Document

MANAGEMENT'S

DISCUSSION

AND ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. HOW WE REPORT OUR RESULTS |

|

J. CAPITAL AND LIQUIDITY MANAGEMENT |

|

|

|

1. Capital |

|

B. OVERVIEW |

|

2. Capital Adequacy |

|

1. Strategy |

|

3. Shareholder Dividends |

|

2. Financial Objectives |

|

4. Principal Sources and Uses of Funds |

|

3. Sustainability Plan |

|

5. Liquidity |

|

4. Acquisitions and Other |

|

|

|

|

|

K. RISK MANAGEMENT |

|

C. FINANCIAL SUMMARY |

|

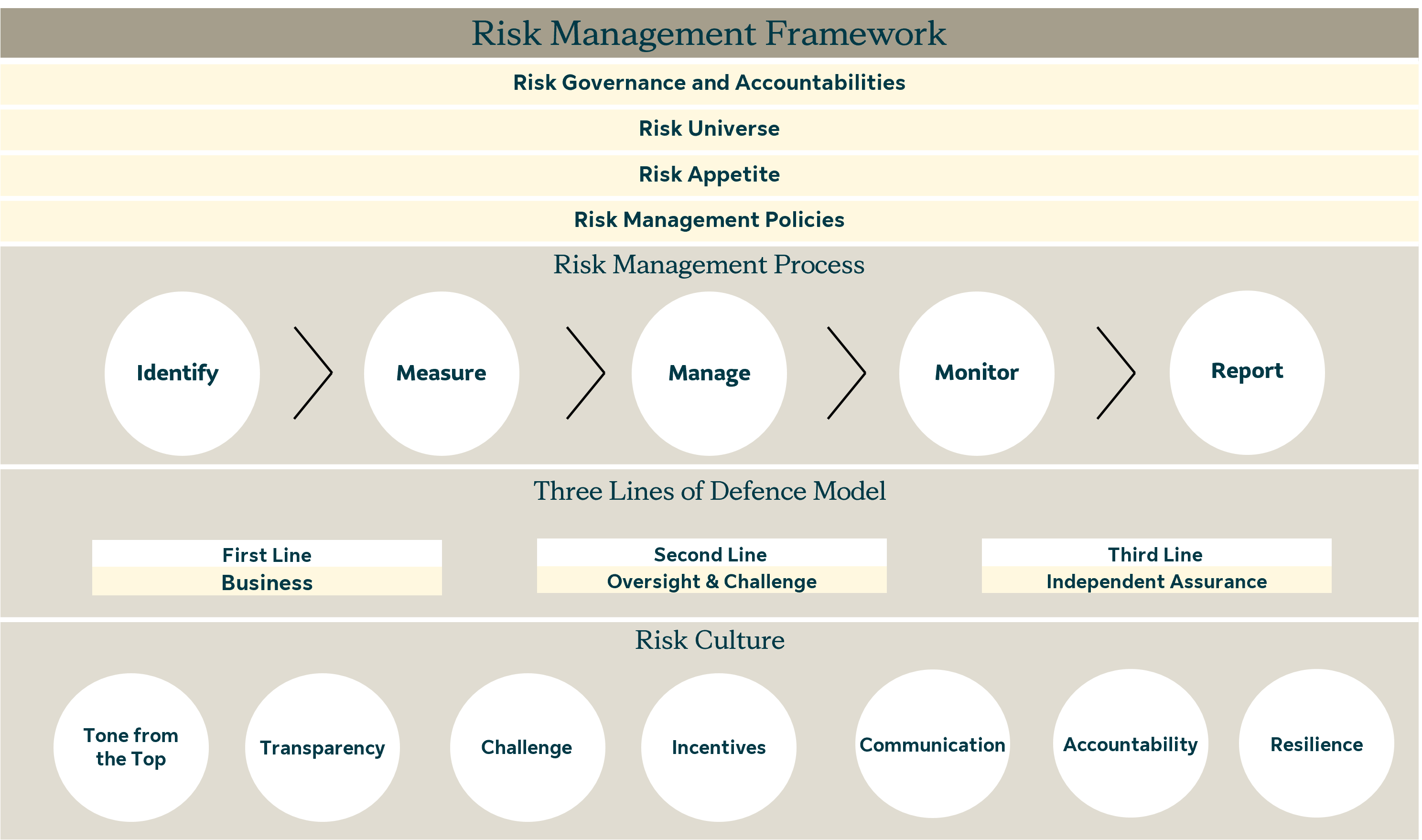

1. Risk Management Framework |

|

|

|

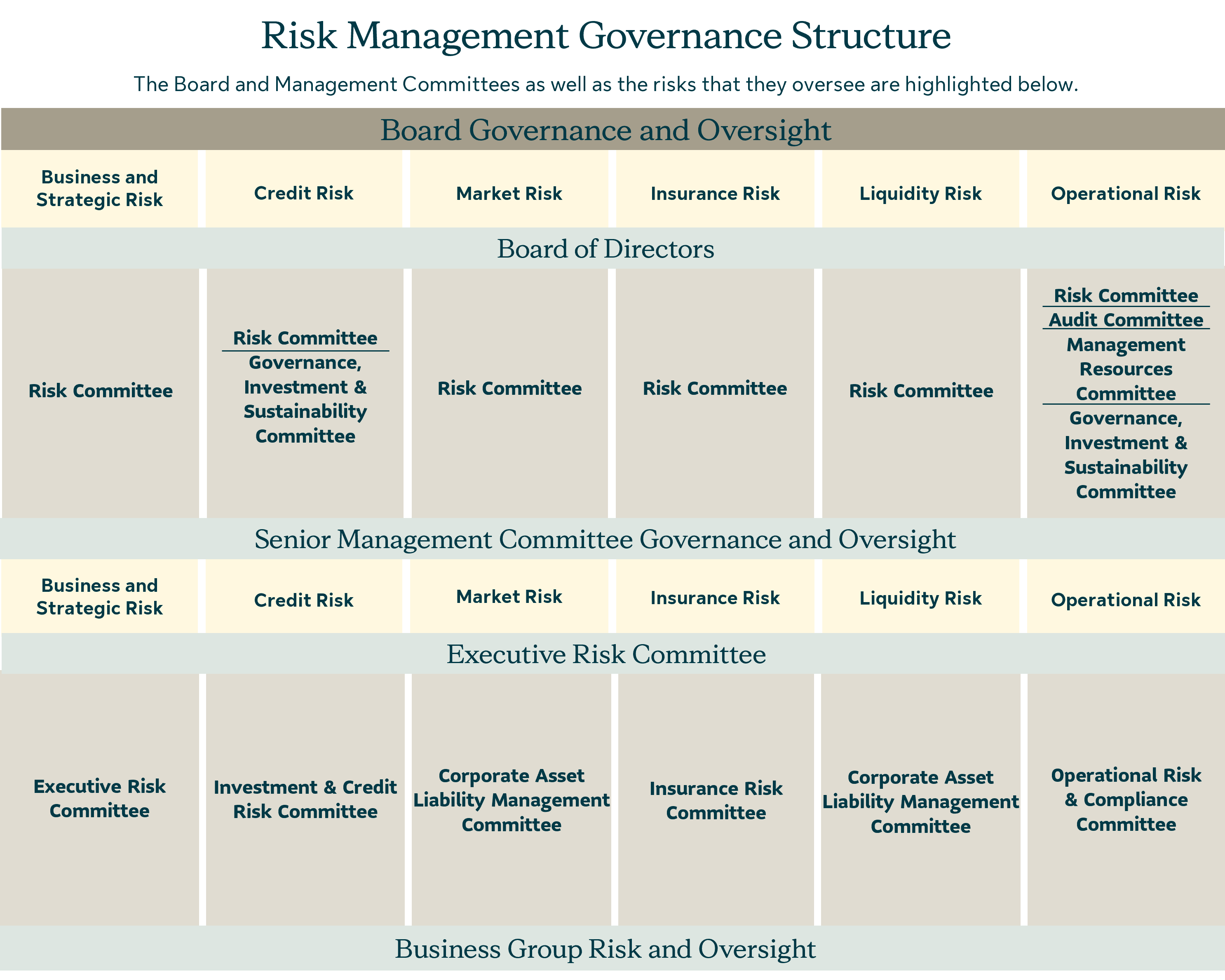

2. Risk Governance |

|

D. PROFITABILITY |

|

3. Risk Universe |

|

|

|

4. Risk Appetite |

|

E. GROWTH |

|

5. Risk Management Policies |

|

1. Sales, Gross Flows and Value of New Business |

|

6. Risk Management Process |

|

2. Assets Under Management |

|

7. Three Lines of Defence |

|

|

|

8. Risk Culture and Philosophy |

|

F. CONTRACTUAL SERVICE MARGIN |

|

9. Risk Categories |

|

|

|

|

|

G. FINANCIAL STRENGTH |

|

L. ADDITIONAL FINANCIAL DISCLOSURE |

|

|

|

1. Selected Annual Information |

|

H. PERFORMANCE BY BUSINESS GROUP |

|

2. Items related to Statement of Operations |

|

1. Asset Management |

|

3. Items related to Statement of Financial Position |

|

2. Canada |

|

4. Fourth Quarter 2023 Profitability |

|

3. U.S. |

|

5. Fourth Quarter 2023 Growth |

|

4. Asia |

|

6. Previous Quarters |

|

5. Corporate |

|

|

|

|

|

M. NON-IFRS FINANCIAL MEASURES |

|

I. INVESTMENTS |

|

|

|

1. Investment Profile |

|

N. ACCOUNTING AND CONTROL MATTERS |

|

2. Debt Securities |

|

1. Critical Accounting Policies and Estimates |

|

3. Equities |

|

2. Changes in Accounting Policies |

|

4. Mortgages and Loans |

|

3. Disclosure Controls and Procedures |

|

5. Derivatives |

|

|

|

6. Investment Properties |

|

O. LEGAL AND REGULATORY PROCEEDINGS |

|

7. Loss Allowance and Provision for Credit Loss |

|

|

|

|

|

P. FORWARD-LOOKING STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 1

|

|

|

Management's Discussion and Analysis |

February 7, 2024

|

|

|

|

|

|

| A. How We Report Our Results |

|

Sun Life is a leading international financial services organization providing asset management, wealth, insurance and health solutions to individual and institutional Clients. Sun Life has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of December 31, 2023, Sun Life had total assets under management ("AUM") of $1.40 trillion. For more information please visit www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

Sun Life Financial Inc. ("SLF Inc.") is a publicly traded company domiciled in Canada and is the holding company of Sun Life Assurance Company of Canada ("Sun Life Assurance"). In this management's discussion and analysis ("MD&A"), SLF Inc., its subsidiaries and, where applicable, its joint ventures and associates are collectively referred to as "the Company", "Sun Life", "we", "our", and "us". Unless otherwise indicated, all information in this MD&A is presented as at and for the year ended December 31, 2023 and the information contained in this document is in Canadian dollars. Amounts in this document are impacted by rounding.

Where information at and for the year ended December 31, 2023 is not available, information available for the latest period before December 31, 2023 is used. Except where otherwise noted, financial information is presented in accordance with International Financial Reporting Standards ("IFRS") and the accounting requirements of the Office of the Superintendent of Financial Institutions ("OSFI"). Reported net income (loss) refers to Common shareholders' net income (loss) determined in accordance with IFRS.

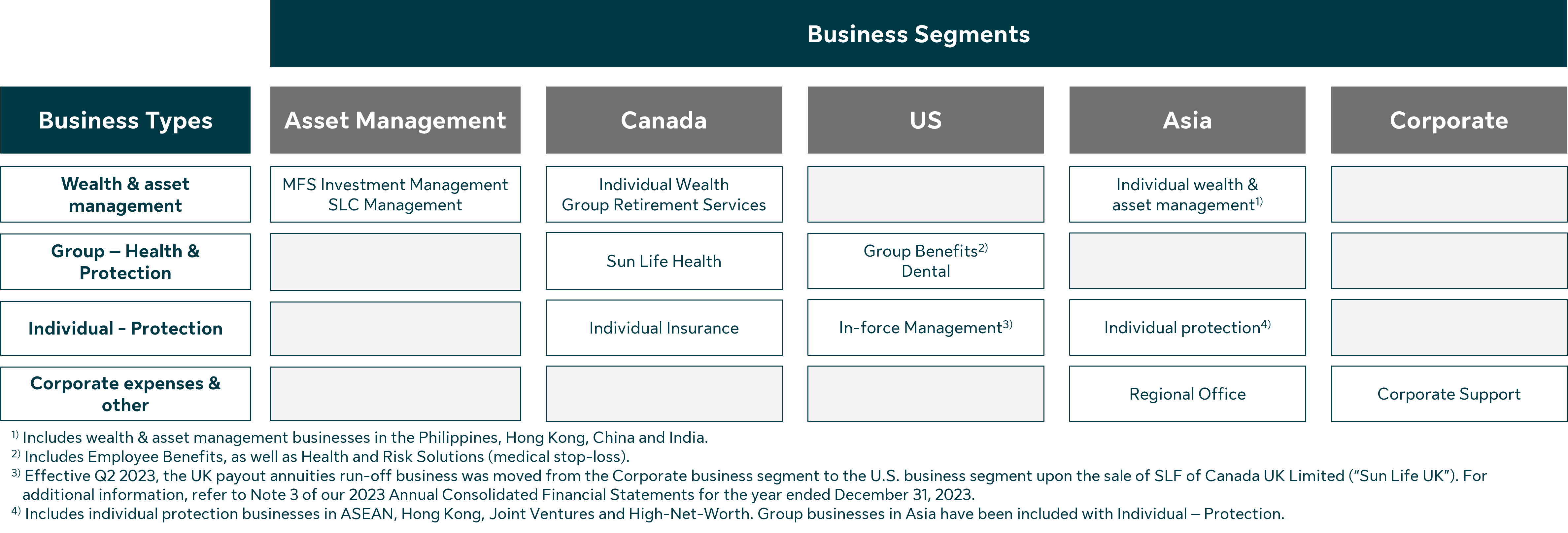

We manage our operations and report our financial results in five business segments: Asset Management, Canada, United States ("U.S."), Asia, and Corporate. Information concerning these segments is included in our annual and interim consolidated financial statements and accompanying notes ("Annual Consolidated Financial Statements" and "Interim Consolidated Financial Statements", respectively, and "Consolidated Financial Statements" collectively), and this MD&A document.

