To our Shareholders Q3’24 Results We are pleased to report another quarter of growth in Q3'24. Momentum is strong across the business, with solid growth in unique buyers, Fintech monthly active users (MAU), GMV, the credit portfolio and acquiring TPV in all major geographies. We believe we are making excellent progress on our long-term strategic goals of increasing the penetration of online commerce in Latin America, becoming the principal financial services provider to users of Mercado Pago and scaling our acquiring business. Our competitive position is strengthening as retention improves across our businesses. This gives us great confidence as we invest to fully capitalize on the many growth opportunities that are ahead of us, knowing that our ecosystem is uniquely placed to capture those opportunities. Net revenues & financial income of $5.3 billion, up 35% YoY and 103% FX-neutral Income from operations of $557 million, with a 10.5% margin Net income of $397 million, with a 7.5% margin $50.7 billion Total Payment Volume, up 34% YoY and 73% FX-neutral $12.9 billion Gross Merchandise Volume, up 14% YoY and 71% FX-neutral ͏MONTEVIDEO, Uruguay; November 6th, 2024 -- MercadoLibre, Inc. (Nasdaq: MELI) (http://www.mercadolibre.com), Latin America’s leading e-commerce and fintech company, today reported financial results for the quarter ended September 30, 2024. Commerce We are excited about the prospect of driving offline retail online in Latin America, where ecommerce penetration lags the USA by almost a decade. We see a huge runway for growth. We executed well on this opportunity in Q3'24, with very strong FX-neutral GMV growth of 34% YoY in Brazil and 27% YoY in Mexico. In Argentina, items sold grew by an impressive 16% YoY as consumption trends continued to improve. Market share grew in all major geographies. Unique buyers across the region reached almost 61mn, rising 21% YoY. This is the second quarter in succession that unique buyer growth has accelerated to a new post-pandemic high. This performance reinforces our conviction in the investments we are making to capture the long-term, structural growth opportunities ahead of us. Offline to online is a secular trend, but it doesn't happen in a vacuum; it is fueled by innovation and investment to constantly improve the online buying experience. Initiatives in Q3'24 included the launch of installation appointments for autoparts, bulk purchase discounts in apparel, virtual try-on for makeup and dynamic pricing tools for sellers. Despite being the leading ecommerce platform with 25 years of history in the region, we still see plenty of scope to expand our user base given the population of more than 650mn in Latin America. In Q3’24 we split our loyalty scheme, MELI+, into two tiers called “MELI+ Essencial” and “MELI+ Total”. "Meli+ Essencial", at just below $2 per month, provides users with a unique package of ecosystemic benefits including a lower threshold for free shipping, extra installments on purchases in Mercado Libre and cashback on purchases on and off Mercado Libre. The “MELI+ Total”, at roughly $5 per month, includes all these ecosystemic benefits plus access to content from Disney+ and Deezer, and discounts on other streaming services. With these changes, we are extending the reach of our loyalty scheme providing more value to users. 1 MercadoLibre, Inc. Letter to Shareholders

Fintech Services We have great momentum in Fintech Services as more users choose Mercado Pago as their financial services partner. MAU rose 35% YoY to 56mn in Q3'24. Engagement is rising, with "power users" (those transacting in nine out of the last twelve weeks) growing at a much faster rate, and transactions and products per MAU also rising. The expansion of our credit offer, particularly the Mercado Pago credit card, and rising awareness of our remunerated account are driving this performance, as well as NPS gains. The credit card had another good quarter in Q3'24, with the portfolio of $2.3bn growing strongly by 172% YoY and 28% QoQ. We are scaling the credit card at pace because our scoring models are increasingly accurate and our older cohorts are showing a good path towards profitability (with solid NIMAL spreads), with some of them already being profitable. In Q3’24 we invested $76mn in scaling our credit card portfolio. Despite short- term margin pressure, these investments are strategically important because the credit card drives the adoption of Mercado Pago as a principal account and brings positive ecosystemic behavior. The total credit portfolio grew at its fastest pace since Q1'22, rising 77% YoY to $6.0bn. Growth was strong across products and geographies. The consumer book grew 37% YoY, helped by successfully extending larger, longer duration loans to lower risk users in Brazil, Mexico and Argentina. The portfolio in Argentina reached record levels and delivered solid profitability. We also surpassed the milestone of $1bn in merchant loans across the region for the first time. Our consumer and merchant loans are a solid source of profitability that more than offset the investments in our credit card. The NIMAL spread of 24% fell 13ppts YoY, despite solid asset quality indicators with broadly stable roll rates and the 15-90 day NPL of 7.8%. There were three reasons behind the reduction in NIMAL: the ramp up of the credit card, the move upmarket in consumer and merchant credit, and the overall acceleration of our credit originations in the quarter. As we scale the credit card, its share in the total portfolio rose from 25% in Q3'23 to 39% in Q3'24. This created a negative mix effect on NIMAL, because the credit card is a structurally lower spread product. The second reason for the NIMAL decline was our strategic decision to continue moving upmarket with our credit offering to lower risk users with lower spreads. This is incremental to portfolio dollars and has a positive impact on NPS. Finally, we accelerated our origination across products in this quarter and, given that we provision our expected losses up front, this resulted in higher bad debt in this quarter. Our logistics network is a powerful tool to drive offline retail online by providing a better user experience for both buyers and sellers. Fulfillment leads to higher GMV growth because of faster delivery promises, higher conversion and stronger buyer and seller NPS. This is a self-reinforcing process that repeats as we increase fulfillment. This is the reason why we continue investing in expanding our logistics infrastructure to increase the penetration of fulfillment in Brazil and to keep up with the strong pace of growth in our Commerce operation in Mexico. As such, we opened five fulfillment centers in Brazil in Q3'24, plus one in Mexico. Although new facilities can create short-term margin pressure, they are critical to our long-term growth, scale and cost dilution. 1P GMV surpassed last year's peak quarter (Q4'23) due to growth of 62% YoY in Q3'24. Our strategy of expanding our product assortment at competitive prices where there are gaps in our 3P selection is succeeding. We introduced presale functionality for the iPhone 16 launch, for which we had a full assortment and competitive prices. We also had exclusivity for the launch of the Motorola G85, an accessible smartphone with a premium design. These examples show how 1P is turning MELI into a destination for categories in which we have historically had less presence in. As we scale 1P, we continue to see improvements in its profitability. As such, 1P did not act as a drag on the YoY evolution of our income from operations margin Q3'24. Advertising is a strong profit driver for Mercado Libre, with significant potential for growth as the digital Retail Media trend gathers steam and first-party data becomes increasingly important. We also see growth opportunities as we build our presence in advertising formats beyond Product Ads, which currently accounts for most of our revenue. Advertising revenue grew 37% YoY in Q3'24, well ahead of GMV, reaching a penetration of 2.0% of GMV, up 30 bps YoY. Q3’24 Results 2

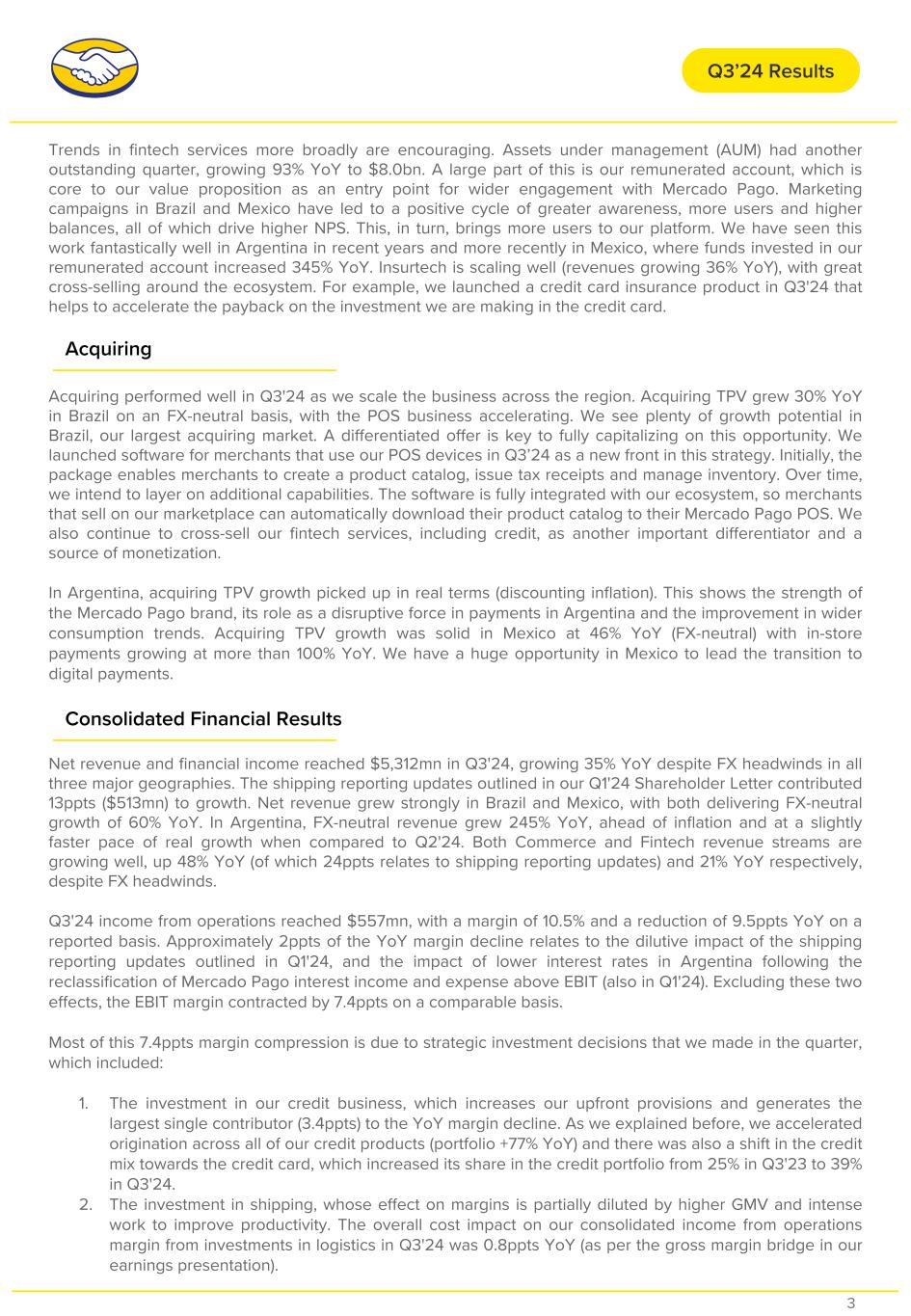

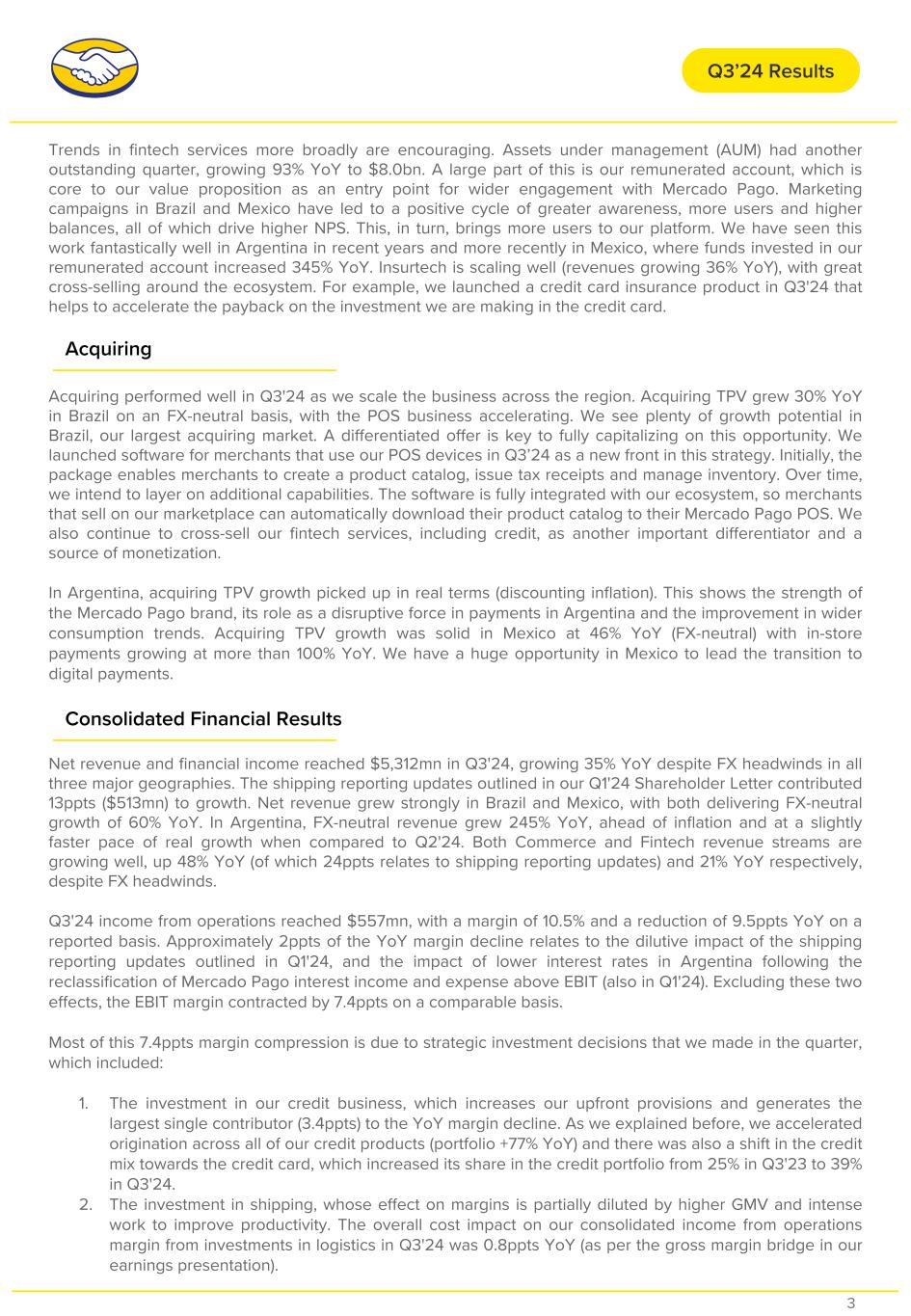

Acquiring Acquiring performed well in Q3'24 as we scale the business across the region. Acquiring TPV grew 30% YoY in Brazil on an FX-neutral basis, with the POS business accelerating. We see plenty of growth potential in Brazil, our largest acquiring market. A differentiated offer is key to fully capitalizing on this opportunity. We launched software for merchants that use our POS devices in Q3’24 as a new front in this strategy. Initially, the package enables merchants to create a product catalog, issue tax receipts and manage inventory. Over time, we intend to layer on additional capabilities. The software is fully integrated with our ecosystem, so merchants that sell on our marketplace can automatically download their product catalog to their Mercado Pago POS. We also continue to cross-sell our fintech services, including credit, as another important differentiator and a source of monetization. In Argentina, acquiring TPV growth picked up in real terms (discounting inflation). This shows the strength of the Mercado Pago brand, its role as a disruptive force in payments in Argentina and the improvement in wider consumption trends. Acquiring TPV growth was solid in Mexico at 46% YoY (FX-neutral) with in-store payments growing at more than 100% YoY. We have a huge opportunity in Mexico to lead the transition to digital payments. Q3’24 Results Consolidated Financial Results Net revenue and financial income reached $5,312mn in Q3'24, growing 35% YoY despite FX headwinds in all three major geographies. The shipping reporting updates outlined in our Q1'24 Shareholder Letter contributed 13ppts ($513mn) to growth. Net revenue grew strongly in Brazil and Mexico, with both delivering FX-neutral growth of 60% YoY. In Argentina, FX-neutral revenue grew 245% YoY, ahead of inflation and at a slightly faster pace of real growth when compared to Q2'24. Both Commerce and Fintech revenue streams are growing well, up 48% YoY (of which 24ppts relates to shipping reporting updates) and 21% YoY respectively, despite FX headwinds. Q3'24 income from operations reached $557mn, with a margin of 10.5% and a reduction of 9.5ppts YoY on a reported basis. Approximately 2ppts of the YoY margin decline relates to the dilutive impact of the shipping reporting updates outlined in Q1'24, and the impact of lower interest rates in Argentina following the reclassification of Mercado Pago interest income and expense above EBIT (also in Q1'24). Excluding these two effects, the EBIT margin contracted by 7.4ppts on a comparable basis. Most of this 7.4ppts margin compression is due to strategic investment decisions that we made in the quarter, which included: 1. The investment in our credit business, which increases our upfront provisions and generates the largest single contributor (3.4ppts) to the YoY margin decline. As we explained before, we accelerated origination across all of our credit products (portfolio +77% YoY) and there was also a shift in the credit mix towards the credit card, which increased its share in the credit portfolio from 25% in Q3'23 to 39% in Q3'24. 2. The investment in shipping, whose effect on margins is partially diluted by higher GMV and intense work to improve productivity. The overall cost impact on our consolidated income from operations margin from investments in logistics in Q3'24 was 0.8ppts YoY (as per the gross margin bridge in our earnings presentation). Trends in fintech services more broadly are encouraging. Assets under management (AUM) had another outstanding quarter, growing 93% YoY to $8.0bn. A large part of this is our remunerated account, which is core to our value proposition as an entry point for wider engagement with Mercado Pago. Marketing campaigns in Brazil and Mexico have led to a positive cycle of greater awareness, more users and higher balances, all of which drive higher NPS. This, in turn, brings more users to our platform. We have seen this work fantastically well in Argentina in recent years and more recently in Mexico, where funds invested in our remunerated account increased 345% YoY. Insurtech is scaling well (revenues growing 36% YoY), with great cross-selling around the ecosystem. For example, we launched a credit card insurance product in Q3'24 that helps to accelerate the payback on the investment we are making in the credit card. 3

