Sumitomo Mitsui Banking Corporation, and Truist Bank.

The foregoing description of the U.S. Securitization Amendment does not purport to be complete, and is qualified in its entirety by reference to the full text of the U.S. Securitization Amendment, which is filed as Exhibit 10.2 to this Current Report on Form 8-K.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The disclosures set forth in Item 1.01 above are incorporated herein by reference in their entirety.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ARROW ELECTRONICS, INC. | ||

| Date: September 22, 2022 | By: | /s/ Carine Jean-Claude |

| Name: | Carine Jean-Claude | |

| Title: | Senior Vice President, Chief Legal Officer and Secretary | |

Exhibit 10.1

[*****] Indicates omitted information. This redacted information has been excluded because it is both (i) not material and (ii) of the type that the registrant treats as private and confidential.

THIS OMNIBUS DEED OF AMENDMENT NO. 1 (this “Amendment”) is dated December 23_, 2021 and made among ARROW EMEA FUNDING CORP B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of The Netherlands, as the SPV (the “SPV”), BNP PARIBAS (“BNPP”), a société anonyme incorporated under the laws of France, as the Administrative Agent (in such capacity, the “Administrative Agent”), as Purchaser Agent for the BNP Purchaser Group (in such capacity, the “BNPP Purchaser Agent”) and as a Committed Purchaser, MATCHPOINT FINANCE PLC, a public limited company incorporated under the laws of Ireland, as a Conduit Purchaser (“Matchpoint”), ING BELGIUM S.A./N.V., a public limited liability company (société anonyme/naamloze vennootschap) organised under the laws of Belgium, as Purchaser Agent for the ING Purchaser Group (the “ING Purchaser Agent”), MONT BLANC CAPITAL CORP, a corporation organised under the laws of the State of Delaware, as a Committed Purchaser and as a Conduit Purchaser (“Mont Blanc”), ARROW ELECTRONICS (UK) LIMITED, a limited liability company incorporated under the laws of England and Wales, as an Agent Servicer, an SPV Servicer and an Originator (“Arrow UK”), ARROW CENTRAL EUROPE GMBH, a limited liability company (Gesellschaft mit beschränkter Haftung) incorporated under the laws of Germany, as an Agent Servicer, an SPV Servicer and an Originator (“Arrow Germany”), ARROW ELECTRONICS, INC., a corporation organised under the laws of the State of New York, as the Parent (the “Parent”), ARROW ELECTRONICS FC B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of The Netherlands, as the Subordinated Lender (the “Subordinated Lender”), U.S. BANK TRUSTEES LIMITED, a limited liability company incorporated under the laws of England and Wales, as the Security Trustee (the “Security Trustee”), ELAVON FINANCIAL SERVICES DAC, a designated activity company registered in Ireland, as the Paying Agent (the “Paying Agent”), and DEMICA LIMITED, a private company with limited liability incorporated under the Laws of England and Wales, as the Reporting Services Provider (the “Reporting Services Provider”). Each Person above shall be a “Party” and together shall be the “Parties”.

WITNESSETH

WHEREAS, the SPV, the Administrative Agent, the BNPP Purchaser Agent, Matchpoint, the ING Purchaser Agent, Mont Blanc, Arrow UK, Arrow Germany, the Parent, the Subordinated Lender, the Security Trustee and the Paying Agent have entered into that certain Master Framework Agreement, dated as of January 27, 2020 (as amended up to the date of this Amendment, the “Master Framework Agreement”);

WHEREAS, the SPV, the Administrative Agent, the BNPP Purchaser Agent, Matchpoint, the ING Purchaser Agent, Mont Blanc, Arrow UK, Arrow Germany, the Security Trustee and the Paying Agent have entered into that certain Receivables Transfer Agreement, dated as of January 27, 2020 (as amended up to the date of this Amendment, the “Receivables Transfer Agreement”);

WHEREAS, Arrow UK and the SPV have entered into that certain English Receivables Sale Agreement, dated as of January 27, 2020 (as amended up to the date of this Amendment, the “English RSA”);

WHEREAS, the SPV, the Administrative Agent, Arrow UK, Arrow Germany, the Security Trustee and the Paying Agent have entered into that certain Receivables Servicing Deed, dated as of January 27, 2020 (as amended up to the date of this Amendment, the "Servicing Deed"); WHEREAS, the SPV, Arrow Germany and the Security Trustee have entered into that certain English Declaration of Trust (German Collection Accounts), dated as of January 27, 2020 (as amended up to the date of this Amendment, the "Arrow Germany DOT");

WHEREAS, the SPV, Arrow UK, and the Security Trustee have entered into that certain English Declaration of Trust (English Collection Accounts), dated as of January 27, 2020 (as amended up to the date of this Amendment, the "Arrow UK DOT");

WHEREAS, the Parent, the SPV, the Administrative Agent and the Security Trustee have entered into that certain Parent Undertaking Agreement, dated as of January 27, 2020 (as amended up to the date of this Amendment, the “Parent Undertaking”);

WHEREAS, the Subordinated Lender, the SPV, Arrow UK, Arrow Germany and the Administrative Agent have entered into that certain Subordinated Loan Agreement, dated as of January 27, 2020 (as amended up to the date of this Amendment, the “Subordinated Loan Agreement”);

WHEREAS, the SPV, Arrow UK, Arrow Germany, the Administrative Agent and the Reporting Services Provider have entered into that certain Reporting Services Agreement, dated as of January 27, 2020 (as amended up to the date of this Amendment, the “Reporting Services Agreement” and, together with the Master Framework Agreement, Receivables Transfer Agreement, English RSA, Servicing Deed, Arrow Germany DOT, Arrow UK DOT, Parent Undertaking and Subordinated Loan Agreement, the “Agreements” and each Agreement, reflecting the amendment of such Agreement effected or proposed to be effected pursuant to this Amendment, the “Amended Agreements”);

WHEREAS, concurrently herewith Arrow Germany, the SPV and the Administrative Agent are entering into that certain First Amendment to German Receivables Sale Agreement, dated as of the Effective Date (the “German RSA Amendment”);

WHEREAS, concurrently herewith Arrow Germany, Arrow UK and the Security Trustee are entering into that certain Dutch Account Security Agreement, dated as of the Effective Date (the “Dutch Account Security Agreement”);

WHEREAS, the Parties desire to amend the Agreements to which they are a party as provided herein; and

NOW THEREFORE, the Parties agree as follows.

THIS DEED WITNESSES that:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Terms defined in the Amended Agreements |

Terms defined in each Amended Agreement but not in this Amendment shall have the same meaning in this Amendment as in such Amended Agreement or, if not defined therein, in the Master Framework Agreement.

| 1.2 | Interpretation |

The principles of interpretation set out in Clause 2.2 (Interpretation) of the Master Framework Agreement apply to this Amendment, mutatis mutandis, as if fully set forth herein.

| 2. | AMENDMENTS TO THE AGREEMENTS |

| 2.1 | Amendment of Master Framework Agreement. The Parties to the Master Framework Agreement hereby agree that with effect from the Effective Date, the Master Framework Agreement shall be amended as follows: |

| (a) | Clause 2.1 is hereby amended by adding the following defined terms in the appropriate alphabetical order: |

"Affected Financial Institution" means (a) any EEA Financial Institution or (b) any UK Financial Institution.