On January 1, 2023 we adopted IFRS 17 Insurance Contracts ("IFRS 17"), which replaces IFRS 4 Insurance Contracts ("IFRS 4"). IFRS 17 establishes the principles for the recognition, measurement, presentation, and disclosure of insurance contracts. On January 1, 2023, we also adopted IFRS 9 Financial Instruments ("IFRS 9"), which replaces IAS 39 Financial Instruments: Recognition and Measurement ("IAS 39"). The nature and effects of the key changes in our critical accounting policies and estimated impacts from the adoption of the new standards are summarized in section N - Accounting and Control Matters in this document. For more information including the measurement and classification of opening balances, refer to Note 2 of our 2023 Annual Consolidated Financial Statements.

Note to Readers: 2022 Restated Results on Adoption of IFRS 17 and IFRS 9

2022 results have been restated for the adoption of IFRS 17 and the related IFRS 9 classification overlay (“the new standards”). The restated results may not be fully representative of our future earnings profile, as we were not managing our asset and liability portfolios under the new standards. The majority of the actions taken to re-balance asset portfolios and transition asset-liability management execution to an IFRS 17 basis occurred in Q1'23. Accordingly, analysis based on 2022 comparative results may not necessarily be indicative of future trends, and should be interpreted with this context. Using sensitivities to analyze the outlook for market risk and related impacts (e.g., interest rate sensitivities) will be more representative starting with the sensitivities disclosed for Q1’23 and onward in section K - Risk Management in this document and section I - Risk Management in each quarter's respective interim MD&A document. Certain 2022 restated results and 2023 interim results in the Drivers of Earnings and CSM Movement Analysis were refined to more accurately reflect how management views the business.

2 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life has a diversified mix of businesses and our earnings by business type supports the analysis of our results:

Underlying net income by Business Types

•Wealth & asset management: Sun Life’s wealth & asset management businesses generate fee income and/or spread on investment products.

•Group - Health & Protection: Group businesses provide health and protection benefits to employer and government plan members. The products generally have shorter-term coverage periods, and more frequent repricing. The revenues are driven by premiums for coverage provided as well as fee-based earnings (i.e., Administrative Services Only plans, and dental fees).

•Individual - Protection: Generally, individual protection businesses have a longer-term profitability profile and are more sensitive to experience trends. The premiums include a margin for providing protection and are invested to earn a return over the expected amounts required to fulfill insurance liabilities.

The following provides an overview of the business types in Sun Life's business segments/business groups:

1. Use of Non-IFRS Financial Measures

We report certain financial information using non-IFRS financial measures, as we believe that these measures provide information that is useful to investors in understanding our performance and facilitate a comparison of our quarterly and full year results from period to period. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed in isolation from or as alternatives to measures of financial performance determined in accordance with IFRS. Additional information concerning non-IFRS financial measures and, if applicable, reconciliations to the closest IFRS measures are available in section M - Non-IFRS Financial Measures in this document and the Supplementary Financial Information package on www.sunlife.com under Investors - Financial results and reports.

2. Forward-looking Statements

Certain statements in this document are forward-looking statements within the meaning of certain securities laws, including the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Additional information concerning forward-looking statements and important risk factors that could cause our assumptions, estimates, expectations and projections to be inaccurate and our actual results or events to differ materially from those expressed in or implied by such forward-looking statements can be found in section P - Forward-looking Statements in this document.