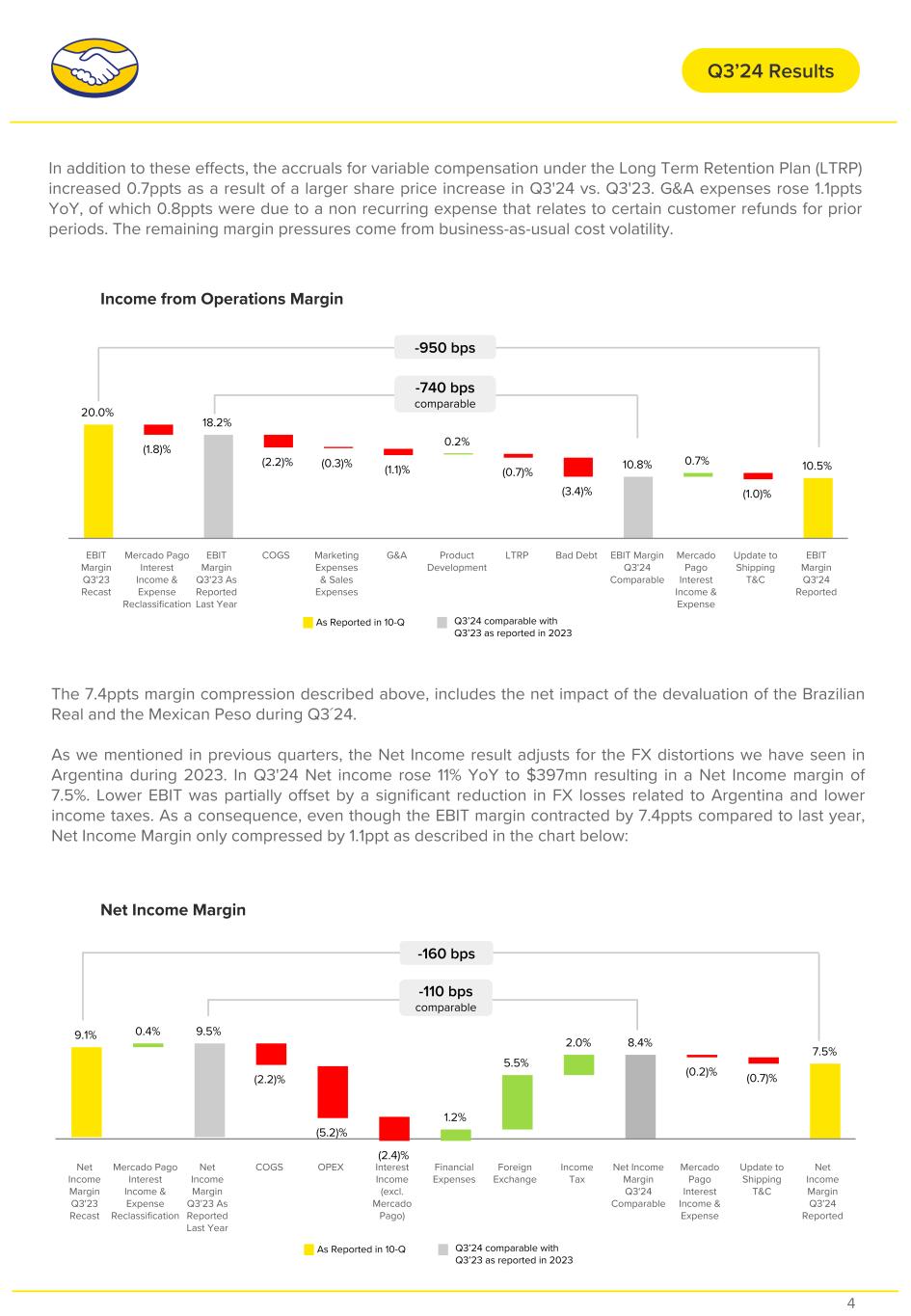

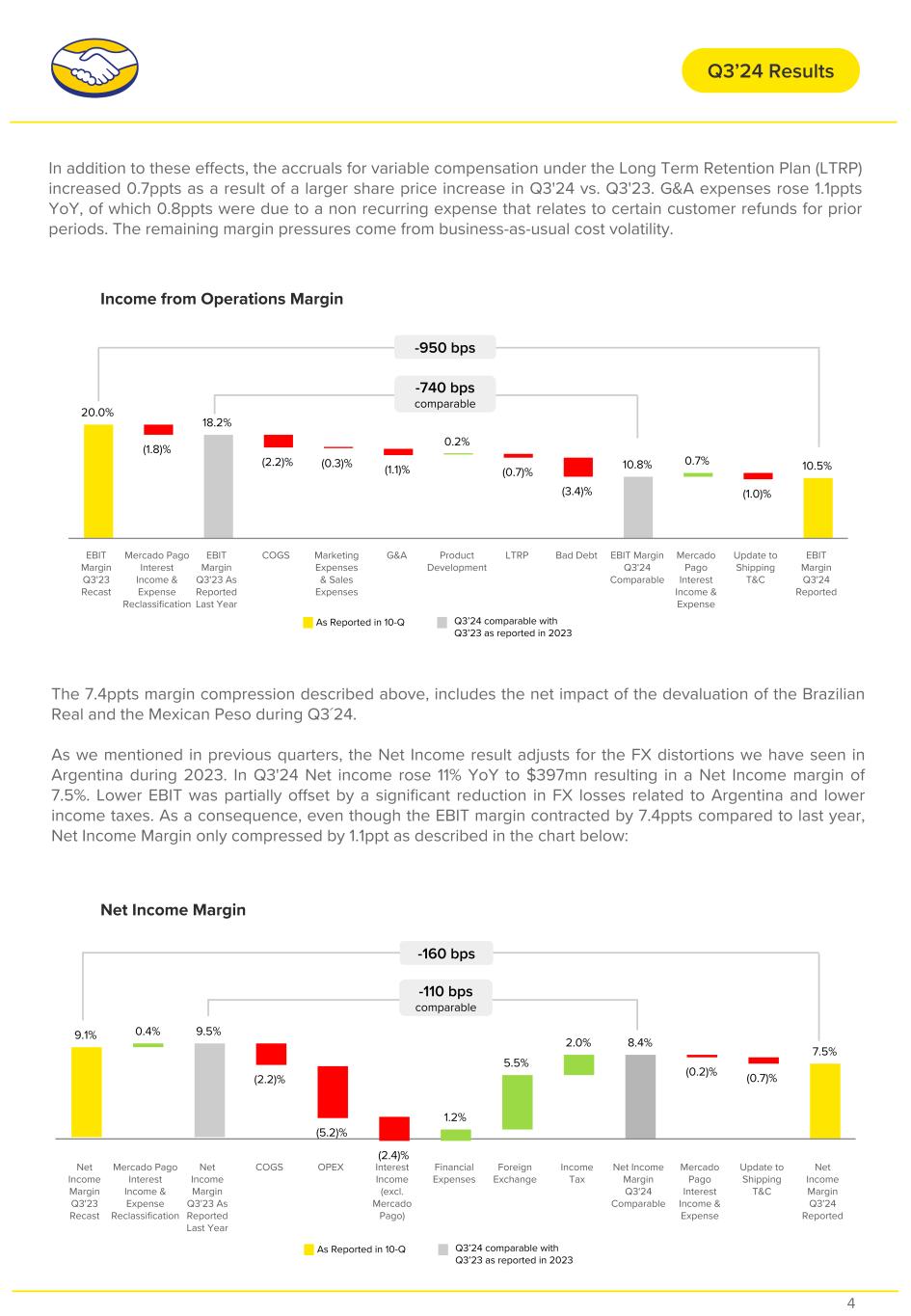

Q3’24 Results In addition to these effects, the accruals for variable compensation under the Long Term Retention Plan (LTRP) increased 0.7ppts as a result of a larger share price increase in Q3'24 vs. Q3'23. G&A expenses rose 1.1ppts YoY, of which 0.8ppts were due to a non recurring expense that relates to certain customer refunds for prior periods. The remaining margin pressures come from business-as-usual cost volatility. 4 20.0% (1.8)% 18.2% (2.2)% (0.3)% (1.1)% 0.2% (0.7)% (3.4)% 10.8% 0.7% (1.0)% 10.5% EBIT Margin Q3'23 Recast Mercado Pago Interest Income & Expense Reclassification EBIT Margin Q3'23 As Reported Last Year COGS Marketing Expenses & Sales Expenses G&A Product Development LTRP Bad Debt EBIT Margin Q3'24 Comparable Mercado Pago Interest Income & Expense Update to Shipping T&C EBIT Margin Q3'24 Reported -740 bps comparable -950 bps As Reported in 10-Q Q3’24 comparable with Q3’23 as reported in 2023 The 7.4ppts margin compression described above, includes the net impact of the devaluation of the Brazilian Real and the Mexican Peso during Q3´24. As we mentioned in previous quarters, the Net Income result adjusts for the FX distortions we have seen in Argentina during 2023. In Q3'24 Net income rose 11% YoY to $397mn resulting in a Net Income margin of 7.5%. Lower EBIT was partially offset by a significant reduction in FX losses related to Argentina and lower income taxes. As a consequence, even though the EBIT margin contracted by 7.4ppts compared to last year, Net Income Margin only compressed by 1.1ppt as described in the chart below: 9.1% 0.4% 9.5% (2.2)% (5.2)% (2.4)% 1.2% 5.5% 2.0% 8.4% (0.2)% (0.7)% 7.5% Net Income Margin Q3'23 Recast Mercado Pago Interest Income & Expense Reclassification Net Income Margin Q3'23 As Reported Last Year COGS OPEX Interest Income (excl. Mercado Pago) Financial Expenses Foreign Exchange Income Tax Net Income Margin Q3'24 Comparable Mercado Pago Interest Income & Expense Update to Shipping T&C Net Income Margin Q3'24 Reported -110 bps comparable -160 bps As Reported in 10-Q Q3’24 comparable with Q3’23 as reported in 2023 Income from Operations Margin Net Income Margin

Q3’24 Results Looking Ahead Momentum is fantastic across Mercado Libre, and we are optimistic about the long runway of growth we see in commerce, advertising, fintech services and acquiring across our region. We are confident that our investments are unlocking these structural growth opportunities, and our Q3'24 results are evidence of that. We are committed to investing with discipline to maximize the size of the business in the long-term in a sustainable, profitable and cash generative manner. We look ahead with excitement because the best is yet to come. 5 During Q3'24 we consumed $203mn of adjusted free cash flow mostly explained by the accelerated growth of the credit portfolio. Year to date, we have generated more than $635mn of adjusted free cash flow. Our robust financial flexibility, conservative capital structure and positive long-term fundamentals, led to Fitch upgrading its credit rating on Mercado Libre to Investment Grade in October (BBB-).

