0001099219false00010992192025-12-302025-12-300001099219us-gaap:CommonStockMember2025-12-302025-12-300001099219us-gaap:SeriesAPreferredStockMember2025-12-302025-12-300001099219us-gaap:SeriesEPreferredStockMember2025-12-302025-12-300001099219us-gaap:SeriesFPreferredStockMember2025-12-302025-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 30, 2025

METLIFE, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1-15787 |

|

13-4075851 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

200 Park Avenue, |

New York, |

NY |

|

|

10166-0188 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(212) 578-9500

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 |

MET |

New York Stock Exchange |

Floating Rate Non-Cumulative Preferred Stock,

Series A, par value $0.01 |

MET PRA |

New York Stock Exchange |

Depositary Shares, each representing a 1/1,000th

interest in a share of 5.625% Non-Cumulative

Preferred Stock, Series E |

MET PRE |

New York Stock Exchange |

| Depositary Shares, each representing a 1/1,000th interest in a share of 4.75% Non-Cumulative Preferred Stock, Series F |

MET PRF

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On December 30, 2025, MetLife, Inc. issued a news release announcing the closing of the acquisition (the “Acquisition”) by MetLife Investment Management of PineBridge Investments, LLC and certain of its affiliates (collectively, “PineBridge”). A copy of the news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The news release is furnished as of December 30, 2025, but not filed, pursuant to Instruction B.2 of Form 8-K.

Item 8.01 Other Events.