3. Additional Information

Additional information about SLF Inc. can be found in the Consolidated Financial Statements, the annual and interim MD&A, and SLF Inc.'s Annual Information Form ("AIF") for the year ended December 31, 2023. These documents are filed with securities regulators in Canada and are available at www.sedarplus.ca. SLF Inc.'s Annual Consolidated Financial Statements, annual MD&A and AIF are filed with the United States Securities and Exchange Commission ("SEC") in SLF Inc.'s annual report on Form 40-F and SLF Inc.'s interim MD&A and Interim Consolidated Financial Statements are furnished to the SEC on Form 6-Ks and are available at www.sec.gov.

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 3

Sun Life is a leading international financial services organization providing a diverse range of asset management, wealth, insurance, and health solutions to individual and institutional Clients. We have four business pillars: Asset Management, Canada, U.S. and Asia.

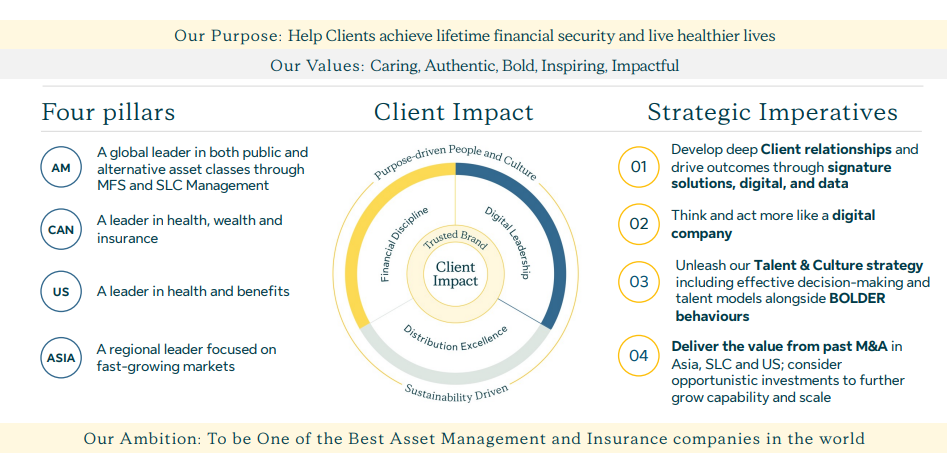

1. Strategy

Our strategy places the Client at the centre of everything we do. Our enterprise strategy, as described below, reflects our priorities and our diversified business mix. We believe by effectively executing on our strategy, we can fulfill our Purpose, create a positive impact for our Clients, and achieve our goal to be a leader in each of our four pillars.

Purpose and Ambition

Our Purpose is to help our Clients achieve lifetime financial security and live healthier lives.

We seek to provide outstanding value and impact for our Clients in three ways:

Driving positive financial actions by:

•Helping Clients build and protect their wealth.

•Providing quality products and solutions that meet the needs of our Clients.

•Delivering timely and expert advice through consistently superior Client experiences.

Delivering solid long-term Client investment returns by:

•Leveraging our collective expertise to make better investment decisions.

•Sourcing broad investment capabilities to serve global Client needs.

•Actively engaging with our Clients to think and act sustainably.

Driving positive health actions by:

•Being a trusted provider of a broad range of health and wellness coverages.

•Helping Clients access, navigate, manage, and receive the care they need.

•Improving health outcomes, including physical and mental well-being, by providing health solutions.

Our Ambition is "to be one of the best asset management and insurance companies in the world". We aim to achieve our ambition by maintaining our balanced business mix and leading positions across our pillars, delivering on our Purpose and Client Impact strategy, and focusing on strong execution to meet our medium-term financial objectives(1)(2):

•Underlying Earnings Per Share ("EPS") growth: 8-10%.

•Underlying Return on Equity ("ROE"): 18%+.

•Underlying Dividend Payout Ratio: 40%-50%.

(1)For more information about our medium-term financial objectives, see section B - Overview - 2 - Financial Objectives in this document. Underlying EPS, underlying ROE and underlying dividend payout ratio are Non-IFRS financial measures. See section M - Non-IFRS Financial Measures in this document.

(2)Our medium-term financial objective for underlying ROE changed to 18%+ following the adoption of IFRS 17 and IFRS 9, an increase from 16%+ prior to transition. Our medium-term financial objectives remain consistent for underlying earnings per share and underlying dividend payout ratio following the adoption of both standards.

4 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS Our four pillars define the businesses and markets in which we operate.

Our Four Pillars

In each of these pillars, we focus on creating value and positively impacting our Clients through businesses that meet Client needs and have strong growth prospects, favourable ROE and strong capital generation in attractive global markets. We are well-positioned across each of our pillars.

Asset Management: A global leader in both public and alternative asset classes through MFS and SLC Management

We deliver value and drive positive Client impact through our offering of quality investment products:

•MFS Investment Management ("MFS") is a long-standing premier active investment manager offering a comprehensive set of asset management products and services to retail and institutional investors around the world.

•SLC Management is an institutional investment manager delivering alternative fixed income, private credit, infrastructure and global real estate solutions to institutional investors. In addition, with the acquisition of a majority interest in Advisors Asset Management, Inc. (“AAM”) and the partnership with Scotia Global Wealth Management, SLC Management will also deliver solutions to the retail High-Net-Worth ("HNW") market in North America.

Canada: A leader in health, wealth, and insurance

We deliver value and impact to approximately 5.5 million Clients via our group and individual businesses by:

•Providing a wide range of asset management, wealth, health and protection solutions to retail Clients.

•Helping Canadians live healthy lives, both as a major provider of group benefits and through a growing focus on innovative products and services that lead to better health outcomes.

•Remaining a market leader in group retirement services in the workplace, including defined contribution pensions, and defined benefit pension de-risking.

U.S.: A leader in health and benefits

We have deep expertise in the health care market, and help our Clients get the coverage they need while improving health outcomes. We are:

•The largest independent medical stop-loss provider in the U.S., offering protection against large medical claims for employers who self-insure their employee health plans and health care navigation services to help members improve outcomes.

•The second largest dental benefits provider in the U.S.(1), serving approximately 36 million members(2) through government programs and commercial group dental and vision solutions for employers of all sizes.

•A top ten group life and disability provider in the U.S., offering a broad portfolio of group insurance products and services, as well as turnkey risk management solutions for health plans and other insurance carriers.

Asia: A regional leader focused on fast-growing markets

We are well-positioned in Asia to achieve our growth aspirations, through our portfolio of distinct businesses in the Philippines, Indonesia, Vietnam, Hong Kong, China, India, Malaysia, and High-Net-Worth including International and Singapore. These markets account for approximately 67% of Asia’s GDP with high potential for future growth(3). We are:

•A provider of individual life and health insurance that delivers Client value across all of our markets.

•A provider, in select markets, of asset management and group retirement products and services.

•Among the global leaders in providing life insurance solutions to HNW Clients.

Our Client Impact Strategy

Our Client Impact strategy has seven areas of focus that we are pursuing across our four pillars. These areas of focus define how we compete in our markets, extend our competitive advantages, fulfill our Purpose and support our ambition to be one of the best asset management and insurance companies in the world.

Client Impact: Our Clients are at the centre of everything we do. Whether it is helping to navigate health concerns, save and plan for retirement or provide financial security for their families, our focus is on the positive impact we have on our Clients' lives. We believe this allows us to develop and offer the right solutions and experiences, build lasting and trusted Client relationships, and create value for Clients that also deliver better business outcomes for Sun Life. We are committed to helping Clients by driving positive health and financial actions, and delivering solid long-term investment returns.

Trusted Brand: Preserving our long standing reputation of being a trusted brand is paramount in an increasingly complex and digitized world. For more than 150 years, we have built and enjoyed strong, trusted relationships with our Clients in all Sun Life markets and through our distribution partnerships. Our brand reflects the differentiated Sun Life experiences we create, the products and service experiences we deliver, and the culture we live by, to achieve our Purpose. Our forward-looking brand strategy remains focused on delivering Client Impact and we will work to build our future competitive advantage and brand appeal with both new and existing Clients.

(1)Based on membership as of December 31, 2022. Ranking compiled by Sun Life and based on data disclosed by competitors.

(2)Includes members who also have a Sun Life Group coverage.

(3)Source: International Monetary Fund, October 2023.

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 5

Distribution Excellence: We have established an omni-channel approach to distribution that makes it easier for Clients to do business with us across all markets. To excel at distribution, we prioritize exceptional service, connecting with our Clients when and how they want to engage, and providing personalized and holistic solutions. We are focused on meeting our Clients' needs by being an exceptional distribution partner that empowers our advisors and partners to provide seamless Client experiences.

Digital Leadership: We are focused on enabling our businesses to create meaningful, digitally-enabled connections with Clients to generate the greatest Client and Business impact. Through the Digital Leadership strategy, we are thinking and acting more like a digital company and deepening Client relationships in each Business Group by leveraging digital capabilities and ways of working.

Our Digital Enterprise strategy is focused on:

•Delivering exceptional and personalized digital experiences for Clients, employees, advisors and partners.

•Leveraging digital capabilities to deliver these experiences more quickly and cost-effectively.

•Evolving our digital ways of working for greater speed, agility, and Client-centric thinking.