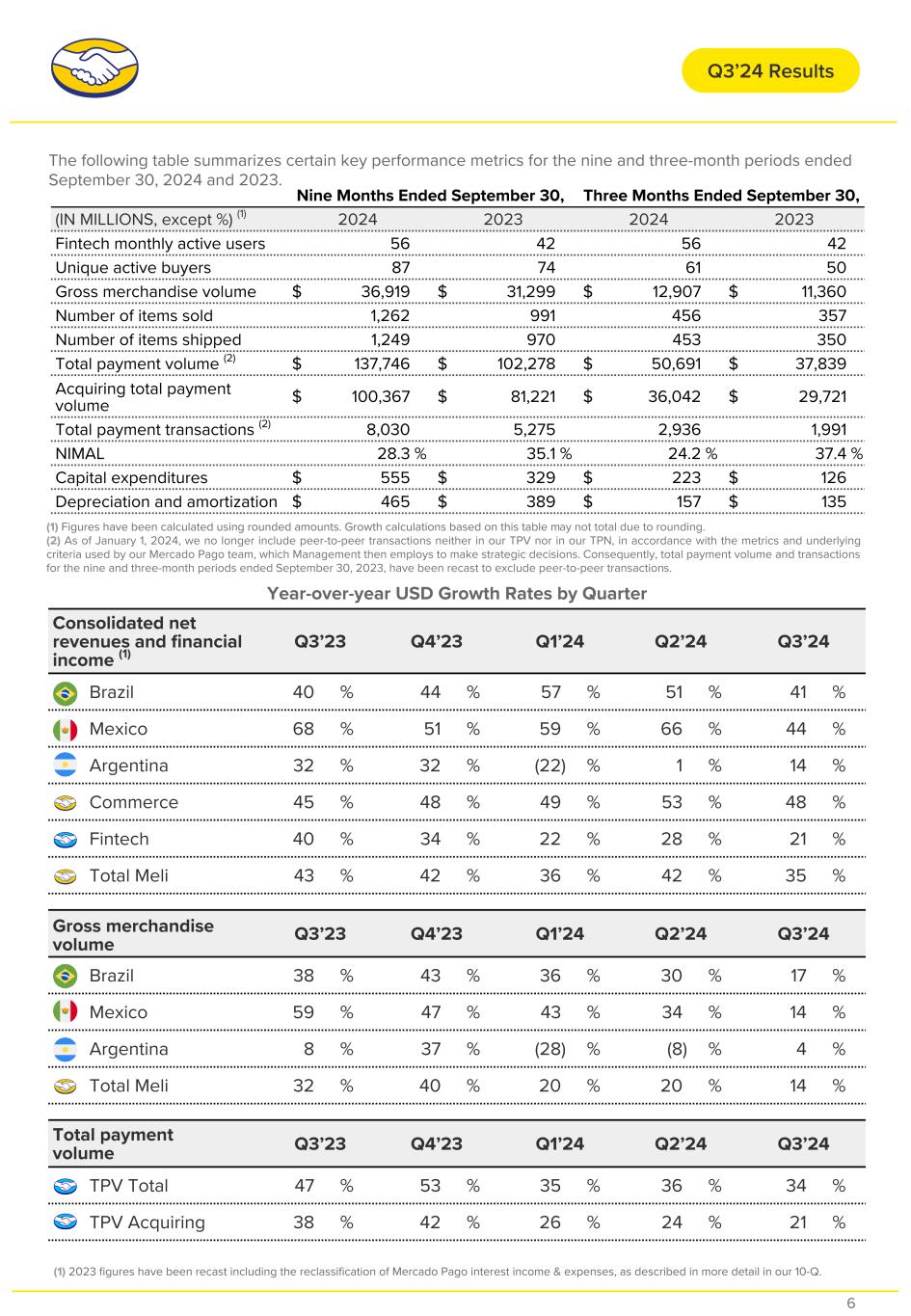

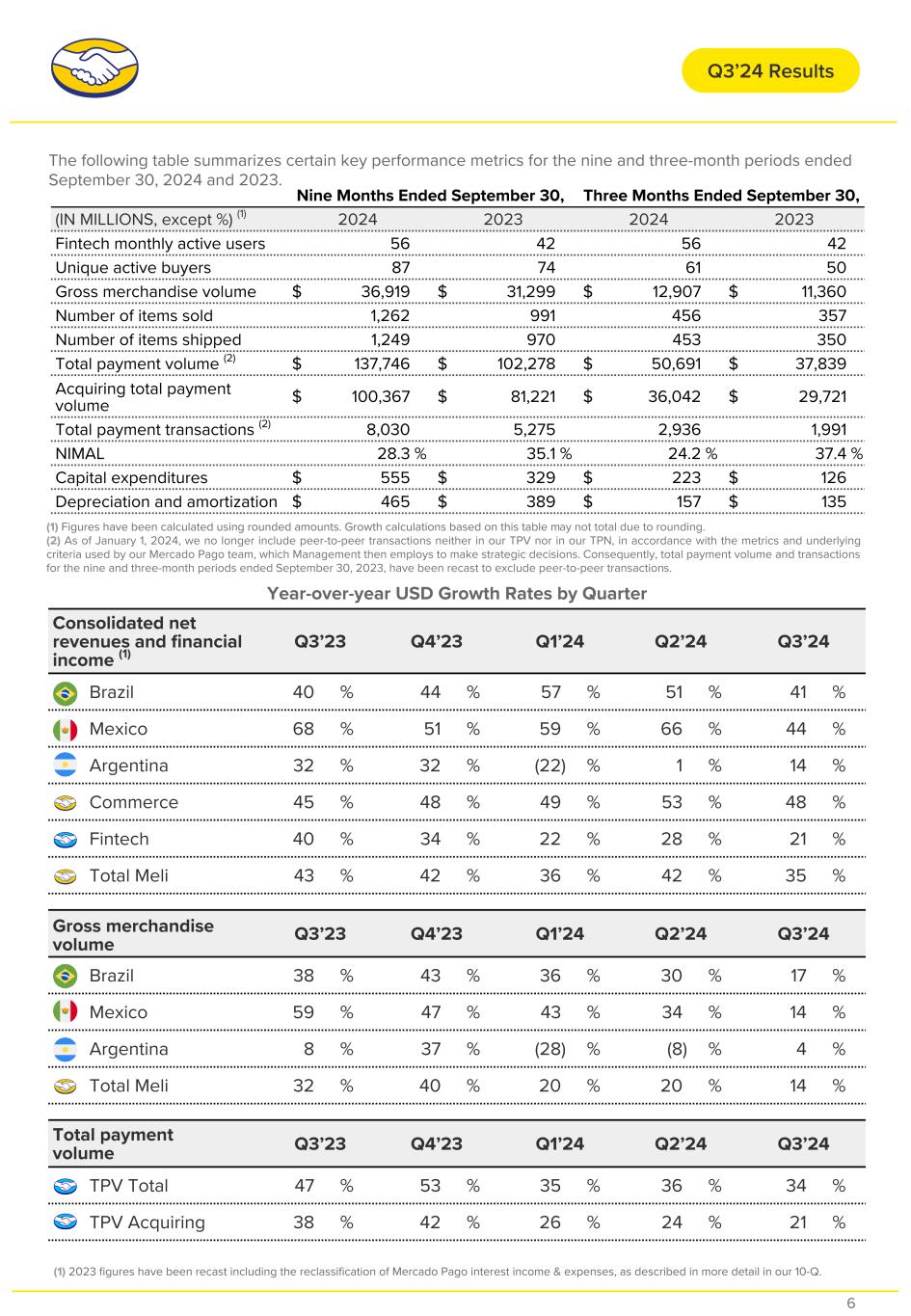

The following table summarizes certain key performance metrics for the nine and three-month periods ended September 30, 2024 and 2023. Year-over-year USD Growth Rates by Quarter Consolidated net revenues and financial income (1) Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Brazil 40 % 44 % 57 % 51 % 41 % Mexico 68 % 51 % 59 % 66 % 44 % Argentina 32 % 32 % (22) % 1 % 14 % Commerce 45 % 48 % 49 % 53 % 48 % Fintech 40 % 34 % 22 % 28 % 21 % Total Meli 43 % 42 % 36 % 42 % 35 % Gross merchandise volume Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Brazil 38 % 43 % 36 % 30 % 17 % Mexico 59 % 47 % 43 % 34 % 14 % Argentina 8 % 37 % (28) % (8) % 4 % Total Meli 32 % 40 % 20 % 20 % 14 % Total payment volume Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 TPV Total 47 % 53 % 35 % 36 % 34 % TPV Acquiring 38 % 42 % 26 % 24 % 21 % Nine Months Ended September 30, Three Months Ended September 30, (IN MILLIONS, except %) (1) 2024 2023 2024 2023 Fintech monthly active users 56 42 56 42 Unique active buyers 87 74 61 50 Gross merchandise volume $ 36,919 $ 31,299 $ 12,907 $ 11,360 Number of items sold 1,262 991 456 357 Number of items shipped 1,249 970 453 350 Total payment volume (2) $ 137,746 $ 102,278 $ 50,691 $ 37,839 Acquiring total payment volume $ 100,367 $ 81,221 $ 36,042 $ 29,721 Total payment transactions (2) 8,030 5,275 2,936 1,991 NIMAL 28.3 % 35.1 % 24.2 % 37.4 % Capital expenditures $ 555 $ 329 $ 223 $ 126 Depreciation and amortization $ 465 $ 389 $ 157 $ 135 (1) Figures have been calculated using rounded amounts. Growth calculations based on this table may not total due to rounding. (2) As of January 1, 2024, we no longer include peer-to-peer transactions neither in our TPV nor in our TPN, in accordance with the metrics and underlying criteria used by our Mercado Pago team, which Management then employs to make strategic decisions. Consequently, total payment volume and transactions for the nine and three-month periods ended September 30, 2023, have been recast to exclude peer-to-peer transactions. Q3’24 Results (1) 2023 figures have been recast including the reclassification of Mercado Pago interest income & expenses, as described in more detail in our 10-Q. 6

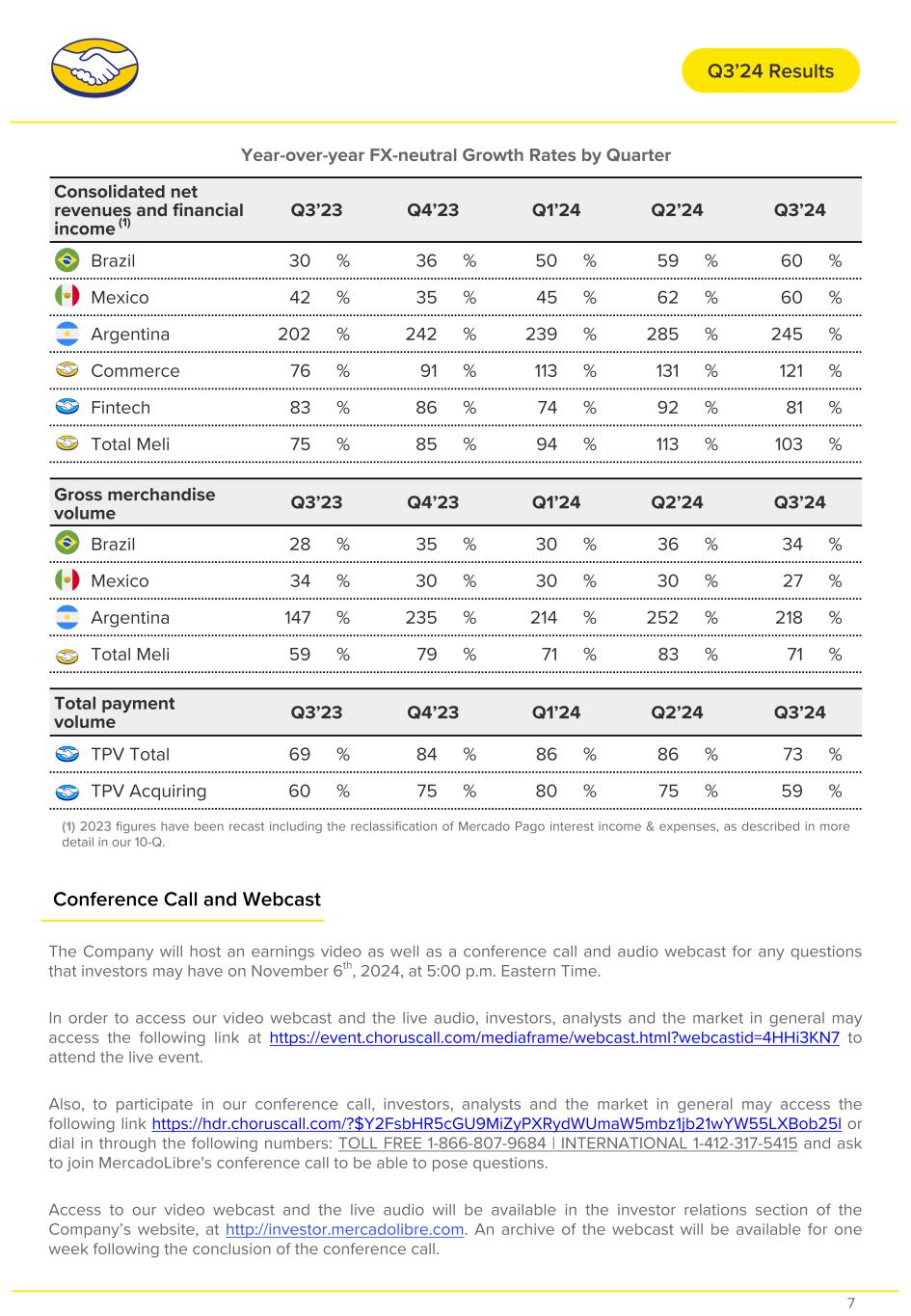

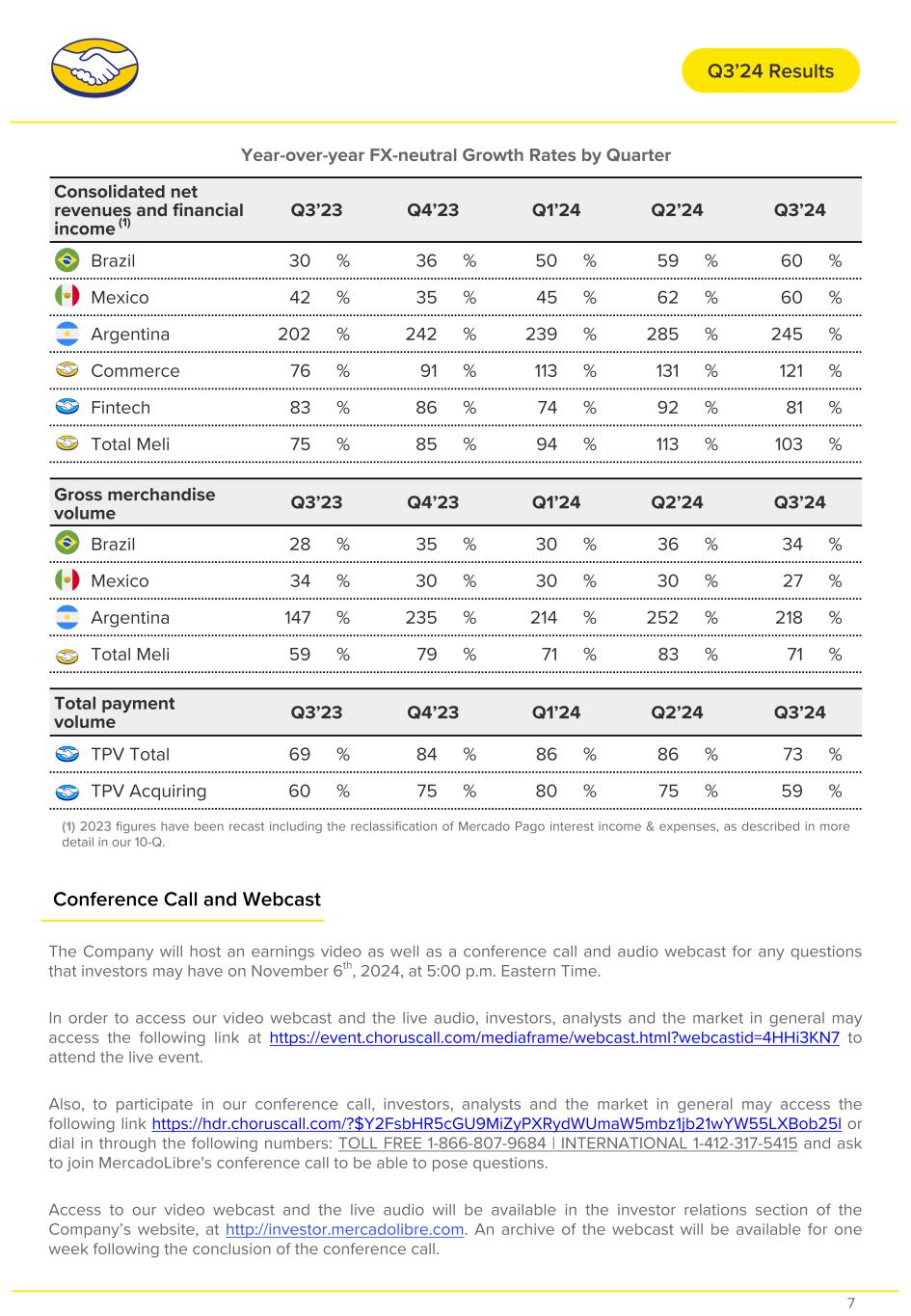

The Company will host an earnings video as well as a conference call and audio webcast for any questions that investors may have on November 6th, 2024, at 5:00 p.m. Eastern Time. In order to access our video webcast and the live audio, investors, analysts and the market in general may access the following link at https://event.choruscall.com/mediaframe/webcast.html?webcastid=4HHi3KN7 to attend the live event. Also, to participate in our conference call, investors, analysts and the market in general may access the following link https://hdr.choruscall.com/?$Y2FsbHR5cGU9MiZyPXRydWUmaW5mbz1jb21wYW55LXBob25l or dial in through the following numbers: TOLL FREE 1-866-807-9684 | INTERNATIONAL 1-412-317-5415 and ask to join MercadoLibre's conference call to be able to pose questions. Access to our video webcast and the live audio will be available in the investor relations section of the Company’s website, at http://investor.mercadolibre.com. An archive of the webcast will be available for one week following the conclusion of the conference call. Year-over-year FX-neutral Growth Rates by Quarter Consolidated net revenues and financial income (1) Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Brazil 30 % 36 % 50 % 59 % 60 % Mexico 42 % 35 % 45 % 62 % 60 % Argentina 202 % 242 % 239 % 285 % 245 % Commerce 76 % 91 % 113 % 131 % 121 % Fintech 83 % 86 % 74 % 92 % 81 % Total Meli 75 % 85 % 94 % 113 % 103 % Gross merchandise volume Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Brazil 28 % 35 % 30 % 36 % 34 % Mexico 34 % 30 % 30 % 30 % 27 % Argentina 147 % 235 % 214 % 252 % 218 % Total Meli 59 % 79 % 71 % 83 % 71 % Total payment volume Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 TPV Total 69 % 84 % 86 % 86 % 73 % TPV Acquiring 60 % 75 % 80 % 75 % 59 % Q3’24 Results Conference Call and Webcast (1) 2023 figures have been recast including the reclassification of Mercado Pago interest income & expenses, as described in more detail in our 10-Q. 7

