| 1-15787 | 13-4075851 | |||||||||||||||||||

| (Commission File Number) | (IRS Employer Identification No.) | |||||||||||||||||||

| 200 Park Avenue, | New York, | NY | 10166-0188 | |||||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 | MET | New York Stock Exchange | ||||||

| Floating Rate Non-Cumulative Preferred Stock, Series A, par value $0.01 |

MET PRA | New York Stock Exchange | ||||||

| Depositary Shares, each representing a 1/1,000th interest in a share of 5.625% Non-Cumulative Preferred Stock, Series E |

MET PRE | New York Stock Exchange | ||||||

| Depositary Shares, each representing a 1/1,000th interest in a share of 4.75% Non-Cumulative Preferred Stock, Series F | MET PRF |

New York Stock Exchange |

||||||

| 101 | Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language) | ||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101) | ||||

| METLIFE, INC. | ||||||||||||||

| By: | /s/ Tamara L. Schock | |||||||||||||

| Name: | Tamara L. Schock | |||||||||||||

| Title: | Executive Vice President and Chief Accounting Officer |

|||||||||||||

| ($ in millions, except per share data) | Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||||||

| Premiums, fees and other revenues | $ | 14,475 | $ | 13,687 | 6% | $ | 52,520 | $ | 51,961 | 1% | ||||||||||||||||||||||||||||||||||

Net investment income |

5,405 | 5,366 | 1% | 21,273 | 19,908 | 7% | ||||||||||||||||||||||||||||||||||||||

Net investment gains (losses) |

(311) | (174) | (1,184) | (2,824) | ||||||||||||||||||||||||||||||||||||||||

| Net derivative gains (losses) | (903) | 149 | (1,623) | (2,140) | ||||||||||||||||||||||||||||||||||||||||

Total revenues |

$ | 18,666 | $ | 19,028 | $ | 70,986 | $ | 66,905 | ||||||||||||||||||||||||||||||||||||

Adjusted premiums, fees and other revenues |

$ | 14,437 | $ | 13,671 | 6% | $ | 52,379 | $ | 51,966 | 1% | ||||||||||||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues, excluding pension risk transfers (PRT) | $ | 11,844 | $ | 11,811 | $ | 47,530 | $ | 46,642 | 2% | |||||||||||||||||||||||||||||||||||

| Market risk benefit remeasurement gains (losses) | $ | 764 | $ | (431) | $ | 1,109 | $ | 994 | ||||||||||||||||||||||||||||||||||||

Net income (loss) |

$ | 1,239 | $ | 574 | 116% | $ | 4,226 | $ | 1,380 | 206% | ||||||||||||||||||||||||||||||||||

Net income (loss) per share |

$ | 1.78 | $ | 0.77 | 131% | $ | 5.94 | $ | 1.81 | 228% | ||||||||||||||||||||||||||||||||||

Adjusted earnings |

$ | 1,459 | $ | 1,361 | 7% | $ | 5,796 | $ | 5,525 | 5% | ||||||||||||||||||||||||||||||||||

Adjusted earnings per share |

$ | 2.09 | $ | 1.83 | 14% | $ | 8.15 | $ | 7.25 | 12% | ||||||||||||||||||||||||||||||||||

Adjusted earnings, excluding total notable items |

$ | 1,449 | $ | 1,437 | 1% | $ | 5,770 | $ | 5,587 | 3% | ||||||||||||||||||||||||||||||||||

Adjusted earnings, excluding total notable items per share |

$ | 2.08 | $ | 1.93 | 8% | $ | 8.11 | $ | 7.33 | 11% | ||||||||||||||||||||||||||||||||||

Book value per share |

$ | 34.28 | $ | 35.85 | (4)% | $ | 34.28 | $ | 35.85 | (4)% | ||||||||||||||||||||||||||||||||||

| Adjusted book value* per share | $ | 54.81 | $ | 53.75 | 2% | $ | 54.81 | $ | 53.75 | 2% | ||||||||||||||||||||||||||||||||||

Expense ratio |

17.8 | % | 18.6 | % | 19.0 | % | 18.7 | % | ||||||||||||||||||||||||||||||||||||

Direct expense ratio, excluding total notable items related to direct expenses and PRT |

13.1 | % | 12.4 | % | 12.1 | % | 12.2 | % | ||||||||||||||||||||||||||||||||||||

| Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT | 21.9 | % | 20.6 | % | 20.9 | % | 20.5 | % | ||||||||||||||||||||||||||||||||||||

ROE |

19.6 | % | 9.6 | % | 16.9 | % | 5.4 | % | ||||||||||||||||||||||||||||||||||||

| Adjusted ROE* | 15.4 | % | 13.8 | % | 15.2 | % | 13.6 | % | ||||||||||||||||||||||||||||||||||||

| Adjusted ROE,* excluding total notable items | 15.3 | % | 14.6 | % | 15.2 | % | 13.8 | % | ||||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2024 |

Year Ended December 31, 2024 |

|||||||||||||

| Segment | Change from prior-year period (on a reported basis) |

Change from prior-year period (on a constant currency basis) |

Change from prior year |

Change from prior year (on a constant currency basis) |

||||||||||

| Group Benefits | (11)% | (3)% | ||||||||||||

| Retirement and Income Solutions (RIS) | (8)% | (2)% | ||||||||||||

| Asia | 50% | 52% | 26% | 30% | ||||||||||

| Latin America | (3)% | 10% | 5% | 11% | ||||||||||

Europe, the Middle East and Africa (EMEA) |

26% | 31% | 7% | 12% | ||||||||||

| MetLife Holdings | (2)% | (12)% | ||||||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | ||||||||

Adjusted earnings |

$416 | $466 | (11)% | ||||||||

| Notable item(s) | $0 | $0 | |||||||||

| Adjusted earnings ex. notables | $416 | $466 | (11)% | ||||||||

Adjusted premiums, fees and other revenues |

$6,184 | $6,001 | 3% | ||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | ||||||||

Adjusted earnings |

$386 | $421 | (8)% | ||||||||

| Notable item(s) | $0 | $0 | |||||||||

| Adjusted earnings ex. notables | $386 | $421 | (8)% | ||||||||

Adjusted premiums, fees and other revenues |

$3,620 | $2,883 | 26% | ||||||||

Adjusted premiums, fees and other revenues, excluding PRT |

$1,027 | $1,023 | —% | ||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | Constant currency change |

||||||||||

| Adjusted earnings | $443 | $296 | 50% | 52% | ||||||||||

| Notable item(s) | $0 | $0 | ||||||||||||

| Adjusted earnings ex. notables | $443 | $296 | 50% | 52% | ||||||||||

Adjusted premiums, fees and other revenues |

$1,635 | $1,705 | (4)% | (1)% | ||||||||||

| Asia general account assets under management (at amortized cost) | $129,959 | $130,093 | —% | 5% | ||||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | Constant currency change |

||||||||||

| Adjusted earnings | $201 | $207 | (3)% | 10% | ||||||||||

| Notable item(s) | $0 | $0 | ||||||||||||

| Adjusted earnings ex. notables | $201 | $207 | (3)% | 10% | ||||||||||

Adjusted premiums, fees and other revenues |

$1,438 | $1,486 | (3)% | 9% | ||||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | Constant currency change |

||||||||||

Adjusted earnings |

$59 | $47 | 26% | 31% | ||||||||||

Notable item(s) |

$0 | $0 | ||||||||||||

| Adjusted earnings ex. notables | $59 | $47 | 26% | 31% | ||||||||||

Adjusted premiums, fees and other revenues |

$652 | $595 | 10% | 13% | ||||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | ||||||||

Adjusted earnings |

$153 | $156 | (2)% | ||||||||

Notable item(s) |

$0 | $0 | |||||||||

| Adjusted earnings ex. notables | $153 | $156 | (2)% | ||||||||

Adjusted premiums, fees and other revenues |

$815 | $901 | (10)% | ||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | ||||||||

| Adjusted earnings | $(199) | $(232) | |||||||||

| Notable item(s) | $10 | $(76) | |||||||||

| Adjusted earnings ex. notables | $(209) | $(156) | |||||||||

| ($ in millions) | Three Months Ended December 31, 2024 |

Three Months Ended December 31, 2023 |

Change | ||||||||

Adjusted net investment income |

$5,301 | $5,047 | 5% | ||||||||

($ in millions) |

Adjusted Earnings |

|||||||||||||||||||||||||

| Three Months Ended December 31, 2024 | ||||||||||||||||||||||||||

| Notable Items | Group Benefits | RIS | Asia | Latin America |

EMEA | MetLife Holdings |

Corporate & Other |

Total | ||||||||||||||||||

| Litigation reserves and settlement costs | $0 | $0 | $0 | $0 | $0 | $0 | $(47) | $(47) | ||||||||||||||||||

| Tax adjustments | $0 | $0 | $0 | $0 | $0 | $0 | $57 | $57 | ||||||||||||||||||

| Total notable items | $0 | $0 | $0 | $0 | $0 | $0 | $10 | $10 | ||||||||||||||||||

| Any references in this news release (except in this section and the tables that accompany this release) to: | should be read as, respectively: | |||||||||||||

| (i) | net income (loss); | (i) | net income (loss) available to MetLife, Inc.’s common shareholders; | |||||||||||

| (ii) | net income (loss) per share; | (ii) | net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; | |||||||||||

| (iii) | adjusted earnings; | (iii) | adjusted earnings available to common shareholders; | |||||||||||

| (iv) | adjusted earnings per share; | (iv) | adjusted earnings available to common shareholders per diluted common share; | |||||||||||

| (v) | book value per share; | (v) | book value per common share; | |||||||||||

| (vi) | adjusted book value per share; | (vi) | adjusted book value per common share; | |||||||||||

| (vii) | return on equity; and | (vii) | return on MetLife, Inc.’s common stockholders’ equity; and |

|||||||||||

| (viii) | adjusted return on equity. | (viii) | adjusted return on MetLife, Inc.’s common stockholders’ equity. |

|||||||||||

| Non-GAAP financial measures: | Comparable GAAP financial measures: | |||||||||||||