Financial Discipline: Our strategy is underpinned by a continued commitment to strong financial performance and risk management, coupled with a focus on capital management. Sustained focus across these areas support our medium-term financial objectives and our aim of top quartile total shareholder returns. Specific areas of focus include:

•Delivering strong, stable earnings growth and disciplined expense management.

•Managing our capital to protect our policyholders and to maintain financial flexibility, to generate shareholder value.

•Disciplined organic investments and a programmatic M&A(1) approach to build scale and capabilities to drive future growth.

Sustainability Driven: Sustainability is essential to our long-term business success. We embed sustainability into our strategy, culture, and operations, to drive meaningful social and economic outcomes for our Clients, employees, advisors, investors and communities. We believe our actions will contribute to a healthier, more financially resilient, environmentally secure, and economically prosperous world. See

Section B - Overview - 3 - Sustainability Plan in this document for more information about our approach to sustainability.

Purpose-Driven People and Culture: Delivering on our strategy is supported by our ability to attract, retain, and develop the best talent, and to empower our people to drive results. We are focused on preserving and strengthening our strong culture of Client focus, integrity, collaboration and inclusivity. Specifically, our focus is to:

•Empower employees and advisors to take action, make decisions, and be accountable.

•Develop talent that combines strong leadership skills with technological savvy, to support our transformation to a leading digital organization.

•Maintain momentum on our diversity, equity and inclusion (“DE&I”) commitment, embedding DE&I into our decision-making to reflect our values.

•Design our Future of Work with intent, offering employees choice and flexibility in how and where we work.

•Be the employer of choice for top talent.

Key Strategic Priorities

Together with the strong foundation of our four pillars and key strategic areas of focus, our strategy emphasizes four key strategic priorities to accelerate growth and improve competitive positioning:

1.Develop deep Client relationships and drive outcomes through signature solutions, digital, and data.

2.Think and act more like a digital company.

3.Unleash our Talent & Culture strategy including effective decision-making and talent models alongside BOLDER (Biased for action, Open to listen, Learn all the time, Drive outcomes, Empowered, Resilient) behaviours.

4.Deliver the value from past M&A in SLC Management, the U.S., and Asia; consider opportunistic investments to further grow capability and scale.

We believe we are well-positioned to execute on each of these strategic priorities and that by doing so we will create positive Client Impact.

Our balanced four pillars, holistic Client Impact strategy, and focus on our key strategic priorities combine elements that have been core to our success. Looking ahead, we are confident that our strategy will allow us to deliver on our Purpose, drive positive Client outcomes, create meaningful value for our shareholders, and support our ambition to be one of the best asset management and insurance companies in the world.

(1)Mergers & Acquisitions ("M&A").

6 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS Following the adoption of IFRS 17 and IFRS 9, progress against our medium-term financial objectives are measured on a two-year basis.

2. Financial Objectives

Our medium-term financial objectives are outlined as follows:

|

|

|

|

|

|

|

|

|

|

|

IFRS 17 and IFRS 9 |

|

Measure(1) |

Medium-term

financial objectives(2)(3)

|

2-Year(2)(4) |

|

|

Underlying EPS growth

Growth in EPS reflects the Company's focus on generating sustainable earnings for shareholders.

|

8%-10% |

11% |

|

|

Underlying ROE

ROE is a significant driver of shareholder value and is a major focus for management across all businesses.

|

18%+ |

17.4% |

|

|

Underlying dividend payout ratio

Payout of capital versus shareholder value, based on underlying net income.

|

40%-50% |

48% |

|

(1)Underlying EPS, underlying ROE and underlying dividend payout ratio are non-IFRS financial measures. See section M - Non-IFRS Financial Measures in this document. Underlying dividend payout ratio represents the ratio of common shareholders' dividends to diluted underlying EPS. See

section J - Capital and Liquidity Management - 3 - Shareholder Dividends in this document for further information regarding dividends.

(2)Our medium-term financial objective for underlying ROE changed to 18%+ following the adoption of IFRS 17 and IFRS 9, an increase from 16%+ prior to transition. Our medium-term financial objectives remain consistent for underlying earnings per share and underlying dividend payout ratio following the adoption of both standards. 2022 restated results may not be fully representative of our future earnings profile, as we were not managing our asset and liability portfolios under the new standards. See the heading "Note to Readers: 2022 Restated Results on Adoption of IFRS 17 and IFRS 9" in section A - How We Report Our Results in this document.

(3)Although considered reasonable, we may not be able to achieve our medium-term financial objectives as our assumptions may prove to be inaccurate. Accordingly, our actual results could differ materially from our medium-term financial objectives as described above. Our medium-term financial objectives do not constitute guidance. Our medium-term financial objectives are forward-looking non-IFRS financial measures and additional information is provided in this MD&A in section P - Forward-looking Statements - Medium-Term Financial Objectives.

(4)Underlying EPS growth, ROE and dividend payout ratio are calculated using an average. Underlying EPS growth reflects one-year growth (2023 over 2022). The beginning period is January 1, 2022 and ending period is December 31, 2023.

In the year and over the medium-term, we have performed well against our medium-term financial objectives in a challenging operating environment reflecting economic and geopolitical uncertainties.

3. Sustainability Plan

Our sustainability ambition is to maximize our positive impact and ensure the resiliency of our organization, in support of our Purpose of helping Clients achieve lifetime financial security and live healthier lives. We aim to create competitive advantage and differentiation for our business through the following focus areas of our sustainability plan:

Increasing Financial Security: We aspire to increase the lifetime financial security of our Clients, employees and communities. We’re increasing access to and use of insurance and wealth products, and empowering and educating people to improve financial security outcomes.

Fostering Healthier Lives: We aspire to improve health and wellness outcomes for our Clients, employees and communities. We're improving access to and use of health insurance and health care, and empowering people to navigate and manage their health journey to improve health outcomes. Our investments in community health complement these efforts.

Advancing Sustainable Investing: We aspire to deliver sustainable returns for Clients and drive the transition to a low-carbon, inclusive economy. We manage assets with material environmental, social and governance ("ESG") factors embedded in our investment processes and offer our Clients sustainable investing opportunities. In addition, we invest our own assets in ways that support a low-carbon and more inclusive economy.

Climate change: We are committed to being part of the climate solution. We’re decarbonizing our business and engaging with our stakeholders to support the transition to a low-carbon economy. Meaningful climate action is essential to delivering on our Purpose and ensuring the resiliency of our business.

Our sustainability plan builds from our foundation as a Trusted and Responsible Business. We aspire to be a responsibly-managed business that is Client-focused, competitive, forward-thinking and sustainable for the long term.

For additional information on our sustainability plan and recent progress, refer to www.sunlife.com/sustainability and the headings "2023 Highlights" throughout section H - Performance by Business Segment in this document. For more information on our approach to climate change, refer to the heading "Environmental and Social Risk Section" in section K - Risk Management - 9 - Risk Categories - iv - Business and Strategic Risk of this document, which includes our disclosure based on the recommendations of the Task Force on Climate-related Financial Disclosures ("TCFD").

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 7

4. Acquisitions and Other

The following developments occurred since January 1, 2023. Additional information concerning acquisitions and dispositions is provided in Note 3 in our 2023 Annual Consolidated Financial Statements.

On February 1, 2023, we completed the acquisition of a 51%(1) interest in Advisors Asset Management, Inc. ("AAM"), a leading independent U.S. retail distribution firm. AAM's strong U.S. retail distribution capabilities provides an attractive opportunity for SLC Management to meet the growing demand for alternative assets among U.S. HNW investors. AAM provides a range of solutions and products to financial advisors at wirehouses, registered investment advisors and independent broker-dealers, overseeing US$41.4 billion (approximately C$54.9 billion) in assets as at December 31, 2023, with 10 offices across nine U.S. states. Sun Life has the option to acquire the remaining interest in AAM starting in 2028. As a result of the transaction, total shareholders’ equity was reduced by $156 million, primarily driven by the establishment of financial liabilities associated with the anticipated increase of our future ownership in AAM.

On February 1, 2023, we completed the sale of the sponsored markets business(2) from Sun Life Assurance to Canadian Premier Life Insurance

Company (re-branded to Securian Canada).

On April 3, 2023 we completed the sale of SLF of Canada UK Limited ("Sun Life UK") to Phoenix Group Holdings plc ("Phoenix Group") for approximately $418 million. Sun Life UK managed life and pension policies as well as payout annuities for UK Clients, was closed to new sales and operated as a run-off business since 2001. Under the agreement, we will retain our economic interest in the payout annuities business through a reinsurance treaty, which, effective Q2'23, is recorded in In-force Management within the U.S. business group. Phoenix Group is the UK's largest long-term savings and retirement business, with £269 billion(3) of assets under administration and approximately 12 million customers(3). As part of the sale, we will establish a long-term partnership to become a strategic asset management partner to Phoenix Group. Our asset management companies, MFS and SLC Management, will continue to manage approximately $8 billion of Sun Life UK's general account. In addition, Phoenix Group has set a goal to invest approximately US$25 billion in North American public and private fixed income and alternative investments over the next five years. MFS and SLC Management will be material partners to Phoenix Group in achieving this goal. In Q3'22, we recognized an impairment charge pertaining to the attributed goodwill that was not expected to be recovered through the sale. In Q2'23, we recognized a gain of $19 million in reported net income.