▪ Fintech monthly active users (MAU) – defined as Fintech payers and/or collectors as of September 30, 2024, that, during the last month of the reporting period, performed at least one of the following actions during such month: 1) made a debit or credit card payment, 2) made a QR code payment, 3) made an off- platform online payment using our checkout or link of payment solutions while logged in to our Mercado Pago fintech platform, 4) made an investment or employed any of our savings solutions, 5) purchased an insurance policy, 6) took out a loan through our Mercado Credito solution, or 7) received the payment from a sale or transaction either on or off marketplace. ▪ Unique active buyers – defined as users that have performed at least one purchase on the Mercado Libre Marketplace during the reported period. ▪ Foreign Exchange (“FX”) Neutral – Calculated by using the average monthly exchange rate of each month of 2023 and applying it to the corresponding months in the current year, so as to calculate what the results would have been had exchange rates remained constant. Intercompany allocations are excluded from this calculation. These calculations do not include any other macroeconomic effect such as local currency inflation effects or any price adjustment to compensate local currency inflation or devaluations. ▪ Gross merchandise volume (GMV) – Measure of the total U.S. dollar sum of all transactions completed through the Mercado Libre Marketplace, excluding Classifieds transactions. ▪ Total payment transactions – Measure of the number of all transactions paid for using Mercado Pago, excluding peer-to-peer transactions. ▪ Total payment volume (TPV) – Measure of total U.S. dollar sum of all transactions paid for using Mercado Pago, including marketplace and non-marketplace transactions, excluding peer-to-peer transactions. ▪ Acquiring total payment volume – Measure of the total U.S. dollar sum of all transactions settled using our Mercado Pago and its payment processing and settling services in marketplace and non-marketplace transactions and consist of the following transactions volume: 1) point of sale payment volume, 2) commerce payment volume through our Mercado Libre Marketplace, 3) online payment volume through our checkout or link payment solution for merchants, and 4) QR code payment volume. ▪ MPOS – Mobile point-of-sale is a dedicated wireless device that performs the functions of a cash register or electronic point-of-sale terminal wirelessly. ▪ Commerce – Revenues from core marketplace fees, shipping fees, first-party sales, ad sales, classified fees and other ancillary services. ▪ Fintech – Revenues includes fees from off-platform transactions, financing fees, interest earned from merchant and consumer credits, interest earned on cash and investments as part of Mercado Pago activities net of interest gains passed through to our Brazilian users in connection with our asset management product, and sale of MPOS. ▪ Items sold – Measure of the number of items that were sold/purchased through the Mercado Libre Marketplace, excluding Classifieds items. ▪ Items shipped – Measure of the number of items that were shipped through our shipping service. ▪ G&A - General and administrative expenses. ▪ Local Currency Growth Rates – Refer to FX Neutral definition. ▪ Net income margin – Defined as net income as a percentage of net revenues. ▪ Operating margin – Defined as income from operations as a percentage of net revenues. ▪ Net Interest Margins After Losses (NIMAL) – NIMAL is the spread between credit revenues and the expenses associated with provisions for doubtful accounts and funding costs, and usually expressed as a percentage of the average portfolio for the period. ▪ Non-performing loan (NPL) ratio – Shows the percentage of the loan portfolio that is not being paid on- time. Q3’24 Results Definition of Selected Metrics 8

Founded in 1999, MercadoLibre is the largest ecommerce and fintech ecosystem in Latin America. The company's efforts are centered on enabling e-commerce and digital financial services for our users through a complete suite of technology solutions, with a mission of democratizing access to commerce and financial services. The Company is listed on NASDAQ (Nasdaq: MELI) following its initial public offering in 2007. For more information about the Company visit: http://investor.mercadolibre.com. The MercadoLibre, Inc. logo is available at https://resource.globenewswire.com/Resource/ Download/6ab227b7-693f-4b17-b80c-552ae45c76bf?size=0 This press release and the investor conference call contain forward-looking statements, including, but not limited to, statements regarding MercadoLibre Inc.’s possible or assumed future results of operations; expectations, objectives and progress against strategic priorities; initiatives and strategies related to our products and services; business and market outlook, opportunities, strategies and trends; financing plans; competitive position; impacts of foreign exchange; the potential impact of the uncertain macroeconomic and geopolitical environment on our financial results; customer demand and market expansion; our planned product and services releases and capabilities; industry growth rates; future stock repurchases; our expected tax rate and tax strategies; and the effects of future regulation and competition. Words such as, but not limited to, “believe,” “will,” “so we can,” “when,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are used to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements convey MercadoLibre, Inc.’s current assumptions, expectations or forecasts of future events. Forward-looking statements regarding MercadoLibre, Inc. involve known and unknown risks, uncertainties and other factors that may cause MercadoLibre, Inc.’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Additional information on the potential risks, uncertainties and factors that could affect MercadoLibre, Inc.’s results is included in filings we make with the Securities and Exchange Commission ("SEC") from time to time, including in the sections entitled “Risk Factors,” “Forward-Looking Statements” and “Cautionary Note Regarding Forward-Looking Statements” of MercadoLibre, Inc.’s annual report on Form 10-K for the year ended December 31, 2023 and in any of MercadoLibre, Inc.’s other applicable filings with the SEC. The financial information contained in this press release should be read in conjunction with the consolidated financial statements and notes thereto included in MercadoLibre, Inc.’s most recent reports on Forms 10-K and 10-Q, each as may be amended from time to time. MercadoLibre, Inc.’s financial results for its third quarter of 2024 are not necessarily indicative of MercadoLibre Inc.’s operating results for any future periods. The information provided herein is as of November 6, 2024. Unless required by law, MercadoLibre, Inc. undertakes no obligation to, and does not intend to, publicly update or revise any forward-looking statements to reflect circumstances or events after the date hereof. Q3’24 Results About Mercado Libre Forward-Looking Statements 9

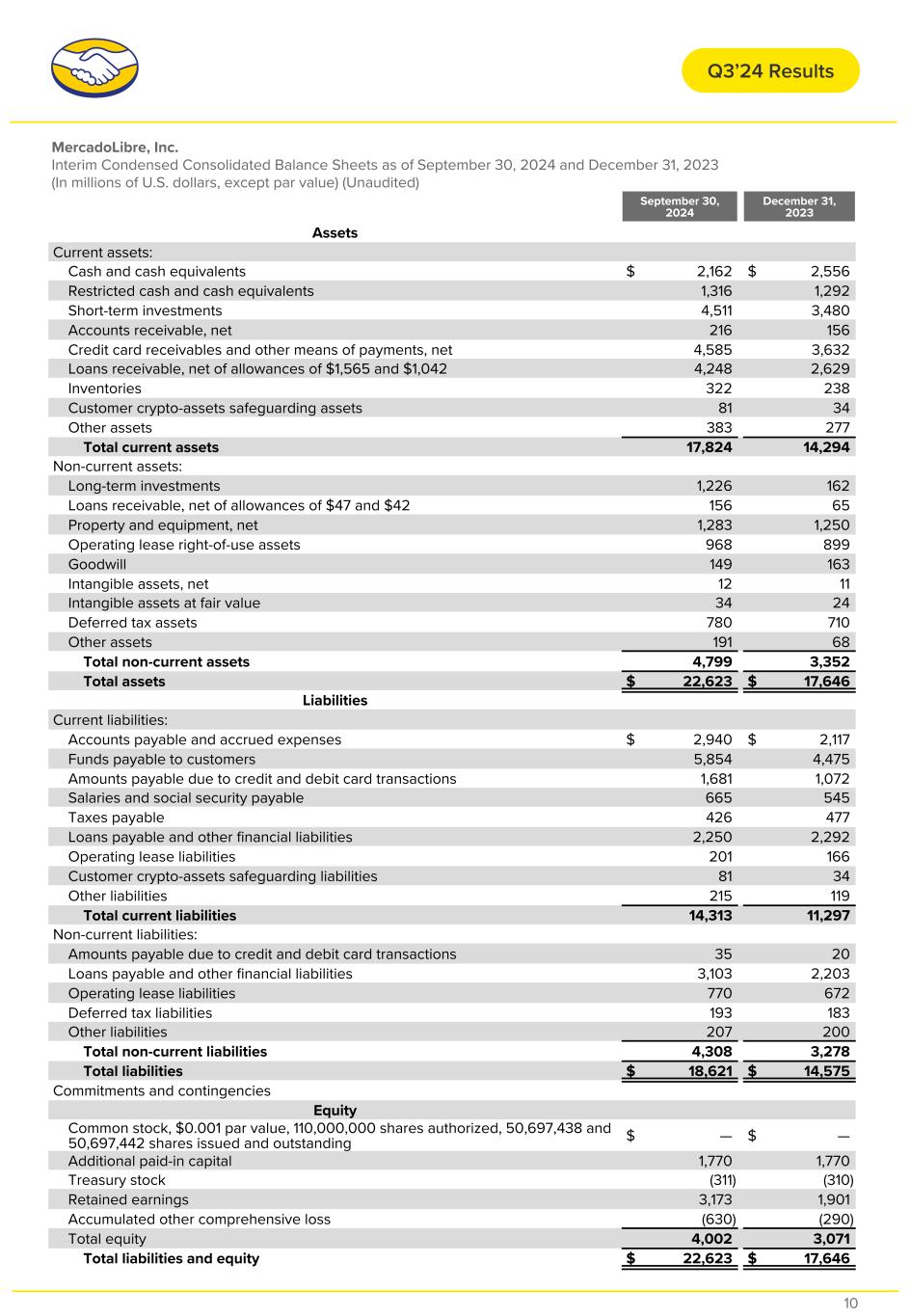

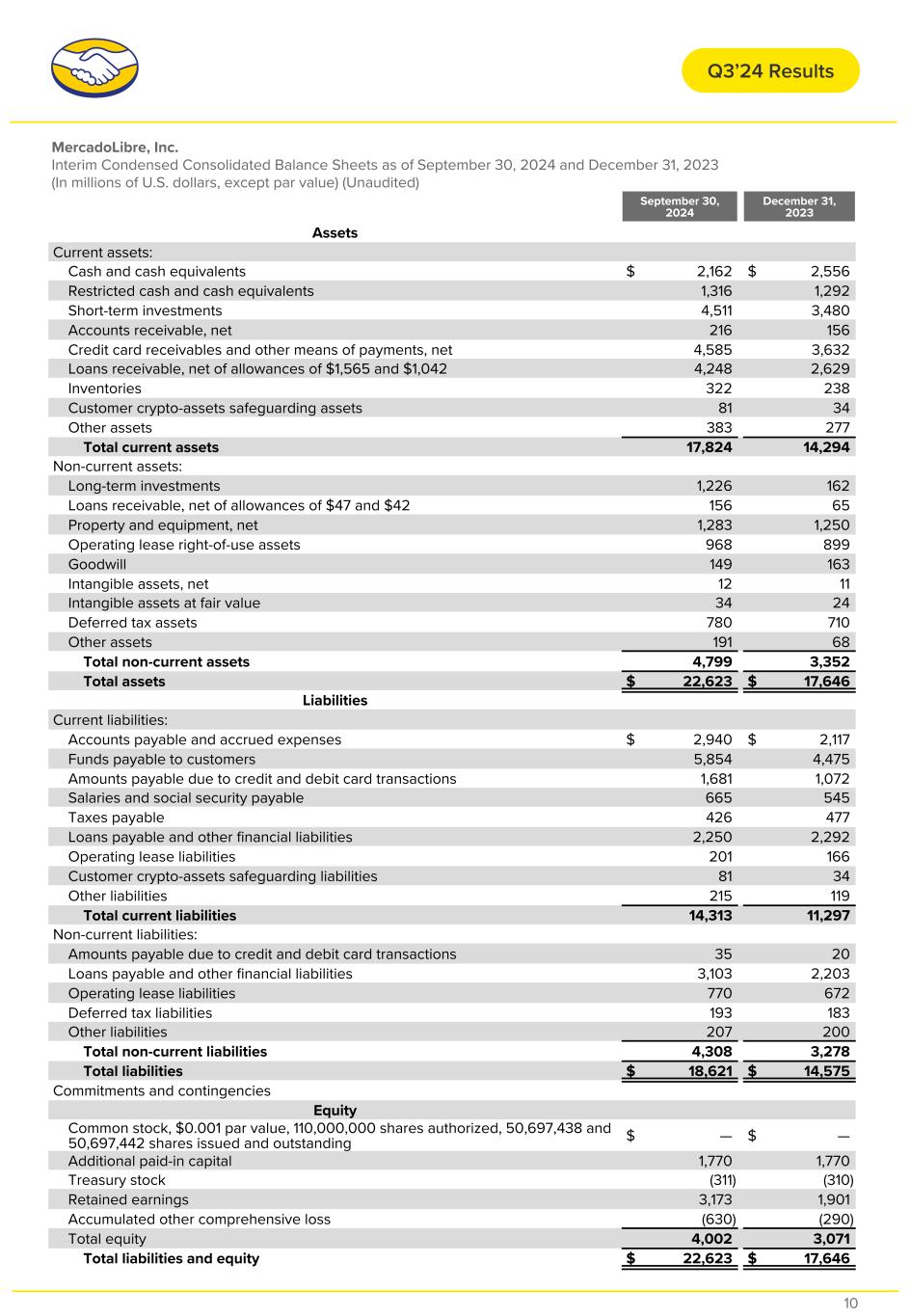

MercadoLibre, Inc. Interim Condensed Consolidated Balance Sheets as of September 30, 2024 and December 31, 2023 (In millions of U.S. dollars, except par value) (Unaudited) September 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 2,162 $ 2,556 Restricted cash and cash equivalents 1,316 1,292 Short-term investments 4,511 3,480 Accounts receivable, net 216 156 Credit card receivables and other means of payments, net 4,585 3,632 Loans receivable, net of allowances of $1,565 and $1,042 4,248 2,629 Inventories 322 238 Customer crypto-assets safeguarding assets 81 34 Other assets 383 277 Total current assets 17,824 14,294 Non-current assets: Long-term investments 1,226 162 Loans receivable, net of allowances of $47 and $42 156 65 Property and equipment, net 1,283 1,250 Operating lease right-of-use assets 968 899 Goodwill 149 163 Intangible assets, net 12 11 Intangible assets at fair value 34 24 Deferred tax assets 780 710 Other assets 191 68 Total non-current assets 4,799 3,352 Total assets $ 22,623 $ 17,646 Liabilities Current liabilities: Accounts payable and accrued expenses $ 2,940 $ 2,117 Funds payable to customers 5,854 4,475 Amounts payable due to credit and debit card transactions 1,681 1,072 Salaries and social security payable 665 545 Taxes payable 426 477 Loans payable and other financial liabilities 2,250 2,292 Operating lease liabilities 201 166 Customer crypto-assets safeguarding liabilities 81 34 Other liabilities 215 119 Total current liabilities 14,313 11,297 Non-current liabilities: Amounts payable due to credit and debit card transactions 35 20 Loans payable and other financial liabilities 3,103 2,203 Operating lease liabilities 770 672 Deferred tax liabilities 193 183 Other liabilities 207 200 Total non-current liabilities 4,308 3,278 Total liabilities $ 18,621 $ 14,575 Commitments and contingencies Equity Common stock, $0.001 par value, 110,000,000 shares authorized, 50,697,438 and 50,697,442 shares issued and outstanding $ — $ — Additional paid-in capital 1,770 1,770 Treasury stock (311) (310) Retained earnings 3,173 1,901 Accumulated other comprehensive loss (630) (290) Total equity 4,002 3,071 Total liabilities and equity $ 22,623 $ 17,646 Q3’24 Results 10