| (i) | total adjusted revenues; | (i) | total revenues; | |||||||||||

| (ii) | total adjusted expenses; | (ii) | total expenses; | |||||||||||

| (iii) | adjusted premiums, fees and other revenues; | (iii) | premiums, fees and other revenues; | |||||||||||

| (iv) | adjusted premiums, fees and other revenues, excluding PRT; | (iv) | premiums, fees and other revenues; | |||||||||||

| (v) | adjusted net investment income; | (v) | net investment income; | |||||||||||

| (vi) | adjusted earnings available to common shareholders; | (vi) | net income (loss) available to MetLife, Inc.’s common shareholders; | |||||||||||

| (vii) | adjusted earnings available to common shareholders, excluding total notable items; | (vii) | net income (loss) available to MetLife, Inc.’s common shareholders; | |||||||||||

| (viii) | adjusted earnings available to common shareholders per diluted common share; | (viii) | net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; | |||||||||||

| (ix) | adjusted earnings available to common shareholders, excluding total notable items, per diluted common share; | (ix) | net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; | |||||||||||

| (x) | adjusted return on equity; | (x) | return on equity; | |||||||||||

| (xi) | adjusted return on equity, excluding total notable items; | (xi) | return on equity; | |||||||||||

| (xii) | investment portfolio gains (losses); | (xii) | net investment gains (losses); | |||||||||||

| (xiii) | derivative gains (losses); | (xiii) | net derivative gains (losses); | |||||||||||

| (xiv) | adjusted capitalization of deferred policy acquisition costs (DAC); | (xiv) | capitalization of DAC; | |||||||||||

| (xv) | total MetLife, Inc.’s adjusted common stockholders’ equity; | (xv) | total MetLife, Inc.’s stockholders’ equity; | |||||||||||

| (xvi) | total MetLife, Inc.’s adjusted common stockholders’ equity, excluding total notable items; | (xvi) | total MetLife, Inc.’s stockholders’ equity; | |||||||||||

| (xvii) | adjusted book value per common share; | (xvii) | book value per common share; | |||||||||||

| (xviii) | adjusted other expenses; | (xviii) | other expenses; | |||||||||||

| (xix) | adjusted other expenses, net of adjusted capitalization of DAC; | (xix) | other expenses, net of capitalization of DAC; |

|||||||||||

| (xx) | adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses; | (xx) | other expenses, net of capitalization of DAC; | |||||||||||

| (xxi) | adjusted expense ratio; | (xxi) | expense ratio; | |||||||||||

| (xxii) | adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT; | (xxii) | expense ratio; |

|||||||||||

| (xxiii) | direct expenses; | (xxiii) | other expenses; | |||||||||||

| (xxiv) | direct expenses, excluding total notable items related to direct expenses; | (xxiv) | other expenses; |

|||||||||||

| (xxv) | direct expense ratio; | (xxv) | expense ratio; | |||||||||||

| (xxvi) | direct expense ratio, excluding total notable items related to direct expenses and PRT; | (xxvi) | expense ratio; | |||||||||||

| (xxvii) | future policy benefits at original discount rate; and | (xxvii) | future policy benefits at balance sheet discount rate; and | |||||||||||

| (xxviii) | free cash flow of all holding companies. | (xxviii) | MetLife, Inc. (parent company only) net cash provided by (used in) operating activities. | |||||||||||

| MetLife, Inc. | ||||||||||||||||||||||||||

| GAAP Consolidated Statements of Operations | ||||||||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||

| Premiums | $ | 12,617 | $ | 11,786 | $ | 44,945 | $ | 44,283 | ||||||||||||||||||

| Universal life and investment-type product policy fees | 1,217 | 1,241 | 4,974 | 5,152 | ||||||||||||||||||||||

| Net investment income | 5,405 | 5,366 | 21,273 | 19,908 | ||||||||||||||||||||||

| Other revenues | 641 | 660 | 2,601 | 2,526 | ||||||||||||||||||||||

| Net investment gains (losses) | (311) | (174) | (1,184) | (2,824) | ||||||||||||||||||||||

| Net derivative gains (losses) | (903) | 149 | (1,623) | (2,140) | ||||||||||||||||||||||

| Total revenues | 18,666 | 19,028 | 70,986 | 66,905 | ||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||

| Policyholder benefits and claims | 12,572 | 11,779 | 44,728 | 44,590 | ||||||||||||||||||||||

| Policyholder liability remeasurement (gains) losses | (42) | (3) | (206) | (45) | ||||||||||||||||||||||

| Market risk benefit remeasurement (gains) losses | (764) | 431 | (1,109) | (994) | ||||||||||||||||||||||

| Interest credited to policyholder account balances | 2,012 | 2,405 | 8,339 | 7,860 | ||||||||||||||||||||||

| Policyholder dividends | 150 | 159 | 595 | 622 | ||||||||||||||||||||||

| Amortization of DAC, VOBA and negative VOBA | 517 | 498 | 2,021 | 1,926 | ||||||||||||||||||||||

| Interest expense on debt | 259 | 269 | 1,037 | 1,045 | ||||||||||||||||||||||

| Other expenses, net of capitalization of DAC | 2,581 | 2,549 | 9,959 | 9,739 | ||||||||||||||||||||||

| Total expenses | 17,285 | 18,087 | 65,364 | 64,743 | ||||||||||||||||||||||

| Income (loss) before provision for income tax | 1,381 | 941 | 5,622 | 2,162 | ||||||||||||||||||||||

| Provision for income tax expense (benefit) | 106 | 327 | 1,178 | 560 | ||||||||||||||||||||||

| Net income (loss) | 1,275 | 614 | 4,444 | 1,602 | ||||||||||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests | 4 | 7 | 18 | 24 | ||||||||||||||||||||||

| Net income (loss) attributable to MetLife, Inc. | 1,271 | 607 | 4,426 | 1,578 | ||||||||||||||||||||||

| Less: Preferred stock dividends | 32 | 33 | 200 | 198 | ||||||||||||||||||||||

| Net income (loss) available to MetLife, Inc.'s common shareholders | $ | 1,239 | $ | 574 | $ | 4,226 | $ | 1,380 | ||||||||||||||||||

| See footnotes on last page. | ||||||||||||||||||||||||||

| MetLife, Inc. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except per share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation to Adjusted Earnings Available to Common Shareholders | Earnings Per Weighted Average Common Share Diluted (1) |

Earnings Per Weighted Average Common Share Diluted (1) |

Earnings Per Weighted Average Common Share Diluted (1) |

Earnings Per Weighted Average Common Share Diluted (1) |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) available to MetLife, Inc.'s common shareholders | $ | 1,239 | $ | 1.78 | $ | 574 | $ | 0.77 | $ | 4,226 | $ | 5.94 | $ | 1,380 | $ | 1.81 | |||||||||||||||||||||||||||||||||||||

| Adjustments from net income (loss) available to common shareholders to adjusted earnings available to common shareholders: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Net investment gains (losses) | (311) | (0.45) | (174) | (0.23) | (1,184) | (1.67) | (2,824) | (3.70) | |||||||||||||||||||||||||||||||||||||||||||||

| Net derivative gains (losses) | (903) | (1.29) | 149 | 0.20 | (1,623) | (2.28) | (2,140) | (2.81) | |||||||||||||||||||||||||||||||||||||||||||||

| Market risk benefit remeasurement gains (losses) | 764 | 1.09 | (431) | (0.58) | 1,109 | 1.56 | 994 | 1.30 | |||||||||||||||||||||||||||||||||||||||||||||

| Premiums | 15 | 0.02 | — | — | 31 | 0.04 | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Universal life and investment-type product policy fees | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Net investment income | 104 | 0.15 | 319 | 0.43 | 601 | 0.85 | 159 | 0.21 | |||||||||||||||||||||||||||||||||||||||||||||

| Other revenues | 23 | 0.03 | 16 | 0.02 | 110 | 0.15 | (5) | (0.01) | |||||||||||||||||||||||||||||||||||||||||||||

| Policyholder benefits and claims and policyholder dividends | (12) | (0.02) | 36 | 0.05 | 18 | 0.03 | 5 | 0.01 | |||||||||||||||||||||||||||||||||||||||||||||

| Policyholder liability remeasurement (gains) losses | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Interest credited to policyholder account balances | (180) | (0.23) | (685) | (0.93) | (1,184) | (1.67) | (1,251) | (1.65) | |||||||||||||||||||||||||||||||||||||||||||||

| Capitalization of DAC | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Amortization of DAC, VOBA and negative VOBA | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Interest expense on debt | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Other expenses | (68) | (0.10) | (16) | (0.02) | (117) | (0.16) | (93) | (0.12) | |||||||||||||||||||||||||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Provision for income tax (expense) benefit | 352 | 0.50 | 6 | 0.01 | 687 | 0.97 | 1,034 | 1.36 | |||||||||||||||||||||||||||||||||||||||||||||

| Add: Net income (loss) attributable to noncontrolling interests | 4 | 0.01 | 7 | 0.01 | 18 | 0.03 | 24 | 0.03 | |||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock redemption premium | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | 1,459 | 2.09 | 1,361 | 1.83 | 5,796 | 8.15 | 5,525 | 7.25 | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Total notable items | 10 | 0.01 | (76) | (0.10) | 26 | 0.04 | (62) | (0.08) | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 1,449 | $ | 2.08 | $ | 1,437 | $ | 1.93 | $ | 5,770 | $ | 8.11 | $ | 5,587 | $ | 7.33 | |||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders on a constant currency basis | $ | 1,459 | $ | 2.09 | $ | 1,329 | $ | 1.79 | $ | 5,796 | $ | 8.15 | $ | 5,430 | $ | 7.12 | |||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis | $ | 1,449 | $ | 2.08 | $ | 1,405 | $ | 1.89 | $ | 5,770 | $ | 8.11 | $ | 5,492 | $ | 7.20 | |||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 697.9 | 743.4 | 711.1 | 762.3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| See footnotes on last page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| MetLife, Inc. | ||||||||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Premiums, Fees and Other Revenues | ||||||||||||||||||||||||||