Effective July 1, 2023 we commenced our 15-year exclusive bancassurance partnership with Dah Sing Bank ("Dah Sing"). Under this

partnership, Sun Life will be the exclusive provider of life insurance solutions to Dah Sing's approximately 570,000 retail banking customers, helping to fulfill their savings and protection needs at different life stages. This is Sun Life's first exclusive bancassurance partnership in Hong Kong and will be a valuable complement to our existing network of over 2,500 expert insurance advisors.

On October 3, 2023, we acquired Dialogue Health Technologies Inc. ("Dialogue"). As a result of this acquisition, our ownership interest increased from 23% to 95% for cash proceeds of $272 million (for equity not previously owned by Sun Life or rolled by certain members of Dialogue's executive management). Dialogue is a Canadian based health and wellness virtual care platform.

(1)On a fully diluted basis.

(2)Sponsored markets include a variety of association & affinity, and group creditor clients. This business was previously part of the Sun Life Health business unit in the Canada business segment.

(3)As at June 30, 2023.

8 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, unless otherwise noted) |

|

|

|

|

| Profitability |

|

|

|

|

|

2023 |

2022(1) |

|

Net income (loss) |

|

|

|

|

|

|

|

|

Underlying net income (loss)(2) |

|

|

|

|

|

3,728 |

3,369 |

|

Reported net income (loss) - Common shareholders |

|

|

|

|

|

3,086 |

2,871 |

|

Diluted earnings per share ("EPS") ($) |

|

|

|

|

|

|

|

|

Underlying EPS (diluted)(2) |

|

|

|

|

|

6.36 |

5.75 |

|

Reported EPS (diluted) |

|

|

|

|

|

5.26 |

4.89 |

|

Return on equity ("ROE") (%) |

|

|

|

|

|

|

|

|

Underlying ROE(2) |

|

|

|

|

|

17.8% |

17.0% |

|

Reported ROE(2) |

|

|

|

|

|

14.7% |

14.5% |

|

|

|

|

|

|

|

|

|

| Growth |

|

|

|

|

|

2023 |

2022(1) |

|

Sales |

|

|

|

|

|

|

|

|

Wealth sales & asset management gross flows(2)(3) |

|

|

|

|

|

173,820 |

198,650 |

|

Group - Health & Protection sales(2)(4) |

|

|

|

|

|

2,942 |

2,554 |

|

Individual - Protection sales(2) |

|

|

|

|

|

2,491 |

1,767 |

|

Total AUM ($ billions)(2) |

|

|

|

|

|

1,399.6 |

1,318.6 |

|

New business Contractual Service Margin ("CSM")(2) |

|

|

|

|

|

1,253 |

762 |

|

|

|

|

|

|

|

|

|

| Financial Strength |

|

|

|

|

|

2023 |

As at

January 1, 2023(6)

|

|

LICAT ratios(5)(6) |

|

|

|

|

|

|

|

|

Sun Life Financial Inc. |

|

|

|

|

|

149% |

142% |

|

Sun Life Assurance(7) |

|

|

|

|

|

141% |

139% |

|

Financial leverage ratio(2)(8) |

|

|

|

|

|

21.5% |

23.7% |

|

Book value per common share ($) |

|

|

|

|

|

36.51 |

34.60 |

|

Weighted average common shares outstanding for basic EPS (millions) |

|

|

|

|

|

586 |

586 |

|

Closing common shares outstanding (millions) |

|

|

|

|

|

585 |

586 |

(1)2022 restated results may not be fully representative of our future earnings profile, as we were not managing our asset and liability portfolios under the new standards. See the heading "Note to Readers: 2022 Restated Results on Adoption of IFRS 17 and IFRS 9" in section A - How We Report Our Results in this document.

(2)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(3)Effective January 1, 2023, Canada wealth sales & asset management gross flows have been updated to exclude retained sales. Prior period amounts have been updated to reflect this change.

(4)Prior period amounts related to U.S. Dental sales have been restated to reflect new information.

(5)Life Insurance Capital Adequacy Test ("LICAT") ratio. Our LICAT ratios are calculated in accordance with the OSFI-mandated guideline.

(6)OSFI's 2023 LICAT Guideline, effective January 1, 2023, specifies that available capital for LICAT purposes includes the Contractual Service Margin. Prior period restatement and resubmissions are not mandated. Pro-forma January 1, 2023 LICAT ratios are disclosed to illustrate transition impact. These pro-forma calculations will not be formally submitted to OSFI.

(7)Sun Life Assurance is SLF Inc.’s principal operating life insurance subsidiary.

(8)Effective January 1, 2023, the calculation for the financial leverage ratio was updated to include the CSM balance (net of taxes) in the denominator. The CSM (net of taxes) was $9.6 billion as at December 31, 2023 (January 1, 2023 - $8.7 billion).

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 9

The following table reconciles our Common shareholders' net income ("reported net income") and underlying net income. All factors discussed in this document that impact underlying net income are also applicable to reported net income. Certain adjustments and notable items also impact the CSM, such as mortality experience and assumption changes; see section F - Contractual Service Margin in this document for more information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, after-tax) |

|

|

|

2023 |

2022(1) |

Underlying net income by business type(2): |

|

|

|

|

|

| Wealth & asset management |

|

|

|

1,726 |

1,673 |

| Group - Health & Protection |

|

|

|

1,313 |

963 |

| Individual - Protection |

|

|

|

1,137 |

1,000 |

| Corporate expenses & other |

|

|

|

(448) |

(267) |

Underlying net income(2) |

|

|

|

3,728 |

3,369 |

Add: Market-related impacts(1) |

|

|

|

(454) |

(21) |

Assumption changes and management actions ("ACMA") |

|

|

|

36 |

(168) |

Other adjustments |

|

|

|

(224) |

(309) |

| Reported net income - Common shareholders |

|

|

|

3,086 |

2,871 |

Underlying ROE(2) |

|

|

|

17.8% |

17.0% |

Reported ROE(2) |

|

|

|

14.7% |

14.5% |

Notable items attributable to reported and underlying net income(2): |

|

|

|

|

|

| Mortality |

|

|

|

6 |

(152) |

| Morbidity |

|

|

|

324 |

175 |

| Lapse and other policyholder behaviour ("policyholder behaviour") |

|

|

|

(24) |

(14) |

| Expenses |

|

|

|

(72) |

2 |

Credit(3) |

|

|

|

(34) |

(28) |

Other(4) |

|

|

|

34 |

25 |

(1)2022 restated results may not be fully representative of our future earnings profile, as we were not managing our asset and liability portfolios under the new standards. See the heading "Note to Readers: 2022 Restated Results on Adoption of IFRS 17 and IFRS 9" in section A - How We Report Our Results in this document.

(2)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document. For more information about business types in Sun Life's business groups, see section A - How We Report Our Results in this document.

(3)Credit includes rating changes on assets measured at Fair value through profit or loss ("FVTPL"), and the Expected credit loss ("ECL") impact for assets measured at Fair value through other comprehensive income ("FVOCI").

(4)Other notable items are recorded in Net Insurance Service Result and Net Investment Result in the Drivers of Earnings analysis. For more details, see section M - Non-IFRS Financial Measures in this document.

2023 vs. 2022

Underlying net income of $3,728 million increased $359 million or 11%, driven by:

•Wealth & asset management up $53 million: Higher investment income driven by volume growth and an increase in yields, partially offset by lower fee-related earnings in MFS, Canada, and Asia.

•Group - Health & Protection up $350 million: Business premium growth across all U.S. businesses and Canada, improved disability experience in Canada, higher investment contributions in the U.S., and DentaQuest contributions.

•Individual - Protection up $137 million: Business growth reflecting good sales momentum in Asia, improved protection experience, and higher investment contributions in Canada, partially offset by lower earnings due to the sale of Sun Life UK(1).

•Corporate expenses & other $(181) million increase in net loss includes higher debt financing costs.

•In addition, the earnings by business type above include higher earnings on surplus, driven by an increase in realized gains and net interest income from higher rates, and higher operating expenses reflecting volume growth and continued investments in the business.

(1)On April 3, 2023 we completed the sale of SLF of Canada UK Limited to Phoenix Group Holdings plc ("the sale of Sun Life UK"). For additional information, refer to Note 3 of our 2023 Annual Consolidated Financial Statements.

10 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS Reported net income of $3,086 million increased $215 million or 7%, driven by the increase in underlying net income and:

•ACMA impacts;

•Gain on the sale of the sponsored markets business in Canada(1); and

•The impact of the Bermuda Corporate Income Tax Change(2); partially offset by

•Market-related impacts reflecting real estate experience(3) and interest rates, partially offset by equity markets;

•Fair value changes in management's ownership of MFS shares; and

•The impact of the Canada Tax Rate Change(4) and a gain on the sale-leaseback of the Wellesley office in the U.S. in the prior year were mostly offset by a $170 million charge related to the sale of Sun Life UK(5) and a higher increase in SLC Management's acquisition-related liabilities(6) in the prior year.