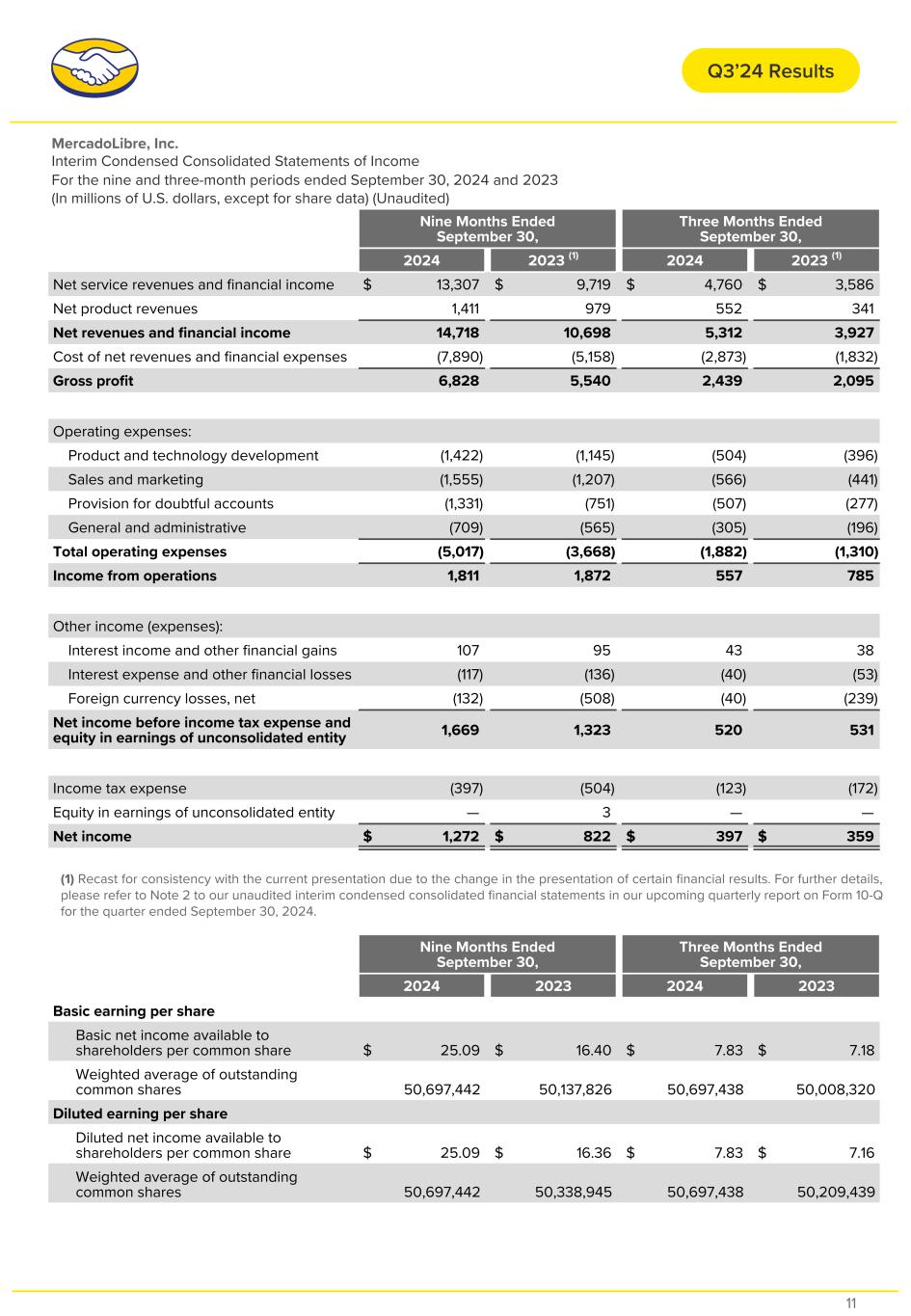

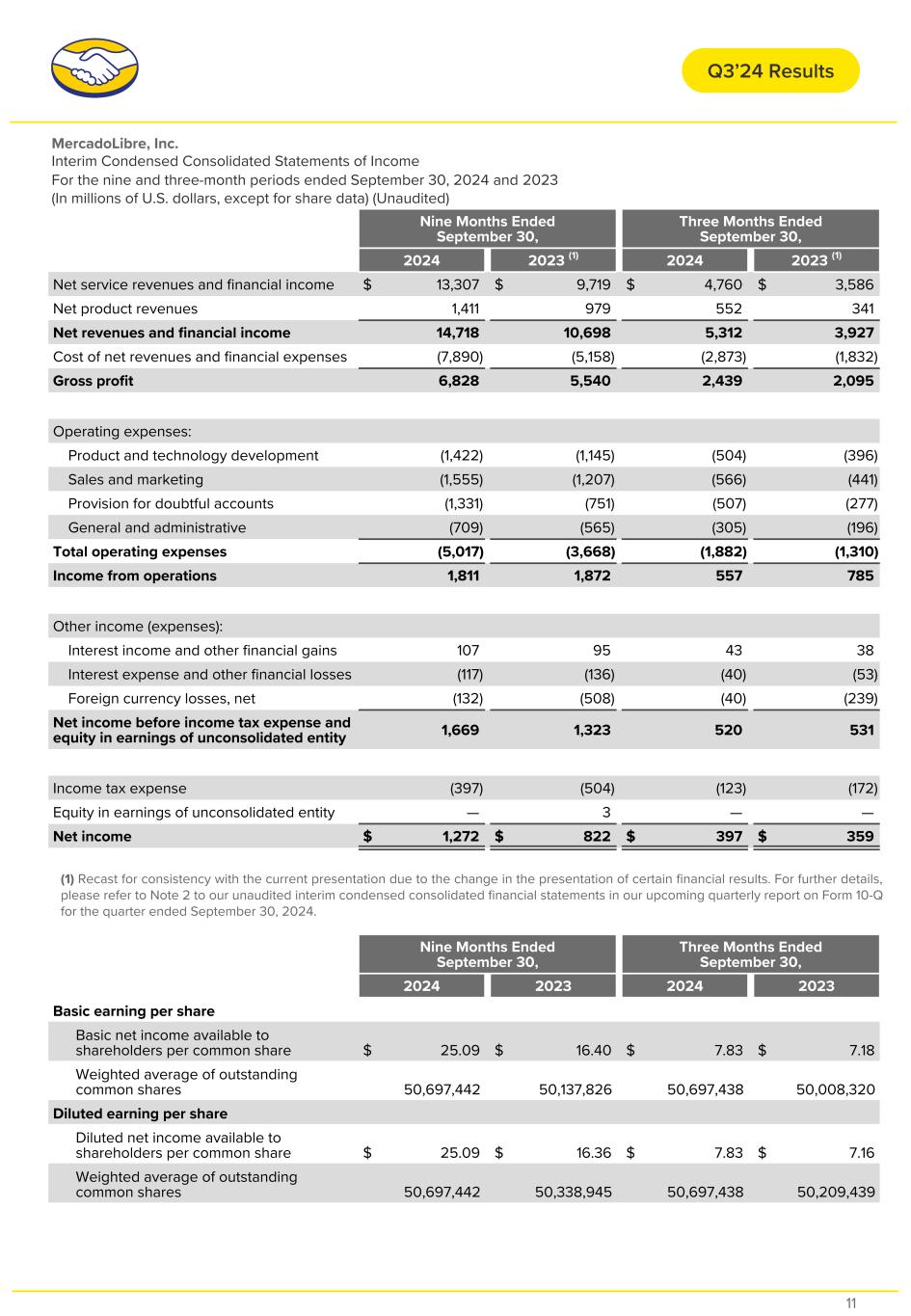

MercadoLibre, Inc. Interim Condensed Consolidated Statements of Income For the nine and three-month periods ended September 30, 2024 and 2023 (In millions of U.S. dollars, except for share data) (Unaudited)͏ Nine Months Ended September 30, Three Months Ended September 30, 2024 2023 (1) 2024 2023 (1) Net service revenues and financial income $ 13,307 $ 9,719 $ 4,760 $ 3,586 Net product revenues 1,411 979 552 341 Net revenues and financial income 14,718 10,698 5,312 3,927 Cost of net revenues and financial expenses (7,890) (5,158) (2,873) (1,832) Gross profit 6,828 5,540 2,439 2,095 Operating expenses: Product and technology development (1,422) (1,145) (504) (396) Sales and marketing (1,555) (1,207) (566) (441) Provision for doubtful accounts (1,331) (751) (507) (277) General and administrative (709) (565) (305) (196) Total operating expenses (5,017) (3,668) (1,882) (1,310) Income from operations 1,811 1,872 557 785 Other income (expenses): Interest income and other financial gains 107 95 43 38 Interest expense and other financial losses (117) (136) (40) (53) Foreign currency losses, net (132) (508) (40) (239) Net income before income tax expense and equity in earnings of unconsolidated entity 1,669 1,323 520 531 Income tax expense (397) (504) (123) (172) Equity in earnings of unconsolidated entity — 3 — — Net income $ 1,272 $ 822 $ 397 $ 359 Nine Months Ended September 30, Three Months Ended September 30, 2024 2023 2024 2023 Basic earning per share Basic net income available to shareholders per common share $ 25.09 $ 16.40 $ 7.83 $ 7.18 Weighted average of outstanding common shares 50,697,442 50,137,826 50,697,438 50,008,320 Diluted earning per share Diluted net income available to shareholders per common share $ 25.09 $ 16.36 $ 7.83 $ 7.16 Weighted average of outstanding common shares 50,697,442 50,338,945 50,697,438 50,209,439 Q3’24 Results (1) Recast for consistency with the current presentation due to the change in the presentation of certain financial results. For further details, please refer to Note 2 to our unaudited interim condensed consolidated financial statements in our upcoming quarterly report on Form 10-Q for the quarter ended September 30, 2024. 11

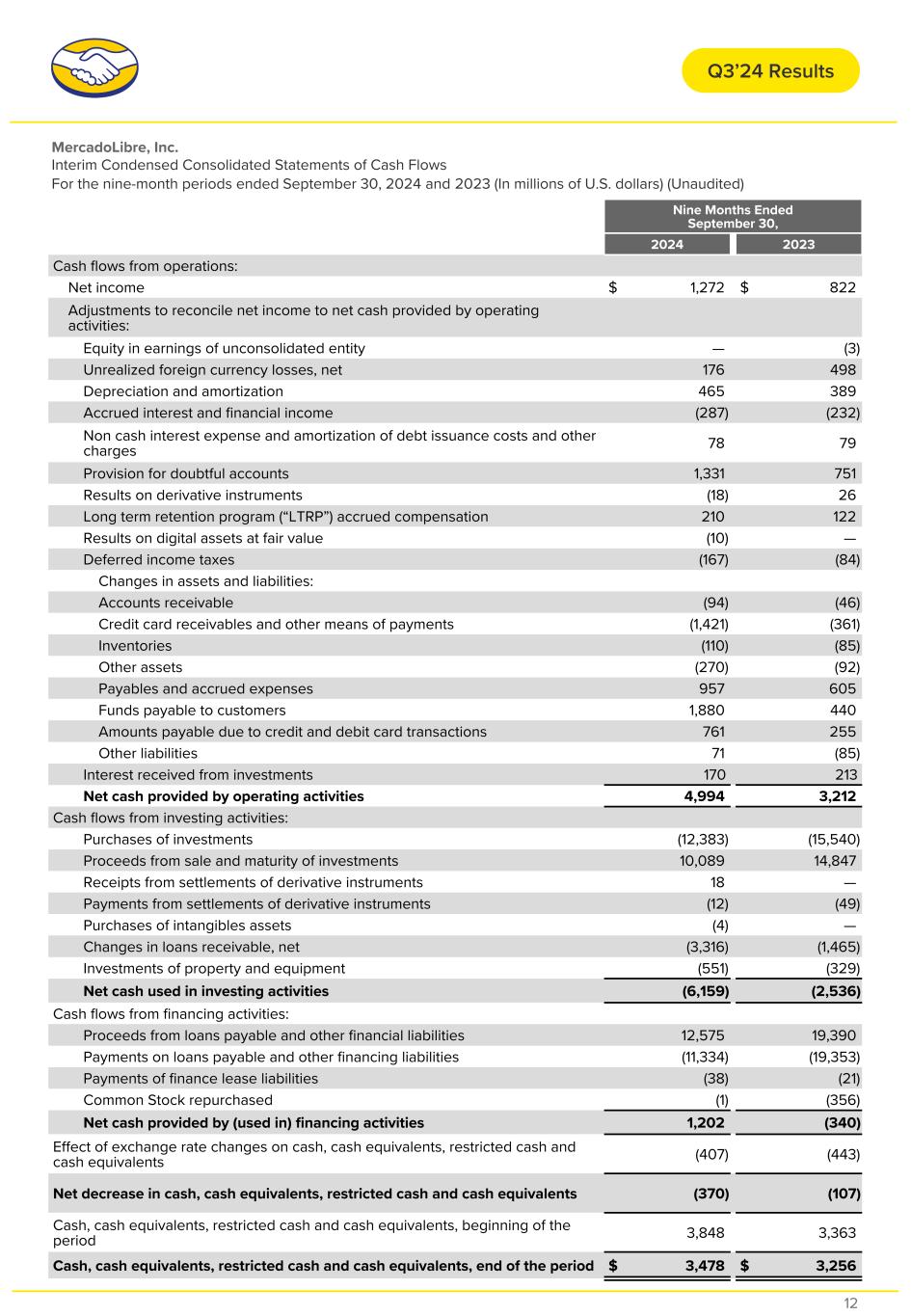

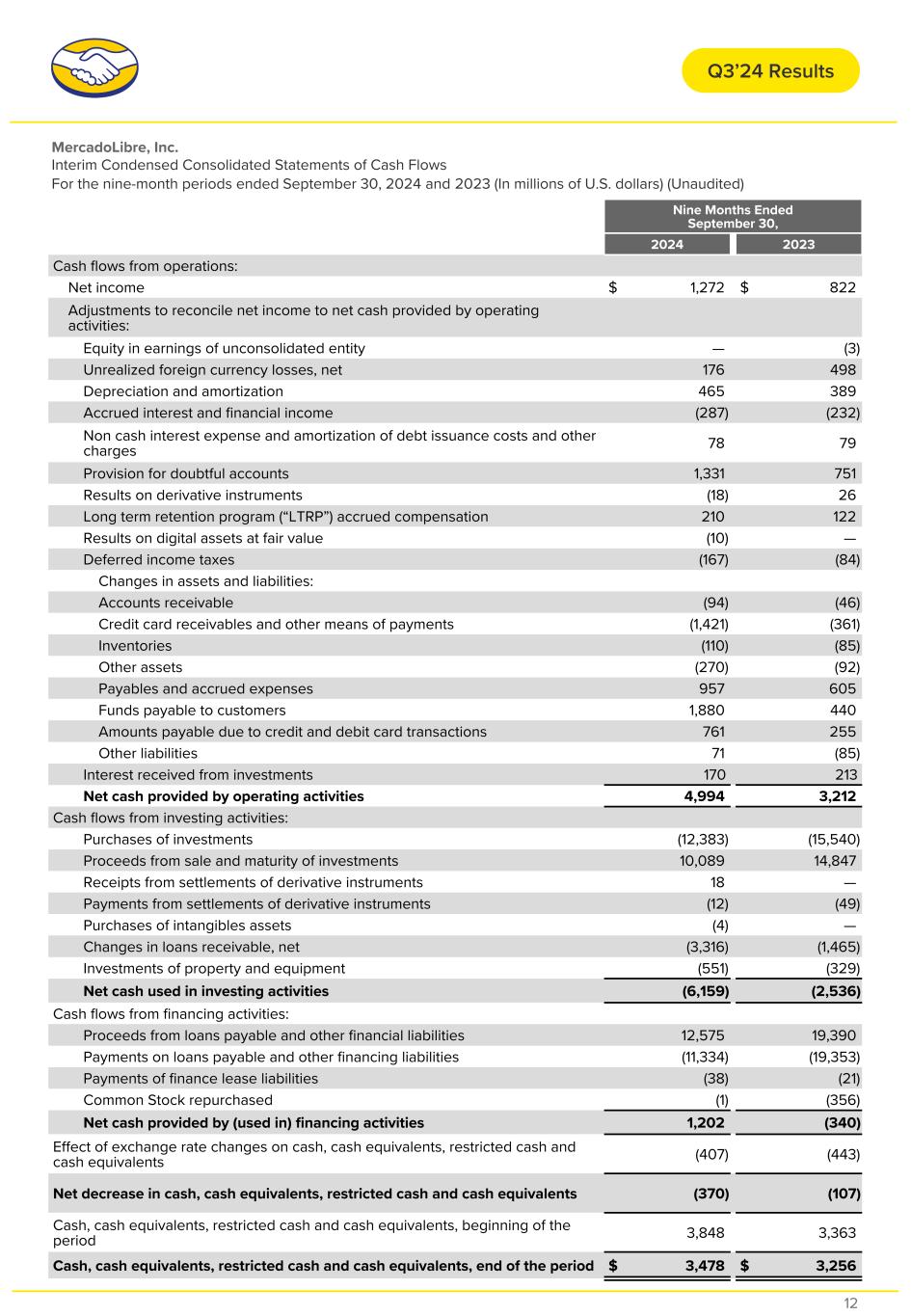

MercadoLibre, Inc. Interim Condensed Consolidated Statements of Cash Flows For the nine-month periods ended September 30, 2024 and 2023 (In millions of U.S. dollars) (Unaudited) Nine Months Ended September 30, 2024 2023 Cash flows from operations: Net income $ 1,272 $ 822 Adjustments to reconcile net income to net cash provided by operating activities: Equity in earnings of unconsolidated entity — (3) Unrealized foreign currency losses, net 176 498 Depreciation and amortization 465 389 Accrued interest and financial income (287) (232) Non cash interest expense and amortization of debt issuance costs and other charges 78 79 Provision for doubtful accounts 1,331 751 Results on derivative instruments (18) 26 Long term retention program (“LTRP”) accrued compensation 210 122 Results on digital assets at fair value (10) — Deferred income taxes (167) (84) Changes in assets and liabilities: Accounts receivable (94) (46) Credit card receivables and other means of payments (1,421) (361) Inventories (110) (85) Other assets (270) (92) Payables and accrued expenses 957 605 Funds payable to customers 1,880 440 Amounts payable due to credit and debit card transactions 761 255 Other liabilities 71 (85) Interest received from investments 170 213 Net cash provided by operating activities 4,994 3,212 Cash flows from investing activities: Purchases of investments (12,383) (15,540) Proceeds from sale and maturity of investments 10,089 14,847 Receipts from settlements of derivative instruments 18 — Payments from settlements of derivative instruments (12) (49) Purchases of intangibles assets (4) — Changes in loans receivable, net (3,316) (1,465) Investments of property and equipment (551) (329) Net cash used in investing activities (6,159) (2,536) Cash flows from financing activities: Proceeds from loans payable and other financial liabilities 12,575 19,390 Payments on loans payable and other financing liabilities (11,334) (19,353) Payments of finance lease liabilities (38) (21) Common Stock repurchased (1) (356) Net cash provided by (used in) financing activities 1,202 (340) Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents (407) (443) Net decrease in cash, cash equivalents, restricted cash and cash equivalents (370) (107) Cash, cash equivalents, restricted cash and cash equivalents, beginning of the period 3,848 3,363 Cash, cash equivalents, restricted cash and cash equivalents, end of the period $ 3,478 $ 3,256 Q3’24 Results 12