| Premiums, fees and other revenues | $ | 14,475 | $ | 13,687 | $ | 52,520 | $ | 51,961 | ||||||||||||||||||

| Less: Adjustments to premiums, fees and other revenues: | ||||||||||||||||||||||||||

| Asymmetrical and non-economic accounting | 34 | 29 | 158 | 29 | ||||||||||||||||||||||

| Other adjustments | (11) | (13) | (48) | (34) | ||||||||||||||||||||||

| Divested businesses | 15 | — | 31 | — | ||||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 14,437 | $ | 13,671 | $ | 52,379 | $ | 51,966 | ||||||||||||||||||

| Adjusted premiums, fees and other revenues, on a constant currency basis | $ | 14,437 | $ | 13,440 | $ | 52,379 | $ | 51,966 | ||||||||||||||||||

| Less: PRT | 2,593 | 1,860 | 4,849 | 5,324 | ||||||||||||||||||||||

| Adjusted premiums, fees and other revenues, excluding PRT, on a constant currency basis | $ | 11,844 | $ | 11,580 | $ | 47,530 | $ | 46,642 | ||||||||||||||||||

| Net Investment Income | ||||||||||||||||||||||||||

| Net investment income | $ | 5,405 | $ | 5,366 | $ | 21,273 | $ | 19,908 | ||||||||||||||||||

| Less: Adjustments to net investment income | ||||||||||||||||||||||||||

| Investment hedge adjustments | (127) | (253) | (604) | (1,012) | ||||||||||||||||||||||

| Joint venture adjustments | 16 | (8) | 82 | (12) | ||||||||||||||||||||||

| Unit-linked contract income and reinsurance adjustments | 214 | 580 | 1,122 | 1,183 | ||||||||||||||||||||||

| Divested businesses | 1 | — | 1 | — | ||||||||||||||||||||||

| Adjusted net investment income | $ | 5,301 | $ | 5,047 | $ | 20,672 | $ | 19,749 | ||||||||||||||||||

| Revenues and Expenses | ||||||||||||||||||||||||||

| Total revenues | $ | 18,666 | $ | 19,028 | $ | 70,986 | $ | 66,905 | ||||||||||||||||||

| Less: Adjustments to total revenues: | ||||||||||||||||||||||||||

| Net investment gains (losses) | (311) | (174) | (1,184) | (2,824) | ||||||||||||||||||||||

| Net derivative gains (losses) | (903) | 149 | (1,623) | (2,140) | ||||||||||||||||||||||

| Investment hedge adjustments | (127) | (253) | (604) | (1,012) | ||||||||||||||||||||||

| Asymmetrical and non-economic accounting | 34 | 29 | 158 | 29 | ||||||||||||||||||||||

| Joint venture adjustments | 16 | (8) | 82 | (12) | ||||||||||||||||||||||

| Unit-linked contract income and reinsurance adjustments | 214 | 580 | 1,122 | 1,183 | ||||||||||||||||||||||

| Other adjustments | (11) | (13) | (48) | (34) | ||||||||||||||||||||||

| Divested businesses | 16 | — | 32 | — | ||||||||||||||||||||||

| Total adjusted revenues | $ | 19,738 | $ | 18,718 | $ | 73,051 | $ | 71,715 | ||||||||||||||||||

| Total expenses | $ | 17,285 | $ | 18,087 | $ | 65,364 | $ | 64,743 | ||||||||||||||||||

| Less: Adjustments to total expenses: | ||||||||||||||||||||||||||

| Market risk benefit remeasurement (gains) losses | (764) | 431 | (1,109) | (994) | ||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | ||||||||||||||||||||||

| Asymmetrical and non-economic accounting | 46 | 129 | 322 | 247 | ||||||||||||||||||||||

| Market volatility | (49) | (62) | (256) | (184) | ||||||||||||||||||||||

| Unit-linked contract costs and reinsurance adjustments | 215 | 582 | 1,111 | 1,183 | ||||||||||||||||||||||

| Other adjustments | 25 | 7 | 49 | 55 | ||||||||||||||||||||||

| Divested businesses | 23 | 9 | 57 | 38 | ||||||||||||||||||||||

| Total adjusted expenses | $ | 17,789 | $ | 16,991 | $ | 65,190 | $ | 64,398 | ||||||||||||||||||

| See footnotes on last page. | ||||||||||||||||||||||||||

| MetLife, Inc. | |||||||||||||||||||||||||||||

| (In millions, except per share and ratio data) | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||

| Expense Detail and Ratios | |||||||||||||||||||||||||||||

| Reconciliation of Capitalization of DAC to Adjusted Capitalization of DAC | |||||||||||||||||||||||||||||

| Capitalization of DAC | $ | (719) | $ | (728) | $ | (2,833) | $ | (2,917) | |||||||||||||||||||||

| Less: Divested businesses | — | — | — | — | |||||||||||||||||||||||||

| Adjusted capitalization of DAC | $ | (719) | $ | (728) | $ | (2,833) | $ | (2,917) | |||||||||||||||||||||

| Reconciliation of Other Expenses to Adjusted Other Expenses | |||||||||||||||||||||||||||||

| Other expenses | $ | 3,300 | $ | 3,277 | $ | 12,792 | $ | 12,656 | |||||||||||||||||||||

| Less: Reinsurance adjustments | 30 | — | 30 | — | |||||||||||||||||||||||||

| Less: Other adjustments | 25 | 7 | 49 | 55 | |||||||||||||||||||||||||

| Less: Divested businesses | 13 | 9 | 38 | 38 | |||||||||||||||||||||||||

| Adjusted other expenses | $ | 3,232 | $ | 3,261 | $ | 12,675 | $ | 12,563 | |||||||||||||||||||||

| Other Detail and Ratios | |||||||||||||||||||||||||||||

| Other expenses, net of capitalization of DAC | $ | 2,581 | $ | 2,549 | $ | 9,959 | $ | 9,739 | |||||||||||||||||||||

| Premiums, fees and other revenues | $ | 14,475 | $ | 13,687 | $ | 52,520 | $ | 51,961 | |||||||||||||||||||||

| Expense ratio | 17.8 | % | 18.6 | % | 19.0 | % | 18.7 | % | |||||||||||||||||||||

| Direct expenses | $ | 1,396 | $ | 1,559 | $ | 5,611 | $ | 5,808 | |||||||||||||||||||||

| Less: Total notable items related to direct expenses | (152) | 96 | (152) | 96 | |||||||||||||||||||||||||

| Direct expenses, excluding total notable items related to direct expenses | $ | 1,548 | $ | 1,463 | $ | 5,763 | $ | 5,712 | |||||||||||||||||||||

| Adjusted other expenses | $ | 3,232 | $ | 3,261 | $ | 12,675 | $ | 12,563 | |||||||||||||||||||||

| Adjusted capitalization of DAC | (719) | (728) | (2,833) | (2,917) | |||||||||||||||||||||||||

| Adjusted other expenses, net of adjusted capitalization of DAC | 2,513 | 2,533 | 9,842 | 9,646 | |||||||||||||||||||||||||

| Less: Total notable items related to adjusted other expenses | (85) | 96 | (85) | 96 | |||||||||||||||||||||||||

| Adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses | $ | 2,598 | $ | 2,437 | $ | 9,927 | $ | 9,550 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 14,437 | $ | 13,671 | $ | 52,379 | $ | 51,966 | |||||||||||||||||||||

| Less: PRT | 2,593 | 1,860 | 4,849 | 5,324 | |||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues, excluding PRT | $ | 11,844 | $ | 11,811 | $ | 47,530 | $ | 46,642 | |||||||||||||||||||||

| Direct expense ratio | 9.7 | % | 11.4 | % | 10.7 | % | 11.2 | % | |||||||||||||||||||||

| Direct expense ratio, excluding total notable items related to direct expenses and PRT | 13.1 | % | 12.4 | % | 12.1 | % | 12.2 | % | |||||||||||||||||||||

| Adjusted expense ratio | 17.4 | % | 18.5 | % | 18.8 | % | 18.6 | % | |||||||||||||||||||||

| Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT | 21.9 | % | 20.6 | % | 20.9 | % | 20.5 | % | |||||||||||||||||||||

| See footnotes on last page. | |||||||||||||||||||||||||||||

| MetLife, Inc. | ||||||||||||||

| (In millions, except per share data) | ||||||||||||||

| December 31, | ||||||||||||||

| Equity Details | 2024 | 2023 | ||||||||||||

| Total MetLife, Inc.'s stockholders' equity | $ | 27,445 | $ | 30,015 | ||||||||||

| Less: Preferred stock | 3,818 | 3,818 | ||||||||||||

| MetLife, Inc.'s common stockholders' equity | 23,627 | 26,197 | ||||||||||||

| Less: Unrealized investment gains (losses), net of related offsets and income tax | (19,402) | (14,506) | ||||||||||||

| Deferred gains (losses) on derivatives, net of income tax | 370 | 183 | ||||||||||||

| Future policy benefits discount rate remeasurement gain (losses), net of income tax | 6,529 | 2,658 | ||||||||||||

| Market risk benefits instrument-specific credit risk remeasurement gains (losses), net of income tax | (71) | 27 | ||||||||||||

| Defined benefit plans adjustment, net of income tax | (1,442) | (1,446) | ||||||||||||

| Estimated fair value of certain ceded reinsurance-related embedded derivatives, net of income tax | (129) | — | ||||||||||||

| Total MetLife, Inc.'s adjusted common stockholders' equity | 37,772 | 39,281 | ||||||||||||

| Less: Accumulated year-to-date total notable items, net of income tax | 26 | (62) | ||||||||||||

| Total MetLife, Inc.'s adjusted common stockholders' equity, excluding total notable items | $ | 37,746 | $ | 39,343 | ||||||||||

| December 31, | ||||||||||||||

| Book Value (2) | 2024 | 2023 | ||||||||||||

| Book value per common share | 34.28 | 35.85 | ||||||||||||

| Less: Unrealized investment gains (losses), net of related offsets and income tax | (28.15) | (19.85) | ||||||||||||