"Agent Entity" is defined in Clause 8.11 (Erroneous Payments) of the Receivables Transfer Agreement.

"Compounded Reference Rate" means, in relation to any RFR Banking Day, the percentage rate per annum which is the aggregate of:

| (a) | the Daily Non-Cumulative Compounded RFR for that RFR Banking Day; and |

| (b) | the applicable Credit Adjustment Spread. |

"Credit Adjustment Spread" means any rate which is specified as such in the Reference Rate Terms.

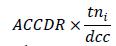

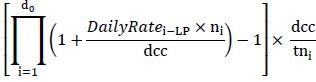

"Daily Non-Cumulative Compounded RFR Rate" means, in relation to any RFR Banking Day, the percentage rate per annum determined by the Reporting Services Provider in accordance with the methodology set out in Schedule 4 (Daily Non- Cumulative Compounded RFR Rate).

"Dutch Account Pledge Agreement (German and English Collection Accounts)" means that certain Dutch account security agreement, dated on or around December 23, 2021, among the German Originator, the English Originator and the Security Trustee.

"Effective Date" means December 23, 2021.

"EU Securitisation Regulation" means Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation, and amending certain other European Union Directives and Regulations, as amended and in effect from time to time.

"EU Securitisation Regulation Rules" means the EU Securitisation Regulation, together with all relevant implementing regulations in relation thereto, all regulatory technical standards, implementing technical standards and delegated regulations in relation thereto or applicable in relation thereto pursuant to any transitional arrangements made pursuant to the EU Securitisation Regulation and, in each case, any relevant guidance or policy statements published in relation thereto by European Banking Authority, the European Securities and Markets Authority and the European Insurance and Occupational Pensions Authority (or in each case, any predecessor or successor or any other applicable regulatory authority) or by the European Commission, in each case as amended and in effect from time to time.

"EUWA" means the European Union (Withdrawal) Act 2018, as amended.

"FCA" means the Financial Conduct Authority.

"ICE TERM SONIA" means the ICE Term SONIA reference rate administered and published by ICE Benchmark Administration Limited, or any other person which takes over the administration of such rate, published on the ICE Term Risk Free Rates portal at or around 11:55 am (London time).

"Other Party Entity" is defined in Clause 8.11 (Erroneous Payments) of the Receivables Transfer Agreement.

"PRA" means the United Kingdom Prudential Regulation Authority.

"Reference Rate Terms" means the terms set out in Schedule 3 (Reference Rate Terms).

"Resolution Authority" means an EEA Resolution Authority or, with respect to any UK Financial Institution, a UK Resolution Authority.

"RFR" means the rate specified as such in the Reference Rate Terms.

"RFR Banking Day" means any day specified as such in the Reference Rate Terms.

"Securitisation Regulation Rules" means the EU Securitisation Regulation Rules and the UK Securitisation Regulation Rules.

"UK Financial Institution" means any BRRD Undertaking (as such term is defined under the PRA Rulebook (as amended form time to time) promulgated by the United Kingdom Prudential Regulation Authority) or any person falling within IFPRU 11.6 of the FCA Handbook (as amended from time to time) promulgated by the United Kingdom Financial Conduct Authority, which includes certain credit institutions and investment firms, and certain affiliates of such credit institutions or investment firms.

"UK Insolvency Regulation" means the EU Insolvency Regulation, as it forms part of UK domestic law as "retained EU law" by operation of the EUWA, and as amended by the Insolvency (Amendment) (EU Exit) Regulations 2019, SI 2019/146.

"UK Securitisation Regulation" means Regulation (EU) 2017/2402 as it forms part of UK domestic law as "retained EU law" by operation of the EUWA, and as amended by the Securitisation (Amendment) (EU Exit) Regulations 2019, and as further amended from time to time.

"UK Securitisation Regulation Rules" means the UK Securitisation Regulation together with (a) all applicable binding technical standards made under the UK Securitisation Regulation; (b) all EU regulatory technical standards and implementing technical standards relating to the EU Securitisation Regulation (including such regulatory technical standards or implementing technical standards which are applicable pursuant to any transitional provisions of the EU Securitisation Regulation) forming part of UK domestic law by operation of the EUWA; (c) relevant guidance, policy statements or directions relating to the application of the UK Securitisation Regulation (or any binding technical standards) published by the PRA and/or the FCA (or their successors); (d) any guidelines relating to the application of the EU Securitisation Regulation which are applicable in the UK, (e) any other relevant transitional, saving or other provision relevant to the UK Securitisation Regulation by virtue of the operation of the EUWA; and (f) any other applicable laws, acts, statutory instruments, rules, guidance or policy statements published or enacted relating to the UK Securitisation Regulation, in each case as may be amended from time to time.

"UK Resolution Authority" means the Bank of England or any other public administrative authority having responsibility for the resolution of any UK Financial Institution.

| (b) | The definition of “Bail-In Action” in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Bail-In Action" means the exercise of any Write-Down and Conversion Powers by the applicable Resolution Authority in respect of any liability of an Affected Financial Institution.

| (c) | The definition of “Bail-In Legislation” in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Bail-In Legislation" means (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, regulation rule or requirement for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule and (b) with respect to the United Kingdom, Part I of the United Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings).

| (d) | The definition of "Collection Account" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Collection Account" means any account, at an Eligible Account Bank, described in Schedule 3 (Accounts) to the Receivables Transfer Agreement under the heading "Collection Account" and any account added as a Collection Account in accordance with the Transaction Documents.

| (e) | The definition of "Collection Account Agreements" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Collection Account Agreements" means, collectively, the English Declaration of Trust (English Collection Accounts), the English Declaration of Trust (German Collection Accounts), the Dutch Account Pledge Agreement (German Collection Accounts), the Dutch Account Pledge Agreement (German and English Collection Accounts), the Irish Declaration of Trust and the German Account Pledge Agreement, and each other control or other security agreement or arrangement, in form and substance reasonably satisfactory to the Administrative Agent and the Security Trustee and as may be appropriate under the laws of any relevant jurisdiction, with respect to a Collection Account.

| (f) | The definition of "Data Protection Law" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Data Protection Law" means Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data (repealing Directive 95/46/EC (General Data Protection Regulation)), including as it forms part of English law pursuant to the EUWA, the German Data Protection Act (Bundesdatenschutzgesetz) or any other applicable Law relating to data protection or privacy.

| (g) | The definition of “Dutch Account Pledge Agreement (Collection Accounts)” in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Dutch Account Pledge Agreement (German Collection Accounts)" means that certain Dutch account security agreement, dated on or around the Closing Date, among the German Originator and the Security Trustee.

| (h) | The definition of “Existing Law” in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Existing Law" means (a) the Dodd-Frank Wall Street Reform and Consumer Protection Act; (b) the third Basel Accord issued by the Basel Committee on Banking Supervision as set out in the publications entitled "Basel III: A global regulatory framework for more resilient banks and banking systems", "Basel III: International framework for liquidity risk measurement, standards and monitoring" and "Guidance for national authorities operating the countercyclical capital buffer" as updated from time to time (collectively "Basel III") and any further guidance or standards published by the Basel Committee relating to Basel III, (c) any rules, regulations, guidance, interpretations, directives or requests from any Official Body relating to, or implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act or Basel III (whether or not having the force of law), or (d) the Securitisation Regulation Rules.