Foreign exchange translation led to an increase of $77 million and $73 million to underlying net income and reported net income, respectively.

Underlying ROE was 17.8% and reported ROE was 14.7% (2022 - 17.0% and 14.5%, respectively).

1.Market-related impacts

Market-related impacts represent the difference between actual versus expected market movements(7). Market-related impacts resulted in a decrease of $454 million to reported net income, primarily reflecting unfavourable real estate experience.

2.Assumption changes and management actions

The net impact of assumption changes and management actions was an increase of $36 million to reported net income and includes methods and assumptions changes on insurance contracts as well as related impacts. These included favourable impacts from modelling enhancements in Asia and financial-related assumptions, which were partially offset by unfavourable policyholder behaviour updates in Asia, mortality updates in the U.S., and refinements to Sun Life Health in Canada. For additional details refer to "Assumption Changes and Management Actions by Type" in section F - Contractual Service Margin in this document.

3.Other adjustments

Other adjustments decreased reported net income $224 million, reflecting DentaQuest integration costs and amortization of acquired intangible assets, and SLC Management acquisition-related costs(8), partially offset by gains on the sale of the sponsored markets business in Canada(1) and the sale of Sun Life UK(5), and the impact of the Bermuda Corporate Income Tax Change(2).

4. Experience-related items

Notable experience items in the current year included:

•Favourable morbidity experience largely in Canada and in U.S. medical stop-loss;

•Unfavourable expense experience largely in Canada, U.S. Dental, and Asia;

•Unfavourable credit experience that impacted Canada results; and

•Other experience was favourable reflecting various smaller items.

5.Income taxes

The statutory tax rate is impacted by various items, such as lower taxes on income subject to tax in foreign jurisdictions, tax-exempt investment income, and other sustainable tax benefits.

On December 27, 2023, Bermuda enacted its Corporate Income Tax Act 2023, which will apply a 15% income tax beginning on

January 1, 2025. Bermuda Corporate Income Taxes are expected to be a covered tax and will reduce Pillar Two top-up taxes which would otherwise be payable to other jurisdictions. The enacted legislation provides an economic transition adjustment that aligns an entity’s starting point for the tax regime more closely with its economic position prior to the application of the Corporate Income Tax 2023. The benefit of this economic transition adjustment has been recognized in 2023. As a result, total Company reported net income increased by $51 million, reflected in Other adjustments. The Bermuda Corporate Income Tax is not expected to have a material impact on Sun Life’s consolidated financial statements when it becomes effective in 2025. Refer to Note 19 in the 2023 Annual Consolidated Financial Statements for more information.

The effective income tax rate(9) on underlying net income and reported net income was 17.3% and 11.7%, respectively.

(1)On February 1, 2023, we completed the sale of the sponsored markets business from Sun Life Assurance, a wholly owned subsidiary of SLF Inc., to Canadian Premier Life Insurance Company (re-branded to Securian Canada) ("sale of the sponsored markets business").

(2)Refer to the heading "Income taxes" in this section for more information.

(3)Real estate experience reflects the difference between the actual value of real estate investments compared to management's longer-term expected returns supporting insurance contract liabilities ("real estate experience").

(4)On December 15, 2022, legislation implementing an additional surtax of 1.5% applicable to banks and life insurer's taxable income in excess of $100 million was enacted in Canada ("Canada Tax Rate Change"). This legislation applied retroactively to the Federal Budget date of April 7, 2022. As a result, total Company reported net income increased by $141 million in Q4'22, reflected in Other adjustments.

(5)On April 3, 2023 we completed the sale of SLF of Canada UK Limited to Phoenix Group Holdings plc ("the sale of Sun Life UK"). In Q3'22, we recognized an impairment charge of $170 million pertaining to the attributed goodwill that was not expected to be recovered through the sale.

(6)Reflects the changes in estimated future payments for acquisition-related contingent considerations and options to purchase remaining ownership interests of SLC Management affiliates.

(7)Except for risk free rates which are based on current rates, expected market movements are based on our medium-term outlook which is reviewed annually.

(8)Includes an increase in SLC Management's acquisition-related liabilities in Q3'23, which reflects the changes in estimated future payments for acquisition-related contingent considerations and options to purchase remaining ownership interests of SLC Management affiliates.

(9)Our effective income tax rate on reported net income is calculated using Total income (loss) before income taxes, as detailed in Note 19 in our 2023 Annual Consolidated Financial Statements. Our effective income tax rate on underlying net income is calculated using pre-tax underlying net income, as detailed in section M - Non-IFRS Financial Measures in this document, and the associated income tax expense.

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 11

6. Impacts of foreign exchange translation

We operate in many markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda, and generate revenues and incur expenses in local currencies in these jurisdictions, which are translated to Canadian dollars.

Items impacting a reporting period, such as Revenue, Expenses, and Reported net income (loss) in our Consolidated Statements of Operations, as well as underlying net income (loss), and sales, are translated into Canadian dollars using average exchange rates for the appropriate daily, monthly, or quarterly period. For Assets and Liabilities in our Consolidated Statements of Financial Position, as well as the AUM and certain components of the Drivers of Earnings disclosure, period-end rates are used for currency translation purposes.

The following table provides the foreign exchange rates for the U.S. dollar, which generates the most significant impact of foreign exchange translation, over the past four quarters and two years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange rate |

Quarterly results |

Full year |

|

Q4'23 |

Q3'23 |

Q2'23 |

Q1'23 |

2023 |

2022 |

U.S. Dollar - Average |

1.361 |

1.341 |

1.343 |

1.352 |

1.350 |

1.301 |

U.S. Dollar - Period end |

1.325 |

1.358 |

1.324 |

1.352 |

1.325 |

1.355 |

The relative impacts of foreign exchange translation in any given period are driven by the movement of foreign exchange rates as well as the proportion of earnings generated in our foreign operations. In general, net income benefits from a weakening Canadian dollar and is adversely affected by a strengthening Canadian dollar as net income from the Company's international operations is translated back to Canadian dollars. Conversely, in a period of losses, the weakening of the Canadian dollar has the effect of increasing losses in foreign jurisdictions. We generally express the impacts of foreign exchange translation on net income on a year-over-year basis.

Foreign exchange translation led to an increase of $77 million and $73 million in underlying net income and reported net income, respectively.

12 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS

1. Sales and Gross Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions) |

|

|

|

2023 |

2022 |

Wealth sales & asset management gross flows by business segment(1) |

|

|

|

|

|

Asset Management gross flows |

|

|

|

151,068 |

172,881 |

Canada wealth sales & asset management gross flows(2) |

|

|

|

15,039 |

14,629 |

| Asia wealth sales & asset management gross flows |

|

|

|

7,713 |

11,140 |

Total wealth sales & asset management gross flows(1) |

|

|

|

173,820 |

198,650 |

Group - Health & Protection sales by business segment(1) |

|

|

|

|

|

| Canada |

|

|

|

591 |

533 |

|

U.S.(3) |

|

|

|

2,275 |

1,948 |

|

Asia(4) |

|

|

|

76 |

73 |

Total group sales(1) |

|

|

|

2,942 |

2,554 |

Individual - Protection sales by business segment(1) |

|

|

|

|

|

| Canada |

|

|

|

609 |

496 |

| Asia |

|

|

|

1,882 |

1,271 |

Total individual sales(1) |

|

|

|

2,491 |

1,767 |

CSM - Impact of new insurance business ("New business CSM")(1) |

|

|

|

1,253 |

762 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(2)Effective January 1, 2023, Canada wealth sales & asset management gross flows have been updated to exclude retained sales. Prior period amounts have been updated to reflect this change.

(3)Prior period amounts related to U.S. Dental sales have been restated to reflect new information.

(4)In underlying net income by business type, Group businesses in Asia have been included with Individual – Protection. For more information about business types in Sun Life's business groups, see section A - How We Report Our Results in this document.

Total wealth sales & asset management gross flows decreased $24.8 billion or 12% year-over-year ($30.2 billion(1) or 15%(1), excluding foreign exchange translation).

•Asset Management gross flows decreased $27.1 billion(1) or 16%(1), reflecting lower gross flows in MFS and SLC Management.

•Canada wealth sales & asset management gross flows increased $0.4 billion or 3%, driven by higher Individual Wealth sales, primarily from mutual funds, largely offset by lower defined contribution sales in Group Retirement Services ("GRS").

•Asia wealth sales & asset management gross flows decreased $3.5 billion(1) or 31%(1), primarily reflecting lower money market fund sales in the Philippines.

Total group health & protection sales increased $388 million or 15% from prior year ($332 million(1) or 13%(1), excluding foreign exchange translation).

•Canada group sales increased $58 million or 11%, driven by higher large case sales.

•U.S. group sales increased $270 million(1) or 15%(1), driven by higher Dental(2) sales in Medicare Advantage, Medicaid, and commercial dental, as well as higher medical stop-loss sales, partially offset by lower employee benefits sales.