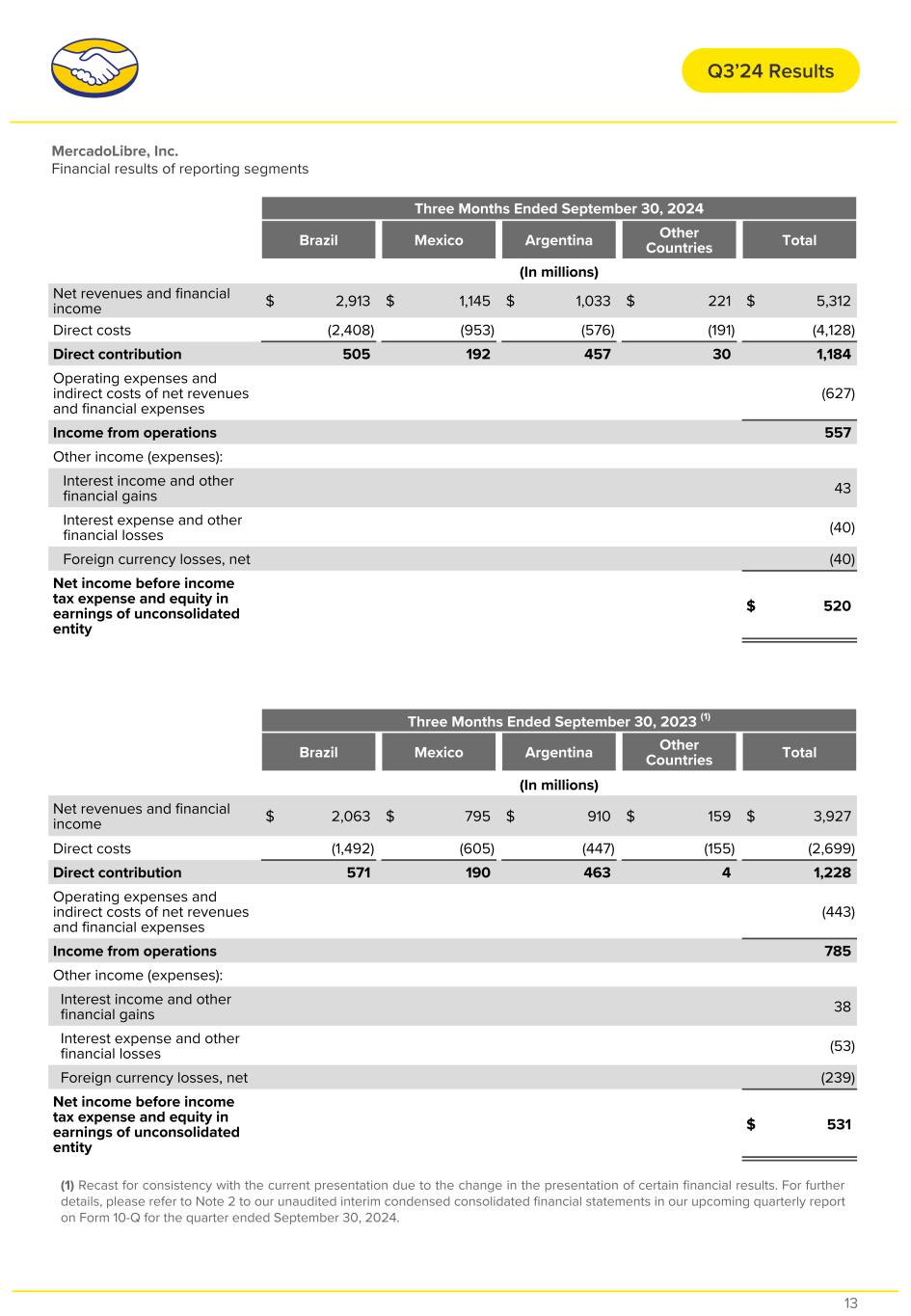

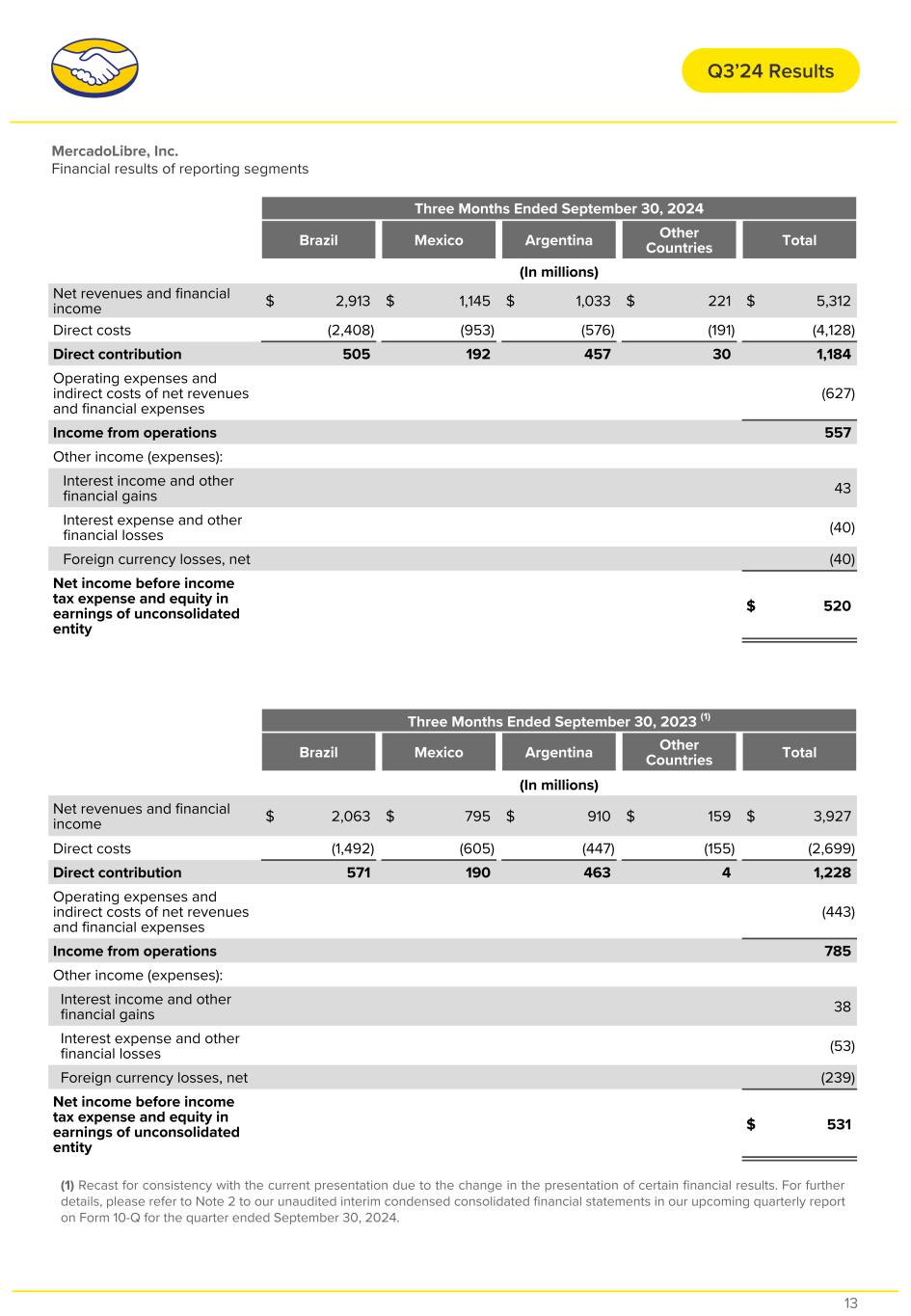

MercadoLibre, Inc. Financial results of reporting segments Three Months Ended September 30, 2024 Brazil Mexico Argentina Other Countries Total (In millions) Net revenues and financial income $ 2,913 $ 1,145 $ 1,033 $ 221 $ 5,312 Direct costs (2,408) (953) (576) (191) (4,128) Direct contribution 505 192 457 30 1,184 Operating expenses and indirect costs of net revenues and financial expenses (627) Income from operations 557 Other income (expenses): Interest income and other financial gains 43 Interest expense and other financial losses (40) Foreign currency losses, net (40) Net income before income tax expense and equity in earnings of unconsolidated entity $ 520 Three Months Ended September 30, 2023 (1) Brazil Mexico Argentina Other Countries Total (In millions) Net revenues and financial income $ 2,063 $ 795 $ 910 $ 159 $ 3,927 Direct costs (1,492) (605) (447) (155) (2,699) Direct contribution 571 190 463 4 1,228 Operating expenses and indirect costs of net revenues and financial expenses (443) Income from operations 785 Other income (expenses): Interest income and other financial gains 38 Interest expense and other financial losses (53) Foreign currency losses, net (239) Net income before income tax expense and equity in earnings of unconsolidated entity $ 531 Q3’24 Results (1) Recast for consistency with the current presentation due to the change in the presentation of certain financial results. For further details, please refer to Note 2 to our unaudited interim condensed consolidated financial statements in our upcoming quarterly report on Form 10-Q for the quarter ended September 30, 2024. 13