| (i) | The definition of "GBP Investment Interest Reserve Percentage" in Clause 2.1 is hereby amended in its entirety as follows: |

"GBP Investment Interest Reserve Percentage" means, as at any Monthly Calculation Date, the ratio (expressed as a percentage) determined as:

| (a) | the product of: |

| (i) | the maximum between: |

(A) ICE TERM SONIA for a period of one (1) month as at such Monthly Calculation Date multiplied by [*****], and

(B) ICE TERM SONIA for a period of one (1) month as at such Monthly Calculation Date plus [*****], multiplied by

| (ii) | the product determined as: |

| (A) | the Facility Limit, multiplied by |

| (B) | the quotient determined as: |

(x) the Base Currency Equivalent of the GBP Net Eligible Receivables Balance as at the Month End Date immediately preceding such Monthly Calculation Date, divided by

(y) the Net Eligible Receivables Balance as at the Month End Date immediately preceding such Monthly Calculation Date, multiplied by

(iii) the DSO as at the Month End Date immediately preceding such Monthly Calculation Date, multiplied by

| (iv) | the Relevant Stress Factor, multiplied by |

| (v) | 1/360; divided by |

(b) the Net Eligible Receivables Balance as at the Month End Date immediately preceding such Monthly Calculation Date.

| (j) | Clause 2.1 is hereby amended by the deletion of the definition of "LIBOR GBP" in its entirety. |

| (k) | The definition of "Minimum Total Reserve Percentage" in Clause 2.1 is hereby amended so that references to the "Securitisation Regulation" are replaced by references to the "EU Securitisation Regulation". |

| (l) | The definition of "Retained Interest" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Retained Interest" means a material net economic interest of not less than 5% as required by Article 6(1) of each of the Securitisation Regulations in the form of a first loss tranche pursuant to (i) paragraph (d) of Article 6(3) of the EU Securitisation Regulation, and (ii) paragraph (d) of Article 6(3) of the UK Securitisation Regulation, in each case as in effect on the Effective Date.

| (m) | The definition of "Securitisation Regulation" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Securitisation Regulations" means the EU Securitisation Regulation and the UK Securitisation Regulation.

| (n) | Clause 2.1 is hereby amended by the deletion of the definition of "Securitisation Regulation Requirements" in its entirety. |

| (o) | The definition of "SPV Account" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"SPV Account" means any account, at an Eligible Account Bank, described in Schedule 3 (Accounts) to the Receivables Transfer Agreement under the heading "SPV Accounts" and any account added as an SPV Account in accordance with the Transaction Documents.

| (p) | The definition of "STS Requirements" in Clause 2.1 is hereby amended so that references to the "Securitisation Regulation" are replaced by references to the "EU Securitisation Regulation". |

| (q) | The definition of "Subordinated Loan Interest Rate" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Subordinated Loan Interest Rate" means, (A) with respect to any Currency other than GBP, (i) the offered rate that appears on the page of the Bloomberg Screen that displays an average ICE Benchmark Administration Limited (or any successor thereof acceptable to the Subordinated Lender) London interbank offered rate for deposits in such Currency with a term equivalent to three months at 11:00 a.m. London time on the applicable Settlement Date; or (ii) in the event such offered rate does not appear on such page or service or such page or service shall cease to be available (other than under the circumstances set forth in Clause 2.5(e) (Successor Applicable Currency Benchmark Rate) of the Receivables Transfer Agreement), the offered rate per annum (rounded upwards to five decimal places) equal to the offered rate determined by the Subordinated Lender to be the offered rate on another page or other service that displays an average ICE Benchmark Administration Limited (or any successor thereof acceptable to the Subordinated Lender) London interbank offered rate for deposits in such Currency with a term equivalent to three months, in each case determined as of the most recent Subordinated Loan Interest Determination Date, or (B) with respect to GBP, the Compounded Reference Rate on the applicable Settlement Date. If the calculation of the Subordinated Loan Interest Rate results in a Subordinated Loan Interest Rate of less than zero (0), the Subordinated Loan Interest Rate shall be deemed to be zero (0) for all purposes hereunder.

| (r) | The definition of "Total Reserve Percentage" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Total Reserve Percentage" means, for any Monthly Calculation Period, a percentage equal to the greater of:

| (a) | The Minimum Total Reserve Percentage, and |

| (b) | the sum of: |

(i) the Loss Reserve Percentage as at the Month End Date immediately preceding such Monthly Calculation Period, plus

(ii) the Non-Contractual Dilution Reserve Percentage as at the Month End Date immediately preceding such Monthly Calculation Period, plus

(ii) the Yield and Expenses Reserve Percentage as at the Month End Date immediately preceding such Monthly Calculation Period.

| (s) | The definition of "Write-Down and Conversion Powers" in Clause 2.1 is hereby amended in its entirety to read as follows: |

"Write-Down and Conversion Powers" means, (a) with respect to any EEA Resolution Authority, the write-down and conversion powers of such EEA Resolution Authority from time to time under the Bail-In Legislation for the applicable EEA Member Country, which write-down and conversion powers are described in the EU Bail-In Legislation Schedule, and (b) with respect to the United Kingdom, any powers of the applicable Resolution Authority under the Bail-In Legislation to cancel, reduce, modify or change the form of a liability of any UK Financial Institution or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability or any of the powers under that Bail-In Legislation that are related to or ancillary to any of those powers.

| (t) | A new Schedule 3 (Reference Rate Terms) is hereby added in the form set forth on Annex B attached hereto. |

| (u) | A new Schedule 4 (Daily Non-Cumulative Compounded RFR Rate) is hereby added in the form set forth on Annex C attached hereto. |

| 2.2 | Amendment of Receivables Transfer Agreement. The Parties to the Receivables Transfer Agreement hereby agree that with effect from the Effective Date, the Receivables Transfer Agreement shall be amended as follows: |

| (a) | The definition of "Alternate Rate" in Clause 2.5(c) is hereby amended in its entirety to read as follows: |

"Alternate Rate" means, for any Investment, for each day in any applicable Rate Period:

| (i) | initially funded in Dollars, the greater of (a) zero and (b) the sum of (x) LIBOR on such day for a period of one (1) month and (y) the Applicable Margin; |

| (ii) | initially funded in Euros, the greater of (a) zero and (b) the sum of (x) EURIBOR on such day for a period of one (1) month and (y) the Applicable Margin; |

| (iii) | initially funded in GBP, the greater of (a) zero and (b) the sum of (x) the Compounded Reference Rate on such day, provided that if such day is not a RFR Banking Day, the rate of interest for that day will be the rate applicable to the immediately preceding RFR Banking Day, as calculated by the Reporting Services Provider and (y) the Applicable Margin; and |

| (iv) | on any day in any Rate Period falling on or after the date of any declaration or automatic occurrence of the Termination Date pursuant to Clause 6.3 (Remedies), a rate per annum equal to the Default Rate for such Currency. |

| (b) | The definition of "Applicable Currency Benchmark Rate" in Clause 2.5(c) is hereby amended in its entirety to read as follows: |

"Applicable Currency Benchmark Rate" means, (i) with respect to any Investment denominated in Dollars, LIBOR, and (ii) with respect to any Investment denominated in Euros, EURIBOR.