| Deferred gains (losses) on derivatives, net of income tax | 0.54 | 0.25 | ||||||||||||

| Future policy benefits discount rate remeasurement gain (losses), net of income tax | 9.46 | 3.64 | ||||||||||||

| Market risk benefits instrument-specific credit risk remeasurement gains (losses), net of income tax | (0.10) | 0.04 | ||||||||||||

| Defined benefit plans adjustment, net of income tax | (2.09) | (1.98) | ||||||||||||

| Estimated fair value of certain ceded reinsurance-related embedded derivatives, net of income tax | (0.19) | — | ||||||||||||

| Adjusted book value per common share | $ | 54.81 | $ | 53.75 | ||||||||||

| Common shares outstanding, end of period (3) | 689.2 | 730.8 | ||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||

| December 31, (4) | December 31, | |||||||||||||||||||||||||

| Return on Equity | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Return on MetLife, Inc.'s: | ||||||||||||||||||||||||||

| Common stockholders' equity | 19.6 | % | 9.6 | % | 16.9 | % | 5.4 | % | ||||||||||||||||||

| Adjusted return on MetLife, Inc.'s: | ||||||||||||||||||||||||||

| Adjusted common stockholders' equity | 15.4 | % | 13.8 | % | 15.2 | % | 13.6 | % | ||||||||||||||||||

| Adjusted common stockholders' equity, excluding total notable items | 15.3 | % | 14.6 | % | 15.2 | % | 13.8 | % | ||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| Average Common Stockholders' Equity | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Average common stockholders' equity | $ | 25,347 | $ | 24,019 | $ | 25,008 | $ | 25,784 | ||||||||||||||||||

| Average adjusted common stockholders' equity | $ | 37,867 | $ | 39,368 | $ | 38,084 | $ | 40,599 | ||||||||||||||||||

| Average adjusted common stockholders' equity, excluding total notable items | $ | 37,846 | $ | 39,392 | $ | 38,076 | $ | 40,608 | ||||||||||||||||||

| See footnotes on last page. | ||||||||||||||||||||||||||

| MetLife, Inc. | |||||||||||||||||||||||||||||

| Adjusted Earnings Available to Common Shareholders | |||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||

| Group Benefits (5): | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 416 | $ | 466 | $ | 1,606 | $ | 1,655 | |||||||||||||||||||||

| Less: Total notable items | — | — | (58) | 27 | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 416 | $ | 466 | $ | 1,664 | $ | 1,628 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 6,184 | $ | 6,001 | $ | 24,870 | $ | 23,929 | |||||||||||||||||||||

| Retirement & Income Solutions (5): | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 386 | $ | 421 | $ | 1,667 | $ | 1,708 | |||||||||||||||||||||

| Less: Total notable items | — | — | 104 | 61 | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 386 | $ | 421 | $ | 1,563 | $ | 1,647 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 3,620 | $ | 2,883 | $ | 8,594 | $ | 8,832 | |||||||||||||||||||||

| Less: PRT | 2,593 | 1,860 | 4,849 | 5,324 | |||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues, excluding PRT | $ | 1,027 | $ | 1,023 | $ | 3,745 | $ | 3,508 | |||||||||||||||||||||

| Asia: | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 443 | $ | 296 | $ | 1,621 | $ | 1,282 | |||||||||||||||||||||

| Less: Total notable items | — | — | (41) | (94) | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 443 | $ | 296 | $ | 1,662 | $ | 1,376 | |||||||||||||||||||||

| Adjusted earnings available to common shareholders on a constant currency basis | $ | 443 | $ | 291 | $ | 1,621 | $ | 1,248 | |||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis | $ | 443 | $ | 291 | $ | 1,662 | $ | 1,342 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 1,635 | $ | 1,705 | $ | 6,757 | $ | 6,969 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues, on a constant currency basis | $ | 1,635 | $ | 1,654 | $ | 6,757 | $ | 6,608 | |||||||||||||||||||||

| Latin America: | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 201 | $ | 207 | $ | 881 | $ | 840 | |||||||||||||||||||||

| Less: Total notable items | — | — | 4 | — | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 201 | $ | 207 | $ | 877 | $ | 840 | |||||||||||||||||||||

| Adjusted earnings available to common shareholders on a constant currency basis | $ | 201 | $ | 182 | $ | 881 | $ | 791 | |||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis | $ | 201 | $ | 182 | $ | 877 | $ | 791 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 1,438 | $ | 1,486 | $ | 5,936 | $ | 5,727 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues, on a constant currency basis | $ | 1,438 | $ | 1,325 | $ | 5,936 | $ | 5,392 | |||||||||||||||||||||

| See footnotes on last page. | |||||||||||||||||||||||||||||

| MetLife, Inc. | |||||||||||||||||||||||||||||

| Adjusted Earnings Available to Common Shareholders (Continued) | |||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||

| EMEA: | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 59 | $ | 47 | $ | 283 | $ | 265 | |||||||||||||||||||||

| Less: Total notable items | — | — | (5) | 18 | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 59 | $ | 47 | $ | 288 | $ | 247 | |||||||||||||||||||||

| Adjusted earnings available to common shareholders on a constant currency basis | $ | 59 | $ | 45 | $ | 283 | $ | 253 | |||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis | $ | 59 | $ | 45 | $ | 288 | $ | 235 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 652 | $ | 595 | $ | 2,548 | $ | 2,346 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues, on a constant currency basis | $ | 652 | $ | 576 | $ | 2,548 | $ | 2,271 | |||||||||||||||||||||

| MetLife Holdings (5): | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 153 | $ | 156 | $ | 647 | $ | 733 | |||||||||||||||||||||

| Less: Total notable items | — | — | 12 | 2 | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | 153 | $ | 156 | $ | 635 | $ | 731 | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 815 | $ | 901 | $ | 3,272 | $ | 3,708 | |||||||||||||||||||||

| Corporate & Other (5): | |||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | (199) | $ | (232) | $ | (909) | $ | (958) | |||||||||||||||||||||

| Less: Total notable items | 10 | (76) | 10 | (76) | |||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items | $ | (209) | $ | (156) | $ | (919) | $ | (882) | |||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 93 | $ | 100 | $ | 402 | $ | 455 | |||||||||||||||||||||

| See footnotes on last page. | |||||||||||||||||||||||||||||

| MetLife, Inc. | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||

| March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31,2024 | ||||||||||||||||||||||||||||

| Variable investment income (post-tax, in millions) (6) |

||||||||||||||||||||||||||||||||

| Group Benefits | $ | 4 | $ | 3 | $ | 2 | $ | 1 | $ | 10 | ||||||||||||||||||||||

| RIS | 73 | 64 | 50 | 71 | 258 | |||||||||||||||||||||||||||

| Asia | 56 | 99 | 44 | 121 | 320 | |||||||||||||||||||||||||||

| Latin America | 1 | 2 | 8 | 4 | 15 | |||||||||||||||||||||||||||

| EMEA | — | — | — | — | — | |||||||||||||||||||||||||||

| MetLife Holdings | 55 | 46 | 29 | 29 | 159 | |||||||||||||||||||||||||||

| Corporate & Other | 16 | 21 | (5) | 6 | 38 | |||||||||||||||||||||||||||

| Total variable investment income | $ | 205 | $ | 235 | $ | 128 | $ | 232 | $ | 800 | ||||||||||||||||||||||

| Segments: Group Benefits, RIS, Asia, Latin America and EMEA (7) | ||||||||||||||||||||||||||||||||

| Capital Deployed | Value of New Business | Internal Rate of Return | Payback (Years) | |||||||||||||||||||||||||||||