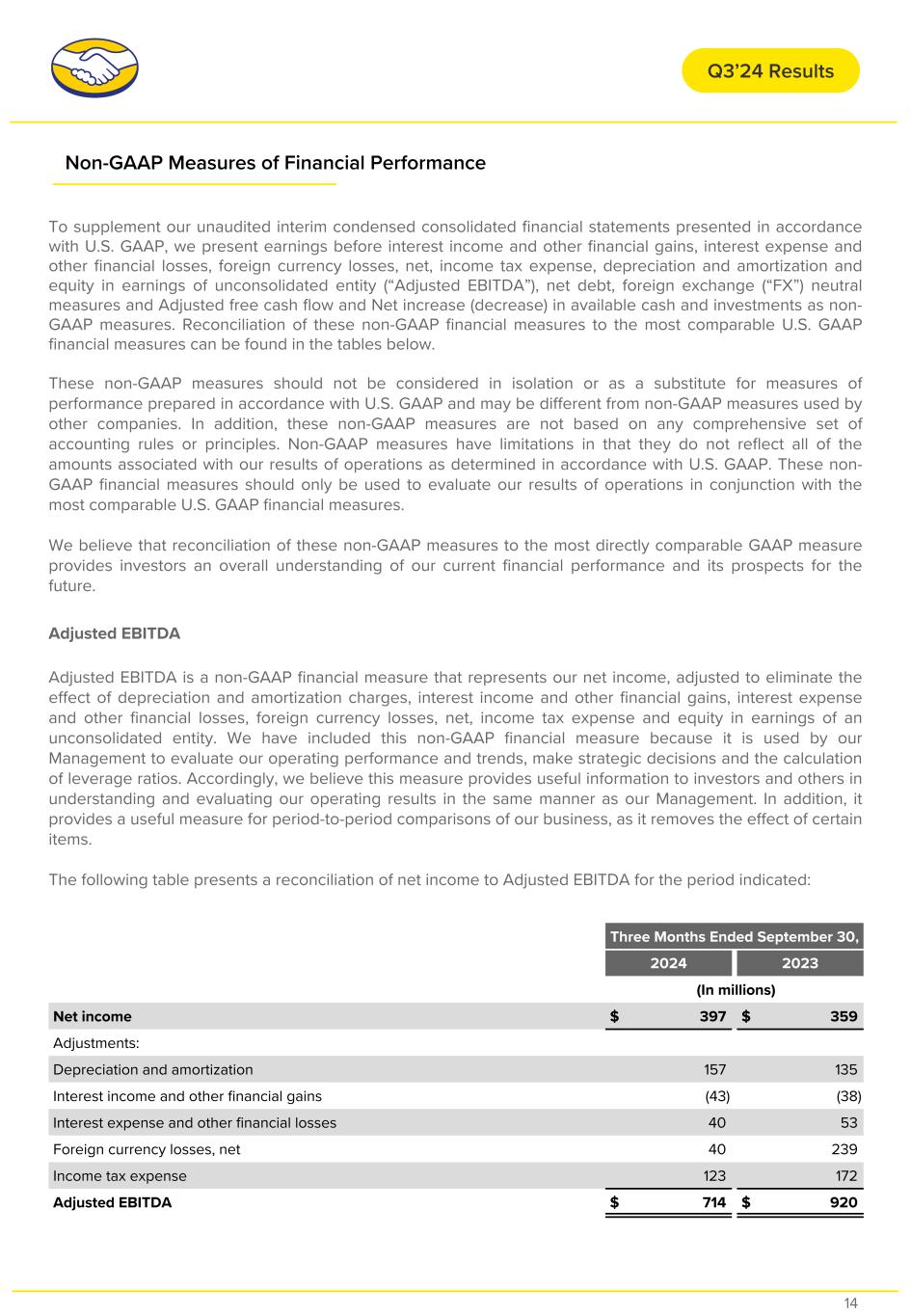

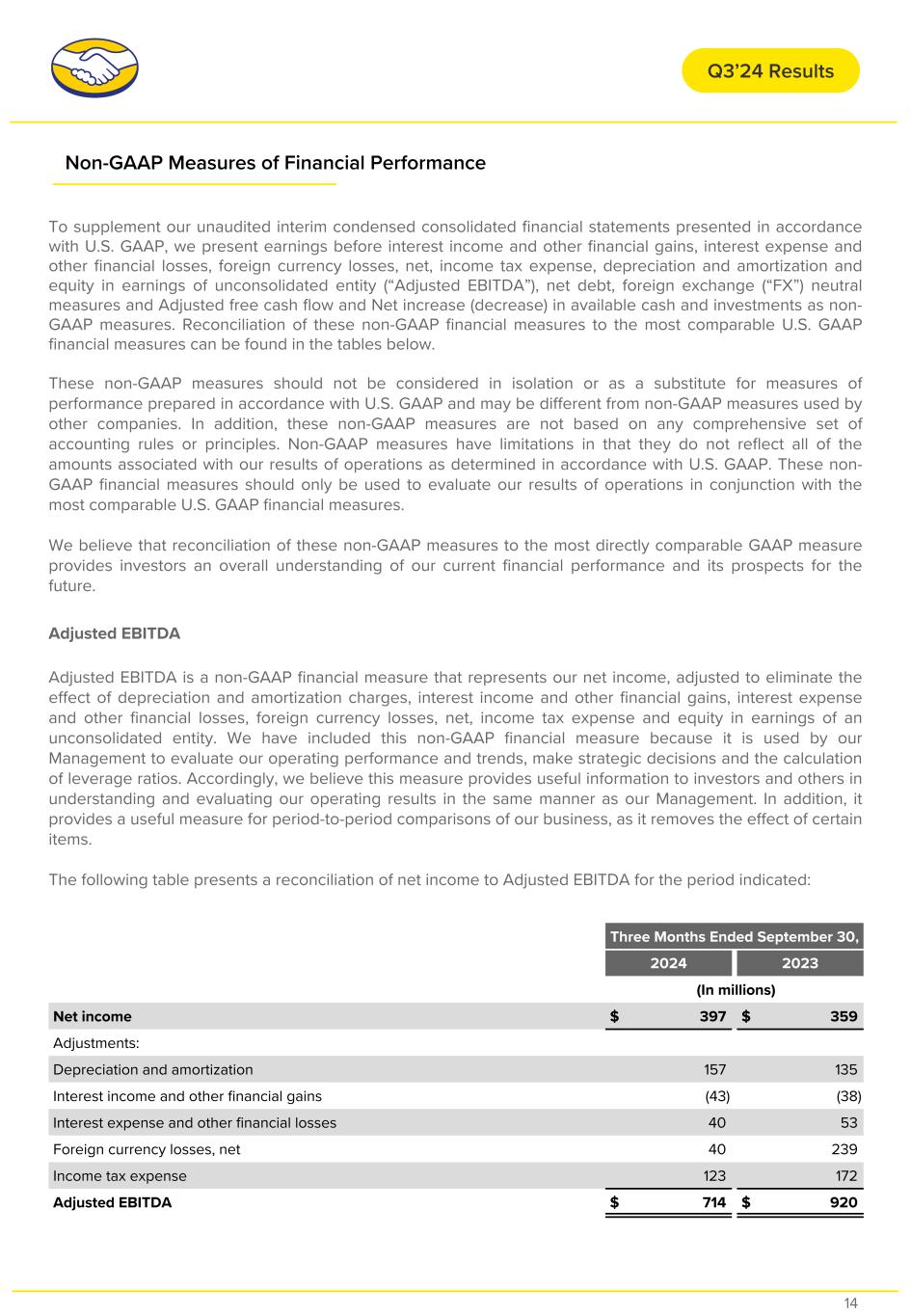

To supplement our unaudited interim condensed consolidated financial statements presented in accordance with U.S. GAAP, we present earnings before interest income and other financial gains, interest expense and other financial losses, foreign currency losses, net, income tax expense, depreciation and amortization and equity in earnings of unconsolidated entity (“Adjusted EBITDA”), net debt, foreign exchange (“FX”) neutral measures and Adjusted free cash flow and Net increase (decrease) in available cash and investments as non- GAAP measures. Reconciliation of these non-GAAP financial measures to the most comparable U.S. GAAP financial measures can be found in the tables below. These non-GAAP measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with U.S. GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with U.S. GAAP. These non- GAAP financial measures should only be used to evaluate our results of operations in conjunction with the most comparable U.S. GAAP financial measures. We believe that reconciliation of these non-GAAP measures to the most directly comparable GAAP measure provides investors an overall understanding of our current financial performance and its prospects for the future. Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that represents our net income, adjusted to eliminate the effect of depreciation and amortization charges, interest income and other financial gains, interest expense and other financial losses, foreign currency losses, net, income tax expense and equity in earnings of an unconsolidated entity. We have included this non-GAAP financial measure because it is used by our Management to evaluate our operating performance and trends, make strategic decisions and the calculation of leverage ratios. Accordingly, we believe this measure provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our Management. In addition, it provides a useful measure for period-to-period comparisons of our business, as it removes the effect of certain items. The following table presents a reconciliation of net income to Adjusted EBITDA for the period indicated: Three Months Ended September 30, 2024 2023 (In millions) Net income $ 397 $ 359 Adjustments: Depreciation and amortization 157 135 Interest income and other financial gains (43) (38) Interest expense and other financial losses 40 53 Foreign currency losses, net 40 239 Income tax expense 123 172 Adjusted EBITDA $ 714 $ 920 Q3’24 Results Non-GAAP Measures of Financial Performance 14

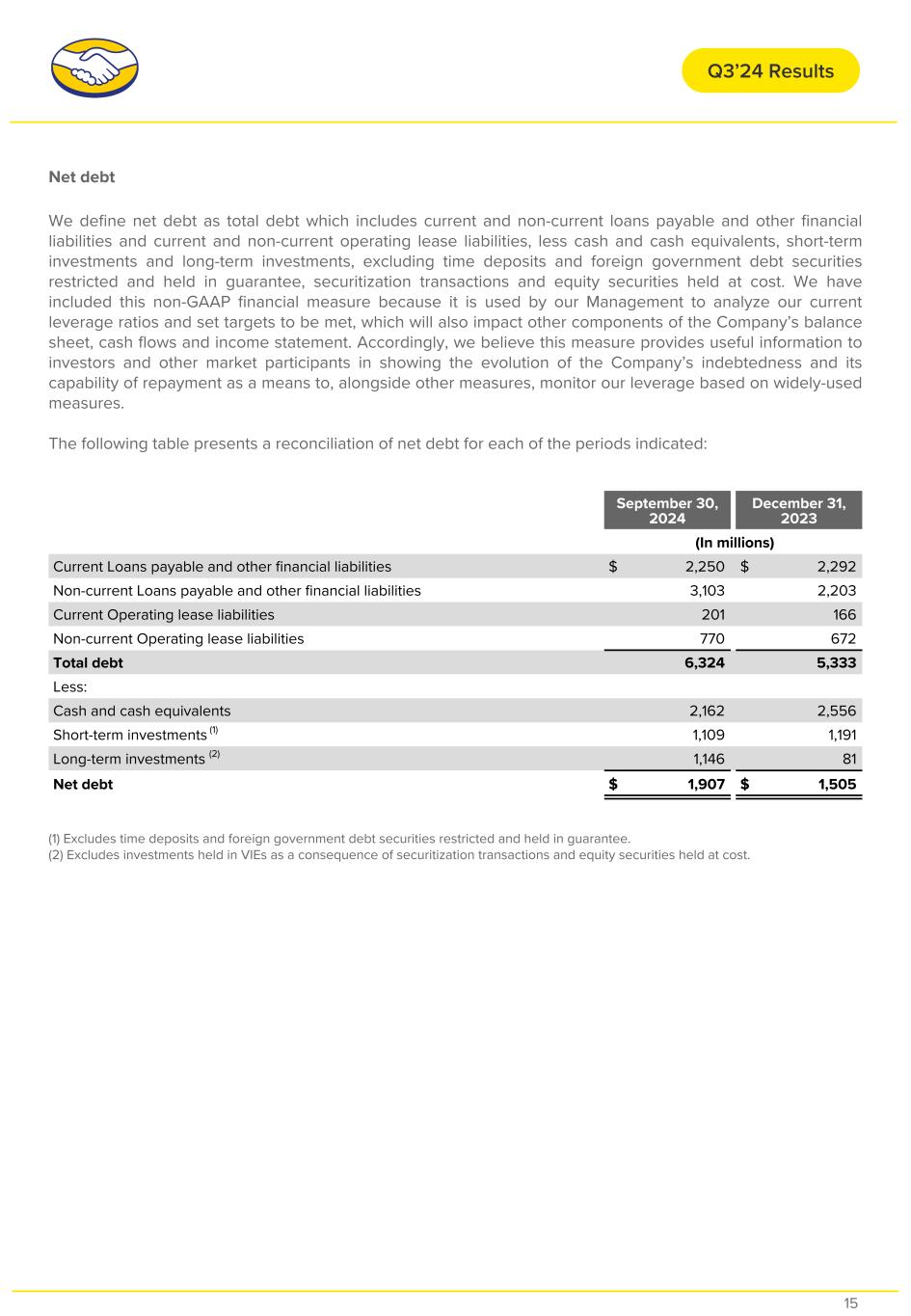

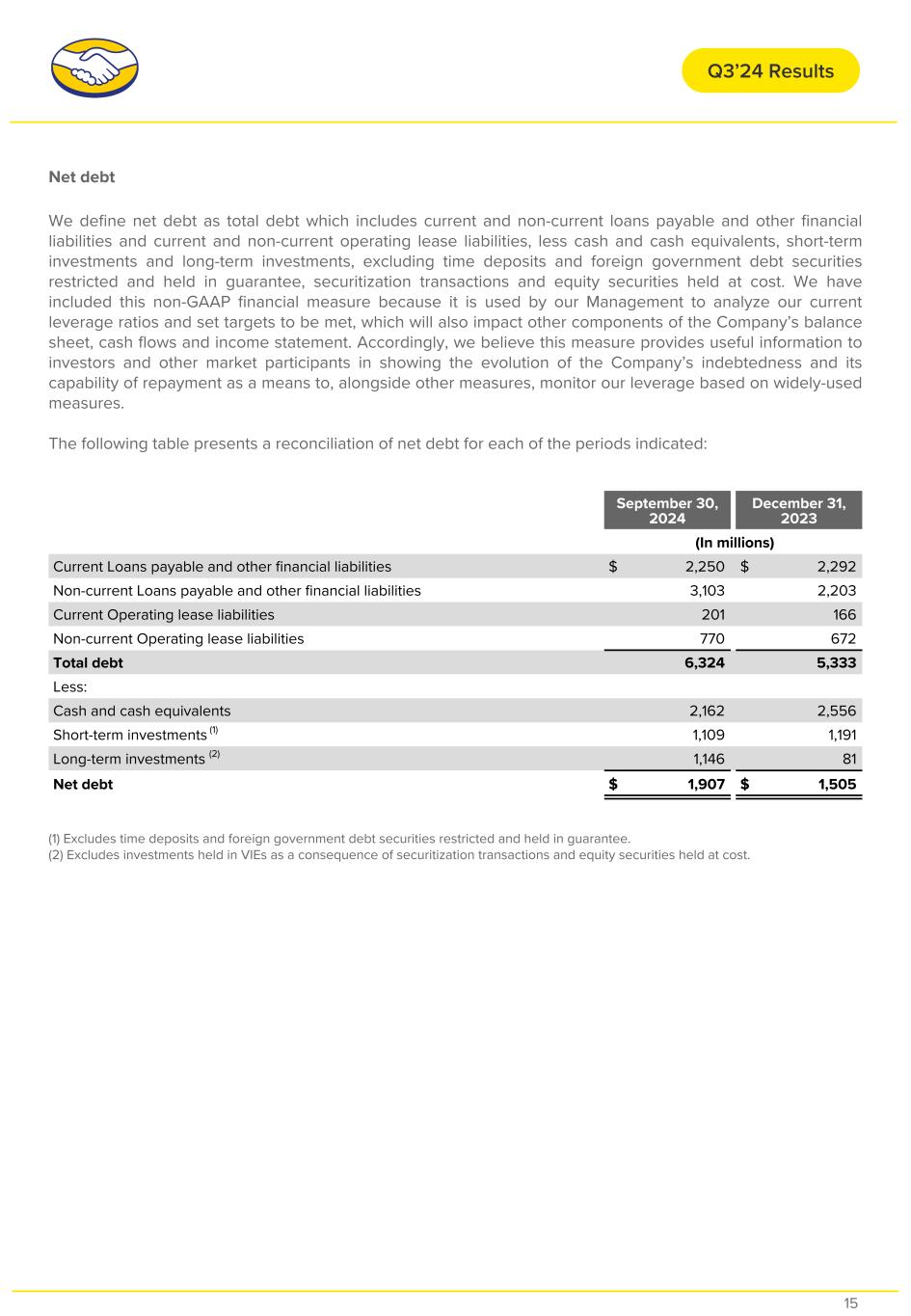

Net debt We define net debt as total debt which includes current and non-current loans payable and other financial liabilities and current and non-current operating lease liabilities, less cash and cash equivalents, short-term investments and long-term investments, excluding time deposits and foreign government debt securities restricted and held in guarantee, securitization transactions and equity securities held at cost. We have included this non-GAAP financial measure because it is used by our Management to analyze our current leverage ratios and set targets to be met, which will also impact other components of the Company’s balance sheet, cash flows and income statement. Accordingly, we believe this measure provides useful information to investors and other market participants in showing the evolution of the Company’s indebtedness and its capability of repayment as a means to, alongside other measures, monitor our leverage based on widely-used measures. The following table presents a reconciliation of net debt for each of the periods indicated: (1) Excludes time deposits and foreign government debt securities restricted and held in guarantee. (2) Excludes investments held in VIEs as a consequence of securitization transactions and equity securities held at cost. September 30, 2024 December 31, 2023 (In millions) Current Loans payable and other financial liabilities $ 2,250 $ 2,292 Non-current Loans payable and other financial liabilities 3,103 2,203 Current Operating lease liabilities 201 166 Non-current Operating lease liabilities 770 672 Total debt 6,324 5,333 Less: Cash and cash equivalents 2,162 2,556 Short-term investments (1) 1,109 1,191 Long-term investments (2) 1,146 81 Net debt $ 1,907 $ 1,505 Q3’24 Results 15