| (c) | Clause 2.5(c) is hereby amended by the deletion of the definition of "LIBOR GBP" in its entirety. |

| (d) | The definition of "Yield" in Clause 2.5(c) is hereby amended in its entirety to read as follows: |

"Yield" [*****]

| (e) | Clause 2.5(e) is hereby amended by adding a new paragraph to the end of such Clause to read as follows: |

Without prejudice to any other provision of this Agreement, each party hereto acknowledges and agrees that, as of the Effective Date, the circumstances set forth in Clause 2.5(e)(ii)(B) above have arisen with respect to LIBOR.

| (f) | Clause 2.5 is hereby amended by adding a new sub-clause (f) at the end of such Clause to read as follows: |

| (f) | Successor RFR. |

| (i) | Notwithstanding anything to the contrary in this Agreement or any other Transaction Document, if the SPV or the Majority Purchasers notify the Administrative Agent (with, in the case of the Majority Purchasers, a copy to the SPV) that the SPV or the Majority Purchasers (as applicable) have determined that: |

| (A) | the methodology, formula or other means of determining the RFR has, in the opinion of the Majority Purchasers or the SPV, materially changed; |

| (B) | the administrator of the RFR or its supervisor publicly announces that such administrator is insolvent and there is no successor administrator to continue to provide the RFR; |

| (C) | the administrator of the RFR publicly announces that it has ceased or will cease to provide the RFR permanently or indefinitely and, at that time, there is no successor administrator to continue to provide the RFR; |

| (D) | the supervisor of the administrator of the RFR publicly announces that the RFR has been or will be permanently or indefinitely discontinued; |

| (E) | the administrator of the RFR or its supervisor announces that the RFR may no longer be used; or |

| (F) | the administrator of the RFR (or the administrator of an interest rate which is a constituent element of the RFR) determines that the RFR should be calculated in accordance with its reduced submissions or other contingency or fallback policies or arrangements and the circumstance(s) or event(s) leading to such determination are not (in the opinion of the Majority Purchasers and the SPV) temporary, |

then the Administrative Agent, the SPV and the Servicers shall endeavour to establish an alternate rate of interest to such RFR that gives due consideration to the then-prevailing market convention for determining a rate of interest for syndicated loans in England at such time, and shall enter into an amendment to this Agreement and the other Transaction Documents to reflect such alternate rate of interest and such other related changes to this Agreement and the other Transaction Documents as may be applicable (but, for the avoidance of doubt, such related changes shall not include a reduction of the Applicable Margin).

Notwithstanding anything to the contrary in Clause 12 (Amendments and Waivers), such amendment shall become effective without any further action or consent of any other party to this Agreement so long as the Administrative Agent shall not have received, within five (5) Business Days of the date notice of such alternate rate of interest is provided to the Purchaser Agents and the Purchasers, a written notice from the Majority Purchasers of an objection to such amendment. Until an alternate rate of interest shall be determined in accordance with this Clause 2.5(f), (1) the obligation of the Purchasers to make or maintain Investments with Yield calculated by reference to such RFR shall be suspended (to the extent of the affected Investments or Rate Periods), and (2) the related RFR component shall no longer be utilized in determining the Alternate Rate, if applicable. Upon receipt of such notice, the SPV may revoke any pending request for an Investment (to the extent of the affected Investment or Rate Periods) or, failing that, will be deemed to have converted such request into a request for an Investment with Yield calculated at the Base Rate.

| (g) | Clause 3(a)(v) is hereby amended in its entirety to read as follows: |

(v) is not established in a third country referred to in Article 4 of the EU Securitisation Regulation or in Article 4 of the UK Securitisation Regulation.

| (h) | Clause 5.1(x) is here amended in its entirety to read as follows: |

(i) Securitisation Regulations. The SPV shall promptly provide each Purchaser and the Subordinated Lender with such information relating to the Receivables or the transactions under the Transaction Documents as any Purchaser or the Subordinated Lender may from time to time reasonably request in order to enable such Purchaser (in its capacity as Purchaser or as a sponsor) or the Subordinated Lender to comply with any and all applicable requirements of Article 5 and/or Article 7 of each Securitisation Regulation and any other due diligence provision or transparency provision of the Securitisation Regulation Rules. The SPV shall make available all the information that a securitisation special purpose entity is required to make available in accordance with Article 7 of the EU Securitisation Regulation and Article 7 of the UK Securitisation Regulation.

| (i) | Clause 5.2(d) is here amended in its entirety to read as follows: |

(d) Change in payment instructions to Obligors. The SPV shall not add or terminate any bank as an Account Bank or any account as an Account to or from those listed in Schedule 3 (Accounts) or, except to the extent permitted or required by the Transaction Documents, make any change in its instructions to Obligors regarding payments to be made to any Account, unless (i) such instructions are to deposit such payments for a Receivable to another existing Account, (ii) with respect to the addition or termination of any bank as an Account Bank or any account as an Account, (A) the Administrative Agent and each Purchaser Agent have received written notice of such addition, termination or change at least thirty (30) days prior thereto, (B) the Majority Purchasers have consented to each new Account Bank and/or the termination of any Account Bank (in each case, where applicable, and provided that such consent or instructions are not unreasonably withheld or delayed), (C) the Administrative Agent and each Purchaser Agent have received a duly executed Account Agreement with respect to each new Account, where applicable, and (D) the Administrative Agent and each Purchaser Agent have received an updated Schedule 3 (Accounts) along with a certification from the SPV that all conditions to add or remove such Account and/or Account Bank under the Transaction Documents have been satisfied, or (iii) on and after the Account Redirection Date, such instructions are to deposit payments into an SPV Account (it being agreed that, at any time on and after the Account Redirection Date, the SPV shall instruct all Obligors to make all payments in respect of the Receivables and associated Related Rights to an SPV Account).

| (j) | Clause 7.2(a)(i)(B) is hereby amended so that the words "or Compounded Reference Rate" are added after the words "the Applicable Currency Benchmark Rate" and before the word "hereunder". |

| (k) | Clause 7.4(a)(ii) is hereby amended in its entirety to read as follows: |

(ii) any costs and expenses in connection with the requirements of the EU Securitisation Regulation and the UK Securitisation Regulation, in each case including any costs or fees related to the provision of information required in connection with transparency, due diligence or reporting requirements requested by the Administrative Agent or any Purchaser,

| (l) | Clause 8 is hereby amended by adding a new Clause 8.11 to the end of such Clause to read as follows: |