| Value of new business ($ in billions) | ||||||||||||||||||||||||||||||||

| 2023 | $ | 3.6 | $ | 2.6 | 19 | % | 5 | |||||||||||||||||||||||||

| 2022 | $ | 3.7 | $ | 2.3 | 17 | % | 6 | |||||||||||||||||||||||||

| 2021 | $ | 2.8 | $ | 1.9 | 17 | % | 6 | |||||||||||||||||||||||||

| 2020 | $ | 3.2 | $ | 1.9 | 17 | % | 6 | |||||||||||||||||||||||||

| 2019 | $ | 3.8 | $ | 1.8 | 15 | % | 7 | |||||||||||||||||||||||||

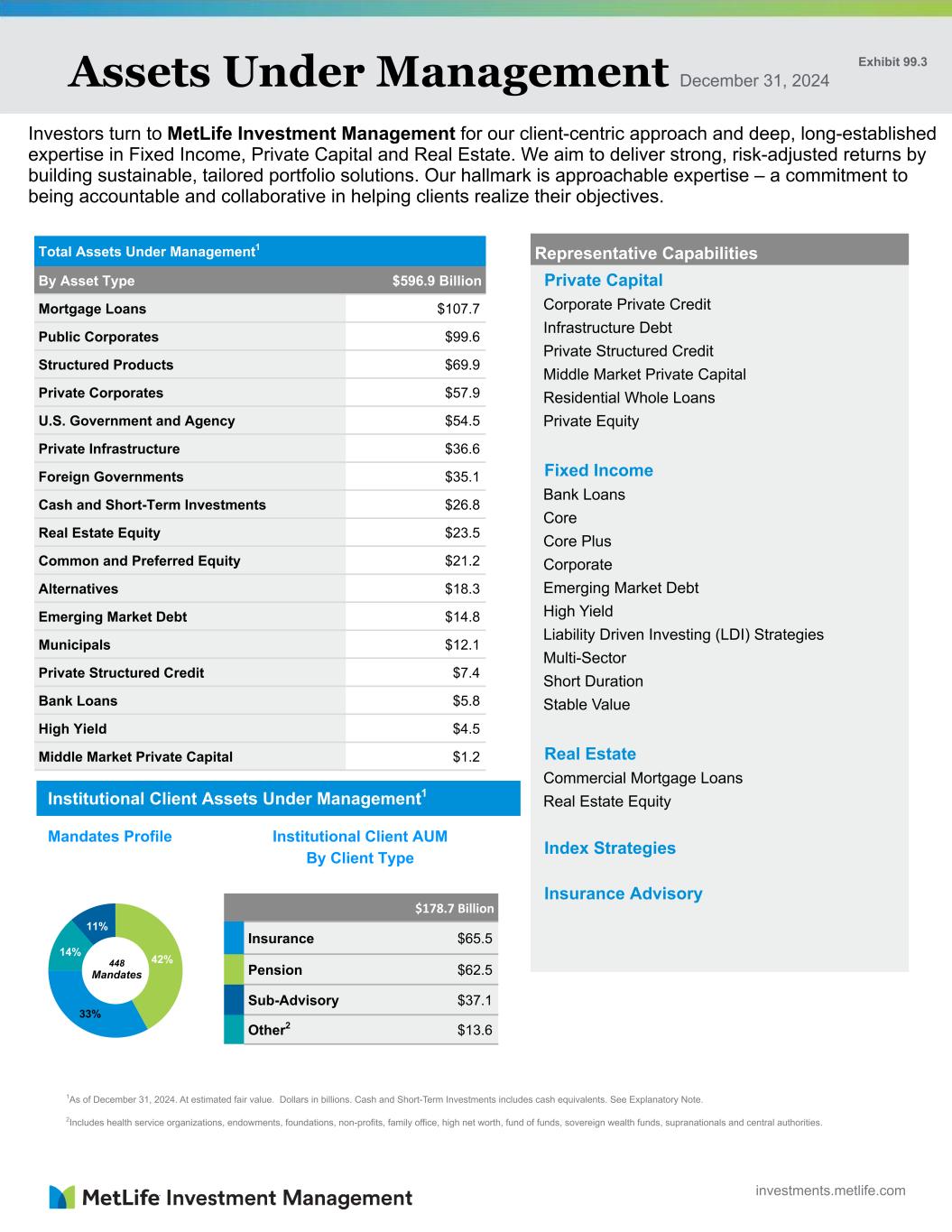

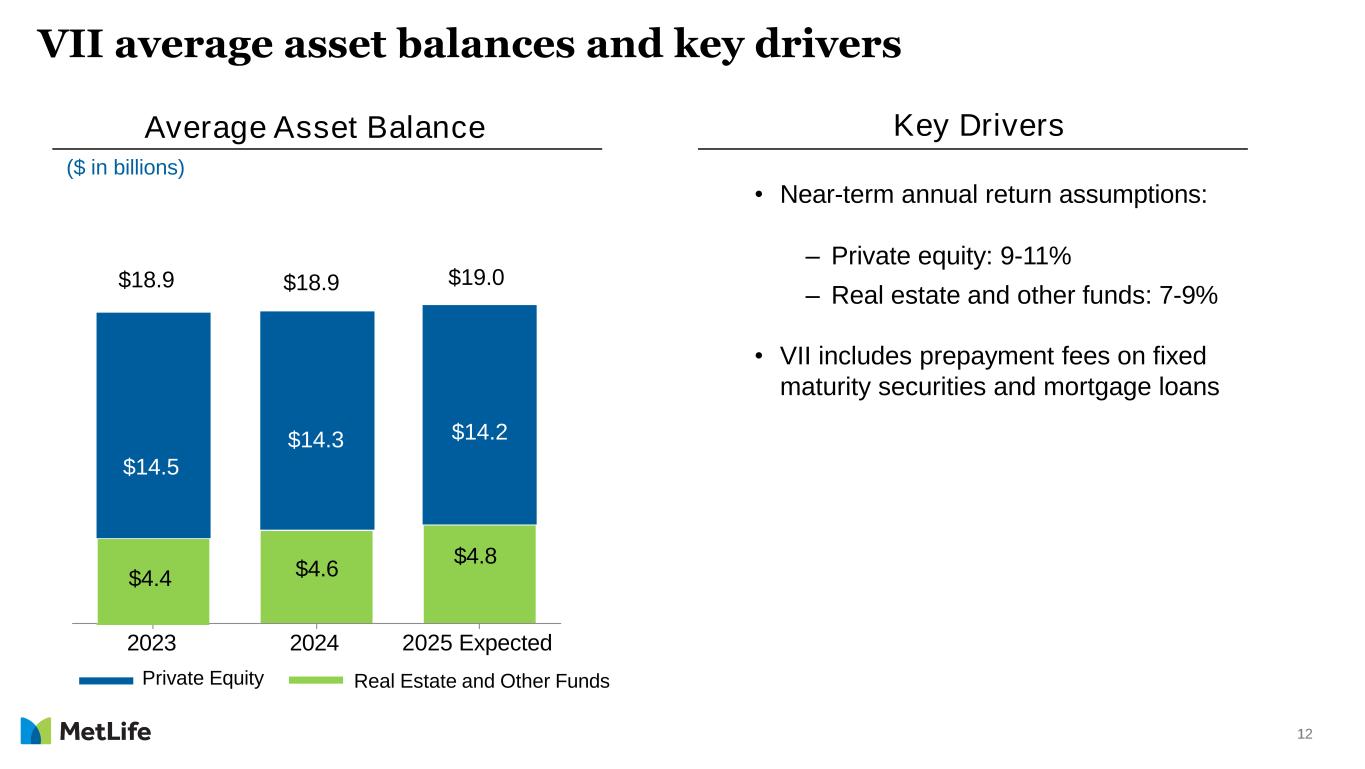

| Average asset balances (in billions) | ||||||||||||||||||||||||||||||||

| Private equity | $ | 14.3 | ||||||||||||||||||||||||||||||

| Real estate and other funds | 4.6 | |||||||||||||||||||||||||||||||

| Total average asset balances | $ | 18.9 | ||||||||||||||||||||||||||||||

| See footnotes on last page. | ||||||||||||||||||||||||||||||||

| Condensed Reconciliation of Net Cash Provided by Operating Activities of MetLife, Inc. | ||||||||||||||

| to Free Cash Flow of All Holding Companies | ||||||||||||||

| (In billions, except ratios) | ||||||||||||||

| For the Year Ended December 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| MetLife, Inc. (parent company only) net cash provided by operating activities | $ | 4.7 | $ | 4.2 | ||||||||||

| Adjustments from net cash provided by operating activities to free cash flow: | ||||||||||||||

| Add: Incremental debt to be at or below target leverage ratios | — | — | ||||||||||||

| Add: Adjustments from net cash provided by operating activities to free cash flow (8) | (0.1) | (0.7) | ||||||||||||

| MetLife, Inc. (parent company only) free cash flow | 4.6 | 3.5 | ||||||||||||

| Other MetLife, Inc. holding companies free cash flow (9) | — | 0.1 | ||||||||||||

| Free cash flow of all holding companies | $ | 4.6 | $ | 3.6 | ||||||||||

| Ratio of net cash provided by operating activities to consolidated net income (loss) available to MetLife, Inc.'s common shareholders: | ||||||||||||||

| MetLife, Inc. (parent company only) net cash provided by operating activities | $ | 4.7 | $ | 4.2 | ||||||||||

| Consolidated net income (loss) available to MetLife, Inc.'s common shareholders | $ | 4.2 | $ | 1.4 | ||||||||||

| Ratio of net cash provided by operating activities (parent company only) to consolidated net income (loss) available to MetLife, Inc.'s common shareholders (10) | 112 | % | 303 | % | ||||||||||

| Ratio of free cash flow to adjusted earnings available to common shareholders: | ||||||||||||||

| Free cash flow of all holding companies (11) | $ | 4.6 | $ | 3.6 | ||||||||||

| Consolidated adjusted earnings available to common shareholders (11) | $ | 5.8 | $ | 5.5 | ||||||||||

| Ratio of free cash flow of all holding companies to consolidated adjusted earnings available to common shareholders (11) | 79 | % | 66 | % | ||||||||||

| See footnotes on last page. | ||||||||||||||

| MetLife, Inc. | ||||||||||||||

| December 31, 2024 | ||||||||||||||

| Cash & Capital (12), (13), (14) (in billions) | ||||||||||||||

Holding Companies Cash & Liquid Assets |

$ | 5.1 | ||||||||||||

Footnotes |

||||||||||||||

(1) |

Adjusted earnings available to common shareholders, excluding total notable items, per diluted common share is calculated on a standalone basis and may not equal (i) adjusted earnings available to common shareholders per diluted common share, less (ii) total notable items per diluted common share. | |||||||||||||

| (2) | Book values exclude $3,818 million of equity related to preferred stock at both December 31, 2024 and 2023. | |||||||||||||

| (3) | There were share repurchases of approximately $0.4 billion and $3.2 billion for the three months and year ended December 31, 2024, respectively. There were share repurchases of approximately $470 million in January 2025. | |||||||||||||

| (4) | Annualized using quarter-to-date results. | |||||||||||||

| (5) | Results on a constant currency basis are not included as constant currency impact is not significant. | |||||||||||||

| (6) | Assumes a 21% tax rate. |

|||||||||||||

| (7) | Excludes MetLife Holdings; Value of New Business is the present value of future profits net of the cost of capital and time value of guarantees from new sales. | |||||||||||||

| (8) | Adjustments include: (i) capital contributions to subsidiaries; (ii) returns of capital from subsidiaries; (iii) repayments on and (issuances of) loans to subsidiaries, net; and (iv) investment portfolio and derivatives changes and other, net. | |||||||||||||

| (9) | Components include: (i) dividends and returns of capital from subsidiaries; (ii) capital contributions to subsidiaries; (iii) repayments on and (issuances of) loans to subsidiaries, net; (iv) other expenses; (v) dividends and returns of capital to MetLife, Inc. and (vi) investment portfolio and derivatives changes and other, net. | |||||||||||||

| (10) | Including the free cash flow of other MetLife, Inc. holding companies of $0 and $0.1 billion for the years ended December 31, 2024 and 2023, respectively, in the numerator of the ratio, this ratio, as adjusted, would be 112% and 311%, respectively. | |||||||||||||