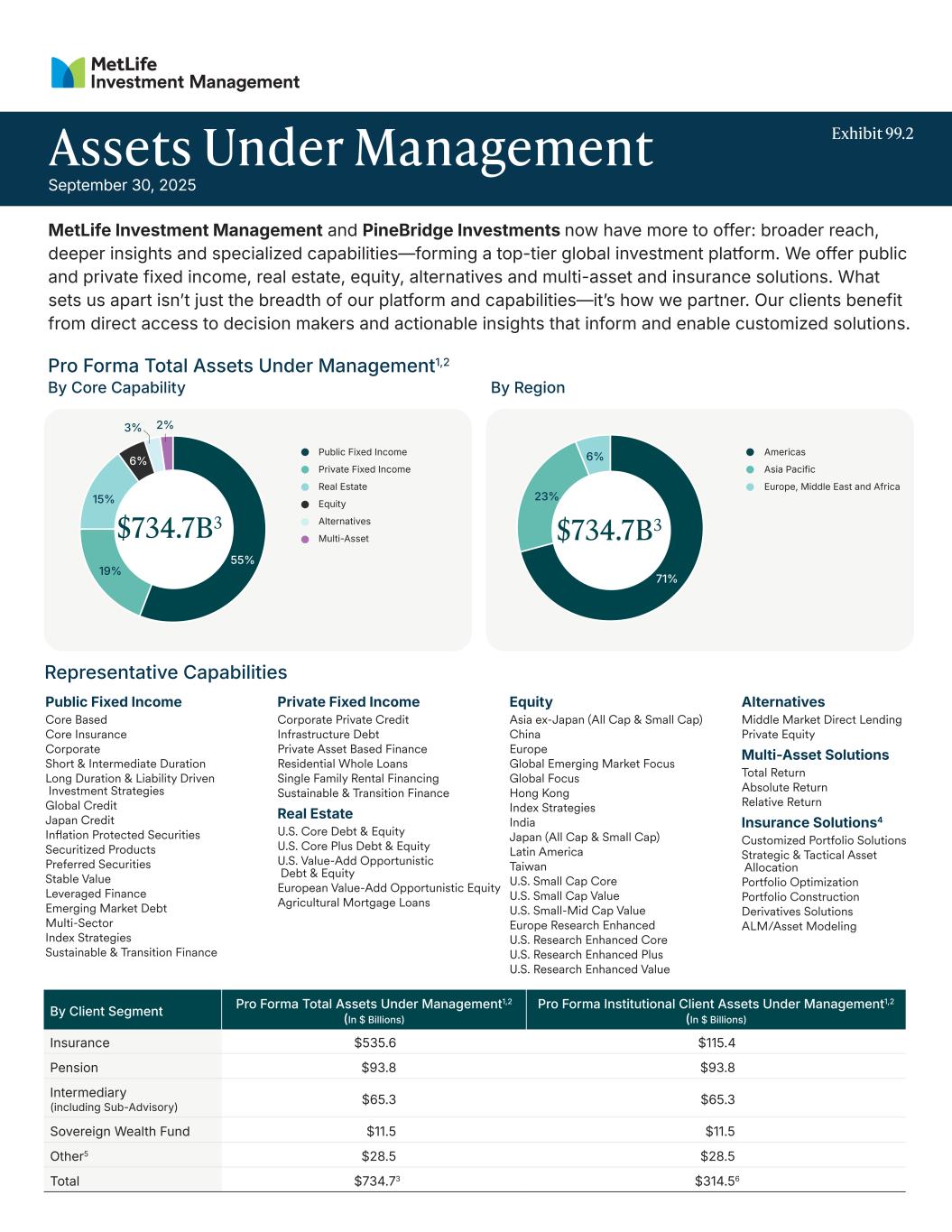

On December 30, 2025, MetLife, Inc. issued a fact sheet setting forth the pro forma combined total assets under management of MetLife Investment Management and PineBridge, as if the Acquisition had occurred as of September 30, 2025 (the “Pro Forma Combined Total AUM Fact Sheet”), a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The foregoing description of the Pro Forma Combined Total AUM Fact Sheet is not complete and is qualified in its entirety by reference to the Pro Forma Combined Total AUM Fact Sheet.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

| 101 |

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language) |

|

|

|

|

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| METLIFE, INC. |

|

|

| By: |

|

/s/ Adrienne O’Neill |

|

|

Name: |

|

Adrienne O’Neill |

|

|

Title: |

|

Executive Vice President and

Chief Accounting Officer |

Date: December 30, 2025

EX-99.1

2

ex991mim_pbxclosepressre.htm

EX-99.1

ex991mim_pbxclosepressre

Exhibit 99.1 MetLife Investment Management Completes Acquisition of PineBridge Investments The combination brings together global scale and deep specialization, accelerating MetLife’s growth in asset management WHIPPANY, N.J., December 30, 2025 – MetLife Investment Management (MIM), the institutional asset management business of MetLife, Inc. (NYSE: MET), closed today on its acquisition of PineBridge Investments (PineBridge). The combined business manages $734.7 billion1 of assets, serving clients around the world. Accelerating growth in asset management is a top priority for MetLife in its New Frontier strategy. The acquisition brings together MIM’s institutional strength and scale with PineBridge’s global footprint and deep specialization to position MIM as a top-tier diversified global asset manager. “Together, we are building a firm designed to meet today’s market challenges and capture tomorrow’s investment opportunities,” said John McCallion, Chief Financial Officer of MetLife and Head of MIM. “We’re confident the combination of these two firms furthers our ambition to accelerate growth in line with our New Frontier strategy.” MIM also announced its new senior leadership team, drawing top talent from both organizations. Brian Funk, president of MIM, will lead the combined business post- close. For more information on MIM’s leadership team, visit https://investments.metlife.com or https://www.pinebridge.com. “Our leadership team reflects the best of both firms,” said Funk. “Together, our expertise and shared vision enable us to generate greater long-term value for our clients.” In December 2024, MIM announced its agreement to acquire PineBridge from the Pacific Century Group. More than half of the client assets acquired in the transaction are held by investors outside of the U.S., with one-third in Asia. The acquisition excludes PineBridge’s private equity funds group business and its joint venture in China. # # # For Media: Brian Blaser +1 (917) 674-3558 bblaser@metlife.com

For Investors: John Hall +1 (212) 578-7888 John.A.Hall@metlife.com About MetLife Investment Management MetLife Investment Management, the institutional asset management business of MetLife, Inc. (NYSE: MET), provides tailored investment management solutions to institutional investors worldwide. MetLife Investment Management has long-established global expertise in multi-asset, equities, public and private fixed income, real estate, alternatives, and insurance solutions and provides public and private pension plans, insurance companies, endowments, funds and other institutional clients with a range of bespoke investment solutions that seek to meet a range of long-term investment objectives and risk-adjusted returns over time. MetLife Investment Management has over 150 years of investment experience and, as of September 30, 2025, had $734.7 billion in pro forma combined total assets under management. For more information, see the Pro Forma Combined Total Assets Under Management Fact Sheet for the quarter ended September 30, 2025 available on MetLife’s Investor Relations webpage (https://investor.metlife.com). About MetLife MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates (“MetLife”), is one of the world’s leading financial services companies, providing insurance, annuities, employee benefits and asset management to help individual and institutional customers build a more confident future. Founded in 1868, MetLife has operations in more than 40 markets globally and holds leading positions in the United States, Asia, Latin America, Europe and the Middle East. For more information, visit https://www.metlife.com. Forward-Looking Statements The forward-looking statements in this news release, using words such as “confident,” “enable,” “furthers,” “position,” “seek,” and “will” are based on assumptions and expectations that involve risks and uncertainties, including the “Risk Factors” MetLife, Inc. describes in its U.S. Securities and Exchange Commission filings. MetLife’s future results could differ, and it does not undertake any obligation to publicly correct or update any of these statements. Endnotes 1 At estimated fair value. Represents the pro forma combined assets managed or advised by MIM and PineBridge, as if the acquisition had occurred as of September 30, 2025. The pro forma figure is presented for illustrative purposes only and does not reflect actual combined results for the completed period.