8.11 Erroneous Payments

Where a sum is to be paid to the Administrative Agent, a Purchaser Agent or the Paying Agent, as applicable, under this Agreement or any other Transaction Document for another party hereto or thereto, the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, is not obliged to pay that sum to that other party (or to enter into or perform any related exchange contract) until it has been able to establish to its satisfaction that it has actually received that sum. If the Administrative Agent, a Purchaser Agent or the Paying Agent, as applicable, or its Affiliate or representative on its behalf or direction (the Administrative Agent, each Purchaser Agent and the Paying Agent, as applicable, and their applicable Affiliate or representative, an "Agent Entity") pays an amount to another party (unless the immediately following sentence applies) or, at the direction of such party, that party’s Affiliate, related fund or representative (such party and its applicable Affiliate, related fund or representative, an "Other Party Entity") and it proves to be the case (in the sole determination of the Administrative Agent, a Purchaser Agent or the Paying Agent, as applicable) that (a) neither the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, nor the applicable Agent Entity actually received that amount or (b) such amount was otherwise paid in error (whether such error was known or ought to have been known to such other party or applicable Other Party Entity), then the party to whom that amount (or the proceeds of any related exchange contract) was paid (or on whose direction its applicable Other Party Entity was paid) by the applicable Agent Entity shall hold such amount on trust or, to the extent not possible as a matter of law, for the account (or will procure that its applicable Other Party Entity holds on trust or for the account) of the Agent Entity and on demand (or will procure that its applicable Other Party Entity shall) refund the same to the Agent Entity together with interest on that amount from the date of payment to the date of receipt by the Agent Entity, calculated by the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, to reflect its cost of funds. If the Administrative Agent, a Purchaser Agent or the Paying Agent, as applicable, has notified the Purchasers that it is willing to make available amounts for the account of the SPV before receiving funds from the Purchasers then if and to the extent that the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, does so but it proves (in the sole determination of the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable) to be the case that it does not then receive funds from a Purchaser in respect of a sum which it paid to the SPV: (i) the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, shall notify Arrow of that Purchaser’s identity and the SPV to whom that sum was made available shall hold such amount on trust or, to the extent not possible as a matter of law, for the account, of the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, and on demand refund it to the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable; and (ii) the Purchaser by whom those funds should have been made available shall on demand pay to the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, the amount (as certified by the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable) which will indemnify the Administrative Agent, such Purchaser Agent or the Paying Agent, as applicable, against any funding cost incurred by it as a result of paying out that sum before receiving those funds from that Purchaser.

| (m) | Clause 25 is hereby amended in its entirety to read as follows: |

25. Acknowledgement and Consent to Bail-In of Affected Financial Institutions

Notwithstanding anything to the contrary in any Transaction Document or in any other agreement, arrangement or understanding among any such parties, each party hereto acknowledges that any liability of any Affected Financial Institution arising under any Transaction Document, to the extent such liability is unsecured, may be subject to the write-down and conversion powers of the applicable Resolution Authority and agrees and consents to, and acknowledges and agrees to be bound by:

(a) the application of any Write-Down and Conversion Powers by the applicable Resolution Authority to any such liabilities arising hereunder which may be payable to it by any party hereto that is an Affected Financial Institution; and

| (b) | the effects of any Bail-in Action on any such liability, including, if applicable: |

(i) a reduction in full or in part or cancellation of any such liability;

(ii) a conversion of all, or a portion of, such liability into shares or other instruments of ownership in such Affected Financial Institution, its parent undertaking, or a bridge institution that may be issued to it or otherwise conferred on it, and that such shares or other instruments of ownership will be accepted by it in lieu of any rights with respect to any such liability under this Agreement or any other Transaction Document; or

(iii) the variation of the terms of such liability in connection with the exercise of the write-down and conversion powers of the applicable Resolution Authority.

| (n) | Schedule 3 is hereby amended in its entirety as set forth on Annex A attached hereto. |

| 2.3 | Amendment of English RSA. The Parties to the English RSA hereby agree that with effect from the Effective Date, the English RSA shall be amended as follows: |

(a) Clause 5.1(g) of the English RSA shall be amended in its entirety to read as follows:

(g) Centre of Main Interest. For the purpose of the UK Insolvency Regulation, its centre of main interest (as that term is used in Article 3(1) of the UK Insolvency Regulation) is situated in the jurisdiction of its registered office.

(b) Clause 6.1(d) of the English RSA shall be amended in its entirety to read as follows:

(d) Centre of Main Interest. For the purpose of the UK Insolvency Regulation, it shall have and maintain its centre of main interest (as that term is used in Article 3(1) of the UK Insolvency Regulation) situated in the jurisdiction of its registered office.

(c) Clause 6.2(n) of the English RSA shall be amended in its entirety to read as follows:

(n) Securitisation Regulations. Upon request by a Purchaser or the Subordinated Lender, the Seller shall promptly provide each Purchaser or the Subordinated Lender, as applicable, with such information relating to the Purchased Receivables and the transactions under the Transaction Documents as any Purchaser or the Subordinated Lender may from time to time reasonably request in order to enable such Purchaser (in its capacity as Purchaser or as a sponsor) or the Subordinated Lender, as applicable, to comply with any and all applicable requirements of Article 5 and/or Article 7 of each Securitisation Regulation and any other due diligence provision or transparency provision of the Securitisation Regulation Rules. The Seller shall make available all the information that an originator is required to make available in accordance with Article 7 of the EU Securitisation Regulation and Article 7 of the UK Securitisation Regulation.

(d) Clause 6.3(e) of the English RSA shall be amended in its entirety to read as follows:

(e) Change in payment instructions to Obligors. The Seller shall not add or terminate any bank as an Account Bank or any account as an Account to or from those listed in schedule 3 (Accounts) to the Receivables Transfer Agreement or make any change, except to the extent permitted or required by the Transaction Documents, in its instructions to Obligors regarding payments for a Purchased Receivable to be made to any Account, unless (i) such instructions are to deposit such payments to another existing Account, (ii) with respect to the addition or termination of any bank as an Account Bank or any account as an Account, (A) the Buyer and the Administrative Agent have received written notice of such addition, termination or change at least thirty (30) days prior thereto, (B) the Buyer and the Administrative Agent (acting on the instructions of the Majority Purchasers) have consented to each new Account Bank and/or the termination of any Account Bank (in each case, where applicable, and provided that such consent or instructions are not unreasonably withheld or delayed), (C) the Security Trustee has received a duly executed Account Agreement with respect to each new Account, where applicable, and (D) the Administrative Agent and each Purchaser Agent have received an updated Schedule 3 (Accounts) to the Receivables Transfer Agreement along with a certification from the Seller that all conditions to add or remove such Account and/or Account Bank under the Transaction Documents have been satisfied, or (iii) on and after the Account Redirection Date, such instructions are to deposit payments to an SPV Account (it being agreed that, at any time on and after the Account Redirection Date, the Seller and the Buyer or its assigns shall jointly instruct all Obligors to make all payments in respect of the Purchased Receivables and their Related Security (other than any Receivable originated prior to such date) to an SPV Account).

| 2.4 | Amendment of Servicing Deed. The Parties to the Servicing Deed hereby agree that with effect from the Effective Date, the Servicing Deed shall be amended as follows: |

| (a) | Clause 3.4(a) is hereby amended in its entirety to read as follows: |

| (a) | With respect to each Monthly Calculation Period, by no later than 6:00 p.m. (London time) on: |

| (i) | the Monthly Calculation Date for such Monthly Calculation Period; and |

| (ii) | after the occurrence of a Servicer Default which is continuing, the second (2nd) Business Day after any request from the Administrative Agent or any Purchaser Agent, |

each Agent Servicer shall prepare and forward to the Administrative Agent, each Purchaser Agent, the Paying Agent and the SPV a Monthly Servicer Report, certified by such Agent Servicer and containing, among other things, all information required by the Subordinated Lender to comply with its requirements under Article 7 of the EU Securitisation Regulation in accordance with the Subordinated Loan Agreement and the related regulatory technical standards and implementing technical standards, as amended or replaced from time to time and Article 7 of the UK Securitisation Regulation in accordance with the Subordinated Loan Agreement and the related technical standards, as amended or replaced from time to time.