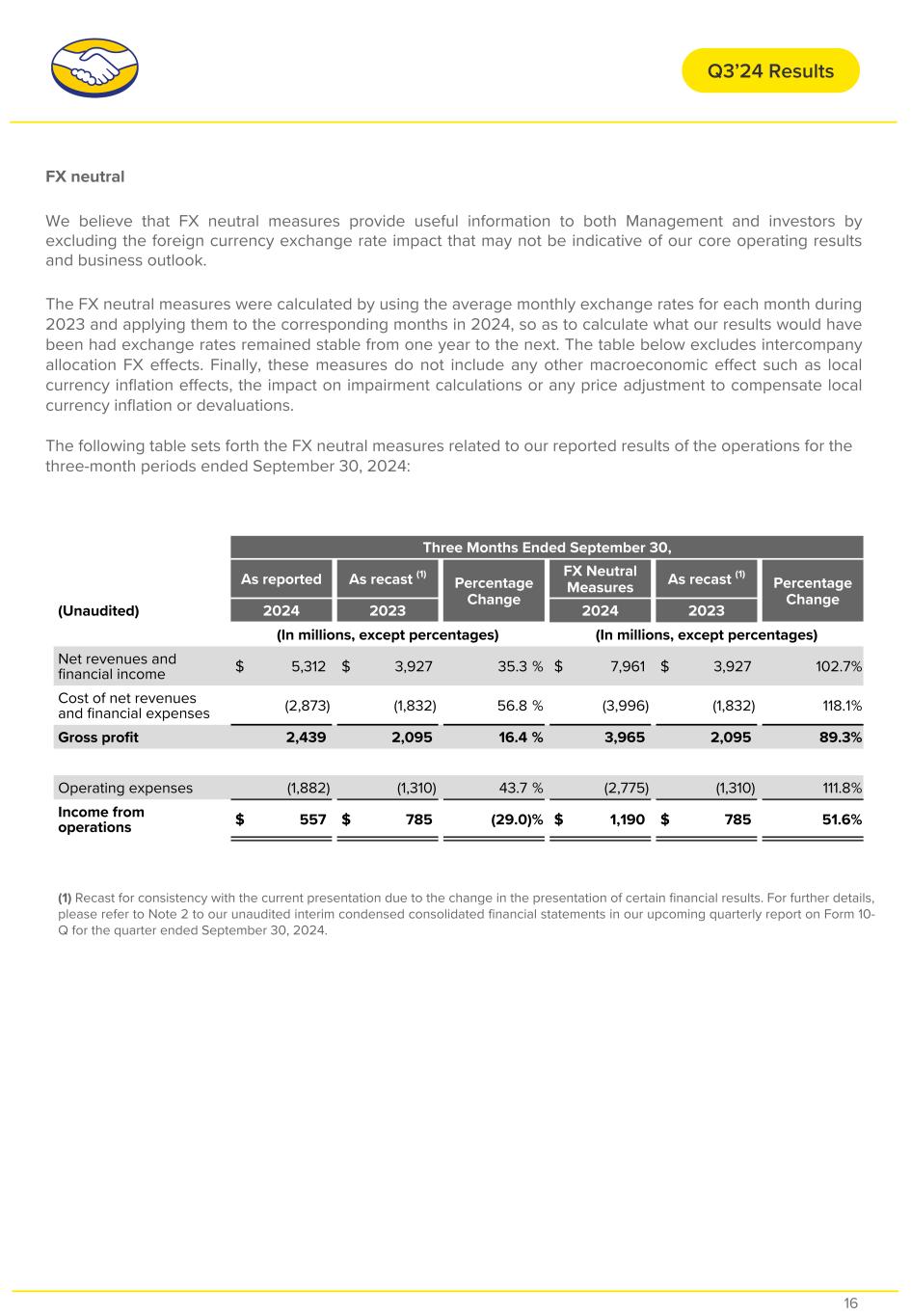

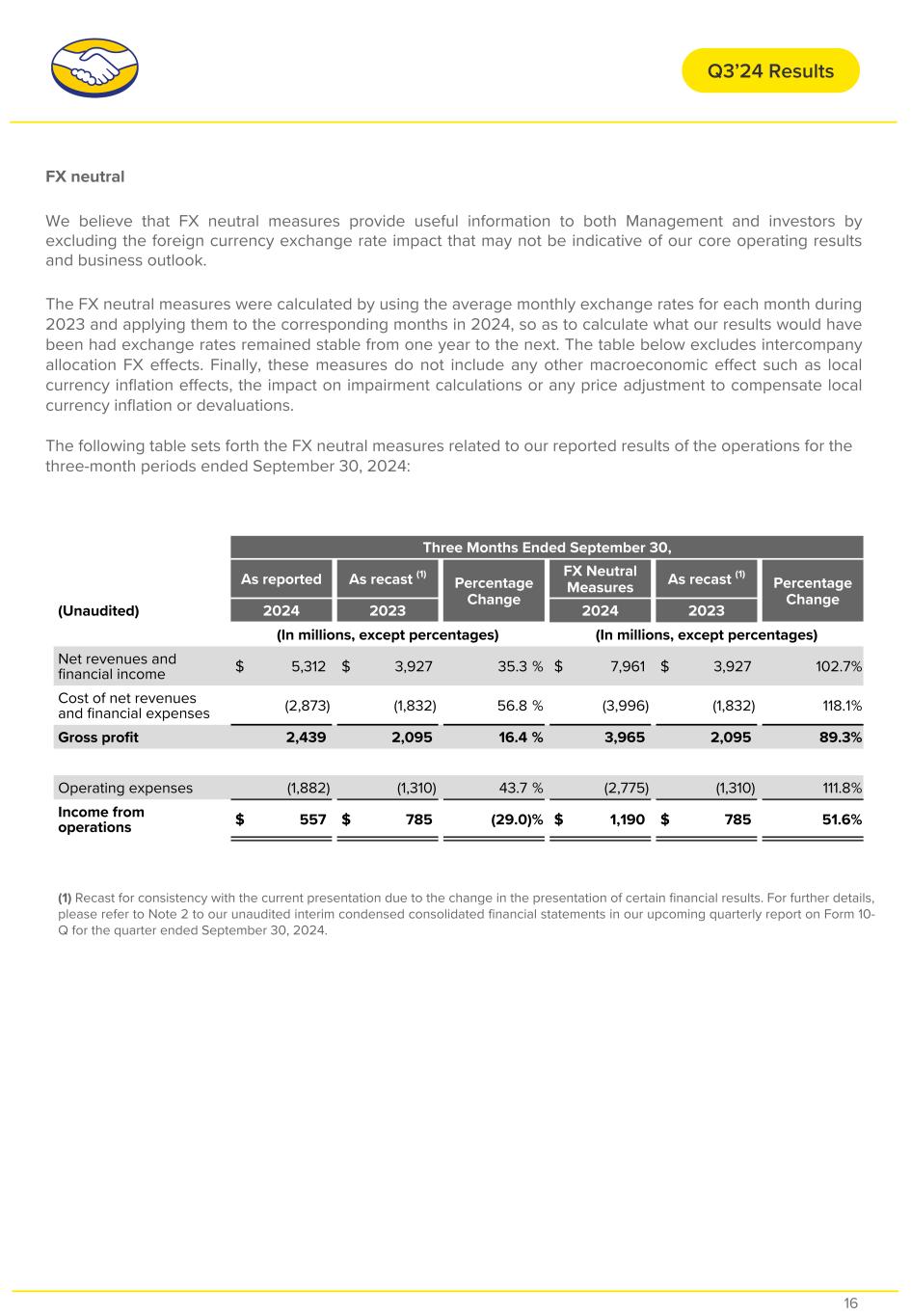

FX neutral We believe that FX neutral measures provide useful information to both Management and investors by excluding the foreign currency exchange rate impact that may not be indicative of our core operating results and business outlook. The FX neutral measures were calculated by using the average monthly exchange rates for each month during 2023 and applying them to the corresponding months in 2024, so as to calculate what our results would have been had exchange rates remained stable from one year to the next. The table below excludes intercompany allocation FX effects. Finally, these measures do not include any other macroeconomic effect such as local currency inflation effects, the impact on impairment calculations or any price adjustment to compensate local currency inflation or devaluations. The following table sets forth the FX neutral measures related to our reported results of the operations for the three-month periods ended September 30, 2024: Three Months Ended September 30, As reported As recast (1) Percentage Change FX Neutral Measures As recast (1) Percentage Change (Unaudited) 2024 2023 2024 2023 (In millions, except percentages) (In millions, except percentages) Net revenues and financial income $ 5,312 $ 3,927 35.3 % $ 7,961 $ 3,927 102.7 % Cost of net revenues and financial expenses (2,873) (1,832) 56.8 % (3,996) (1,832) 118.1 % Gross profit 2,439 2,095 16.4 % 3,965 2,095 89.3 % Operating expenses (1,882) (1,310) 43.7 % (2,775) (1,310) 111.8 % Income from operations $ 557 $ 785 (29.0) % $ 1,190 $ 785 51.6 % Q3’24 Results (1) Recast for consistency with the current presentation due to the change in the presentation of certain financial results. For further details, please refer to Note 2 to our unaudited interim condensed consolidated financial statements in our upcoming quarterly report on Form 10- Q for the quarter ended September 30, 2024. 16

Adjusted free cash flow and Net increase (decrease) in available cash and investments Adjusted free cash flow Adjusted free cash flow represents cash from operating activities less the increase (decrease) in cash and cash equivalents and investments related to customer funds due to regulatory requirements and other restrictions and equity securities held at cost, investments in property and equipment and intangible assets, changes in loans receivable, net and net proceeds from/payments on loans payable and other financial liabilities related to our Fintech solutions, since we consider those liabilities as the working capital of the Fintech activities. We consider adjusted free cash flow to be a measure of liquidity generation that provides useful information to management and investors since it shows how much cash the Company generates with its core activities that can be used for discretionary purposes and to repay its corporate and/or commerce debt. A limitation of the utility of adjusted free cash flow as a measure of liquidity generation is that it is a partial representation of the total increase or decrease in our available cash and investments balance for the period. Therefore, we believe it is important to view the adjusted free cash flow measure only as a complement to our entire consolidated statements of cash flows. Net increase (decrease) in available cash and investments Net increase (decrease) in available cash and investments represents adjusted free cash flow less net proceeds from/payments on loans payable and other financial liabilities, related to our Commerce and corporate activities, payments of finance lease obligations, other investing and/or financing activities not considered above and the effect of exchange rates changes on available cash and investments. We consider Net increase (decrease) in available cash and investments to be a measure of liquidity availability that provides useful information to management and investors after netting out all other debt and corporate payments and activities from the adjusted free cash flow. Q3’24 Results 17

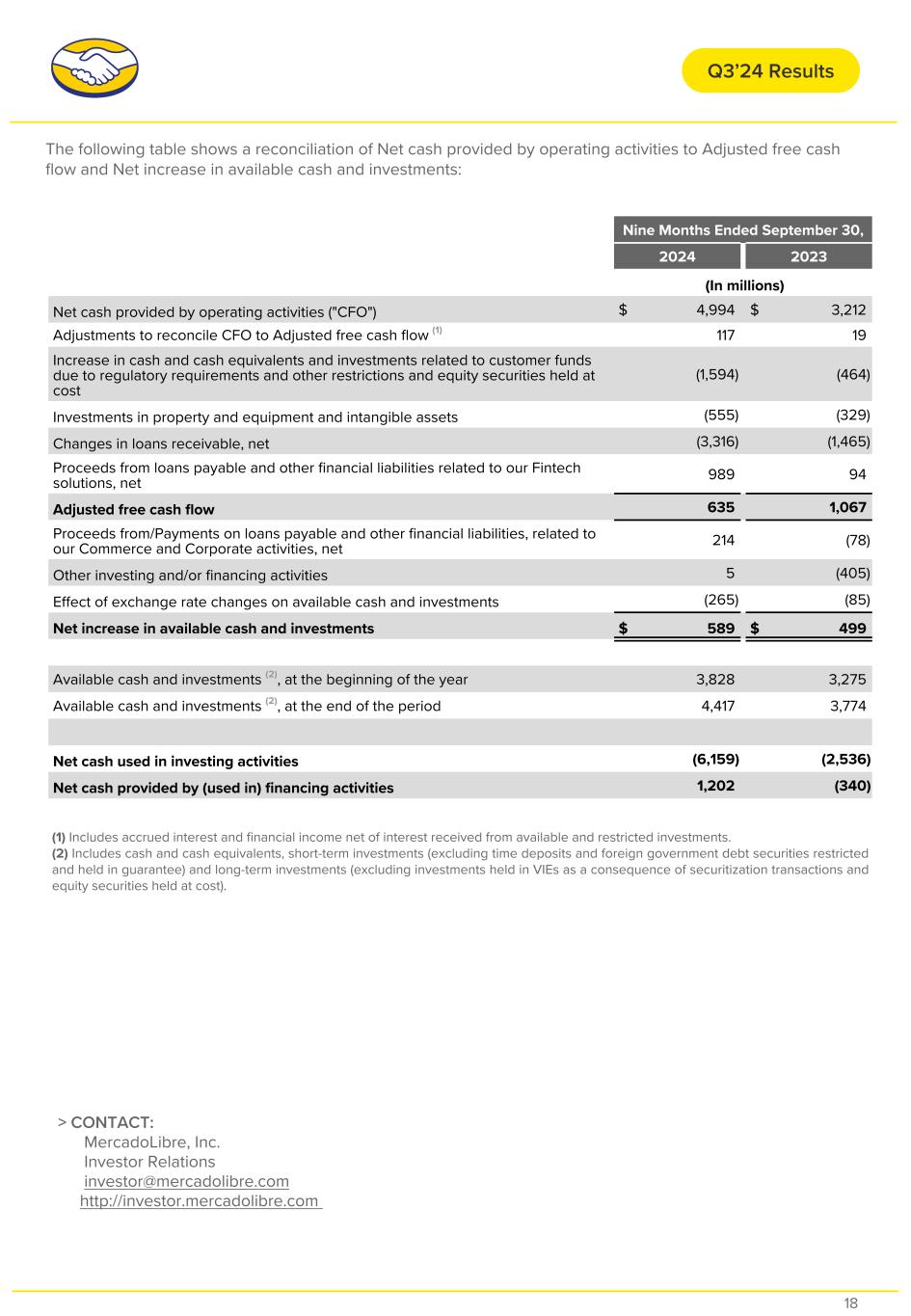

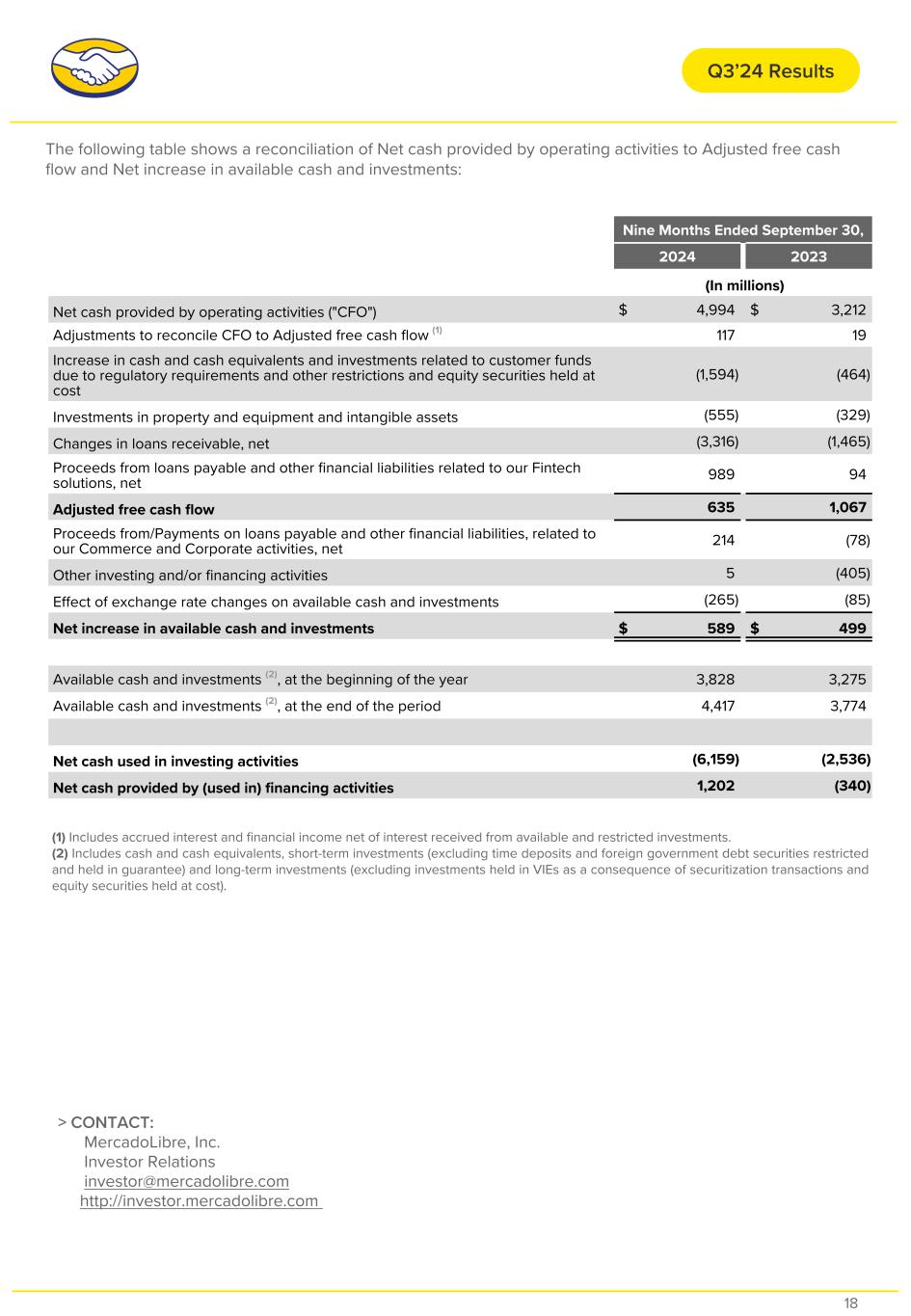

> CONTACT: MercadoLibre, Inc. Investor Relations investor@mercadolibre.com http://investor.mercadolibre.com The following table shows a reconciliation of Net cash provided by operating activities to Adjusted free cash flow and Net increase in available cash and investments: Q3’24 Results Nine Months Ended September 30, 2024 2023 (In millions) Net cash provided by operating activities ("CFO") $ 4,994 $ 3,212 Adjustments to reconcile CFO to Adjusted free cash flow (1) 117 19 Increase in cash and cash equivalents and investments related to customer funds due to regulatory requirements and other restrictions and equity securities held at cost (1,594) (464) Investments in property and equipment and intangible assets (555) (329) Changes in loans receivable, net (3,316) (1,465) Proceeds from loans payable and other financial liabilities related to our Fintech solutions, net 989 94 Adjusted free cash flow 635 1,067 Proceeds from/Payments on loans payable and other financial liabilities, related to our Commerce and Corporate activities, net 214 (78) Other investing and/or financing activities 5 (405) Effect of exchange rate changes on available cash and investments (265) (85) Net increase in available cash and investments $ 589 $ 499 Available cash and investments (2), at the beginning of the year 3,828 3,275 Available cash and investments (2), at the end of the period 4,417 3,774 Net cash used in investing activities (6,159) (2,536) Net cash provided by (used in) financing activities 1,202 (340) (1) Includes accrued interest and financial income net of interest received from available and restricted investments. (2) Includes cash and cash equivalents, short-term investments (excluding time deposits and foreign government debt securities restricted and held in guarantee) and long-term investments (excluding investments held in VIEs as a consequence of securitization transactions and equity securities held at cost). 18