Total individual protection sales increased $724 million or 41% from prior year ($694 million(1) or 39%(1), excluding foreign exchange translation).

•Canada individual sales increased $113 million or 23%, driven by higher participating whole life insurance sales.

•Asia individual sales increased $581 million(1) or 46%(1), driven by higher sales in Hong Kong, International, and India, partially offset by lower sales in Vietnam.

New business CSM represents growth derived from sales activity in the period. The impact of new insurance business drove a $1,253 million increase in CSM, compared to $762 million in the prior year, driven by higher individual protection sales in Asia in Hong Kong and High-Net-Worth ("HNW"), and Canada.

1)This change excludes the impacts of foreign exchange translation. For more information about these non-IFRS financial measures, see section

M - Non-IFRS Financial Measures in this document.

2)Dental sales include sales from DentaQuest, acquired on June 1, 2022.

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 13

2. Assets Under Management

AUM consists of general funds, the investments for segregated fund holders ("segregated funds") and third-party assets managed by the Company. Third-party AUM is comprised of institutional and managed funds, as well as other AUM related to our joint ventures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions) |

|

|

|

|

|

2023 |

2022 |

Assets under management(1) |

|

|

|

|

|

|

|

| General fund assets |

|

|

|

|

|

204,789 |

198,316 |

| Segregated funds |

|

|

|

|

|

128,452 |

125,292 |

Third-party assets under management(1) |

|

|

|

|

|

|

|

Retail |

|

|

|

|

|

567,657 |

527,617 |

Institutional, managed funds and other |

|

|

|

|

|

537,424 |

507,673 |

Total third-party AUM(1) |

|

|

|

|

|

1,105,081 |

1,035,290 |

| Consolidation adjustments |

|

|

|

|

|

(38,717) |

(40,337) |

Total assets under management(1) |

|

|

|

|

|

1,399,605 |

1,318,561 |

(1)Represents a non-IFRS financial measure. See section M - Non-IFRS Financial Measures in this document.

AUM increased $81.0 billion or 6% from December 31, 2022, primarily driven by:

(i)favourable market movements on the value of segregated, retail, institutional and managed funds of $126.9 billion;

(ii)an increase in AUM of general fund assets of $6.5 billion primarily due to net fair value growth from declining interest rates; and

(iii)an increase of $5.2 billion from AUM primarily driven by the AAM acquisition(1); partially offset by

(iv)net outflows from segregated funds and third-party AUM of $26.9 billion;

(v)a decrease of $24.4 billion from foreign exchange translation (excluding the impacts of general fund assets); and

(vi)Client distributions of $6.5 billion.

Segregated fund and third-party AUM net outflows of $26.9 billion for the year were comprised of:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ billions) |

|

|

|

|

|

2023 |

2022 |

Net flows for Segregated fund and Third-party AUM: |

|

|

|

|

|

|

|

MFS |

|

|

|

|

|

(38.9) |

(43.4) |

| SLC Management |

|

|

|

|

|

12.5 |

21.4 |

| Canada, Asia and other |

|

|

|

|

|

(0.5) |

0.5 |

Total net flows for Segregated fund and Third-party AUM |

|

|

|

|

|

(26.9) |

(21.5) |

Third-Party AUM increased by $69.8 billion or 7% from December 31, 2022, primarily driven by:

(i)favourable market movements of $113.9 billion;

(ii)other business activities of $9.3 billion; and

(iii)an increase of $5.2 billion from AUM primarily driven by the AAM acquisition(1); partially offset by

(iv)net outflows of $27.0 billion;

(v)foreign exchange translation of $25.1 billion; and

(vi)Client distributions of $6.5 billion.

(1)The acquisition of a majority stake in Advisors Asset Management, Inc. ("AAM acquisition"). For additional information, refer to Note 3 in our 2023 Annual Consolidated Financial Statements.

14 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS Contractual Service Margin represents a source of stored value for future insurance profits and qualifies as available capital for LICAT purposes.

|

|

|

|

|

|

| F. Contractual Service Margin |

|

CSM is a component of insurance contract liabilities. The following table shows the change in CSM including its recognition into net income in the period, as well as the growth from new insurance sales activity.

|

|

|

|

|

|

|

|

|

|

For the full year ended |

For the full year ended |

| ($ millions) |

December 31, 2023 |

December 31, 2022 |

| Beginning of Period |

10,865 |

9,797 |

Impact of new insurance business(1) |

1,253 |

762 |

Expected movements from asset returns & locked-in rates(1) |

560 |

362 |

Insurance experience gains/losses(1) |

67 |

89 |

| CSM recognized for services provided |

(919) |

(861) |

Organic CSM Movement(1) |

961 |

352 |

Impact of markets & other(1) |

(38) |

37 |

Impact of change in assumptions(1) |

364 |

431 |

| Currency impact |

(104) |

248 |

Disposition(2) |

(262) |

— |

| Total CSM Movement |

921 |

1,068 |

| Contractual Service Margin, End of Period |

11,786 |

10,865 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(2)Relates to the sale of Sun Life UK. For additional information, refer to Note 3 in our 2023 Annual Consolidated Financial Statements.

Total CSM ended Q4'23 at $11.8 billion, an increase of $0.9 billion or 8% from December 31, 2022:

•Organic CSM movement was driven by the impact of new insurance business, reflecting strong individual protection sales in Asia and Canada.

•Favourable insurance experience occurred in Canada and Asia.

•Unfavourable markets and other impacts driven by interest rates.

•Impact of change in assumptions include favourable net mortality and net favourable model refinements.

•A $262 million reduction to the CSM balance from the sale of Sun Life UK.

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 15

Assumption Changes and Management Actions by Type

The impact on CSM of ACMA is attributable to insurance contracts and related impacts under the general measurement approach ("GMA") and variable fee approach ("VFA"). For insurance contracts measured under the GMA, the impacts flow through the CSM at locked-in discount rates. For insurance contracts measured under the VFA, the impact flows through the CSM at current discount rates.

The following table sets out the impacts of ACMA on our reported net income and CSM in 2023.

|

|

|

|

|

|

|

|

|

|

|

|

At and For the Year Ended December 31, 2023 |

|

| ($ millions) |

Reported net income impacts (Post-tax)(1)(2)(3) |

Deferred in CSM (Pre-tax)(2)(3)(4) |

Comments |

| Mortality/morbidity |

(98) |

179 |

Updates to reflect mortality/morbidity experience in all jurisdictions. The largest items were favourable mortality impacts in the UK Annuities in the U.S and GRS in Canada.

These were offset partially by adverse mortality in In-force Management in the U.S. Mortality updates impacting CSM favourably are funded at locked-in rates that are lower than current rates resulting in a negative net income impact. Additionally, favourable morbidity impacts in Group Benefits in the U.S. were largely offset by unfavourable morbidity updates in Sun Life Health in Canada.

|

| Policyholder behaviour |

(91) |

(274) |

Updates to reflect lapse and policyholder behaviour in all jurisdictions. The largest items were an adverse lapse impact in Individual Term and Universal Life in Canada, and in International, Hong Kong and Vietnam in Asia. |

| Expense |

7 |

(171) |

Updates to reflect higher costs related to IFRS 17 infrastructure and higher costs in Canada. |

| Financial |

116 |

202 |

Updates to various financial related assumptions including the ultimate risk-free rate. |

| Modelling enhancement and other |

102 |

428 |

Various enhancements and methodology changes. The largest items were favourable impacts from refinements to the modelling of guarantees for the Individual Par in Canada and International Universal Life in Asia, as well as modelling enhancements in Vietnam in Asia offset partially by a refinement in Sun Life Health in Canada and to reinsurance and other provisions in Hong Kong in Asia. |

Total impact of change in assumptions |

36 |

364 |

|

(1)In this document, the reported net income impact of ACMA is shown in aggregate for Net insurance service result and Net investment result, and excludes amounts attributable to participating policyholders.

(2)CSM is shown on a pre-tax basis as it reflects the changes in our insurance contract liabilities, while reported net income is shown on a post-tax basis to reflect the impact on capital.

(3)The impact of ACMA of $90 million and $318 million of pre-tax net income and CSM, respectively, disclosed in Note 10.B of the 2023 Annual Consolidated Financial Statements, differs from the $36 million and $364 million, respectively, of ACMA shown above. This is a variance of $54 million and $(46) million, respectively. The difference is $16 million of tax on net income, and $38 million and $(46) million, respectively, of net income and CSM for non-liability impacts related to ACMA included in the above but excluded from Note 10.B in the 2023 Annual Consolidated Financial Statements.

(4)Total impact of change in assumptions represents a non-IFRS financial measure for amounts deferred in CSM. For more details, see section

M - Non-IFRS Financial Measures in this document.