| (b) | Clause 5(r) is hereby amended in its entirety to read as follows: |

(r) Centre of Main Interests. Each Servicer has its centre of main interests (as such term is used in the EU Insolvency Regulation or the UK Insolvency Regulation, as applicable) in its jurisdiction of organization and it has no "establishment" (as such term is used in the EU Insolvency Regulation or the UK Insolvency Regulation, as applicable) outside its jurisdiction of registered office other than in Austria, Belgium, The Netherlands and Switzerland.

| (c) | Clause 5(t) is hereby amended to include the words "or a UK Financial Institution" at the end. |

| (d) | Clause 6.1(q) is hereby amended in its entirety to read as follows: |

(q) Securitisation Regulations. Upon request by a Purchaser, each Servicer shall promptly provide each Purchaser with such information relating to the Receivables and the transactions under the Transaction Documents as any Purchaser may from time to time reasonably request in order to enable such Purchaser (in its capacity as Purchaser or as a sponsor) to comply with any and all applicable requirements of Article 5 and/or Article 7 of each Securitisation Regulation and any other due diligence provision or transparency provision of the Securitisation Regulation Rules. Each Servicer shall make available all the information that an originator, sponsor or securitisation special purpose entity is required to make available in accordance with Article 7 of the EU Securitisation Regulation and Article 7 of the UK Securitisation Regulation.

| (e) | Clause 6.2(d) is hereby amended in its entirety to read as follows: |

(d) No change in payment instructions to Obligors. No Servicer shall add or terminate any bank as an Account Bank or any account as an Account to or from those listed in Schedule 3 (Accounts) to the Receivables Transfer Agreement or make any, except to the extent permitted or required by the Transaction Documents, change in its instructions to Obligors regarding payments to be made to any Account, unless (i) such instructions are to deposit such payments to another existing Account, (ii) with respect to the addition or termination of any bank as an Account Bank or any account as an Account, (A) the Administrative Agent has received written notice of such addition, termination or change at least thirty (30) days prior thereto, (B) the Administrative Agent (acting on the instructions of the Majority Purchasers) has consented to each new Account Bank and/or the termination of any Account Bank (in each case, where applicable, and provided that such consent or instructions are not unreasonably withheld or delayed), (C) the Security Trustee has received a duly executed Account Agreement with respect to each new Account, where applicable, and (D) the Administrative Agent and each Purchaser Agent have received an updated Schedule 3 (Accounts) to the Receivables Transfer Agreement along with a certification from the related Servicer that all conditions to add or remove such Account and/or Account Bank under the Transaction Documents have been satisfied, or (iii) on and after the Account Redirection Date, such instructions are to deposit payments to an SPV Account (it being agreed that at any time on and after the Account Redirection Date, each Servicer shall instruct all Obligors to make all payments in respect of the Receivables and their Related Rights (other than any Receivable originated prior to such date) to an SPV Account).

| 2.5 | Amendment of Arrow Germany DOT. The Parties to the Arrow Germany DOT hereby agree that with effect from the Effective Date, the Arrow Germany DOT shall be amended as follows: |

| (a) | The definition of "Trust Accounts" in Clause 1.4 is hereby amended in its entirety to read as follows: |

"Trust Accounts" means the Collection Accounts listed in Schedule 1 (Trust Accounts) and any other account of Collection Account Trustee deemed a Collection Account under the Transaction Documents (each such account being a "new Trust Account").

| (b) | Clause 4 is hereby amended in its entirety to read as follows: The Collection Account Trustee shall: |

(a) immediately on the date of this Declaration of Trust and on the date on which any new Trust Account is opened, deliver (with a copy to the SPV, the Security Trustee and, with respect to any new Trust Account, the Administrative Agent) a duly executed Notice of Declaration of Trust to each relevant Collection Account Bank; and

(b) ensure that such Collection Account Bank acknowledges such Notice of Declaration of Trust by providing a duly executed Acknowledgement of Declaration of Trust to (i) the SPV and the Security Trustee, on or prior to the Closing Date, or (ii) with respect to any new Trust Account which has been opened, the SPV, the Security Trustee and the Administrative Agent, promptly but in any event no later than thirty (30) days after the date on which such new Trust Account has been opened.

| 2.6 | Amendment of Arrow UK DOT. The Parties to the Arrow UK DOT hereby agree that with effect from the Effective Date, the Arrow UK DOT shall be amended as follows: |

| (a) | The definition of "Trust Accounts" in Clause 1.4 is hereby amended in its entirety to read as follows: |

"Trust Accounts" means the Collection Accounts listed in Schedule 1 (Trust Accounts) and any other account of Collection Account Trustee deemed a Collection Account under the Transaction Documents (each such account being a "new Trust Account").

| (b) | Clause 4 is hereby amended in its entirety to read as follows: The Collection Account Trustee shall: |

(a) immediately on the date of this Declaration of Trust and on the date on which any new Trust Account is opened, deliver (with a copy to the SPV, the Security Trustee and, with respect to any new Trust Account, the Administrative Agent) a duly executed Notice of Declaration of Trust to each relevant Collection Account Bank; and

(b) ensure that such Collection Account Bank acknowledges such Notice of Declaration of Trust by providing a duly executed Acknowledgement of Declaration of Trust to (i) the SPV and the Security Trustee, on or prior to the Closing Date, or (ii) with respect to any new Trust Account which has been opened, the SPV, the Security Trustee and the Administrative Agent, promptly but in any event no later than thirty (30) days after the date on which such new Trust Account has been opened.

| 2.7 | Amendment of Parent Undertaking. The Parties to the Parent Undertaking hereby agree that with effect from the Effective Date, the Parent Undertaking shall be amended as follows: |

| (a) | Clause 5.1 is hereby amended so that references to "the Securitisation Regulation" are replaced by references to "each Securitisation Regulation". |

| (b) | Clause 5.3(a)(ii) is hereby amended in its entirety to read as follows: |

(ii) any costs and expenses in connection with the requirements of the EU Securitisation Regulation and the UK Securitisation Regulation, in each case including any costs or fees related to the provision of information required in connection with transparency, due diligence or reporting requirements requested by the Administrative Agent or any Purchaser,

| (c) | Clause 5.3(a)(vi) is hereby amended in its entirety to read as follows: |

(vi) any and all costs and expenses, including any increased capital costs, fines or penalties, relating to its participation in the transactions contemplated by the Transaction Documents arising as a result of the failure of any Arrow Party, the SPV or such transactions to comply with the EU Securitisation Regulation or the UK Securitisation Regulation.