| (11) | i) Consolidated adjusted earnings available to common shareholders for the year ended December 31, 2024, was positively impacted by notable items, primarily related to tax adjustments of $0.1 billion, net of income tax, and actuarial assumption review and other insurance adjustments of $0.02 billion, net of income tax, offset by litigation reserves and settlement costs of ($0.05) billion, net of income tax. Excluding these notable items from the denominator of the ratio, the adjusted free cash flow ratio for 2024, would be 79%. ii) Consolidated adjusted earnings available to common shareholders for the year ended December 31, 2023, was negatively impacted by notable items, related to litigation reserves and settlement costs of ($0.1) billion, net of income tax, offset by actuarial assumption review and other insurance adjustments of $0.01 billion, net of income tax. Excluding these notable items from the denominator of the ratio, the adjusted free cash flow ratio for 2023, would be 65%. |

|||||||||||||

| (12) | The 2024 combined U.S. risk based capital (RBC) ratio is estimated to be above MetLife's 360% target on an NAIC basis. This ratio includes MetLife, Inc.'s principal U.S. insurance subsidiaries, excluding American Life Insurance Company. MetLife calculates RBC annually as of December 31 and, accordingly, the calculation does not reflect conditions and factors occurring after the year end. | |||||||||||||

| (13) | The total U.S. statutory adjusted capital is expected to be approximately $17.4 billion at December 31, 2024, down 1% from September 30, 2024. This balance includes MetLife, Inc.'s principal U.S. insurance subsidiaries, excluding American Life Insurance Company. | |||||||||||||

| (14) | The expected Japan solvency margin ratio as of December 31, 2024 is approximately 675%. | |||||||||||||

| METLIFE TABLE OF CONTENTS |

||||||||

| METLIFE | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| As used in this QFS, “MetLife," “we” and “our” refer to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates. In this QFS, MetLife presents certain measures of its performance that are not calculated in accordance with GAAP. We believe that these non-GAAP financial measures enhance our investors' understanding of MetLife's performance by highlighting the results of operations and the underlying profitability drivers of its business. See Appendix for definitions of non-GAAP financial measures and other financial disclosures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Premiums | $ | 11,786 | $ | 10,053 | $ | 11,628 | $ | 10,647 | $ | 12,617 | $ | 44,283 | $ | 44,945 | |||||||||||||||||||||||||||||||||||||||

| Universal life and investment-type product policy fees | 1,241 | 1,248 | 1,281 | 1,228 | 1,217 | 5,152 | 4,974 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net investment income | 5,366 | 5,436 | 5,205 | 5,227 | 5,405 | 19,908 | 21,273 | ||||||||||||||||||||||||||||||||||||||||||||||

| Other revenues | 660 | 674 | 638 | 648 | 641 | 2,526 | 2,601 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net investment gains (losses) | (174) | (375) | (421) | (77) | (311) | (2,824) | (1,184) | ||||||||||||||||||||||||||||||||||||||||||||||

| Net derivative gains (losses) | 149 | (979) | (508) | 767 | (903) | (2,140) | (1,623) | ||||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 19,028 | 16,057 | 17,823 | 18,440 | 18,666 | 66,905 | 70,986 | ||||||||||||||||||||||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Policyholder benefits and claims | 11,779 | 10,074 | 11,485 | 10,597 | 12,572 | 44,590 | 44,728 | ||||||||||||||||||||||||||||||||||||||||||||||

| Policyholder liability remeasurement (gains) losses | (3) | (22) | (10) | (132) | (42) | (45) | (206) | ||||||||||||||||||||||||||||||||||||||||||||||

| Market risk benefit remeasurement (gains) losses | 431 | (694) | (182) | 531 | (764) | (994) | (1,109) | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest credited to policyholder account balances | 2,405 | 2,290 | 2,000 | 2,037 | 2,012 | 7,860 | 8,339 | ||||||||||||||||||||||||||||||||||||||||||||||

| Policyholder dividends | 159 | 147 | 148 | 150 | 150 | 622 | 595 | ||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of DAC, VOBA and negative VOBA | 498 | 502 | 493 | 509 | 517 | 1,926 | 2,021 | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense on debt | 269 | 264 | 257 | 257 | 259 | 1,045 | 1,037 | ||||||||||||||||||||||||||||||||||||||||||||||

| Other expenses, net of capitalization of DAC | 2,549 | 2,451 | 2,430 | 2,497 | 2,581 | 9,739 | 9,959 | ||||||||||||||||||||||||||||||||||||||||||||||

| Total expenses | 18,087 | 15,012 | 16,621 | 16,446 | 17,285 | 64,743 | 65,364 | ||||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before provision for income tax | 941 | 1,045 | 1,202 | 1,994 | 1,381 | 2,162 | 5,622 | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income tax expense (benefit) | 327 | 170 | 249 | 653 | 106 | 560 | 1,178 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | 614 | 875 | 953 | 1,341 | 1,275 | 1,602 | 4,444 | ||||||||||||||||||||||||||||||||||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests | 7 | 8 | 7 | (1) | 4 | 24 | 18 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to MetLife, Inc. | 607 | 867 | 946 | 1,342 | 1,271 | 1,578 | 4,426 | ||||||||||||||||||||||||||||||||||||||||||||||

| Less: Preferred stock dividends | 33 | 67 | 34 | 67 | 32 | 198 | 200 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) available to MetLife, Inc.'s common shareholders | $ | 574 | $ | 800 | $ | 912 | $ | 1,275 | $ | 1,239 | $ | 1,380 | $ | 4,226 | |||||||||||||||||||||||||||||||||||||||

| Premiums, fees and other revenues | $ | 13,687 | $ | 11,975 | $ | 13,547 | $ | 12,523 | $ | 14,475 | $ | 51,961 | $ | 52,520 | |||||||||||||||||||||||||||||||||||||||

| METLIFE CORPORATE OVERVIEW |

||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions, except per share data) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) available to MetLife, Inc.'s common shareholders | $ | 574 | $ | 800 | $ | 912 | $ | 1,275 | $ | 1,239 | ||||||||||||||||||||||||||||||||||||||||

| Adjustments from net income (loss) available to MetLife, Inc.'s common shareholders to adjusted earnings available to common shareholders: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Net investment gains (losses) | (174) | (375) | (421) | (77) | (311) | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Net derivative gains (losses) | 149 | (979) | (508) | 767 | (903) | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Market risk benefit remeasurement gains (losses) | (431) | 694 | 182 | (531) | 764 | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Goodwill impairment | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Other adjustments to net income (loss) (1) | (330) | (126) | (232) | (65) | (118) | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Provision for income tax (expense) benefit | 6 | 260 | 270 | (195) | 352 | |||||||||||||||||||||||||||||||||||||||||||||

| Add: Net income (loss) attributable to noncontrolling interests | 7 | 8 | 7 | (1) | 4 | |||||||||||||||||||||||||||||||||||||||||||||

| Add: Preferred stock redemption premium | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | 1,361 | 1,334 | 1,628 | 1,375 | 1,459 | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Total notable items (2) | (76) | — | — | 16 | 10 | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items (2) | $ | 1,437 | $ | 1,334 | $ | 1,628 | $ | 1,359 | $ | 1,449 | ||||||||||||||||||||||||||||||||||||||||

| Net income (loss) available to MetLife, Inc.'s common shareholders per diluted common share | $ | 0.77 | $ | 1.10 | $ | 1.28 | $ | 1.81 | $ | 1.78 | ||||||||||||||||||||||||||||||||||||||||

| Less: Net investment gains (losses) | (0.23) | (0.51) | (0.59) | (0.11) | (0.45) | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Net derivative gains (losses) | 0.20 | (1.34) | (0.71) | 1.09 | (1.29) | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Market risk benefit remeasurement gains (losses) | (0.58) | 0.95 | 0.25 | (0.75) | 1.09 | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Goodwill impairment | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Other adjustments to net income (loss) | (0.45) | (0.18) | (0.32) | (0.09) | (0.15) | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Provision for income tax (expense) benefit | 0.01 | 0.36 | 0.38 | (0.28) | 0.50 | |||||||||||||||||||||||||||||||||||||||||||||

| Add: Net income (loss) attributable to noncontrolling interests | 0.01 | 0.01 | 0.01 | — | 0.01 | |||||||||||||||||||||||||||||||||||||||||||||

| Add: Preferred stock redemption premium | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders per diluted common share | 1.83 | 1.83 | 2.28 | 1.95 | 2.09 | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Total notable items per diluted common share (2) | (0.10) | — | — | 0.02 | 0.01 | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders, excluding total notable items, per diluted common share (2), (3) | $ | 1.93 | $ | 1.83 | $ | 2.28 | $ | 1.93 | $ | 2.08 | ||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions, except per share data) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||

| Notable items impacting adjusted earnings available to common shareholders (2): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Actuarial assumption review and other insurance adjustments | $ | — | $ | — | $ | — | $ | 16 | $ | — | ||||||||||||||||||||||||||||||||||||||||

| Litigation reserves and settlement costs | (76) | — | — | — | (47) | |||||||||||||||||||||||||||||||||||||||||||||

| Tax adjustments | — | — | — | — | 57 | |||||||||||||||||||||||||||||||||||||||||||||

| Total notable items | $ | (76) | $ | — | $ | — | $ | 16 | $ | 10 | ||||||||||||||||||||||||||||||||||||||||

| Notable items impacting adjusted earnings available to common shareholders per diluted common share (2): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Actuarial assumption review and other insurance adjustments | $ | — | $ | — | $ | — | $ | 0.02 | $ | — | ||||||||||||||||||||||||||||||||||||||||

| Litigation reserves and settlement costs | (0.10) | — | — | — | (0.07) | |||||||||||||||||||||||||||||||||||||||||||||

| Tax adjustments | — | — | — | — | 0.08 | |||||||||||||||||||||||||||||||||||||||||||||

| Total notable items | $ | (0.10) | $ | — | $ | — | $ | 0.02 | $ | 0.01 | ||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 743.4 | 728.4 | 714.7 | 703.7 | 697.9 | |||||||||||||||||||||||||||||||||||||||||||||