16 December 31, 2023 Sun Life Financial Inc. MANAGEMENT'S DISCUSSION & ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IFRS 17 and IFRS 9 |

|

|

IFRS 4 and IAS 39(1) |

| ($ millions, unless otherwise stated) |

2023 |

|

|

|

|

As at

January 1, 2023(2)

|

|

|

2022 |

| LICAT ratio |

|

|

|

|

|

|

|

|

|

Sun Life Financial Inc.(1)(2) |

149% |

|

|

|

|

142% |

|

|

130% |

Sun Life Assurance(1)(2) |

141% |

|

|

|

|

139% |

|

|

127% |

Capital |

|

|

|

|

|

|

|

|

|

| Subordinated debt |

6,178 |

|

|

|

|

6,676 |

|

|

6,676 |

Innovative capital instruments(3) |

200 |

|

|

|

|

200 |

|

|

200 |

| Equity in the participating account |

457 |

|

|

|

|

268 |

|

|

1,837 |

| Non-controlling interests |

161 |

|

|

|

|

90 |

|

|

90 |

| Preferred shares and other equity instruments |

2,239 |

|

|

|

|

2,239 |

|

|

2,239 |

Common shareholders' equity(4) |

21,343 |

|

|

|

|

20,290 |

|

|

25,211 |

Contractual Service Margin(2)(5) |

11,786 |

|

|

|

|

10,865 |

|

|

|

Total capital(1)(2) |

42,364 |

|

|

|

|

40,628 |

|

|

36,253 |

Financial leverage ratio(1)(5)(6) |

21.5% |

|

|

|

|

23.7% |

|

|

25.1% |

| Dividend |

|

|

|

|

|

|

|

|

|

Underlying dividend payout ratio(1)(6) |

47% |

|

|

|

|

47% |

|

|

44% |

| Dividends per common share ($) |

3.000 |

|

|

|

|

0.720 |

|

|

2.760 |

Book value per common share ($)(1) |

36.51 |

|

|

|

|

34.60 |

|

|

42.99 |

(1)This measure has not been restated for periods in 2022 and earlier as IFRS 17 and IFRS 9 were not the accounting standards in effect, and therefore were not applicable to our capital management practices at the time.

(2)OSFI's 2023 LICAT Guideline, effective January 1, 2023, specifies that available capital for LICAT purposes includes the CSM, and as such total capital was also updated to include the CSM balance. Prior period restatement and resubmissions are not mandated. Pro-forma January 1, 2023 LICAT ratios are disclosed to illustrate transition impact. These pro-forma calculations will not be formally submitted to OSFI.

(3)Innovative capital instruments consist of Sun Life ExchangEable Capital Securities ("SLEECS"), see section J - Capital and Liquidity Management in this document.

(4)Common shareholders’ equity is equal to Total shareholders’ equity less Preferred shares and other equity instruments.

(5)Effective January 1, 2023, the calculation for the financial leverage ratio was updated to include the CSM balance (net of taxes) in the denominator. The CSM (net of taxes) was $9.6 billion as at December 31, 2023 (January 1, 2023 - $8.7 billion).

(6)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

1. Life Insurance Capital Adequacy Test

The Office of the Superintendent of Financial Institutions has developed the regulatory capital framework referred to as the Life Insurance Capital Adequacy Test for Canada. LICAT measures the capital adequacy of an insurer using a risk-based approach and includes elements that contribute to financial strength through periods when an insurer is under stress as well as elements that contribute to policyholder and creditor protection wind-up.

SLF Inc. is a non-operating insurance company and is subject to the LICAT guideline. Sun Life Assurance, SLF Inc.'s principal operating life insurance subsidiary, is also subject to the LICAT guideline.

SLF Inc.'s LICAT ratio of 142% and Sun Life Assurance's LICAT ratio of 139% as at January 1, 2023 increased 12 percentage points compared to December 31, 2022, from the transition to IFRS 17. The largest driver of change was the reduction in the LICAT base solvency buffer ("BSB") scalar from 1.05 to 1.0 which contributed seven percentage points.

SLF Inc.'s LICAT ratio of 149% as at December 31, 2023 increased seven percentage points compared to January 1, 2023, driven by reported net income, capital optimization and market movements, partially offset by shareholder dividend payments, subordinated debt redemption, M&A activity, and share buybacks.

Sun Life Assurance's LICAT ratio of 141% as at December 31, 2023 increased two percentage points compared to January 1, 2023, driven by reported net income, capital optimization, and market movements, largely offset by dividend payments to SLF Inc. and M&A activity.

The Sun Life Assurance LICAT ratios in both periods are well above OSFI's supervisory ratio of 100% and regulatory minimum ratio of 90%.

MANAGEMENT'S DISCUSSION & ANALYSIS Sun Life Financial Inc. December 31, 2023 17

2. Capital

On transition to the new standards, total capital of $40.6 billion as at January 1, 2023 increased $4.4 billion compared to December 31, 2022 driven by the establishment of the CSM, which includes transfers from Common shareholders' equity and equity in the participating account to the CSM.

Our total capital consists of subordinated debt and other capital instruments, CSM, equity in the participating account and total shareholders' equity which includes common shareholders' equity, preferred shares and other equity instruments, and non-controlling interests. As at December 31, 2023, our total capital was $42.4 billion, an increase of $1.7 billion compared to January 1, 2023. The increase to total capital included reported net income of $3,086 million, an increase of $921 million in CSM, the issuance of $500 million principal amount of Series 2023-1 Subordinated Unsecured 5.50% Fixed/Floating Debentures, which is detailed below, and net unrealized gains on FVOCI assets of

$485 million. This was partially offset by the payment of $1,762 million of dividends on common shares of SLF Inc. ("common shares"), the redemption of $1 billion principal amount of Series 2016-2 Subordinated Unsecured 3.05% Fixed/Floating Debentures, which is detailed below, the unfavourable impacts of foreign exchange translation of $344 million included in other comprehensive income (loss) ("OCI"), a decrease of $186 million from the repurchase and cancellation of common shares, and the impact related to the acquisition of AAM of

$156 million(1).

Our capital and liquidity positions remain strong with a LICAT ratio of 149% at SLF Inc., a financial leverage ratio of 21.5%(2) and $1.6 billion in cash and other liquid assets(2) as at December 31, 2023 in SLF Inc.(3) (December 31, 2022 - $1.1 billion).

Capital Transactions

On July 4, 2023, SLF Inc. issued $500 million principal amount of Series 2023-1 Subordinated Unsecured 5.50% Fixed/Floating Debentures due 2035. Sun Life intends to use an amount equal to the net proceeds from the offering to finance or refinance, in whole or in part, eligible assets as defined in our Sustainability Bond Framework.

On September 19, 2023, SLF Inc. redeemed all of the outstanding $1 billion principal amount of Series 2016-2 Subordinated Unsecured 3.05% Fixed/Floating Debentures, in accordance with the redemption terms attached to such debentures. The redemptions were funded from existing cash and liquid assets in SLF Inc.

Normal Course Issuer Bids

On August 24, 2023, SLF inc. announced that OSFI and the Toronto Stock Exchange ("TSX") had approved its previously announced normal course issuer bid to purchase up to 17 million of its common shares (the "NCIB”). The NCIB commenced on August 29, 2023 and continues until

August 28, 2024, such earlier date as SLF Inc. may determine, or such date as SLF Inc. completes its purchases of common shares pursuant to the NCIB. Purchases under the NCIB may be made through the facilities of the TSX, other Canadian stock exchanges and/or alternative Canadian trading platforms, at prevailing market rates. Subject to regulatory approval, purchases under the NCIB may also be made by way of private agreements or share repurchase programs under issuer bid exemption orders issued by securities regulatory authorities. Any purchases made under an exemption order issued by a securities regulatory authority will generally be at a discount to the prevailing market price. The actual number of common shares purchased under the NCIB, and the timing of such purchases (if any), will be determined by SLF Inc. Any common shares purchased by SLF Inc. pursuant to the NCIB will be cancelled or used in connection with certain equity settled incentive arrangements. The NCIB will provide the Company with the flexibility to acquire common shares in order to return capital to shareholders as part of its overall capital management strategy.

In 2023, SLF Inc. purchased approximately 2.8 million common shares at a total cost of $186 million pursuant to the NCIB. All of the common shares purchased under SLF Inc.'s NCIB were subsequently cancelled.

Financial Strength Ratings

Independent rating agencies assign credit ratings to securities issued by companies and assign financial strength ratings to financial institutions such as Sun Life Assurance.

The financial strength ratings assigned by rating agencies are intended to provide an independent view of the creditworthiness and financial strength of a financial institution. Each rating agency has developed its own methodology for the assessment and subsequent rating of life insurance companies.

Rating agencies do not assign a financial strength rating for SLF Inc., however, credit ratings are assigned to the securities issued by SLF Inc. and its subsidiaries and are described in SLF Inc.'s AIF under the heading Security Ratings.

The following table summarizes the financial strength ratings for Sun Life Assurance as at January 31, 2024 and January 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A.M. Best |

DBRS |

Moody's |

Standard & Poor's |

| January 31, 2024 |

A+ |

AA |

Aa3 |

AA |

| January 31, 2023 |

A+ |

AA |

Aa3 |

AA |

Most recent rating agency actions on the financial strength rating of Sun Life Assurance:

•March 28, 2023 - Standard and Poor's ("S&P") affirmed the financial strength rating with a stable outlook.