| 2.8 | Amendment of Subordinated Loan Agreement. The Parties to the Subordinated Loan Agreement hereby agree that with effect from the Effective Date, Clause 6 of the Subordinated Loan Agreement shall be amended in its entirety to read as follows: |

| 6. | COMPLIANCE WITH SECURITISATION REGULATION |

| 6.1 | Risk Retention |

At all times prior to the Final Payout Date, the Subordinated Lender represents, warrants and covenants that:

| (a) | it (i) is an Affiliate of each of the Originators and (ii) is, through the Originators (as related entities), involved in the Contracts and any other agreements which give rise to the Receivables; |

| (b) | by virtue of clause (a) above, it reasonably believes that it is an "originator" for purposes of each of the EU Securitisation Regulation and the UK Securitisation Regulation and will hold and will retain, on an ongoing basis, the Retained Interest by holding 100% of the outstanding principal balance of the Subordinated Loans; |

| (c) | it will not sell, hedge or otherwise mitigate its credit risk under or associated with the Retained Interest or the Receivables or sell, transfer or otherwise surrender all or part of its rights, benefits or obligations arising from the Retained Interest, except to the extent permitted in accordance with the Securitisation Regulation Rules; |

| (d) | it will not change the retention option or the method of calculating the Retained Interest except under exceptional circumstances in accordance with the Securitisation Regulation Rules; |

| (e) | (i) it was not established for, and does not operate for, the sole purpose of securitising exposures, and it has a strategy and the capacity to meet payment obligations consistent with a broader business model that involves material support from capital, assets, fees or other sources of income, by virtue of which it does not rely on the exposures to be securitised, on any interests retained or proposed to be retained in accordance with the Securitisation Regulation Rules, or on any corresponding income from such exposures and interests as its sole or predominant source of revenue; and (ii) its responsible decision makers have the necessary experience to enable it to pursue the established business strategy, as well as adequate corporate governance arrangements; |

| (f) | the Subordinated Lender shall confirm its continued compliance with the undertakings set out in clauses (a) through (e) of this Clause 6.1 (Risk Retention) to the Borrower, the Security Trustee and each Purchaser Agent in writing (which may be by way of email) (i) in each Monthly Servicer Report and (ii) promptly upon the reasonable written request of any of the Borrower, the Security Trustee or a Purchaser; |

| (g) | the Subordinated Lender shall, and shall procure that each Arrow Party shall, notify the Borrower, the Security Trustee and each Purchaser Agent as soon as reasonably practicable if for any reason it fails to comply with the provisions clauses (a) to (e) of this Clause 6.1 (Risk Retention) in any way. |

| 6.2 | Information Requirements |

| (a) | The Subordinated Lender and each Originator shall, and shall procure that each other Arrow Party shall, promptly provide each Purchaser and the Subordinated Lender with such information relating to the Receivables and the transactions under the Transaction Documents as the Subordinated Lender, any Purchaser and/or the Borrower may from time to time reasonably request in order to enable those persons to comply with any and all applicable requirements of Article 5 and/or Article 7 of each Securitisation Regulation, including the completion of all relevant information required by the regulatory technical standards and implementing technical standards, as amended or replaced from time to time in relation to Article 7 of the EU Securitisation Regulation and the technical standards, as amended or replaced from time to time, in relation to Article 7 of the UK Securitisation Regulation, and any other due diligence provision or transparency provision of the Securitisation Regulation Rules, provided that such information is in the possession of or reasonably obtainable by the Subordinated Lender, the relevant Originator and/or such other Arrow Party, as applicable. | |

| (b) | For the purposes of Article 7(2) of the EU Securitisation Regulation and Article 7(2) of the UK Securitisation Regulation, the Originators, the Subordinated Lender (as an “originator” as defined in each Securitisation Regulation) and the Borrower designate the Subordinated Lender to fulfil the information requirements of Article 7(1) of the EU Securitisation Regulation and Article 7(1) of the UK Securitisation Regulation and the Subordinated Lender hereby accepts such designations. |

| (c) | The Subordinated Lender shall promptly make available, or shall procure that the same is made available to the Purchasers, any relevant competent authorities (as defined under the EU Securitisation Regulation and the UK Securitisation Regulation) and, upon request therefor, potential investors, and to the Agent Servicers, all documents, reports and information necessary to fulfil the reporting requirements under Article 7 of the EU Securitisation Regulation and Article 7 of the UK Securitisation Regulation including: |

| (i) | the provision of the applicable templates, completed with all relevant information, in accordance with the regulatory technical standards and implementing technical standards, as amended or replaced from time to time, in relation to Article 7 of the EU Securitisation Regulation and the technical standards, as amended or replaced from time to time, in relation to the Article 7 of the UK Securitisation Regulation; and |

| (ii) | information required to be disclosed pursuant to Article 7(1)(g) of the EU Securitisation Regulation and Article 7(1)(g) of the UK Securitisation Regulation. |

| (d) | Pursuant to the Securitisation Regulations 2018, the FCA has been appointed as the competent authority in the United Kingdom with respect to the English Originator for the purposes of the UK Securitisation Regulation. Pursuant to the Direction of the FCA and the PRA (the "FCA/PRA Direction") in relation to regulation 25 of the UK Securitisation Regulations 2018 (the "Securitisation Regulations 2018"), the English Originator must, either directly or through the entity designated under the first sub-paragraph of Article 7(2) of the UK Securitisation Regulation, before pricing, make a notification to the FCA in the form and manner prescribed in the FCA/PRA Direction. The Subordinated Lender undertakes to make (or procure that the English Originator makes) such a notification to the FCA within the time required and otherwise in accordance with the Securitisation Regulations 2018 and the FCA/PRA Direction, and to provide all such other notifications and information required under the Securitisation Regulations 2018 and the FCA/PRA Direction in accordance with the Securitisation Regulations 2018 and the FCA/PRA Direction. |

| (e) | The Subordinated Lender shall (or shall procure that the German Originator shall) provide such notices and other information to Bundesanstalt für Finanzdienstleistungsaufsicht in the form and manner prescribed in Gesetz zur Anpassung von Finanzmarktgesetzen an die Verordnung (EU) 2017/2402 und an die durch die Verordnung (EU) 2017/2401 geänderte Verordnung (EU) Nr. 575/2013, and otherwise comply with such regulation. |

| (f) | The Subordinated Lender will make (or procure that the Borrower makes) the following information available to the Authority for the Financial Markets (Autoriteit Financiële Markten) ("AFM") in the Netherlands (i) at the latest on the signing date of the Transaction Documents, an Excel file based on the template of the FCA prescribed in accordance with the FCA/PRA Direction with information in respect of the securitisation; (ii) as soon as possible when requested by the AFM, the information set forth in Article 7(1)(a) and (e) of the EU Securitisation Regulation; and (iii) without delay, any information required to be disclosed pursuant to Article 7(1)(g) of the EU Securitisation Regulation, by sending such information to the following email address: [*****], provided that as soon as any legislation, regulation or instruction has been provided or published by the relevant competent authority in the Netherlands, the Subordinated Lender shall make (or procure that the Borrower makes) the information referred to in Article 7(1)(a), (e) and (g) of the EU Securitisation Regulation available in accordance with such legislation, regulation or instruction. | |

| 6.3 | Securitisation Regulation Compliance |

At all times prior to the Final Payout Date, the Originators and the Subordinated Lender represent and warrant that:

| (a) | they shall not select Receivables to be transferred to the Borrower with the aim of rendering losses on those Receivables, measured over the life of the transaction contemplated by the Transaction Documents, higher than the losses over the same period on comparable accounts receivable held on its balance sheet, in accordance with Article 6(2) of the EU Securitisation Regulation and Article 6(2) of the UK Securitisation Regulation; |

| (b) | none of the Receivables is a securitisation position (as defined in each of the Securitisation Regulations); and |