(1)See Pages A-1 and A-7 for further detail. |

||||||||||||||||||||||||||||||||||||||||||||||||||

(2)These notable items represent a positive (negative) impact to adjusted earnings available to common shareholders and adjusted earnings available to common shareholders per diluted common share. The per share data for each notable item is calculated on a standalone basis and may not sum to total notable items. Notable items reflect the unexpected impact of events that affect MetLife's results, but that were unknown and that MetLife could not anticipate when it devised its business plan. Notable items also include certain items regardless of the extent anticipated in the business plan, to help investors have a better understanding of MetLife's results and to evaluate and forecast those results. See Pages A-2 and A-3 for further detail. |

||||||||||||||||||||||||||||||||||||||||||||||||||

(3)Calculated on a standalone basis and may not equal (i) adjusted earnings available to common shareholders per diluted common share, less (ii) total notable items per diluted common share. |

||||||||||||||||||||||||||||||||||||||||||||||||||

| METLIFE CORPORATE OVERVIEW (CONTINUED) |

|||||||||||||||||||||||||||||||||||||||||

| Unaudited | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||

| Book value per common share (1) | $ | 35.85 | $ | 34.54 | $ | 33.30 | $ | 39.02 | $ | 34.28 | |||||||||||||||||||||||||||||||

| Adjusted book value per common share (1) (2) | $ | 53.75 | $ | 53.13 | $ | 53.12 | $ | 54.72 | $ | 54.81 | |||||||||||||||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| Unaudited | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||

| Return on MetLife, Inc.'s (3): | |||||||||||||||||||||||||||||||||||||||||

| Common stockholders' equity | 9.6 | % | 12.6 | % | 15.2 | % | 20.2 | % | 19.6 | % | |||||||||||||||||||||||||||||||

| Adjusted return on MetLife, Inc.'s (2) (3): | |||||||||||||||||||||||||||||||||||||||||

| Adjusted common stockholders' equity | 13.8 | % | 13.8 | % | 17.3 | % | 14.6 | % | 15.4 | % | |||||||||||||||||||||||||||||||

Adjusted common stockholders' equity, excluding total notable items (3) |

14.6 | % | 13.8 | % | 17.3 | % | 14.4 | % | 15.3 | % | |||||||||||||||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||

| Common shares outstanding, beginning of period | 744.4 | 730.8 | 715.7 | 703.8 | 693.7 | ||||||||||||||||||||||||||||||||||||

| Share repurchases | (13.7) | (16.9) | (12.0) | (10.5) | (4.6) | ||||||||||||||||||||||||||||||||||||

| Newly issued shares | 0.1 | 1.8 | 0.1 | 0.4 | 0.1 | ||||||||||||||||||||||||||||||||||||

| Common shares outstanding, end of period | 730.8 | 715.7 | 703.8 | 693.7 | 689.2 | ||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding - basic | 738.6 | 723.2 | 710.5 | 699.3 | 693.0 | ||||||||||||||||||||||||||||||||||||

| Dilutive effect of the exercise or issuance of stock-based awards | 4.8 | 5.2 | 4.2 | 4.4 | 4.9 | ||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 743.4 | 728.4 | 714.7 | 703.7 | 697.9 | ||||||||||||||||||||||||||||||||||||

| MetLife Policyholder Trust Shares | 117.6 | 116.0 | 114.3 | 113.1 | 111.6 | ||||||||||||||||||||||||||||||||||||

| (1) Calculated using common shares outstanding, end of period. | |||||||||||||||||||||||||||||||||||||||||

(2)Beginning with fourth quarter and full year 2024 results and going forward, “adjusted book value” refers to book value, excluding AOCI, other than FCTA and certain ceded reinsurance-related embedded derivatives, and “adjusted return on equity” refers to return on equity, excluding AOCI other than FCTA and certain ceded reinsurance-related embedded derivatives. These changes did not impact prior period amounts. |

|||||||||||||||||||||||||||||||||||||||||

| (3) Annualized using quarter-to-date results. See Page A-4 for further detail. | |||||||||||||||||||||||||||||||||||||||||

(4)Notable items reflect the unexpected impact of events that affect MetLife’s results, but that were unknown and that MetLife could not anticipate when it devised its business plan. Notable items also include certain items regardless of the extent anticipated in the business plan, to help investors have a better understanding of MetLife's results and to evaluate and forecast those results. Notable items can affect MetLife’s results either positively or negatively. See Pages A-2 and A-3 for further detail. |

|||||||||||||||||||||||||||||||||||||||||

| METLIFE KEY ADJUSTED EARNINGS STATEMENT LINE ITEMS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | $ | 19,028 | $ | 16,057 | $ | 17,823 | $ | 18,440 | $ | 18,666 | $ | 66,905 | $ | 70,986 | |||||||||||||||||||||||||||||||||||||||

| Less: Adjustments to total revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment gains (losses) | (174) | (375) | (421) | (77) | (311) | (2,824) | (1,184) | ||||||||||||||||||||||||||||||||||||||||||||||

| Net derivative gains (losses) | 149 | (979) | (508) | 767 | (903) | (2,140) | (1,623) | ||||||||||||||||||||||||||||||||||||||||||||||

| Investment hedge adjustments | (253) | (176) | (172) | (129) | (127) | (1,012) | (604) | ||||||||||||||||||||||||||||||||||||||||||||||

| Asymmetrical and non-economic accounting | 29 | 39 | 35 | 50 | 34 | 29 | 158 | ||||||||||||||||||||||||||||||||||||||||||||||

Joint venture adjustments |

(8) | 2 | (2) | 66 | 16 | (12) | 82 | ||||||||||||||||||||||||||||||||||||||||||||||

Unit-linked contract income and reinsurance adjustments |

580 | 542 | 219 | 147 | 214 | 1,183 | 1,122 | ||||||||||||||||||||||||||||||||||||||||||||||

| Other adjustments | (13) | (12) | (11) | (14) | (11) | (34) | (48) | ||||||||||||||||||||||||||||||||||||||||||||||

Divested businesses |

— | — | — | 16 | 16 | — | 32 | ||||||||||||||||||||||||||||||||||||||||||||||

| Total adjusted revenues | $ | 18,718 | $ | 17,016 | $ | 18,683 | $ | 17,614 | $ | 19,738 | $ | 71,715 | $ | 73,051 | |||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net investment income | $ | 5,366 | $ | 5,436 | $ | 5,205 | $ | 5,227 | $ | 5,405 | $ | 19,908 | $ | 21,273 | |||||||||||||||||||||||||||||||||||||||

| Less: Adjustments to net investment income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment hedge adjustments | (253) | (176) | (172) | (129) | (127) | (1,012) | (604) | ||||||||||||||||||||||||||||||||||||||||||||||

Joint venture adjustments |

(8) | 2 | (2) | 66 | 16 | (12) | 82 | ||||||||||||||||||||||||||||||||||||||||||||||

Unit-linked contract income and reinsurance adjustments |

580 | 542 | 219 | 147 | 214 | 1,183 | 1,122 | ||||||||||||||||||||||||||||||||||||||||||||||

| Divested businesses | — | — | — | — | 1 | — | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted net investment income | $ | 5,047 | $ | 5,068 | $ | 5,160 | $ | 5,143 | $ | 5,301 | $ | 19,749 | $ | 20,672 | |||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

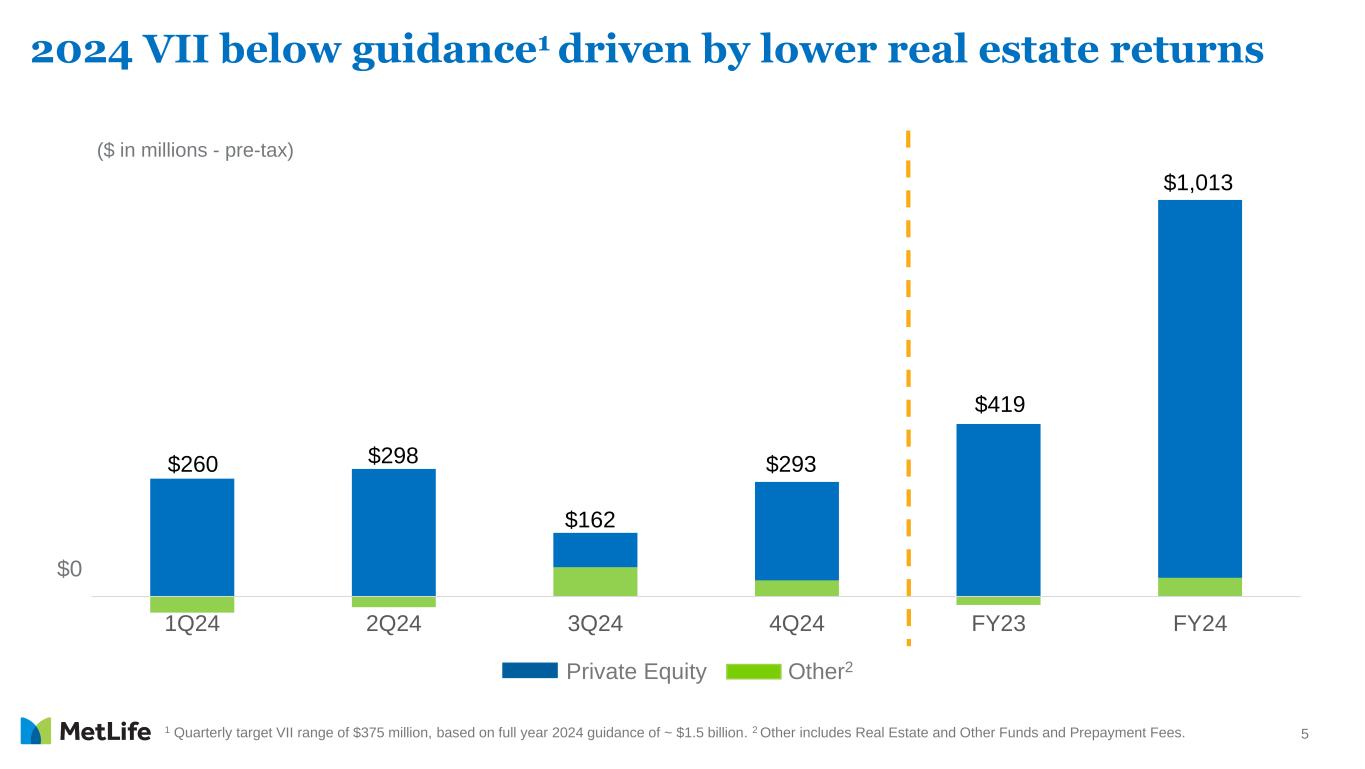

| Variable investment income (Included in net investment income above) | $ | 63 | $ | 260 | $ | 298 | $ | 162 | $ | 293 | $ | 419 | $ | 1,013 | |||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Premiums, fees and other revenues | $ | 13,687 | $ | 11,975 | $ | 13,547 | $ | 12,523 | $ | 14,475 | $ | 51,961 | $ | 52,520 | |||||||||||||||||||||||||||||||||||||||

| Less: Adjustments to premiums, fees and other revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asymmetrical and non-economic accounting | 29 | 39 | 35 | 50 | 34 | 29 | 158 | ||||||||||||||||||||||||||||||||||||||||||||||

| Other adjustments | (13) | (12) | (11) | (14) | (11) | (34) | (48) | ||||||||||||||||||||||||||||||||||||||||||||||