| (c) | they applied to the Receivables the same sound and well-defined criteria for credit-granting which they apply to non-securitised receivables and the same clearly established processes for approving and, where relevant, amending, renewing and refinancing the Receivables have been and will be applied and the Originators have effective systems in place to apply those criteria and processes in order to ensure that credit-granting is based on a thorough assessment of the creditworthiness, taking appropriate account of each Obligor meeting its obligations under the relevant Contract. |

| 2.9 | Amendment of Reporting Services Agreement. The Parties to the Reporting Services Agreement hereby agree that with effect from the Effective Date, the Reporting Services Agreement shall be amended so that references to "the Securitisation Regulation" are replaced by references to "each Securitisation Regulation". |

| 3. | EFFECTIVENESS |

| 3.1 | Effective Date |

Subject to Clause 3.3 below, this Amendment shall become effective on the date hereof (the “Effective Date”), provided that the Administrative Agent shall have received (a) a counterpart (or counterparts) of this Amendment executed and delivered by each of the Parties, (b) a counterpart (or counterparts) of the German RSA Amendment executed and delivered by each of the parties hereto and (c) a counterpart (or counterparts) of the Dutch Account Security Agreement executed and delivered by each of the parties thereto. All covenants, agreements, representations and warranties made herein and in each Agreement shall survive the execution and delivery of this Amendment and shall continue in full force and effect.

| 3.2 | Status |

This Amendment is designated as a Transaction Document.

| 3.3 | Continuing effect; Further Assurances |

| (a) | On the Effective Date, and immediately following receipt of the items specified in Clause 3.1 above, the amendments and modifications to the Agreements shall be, and shall be deemed to be, effective, modified and amended in accordance herewith and, in each case, the respective rights, limitations, obligations, duties, liabilities and immunities of the respective parties thereto and hereto shall hereafter be determined, exercised and enforced subject in all respects to the modifications and amendments, and all the terms and conditions of this Amendment shall be deemed to be a part of the respective terms and conditions of the applicable Agreement for any and all purposes. | |

| (b) | Except as modified and expressly amended by this Amendment, each Agreement is in all respects ratified and confirmed, and all the terms, provisions and conditions thereof shall be and remain in full force and effect. |

| (c) | Nothing in this Amendment shall constitute an amendment, waiver, consent or release of any right or remedy of the Administrative Agent, any Purchaser or any other Secured Party under the Transaction Documents nor otherwise prejudice the right or remedy of the Administrative Agent, any Purchaser or any other Secured Party under any Transaction Document and each of the Administrative Agent, any Purchaser or any other Secured Party reserves any other right or remedy it may have now or subsequently under the Transaction Documents. |

| (d) | Each Originator shall at the request of the Administrative Agent or the Security Trustee and at its own expense promptly execute (in such form as the Administrative Agent or Security Trustee may reasonably require) and do any document, act or thing which the Administrative Agent or Security Trustee considers necessary or appropriate to preserve, perfect, protect or give effect to, the amendments contained in this Amendment. |

| 4. | CERTAIN REPRESENTATIONS/REAFFIRMATIONS |

| 4.1 | The SPV and each Arrow Party hereby represents and warrants to each of the other Parties that: |

| (a) | the representations and warranties made by it in the Agreements to which it is a party, in each case as amended by this Amendment, and each of the other Transaction Documents to which it is a party are true and correct in all material respects (except those representations and warranties qualified by materiality or by reference to a material adverse effect, which are true and correct in all respects) on and as of the Effective Date unless such representations and warranties by their terms refer to an earlier date, in which case they were true and correct in all material respects (except those representations and warranties qualified by materiality or by reference to a material adverse effect, which are true and correct in all respects) on and as of such earlier date; | |

| (b) | the execution and delivery by it of this Amendment and the performance of its obligations under this Amendment, the Agreements to which it is a party (each as amended hereby) and the other Transaction Documents to which it is a party are within its organizational powers and have been duly authorized by all necessary action on its part, and this Amendment, the Agreements to which it is a party (each as amended hereby) and the other Transaction Documents to which it is a party are its valid and legally binding obligations, enforceable in accordance with their respective terms, subject to the effect of bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally, and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law; and | |

| (c) | immediately before and after giving effect to this Amendment, no Early Amortisation Event, Potential Event of Default, Event of Default, Potential Servicer Default or Servicer Default has occurred and is continuing. |

| 4.2 | By its signature below, the Parent hereby affirms, agrees and acknowledges, as of the Effective Date, that (a) all of the terms and conditions set forth in the Parent Undertaking and all of the covenants made by the Parent therein are hereby confirmed and ratified, and (b) all of its obligations under the Parent Undertaking shall continue and remain in full force and effect, notwithstanding the amendments set forth in Article 2 (Amendments to the Agreements) of this Amendment and the amendments effected by the German RSA Amendment. |

| 5. | CONFIRMATIONS |

The SPV confirms to the Administrative Agent, each Purchaser and each other Secured Party that:

| (a) | its obligations under, and the Security granted by it in and pursuant to, the Security Documents are not discharged or otherwise affected by the amendments contained in or the other provisions of this Amendment and shall accordingly remain in full force and effect; and |

| (b) | the Secured Liabilities (as defined in each Security Document) shall after the Effective Date extend to the obligations of the SPV under the Amended Agreements and under any other Transaction Documents. |

| 6. | MISCELLANEOUS |

| 6.1 | Costs and Expenses |

The Originators shall promptly on demand pay the Administrative Agent, each Purchaser and each other Secured Party the amount of all costs and expenses (including legal fees) incurred by any of them in connection with the negotiation, preparation, printing, execution of this Amendment and any other documents referred to in this Amendment. The Originators shall pay all costs and expenses (including legal fees) referred to in the immediately preceding sentence and invoiced on or prior to the date hereof within thirty (30) days of the Effective Date.

| 6.2 | Counterparts |

This Amendment may be executed in any number of counterparts, and this has the same effect as if the signatures (and if applicable, seals) on the counterparts were on a single copy of this Amendment. Delivery by electronic mail of an executed signature page of this Amendment shall be effective as delivery of an executed counterpart of this Amendment.

| 6.3 | Third Party Rights |

Except in respect of the Secured Parties not party to this Amendment, which Persons (including, for the avoidance of doubt, their respective successors and permitted assigns) are intended to have the benefit of (but shall not enforce other than via the Administrative Agent) this Amendment pursuant to the Contracts (Rights of Third Parties) Act 1999, a Person who is not a Party has no rights under the Contracts (Rights of Third Parties) Act 1999 to enforce or to enjoy the benefit of any term of this Amendment.

| 6.4 | Notices |

The provisions of Clause 4.1 (Notices) of the Master Framework Agreement shall apply to this Amendment as if set out in full again here, with such changes as are appropriate to fit this context.

| 6.5 | GOVERNING LAW |

This Amendment and any non-contractual obligations arising out of or in connection with it shall be governed by and construed in accordance with the laws of England.

| 6.6 | Jurisdiction of the English Courts |

| (a) | The Parties agree that the courts of England shall have jurisdiction to hear and determine any suit, action or proceeding, and to settle any dispute, which may arise out of or in connection with this Amendment (including Clause 6.5 (Governing Law) and this Clause 6.6), or the transactions contemplated hereby, and, for such purposes, irrevocably submits to the exclusive jurisdiction of such courts. |