Divested businesses |

— | — | — | 16 | 15 | — | 31 | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 13,671 | $ | 11,948 | $ | 13,523 | $ | 12,471 | $ | 14,437 | $ | 51,966 | $ | 52,379 | |||||||||||||||||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues, on a constant currency basis | $ | 13,440 | $ | 11,718 | $ | 13,372 | $ | 12,348 | $ | 14,437 | |||||||||||||||||||||||||||||||||||||||||||

| METLIFE KEY ADJUSTED EARNINGS STATEMENT LINE ITEMS (CONTINUED) |

||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Total expenses | $ | 18,087 | $ | 15,012 | $ | 16,621 | $ | 16,446 | $ | 17,285 | $ | 64,743 | $ | 65,364 | ||||||||||||||||||||||||||||||||||||

| Less: Adjustments to total expenses: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Market risk benefit remeasurement (gains) losses | 431 | (694) | (182) | 531 | (764) | (994) | (1,109) | |||||||||||||||||||||||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Asymmetrical and non-economic accounting | 129 | 38 | 166 | 72 | 46 | 247 | 322 | |||||||||||||||||||||||||||||||||||||||||||

| Market volatility | (62) | (67) | (88) | (52) | (49) | (184) | (256) | |||||||||||||||||||||||||||||||||||||||||||

Unit-linked contract costs and reinsurance adjustments |

582 | 539 | 214 | 143 | 215 | 1,183 | 1,111 | |||||||||||||||||||||||||||||||||||||||||||

| Other adjustments | 7 | 7 | 5 | 12 | 25 | 55 | 49 | |||||||||||||||||||||||||||||||||||||||||||

Divested businesses |

9 | 4 | 4 | 26 | 23 | 38 | 57 | |||||||||||||||||||||||||||||||||||||||||||

| Total adjusted expenses | $ | 16,991 | $ | 15,185 | $ | 16,502 | $ | 15,714 | $ | 17,789 | $ | 64,398 | $ | 65,190 | ||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Capitalization of DAC | $ | (728) | $ | (740) | $ | (683) | $ | (691) | $ | (719) | $ | (2,917) | $ | (2,833) | ||||||||||||||||||||||||||||||||||||

| Less: Divested businesses | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted capitalization of DAC | $ | (728) | $ | (740) | $ | (683) | $ | (691) | $ | (719) | $ | (2,917) | $ | (2,833) | ||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Other expenses | $ | 3,277 | $ | 3,191 | $ | 3,113 | $ | 3,188 | $ | 3,300 | $ | 12,656 | $ | 12,792 | ||||||||||||||||||||||||||||||||||||

| Less: Adjustments to other expenses: | ||||||||||||||||||||||||||||||||||||||||||||||||||

Reinsurance adjustments |

— | — | — | — | 30 | — | 30 | |||||||||||||||||||||||||||||||||||||||||||

| Other adjustments | 7 | 7 | 5 | 12 | 25 | 55 | 49 | |||||||||||||||||||||||||||||||||||||||||||

| Divested businesses | 9 | 4 | 4 | 17 | 13 | 38 | 38 | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted other expenses | $ | 3,261 | $ | 3,180 | $ | 3,104 | $ | 3,159 | $ | 3,232 | $ | 12,563 | $ | 12,675 | ||||||||||||||||||||||||||||||||||||

| Adjusted other expenses on a constant currency basis | $ | 3,164 | $ | 3,090 | $ | 3,056 | $ | 3,112 | $ | 3,232 | ||||||||||||||||||||||||||||||||||||||||

| METLIFE EXPENSE DETAIL AND RATIOS |

||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions, except ratio data) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Other expenses, net of capitalization of DAC | $ | 2,549 | $ | 2,451 | $ | 2,430 | $ | 2,497 | $ | 2,581 | $ | 9,739 | $ | 9,959 | ||||||||||||||||||||||||||||||||||||

| Premiums, fees and other revenues | $ | 13,687 | $ | 11,975 | $ | 13,547 | $ | 12,523 | $ | 14,475 | $ | 51,961 | $ | 52,520 | ||||||||||||||||||||||||||||||||||||

| Expense ratio | 18.6 | % | 20.5 | % | 17.9 | % | 19.9 | % | 17.8 | % | 18.7 | % | 19.0 | % | ||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

Adjusted other expenses by major category |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Direct expenses | $ | 1,559 | $ | 1,426 | $ | 1,397 | $ | 1,392 | $ | 1,396 | $ | 5,808 | $ | 5,611 | ||||||||||||||||||||||||||||||||||||

| Pension, postretirement and postemployment benefit costs | 69 | 65 | 65 | 65 | 71 | 246 | 266 | |||||||||||||||||||||||||||||||||||||||||||

| Premium taxes, other taxes, and licenses & fees | 153 | 176 | 171 | 183 | 253 | 660 | 783 | |||||||||||||||||||||||||||||||||||||||||||

| Commissions and other variable expenses | 1,480 | 1,513 | 1,471 | 1,519 | 1,512 | 5,849 | 6,015 | |||||||||||||||||||||||||||||||||||||||||||

Adjusted other expenses |

3,261 | 3,180 | 3,104 | 3,159 | 3,232 | 12,563 | 12,675 | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted capitalization of DAC | (728) | (740) | (683) | (691) | (719) | (2,917) | (2,833) | |||||||||||||||||||||||||||||||||||||||||||

Adjusted other expenses, net of adjusted capitalization of DAC |

$ | 2,533 | $ | 2,440 | $ | 2,421 | $ | 2,468 | $ | 2,513 | $ | 9,646 | $ | 9,842 | ||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited (In millions, except ratio data) | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Employee-related costs | $ | 882 | $ | 950 | $ | 900 | $ | 891 | $ | 955 | $ | 3,619 | $ | 3,696 | ||||||||||||||||||||||||||||||||||||

| Third-party staffing costs | 399 | 342 | 356 | 354 | 439 | 1,426 | 1,491 | |||||||||||||||||||||||||||||||||||||||||||

| General and administrative expenses | 278 | 134 | 141 | 147 | 2 | 763 | 424 | |||||||||||||||||||||||||||||||||||||||||||

| Direct expenses | 1,559 | 1,426 | 1,397 | 1,392 | 1,396 | 5,808 | 5,611 | |||||||||||||||||||||||||||||||||||||||||||

| Less: Total notable items related to direct expenses (1) | 96 | — | — | — | (152) | 96 | (152) | |||||||||||||||||||||||||||||||||||||||||||

| Direct expenses, excluding total notable items related to direct expenses (1) | $ | 1,463 | $ | 1,426 | $ | 1,397 | $ | 1,392 | $ | 1,548 | $ | 5,712 | $ | 5,763 | ||||||||||||||||||||||||||||||||||||

Adjusted other expenses, net of adjusted capitalization of DAC |

$ | 2,533 | $ | 2,440 | $ | 2,421 | $ | 2,468 | $ | 2,513 | $ | 9,646 | $ | 9,842 | ||||||||||||||||||||||||||||||||||||

| Less: Total notable items related to adjusted other expenses (1) | 96 | — | — | — | (85) | 96 | (85) | |||||||||||||||||||||||||||||||||||||||||||

Adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses (1) |

$ | 2,437 | $ | 2,440 | $ | 2,421 | $ | 2,468 | $ | 2,598 | $ | 9,550 | $ | 9,927 | ||||||||||||||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues | $ | 13,671 | $ | 11,948 | $ | 13,523 | $ | 12,471 | $ | 14,437 | $ | 51,966 | $ | 52,379 | ||||||||||||||||||||||||||||||||||||

| Less: PRT | 1,860 | (25) | 1,752 | 529 | 2,593 | 5,324 | 4,849 | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted premiums, fees and other revenues, excluding PRT | $ | 11,811 | $ | 11,973 | $ | 11,771 | $ | 11,942 | $ | 11,844 | $ | 46,642 | $ | 47,530 | ||||||||||||||||||||||||||||||||||||

| Direct expense ratio | 11.4 | % | 11.9 | % | 10.3 | % | 11.2 | % | 9.7 | % | 11.2 | % | 10.7 | % | ||||||||||||||||||||||||||||||||||||

| Direct expense ratio, excluding total notable items related to direct expenses and PRT (1) | 12.4 | % | 11.9 | % | 11.9 | % | 11.7 | % | 13.1 | % | 12.2 | % | 12.1 | % | ||||||||||||||||||||||||||||||||||||

| Adjusted expense ratio | 18.5 | % | 20.4 | % | 17.9 | % | 19.8 | % | 17.4 | % | 18.6 | % | 18.8 | % | ||||||||||||||||||||||||||||||||||||

| Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT (1) | 20.6 | % | 20.4 | % | 20.6 | % | 20.7 | % | 21.9 | % | 20.5 | % | 20.9 | % | ||||||||||||||||||||||||||||||||||||